We use cookies to offer you a better browsing experience and analyse our website performance. We also use third-party cookies to further customise your experience showing relevant content while you are navigating on third-party platforms.

Our Priorities MedTech Europe strives to support our dynamic sector in meeting the needs of patients and health systems. To achieve this, we focus on engaging with healthcare stakeholders on key issues from regulations and market access to digital health and Brexit, among others.

- COVID-19 Information Hub

- Interactions with the Medical Community

- Access to Medical Technology

- Medical Technology Regulations

- Digital Health

- International

- Environmental and Social Sustainability

- Market Data

- Research and Innovation

- Innovative Health Initiative (IHI)

Sector Groups MedTech Europe sector groups bring together company experts to drive forward key healthcare domains, helping to address issues facing these sectors and shaping their future. We have dedicated groups focused on cardiovascular health, ophthalmology, diabetes, orthopaedics, and AMR/HAI.

- Antimicrobial Resistance (AMR) and Healthcare Associated Infections (HAIS)

- Cardiovascular

- Homecare & Community Care

- Orthopaedic

Real stories of people’s lives transformed by medtech.

Your platform for dialogue about medical technologies.

Search on this website

Research Use Only Products

What are Research Use Only (RUO) products? Research Use Only (RUO) products are a distinct category of in vitro diagnostics (IVDs) exclusively tailored for laboratory research. RUOs encompass specialised reagents, equipment, and materials crucial for scientific investigations, contributing significantly to the development of cutting-edge tools and solutions for research applications.

Research Use Only (RUO) products play a crucial role in medical research and innovative management of many patients. These specialised products, which include laboratory reagents and equipment, are exclusively designed for research in controlled laboratory environments. As essential tools for medical and scientific investigations, experimentation, and analysis, RUOs contribute to developing innovative solutions and advancements in medical research.

For example: RUO products can be used for Fundamental Research, in Pharmaceutical Research to find new drug compounds, and for a better identification and quantification of individual chemical substances. In diagnostics research, RUO products are essential to the development of new diagnostic assays and tools.

Unlike in vitro diagnostic medical devices (IVDs), RUOs are dedicated to facilitating research initiatives and are not intended for direct medical procedures with human patients. RUOs are not defined in the EU’s In Vitro Diagnostic Medical Devices Regulation 2017/746 (IVDR); they are regulated by the EU General Product Safety Regulation and other applicable EU legislations. Manufacturers of RUO products clearly label them as “Research Use Only” and use the RUO label.

From a production and specifications general perspective, the knowledge and processes needed to manufacture RUOs are very similar to those needed to manufacture CE marked IVDs. Many companies which operate in the IVD space will have RUO products in their portfolio. RUOs will generally have a similar chemical and physical composition compared to IVDs, but their intended purpose will be different. While RUO or IVDs might seem similar in their appearance and specifications, unambiguous and documented evidence associating the use of devices with in vitro diagnostic examination procedures is required to qualify a device as an IVD.

RUOs provide researchers and scientists – including those operating in medical laboratories – with valuable resources to advance in the understanding of disease, in drug discovery, in the development of new therapies and diagnostic tools. Laboratories or research consortia often collaborate with RUO manufacturers to tailor products to meet specific research needs and requirements, fostering a collaborative environment and contributing to the continuous evolution of research tools and solutions.

One critical application of RUO is to enable medical laboratories to develop in-house assays to e.g. diagnose rare and emerging conditions or to improve the current knowledge and management of specific diseases for which no adequate CE marked IVDs exist. This not only fulfils a critical and imminent healthcare need but is also a key stepping stone in the eventual development of IVDs. A poignant example of this was the development of COVID-19 assays during the early phase of the pandemic – initially, reference laboratories developed in house assays test for the SARS-CoV-2 virus, and shortly afterwards, commercial IVDs began to reach the market in order to fulfil a critical need during the global health crisis. However, it is worth noting that the use of in-house assays is regulated in IVDR and is subject to certain conditions.

In essence, RUO products provide researchers and physicians with the necessary tools to conduct experiments and studies, contributing to the overall progress in medical research. Their intended use in laboratory settings supports the development of new technologies and innovative solutions for various research applications.

Share this page

MedTech Europe Manifesto for 2024 – 2029

Empowering Patients, Inspiring Innovation

Sign up for your monthly newsletter

By clicking the Subscribe button, you give consent to MedTech Europe AISBL to use of the information you provided and send you content on the services you selected. We will ensure that the information is processed confidentially, and will only share it with third party providers that assist in providing these services. These providers may be located outside the EU; in this case, we will ensure that they are subject to a legal framework adequate in safeguarding your data, in compliance with European data protection law. You can unsubscribe, change your preferences or update your information at any time by clicking on the unsubscribe button available on all messages. For more information on how MedTech Europe will handle your personal data, please refer to our Privacy Policy . You can contact us at [email protected] for further questions related to your privacy and your rights.

BREAKING: Market Strong But Risks Rise With Powell On Tap

- The Big Picture

- Stock Market Data

- Stock Market Today

- New? Start Here

- ETF Market Strategy

- IBD Digital: 2 Months for $20

- Psychological Indicators

- My Stock Lists

- Stocks Near A Buy Zone

- IBD ETF Indexes

- IBD Sector Leaders

- Stock Lists Update

- Relative Strength at New High

- IBD Data Tables

- IBD Big Cap 20

- Stocks On The Move

- Rising Profit Estimates

- IBD Long-Term Leaders

- Stocks Funds Are Buying

- IPO Leaders

- Stock Spotlight

- Your Weekly Review

- IBD Stock Checkup

- Investing Action Plan

- The Income Investor

- Stock Of The Day

- Earnings Preview

- IBD Stock Analysis

- Screen Of The Day

- Earnings Calendar

- Industry Snapshot

- Industry Themes

- IBD 50 Stocks To Watch

- Stock Screener

- The New America

- IBD Data Stories

- Swing Trading

- Best Mutual Funds

- MarketSurge

- Leaderboard

- SwingTrader

- Cryptocurrency

- Magnificent Seven Stocks

- Personal Finance

- Industry News Pages

- Special Reports

- Economic Calendar

- Economic News

- Investing With IBD Podcast

- How To Invest Videos

- Growth Stories Podcast

- Options Videos

- Online Courses

- How To Invest In Stocks

- When To Sell Stocks

- 3 Keys To Stock Investing

- Short Selling

- Stock Market Timing

- Tracking Stock Market Trends

- What Is Crypto

- How To Read Stock Charts

- Premium Online Courses

- How To Buy Stocks

- Investing Strategies Video Series

- Investor's Corner

- 12 Days Of Learning

- Investing Infographics

- Events & Webinars

- Chart School

- IBD Moneyworks

- Shopping Cart Your cart is currently empty. Visit the IBD Store to get started.

- My Products

- My Favorites

- Sign In or Subscribe

How Does An HSA Work, And 8 Other HSA Account Questions Answered

- ADELIA CELLINI LINECKER

- 05:07 PM ET 03/15/2019

Opening an HSA account can be one of the most important decisions you make. Health savings accounts are one of the best tax-advantaged vehicles to help cut health care cost s. But how does an HSA work?

If you have a high-deductible health plan (HDHP), you qualify for an HSA. Funds can be used to pay for medical expenses, and you may also invest some or all of the funds in the account.

While 401(k)s are still the most popular investment vehicles for retirement, HSAs are gaining ground. Overall, participation in HSAs among consumers with eligible HDHPs grew to 81% in 2018 from 50% in 2017, according to a recent Society for Human Resource Management survey .

One reason HSAs are becoming more popular : More employers now offer HSAs. More than half (56%) of all employers offer HSAs. And 37% of them make contributions to their employees' HSAs, according to SHRM.

While it's true 401(k) plans often offer more investment options than HSA providers do, that's changing. A growing number of the best HSA providers are offering a variety of HSA investment options . For example, HSA Bank now offers more than 5,000 funds, in addition to stocks and bonds.

- Read Our 2019 Best HSA Accounts Special Report

- See Our List Of The 10 Best HSA Providers And All Their Account Features

Still, many consumers are unsure of details about how an HSA works. If you're wondering whether to jump on the bandwagon, here are answers to eight more of the most frequently asked questions about HSA accounts.

