- Coaching Team

- Investor Tools

- Student Success

Real Estate Investing Strategies

- Real Estate Business

- Real Estate Markets

- Real Estate Financing

- REITs & Stock Investing

How To Navigate The Real Estate Assignment Contract

What is assignment of contract?

Assignment of contract vs double close

How to assign a contract

Assignment of contract pros and cons

Even the most left-brained, technical real estate practitioners may find themselves overwhelmed by the legal forms that have become synonymous with the investing industry. The assignment of contract strategy, in particular, has developed a confusing reputation for those unfamiliar with the concept of wholesaling. At the very least, there’s a good chance the “assignment of contract real estate” exit strategy sounds more like a foreign language to new investors than a viable means to an end.

A real estate assignment contract isn’t as complicated as many make it out to be, nor is it something to shy away from because of a lack of understanding. Instead, new investors need to learn how to assign a real estate contract as this particular exit strategy represents one of the best ways to break into the industry.

In this article, we will break down the elements of a real estate assignment contract, or a real estate wholesale contract, and provide strategies for how it can help investors further their careers. [ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

What Is A Real Estate Assignment Contract?

A real estate assignment contract is a wholesale strategy used by real estate investors to facilitate the sale of a property between an owner and an end buyer. As its name suggests, contract assignment strategies will witness a subject property owner sign a contract with an investor that gives them the rights to buy the home. That’s an important distinction to make, as the contract only gives the investor the right to buy the home; they don’t actually follow through on a purchase. Once under contract, however, the investor retains the sole right to buy the home. That means they may then sell their rights to buy the house to another buyer. Therefore, when a wholesaler executes a contact assignment, they aren’t selling a house but rather their rights to buy a house. The end buyer will pay the wholesale a small assignment fee and buy the house from the original buyer.

The real estate assignment contract strategy is only as strong as the contracts used in the agreement. The language used in the respective contract is of the utmost importance and should clearly define what the investors and sellers expect out of the deal.

There are a couple of caveats to keep in mind when considering using sales contracts for real estate:

Contract prohibitions: Make sure the contract you have with the property seller does not have prohibitions for future assignments. This can create serious issues down the road. Make sure the contract is drafted by a lawyer that specializes in real estate assignment contract law.

Property-specific prohibitions: HUD homes (property obtained by the Department of Housing and Urban Development), real estate owned or REOs (foreclosed-upon property), and listed properties are not open to assignment contracts. REO properties, for example, have a 90-day period before being allowed to be resold.

What Is An Assignment Fee In Real Estate?

An assignment fee in real estate is the money a wholesaler can expect to receive from an end buyer when they sell them their rights to buy the subject property. In other words, the assignment fee serves as the monetary compensation awarded to the wholesaler for connecting the original seller with the end buyer.

Again, any contract used to disclose a wholesale deal should be completely transparent, and including the assignment fee is no exception. The terms of how an investor will be paid upon assigning a contract should, nonetheless, be spelled out in the contract itself.

The standard assignment fee is $5,000. However, every deal is different. Buyers differ on their needs and criteria for spending their money (e.g., rehabbing vs. buy-and-hold buyers). As with any negotiations , proper information is vital. Take the time to find out how much the property would realistically cost before and after repairs. Then, add your preferred assignment fee on top of it.

Traditionally, investors will receive a deposit when they sign the Assignment of Real Estate Purchase and Sale Agreement . The rest of the assignment fee will be paid out upon the deal closing.

Assignment Contract Vs Double Close

The real estate assignment contract strategy is just one of the two methods investors may use to wholesale a deal. In addition to assigning contracts, investors may also choose to double close. While both strategies are essentially variations of a wholesale deal, several differences must be noted.

A double closing, otherwise known as a back-to-back closing, will have investors actually purchase the home. However, instead of holding onto it, they will immediately sell the asset without rehabbing it. Double closings aren’t as traditional as fast as contract assignment, but they can be in the right situation. Double closings can also take as long as a few weeks. In the end, double closings aren’t all that different from a traditional buy and sell; they transpire over a meeter of weeks instead of months.

Assignment real estate strategies are usually the first option investors will want to consider, as they are slightly easier and less involved. That said, real estate assignment contract methods aren’t necessarily better; they are just different. The wholesale strategy an investor chooses is entirely dependent on their situation. For example, if a buyer cannot line up funding fast enough, they may need to initiate a double closing because they don’t have the capital to pay the acquisition costs and assignment fee. Meanwhile, select institutional lenders incorporate language against lending money in an assignment of contract scenario. Therefore, any subsequent wholesale will need to be an assignment of contract.

Double closings and contract assignments are simply two means of obtaining the same end. Neither is better than the other; they are meant to be used in different scenarios.

Flipping Real Estate Contracts

Those unfamiliar with the real estate contract assignment concept may know it as something else: flipping real estate contracts; if for nothing else, the two are one-in-the-same. Flipping real estate contracts is simply another way to refer to assigning a contract.

Is An Assignment Of Contract Legal?

Yes, an assignment of contract is legal when executed correctly. Wholesalers must follow local laws regulating the language of contracts, as some jurisdictions have more regulations than others. It is also becoming increasingly common to assign contracts to a legal entity or LLC rather than an individual, to prevent objections from the bank. Note that you will need written consent from all parties listed on the contract, and there cannot be any clauses present that violate the law. If you have any questions about the specific language to include in a contract, it’s always a good idea to consult a qualified real estate attorney.

When Will Assignments Not Be Enforced?

In certain cases, an assignment of contract will not be enforced. Most notably, if the contract violates the law or any local regulations it cannot be enforced. This is why it is always encouraged to understand real estate laws and policy as soon as you enter the industry. Further, working with a qualified attorney when crafting contracts can be beneficial.

It may seem obvious, but assignment contracts will not be enforced if the language is used incorrectly. If the language in a contract contradicts itself, or if the contract is not legally binding it cannot be enforced. Essentially if there is any anti-assignment language, this can void the contract. Finally, if the assignment violates what is included under the contract, for example by devaluing the item, the contract will likely not be enforced.

How To Assign A Real Estate Contract

A wholesaling investment strategy that utilizes assignment contracts has many advantages, one of them being a low barrier-to-entry for investors. However, despite its inherent profitability, there are a lot of investors that underestimate the process. While probably the easiest exit strategy in all of real estate investing, there are a number of steps that must be taken to ensure a timely and profitable contract assignment, not the least of which include:

Find the right property

Acquire a real estate contract template

Submit the contract

Assign the contract

Collect the fee

1. Find The Right Property

You need to prune your leads, whether from newspaper ads, online marketing, or direct mail marketing. Remember, you aren’t just looking for any seller: you need a motivated seller who will sell their property at a price that works with your investing strategy.

The difference between a regular seller and a motivated seller is the latter’s sense of urgency. A motivated seller wants their property sold now. Pick a seller who wants to be rid of their property in the quickest time possible. It could be because they’re moving out of state, or they want to buy another house in a different area ASAP. Or, they don’t want to live in that house anymore for personal reasons. The key is to know their motivation for selling and determine if that intent is enough to sell immediately.

With a better idea of who to buy from, wholesalers will have an easier time exercising one of several marketing strategies:

Direct Mail

Real Estate Meetings

Local Marketing

2. Acquire A Real Estate Contract Template

Real estate assignment contract templates are readily available online. Although it’s tempting to go the DIY route, it’s generally advisable to let a lawyer see it first. This way, you will have the comfort of knowing you are doing it right, and that you have counsel in case of any legal problems along the way.

