What is Cost Assignment?

Share This...

Cost assignment.

Cost assignment is the process of associating costs with cost objects, such as products, services, departments, or projects. It encompasses the identification, measurement, and allocation of both direct and indirect costs to ensure a comprehensive understanding of the resources consumed by various cost objects within an organization. Cost assignment is a crucial aspect of cost accounting and management accounting, as it helps organizations make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

There are two main components of cost assignment:

- Direct cost assignment: Direct costs are those costs that can be specifically traced or identified with a particular cost object. Examples of direct costs include direct materials, such as raw materials used in manufacturing a product, and direct labor, such as the wages paid to workers directly involved in producing a product or providing a service. Direct cost assignment involves linking these costs directly to the relevant cost objects, typically through invoices, timesheets, or other documentation.

- Indirect cost assignment (Cost allocation): Indirect costs, also known as overhead or shared costs, are those costs that cannot be directly traced to a specific cost object or are not economically feasible to trace directly. Examples of indirect costs include rent, utilities, depreciation, insurance, and administrative expenses. Since indirect costs cannot be assigned directly to cost objects, organizations use various cost allocation methods to distribute these costs in a systematic and rational manner. Some common cost allocation methods include direct allocation, step-down allocation, reciprocal allocation, and activity-based costing (ABC).

In summary, cost assignment is the process of associating both direct and indirect costs with cost objects, such as products, services, departments, or projects. It plays a critical role in cost accounting and management accounting by providing organizations with the necessary information to make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

Example of Cost Assignment

Let’s consider an example of cost assignment at a bakery called “BreadHeaven” that produces two types of bread: white bread and whole wheat bread.

BreadHeaven incurs various direct and indirect costs to produce the bread. Here’s how the company would assign these costs to the two types of bread:

- Direct cost assignment:

Direct costs can be specifically traced to each type of bread. In this case, the direct costs include:

- Direct materials: BreadHeaven purchases flour, yeast, salt, and other ingredients required to make the bread. The cost of these ingredients can be directly traced to each type of bread.

- Direct labor: BreadHeaven employs bakers who are directly involved in making the bread. The wages paid to these bakers can be directly traced to each type of bread based on the time spent working on each bread type.

For example, if BreadHeaven spent $2,000 on direct materials and $1,500 on direct labor for white bread, and $3,000 on direct materials and $2,500 on direct labor for whole wheat bread, these costs would be directly assigned to each bread type.

- Indirect cost assignment (Cost allocation):

Indirect costs, such as rent, utilities, equipment maintenance, and administrative expenses, cannot be directly traced to each type of bread. BreadHeaven uses a cost allocation method to assign these costs to the two types of bread.

Suppose the total indirect costs for the month are $6,000. BreadHeaven decides to use the number of loaves produced as the allocation base , as it believes that indirect costs are driven by the production volume. During the month, the bakery produces 3,000 loaves of white bread and 2,000 loaves of whole wheat bread, totaling 5,000 loaves.

The allocation rate per loaf is:

Allocation Rate = Total Indirect Costs / Total Loaves Allocation Rate = $6,000 / 5,000 loaves = $1.20 per loaf

BreadHeaven allocates the indirect costs to each type of bread using the allocation rate and the number of loaves produced:

- White bread: 3,000 loaves × $1.20 per loaf = $3,600

- Whole wheat bread: 2,000 loaves × $1.20 per loaf = $2,400

After completing the cost assignment, BreadHeaven can determine the total costs for each type of bread:

- White bread: $2,000 (direct materials) + $1,500 (direct labor) + $3,600 (indirect costs) = $7,100

- Whole wheat bread: $3,000 (direct materials) + $2,500 (direct labor) + $2,400 (indirect costs) = $7,900

By assigning both direct and indirect costs to each type of bread, BreadHeaven gains a better understanding of the full cost of producing each bread type, which can inform pricing decisions, resource allocation, and performance evaluation.

Other Posts You'll Like...

TCP CPA Practice Questions Explained: Using Insurance to Mitigate Risk

5 High Impact CPA Study Strategies

TCP CPA Practice Questions Explained: Planning for Funding Post-Secondary Education

TCP CPA Practice Questions Explained: Municipal Bonds

How to Calculate Gains or Losses on the Disposal of Long-Lived Assets

TCP CPA Practice Questions Explained: Equity Securities and Corporate Bonds

Helpful links.

- Learn to Study "Strategically"

- How to Pass a Failed CPA Exam

- Samples of SFCPA Study Tools

- SuperfastCPA Podcast

How Melodie Passed Her CPA Exams by Making Every Morning Count

Inconsistent CPA Study? Try These 4 Strategies

When More Study Time Isn’t the Answer: How Thomas Passed His CPA Exams

How Ekta Passed Her CPA 6 Months Faster Than She Planned

2024 CPA Exams F.A.Q.s Answered

Want to pass as fast as possible, ( and avoid failing sections ), watch one of our free "study hacks" trainings for a free walkthrough of the superfastcpa study methods that have helped so many candidates pass their sections faster and avoid failing scores....

Make Your Study Process Easier and more effective with SuperfastCPA

Take Your CPA Exams with Confidence

- Free "Study Hacks" Training

- SuperfastCPA PRO Course

- SuperfastCPA Review Notes

- SuperfastCPA Audio Notes

- SuperfastCPA Quizzes

Get Started

- Free "Study Hacks Training"

- Read Reviews of SuperfastCPA

- Busy Candidate's Guide to Passing

- Subscribe to the Podcast

- Purchase Now

- Nate's Story

- Interviews with SFCPA Customers

- Our Study Methods

- SuperfastCPA Reviews

- CPA Score Release Dates

- The "Best" CPA Review Course

- Do You Really Need the CPA License?

- 7 Habits of Successful Candidates

- "Deep Work" & CPA Study

The Comprehensive Guide to Cost Allocation in Accounting

Accounting is a fascinating field, and cost allocation is one of the most important concepts in accounting. Whether you’re an accounting student or an accountant just starting out, it’s important to understand how to allocate costs.

In this comprehensive guide, we’ll cover everything from what it means to its pros and cons.

How Can Costs Be Allocated Among Departments or Product Lines When There Is No Clear Source?

Allocation is distributing costs among different departments or product lines in an organization. Trying to accurately estimate the cost of producing a good or rendering a service is a common challenge for many businesses.

This is especially true when there is no apparent source of the costs, as it requires the use of various techniques and methods to distribute the expenses fairly and reasonably.

What Is the Concept of Allocation?

Allocation (also known as “cost allocation”) is a process used to distribute the costs of a shared resource or expense among different departments, product lines, or activities within an organization.

This process is necessary to accurately determine the cost of producing a product, providing a service, or running a business. Allocation allows firms to identify the expenses incurred by each department or product line and helps make informed decisions about allocating resources.

The allocation concept has existed for centuries and is a fundamental part of modern accounting and financial management. The cost allocation process involves assigning costs to specific departments or product lines based on objective criteria, such as resource use or the benefit received from the expense.

The objective criteria used in the allocation process may vary depending on the type of business, but the goal is always to distribute the costs fairly and reasonably.

One of the main challenges of allocation is that many expenses cannot be traced directly to a specific department or product line. For example, the cost of electricity used to run a manufacturing plant cannot be directly traced to one particular product line.

In such cases, the cost of electricity must be allocated to different departments or product lines based on objective criteria, such as the number of hours each department uses the electricity or the production output of each product line.

