Best 10 BCG Matrix Examples for Students

Discover more helpful information.

BCG Matrix is an apparatus utilized to incorporate methodology to break down specialty units or product offerings dependent on two factors: relative piece of the overall industry and the market development rate. By joining these two factors into a matrix, an organization can plot their specialty units as needs are and figure out where to dispense extra (financial) assets, where to money out, and where to strip.

The primary reason for the BCG Matrix is accordingly to settle on speculation choices on a corporate level. Contingent upon how well the unit and the business are doing, four different classification names can be credited to every group:

- Question Marks

This article covers every classification and how to utilize the BCG Matrix appropriately.

10 Examples of BCG Matrix (of famous companies)

The BCG Model depends on items as opposed to administrations, be that as it may, it applies to both. You could utilize this if checking on a scope of items, particularly before growing new ones. Here are the example list:

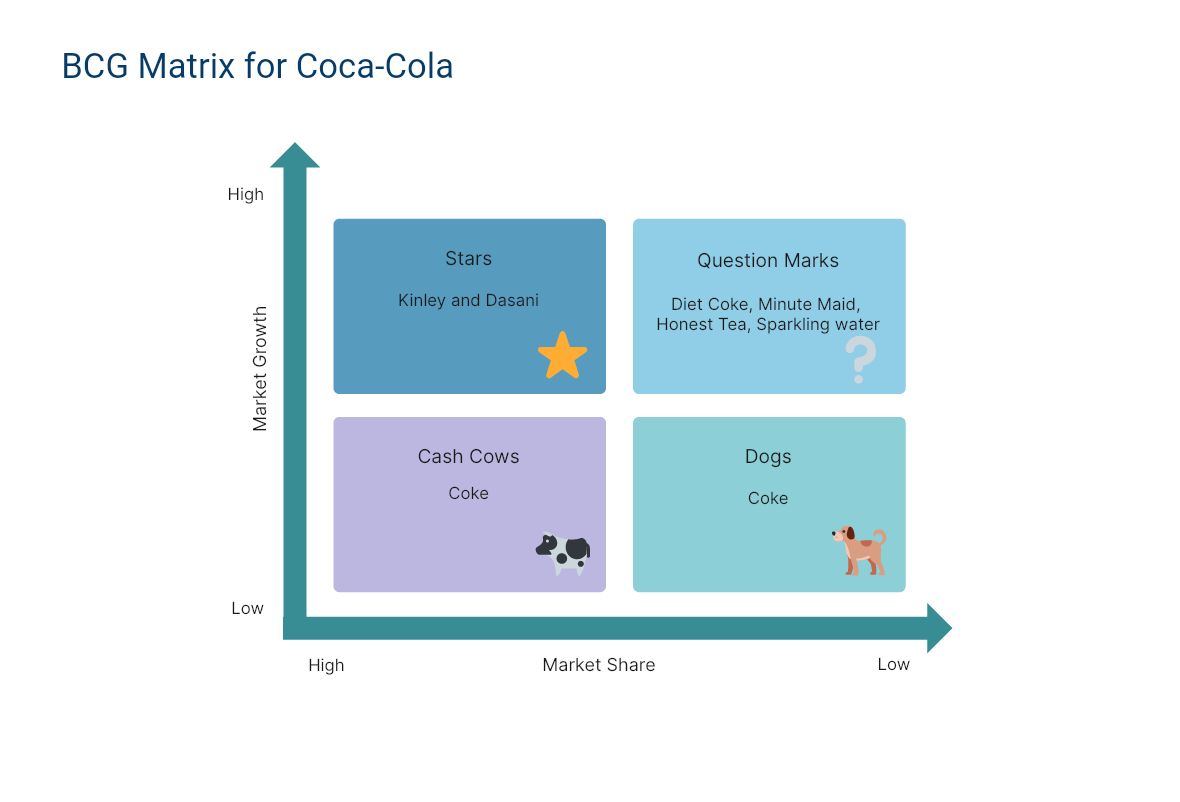

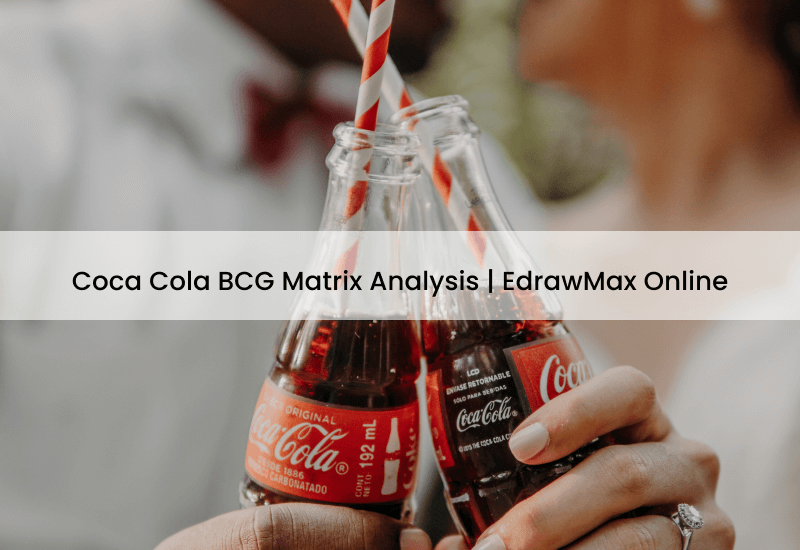

1. BCG Matrix of Coca-Cola

A world-driving ready-to-drink refreshment company, Coca-Cola Company has more than 500 soda pop brands, from Fuse Tea to Oasis to Lilt to Powerade. Yet, none of them is anyplace near the coke brand in terms of mindfulness, income, and benefit.

Stage 1. Choose the Product/Firm/Brand

We pick the firm Coca-Cola for investigation. Also, you need to identify the market, as the picked market is beverages, diet cokes, and mineral water.

Stage 2. Calculate Relative Market Share & Find out the Market Growth Rate

By and tremendous Growth rate in Coke is that it is no: in more than 200 countries.

Stage 3. Draw the Circles on a Matrix

2. BCG Matrix of Samsung

Stage 1. choose the product/firm/brand.

We pick the firm Samsung for investigation.

The picked market is the consumer electronics industry which incorporates smartphones, computers, tablets, etc.

Stage 3. Calculate Relative Market Share

By and tremendous Growth rate in Samsung home appliances by making 60% of the sales.