One of the things proper wholesale real estate contracts add is the phrase “and/or assigns” next to your name. This clause will give you the authority to sell the property or assign the property to another buyer.

You do need to disclose this to the seller and explain the clause if needed. Assure them that they will still get the amount you both agreed upon, but it gives you deal flexibility down the road.

3. Submit The Contract

Depending on your state’s laws, you need to submit your real estate assignment contract to a title company, or a closing attorney, for a title search. These are independent parties that look into the history of a property, seeing that there are no liens attached to the title. They then sign off on the validity of the contract.

4. Assign The Contract

Finding your buyer, similar to finding a seller, requires proper segmentation. When searching for buyers, investors should exercise several avenues, including online marketing, listing websites, or networking groups. In the real estate industry, this process is called building a buyer’s list, and it is a crucial step to finding success in assigning contracts.

Once you have found a buyer (hopefully from your ever-growing buyer’s list), ensure your contract includes language that covers earnest money to be paid upfront. This grants you protection against a possible breach of contract. This also assures you that you will profit, whether the transaction closes or not, as earnest money is non-refundable. How much it is depends on you, as long as it is properly justified.

5. Collect The Fee

Your profit from a deal of this kind comes from both your assignment fee, as well as the difference between the agreed-upon value and how much you sell it to the buyer. If you and the seller decide you will buy the property for $75,000 and sell it for $80,000 to the buyer, you profit $5,000. The deal is closed once the buyer pays the full $80,000.

Assignment of Contract Pros

For many investors, the most attractive benefit of an assignment of contract is the ability to profit without ever purchasing a property. This is often what attracts people to start wholesaling, as it allows many to learn the ropes of real estate with relatively low stakes. An assignment fee can either be determined as a percentage of the purchase price or as a set amount determined by the wholesaler. A standard fee is around $5,000 per contract.

The profit potential is not the only positive associated with an assignment of contract. Investors also benefit from not being added to the title chain, which can greatly reduce the costs and timeline associated with a deal. This benefit can even transfer to the seller and end buyer, as they get to avoid paying a real estate agent fee by opting for an assignment of contract. Compared to a double close (another popular wholesaling strategy), investors can avoid two sets of closing costs. All of these pros can positively impact an investor’s bottom line, making this a highly desirable exit strategy.

Assignment of Contract Cons

Although there are numerous perks to an assignment of contract, there are a few downsides to be aware of before searching for your first wholesale deal. Namely, working with buyers and sellers who may not be familiar with wholesaling can be challenging. Investors need to be prepared to familiarize newcomers with the process and be ready to answer any questions. Occasionally, sellers will purposely not accept an assignment of contract situation. Investors should occasionally expect this, as to not get discouraged.

Another obstacle wholesalers may face when working with an assignment of contract is in cases where the end buyer wants to back out. This can happen if the buyer is not comfortable paying the assignment fee, or if they don’t have owner’s rights until the contract is fully assigned. The best way to protect yourself from situations like this is to form a reliable buyer’s list and be upfront with all of the information. It is always recommended to develop a solid contract as well.

Know that not all properties can be wholesaled, for example HUD houses. In these cases, there are often anti-assigned clauses preventing wholesalers from getting involved. Make sure you know how to identify these properties so you don’t waste your time. Keep in mind that while there are cons to this real estate exit strategy, the right preparation can help investors avoid any big challenges.

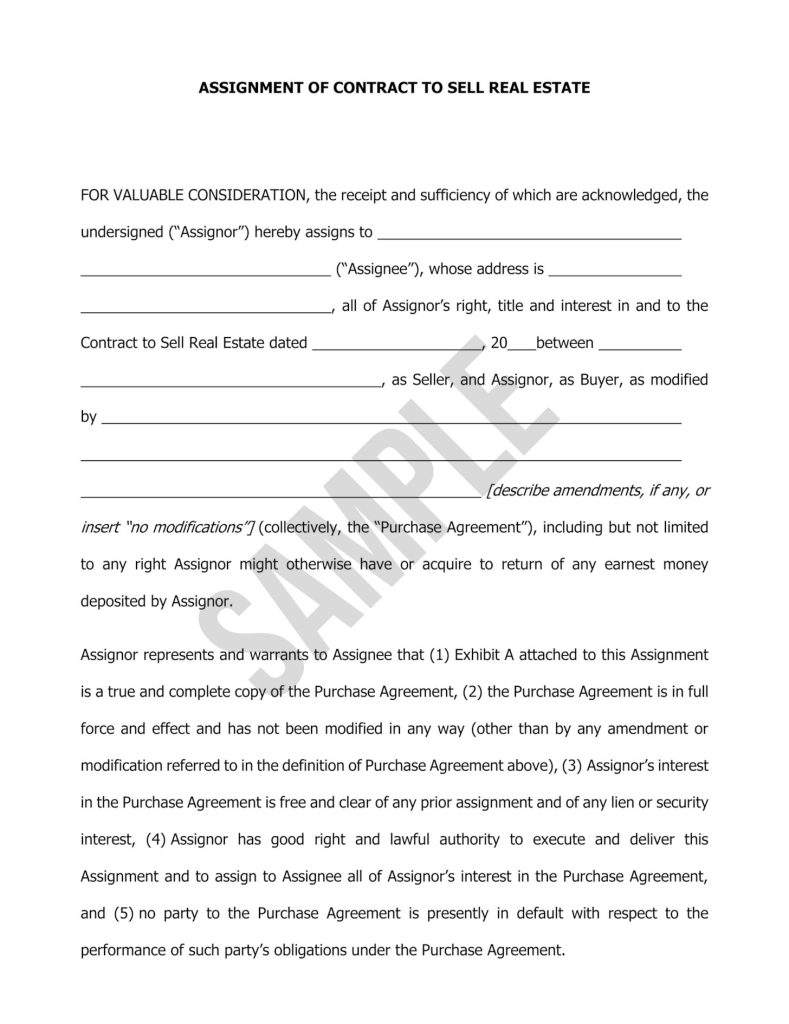

Assignment of Contract Template

If you decide to pursue a career wholesaling real estate, then you’ll want the tools that will make your life as easy as possible. The good news is that there are plenty of real estate tools and templates at your disposal so that you don’t have to reinvent the wheel! For instance, here is an assignment of contract template that you can use when you strike your first deal.

As with any part of the real estate investing trade, no single aspect will lead to success. However, understanding how a real estate assignment of contract works is vital for this business. When you comprehend the many layers of how contracts are assigned—and how wholesaling works from beginning to end—you’ll be a more informed, educated, and successful investor.

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

What is an STR in Real Estate?

Wholetailing: a guide for real estate investors, what is chain of title in real estate investing, what is a real estate fund of funds (fof), reits vs real estate: which is the better investment, multi-family vs. single-family property investments: a comprehensive guide.

What Is an Assignment of Contract? [How It Works In Real Estate]

What Is an Assignment of Contract?

One intriguing strategy in real estate investing that often stirs interest among newbie investors is the assignment of contracts. This approach, which allows an investor to pass the contractual rights and obligations of a property purchase contract to another buyer, is seen to provide highly profitable opportunities.

If you are an investor who wants to try this technique to achieve financial freedom, this blog is for you! Here, we'll delve into the nitty-gritty of contract assignment, explaining its mechanism, benefits, potential pitfalls, and the crucial steps involved. We hope that after reading this blog, you can navigate the real estate market with confidence!

