Due to recent expansions in US sanctions against Russia and Belarus as well as existing country-level sanctions in Iran, North Korea, Syria, Cuba, and the Crimea region (each a “sanctioned country”), Zapier will no longer be able to provide services in any sanctioned country starting September 12, 2024. These sanctions prohibit US companies from offering certain IT and enterprise software services in a sanctioned region.

Starting September 12, 2024, Zapier customers will no longer be able to access Zapier services from a sanctioned country. We understand this may be inconvenient and appreciate your understanding as we navigate these regulatory requirements.

- Pollfish School

- Market Research

- Survey Guides

- Get started

Market Research Survey: The Complete Guide

This process involves gathering primary (self-conducted) and secondary (information already researched and made available) sources, to fully assess how a business will fare within a particular market and audience.

A market research survey is typically a source of primary information that businesses can use as part of their market research campaigns. It can also exist as a secondary source, in which case, its studies and results are published online or in a print publication.

This article will take a close look at the market research survey, so that you can use it to the optimum benefit for your business.

What Can you Achieve with Market Research?

A market research survey, as its name entails, is used for research purposes. Before we dive into all the aspects of this survey, it is apt to learn how you can use market research to your full advantage.

Market research is critical for a variety of purposes, including marketing , advertising , and branding campaigns.

Aside from providing data-based support for these macro purposes, market research gains you invaluable insight into particular markets. For example, you may consider running a research campaign for the retail market . Market research will help you gather all the relevant information pertaining to this specific market.

Aside from retail, you can conduct market research in a number of verticals, including ecommerce , technology, real estate and many others.

There are plenty of other applications for market research. Here are some of the ways to use market research to your advantage:

- Observe data to prepare for challenges in advance

- Gauge the demand for your product or service

- Learn key market trends and staples

- Discover how your competitors are winning or losing

- Uncover your target market’s desires, preferences, aversions and thoughts

The final point is remarkably crucial for market research and for generally keeping your business afloat. And so, we’ll now dig deep into the market research survey, as this tool is especially useful for this purpose.

Defining a Market Research Survey

This tool is the most commonly used market research method — and for good reason. A market research survey allows you to gather data on your target market. Moreover, it allows businesses to do so by accessing any insights they need, as long as they form corresponding questions to their investigation.

Surveys have a far-reaching history, as they date back to ancient civilizations such as Greece and Rome. There was a surge in survey use in 1930s America, in which the government sought to understand the economic and social state of the nation.

Surveys have taken up a variety of forms, including analog forms, such as paper and mail-in formats .

Telephone surveys were the medium of choice for survey research during the 1960s-90s. But, as technological advancements would have it, those have declined in usefulness as well.

In the present day, surveys are conducted online, particularly through the use of designated software platforms. This type of software has paved the way for easy access to primary research.

Businesses can use online survey software and tools and to carry out all their survey research (save for creating the screener and questions). Many such tools available both allow you to build surveys along with deploying them.

To reiterate, market research surveys are powerful tools, in that they empower businesses to ask any question they choose to better understand their market and consumer base. They also can offer key insights into competitors.

The Components of a Market Research Survey

This tool contains two major components: the screener and the questionnaire . These form the bulk of the insights your primary research will gather.

There are also two auxiliary components to incorporate to make your survey research successful. These include the call-out (introduction) and the thank you message (conclusion).

Unlike the essential components, the need to use these will vary based on your survey deployment method and campaign. For example, an emailed survey won’t require a call-out, as the email itself serves this purpose.

A web or mobile survey, on the other hand, will need a call-out to get the attention of your respondents.

Here is a break-down of each component, beginning with the essential elements:

- These conditions often deal with demographics, which is incredibly important, as you would need to first and foremost, survey your target market. The screener will ensure it is only your target market that takes part in the survey.

- The screener is often comprised of 2-3 questions.

- The questionnaire should ask all the necessary questions you need for a particular campaign or sub-campaign. Or, if used in a preliminary stage of your market research, they can deal with questions particularly designed to segment your target market.

- If respondents are contacted via email, the call-out is in the email’s body, inviting participants to take it, listing why it’s important, its length and what it’s used for.

- If the survey exists within a website (either as a banner, or button), the call-out is the clickable element itself (the button/banner to the survey). It too should explain the survey to respondents.

- If the survey is on a website/app, the call-out has to be visible and attractive enough for users to notice it and click on it.

- The survey often routes users to another page with a thank you message.

- It’s important, as it lets participants know that their survey has in fact been submitted.

How to Create a Market Research Survey

Here are a few steps to take into consideration when starting on a market research survey project.

Step 1: Find a topic your business needs to learn more about.

This is particularly important if it is a topic that has little to no secondary sources. In this case, opting for a survey is the best way to learn more about it firsthand, from the people who matter most: your target market. Pay attention to any problems your business may experience, as surveys should help resolve them.

Step 2: Consider the topic in regards to your target market

When you’ve narrowed down a problem or two, think about your target market. Do you know who constitutes it? If yes, tailor your survey topic into a subtopic that they’ll be most likely to respond to. For example, if your target market is middle-aged men who watch sports, consider whether your problem/topic will be relevant to them.

If you don’t know your target market, you should conduct some secondary research about it first, then perform market segmentation (surveys can help on this front too).

