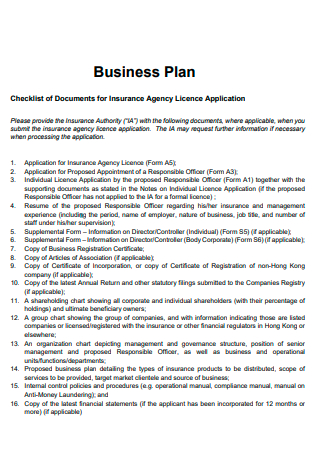

Insurance Business Plan Template

Written by Dave Lavinsky

Business Plan Outline

- Insurance Business Plan Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

Insurance Agency Business Plan

You’ve come to the right place to create your own business plan.

We have helped over 100,000 entrepreneurs and business owners create business plans and many have used them to start or grow their insurance companies.

Essential Components of a Business Plan For an Insurance Agency

Below we describe what should be included in each section of a business plan for a successful insurance agency and links to a sample of each section:

- Executive Summary – In the Executive Summary, you will provide a high-level overview of your business plan. It should include your agency’s mission statement, as well as information on the products or services you offer, your target market, and your insurance agency’s goals and objectives.

- Company Overview – This section provides an in-depth company description, including information on your insurance agency’s history, ownership structure, and management team.

- Industry Analysis – Also called the Market Analysis, in this section, you will provide an overview of the industry in which your insurance agency will operate. You will discuss trends affecting the insurance industry, as well as your target market’s needs and buying habits.

- Customer Analysis – In this section, you will describe your target market and explain how you intend to reach them. You will also provide information on your customers’ needs and buying habits.

- Competitive Analysis – This section will provide an overview of your competition, including their strengths and weaknesses. It will also discuss your competitive advantage and how you intend to differentiate your insurance agency from the competition.

- Marketing Plan – In this section, you will detail your marketing strategy, including your advertising and promotion plans. You will also discuss your pricing strategy and how you intend to position your insurance agency in the market.

- Operations Plan – This section will provide an overview of your agency’s operations, including your office location, hours of operation, and staff. You will also discuss your business processes and procedures.

- Management Team – In this section, you will provide information on your insurance agency’s management team, including their experience and qualifications.

- Financial Plan – This section will detail your insurance agency’s financial statements, including your profit and loss statement, balance sheet, and cash flow statement. It will also include information on your funding requirements and how you intend to use the funds.

Next Section: Executive Summary >

Insurance Agency Business Plan FAQs

What is an insurance agency business plan.

An insurance agency business plan is a plan to start and/or grow your insurance business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your insurance agency business plan using our Insurance Agency Business Plan Template here .

What Are the Main Types of Insurance Companies?

There are a few types of insurance agencies. Most companies provide life and health insurance for individuals and/or households. There are also agencies that specialize strictly in auto and home insurance. Other agencies focus strictly on businesses and provide a variety of liability insurance products to protect their operations.

What Are the Main Sources of Revenue and Expenses for an Insurance Agency Business?

The primary source of revenue for insurance agencies are the fees and commissions paid by the client for the insurance products they choose.

The key expenses for an insurance agency business are the cost of purchasing the insurance, licensing, permitting, and payroll for the office staff. Other expenses are the overhead expenses for the business office, utilities, website maintenance, and any marketing or advertising fees.

How Do You Get Funding for Your Insurance Agency Business Plan?

Insurance agency businesses are most likely to receive funding from banks. Typically you will find a local bank and present your business plan to them. Other options for funding are outside investors, angel investors, and crowdfunding sources. This is true for a business plan for insurance agent or an insurance company business plan.

What are the Steps To Start an Insurance Business?

Starting an insurance business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop An Insurance Business Plan - The first step in starting a business is to create a detailed insurance business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

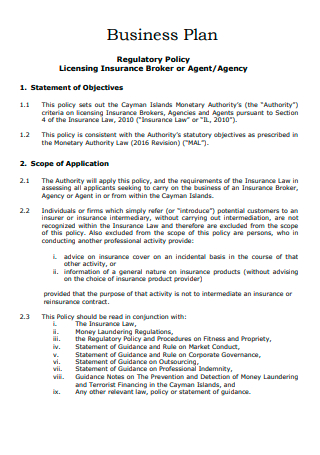

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your insurance business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your insurance business is in compliance with local laws.

3. Register Your Insurance Business - Once you have chosen a legal structure, the next step is to register your insurance business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your insurance business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Insurance Equipment & Supplies - In order to start your insurance business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your insurance business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful insurance business:

- How to Start an Insurance Business

Where Can I Get an Insurance Business Plan PDF?

You can download our free insurance business plan template PDF here . This is a sample insurance business plan template you can use in PDF format.

How to build an insurance agency business plan

A great business plan can guide you through every critical early step of building your company. As you start your insurance company , your plan can help you refine your vision, set objectives, and define the details of your business.

Done right, it can help you secure investors, financing, and more. Done poorly or not at all, your new agency may not get off the ground.

Let’s look at the benefits of creating a business plan and what yours should include.

Why do you need a business plan?

Before diving into the details of building a plan, let’s start with why you should write one in the first place.

After all, a good business plan requires careful research, writing, and review. But it’s worth the effort.

Companies that plan grow 30% faster than those who don’t.

A solid plan can help you make sound decisions when you’re first starting out and as you grow. Even down the road, it can help you secure funding from banks and investors. And insurance carriers often want to see your plan before they’ll partner with your agency.

Beyond these benefits and your own peace of mind, creating a business plan can help you:

- Set realistic objectives.

- Allocate resources.

- Streamline workflows.

- Improve communication.

- Grow your business.

Once your business gets off the ground, periodically reviewing your plan is a great way to clarify your goals and refine how you’ll reach them.

A Journal of Business Venturing study has shown that companies that plan grow 30% faster than those who don’t.

How do you write a business plan?

Business plans can be as different as the businesses they describe, but they generally provide highlights of your business in 5,000 words or less.

Your insurance agency plan must define your business strategy if you plan to seek financing. Essentially, your plan needs to be useful to you and intriguing to investors.

Standard business plan templates typically include these sections.

Executive summary

The executive summary is a snapshot of your insurance business.

For an established agency, this section might include its mission statement and detail its past successes. For a startup, the executive summary might highlight the experience of the business owners and their motivation for starting an insurance agency.

For both new and established businesses, you can also include your agency’s general financial information. This might be an overview of your book of business or a list of current investors.

The executive summary is usually the first impression investors have of your business. Make sure it packs a punch and provides a compelling story.

Company description

A company description gets more specific about what your business does on a day-to-day basis.

The company description explains your keys to success. These can be the value you provide to customers and what sets you apart from the competition. Sometimes they’re one and the same. Pinpoint what you bring to the local insurance market, like:

- A prime office location

- Unparalleled expertise

- Unique products

You may want to include a SWOT analysis that details your business’s strengths, weaknesses, opportunities, and threats.