What Can An HSA Account Be Used F or?

Generally, money from an HSA account can be used for qualified medical expenses. What kind of expenses? The IRS lists eligible expenses . They include doctor and dentist visits. Also eligible are certain items purchased without prescriptions, including athletic braces and supports, breast pumps, glucose monitors and first-aid kits. Some items, like acne treatments, eye drops, pain relievers and sleep aids, are covered but require a prescription. In some cases, products such as air filters and anti-snore guards can be eligible if you get a letter of medical necessity.

"In addition to being able to cover doctor co-payments and specialist visits, HSA funds can cover those products you probably pay for out of pocket, such as sunscreen, first-aid supplies, over-the-counter medicines and pain relief products (with a prescription), prescription eyeglasses/contacts and accessories, and a lot more," said HSAstore.com founder Jeremy Miller.

Caution: Don't use HSA account funds to pay for non-eligible medical expenses. Why? You'll incur a 20% tax penalty on the withdrawal in addition to income taxes, Miller adds.

Can I Open A Health Savings Account On My Own?

Yes, you can open an HSA account on your own. You can even have more than one HSA account. That means you can have an HSA account with your employer and another one on your own.

Banks, brokers and other financial companies offer health savings accounts. All of the top HSA providers offer individual and family plans directly to consumers. One caveat: Your annual contribution limit is cumulative. That means, you can't exceed the $3,500 limit for individuals and $7,000 for families for 2019.

If you're evaluating HSA administrators, check out Investor's Business Daily's list of 10 Best HSAs based on fees, account features, investment options and other account criteria. HSA providers on the list include Health Equity ( HQY ), HSA Bank and Fidelity Investments, the brokerage powerhouse that earns high marks each year in IBD's Best Online Brokers investor survey .

What Happens If You Put Too Much Money Into An HSA?

Be careful not to put in more money than you're allowed in all of your HSAs combined. You will have to pay a penalty for any extra money that's not supposed to be in the HSA account.

Joseph Messiha, a Los Angeles-based CPA, says contributions that go beyond what's allowed annually are not deductible if made by or for an individual. The extra HSA contributions are included in the employee's taxable gross income if it's an employer-administered plan. You are also "subject to a 6% excise tax imposed on the account beneficiary unless withdrawn (with earnings) by the (tax) return due date (including extensions)," Messiha said.

Can I Use HSA Money To Pay Off Old Medical Bills?

Yes, you can use HSA account funds to pay off old medical bills or reimburse yourself for money you spent on HSA eligible expenses in prior years.

"There's no time limit on getting reimbursed for an HSA-eligible expense," Miller said. "As long as you had the HSA open when you accrued a medical bill, you can be reimbursed for the cost — even years after the fact." But remember to save those receipts.

Can I Use My HSA To Pay For Someone Else?

HSA account funds can be used to cover medical expenses for the account holder, spouses and dependents. "They are structured to help you cover medical expenses for your immediate family," Miller said. "So a good rule of thumb to keep in mind is if they are listed on your tax return, your HSA will probably cover them."

The IRS explains who is covered by an HSA . HSA funds can be used for your spouse and eligible dependents even if they are not covered by the HSA-compatible health plan.

For example, your 20-year-old son has a non-HDHP health insurance plan through his college. If you claim your son as a dependent on your federal tax return, you can use HSA funds to pay for his medical bills. You can do this as long as he is a student and until he's 24.

For HSA purposes, you can also claim an adult child who is out of school as a dependent if the child is on your HDHP insurance.

Unless you have other family members on your high-deductible health plan, you can still only contribute the 2019 maximum for individuals to your HSA ($3,500), since you have self-only HDHP coverage.

Can FSA Funds Be Transferred To An HSA?

Many consumers are uncertain about the rules about using an HSA vs. FSA , or flexible spending account. "The quickest answer is, you can't move FSA funds into any other account once you've elected your contribution for the year," Miller said.

Why? While you contribute money to an FSA in a similar way to an HSA, FSAs are employer-owned and managed by a benefits administrator, he says.

"This money can only be used for qualifying medical expenses," he said. "And you can't withdraw FSA funds in the same way as you could with an HSA."

Can I Move My HSA From One Bank To Another?

Yes, you can transfer your HSA from one provider to another as many times as you want in a given year. Transfers are not the same as rollovers, though.

Here's the difference: The IRS lets you roll over funds to a new HSA provider every 12 months without losing tax advantages. When you request a rollover, you will get a check or money transfer to your personal bank account. You then have 60 days from receipt to deposit those funds to a new HSA. Miss that deadline and you pay ordinary taxes and a 20% penalty.

It's less complicated if you transfer from one HSA provider directly to another provider without ever touching the money. How do you do this? Go to your provider and ask to fill out the form for a trustee-to-trustee transfer. This way you avoid any kind of tax and penalty.

Can I Use My HSA After Age 65?

You can't contribute to an HSA account if you're enrolled in Medicare or if you're a dependent on anyone's tax returns. But you can contribute to an account if you decline Medicare when you turn 65.

Also, once you reach Medicare eligibility at 65, HSA account funds can be withdrawn for nonmedical expenses. The funds are simply taxed as income, says Miller.

"And qualifying health expenses are still covered in retirement," he added. In fact, that's a prime benefit of an HSA account.

YOU MAY ALSO LIKE:

Health Savings Account Rules: 6 Little-Known HSA Tips That Will Save You Money

What Is An HSA? Health Savings Account Tax Advantages Draw Fans

Want More IBD Videos? Subscribe To Our YouTube Channel!

For Weekly Tips On Investing, Get The 'How To Invest' Newsletter

You Need This Much Retirement Savings At Your Age And Income

Take a Trial Today

Get instant access to exclusive stock lists, expert market analysis and powerful tools with 2 months of IBD Digital for only $20!

Get market updates, educational videos, webinars, and stock analysis.

Get Started

Learn how you can make more money with IBD's investing tools, top-performing stock lists, and educational content.

Great, you have saved this article to you My Learn Profile page.

Clicking a link will open a new window.

4 things you may not know about 529 plans

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. The subject line of the email you send will be “Fidelity.com”.

Thanks for you sent email.

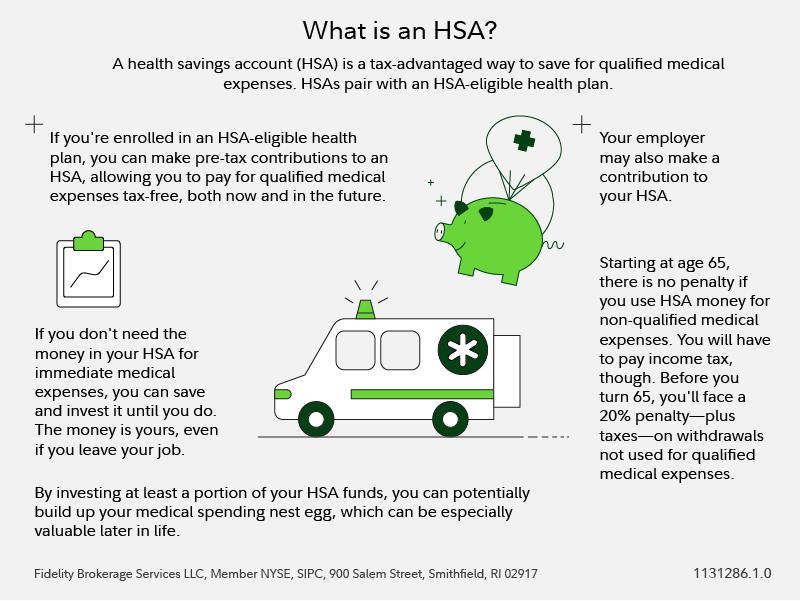

What is an HSA, and how does it work?

Key takeaways

- A health savings account (HSA) is a tax-advantaged way to save for qualified medical expenses.

- HSAs pair with an HSA-eligible health plan.

- Because it offers potential tax advantages and money within the account can be invested, an HSA can be used to pay for both near-term medical expenses and expenses in retirement.