What Is an Assignment of a Contract in Real Estate?

In real estate wholesaling, an investor agrees to buy a personal property, often at a below-market price, then assigns the contract to a different buyer, often another investor, for a higher price.

The difference between the contracted price and the price paid by the end buyer represents the wholesaler's profit, known as the assignment fee.

For example, an investor might secure a contract to purchase a personal property for $100,000, then find an end buyer or new party willing to pay $120,000 for the same property. By assigning the contract to the end buyer, the investor earns a $20,000 assignment fee.

However, it's crucial to note that not all real estate contracts can be freely assigned. Some contracts may include a "no assignment" clause that prevents the transfer of the contract to another party.

Thus, an investor needs to ensure that assigning contractual rights is allowed before proceeding with this strategy. If an assignment clause is not present in the contract, the investor may need to negotiate with the original party or owner to include in the contract rights it or find an alternate method to transfer the property to a new party.

In essence, an assignment contract is a way for real estate investors to connect sellers and buyers, while generating a profit from the transaction without needing to purchase, own, or manage the property themselves. It's a strategy that requires careful planning, thorough due diligence, and an understanding of real estate laws and market conditions.

Assignment Contract vs. Double Closing

Both assignment contracts and double closings are strategies used in real estate investing, particularly wholesaling, but they function differently.

As previously discussed, an assignment of contract involves the wholesaler (assignor) transferring their contractual rights in a property purchase agreement to another party (assignee), typically another investor.

The wholesaler never actually purchases the property . Instead, they sell their contract to buy the property. The assignee pays an assignment fee to the wholesaler, then proceeds to close the deal with the original seller. In this arrangement, the end buyer is aware of the wholesaler's profit.

Meanwhile, double closing , also known as a "simultaneous close," involves the wholesaler actually purchasing the property before quickly reselling it to the end buyer. This is perhaps the main difference between the two.

Essentially, there are two separate transactions: one where the wholesaler buys from the original seller and another where the wholesaler sells to the end buyer.

Both transactions of the contract occurs back-to-back, even on the same day. The wholesaler uses the funds from the end buyer to pay the original seller and keeps the difference as profit. This approach allows the wholesaler's profit to remain hidden from all parties.

Is an Assignment Contract Considered Legal?

Yes, an assignment contract is generally considered legal in real estate transactions. It is a common practice, especially in real estate investing and wholesaling.

However, the legality can depend on several factors, including the terms of the original contract and the laws in a particular area.

Some contracts may disallow assignment through a clause that "prohibits the assignment of the contract without the consent of the other party." In such cases, assignment of the written contract without consent would violate public policy and could potentially lead to legal repercussions. This may also encourage litigation.

Additionally, while an assignment contract is generally legal, some states in the U.S. have specific rules and regulations about how real estate contract assignments and wholesaling, more generally, should be conducted.

Some require specific disclosures to be given to the other party to the contract or have particular rules about how the transaction can be advertised. Some do not also allow material alteration, In some jurisdictions, regular wholesaling activity might require a real estate license, contract expiration date for commercial contracts, etc.

Pros and Cons of Assignment of Contract in Real Estate

The assignment of contracts in real estate comes with its own set of advantages and disadvantages, which investors need to consider carefully before entering any deal.

To help you decide if this real estate investing strategy is indeed for you, read the following pros and cons.

Pros of Assignment of Contract

- Less Capital Required: Because the wholesaler is simply assigning the contract and not actually purchasing the property, less capital is required compared to traditional real estate transactions.

- Profit Potential: Assigning a contract can be profitable, especially when properties are secured under market value and the seller and buyer guarantees performance. The difference between the contract agreement price from the assignee and the purchase price the end buyer pays can result in significant earnings.

- Faster Transactions: Assignments often lead to faster transactions as the assignor is not taking possession of the property. They don't have to do heavy obligations such as a title search, contact a company to make repairs, etc. Once a suitable assignee is found, the existing contract can be assigned and the transaction completed.

Cons of Assignment of Contract

- Dependent on Buyers: Wholesalers are reliant on finding end buyers and getting a closing date. If an assignee can't be found in time, the wholesaler may be forced to back out of the deal or risk legal consequences.

- Limited Control: The wholesaler doesn't own the property and therefore has limited control over it. They can't make improvements or changes to increase its value since it isn't part of their obligations.

- Transparency of Profit: In an assignment, the assignee can see how much profit the assignor is making, which could potentially lead to negotiations or dissatisfaction in the obligations. But, of course, the assignor warrants that the fee is fair.

- Legal Considerations: You cannot assign rights to all types of contracts, and the federal government law may have specific regulations around how assignments work. Wholesalers must be aware of the legal landscape to ensure they conduct business following the law and that the two parties they will involve know the legal term of transfer.

Steps in Contract Assignment in Real Estate

Contract assignment in real estate can be a profitable strategy when done correctly. Each step in this process requires careful attention to detail and due diligence so as not to break the law. It is ideal to consult with a real estate attorney or other professionals before doing any transfer of property.

Nevertheless, here are the steps typically involved in a contract assignment in real estate.

Step 1. Find the Right Investment Property

The first step in contract assignment is identifying a suitable investment property. You need to find a property that can be purchased under market value and resold at a profit.

This could be a distressed property, a foreclosed property, or simply a property that a seller needs to unload quickly. Market research and property analysis are critical at this stage.

Step 2. Prepare the Real Estate Contract

Once a property has been identified, you need to prepare a real estate purchase agreement. This is the contract agreement that you will eventually assign to another buyer. It's crucial that this original contract either expressly allows for assignment or at least does not prohibit it.

If you are using a template from others or it has a trade name, make sure you are not going against the intellectual property law. There are already certain claims in the past about this, so be cautious.

Step 3. Submit the Contract

After preparing the original contract, it needs to be submitted to the seller. The seller may accept the contract as is, reject it outright, or propose changes. If changes are proposed, negotiations will take place until an agreement is reached.

Step 4. Find an End Buyer Who Will Accept the Contractual Obligations

With an accepted contract in hand, you can now seek an end buyer to whom the contract will be assigned.

This could be another investor or a traditional homebuyer. Marketing the original contract can involve networking, advertising on real estate platforms, or working with a real estate agent.

Step 5. Assign the Contract to an End Buyer

After identifying an end buyer, you will assign or transfer the existing contract agreement to them (this may be an individual or a real estate company).

This involves an assignment agreement, which transfers your contractual rights and obligations under the original purchase contract agreement to one party or the end buyer (real estate company or investor).

The assignment agreement should clearly outline the original terms of the assignment, including the assignment fee that you, as the assignor, will receive.

Step 6. Collect the Fee

After the assignment agreement has been signed and transferred on the closing date, you can collect the assignment fee from one party. This is your profit from the assignment contract transaction.

The closing process then proceeds between the original seller and the end buyer, without any further involvement on your part. The property ownership will be transferred to the end buyer and you would no longer have any responsibilities or duties with them.

Final Thoughts: What are Assignment Contracts? [How Does Assignment of Contract Work in Real Estate]

Whether you're a seasoned real estate wholesaler or just starting, it's clear that understanding assignment contracts and how they function within the real estate sector can open doors to new opportunities and potentially profitable ventures.

With the right approach, a keen understanding of the property market, negotiation skills, thorough due diligence, and creativity, these contracts can be your main income stream.

If you want to find leads on properties that you can assign to another buyer, reach out to us at Property Leads . We offer highly motivated seller leads in your target area for a very reasonable price. We guarantee a high conversion rate since we generate our leads through SEO.