Stage 4. Draw the circles on a matrix

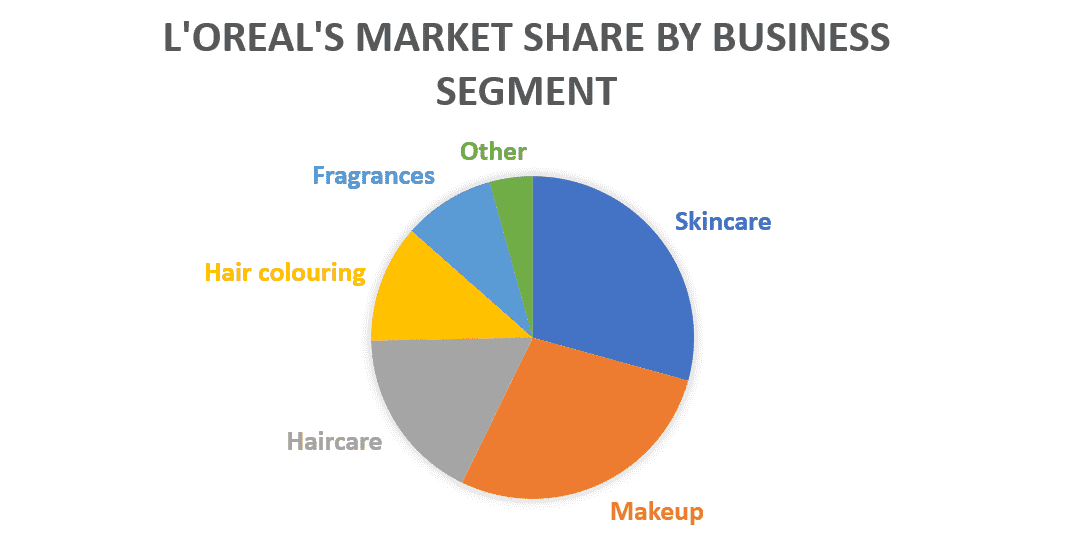

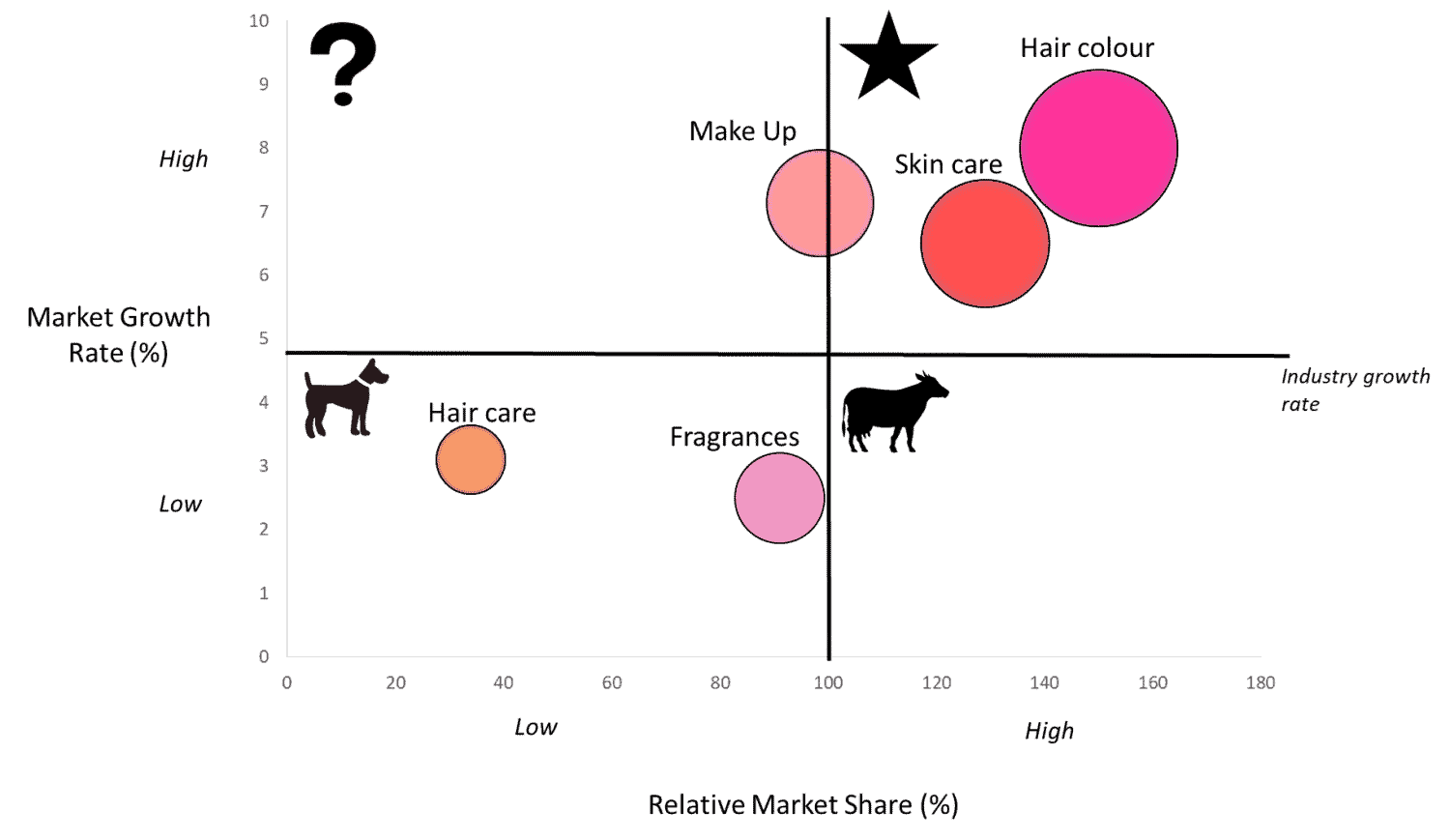

3. BCG Matrix of L'Oréal

We pick the firm L'Oréal for investigation.

Stage 2. Identify Market

The picked market is the Cosmetics Industry, which essentially incorporates Skincare, Makeup, Haircare, Hair shading, and Fragrances.

Stage 4. Find out the Market Growth rate

By and tremendous Growth rate in Cosmetics Industry (starting at 2018) = 4.8%

Stage 5. Draw the circles on a matrix

Note: Just follow the above pattern with every example and BCG matrix you will be making for your class.

4. BCG Matrix of PepsiCo

5. BCG Matrix of Apple

6. BCG Matrix of Nestle

7. BCG Matrix of Unilever

8. BCG Matrix of McDonalds

9. BCG Matrix of KFC

10. BCG Matrix of Amazon

What is BCG Matrix?

The Boston Consulting Group's item portfolio matrix ( BCG matrix ), otherwise called the Growth/Share Matrix, is a vital arranging device that enables a business to consider development openings by inspecting its arrangement of items to choose where to contribute to suspend or create things. It's otherwise called the Growth/Share Matrix. The Matrix is separated into four quadrants dependent on an investigation of market development and the relative peace of the overall industry.

It depends on the mix of market development and the overall industry comparative with the following best contender.

High Growth, High Market Share

Star units are pioneers in the classification. Items situated in this quadrant are appealing as they are located in a hearty class, and these items are exceptionally serious in the classification.

2. Question Marks

High Growth, Low Market Share

Like the name proposes, the future capability of these items is dubious. Since the development rate is high here, with the correct systems and ventures, they can become Cash cows and, at last, Stars if they have a flat piece of the overall industry so that off-base ventures can downsize them to Dogs significantly after loads of speculation.

3. Cash Cows

Low Growth, High Market Share

In the long run, if you are working for quite a while working in the business, advertising development may decay, and incomes deteriorate. At this stage, your Stars are probably going to change into Cash Cows. Since they despise everything that has a substantial relative piece of the overall industry in a deteriorating (developed) market, benefits and cash streams are relied upon to be high. As a result of the lower development rate, ventures required ought to likewise below. Along these lines, cash cows ordinarily produce cash in an overabundance of the measure of money expected to keep up the business. This 'overabundance cash' should be 'drained' from the Cash Cow for interests in different specialty units (Stars and Question Marks). Cash Cows eventually carry parity and security to a portfolio.

Low Growth, Low Market Share

Dogs hold a flat piece of the overall industry contrasted with contenders. Neither do they create cash, nor do they require huge cash. As a rule, the resources are not worth putting into because they create low or negative cash returns and may need enormous entireties of money to help. Because of the flat piece of the pie, these items face cost inconveniences.

How to Make a BCG Matrix Diagram?

So far, we realize products are ordered in four sorts. Presently we will see on what premise and how that order is done. We will comprehend the five procedures of improving a BCG matrix by making one for L'Oréal in the areas to follow.

Stage 1. Choose the Product

BCG matrix can be utilized to operate Business Units, separate brands, products, or firms as a unit itself. The decision of the group impacts the entire investigation. Along these lines, characterizing the unit is essential.

Stage 2. Define the Market

A mistakenly characterized market can prompt a weak characterization of products. For instance, if we investigate Daimler's Mercedes-Benz vehicle brand in the traveler vehicle market, it would wind up as a dog (it holds under 20% relative market share). However, it would be a cash cow in the extravagant vehicle market. Characterizing the market is a significant pre-imperative for a better understanding of the portfolio position.

Stage 3. Calculate the Relative Market Share

Market share is the level of the entire market taken into account by your company, estimated either in income terms or unit volume terms.

We utilize Relative Market Share in a BCG matrix, contrasting our product deals and the main adversary's sales for a similar product.

Relative Market Share = Product's business this year/Leading opponent's business this year

For instance, if your rival's market share in the vehicle business was 25% and your association's image market share was 10% around the same time, your relative market share would be just 0.4. The relative market share is given on the x-axis.

Stage 4. Find out the Market Development Rate

The business development rate can be effortlessly found through free online sources. It can likewise be determined by deciding the healthy income development of the leading firms. The market development rate is estimated in rate terms.

Market development rate was typically given side-effects (business this year – Product's business a year ago)/Product's business a year ago.

Markets with high development are ones where the total market share accessible is growing, so there are a lot of chances for all organizations to bring in cash.

Stage 5. Draw the Circles on a Matrix

Having determined the above measures, you have to plot the brands on the Matrix simply on EdrawMind desktop version. It has the premade templates for BCG. All you have to do is put up the data just like we did with every example.

The x-axis shows the relative market share, and the they-pivot shows the business development rate. You can plan a hover for every unit/brand/product, the size of which ought to relate to the extent of income created by it in a perfect world.

Taken these variables together, you can attract the perfect way to follow the BCG Matrix, from start-up to market pioneer. Question Marks and Stars should be financed with ventures produced with Cash Cows. What's more, Dogs should be stripped or exchanged to let loose cash with minimal potential and use it somewhere else. At long last, you will require a reasonable arrangement of Question Marks, Stars, and Cash Cows to guarantee positive cash streams later on.

[2023] Story Summary Examples

7 Types of Organizational Charts (With Examples)

Sunburst Chart: Explained with Examples & Templates

Story Outline Examples

To-Do List Mind Map Template

Subscribe for Free Business and Finance Resources

What is the bcg matrix explaining its components and quadrants.

If you're interested in breaking into finance, check out our Private Equity Course and Investment Banking Course , which help thousands of candidates land top jobs every year.

Understanding BCG Matrix

Strategic analysis is crucial in the world of finance, helping professionals make informed decisions to drive growth and maximize returns.

One such tool that has stood the test of time is the BCG Matrix . Developed by the Boston Consulting Group , this matrix offers a systematic approach to analyzing a company's portfolio of products or business units.

In this article, we will delve into the intricacies of the BCG Matrix, explore its components and quadrants, and discuss how it can be applied to make strategic decisions in the finance industry.

What is the BCG Matrix?

The BCG Matrix, also known as the Growth-Share Matrix, is a visual representation of a company's portfolio of products or business units . It was developed by the Boston Consulting Group in the 1970s and is widely used across industries to assess the strategic position of different offerings.

By plotting products or units on a matrix based on their market growth rate and relative market share, the BCG Matrix provides valuable insights into the potential and profitability of each element in the portfolio .

Components of the BCG Matrix

Market Growth Rate

The market growth rate refers to the rate at which a particular market is growing . It is an important factor to consider when analyzing a company's portfolio because high-growth markets tend to offer greater opportunities for expansion and profitability. By assessing the market growth rate, finance professionals can identify industries or sectors with significant growth potential and allocate resources accordingly.

Relative Market Share

Relative market share is a measure of a company's market share compared to its competitors in a specific market . It provides insights into a company's competitive position and its ability to capture a significant portion of the market. A high relative market share indicates a strong market presence, which can lead to economies of scale, pricing power, and competitive advantages.

Quadrants of the BCG Matrix

The BCG Matrix divides the portfolio into four quadrants, each representing a different strategic outlook. Let's explore each quadrant:

Stars represent products or business units with a high market growth rate and a high relative market share . These are the growth drivers of a company's portfolio. Stars require substantial investment to sustain their growth trajectory and capture the market's potential. While they generate revenue, they also consume resources to fuel their expansion. Companies should develop strategies to support and maximize the potential of stars, as they can become future cash cows.