Step 3: Find the larger application of the survey campaign

Now that you’ve settled on a topic/problem and decided on whether it’s fitting for your target market, consider what the parent campaign of the survey would be. Let’s hypothetically say your topic is related to a product. Would a survey on that topic benefit a branding campaign like finding your next slogan? Would it be better suited to settle on a theme for an advertising campaign?

Once you find the most appropriate application or macro campaign to house the survey, your market research will be organized and your survey will be better set up for success.

Step 4: Calculate your margin of error

A margin of error , in simple terms, is a measurement of how effective your survey will be. Expressed as a percentage, it measures the difference between survey results and the population value.

You need to measure this unit, as surveys represent a large group of people, but are made up of a much smaller group. Therefore, the larger the margin of error, the less accurate the opinions of the survey represent an entire population.

Step 5: Create your survey(s)

Now that you’ve calculated the margin of error, start creating your campaign. Decide on how many surveys you would need, in regard to your margin of error and your market research needs.

Start with a broader topic and get more specific in each question. Or, create multiple surveys focused on different but closely related subtopics to your main topic.

Send out your surveys through a trusted survey platform.

Questions to Ask for Various Campaigns

The steps laid out above are part of a simple procedure in developing a market research survey. However, there is much more to these steps, especially that of creating the survey.

Namely, you would need the correct set of questions, as they are the lifeblood of a survey. With so many different survey research campaigns and purposes, brainstorming questions can seem almost counterintuitive.

To avoid information overload and any confusion that creating a survey may incite, review the below question examples. They are organized per campaign type, so you can discern which questions are most suitable for which corresponding research purpose.

Questions for Branding

Branding campaigns include efforts that build the identity of your business; this includes gathering data-backed ideas on logos, imagery, messaging and core themes surrounding your brand. You can use these when embarking on a new campaign, revamping an existing one or when you’re looking to change your brand’s reputation and style.

- Which of these brands do you know?

- What do you like most/least about this brand?

- Which idea is more important? (Use an idea behind setting up your brand’s image/style)

- Which images do you find the most inspiring? (To compare images you’ll use in your marketing/ definitive to your brand)

- What do you like about [brand]? (Can be open-ended)

Questions for Advertising

Using market research for advertising will help you obtain ideas for new advertising campaigns, testing already established campaign ideas and predicting the success of new ones.

- How would you rate the motivating power of this ad?

- Which of the following ads resonate the most with you?

- Do you remember this ad? (Name and image/video of a popular ad within your industry)

- How do you feel after watching this ad?

- What kind of use do you think this product/service produces?

Questions for Comparing Yourself with Competitors

Studying your competitors is often associated with secondary research, but you can gain intelligence on this topic through your own survey research. The great thing about surveys is that you don’t have to focus on one competitor when managing these surveys.

- How often do you use this product/service?

- Which brand do you use for this product/service? (Include one open-ended answer).

- Which of the following products (same kind, different brand) do you find the most useful?

- What about [competitor product] would you like to see change?

- Which brand has improved your life? (Include one open-ended question).

Questions for Market Segmentation

This application is possibly the most challenging, as it involves understanding who your target market already is, then further segmenting it. We understand coming to terms with your target market first, before narrowing it any further down.

Here is how to segment your target market; you’ll notice that the questions are much more granular than the typical questions associated with each topic. (Ex: demographics typically ask for race, age, gender, income, etc).

- Demographic segmentation: Which of the following groups do you identify with most closely? (It can involve anything from music, to shopping habits, to lifestyle choices)

- Geographic segmentation: Which of the following areas do you typically spend time in to make physical purchases?

- Psychographic segmentation: How do you feel about retailers who test their products on animals?

- Behavioral segmentation: How often do you buy this kind of product?

- Sentimental segmentation: How do the following [practices, images, actions] make you feel?

Securing the Most Benefits Out of Your Market Research Survey

As we can deduce from this guide, the market research survey is a critical tool for market research . There is so much to discover about your industry, competitors and chiefly, your customers. But before making any hasty decisions, it is vital to peruse all your research documents, not just the primary research ones, such as surveys.

When you combine primary and secondary research sources, you’re setting up any business move for greater success.

That’s because market research involves studying more than one source. It may appear daunting, but with the right tools, you can design better products, innovate on existing products, appeal to a wider audience and gain more revenue from your marketing efforts.

Thus, pair your market research survey with other research means for a lucrative market research campaign. Knowledge truly is power.

Frequently asked questions

What is a market research survey.

A market research survey is a survey used for conducting primary market research and is the most commonly used market research method. Market research surveys help you understand your target market, gathering data necessary to make informed decisions on content creation, product development, and more.

What are the components of a market research survey?

There are 4 major components in a market research survey. First, we have the callout to get digital visitors to participate in a survey. Next is the screener which determines who is eligible to take the survey based on their demographics information and answers to screening questions. Then, there is the questionnaire—-- this is the heart of the survey, containing a set of open-ended or closed-ended questions. Lastly, there’s the callout. This introduces the survey to respondents. Next, there’s the thank you message. This acts as the conclusion to the survey.

How can you create a market research survey?

Creating a market research survey starts with identifying the topics your business needs to learn more about. Next, you consider topics within the context of your target market and find the larger application of the survey campaign. Calculate your margin of error and then create your survey using online software.

What types of questions should you ask on your market research survey?

