College of Islamic Studies CIS Hamad Bin Khalifa University Hamad Bin Khalifa University

PhD in Islamic Finance and Economy

- --> --> --> -->

The Doctor of Philosophy (PhD) in Islamic Finance and Economy is an innovative multidisciplinary program that provides students with the required analytical and research skills to understand, analyze, and interpret the workings of the rapidly expanding Islamic financial services and market sectors, and to tackle their emerging challenges and opportunities.

The program is centered on the national priorities as set out in the Qatar National Vision 2030, on the local aspirations as enshrined in the objectives of the Shari’a, and on global targets such as the UN Sustainable Development Goals.

A key motivation for the PhD program is to develop unique and innovative approaches for the continuous transformation of economies to be more responsible, inclusive, and resilient. The policy relevance for Islamic finance continues to increase, alongside the need to understand and integrate concepts such as responsible finance, green finance, and circular economies.

Program Focus

The program focuses on Qatar’s economy and businesses with expected spillover benefits in the region and globally. In this sense, the program’s curriculum philosophy and content are unique as they refer to local values, national targets, and international goals. It also seeks to develop synergy between the three through transformation, social entrepreneurship, and shared prosperity and well-being.

The following are the main features of the program:

- Quantitative foundation Examine how to critically investigate and analyze the relationship between finance, economics, and Shari’a by using both qualitative and quantitative research methodologies.

- Shari’a studies Acquire the abilities to interweave the tenets and values of Shari’a with the theory and practice of finance and economics, and develop a mindset to analyze, innovate, and create solutions to contemporary challenges.

- Social entrepreneurship Promote innovation, original thinking, and entrepreneurial creativity and acumen in applying Islamic finance and economics theories in Qatar and other circular economy contexts.

- Sustainability Provide students with an in-depth understanding of the pivotal role played by entrepreneurs in developing a sustainable economy and promoting inclusive and sustainable economic growth and wealth.

- Responsible finance and economics Foster a deep understanding of environmental, social, and governance concerns and analysis of Islamic finance and economic principles, through which students become prepared to participate effectively in reforming theories, practices, and policies.

A 60-credit program taught over four years in English that includes:

Five core courses (12 credits).

- Applied Econometrics

- Applied Topics in Usul Al Fiqh and Maqasid Al Shari’a

- Advanced Topics in Islamic and Sustainable Economy

- Advanced Topics in Islamic and Sustainable Finance

- Advanced Research Methods

Two elective courses (6 credits)

- Students can select one course offered in the program

- Students can select one course from the PhD course catalogs of other HBKU colleges

Dissertation (42 credits)

- This component includes dissertation proposal seminars, dissertation progress workshops, and dissertation defense seminars, in addition to a pre-dissertation comprehensive examination.

- Admission Requirements

- Research at CIS

- How to Contact Us

- Library & Collections

- Business School

- Things To Do

/prod01/prodbucket01/media/durham-university/research-/doctoral-training-centres/durham-doctoral-training-centre-in-islamic-finance/52790-1-1920X290.jpg)

PhD by Research

DCIEF has a large PhD community, with over 60 students from across the world.

We offer specialised research degrees in most areas of Islamic economics, banking and finance. As part of the degree programme students normally attend a module on Islamic economics and Shari'ah compliant finance. There are also weekly Research Support Workshops.

Our Islamic Finance research degrees are recognised by the Saudi Ministry of Higher Education, the Central Bank of Bahrain and Bank Negara, the Central Bank of Malaysia.

The Islamic Finance programme and the Summer School places one in a highly advantageous position to enter the Islamic Finance Industry.

Current PhD research areas

- An Empirical Investigation of Operational Risk Management in Islamic Banks: An Integrated Approach

- Performance Measurement and Profitability of Islamic Banks in Sudan

- The Merits in Applying AAOIFI Accounting Standards in the Islamic Banking Sector in Saudi Arabia

- A Study of the Investment Policies of Takaful Companies and the Factors Influencing their Investment Decisions

- Modelling Risk Management for Islamic Financial Products in Malaysia

- Comparative Analysis on Capital Adequacy and Risk-Taking Behaviour among Financial Institutions across Select Middle East Countries and Malaysia

- Institutional Dimensions of Economic Stagnation in the Muslim World: An Islamic Political Economy Approach

- Social Dimensions of Islamic Investment in Malaysia

- Service Quality Measurement in Islamic Banks in the UAE

- Measuring the Performance of Islamic Mutual Funds

- Developing Sukuk Structure Beyond the Traditional Models: Overcoming Risk Implications

- Religious Determinants of Economic Behaviour: The Case of Algerian Youth

- Evaluating Islamic Home Financing in Malaysia

- Islamic Home Financing in Kuwait

- Islamic Corporate Social Governance and Ethical Investment in Turkey

- Developing Financing for SME's in Saudi Arabia

- Exploring the Potential for Islamic Finance in Libya

- Evaluating the Demand for Islamic Mortgages in the UK

A CHARTERED UNIVERSITY & INTERGOVERNMENTAL INSTITUTE WITHIN EUCLID

Online PhD in IRGD (Islamic Finance and Economics)

AT EULER | EULER-FRANEKER MEMORIAL UNIVERSITY | INSTITUTE

QUICK ACCESS

Program type, school / institute.

Online (Asynchonous)

USD 145 per credit hour

Scholarships

Full (officials of CW and EPS); 15% off (IGOs)

Degree Issuance

EUCLID (Euclid University) + Dual degree with EULER (post 11/2024 / AAC completion)

EULER Credits | ECTS

240 (Bachelor) + 80-120 (Master) | +240 (PhD)

EUCLID Credits | US CH

120 (Bachelor) + 40 (Master) | +55-60 (PhD)

The EUCLID online PhD in Islamic Finance and Economics is among the programs developed as part of a Joint Initiative between EUCLID (an intergovernmental treaty-based institution) and ICCI (now ICCIA , the Islamic Chamber of Commerce, Industry and Agriculture), starting 2008.

This PhD program represents a convergence of EUCLID’s expertise in global governance, international civil service, and interfaith studies. It is the only online graduate program in this important field of academic study and professional practice organized by a public intergovernmental organization and officially used by active civil servants over 4 continents. In this regards, it is an excellent choice for both Muslim and non-Muslim students alike.

Academic Presentation

EULER's online PhD in Islamic Finance and Economics represents 90 US credits (120 ECTS) of coursework beyond the Bachelor’s. In practice, students may enter the DIFE with a relevant Master’s degree, complete 30 to 35 US credits of core doctoral courses, followed by the actual writing of the dissertation in 5 phases. The resulting thesis should be a publishable book offering a clear contribution to the field and establishing the author as a subject-matter expert.

Among the suggested areas of focus are:

- Islamic Banking Sustainable development

- Islamic Microfinance

- Alternative Banking Models

- Comparative Economics

- Islamic Economics in Africa

- Sustainable Financial Systems

EUCLID = ISLAMIC FINANCE IN PRACTICE

Photo above: EUCLID’s Secretary-General Syed Zahid Ali with the President of the Islamic Development Bank (2008). EUCLID became an IsDB Partner in 2014.

MORE INFORMATION:

- Admissions Checklist

- Scholarship Programs

- Accreditation

- Admissions Group

- Tuition and Fees

- Why choose EULER?

- Faculty Profiles

- Alumni Profiles

Requirements

Featured video, basic program outline (indicative).

| Economics Module | ||

| MBA Core (MBA Essentials with Fundamentals of Management) | ||

| Introduction to Banking, International Banking and Finance | ||

| Quantitative Finance (A) | ||

| Overview of Islam, Islamic Law (Shar'iah) and the Islamic World | ||

| Islamic Economics | ||

| Foundations and Principles of Islamic Finance | ||

| Advanced Studies in Islamic Finance: 1 | ||

| Advanced Studies in Islamic Finance: 2 | ||

| Business Profit and Loss (P&L) Assessment | ||

| International Academic Writing (Doctorate) | ||

| Argumentation and Critical Thinking | ||

| Doctoral Thesis 1/5 | ||

| Doctoral Thesis 2/5 | ||

| Doctoral Thesis 3/5 | ||

| Doctoral Thesis 4/5 | ||

| Doctoral Thesis 5/5 | ||

Note: to consult the current and official curriculum/list of courses from the EUCLID CMS database, please visit: EUCLID Available Degree Programs and follow the program link.