For example Tesla's electric vehicles (EVs) in the early 2010s. With a high market growth rate and a dominant market share in the electric vehicle industry, Tesla was considered a star. The company invested heavily in expanding its manufacturing capacity and charging infrastructure to capitalize on the growing demand for EVs.

Cash cows are products or business units with a low market growth rate but a high relative market share . These offerings have reached maturity and generate significant cash flow for the company. Cash cows typically have established customer bases and enjoy economies of scale, resulting in healthy profit margins. Finance professionals should focus on sustaining and extracting value from cash cows to fund other areas of the business .

Example Microsoft's Office Suite. Although the market growth rate for office productivity software is relatively low, Microsoft's Office Suite dominates the market with a high relative market share. This product line generates substantial revenue and profit, which supports the company's investments in other emerging areas, such as cloud computing.

Question Marks (Problem Children)

Question marks, also known as problem children or wildcards, are products or business units with a high market growth rate but a low relative market share . They require careful analysis and strategic decision-making due to the uncertainty surrounding their potential. Question marks may either become stars or fail to gain market traction. Companies need to assess the viability and potential of question marks and allocate resources accordingly.

Example: Uber's food delivery service, Uber Eats, during its early years. With the rapid growth of the food delivery market, Uber Eats had a high market growth rate. However, it faced intense competition from established players like DoorDash. Uber had to strategically invest in marketing and partnerships to gain market share and compete effectively.

Dogs represent products or business units with both a low market growth rate and a low relative market share . These offerings have limited potential and may not generate substantial returns. Companies should evaluate dogs to determine if they can be revitalized or if divestment is a more appropriate course of action.

Example: BlackBerry's smartphones in the mid-2010s. With declining market share and a lack of innovation compared to competitors like Apple and Samsung, BlackBerry's smartphones became dogs in the market. The company eventually shifted its focus to software and services.

Analyzing and Applying the BCG Matrix

To conduct a BCG Matrix analysis, finance professionals should follow these steps:

Gather relevant data and information, such as market growth rates and market shares .

Plot the products or business units on the matrix based on their market growth rate and relative market share.

Interpreting the results and making strategic decisions involves:

Identifying resource allocation priorities based on the quadrant placement.

Developing growth strategies for stars and question marks.

Considering divestment or restructuring options for dogs.

Maximizing the potential and profitability of cash cows.

By applying the BCG Matrix, finance professionals can make informed decisions that optimize resource allocation, drive growth, and enhance overall portfolio performance.

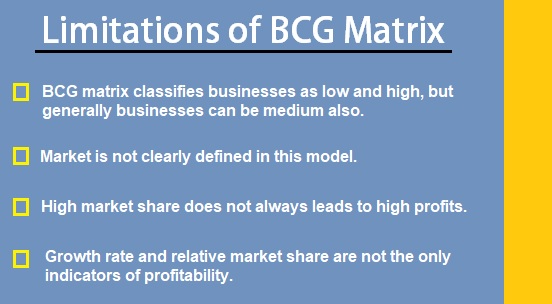

Limitations and Considerations

While the BCG Matrix is a valuable tool, it has some limitations:

The matrix focuses solely on two dimensions (market growth rate and relative market share), neglecting other factors such as competitive dynamics, industry trends, and external factors.

The matrix assumes that a high market share leads to profitability, which may not always hold true.

Industries with different characteristics may require modifications to the matrix for accurate analysis.

Finance professionals should complement the BCG Matrix with other analytical tools and consider the specific context of their industry and market to gain a comprehensive understanding of their portfolio.

Case Study: Application of the BCG Matrix

Let's consider a hypothetical case study to illustrate the application of the BCG Matrix.

Company X operates in the technology industry and has a diverse portfolio of products. After conducting a BCG Matrix analysis, the company identifies the following:

Product A: High market growth rate, high relative market share (star)

Product B : Low market growth rate, high relative market share (cash cow)

Product C: High market growth rate, low relative market share (question mark)

Product D: Low market growth rate, low relative market share (dog)

Based on this analysis, Company X develops strategies to further invest in Product A to maintain its growth trajectory, sustain Product B to continue generating cash flow, evaluate potential opportunities for Product C, and consider divestment or restructuring options for Product D.

The BCG Matrix is a powerful tool for strategic analysis in finance. By analyzing a company's portfolio based on market growth rate and relative market share, finance professionals can make data-driven decisions to allocate resources effectively, identify growth opportunities, and maximize profitability.

The BCG Matrix provides a structured framework for evaluating products or business units and helps finance professionals navigate the complexities of portfolio management.

- Business 101

Recent Posts

Maslow's Hierarchy of Needs: A Tool for Effective Business Management

Figurative Language: A Useful Tool for Business Professionals

What is Strategic Planning and Why is it Important in Business?

Strategic Analysis Hub

Bcg matrix of l’oreal .

L’Oreal BCG Matrix (Boston Consulting Group) is a strategic analysis tool that allows you to analyze the business units and product portfolio of the company. The key insight gained from the BCG matrix analysis offers you further investment opportunities. Today, we’ll discuss the BCG matrix of L’Oreal as a BCG matrix analysis example; it analyzes the market share and growth potential of every business unit and market share in the form of four main quadrants; stars, cash cows, question marks, and dogs.

Eugene Schueller established the personal care and cosmetic company L’Oreal in 1909. L’Oreal is the world’s leading and largest cosmetic brand. Some of the main products and services of cosmetic and personal care product manufacturing company L’Oreal in different categories are as follows;

Some of the main subsidiary brands of L’Oreal are as follows;

- NYX Cosmetics

- Matrix Essentials

Some of the leading products of L’Oreal in the British market are as follows;

- Hair Conditioner

- Face Cream & Lotion

- Face powder and tinted moisturizer

- Cleansing cream

- Hairstyle product

Bruce Henderson founded the BCG Matrix or the growth-share matrix in 1968, and it allows you to analyze the different market share and growth rates of the portfolio product. The matrix comprises two dimensions; market share and growth rate. It has four quadrants like the following

- Stars are when a high market share and high growth rate

- Cash cows have when high market share and a low growth rate

- The question mark is low market share and high growth rate

- The dog is when low market share and low growth rate

Let’s discuss the BCG matrix of L’Oreal as a BCG matrix analysis example;

BCG Matrix of L’Oreal

The four main quadrants of the BCG matrix of L’Oreal are as follows;

Stars of L’Oreal

I-consumer products.

The consumer products of L’Oreal have earned a position in the star quadrants of the matrix because they have a high market share and high growth rate. Some of the star consumer products and brands are as follows;

- L’Oreal Shampoo

- L’Oreal Paris

These brands have established a strong position in the global market and a large database of customer markets. The analysis of high market share and high growth rate outlines that the consumer products of L’Oreal have a high growth potential and high revenue. As a result, the high growth rate and revenue would attract the attention of the market and a lot of competitors.

II-Defensive Approach

In order to retain market share, revenue, and profitability, L’Oreal has to invest a significant amount of capital resources to defend the cosmetic company’s market position. The investment as a defensive strategy helped the company in the following ways;

- Retaining current customers

- Attracting new customers

- New geographical market penetration

- Product line expansion

It would impact the product lifecycle and the market growth rate; it would slow down the product movement from a high growth rate of star to the slow growth rate of a cash cow position.

III-Product Innovation

L’Oreal invests a significant amount of resources in research and development. It has allowed the company to launch innovative products and offer unique customer experience. That’s how the cosmetic brand has fought off the competition and retained its position in the market.

Cash Cows of L’Oreal

I-professional products & brands.

Professional products and brands have earned a position in the cash cows quadrants of the matrix. It outlines that they have a high market share and slow growth rate in the mature and saturated market. Some of the main professional products and brands in the cash cows quadrants are as follows;

Usually, cash cows are the most stable area of any business or company, and the objective of the company is to retain its market share. These brands offer high-quality products and they have established a large market share. When the market is growing, the acquisition rate is slow and the customer retention rate is higher.

II-Cash Surplus

Slow growth and high market share mean that the cash cow professional products are generating a significant amount of cash surplus for the company. L’Oreal reinvests the cash earned from the professional unit to the other consumer product units of the company because they usually require a large investment. However, it shows that the earned revenue from the professional department is much more than its investment.

Question Marks of L’Oreal

I-luxury products & brands.

The luxury products and brands of L’Oreal earned the position in the question marks quadrants of the BCG matrix. It shows that those products and sub-brands have a low market share and high growth rate. Some of the luxury products and brands of L’Oreal in the question mark segment are as follows;

- IT Cosmetics

- KES SAINT Laurent

The analysis of luxury products and brands in the question market shows that they have a high growth potential to become the star. Newly acquired brands and small brand projects usually fall under this category, but they face fierce competition in the

II-Capital Investment

In order to attract the attention of customers, L’Oreal should invest a significant amount of capital resources in the growing products and sub-brands. The invested resources carry a lot of resources, they may either pay off or would result in the form of wastage of investment.

However, new customer acquisition is a great strategy of the company that helps a company to transform question marks products into cash cows and stars.

Dogs of L’Oreal

I-active products.

The active products and sub-brands of L’Oreal earned a position in the dog quadrants of the matrix. The dog quadrants mean that they have a low market share and slow growth rate. Some of the active products and sub-brands of L’Oreal fall in the dog quadrants as follows;

- SKIN CEUTICALS

- LA ROCHE-POSAY

The dog quadrant analysis shows that they are smaller brands and they haven’t attracted the attention of the customer market and face the challenge of tough competition.