You can ask branding related questions to gather information on how your identity of your business is perceived. You can also ask questions that spark ideas for new advertising campaigns. To supplement your secondary research on competitors, ask questions about your business’s place in the industry. Questions can also be used for market segmentation. These are questions on demographic, geographic, psychographic, behavioral and sentimental topics.

How can you get the most benefits out of your market research survey?

You can get the most out of your market research survey by using the correct online survey platform-- one with specific audience targeting for real consumers, radius targeting and quality screening questions-- you’ll get relevant answers from the right audience.

Do you want to distribute your survey? Pollfish offers you access to millions of targeted consumers to get survey responses from $0.95 per complete. Launch your survey today.

Privacy Preference Center

Privacy preferences.

How to use market surveys to gather actionable insights

Last updated

1 April 2024

Reviewed by

New to market surveys? Follow this guide to take the guesswork out of your next product or service launch with easy-to-build market surveys that will get you the data you need.

As one of the most effective research methods , many businesses use market surveys as their primary data collection tool. Whether your team is looking to improve existing client offerings or wants to redesign your current products or services, collecting market research will be an essential part of your project’s success.

Your team must facilitate regular market research to understand your target market. Covering everything you need to know, use this guide to get you started down the path of high-quality market research and insight collection.

Let’s get into it!

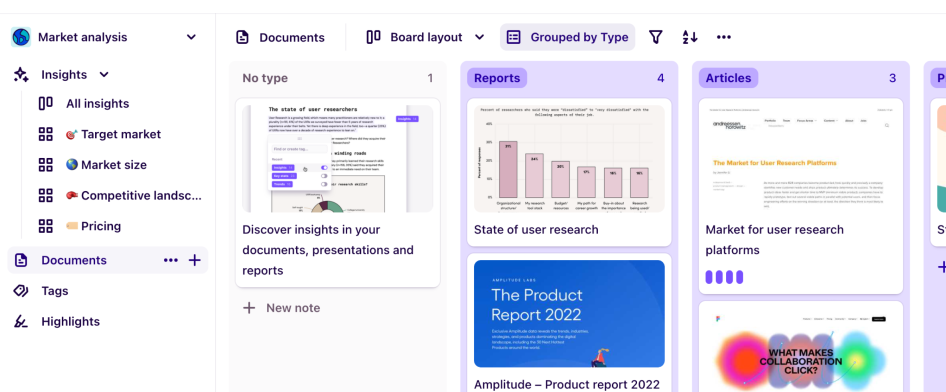

Market analysis template

Save time, highlight crucial insights, and drive strategic decision-making

- What are market surveys?

A market survey is a tool used to collect information and data from a set group of people. Often sent to existing customers, surveys for market research can help your team learn valuable information about your target audience and chosen market.

When used correctly, a market survey will provide your team with data and insights, including:

Demographic information of your top customers

The needs and wants of your target audience

Any pain points or issues with your current product or service

Competitor brands that your customers also use

Trends and information about your target market

Market research vs. marketing research

Despite sounding quite similar, market research and marketing research are two different terms:

Market research

As the primary subject of this article, market research is the practice of collecting and analyzing information from a specific target audience or customer base . It’s commonly done as part of UX research and gives the company better insights into the needs and wants of its customers. Market surveys are some of the most widely used tools to conduct this type of research.

Marketing research

Alternatively, marketing research focuses more on reporting on information specifically related to marketing efforts. This type of research is often focused on gaining insights about new or upcoming marketing messaging, campaign launches, and more. A/B testing packaging, surveying customers, and price trialing are examples of marketing research.

- The benefits of surveys for market research

Market surveys are popular across all industries due to their ease of use and efficient data collection capabilities. As your team begins to develop your market research strategy, here are a few reasons why you should consider using market surveys as part of your plan:

Gain insights for potential future products

Instead of blindly creating a new product or service that you think your customers will like, use market research surveys to create exactly what they’re looking for from the start.

Brand loyalty is built through trust and collaboration with your customers. By inviting them into the process (by getting them to share their experiences and preferences), your team not only gains direct feedback about how to move forward but also creates a sense of community and appreciation.

Using open-ended questions as part of your market research surveys allows your customers to talk about their preferences, experiences, and desires for your brand. This allows their needs and concerns to be heard while providing you with a road map for future success. Talk about a win-win!

Analyze your competitors

Do you know where your brand measures up compared to other competitors in your industry? Learn why your customers choose you (and why others opt for your competitors) with well-crafted surveys for market research.

No matter the industry your company works within, there is always competition between different brands. Help your business stand out from the others by conducting regular market research about your target audience’s experiences—giving you great insights about where your offerings currently stand and what you can do to improve and better serve your customers.

Test your marketing efforts before the big launch

Don’t blow your marketing budget on a campaign that isn’t going to land with your target audience. Instead, top-performing teams use market research surveys to A/B test ideas and storylines within their marketing materials before the big launch—and the results are worth the extra effort!

Focus groups , customer interviews , and small-batch surveys are great ways to learn more about the effectiveness of your current marketing materials. When done currently, your market surveys will give you direct insights into the wording and phrasing used to convey their primary concerns (something that will go a long way for relatability while boosting your conversion rates ).

Everyone wants to be heard and understood—so use your market surveys to connect and listen to your target audience to enhance your next marketing campaign.