List of products

This section lists every insurance product that your business offers or plans to offer in the future.

Be sure to include product benefits, sales forecasts, and how you plan to acquire and manage the products.

You may also want to explain how independent agents can secure direct appointments with insurance carriers. Many investors may be unfamiliar with this process.

Market analysis

The market analysis shows your understanding of the insurance market in general. And more importantly, where your agency fits in the mix.

If you plan to fill a niche, explain why and how. Either way, describe your target market and the competition.

Potential investors may also want to see specific market goals, such as your target market share along with an explanation of how and when you’ll achieve it.

Marketing strategy

Every insurance agency needs to reach new customers to grow its business and be successful. In this section, outline how you’ll market your business to attract new customers and increase sales to current ones.

Briefly summarize your strategy, including some details like whether you plan to use traditional and/or digital marketing channels. This might also be a good place to share your sales strategy for converting leads into customers.

Organization and management

The organization and management section introduces your executive and management teams, including a summary of their unique qualifications.

Detailing your team’s experience and talent helps establish your agency’s credibility. It also builds trust in your business and leadership team.

You may also want to include an organizational chart that breaks down your business infrastructure and operations.

Financial plan

If your business is looking for funding, you’ll usually need to identify start-up costs and provide five years of prospective financial data. This typically includes:

- Balance sheets

- Income statements

- Cash-flow statements

- Capital expenditure budgets

You may want to include a break-even analysis that delves into the specific profitability of your products. Consider adding a short financial analysis of the most profitable industry trends.

Funding request

If you're seeking investors for your insurance company, add a funding request at the end of your business plan. Typically, a funding request mentions:

- The amount of funding you’re looking to secure.

- An estimate of your future funding needs.

- How you plan to use the funding.

- Your strategy for dealing with developments like a buyout.

If you’re ready to draft your business plan, the Small Business Administration (SBA) provides this business plan template to help you get started.

How to present your insurance agency business plan

Once you’ve completed your business plan, give it a chance to shine in the spotlight.

Presentation matters, so make it professional. Use an easy-to-read font and clear charts and diagrams to illustrate your points. Be prepared to provide both a digital and print version to potential business partners, banks, or investors.

How you present matters, too. Whenever possible, meet in person to build more trust and rapport.

And even though your business plan is full of details, your audience will likely ask you to expand or explain. Come prepared to respond to any potential objections.

Your thorough, compelling business plan can help build the foundation for your success. If you devote the time and energy needed to create a great one, it could pay large dividends for your business.

Complete Insureon’s easy online application today to compare quotes for business insurance from top-rated U.S. carriers. Once you find the right policy for your small business, you can begin coverage in less than 24 hours.

Hannah Filmore-Patrick, Contributing Writer

Hannah is a contributing writer with a diverse writing and content building background. She's worked on topics from technology to insurance. She's competent with both language and SEO, and continues to work with a variety of business verticals to create engaging, optimized content.

Get business insurance quotes from trusted carriers

How To Write an Insurance Company Business Plan + Template

Creating a business plan is essential for any business, but it can be especially helpful for insurance companies that want to improve their strategy and/or raise funding.

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success.

This article provides an overview of the key elements that every insurance company owner should include in their business plan.

Download the Ultimate Insurance Business Plan Template

What is an Insurance Company Business Plan?

An insurance company business plan is a formal written document that describes your company’s business strategy and its feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a key document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write an Insurance Company Business Plan?

An insurance company business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Insurance Company Business Plan

The following are the key components of a successful insurance company business plan:

Executive Summary

The executive summary of an insurance company business plan is a one to two page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your insurance company

- Provide a short summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started, and provide a timeline of milestones your company has achieved.

If you are just starting your insurance company , you may not have a long company history. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company before or have been involved in an entrepreneurial venture before starting your insurance company firm, mention this.

You will also include information about your chosen insurance company business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an important component of an insurance company business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the insurance industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support the success of your company)?

You should also include sources for the information you provide, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, the customers of an insurance company may include individuals, families, small businesses, and large corporations.

You can include information about how your customers make the decision to buy from you as well as what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or insurance company services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will be different from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive differentiation and/or advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your insurance company may have:

- Specialized industry knowledge

- Proven track record

- Strong customer relationships

- Robust product offerings

- Innovative solutions

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be clearly laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, launch a direct mail campaign.

- Or, you may promote your insurance company business via word of mouth.

Operations Plan

This part of your insurance company business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone only?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

The operations plan is where you also need to include your company’s business policies. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, in your Operations Plan, you will lay out the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for an insurance company include reaching $X in sales. Other examples include expanding to a new geographic market, launching a new product or service line, or signing on new major customers.

Management Team

List your team members here including their names and titles, as well as their expertise and experience relevant to your specific insurance industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs, as well as the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Insurance Company

| Revenues | $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 |

| $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 | |

| Direct Cost | |||||

| Direct Costs | $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 |

| $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 | |

| $ 268,880 | $ 360,750 | $ 484,000 | $ 649,390 | $ 871,280 | |

| Salaries | $ 96,000 | $ 99,840 | $ 105,371 | $ 110,639 | $ 116,171 |

| Marketing Expenses | $ 61,200 | $ 64,400 | $ 67,600 | $ 71,000 | $ 74,600 |

| Rent/Utility Expenses | $ 36,400 | $ 37,500 | $ 38,700 | $ 39,800 | $ 41,000 |

| Other Expenses | $ 9,200 | $ 9,200 | $ 9,200 | $ 9,400 | $ 9,500 |

| $ 202,800 | $ 210,940 | $ 220,871 | $ 230,839 | $ 241,271 | |

| EBITDA | $ 66,080 | $ 149,810 | $ 263,129 | $ 418,551 | $ 630,009 |

| Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| EBIT | $ 60,880 | $ 144,610 | $ 257,929 | $ 413,351 | $ 625,809 |

| Interest Expense | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 |

| $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 | |

| Taxable Income | $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 |

| Income Tax Expense | $ 18,700 | $ 47,900 | $ 87,600 | $ 142,000 | $ 216,400 |

| $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 | |

| 10% | 20% | 27% | 32% | 37% | |

Balance Sheet

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : All of the things you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Insurance Company

| Cash | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

| Other Current Assets | $ 41,600 | $ 55,800 | $ 74,800 | $ 90,200 | $ 121,000 |

| Total Current Assets | $ 146,942 | $ 244,052 | $ 415,681 | $ 687,631 | $ 990,278 |

| Fixed Assets | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Accum Depreciation | $ 5,200 | $ 10,400 | $ 15,600 | $ 20,800 | $ 25,000 |

| Net fixed assets | $ 19,800 | $ 14,600 | $ 9,400 | $ 4,200 | $ 0 |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

| Current Liabilities | $ 23,300 | $ 26,100 | $ 29,800 | $ 32,800 | $ 38,300 |

| Debt outstanding | $ 108,862 | $ 108,862 | $ 108,862 | $ 108,862 | $ 0 |

| $ 132,162 | $ 134,962 | $ 138,662 | $ 141,662 | $ 38,300 | |

| Share Capital | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Retained earnings | $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 |

| $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 | |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

Cash Flow Statement

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include:

- Cash Flow From Operations

- Cash Flow From Investments

- Cash Flow From Financing

Below is a sample of a projected cash flow statement for a startup insurance company business.

