- Start free trial

Start selling with Shopify today

Start your free trial with Shopify today—then use these resources to guide you through every step of the process.

The Marketing Research Process in 6 Steps

Learn about the six steps in the marketing research process so you can better understand your target consumer and your marketing strategy.

When launching into marketing strategy, it’s important to have a marketing research process so that one isn’t going into it unprepared. Your market research process may involve tracking the engagement with social media posts or questioning a focus group about their household spending habits. Whatever the path, companies have long embraced different types of research methods to gain consumer insight, help strengthen a brand, and achieve a competitive edge in the market.

These approaches are part of marketing research, a process that can reveal information about a company’s marketing efforts, such as which products have the highest potential for success or what advertising strategies will be the most impactful. Marketing research is a valuable tool in developing an effective marketing strategy. For example, conducting marketing research helps a business discover key information about its market standing and target customers. It also provides essential details about demographics and where to prioritize marketing investments. Yet, less than 40% of marketers use consumer research to influence their decisions.

Free marketing plan template

Calibrate your strategy and create a content roadmap for paid and organic channels to earn new customers and keep the ones you've got with our marketing strategy template.

What is marketing research?

Marketing research is the process of collecting and analyzing data from consumers and competitors to help businesses explore who their target customer is and what they want from the brand. Good marketing research can also provide insight into how effective marketing efforts are, and explore potential areas for growth. Marketing research covers a business’s entire marketing plan—from creating brand awareness to securing brand loyalists.

To conduct marketing research, businesses collect information from consumers to help identify a product’s target market and how best to reach it. They do this by gathering consumer feedback from product surveys, focus groups, social media tracking, phone interviews, and consumer observation. A company may also complete a competitor analysis to assess market share and check how it’s stacking up against the competition.

The 6 steps in the marketing process

The market research process is designed to paint a thorough picture of a company’s marketing plan, helping to identify where the weaknesses and strengths exist. The first step in the marketing research process is defining the problem or the question your research is trying to answer, followed by developing a research plan to answer that question, collecting and analyzing the data, and then producing a report.

1. Identify the opportunity

The first step is to define the problem you’re aiming to solve. Asking specific questions will help pinpoint the most pressing needs or reveal the biggest opportunities to reach your research objectives . Questions you might ask in this initial stage include:

- How many of our recent buyers are first-time customers?

- How can we turn them into repeat customers?

- Why are sales lower than last quarter?

- Are our prices too high?

- Why do customers put items in their shopping cart but don’t complete the purchase?

- How can we make our checkout flow more efficient?

2. Develop a research plan

A marketing research plan can help a business outline how to find the ways to address the questions it seeks to answer or the problems it wishes to solve. How you plan and design this research depends on the budget available, the research method chosen to source data, and the scope of the project.

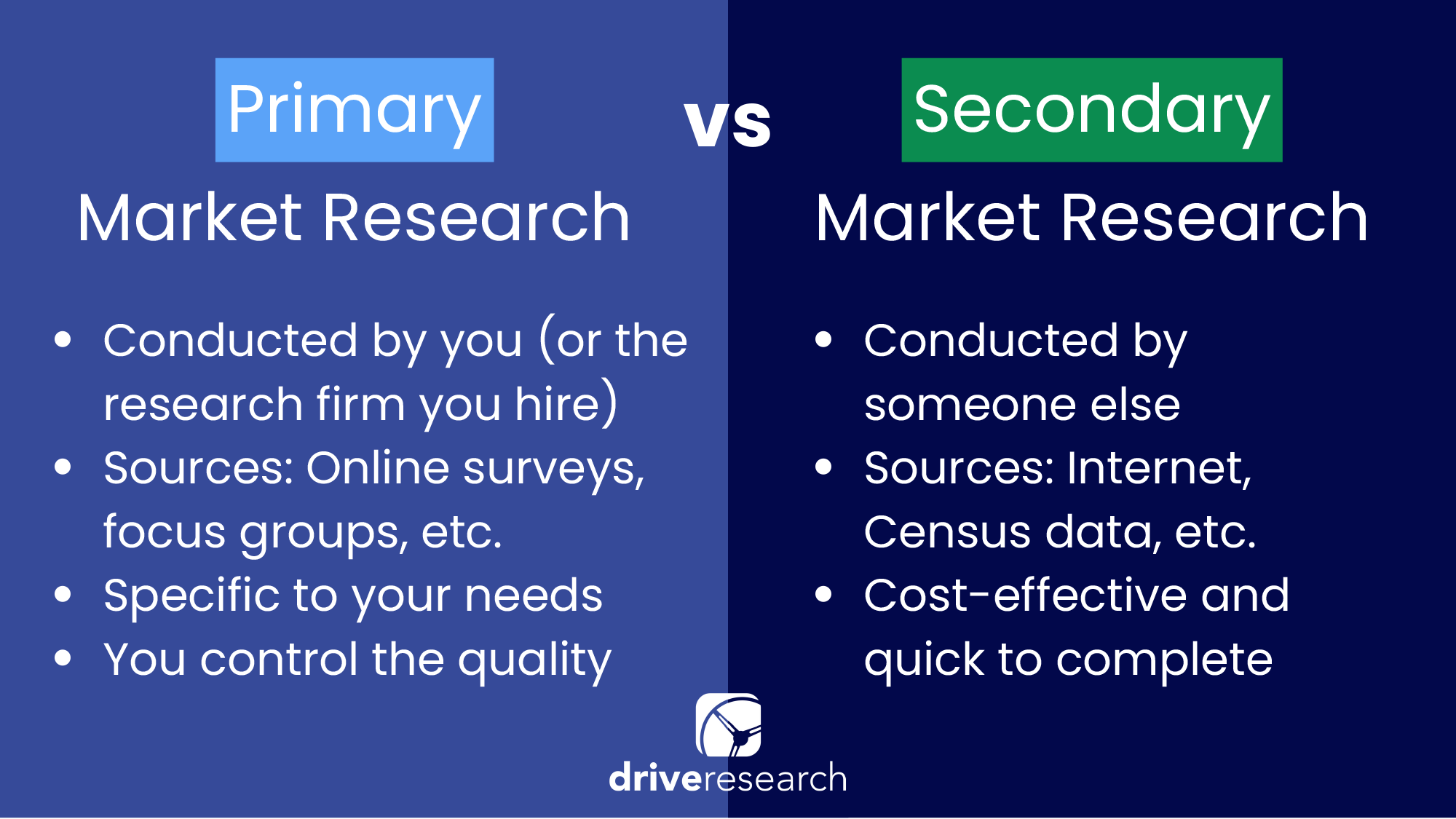

There are two main research methods you can use to collect your data: primary research and secondary research. Each pulls information from different sources to provide a clear snapshot of your marketing research plan.

- Primary research. Primary research involves gathering original data through collection methods such as surveys or in-person interviews, then synthesizing that data into a report. Although potentially time-consuming and costly, it may be among the best ways to accurately collect answers to your questions.

- Secondary research. Secondary research data involves gathering and synthesizing information gleaned from other sources, such as research reports, websites, or government files. Most research plans start with secondary data since it’s usually less expensive and readily available. You can use the information you gleaned using secondary data to inform how you will approach your primary research.

The scope and budget for the plan will likely influence the time it takes to complete the research. A smaller sample size, for example, may only need a few weeks, while a larger, complex research project may take months (and more money) to collect the necessary information.

3. Collect the data

After identifying objectives, it’s important to start collecting information . There are several different data collection methods that you can use to source information.

- Surveys. Conducting a survey is an effective primary research method that can provide valuable feedback about business practices, marketing tactics, and product demand. Unbiased survey research can help capture the thoughts and feelings of a particular demographic.

- A/B testing. This research methodology compares two or more versions of a variable— say, two layouts of the same website (version A and B)—to collect information to test which would result in better outcomes and consumer engagement. In this scenario, the goal may be to see which site attracts more direct traffic to increase the number of monthly visitors.