Employment Outlook

Why Study @ EULER

EULER’s parent institution, EUCLID is the only intergovernmental, treaty-based university with a UN-registered charter and recognized expertise in diplomacy. Join the alma mater of ambassadors and senior officials globally.

Note: if the PDF brochure is unavailable (or outdated by 2 years), please contact [email protected]

EULER AND EUCLID AT WORK: RECENT NEWS AND ARTICLES

The appropriate office and officials will reply within 2 business days. If calling a EUCLID office, make sure to call the correct location based on your profile.

The application review process takes 4-6 business days after receipt of documents.

EULER | The Euler-Franeker Memorial University Institute (at EUCLID) & The Euler-Franeker Memorial University

A EUCLID-affiliated institute and academic partner with international liaison and representative offices in: The Hague, Washington DC, Willemstad

EUCLID (Pôle Universitaire Euclide |Euclid University) A treaty-based organization with international liaison and representative offices in: New York, Washington DC, Montpellier (France). Headquarters: Bangui, Central African Republic | Commonwealth & ECOWAS Headquarters: Banjul, The Gambia

Studying with EULER

- Ph.D. / Doctorate degrees

- Master's degrees

- Bachelor's degrees

- Habilitation and Post-Doc

- Specialized Certificates

Our Academic Journal

Quick Access

- News and Events

Legal Protection Switzerland

About EUCLID

- Legal Status

- Offices and HQs

- EUCLID Website

The EUCLID Charter in UNTS

EUCLID | WWW.EUCLID.INT: THE GLOBAL, INTER-DISCIPLINARY, TREATY-BASED UNIVERSITY

- Contact IIUM

- Researchers

- EN | MY | AR

- Search

- Staff Achievements

- Centres of Excellence

- Student Achievement

- Prominent Alumni

- Our Achievement

- Undergraduate

Postgraduate

- Short Courses

Doctor of Philosophy in Islamic Banking and Finance (MQA/FA6272)

Ph.D. in Islamic Banking and Finance (PIBF) is awarded to graduates for a meaningful completion of doctoral research that advances the theory and principles of Islamic Banking and Finance from inter-disciplinary perspectives. Upon completion of a multi-disciplinary doctoral programme, the graduate is expected to undertake independent research and contribute to quality publications in their field of expertise.

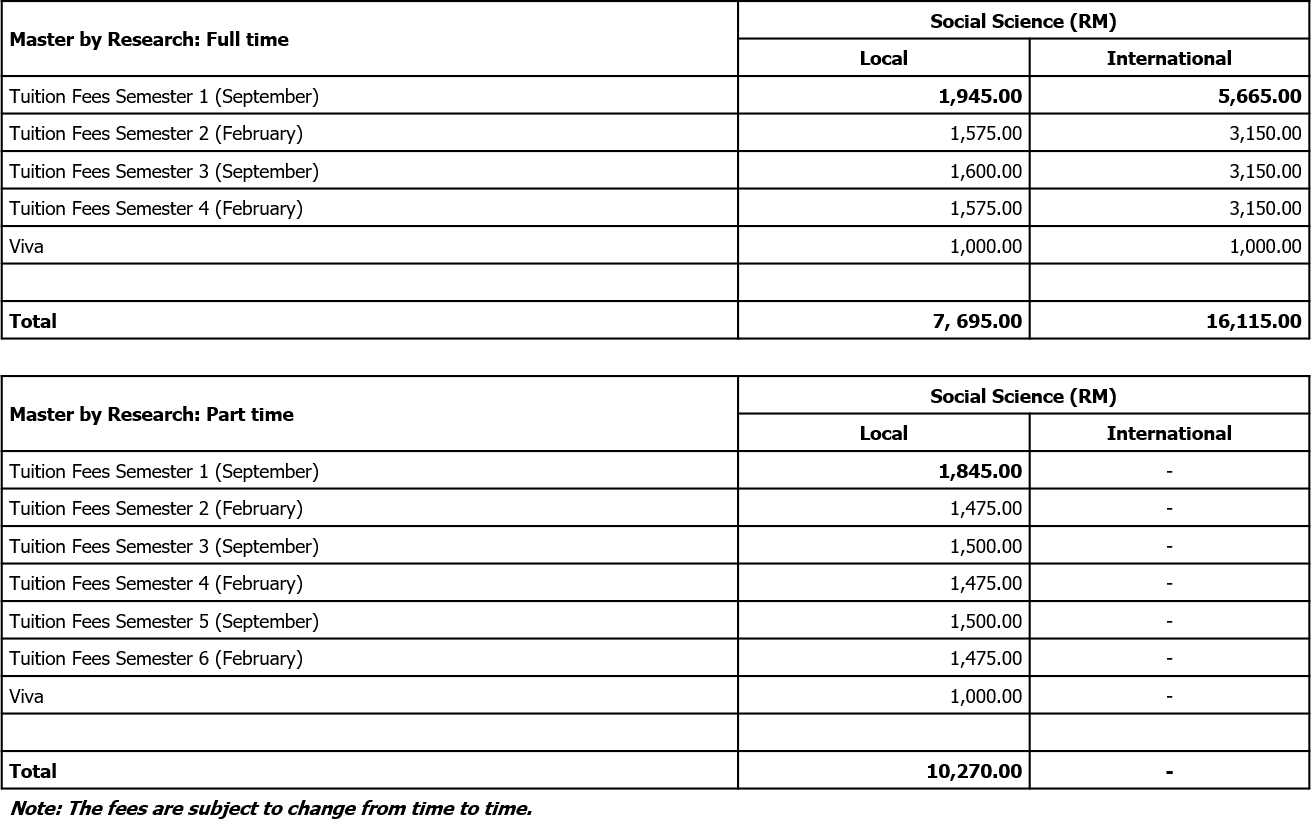

TUITION FEES

Programme Objective

- To attract and train high potential talent in Islamic banking and finance

- To further develop and enhance the theory and practice of Islamic banking and finance

- To meet the global demand for expertise in the Islamic banking and finance industry

Programme and Mode of Structure

Two courses are compulsory and one is an elective course. The courses for the Ph. D programme are:

Compulsory Special Requirement Courses

| Course Code | Course Name |

|---|---|

| IBF 8711 | Research Methodology |

| IBF 8712 | Contemporary Issues in Islamic Finance |

Elective Special Requirement Courses

| Course Code | Course Name |

|---|---|

| IBF 8713 | Qualitative Methods |

| IBF 8714 | Quantitative Methods |

Research Areas

- Fiqh Muamalat in Islamic Banking and Finance

- Islamic Banking and Finance Law

- Performance and Efficiency of Islamic Banks and Takaful

- Economics Policy and Analysis of Islamic Banking and Finance

- Regulatory and Governance

- Takaful and Re-Takaful

- Investment Banking

- Islamic Wealth Management

- Islamic Capital Market

- Islamic Micro-Credit and Micro-Financing

- Corporate and Shari'ah Governance for Islamic Banking and Finance

- Risk Management

*Subject to availability of supervisors

Ph. D Thesis

Upon registration as a doctoral student, the student is expected to prepare and submit a thesis proposal for defense with the guidance of the thesis advisory committee within the prescribed period. Upon successful defense, the doctoral student is now a candidate to undertake and complete the research for final submission for viva-voce to be examined by both internal and external examiners.

Following the viva voce, one of the following recommendations will be made:

- Pass with minor revisions to be completed in six (6) months

- Pass with major revisions to be completed within the minimum period of six (6) to maximum period of twelve (12) months

- Resubmission with viva to be completed within the minimum period of twelve (12) to maximum period of eighteen (18) months

Duration of Studies

| Status | Minimum | Normal | Maximum |

|---|---|---|---|

| Full-time | 2 academic years | 3 academic years | 6 academic years |

| Part-time | 3 academic years | 6 academic years | 8 academic years |

Admission Requirements

- A relevant Bachelor's degree with good grades from an accredited institution of higher learning or any other certificates recognised to be equivalent to a Bachelor's degree and with relevant professional experience AND:

- A relevant Master's degree with good grades from an accredited institution of higher learning.

English Language Requirements

In addition to the Institute's requirements, an applicant must produce satisfactory proof of proficiency of English Language by:

Thesis written in English language

- The Test of English as Foreign Language (TOEFL) with a minimum score of 550 of: Paper based: 550 or computer based: 213 or Internet based: 7

- The International English Language Testing Services (IELTS) with a score of 6.0 or

- The IIUM-administered English Placement Test (EPT) with a minimum score 6.0

Thesis written in Arabic language

- The IIUM-administered Arabic Placement Test (APT) with a minimum score 3.0

*All information is correct at the time of publication. All requirements are subject to amendment by the Management of International Islamic University Malaysia.