Create fresh content that connects

Creating high-quality content is hard—especially if you operate within a narrow niche. If your company uses content marketing to connect with its target audience, marketing surveys can be incredibly valuable.

Instead of racking your brain to find content ideas that you think will resonate with your target audience, your team can use market surveys to get ideas, perspectives, and stories that can be turned into earnest and compelling content for your brand.

Sending out a market survey asking for opinions or ideas for content is a surprisingly easy (and effective) way to build a winning content strategy—and we highly recommend adding it to your current marketing strategy!

Understand customer sentiment

How do your customer base and the general public feel about your brand? If you don’t have a clear answer to this question, you need to use well-crafted market surveys to find out.

The way your customers perceive your brand, products, and services has a dramatic impact on the success of your business. Customer sentiment analysis (which can be part of your market research strategy) is a great way to explore this topic—giving you direct insights into the experiences and sentiments about your offerings. Often sent after a purchase or speaking with a customer service representative, this type of market survey helps your team stay on top of your public image.

If you start noticing an influx of negative reviews, you know it’s time to change. If your brand is well-loved, you need to focus on initiatives supporting and fostering this sentiment further.

But, without market research surveys, your team will be unaware of customer sentiment , making all decisions reactionary and late rather than as part of your day-to-day decision-making process and strategy.

- Types of market surveys (with examples)

Now that we have explored the incredible value that market research surveys can bring to your team, let’s jump into some of the most common types of surveys used by businesses looking to learn more about their chosen market:

Market description surveys

Market description surveys determine the size and interests of a particular niche segment. When done correctly, market description surveys will give your team insights into the following:

Potential market growth

Existing competitors within the space

The core issues and problems this market is looking to address

Market description surveys are often sent out to a large number of participants to collect data from a wide range of sources. This type of survey is great to implement during the early stages of a new project, as you can use any of the feedback quickly to improve your business.

Market segmentation surveys

Market segmentation surveys are created to learn more about the specifics of your target audience. Who are they, and who is not a part of this group, and why? What do they like, and what do they need now and into the future?

By sending market segmentation surveys to your customers and target audience, your team will gain information about:

The different types of people within your chosen market

Market demographic, including age, geographic location, income and gender

Your customer’s primary wants and preferences

Your customer’s pain points and concerns

To create better quality products and services that resonate with your target audience, you first need to understand who they are. Using a market segmentation survey template from SurveyMonkey, your team will be able to segment your market into groups based on shared interests and preferences—allowing you to create more personalized and detailed offerings and marketing campaigns that will convert.

Purchase tracking surveys

Market research surveys can understand and track your customer’s purchase experience and habits. They can highlight each customer’s journey , from learning about your product to paying for your product or service. Purchase tracking surveys provide insights into:

How your customers became aware of your brand

The impact of marketing campaigns

Customer purchase behavior (including the likelihood of repurchase)

Pain points or barriers that prevent customers from buying

Understanding your customer’s path to purchase and experience with your brand is essential for long-term brand success. We recommend using the SurveyMonkey purchase tracking survey template to get started with effective customer purchase tracking research.

Just adapt the questions to your specific customer base and set the survey to be sent a few days after a purchase—you will be blown away by the amount of information you can collect!

- Common market survey mistakes to avoid

Using the information and templates provided throughout this article, your team can now create and distribute market surveys to your customers and chosen market. To get the most out of your efforts (and to avoid mistakes that can diminish the value of your surveys), here are a few of our top market research survey mistakes you should avoid:

Choosing the wrong audience

No matter how well you write your market survey questions, if you send the content to the wrong group of people, you will not collect helpful information.

To avoid this fate, spending extra time identifying your target audience can be helpful. Whether you do this through team brainstorming sessions, smaller custom research projects, or by segmenting your already existing target audience, these efforts will be tremendously helpful for getting accurate and nuanced insights from your surveys down the line.

Using the wrong sample size

The number of people you survey will significantly impact the quality and accuracy of the results you receive—and should be something your team is aware of before you even send out your first market research survey!

To determine what size of sample size will be best suited for your project, you first need to think about the type of information you are looking to collect:

Generalized market analysis

Broad-scoped research projects need a large number of participants to provide an accurate portrayal of your target audience. If your team wants to learn more about a new market, making sure you send and receive surveys from a large sample size will be essential.

Collecting customer demographics and exploring purchasing behaviors are two examples of market research categories that require a larger sample size to give reliable results.

User experience

Alternatively, anecdotal and personalized information is often more beneficial when provided by a smaller (but high-quality) group of participants. Instead of collecting large amounts of vague information from a bigger group, interviewing or surveying a smaller group of qualified people can provide specific and detailed insights into the experiences of your top customers.

Learning more about product or service pain points or exploring the reception to a new feature are examples of market research projects that can benefit from a smaller sample size.

Not optimizing survey send times

How (and when) you send your market research surveys to your target audience matters.

Demographic surveys can be sent to new subscribers, ideally during the workday, to prevent notification during the evening or at night. Ensure that your surveys get seen and completed by factoring in send time into your strategy. If you collect post-purchase data, send your survey after a recent purchase.

Whenever you ask your customers to complete a survey, you’re asking for a favor. So, do your best to be appreciative and polite—and always avoid sending too much email spam!

Writing unclear survey questions

Possibly one of the most commonly made mistakes when beginning market research is writing confusing and non-specific questions for surveys.