There are different methods of allocation, each with its strengths and weaknesses. Some of the most common ways include direct allocation, step-down allocation, sequential allocation, and activity-based allocation. Each mode uses a different approach to allocating costs, but the goal is always to ensure that the costs are distributed fairly and reasonably.

What Doesn’t the Term Allocation Mean?

The term allocation” is commonly used in various contexts, such as finance, economics, project management, and resource management. However, it’s essential to understand that allocation ” doesn’t mean “equal distribution” or “uniform distribution” of resources.

Allocation refers to assigning a portion of resources, such as time, money, or labor, to specific tasks or activities. The goal of allocation is to optimize the use of resources to achieve the desired outcomes.

One of the most common misunderstandings about allocation is that it means dividing resources equally among tasks or activities. However, this is only sometimes the case. Resources are often not distributed evenly because different tasks or activities have different requirements and priorities.

For example, in project management, some jobs may require more time, money, or labor than others. In such cases, the project manager must allocate more resources to these critical tasks to ensure the project’s success.

Another misunderstanding about allocation is that it means distributing resources inflexibly and rigidly. Allocation is a flexible process that can be adjusted based on priorities or changes in resource availability. For example, in a business setting, the budget allocation may change based on market conditions or changes in customer demand. In these situations, the business must be able to reallocate its resources to respond to these changes.

The allocation also doesn’t mean that the resources are assigned once and never adjusted. Allocation is an ongoing process requiring constant monitoring and adjustments to ensure that resources are used optimally.

For example, in finance, the allocation of investments must be reviewed regularly to ensure that the portfolio is aligned with the investor’s goals and objectives.

Another misconception about allocation is that it only applies to tangible resources, such as money or equipment. However, allocation also applies to intangible resources like time and labor. These intangible resources are often more critical and limited than tangible ones. For example, allocating time is crucial in project management to ensure that projects are completed on time and within budget.

As you can see, allocation is a complex and flexible process that requires careful consideration of multiple factors, such as resource availability, priorities, and goals. It’s essential to understand that allocation doesn’t mean equal distribution or limited distribution of resources.

Instead, it’s a dynamic process that requires ongoing monitoring and adjustments to ensure the optimal use of resources. By avoiding common misconceptions about allocation, individuals and organizations can more effectively allocate their resources and achieve their desired outcomes.

Where the Term Allocation Originated From?

The word “allocation” comes from the Latin word “allocare.” The word allocation ” refers to setting aside or assigning a particular portion, amount, or portion of something for a specific purpose or recipient.

The allocation comes from the Latin prefix ad- (meaning “to”) and the noun loci (meaning “place”). The combination of these two words implies the idea of assigning a place, or portion of something, for a specific purpose.

In finance and economics, “allocation” refers to distributing resources, such as money, to different projects or initiatives based on their perceived importance and likelihood of success.

The allocation concept is ancient and can be traced back to the earliest civilizations, where resources were allocated based on the community’s needs. In early societies, central planning or direct control by the ruling class were common methods of allocation.

However, with the advent of market-based economies, the allocation has become more decentralized and is now primarily done through the market mechanism of supply and demand.

In modern economies, allocation is crucial in ensuring that resources are used efficiently and effectively. For example, in capital allocation, investors allocate their funds to different projects and businesses based on the perceived potential return on investment. This helps direct investment toward the most promising and profitable opportunities, thereby increasing the economy’s overall efficiency.

Similarly, prices play a crucial role in allocating goods and services in directing resources to where they are most needed. In a market economy, the interaction of supply and demand determines prices. When demand for a particular good or service is high, the price will increase, directing more resources toward its production. On the other hand, when demand is low, the price will decrease, reducing the allocation of resources to its production.

Government policies and regulations can also have an impact on allocation in addition to the market mechanism. For example, the government may allocate resources to specific sectors through funding or subsidies, such as education or healthcare.

Similarly, government regulations and taxes can also impact the allocation of resources by affecting the incentives for businesses and individuals to allocate their resources in a particular way.

How Allocation Relates to Accounting?

In accounting, allocation determines the cost of producing a product or providing a service. This information is then used to create accurate financial statements and make informed decisions about allocating resources in the future.

For example, a company may allocate resources to a new product line based on the expected revenue it will generate or distribute costs to specific departments based on their usage of resources.

The allocation also plays a crucial role in cost accounting . Cost accounting involves analyzing the cost of production, including direct and indirect costs, and using this information to make decisions about pricing and resource allocation.

By accurately allocating costs, a company can determine the actual cost of production and make informed decisions about pricing , production volume, and resource allocation.

In addition, allocation is used to allocate the costs of long-term assets, such as property, plant, and equipment. This is done through the process of depreciation, which is a systematic allocation of the cost of an asset over its useful life. Depreciation is used to determine the value of an investment for financial reporting purposes and the amount of tax that a company must pay.

Finally, allocation is also used in the budgeting process. In budgeting, an organization allocates resources to various departments and activities based on their priorities and goals. By accurately allocating resources, a company can ensure that it has enough resources to meet its goals and objectives while staying within its budget.

3 Examples of Allocation Being Used in Accounting Practice

Example #1 of allocation being used in accounting practice.

Allocating the Cost of Goods Sold In accounting, “cost of goods sold” (COGS) refers to the direct costs associated with producing a product or providing a service. These costs include the raw materials, labor, and overhead expenses incurred to produce the goods. COGS is crucial in determining a company’s gross profit because it represents the cost of producing and selling a product.

One example of allocation in accounting practice is when a company allocates the cost of goods sold to each product. This is done to understand the cost of producing each product and identify the most profitable products.

The allocation process involves dividing the total COGS by the number of units sold to arrive at an average cost per unit. This average cost per unit is then applied to each unit of product sold to determine the COGS for that specific product.

This allocation process is vital because it allows the company to accurately determine the cost of producing each product. This information is then used to make informed business decisions such as pricing strategies, production decisions, and cost control measures.

For example, suppose a company realizes that the cost of producing one product is much higher than the cost of producing another. In that case, it may choose to discontinue the higher-cost product or find ways to reduce the cost of production.

Example #2 of Allocation Being Used in Accounting Practice

One example of allocation in accounting practice is allocating indirect costs to different departments or products within a company. Indirect costs, such as rent, utilities, and office supplies, cannot be directly traced to a specific product or department. These costs must be allocated among different departments or products to calculate the cost of each accurately.

For example, consider a manufacturing company with three departments: production, research and development, and administration. The company has a total indirect cost of $100,000 for the year, which includes rent, utilities, and office supplies.

The company might determine the proportion of space each department uses to allocate these costs. If production uses 40% of the total space, R&D uses 30%, and administration uses 30%, the company would allocate 40% of the indirect costs to production, 30% to R&D, and 30% to administration.

Next, the company might allocate indirect costs based on the number of employees in each department. If production has 20 employees, R&D has 15, and administration has 10, the company would allocate indirect costs based on the ratio of employees in each department.

In this example, production would receive 40% of the indirect costs, R&D would receive 30%, and administration would receive 30%.

Finally, the company might allocate indirect costs based on the number of products produced in each department. If production produces 1000 products, R&D produces 500, and administration produces none, the company would allocate indirect costs based on the ratio of products produced in each department.

In this example, production would receive 67% of the indirect costs, R&D would receive 25%, and administration would receive 8%.

Example #3 of Allocation Being Used in Accounting Practice

Suppose a manufacturing company produces two products: Product A and Product B. To determine the cost of each product, the company must allocate the factory overhead costs, including utilities, rent, maintenance, and supplies, among other expenses. The overhead costs must be assigned to each product based on the proportion of total machine hours used to produce each product.