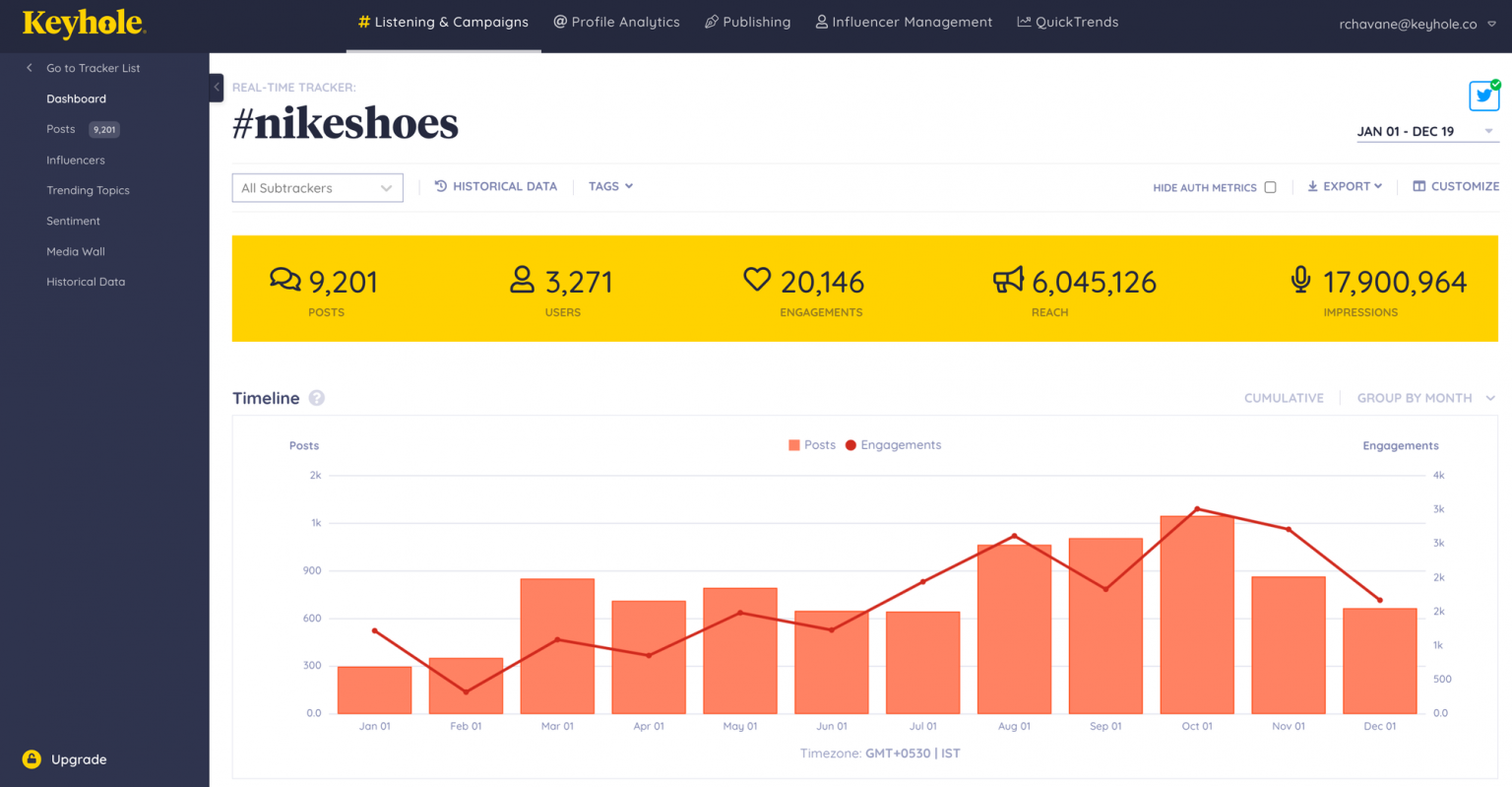

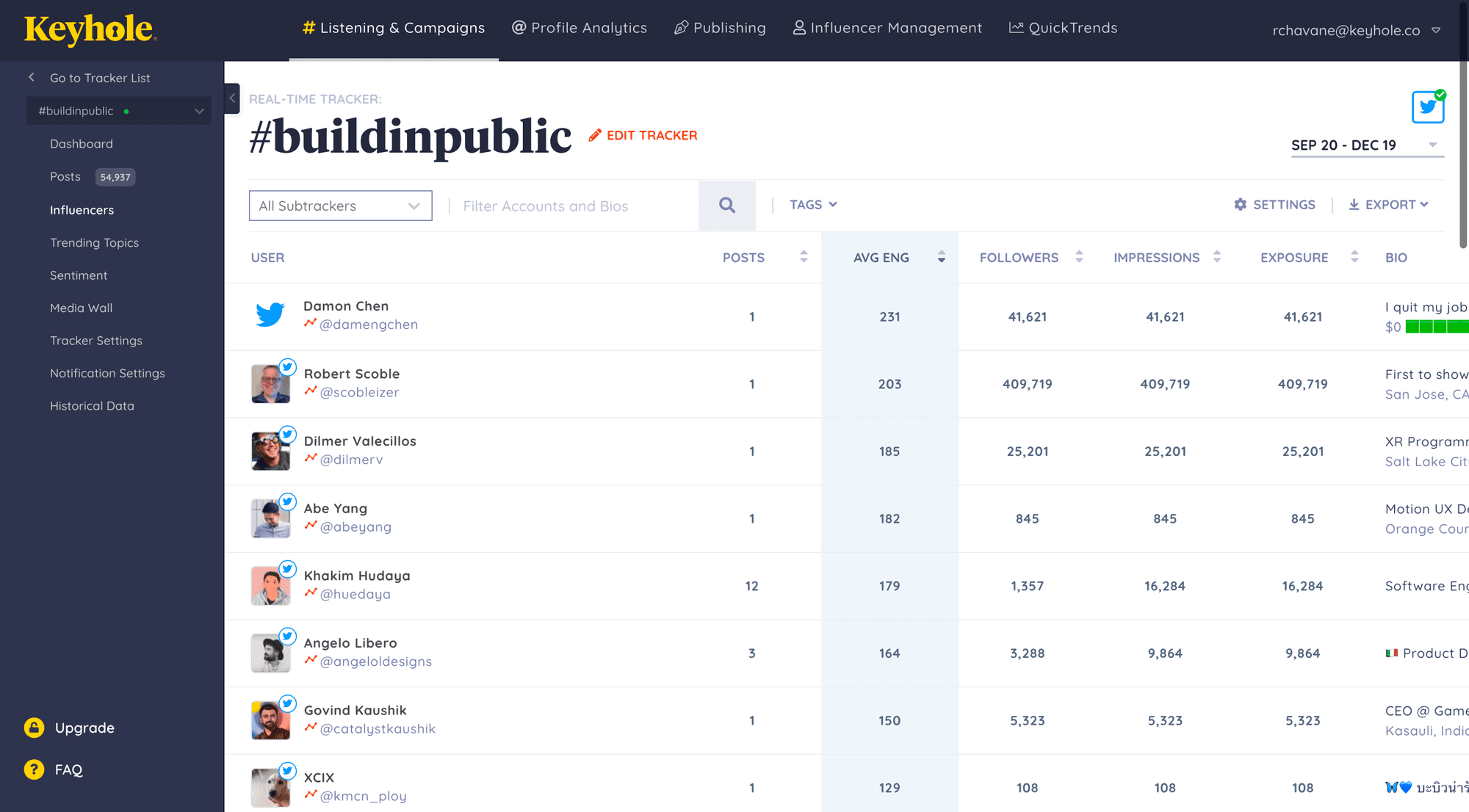

- Social media polling. Setting up a social media poll can be an effective and inexpensive way to collect user data. Polling current and potential customers gathers insight from your target audience, which can impact how the company curates its products and user experiences.

- Interviews. Face-to-face or phone interviews can help companies assess consumer expectations from a brand. During these interviews, participants may be asked questions like: How long have you been a customer? Or: Why did you choose this brand over the competitor?

- Focus groups. Focus groups gather a select group of people together based on demographics, buying history, or other factors to collect non-numerical (qualitative) data about a particular product or service . With focus groups, moderators can capture a variety of opinions and emotions via open-ended conversation or lines of questioning to capture the feelings potential (or current) customers have toward a product or service.

4. Analyze your data

Analyzing data is a way to uncover trends or patterns within the company or in the marketplace that can impact a business’s market performance. Data analysis transforms raw metrics into digestible information to provide the answers to your initial research questions.

There are four main types of analysis you can use to evaluate data:

- Descriptive analytics. Analysis tools that lay out data in charts and graphs, for example, so you can see the big picture are known as descriptive analytics. This type of analysis presents a snapshot of performance in numbers, such as unique users or page views.

- Diagnostic analytics. Analysis tools that provide more than a general overview can help you find the “cause and effect” of a problem. For example, if the number of visitors to your website has decreased by 15% within the last six months, you’ll want to investigate why. Are too many pop-ups making it more difficult for users to navigate the site, or is the page load speed too slow and users are clicking out to another website?

- Predictive analytics. Based on existing data, predictive analytics help companies establish predictive models to forecast future outcomes more accurately. For instance, if data points to a correlation between the start of the school year and increased clothing sales, your ecommerce company may need additional solutions to help take care of increased web traffic during this time of year.

- Prescriptive analytics. This analytics tool combines descriptive, diagnostic, and predictive analytics methods to help companies optimize their best course of action. For example, if predictive analytics show clothing sales go up at the beginning of the school year, prescriptive analytics would assist in prescribing a solution—in this case, finding web hosting plans that upgrade site bandwidth to accommodate increased web traffic.