Fill out our form below to start finding the best contract reassignment deals!

PROPERTY LEADS

30 N Gould St Ste N Sheridan, WY 82801 (207) 309-3949 [email protected]

Assignment of Contract – Assignable Contract Basics for Real Estate Investors

What is assignment of contract? Learn about this wholesaling strategy and why assignment agreements are the preferred solution for flipping real estate contracts.

Beginners to investing in real estate and wholesaling must navigate a complex landscape littered with confusing terms and strategies. One of the first concepts to understand before wholesaling is assignment of contract, also known as assignment of agreement or “flipping real estate contracts.”

An assignment contract is the most popular exit strategy for wholesalers, and it isn’t as complicated as it may seem. What does assignment of contract mean? How can it be used to get into wholesaling? Here’s what you need to know.

What Is Assignment of Contract?

How assignment of contract works in real estate wholesaling, what is an assignment fee in real estate, assignment of agreement pros & cons, assignable contract faqs.

- Transactly Saves Time. Learn How Now!

Assignment of real estate purchase and sale agreement, or simply assignment of agreement or contract, is a real estate wholesale strategy that facilitates a sale between the property owner and the end buyer.

This strategy is also known as flipping real estate contracts because that’s essentially how it works:

- The wholesaler finds a property that’s already discounted or represents a great deal and enters into a contract with the seller,

- The contract contains an assignment clause that allows the wholesaler to assign the contract to someone else (if they choose to!), then

- The wholesaler can assign the contract to another party and receive an assignment fee when the transaction closes.

Assignment of contract in real estate is a popular strategy for beginners in real estate investment because it requires very little or even no capital. As long as you can find an interested buyer, you do not need to come up with a large sum of money to buy and then resell the property – you are only selling your right to buy it .

An assignment contract passes along your purchase rights as well as your contract obligations. After the contract assignment, you are no longer involved in the transaction with no right to make claims or responsibilities to get the transaction to closing.

Until you assign contract to someone else, however, you are completely on the hook for all contract responsibilities and rights.

This means that you are in control of the deal until you decide to assign the contract, but if you aren’t able to get someone to take over the contract, you are legally obligated to follow through with the sale .

Assignment of Contract vs Double Closing

Double closing and assignment of agreement are the two main real estate wholesaling exit strategies. Unlike the double closing strategy, an assignment contract does not require the wholesaler to purchase the property.

Assignment of contract is usually the preferred option because it can be completed in hours and does not require you to fund the purchase . Double closings take twice as much work and require a great deal of coordination. They are also illegal in some states.

Ready to see how an assignment contract actually works? Even though it has a low barrier to entry for beginner investors, the challenges of completing an assignment of contract shouldn’t be underestimated. Here are the general steps involved in wholesaling.

Step #1. Find a seller/property

The process begins by finding a property that you think is a good deal or a good investment and entering into a purchase agreement with the seller. Of course, not just any property is suitable for this strategy. You need to find a motivated seller willing to accept an assignment agreement and a price that works with your strategy. Direct mail marketing, online marketing, and checking the county delinquent tax list are just a few possible lead generation strategies you can employ.

Step #2: Enter into an assignable contract

The contract with the seller will be almost the same as a standard purchase agreement except it will contain an assignment clause.

An important element in an assignable purchase contract is “ and/or assigns ” next to your name as the buyer . The term “assigns” is used here as a noun to refer to a potential assignee. This is a basic assignment clause authorizing you to transfer your position and rights in the contract to an assignee if you choose.

The contract must also follow local laws regulating contract language. In some jurisdictions, assignment of contract is not allowed. It’s becoming increasingly common for wholesalers to assign agreements to an LLC instead of an individual. In this case, the LLC would be under contract with the seller. This can potentially bypass lender objections and even anti-assignment clauses for distressed properties. Rather than assigning the contract to someone else, the investor can reassign their interest in the LLC through an “assignment of membership interest.”

Note: even the presence of an assignment clause can make some sellers nervous or unwilling to make a deal . The seller may be picky about whom they want to buy the property, or they may be suspicious or concerned about the concept of assigning a contract to an unknown third party who may or may not be able to complete the sale.

The assignment clause should always be disclosed and explained to the seller. If they are nervous, they can be assured that they will still get the agreed-upon amount.

Step #3. Submit the assignment contract for a title search

Once you are under contract, you must typically submit the contract to a title company to perform the title search. This ensures there are no liens attached to the property.

Step #4. Find an end buyer to assign the contract

Next is the most challenging step: finding a buyer who can fulfill the contract’s original terms including the closing date and purchase price.

Successful wholesalers build buyers lists and employ marketing campaigns, social media, and networking to find a good match for an assignable contract.

Once you locate an end buyer, your contract should include earnest money the buyer must pay upfront. This gives you some protection if the buyer breaches the contract and, potentially, causes you to breach your contract with the seller. With a non-refundable deposit, you can be sure your earnest money to the seller will be covered in a worst-case scenario.

You can see an assignment of contract example here between an assignor and assignee.

Step #5. Receive your assignment fee

The final step is receiving your assignment fee. This fee is your profit from the transaction, and it’s usually paid when the transaction closes.

The assignment fee is how the wholesaler makes money through an assignment contract. This fee is paid by the end buyer when they purchase the right to buy the property as compensation for being connected to the original seller. Assignment contracts should clearly spell out the assignment fee and how it will be paid.

An assignment fee in real estate replaces the broker or Realtor fee in a typical transaction as the assignor or investor is bringing together the seller and end buyer.

The standard real estate assignment fee is $5,000 . However, it varies by transaction and calculating the assignment fee may be higher or lower depending on whether the buyer is buying and holding the property or rehabbing and flipping.

The assignment fee is not always a flat amount. The difference between the agreed-upon price with the seller and the end buyer is the profit you stand to earn as the assignor. If you agreed to purchase the property for $150,000 from the seller and assign the contract to a buyer for $200,000, your assignment fee or profit would be $50,000.

In most cases, an investor receives a deposit when the Assignment of Purchase and Sale Agreement is signed with the rest paid at closing.

Be aware that assignment agreements can have a bad reputation . This is usually the case when the end buyer and seller are unsatisfied, realizing they could have sold higher or bought lower and essentially paid thousands to an investor who never even wanted to buy the property.

Opting for the standard, flat assignment fee is much more readily accepted by sellers and buyers as it’s comparable to a real estate agent’s commission or even much lower and the parties can avoid working with an agent.

Real estate investors enjoy many benefits of an assignment of contract:

- This strategy requires little or no capital which makes it a popular entry to wholesaling as investors learn the ropes.

- Investors are not added to the title chain and never own the property which reduces costs and the amount of time the deal takes.

- An assignment of agreement is easier and faster than double closing which requires two separate closings and two sets of fees and disclosures.

- Wholesaling can be a great tool to expand an investor’s network for future opportunities.

As with most things, there are important drawbacks to consider. Before jumping into wholesaling and flipping real estate contracts, consider the downsides .

- It can be difficult to work with sellers and buyers who are not familiar with wholesaling or assignment agreements.

- Some sellers avoid or decline assignment of contract offers because they are suspicious of the arrangement, think it is too risky, or want to know who they are selling to.

- There is a limited time to find an end buyer. Without a reliable buyer’s list, it can be very challenging to find a viable end buyer before the closing date.

- The end buyer may back out at the last minute. This may happen if they do not have owner’s rights until the contract is assigned or they do not want to pay an assignment fee.