A health savings account (HSA) has potential financial benefits for now and later. Not only can you save pre-tax dollars in this account to pay for qualified medical expenses, but HSAs can also provide valuable retirement benefits.

Here's how to take full advantage of HSAs.

What is an HSA?

An HSA is a tax-advantaged account that can be used to pay for qualified medical expenses, including copays, prescriptions, dental care, contacts and eyeglasses, bandages, X-rays, and a lot more. It’s "tax-advantaged" because your contributions reduce your taxable income, and the money isn't taxed while it’s in the account—even if it earns interest or investment returns. Bonus: As long as you use your HSA funds for qualified medical expenses, you won't owe taxes when you take money out of the account. These 3 reasons are why HSAs are considered "triple" tax advantaged. 1 This means they provide more tax advantages than retirement accounts, such as 401(k)s or individual retirement accounts (IRAs).

Feed your brain. Fund your future.

How does an HSA work?

HSAs work together with an HSA-eligible health plan. If you're enrolled in this type of health plan, you can make pre-tax contributions to an HSA, allowing you to pay for qualified medical expenses tax-free. This can help create a cash cushion to offset the higher deductibles that HSA-eligible health plans typically have.

If you don't need the money in your HSA for immediate medical expenses, you can save and invest it until you do. This sets HSAs apart from another popular account, the health care flexible spending account (FSA). Unlike an HSA, money held in a health care FSA typically must be spent by the end of the plan year in which it's contributed, can't be invested, and can't be carried with you when you leave an employer.

Who can contribute to an HSA?

Not everyone is eligible to contribute to an HSA, even if they are enrolled in an HSA-eligible health plan. You can contribute to an HSA only if:

- You aren't enrolled in a health plan sponsored by your spouse or parent that is not an HSA-eligible health plan.

- You're not enrolled in Medicare.

- You can't be claimed as a dependent on someone else's tax return.

Read more: 6 benefits of an HSA in your 20s and 30s

More on HSA benefits

Here's more about what you need to know about the financial advantages of HSAs.

You can deduct your contributions from your taxes HSA contributions are typically made with pre-tax income from your paychecks, similar to the way 401(k) contributions are set up. If you fund your HSA with after-tax dollars instead, you may be able to take a tax deduction on your personal taxes when you file.

HSA tax deductions can have powerful benefits: For instance, someone in the 22% federal income tax bracket could potentially save nearly 30% in taxes (federal income + FICA + potentially state income) on every dollar contributed to the HSA. That helps increase the amount of money you have for medical spending. But it's important to keep in mind, contributing via payroll deductions will lead to the most tax savings. Only contributions made with payroll deduction avoid Medicare and Social Security taxes.

Your employer may make contributions to your HSA Almost 80% of employers help employees pay for medical expenses through contributions to their HSAs. 2 Think of it as a 401(k) match for your health. You won't get a tax deduction on what your employer contributes, but you will get extra money that has the potential to grow over time if invested.

You can invest funds held in your HSA By investing at least a portion of your HSA funds, you can potentially build up your medical spending nest egg, which can be especially valuable later in life. According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple age 65 in 2023 may need approximately $315,000 saved (after-tax) to cover health care expenses in retirement. 3

HSAs are not subject to "use-it-or-lose-it" rules This means you don't forfeit any money you don't use in a given year, and you can carry it forward until you reach a time that you want or need to use the money in your HSA. Combined with the ability to invest funds, this allows your health savings to benefit from compounding returns. Over 30 years of contributing and investing the 2023 HSA family maximum contribution , you could end up with over $650,000, assuming a 6% rate of return. 4

Your HSA is your account, not your employer's Unlike health care FSAs, which your employer technically owns, your HSA belongs to you. So when you leave a job, you keep all of the money you've saved up in your HSA and can transfer into a new HSA or employer-sponsored HSA at your next job. You can even open an HSA if you're in an HSA-eligible health plan and your employer does not provide one—or if they do but you prefer a third-party option. It's also possible to have multiple HSAs. Some people have one for investing and another for cash to pay medical expenses.

You can still have an FSA to address certain immediate qualified medical expenses People often think the issue of FSA vs. HSA is either/or. The truth: HSA holders can have a limited-purpose FSA to pay for qualified expenses associated with dental and vision care. That can help you have the best of both worlds: using an HSA to save for future medical expenses while you finance some current ones with an FSA. You can only open a limited-purpose FSA if your employer allows for it, however.

Starting at age 65, there is no penalty if you use HSA money for non-qualified medical expenses You will have to pay income tax, though, similar to making withdrawals from other retirement savings vehicles, like traditional 401(k)s or IRAs. It's important to note that before you turn 65, you'll face a 20% penalty—plus any applicable taxes—on withdrawals not used for qualified medical expenses.

HSAs are not subject to required minimum distributions ( RMDs ) Unlike 401(k)s and traditional IRAs, which require you start minimum withdrawals called RMDs when you turn 73, 5 you'll never be required to take any funds out of your HSA. This can provide versatility in retirement income planning.

HSA contribution limits

Contributing to your HSA early and often and investing those savings can help you better afford medical care later. The contribution limit for 2023 is $3,850 for individual coverage and $7,750 for family coverage.

You and your employer may both contribute to your HSA, though the contribution limit remains the same, regardless of how much your employer puts in. For example, if your employer deposits $1,000 into your HSA, then you'd only be able to contribute $2,850 if you are enrolled in individual coverage in 2023.

In addition, depending on when you enroll in an HSA-eligible health plan and how long you stay enrolled, your total contribution limit may be reduced. Also you typically have until the federal tax filing deadline (usually April 15) to contribute to an HSA for the prior tax year.

How to open an HSA

Step 1: Make sure you're eligible to open an HSA To open and contribute to an HSA, you'll need to be enrolled in an HSA-eligible health plan. This health plan does not have to be provided by your employer, but it must meet the requirements outlined above. If you aren't sure whether your plan qualifies, check with your benefits administrator or plan provider.

Step 2: Pick an HSA provider While HSAs are all similar in the tax advantages they offer, the specific features available at different providers vary. If you're interested in investing your HSA, for instance, you may want to go with a provider that requires no—or a low—amount of your HSA to remain uninvested in cash. You may want to research if potential HSA providers offer low-cost funds or automated investing options, like robo-advisors, that meet your needs. You may also want to compare fees across different providers. Remember, too, you can have the flexibility to change your HSA provider even if you're no longer covered by an HSA-eligible health plan.

Step 3: Don't forget to invest your HSA If you intend to use your HSA to save for long-term medical expenses, don't forget to set up your investments. Nearly 80% of participants do not invest their HSA assets, 6 suggesting the vast majority of Americans aren't using this valuable wealth-building tool as well as they could.

Read more: How to invest your HSA

Consider a health savings account (HSA)

With an HSA, you can pay for qualified medical expenses in a tax-advantaged way.

More to explore

Invest your hsa your way, get more fidelity smart money sm, subscribe to fidelity smart money ℠, looking for more ideas and insights, thanks for subscribing.

