Earnings News

The home depot announces first quarter 2021 results.

ATLANTA, May 18, 2021 -- The Home Depot, the world's largest home improvement retailer, today reported sales of $37.5 billion for the first quarter of fiscal 2021, an increase of $9.2 billion, or 32.7 percent from the first quarter of fiscal 2020. Comparable sales for the first quarter of fiscal 2021 increased 31.0 percent, and comparable sales in the U.S. increased 29.9 percent.

Net earnings for the first quarter of fiscal 2021 were $4.1 billion, or $3.86 per diluted share, compared with net earnings of $2.2 billion, or $2.08 per diluted share, in the same period of fiscal 2020. For the first quarter of fiscal 2021, diluted earnings per share increased 85.6 percent from the same period in the prior year.

“Fiscal 2021 is off to a strong start as we continue to build on the momentum from our strategic investments and effectively manage the unprecedented demand for home improvement projects,” said Craig Menear, chairman and CEO. “I am proud of the resilience and strength our associates have continued to demonstrate, and I would like to thank them and our supplier partners for their hard work and dedication to our customers.”

The Home Depot will conduct a conference call today at 9 a.m. ET to discuss information included in this news release and related matters. The conference call will be available in its entirety through a webcast and replay at ir.homedepot.com/events-and-presentations .

At the end of the first quarter, the Company operated a total of 2,298 retail stores in all 50 states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, 10 Canadian provinces and Mexico. The Company employs approximately 500,000 associates. The Home Depot's stock is traded on the New York Stock Exchange (NYSE: HD) and is included in the Dow Jones industrial average and Standard & Poor's 500 index.

Certain statements contained herein constitute “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements may relate to, among other things, the impact of the COVID-19 pandemic and the related recovery on our business, operations and financial results (which, among other things, may affect many of the items listed below); the demand for our products and services; net sales growth; comparable sales; effects of competition; our brand and reputation; implementation of store, interconnected retail, supply chain and technology initiatives; inventory and in-stock positions; state of the economy; state of the housing and home improvement markets; state of the credit markets, including mortgages, home equity loans and consumer credit; impact of tariffs; issues related to the payment methods we accept; demand for credit offerings; management of relationships with our associates, suppliers and service providers; international trade disputes, natural disasters, public health issues (including pandemics and quarantines, related shut-downs and other governmental orders, and similar restrictions, as well as subsequent re-openings), and other business interruptions that could disrupt supply or delivery of, or demand for, the Company’s products or services; continuation or suspension of share repurchases; net earnings performance; earnings per share; dividend targets; capital allocation and expenditures; liquidity; return on invested capital; expense leverage; stock-based compensation expense; commodity price inflation and deflation; the ability to issue debt on terms and at rates acceptable to us; the impact and expected outcome of investigations, inquiries, claims and litigation, including compliance with related settlements; the effect of accounting charges; the effect of adopting certain accounting standards; the impact of regulatory changes, including changes to tax laws and regulations; store openings and closures; guidance for fiscal 2021 and beyond; financial outlook; and the impact of acquired companies, including HD Supply Holdings, Inc., on our organization and the ability to recognize the anticipated benefits of those acquisitions. Forward-looking statements are based on currently available information and our current assumptions, expectations and projections about future events. You should not rely on our forward-looking statements. These statements are not guarantees of future performance and are subject to future events, risks and uncertainties – many of which are beyond our control, dependent on the actions of third parties, or are currently unknown to us – as well as potentially inaccurate assumptions that could cause actual results to differ materially from our expectations and projections. These risks and uncertainties include, but are not limited to, those described in Item 1A, “Risk Factors,” and elsewhere in our Annual Report on Form 10-K for our fiscal year ended January 31, 2021 and in our subsequent Quarterly Reports on Form 10-Q.

Forward-looking statements speak only as of the date they are made, and we do not undertake to update these statements other than as required by law. You are advised, however, to review any further disclosures we make on related subjects in our periodic filings with the Securities and Exchange Commission.

For more information, contact:

Financial Community Isabel Janci Vice President of Investor Relations and Treasurer 770-384-2666 [email protected]

News Media Sara Gorman Senior Director of Corporate Communications 770-384-2852 [email protected]

Keep up with all the latest Home Depot news! Subscribe to our bi-weekly news update and get the top Built from Scratch stories delivered straight to your inbox.

RELATED STORIES & ARTICLES

- Today's news

- Reviews and deals

- Climate change

- 2024 election

- Fall allergies

- Health news

- Mental health

- Sexual health

- Family health

- So mini ways

- Unapologetically

- Buying guides

Entertainment

- How to Watch

- My Portfolio

- Latest News

- Stock Market

- Biden Economy

- Stocks: Most Actives

- Stocks: Gainers

- Stocks: Losers

- Trending Tickers

- World Indices

- US Treasury Bonds

- Top Mutual Funds

- Highest Open Interest

- Highest Implied Volatility

- Stock Comparison

- Advanced Charts

- Currency Converter

- Basic Materials

- Communication Services

- Consumer Cyclical

- Consumer Defensive

- Financial Services

- Industrials

- Real Estate

- Mutual Funds

- Credit Cards

- Balance Transfer Cards

- Cash-back Cards

- Rewards Cards

- Travel Cards

- Student Loans

- Personal Loans

- Car Insurance

- Mortgage Calculator

- Morning Brief

- Market Domination

- Market Domination Overtime

- Asking for a Trend

- Opening Bid

- Stocks in Translation

- Lead This Way

- Good Buy or Goodbye?

- Fantasy football

- Pro Pick 'Em

- College Pick 'Em

- Fantasy baseball

- Fantasy hockey

- Fantasy basketball

- Download the app

- Daily fantasy

- Scores and schedules

- GameChannel

- World Baseball Classic

- Premier League

- CONCACAF League

- Champions League

- Motorsports

- Horse racing

- Newsletters

New on Yahoo

- Privacy Dashboard

Yahoo Finance

The home depot, inc. (nyse:hd) q4 2023 earnings call transcript.

The Home Depot, Inc. (NYSE: HD ) Q4 2023 Earnings Call Transcript February 20, 2024

The Home Depot, Inc. beats earnings expectations. Reported EPS is $2.82, expectations were $2.77. The Home Depot, Inc. isn’t one of the 30 most popular stocks among hedge funds at the end of the third quarter ( see the details here ).

Operator: Greetings, and welcome to the Home Depot Fourth Quarter 2023 Earnings Conference Call. At this time, all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation. [Operator Instructions] As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Isabel Janci. Please go ahead.

Isabel Janci : Thank you, Christine, and good morning, everyone. Welcome to Home Depot's fourth quarter and fiscal year 2023 earnings call. Joining us on our call today are Ted Decker, Chair, President and CEO; Ann-Marie Campbell, Senior Executive Vice President; Billy Bastek, Executive Vice President of Merchandising; and Richard McPhail, Executive Vice President and Chief Financial Officer. Following our prepared remarks, the call will be open for questions. Questions will be limited to analysts and investors. [Operator Instructions] If we are unable to get to your question during the call, please call our Investor Relations department at 770-384-2387. Before I turn the call over to Ted, let me remind you that today's press release and the presentations made by our executives include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995.

These statements are subject to risks and uncertainties that could cause actual results to differ materially from our expectations and projections. These risks and uncertainties include but are not limited to the factors identified in the release and in our filings with the Securities and Exchange Commission. Today's presentation will also include certain non-GAAP measures. Reconciliation of these measures is provided on our website. Now, let me turn the call over to Ted.

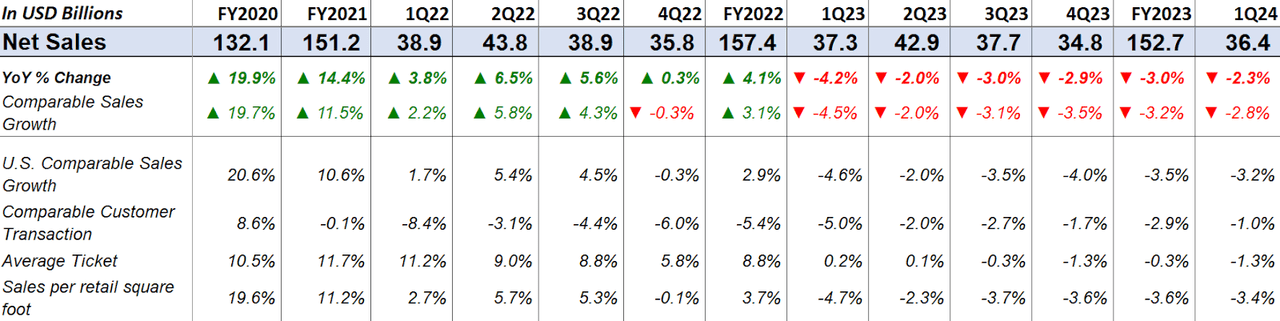

Edward Decker : Thank you, Isabel, and good morning, everyone. As you'll hear from the team shortly, the fourth quarter of fiscal 2023 was largely in line with our expectations. For fiscal 2023, sales were $152.7 billion, down 3% from the prior year. Comp sales declined 3.2% versus last year, and our U.S. stores had negative comps of 3.5%. Diluted earnings per share were $15.11 compared to $16.69 in the prior year. After three years of exceptional growth for our business, 2023 was a year of moderation. It was also a year of opportunity. We focused on several operational improvements to strengthen the business, while also staying true to the growth opportunities detailed at our Investor Conference in June. As we reflect on 2023, we are better positioned in four key areas.