Sample Cash Flow Statement for a Startup Insurance Company

| Net Income (Loss) | $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 |

| Change in Working Capital | $ (18,300) | $ (11,400) | $ (15,300) | $ (12,400) | $ (25,300) |

| Plus Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| Net Cash Flow from Operations | $ 21,480 | $ 82,910 | $ 152,629 | $ 256,551 | $ 380,709 |

| Fixed Assets | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Net Cash Flow from Investments | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Equity | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Debt financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow from Financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow | $ 105,342 | $ 82,910 | $ 152,629 | $ 256,551 | $ 271,847 |

| Cash at Beginning of Period | $ 0 | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 |

| Cash at End of Period | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and/or grow your insurance company . It not only outlines your business vision but also provides a step-by-step process of how you are going to accomplish it. All in all, a business plan is a key to the success of any business.

Finish Your Insurance Business Plan in 1 Day!

Other helpful articles.

How To Write an Insurance Agency Business Plan + Template

* Mandatory fields

By clicking "Get Started", I consent by electronic signature to being contacted by EverQuote, including by automatic telephone dialing and/or an artificial or prerecorded voice (including SMS and MMS - charges may apply), regarding EverQuote for Agents, even if my phone number is listed on a Do Not Call Registry. I also understand that my agreement to be contacted is not a condition of purchasing any goods or services, and that I may call (844) 707-8800 to speak with someone about EverQuote for Agents.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent. Consent.

- Agents Blog

- Running & Growing your Agency

- Upcoming Webinars

- IAA Presentations

- Share this Hub

- EverQuote Pro Blog »

Launch Your New Insurance Agency With This Business Plan Template

Whether you're a brand new agent or one with several decades of experience, the idea of opening a new insurance agency probably seems daunting—where do you start?

One of the first things you’ll need to do is come up with a business plan for your insurance agency. After all, you can walk into a bank or a potential investor’s office looking for funding, but you won’t get very far unless you have a robust insurance agency business plan that proves you’re on the right track toward turning a profit in the near future.

Follow the steps below when building out your insurance business plan to maximize your chances of securing funding and getting your new agency off to a strong start.

7 Steps To Build Your Insurance Agency Business Plan

1. develop your executive and business summaries..

In business plan terms, the executive summary is the driving force behind your other decisions. It should explain why you’re starting your agency. The business summary is similar, but it should narrow down your “why” into a list of “hows.”

Ask yourself:

- Why do you want to open an agency?

- What types of insurance do you wish to sell?

- What do you hope to accomplish?

- What return on investment do you expect to receive?

- How are you going to generate demand and ensure supply for your service?

Jot your answers down so you can refer back to them as you move forward.

2. Decide whether you want to be a captive agent or an independent agent.

Many large agencies, such as Allstate and Farmers, work with captive agents who can only sell insurance for that specific provider. Independent agents, on the other hand, can sell insurance for multiple providers, but they get locked out of working with the big-name captive carriers who only work with captive agents. (Read more about captive agents here and get a seasoned agent’s POV on both types of agents here. )

Before you can nail down the details of the rest of your business plan, you’ll have to make a choice between these two options.

3. Do a market analysis.

Though it might seem like a tedious process, conducting a thorough market analysis is crucial to your success. Analyzing your local market—including the backgrounds, shopping behaviors, and preferences of your target customers—gives you the insights you’ll need to attract these folks to your business.

Your market analysis will look a little different depending on whether you prefer to be a captive or an independent agent. The state you live in is another factor that will affect your analysis—in fact, it may even influence your decision to be captive or independent.

Take a close look at the demographics of your region.

- How many homeowners live in your state?

- What’s the average insurance premium per home?

- How many people live in each home, on average?

- How many drivers live in your state?

- How many vehicles does the average household own?

- Do you live in an area with an aging population ?

- How many families live in your region?

- What insurance carriers do locals in your state gravitate toward?

- In your area, what might be some successful strategies for retaining clients (rather than just acquiring them)?

These questions are all important, but pay particular attention to the last one. If you open an agency without a plan for client retention, you’re going to struggle. And, unfortunately, this is one of the most overlooked aspects of an insurance agency business plan.

4. Identify where you’ll find your first clients.

It’s one thing to know there are X number of potential clients living in your state, but it’s quite another to have a plan that will help you reach out to those folks and land your first policy sales.

Some investors will require a list of leads before they’ll even consider funding your agency. Even if it’s not a requirement, it’s always a good idea to have a pipeline ready to go. This is where getting set-up for purchasing warm leads from EverQuote can put you in a great position for success.

Plus, tackling this step before you even open your doors will help you better understand the costs you’ll incur—and therefore how much startup funding you will need.

You might also consider other options, such as placing ads in local newspapers, going to networking events, investing in digital marketing, sponsoring local Little League teams, or asking for referrals.

5. Create a financial plan.

Many new agencies fail because their owners overlooked something critical during startup. Do your best to look at your financial plans from every angle:

- Where will you find leads, and how much will they cost?

- What is your advertising budget?

- Does this budget line up with the going rates of local newspapers, billboards, or online ads?

- Do you plan to have 1099 employees or W2 employees selling insurance for your agency?

- How will you decide on a commission and benefits structure for these employees?

- What retention and loss ratios (for clients and employees) do you expect based on the numbers of other agencies in your area?

- How will you handle the delay between policy renewals and income hitting your bank account?

- If there are X amount of people shopping for insurance in your area, what percentage of those people are in a niche you can serve?

- From that percentage of potential clients, how many do you think you can successfully land?

- If you sell policies to these customers, how much will you earn from their premiums?

- How do your projected profits compare to your expected advertising costs, the cost to buy leads, office rent, and other expenses?

Take detailed notes of your calculations, and try to run the numbers a few different ways to obtain a conservative outcome, a likely outcome, and a “best case scenario.”

6. Draw up a formal business plan using a proven format.

Your notes will be incredibly valuable as you move forward, but you’ll need a way to present them clearly and concisely in a way that looks attractive to investors.

Loan officers and investors don’t want to read long-form essays detailing your business background and your ideas for the future. Keep your format simple and straightforward, with clear sections that answer the questions investors will want to know.