Deadline for Application

| September Intake (First Semester) | 30th June of the year |

| February Intake (Second Semester) | 30th November of the year |

| September Intake (First Semester) | 30th April of the year |

| February Intake (Second Semester) | 30th September of the year |

Ph.D Thesis Proposal Guideline

| | ||

| | ||

| | | |

Fee Structure

Useful links.

- Admission Information

- Scholarships

Student Affair

per semester

International

Interested in doctor of philosophy in islamic banking and finance (mqa/fa6272) .

International Islamic University Malaysia

P.O. Box 10, 50728 Kuala Lumpur

Phone : (+603) 6421 6421 Fax : (+603) 6421 4053 Email : [email protected]

Students & Parents

- Academic Calendars

- Student Resources

- Scholarship & Financial Assistance

Researchers, Lecturers & Alumni

- Research Centre

- Thesis, Journal & Papers

- List of Expertise

- IIUM Repository

- E-Bookstore

- Alumni Chapters

- About Alumni Society

- Staff Email

Business, Government & Related Links

- IIUM Holdings Sdn. Bhd.

- Vendor Portal

- Job Opportunities

- MyIIUM Portal

- List of Mobile Apps

- Give to IIUM

- IIUM News Bulletin

- Disclaimers

- Corporate Identity Manual

- 35th Convocation

AN INTERGOVERNMENTAL UNIVERSITY UNDER UNITED NATIONS TS 49006/7 — EUCLID RESPONSIVE SITE —

- Overview | Legal Status

- Memberships | Partnerships

- Accreditation | Recognition

- Officials | Administration

- Participating States

- EUCLID Institutes

- HQs and Offices

- History | Timeline

- Annual Reports

- Groups and Procedures

- General Public

- Government Officials

- Scholarship Programs

- Why choose EUCLID?

- ECOWAS Region Applicants

- Registrar’s Office

- Master’s Programs @ EUCLID

- PhD Programs @ EUCLID

- Tuition and Fees

- Pedagogical Approach

- Faculty Profiles

- Academic Standards

- Joint and Dual Degrees

- Online Programs @ EULER

- Alumni Profiles and Quotes

- Academic Journal IRPJ

- News & Events

- EUCLID Institutional and CMS

- EUCLID Treaty Site

- LinkedIn (Academic)

Home » Online PhD in Islamic Finance and Economics (DIFE)

Online PhD in Islamic Finance and Economics (DIFE)

Online phd in islamic finance and economics.

EUCLID’s online PhD in Islamic Finance and Economics program was developed at the convergence of EUCLID’s expertise in global governance, international civil service and interfaith studies. Historically, this PhD program was developed after EUCLID signed an agreement with the OIC-affiliated Islamic Chamber of Commerce and Industry (ICCI, now ICCIA) which called for the creation of an MBA in Islamic Finance as a Joint Initiative between EUCLID and ICCI. This PhD builds on EUCLID’s experience and offers a unique opportunity to achieve a terminal degree and the higher level of experience in both Islamic economics and finance.

Academic Presentation

EUCLID’s Doctorate in Islamic Finance and Economics represents 90 US credits (120 ECTS) of coursework beyond the Bachelor’s. In practice, students may enter the DIFE with a relevant Master’s degree, complete 30 to 35 US credits of core doctoral courses, followed by the actual writing of the dissertation in 5 phases. The resulting thesis should be a publishable book offering a clear contribution to the field and establishing the author as a subject-matter expert.

Among the suggested areas of focus are:

- Islamic Banking Sustainable development

- Islamic Microfinance

- Alternative Banking Models

EUCLID = Islamic Finance in Practice

Photo above: EUCLID’s Secretary General Syed Zahid Ali with the President of the Islamic Development Bank (2008). EUCLID became an IsDB Partner in 2014.

Gambia to Host OIC Summit

On the 04th and 05th of May 2024, the Republic of the Gambia will host the 15th Heads of State and Government Summit of the

EUCLID publishes 2023 Annual Report

The EUCLID Secretariat General is pleased to announce the release and publication of the EUCLID Annual Report for the civil year 2023. As the Secretary-General

EUCLID Secretary-General Dookeran delivers UN ECLAC lecture

As part of the commemoration of the seventy-fifth anniversary of the Economic Commission for Latin America and the Caribbean (ECLAC), EUCLID Secretary-General Winston Dookeran was

EUCLID Delegation at COP28

EUCLID (Euclid University) was officially approved as an intergovernmental observer at the COP28 and authorized to send a high-level. Prof Charalee Graydon headed the EUCLID

EUCLID Convocation and Graduation held in Gambia

On November 29, 2023, EUCLID (Euclid University) organized a recognition and graduation event for select graduates and alumni, notably those able to travel from within

EUCLID UNIVERSITY VC, BOARD CHAIRMAN AND MEMBERS MEET WITH GAMBIA VICE PRESIDENT ON IMMINENT GRADUATION EVENT

On Friday, the 17th November 2023, Euclid University VC Prof Momodou Mustapha Fanneh and Euclid University Board Advisors Chairperson and members met with His Excellency

The appropriate office and officials will reply within 2 business days. If calling a EUCLID office, make sure to call the correct location based on your profile.

The application review process takes 4-6 business days after receipt of documents.

EUCLID (Pôle Universitaire Euclide |Euclid University) A treaty-based organization with international liaison and representative offices in: New York, Washington DC, Montpellier (France)

Headquarters: Bangui, Central African Republic Commonwealth / ECOWAS Headquarters: Banjul, The Gambia

Studying with EUCLID

- Ph.D. / Doctorate

- Master's degrees

- Bachelor's degrees

- Habilitation and Post-Doc

- Specialized Certificates

Quick Access

- News and Events

Legal Protection Switzerland

About EUCLID

- Legal Status

- Accreditation

- Offices and HQs

The EUCLID Charter in UNTS

EUCLID | WWW.EUCLID.INT: THE GLOBAL, INTER-DISCIPLINARY, TREATY-BASED UNIVERSITY

- Registration and Admission

- Staff Directory

- Asked Questions

Faculty of Finance & Administrative Sciences Al-madinah International University Faculty of Finance & Administrative Sciences

Phd in islamic banking and finance.

All Programs , PhD 1,344 Views

A leading international university that provides a wide range of knowledge in its various aspects to serve humanity and to promote its advancement.

Disseminating knowledge using the best means and learning methods; knowledge development and intellectual exchange consistent with international level of excellence; to create conducive educational and research environment for knowledge seekers all over the world that serves society and preserves ethical values.

- Enriching the students with the Fiqh al-Mua’malat.

- Preparing students to become researchers in various fields of Islamic Banking and Finance.

- Developing the social interactive Da’wah skills into students.

Learning Outcomes

- Graduating a generation of specialist researchers in different fields of Islamic Banking and Finance.

- Facilitating the means of learning Islamic Banking and Finance.

- Implanting the Islamic belief system in the hearts of the Muslims.

- Enriching the research in Islamic Banking and Finance by making use of the modern technical revolution in the field of computers.

Entry Requirements

i. Master’s Degree in relevant fields from MEDIU or any recognized institutions of higher learning;or ii. Master’s degree with at least one year of relevant work experience; or iii. Other qualifications recognized as equivalent by the Government of Malaysia.

English Requirements Candidates who wish to enter a program which medium of instruction is English language must pass the English Language Qualification (TOEFL: 6.00 / IELTS: 6.00 or equivalent). Exemptions will be given subject to the University Senate’s approval based on situations.

Accreditation Ref. No.

This program is accredited and certified by Ministry of Higher Education (MOHE) and the Malaysian Qualifications Agency (MQA). Accreditation reference numbers are shown below:

Ministry of Higher Education (MOHE)

| On Campus / On Line | |

| R-CDL/343/8/0010 |

Malaysian Qualifications Agency (MQA)

| On Campus / On Line | |

| MQA/FA0387 |

Program Structure

The applicant could enroll for this program under [Structure A].

The applicant is required to study a subject named Research Methodology, then the applicant can start the research under the supervision of an academic member of the Postgraduate Studies Department.