- Tell us the topics you want to learn more about

- View content you've saved for later

- Subscribe to our newsletters

We're on our way, but not quite there yet

Oh, hello again, thanks for subscribing to looking for more ideas and insights you might like these too:, looking for more ideas and insights you might like these too:, fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. done add subscriptions no, thanks. managing health care cost preparing for retirement living in retirement finding stock and sector ideas investing for beginners managing taxes changing jobs investing for income saving for retirement 1. with respect to federal taxation only. contributions, investment earnings, and distributions may or may not be subject to state taxation. please consult with your tax advisor regarding your specific situation. 2. "2022 health savings account survey," plan sponsor council of america, october 25, 2022 3. estimate based on a single person retiring in 2023, 65-years-old, with life expectancies that align with society of actuaries' rp-2014 healthy annuitant rates projected with mortality improvements scale mp-2020 as of 2022. actual assets needed may be more or less depending on actual health status, area of residence, and longevity. estimate is net of taxes. the fidelity retiree health care cost estimate assumes individuals do not have employer-provided retiree health care coverage, but do qualify for the federal government’s insurance program, original medicare. the calculation takes into account medicare part b base premiums and cost-sharing provisions (such as deductibles and coinsurance) associated with medicare part a and part b (inpatient and outpatient medical insurance). it also considers medicare part d (prescription drug coverage) premiums and out-of-pocket costs, as well as certain services excluded by original medicare. the estimate does not include other health-related expenses, such as over-the-counter medications, most dental services, and long-term care. 4. this calculation assumes you begin your contributions at the age of 30 and annually contribute up to the 2023 hsa contribution limit for family coverage of $7,750 over the entire period. this example also assumes a 6% rate of return, the absence of withdrawals over this 30-year period, and annual hsa catch-up contributions of an additional $1,000 starting at the age of 55 until the end of the 30-year time horizon. 5. the change in the rmds age requirement from 72 to 73 applies only to individuals who turn 73 on or after january 1, 2023. after you reach age 73, the irs generally requires you to withdraw an rmd annually from your tax-advantaged retirement accounts (excluding roth iras, and roth accounts in employer retirement plans accounts after december 31, 2023). please speak with your tax advisor regarding the impact of this change on future rmds. 6. plan sponsor, october 25, 2022 this information is intended to be educational and is not tailored to the investment needs of any specific investor. recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. as always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor. fidelity does not provide legal or tax advice. the information herein is general and educational in nature and should not be considered legal or tax advice. tax laws and regulations are complex and subject to change, which can materially impact investment results. fidelity cannot guarantee that the information herein is accurate, complete, or timely. fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. consult an attorney or tax professional regarding your specific situation. keep in mind that investing involves risk. the value of your investment will fluctuate over time, and you may gain or lose money. the information provided herein is general in nature. it is not intended, nor should it be construed, as legal or tax advice. because the administration of an hsa is a taxpayer responsibility, you are strongly encouraged to consult your tax advisor before opening an hsa. you are also encouraged to review information available from the internal revenue service (irs) for taxpayers, which can be found on the irs website at irs.gov . you can find irs publication 969, health savings accounts and other tax-favored health plans , and irs publication 502, medical and dental expenses , online, or you can call the irs to request a copy of each at 800-829-3676. fidelity brokerage services llc, member nyse, sipc , 900 salem street, smithfield, ri 02917 1036027.2.1 mutual funds etfs fixed income bonds cds options active trader pro investor centers stocks online trading annuities life insurance & long term care small business retirement plans 529 plans iras retirement products retirement planning charitable giving fidsafe , (opens in a new window) finra's brokercheck , (opens in a new window) health savings account stay connected.

- News Releases

- About Fidelity

- International

- Terms of Use

- Accessibility

- Contact Us , (Opens in a new window)

- Disclosures , (Opens in a new window)

Regulatory overview of clinical trials

Understand the regulatory framework of clinical trials, clinical research materials and active ingredients used in its manufacturing, under the Health Products Act and the Medicines Act.

What is a clinical trial

A clinical trial is a research study of a health product to investigate any of the following in humans:

- Discover or verify its clinical, pharmacological or pharmacodynamic effects

- Identify any adverse effect that may arise from its use

- Study its absorption, distribution, metabolism and excretion

- Ascertain its safety or efficacy

Regulation of clinical trials

All clinical trials of therapeutic products , Class 2 cell, tissue and gene therapy products (CTGTPs) and medicinal products (e.g. Chinese Proprietary Medicines, health supplements that are being investigated for the treatment or prevention of disease), are regulated by us except for observational clinical trials. Medical device clinical trials, observational clinical trials and Class 1 CTGTP trials are required to comply with the requirements of the Human Biomedical Research Act , regulated under the Ministry of Health.

More information on medical device clinical trials could be found here .

Regardless of whether HSA regulates the clinical trial, the manufacture, import and supply of therapeutic products, CTGTPs, medicinal products or medical devices used as a clinical research material (CRM) in Singapore must comply with the regulatory controls for clinical research materials .

The table below summarises the key regulations and submission routes:

| Product type | Key regulation | Submission route |

|---|---|---|

| Therapeutic products | and | Clinical Trial Authorisation (CTA) or Clinical Trial Notification (CTN) |

| Medicinal products | and | Clinical Trial Certificate (CTC) |

Refer to our guide on how to submit an application for CTA, CTN or CTC for more information.

To determine whether a clinical trial is regulated by us, please refer to our Guidance on Determination of Whether a Clinical Trial Requires CTA, CTN or CTC 498 KB . If still unsure, the sponsor may send an enquiry to [email protected] .

Regulation of Clinical Research Materials

What are clinical research materials.

Clinical Research Materials (CRM) refer to any registered or unregistered therapeutic product, medicinal product, medical device, applicable cell, tissue and gene therapy product (CTGTP)* or placebo, that is manufactured, imported or supplied for the purpose of being used in clinical research, by way of administration to a trial participant in accordance with the research protocol or for a clinical purpose.

Regardless of whether we regulate the clinical trial, the manufacture, import and supply of CRM in Singapore must comply with the respective regulatory controls for CRM, which are described in the table below:

| Product type | Key regulations for CRM |

|---|---|

| Therapeutic products | |

| * * | |

| Medicinal products | |

| Medical devices |

CRM notification

To facilitate access to CRM, dealers' licences for the manufacture, import and wholesale supply of CRM, and product registration for the supply of CRM are not required. This is provided a CRM notification is made before:

- Import of CRM for local clinical research use

- Supply by the local manufacturer of CRM for local clinical research use, including CRM compounded at the local trial site

You do not need a CRM notification for the following scenarios:

- Locally registered CRM obtained from local commercial sources

- Import of locally registered CRM for local clinical research use if the importer already has a valid importer’s licence for the import of CRM

- Supply of a locally registered CRM by its local manufacturer for local clinical research use if the manufacturer has a valid manufacturer's licence

- Supply of CRM by a local manufacturer if the manufacture of the CRM being supplied comprises solely of the packaging or labelling of the CRM

- Import of a minimally manipulated CTGTP CRM for local clinical research use by a known importer

- Supply of a minimally manipulated CTGTP CRM by its known manufacturer for local clinical research use

For products imported solely for export to overseas trial sites, CRM notification is not applicable. You would need to apply for an approval to import these products accordingly:

- Therapeutic products: Importer's licence for therapeutic products

- Medical devices: Import for re-export approval for medical device

- CTGTP: Import for re-export for CTGTP

The table below summarises various routes for importing therapeutic products (TP), CTGTP and medical devices (MD) for local research use versus overseas research use.

| Clinical research | Local | CRM notification |

| Overseas (import for re-export) |

| |

| Laboratory analysis of human biological samples from clinical research | Local (i.e. samples from local trial participants) | CRM Notification |

| Overseas (i.e. samples from overseas trial participants) |

For import of unused therapeutic products from overseas trial sites for local disposal, CRM notification is not applicable. You will need to apply for an importer's licence for therapeutic products for restricted activity, and comply with duties and obligations outlined in the Health Products (Therapeutic Products) Regulations (e.g., record-keeping and ensuring that the product is not supplied to the public). You may also wish to check with the National Environment Agency (NEA) for any other applicable requirements.

Additional requirements

If a CRM comprises any of the following substances, there will be additional requirements as indicated in the table below.

| Substances | Additional requirements |

|---|---|

| Controlled drugs and psychotropic substances |

CTA/CTN/CTC and/or CRM notification acknowledgement (as applicable) should be provided in the application for the above licences. Upon trial completion, any leftover CRM must be destroyed, and the procedure witnessed by a HSA inspector. If the CRM is to be exported, a corresponding export licence should be applied and issued before the export is made. |

| Poisons | CRMs which are therapeutic products are excluded from this requirement. |

| Radiopharmaceuticals | The import, export, possession, use, transport and disposal of radioactive material is regulated under the Radiation Protection Act by the . |

In addition, import of telecommunication devices (e.g. tablets or mobile phones) into Singapore is regulated by the Infocomm Media Development Authority (IMDA). Importers will need to provide information regarding proposed use of devices via the TradeNet's online declaration form or email to IMDA. Please refer to our letter 713 KB and IMDA's presentation slides 619 KB for more details.