For example, if the company uses 60% of the total machine hours to produce Product A and 40% to produce Product B, then 60% of the factory overhead costs would be allocated to Product A and 40% to Product B. The company would then use the allocated overhead costs and the direct costs of material and labor to calculate the total cost of each product.

The allocation of overhead costs to each product is critical for the company to accurately determine the cost of goods sold and price its products competitively. The company can use an allocation method to ensure a fair and accurate picture of the costs of producing each product.

How to Do Cost Allocation in Simple Steps?

Cost allocation can be complex, but it doesn’t have to be. Here are five simple steps for cost allocation:

Step 1: Identify the Costs That Need to Be Allocated

The first step in cost allocation is identifying the costs that need to be allocated. This includes both direct and indirect costs. Direct costs can be easily traced to specific products or services, while indirect costs, such as rent and utilities, cannot.

Step 2: Choose the Appropriate Method of Cost Allocation

Once you have identified the costs that need to be allocated, the next step is to choose the appropriate cost allocation method. The most common methods include direct cost allocation, step-down allocation, sequential allocation, and activity-based costing. The method chosen will depend on the nature of the costs and the objectives of the cost allocation process.

Step 3: Determine the Allocation Base

The allocation base is the basis on which the costs will be allocated. This can be the number of units produced, the number of employees, or any other relevant factor that can be used to determine the cost of goods or services.

Step 4: Allocate the Costs

Once you have determined the allocation base, the next step is to allocate the costs. This can be done by dividing the total cost by the number of units, employees, or another relevant factor and multiplying this by the number of units, employees, or another relevant factor for each product, service, or department.

Step 5: Review and Adjust the Cost Allocation

Once the costs have been allocated, the final step is to review and adjust the cost allocation as necessary. This may involve reallocating costs based on new information or changes in the business.

Which Industries Can Cost Allocation Be Applied?

With the proper guidance, cost allocation can be applied to almost any industry. It’s all about the data you have and how you use it.

Let’s take a look at some of the industries that could benefit from cost allocation:

The healthcare industry is one of the most expensive in the world. It is also one of the most heavily regulated. These factors make cost allocation a necessity for many healthcare providers.

Healthcare organizations have many different costs, but the most significant sources are labor and supplies. Labor costs can be very high in this industry because it requires highly skilled people to perform various tasks, including surgery, patient care, and patient education. Supplies like bandages and IV bags are also expensive because they have to be sterile and meet regulatory requirements.

A hospital’s supply department has much control over its budget, but it also has little control over what happens in other departments, such as surgery or patient care. This makes it difficult to allocate costs accurately when they don’t know how much they will spend on supplies or how many patients they’ll see each year.

Cost allocation helps solve these problems by allowing managers to see which departments are consuming the most resources. They can adjust accordingly without guessing what’s happening behind closed doors (or behind locked doors).

Manufacturing

The manufacturing industry is one of the most common places where cost allocation can be applied. In this industry, it is crucial to know how much it costs to make each product and how much it costs to produce goods (including materials and labor) for sale.

With this information, manufacturers can determine how much they need to charge for their products to cover all of their expenses, including overhead costs like rent or electricity bills.

Cost allocation can also help manufacturers determine which products are more profitable than others so that they can focus on those areas instead of wasting time and money on less popular lines of goods. For example, suppose a company produces clothing and electronics but finds its clothing line more popular among consumers than its electronics line.

In that case, it may want to stop producing electronics altogether because there would need to be more demand for these products for them to make any money off of them.

This is an industry that benefits from cost allocation. Energy companies have long been able to allocate costs to different projects and branches, but they often face challenges when assigning overhead expenses. That’s because overhead costs are shared among the company’s functions, making them difficult to track.

Cost allocation software can help energy companies assign overhead expenses in a way that makes sense for each project or branch. The software also allows them to better understand where their money is going and gives them more flexibility in budgeting and forecasting future expenses.

Retailers are a great example of an industry that can benefit from cost allocation.

Retailers are often sold on the idea of one-stop shopping: you go to a store and buy everything you need, from clothing to food to furniture. But in reality, there are many different types of retailers, such as grocery stores, department stores, clothing stores, etc. And each has its own distinct set of costs for running that type of business. So how do these retailers know how much each product line contributes to their overall profits? They use cost allocation.

Cost allocation is a technique for allocating overhead costs across product lines based on their relative importance to the company’s overall performance. This way, retailers can determine which products contribute most (or least) to their bottom line and make decisions accordingly.

Information Technology

Information technology (IT) is one of the most significant cost allocation areas. IT costs are often divided into two categories: direct costs and indirect costs. The former refers to those costs that can be directly attributed to a particular project or product, while the latter refers to those costs that cannot be directly attributed.

Cost allocation in IT has many benefits. It helps managers determine how much it costs to develop a new product or service and where inefficiencies lie in their IT departments.

It also allows them to understand better how much revenue they’re generating from each product or service line, which will help them make better decisions about future investments in the company’s infrastructure.

Construction

This is one of the most apparent industries to apply cost allocation. Construction projects are often massive and complex, with many different stakeholders involved in the planning, execution, and completion of a project. It’s common for construction projects to have hundreds or thousands of contracts with hundreds or thousands of different suppliers.

Cost allocation helps ensure that those involved in the project are paid what they’re owed without overpaying anyone else who participated. It’s also used to ensure that a company only spends a little money on a project by ensuring that every expense is only charged once.

Transportation

This is the industry that can benefit the most from cost allocation.

Transportation has many parts that must work in unison to transport goods or passengers. It can be difficult to determine which part of a vehicle’s operation should be allocated to specific parts, and it usually requires a lot of math.

Cost allocation can make it easier for companies in this industry to understand which parts are costing them more than they expected so that they can make changes accordingly.

Food and Beverage

Food and beverage companies can benefit significantly from cost allocation. These companies are typically comprised of many different departments that must be managed to ensure the entire business runs smoothly. Each department has specific costs that it incurs, so allocating those costs among all of the departments will help you understand where your money is going and how it can be used most effectively.

Cost allocation is also helpful when dealing with food or beverage products because it allows you to track the costs associated with each product line and make sure you profit on every product line. This way, you know what kinds of products are selling well, which ones aren’t selling as well, and how much money each product line has made for your company.

Real Estate

This is one of the most common industries to use cost allocation methods. Real estate developers often create multiple project phases, which must be accounted for separately. The costs of these phases are usually allocated to determine how much profit (or loss) will be made in each phase.

This lets developers decide which phases should be completed first and what incentives may be offered to convince buyers to purchase units from those phases.

Utilities are another excellent example of an industry where cost allocation can be used.

They must deal with various costs, including purchasing raw materials, paying for labor, and buying equipment. The type of utility and the sector it operates in determine the cost of each of these. For example, a water utility may have very high costs for purchasing raw materials but low costs for labor and employee benefits because they only need a few employees or benefit packages.

Cost allocation can help utilities determine how much money they should spend on each part of their business so that they’re not overspending on one part while underinvesting in another.

Pros of Cost Allocation

Cost allocation is a common business practice. Companies use it to help determine the profitability of individual products, services, and departments within a company. Here are the pros of cost allocation:

Improved Decision Making

Cost allocation helps businesses make informed decisions by accurately determining the cost of goods or services. Companies can make informed decisions on pricing, production, and marketing strategies with a better understanding of the costs associated with producing a product or offering a service.

Better Resource Allocation

Cost allocation helps businesses to determine the costs associated with different departments, products, or services. This information can then be used to allocate resources more efficiently and allocate more resources to more profitable areas.