Study Duration

| Workload | Minimum Duration | Maximum Duration |

| Full Time | 3 Years (6 Semesters) | 5 Years (10 Semesters) |

| Part Time | 4 Years (8 Semesters) | 7 Years (14 Semesters) |

Tuition Fees

| Learning Mode | Workload | Local Student | Foreign Student |

|---|

- For international students studying On Campus (OC) mode, Visa Fees and University Bond fees are excluded.

- Visa Fees & University Bond fees costs around RM5,120, it depends on the students nationality.

- All fees are subjected to change at the University’s discretion.

- Stumbleupon

Bachelor of Business Administration (Hons)

Bachelor of Business Administration (Hons) (R2-DL/340/6/0578) (07/26) (A9478) Online Bachelor of Business Administration (Honours) (R2/0414/6/0181) …

Corporate Profile

- Rector’s Message

- Organisational Structure

- Logo, Symbols and Meanings

- Our Background

- Vision & Mission

- Core Values

- Quality Objective & Quality Policy

- Sustainable Development Goals (SDGs)

- Pro Chancellor

- Executive Officers

- Principal Officers

- Rector Office

- Assistant Rector (Research, International & Service) Office

- Assistant Rector (Academic) Office

- Assistant Rector (Student Affairs & Alumni) Office

- Registrar Office

- Bursar Office

- Strategic Planning and Development Office

- Office of Academic Management

- Students Affairs

- Estate Office

- Alumni Affairs Office

- Office of Career Advancement and Industrial Networking

Management Centres

- Centre for Research and Publication

- Centre of International and Public Relations

- Technology and Multimedia Centre

- Undergraduate

- Short Programmes

- Search All Programmes

- Faculty of Usuluddin

- Faculty of Shariah

- Sultan Haji Hassanal Bolkiah Faculty Of Law

- Faculty of Arabic Language

- Faculty of Islamic Economics and Finance

- Faculty of Islamic Development Management

- Faculty of Islamic Technology

- Faculty of Agriculture

Centre of Excellence

- Halalan Thayyiban Research Centre

- Mazhab Shafi’i Research Centre

- Centre for Leadership and Lifelong Learning

- Centre for Graduate Studies

- Centre for Promotion of Knowledge and Language

- Ibnu Sina Laboratory Centre

General Entry Requirements

- Tuition Fee

News & Events

- Event Calendar

- Job Opportunities

- Skim Khubara'

- Tender & Quotations

- Academic Calender

- KAIB 15 (2024)

- Sun, 2 Zulhijjah 1445 | 9 Jun 2024

(FIEF) PhD in Islamic Banking and Finance (Research)

Programme details, id: b301, name: (fief) phd in islamic banking and finance (research), programme overview.

Doctor of Philosophy (PhD)

PhD in Islamic Banking and Finance

English, Arabic and Malay

Full Time (2-5 years), Part Time (2.5-7 years)

Full Time (BND $9,095.00), Part TIme (BND $10,669.00)

For local or international apply through our Online Application

Application Deadline

| Intake | Deadline for All Applicants |

|---|---|

| August | 31st March |

| January | 31st August |

Entry Requirement

Applications are invited from qualified candidates for admission to the programmes offered. To be considered for admission, applicants must satisfy the general entry requirements and specific entry requirements as set for each programme.

Applicants must note that fulfilling the general entry requirements and specific entry requirements does not guarantee entry into UNISSA's programmes as admission to all programmes is competitive and limited subject to availability of spaces.

- Passed The Primary School Religious Certificates ( Sijil Sekolah-Sekolah Rendah Ugama Brunei) examination or its equivalent.

- Applicants applying for graduate programmes must fulfil any other special requirements from the Facult/Centre concerned

- Applicants applying for postgraduate programmes may also be required to sit for al-Qur'an al-Karim recitation test conducted by the University.

- If deemed necessary, applicants may also be required to attend an interview conducted by the relevant Faculty/Centre.

- Application for a Degree by Research must be accompanied by a research proposal. The proposal should include, but not be confined to: Introduction to the research topic; Research aims and objectives, including any working hypotheses if applicable; Literature review; Methodology, including any data requirements; Resource requirements, and; Timetable of work (Gantt Chart). The research proposal should be approximately 1,000 - 1,5000 words in length.

| Ph.D Programme |

|---|

Language Requirement

| English Medium | Applicants are required to obtain at least: |

Contact Info

Faculty/Centre: Faculty of Islamic Economics and Finance Office

Contact Name: Faculty of Islamic Economics and Finance Office

Email [email protected]

BACHELOR DEGREE AND HIGHER NATIONAL DIPLOMA PROGRAMMES

GENERAL NOTES FOR UNDERGRADUATE

- Universiti Islam Sultan Sharif Ali reserves the right to reject applications which are incomplete, received after the closing date or containing false information.

- Only shortlisted / successful candidates will be

- Only qualifications from a University / Institution / Examination Board recognised by the University Senate will be

- For entry to first degree programmes only Sijil Tinggi Pelajaran Ugama Brunei (STPUB) and Brunei-Cambridge GCE ‘A’ Level qualifications or equivalent qualifications obtained in not more than 3 sittings and not exceeding three (3) years of last examination will be

- Applicants with other equivalent qualification such as Higher National Diploma (HND) may be considered subject to fulfilling the entry requirement set by the programme they have applied

- General Paper and English as a Second Language will not be considered as Advanced Level

- The London GCE ‘O’ Level Malay will not be considered .

- Applicants who do not meet the normal entry requirements may be considered for admission to first degree programmes as mature applicants subject to the requirements set by the University as set out

- Applicants must satisfy other requirements as set by faculties in Universiti Islam Sultan Sharif Ali from time to

- Required to go through prescribed medical fitness examination and must be certified as fit to join the

- If deemed necessary, applicants may also be required to attend an interview conducted by the relevant

- Points will be allocated to ‘A’ Level grades according to the following scheme, which is based on that used by the University Colleges Admission Services (UCAS), United Kingdom. Advanced Subsidiary (AS) Level qualifications are not awarded points in the UNISSA scheme and are not taken into account when determining acceptable qualifications for entry to

- For English Medium programmes, applicants must have at least a credit 6 in English Language at GCE ‘O’ Level Examination or a grade ‘ C ’ in IGCSE English (as a Second Language) or an IELTS score of 0 or a TOEFL minimum overall score of 550 .

- Passed Primary School Religious Certificate ( Sijil Sekolah-Sekolah Rendah Ugama Brunei ) examination or its equivalent including Penilaian Sekolah Rendah Certificate examination for applicants from Institut Tahfiz al-Qur’an Sultan Haji Hassanal Bolkiah (ITQSHHB) and Arabic Schools, or equivalent qualifications recognised by University

- Pass al-Qur’an al-Karim recitation test conducted by the

- Universiti Islam Sultan Sharif Ali reserves the right toreject applications which are incomplete, receivedafter the closing date, or containing false information.

- Only shortlisted / successful candidates will be contacted.

- Only qualifications from a University / Institution /Examination Board recognised by the UniversitySenate will be considered.

- Passed the Primary School Religious Certificate ( Sijil Sekolah-Sekolah Rendah Ugama Brunei ) examination or its equivalent.

- Applicants applying for graduate programmes must fulfil any other special requirements from the Faculty / Centre concerned and may also be required to sit for al-Qur’an al-Karim recitation test conducted by the University.

- If deemed necessary, applicants may also be required to attend an interview conducted by the relevant Faculty/ Centre.

- Application for a Research mode programme must be accompanied by a research proposal approximately 1,000 – 1,500 words in length.

LANGUAGE REQUIREMENTS

SPECIFIC ENTRY REQUIREMENTS

Tuition fees for undergraduate.

TUITION FEES FOR POSTGRADUATE

Center Postgraduate Studies Just another Centre Sites Sites site

Phd in islamic banking and finance.

A leading international university that provides a wide range of knowledge in its various aspects to serve humanity and to promote its advancement.

Disseminating knowledge using the best means and learning methods; knowledge development and intellectual exchange consistent with international level of excellence; to create conducive educational and research environment for knowledge seekers all over the world that serves society and preserves ethical values.

- Enriching the students with various business skills.

- Preparing students to become researchers in various fields of economics.

- Developing the social responsibility and interactive skills into students.

Learning Outcomes

- Graduating a generation of specialist researchers in different fields of Islamic Banking and Finance.

- Facilitating the means of learning Islamic Banking and Finance.