Dealer's duties and obligations

The CRM regulations are intended to ensure supply chain integrity, and prevent the inadvertent or deliberate release of unregistered CRM into the market for use other than in clinical research.

It is critical for all local manufacturers, importers and suppliers of CRM (including local sponsors and investigators) to maintain the integrity of the CRM supply chain through proper record keeping, labelling and disposal.

All local manufacturers, importers or suppliers of CRM must only supply the CRM for use in a clinical research, unless the CRM is locally registered and is manufactured, imported or supplied with a valid dealer's licence. The local sponsor of the clinical research must also ensure that the CRM is only used in a research study approved by an Institutional Review Board (IRB), and in accordance with the research protocol, and must ensure that any unused CRM is disposed or exported within 6 months of study conclusion.

If the local sponsor wishes instead to put such unused CRM to other uses after the clinical research is completed, the sponsor must obtain written permission from us via email to [email protected] .

Refer to the following for more information:

- Duties and obligations of CRM dealers 783 KB

- How to submit a CRM notification

- How to report adverse events in clinical trials

- Report a CRM non-compliance

Regulation of Active Ingredients Used in the Manufacture of Clinical Research Materials

The import and supply of active ingredients for use in the manufacture of clinical research materials (CRM) for use in local clinical research / clinical trial is regulated by us.

Under the Health Products (Active Ingredients) Regulations, dealer licences are not required for the manufacture, import and wholesale supply of active ingredients for use in the manufacture of CRM for use in local clinical research / clinical trial. This is provided an active ingredients notification is made to HSA prior to the import or supply of active ingredients, as summarised in the table below:

| Activity | Who should submit active ingredients notification | When active ingredients notification should be submitted |

|---|---|---|

| Importer of the active ingredient(s) | Before importing the active ingredient(s) | |

| Local manufacturer of the active ingredient(s) | Before supply of the active ingredient(s) by the local manufacture of the active ingredient(s) |

You do not need to make an active ingredients notification if you are an importer or manufacturer who already holds a valid licence that allows you to import or supply the active ingredients for use in the manufacture of a health product.

You do not need an active ingredients notification for the following scenarios:

- Import of active ingredient(s) for use in the manufacture of CRM for use in local clinical research / clinical trial, if the importer already has a valid importer's licence for active ingredients

- Import of active ingredient(s) by the local manufacturer of CRM for use in local clinical research / clinical trial, if the manufacturer has a valid manufacturing licence for the relevant health product

- Supply of active ingredient(s) by its local manufacturer for use in the manufacture of CRM for use in local clinical research / clinical trial, if the manufacturer has a valid manufacturing licence for the active ingredients

- The local manufacturer of the active ingredients is also the local manufacturer of the CRM, and the active ingredients is used for the manufacture of CRM for use in local clinical research / clinical trial

Click here to find out more information on the application process and documents required for active ingredients notification.

Clinical trials

Regulatory overview

CTA, CTN or CTC submissions

Submit a CRM notification

Good Clinical Practice Inspections

Report adverse events

Innovation Office

Conducting clinical trials

Participating in clinical trials

Guidance documents

Clinical Trials Register

Clinical trials statistics

PRISM (Clinical trials)

Do You Really Know What Your HSA Can Do for You?

Not only do HSAs offer triple tax benefits — pre-tax contributions, tax-free growth and tax-free withdrawals — but they can be used for health care expenses in retirement.

- Newsletter sign up Newsletter

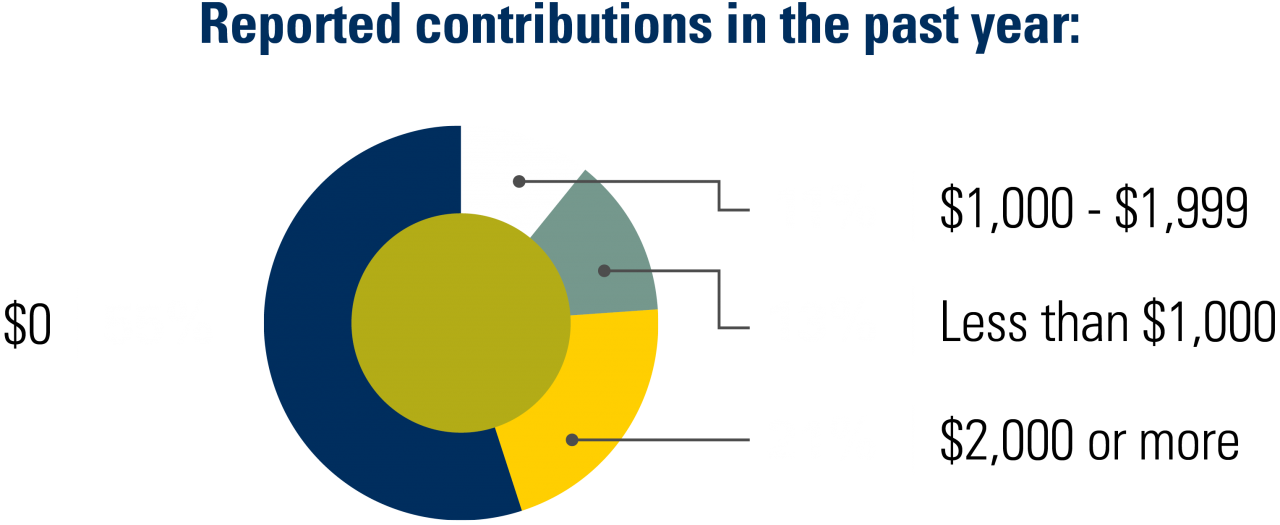

Over the past several years, health savings accounts ( HSAs ) have grown in both interest and popularity — so much so that there were $104 billion in HSA assets held among 35.5 million accounts at the end of 2022, according to Devenir Research . It’s easy to understand why this interest is on the rise, as HSAs can be a great solution to help cover eligible out-of-pocket medical costs. However, while the interest is high, the reality is that many individuals may not fully understand all that HSAs have to offer — especially when it comes to saving for their future, too.

With employers increasingly offering high-deductible health plans with an HSA option to their employees, you may already have an HSA or perhaps are considering opening one. So, as we enter open enrollment season, now presents a great time to make sure you really understand how your HSA can benefit you both today and in the future. Here are a few things to keep in mind.

HSAs can be used to pay for health care expenses in retirement

An HSA is a savings account that eligible individuals can open and contribute to on a pre-tax basis, effectively reducing their taxable income. As long as there are funds in the account, it can be used to pay qualified medical expenses today, tomorrow and throughout retirement years.

Subscribe to Kiplinger’s Personal Finance

Be a smarter, better informed investor.

Sign up for Kiplinger’s Free E-Newsletters

Profit and prosper with the best of expert advice on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Profit and prosper with the best of expert advice - straight to your e-mail.

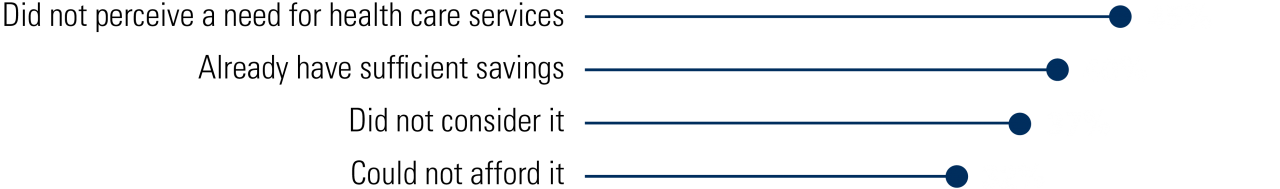

However, according to Voya research , while the general understanding that HSAs can be used to pay for health care expenses in retirement has increased noticeably (from 43% in 2020 to 55% in 2023), just over half of Americans know that HSAs can be used for health care expenses in retirement.(1)

Due to the trend of rising health care costs and the fact that health care needs generally increase as one ages, a big contributor to the potential retirement savings gap is the ever-increasing cost of health care. Consider the dynamic of retirees who depend on their savings for a portion of their retirement income . As they age, their savings balances are drawn down.