II-Divestment

The cosmetic brand should carefully analyze these segments, if they don’t show any sign of improvement, then the company should consider divestment and sell them off. Divestment is a great strategic approach for the dog quadrant products. Instead of wasting resources on non-growing products and brands, L’Oreal should focus on growing products.

Conclusion: L’Oreal BCG Matrix

After an in-depth study of the BCG matrix of L’Oreal; we have the realized that BCG (Boston Consulting Group) matrix is a highly useful tool for analyzing market share and growth rate. If you are learning about L’Oreal BCG matrix analysis as a BCG matrix analysis example of a cosmetic brand, then you should keep in mind the abovementioned elements involved in the quadrants of cash cows, stars, question marks, and dogs.

Ahsan is an accomplished researcher and has a deep insight in worldly life affairs. He goes Live 3 days a week on various social media platforms. Other than research writing, he’s a very interesting person.

Related Posts

Ansoff Matrix of Adidas

Ansoff Matrix of Mercedes-Benz

BCG Matrix of Banking Industry

B2U – Business-to-you.com

THE place that brings real life business, management and strategy to you

BCG Matrix: Portfolio Analysis in Corporate Strategy

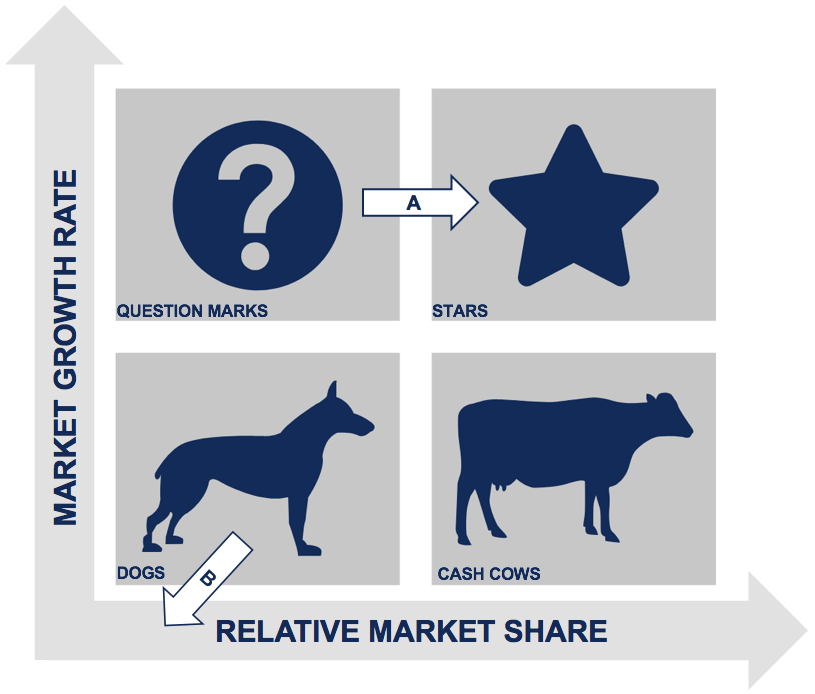

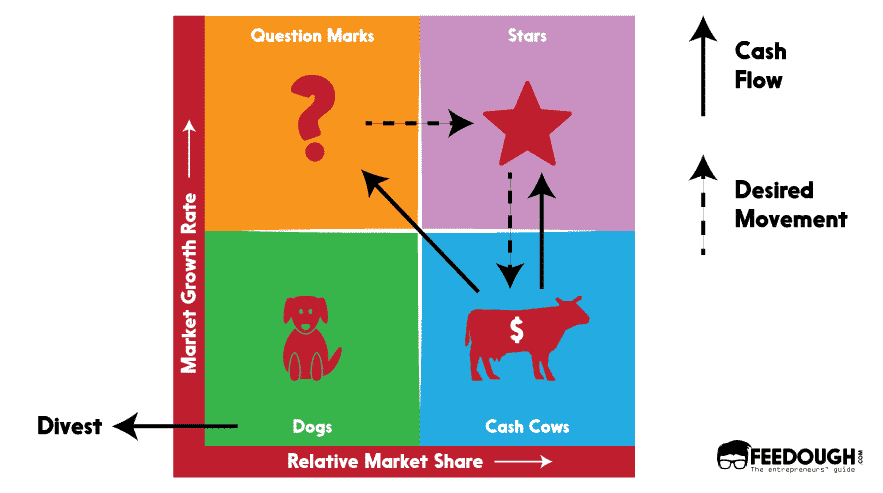

BCG Matrix (also known as the Boston Consulting Group analysis, the Growth-Share matrix, the Boston Box or Product Portfolio matrix) is a tool used in corporate strategy to analyse business units or product lines based on two variables: relative market share and the market growth rate. By combining these two variables into a matrix, a corporation can plot their business units accordingly and determine where to allocate extra (financial) resources, where to cash out and where to divest. The main purpose of the BCG Matrix is therefore to make investment decisions on a corporate level. Depending on how well the unit and the industry is doing, four different category labels can be attributed to each unit: Dogs, Question Marks, Cash Cows and Stars. This article will cover each of these categories and how to properly use the BCG Matrix yourself.

Figure 1: BCG Matrix

BCG Matrix Example: Samsung’s Product Portfolio

Samsung is a conglomerate consisting of multiple strategic business units (SBUs) with a diverse set of products. Samsung sells phones, cameras, TVs, microwaves, refrigerators, laundry machines, and even chemicals and insurances. This is a smart corporate strategy to have because it spreads risk among a large variety of business units. In case something might happen to the camera industry for instance, Samsung is still likely to have positive cash flows from other business units in other product categories. This helps Samsung to cope with the financial setback elsewhere. However even in a well balanced product portfolio, corporate strategists will have to make decisions on allocating money to and distributing money across all of those business units. Where do you put most of the money and where should you perhaps divest? The BCG Matrix uses Relative Market Share and the Market Growth Rate to determine that.

BCG Matrix Video Tutorial

Relative Market Share

The creator of the BCG Matrix used this variable to actually measure a company’s competitiveness . The exact measure for Relative Market Share is the focal company’s share relative to its largest competitor. So if Samsung has a 20 percent market share in the mobile phone industry and Apple (its largest competitor) has 60 percent so to speak, the ratio would be 1:3 (0.33) implying that Samsung has a relatively weak position. If Apple only had a share of 10 percent, the ratio would be 2:1 (2.0), implying that Samsung is in a relatively strong position, which might be reflected in above average profits and cash flows. The cut-off point here is 1.0, meaning that the focal company should at least have a similar market share as its largest competitor in order to have a high relative market share. The assumption in this framework is that an increase in relative market share will result in an increase in the generation of cash , since the focal company benefits from economies of scales and thus gains a cost advantage relative to its competitors.

Market Growth Rate

The second variable is the Market Growth Rate , which is used to measure the market attractiveness . Rapidly growing markets are what organizations usually strive for, since they are promising for interesting returns on investments in the long term. The drawback however is that companies in growing markets are likely to be in need for investments in order to make growth possible. The investments are for example needed to fund marketing campaigns or to increase capacity. High or low growth rates can vary from industry to industry, but the cut-off point in general is usually chosen around 10 percent per annum. This means that if Samsung would be operating in an industry where the market is growing 12 percent a year on average, the market growth rate would be considered high.

Question Marks

Ventures or start-ups usually start off as Question Marks . Question Marks (or Problem Children) are businesses operating with a low market share in a high growth market. They have the potential to gain market share and become Stars (market leaders) eventually. If managed well, Question Marks will grow rapidly and thus consume a large amount of cash investments. If Question Marks do not succeed in becoming a market leader, they might degenerate into Dogs when market growth declines after years of cash consumption. Question marks must therefore be analyzed carefully in order to determine whether they are worth the investment required to grow market share.

Stars are business units with a high market share (potentially market leaders) in a fast-growing industry. Stars generate large amounts of cash due to their high relative market share but also require large investments to fight competitors and maintain their growth rate. Successfully diversified companies should always have some Stars in their portfolio in order to ensure future cash flows in the long term. Apart from the assurance that Stars give for the future, they are also very good to have for your corporate’s image.

Eventually after years of operating in the industry, market growth might decline and revenues stagnate. At this stage, your Stars are likely to transform into Cash Cows . Because they still have a large relative market share in a stagnating (mature) market, profits and cash flows are expected to be high. Because of the lower growth rate, investments needed should also be low. Cash cows therefore typically generate cash in excess of the amount of cash needed to maintain the business. This ‘excess cash’ is supposed to be ‘milked’ from the Cash Cow for investments in other business units (Stars and Question Marks). Cash Cows ultimately bring balance and stability to a portfolio.

Business units in a slow-growth or declining market with a small relative market share are considered Dogs. These units typically break even (they neither create nor consume a large amount of cash) and generate barely enough cash to maintain the business’s market share. These businesses are therefore not so interesting for investors. Since there is still money involved in these business units that could be used in units with more potential, Dogs are likely to be divested or liquidated.

Figure 2: Cash Flows and Desired Movement in BCG Matrix

BCG Matrix and the Product Life Cycle

The BCG matrix has a strong connection with the Product Life Cycle . The Question Marks represent products or SBU’s that are in the introduction phase. This is when new products are being launched in the market. Stars are SBU’s or products in their growth phase. This is when sales are increasing at their fastest rate. Cash Cows are in the maturity phase: when sales are near their highest, but the rate of growth is slowing down due to saturation in the market. And Dogs are in the decline phase: the final stage of the cycle, when sales begin to fall.