We recommend a format similar to the following:

Executive Summary Overall mission Primary objectives Keys to success Financial plans Profit forecast for at least three years Business Summary Business overview Summary of startup costs Funding you’ll require Company executives/ownership Services Services you provide Market Analysis Overall business analysis Details of your competition Buying patterns of your competition Your planned buying patterns Market segmentation and analysis Target market strategies Include details for each market segment Strategy Your competitive edge Marketing strategy Sales strategy Yearly sales projections Key milestones Management Your plan for finding staff Financial Plan Funding you have accepted Funding you will need Detailed startup costs Calculations for your break-even point Projected profit Yearly profit Gross and net yearly profit Anticipated losses, if any Cash flow patterns Plans for balance sheet Calculations of important business ratios

7. Revise and adjust your plan over time.

You may not secure funding for your agency immediately. Even if you do, you’ll likely find that your real world numbers don’t match up exactly with your calculated projections. Plus, carriers frequently change their underwriting policies, and the economy itself is always in a state of flux.

Keep your business plan current by updating the information anytime circumstances change.

Start your journey with a full lead pipeline from EverQuote.

One of the scariest parts about starting a new agency is not being certain where and when you’ll be able to start making sales.

Skip the fear and the unknown and go right to making sales with warm real-time leads from EverQuote. Whether you’re still trying to find startup funding or your doors are already open, you can always boost your business and maximize your chances of a steady income by working with EverQuote.

Connect with us today.

Topics: Featured , Insurance Agency Growth

About the Author Chris Durling, VP of P&C Sales

Chris Durling is a visionary leader in P&C insurance sales and distribution, with over 10 years of experience in the industry.

Most Recent Articles

If you’re a P&C agent, you’ve probably built your agency on auto or home insurance sales. There’s...

In the grand scheme of digital insurance agency marketing, paid advertisements might seem like a...

If you’re at all familiar with digital marketing—maybe you’ve dabbled in it a bit or even just done...

Scott Grates, insurance agent and co-founder of Insurance Agency Optimization, is renowned for his...

When it comes to nurturing your insurance agency’s online business reputation, there are numerous...

If the year 2023 had a buzzword, that buzzword was definitely AI. Artificial intelligence took off...

Despite current economic complexities, many industries are still hiring at a dependable pace. Among...

If you had to name the most tedious, time-consuming, thankless task in your insurance sales job,...

Previous Article

Next Article

Ready to see what partnering with EverQuote can do for you?

Our representatives are standing by to help you succeed.

Call 844-707-8800

Weekdays, 9AM-5PM (ET)

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent.

By clicking "Get Started", I affirm that I have read and agree to this website’s Privacy Policy and Terms of Use , including the arbitration provision and the E-SIGN Consent. For quality control purposes, activity on this website may be monitored or recorded by EverQuote or its service providers.

Terms of Use

Privacy Policy

For quality control purposes, activity on this website may be monitored or recorded by EverQuote or its service providers

Insurance Business Plan Template & Example [Updated 2024]

Insurance Business Plan

If you want to start a successful insurance agency or expand your current insurance business, you need a business plan.

The following sample insurance business plan provides the key elements to include in a successful insurance agency business plan.

You can download our Insurance Agency Business Plan Template (including a full, customizable financial model) to your computer here.

Sample Insurance Agency Business Plan

Below are links to a sample of each of the key sections of a successful insurance agency business plan.

- Executive Summary – The Executive Summary of your insurance agency business plan should include a brief overview of your entire business plan touching on key points such as the insurance products you offer, your target market, and why customers should choose your insurance agency.

- Company Overview – This section should provide an in-depth overview of your insurance company, its history, legal structure, and the milestones you hope to achieve.

- Industry Analysis – In this section, you should describe the insurance industry and any major trends that might impact your insurance business.

- Customer Analysis – In the Customer Analysis section, you should include an analysis of the target customers you plan to serve including demographics and psychographics.

- Competitive Analysis – In this section, you should include information about your competitors, their strengths and weaknesses, and how your competitive advantage will put you above the competition.

- Marketing Plan – In the Marketing Plan section, you should include an overview of your marketing strategy and outline the channels you will use to reach and engage your target customers.

- Operations Plan – The Operations Plan section should provide an overview of the daily operations of your insurance business and outline any systems, processes, and procedures you have in place.

- Management Team – In the Management Team section, you should include information about each key team member and the experience they bring to the business.

- Financial Plan – The Financial Plan section should include a 3 to 5-year profit and loss statement, cash flow statement, balance sheet, breakeven analysis, and other financial projections to demonstrate the success of your agency.

Comments are closed.

Insurance Business Plan Outline

How to Create a Business Plan for an Insurance Agency

If the adage is true that even the greatest enthusiasm is no substitute for planning, independent insurance agents know that both are required in order for an agency to succeed.

An insurance agency business plan is therefore essential, especially for brand-new agencies in addition to established firms. A thoughtfully developed plan provides you direction for your efforts and structure for ongoing business development.

Without a plan, all you have is good intentions – and those won’t get you where you want to go. A map, on the other hand, will.

With this in mind, let’s dive into how to create a business plan for insurance agents and the things you’ll need to do to set your agency on the path to success.

Why is an agency business plan important?

A well-constructed insurance agency business plan helps you to set realistic goals, define your needs for specific resources, and focus your attention on the essential must-dos for accelerating your business.

As the principal, you must continually refine your vision for what you ultimately want to achieve: the type of business you want to run, its operations, its cash flow, its culture, and its workflows. Then, you can list the necessary steps to reverse-engineer the ideal agency that you’ve pictured.

Not only will the business plan for your insurance agency serve as a tool for internal management and decision-making, but it’s also extremely useful in conveying the vision for your business to other parties. Among these are investors, lenders, and potential partners – and new insurance carriers will often want to review your agency’s business plan before they’ll partner with you.

It’s worth noting that over time, the business plan for an insurance agency can and will change, and the agency owner must be flexible in both thought and execution as a new agency is forged. For example, you may envision writing a large portion of your agency’s book of business in a certain line, and later discover that market conditions or intense competition will encourage you to pivot to other lines that may also prove profitable.

What should be included in the business plan for an insurance agency

Agency principals will create a comprehensive summary that mindfully considers everything from the agency’s location and target markets to the products it will offer.

To get started, let’s review the various sections that make up a comprehensive business plan, and how each section contributes to the overall plan’s effectiveness.

Your insurance agency business plan should run about 5,000 words, outlining the following in detail:

- An executive summary detailing your “vision” for your agency

- Description of your company

- List of the insurance products your agency plans to offer

- Business analysis of your market

- Your agency’s marketing strategy

- Organizational structure

- Your agency’s financial plan

- Agency funding needs

If you’re already thinking, “I’m not a writer; I can’t do this,” fear not. You’re summarizing what you’re setting out to achieve and how you plan to get there – not writing a sonnet. Once you start writing, you’ll be surprised how far you’ll get.