The questions you choose to add to your survey should be intentional—meaning that they have gone through rounds of editing and prioritization to be clear and compelling to your audience while providing your team with insightful and specific data.

We highly recommend hosting a brainstorming session for potential survey questions with your team. After you have written out as many ideas and iterations for questions as you can, spend the time to rewrite, reorganize, and rate the strength of each question you want to include in your survey. Only the best of the best should make the cut—making your survey short, sweet, and impactful.

- Maximize your market research insights

Using this guide, we hope your team now understands the importance of market research on the success of your upcoming lunch or brand redesign. No matter the size of your company, taking the time to learn more about your chosen market will always improve your offerings—so we encourage you to get started as soon as possible!

But, once you get started, the fun has only just begun. Market surveys are an excellent tool for gathering information about your target audience—but how can you get the most out of the data you have collected?

A customer insights hub can give your team access to customer insights , no matter the type of data you want to collect and analyze. Made to store your market research data in an accessible and flexible way, use it to infuse customer insights seamlessly into your existing workflow.

We hope you found this guide helpful—now get out there and create high-quality market surveys!

Should you be using a customer insights hub?

Do you want to discover previous research faster?

Do you share your research findings with others?

Do you analyze research data?

Start for free today, add your research, and get to key insights faster

Editor’s picks

Last updated: 3 April 2024

Last updated: 17 October 2024

Last updated: 13 May 2024

Last updated: 22 July 2023

Last updated: 23 July 2024

Last updated: 2 October 2024

Last updated: 12 September 2024

Last updated: 22 February 2024

Latest articles

Related topics, a whole new way to understand your customer is here, log in or sign up.

Get started for free

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

Market research definition

Market research – in-house or outsourced, market research in the age of data, when to use market research.

- Types of market research

Different types of primary research

How to do market research (primary data), how to do secondary market research, communicating your market research findings, choose the right platform for your market research, try qualtrics for free, the ultimate guide to market research: how to conduct it like a pro.

27 min read Wondering how to do market research? Or even where to start learning about it? Use our ultimate guide to understand the basics and discover how you can use market research to help your business.

Market research is the practice of gathering information about the needs and preferences of your target audience – potential consumers of your product.

When you understand how your target consumer feels and behaves, you can then take steps to meet their needs and mitigate the risk of an experience gap – where there is a shortfall between what a consumer expects you to deliver and what you actually deliver. Market research can also help you keep abreast of what your competitors are offering, which in turn will affect what your customers expect from you.

Market research connects with every aspect of a business – including brand , product , customer service , marketing and sales.

Market research generally focuses on understanding:

- The consumer (current customers, past customers, non-customers, influencers))

- The company (product or service design, promotion, pricing, placement, service, sales)

- The competitors (and how their market offerings interact in the market environment)

- The industry overall (whether it’s growing or moving in a certain direction)

Free eBook: This Year’s Global Market Research Trends Report

Why is market research important?

A successful business relies on understanding what like, what they dislike, what they need and what messaging they will respond to. Businesses also need to understand their competition to identify opportunities to differentiate their products and services from other companies.

Today’s business leaders face an endless stream of decisions around target markets, pricing, promotion, distribution channels, and product features and benefits . They must account for all the factors involved, and there are market research studies and methodologies strategically designed to capture meaningful data to inform every choice. It can be a daunting task.

Market research allows companies to make data-driven decisions to drive growth and innovation.

What happens when you don’t do market research?

Without market research, business decisions are based at best on past consumer behavior, economic indicators, or at worst, on gut feel. Decisions are made in a bubble without thought to what the competition is doing. An important aim of market research is to remove subjective opinions when making business decisions. As a brand you are there to serve your customers, not personal preferences within the company. You are far more likely to be successful if you know the difference, and market research will help make sure your decisions are insight-driven.

Traditionally there have been specialist market researchers who are very good at what they do, and businesses have been reliant on their ability to do it. Market research specialists will always be an important part of the industry, as most brands are limited by their internal capacity, expertise and budgets and need to outsource at least some aspects of the work.

However, the market research external agency model has meant that brands struggled to keep up with the pace of change. Their customers would suffer because their needs were not being wholly met with point-in-time market research.

Businesses looking to conduct market research have to tackle many questions –

- Who are my consumers, and how should I segment and prioritize them?

- What are they looking for within my category?

- How much are they buying, and what are their purchase triggers, barriers, and buying habits?

- Will my marketing and communications efforts resonate?

- Is my brand healthy ?

- What product features matter most?

- Is my product or service ready for launch?

- Are my pricing and packaging plans optimized?

They all need to be answered, but many businesses have found the process of data collection daunting, time-consuming and expensive. The hardest battle is often knowing where to begin and short-term demands have often taken priority over longer-term projects that require patience to offer return on investment.

Today however, the industry is making huge strides, driven by quickening product cycles, tighter competition and business imperatives around more data-driven decision making. With the emergence of simple, easy to use tools , some degree of in-house market research is now seen as essential, with fewer excuses not to use data to inform your decisions. With greater accessibility to such software, everyone can be an expert regardless of level or experience.

How is this possible?

The art of research hasn’t gone away. It is still a complex job and the volume of data that needs to be analyzed is huge. However with the right tools and support, sophisticated research can look very simple – allowing you to focus on taking action on what matters.