Increased Profitability

By allocating costs accurately, businesses can identify less profitable areas and make changes to improve profitability. This could involve reducing costs, improving efficiency, or adjusting pricing.

Better Budget Planning

Cost allocation helps businesses to create more accurate budgets. Companies can plan their budgets more effectively as they understand the costs associated with each product, service, or department.

Improved Internal Control

Cost allocation helps businesses to maintain better internal control over their operations. By allocating costs accurately, companies can track expenses and identify improvement areas. This helps to prevent fraud and embezzlement and increases accountability within the company.

Better Understanding of Overhead Costs

Overhead costs can be challenging to understand and allocate accurately. Cost allocation helps businesses to understand these costs better and allocate them to the proper departments or products. This allows companies to make informed decisions on pricing and production.

Improved Cost Reporting

Cost allocation helps businesses to produce more accurate cost reports. This allows companies to make informed pricing, production, and marketing strategies decisions. Cost reports are also essential for tax purposes and to meet regulatory requirements.

Better Negotiations

Cost allocation helps businesses to understand their costs better, which can be used in negotiations with suppliers and customers. Companies can better understand costs and negotiate better prices, terms, and conditions with suppliers and customers. This helps businesses to maintain better relationships and increase profitability.

Cons of Cost Allocation

Cost allocation can be an excellent tool for helping you understand where your money is going and how to save it, but this method has some drawbacks.

Time-Consuming Process

Cost allocation can be time-consuming and requires significant effort from various departments within the company. This can divert resources from other important tasks and may slow down other processes.

Increased Complexity

Cost allocation can be complex, especially for large organizations with multiple departments and products. This complexity can result in errors and misunderstandings, negatively impacting the accuracy of cost reports and other important financial information.

Implementing a cost allocation system can be expensive and require a significant investment in technology, software, and training. This cost can be a barrier for smaller organizations or those with limited resources.

Unreliable Data

Cost allocation is only as accurate as the data used in the process. Poor quality data, errors in data entry, and outdated data can all result in inaccurate cost reports and inefficient resource allocation.

Resistance to Change

Some employees may resist implementing a cost allocation system, especially if they feel the process may negatively impact their department or lead to job loss.

Limited Flexibility

Cost allocation systems are often rigid and lack the flexibility to adapt to changes in business conditions. This can result in inefficiencies and limit the ability of the company to respond to new opportunities or challenges.

Potential for Misallocation

If not implemented correctly, cost allocation can misallocate costs, negatively impacting decision-making and profitability.

Dependence on Cost Allocation

Overreliance on cost allocation can lead to a lack of creativity and initiative within departments. Employees may become too focused on cost allocation and need to be more focused on driving innovation and growth for the company. This can limit the ability of the company to adapt to changing market conditions.

Frequently Asked Questions- Cost Allocation in Accounting

What are the main objectives of cost allocation.

The main objectives of cost allocation are to accurately determine the cost of goods or services, improve resource allocation, increase profitability, create more accurate budgets, improve internal control, and provide better cost reporting.

What Is Direct Cost Allocation?

Direct cost allocation refers to assigning costs directly to specific products or services. This method is used when the costs can be easily traced to specific business areas.

What Is Step-Down Allocation?

Step-down allocation refers to allocating costs from one department to another department or product. This method is used when costs cannot be directly traced to specific products or services.

What Is Sequential Allocation?

Sequential allocation refers to allocating costs based on the sequence in which they are incurred. This method is used when costs cannot be directly traced to specific products or services.

What Is Activity-Based Costing?

Activity-based costing refers to allocating costs based on the activities involved in producing a product or offering a service. This method is used when multiple activities are involved in creating a product or service.

Why Is Cost Allocation Important for Businesses?

Cost allocation is essential for businesses as it helps them understand the costs associated with each business area and make informed pricing, production, and resource allocation decisions. This leads to improved profitability and better resource allocation.

How Does Cost Allocation Impact Resource Allocation?

Cost allocation helps companies determine the costs associated with each department, product, or service, which are used to allocate resources more efficiently. By allocating resources based on accurate cost

How Does Cost Allocation Impact Pricing Decisions?

Cost allocation helps companies understand the costs associated with each product or service used to make informed pricing decisions. By accurately determining the cost of goods or services, companies can ensure that their pricing is based on a solid understanding of the costs involved.

The Comprehensive Guide to Cost Allocation in Accounting – Conclusion

Allocation of costs is a critical component of any business. By allocating costs, you can ensure that your company makes the best use of its resources and operates efficiently.

The ability to allocate costs allows you to make strategic decisions about your business’s operations and management and take appropriate actions regarding financial reporting.

The Comprehensive Guide to Cost Allocation in Accounting – Recommended Reading

Corporate Accountant: What Are the Responsibilities, Duties, & Salary of a Corporate Accountant?

How Can Business Intelligence Help with Budget Planning (in 2023)

Standard Costing- Common Problems (And How to Solve Them)

Updated: 5/19/2023

Meet The Author

Danica De Vera

Related posts.

The Price of Happiness: Examining Trade-Offs Between Wealth and Well-Being

In today’s society, the pursuit of wealth often leads to trade-offs in well-being. True contentment encompasses mental, emotional, and physical health, purpose, and relationships. Wealth does not guarantee happiness and can impact mental health, relationships, and sustainable living. Balancing wealth with well-being results in a more fulfilling life.

How Can Diversity of Thought Lead to Good Ethical Decisions?

Diversity of thought, or cognitive diversity, encompasses varied perspectives and beliefs. Embracing this diversity leads to better ethical decision-making by broadening perspectives, enhancing critical thinking, mitigating groupthink, fostering cultural competence, strengthening stakeholder engagement, promoting ethical leadership, improving risk management, and fostering employee engagement.

The 26 Most Influential Leadership Quotes from Silicon Valley Icons

Silicon Valley, a hotbed of innovation and entrepreneurship, is driven by a unique culture of risk-taking, an abundant talent pool, access to capital, and a strong sense of community. The region’s success is propelled by visionary leadership, resilience, innovation, risk-taking, and customer-centric approaches.

Subscribe to discover my secrets to success. Get 3 valuable downloads, free exclusive tips, offers, and discounts that we only share with my email subscribers.

Social media.

Quick links

- Terms of Service

Other Pages

Contact indo.

- 302-981-1733

- [email protected]

© Accounting Professor 2023. All rights reserved

Discover more from accounting professor.org.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

Cost Allocation

Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets. Start Free

What is Cost Allocation?

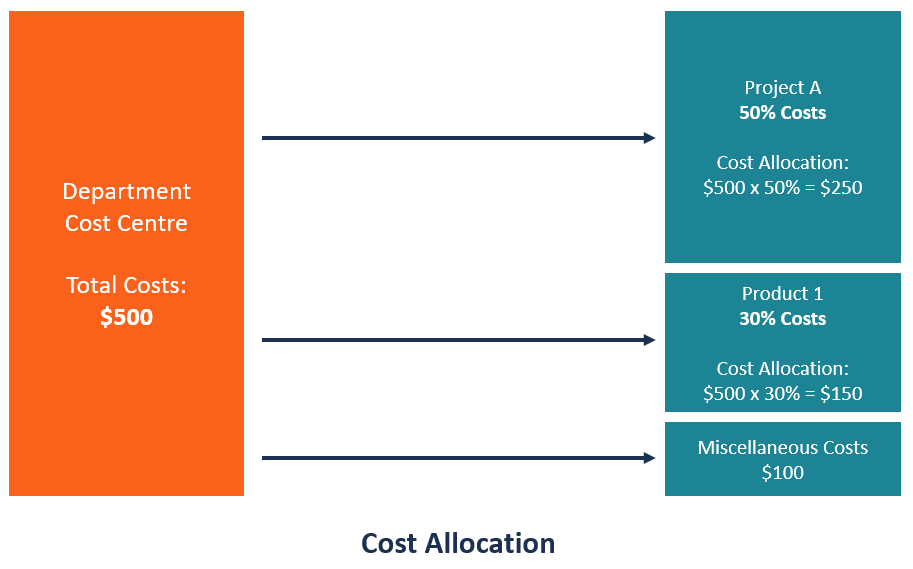

Cost allocation is the process of identifying, accumulating, and assigning costs to costs objects such as departments, products, programs, or a branch of a company. It involves identifying the cost objects in a company, identifying the costs incurred by the cost objects, and then assigning the costs to the cost objects based on specific criteria.