We invested in our associates, the heartbeat of our company and the storage of customer service, effectively manage disinflation, while maintaining a strong value proposition for our customers, right sized our inventory position in increased in-stock and on-shelf availability levels, and we reduced fixed costs in the business that were introduced during the pandemic. As you know, at the beginning of 2023, we announced an approximately $1 billion investment in increased annualized compensation for our frontline hourly associates. This allowed us to improve customer service, position ourselves favorably in the market, attract and retain the most qualified talent, drive greater efficiency and productivity across the business, and improve safely broadly.

We also navigated a unique disinflationary environment. We did this by leveraging our best-in-class cost finance team in merchants to effectively manage cost movements, while also being our customers advocate for value. And we believe prices have essentially settled in the marketplace. After several years of unprecedented sales growth, we entered 2023 with more inventory than we would've preferred. While the products we sell have low obsolescence, our teams work throughout the year to improve inventory productivity while delivering the highest in-stock and on-shelf availability rates since the pandemic. Today, we feel very good about our inventory position heading into 2024. Productivity and efficiency are hallmarks of the Home Depot, and as you heard at our Investor Conference in June, we announced our commitment to reduce fixed costs by approximately $500 million to be fully realized in 2024.

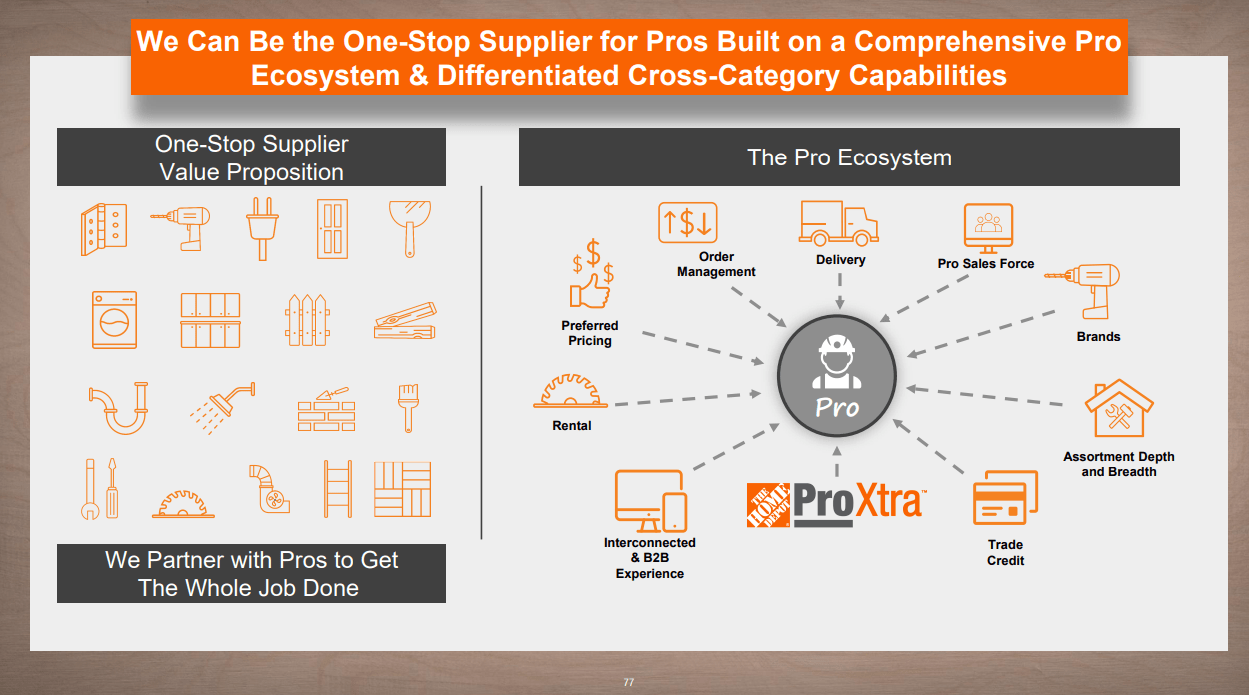

We've now taken the necessary actions to achieve this cost benefit, which Richard will detail in a moment. As we look forward to 2024, we remain focused on our strategic opportunities of creating the best interconnected experience, growing our Pro wallet share through our unique ecosystem of capabilities and building new stores. In December 2023, we made a strategic acquisition of Construction Resources, a leading distributor of design-oriented surfaces, appliances, and architectural specialty products for Pro contractors focused on renovation, remodeling, and residential home building. This acquisition adds to our robust product offering of products and services. It allows our complex Pro’s to easily shop across aesthetic product categories in a showroom setting, which is how they're accustomed to shopping for these types of goods.

We are excited to welcome Construction Resources into the Home Depot family. In 2024, we will continue learning and building out new capabilities for the complex Pro. We are expanding our assortments, fulfillment options and our outside sales force and just recently began piloting trade credit options. In addition, we continue to work on new order management capabilities to better manage complex Pro orders. For the complex Pro opportunity, this means that by the end of 2024, we will have 17 of our top Pro markets equipped with new fulfillment options, localized product assortment and expanded sales force and enhanced digital capabilities with trade credit and order management in pilot for development. What I hope you take away today is how great we feel about our business and how well we are positioning the business for the future.

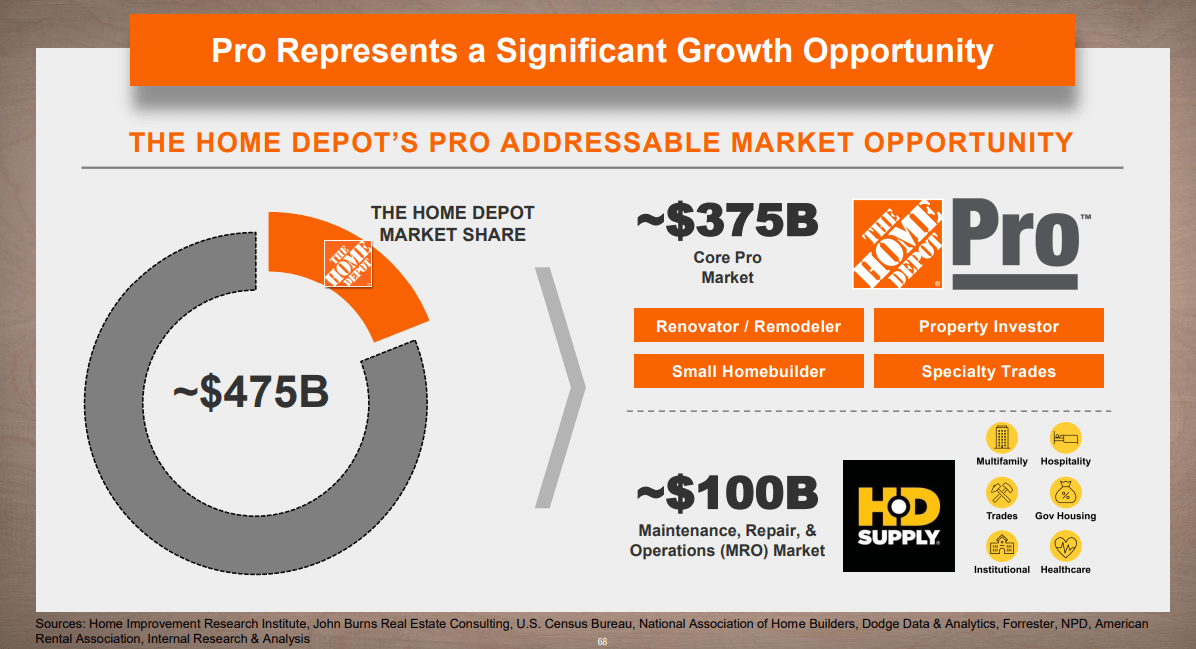

We remain excited about the opportunity to grow our share of a fragmented $950 billion-plus market. Our associates and supplier partners have continually demonstrated agility and resilience, and I want to thank them for their hard work and dedication to serving our customers and communities. And with that, I'd like to turn the call over to Ann.