Figure 3: BCG Matrix and Product Life Cycle

BCG Matrix In Sum

Taken all of these factors together, you can draw the ideal path to follow in the BCG Matrix, from start-up to market leader. Question Marks and Stars are supposed to be funded with investments generated by Cash Cows. And Dogs need to be divested or liquidated to free up cash with little potential and use it elsewhere. In the end, you will need a balanced portfolio of Question Marks, Stars and Cash Cows to assure positive cash flows in the future. If you want to know more about HOW to spend these investments in order to grow a business unit, you might want to read more about the Ansoff Matrix . Besides the BCG Matrix, there are other portfolio management frameworks you might want to have a look at such as the GE McKinsey Nine Box Matrix .

Further Reading:

- Henderson, B. (1970). Growth-Share Matrix. BCG Perspectives.

- https://www.bcgperspectives.com/content/articles/corporate_strategy_portfolio_management_strategic_planning_growth_share_matrix_bcg_classics_revisited/

- https://www.bcg.com/publications/1970/strategy-the-product-portfolio.aspx

Share this:

- Click to share on Facebook (Opens in new window)

- Click to share on LinkedIn (Opens in new window)

- Click to share on WhatsApp (Opens in new window)

- Click to share on Reddit (Opens in new window)

- Click to share on Pinterest (Opens in new window)

- Click to share on Telegram (Opens in new window)

- Click to share on X (Opens in new window)

- ← Marketing Funnel: Visualizing the Customer Journey

- Value Chain Analysis: An Internal Assessment of Competitive Advantage →

10 thoughts on “ BCG Matrix: Portfolio Analysis in Corporate Strategy ”

Simple, easy to follow and moreover Clear and Perfect presentation Sir.

impressing thank you so much……well articulated easily understandable tutorial/lecture.

Thank you, all the videos have helped me with my studies and progress in my MBA

Great videos, really helps

Great video it was really easy to follow!!

From ILOVEADIAN

This is a great video. Explained BCG matrix succinctly

Fantastic breakdown of the BCG matrix. greatly simplified!

What a powerful presantation of the BCG Matrix. You are simply the best.

Great website. It helps to add further clarity and more context to my textbook.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Boston Consulting Group (BCG) Matrix

A business planning tool used to evaluate the strategic position of a firm's’ brand portfolio

What is the Boston Consulting Group (BCG) Matrix?

The Boston Consulting Group Matrix (BCG Matrix), also referred to as the product portfolio matrix, is a business planning tool used to evaluate the strategic position of a firm’s brand portfolio . The BCG Matrix is one of the most popular portfolio analysis methods. It classifies a firm’s product and/or services into a two-by-two matrix. Each quadrant is classified as low or high performance, depending on the relative market share and market growth rate . Learn more about strategy in CFI’s Business Strategy Course .

Understanding the Boston Consulting Group (BCG) Matrix

The horizontal axis of the BCG Matrix represents the amount of market share of a product and its strength in the particular market. By using relative market share, it helps measure a company’s competitiveness .

The vertical axis of the BCG Matrix represents the growth rate of a product and its potential to grow in a particular market.

In addition, there are four quadrants in the BCG Matrix:

- Question marks : Products with high market growth but a low market share.

- Stars : Products with high market growth and a high market share.

- Dogs : Products with low market growth and a low market share.

- Cash cows : Products with low market growth but a high market share.

The assumption in the matrix is that an increase in relative market share will result in increased cash flow. A firm benefits from utilizing economies of scale and gains a cost advantage relative to competitors. The market growth rate varies from industry to industry but usually shows a cut-off point of 10% – growth rates higher than 10% are considered high, while growth rates lower than 10% are considered low.

Learn more about strategy in CFI’s Business Strategy Course .

The BCG Matrix: Question Marks

Products in the question marks quadrant are in a market that is growing quickly but where the product(s) have a low market share. Question marks are the most managerially intensive products and require extensive investment and resources to increase their market share. Investments in question marks are typically funded by cash flows from the cash cow quadrant.

In the best-case scenario, a firm would ideally want to turn question marks into stars (as indicated by A). If question marks do not succeed in becoming a market leader, they end up becoming dogs when market growth declines.

The BCG Matrix: Dogs

Products in the dogs quadrant are in a market that is growing slowly and where the product(s) have a low market share. Products in the dogs quadrant are typically able to sustain themselves and provide cash flows, but the products will never reach the stars quadrant. Firms typically phase out products in the dogs quadrant (as indicated by B) unless the products are complementary to existing products or are used for a competitive purpose.

The BCG Matrix: Stars

Products in the star quadrant are in a market that is growing quickly and one where the product(s) have a high market share. Products in the stars quadrant are market-leading products and require significant investment to retain their market position, boost growth, and maintain a competitive advantage .

Stars consume a significant amount of cash but also generate large cash flows. As the market matures and the products remain successful, stars will migrate to become cash cows. Stars are a company’s prized possession and are top-of-mind in a firm’s product portfolio.

The BCG Matrix: Cash Cows

Products in the cash cows quadrant are in a market that is growing slowly and where the product(s) have a high market share. Products in the cash cows quadrant are thought of as products that are leaders in the marketplace. The products already have a significant amount of investments in them and do not require significant further investments to maintain their position.

Cash flows generated by cash cows are high and are generally used to finance stars and question marks. Products in the cash cows quadrant are “milked” and firms invest as little cash as possible while reaping the profits generated from the products.

More Resources

Thank you for reading CFI’s guide to the BCG Matrix. To keep learning and advancing your career, the additional CFI resources below will be useful:

- Aggregate Supply and Demand

- Market Positioning

- Network Effect

- Substitute Products

- See all management & strategy resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Save 50% on Online Finance Courses

- The Investment Banker Micro-degree

- The Project Financier Micro-degree

- The Private Equity Associate Micro-degree

- The Research Analyst Micro-degree

- The Portfolio Manager Micro-degree

- The Restructurer Micro-degree

- Fundamental Series

- Asset Management

- Markets and Products

- Corporate Finance

- Mergers & Acquisitions

- Financial Statement Analysis

- Private Equity

- Financial Modeling

- Try for free

- Pricing Full access for individuals and teams

- View all plans

- Public Courses

- Investment Banking

- Investment Research

- Equity Research

- Professional Development for Finance

- Commercial Banking

- Data Analysis

- Team Training

- Felix Continued education, eLearning, and financial data analysis all in one subscription

- Learn more about felix

- Publications

- Online Courses

- Classroom Courses

- My Store Account

- Learning with Financial Edge

- Certification

- Masters in Investment Banking MSc

- Find out more

- Diversity and Inclusion

- The Investment banker

- The Private Equity

- The Portfolio manager

- The real estate analyst

- The credit analyst

- Felix: Learn online

- Masters Degree

- Public courses

By Oliver Sealey |

Reviewed By Rebecca Baldridge |

May 17, 2022

What is the BCG Matrix?

The Boston Consulting Group (BCG) designed its four-celled matrix, the BCG Matrix, to aid in long-term strategic planning. The matrix is used to assess the growth opportunities of different products/brands that an organization has in its portfolio based on relative market share and market growth rates across industries/sectors.

The matrix makes it possible to examine the business potential and market environment of different products and brands, which enables the company to decide where to invest, divest, or develop new products.

For credit analysts, the matrix can be a helpful framework for analyzing business risk , an essential part of deciding the credit-worthiness of a company.

In this article we’ll examine how the matrix categorizes products, giving examples. We’ll then see what actions companies can take having decided on the categories. Finally we’ll look at some of the limitations of the matrix.

Key Learning Points

- The BCG matrix is divided into four quadrants and is based on two parameters, relative market share and market growth rate

- The BCG Matrix includes four categories: stars, cash cows, question marks, and dogs

- To calculate the relative market share of a product, divide its market share by the market share of the product’s largest competitor

- This matrix can help businesses make good choices around their portfolio. For example, it can help companies decide which products should be their focus and which should be discontinued

- Care should be exercised around the use of the matrix. It can over-simplify concepts due to its two axis nature

- “High” and “low” market share and market growth determine which category a product ends up in, but deciding what “high” is can be difficult

- Defining the market can also be difficult. Deciding define the market broadly or more narrowly will make a big difference to the matrix and the categories it suggests for a company’s products.

BCG Matrix – Key Terminologies

The BCG matrix is divided into four quadrants and is based on two parameters – relative market share and the market growth rate. The horizontal axis of this matrix represents relative market share, while the vertical axis represents the market growth rate. The four cells of this matrix are designated stars, cash cows, question marks, and dogs. There are general actions associated with the 4 different types, but in the real world companies may of course decide to do something completely different if it suits their plans!

“High” and “Low”

The axes are categorized by “high” and “low”, which means there may be some difficult choices. When analyzing market growth, 10% is often used to decide a market is “high” growth. This can seem arbitrary. Imagine two markets, one with 10.1% growth, and another with 9.9% growth. Some judgement may be needed to decide what “high” and “low” mean in BCG market growth.

Market share is somewhat easier to analyze. The market share of all players in the market are compared. If the market share of the company being analyzed is greater than its next biggest rival, it’s deemed “high” (we’ll look at how that works in more detail later in this article).

Four Quadrants of the BCG Matrix

The four quadrants of the BCG Matrix are:

Exhibit high growth and command a high market share. A company should invest more in stars, as they are well-established products or brands in high-growth markets. Stars are leading brands in exciting markets. The Apple Watch in 2022 is a star. It’s selling around a third of smartwatches worldwide and has more than three times the market share of its nearest rival, Huawei. The market is predicted to grow by around 28% every year at this point, making it a very high-growth market. Despite being the market leader Apple will have to hold its position. This means it will have to spend a great deal on marketing, and making sure its product stays competitive. Because of this, as of 2022 the Apple watch probably isn’t the most cash-positive product in Apple’s portfolio. If Apple keep spending and making good choices, the watch market may mature and the Apple watch may become a cash cow. This would be the best outcome according to the BCG matrix.