If you’re not yet using technology to augment your in-house market research, now is the time to start.

The most successful brands rely on multiple sources of data to inform their strategy and decision making, from their marketing segmentation to the product features they develop to comments on social media. In fact, there’s tools out there that use machine learning and AI to automate the tracking of what’s people are saying about your brand across all sites.

The emergence of newer and more sophisticated tools and platforms gives brands access to more data sources than ever and how the data is analyzed and used to make decisions. This also increases the speed at which they operate, with minimal lead time allowing brands to be responsive to business conditions and take an agile approach to improvements and opportunities.

Expert partners have an important role in getting the best data, particularly giving access to additional market research know-how, helping you find respondents , fielding surveys and reporting on results.

How do you measure success?

Business activities are usually measured on how well they deliver return on investment (ROI). Since market research doesn’t generate any revenue directly, its success has to be measured by looking at the positive outcomes it drives – happier customers, a healthier brand, and so on.

When changes to your products or your marketing strategy are made as a result of your market research findings, you can compare on a before-and-after basis to see if the knowledge you acted on has delivered value.

Regardless of the function you work within, understanding the consumer is the goal of any market research. To do this, we have to understand what their needs are in order to effectively meet them. If we do that, we are more likely to drive customer satisfaction , and in turn, increase customer retention .

Several metrics and KPIs are used to gauge the success of decisions made from market research results, including

- Brand awareness within the target market

- Share of wallet

- CSAT (customer satisfaction)

- NPS (Net Promoter Score)

You can use market research for almost anything related to your current customers, potential customer base or target market. If you want to find something out from your target audience, it’s likely market research is the answer.

Here are a few of the most common uses:

Buyer segmentation and profiling

Segmentation is a popular technique that separates your target market according to key characteristics, such as behavior, demographic information and social attitudes. Segmentation allows you to create relevant content for your different segments, ideally helping you to better connect with all of them.

Buyer personas are profiles of fictional customers – with real attributes. Buyer personas help you develop products and communications that are right for your different audiences, and can also guide your decision-making process. Buyer personas capture the key characteristics of your customer segments, along with meaningful insights about what they want or need from you. They provide a powerful reminder of consumer attitudes when developing a product or service, a marketing campaign or a new brand direction.

By understanding your buyers and potential customers, including their motivations, needs, and pain points, you can optimize everything from your marketing communications to your products to make sure the right people get the relevant content, at the right time, and via the right channel .

Attitudes and Usage surveys

Attitude & Usage research helps you to grow your brand by providing a detailed understanding of consumers. It helps you understand how consumers use certain products and why, what their needs are, what their preferences are, and what their pain points are. It helps you to find gaps in the market, anticipate future category needs, identify barriers to entry and build accurate go-to-market strategies and business plans.

Marketing strategy

Effective market research is a crucial tool for developing an effective marketing strategy – a company’s plan for how they will promote their products.

It helps marketers look like rock stars by helping them understand the target market to avoid mistakes, stay on message, and predict customer needs . It’s marketing’s job to leverage relevant data to reach the best possible solution based on the research available. Then, they can implement the solution, modify the solution, and successfully deliver that solution to the market.

Product development

You can conduct market research into how a select group of consumers use and perceive your product – from how they use it through to what they like and dislike about it. Evaluating your strengths and weaknesses early on allows you to focus resources on ideas with the most potential and to gear your product or service design to a specific market.

Chobani’s yogurt pouches are a product optimized through great market research . Using product concept testing – a form of market research – Chobani identified that packaging could negatively impact consumer purchase decisions. The brand made a subtle change, ensuring the item satisfied the needs of consumers. This ability to constantly refine its products for customer needs and preferences has helped Chobani become Australia’s #1 yogurt brand and increase market share.

Pricing decisions

Market research provides businesses with insights to guide pricing decisions too. One of the most powerful tools available to market researchers is conjoint analysis, a form of market research study that uses choice modeling to help brands identify the perfect set of features and price for customers. Another useful tool is the Gabor-Granger method, which helps you identify the highest price consumers are willing to pay for a given product or service.

Brand tracking studies

A company’s brand is one of its most important assets. But unlike other metrics like product sales, it’s not a tangible measure you can simply pull from your system. Regular market research that tracks consumer perceptions of your brand allows you to monitor and optimize your brand strategy in real time, then respond to consumer feedback to help maintain or build your brand with your target customers.

Advertising and communications testing

Advertising campaigns can be expensive, and without pre-testing, they carry risk of falling flat with your target audience. By testing your campaigns, whether it’s the message or the creative, you can understand how consumers respond to your communications before you deploy them so you can make changes in response to consumer feedback before you go live.

Finder, which is one of the world’s fastest-growing online comparison websites, is an example of a brand using market research to inject some analytical rigor into the business. Fueled by great market research, the business lifted brand awareness by 23 percent, boosted NPS by 8 points, and scored record profits – all within 10 weeks.

Competitive analysis

Another key part of developing the right product and communications is understanding your main competitors and how consumers perceive them. You may have looked at their websites and tried out their product or service, but unless you know how consumers perceive them, you won’t have an accurate view of where you stack up in comparison. Understanding their position in the market allows you to identify the strengths you can exploit, as well as any weaknesses you can address to help you compete better.

Customer Story

See How Yamaha Does Product Research

Types of market research

Although there are many types market research, all methods can be sorted into one of two categories: primary and secondary.