Ann-Marie Campbell: Thanks, Ted, and good morning, everyone. I couldn’t be more pleased with our operational excellence and the investments we continue to make in the business. As you heard from Ted, we remain focused on three main strategic opportunities of creating the best interconnected experience, growing our Pro wallet share through our unique ecosystem of capabilities and build in new stores. As we continue to create the best interconnected experience and remove friction from our customers shopping journey, one of our biggest areas of opportunity is within our post-sale experience. For the majority of our customers, this process has largely been unchanged for the last 44 years, and we have opportunities to improve this experience.

In 2023, we made significant progress taking friction out of our online order management process. Today, we have enhanced our systems to better allow our customers to both modify orders and self-service online returns. In 2024, we will focus on building more robust capabilities to support an interconnected self-service returns process where customers will have the ability to start a return online and complete that return via mail or in-store. We have just begun all of this work in earnest and are very excited about the friction we will remove through this process while realizing significant productivity benefits over the long term. Through these enhancements and new capabilities in our returns process, we gain efficiencies by reducing transaction time and improving on-shelf availability, enabling better inventory management.

We also improved customer service by allowing the customer to start and complete their return, however they want. As you've heard us say many times, we are focused on making our interconnected experience better and more convenient no matter how our customers choose to engage with us. As we mentioned at our Investor Conference in June, we plan to open approximately 80 new stores over the next five years. Our current network of over 2,300 stores throughout North America makes the Home Depot the most convenient physical destination for customers to shop for their home improvement products. We have a premier real estate footprint that provides convenience for the customer that we believe is nearly impossible to replicate. And we will continue to build out this footprint in a very strategic way by investing in new stores in areas that have experienced significant population growth or where it makes sense to relieve some pressure on existing high-volume stores.

In fiscal 2023, we opened 13 new stores. Eight in the U.S. and five in Mexico. In the U.S., our eight new stores were roughly split between stores relieving pressure from higher volume existing stores and stores where we identified void in new high-growth areas. As an example, we are already seeing great results for many of these new stores and are particularly pleased with our Mapunapuna store in Honolulu, which allows us to better serve the Honolulu market. For fiscal 2024, we plan to open approximately 12 new stores. Beyond our focus on removing friction and growing to new stores, we have a lot of initiatives in 2024 geared at growing our share of wallet with the Pro. My new organization will be focused on better enabling alignment so we can more seamlessly deliver on our unique value proposition for all Pros.

When we invest in new assets and capabilities to better serve the complex Pro, this also improves our Pro experience in our stores. For example, more job site delivery orders fulfilled from our distribution centers means less congestion in our stores and less time dedicated to picking, packing and staging orders for delivery. This gives our in-store Pro sales associates more time to dedicate to our Pros. Additionally, the ability to fulfill large orders through our distribution network also means that we have more product in stock and available for sale for all those Pros shopping in our stores. These improvements benefit our associates and all of our Pros. Our investments in these strategic initiatives as well as the investments in our associates has set us up for success.

Recall that at the beginning of the year, we announced a significant investment of approximately $1 billion in increased annualized compensation for frontline hourly associates. As a result of this investment, we saw what we intended to see meaningful improvement in our attrition rates, particularly among our most tenured associates, which drove improved customer service, productivity and safety. I'm excited to see all of our initiatives gaining traction, and I want to thank our amazing associates for all that they do. With that, let me turn the call over to Billy.

William Bastek: Thank you, Ann, and good morning, everyone. I want to start by also thanking all of our associates and supplier partners for their ongoing commitment to serving our customers and communities. As you heard from Ted, during the fourth quarter, our sales were largely in line with our expectations. However, we did have some unfavorable impacts from weather in January and core commodity deflation. We saw a continuation of the trend that we've been observing throughout the year, with softness in certain big ticket discretionary type purchases. Our customers continue to take on smaller projects while still deferring larger projects. Turning to our department comp performance for the fourth quarter, our building materials and outdoor garden departments posted positive comps and 6 of our remaining 12 merchandising departments posted comps above the company average, including appliances, plumbing, tools, paint, indoor garden, and hardware.

During the fourth quarter, our comp transactions decreased 2.1% and comp average ticket decreased 1.3%. However, we continue to see our customers trading up for new and innovative products. Deflation from core commodity categories negatively impacted our average ticket by 35 basis points during the fourth quarter, driven by deflation in lumber and copper wire. During the fourth quarter, we continued to see, on average, a decline in lumber prices relative to a year ago. However, framing and panel lumber pricing experienced the most stable pricing levels during the quarter in some time. As an example, framing lumber started the quarter at approximately $370 per 1,000 board feet compared to ending the quarter at approximately $395, representing a change of less than 7%.

The big ticket comp transactions or those over $1,000, were down 6.9% compared to the fourth quarter of last year. We continued to see softer engagement in big-ticket discretionary categories like flooring, countertops and cabinets. During the fourth quarter, our Pro and DIY customers performance was relatively in line with one another. While internal and external surveys suggest that Pro backlogs are lower than they were a year ago, they have remained stable and elevated relative to historical norms. Turning to total company online sales. Sales leveraging our digital platforms increased approximately 2% compared to the fourth quarter of last year. We continue to enhance our digital customer experience with a number of new capabilities, including an enhanced browsing experience featuring the best sellers in a local market and new product discovery zones, which highlights what's trending based on new and highly rated products.

For those customers that transacted with us online during the fourth quarter, nearly half of our online orders were fulfilled through our stores. During the fourth quarter, we hosted our annual decorative holiday, Gift Center and Black Friday events. We saw strong engagement across all these events with our decorative holiday event posting a record sales year. As Ted mentioned, 2023 marked the year of significant progress for our inventory management and on-shelf availability while effectively navigating a disinflationary pricing environment and maintaining our position as the customer's advocate for value. Today, we are in a great position regarding our inventory levels. Our in-stocks are the best they've been in a number of years, and we are delivering a compelling assortment for our customers' home improvement needs.

We are looking forward to the year ahead, particularly with the spring selling season right around the corner, and we have a great lineup of new and innovative products in live goods to outdoor power equipment. We're excited to expand our offering of Pro outdoor tools with the launch of our new cordless battery powered, Milwaukee, M18, backpack blower and straight shaft trimmer, broadening our assortment for the Pro landscaper. And our Spring Gift Center event continues to lean into cordless technology with a wide variety of products from RYOBI, Milwaukee, Makita and DEWALT, many of which are exclusive to the Home Depot and the big box retail channel. We're also excited about our live goods program. Each year, our merchants partner with our national and regional growers to provide our customers with new and improved varieties to enhance the overall garden experience.

We've made significant investments in partnership with our growers to bring new varieties to our customers that are more disease resistant, tolerant to different climates and require less watering. Investing in our relationships with our growers will allow us to continue to drive innovation to meet our customers' needs and improve their shopping experience while building loyalty to the Home Depot. As we look forward to spring, we're excited about continuing to provide a broad assortment of best-in-class products that are in stock and available for our customers when and how they need it. With that, I'd like to turn the call over to Richard.

Richard McPhail: Thank you, Billy, and good morning, everyone. In the fourth quarter, total sales were $34.8 billion, a decrease of 2.9% from last year. During the fourth quarter, our total company comps were negative 3.5% with comps of negative 2.5% in November, positive 1.1% in December and negative 8.5% in January. Comps in the U.S. were negative 4% for the quarter with comps of negative 2.7% in November, positive 0.6% in December and negative 9.1% in January. In local currency, Mexico and Canada posted comps above the company average with Mexico posting positive comps. It is important to note that adjusting for holiday shifts and weather-related impacts in January, monthly comps relatively consistent across the quarter. For the year, our sales totaled $152.7 billion, a decrease of 3% versus fiscal 2022.