Exhibit low market growth but command high market share. These are the ideal products to have, according to the BCG matrix. They are leading brands, in slower markets. It may seem counterintuitive that slower market growth would be seen as positive, but cash cows require little investment. The brand is dominant, and the fewer new buyers to the market will naturally gravitate to the brand. The market is less frenetic than before, and the company doesn’t have to spend as much cash winning the hearts and minds of all that growth!

The cash these products generate can be invested elsewhere. This is an important part of BCG, not immediately obvious from the diagram. The portfolio of a company should be a pipeline, with cash-positive products (primarily the cash cow) paying for the development of question marks and stars.

Coca-Cola has been a cash cow product for the Coca-Cola company for a long time. As of 2023, it holds around 46% of the soft drink market sales, far beyond its nearest rival. The market growth is modest, around 3.2% per year at this point. Coca-Cola has created excellent positive cashflows for the company, which they can use for other ventures such as their less mature food business. The part of Coca-Cola that doesn’t fit as well is the marketing spend. You’re probably aware of Coca-Cola adverts. A better BCG fit would have Coca-Cola not feeling the need to spend so much on marketing. Again, the real world means not everything fits nicely into a matrix.

Question Marks

Show high growth but command low market share. Question marks require significant investment to maintain or increase market share, but are excellent prospects for the company.

Question marks are usually recently introduced products with sound commercial prospects. With sufficient investment, they have the potential to become stars. If neglected, they may become dogs. Wise companies will know if they can’t build a question mark into a star. They’ll divest despite the exciting market.

It’s easy to think of examples of successful question marks, just think of any star or cash cow and rewind some years. It’s more interesting to think of a failed question mark. You could argue that Google Glass was a question mark that went wrong. Their wearable smart glasses were introduced around 2013. At that point, their market share of wearable tech was small, as not many wearable glasses were being sold compared to e.g. watches (this does rely on us putting glasses in with the broader “wearables” market, highlighting one issue of BCG: defining the market). But, the market was growing. It was arguably a case of “too early”, which is fairly common in tech. Google found the technology wasn’t quite good enough, and presumably was having to spend colossal amounts of money behind the scenes to develop, market and distribute the glasses. They ended up halting the production of the glasses in 2015.

Have both low growth and low market share. The bad performance may be due to high costs, inferior quality, or a lack of effective marketing.

Unless there is some hope of gaining market share, a company is wise to dispose of these products if they are a drain on cash. Dogs are often, but don’t have to be, cash negative.

Imagine you are the undisputed market leader in producing vinyl records in the 1990s. You probably have a great cash cow, but the years to come will reduce that to a dog. CDs and streaming will make your position obsolete and turn your product into a dog. It may be tempting to divest all dogs, but they may still be cash-generative. Vinyl now commands a premium price, so although they represent a slim minority of music sales it is still probably worth being in the market.

BCG Matrix – Advantages and Lim itations

The BCG matrix is very useful for manufacturing companies since an understanding of a product’s market position is imperative to understanding its growth potential. The BCG matrix can also be used to assess the market share of a product relative to competing products. The matrix offers a useful framework for allocating resources to particular products.

However, the matrix does have certain limitations. First, markets may be less clearly defined than the matrix suggests. Moreover, it doesn’t offer information about what the competition is doing. Second, the market growth rate and relative market share are not the only indicators of profitability. Third, this four-quadrant approach may be overly simplistic considering the dynamic nature of markets and industries/sectors. Finally, a high market share does not always result in strong profits given that high costs may also be involved in maintaining that market share.

BCG Matrix – How to use the BCG Matrix

Using five parameters – the definition of the market, relative market share, market growth rate, cash generation, and usage of cash – a company should allocate its products to the relevant quadrant. Based on this allocation, the company can determine which products to invest in and which to discontinue.

It might be noted that defining the market is the most important step. If a market is incorrectly defined, the product could be incorrectly classified. The relative market share is calculated by dividing the selected product’s market share (or revenue) by the market share or revenue of the largest competitor in the sector. Moreover, it’s also necessary to calculate the market growth rate. This can be estimated by assessing the average revenue growth of the leading companies within the product sector.

BCG Matrix – Advantages and Limitations

The BCG matrix is very useful for companies since an understanding of a product’s market position is useful for understanding its growth potential. The BCG matrix can also be used to assess the market share of a product relative to competing products. The matrix offers a useful framework for allocating resources to particular products and building a healthy pipeline in a product portfolio.

However, the matrix does have certain limitations. First, markets may be less clearly defined than the matrix suggests. We’ve seen in the examples that you could narrowly define the vinyl market, or put it as part of the wider music market.

Market growth rate and relative market share are not the only indicators of profitability. We saw that vinyl still has good cashflows for some companies, and question marks may not always be the best to build if it is a pointless drain on company resources with no future.

Finally, we need to be mindful that categorizing by “high” and “low” may lead to some products that are very similar being given different categories. Our earlier example of a 9.9 and 10.1% market growth is relevant here. Some judgment and discussion would be needed to get the most out of the matrix in this case.

Calculating Relative Market Share

The relative market share is used to compare a company’s brand market share with the market share of its largest competitor in the industry. When we calculate relative market share, the market leader’s market share is used as the benchmark.

Relative Market Share Formula:

Relative Market Share = % market share of the company’s product divided by the market share of the largest competing product.

Below we’ve calculated the hypothetical relative market shares of two products from one company using the market share of the largest competitor in that industry. If you’d like to practice this yourself, please see the download attached to this article. This attachment has more products to practice on beyond what’s in the graphic below.

Brand B appears to be dominant in its market, far beyond the share of its nearest rival, rival 1. It is a star or cash cow, depending on the market growth.

Brand A is lagging. It operates in a different market to brand B, and can’t compete on share with its rival 1. It will be a question mark or dog.

The BCG matrix can be a helpful tool for thinking about a company’s portfolio. It creates clear categories and can create great discussions about the balance of products, their cashflows, and their future. It can also suggest sensible actions to create that balance. However, it should be treated with care. It is arguably too simple, reducing the world to two axes. It’s also important to think carefully about what the market is before starting the analysis.

For credit analysts, BCG can create a clear set of categories and language when putting together presentations on a company’s business risk.

If you’re interested in learning more about the world of business, you may be interested in our Investment Banking course . This course gives you the same training as new hires in the top investment banks and covers a wide range of subjects.

Additional resources

Porters Five Forces

Credit Risk

Financial Modeling Course

Share this article

Bcg matrix workout example.

Sign up to access your free download and get new article notifications, exclusive offers and more.