The aforementioned word count, while a solid goal, isn’t set in stone. Don’t pad what you’re writing; stick to the facts. In the end, your business plan should be thorough, useful to you, and appealing to investors.

Let’s break down each of these sections one by one.

Executive summary

Think of this section as a concise overview of the overall business plan for your agency – your mission statement. Include highlights of your agency’s mission, goals, and its competitive advantage. Highlight your agency’s projected growth and potential profitability.

Be realistic and truthful in your assessments. It’s good to be optimistic, but not pie-in-the-sky level, especially for new agencies. Remember, you could find yourself answering to an investor sometime in the future.

Company description

Here’s where you explain what makes your agency special. Tell your story powerfully. What’s your vision for your organization? How would you describe your company culture ? How do you recruit new talent ?

What is your target market? What are your customer demographics? Who will be selling, and what are their strengths? How do you manage your relationships with your insurance carrier partners? What types of agency technology do you leverage in your customer service efforts?

Offer details on what you consider your unique selling proposition. Do you offer specialization in certain lines of business? If so, explain the inherent value in the expertise you possess.

Keep this question in mind as you write: What makes your firm exceptional, and why would someone want to invest in it?

List of products

The composition of your agency’s book of business is critical , and here you’ll lay out exactly what products you’re selling (or plan to sell). Provide a detailed breakdown of the insurance products and services offered by your agency, including a brief explanation of each product’s features and benefits.

In addition, include ideas for expanding your product lineup in years to come.

Market analysis

Investors and carriers alike want to know that you possess comprehensive knowledge of both your local insurance market and the forces influencing the wider industry. Offer analysis of your agency’s target market, including the demographics of your potential clients.

Then, provide a thorough analysis of the insurance industry’s current challenges and evolving exposures, with emphasis on how those trends affect the types of clients you serve. (This section doesn’t need to be exhaustive – again, don’t pad it – but it should reflect your macro perspective on the P&C market as well as how market forces will factor into your pricing and risk selection.)

Marketing strategy

How do you market your agency to prospects? Do you utilize digital marketing, social media, or create content that will resonate with potential customers? Community engagement is key in endearing your business to local prospects, as are networking events.

Detail your marketing strategy, and explain which types of outreach you’ve found most effective.

Note: As an agency owner it’s especially important to be flexible with your plans in this area, as certain approaches may prove less effective over time. When they do, you’ll need to pivot.

Organization and management

Effective leadership and a clear organizational chart will contribute greatly to your agency’s success. In this section, lay out your agency’s organizational structure – the hierarchy of your leaders. Include profiles of key team members, highlighting their various expertise.

Financial plan

Here’s where you begin to get more detailed on dollars and cents. Offer your realistic financial projections for your agency, taking into account expenses, revenue, and projected profitability.

Your projections should include a breakdown of any and all financial forecasts and possible variables taken into consideration. Contingency plans to address potential financial challenges should likewise be included.

Agency funding

Your agency’s financial needs are assessed in detail here. Apply your knowledge of what you want your agency to achieve, versus what it will cost. This includes (but is not limited to) rent, payroll, utilities, phone service, and business insurance.

Include the purpose behind each expenditure, and demonstrate how funding for your firm will be used to cultivate growth.

By the time this section is complete, you’ll have an informed understanding of exactly what it will cost to fund your organization – and how much you may need to borrow to manifest your vision. Provide an outline of potential sources of funding, including personal investments, loans, or investors.

What is the Best Business Structure for an Insurance Agency?

There are several business structures you can consider for your agency, each with various benefits. These include:

- Sole proprietorship

- Partnership

- Corporation

There are various legal, financial, and operational factors to consider in selecting the structure that’s best for you, which we’ll explore in greater detail in a future blog.

How your insurance agency business plan will evolve

As your agency evolves over time, so too will your firm’s business plan. It’s best to revisit and refine your overall plan at least every seven to 12 months, in order to chart your progress and adopt new strategies that will help to continuously drive revenue.

The path to agency success is long and at times extremely difficult, but thoughtful planning will aid your firm’s execution and growth for years to come.

About Renaissance

Powered by a differentiated suite of technology products and services, Renaissance drives organic, profitable revenue growth for your insurance agency.

Keep Reading

How insurance agencies can benchmark their success, how independent insurance agents can raise the bar on customer service, 4 strategies for growing your independent insurance agency.

155 N Wacker Dr., Suite 820 Chicago, IL 60606 (800) 514-2667

NON-DISCLOSURE TERMS AND CONDITIONS

These Non-Disclosure Terms and Conditions (“ Agreement ”) govern the provision of information by Renaissance Alliance Insurance Services, LLC (“ Renaissance ”) to a prospective agency member (“ Recipient ”). Renaissance and Recipient Renaissance and Recipient are hereinafter referred to together as the “ Parties ,” and each may be referred to separately as a “ Party .”

The Parties acknowledge that Renaissance may disclose to Recipient certain of Renaissance’s confidential, sensitive and/or proprietary information including, but not limited to, business, financial or technical information, in connection with the potential establishment and/or conduct of a business relationship or transaction between the Parties (the “ Transaction ”). In connection therewith, for good and valuable consideration, the receipt and sufficiency of which consideration are hereby acknowledged by Recipient, and as a condition of the provision of Confidential Information (as defined below) to Recipient, Recipient hereby agrees as follows:

- Confidential Information. “ Confidential Information ” means any and all information provided by Renaissance to Recipient in any form, and at any time (including prior to or following the execution of this Agreement), including but not limited to any such information that (a) is related to Renaissance’s business, finances, financial information, pricing, business plans, profitability, projections, business or financial opportunities, investment strategies, other strategies, data, products, services, concepts, contacts, personnel, customers, vendors, prospects, intentions, formulas, methods, processes, practices, models, tools, computer programs, software, discoveries, inventions, know-how, negative know-how, business relationships, agreements (including this Agreement), intellectual property, trade secrets (whether or not patentable or copyrightable), trade secrets, or other confidential or proprietary information, (b) contains or is related to any communications, negotiations or proposals regarding the Transaction; (c) Recipient has either been informed, or reasonably should know, is confidential in nature; or (d) consists of or contains names, addresses or other information of any description relating to any of Renaissance’ member agencies or any of such member agencies’ customers or clients. Confidential Information shall also include any analyses, compilations, studies or other documents or materials prepared by Recipient or by any of its Representatives, that contain, rely upon, are derivative of or otherwise reflect any Confidential Information as described in the preceding sentence. The foregoing notwithstanding, Confidential Information shall not include any information which, at the time it is provided to Recipient; (i) is already known to Recipient, (ii) is then or later becomes available to the general public without violation of any requirement of confidentiality.