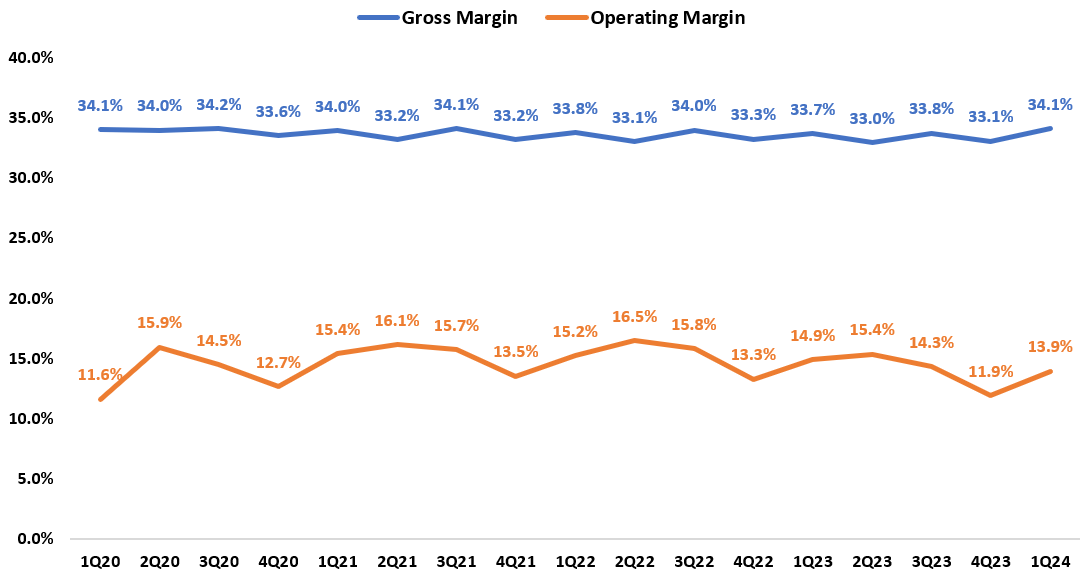

For the year, total company comp sales decreased 3.2% and U.S. comp sales decreased 3.5%. In the fourth quarter, our gross margin was approximately 33.1%, a decrease of 20 basis points from last year. For the year, our gross margin was approximately 33.4%, a decrease of 15 basis points from last year, which was in line with our expectations. During the fourth quarter, operating expenses as a percentage of sales increased approximately 115 basis points to 21.2% compared to the fourth quarter of 2022. Our operating expense performance during the fourth quarter reflects our previously executed compensation increases for hourly associates as well as deleverage from our top line results. For the year, operating expenses were approximately 19.2% of sales, representing an increase of approximately 90 basis points from fiscal 2022.

Our operating margin for the fourth quarter was approximately 11.9% and for the year was approximately 14.2%. Interest and other expense for the fourth quarter increased by $50 million to $458 million. In the fourth quarter and for fiscal 2023, our effective tax rate was 24%. Our diluted earnings per share for the fourth quarter were $2.82, a decrease of 14.5% compared to the fourth quarter of 2022. Diluted earnings per share for fiscal 2023 were $15.11, a decrease of 9.5% compared to fiscal 2022. At the end of the quarter, merchandise inventories were $21 billion, down $3.9 billion or approximately 16% versus last year, and inventory turns were 4.3x, up from 4.2x from the second period last year. Moving on to capital allocation. During the fourth quarter, we invested approximately $860 million back into our business in the form of capital expenditures.

This brings total capital expenditures for fiscal 2023 to approximately $3.2 billion. During the year, we opened 13 new stores, bringing our store count to 2,335 at the end of fiscal 2023. Retail selling square footage was approximately 242 million square feet and total sales per retail square foot were approximately $605 in fiscal 2023. Additionally, we invested approximately $1.5 billion on three acquisitions during fiscal 2023, accelerating our strategic initiatives and providing us with better capabilities to serve our customers. During the year, we paid approximately $8.4 billion of dividends to our shareholders. Today, we announced our Board of Directors increased our quarterly dividend by 7.7% to $2.25 per share, which equates to an annual dividend of $9 per share.

And finally, during fiscal 2023, we returned approximately $8 billion to our shareholders in the form of share repurchases, including $1.5 billion in the fourth quarter. Computed on the average of beginning and ending long-term debt and equity for the trailing 12 months, return on invested capital was 36.7% compared to 44.6% at the end of the fourth quarter of fiscal 2022. Now I'll comment on our outlook for 2024. First, let me point out that fiscal 2024 will include a 53rd week, so the fourth quarter of fiscal 2024 will consist of 14 weeks. We will continue to report comps on a 52-week basis, but we will base our overall guidance on 53 weeks. As you heard from Ted, we feel great about the actions we took in 2023 to position us well heading into 2024.

And while there are signs that the economy is on the way towards normalization, the home improvement market still faces headwinds as we look ahead to fiscal 2024. We considered several factors that informed our outlook for fiscal 2024. On the positive side, we faced a number of pressures in fiscal 2023 that are unlikely to repeat in fiscal 2024. In 2023, we saw four increases in the Fed funds rate, a sharp decline in existing home sales and approximately 110 basis points of comp pressure from lumber deflation. However, we still expect pressures to our business in fiscal 2024. Personal consumption growth as measured by PCE is expected to decelerate compared to 2023. Our share of PCE also remains slightly elevated relative to 2019 and has been on a glide path towards 2019 levels.

Higher interest rates at the beginning of 2024 relative to last year will likely continue to pressure demand for larger projects. And the effects from pull forward of demand during the pandemic as well as some project deferral could impact demand into 2024. As we consider these influences on home improvement demand, we are planning for a year of continued moderation but with slightly less pressure to comp sales than what we faced in fiscal 2023. Our fiscal 2024 outlook is for total sales growth to outpace sales comp with sales growth of approximately positive 1% and comp sales of approximately negative 1% compared to fiscal 2023. Total sales growth will benefit from a 53rd week as well as from the acquisitions we made and the new stores we opened in fiscal 2023 and the stores we plan to open in fiscal 2024.

We expect the 53rd week will contribute approximately $2.3 billion in sales. Our gross margin is expected to be approximately 33.9%, an increase of approximately 50 basis points compared to fiscal 2023. This primarily reflects a lower product and transportation cost environment relative to fiscal 2023 as well as benefits from a portion of the approximately $500 million in reduced fixed costs that we will realize in fiscal 2024. Further, we expect operating margin of approximately 14.1%. This reflects deleverage from sales and pressure from targeted incentive compensation as we are overlapping lower incentive compensation paid than planned in 2023. This will be partially offset by the benefits from the approximately $500 million in fixed costs that we will realize in fiscal 2024 in both cost of goods sold and operating expenses.

Our effective tax rate is targeted at approximately 24.5%. We expect net interest expense of approximately $1.8 billion. Our diluted earnings per share percent growth is targeted to be approximately 1% compared to fiscal 2023, with the extra week contributing approximately $0.30. We plan to continue investing in our business with capital expenditures of approximately 2% of sales on an annual basis. After investing in our business and paying our dividend, it is our intent to return excess cash to shareholders in the form of share repurchases. We believe we have positioned ourselves to meet the needs of our customers in any environment. The investments we've made in our business have enabled agility in our operating model. As we look forward, we will continue to invest to strengthen our position with our customers, leverage our scale and low-cost position to drive growth faster than the market and deliver shareholder value.

Thank you for your participation in today's call. And Christine, we are now ready for questions.

See also 25 Most Popular Email Newsletters in the US in 2024 and 13 High Growth Penny Stocks That Are Profitable .

To continue reading the Q&A session, please click here .

Customer Service 1 (800) 466-3337

- Timeline & History

- Sponsorship & Paid Media

- Economic Impact

- Values Wheel

- News Releases

- Give Me An H Podcast

Investor Relations

Stock Quote & Chart

- Historical Lookup

- Investment Calculator

- Stock Splits

- Dividend History

- Analyst Coverage

- Quarterly Earnings

- Current Forms

- Annual Reports

- SEC Filings

- Events & Presentations

- Board of Directors

- Committee Members & Charters

- Shareholder Services

- Direct Stock Purchase Plan

- Stock Transfer Agent

- Account Access

- Employee Stock Plan Contact

- Electronic Delivery of Proxy Materials

- Annual Meeting

- Contact Investor Relations

- 2023 Investor and Analyst Conference

- Investor Documents

- Request Printed Materials

- Email Alerts

- ESG Investors

- Serving Veterans

- Disaster Relief

- Path to Pro

- Responsibility

- 2023 ESG Report

- Resources & Reports

- Diversity, Equity and Inclusion

- Supplier Diversity

- Political Engagement

- Shop Online

- Store Finder

- Stock Information

- Financial Reports

- Corporate Governance

- Investor Resources

- E-mail Alerts

You may automatically receive The Home Depot, Inc. financial information by e-mail. To choose your options for e-mail notification, please enter your e-mail address below and click Submit.