- Not all properties are eligible for wholesaling like HUD and REO properties. There may be anti-assignment clauses or other hurdles. It is possible to get around this by purchasing the property with an LLC which can then be sold, but this is a level of complication that many wholesalers want to avoid.

- Assignors do not have owner’s rights. When the property is under contract, investors cannot make repairs or improvements. This makes it harder to assign a contract for a distressed property in poor condition.

- It can be hard to confirm an end buyer is qualified. The end buyer is responsible for paying the agreed upon price set by the seller and assignor. Many lenders do not handle assignment agreements which usually means turning to all-cash end buyers. Depending on the market, they can be hard to find.

In the worst-case scenario, if a wholesaling deal falls through because the end buyer backs out, the investor or assignor is still responsible for buying the property and must follow through with the purchase agreement. If you do not, you are in breach of contract and lose the earnest money you put down.

To avoid this worst-case scenario, be prepared with a good buyer’s list. You should only put properties under contract that you consider a good deal and you can market to other investors or homeowners. You may be able to get more time by asking for an extension to the assignment of contract while you find another buyer or even turn to other wholesalers to see if they have someone who would be a good fit.

What is the difference between assignor vs assignee?

In an assignment clause, the assignor is the buyer who then assigns the contract to an assignee. The assignee is the end buyer or final buyer who becomes the owner when the transaction closes. After the assignment, contract rights and obligations are transferred from the assignor to the assignee.

What Is an assignable contract?

An assignable contract in real estate is a purchase agreement that allows the buyer to assign their rights and obligations to another party before the contract expires. The assignee then becomes obligated to meet the terms of the contract and, at closing, get title to the property.

Is Assignment of Agreement Legal?

Assignment of contract is legal as long as state regulations are followed and it’s an assignable contract. The terms of your agreement with the seller must allow for the contract to be assumed. To be legal and enforceable, the following general requirements must be met.

- The assignment does not violate state law or public policy. In some states and jurisdictions, contract assignments are prohibited.

- There is no assignment clause prohibiting assignment.

- There is written consent between all parties.

- The property does not have restrictions prohibiting assignment. Some properties have deed restrictions or anti-assignment clauses prohibiting assignment of contract within a specific period of time. This includes HUD properties, short sales, and REO properties which usually prohibit a property from being resold for 90 days. There is potentially a way around these non-assignable contracts using an LLC.

Can a non-assignable contract still be assigned?

Even an non-assignable contract can become an assignable contract in some cases. A common approach is creating an agreement with an LLC or trust as the purchaser. The investor can then assign the entity to someone else because the contractual rights and obligations are the entity’s.

Assignment agreements are not as complicated as they may sound, and they offer an excellent entry into real estate investing without significant capital. A transaction coordinator at Transactly can be an invaluable solution, no matter your volume, to keep your wholesaling business on track and facilitate every step of the transaction to closing – and your assignment fee!

Adam Valley

Similar posts, getting to close: contract to close checklist for sellers.

Review our contract to close checklist for sellers to find out what exactly it is the seller is responsible for to make sure the home..

Option Contract in Real Estate Defined

Understanding the option contract real estate definition will better prepare you for your next purchase or selling of a property.

What Does a Contract to Close Coordinator Do?

A contract to close coordinator is simply just someone that is able to help you out in the complicated real estate process without stepping on your...

Get notified with new real estate posts.

Be the first to know about new real estate tech insights. Subscribe to stay up-to-date with Transactly.

Assignment Definition

Investing Strategy , Jargon, Legal, Terminology, Title

Table of Contents

- What Is an Assignment?

- What is an Assignment in Real Estate?

- What Does it Mean to Assign a Contract in Real Estate?

- How Does a Contract Assignment Work?

- Pros and Cons of Assigning Contracts

REtipster does not provide legal advice. The information in this article can be impacted by many unique variables. Always consult with a qualified legal professional before taking action.

An assignment or assignment of contract is a way to profit from a real estate transaction without becoming the owner of the property.

The assignment method is a standard tool in a real estate wholesaler’s kit and lowers the barrier to entry for a real estate investor because it does not require the wholesaler to use much (or any) of their own money to profit from a deal.

Contract assignment is a common wholesaling strategy where the seller and the wholesaler (acting as a middleman in this case) sign an agreement giving the wholesaler the sole right to buy a property at a specified price, within a certain period of time.

The wholesaler then finds another buyer and assigns the contract to him or her. The wholesaler isn’t selling the property to the end buyer because the wholesaler never takes title to the property during the process. The wholesaler is simply selling the contract, which gives the end buyer the right to buy the property in accordance with the original purchase agreement.

In doing this, the wholesaler can earn an assignment fee for putting the deal together.

Some states require a real estate wholesaler to be a licensed real estate agent, and the assignment strategy can’t be used for HUD homes and REOs.

The process for assigning a contract follows some common steps. In summary, it looks like this:

- Find the right property.

- Get a purchase agreement signed.

- Find an end buyer.

- Assign the contract.

- Close the transaction and collect your assignment fee.

We describe each step in the process below.

1. Find the Right Property

This is where the heavy lifting happens—investors use many different marketing tactics to find leads and identify properties that work with their investing strategy. Typically, for wholesaling to work, a wholesaler needs a motivated seller who wants to unload the property as soon as possible. That sense of urgency works to the wholesaler’s advantage in negotiating a price that will attract buyers and cover their assignment fee.

RELATED: What is “Driving for Dollars” and How Does It Work?

2. Get a Purchase Agreement Signed

Once a motivated seller has agreed to sell their property at a discounted price, they will sign a purchase agreement with the wholesaler. The purchase agreement needs to contain specific, clear language that allows the wholesaler (for example, you) to assign their rights in the agreement to a third party.

Note that most standard purchase agreements do not include this language by default. If you plan to assign this contract, make sure this language is included. You can consult an attorney to cover the correct verbiage in a way that the seller understands it.

RELATED: Wholesaling Made Simple! A Comprehensive Guide to Assigning Contracts

This can’t be stressed enough: It’s extremely important for a wholesaler to communicate with their seller about their intent to assign the contract. Many sellers are not familiar with the assignment process, so if the role of the buyer is going to change along the way, the seller needs to be aware of this on or before they sign the original purchase agreement.

3. Find an End Buyer

This is the other half of a wholesaler’s job—marketing to find buyers. Once they find an end buyer, the wholesaler can assign the contract to the new party and work with the original seller and the end buyer to schedule a closing date.

4. Assign the Contract

Assigning the contract works through a simple assignment agreement. This agreement allows the end buyer to step into the wholesaler’s shoes as the buyer in the original contract.

In other words, this document “replaces” the wholesaler with the new end buyer.

Most assignment contracts include language for a nonrefundable deposit from the end buyer, which protects the wholesaler if the buyer backs out. While you can download assignment contract templates online, most experts recommend having an attorney review your contracts. The assignment wording has to be precise and comply with applicable local laws to protect you from issues down the road.

5. Close the Transaction and Collect the Assignment Fee

Finally, you will receive your assignment fee (or wholesale fee) when the end buyer closes the deal.

The assignment fee is often the difference between the original purchase price (the price that the seller agreed with the wholesaler) and the end buyer’s purchase price (the price the wholesaler agreed with the end buyer), but it can also be a percentage of it or even a flat amount.

According to UpCounsel, most contract assignments are done for about $5,000, although depending on the property and the market, it could be higher or lower.