Primary research

Primary research is market research data that you collect yourself. This is raw data collected through a range of different means – surveys , focus groups, , observation and interviews being among the most popular.

Primary information is fresh, unused data, giving you a perspective that is current or perhaps extra confidence when confirming hypotheses you already had. It can also be very targeted to your exact needs. Primary information can be extremely valuable. Tools for collecting primary information are increasingly sophisticated and the market is growing rapidly.

Historically, conducting market research in-house has been a daunting concept for brands because they don’t quite know where to begin, or how to handle vast volumes of data. Now, the emergence of technology has meant that brands have access to simple, easy to use tools to help with exactly that problem. As a result, brands are more confident about their own projects and data with the added benefit of seeing the insights emerge in real-time.

Secondary research

Secondary research is the use of data that has already been collected, analyzed and published – typically it’s data you don’t own and that hasn’t been conducted with your business specifically in mind, although there are forms of internal secondary data like old reports or figures from past financial years that come from within your business. Secondary research can be used to support the use of primary research.

Secondary research can be beneficial to small businesses because it is sometimes easier to obtain, often through research companies. Although the rise of primary research tools are challenging this trend by allowing businesses to conduct their own market research more cheaply, secondary research is often a cheaper alternative for businesses who need to spend money carefully. Some forms of secondary research have been described as ‘lean market research’ because they are fast and pragmatic, building on what’s already there.

Because it’s not specific to your business, secondary research may be less relevant, and you’ll need to be careful to make sure it applies to your exact research question. It may also not be owned, which means your competitors and other parties also have access to it.

Primary or secondary research – which to choose?

Both primary and secondary research have their advantages, but they are often best used when paired together, giving you the confidence to act knowing that the hypothesis you have is robust.

Secondary research is sometimes preferred because there is a misunderstanding of the feasibility of primary research. Thanks to advances in technology, brands have far greater accessibility to primary research, but this isn’t always known.

If you’ve decided to gather your own primary information, there are many different data collection methods that you may consider. For example:

- Customer surveys

- Focus groups

- Observation

Think carefully about what you’re trying to accomplish before picking the data collection method(s) you’re going to use. Each one has its pros and cons. Asking someone a simple, multiple-choice survey question will generate a different type of data than you might obtain with an in-depth interview. Determine if your primary research is exploratory or specific, and if you’ll need qualitative research, quantitative research, or both.

Qualitative vs quantitative

Another way of categorizing different types of market research is according to whether they are qualitative or quantitative.

Qualitative research

Qualitative research is the collection of data that is non-numerical in nature. It summarizes and infers, rather than pin-points an exact truth. It is exploratory and can lead to the generation of a hypothesis.

Market research techniques that would gather qualitative data include:

- Interviews (face to face / telephone)

- Open-ended survey questions

Researchers use these types of market research technique because they can add more depth to the data. So for example, in focus groups or interviews, rather than being limited to ‘yes’ or ‘no’ for a certain question, you can start to understand why someone might feel a certain way.

Quantitative research

Quantitative research is the collection of data that is numerical in nature. It is much more black and white in comparison to qualitative data, although you need to make sure there is a representative sample if you want the results to be reflective of reality.

Quantitative researchers often start with a hypothesis and then collect data which can be used to determine whether empirical evidence to support that hypothesis exists.

Quantitative research methods include:

- Questionnaires

- Review scores

Exploratory and specific research

Exploratory research is the approach to take if you don’t know what you don’t know. It can give you broad insights about your customers, product, brand, and market. If you want to answer a specific question, then you’ll be conducting specific research.

- Exploratory . This research is general and open-ended, and typically involves lengthy interviews with an individual or small focus group.

- Specific . This research is often used to solve a problem identified in exploratory research. It involves more structured, formal interviews.

Exploratory primary research is generally conducted by collecting qualitative data. Specific research usually finds its insights through quantitative data.

Primary research can be qualitative or quantitative, large-scale or focused and specific. You’ll carry it out using methods like surveys – which can be used for both qualitative and quantitative studies – focus groups, observation of consumer behavior, interviews, or online tools.

Step 1: Identify your research topic

Research topics could include:

- Product features

- Product or service launch

- Understanding a new target audience (or updating an existing audience)

- Brand identity

- Marketing campaign concepts

- Customer experience

Step 2: Draft a research hypothesis

A hypothesis is the assumption you’re starting out with. Since you can disprove a negative much more easily than prove a positive, a hypothesis is a negative statement such as ‘price has no effect on brand perception’.

Step 3: Determine which research methods are most effective

Your choice of methods depends on budget, time constraints, and the type of question you’re trying to answer. You could combine surveys, interviews and focus groups to get a mix of qualitative and quantitative data.

Step 4: Determine how you will collect and analyze your data.

Primary research can generate a huge amount of data, and when the goal is to uncover actionable insight, it can be difficult to know where to begin or what to pay attention to.

The rise in brands taking their market research and data analysis in-house has coincided with the rise of technology simplifying the process. These tools pull through large volumes of data and outline significant information that will help you make the most important decisions.

Step 5: Conduct your research!

This is how you can run your research using Qualtrics CoreXM

- Pre-launch – Here you want to ensure that the survey/ other research methods conform to the project specifications (what you want to achieve/research)

- Soft launch – Collect a small fraction of the total data before you fully launch. This means you can check that everything is working as it should and you can correct any data quality issues.