5. Present your results

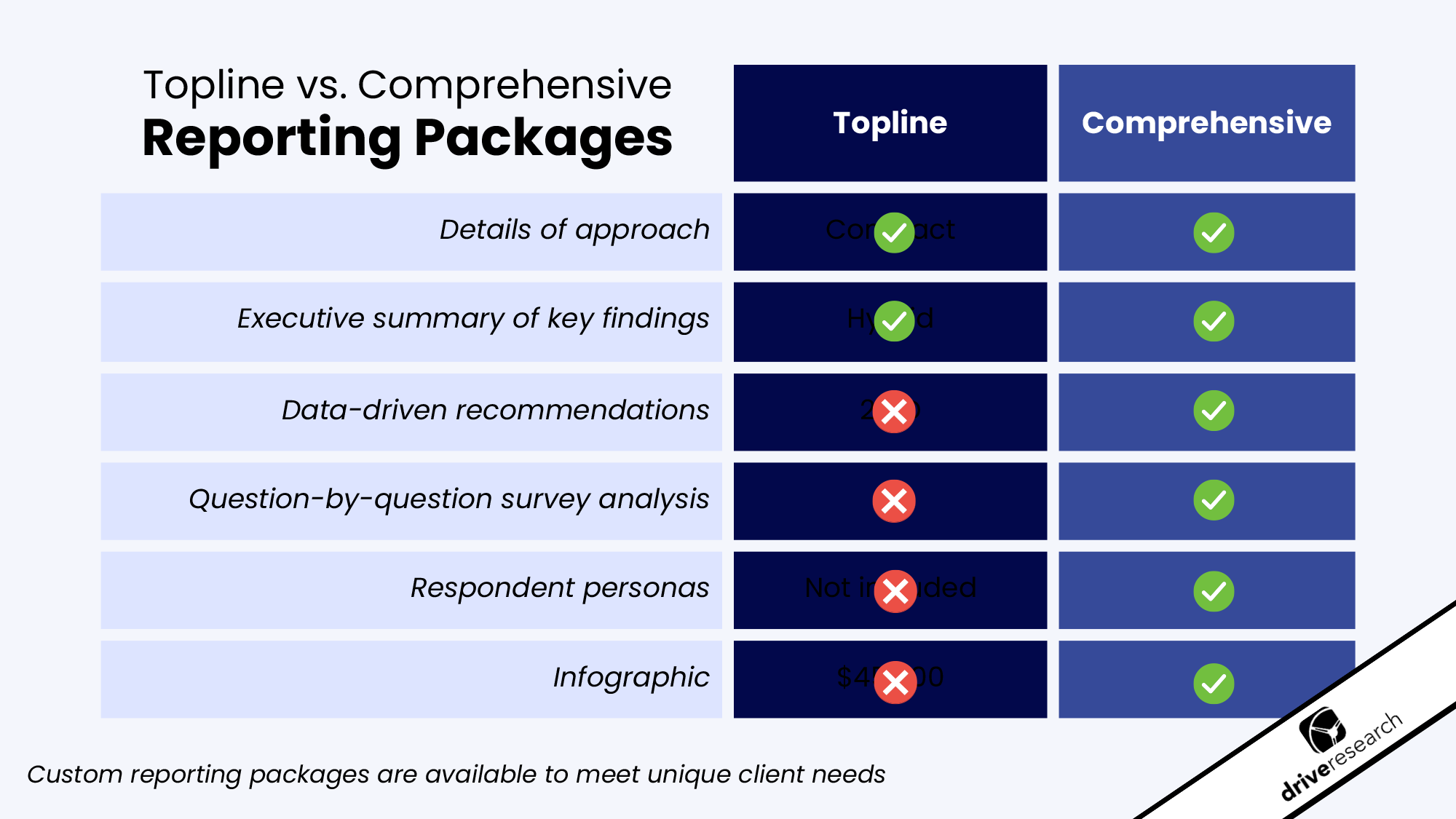

Once you’ve done the research and analyzed the data, you can build a research report to present your key findings. You can present your report in a slideshow format, as an illustrated book, as a video, or in an interactive dashboard that allows users to look at the data in different ways. The emphasis should be to present the information in a way that is comprehensible and accessible.

Marketing research reports contain, at minimum, key company-specific details like customer profiles, target audience buying habits, and market competitors, and address the questions your research sought to answer. Beyond that, reports typically present the findings from the research in a narrative format that incorporates visuals, like charts and graphs, alongside “real people” feedback. You’re not looking to present a stack of numbers—you want to establish a story about real people, how they behave, and their desires (as they pertain to the company or product). The report also needs to present the solutions to these problems—how the company should tailor its strategies to optimize its marketing and target its consumers better.

Other information to include in your report is how you arrived at these conclusions. Which research methods did you use? How long did it take? How big were your sample groups? Once the report is compiled, share these results with all necessary parties, like relevant stakeholders such as the marketing team, company managers, or other people this proposed shift in strategy might affect, like engineering.

6. Incorporate your findings

Once you’ve presented your data, it’s time to develop actionable plans that put your findings into play, whether it’s developing brand-new strategies or improving existing ones. Some findings may result in big shifts to your marketing plans or small improvements that can help you optimize your company strategy overall.

For instance, if your marketing report points to an issue with retaining a younger audience, you may need to redesign your entire social media campaign to accommodate a wider demographic. Or, you might only need a smaller shift, like offering extra promotions through social media accounts to entice current young customers to stay loyal. An ever-changing market means that your data won’t stay relevant forever, so turning your info into action can help you improve your business when it counts.

- Finding Your Ideal Customer- How to Define and Reach Your Target Audience

- YouTube Ads for Beginners: How To Successfully Advertise on YouTube

- Learn the Difference Between Sales and Marketing

- Get to know and engage with your audience with customer segmentation

- Reach the Right Shoppers at the Right Time With Shopify's Google Channel

- How to Create a Hype-worthy Product Launch

- How to Conduct a Successful Marketing Experiment

- Marketing Objectives- How to Set Good Marketing Objectives

- 30+ Influencer Marketing Statistics to Have on Your Radar (2021)

- How to Build Backlinks for Your Ecommerce Store

Marketing Research FAQ

What is an example of marketing research, what are the 7 types of marketing research.

- Exploratory Research

- Descriptive Research

- Causal Research

- Survey Research

- Secondary Research

- Experimental Research

- Qualitative Research

What is the main idea of marketing research?

Keep up with the latest from Shopify

Get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

By entering your email, you agree to receive marketing emails from Shopify.

popular posts

The most intuitive, powerful

Shopify yet

Shopify Editions Summer ’24

Subscribe to our blog and get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

Unsubscribe anytime. By entering your email, you agree to receive marketing emails from Shopify.

Latest from Shopify

Jul 3, 2024

Jul 2, 2024

Jul 1, 2024

Learn on the go. Try Shopify for free, and explore all the tools you need to start, run, and grow your business.

Try Shopify for free, no credit card required.