IMPORTANT: the end buyer will see precisely how much the assignment fee is. This is because they must sign two documents that show the original price and the assignment fee: the closing statement and the assignment agreement, respectively, to close the transaction.

In many cases, if the assignment fee is a reasonable amount relative to the purchase price, most buyers won’t take any issue with the wholesaler taking their fee—after all, the wholesaler made the deal happen, and it’s compensation for their efforts. However, if the assignment fee is too big (such as the wholesaler taking $20,000 from an original purchase price of $10,000, while the end buyer buys it for $50,000), it may ruffle some feathers and lead to uncomfortable questions.

In these instances where the wholesaler has a substantially higher profit margin, a wholesaler can instead do a double closing . In a double closing, the wholesaler closes two separate deals (one with the seller and another with the buyer) on the same day, but the seller and buyer cannot see the numbers and overall profit margin the wholesaler makes between the two transactions. This makes a double closing a much safer way to conclude a transaction.

Assigning contracts is a way to lower the barrier to entry for many new real estate investors; because they don’t need to put up their own money to buy a property or assume any risk in financing a deal.

The wholesaler isn’t part of the title chain, which streamlines the process and avoids the hassle of closing two times. Compared to the double-close strategy, assignment contracts require less paperwork and are usually less costly (because there is only one closing occurring, rather than two separate transactions).

On the downside, the wholesaler has to sell the property as-is, because they don’t own it at any point and they cannot make repairs or renovations to make the property look more attractive to a potential buyer. Financing may be much more difficult for the end buyer because many mortgage lenders won’t work with assigned contracts. Purchase Agreements also have expiration dates, which means the wholesaler has a limited window of time to find an end buyer and get the deal done.

Being successful with assignment contracts usually comes down to excellent marketing, networking, and communication between all parties involved. It’s all about developing strategies to find the right properties and having a solid network of investors you can assign them to quickly.

It’s also critical to be aware of any applicable laws in the jurisdiction where the wholesaler is working and holding any licenses required for these kinds of real estate transactions.

Related terms

Double closing, wholesaling (real estate wholesaling), transactional funding.

Bonus: Get a FREE copy of the INVESTOR HACKS ebook when you subscribe!

Free Subscriber Toolbox

Want to learn about the tools I’ve used to make over $40,000 per deal ? Get immediate access to videos, guides, downloads, and more resources for real estate investing domination. Sign up below for free and get access forever.

Join our growing community

subscribers

Welcome to REtipster.com

We noticed you are using an ad blocker.

We get it, too much advertising can be annoying.

Our few advertisers help us continue bringing lots of great content to you for FREE.

Please add REtipster.com to your Ad Blocker white list, to receive full access to website functionality.

Thank you for supporting. We promise you will find ample value from our website.

Thanks for contacting us! We will get in touch with you shortly.

Real Estate Contracts

What is an assignment contract.

Assignment contracts are a vehicle used by real estate investors to transfer one party’s rights and obligations under an existing real estate contract to another party. Assignment contracts don’t involve transferring or selling the property directly like a purchase agreement. Instead, the buyer under the original purchase agreement (the assignor) assigns their rights and obligations under the purchase agreement to the assignee, sometimes for a profit. The assignee then becomes the buyer under the original real estate contract.

By clicking Subscribe Now!, you agree to receive Academy Newsletter emails from Blueprint. You also agree to our privacy policy and terms of use . You can update your subscription preferences at any time by clicking the unsubscribe link in our emails.

When Is an Assignment Contract Used?

In one scenario, a type of real estate investor called a wholesaler contracts with the current owner(s) of a distressed property that may be unsellable to average homebuyers. The wholesaler creates a purchase agreement with that owner to buy their property. The wholesaler then finds an end buyer who wants to take possession of the property. The assignment contract is then created to transfer the wholesaler’s rights and obligations under the original purchase agreement to the end buyer.

Elements of an Assignment Contract

- Assignor : the real estate wholesaler. This is the person who is the buyer under the original purchase agreement and who is selling or transferring their rights and obligations under that contract.

- Assignee : the end buyer. This is the person who is purchasing or receiving the assignor’s rights and obligations under the original purchase agreement and who would ultimately pay the purchase price (plus any assignment fee agreed to in the assignment contract) and take possession of the property.

- Description or identification of contract being assigned: a description of the original purchase agreement being assigned. Oftentimes, the assignment contract will also attach the original purchase agreement or state that it has been provided to the assignee.

- Subject property information: the property address, legal description, or property identification number/parcel number for the property that is the subject of the original purchase agreement.

- Assignment earnest money amount: like with other types of real estate contracts, earnest money shows the assignee is a serious buyer. The money helps ensure that the assignee won’t back out of the deal for frivolous reasons.

- Assignee’s purchase amount: the amount the end buyer agrees to pay that fulfills or exceeds the original purchase agreement amount.

- Assignment fee: the amount of money the assignor will make for finding an end buyer. The assignment fee should be clearly set forth in the assignment contract.

- Name of the company holding escrow : the assignment contract will designate what company is holding escrow. This escrow company should match the escrow company listed in the original purchase agreement or you will need an amendment to the original purchase agreement or, in states where it is permissible, a split escrow.

- Closing date: the date by which the transaction should be finalized. This should correspond to the original purchase agreement’s closing date. If a different date is used, an amendment to the original purchase agreement may be required.

- How assignment earnest money is handled : should one party cancel the contract or fail to meet the contractual obligations, the earnest money may either be forfeited by the assignee or returned. In instances of a dispute between the parties, the third party holding escrow may release the assignment earnest money pursuant to the terms and conditions of the assignment contract.

Writing a comprehensive assignment contract is a vital part of several real estate investing strategies. If you’re new to creating these kinds of contracts, be sure to get some legal advice before moving forward. Once you have a solid assignment contract template in place, transactions using this contracting tool will run more smoothly.

* The information provided on this site does not, and is not intended to, constitute legal, financial, tax, or real estate advice. Please consult your expert for advice in those areas. All content is for general informational purposes only and is not intended to provide a complete description of the subject matter. Although Blueprint provides information it believes to be accurate, Blueprint makes no representations or warranties about the accuracy or completeness of the information contained on this site. Specific processes will vary based on applicable law. The title and closing process will be handled by a third-party attorney to the extent required by law. Product offerings vary by jurisdiction and are not available or solicited in any state where we are not licensed.

- Cookie Policy

- Privacy Policy

- Terms of Service

- Blueprint Platform

- Blueprint API

- Underwriting Partner

- Where We Work

- For Investors

- For Wholesalers

- For Lenders

- For Proptech

- API Documentation

- Blueprint Academy

- Guides & eBooks

Quick Links

Get in touch.

(615) 933-0075

401 Church St. #1710 Nashville, TN 37219

We, us, and Blueprint refer to Blueprint’s licensed title agencies . We act as an agency for one or more affiliated and unaffiliated insurance companies. Product offerings vary by jurisdiction and are not available or solicited in any state where we are not licensed. Closings will be handled by a third-party attorney where required by law. Features and services availability vary by market and applicable law.

Copyright ©2023 Blueprint Title Company All Rights Reserved Copyright

Assigning Real Estate Contracts: Everything You Need to Know

Assigning real estate contracts refers to a method of earning money from buying and selling real estate. You find a seller who is eager to sell their property at a price that is far below its market value. 3 min read updated on February 01, 2023

Updated July 10, 2020:

Assigning real estate contracts refers to a method of earning money from buying and selling real estate. You find a seller who is eager to sell their property at a price that is far below its market value. Then, you find a buyer willing to pay a higher price for it.