Email: [email protected] IR Coordinator: 770-384-2871

For all other inquiries including Customer Care issues please call The Home Depot Store Support Center at 1-770-433-8211 , or toll free 1-800-654-0688 .

Quick Links

- Buy Stock Direct

- Privacy & Security Statement

UK Tax Strategy

About The Home Depot

©2024 Home Depot Product Authority, LLC All Rights Reserved. Use of this site is subject to certain Terms of Use.

Home Depot: Improving Growth Prospects

- The Home Depot is well-positioned for revenue and margin growth, with benefits from easing AUR comparisons and normalized demand patterns.

- The company's revenue outlook is positive, with strong customer engagement and sales, especially in Pro sales and building materials.

- Margin growth prospects are positive, with benefits from operating leverage, lower shrinkage, and technological advancements to improve efficiency.

Oleg Kovtun/iStock Editorial via Getty Images

Investment Thesis

I last covered The Home Depot, Inc. ( NYSE: HD ) in May 2023 and the stock has given a good 23% return since then. Moving forward, the company is well-positioned to deliver revenue and margin growth. The company’s revenue should benefit from easing Average Unit Retail ('AUR') comparisons, normalizing demand patterns for SKUs like gardening and outdoor power equipment which saw pull forward demand during Covid, and strength in the company’s Pro sales channel driven by good execution and market share gains.

On the margin front, the company should benefit from operating leverage, a decrease in shrinkage from efficiency initiatives, easier margin comparisons, and a favorable cost environment. I believe the company’s revenues have bottomed, and the outlook is positive in the coming years. The valuation is also reasonable. Hence, I am continuing with my buy rating on the HD Stock.

Home Depot Revenue Analysis and Outlook

During COVID-19, the company’s revenue benefited from strong demand for home improvement projects and higher average tickets driven by inflationary commodity prices. However, from FY 2023, the company’s revenues started getting hit by demand moderation from peak levels.

In the first quarter of 2024, the company’s revenue continued to face headwinds from moderating demand, driven by softness in large discretionary projects. In addition, a late start to the spring season also impacted transactions. This was partially offset by strength in Pro sales as well as positive comp sales among building materials, and power equipment categories. As a result, total company sales declined by 2.3% Y/Y to $36.4 billion. On a comparable basis, sales declined by 2.8% Y/Y driven by a 1 percentage point decline in comparable transactions and a 1.3 percentage point decline in average ticket.

HD’s Historical Revenue (Company Data, GS Analytics Research)

Looking forward, the company’s revenue outlook looks positive. While the company’s sales were negatively impacted by the late start of the spring season in Q1, it maintained its annual sales guidance. Management also noted that the company saw good customer engagement and sales in the weeks when the weather was favorable, indicating strong underlying demand. The company hosted its annual spring Black Friday and spring Gift Center events in the first quarter and saw strong performance across both events.

Further, management noted that the company has started seeing normalized demand patterns in categories like riding lawnmowers, and outdoor power equipment. These categories benefited during COVID-19 as the demand got pulled forward. However, once the economy reopened, these categories were seeing demand headwinds. These headwinds now seem to be dissipating, with demand returning to normal patterns. This is good news for sales growth moving forward.

Management is also doing a good job of increasing its Pro Sales. The company is expanding its capabilities and services focusing on Pro customers by developing more fulfillment options, a dedicated sales force, specific digital assets, trade credit, and order management capabilities. It refers to it as a Pro Ecosystem and has rolled out foundational elements of this ecosystem in 17 markets by the end of the last fiscal year. On the recent earnings call, management noted that these markets are outperforming the company’s overall Pro sales, indicating that Pro Ecosystem initiatives are working well. As the company continues to roll out these initiatives in more markets, it should see good gains in Pro market share.

HD Pro Opportunity (2023 Investor Conference Presentation Slide)

In addition, the company’s comparable sales should also benefit from easing Average Unit Retail comparisons as the year progresses. On its recent earnings call , answering a question on comp sales improvement in the back half of the year, the company’s CFO highlighted easing AUR comparisons. Below is the relevant excerpt.

Steve Zaccone – Citi, Analyst Great. Good morning. Thanks very much for taking my question. I wanted to follow up on Michael Lasser's question. Can you just help us understand what drives the second half improvement in same-store sales, just given the fact that the first half has been a little bit softer here with this delayed start to spring? Richard McPhail - The Home Depot, Inc. - EVP & CFO Well, the primary factor is actually AUR, which we just outlined. So if you think about pressure going from the beginning of the year in Q1 of 2 percentage points sort of falling to 0 by the end of the year, that's really the majority of the arithmetic with respect to the year.”

So, I believe the worst is behind us and the company should see an improving sales trend as the year progresses.

Margin Analysis and Outlook

In the last fiscal year, the company’s margins were impacted by volume deleverage, along with an increase in shrinkage.

In the first quarter of 2024, while volume deleverages continued to impact margins, the company’s gross margin saw benefits from lower transportation costs and lower shrinkage driven by improving efficiency from technological advancements within the stores. This resulted in a 40 bps Y/Y growth in gross margin to 34.1%. However, the benefits to gross margins were offset by higher SG&A as a percentage of sales compared to the previous year’s quarter. The SG&A faced headwinds from tough comparisons from last year’s quarter, as SG&A in Q1 2023 benefited from a legal settlement. This resulted in a 100 bps YoY decline in operating margin to 13.9%.

HD’s Historical Gross and Operating Margin (Company Data, GS Analytics Research)

Looking forward, I am optimistic about the company’s margin growth prospects. Home Depot’s margins should benefit from operating leverage from a recovery in sales as the year progresses. The company also witnessed difficult margin comparisons in Q1 as the first quarter of the last year benefited from a legal settlement which should not reoccur in the coming quarters, benefiting Y/Y margins. Further, the company is leveraging computer vision technology to reduce shrinkage. Computer vision can identify complex carts and signal the cashier to ensure all products are scanned and accounted for. This technology has shown good results so far and as the company continues to roll out this application, it should continue to see reductions in shrink which should help margin improvement.

Valuation and Conclusion

Home Depot is currently trading at a 22.72x FY24 consensus EPS estimate of $15.34 and a 21.40x FY25 consensus EPS estimate of $16.29. Over the last 5 years, the stock has traded at an average P/E ('FWD') of 21.64x. HD Stock also offers a good forward dividend yield of 2.58%.

Considering we are near the bottom of the cycle, I find the company’s current valuation reasonable.