When costs are allocated in the right way, the business is able to trace the specific cost objects that are making profits or losses for the company. If costs are allocated to the wrong cost objects, the company may be assigning resources to cost objects that do not yield as much profits as expected.

Types of Costs

There are several types of costs that an organization must define before allocating costs to their specific cost objects. These costs include:

1. Direct costs

Direct costs are costs that can be attributed to a specific product or service, and they do not need to be allocated to the specific cost object. It is because the organization knows what expenses go to the specific departments that generate profits and the costs incurred in producing specific products or services . For example, the salaries paid to factory workers assigned to a specific division is known and does not need to be allocated again to that division.

2. Indirect costs

Indirect costs are costs that are not directly related to a specific cost object like a function, product, or department. They are costs that are needed for the sake of the company’s operations and health. Some common examples of indirect costs include security costs, administration costs, etc. The costs are first identified, pooled, and then allocated to specific cost objects within the organization.

Indirect costs can be divided into fixed and variable costs. Fixed costs are costs that are fixed for a specific product or department. An example of a fixed cost is the remuneration of a project supervisor assigned to a specific division. The other category of indirect cost is variable costs, which vary with the level of output. Indirect costs increase or decrease with changes in the level of output.

3. Overhead costs

Overhead costs are indirect costs that are not part of manufacturing costs. They are not related to the labor or material costs that are incurred in the production of goods or services. They support the production or selling processes of the goods or services. Overhead costs are charged to the expense account, and they must be continually paid regardless of whether the company is selling goods or not.

Some common examples of overhead costs are rental expenses, utilities, insurance, postage and printing, administrative and legal expenses , and research and development costs.

Cost Allocation Mechanism

The following are the main steps involved when allocating costs to cost objects:

1. Identify cost objects

The first step when allocating costs is to identify the cost objects for which the organization needs to separately estimate the associated cost. Identifying specific cost objects is important because they are the drivers of the business, and decisions are made with them in mind.

The cost object can be a brand , project, product line, division/department, or a branch of the company. The company should also determine the cost allocation base, which is the basis that it uses to allocate the costs to cost objects.

2. Accumulate costs into a cost pool

After identifying the cost objects, the next step is to accumulate the costs into a cost pool, pending allocation to the cost objects. When accumulating costs, you can create several categories where the costs will be pooled based on the cost allocation base used. Some examples of cost pools include electricity usage, water usage, square footage, insurance, rent expenses , fuel consumption, and motor vehicle maintenance.

What is a Cost Driver?

A cost driver causes a change in the cost associated with an activity. Some examples of cost drivers include the number of machine-hours, the number of direct labor hours worked, the number of payments processed, the number of purchase orders, and the number of invoices sent to customers.

Benefits of Cost Allocation

The following are some of the reasons why cost allocation is important to an organization:

1. Assists in the decision-making process

Cost allocation provides the management with important data about cost utilization that they can use in making decisions. It shows the cost objects that take up most of the costs and helps determine if the departments or products are profitable enough to justify the costs allocated. For unprofitable cost objects, the company’s management can cut the costs allocated and divert the money to other more profitable cost objects.

2. Helps evaluate and motivate staff

Cost allocation helps determine if specific departments are profitable or not. If the cost object is not profitable, the company can evaluate the performance of the staff members to determine if a decline in productivity is the cause of the non-profitability of the cost objects.

On the other hand, if the company recognizes and rewards a specific department for achieving the highest profitability in the company, the employees assigned to that department will be motivated to work hard and continue with their good performance.

Additional Resources

Thank you for reading CFI’s guide to Cost Allocation. In order to help you become a world-class financial analyst and advance your career to your fullest potential, these additional resources will be very helpful:

- Break-Even Analysis

- Cost of Production

- Fixed and Variable Costs

- Projecting Income Statement Line Items

- See all accounting resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Cost Allocation – Meaning, Importance, Process and More

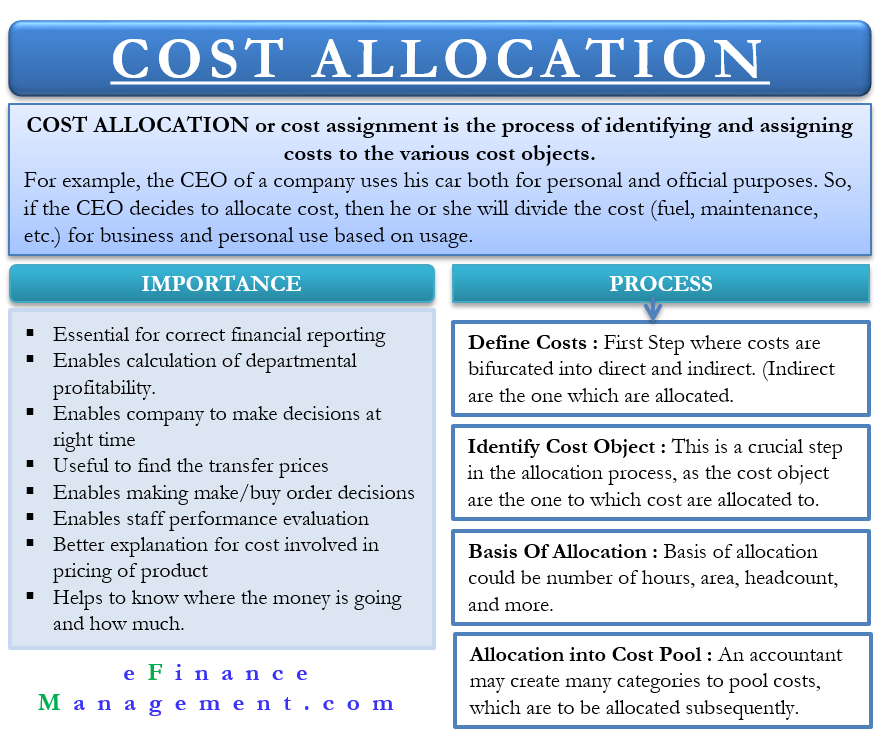

Cost Allocation or cost assignment is the process of identifying and assigning costs to the various cost objects. These cost objects could be those for which the company needs to find out the cost separately. A few examples of cost objects can be a product, customer, project, department, and so on.

The need for cost allocation arises because some costs are not directly attributable to the particular cost object. In other words, these costs are incurred for various objects, and then the sum is split and allocated to multiple cost objects. These costs are generally indirect. Since these costs are not directly traceable, an accountant uses their due diligence to allocate these costs in the best possible way. It results in an allocation that could be partially arbitrary, and thus, many refer cost allocation exercise as the spreading of a cost.