How Contract Assignment Works

The first thing you need to do for contract assignment is to find a motivated seller. This is a person who owns a property, and for some reason, needs to sell in a hurry. This is generally because of a problem they are having, such as needing to move to a new home quickly. You'll need to be able to tell the difference between this sort of seller and someone who isn't in so much of a hurry to sell, and perhaps just wants to know what the property is worth.

You can find motivated sellers by placing ads in the newspaper, marketing on the internet, or sending direct mail. A combination of strategies works best.

The next thing you need to do is to obtain an assignment contract document. You can find templates on the web, but it's a good idea to have an attorney look it over before signing anything. That way, you will know that everything is completely legal. You will also be able to use that attorney if things don't work out as planned.

After the contract is signed, you submit it to a title company or an attorney who handles real estate closings . They will then do a title search. This ensures there are no existing liens against the property. This step is crucial because you do not want to buy a property that has a problem with the title. The title company is objective and independent and therefore makes sure everything is fair and legal.

At this point, you may search for a buyer. This will require more marketing strategies and can be a difficult process, but when you do find a buyer, you can move on to the next step - closing on the property. You'll need to collect a non-refundable deposit known as “earnest money” to make sure the buyer won't back out. If the buyer does change their mind, you get to keep the earnest money. This amount can be determined by you or the buyer.

Next, you get paid! The amount you receive will cover the amount you agreed to pay the property seller, along with an amount you get to keep in return for finding the buyer and making the transaction happen.

While this process takes place, you should make sure the seller understands how the process works , and that you will make a profit from the transaction. Otherwise, either the seller or buyer may decide they don't like the idea of your profiting from the sale and may back out. Reassure the seller that they are still getting the amount agreed upon for the sale.

Most contract assignments are done for $5,000 profit or less, but you can do it for a higher amount if you choose. If problems arise, it's possible to do a double or simultaneous closing, thereby keeping both parts of the sale separate and anonymous. Some title companies may not agree to do this, so if it becomes an issue, you should discuss it in advance.

Drawbacks of Contract Assignment

Contract assignment, or wholesaling, can be a profitable venture , but there are a few pitfalls to watch out for, such as:

- You cannot make any repairs or renovations to the property because you do not own it at any point.

- You cannot offer any type of financing to the buyer.

- You must get the sale accomplished within a short amount of time before the contract expires.

- The process of closing on the property is detailed and can be complicated.

- You must find a buyer who is willing to pay in cash because it's hard to find a lender who will approve a mortgage for an assigned contract.

You also need to check the laws in your state, because in some states it is not legal to market a property that you don't own.

If you need more information or help with assigning real estate contracts, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Property Contracts

- Sample Real Estate Contracts

- Land Sale Contracts

- Commercial Real Estate Contract Provisions

- Deed Contract Agreement

- Assignment Of Contracts

- Define Subject to Contract

- As Is Sales Contract

- Bill of Sale Land Contract

- Extension Addendum to Contract

Assignment of Contract

Jump to section, what is an assignment of contract.

An assignment of contract is a legal term that describes the process that occurs when the original party (assignor) transfers their rights and obligations under their contract to a third party (assignee). When an assignment of contract happens, the original party is relieved of their contractual duties, and their role is replaced by the approved incoming party.

How Does Assignment of Contract Work?

An assignment of contract is simpler than you might think.

The process starts with an existing contract party who wishes to transfer their contractual obligations to a new party.

When this occurs, the existing contract party must first confirm that an assignment of contract is permissible under the legally binding agreement . Some contracts prohibit assignments of contract altogether, and some require the other parties of the agreement to agree to the transfer. However, the general rule is that contracts are freely assignable unless there is an explicit provision that says otherwise.

In other cases, some contracts allow an assignment of contract without any formal notification to other contract parties. If this is the case, once the existing contract party decides to reassign his duties, he must create a “Letter of Assignment ” to notify any other contract signers of the change.

The Letter of Assignment must include details about who is to take over the contractual obligations of the exiting party and when the transfer will take place. If the assignment is valid, the assignor is not required to obtain the consent or signature of the other parties to the original contract for the valid assignment to take place.

Check out this article to learn more about how assigning a contract works.

Contract Assignment Examples

Contract assignments are great tools for contract parties to use when they wish to transfer their commitments to a third party. Here are some examples of contract assignments to help you better understand them:

Anna signs a contract with a local trash company that entitles her to have her trash picked up twice a week. A year later, the trash company transferred her contract to a new trash service provider. This contract assignment effectively makes Anna’s contract now with the new service provider.

Hasina enters a contract with a national phone company for cell phone service. The company goes into bankruptcy and needs to close its doors but decides to transfer all current contracts to another provider who agrees to honor the same rates and level of service. The contract assignment is completed, and Hasina now has a contract with the new phone company as a result.

Here is an article where you can find out more about contract assignments.

Assignment of Contract in Real Estate

Assignment of contract is also used in real estate to make money without going the well-known routes of buying and flipping houses. When real estate LLC investors use an assignment of contract, they can make money off properties without ever actually buying them by instead opting to transfer real estate contracts .

This process is called real estate wholesaling.

Real Estate Wholesaling

Real estate wholesaling consists of locating deals on houses that you don’t plan to buy but instead plan to enter a contract to reassign the house to another buyer and pocket the profit.

The process is simple: real estate wholesalers negotiate purchase contracts with sellers. Then, they present these contracts to buyers who pay them an assignment fee for transferring the contract.

This process works because a real estate purchase agreement does not come with the obligation to buy a property. Instead, it sets forth certain purchasing parameters that must be fulfilled by the buyer of the property. In a nutshell, whoever signs the purchase contract has the right to buy the property, but those rights can usually be transferred by means of an assignment of contract.

This means that as long as the buyer who’s involved in the assignment of contract agrees with the purchasing terms, they can legally take over the contract.

But how do real estate wholesalers find these properties?

It is easier than you might think. Here are a few examples of ways that wholesalers find cheap houses to turn a profit on:

- Direct mailers

- Place newspaper ads

- Make posts in online forums

- Social media posts

The key to finding the perfect home for an assignment of contract is to locate sellers that are looking to get rid of their properties quickly. This might be a family who is looking to relocate for a job opportunity or someone who needs to make repairs on a home but can’t afford it. Either way, the quicker the wholesaler can close the deal, the better.

Once a property is located, wholesalers immediately go to work getting the details ironed out about how the sale will work. Transparency is key when it comes to wholesaling. This means that when a wholesaler intends to use an assignment of contract to transfer the rights to another person, they are always upfront about during the preliminary phases of the sale.

In addition to this practice just being good business, it makes sure the process goes as smoothly as possible later down the line. Wholesalers are clear in their intent and make sure buyers know that the contract could be transferred to another buyer before the closing date arrives.

After their offer is accepted and warranties are determined, wholesalers move to complete a title search . Title searches ensure that sellers have the right to enter into a purchase agreement on the property. They do this by searching for any outstanding tax payments, liens , or other roadblocks that could prevent the sale from going through.

Wholesalers also often work with experienced real estate lawyers who ensure that all of the legal paperwork is forthcoming and will stand up in court. Lawyers can also assist in the contract negotiation process if needed but often don’t come in until the final stages.

If the title search comes back clear and the real estate lawyer gives the green light, the wholesaler will immediately move to locate an entity to transfer the rights to buy.