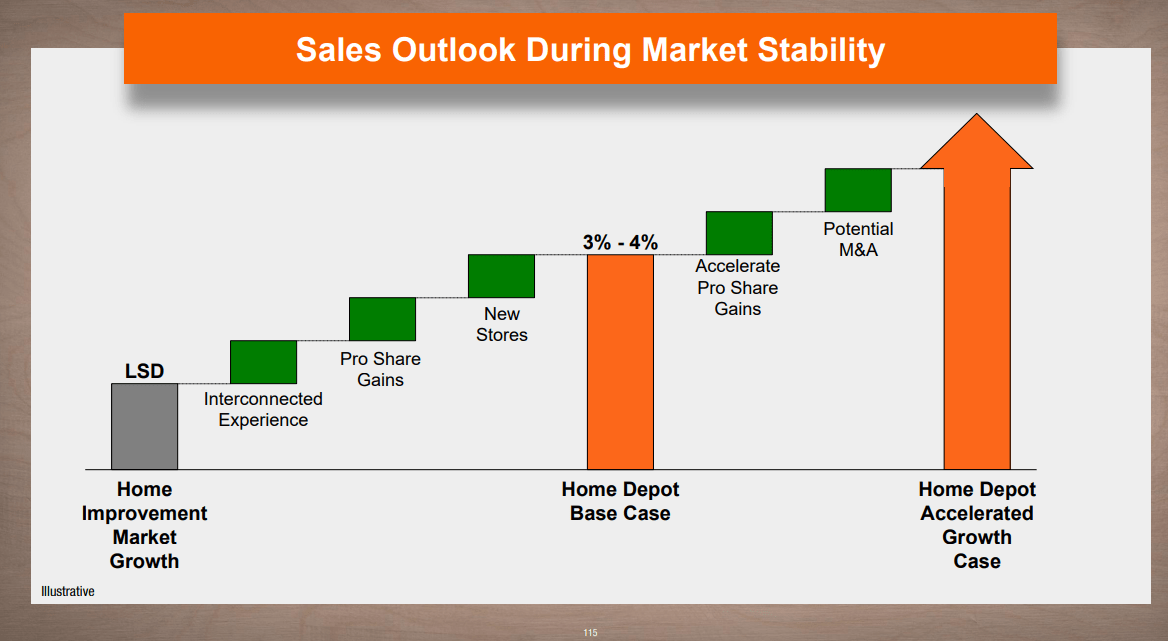

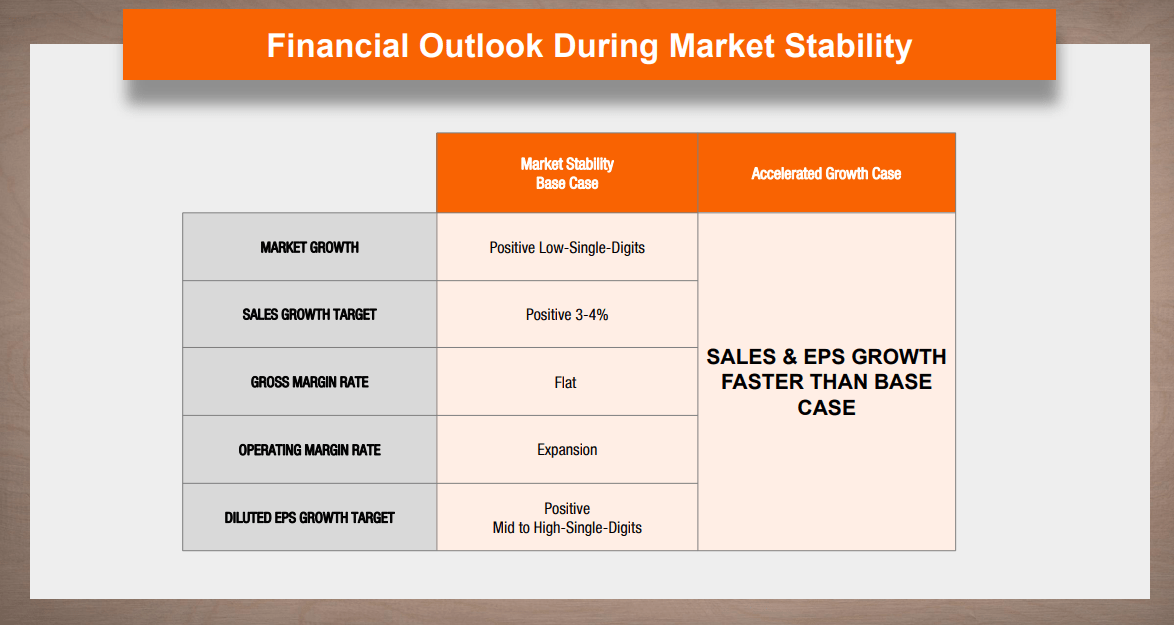

The company is poised to resume its revenue growth in the coming quarters and once the interest rate cycle starts reversing and the market starts stabilizing, the company’s growth should start to accelerate meaningfully from the next fiscal year onwards. Management has shared a 3% to 4% revenue growth target and mid to high single-digit EPS growth target in the base case scenario once the market stabilizes. There is also further upside possible in growth through M&As (like the recent SRS acquisition) and accelerated Pro share gains.

Home Depot Growth Targets (HD Investor Presentation)

Home Depot Financial Outlook (Investor Presentation)

I anticipate the growth to start recovering in the coming quarters and the company to start hitting these targets from next fiscal year onwards. With mid to high single digit EPS growth in management’s base case and 2.58% dividend yield, the stock can deliver high single-digit/ low double digits CAGR, assuming its P/E remains at the current levels. I believe a slightly higher return is more likely given the renewed focus of management on M&As (as is evident by the recent SRS acquisition ) and the excellent execution of Pro initiatives so far. I don’t see P/E multiple contracting from here, as we are in the early phases of recovery. With growth resuming in the coming quarters and accelerating next year, investors are likely to be more inclined to give the stock a higher valuation multiple. Hence, I believe the stock offers a good upside.

While I am optimistic about the company’s growth prospects ahead, there are some risks that investors should keep in mind. The company’s sales could be impacted by changing customer presences, shopping habits, or home improvement trends. In addition, lingering impacts from moderating demand in an uncertain macroeconomic environment could delay the revenue recovery prospects in the coming quarters. Additionally, the company's failure to properly execute efficiency initiatives within the stores could impact margin growth prospects.

Home Depot exhibits strong potential for both revenue and margin growth in the coming years. Easing comparisons, normalized demand patterns, and the company's focus on strengthening its Pro sales channel and increasing market share gain in this category should drive revenue growth. Furthermore, efficiency initiatives through improving the digital infrastructure at the stores should contribute positively to margin expansion. Moreover, the current valuation provides a reasonable opportunity for long-term investors. I believe the stock should see a good upside as the company returns to growth with support from the above-mentioned tailwinds. Hence, I maintain a buy rating on the stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. This article is written by Gayatri S.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

About hd stock.

| Symbol | Last Price | % Chg |

|---|

Related Stocks

| Symbol | Last Price | % Chg |

|---|---|---|

| HD | - | - |

| HD:CA | - | - |

Trending Analysis

Trending news.

- Bahasa Indonesia

- Eastern Europe

- Moscow Oblast

Elektrostal

Elektrostal Localisation : Country Russia , Oblast Moscow Oblast . Available Information : Geographical coordinates , Population, Altitude, Area, Weather and Hotel . Nearby cities and villages : Noginsk , Pavlovsky Posad and Staraya Kupavna .

Information

Find all the information of Elektrostal or click on the section of your choice in the left menu.

- Update data

| Country | |

|---|---|

| Oblast |

Elektrostal Demography

Information on the people and the population of Elektrostal.

| Elektrostal Population | 157,409 inhabitants |

|---|---|

| Elektrostal Population Density | 3,179.3 /km² (8,234.4 /sq mi) |

Elektrostal Geography

Geographic Information regarding City of Elektrostal .

| Elektrostal Geographical coordinates | Latitude: , Longitude: 55° 48′ 0″ North, 38° 27′ 0″ East |

|---|---|

| Elektrostal Area | 4,951 hectares 49.51 km² (19.12 sq mi) |

| Elektrostal Altitude | 164 m (538 ft) |

| Elektrostal Climate | Humid continental climate (Köppen climate classification: Dfb) |

Elektrostal Distance

Distance (in kilometers) between Elektrostal and the biggest cities of Russia.

Elektrostal Map

Locate simply the city of Elektrostal through the card, map and satellite image of the city.

Elektrostal Nearby cities and villages

Elektrostal Weather

Weather forecast for the next coming days and current time of Elektrostal.

Elektrostal Sunrise and sunset

Find below the times of sunrise and sunset calculated 7 days to Elektrostal.

| Day | Sunrise and sunset | Twilight | Nautical twilight | Astronomical twilight |

|---|---|---|---|---|

| 8 June | 02:43 - 11:25 - 20:07 | 01:43 - 21:07 | 01:00 - 01:00 | 01:00 - 01:00 |

| 9 June | 02:42 - 11:25 - 20:08 | 01:42 - 21:08 | 01:00 - 01:00 | 01:00 - 01:00 |

| 10 June | 02:42 - 11:25 - 20:09 | 01:41 - 21:09 | 01:00 - 01:00 | 01:00 - 01:00 |

| 11 June | 02:41 - 11:25 - 20:10 | 01:41 - 21:10 | 01:00 - 01:00 | 01:00 - 01:00 |

| 12 June | 02:41 - 11:26 - 20:11 | 01:40 - 21:11 | 01:00 - 01:00 | 01:00 - 01:00 |

| 13 June | 02:40 - 11:26 - 20:11 | 01:40 - 21:12 | 01:00 - 01:00 | 01:00 - 01:00 |

| 14 June | 02:40 - 11:26 - 20:12 | 01:39 - 21:13 | 01:00 - 01:00 | 01:00 - 01:00 |

Elektrostal Hotel

Our team has selected for you a list of hotel in Elektrostal classified by value for money. Book your hotel room at the best price.

| Located next to Noginskoye Highway in Electrostal, Apelsin Hotel offers comfortable rooms with free Wi-Fi. Free parking is available. The elegant rooms are air conditioned and feature a flat-screen satellite TV and fridge... | from | |

| Located in the green area Yamskiye Woods, 5 km from Elektrostal city centre, this hotel features a sauna and a restaurant. It offers rooms with a kitchen... | from | |

| Ekotel Bogorodsk Hotel is located in a picturesque park near Chernogolovsky Pond. It features an indoor swimming pool and a wellness centre. Free Wi-Fi and private parking are provided... | from | |

| Surrounded by 420,000 m² of parkland and overlooking Kovershi Lake, this hotel outside Moscow offers spa and fitness facilities, and a private beach area with volleyball court and loungers... | from | |

| Surrounded by green parklands, this hotel in the Moscow region features 2 restaurants, a bowling alley with bar, and several spa and fitness facilities. Moscow Ring Road is 17 km away... | from | |

Elektrostal Nearby

Below is a list of activities and point of interest in Elektrostal and its surroundings.