- Implanting the Islamic belief system in the hearts of the Muslims.

- Enriching the research in Islamic Banking and Finance by making use of the modern technical revolution in the field of computers.

Entry Requirements

i. Master’s Degree in relevant fields from MEDIU or any recognized institutions of higher learning;or ii. Master’s degree with at least one year of relevant work experience; or iii. Other qualifications recognized as equivalent by the Government of Malaysia.

All applicants must meet the English language requirement before being admitted to the programme. Examples include:

- Having English as their mother tongue.

- Substantially worked or studied in an English-speaking country (such as Australia, Canada, New Zealand, the United Kingdom or the United States).

- English language proficiency exam with a minimum overall band score of 600 in TOEFL or 6.0 in IELTS.

- Any other qualification which is of equivalent level as determined by the Senate of the University.

ACCREDITATION REF. NO.

This program is accredited and certified by Ministry of Education Malaysia (Higher Education) and the Malaysian Qualifications Agency (MQA). Accreditation reference numbers are shown below:

Ministry of Higher Education (MOHE)

| On Campus / On Line | |

| R-CDL/343/8/0010 |

Malaysian Qualifications Agency (MQA)

| On Campus / On Line | |

| MQA/FA0387 |

PROGRAM STRUCTURE

The applicant could enroll for this program under [Structure A].

Structure A

The applicant is required to study a subject named Research Methodology, then the applicant can start the research under the supervision of an academic member of the Postgraduate Studies Department.

Study Duration

| Workload | Minimum Duration | Maximum Duration |

| Full Time | 6 Semesters (3 Academic Years) | 10 Semesters (5 Academic Years) |

| Part Time | 8 Semesters (4 Academic Years) | 14 Semesters (7 Academic Years) |

Tuition Fees

| Learning Mode | Workload | Local Student | Foreign Student |

|---|

- For international students studying On Campus (OC) mode, Visa Fees and University Bond fees are excluded.

- Visa Fees & University Bond fees costs around RM5,120, it depends on the students nationality.

- All fees are subjected to change at the University’s discretion.

- Stumbleupon

- Bachelor of Business Administration

- Bachelor of Business and Information Systems

- BS Operations and Supply Chain

- BS Economics

- BS Entrepreneurship

- BS Agribusiness Management

- BS Islamic Banking and Finance

- BS Management and Technology

- BS Real Estate Management

- Executive MBA

- MS Business Analytics

- MS Economics

- Policies and Forms

- MS Islamic Banking and Finance

- MS Management

- MS Marketing

- MS Strategic Human Resource Management

- MS Supply Chain Management

- BS Accounting and Finance

- PhD Economics

- Admission Criteria

- PhD Statistics

- PhD Programs

PhD Islamic Banking and Finance

Fostering excellence in islamic banking and finance, introduction.

Keeping in view the increasing and growing demand for the Islamic banking and finance industry, Hasan Murad School of Management (HSM) planned to launch the first-ever program in Lahore dedicated to fulfilling the demand of this increasing trend. The growth of Islamic banking in the country has been over 30% in the last few years, which is certainly above the average global growth rate of Islamic banking and finance. If this trend continues, then one should expect that in the next three years Islamic banking assets will at least double from their current size of Rs 926 billion.

PhD in Islamic Banking and Finance is envisioned as a pioneering educational and training program for participants to acquire both theoretical knowledge and practical skills to win a distinguished place in the emerging global market of Islamic Banking and Finance.

Aims and Objectives

PhD in Islamic Banking and Finance is aimed at providing relevant education and training in all aspects of the operation of Islamic Banking. The program's specific objectives are:

- To provide an opportunity to graduates with relevant experience to acquire knowledge and training for a career in Islamic Banking and Finance.

- To train executives desiring specialization in Islamic Banking and Finance in expanding banking and financial institutions.

- To provide an opportunity for graduates in related disciplines to prepare them to enter the ever-expanding job market in Islamic Banking and Finance.

Career Opportunities

The participants after successfully completing the PhD program are expected to be competent for a wide variety of positions in Islamic Banking. They can be considered for jobs in both public and private educational institutions, research organizations, the State Bank of Pakistan, and commercial banks. They can also expect to hold positions in various Federal and Provincial ministries.

If you have got the ability and talent to be successful in life, UMT believes in empowering the youth to learn and lead. UMT offers a range of generous scholarship and financial aid packages in a bid to bring the best students to the varsity, regardless of their ability to pay. The aim is to make quality higher education accessible to all.

UMT offers 150+ academic programs in 55+ disciplines. Become a part of the UMT Family and strive toward academic excellence

Admissions Open for Spring 2024

- Apply Online!

Popular Searches

Scholarship programs 2024-2025.

- Scholarship Programs

- Publications

- IsDB Member Countries

We are pleased to inform you that the applications period for the IsDB Scholarship Programs for the academic year 2024 – 2025 officially concluded on April 30, 2024. We appreciate the effort et enthusiasm of all applicants who participated.

Successful awardees will be notified through emails by July 15, 2024. We wish all applicants the best of luck and look forward to announcing the list of awardees of our Scholarship Programs soon.

I. Introduction

Mindful of the importance of qualified human resources for social advancement and sustainable development, the Islamic Development Bank (IsDB) has been very keen from the outset of its establishment to focus on human capital development alongside its mainstream development financing activities.

In recognition of the vital need to develop the human resources of the Muslim communities in non-Member Countries (non-MCs), IsDB launched its undergraduate scholarship program (SP) in 1983 under the title Scholarship Program for Muslim Communities (SPMC).

Capitalizing on the experience of a decade of the SPMC, IsDB decided to establish the Merit Scholarship Program (MSP) for Ph.D. studies and post-doctoral research in applied science and high technology to strengthen the scientific, technological and research capabilities of institutions in Member Countries (MCs), which was launched in 1992. Later, the Master of Science Scholarship Program (M.Sc.) was launched in 1998 as a feeding program for the MSP, realizing that 20 of the Least Developed Member Countries (LDMCs) could not benefit from the latter.

In IsDB’s Realigned Strategy 2023 – 2025, the Bank dedicated an entire pillar to the support of comprehensive and inclusive human capital development. Through this pillar, IsDB aims to help MCs and Muslim communities in non-MCs to address these challenges with capacity-development initiatives, including scholarship programs. It is also an important component of IsDB’s efforts to promote economic development and shared prosperity through the global development of human capital by investing in education.

For more information about the programs please click the link for the watch the video:

Scholarships

By browsing our website you accept our Terms & Conditions

Postgraduate Programme

Doctor of Philosophy (PhD) in Islamic Banking & Finance

Duration of Study

Mode of study.

Programme Info

Master in Islamic Finance is aimed at producing graduates who are well-versed in the theories and practices of Islamic Finance via providing comprehensive education and rigorous training capturing from a low level of concepts to a high level of synthesis, which in turn will produce balanced and skillful scholars in the area. The programme is available on part time and full time basis.

Programme Educational Objectives (PEOs)

- To nurture graduates who will contribute to the advancement of new knowledge/ value added knowledge.

- To enhance theories in Islamic Finance to various areas of Islamic Finance.

- To provide graduates with an opportunity for understanding the nature and potential of a research area.

Career Prospect

- UMS Leadership

- UMS Strategic Plan

- UMS Bertekad Cemerlang

Useful Links

- Staff Directory

- Expertise Directory

- Staff Portal

- Student Portal

+6 087-503 000 Ext.: 410 000

fkalgo[at]ums.edu.my

+6 087 503 113

Download App

Download Now!