One of the most attractive advantages of real estate wholesaling is that very little money is needed to get started. The process of finding a seller, negotiating a price, and performing a title search is an extremely cheap process that almost anyone can do.

On the other hand, it is not always a positive experience. It can be hard for wholesalers to find sellers who will agree to sell their homes for less than the market value. Even when they do, there is always a chance that the transferred buyer will back out of the sale, which leaves wholesalers obligated to either purchase the property themselves or scramble to find a new person to complete an assignment of contract with.

Learn more about assignment of contract in real estate by checking out this article .

Who Handles Assignment of Contract?

The best person to handle an assignment of contract is an attorney. Since these are detailed legal documents that deal with thousands of dollars, it is never a bad idea to have a professional on your side. If you need help with an assignment of contract or signing a business contract , post a project on ContractsCounsel. There, you can connect with attorneys who know everything there is to know about assignment of contract amendment and can walk you through the whole process.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Lawyers

I am a startup veteran with a demonstrated history of execution with companies from formation through growth stage and acquisition. A collaborative and data-driven manager, I love to build and lead successful teams, and enjoy working full-stack across all aspects of the business.

I'm an employment lawyer. I counsel and represent employees in all professions, from hourly workers to doctors and executives, and all in between. I also counsel and represent employers in many aspects of employment law.

Elbert Thomas is the founder of the Thomas Law Group, LLC. Elbert is proficient in contract creation, drafting, reviewing, and negotiating various business contracts and demand letters in industries such as construction, personal, professional services, non-profits, and real estate. Elbert typically represents small and large companies in drafting and negotiating countless agreements such as purchase sale agreements, interconnection agreements, lease agreements, demand letters, cease & desist letters, transfer of deeds in real property, and merger/acquisition agreements. In addition, Elbert is also experienced in start-ups, small business formation, drafting operating agreements, and estate planning.

I am a solo practitioner and the founding attorney at Uzay Law, PLLC, where I provide legal services in family-based immigration, citizenship, and naturalization. In the past, I also advised clients on employment-based immigration, contract, and business matters. I am licensed to practice law in Texas. Before practicing law, I worked as a producer and film consultant in New York for almost two decades. I am fluent in English and Turkish.

As an entrepreneur at heart, I enjoy working with business owners and executives on a variety of corporate matters, including mergers and acquisitions, corporate financing, corporate governance, public and private securities offerings, privacy regulation and early-stage corporate matters including formation. As a lawyer and business professional, I understand the value of providing personal service and focused legal answers to clients navigating a rapidly changing regulatory environment. Whether in Aerospace, Consumer Goods, or Technology, I find great success in work collaboratively with clients to strategical structure their business or implementing strategic growth-oriented financing opportunities.

Thaddeus W.

Experienced legal counsel to entrepreneurs, small businesses, and investors. Advising clients starting, buying, selling, operating, financing, and investing in businesses // U.S. Army Veteran // Ironman Triathlete, Marathoner, Open Water Swimmer, USAT Triathlon Coach // Lover of Dogs, Cribbage, Craft Beer, Bourbon, and Cigars

Licensed attorney in KY and Federally JD, 2006 University of Louisville MBA, 2006 University of Louisville BS, 2001 Berea College Licensed Title Agent Arbitrator and Certified Mediator Business Consultant Adjunct Professor, Law and Business

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Need help with a Contract Agreement?

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

CONTRACT LAWYERS BY TOP CITIES

- Austin Contracts Lawyers

- Boston Contracts Lawyers

- Chicago Contracts Lawyers

- Dallas Contracts Lawyers

- Denver Contracts Lawyers

- Houston Contracts Lawyers

- Los Angeles Contracts Lawyers

- New York Contracts Lawyers

- Phoenix Contracts Lawyers

- San Diego Contracts Lawyers

- Tampa Contracts Lawyers

ASSIGNMENT OF CONTRACT LAWYERS BY CITY

- Austin Assignment Of Contract Lawyers

- Boston Assignment Of Contract Lawyers

- Chicago Assignment Of Contract Lawyers

- Dallas Assignment Of Contract Lawyers

- Denver Assignment Of Contract Lawyers

- Houston Assignment Of Contract Lawyers

- Los Angeles Assignment Of Contract Lawyers

- New York Assignment Of Contract Lawyers

- Phoenix Assignment Of Contract Lawyers

- San Diego Assignment Of Contract Lawyers

- Tampa Assignment Of Contract Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

How It Works

Want to speak to someone.

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

The Real Advisors Member Vault.

Our Friendly Team is Available:

M-F 9 AM - 5 PM EST

Need answers right away?

Prefer to speak to someone?

1 (813) 279-2723

9 AM - 5 PM EST

Monday -Friday

Not a fan of the phone?

Not a fan of email?

Lesson 5 – Contract Assignment 101: What it Takes to Wholesale a Property

Considering real estate investing but not sure, exactly, where to start? Dig into WHOLESALING. Done right, wholesaling is the simplest and fastest way to generate four- and five-figure paydays without laying down a dime. As a wholesaler, your role is simple:

- Find the deal

- Run the numbers and assess the deal

- Get the deal under contract

- Assign that contract to a cash buyer—usually a rehabber or fellow investor

Because you never personally close on the property, you won’t have to worry about a down payment or about securing funding for the deal. All you’ll have to do is lock it down for a good price—a price that still leaves a healthy profit margin for the “real” buyer.

Understanding Contract Assignments

That last piece—assigning the contract to a rehabber, real estate investor or retail buyer—is often misunderstood and, often, what keeps high-potential wholesalers out of the game. The good news, though? Once you understand the assignment process, it’s very simple and straightforward. As you build your business and your cash buyer lead list, the assignment process gets even easier. After a while, you’ll know exactly who you can assign this deal or that deal to and, with a quick email or two, can assign virtually any property you get under contract.

Sounds pretty good, doesn’t it?

But, first, back to the real question: what IS a contract assignment? It’s actually exactly what it sounds like. You get a property under contract and you ASSIGN that contract to the rehabber or other end buyer. For your powerhouse negotiation skills and ability to lock down a great deal, you get an assignment feed—think of it as a finder’s fee. That fee is baked into the price you present the buyer.

So let’s back up and use a real-world example—this is a recent wholesale deal we got into contract:

- ARV (After Repair Value): $225,000

- Estimated Repairs: $28,950

- Contract Price: $110,800

We got this particular property under contract for $110,800, estimating the ARV at $225,000 based on the comps and $28,950 in repairs. We then flipped the contract to a rehabber for $120,050, including our $8,550 assignment fee. For us, it was a great deal—we made $8,550 with just about two hours worth of work. And the rehabber was more than happy to pay. Even paying a five-figure assignment fee left him with a 30% profit margin—less his 5% to 10% closing costs, he’s still looking at a solid profit once the work is done.

What Assigning MEANS—and What it Doesn’t

The good thing about assignments is that they don’t require much. Once you have a cash buyer on the hook, you simply assign the contract to them as is. In other words, they’re assuming everything you and the seller agreed to—the price, the terms, the contingencies, the close dates and anything else layered into your contract. They’re also accepting your assignment fee, which you dictate.

For some wholesalers, that’s the challenge. They might have good cash buyers standing by, but the terms they’ve negotiated with the seller don’t sync with the buyer’s expectations. Maybe the repairs are more extensive than the wholesalers budgeted for or the deal they negotiated doesn’t leave enough wiggle room for the end buyer. Whatever the situation is, it ultimately leaves the wholesaler holding the contract—and that can be a real challenge.