Elektrostal Page

| Direct link | |

|---|---|

| DB-City.com | Elektrostal /5 (2021-10-07 13:22:50) |

- Information /Russian-Federation--Moscow-Oblast--Elektrostal#info

- Demography /Russian-Federation--Moscow-Oblast--Elektrostal#demo

- Geography /Russian-Federation--Moscow-Oblast--Elektrostal#geo

- Distance /Russian-Federation--Moscow-Oblast--Elektrostal#dist1

- Map /Russian-Federation--Moscow-Oblast--Elektrostal#map

- Nearby cities and villages /Russian-Federation--Moscow-Oblast--Elektrostal#dist2

- Weather /Russian-Federation--Moscow-Oblast--Elektrostal#weather

- Sunrise and sunset /Russian-Federation--Moscow-Oblast--Elektrostal#sun

- Hotel /Russian-Federation--Moscow-Oblast--Elektrostal#hotel

- Nearby /Russian-Federation--Moscow-Oblast--Elektrostal#around

- Page /Russian-Federation--Moscow-Oblast--Elektrostal#page

- Terms of Use

- Copyright © 2024 DB-City - All rights reserved

- Change Ad Consent Do not sell my data

- About company

- GENERAL CONTRACTOR

+7 (495) 526-30-40 +7 (49657) 0-30-99

THE HISTORY OF THE COMPANY CREATION

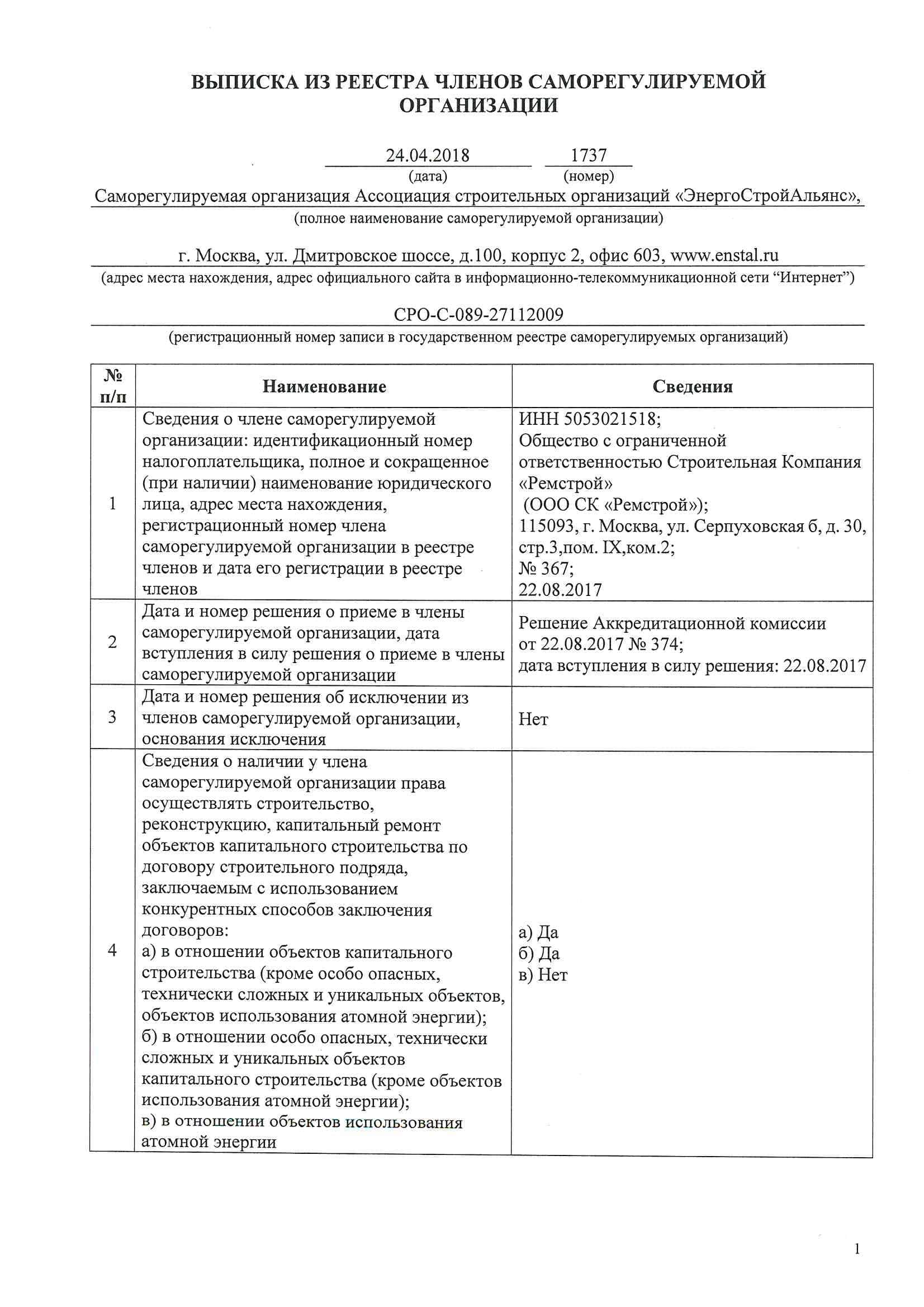

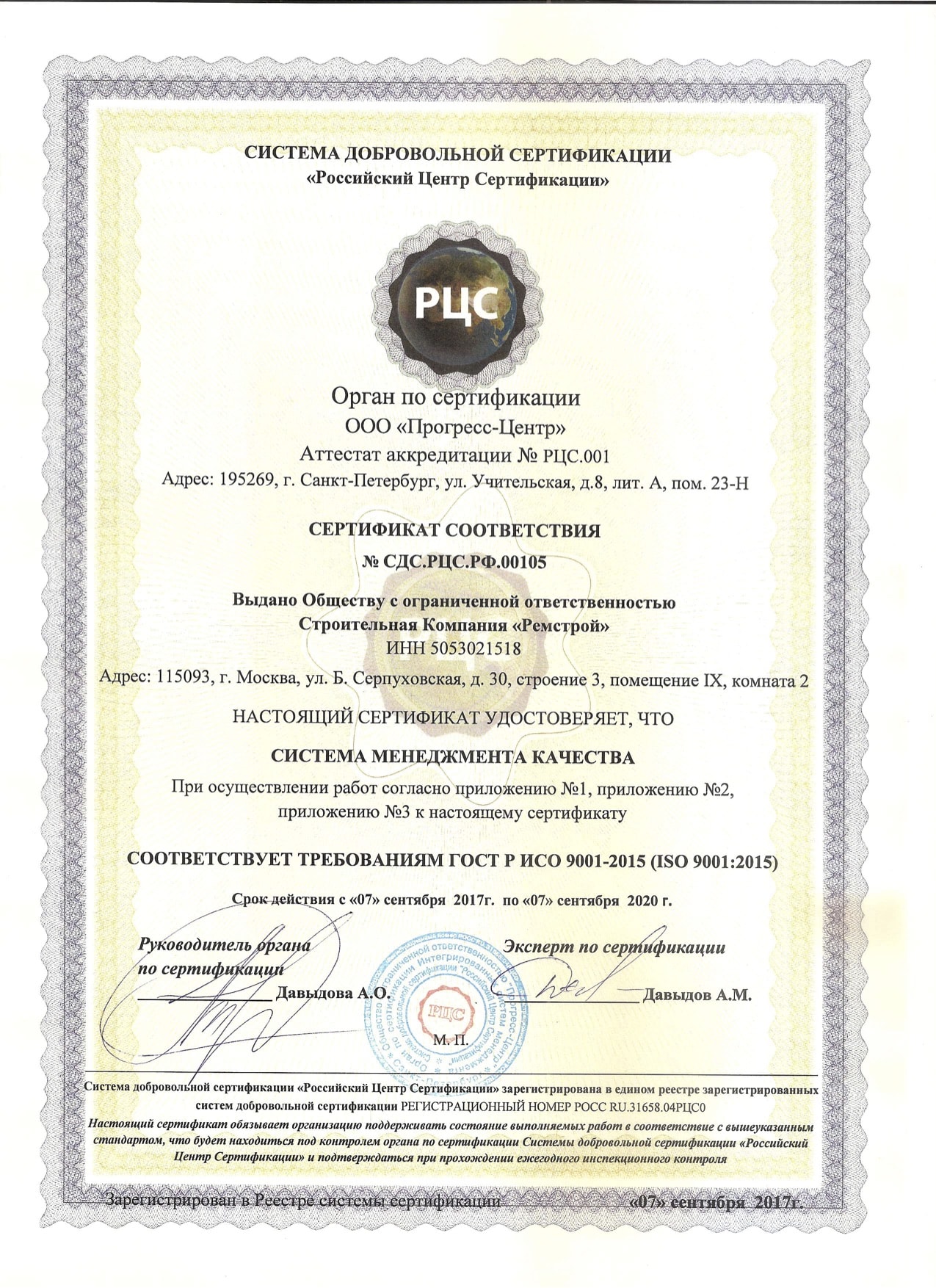

1993 how the construction company remstroy was created the year 1993 was a period when a lot of construction companies, which had been working successfully during the soviet times and had rich staff capacity, were forced to cease their activity for various reasons. a lot of capable specialists either had to look for another job or change their field. but there were also those who were willing to realise their potential in the field of construction in accordance with the received degree and the experience they had accumulated. thus, in 1993 in elektrostal (moscow oblast) a group of specialists and people sharing each other’s ideas, who had enormous educational background and the highest degree in architecture, organized and registered ooo firm erg which began its rapid development and successful work, offering its service both on the construction market and other areas. 2000 industrial construction is the main area seven years of successful work have shown that combining different types of activities in the same company is not always convenient. and in the year 2000 the founders of ooo firm erg decided to create and register a monoprofile construction company ooo remstroy construction company. industrial construction was chosen as the priority area. it was in this area that the directors of ooo sk remstroy began their working life and grew as specialists. in order to achieve the set goal, they selected a mobile team of professionals in the field of industrial construction, which allows us to cope with the tasks assigned to ooo sk remstroy throughout russia and the near abroad. 2010 manufacturing of metal structures we possess modern equipment that allows us to carry out the entire cycle of works on the manufacture of metal structures of any complexity without assistance. designing – production – installation of metal structures. a staff of professionals and well-coordinated interaction of the departments let us carry out the work as soon as possible and in accordance with all customer’s requirements.” extract from the list of members of self-regulatory organizations, construction.

LICENSE OF MINISTRY OF EMERGENCY SITUATIONS

Certificates, system of managing quality.

SYSTEM OF ECOLOGIAL MANAGEMENT

SYSTEM OF OCCUPATIONAL SAFETY AND HEALTH MANAGEMENT

LETTERS OF RECOMMENDATION

THE GEOGRAPHY OF CONSTRUCTION SITES

YOU CAN FIND MORE INFORMATION ON THE CONSTRUCTION SITES OF OOO REMSTROY ON THE PAGE OF THE SITE

OUR CLIENTS

http://remstroi.pro/yandex-promyshlennoe-stroitelstvo

Geographic coordinates of Elektrostal, Moscow Oblast, Russia

City coordinates

Coordinates of Elektrostal in decimal degrees

Coordinates of elektrostal in degrees and decimal minutes, utm coordinates of elektrostal, geographic coordinate systems.

WGS 84 coordinate reference system is the latest revision of the World Geodetic System, which is used in mapping and navigation, including GPS satellite navigation system (the Global Positioning System).

Geographic coordinates (latitude and longitude) define a position on the Earth’s surface. Coordinates are angular units. The canonical form of latitude and longitude representation uses degrees (°), minutes (′), and seconds (″). GPS systems widely use coordinates in degrees and decimal minutes, or in decimal degrees.

Latitude varies from −90° to 90°. The latitude of the Equator is 0°; the latitude of the South Pole is −90°; the latitude of the North Pole is 90°. Positive latitude values correspond to the geographic locations north of the Equator (abbrev. N). Negative latitude values correspond to the geographic locations south of the Equator (abbrev. S).