- Dean's Message

- Labuan Faculty of International Finance

- Our Expertise

- Client Charter

- UH6343004 - International Financial Economics

- UH6343003 - International and Offshore Banking

- UH6343005 - Islamic Finance

- UH6342002 - International Marketing

- UH6343002 - International Finance

- Master of Business (MBuss.) International Business

- Master of Business (MBuss.) International Marketing

- Master of Philosophy (MPhil.) International Marketing

- Master of Finance (International Finance)

- Master of Finance (Islamic Finance)

- Doctor of Philosophy (PhD) in International Business

- Doctor of Philosophy (PhD) in International Marketing

- Doctor of Philosophy (PhD) in International Banking

- Doctor of Philosophy (PhD) in International Finance

- Doctor of Philosophy (PhD) in Islamic Banking & Finance

- Conference & Seminar

- High Indexed Journals (WOS/Scopus/ERA)

- MyCite Indexed Journals

- FKAL Journals

- Communities

- 0311-1222-685

- [email protected]

- Online Admission

- PhD Islamic Economics and Finance

- Faculty of Economics and Management Science

- Islamic Economics, Banking & Finance

- Eligibility Criteria

- Scheme of Studies

- Fee Structure

Eligibility Criteria:

Semester no 1.

| Sr # | Course Code | Course Name | Credit Hours |

|---|---|---|---|

| 1 | IBFA700 | Research Methods in Islamic Economics & Finance | 3 |

| 2 | IBFA707 | Topics in Islamic Monetary Economics | 3 |

| 3 | IBFA702 | Advanced Theories of Islamic Economics | 3 |

| 4 | IBFA714 | Advances in Islamic Capital Markets | 3 |

| Total Credit Hours | 12 | ||

Semester No 2

| Sr # | Course Code | Course Name | Credit Hours |

|---|---|---|---|

| 1 | IBFA702 | Advanced Theories of Islamic Economics | 3 |

| 2 | IBFA706 | Applied Data Analysis Techniques | 3 |

| 3 | IBFA708 | Topics in Takaful & Re-Takaful Standards & Operations | 3 |

| 4 | IBFA714 | Advances in Islamic Capital Markets | 3 |

| Total Credit Hours | 12 | ||

Semester No 3

| Sr # | Course Code | Course Name | Credit Hours |

|---|---|---|---|

| 1 | FYPJ799 | Final Year Project | 3 |

| Total Credit Hours | 3 | ||

Semester No 4

Semester no 5, semester no 6.

| Sr # | Course Code | Course Name | Credit Hours |

|---|---|---|---|

| Total Credit Hours | 0 | ||

| PhD Islamic Economics and Finance | |

|---|---|

| Duration | 3 years Years |

| Total Semester | 6 |

| Total Package | 644,698 |

| At Admission Time | 28,500 |

| Additional Charges at the time of Admission | 2,700 * |

| Examination Fee | 3,500 |

| Total Amount (At Admission) | 31,200 |

| Installment | 49667 * 12 |

| * Additional Charges at the time of Admission | |

|---|---|

| Library Security Fee (Refundable) | 2,000 |

| Student Card | 200 |

| Library & Magazine Fund | 500 |

Features of the Program

Best teachers, low cost services, related programs.

- BS Islamic Banking & Finance

- MS Islamic Banking & Finance

- Associate Degree in Islamic Banking and Finance

Latest News

Admissions Open Spring 2024

MUL Newsletter

Faculty Training Workshop

Minhaj University Lahore

Life at MUL

Students live with standards.

Fee & Scholarship

Facilities at MUL

UNIVERSITY OF MANAGEMENT AND TECHNOLOGY

- admissions@umt.edu.pk

- Undergraduate Programs

- Graduate Programs

- PhD Programs

- Associate Degree Programs

- Post Associate Degree Programs

- Certificate Courses

- Fee Structure

PhD Islamic Banking and Finance

Program introduction.

Keeping in view the increasing and growing demand for the Islamic banking and finance industry, the Hasan Murad School of Management (HSM) planned to launch the first-ever program in Lahore dedicated to fulfilling the demand of this increasing trend. The growth of Islamic banking in the country has been over 30% in the last few years, which is certainly above the average global growth rate of Islamic banking and finance. If this trend continues, then one should expect that in the next three years, Islamic banking assets will at least double from their current size of Rs 926 billion.

PhD in Islamic Banking and Finance is envisioned as a pioneering educational and training program for participants to acquire both theoretical knowledge and practical skills to win a distinguished place in the emerging global market of Islamic Banking and Finance.

Aims and Objectives

PhD in Islamic Banking and Finance is aimed at providing relevant education and training in all aspects of the operation of Islamic Banking. The program's specific objectives are:

- To provide an opportunity to graduates with relevant experience to acquire knowledge and training for a career in Islamic Banking and Finance.

- To train executives desiring specialization in Islamic Banking and Finance in expanding banking and financial institutions.

- To provide an opportunity for graduates in related disciplines to prepare them to enter the ever-expanding job market in Islamic Banking and Finance.

Program Details

18 years degree or MS with a minimum Cumulative Grade Point Average (CGPA) of 3.0 out of 4 Or first division in the Annual System..

- GAT(General) / UMT Graduate Admission Test is mandatory.

- Interview (Panel Interview performance will play a crucial role in student selection).

- No third division in the entire academic career.

- Any other requirement as specified by the Department or regulatory body.

- To apply for a doctoral program, having completed a thesis or research project is mandatory for candidates holding an MS/MPhil degree.

Related Programs

- UMT Profile

- Undergraduate Admission Guide

- Graduate Admission Guide

We have 0 islamic banking PhD Projects, Programmes & Scholarships

All disciplines

All locations

Institution

All Institutions

All PhD Types

All Funding

There are no relevant disciplines based on your search.

islamic banking PhD Projects, Programmes & Scholarships

There are currently no PhDs listed for this Search. Why not try a new PhD search .

FindAPhD. Copyright 2005-2024 All rights reserved.

Unknown ( change )

Have you got time to answer some quick questions about PhD study?

Select your nearest city

You haven’t completed your profile yet. To get the most out of FindAPhD, finish your profile and receive these benefits:

- Monthly chance to win one of ten £10 Amazon vouchers ; winners will be notified every month.*

- The latest PhD projects delivered straight to your inbox

- Access to our £6,000 scholarship competition

- Weekly newsletter with funding opportunities, research proposal tips and much more

- Early access to our physical and virtual postgraduate study fairs

Or begin browsing FindAPhD.com

or begin browsing FindAPhD.com

*Offer only available for the duration of your active subscription, and subject to change. You MUST claim your prize within 72 hours, if not we will redraw.

Do you want hassle-free information and advice?

Create your FindAPhD account and sign up to our newsletter:

- Find out about funding opportunities and application tips

- Receive weekly advice, student stories and the latest PhD news

- Hear about our upcoming study fairs

- Save your favourite projects, track enquiries and get personalised subject updates

Create your account

Looking to list your PhD opportunities? Log in here .

Filtering Results

PhD Islamic Finance - Research Based

Uk accredited and globally recognized online islamic finance phd, phd in islamic banking and finance.

PhD Islamic finance is a research-based program that helps candidates to secure a high position at top-tier organizations. The doctorate produces scholars, who are competent to work in a variety of areas in Islamic banking and finance. PhD in Islamic banking and finance is accredited globally, and it is offered Full-Time / Part-Time through distance learning. Students must prepare a research-based Islamic finance dissertation. Many graduates are now engaged in promoting the evidence based practices. They apply the methodology and have proved themselves as the next generation of scholars. Candidates pursue doctoral research across a broad range of areas in Islamic banking and finance. Our PhD in Islamic finance is available on a part-time and full-time basis.

Reach the Milestone of Your Career

AIMS welcomes you to reach this milestone of graduate study, where the products of your hard work and dedication will enter the permanent scholarly record. AIMS wishes you great success in this important final stage of completing your PhD Islamic Economics and Finance.

Integrate education to deal with the larger problems.

Link education research to Islamic finance policy and practice.

Become the Islamic finance scholar of global standing.

Islamic Finance PhD: At a Glance

| Mode of Study | Research-based and Self-paced learning. |

| Study Requirements | Prepare your dissertation, which is supervised by AIMS’ PhD Faculty. |

| Average Duration of Completion | 2 year. |

| Registration Validity | 3 years. |

| PhD Self-Study Requirements | 10-12 hours per week. |

| Credit Hours | 12. |

| UK Qualification Equivalency | Level-8. |

| Degree Awarded | PhD in Islamic Banking and Finance. |

Islamic Finance Programs

- Certified Islamic Banker (CIB)

- Certified Islamic Finance Expert (CIFE)

- Diploma in Islamic Finacne (MDIF)

- MBA Islamic Banking and Finance Degree

- PhD (Doctorate) in Islamic Finance and Banking

Accreditation!

AIMS is a formally acknowledged institution accredited by CPD and registered with the UKRLP in the United Kingdom. The online Doctorate in Islamic Banking and Finance provided by AIMS complies with the directives specified by the Ofqual Regulated Qualifications Framework (RQF) for Level-8 Ph.D. Degree, as well as adhering to the Shariah Standards established by AAOIFI .