- Providing of Confidential Information. Renaissance may provide to Recipient any Confidential Information, in such manner and at such times as Renaissance may determine, to assist Recipient in evaluating, negotiating and carrying out the Transaction, but shall have no obligation to provide any, or any particular, Confidential Information to Recipient. Renaissance makes no, and disclaims any, representations or warranties regarding any Confidential Information it may provide, except as may be provided in any definitive documentation relating to a Transaction.

- Non-Use and Non-Disclosure; Representatives. Recipient agrees not to use any of Renaissance’s Confidential Information for any purpose other than for or in connection with the evaluation, negotiation, entering into or carrying out of a Transaction. Recipient agrees not to disclose any of Renaissance’s Confidential Information to any third party other than Recipient’s directors, officers, employees, affiliates, counsel, consultants, advisers, representatives and agents (collectively, “ Representatives ”) who have a reasonable need for the same in connection with the uses thereof permitted under this Agreement. Any such Representatives who are provided with any Confidential Information shall be instructed to maintain the same in confidence, and not to make any use or disclosure of the same other than as permitted under this Agreement. Recipient shall be responsible for any breach of this Agreement by any of its Representatives, to the same extent as though Recipient had committed such breach personally. Recipient agrees to use the same level of care in protecting the Confidential Information from unauthorized disclosure as it uses to protect its own confidential or proprietary information, and in any case will use no less than a commercially reasonable level of care in protecting all Confidential Information from unauthorized disclosure. The foregoing notwithstanding, Recipient shall be permitted to disclose so much of the Confidential Information as has been authorized for release by Renaissance in writing, to the persons and upon the conditions so authorized by Renaissance, in connection with the carrying out of the Transaction. Recipient shall not circumvent or seek to circumvent Renaissance’s negotiations with any third party, either by entering into discussions directly with such third party otherwise than on behalf of Renaissance, or otherwise. For purposes of this Section, each Party shall act in good faith and deal fairly with the other Party.

- No License; Return of Confidential Information. Recipient will not acquire any license or other rights whatsoever with respect to any of the Confidential Information by virtue of its disclosure to Recipient pursuant to this Agreement, or by virtue of any use thereof permitted hereunder. Recipient agrees to destroy or to return all Confidential Information to Renaissance, including both originals and all copies thereof (other than copies created as part of the routine backup of Recipient’s servers, or copies retained pursuant to a requirement of a governmental or regulatory authority, all of which retained copies shall be held confidential for so long as such materials are so retained), and to confirm the completion of such return or destruction to Renaissance in writing, promptly upon demand by Renaissance within the term of this Agreement. The term of this Agreement shall be for a period of five (5) years, commencing on the Effective Date set forth above. Either Party may terminate this Agreement at any time, upon written notice to the other Party, provided that the obligations of Recipient hereunder shall nevertheless survive for the period above stated, with respect to all Confidential Information provided prior to such termination.

- Orders Requiring Production. In the event Recipient receives a court subpoena, request for production of documents, court order or other requirement of a governmental agency to disclose any Confidential Information (a “ Disclosure Requirement ”), Recipient shall (unless prohibited by law) give prompt written notice to Renaissance thereof so that Renaissance may seek to challenge or limit the Disclosure Requirement. Recipient agrees to cooperate reasonably in any effort of Renaissance to limit or prevent any required disclosure of Confidential Information, provided that Recipient shall: (i) not be required to incur any expense in connection with such cooperation, and (ii) not be required to disobey any Disclosure Requirement. Recipient shall not be deemed in violation of this Agreement if it complies with any such Disclosure Requirement either after having provided Renaissance with notice thereof and a reasonable opportunity to contest the same, or if such notice is not permitted. Recipient agrees to (a) exercise reasonable efforts to disclose only the minimum amount of Confidential Information that Recipient is compelled to disclose, in the opinion of its legal counsel, and (b) request that confidential treatment (if legally permissible) will be accorded to the Confidential Information being disclosed.

- Injunctive Relief. Recipient acknowledges that the Confidential Information is confidential, and that disclosure or use of said information in violation of the terms of this Agreement would result in substantial and irreparable harm to Renaissance, the actual dollar amount of which damage would be impossible to determine. Accordingly, Recipient agrees that, in addition to any other remedies that may be available, in law, in equity or otherwise, Renaissance shall be entitled to seek injunctive relief against the actual or threatened breach of this Agreement or the continuation of any such breach by Recipient, without the necessity of proving actual damages and without posting bond. This provision shall not limit the right of Renaissance to seek actual damages or any other legal or equitable remedy for any breach hereof.

- Miscellaneous. This Agreement shall be construed in accordance with and governed by the laws of the State of Illinois, without regard to its conflicts of laws principles. Any action or proceeding against either Party relating in any way to this Agreement shall be brought and enforced only in the Federal (to the extent appropriate jurisdiction exists) and State courts located in Cook County in the State of Illinois, and the Parties irrevocably submit to the jurisdiction of such courts in respect of any such action or proceeding, and irrevocably waive any objection to venue in such courts, including but not limited to any objection that such venue is inconvenient. This Agreement embodies the entire agreement of the Parties with respect to the subject matter hereof, and supersedes all prior and contemporaneous agreements and understandings, oral or written. No amendment to this Agreement and no waiver of any provision hereunder shall be effective unless it is in writing and signed by an authorized officer of the Party against whom such amendment or waiver is asserted. No invalidity or unenforceability of any provision of this Agreement shall affect the validity or enforceability of the remaining portions hereof. This Agreement shall be binding upon, and shall inure to the benefit of, each of the Parties and their respective successors and assigns. There are no intended third-party beneficiaries of this Agreement. This Agreement does not in any way bind either Party to enter into or continue any type of business relationship with the other. Nothing in this Agreement shall prevent Renaissance from at any time disclosing any of its Confidential Information to others or negotiating with others for any purpose whatsoever. Nothing contained in this Agreement shall be construed to constitute the Parties as partners, joint venturers, co-owners or otherwise as participants in a joint or common undertaking. Recipient’s indication of assent to this Agreement via electronic means shall be equally binding and effective as an original signature hereon, and shall be deemed duly and effectively delivered if so transmitted or provided.

Newly Launched - AI Presentation Maker

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

Top 5 Insurance Business Plan Templates with Examples and Samples

Success in the insurance business is not about avoiding risks, but rather understanding and managing them effectively.

- Warren Buffett

With his remarkable business acumen, Warren Buffett shares a profound quote that captures the essence of what it takes to succeed in the insurance industry. In a world filled with uncertainties, insurance serves as a safety net, providing individuals and businesses with financial protection against unforeseen events.

Insurance agency leans on insurance business plan templates as their trusted allies, helping them through the complexities of the industry. These templates offer an insurance broker/ insurance agency structured framework to clearly define goals, strategies, and financial projections.

In this blog post, we are here to lend a helping hand and introduce you to some of the best insurance business plan templates. Whether you're venturing into a new start-up in some type of insurance like, home, life, health, automobile insurance or seeking to revamp your current insurance plan, these templates will serve as your guiding star by unveiling the finest selection of insurance business plan templates.