Recommended Course

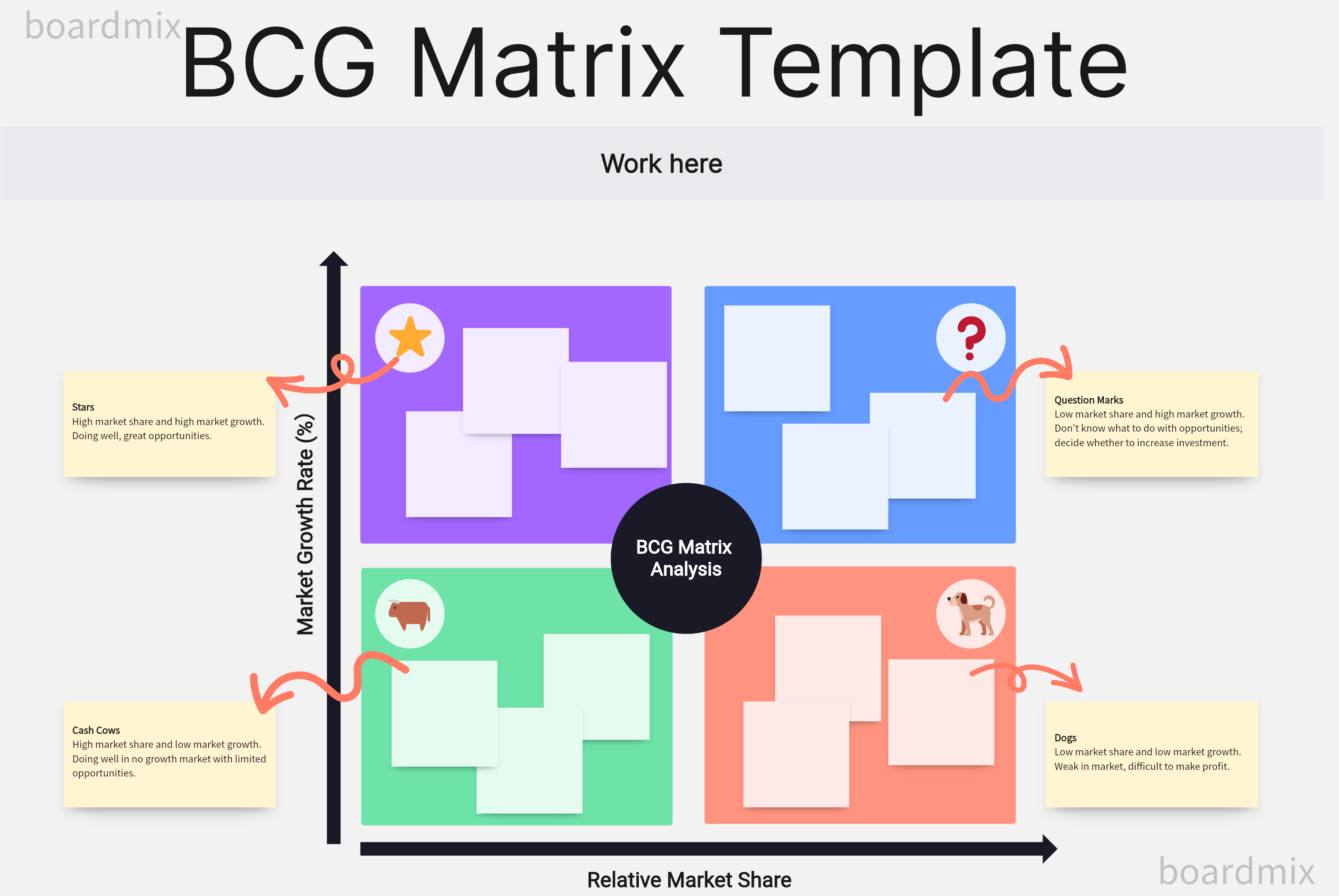

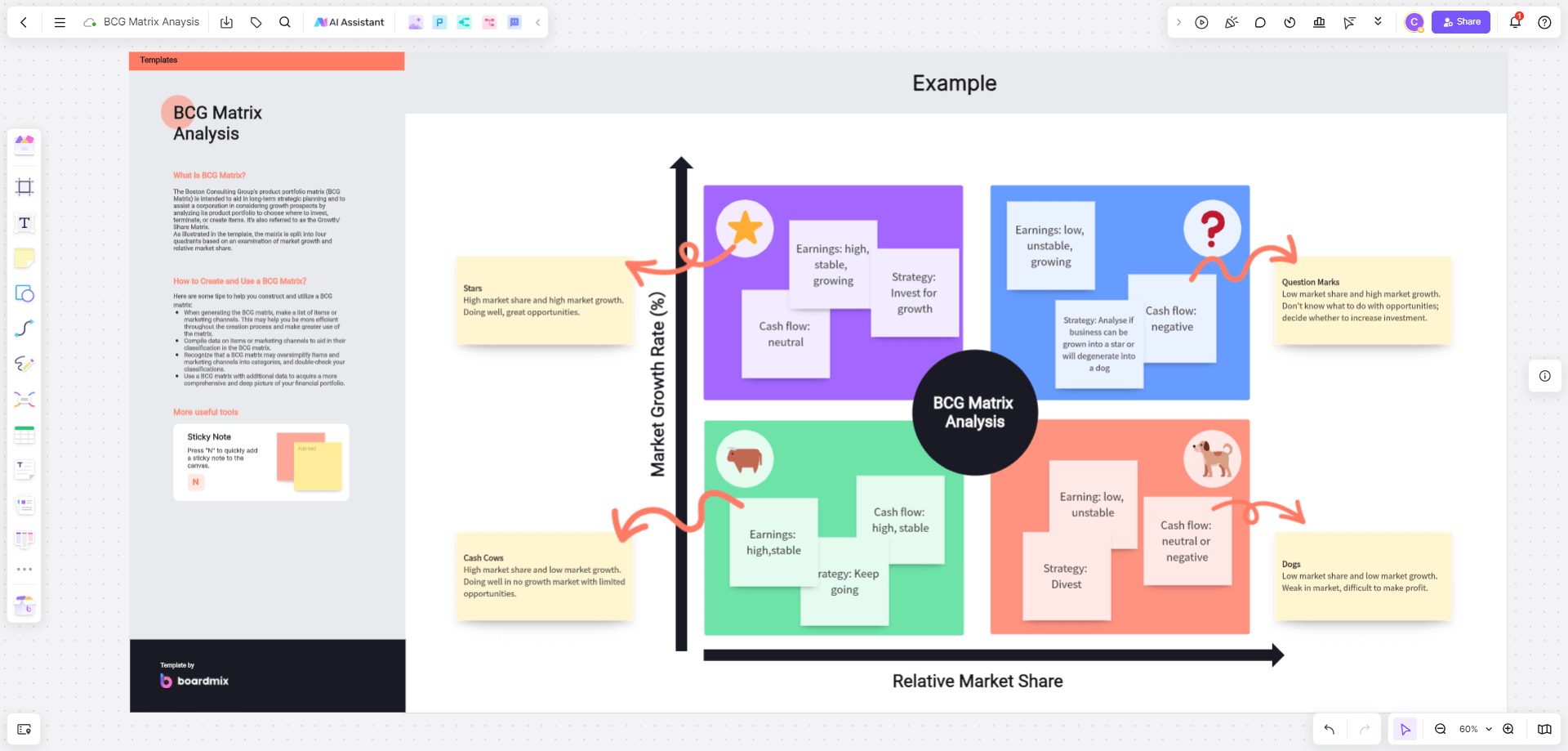

What is the Boston BCG Matrix Analysis: Definition and Case Templates

Harry Foster

Published on Jun 12, 2024, updated on Jun 13, 2024

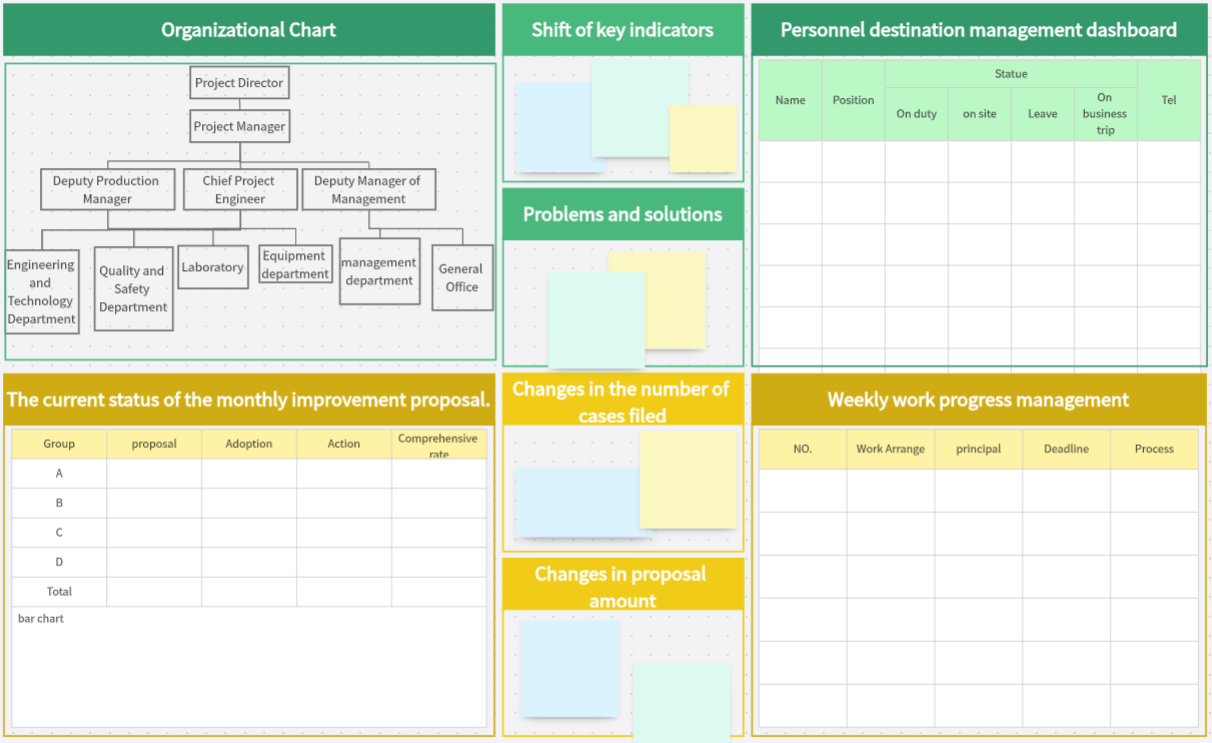

Using the right tools is crucial for improving efficiency and effectiveness. The Boston BCG Matrix is a classic strategic planning tool that many consultants rely on. This article introduces an essential tool for consultancy analysis—Boardmix. By examining a real case, we'll demonstrate how to use Boardmix to master the Boston BCG Matrix model!

What is the Boston BCG Matrix Analysis?

The Boston BCG Matrix Analysis, developed by the Boston Consulting Group, is a strategy for planning a company's product portfolio. Its core purpose is to achieve a balance in cash flow through an optimized business mix. The BCG Matrix primarily analyzes a company's situation from a business perspective, aiming to optimize resource allocation or develop strategic transformation and development plans. It's particularly useful for companies with complex business lines, growing user bases, and uncertain future directions.

To quickly use the Boston BCG Matrix, open the Boardmix online whiteboard in your browser, and select the "Boston BCG Matrix Analysis Template" from the community resources to apply it for free with just one click.

Basic Principles of the Boston BCG Matrix Analysis

The Boston BCG Matrix analyzes future product resource allocation based on market share and sales growth rate. On the BCG Matrix chart, the vertical axis represents the business growth rate, and the horizontal axis represents market share, dividing the chart into four quadrants: "Stars," "Question Marks," "Cash Cows," and "Dogs." These quadrants represent different product types and development prospects:

-Star Products: High sales growth rate and high market share

-Question Mark Products: High sales growth rate but low market share

-Cash Cow Products: Low sales growth rate but high market share

-Dog Products: Low sales growth rate and low market share

As shown in the diagram, the Boston BCG Matrix can categorize products into different types based on various dimensions and develop corresponding management strategies. Numerous such templates are available in the Boardmix community.

Specifically, companies can make different product analysis and planning decisions based on the quadrant a product falls into. They can eliminate "Dogs" with no growth potential, maintain a balanced mix of promising "Stars," "Question Marks," and "Cash Cows," and ensure a positive cycle of product and resource allocation. The specific marketing strategies are:

-Star Products: Maintain or increase funding, actively expand economic scale and market opportunities, aim for long-term benefits, and strengthen competitive position.

-Cash Cow Products: Consolidate current market share, consider further market segmentation, and potentially move the product to a second growth curve.

-Question Mark Products: Adopt a selective investment strategy.