Longitude is counted from the prime meridian ( IERS Reference Meridian for WGS 84) and varies from −180° to 180°. Positive longitude values correspond to the geographic locations east of the prime meridian (abbrev. E). Negative longitude values correspond to the geographic locations west of the prime meridian (abbrev. W).

UTM or Universal Transverse Mercator coordinate system divides the Earth’s surface into 60 longitudinal zones. The coordinates of a location within each zone are defined as a planar coordinate pair related to the intersection of the equator and the zone’s central meridian, and measured in meters.

Elevation above sea level is a measure of a geographic location’s height. We are using the global digital elevation model GTOPO30 .

Elektrostal , Moscow Oblast, Russia

IMAGES

COMMENTS

Email: [email protected] IR Coordinator: 770-384-2871. For all other inquiries including Customer Care issues please call The Home Depot Store Support Center at 1-770-433-8211, or toll free 1-800-654-0688.

HD - Q4'21 Home Depot Earnings Call EVENT DATE/TIME: February 22, 2022 / 09:00AM ET . PRESENTATION . Operator . Greetings, and welcome to The Home Depot Earnings Call. At this time, all participants are in a listen only . mode. A brief question- and-answer session will follow the formal presentation. [Operator Instructions] As a

ATLANTA, May 18, 2021 -- The Home Depot, the world's largest home improvement retailer, today reported sales of $37.5 billion for the first quarter of fiscal 2021, an increase of $9.2 billion, or 32.7 percent from the first quarter of fiscal 2020. Comparable sales for the first quarter of fiscal 2021 increased 31.0 percent, and comparable sales in the U.S. increased 29.9 percent.

The Home Depot Direct Stock Purchase Plan (DSPP) enables you to invest a minimum amount in Home Depot stock and build your stock ownership over time. It's designed for individual investors who might otherwise avoid making small, long-term stock purchases because of large minimum brokerage fees. You always have control.

The Home Depot, Inc. (NYSE:NYSE:HD) 2023 INVESTOR CONFERENCE June 13, 2023 9:00 AM ETCompany ParticipantsIsabel Janci - Investor RelationsTed Decker -...

Email: [email protected] IR Coordinator: 770-384-2871. For all other inquiries including Customer Care issues please call The Home Depot Store Support Center at 1-770-433-8211, or toll free 1-800-654-0688.

The Home Depot, Inc. (NYSE:HD) Q4 2023 Earnings Call Transcript February 20, 2024 The Home Depot, Inc. beats earnings expectations. Reported EPS is $2.82, expectations were $2.77. The Home Depot ...

Home Depot (HD) is one of the stocks most watched by Zacks.com visitors lately. So, it might be a good idea to review some of the factors that might affect the near-term performance of the stock.

Email: [email protected] IR Coordinator: 770-384-2871. For all other inquiries including Customer Care issues please call The Home Depot Store Support Center at 1-770-433-8211, or toll free 1-800-654-0688.

The following slide deck was published by The Home Depot, Inc. ... Home Depot (HD) Investor Presentation - Slideshow. May 22, 2020 4:03 PM ET The Home Depot, Inc. (HD) Stock 3 Likes.

Home Depot exhibits strong potential for both revenue and margin growth in the coming years. Here's why I maintain a buy rating on HD stock. ... (HD Investor Presentation) Home Depot Financial ...

Investors could use the money from Home Depot's excessively high valuation to buy some more promising stocks this year. On the date of publication, Joel Lim did not have (either directly or ...

Listeners may access the webcast and slide presentation by clicking here or may listen to the conference call by dialing +1 (877) 407-1875 (toll-free) or +1 (215) 268-9909 and entering the ...

Elektrostal : Elektrostal Localisation : Country Russia, Oblast Moscow Oblast. Available Information : Geographical coordinates, Population, Area, Altitude, Weather and Hotel. Nearby cities and villages : Noginsk, Pavlovsky Posad and Staraya Kupavna. - City, Town and Village of the world

The successful implementation of a number of sites the investors of which were European companies from England, Germany, Spain and Sweden, allows us to declare with confidence that the work of the construction company Remstroy meets the highest requirements of construction.

Pavel Oderov was appointed as Head of the International Business Department pursuant to a Gazprom order. Pavel Oderov was born in June 1979 in the town of Elektrostal, Moscow Oblast.

Geographic coordinate systems. WGS 84 coordinate reference system is the latest revision of the World Geodetic System, which is used in mapping and navigation, including GPS satellite navigation system (the Global Positioning System).