Elevate Your Planning with These Top 5 Insurance Business Plan Templates

Template 1 - insurance business plan powerpoint presentation slides.

This insurance business plan template presents a captivating blend of functionality and aesthetics. This content-ready PPT slide showcases the critical success factors, mission, vision, and start-up summary, while also incorporating a potential growth analysis, including SWOT analysis and Porter's five force analysis model, customer analysis, and market sizing. While adopting an appealing color palette of soothing blues, vibrant yellows, and sophisticated greys, this engaging color blend evokes a sense of trust, professionalism, and stability that are essential attributes in the insurance industry and also instils confidence in your brand. Check out more about this template here.

Download Now!

Template 2 - Insurance Business Plan Word Document Template

Designed with meticulous attention to detail, this template offers a versatile solution for insurance agencies, brokers, and professionals. It includes comprehensive sections covering every vital aspect of an insurance business plan. It encompasses market analysis, target audience identification, marketing strategies, financial projections, risk assessment, and growth plans. Its inclusive approach ensures a thorough and well-rounded plan. Get your hands on it now and leave your audience in awe with each and every delivery.

Template 3 - Insurance Business Plan PowerPoint Template Bundles

This template offers twelve slides with high-quality visuals, graphics, and images to showcase your expertise effectively. Each slide focusses different aspects of insurance, making information interpretation easier for your audience. The well-researched content stimulates strategic thinking, ensuring your message is conveyed with ease. The design's standout feature is its editable elements, allowing customization of colors, fonts, backgrounds, and more. Grab this template now for unique and captivating presentations every time.

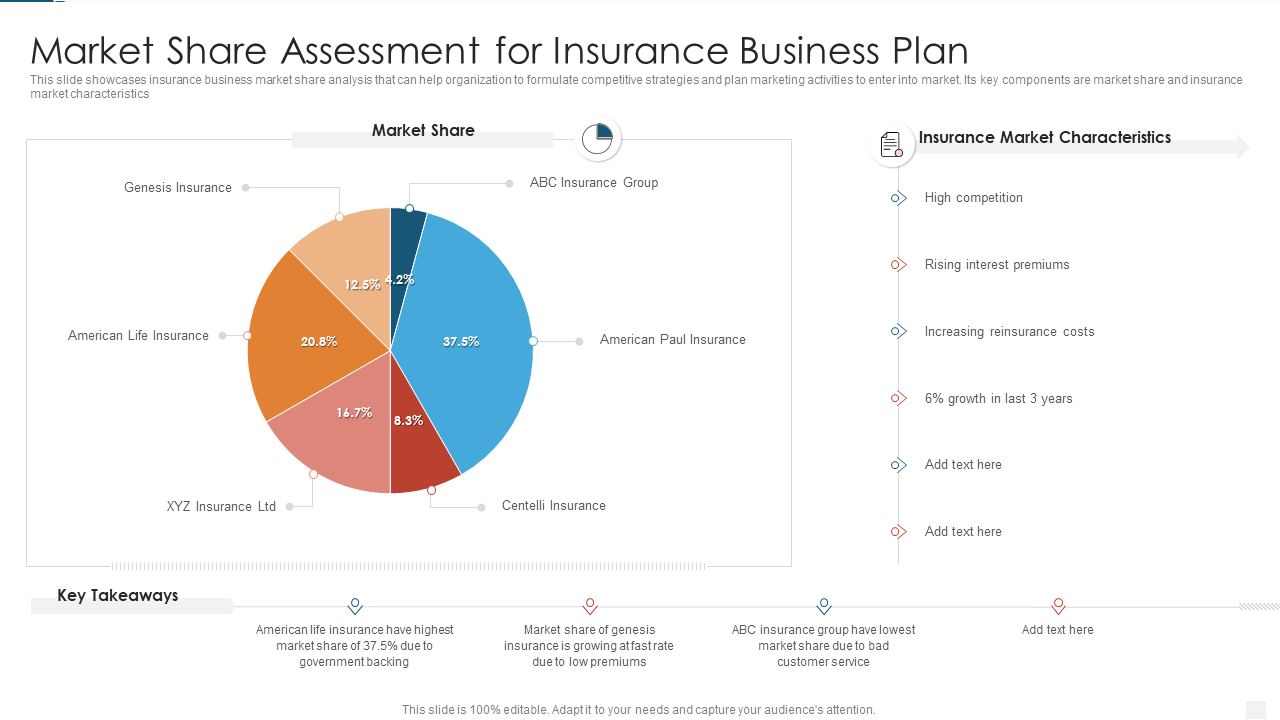

Template 4 - Market Share Assessment for Insurance Business Plan

This ready to use PPT template is expertly designed to highlight market share assessment for an insurance business plan. It consists of a pre-built pie-chart to exhibit the scenario of a market place of insurance companies. Discuss different insurance market characteristics and help your audience make informed decision with this pre-designed PPT slide. Grab your copy now and confidently deliver a persuasive presentation that convinces your audience.

Template 5 - Business Insurance Actionable Steps Template

This ready-made PPT template covers the usage of insurance plan for organizations. Use this flexible PPT diagram and craft a compelling presentation to persuade your audience to invest in different insurance options that safeguard their finances and assets. It offers a structured approach, ensuring that the plan aligns with goals and captures the attention of stakeholders. With its visually appealing design, compelling graphics, and concise text, convey complex information in a clear and impactful manner.

Using business plan templates for an insurance broker agency is a game-changer. It streamlines the planning process, ensuring a clear roadmap for success. We have highlighted the top 5 insurance business plan templates and examples, showcasing their effectiveness in guiding your business strategy. Don't miss out on this opportunity to leverage these templates as a springboard for your own business plans, tailoring them to suit your unique goals. For further assistance, we recommend exploring additional resources and tools that can enhance your business planning journey. Check out this page to unlock your agency or brokerage's full potential.

FAQs on Insurance Business Plan

What is an insurance business plan.

An insurance business plan is a detailed roadmap that outlines the goals, strategies, and operations of an insurance company. It holds significant value in the insurance field to set clear objectives, identify target markets, and determine financial projections. For insurance startups, strong business insurance guides the company, lures investors, and ensures essential licenses.

How to start an insurance startup?

To start an insurance agency, one can conduct thorough market research, define your target audience, obtain necessary licenses, develop a comprehensive insurance business plan, establish strategic partnerships, leverage technology, and create a marketing strategy. Adapt and evolve

your strategies to seize industry opportunities.

What are the 4 types of insurance?

The four types of insurance are Health, Life, Home & Automobile insurance. Health insurance helps with medical expenses, life, and annuity insurance provides financial support to loved ones after you pass away, home/property and casualty insurance covers damage or theft of your property, and automobile insurance protects against car accidents.