- Updated on July 7, 2020

- By Market Research Guy

- In Overviews

The Market Research Process: 6 Steps to Success

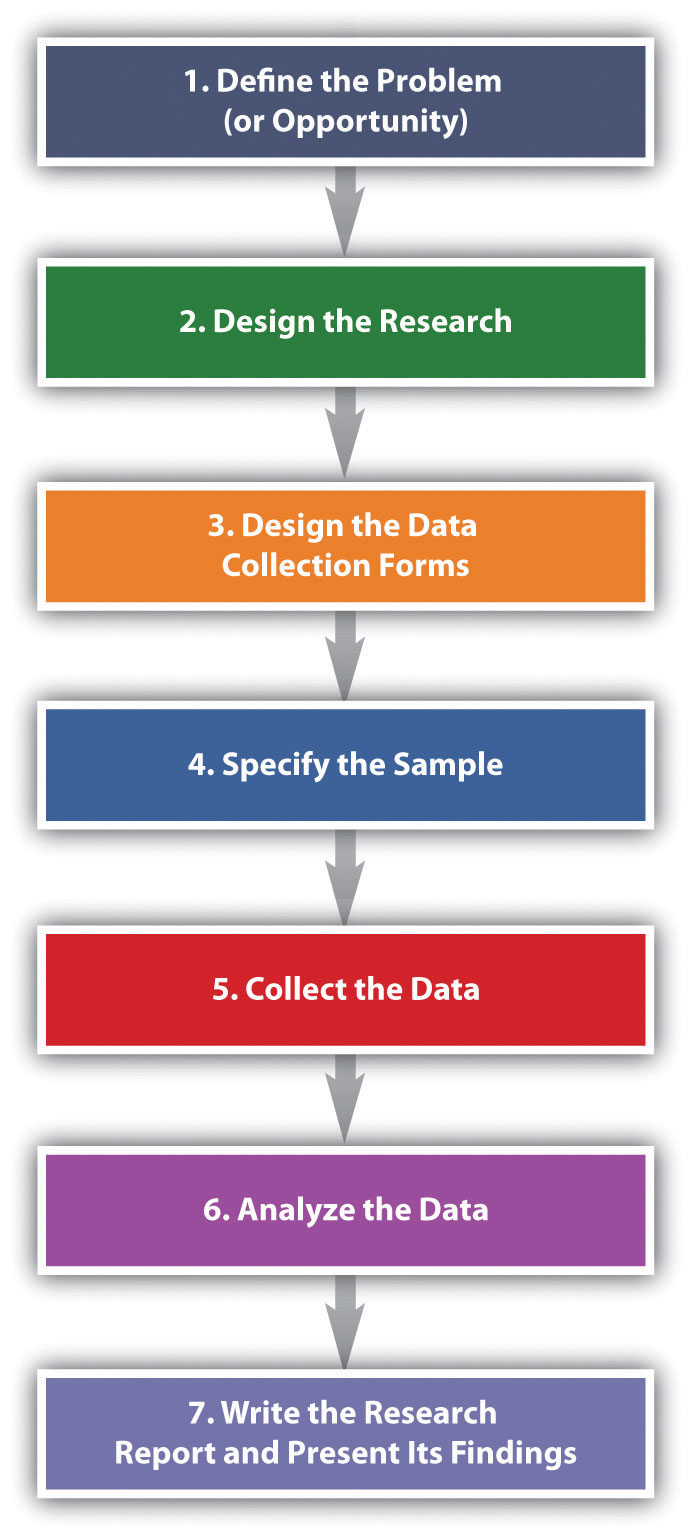

The market research process is a systematic methodology for informing business decisions. The figure below breaks the process down into six steps:

Step 1. Define the Objective & Your “Problem”

Perhaps the most important step in the market research process is defining the goals of the project. At the core of this is understanding the root question that needs to be informed by market research. There is typically a key business problem (or opportunity) that needs to be acted upon, but there is a lack of information to make that decision comfortably; the job of a market researcher is to inform that decision with solid data. Examples of “business problems” might be “How should we price this new widget?” or “Which features should we prioritize?”

By understanding the business problem clearly, you’ll be able to keep your research focused and effective. At this point in the process, well before any research has been conducted, I like to imagine what a “perfect” final research report would look like to help answer the business question(s). You might even go as far as to mock up a fake report, with hypothetical data, and ask your audience: “If I produce a report that looks something like this, will you have the information you need to make an informed choice?” If the answer is yes, now you just need to get the real data. If the answer is no, keep working with your client/audience until the objective is clear, and be happy about the disappointment you’ve prevented and the time you’ve saved.

Step 2. Determine Your “Research Design”

Now that you know your research object, it is time to plan out the type of research that will best obtain the necessary data. Think of the “research design” as your detailed plan of attack. In this step you will first determine your market research method (will it be a survey, focus group, etc.?). You will also think through specifics about how you will identify and choose your sample (who are we going after? where will we find them? how will we incentivize them?, etc.). This is also the time to plan where you will conduct your research (telephone, in-person, mail, internet, etc.). Once again, remember to keep the end goal in mind–what will your final report look like? Based on that, you’ll be able to identify the types of data analysis you’ll be conducting (simple summaries, advanced regression analysis, etc.), which dictates the structure of questions you’ll be asking.

Your choice of research instrument will be based on the nature of the data you are trying to collect. There are three classifications to consider:

Exploratory Research – This form of research is used when the topic is not well defined or understood, your hypothesis is not well defined, and your knowledge of a topic is vague. Exploratory research will help you gain broad insights, narrow your focus, and learn the basics necessary to go deeper. Common exploratory market research techniques include secondary research, focus groups and interviews. Exploratory research is a qualitative form of research.

Descriptive Research – If your research objective calls for more detailed data on a specific topic, you’ll be conducting quantitative descriptive research . The goal of this form of market research is to measure specific topics of interest, usually in a quantitative way. Surveys are the most common research instrument for descriptive research.

Causal Research – The most specific type of research is causal research, which usually comes in the form of a field test or experiment. In this case, you are trying to determine a causal relationship between variables. For example, does the music I play in my restaurant increase dessert sales (i.e. is there a causal relationship between music and sales?).

Step 3. Design & Prepare Your “Research Instrument”

In this step of the market research process, it’s time to design your research tool. If a survey is the most appropriate tool (as determined in step 2), you’ll begin by writing your questions and designing your questionnaire. If a focus group is your instrument of choice, you’ll start preparing questions and materials for the moderator. You get the idea. This is the part of the process where you start executing your plan.

By the way, step 3.5 should be to test your survey instrument with a small group prior to broad deployment. Take your sample data and get it into a spreadsheet; are there any issues with the data structure? This will allow you to catch potential problems early, and there are always problems.

Step 4. Collect Your Data

This is the meat and potatoes of your project; the time when you are administering your survey, running your focus groups, conducting your interviews, implementing your field test, etc. The answers, choices, and observations are all being collected and recorded, usually in spreadsheet form. Each nugget of information is precious and will be part of the masterful conclusions you will soon draw.

Step 5. Analyze Your Data

Step 4 (data collection) has drawn to a close and you have heaps of raw data sitting in your lap. If it’s on scraps of paper, you’ll probably need to get it in spreadsheet form for further analysis. If it’s already in spreadsheet form, it’s time to make sure you’ve got it structured properly. Once that’s all done, the fun begins. Run summaries with the tools provided in your software package (typically Excel , SPSS , Minitab , etc.), build tables and graphs, segment your results by groups that make sense (i.e. age, gender, etc.), and look for the major trends in your data. Start to formulate the story you will tell.

Step 6. Visualize Your Data and Communicate Results

You’ve spent hours pouring through your raw data, building useful summary tables, charts and graphs . Now is the time to compile the most meaningful take-aways into a digestible report or presentation. A great way to present the data is to start with the research objectives and business problem that were identified in step 1. Restate those business questions, and then present your recommendations based on the data, to address those issues.

When it comes time to presenting your results, remember to present insights , answers and recommendations , not just charts and tables. If you put a chart in the report, ask yourself “what does this mean and what are the implications?” Adding this additional critical thinking to your final report will make your research more actionable and meaningful and will set you apart from other researchers.

While it is important to “answer the original question,” remember that market research is one input to a business decision (usually a strong input), but not the only factor.

Here’s an Example

So, that’s the market research process. The figure below walks through an example of this process in action, starting with a business problem of “how should we price this new widget?”

Ok, if you think you understand this stuff here’s a brief quiz:

25 thoughts on “The Market Research Process: 6 Steps to Success”

this site seems to provide solutions to my problems.

Thank you very much i found this information very useful.

Quiet helpful, it was clear and concise

Awesome site, thanks so much, really saved me alot of time 🙂 BIG THANKS 🙂

I had way too much fun using this site, the referencing aspect of it was just invigorating. Hehe

Very good information indeed, it has refreshed my studies.

This site is one of its kind.Really impressed with the manner in which the data is arranged.Thanks Very Much.

Truly rewarding, but my concern, these are the same steps outlined in the marketing research process. Is there no difference between market-research and search marketing?

its very usefull

Is good for my work

This is, perhaps, the most coherent and practical, yet succinct and laconic, summary of the market research process that I have reviewed in quite some time. Thank you.

Wow been struggling to get this kind of information and i have been looking for it. Thank you so much.

This is comprehensive enough

I would like to thank you for the great info

Appreciate it

This is very good paper and I find key concept in this field

very useful

superb keep up the good work

Clear discussion of topic with good examples on subject matter.

you make me pass in my exams

I’ve been in FMCG sales for last 20 years and now started career in market research. This site is very helpful to clear my market research concepts.

thanks for all of those informations and examples it is nice

Very insightful and I have now obtained a much more confident understand of the marketing research steps. Thank you kindly.

very clear and step by step explanation.

Thanks for sharing such an informative blog

Leave a reply Cancel reply

Your email address will not be published. Required fields are marked *

Cookie consent

We use our own and third-party cookies to show you more relevant content based on your browsing and navigation history. Please accept or manage your cookie settings below. Here's our cookie policy

Ready, set, grow! Typeform for Growth is here 📈

- Product Overview

- For Enterprise

- Form builder Signups and orders

- Survey maker Research and feedback

- Quiz maker Trivia and product match

- Find Customers Generate more leads

- Get Feedback Discover ways to improve

- Do research Uncover trends and ideas

- Marketers Forms for marketing teams

- Product Forms for product teams

- HR Forms for HR teams

- Customer success Forms for customer success teams

- Business Forms for general business

- Form templates

- Survey templates

- Quiz templates

- Poll templates

- Order forms

- Feedback forms

- Satisfaction surveys

- Application forms

- Feedback surveys

- Evaluation forms

- Request forms

- Signup forms

- Business surveys

- Marketing surveys

- Report forms

- Customer feedback form

- Registration form

- Branding questionnaire

- 360 feedback

- Lead generation

- Contact form

- Signup sheet

- Help center Find quick answers

- Contact us Speak to someone

- Our blog Get inspired

- Our community Share and learn

- Our guides Tips and how-to

- Updates News and announcements

- Brand Our guidelines

- Partners Browse or join

- Careers Join our team

- → The 6-Step Guide to Market Research P...