Examples of Cost Allocation

- Cost Allocation – Importance

Cost Allocation Method

Define costs, identify cost objects, basis of allocation, accumulate costs into cost pool.

For example, a company’s CEO uses his car for personal and official purposes. So, if the CEO decides to allocate costs, then they will divide the cost (fuel, maintenance, etc.) for business and personal use based on usage.

The following examples will help us understand the cost allocation concept better:

- A company has a building in which there are various departments. One can allocate depreciation costs to the department on the basis square ft area of each department. This cost will then be further assigned to the products on which the department works.

- An accountant can attribute electricity that a production facility consumes to different departments. Then the accountant can assign the department’s electricity cost to the products that the department works on.

- An employee works on three products for a month. To attribute their salary to three products, an accountant can use the number of hours the employee gave to each product.

Cost Allocation – Importance

The following points reflect the importance of allocating costs:

- Allocating cost is essential for financial reporting, i.e., to correctly assign the cost among the cost objects.

- It allows the company to calculate the true profitability of the department or function. This profitability could serve as the basis for making further decisions for that department or service.

- If cost allocation is correct, it allows the business to identify and understand the costs at each stage and their impact on the profit or loss. On the other hand, if the allocation is incorrect, the company may end up making wrong or inconsistent decisions concerning the distribution of resources amongst various cost objects.

- The concept is also useful for finding the transfer prices when there is a transaction between subsidiaries.

- It helps a company make better economic decisions, such as whether or not to accept a new order.

- One can also use the concept to evaluate the performance of the staff.

- It helps in better explaining to the customers the costs that went into the pricing of a product or service.

- Allocation cost helps a company know where the money is going and how much. It will assist the company in using the resources effectively. Pool costs, if not allocated, may give an unbalanced view of the cost of various objects.

As such, there is no specific method to allocate costs. So, an accountant needs to use his or her due diligence to assign a cost to the cost object. Of course, they are considering the practice adopted in a similar industry. For instance, the accountant may decide to allocate expenses based on headcount, area, weightage, and so on.

Also Read: Cost Object – Meaning, Advantages, Types and More

Irrespective of the method an accountant uses, their objective should be to allocate the cost as fairly as possible. Or to allocate cost in a way that is in line with the nature of the cost object. Or to lower the arbitrariness in awarding costs.

Several efforts are underway to better cost allocation techniques. For instance, the overhead allocation for manufacturers, which was on plant-wide rates, is now based on departmental standards. Also, accountants use machine hours instead of direct labor hours for allocation.

Moreover, some accountants are also implementing activity-based costing to better the allocation. So, there can be several ways to allocate costs. But, whatever form the company selects, it is essential to document the reasons backing that method, and that need to be followed consistently for several periods.

A company can ensure documentation by developing allocation formulas or tables. Moreover, if a company wants, it can also pass supporting journal entries to transfer costs to the cost objects or do it via the chargeback module in the ERP system.

Also Read: Cost Hierarchy – Meaning, Levels and Example

Nowadays, cost allocation systems are available to assist in cost allocation. Such systems track the entity that produces the goods or services and the body that consumes those goods or services. The system also identifies the basis to distribute the cost.

The process to Allocate cost

As said above, there are no specific methods for allocating costs. Similarly, there is no particular process for it, as well. However, the process we are detailing is one of the most popular, and many companies use it for allocating costs. Following is the process:

Before allocating the cost, a company must define the various types of costs. Generally, there are three types of costs – direct, indirect, and overhead. Direct costs are those that one can easily attribute to a product or service, such as wages to factory workers or raw material for the specific product.

Indirect costs are ones that a company needs to incur for its operations, such as administration costs. Primarily, these are the costs that a company needs to allocate as it is difficult to attribute them directly to a product or service or any other cost object.

Another type of cost is an overhead cost , which is also an indirect cost. These costs are incurred for the production and selling of goods or services. Such costs do not vary based on production or sales. A company needs to pay them even if it is not producing or selling anything. Research and development costs, rent, etc., are good examples of such a cost.

The company or the accountant must know the cost objects for which they need to allocate the cost. It is crucial as we can’t assign costs to something on which we have no information. A cost object could be the product, customer, region, department, etc.

Along with the cost object , the company must also determine the basis on which it would allocate the cost. This basis could be the number of hours, area, headcount, and more. For example, if headcount is the basis of allocation for insurance costs and a company has 500 employees, then the department with 100 employees will account for 20% of the insurance cost. Experts recommend choosing a cost allocation base that is a crucial cost driver as well.

A cost driver is a variable whose increase or decrease leads to an increase or decrease in the cost as well. For instance, the number of purchase orders could be a cost driver for the cost of the purchasing department.

An accountant may create many categories to pool costs, which are to be allocated subsequently. It is the account head where the costs should be accumulated before assigning them to the cost objects. Cost pools can be insurance, fuel consumption, electricity, rent, depreciation, etc. The selection of the cost pool primarily depends on the use of the cost allocation base.

Continue reading – Costing Terms .

RELATED POSTS

- Cost Structure

- Types of Costs and their Classification

- Cost Accounting and Management Accounting

- Types of Cost Accounting

- Cost Accumulation: Meaning, Types, and More

- Types of Costing

Sanjay Bulaki Borad

MBA-Finance, CMA, CS, Insolvency Professional, B'Com

Sanjay Borad, Founder of eFinanceManagement, is a Management Consultant with 7 years of MNC experience and 11 years in Consultancy. He caters to clients with turnovers from 200 Million to 12,000 Million, including listed entities, and has vast industry experience in over 20 sectors. Additionally, he serves as a visiting faculty for Finance and Costing in MBA Colleges and CA, CMA Coaching Classes.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Sign me up for the newsletter!

Module 5: Job Order Costing

Introduction to accumulating and assigning costs, what you will learn to do: assign costs to jobs.

Financial and managerial accountants record costs of production in an account called Work in Process. The total of these direct materials, direct labor, and factory overhead costs equal the cost of producing the item.

In order to understand the accounting process, here is a quick review of how financial accountants record transactions:

Let’s take as simple an example as possible. Jackie Ma has decided to make high-end custom skateboards. She starts her business on July 1 by filing the proper forms with the state and then opening a checking account in the name of her new business, MaBoards. She transfers $150,000 from her retirement account into the business account and records it in a journal as follows:

| Date | Account/Explanation | Debit | Credit |

|---|---|---|---|

| Jul 01 | Checking Account | 150,000 | |

| Owner’s Capital | 150,000 | ||

For purposes of this ongoing example, we’ll ignore pennies and dollar signs, and we’ll also ignore selling, general, and administrative costs.

After Jackie writes the journal entry, she posts it to a ledger that currently has only two accounts: Checking Account, and Owner’s Capital.

Debits are entries on the left side of the account, and credits are entries on the right side.

Here is a quick review of debits and credits:

You can view the transcript for “Colin Dodds – Debit Credit Theory (Accounting Rap Song)” here (opens in new window) .

Also, this system of debits and credits is based on the following accounting equation:

Assets = Liabilities + Equity.

- Assets are resources that the company owns

- Liabilities are debts

- Equity is the amount of assets left over after all debts are paid

Let’s look at one more initial transaction before we dive into recording and accumulating direct costs such as materials and labor.

Jackie finds the perfect building for her new business; an old woodworking shop that has most of the equipment she will need. She writes a check from her new business account in the amount of $2,500 for July rent. Because she took managerial accounting in college, she determines this to be an indirect product expense, so she records it as Factory Overhead following a three-step process:

- Analyze transaction

Because her entire facility is devoted to production, she determines that the rent expense is factory overhead.