How to Achieve Your PhD in Islamic Banking and Finance with AIMS?

Our Islamic finance PhD UK program offers self-paced learning, and it may be completed in 2 years. You are required to work 10-12 hours a week. Prospective students will need to do their research and find the right fit for their academic and career goals.

Step-1: Admission Approval & Registration:

Firstly, you must email us a scanned copy of your master’s degree and your resume. If your master’s degree major was not Islamic finance, you must also provide proof of a formal qualification in Islamic finance. If you do not have a formal qualification, the Certified Islamic Finance Expert ( CIFE is the best Islamic finance certification course offered online ) may fulfill the PhD in Islamic Finance prerequisite requirements. You may register and pay online if you meet the eligibility criteria. Admission processing time is 4-5 working days.

Step-2: Approval of PhD Dissertation Title:

Prior to proposing your research topic for the phd thesis in Islamic banking and finance, make sure that your research area fits your career goals, style, and experience. You have the opportunity to achieve this by engaging in conversations with our program representatives. The PhD Committee will review it, and when approved, you may begin your dissertation.

Step-3: Writing the PhD Islamic Finance Thesis:

Utilize your skills and potential to create a research proposal with assistance from our academic support team. During your studies, you will receive guidance from the faculty and support from the PhD Islamic Finance Committee. Emails and WhatsApp are among the means of communication that we offer.

Step-4: Evaluation and Doctorate Award:

After completing the PhD thesis in Islamic banking and finance, it will undergo evaluation by the academic support team and the PhD committee. The defense can be conducted online or in person within the United Kingdom. Those who pass will be awarded a PhD in Islamic Banking and Finance.

Strategic Goals

Contribute to the development and advancement of Islamic banking and finance both in theory and practice.

Produce Islamic banking and finance scholars, who are competent to work in a variety of areas in Islamic finance.

A research-based program that can help you secure a high position at top-tier organizations.

Achieve your career goals through a globally recognized and accredited research-based doctoral degree.

Our Student Say!

“Pursuing Islamic finance education at AIMS proved extremely advantageous in my efforts to secure the most suitable Sharia-compliant financial products for my company, as well as for other banking transactions. During my interactions with Islamic banks, I observed that numerous senior officials lacked familiarity with Islamic financial products and methodologies, often resorting to conventional practices. My knowledge of Islamic finance, acquired through AIMS, allowed me to guide my company’s management toward Sharia-compliant operations by adopting an analytical approach.”

“I gained a lot from studying Islamic finance at AIMS, and it greatly benefited both me and my company. Through my experience working with Islamic banks, I noticed that many senior officials tend to handle Islamic products, services, and situations in a conventional way. By specializing in Islamic finance at AIMS, I was able to provide valuable advice to my company’s management on how to operate in a Shariah-compliant manner by developing an analytical approach. My studies have truly made a difference for us”.

Prominent Features of Our PhD Islamic Finance

Internationally accreditation & recognition.

This online PhD in Islamic banking and finance has international accreditation, ensuring it meets high academic standards and is globally recognized. With this degree, graduates can confidently pursue their career aspirations anywhere in the world, knowing that their qualifications will be acknowledged and respected. The international accreditation emphasizes AIMS’s commitment to providing an educational experience of the highest quality, aligning with the best practices in the field of Islamic finance.

Ideal Candidates for PhD in Islamic Finance?

PhD in Islamic Banking and Finance is an excellent choice for professionals, based on their career goals, and professional background.

- Professionals in Islamic Finance who are already working in the Islamic finance sector who wish to deepen their understanding and contribute new knowledge to the field.

- Academics and Educator s who are interested in researching, teaching, or contributing to the academic literature on Islamic finance.

- Banking and Finance Professionals from conventional banking and finance sectors aim to diversify their expertise or transition to Islamic finance.

- Regulatory Authorities and Policy Makers , involved in regulatory affairs or policy-making related to Islamic finance could enhance their ability to develop effective and informed policies.

- Research Scholars interested in exploring the intricacies and potential of Islamic finance could deepen their research capabilities and make significant contributions to the field.

- Consultants working with financial institutions or individuals who want to provide advice on Islamic banking and finance.

Flexible and Globally Accessible Education

The online PhD in Islamic banking and finance program offers a unique blend of flexibility and convenience, allowing you to complete your studies according to a timeline that suits your personal and professional commitments. This distance learning format eliminates the need for physical attendance, enabling you to study from anywhere in the world, at any time that is convenient for you. Throughout your Islamic Finance PhD journey, you can expect to receive consistent and comprehensive supervision to guide your research.

Career Opportunities and Salary Prospects

- President of an Islamic Financial Institution makes high-level decisions, develops business strategies, and builds relationships with key stakeholders.

- Head of the Islamic Bank oversees the bank’s operations, ensuring adherence to Islamic principles and maintaining a profitable banking structure.

- Head of Shariah provides crucial guidance on all matters pertaining to Islamic law.

- Finance Director/Chief Financial Officer is responsible for the financial health of an organization.

- Academic Professor contributes to their fields by teaching students, conducting research, and publishing their findings.

- Finance Consultant advise clients on financial planning, investments, insurance, pension plans, and other financial matters.

- Policy Makers in financial regulatory authorities can influence the direction of Islamic finance through the creation of effective policies.

- Corporate Lawyer ensures the legality of commercial transactions, advising corporations on their legal rights and duties.

Frequently Asked Questions

Why is getting a phd in islamic finance worth it.

Embarking on a PhD in Islamic Finance is undoubtedly a significant investment of time and energy, but the rewards are commensurate with the effort.

- This doctorate in Islamic finance equips you with the tools and knowledge to shape the future of the industry.

- It presents a unique opportunity to delve deep into research, question established norms, and challenge existing assumptions within the field.

- The Islamic Finance PhD fosters an environment that encourages you to explore your passions and push the boundaries of the Islamic banking and finance industry.

- The PhD in Islamic Finance carries with it substantial career benefits. It enhances your salary potential and opens up opportunities for leadership roles in top-tier organizations.

- Whether you aim to work in multinational corporations, or government agencies, or even aspire to teach in world-class universities, the PhD in Islamic finance marks a significant milestone on your journey to these lofty goals.

Thus, far from being just a degree, the PhD in Islamic Banking and Finance is a catalyst that propels your career onto a path paved with opportunities for growth and influence.

What are the Research Preferences at AIMS?

At AIMS, we actively support a diverse student body, offering the chance for you to delve into research topics that resonate with your unique interests and passions. Our Islamic finance PhD program also stands as a compelling choice for those who weigh financial implications against their academic endeavors. As a result, our students can shift their focus toward their research, reducing the financial stress commonly linked with higher education.

How to Choose the Right Research Topic for Your PhD Islamic Finance?

It is a crucial decision that shapes the trajectory of your academic journey. Here are a few steps to guide you through this process:

1. IDENTIFY YOUR AREAS OF INTEREST

The first step is to recognize your areas of interest within the broad field of Islamic Finance. It could be Islamic Banking Practices, Islamic Investment, Takaful (Islamic Insurance) , or Sukuk (Islamic Bonds). Your passion for the area of study will keep you motivated during the challenging times of your Islamic Finance PhD.

2. SCAN THE LITERATURE

Browse through existing literature in your chosen area of interest. Identify gaps in the research that you could potentially fill with your study. It’s important to ensure your research contributes to the overall body of knowledge in Islamic Finance.

3. FEASIBILITY OF THE STUDY

Consider the feasibility of your PhD Islamic Finance research topic. Do you have access to the resources, data, and methodology required to undertake the research? If not, you may need to refine your topic.

4. CONSULT WITH ADVISORS

Discuss your chosen topic with our advisors. They can provide valuable feedback and guide you toward a topic that is academically significant and practical for you to research.

5. ALIGN WITH CAREER GOALS

Lastly, consider how your chosen topic aligns with your future career goals. A PhD Islamic Finance research topic closely related to your career aspirations can open doors for opportunities in the future.

Remember, the journey towards a PhD in Islamic Finance is a marathon, not a sprint. Choosing the right topic can make this journey a rewarding one, leading to professional growth and meaningful contributions to the field of Islamic Finance.