The 6-Step Guide to Market Research Processes

Looking for a step-by-step guide to market research processes? Learn more about the marketing research process and methods to gather data—and make the most of it.

Latest posts on Tips

Typeform | 07.2024

Typeform | 06.2024

Say what you will about McDonald’s, but one of the things most respected about their brand is the international menu concept.

From maple and bacon poutine in Canada and gazpacho in Spain to India’s McPaneer Royale, McDonald’s knows how to give the people what they want.

And how do they inject local appeal in a global brand? By gaining a deep understanding of the consumers in every target market they plan to enter.

If you’re thinking about doing consumer insights research, you should be familiar with market research processes. Let’s start with the basics. What is market research, and how is it different from marketing research?

What is market research?

People often confuse market research and marketing research. Aren’t they just different words for the same thing?

ESOMAR, the global research and data association, and the American Marketing Association would disagree. Here’s the gist:

Market research emphasizes the process of collecting consumer data , while marketing research refers to the product of that information and/or a function within an organization.

Essentially, you might be looking for a marketing researcher to conduct market research. Market research will help you answer questions about your customers, your competitors, or current and potential markets.

The 6-step marketing research process

Market research can seem like a mystery.

However, market research processes are quite systematic—well, in theory. In practice, the steps involve exploration, creativity, and abstraction.

Here are a few steps you can follow to make it a bit easier.

1. Identify the problem

Researchers are curious people. That’s why every research project starts with a question.

What is the part of your business you want to know more about? Identifying the problem is the most important step in market research processes. It’s going to determine every step you take in the future—of market research, anyway.

Not sure where to start? Here are a few tips:

Look for marketing challenges or opportunities. Maybe your brand awareness could use a boost. You've noticed declining customer loyalty, or you’re considering opportunities in emerging markets.

Frame it as a question. Why is customer loyalty decreasing? How can we enter the market for luxury hotels? What does our customer’s typical path to purchase look like?

Determine what type of problem you have. In market research, a problem can be ambiguous, clearly defined, or somewhere in the middle. Do you know the variables and factors influencing what you want to measure? This is important as it'll influence your overall research design, which is up next.

2. Design the research

There are three types of research designs. The design you choose will be informed by how well-defined your problem is.

If you don’t know much about the problem, you need:

Exploratory research: If you don’t know the major variables or factors at play, your research is ambiguous. Exploratory research can help you develop a hypothesis or ask a more precise question. If you have a vague idea about what’s important to solve the problem, you need:

Descriptive research: Descriptive research does what it says on the box— it describes a certain phenomenon or the characteristics of a population. It can build on exploratory research but doesn’t give insight into the how, when, or why. Descriptive research is useful for parsing out market segments and measuring performance. Consequently, you need a pretty good idea of what you’re measuring and how it'll be measured. If you want to know how cause and effect are linked, you need:

Causal research: Market researchers conduct causal research when they want to understand the relationships between two or more variables. Simply put, causal research helps you understand cause and effect.

3. Choose your sample and market research methods

Data is the essence of market research. At the end of these market research processes, data is analyzed, interpreted, and turned into information and actionable insights.

Data can be qualitative or quantitative . Qualitative data can take many forms, from descriptions to audio and video. Quantitative data is typically presented in values and figures.

When choosing your sample, you must select the population you want to study. A population is a group with some shared characteristics that you’re interested in gathering data from. It can be broad (Canadians) or narrow (independent gym owners in Chicago).

No matter how small or large your population, you’ll unlikely be able to work with everyone.

The key to choosing a good sample is that it is representative. That means the people you select to participate (the sample) should reflect the larger group you’re studying.

4. Get the data

There are two forms of data you can collect: primary and secondary data.

Primary data is gathered specifically for your project. Secondary data has already been collected, either internally or externally through government agencies, consulting or market research firms, websites, social networks, and so on.

Depending on your research design, you may want to check internally for secondary data. For example, let’s say you’re trying to understand the annual purchase cycle for your business. You'd gather sales and reports and company records—that's secondary data.

But of course, secondary data still needs to be prepared for analysis

There are two ways to collect primary data: directly or indirectly. Direct data collection is just that—you are speaking to your participants directly. That can be through surveys, interviews, focus groups, and so on. Indirect data collection typically means observation. Think in-store observation, shelf experiments, or website heatmaps.

5. Analyze the data

Data analysis is a process of looking for patterns in data and trying to understand why those patterns exist. Data can be analyzed quantitatively or qualitatively.

Quantitative data analysis is a process more complicated than can be described here. Unless you’re a math whiz, you’ll probably just use a data analysis software like SPSS or StatCrunch.

Qualitative data analysis typically involves coding—but not the computer programming kind, don’t you worry. This type of coding can be done by hand or using software such as NVivo. It involves looking for themes, concepts, and words that are repeated throughout the data.

6. Interpret and present the insights

Interpretation involves answering the question: What does the data tell me about what I wanted to know?

That’s where themes and patterns come in. You can describe trends and present them using figures or descriptions drawn from your participants.

Part of interpretation is using what you know about customers, businesses, or markets to provide recommendations for how to move forward. These data-driven suggestions should offer a solution to the initial problem. The results of the research can also bring to light a problem you weren’t even aware you had.

Overview of market research methods

Market researchers are able to draw on a large toolbox of market research methods. Typically, they fall into the qualitative or quantitative category because of the type of data they produce.

Focus groups

Best for: Exploratory research

Type of method: Qualitative

A market research technique that involves a group discussion about certain topics led by a moderator to uncover the thoughts and opinions of participants.

In-depth interviews

Best for: Descriptive research

An interview that's conducted with an individual aimed at getting deeper insights about attitudes, motivations, or experiences.

Ethnography

Best for: Descriptive research

Also known as participant observation, it involves spending time with participants in their natural environment (as opposed to a lab setting).

Observational

Carefully watch people to understand what they’re doing. It allows you to learn about consumer or employee behavior but not the motivation behind it.

Discourse analysis

Best for: Exploratory or descriptive research

This is a fancy way of saying “analyzing what people say.” Social listening is a form of discourse analysis. Examining customer reviews, help transcripts, social media comments, and more are all forms of discourse analysis.

Type of method: Quantitative

Surveys are the crux of market research. They involve collecting facts, figures, and opinions using a questionnaire. Surveys can also yield qualitative data if participants write out answers. Surveys may seem simple, but there are a lot of factors that can turn good intentions into bad data—be sure to read our tips on the right question types to ask .

Structured observation

Observation research can also be quantitative if you are observing participants without direct involvement and assigning values to certain behaviors.

A/B testing

Also called split testing, this is a way to compare responses to a variation of a single variable to see which performs better. For example, presenting users with two versions of an ad to see which gets more clicks.

Best for: Causal research

Marketing experimentation typically involves manipulating a variable to see how it influences behavior. It can be conducted in a lab or in the field.

Examples of market research

Time to put this into practice. Let’s look at market research examples of various types of research designs.

Exploratory market research

Mobile phone company HTC wanted to understand how they could improve the user experience of their phones. This problem required exploratory research because there wasn’t a specific feature they wanted to test. They simply wanted to learn more from their customers.

With market research, they observed how participants interacted with their phones. They looked for challenges people had with everyday usage. After analyzing these pain points, they added new functions to their next model that made the phones easier to use.

Descriptive market research

Company ABC wants to understand how large the market for vegan cheese is in Canada. They have a somewhat defined research problem: What is the potential market share for vegan cheese?

In order to provide an answer, market researchers will have to describe various characteristics: who the customers are, why they buy vegan cheese, competitor market penetration, and potential opportunities.

This requires mixed-method research. The researchers might collect secondary data on the number of vegans in Canada or how much vegan cheese is sold in the country and through which companies. They may also conduct focus groups to understand what motivates people to buy vegan cheese.

Once complete, they'll be able to present statistics on vegans in Canada and estimate Company ABC’s potential market share.

Causal market research

Causal research requires keeping variables and conditions the same, save for the one you are testing. German marketing and sensory research company iSi is a company that runs both field and lab experiments.

They worked with a chocolate bar company to design an experiment that tested 12 different chocolate bar recipes.

The consumers sequentially tested the recipes and provided ratings (quantitative data) and descriptions (qualitative data) of each one. The result was that consumers were most satiated by “a firm, tough texture and a higher amount of caramel and peanuts.”