What are the 7 main types of insurance?

The seven main types of insurance are Property, Marine, Fire, Liability, Guarantee, Social & Life, and annuity insurance. These cover various aspects, including financial support after death, coverage for marine-related risks, liability-related risks, guarantees, social welfare benefits, and protection for damaged assets and personnel injuries by taking property and casualty insurance.

Related posts:

- How to Design the Perfect Service Launch Presentation [Custom Launch Deck Included]

- Quarterly Business Review Presentation: All the Essential Slides You Need in Your Deck

- [Updated 2023] How to Design The Perfect Product Launch Presentation [Best Templates Included]

- 99% of the Pitches Fail! Find Out What Makes Any Startup a Success

Liked this blog? Please recommend us

Must-Have Technology Brochure Examples with Templates and Samples

Top 10 Sales Content Management Playbook Templates with Samples and Examples

2 thoughts on “top 5 insurance business plan templates with examples and samples”.

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

--> Digital revolution powerpoint presentation slides

--> Sales funnel results presentation layouts

--> 3d men joinning circular jigsaw puzzles ppt graphics icons

--> Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

--> Future plan powerpoint template slide

--> Project Management Team Powerpoint Presentation Slides

--> Brand marketing powerpoint presentation slides

--> Launching a new service powerpoint presentation with slides go to market

--> Agenda powerpoint slide show

--> Four key metrics donut chart with percentage

--> Engineering and technology ppt inspiration example introduction continuous process improvement

--> Meet our team representing in circular format

Insurance Agency Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business ideas » Financial Service Industry » Insurance Agency

Are you about starting an insurance agency ? If YES, here is a complete sample insurance agency business plan template & feasibility study you can use for FREE .

To become an Independent insurance agent means that you have an insurance agency. The agents are also known as insurance sales agents.

These folks are involved in the sale of a variety of insurance and financial products; some of the products they deal in include; property insurance and casualty insurance, life insurance, health insurance, disability insurance, and long-term care insurance.

Suggested for You

- Hedge Fund Business Plan [Sample Template]

- Forex Brokerage Business Plan [Sample Template]

- Top 10 Marketing Ideas for Insurance Agents & Companies

- Judgement Recovery Business Plan [Sample Template]

- Bank Business Plan [Sample Template]

Insurance agencies sell insurance policies that defend individuals and businesses from financial loss that is brought about as a result of automobile accidents, fire, theft, storms, and other events that can damage property.

This is one of the reasons why many people have become so inclined to insurance that they dare not live without it. Therefore, this is one of the areas where having an insurance agency comes in handy.

A Sample Insurance Agency Business Plan Template

Industry overview.

The insurance industry is wide and global in nature; there are numerous aspects anyone interested in starting an insurance agency could choose to specialize in.

For instance; in the United States of America and even in Canada, pet insurance is one aspect of insurance that is gradually opening up and it is interesting to state that it is a very promising market.

Anyone looking towards starting an insurance agency has the option to choose an area of insurance to specialize in or they could choose to start a general insurance company; an insurance company that is involved in the selling of life insurance policies, health insurance policies, auto/car insurance policy and liability insurance amongst others.

The united states of America have the largest insurance market in the world as indicated by the volume of premium payments.

Statistics show that in 2013 alone, out of the total sum of 4.640 trillion US dollars of gross premiums written on a global scale, 1.274 trillion US dollars which translates to 27% were actually written in the United States of America.

This goes to show how big the insurance industry is in the United States of America. Independent insurance agents characteristically show a lot about insurance companies that meet the needs of their clients.

Running an insurance agency means that insurance agents have to be very well trained and knowledgeable about the difficulties of the insurance market and insurance law.

Getting a hang of this means that an insurance agent is able to advise their clients about appropriate amounts of insurance and insurance coverage for their particular needs.

More often than not, independent insurance agents work hand in hand with insurance mediators, in getting quotes from multiple insurance providers and then they go ahead to license them off to the independent agents.

Working with an insurance intermediary service allows the independent agent to appraise many quotes and offer their clients the best policy options ever.

There are a good number of major trade organizations that back the interests and needs of the independent insurance agent; some of them are Agents for Change, The National Organization of Life and Health Agents (NOLHA), the Independent Insurance Agents & Brokers of America, amongst many others.

Starting an insurance agency is a wonderful idea, but a whole lot has to be in place and it includes; getting an insurance license from the organization regulating the insurance industry like the National Association of Insurance Commissioners that regulates the industry.

No doubt, the process of obtaining an insurance agency license might not come too easy, because of the laid down criteria in which the whole process entails an insurance licensure examination is required if you want to start an insurance agency.

If you are serious and determined, you could write and pass the exam in one sitting, but if not, then you should be ready to take the exams over and over again. The bottom line is that these exams do not come cheap; so you must prove your worth before you can be issued a license.

In some countries trust is one of the key factors that may want to slow down the growth of the insurance agencies. Apart from that, then the insurance agencies just like insurance companies are really growing. The industry is a very profitable one with a lot of room for more prospects.

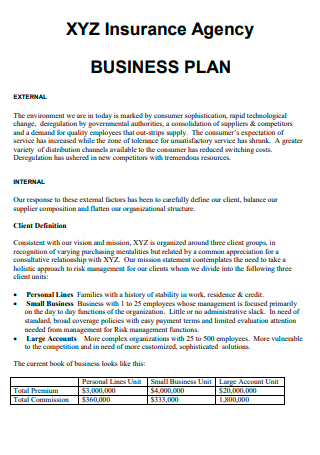

Executive Summary

May Flora brokers is a general insurance agency and were incorporated under United States law as a private Limited Liability Company. It has plans in the nearest future to transform into a public limited liability company. This is so that we can get listed on the New York Stock Exchange.

We will launch the business in heart of New York City – New York where we will have our headquarters and later spread to other major cities in the United States of America.

May Flora Insurance brokers were established with the sole directive of conducting insurance businesses in a highly professional, ethical, and customer-driven approach. We are aware that businesses these days require diverse and sophisticated approaches, which is why we will offer our clients the very best of deals at all times, and all around the year.

We are glad to find ourselves in a hub like the New York insurance market and this is why we have decided to kick start by dealing in various insurance policy covers such as:

Life and Annuities Insurance, Health/Medical Insurance, Car / Vehicle Insurance, Pet Insurance, Agricultural Insurance, Aviation Insurance, Financial Reinsurance, Guaranteed Asset Protection Insurance, Group Insurance, Inland Marine Insurance/Marine Insurance/Shipping Insurance, Travel Insurance, Liability Insurance/ Professional Liability Insurance and Property and Casualty Insurance, and what have you.

At May Flora Brokers, our client’s best interests come first, and everything we do is guided by our professional ethics. We will ensure that we are committed to competence, integrity, innovation, and excellent customer service. We will also guarantee that we only hire employees who are well experienced to help us drive the business.