ISLAMIC FINANCE BLOG

COMPARE PROGRAMS

FREE LECTURES

FAQ’s

In the News

- Israel-Hamas War Live Updates

- Hamas - Israel

- Hezbollah - Iran

- UN 'Blacklist' - Israel

- Israel - Boycott

- Herta Müller

- Israeli Hostages

- Israelis Dead

Explained: What 'Shahid' or 'Martyr' Means for Palestinians and Israelis

Since the Palestinian suicide bombings of the 1990s, for Hebrew speakers in Israel, the word 'shahid' has been synonymous with 'terrorist.' With the term now in use from Al Jazeera to U.S. campuses, its use banned on Facebook and considered incitement by Israeli law enforcement, what does 'martyr' really mean for Arabic speakers in Israel, Gaza and the West Bank?

At the start of the Gaza war last year, State Prosecutor Amit Aisman gave the police sweeping powers to investigate anyone suspected of supporting the October 7 attack.

Israeli Special Forces Officer Killed in Gaza Operation to Free Hostages

After eight months and a day: four israeli hostages reunited with their loved ones, hamas says at least 210 killed in israeli hostage rescue operation in central gaza, gantz cancels expected press conference announcing departure from netanyahu government, israeli special forces rescue four hostages held in gaza by hamas since october 7, learn how to optimize your home solar system, i've seen every jerusalem flag march in last 16 years. this one was the ugliest, this is the greatest threat facing israel. it's not hamas, how hannah arendt would respond to israel being accused of crimes against humanity, the gaza war won't end until netanyahu and israel answer these three questions, israel's lethal carelessness threatens u.s. support for rafah operation, the only ones still buying the israeli army's version of the rafah strike.

IMAGES

VIDEO

COMMENTS

Ph.D in Islamic Banking and Finance (PIBF) is awarded to graduates for a meaningful completion of doctoral research that advances the theory and principles of Islamic Banking and Finance from inter-disciplinary perspectives. Upon completion of a multi-disciplinary doctoral programme, the graduate is expected to undertake independent research ...

The Doctor of Philosophy (PhD) in Islamic Finance and Economy is an innovative multidisciplinary program that provides students with the required analytical and research skills to understand, analyze, and interpret the workings of the rapidly expanding Islamic financial services and market sectors, and to tackle their emerging challenges and opportunities.

As a high-level PhD, the EUCLID DIFE provides outstanding professional and academic preparation to its students for a successful career in Islamic finance at the international, regional, national and local levels. Outlook includes teaching positions at the university level as well as managerial positions in education, banking, and economic policy.

PhD by Research. DCIEF has a large PhD community, with over 60 students from across the world. A long tradition of research at the University underpins the Durham Centre for Islamic Economics and Finance (DCIEF), which offers postgraduate training to equip people with the necessary knowledge and skills to succeed in this dynamic and expanding ...

An affordable online MBA in Islamic Banking and Finance offered by EUCLID, an intergovernmental university in cooperation with ICCIA (an OIC institution). ... EULER's online PhD in Islamic Finance and Economics represents 90 US credits (120 ECTS) of coursework beyond the Bachelor's. In practice, students may enter the DIFE with a relevant ...

Postgraduate. Ph.D. in Islamic Banking and Finance (PIBF) is awarded to graduates for a meaningful completion of doctoral research that advances the theory and principles of Islamic Banking and Finance from inter-disciplinary perspectives. Upon completion of a multi-disciplinary doctoral programme, the graduate is expected to undertake ...

EUCLID's online PhD in Islamic Finance and Economics program was developed at the convergence of EUCLID's expertise in global governance, international civil service and interfaith studies. ... Islamic Banking Sustainable development; Islamic Microfinance; Alternative Banking Models [/vc_column_text][vc_separator type="normal"][vc ...

PhD in Islamic Banking and Finance. All Programs, PhD. Program Code. PhD in Islamic Banking and Finance (R2-CDL/343/8/0010) (03/28) (MQA/FA0387) Online and On Campus. Vision. A leading international university that provides a wide range of knowledge in its various aspects to serve humanity and to promote its advancement. Mission.

PhD Islamic finance is a research-based program that helps candidates to secure a high position at top tier orga-nizations. This program produces scholars, who are competent to work in a variety of areas in Islamic banking and finance. PhD in Islamic banking and finance is accredited globally, and it is offered Full-Time / Part-Time through ...

Scheme of Studies. In one year, i.e., within the first two to three semesters of the program, participants are expected to complete the course work of 18 credit hours (4 Core courses and 2 from Electives) and then carry out research and produce their Ph. D thesis for 27 credit hours after successfully passing the comprehensive exam.

PhD in Islamic Banking and Finance. Medium: English, Arabic and Malay. Duration: Full Time (2-5 years), Part Time (2.5-7 years) Fees: Full Time (BND $9,095.00), Part TIme (BND $10,669.00) How to apply: For local or international apply through our Online Application.

On Line. Part Time. MYR 26,331.00. MYR 26,331.00. For international students studying On Campus (OC) mode, Visa Fees and University Bond fees are excluded. Visa Fees & University Bond fees costs around RM5,120, it depends on the students nationality. All fees are subjected to change at the University's discretion.

Aims and Objectives. PhD in Islamic Banking and Finance is aimed at providing relevant education and training in all aspects of the operation of Islamic Banking. The program's specific objectives are: To provide an opportunity to graduates with relevant experience to acquire knowledge and training for a career in Islamic Banking and Finance.

PhD Islamic Banking & Finance. Scheme of Studies 2010. The University was created to produce scholars and practitioners who are imbued with Islamic ideology, whose character and personality conforms to the teachings of Islam, and who are capable to cater to the economic, social, political, technological and intellectual …. Read More.

We are pleased to inform you that the applications period for the IsDB Scholarship Programs for the academic year 2024 - 2025 officially concluded on April 30, 2024. We appreciate the effort et enthusiasm of all applicants who participated. Successful awardees will be notified through emails by July 15, 2024. We wish all applicants the best of luck and look forward to ...

Laman Rasmi Fakulti Kewangan Antarabangsa Labuan UMS. Master in Islamic Finance is aimed at producing graduates who are well-versed in the theories and practices of Islamic Finance via providing comprehensive education and rigorous training capturing from a low level of concepts to a high level of synthesis, which in turn will produce balanced and skillful scholars in the area.

Eligibility Criteria: Eighteen (18 years qualification) in relevant field or equivalent with a minimum of 3.00 out of 4.0 CGPA and 24 Cr. hrs. + 6 Cr. hrs. thesis in M.Phil. semester system is required. Entry Test + Interview and minimum 60% marks in GAT Subject or 70% marks in MAT Subject.

Aims and Objectives. PhD in Islamic Banking and Finance is aimed at providing relevant education and training in all aspects of the operation of Islamic Banking. The program's specific objectives are: To provide an opportunity to graduates with relevant experience to acquire knowledge and training for a career in Islamic Banking and Finance.

Jabbar Ul-haq, PhD University of Sargodha Verified email at uos.edu.pk. Fadillah Mansor Dr. Verified email at um.edu.my. ... People's perceptions towards the Islamic banking: a fieldwork study on bank account holders' behaviour in Pakistan. M ul Hassan. School of Economics, Nagoya City University Japan 43 (3), 153-176, 2007. 52:

We have 0 islamic banking PhD Projects, Programmes & Scholarships. There are currently no PhDs listed for this Search. Why not try a new PhD search. Find a PhD is a comprehensive guide to PhD studentships and postgraduate research degrees.

PhD Islamic finance is a research-based program that helps candidates to secure a high position at top-tier organizations. The doctorate produces scholars, who are competent to work in a variety of areas in Islamic banking and finance. PhD in Islamic banking and finance is accredited globally, and it is offered Full-Time / Part-Time through ...

School of Islamic Banking & Finance: MS Islamic Banking & Finance 2 years: Male & Female: 16 years degree in Economics / Finance / Commerce / Business Administration with minimum CGPA 2.50/4.00 in semester system or 60% marks in annual system. ... PhD Shariah (Islamic Law & Jurisprudence) *

• Modern Islamic finance is a small but growing industry; it consists largely of commercial banking; most of its assets are concentrated in a few coun-tries, but it does have presence in many countries around the world. Inclusive Field with Shared Ideals Islamic finance is an inclusive field; its ideals are not unique to Islam, nor is

More than one meaning. For Hebrew speakers in Israel, 'shahid' is synonymous with 'terrorist.'. But for Arabic speakers in Israel and the West Bank, the term is used in far more idiomatic and nuanced ways. In an informal survey on Instagram, many said they used the term "martyr of education," referring to people who sacrifice their lives in ...