Discovering market research processes

One thing to remember is that market research is an iterative process. You can keep using what you learn to conduct better studies and evaluate the changing market conditions and the whims of consumers.

Ready to tackle the market research process? Build a market research survey with Typeform—choose from one of our customizable templates to gather beautifully designed data.

About the author

We're Typeform - a team on a mission to transform data collection by bringing you refreshingly different forms.

Liked that? Check these out:

Market research automation: A marketer’s guide for 2024

Market research automation uses AI to simplify and enhance traditional research. AI helps interpret data, create data visualizations, pull insights, and more.

Kevin Branscum | 11.2023

43 customer satisfaction survey questions + 7 do's and don'ts

Use these customer satisfaction survey questions to inspire your next typeform.

Lydia Kentowski | 02.2024

Remote working statistics for CEOs vs. employees: an unexpected finding

COVID-19 has transformed the way we work. But what's been the impact? This infographic has the answers, thanks to input from thousands of workers around the world.

Teresa Lee | 12.2020

See how Cvent can solve your biggest event challenges. Watch a 30-minute demo.

Market Research Process: 6 Steps to Project Success

Market research is all about understanding your audience, but it also includes a deep dive into the broader market landscape, including trends affecting your industry and top competitors within your market. Market research is vital to bolstering marketing and sales efforts. But where do you begin?

What Is Market Research?

Market Research involves gathering data and information to help you identify your target audience, understand their wants and needs, and ultimately shape your messaging and offerings to fit the demands of your market.

The information you gather can include customer feedback about your current products, services, events, or other offerings; insights into your competitors; perception of your brand versus competitors; and more.

Once you’ve captured the right market research data, you can leverage it to make strategic decisions about your products or services, craft more targeted marketing and sales messaging, improve the customer experience, advance your company’s position within your market, and generally help guide business decisions within your company.

Benefits of Market Research

There are numerous benefits to implementing market research. With the right tactics, market research can:

- Help you identify your target audience and gain a deeper understanding of their needs

- Provide insights into current market trends and your top competitors

- Guide product development and identify new market opportunities

- Increase engagement, generate feedback, and build customer loyalty

- Improve marketing and sales channel tactics

- Help you identify business risks, challenges, and opportunities for growth

- Provide a framework for measuring KPIs and ROI

- Allow you to make data-driven, strategic decisions to grow your business

Marketing Research Process Examples

Market research is a critical step to help businesses make informed decisions about their products, services, and market positioning. No matter how large a company may be, there’s always room for improvement.

Take Apple, for instance. To understand why they were losing iPhone customers and Android sales were booming, Apple leveraged market research to determine why consumers decide to buy iPhones (or not).

Coca-Cola is another company that conducts market research to inform business decisions – sometimes to its own detriment. Based on a study in the 1980s, Coca-Cola decided they should completely alter the recipe for Coke and introduce “New Coke.” While the research seemed to support the decision, their market research strategy was flawed , leading to a pretty disastrous decline in sales.

Even the biggest and most competitive brands are looking for ways to grow their businesses, and sometimes, they get it wrong. To help ensure your market research is a success, follow the steps outlined below, and carefully consider how you’re building your study.

6 Steps of the Marketing Research Process

Ready to dive into market research? Follow this six-step process to help you get started, and check out these tips for creating a successful market research strategy.

1. Identify and Define the Problem

The market research process begins by identifying your research question or problem and defining your goals and objectives. Think of your research question as a SMART goal (specific, measurable, achievable, relevant, and time-bound) to help you dig deep.

2. Develop Your Research Approach

In this step, you’ll develop a plan for designing your study and collecting and analyzing your data. This involves:

- Establishing a budget

- Formulating hypotheses

- Evaluating external factors like the economy or environment

- Choosing your data collection methods, including surveys , interviews, focus groups, etc.

- Identifying a sample size and sampling technique

- Determining your methods for analyzing the data

3. Collect the Data

Data can be collected using online surveys, phone interviews, focus groups, or in-person one-on-one interviews. Designing a survey or questionnaire is considered the most important step in any research survey process.

Question design takes a lot of thought and time. We like to say, " If you put garbage in, you'll get garbage out. " This means that if the questions are bad, the data will be bad as well. During the survey research design, keep in mind the sampling methods and data analysis factors you intend to use.

Don't forget to test your survey before to ensure you're fielding the correct data. Thankfully, with the help of an online survey tool , this step is relatively painless.

4. Analyze the Data

Once you’ve collected the pertinent data, it’s time for analysis. Here, you should be able to leverage any online survey tools you’ve used to collect data to help you analyze it quickly. Analyzing your data requires looking for trends, patterns, and insights that can help you answer your research question.

5. Interpret Your Results

The results you generate during data analysis should be viewed from the lens of your research question and applied to your business. Based on your findings, you can draw conclusions about future business decisions, from product development to pricing strategies and marketing campaigns.

At this stage, you’ll use all the rich data you’ve collected to create a go-forward market strategy that’s ready to be shown to your broader teams.

6. Present Your Findings and Take Action

The final step in the market research process is to outline your research process to establish credibility, report your survey research findings, and present your recommendations and call to action based on these findings.

Ready to get started with your market research? Start your study off right with tools to help you collect and analyze your data !

Hope Salvatori

Hope is a Senior Content Marketing Associate who has been with Cvent for more than two years. She has 8 years of experience producing content for corporations, small businesses, associations, nonprofits, and universities. As a content professional, she has created content for a wide range of industries, including meetings and events, government and defense, education, health, and more.

More Reading

The post-event survey questions guide, why polling is the best conference tech for your speakers, ask the experts: how to craft the perfect post event survey.

Subscribe to our newsletter

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry.

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.

You should also consult with key stakeholders and team members to ensure alignment on your research objectives before diving into data collecting. This will help you gain diverse perspectives and insights that will shape your research approach.

2. Identify your target audience

Next, you’ll need to pinpoint your target audience to determine who should be included in your research. Begin by creating detailed buyer personas or stakeholder profiles. Consider demographic factors like age, gender, income and location, but also delve into psychographics, such as interests, values and pain points.

The more specific your target audience, the more accurate and actionable your research will be. Additionally, segment your audience if your research objectives involve studying different groups, such as current customers and potential leads.

If you already have existing customers, you can also hold conversations with them to better understand your target market. From there, you can refine your buyer personas and tailor your research methods accordingly.

3. Choose your research methods

Selecting the right research methods is crucial for gathering high-quality data. Start by considering the nature of your research objectives. If you’re exploring consumer preferences, surveys and interviews can provide valuable insights. For in-depth understanding, focus groups or observational research might be suitable. Consider using a mix of quantitative and qualitative methods to gain a well-rounded perspective.

You’ll also need to consider your budget. Think about what you can realistically achieve using the time and resources available to you. If you have a fairly generous budget, you may want to try a mix of primary and secondary research approaches. If you’re doing market research for a startup , on the other hand, chances are your budget is somewhat limited. If that’s the case, try addressing your goals with secondary research tools before investing time and effort in a primary research study.

4. Use the right market research tools

Whether you’re conducting primary or secondary research, you’ll need to choose the right tools. These can help you do anything from sending surveys to customers to monitoring trends and analyzing data. Here are some examples of popular market research tools:

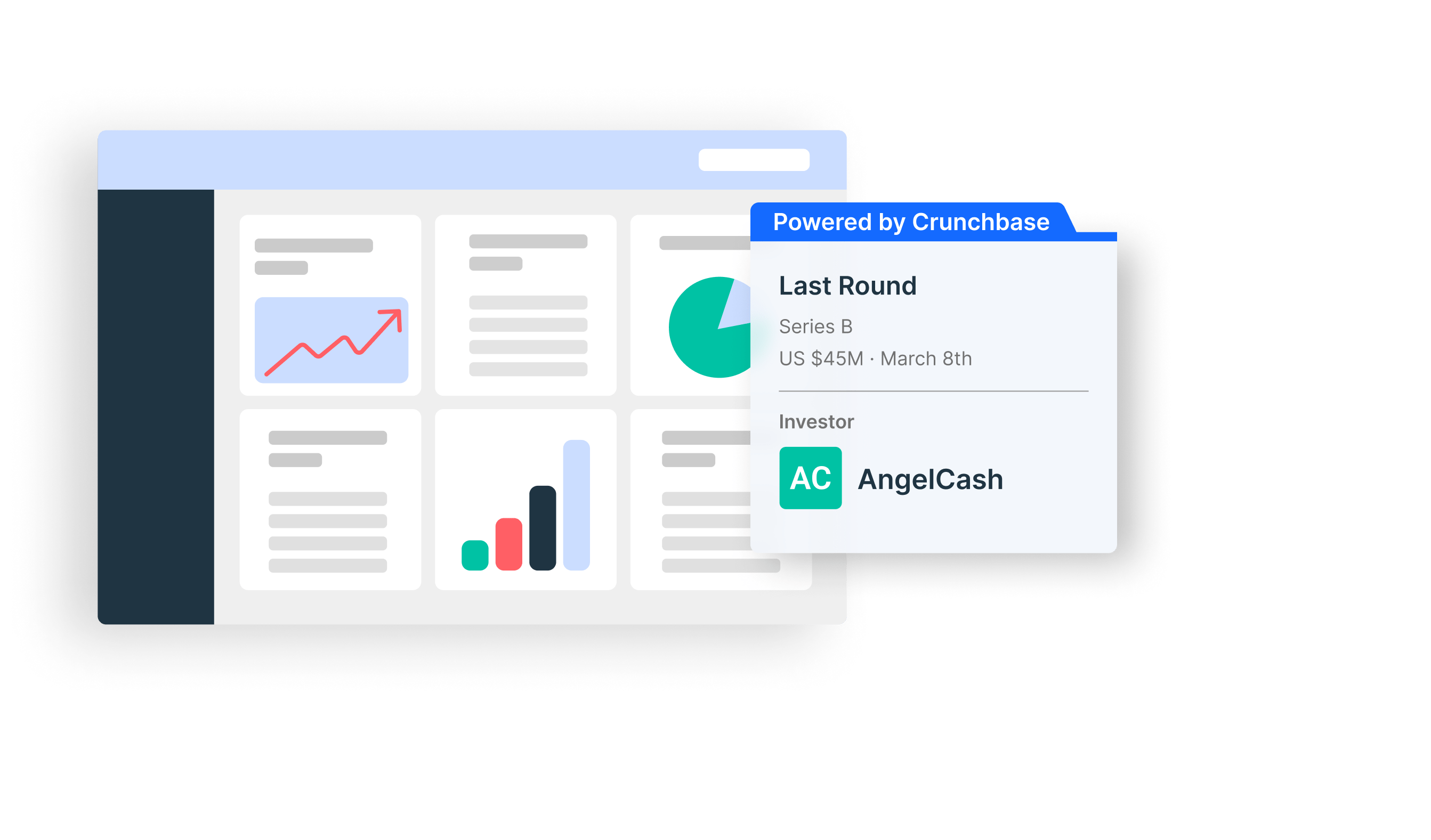

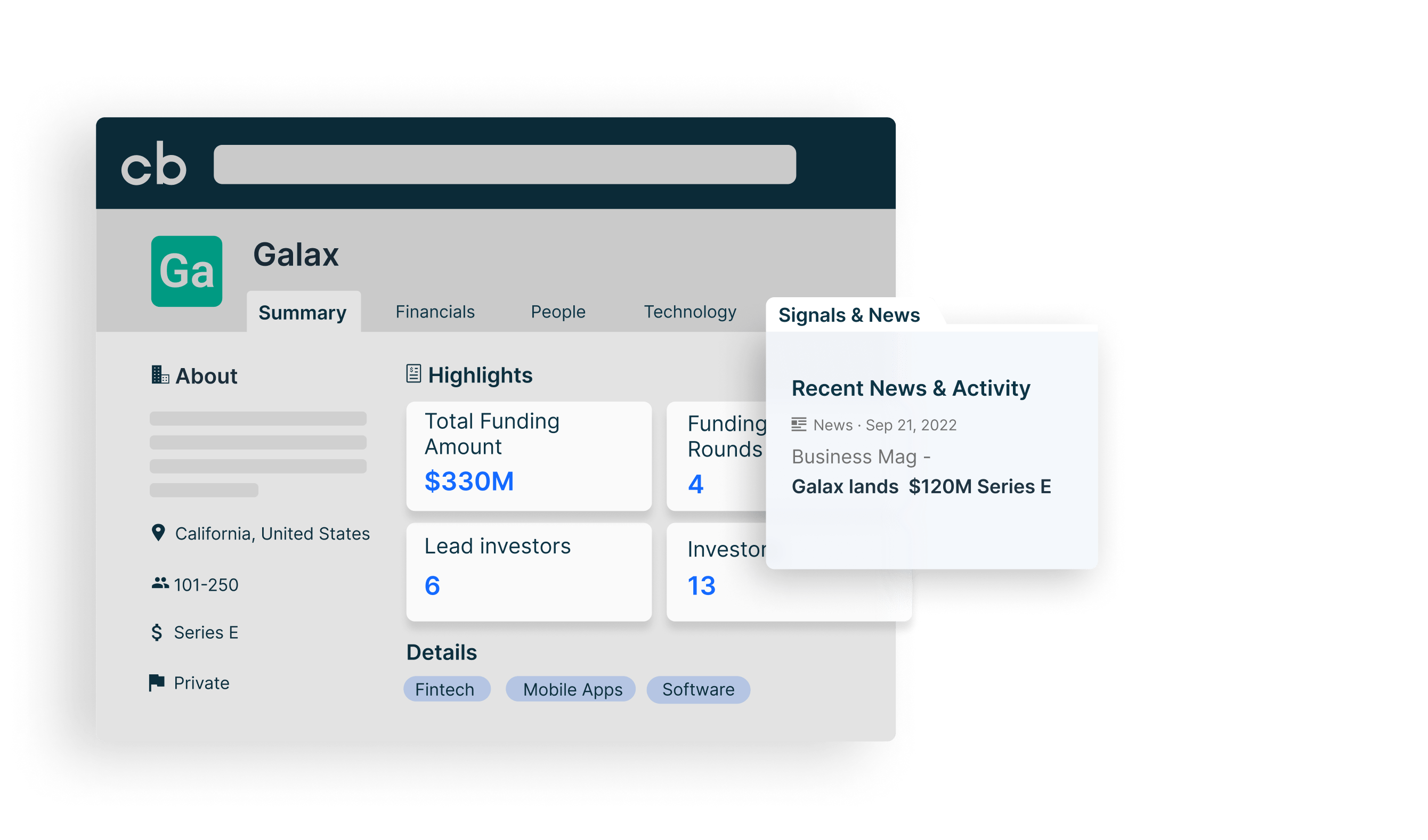

- Market research software: Crunchbase is a platform that provides best-in-class company data, making it valuable for market research on growing companies and industries. You can use Crunchbase to access trusted, first-party funding data, revenue data, news and firmographics, enabling you to monitor industry trends and understand customer needs.

- Survey and questionnaire tools: SurveyMonkey is a widely used online survey platform that allows you to create, distribute and analyze surveys. Google Forms is a free tool that lets you create surveys and collect responses through Google Drive.

- Data analysis software: Microsoft Excel and Google Sheets are useful for conducting statistical analyses. SPSS is a powerful statistical analysis software used for data processing, analysis and reporting.

- Social listening tools: Brandwatch is a social listening and analytics platform that helps you monitor social media conversations, track sentiment and analyze trends. Mention is a media monitoring tool that allows you to track mentions of your brand, competitors and keywords across various online sources.

- Data visualization platforms: Tableau is a data visualization tool that helps you create interactive and shareable dashboards and reports. Power BI by Microsoft is a business analytics tool for creating interactive visualizations and reports.

5. Collect data

There’s an infinite amount of data you could be collecting using these tools, so you’ll need to be intentional about going after the data that aligns with your research goals. Implement your chosen research methods, whether it’s distributing surveys, conducting interviews or pulling from secondary research platforms. Pay close attention to data quality and accuracy, and stick to a standardized process to streamline data capture and reduce errors.

6. Analyze data

Once data is collected, you’ll need to analyze it systematically. Use statistical software or analysis tools to identify patterns, trends and correlations. For qualitative data, employ thematic analysis to extract common themes and insights. Visualize your findings with charts, graphs and tables to make complex data more understandable.

If you’re not proficient in data analysis, consider outsourcing or collaborating with a data analyst who can assist in processing and interpreting your data accurately.

7. Interpret your findings

Interpreting your market research findings involves understanding what the data means in the context of your objectives. Are there significant trends that uncover the answers to your initial research questions? Consider the implications of your findings on your business strategy. It’s essential to move beyond raw data and extract actionable insights that inform decision-making.

Hold a cross-functional meeting or workshop with relevant team members to collectively interpret the findings. Different perspectives can lead to more comprehensive insights and innovative solutions.

8. Identify opportunities and challenges

Use your research findings to identify potential growth opportunities and challenges within your market. What segments of your audience are underserved or overlooked? Are there emerging trends you can capitalize on? Conversely, what obstacles or competitors could hinder your progress?

Lay out this information in a clear and organized way by conducting a SWOT analysis, which stands for strengths, weaknesses, opportunities and threats. Jot down notes for each of these areas to provide a structured overview of gaps and hurdles in the market.