Additionally, the longer retirement lasts, the greater the likelihood that health care needs will increase. So, when it comes down to it in retirement, many individuals simply don’t have enough savings to cover health care expenses and daily living expenses. Enter HSAs, which are uniquely positioned to potentially help lessen the retirement health care savings gap. Not only can HSAs offer flexibility on how the accounts are funded, what the funds can be used for and when, they offer triple tax benefits, including pre-tax contributions — and the potential for both tax-free growth and tax-free withdrawals.

As employees work toward their retirement, they’ll be able to make pre-tax contributions and tax-free withdrawals as needed for HSA-qualified expenses. If funds are used for non-eligible expenses, they are taxed and penalized an additional 20%.

However, what many people may not realize is that once you reach retirement age at 65, HSA funds can be used for non-medical expenses without being assessed a 20% penalty. Therefore, you can use your HSA to pay for general living expenses — like housing, food or travel, for example. However, these distributions will be taxed much like any normal distribution from a retirement account, like an IRA or 401(k) .

And even in retirement, if you decide to spend your HSA dollars on qualifying medical expenses, you will still enjoy tax-free distributions — providing flexibility to spend your money how you want. Just keep in mind once you turn 65 and are enrolled in Medicare , you are no longer eligible to contribute.

HSA funds can be an investment opportunity

According to Voya research, only 26% of working Americans know that HSAs can be used as an investment vehicle — a powerful benefit of these savings solutions. Similar to lineups available in typical workplace retirement accounts, like a 401(k), once you reach a certain threshold in your account, your HSA funds can be invested. While the threshold varies by HSA plan, some plans may require only an HSA balance of $1,000 to begin investing your funds.

So, HSAs can serve as an important vehicle with a potential to grow over the long term. Unless you plan to use your HSA money for planned expenses in the near future, investing can give your money an opportunity to grow over time, but as with any investment, there are risks; make sure to fully explore those risks before choosing to invest your balance.

HSAs can be used for emergency health care savings

According to Voya data, we know that a lack of emergency savings can put one’s retirement at risk, as employees without adequate emergency savings are 13 times more likely to take a hardship withdrawal from their retirement account.(2) And, when faced with a short-term, unexpected need — such as an emergency trip to the hospital — some people may choose to dip into this account to cover the expense.

It’s important to understand that removing funds from a retirement plan may not be an option, and if it is, it should not be done lightly. The interest in growing an emergency fund is becoming more and more critical for individuals today — so much so that recent Voya data has found more than half (55%) of working Americans are more likely to stay with their current employer if they offer a workplace emergency savings plan.(3)

Fortunately, the dollars in your HSA can be used for unplanned or emergency medical expenses as long as they are eligible. All HSA withdrawals used to pay for qualified medical expenses (even if unplanned) are tax-free. Plus, if you are able to, you can choose to cover a medical bill out of pocket and then be reimbursed tax-free for that expense in the future when you then need those funds. This strategy is another way funds in an HSA can serve as emergency savings. Just make sure to hold on to your receipts to verify all distributions.

Your employer may have more to offer than you think

In today’s world, individuals are often faced with competing priorities when it comes to divvying up their paychecks and making decisions about where to save. The important considerations of retirement, health care, paying off debt and the desire to build an emergency fund are all factors to consider when thinking about one’s future. As a result, resources such as health savings accounts, which help offset the burden of medical costs, or student loan debt support and tools for building emergency savings continue to grow in popularity as employers’ “wellness benefits.”

So, as we approach open enrollment season, now presents an opportune time to not only ensure you understand the benefits of your workplace benefits and savings but to also ensure you understand the other optimal resources that might be available to you from your employer.

1) Results of a Voya Financial Consumer Insights & Research survey conducted with Morning Consult between March 9-15, 2023, among n=500 working Americans age 18+ who have both an employer-sponsored retirement plan and a medical/health plan, featuring n=188 health savings account owners.

2) Voya Financial internal data (Oct. 2020).

3) Based on the results of a Voya Financial Consumer Insights & Research survey conducted June 12-13, 2023, among 1,004 adults aged 18+ in the U.S., featuring 483 Americans working full time or part time.

related content

- The Ultimate Retirement Savings Account? Surprise, It’s an HSA!

- No Long-Term Care Plan? Here’s What to Do About It

- Medicare Checklist: Avoid Costly Enrollment Mistakes

- Are You Prepared for Health Care Costs While in Retirement?

- Struggling to Understand Your Employee Benefits Package? Six Ways to Make Sense of It

This article was written by and presents the views of our contributing adviser, not the Kiplinger editorial staff. You can check adviser records with the SEC or with FINRA .

To continue reading this article please register for free

This is different from signing in to your print subscription

Why am I seeing this? Find out more here

Get Kiplinger Today newsletter — free

Profit and prosper with the best of Kiplinger's advice on investing, taxes, retirement, personal finance and much more. Delivered daily. Enter your email in the box and click Sign Me Up.

Nate Black is vice president (VP) of Health Solutions Product for Voya Financial, Inc. (NYSE: VOYA), a leading health, wealth and investment company. In this role, Black leads Voya’s Health Solutions Product teams, including Supplemental Health, Life/Absence/Disability, and Health Account Solutions. In his role, Black is responsible for guiding the management of existing products and bringing new offerings to the market.

High interest rates mean college students will pay more to borrow. Savers will continue to benefit but need to remain vigilant.

By Sandra Block Published 4 July 24

These affordable warm-weather cities for snowbirds offer plenty of housing options, abundant activities for retirees and access to good health care.

Don’t underestimate the power of taking advantage of your company’s 401(k) match, catch-up contributions and more.

By Tony Drake, CFP®, Investment Advisor Representative Published 4 July 24

Your income might not be regular, but your saving, budgeting and financial planning can be. Business experts offer ideas to manage issues associated with fluctuating income.

By Anthony Martin Published 3 July 24

Instead of focusing on arbitrary market returns, in goals-based planning you focus on your personal needs and wants for your retirement.

By Cosmo P. DeStefano Published 3 July 24

Of course you want to spoil your grandchildren. Who doesn't? You can do it in ways that won't teach them bad habits or set unrealistic expectations, though.

By Neale Godfrey, Financial Literacy Expert Published 2 July 24

A business book author answers some key questions a budding entrepreneur might have before making the leap to small-business owner.

By H. Dennis Beaver, Esq. Published 2 July 24

Irrevocable trusts can be set up so that the trust maker no longer pays income taxes, and the taxes are instead paid by the trust. What are the pros and cons?

By Rustin Diehl, JD, LLM Published 1 July 24

Knowing what to give, how to give and where to give can help ensure your charitable giving aligns with your values and maximizes your impact.

By Nicole Jackson-Leslie, JD, 21/64 Certified Advisor Published 1 July 24

The easy swing and follow-through of retirement planning starts with simple fundamentals. Start with your stance (aka your financial plan), choose the right club (aka asset allocation) and go from there.

By Evan T. Beach, CFP®, AWMA® Published 30 June 24

- Contact Future's experts

- Terms and Conditions

- Privacy Policy

- Cookie Policy

- Advertise with us

Kiplinger is part of Future plc, an international media group and leading digital publisher. Visit our corporate site . © Future US, Inc. Full 7th Floor, 130 West 42nd Street, New York, NY 10036.

- Search Search Please fill out this field.

- What Is a Health Savings Account?

How an HSA Works

- Special Considerations

- Advantages and Disadvantages

- Withdrawals

- Contribution Rules

HSA vs. Flexible Spending Account

The bottom line.

- Health Insurance

- Definitions A - M

Health Savings Account (HSA): How HSAs Work, Contribution Rules

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas' experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

:max_bytes(150000):strip_icc():format(webp)/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)

- Health Savings vs. Flexible Spending Account: What's the Difference?

- Flexible Spending Account (FSA)

- Health Savings Account (HSA) Definition CURRENT ARTICLE

- Health Reimbursement Arrangement (HRA)

- Voluntary Employees’ Beneficiary Association Plan (VEBA)

- Medical Savings Account (MSA)

- HRA vs. HSA

- HSAS: Advantages and Disadvantages

- How Flexible Spending Accounts Work

- Does Money in an FSA Roll Over?