2. Journalize transaction using debits and credits

If she is using QuickBooks ® or other accounting software, when she enters the transaction into the system, the software will create the journal entry. In any case, whether she does it by hand or computer, the entry will look much like this:

| Date | Account/Explanation | Debit | Credit |

|---|---|---|---|

| Jul 03 | Factory Overhead | 2,500 | |

| Checking Account | 2,500 | ||

3. Post to the ledger

Again, her computer software will post the journal entry to the ledger, but we will follow this example using a visual system accountants call T-accounts. The T-account is an abbreviated ledger. Click here to view a more detailed example of a ledger .

Jackie posts her journal entry to the ledger (T-accounts here).

She now has three accounts: Checking Account, Owner’s Capital, and Factory Overhead, and the company ledger looks like this:

In a retail business, rent, salaries, insurance, and other operating costs are categorized into accounts classified as expenses. In a manufacturing business, some costs are classified as product costs while others are classified as period costs (selling, general, and administrative).

We’ll treat factory overhead as an expense for now, which is ultimately a sub-category of Owner’s Equity, so our accounting equation now looks like this:

Assets = Liabilities + Owner’s Equity

147,500 = 150,000 – 2,500

Notice that debits offset credits and vice versa. The balance in the checking account is the original deposit of $150,000, less the check written for $2,500. Once the check clears, if Jackie checks her account online, she’ll see that her ledger balance and the balance the bank reports will be the same.

Here is a summary of the rules of debits and credits:

Assets = increased by a debit, decreased by a credit

Liabilities = increased by a credit, decreased by a debit

Owner’s Equity = increased by a credit, decreased by a debit

Revenues increase owner’s equity, therefore an individual revenue account is increased by a credit, decreased by a debit

Expenses decrease owner’s equity, therefore an individual expense account is increased by a debit, decreased by a credit

Here’s Colin Dodds’s Accounting Rap Song again to help you remember the rules of debits and credits:

Let’s continue to explore job costing now by using this accounting system to assign and accumulate direct and indirect costs for each project.

When you are done with this section, you will be able to:

- Record direct materials and direct labor for a job

- Record allocated manufacturing overhead

- Prepare a job cost record

Learning Activities

The learning activities for this section include the following:

- Reading: Direct Costs

- Self Check: Direct Costs

- Reading: Allocated Overhead

- Self Check: Allocated Overhead

- Reading: Subsidiary Ledgers and Records

- Self Check: Subsidiary Ledgers and Records

- Introduction to Accumulating and Assigning Costs. Authored by : Joseph Cooke. Provided by : Lumen Learning. License : CC BY: Attribution

- Colin Dodds - Debit Credit Theory (Accounting Rap Song). Authored by : Mr. Colin Dodds. Located at : https://youtu.be/j71Kmxv7smk . License : All Rights Reserved . License Terms : Standard YouTube License

- What the General Ledger Can Tell You About Your Business. Authored by : Mary Girsch-Bock. Located at : https://www.fool.com/the-blueprint/general-ledger/ . License : All Rights Reserved . License Terms : Standard YouTube License

Privacy Policy

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

2.4: Process Costing (Weighted Average)

- Last updated

- Save as PDF

- Page ID 65677

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

Process Costing consists of the following steps:

- Physical flow of units

- Equivalent Units of Production

- Cost per Equivalent Unit

- Assign Costs to Units completed and Ending work in process inventory

- Reconcile Costs

Keep in mind, there are no Generally Accepted Accounting Principles (GAAP) that mandate how we must do a process cost report. We will focus on the calculations involved and show you an example of a process cost summary report but know there are several ways to present the information, but the calculations are all the same.

In the previous page, we discussed the physical flow of units (step 1) and how to calculate equivalent units of production (step 2) under the weighted average method. We will continue the discussion under the weighted average method and calculate a cost per equivalent unit.

Step 3: Cost per Equivalent Unit

The formula we will use is notice we are primarily using the dollar costs and not units for this section (except we will use TOTAL equivalent units we calculated in the previous section):

| Beg. Work in Process Costs |

| + Costs added this period |

| = Total Costs |

| ÷ Total Equivalent Units |

| = Cost per Equivalent Units |

We will calculate a cost per equivalent unit for each cost element (direct materials and conversion costs (or direct labor and overhead).

A YouTube element has been excluded from this version of the text. You can view it online here: http://pb.libretexts.org/ma/?p=74

Example – Jax Company

To continue with our previous example, we were given the following information:

| The June production and cost data for Jax Company are: | |

| Beginning work in process | -0- |

| Units started this period | 11,000 |

| Units completed and transferred | 9,000 |

| Ending work in process units | 2,000 |

| Direct materials cost | $ 1,100 |

| Direct labor cost | $ 2,880 |

| Applied overhead cost | $ 8,880 |

We calculated total equivalent units of 11,000 units for materials and 9,800 for conversion.

To calculate cost per equivalent unit by taking the total costs (both beginning work in process and costs added this period) and divide by the total equivalent units.

| Materials | Conversion | |

| Beg. Work in Process Costs | -0- | -0- |

| + Costs added this period | $ 1,100 | $ 11,760 |

| (Conv. Cost = DL $2,880 + OH $8,880) | ||

| = Total Costs | $ 1,100 | $ 11,760 |

| ÷ Total Equivalent Units | 11,000 | 9,800 |

| = Cost per Equivalent Units | $ 0.10 | $ 1.20 |

In this example, beginning work in process is zero. This will not always be the case. The problem will provide the information related to beginning work in process inventory costs and units.

Step 4: Assign Costs

In this next section, we will combine the equivalent units (from step 2) and the cost per equivalent units (step 3) to assign costs to units completed and transferred out (also called cost of goods manufactured) and costs of units remaining ending work in process inventory. The basic formula to assign costs is:

|

|

Using the example company, Jax Company, we have the following information:

| Units Completed and Transferred | 9,000 | 9,000 |

| Units in Ending WIP | 2,000 | 800 |

| Total Equivalent Units | 11,000 | 9,800 |

| Cost per Equivalent Units | $ 0.10 | $ 1.20 |

We would assign costs as follows:

| Direct Materials (9,000 equiv units x $0.10) | $ 900 | |

| Conversion (9,000 equiv units x $1.20) | 10,800 | |

| Total cost assigned to units completed | $ 11,700 | |

| Direct Materials (2,000 equiv units x $0.10) | 200 | |

| Conversion (800 equiv units x $1.20) | 960 | |

| Total cost assigned to ending work in process inventory | $ 1,160 |

For costs of units completed and transferred, we take the equivalent units for units completed x cost per equivalent unit. We do the same of ending work in process but using the equivalent units for ending work in process .

Step 5: Cost Reconciliation

Finally, we can check our work. We want to make sure that we have assigned all the costs from beginning work in process and costs incurred or added this period to units completed and transferred and ending work in process inventory.

First, we need to know our total costs for the period (or total costs to account for) by adding beginning work in process costs to the costs incurred or added this period. Then, we compare the total to the cost assignment in step 4 for units completed and transferred and ending work in process to get total units accounted for. Both totals should agree.

For Jax Company, the cost reconciliation would be:

| Beg. Work in Process Cost | -0- |

| + Costs added this period | $ 12,860 |

| Cost assigned to units completed and transferred ( ) | $ 11,700 |

| + Cost assigned to ending work in process inventory ( ) | 1,160 |

The full process cost report can be found by clicking Jax_process cost ).