9. Make informed business decisions

Market research is only valuable if it leads to informed decisions for your company. Based on your insights, devise actionable strategies and initiatives that align with your research objectives. Whether it’s refining your product, targeting new customer segments or adjusting pricing, ensure your decisions are rooted in the data.

At this point, it’s also crucial to keep your team aligned and accountable. Create an action plan that outlines specific steps, responsibilities and timelines for implementing the recommendations derived from your research.

10. Monitor and adapt

Market research isn’t a one-time activity; it’s an ongoing process. Continuously monitor market conditions, customer behaviors and industry trends. Set up mechanisms to collect real-time data and feedback. As you gather new information, be prepared to adapt your strategies and tactics accordingly. Regularly revisiting your research ensures your business remains agile and reflects changing market dynamics and consumer preferences.

Online market research sources

As you go through the steps above, you’ll want to turn to trusted, reputable sources to gather your data. Here’s a list to get you started:

- Crunchbase: As mentioned above, Crunchbase is an online platform with an extensive dataset, allowing you to access in-depth insights on market trends, consumer behavior and competitive analysis. You can also customize your search options to tailor your research to specific industries, geographic regions or customer personas.

- Academic databases: Academic databases, such as ProQuest and JSTOR , are treasure troves of scholarly research papers, studies and academic journals. They offer in-depth analyses of various subjects, including market trends, consumer preferences and industry-specific insights. Researchers can access a wealth of peer-reviewed publications to gain a deeper understanding of their research topics.

- Government and NGO databases: Government agencies, nongovernmental organizations and other institutions frequently maintain databases containing valuable economic, demographic and industry-related data. These sources offer credible statistics and reports on a wide range of topics, making them essential for market researchers. Examples include the U.S. Census Bureau , the Bureau of Labor Statistics and the Pew Research Center .

- Industry reports: Industry reports and market studies are comprehensive documents prepared by research firms, industry associations and consulting companies. They provide in-depth insights into specific markets, including market size, trends, competitive analysis and consumer behavior. You can find this information by looking at relevant industry association databases; examples include the American Marketing Association and the National Retail Federation .

- Social media and online communities: Social media platforms like LinkedIn or Twitter (X) , forums such as Reddit and Quora , and review platforms such as G2 can provide real-time insights into consumer sentiment, opinions and trends.

Market research examples

At this point, you have market research tools and data sources — but how do you act on the data you gather? Let’s go over some real-world examples that illustrate the practical application of market research across various industries. These examples showcase how market research can lead to smart decision-making and successful business decisions.

Example 1: Apple’s iPhone launch

Apple ’s iconic iPhone launch in 2007 serves as a prime example of market research driving product innovation in tech. Before the iPhone’s release, Apple conducted extensive market research to understand consumer preferences, pain points and unmet needs in the mobile phone industry. This research led to the development of a touchscreen smartphone with a user-friendly interface, addressing consumer demands for a more intuitive and versatile device. The result was a revolutionary product that disrupted the market and redefined the smartphone industry.

Example 2: McDonald’s global expansion

McDonald’s successful global expansion strategy demonstrates the importance of market research when expanding into new territories. Before entering a new market, McDonald’s conducts thorough research to understand local tastes, preferences and cultural nuances. This research informs menu customization, marketing strategies and store design. For instance, in India, McDonald’s offers a menu tailored to local preferences, including vegetarian options. This market-specific approach has enabled McDonald’s to adapt and thrive in diverse global markets.

Example 3: Organic and sustainable farming

The shift toward organic and sustainable farming practices in the food industry is driven by market research that indicates increased consumer demand for healthier and environmentally friendly food options. As a result, food producers and retailers invest in sustainable sourcing and organic product lines — such as with these sustainable seafood startups — to align with this shift in consumer values.

The bottom line? Market research has multiple use cases and is a critical practice for any industry. Whether it’s launching groundbreaking products, entering new markets or responding to changing consumer preferences, you can use market research to shape successful strategies and outcomes.

Market research templates

You finally have a strong understanding of how to do market research and apply it in the real world. Before we wrap up, here are some market research templates that you can use as a starting point for your projects:

- Smartsheet competitive analysis templates : These spreadsheets can serve as a framework for gathering information about the competitive landscape and obtaining valuable lessons to apply to your business strategy.

- SurveyMonkey product survey template : Customize the questions on this survey based on what you want to learn from your target customers.

- HubSpot templates : HubSpot offers a wide range of free templates you can use for market research, business planning and more.

- SCORE templates : SCORE is a nonprofit organization that provides templates for business plans, market analysis and financial projections.

- SBA.gov : The U.S. Small Business Administration offers templates for every aspect of your business, including market research, and is particularly valuable for new startups.

Strengthen your business with market research

When conducted effectively, market research is like a guiding star. Equipped with the right tools and techniques, you can uncover valuable insights, stay competitive, foster innovation and navigate the complexities of your industry.

Throughout this guide, we’ve discussed the definition of market research, different research methods, and how to conduct it effectively. We’ve also explored various types of market research and shared practical insights and templates for getting started.

Now, it’s time to start the research process. Trust in data, listen to the market and make informed decisions that guide your company toward lasting success.

Related Articles

- Entrepreneurs

- 15 min read

What Is Competitive Analysis and How to Do It Effectively

Rebecca Strehlow, Copywriter at Crunchbase

17 Best Sales Intelligence Tools for 2024

- Market research

- 10 min read

How to Do Market Research for a Startup: Tips for Success

Jaclyn Robinson, Senior Manager of Content Marketing at Crunchbase

Search less. Close more.

Grow your revenue with Crunchbase, the all-in-one prospecting solution. Start your free trial.

- A/B Monadic Test

- A/B Pre-Roll Test

- Key Driver Analysis

- Multiple Implicit

- Penalty Reward

- Price Sensitivity

- Segmentation

- Single Implicit

- Category Exploration

- Competitive Landscape

- Consumer Segmentation

- Innovation & Renovation

- Product Portfolio

- Marketing Creatives

- Advertising

- Shelf Optimization

- Performance Monitoring

- Better Brand Health Tracking

- Ad Tracking

- Trend Tracking

- Satisfaction Tracking

- AI Insights

- Case Studies

quantilope is the Consumer Intelligence Platform for all end-to-end research needs

Market Research Process: Six Steps to Follow

This blog highlights the six key steps in the market research process, from planning a study questionnaire to data collection, analysis, and the final delivery of research findings.

Table of Contents:

- What is a market research process?

Six steps in the market research process

- Types of market research studies

Examples of market research studies

Accelerate your market research process with quantilope, what is a market research process .

A market research process is exploring and understanding the subjective views of consumers of a certain product or service, as well as the objective facts that characterize the category - such as its value, competitor activity, and the market share of different brands. This process aims to h ave a sound basis on which to make business decisions like launching new products, setting a pricing strategy, or creating persuasive advertising.

Back to Table of Contents

Six main steps that occur in a typical market research study process - from initial problem identification to acting on the final results are:

1. Identify the problem or objective

2. Develop your research strategy 3. Gather data and information

4. Analyze data and information

5. Present findings

6. Act on your findings

Step 1. Identify the problem or objective

To better understand an area of your business, the first task is to define the business objective and the research objective. For some projects, these objectives might be broad while for others, they might be very narrow. Whichever type of project you’re undertaking, it’s worth asking yourself: what do I want to know by the end of this project? This will help you to identify your objectives.

For example, a large strategic study around a business’s social media activity might have an overall business objective of creating a framework to refer to whenever a post is made on social media. Its research objective might be to ‘identify social media usage and preferences amongst our audience.’ Within this will be other objectives, such as ‘segment consumers into user groups to optimize messaging’, ‘understand social media usage patterns’, and so on, all of which will feed into the overall business objective of better aligning social media posts through an identified framework. A narrower study might be focused on new packaging for a fruit juice, with the business objective of creating a pack that is sturdy, attractive, and convenient. The research objective for this would be to identify which out of a number of options is the most appealing to consumers.

Whether you want to test a hypothesis you might have about consumer opinion, simply collect information on what consumers do, or understand how respondents react to concepts (e.g. test different pricing models or gain feedback on three different website layouts) all require identifying a solid objective first.

Step 2. Develop your research strategy

Once you know what your research goals and objectives are, it’s time to decide how you’re going to get your answers.

Research design is a crucial part of the research process; quality data collection right means reliable results. The way you collect your data will depend on the type of information you’re looking for and the research methods available to you.

There are two broad types of research: primary research and secondary research. Primary research is research that you design yourself - or with the help of research experts - and is customized to your unique research objectives. Secondary research means using data that already exists, either in the public realm (e.g. published government statistics) or sold by commercial intelligence agencies. Keep in mind that secondary data (e.g. sales data) is unlikely to be entirely focused on your business problem, nor may it be up-to-date, but it can help set a good foundation.

Within primary research, quantitative research and qualitative research are the main methodologies.