- Full launch – You’ve done the hard work to get to this point. If you’re using a tool, you can sit back and relax, or if you get curious you can check on the data in your account.

- Review – review your data for any issues or low-quality responses. You may need to remove this in order not to impact the analysis of the data.

A helping hand

If you are missing the skills, capacity or inclination to manage your research internally, Qualtrics Research Services can help. From design, to writing the survey based on your needs, to help with survey programming, to handling the reporting, Research Services acts as an extension of the team and can help wherever necessary.

Secondary market research can be taken from a variety of places. Some data is completely free to access – other information could end up costing hundreds of thousands of dollars. There are three broad categories of secondary research sources:

- Public sources – these sources are accessible to anyone who asks for them. They include census data, market statistics, library catalogs, university libraries and more. Other organizations may also put out free data from time to time with the goal of advancing a cause, or catching people’s attention.

- Internal sources – sometimes the most valuable sources of data already exist somewhere within your organization. Internal sources can be preferable for secondary research on account of their price (free) and unique findings. Since internal sources are not accessible by competitors, using them can provide a distinct competitive advantage.

- Commercial sources – if you have money for it, the easiest way to acquire secondary market research is to simply buy it from private companies. Many organizations exist for the sole purpose of doing market research and can provide reliable, in-depth, industry-specific reports.

No matter where your research is coming from, it is important to ensure that the source is reputable and reliable so you can be confident in the conclusions you draw from it.

How do you know if a source is reliable?

Use established and well-known research publishers, such as the XM Institute , Forrester and McKinsey . Government websites also publish research and this is free of charge. By taking the information directly from the source (rather than a third party) you are minimizing the risk of the data being misinterpreted and the message or insights being acted on out of context.

How to apply secondary research

The purpose and application of secondary research will vary depending on your circumstances. Often, secondary research is used to support primary research and therefore give you greater confidence in your conclusions. However, there may be circumstances that prevent this – such as the timeframe and budget of the project.

Keep an open mind when collecting all the relevant research so that there isn’t any collection bias. Then begin analyzing the conclusions formed to see if any trends start to appear. This will help you to draw a consensus from the secondary research overall.

Market research success is defined by the impact it has on your business’s success. Make sure it’s not discarded or ignored by communicating your findings effectively. Here are some tips on how to do it.

- Less is more – Preface your market research report with executive summaries that highlight your key discoveries and their implications

- Lead with the basic information – Share the top 4-5 recommendations in bullet-point form, rather than requiring your readers to go through pages of analysis and data

- Model the impact – Provide examples and model the impact of any changes you put in place based on your findings

- Show, don’t tell – Add illustrative examples that relate directly to the research findings and emphasize specific points

- Speed is of the essence – Make data available in real-time so it can be rapidly incorporated into strategies and acted upon to maximize value

- Work with experts – Make sure you’ve access to a dedicated team of experts ready to help you design and launch successful projects

Trusted by 8,500 brands for everything from product testing to competitor analysis, Our Strategic Research software is the world’s most powerful and flexible research platform . With over 100 question types and advanced logic, you can build out your surveys and see real-time data you can share across the organization. Plus, you’ll be able to turn data into insights with iQ, our predictive intelligence engine that runs complicated analysis at the click of a button.

Free eBook: This Year's Global Market Research Trends Report

Related resources

Mixed methods research 17 min read, market intelligence 10 min read, marketing insights 11 min read, ethnographic research 11 min read, qualitative vs quantitative research 13 min read, primary vs secondary research 14 min read, business research methods 12 min read, request demo.

Ready to learn more about Qualtrics?

IMAGES

VIDEO

COMMENTS

A market research survey is a questionnaire designed to collect key information about a company's target market and audience that will help guide business decisions about products and services, branding angles, and advertising campaigns.

Unlike focus groups or interviews, market research surveys allow you to get detailed feedback at scale — from behaviors to overall experiences — and in a standardized format. Also, as the data is easy to process, you can quickly turn it into actionable insights.

A market research survey is typically a source of primary information that businesses can use as part of their market research campaigns. It can also exist as a secondary source, in which case, its studies and results are published online or in a print publication.

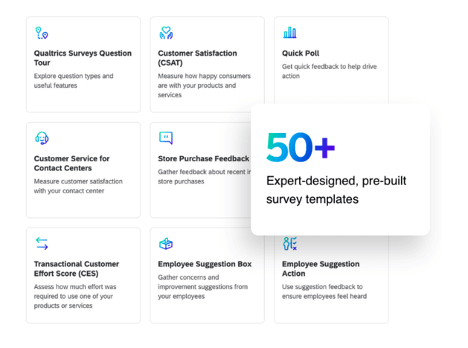

Whether you’re hoping to measure brand awareness, test a product/concept, or understand your target market better, we have a variety of market research survey templates you can customize to your industry.

Don’t blow your marketing budget on a campaign that isn’t going to land with your target audience. Instead, top-performing teams use market research surveys to A/B test ideas and storylines within their marketing materials before the big launch—and the results are worth the extra effort!

It can be a daunting task. Market research allows companies to make data-driven decisions to drive growth and innovation. What happens when you don’t do market research? Without market research, business decisions are based at best on past consumer behavior, economic indicators, or at worst, on gut feel.