- Who Can Use Your FSA?

- What Can You Buy With a FSA?

- How Grace Periods for FSAs Work

- Do FSAs Expire?

- Ways to Use Up Your Flexible Spending Account

- HAS Rules and Limits

- HSA Custodian

- Best Health Savings Account (HSA) Providers

- Why HSAs Appeal More to High-Income Earners

- Transfer IRA Money to an HSA

Investopedia / Paige McLaughlin

What Is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a tax-advantaged account created for or by individuals covered under high-deductible health plans (HDHPs) to save for qualified medical expenses. Contributions are made into the account by the individual or their employer and are limited to a maximum amount each year.

The contributions to an HSA are invested over time and can be used to pay for qualified medical expenses, such as medical, dental, and vision care and prescription drugs.

Key Takeaways

- A Health Savings Account (HSA) is a tax-advantaged account to help you save for medical expenses that are not reimbursed by high-deductible health plans (HDHPs).

- No tax is levied on contributions to an HSA, the HSA’s earnings, or distributions used to pay for qualified medical expenses.

- An HSA, owned by an employee, can be funded by the employee and the employer.

- Contributions are vested, and unused account balances at year-end can be carried forward.

As mentioned above, people with HDHPs can open HSAs. Individuals with HDHPs may qualify for HSAs, and the two are usually paired together. To qualify for a Health Savings Account (HSA) , you must meet eligibility standards established by the Internal Revenue Service (IRS). To be eligible, you must:

- Have a qualified HDHP

- Have no other health coverage

- Not be enrolled in Medicare

- Not be claimed as a dependent on someone else’s tax return

The maximum contribution for an HSA in 2024 is $4,150 for an individual ($3,850 for 2023) and $8,300 for a family ($7,750 in 2023). The annual limits on contributions apply to the total amounts contributed by both the employer and the employee. Individuals age 55 or older by the end of the tax year can make catch-up contributions of an additional $1,000 to their HSAs.

An HSA can also be opened at certain financial institutions. Contributions can only be made in cash , while employer-sponsored plans can be funded by the employee and their employer. Any other person, such as a family member, can also contribute to the HSA of an eligible individual. Self-employed or unemployed individuals may also contribute to an HSA, provided that they meet the eligibility requirements.

Individuals who enroll in Medicare can no longer contribute to an HSA as of the first month of enrollment. However, they can receive tax-free distributions for qualified medical expenses.

HSA Special Considerations

HDHPs have higher annual deductibles (the plan pays nothing until you reach these amounts in out-of-pocket expenses) but lower premiums than other health plans. The financial benefit of an HDHP’s low-premium and high-deductible structure depends on your personal situation.

The minimum deductible required to open an HSA is $1,600 for an individual or $3,200 for a family for the 2024 tax year ($1,500 and $3,000, respectively, for 2023). The plan must also have an annual out-of-pocket maximum of $8,050 for self-coverage for the 2024 tax year ($7,500 for 2023) and $16,100 for families for the 2024 tax year ($15,000 for 2023).

When you pay qualified medical expenses equal to a plan’s deductible amount, additional qualified expenses are divided between you and the plan.

Example of HDHP

For example, the insurer may cover a percentage of the qualified expenses per the contract (usually 80% to 90%), while you may pay the remaining 10% to 20% or a specified co-pay.

So, if you had an annual deductible of $1,600 (in 2023) and a medical claim of $3,500 pays the first $1,600 to cover the annual deductible. You would pay 10% to 20% of the remaining $1,900, and the insurance company would cover the rest.

Once the annual deductible is met in a given plan year, the plan typically covers any additional medical expenses, except for any uncovered costs under the contract, such as co-pays. The insured can withdraw money accumulated in an HSA to cover these out-of-pocket expenses.

Health savings accounts should not be confused with health spending accounts, which employers use in Canada to provide health and dental benefits for their Canadian employees.

Advantages and Disadvantages of an HSA

HSAs have advantages and drawbacks . The effect of these accounts depends on your personal and financial situations.

Contribution tax advantages

Distribution tax advantages

Investment options

Deductible requirements

Requires extra cash

Filing requirements

Pros Explained

Contribution tax advantages : Employer and individual contributions by payroll deduction to an HSA are excluded from the employee’s taxable income. An individual’s direct contributions to an HSA are 100% tax deductible from the employee’s income. Earnings in the account are also tax free. However, excess contributions to an HSA incur a 6% tax and are not tax deductible.

Distribution tax advantages : Distributions from an HSA are tax-free, provided that the funds are used for qualified medical expenses as outlined by the IRS. Distributions used for medical expenses covered under the HDHP plan are included in determining if the HDHP’s deductible has been met.

Investment options : You can also use the money in your HSA to invest in stocks and other securities, potentially allowing for higher returns over time.

Cons Explained

Deductible requirements : The most obvious key drawback is that you need to be a good candidate for an HDHP. In addition, you must have a high-deductible plan, lower insurance premiums, or be affluent enough to afford the high deductibles and benefit from the tax advantages.

Requires extra cash : Individuals who fund their own HSAs, whether through payroll deductions or directly, should be financially capable of setting aside an amount that would cover a substantial portion of their HDHPs’ deductibles. Individuals without enough spare cash to set aside in an HSA may find the high deductible amount burdensome.

Filing requirements : HSAs also come with filing requirements regarding contributions, specific rules on withdrawals, distribution reporting, and a record-keeping burden that may be difficult to maintain.

Withdrawals Permitted Under an HSA

Amounts withdrawn from an HSA aren’t taxed as long as they are used to pay for services that the IRS treats as qualified medical expenses. The plan's manager will issue an IRS Form 1099-SA for distributions from the HSA. Here are some basics you need to know:

- Qualified medical expenses include deductibles, dental services, vision care, prescription drugs, co-pays, psychiatric treatments, and other qualified medical expenses not covered by a health insurance plan.

- Insurance premiums don’t count as a qualified medical expense unless the premiums are for Medicare or other healthcare coverage (provided you are age 65 or older) for health insurance when receiving healthcare continuation coverage (COBRA) , for coverage when receiving unemployment compensation, or for long-term care insurance , subject to annually adjusted limits. Premiums for Medicare supplemental or Medigap policies are not treated as qualified medical expenses.

If distributions are made from an HSA to pay for anything other than a qualified medical expense, that amount is subject to both income tax and an additional 20% tax penalty. However, once an individual turns 65, the 20% tax penalty is eliminated, and only income tax would apply for non-qualified withdrawals.

HSA Contribution Rules

Contributions made to an HSA do not have to be used or withdrawn during the tax year. Instead, they are vested, and any unused contributions can be rolled over to the following year. Also, an HSA is portable, meaning that if employees change jobs, they can still keep their HSAs.

An HSA plan can also be transferred to a surviving spouse tax-free upon the account holder’s death.

However, if the designated beneficiary is not the account holder’s spouse, then the account is no longer treated as an HSA, and the beneficiary is taxed on the account’s fair market value , adjusted for any qualified medical expenses of the decedent paid from the account within a year of the date of death.

The HSA is often compared with the Flexible Spending Account (FSA) . While both accounts can be used for medical expenses, some key differences exist between them:

- FSAs are employer-sponsored plans.

- Only employed individuals can sign up for FSAs.

- Unused funds in the FSA during a given tax year can’t be rolled over and are forfeited once the year ends.

- Your elected contribution amount for an FSA is fixed, unlike HSA contributions.

The maximum contribution for an FSA for the 2024 tax year is $3,200 ($3,050 for 2023).

Can I Open a Health Savings Account (HSA) If I’m Self-Employed?

You can open a Health Savings Account (HSA) if you have a high-deductible health plan. If you are self-employed, you can look into HSAs offered by brokerages or banks like Fidelity, HealthEquity, or Lively. Research your options carefully to ensure you get the best HSA to suit your needs.

Do I Have to Use All of the Money in My HSA Every Year?

Unlike a Flexible Spending Account (FSA), contributions to your Health Savings Account (HSA) can roll over yearly. Since the funds can also be invested, you can build capital for more significant medical needs or use it as an investment fund after retirement.