Contributors and Attributions

- Accounting Principles: A Business Perspective.. Authored by : James Don Edwards, University of Georgia & Roger H. Hermanson, Georgia State University.. Provided by : Endeavour International Corporation. Project : The Global Text Project.. License : CC BY: Attribution

- Cost Per Equivalent Unit (weighted average method) . Authored by : Education Unlocked. Located at : https://youtu.be/Txv05196CWs . License : All Rights Reserved . License Terms : Standard YouTube License

- Cost Classifications

- Relevant Cost of Material

- Manufacturing Overhead Costs

- Conversion Costs

- Quality Costs

- Revenue Expenditure

- Product Cost vs Period Cost

- Direct Costs and Indirect Costs

- Prime Costs and Conversion Costs

- Relevant vs Irrelevant Costs

- Avoidable and Unavoidable Costs

- Cost Allocation

- Joint Products

- Accounting for Joint Costs

- Service Department Cost Allocation

- Repeated Distribution Method

- Simultaneous Equation Method

- Specific Order of Closing Method

- Direct Allocation Method

Cost allocation is the process by which the indirect costs are distributed among different cost objects such as a project, a department, a branch, a customer, etc. It involves identifying the cost object, identifying and accumulating the costs that are incurred and assigning them to the cost object on some reasonable basis.

Cost allocation is important for both pricing and planning and control decisions. If costs are not accurately calculated, a business might never know which products are making money and which ones are losing money. If cost are mis-allocated, a business may be charging wrong price to its customers and/or it might be wasting resources on products that are wrongly categorized as profitable.

Cost allocation is a sub-process of cost assignment , which is the overall process of finding total cost of a cost object. Cost assignment involves both cost tracing and cost allocation. Cost tracing encompasses finding direct costs of a cost object while the cost allocation is concerned with indirect cost charge.

Steps in cost allocation process

Typical cost allocation mechanism involves:

- Identifying the object to which the costs have to be assigned,

- Accumulating the costs in different pools,

- Identifying the most appropriate basis/method for allocating the cost.

Cost object

A cost object is an item for which a business need to separately estimate cost.

Examples of cost object include a branch, a product line, a service line, a customer, a department, a brand, a project, etc.

A cost pool is the account head in which costs are accumulated for further assignment to cost objects.

Examples of cost pools include factory rent, insurance, machine maintenance cost, factory fuel, etc. Selection of cost pool depends on the cost allocation base used. For example if a company uses just one allocation base say direct labor hours, it might use a broad cost pool such as fixed manufacturing overheads. However, if it uses more specific cost allocation bases, for example labor hours, machine hours, etc. it might define narrower cost pools.

Cost driver

A cost driver is any variable that ‘drives’ some cost. If increase or decrease in a variable causes an increase or decrease is a cost that variable is a cost driver for that cost.

Examples of cost driver include:

- Number of payments processed can be a good cost driver for salaries of Accounts Payable section of accounting department,

- Number of purchase orders can be a good cost driver for cost of purchasing department,

- Number of invoices sent can be a good cost driver for cost of billing department,

- Number of units shipped can be a good cost driver for cost of distribution department, etc.

While direct costs are easily traced to cost objects, indirect costs are allocated using some systematic approach.

Cost allocation base

Cost allocation base is the variable that is used for allocating/assigning costs in different cost pools to different cost objects. A good cost allocation base is something which is an appropriate cost driver for a particular cost pool.

T2F is a university café owned an operated by a student. While it has plans for expansion it currently offers two products: (a) tea & coffee and (b) shakes. It employs 2 people: Mr. A, who looks after tea & coffee and Mr. B who prepares and serves shakes & desserts.

Its costs for the first quarter are as follows:

| Mr. A salary | 16,000 |

| Mr. B salary | 12,000 |

| Rent | 10,000 |

| Electricity | 8,000 |

| Direct materials consumed in making tea & coffee | 7,000 |

| Direct raw materials for shakes | 6,000 |

| Music rentals paid | 800 |

| Internet & wi-fi subscription | 500 |

| Magazines | 400 |

Total tea and coffee sales and shakes sales were $50,000 & $60,000 respectively. Number of customers who ordered tea or coffee were 10,000 while those ordering shakes were 8,000.

The owner is interested in finding out which product performed better.

Salaries of Mr. A & B and direct materials consumed are direct costs which do not need any allocation. They are traced directly to the products. The rest of the costs are indirect costs and need some basis for allocation.

Cost objects in this situation are the products: hot beverages (i.e. tea & coffee) & shakes. Cost pools include rent, electricity, music, internet and wi-fi subscription and magazines.

Appropriate cost drivers for the indirect costs are as follows:

| Rent | 10,000 | Number of customers |

| Electricity | 8,000 | United consumed by each product |

| Music rentals paid | 800 | Number of customers |

| Internet & wifi subscription | 500 | Number of customers |

| Magazines | 400 | Number of customers |

| 19,700 |

Since number of customers is a good cost driver for almost all the costs, the costs can be accumulated together to form one cost pool called manufacturing overheads. This would simply the cost allocation.

Total manufacturing overheads for the first quarter are $19,700. Total number of customers who ordered either product are 18,000. This gives us a cost allocation base of $1.1 per customer ($19,700/18,000).

A detailed cost assignment is as follows:

| Tea & Coffee | Shakes | |

| Revenue | 50,000 | 60,000 |

| Costs: | ||

| Salaries | 16,000 | 12,000 |

| Direct materials | 7,000 | 6,000 |

| Manufacturing overheads allocated | 11,000 | 8,800 |

| Total costs | 34,000 | 26,800 |

| Profit earned | 16,000 | 33,200 |

Manufacturing overheads allocated to Tea & Cofee = $1.1×10,000

Manufacturing overheads allocated to Shakes = $1.1×8,000

by Irfanullah Jan, ACCA and last modified on Jul 22, 2020

Related Topics

- Cost Behavior

All Chapters in Accounting

- Intl. Financial Reporting Standards

- Introduction

- Accounting Principles

- Business Combinations

- Accounting Cycle

- Financial Statements

- Non-Current Assets

- Fixed Assets

- Investments

- Revenue Recognition

- Current Assets

- Receivables

- Inventories

- Shareholders' Equity

- Liability Accounts

- Accounting for Taxes

- Employee Benefits

- Accounting for Partnerships

- Financial Ratios

- Cost Accounting Systems

- CVP Analysis

- Relevant Costing

- Capital Budgeting

- Master Budget

- Inventory Management

- Cash Management

- Standard Costing

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

Cost Accounting: What It Is And When To Use It

Updated: Jun 1, 2024, 2:12pm

Table of Contents

What is cost accounting, types of cost accounting, cost accounting vs. financial accounting, cost accounting software, frequently asked questions (faqs).

Knowing how much your business spends is a key component of accounting. After all, if you don’t have this information on hand, it will be difficult to determine whether you’re making a profit. That’s where cost accounting comes in. It revolves around the costs associated with running your business.

Cost accounting is a type of managerial accounting that focuses on the cost structure of a business. It assigns costs to products, services, processes, projects and related activities. Through cost accounting, you can home in on where your business is spending its money, how much it earns and where you might be losing money. Managers and employees may use cost accounting internally to improve your business’s profitability and efficiency.

Featured Partners

Reg. Price: $15 per month; Special Offer: 75% off all plans for 3 months until February 13

On Xero's Website

Sage Intacct

On Sage's Website

On Melio's Website

$15 per month (for the first 3-months, then $30 per month)

Expert help, Invoicing, maximize tax deductions, track mileage