Can I Pay My Insurance Premiums with My HSA Funds?

In most cases, you cannot pay for premiums with Health Savings Account (HSA) funds. HSAs can be used for most medical expenses, like doctor’s appointments, prescriptions, or over-the-counter medications, but not your monthly premium. The only exception to this rule is when the funds are used to pay Medicare premiums or other healthcare continuation coverage, such as COBRA, while you’re on unemployment compensation. You may also pay for long-term care insurance using your HSA.

HSAs are one of the best tax-advantaged savings and investment tools available under the U.S. tax code. They are often referred to as triple tax-advantaged because:

- Contributions are not subject to tax.

- The money can be invested and grown tax free.

- Withdrawals are not taxed as long as you use them for qualified medical expenses.

As a person ages, medical expenses tend to increase, particularly when reaching retirement age and beyond. Therefore, starting an HSA early if you qualify —and allowing it to accumulate over a long period—can benefit your financial future.

Internal Revenue Service. “ Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans ,” Pages 2 and 3.

Internal Revenue Service. “ Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans ,” Page 6.

Internal Revenue Service. “ Rev. Proc. 2023-23 .”

Internal Revenue Service. “ Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans ,” Page 5.

Internal Revenue Service. “ Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans ,” Page 7.

Internal Revenue Service. “ Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans ,” Pages 3–4.

Internal Revenue Service. “ Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans ,” Page 4.

Internal Revenue Service. “ Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans ,” Page 8.

Government of Canada. “ Warning: Buyer Beware When It Comes to Health Spending Accounts .”

Internal Revenue Service. “ Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans ,” Pages 3 and 8.

Internal Revenue Service. “ Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans ,” Pages 8–9.

U.S. Securities and Exchange Commission. “ Investor Bulletin: Health Savings Accounts (HSAs) .”

Internal Revenue Service. “ Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans ,” Pages 8–10.

Internal Revenue Service. “ Topic No. 502 Medical and Dental Expenses .”

Internal Revenue Service. “ IRS Outlines Changes to Health Care Spending Available Under CARES Act .”

Internal Revenue Service. “ Publication 502: Medical and Dental Expenses (Including the Health Coverage Tax Credit) ,” Pages 8–10.

Internal Revenue Service. “ Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans ,” Pages 8 and 10.

Internal Revenue Service. “ Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans ,” Page 10.

Internal Revenue Service. “ Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans ,” Pages 16–17.

Internal Revenue Service. " 2024 Flexible Spending Arrangement Contribution Limit Rises in 2024 ."

Internal Revenue Service. “ IRS Provides Tax Inflation Adjustments for Tax Year 2023 .”

Internal Revenue Service. “ Publication 969: Health Savings Accounts and Other Tax-Favored Health Plans ,” Page 9.

:max_bytes(150000):strip_icc():format(webp)/TransferringIRAMoneytoanHSA-114b4cd3548549569d4044be572096f3.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Please provide your zip code to see plans in your area.

ACA Enrollment

Insurance Options

Medicare & Medicaid

Calculators

Latest News & Topics

Search this site

Home > FAQs > How does a health savings account (HSA) work?

How does a health savings account (HSA) work?

In this article

- An HSA allows you to pay lower federal income taxes by making tax-free deposits each year.

- You can enroll in an HSA-qualified high-deductible health plan during open enrollment or a special enrollment period.

- See HSA contribution limits for 2024 and 2025

- Deposits to your HSA are yours to withdraw at any time to pay for medical expenses not paid by your HDHP.

- You can also use the account to pay for the medical expenses of a spouse or other family members – even if they aren’t covered by your HDHP.

- When you reach age 65 , there’s no longer a penalty for withdrawing HSA funds to use for non-medical expenses, but you will owe income tax on the withdrawals.

- What happens if you switch to a health plan that’s not HSA-qualified?

- How do you report HSA contribution and withdrawal details to the IRS?

Would you like the ability to pay for medical expenses with pre-tax money? What about the option to build retirement savings that can be used at any time – without taxes or penalties – to pay medical expenses that arise along the way? Do you prefer health insurance coverage that comes with a higher deductible and lower premiums?

A health savings account ( HSA ) could be just what the doctor ordered. Used wisely, this innovative approach to health coverage may provide major advantages that could keep both your personal and financial life healthy.

What is a health savings account?

A health savings account is a tax-advantaged personal savings account that works in combination with an HSA-qualified high-deductible health insurance policy (HDHP) to provide both an investment and health coverage.

The savings account provides the funds you use to pay medical expenses that aren’t paid by your HDHP, or — if you don’t need to use it — is an interest-bearing nest egg that grows over time. Unlike FSAs , there is no “use it or lose it” rule with HSAs; the money remains in the account and can be used at any time in the future; and it can grow with interest or investment returns, depending on the type of account you set up.

The HDHP, meanwhile, is your safety net should you need coverage for major medical expenses that exceed the amount of your deductible. And as long as your HDHP isn’t grandfathered , it’s also required to pay for certain preventive care , regardless of whether you’ve met your deductible.

Sounds too good to be true? Well, remember that you’re paying a lower premium for your insurance coverage because it’s a high-deductible plan that doesn’t cover anything other than preventive care before the deductible. If you need to see the doctor for anything else, you’ll pay the entire bill (reduced according to the negotiated rates your health plan has with the doctor) if you haven’t yet met your deductible.

Can ACA Marketplace health plans be paired with HSAs?

Yes. In nearly every area of the country, there are HSA-qualified high-deductible health plans available through the exchange/Marketplace or directly from insurers that sell ACA-compliant coverage. Here’s more about how ACA regulations mesh with HSA compliance rules .

How can I enroll in an HDHP?

If you don’t have access to an employer-sponsored plan, Medicare, or Medicaid, you’ll be purchasing your coverage in the individual/family market.

Nearly everywhere in the country, HSA-qualified HDHPs are for sale in the Marketplace/exchange, and are also available for purchase directly from health insurers (but if you’re eligible for a subsidy , make sure you shop in the Marketplace; you’ll forfeit your subsidy if you buy your plan outside the exchange ).

The open enrollment window for self-purchased health coverage runs from November 1 to January 15 in most states, although some states have different deadlines . Outside of open enrollment, you’ll need a special enrollment period to sign up for any major medical health plan, including HDHPs.

If you’re shopping for health coverage in the marketplace or on an insurer’s website, the HSA-qualified plans will have a label indicating that they can be paired with an HSA. In most cases, the name of the plan will have “HSA” in it. But exchanges and insurer websites also have filtering tools that will let you narrow down the plans to show only those that are HSA-compatible.

If your employer offers an HDHP, you can enroll in that option during your employer’s open enrollment period, or during a special enrollment period triggered by a qualifying life event.

What is the HSA contribution limit for 2024?

Opening an HSA allows you to pay lower federal income taxes by making tax-free deposits into your account each year. For 2024, the HSA contribution limit is $4,150 if your HDHP covers just yourself, and $8,300 if you have family HDHP coverage. 1 If you’re covered under an HDHP in 2024 ( even if it’s just in December ), you’ll have until April 15, 2025 to make HSA contributions for 2024.

If you’re 55 or older, you can contribute an extra $1,000 a year (this is officially called an “additional contribution” and often referred to as a catch-up contribution). This amount isn’t indexed; it stays steady at $1,000 per year. And it’s important to understand that if two spouses are each 55+, they each need their own HSA in order to be able to make a catch-up contribution for each spouse. 2

Most states — all but California and New Jersey — also offer tax breaks on funds deposited in these accounts (some states have no income tax, so HSA contributions would only affect federal taxes in those states, and some states do tax HSA earnings, but not contributions).

Contributions can be made by the individual who owns the account or by an employer, or by anyone else who wants to contribute on behalf of the account owner. When people contribute their own funds to an HSA, they don’t have to pay income tax on those funds. The money is either payroll deducted pre-tax (which means it’s free from income tax and FICA taxes), or deducted from your income tax on your tax return (you can deduct your contributions even if you take the standard deduction and don’t itemize). And if an employer contributes, the money is not taxed as income for the employee.