-Dog Products: Reduce production, gradually exit the market, and focus resources on "Stars" and promising "Question Marks."

Analyzing Coca-Cola with the BCG Matrix

After developing a popular product, companies often expand their product line to enrich their brand's product portfolio. Let's analyze Coca-Cola using Boardmix and the Boston BCG Matrix.

Case Study: Coca-Cola Company Background

In the Chinese market, Coca-Cola has a multi-brand strategy covering sodas, diet sodas, teas, and juices. How does Coca-Cola maintain its consumer appeal while occupying different beverage market segments?

Based on the Boston BCG Matrix principles, Coca-Cola's product marketing strategy is as follows:

-Original Coca-Cola: A Cash Cow with high market share and low growth rate, consistently generating cash flow for the company.

-Diet Coke: A Star product, leading the sugar-free beverage market in China with a 61.5% share in 2021. Although it's a subcategory of sodas, it requires continuous market cultivation and expansion.

-Flavored Colas (Coffee, Cherry): Question Mark products needing market validation to determine which can become Stars and which will turn into Dogs.

-Dog Products: Flavors that were once available but are no longer on the market, discarded due to insufficient profitability.

Through Coca-Cola's BCG Matrix analysis, we see how the model effectively evaluates a company's product portfolio and investment strategy. By using the Boston BCG Matrix, business operators can understand the current product structure and predict future market changes, enabling them to develop correct marketing strategies.

With the efficient Boardmix tool, any product can be easily analyzed using the Boston BCG Matrix, leading to better market decisions. Boardmix's powerful compatibility supports online editing, real-time saving, multi-user collaboration, annotation, marking, sharing, and commenting, allowing deeper exploration of product content and more efficient management.

5 Essential Steps for Creating Effective Flowcharts

10 Essential AI Assistants You Need to Know: Tips and Features

Project Planning: How to Write a Project Plan in 6 Simple Steps

Coca Cola BCG Matrix Analysis

1. Introduction

The Boston Consulting Group (BCG) growth-share matrix is a business planning tool that helps a business prioritize its products by investment and ROI. For example, the BCG matrix of coca-cola plots its products in a four-quadrant matrix in which the y-axis shows the market growth rate and the x-axis depicts the market share. BCG matrix is also called the growth-share matrix.

2. Background of Coca Cola

Coca-Cola is a large-scale beverage company operating for more than a century. It all started on May 8, 1886, when Dr. John Pemberton sold the Coca-Cola drink at Jacobs' Pharmacy in downtown Atlanta. Coca Cola has grown from a small firm to a multinational company with a global presence from this humble beginning. The company has shown sustained growth based on its consistent quality and brands

3. Coca Cola BCG Matrix

The BCG Matrix of Coca-Cola shows different products in four quadrants named the Dogs, Stars, Cash Cows, and the Question Mark. In the BCG Matrix of Coca-Cola , we will analyze its slow growth products, high selling products, high growth products, and high predictive selling and low growth products.

A company's products with low growth and market share and no promising growth chances are called dogs. Management usually does not show any interest in these products and doesn't invest here because of low chances of profit or benefits.

In the BCG matrix of Coca-Cola, we can see that Coke is a potential dog product because of the declining demand for carbonated soft drinks in favor of increasing demand for healthier options or low-calorie drinks. If these factors keep increasing, Coke, a cash cow, can become a low market share product.

The products or business units with a high market share in a high-growth industry are the stars of the business. In the BCG matrix of Coca-Cola, the bottled water segment is categorized as star products. Coca-Cola offers two bottled water brands, namely Kinley and Dasani, operating in separate geographical locations. Kinley is offered in European markets, while Dasani is popular in the US. As the market for healthy drinks and bottled water is expanding, this segment of Coca-Cola is expected to gain a bigger market share and a better opportunity for further investment.

This is why Coca-Cola is investing in more brands like sparkling water and flavored water.

3.3. Cash Cows

Cash cows are products that have low growth markets but high market share. They have a high market share in the industry, and the forecasts suggest low chances of significant growth in the future. However, these products bring maximum revenue with very low investment to sustain profitability.

In the BCG matrix of Coca-Cola, we can see that Coke has been the market leader in the carbonated soft drink industry and a significant revenue generator for the company. It has a global presence and has been an established brand for years, making Coke a cash cow for the Coca-Cola company.

3.4. Question Marks

Question marks are the products that are still in the development stage, and the market's response to these products is still not very well established. These products initially achieved a small market share, but the investment decision is still risky. So, these products can either turn into stars or cash cows.

In the BCG matrix of Coca-Cola, we can see that they are launching many new brands and lines of products, including Diet Coke. Smartwater, Honest Tea, Sparkling Water, Minute Maid. These products are geared towards growing healthy non-carbonated drinks and healthy lifestyles. Coca-Cola is also investing in new products and raising awareness about these products. These products are question marks for the company.

4. Limitations of BCG Matrix

BCG is a very simple method to assess the position of different brands and products in the market to see where to invest more finances and where there are no chances of growth. However, this over simplicity is a cause of reservation because experts believe many other factors determine the market reaction to any product, e.g., geographical demographics, brand power, competition, etc. So, a decision based on only the BCG matrix is very risky.

It is also observed that the BCG matrix was originally developed for different manufacturing and production units owned by one business group. So, translating this model for different products is out of context. For example, when we use the BCG matrix of Coca-Cola for Coke, Kinley, and Dasani, this is not the proper usage of this model.

Another limitation of the BCG matrix is that it does not consider the gray areas or medium growth and medium market share areas in the real world.

5. Key Takeaways

BCG matrix is a business planning tool that helps companies assess the investment options and the growth potential of their products based on market share and growth predictions. In the Coca-Cola BCG matrix , we can see that Coke is a cash cow but is turning into a dog while the bottled water and healthy lifestyle products are the question marks.

A comprehensive drawing software such as EdrawMax is better for drawing BCG matrices because of the exclusive symbols, clipart, and great tools and layout options. The best thing about EdrawMax is the well-stocked template library that gives you a quick start with professionally designed samples for business planning and analysis diagrams. Find more business diagram templates .

6. References

Reading the BCG Growth-Share Matrix. (n.d.). Investopedia. Available at: https://www.investopedia.com/terms/b/bcg.asp (Accessed March 14, 2022).

Airline Industry Porter's Five Forces Analysis

Amazon Porter's Five Forces Analysis

Tesla Porter's Five Forces Analysis

Apple Porter's Five Forces Analysis

Netflix Porter's Five Forces Analysis

Starbucks Porter's Five Forces Analysis

BCG Matrix (2024): Meaning and Example [+ Template]

Home » BCG Matrix | 🕑

Gust de Backer

June 26, 2024, 12 reacties.

👉🏻 Workshop / Keynote / Consultancy

The BCG Matrix also known as the Boston Consulting Group Growth-Share Matrix is a strategic marketing model for assessing product lines for relative market growth and sales volume.

Do you have several products or services that you want to know what their performance is relative to each other and what’s left in terms of market?

Instead of guessing which products to focus on, you can map them out in an orderly fashion and decide which product lines are better stopped and which are worth investing in.

I’m going to show you:

- What the BCG Matrix is

- How to fill in the BCG Matrix

- What you ultimately do with the results of the BCG Matrix

Let’s get started

Table of Contents

What is the BCG Matrix?

The BCG Matrix is a strategic marketing model invented by the Boston Consulting Group .

Companies use the BCG Matrix (portfolio analysis) to compare different products or services against each other to determine whether companies should:

- Continue producing

- Stop producing

- Or invest in it

The BCG Matrix helps companies allocate resources in a way that maximizes the following:

- Market share and market growth

- Company growth

- Long-term profitability for each product line

By understanding where products fall in the BCG Matrix, companies can more effectively determine how to allocate resources.

Four quadrants of the BCG Matrix

The BCG Matrix has four quadrants into which products can fall:

In this, it is notable that you often see that products have a certain Product Lifecycle :

1. Question Marks – Construction

Low market share and high market growth.

The “Question Marks” are a product group in which there is a low market share, but where the market is actually showing high growth.

These products are not necessarily very profitable at this time, but have potential to gain market share with the right investments .

It is therefore possible to build a ‘Question Mark’ into a ‘Star’.

If you introduce a new smartwatch to the market, it will be difficult to gain ground, despite the fact that the market is growing rapidly.

This is because large companies already have strong differentiation combined with large market budgets.

2. Stars – Holding

High market share and high market growth.

The ‘Stars’ are a product group with a high market share and a fast growing market.

These products are profitable and it is worthwhile to continue investing in this product group so that they at least maintain their market share and perhaps even continue to grow.

The Apple Smartwatch is an example of a product where Apple has a high market share and the smartwatch market is experiencing strong growth.

3. Cash Cows – Harvesting

High market share and low market growth.

The ‘Cash Cows’ are a product group with a high market share and a market with hardly any growth.

These products are already profitable with little growth potential in the market. The desired strategy here is to invest as little as possible and still maintain the market position.

The revenue generated from a Cash Cow can be invested in Stars or Question Marks.

Rocket ice creams are an example of OLA, a market with relatively low growth where OLA has a large market share.

The money OLA earns from its rocket ice creams they can invest in, for example, alcoholic ice creams in which there is still a lot of market potential.

4. Dogs – Divestment

Low market share and low market growth.

The Dogs are a product group with a low market share and a market that will hardly grow.

These products are loss-making and have no potential to become profitable.

You want to stop investing in a ‘Dog’, because there is nothing more to be gained from it.

Suppose that a new pharmaceutical company starts developing a corona vaccine in 2023, they will find themselves in a market in which they have virtually no market share and there is no market growth to gain that share.

Points of criticism of the BCG Matrix

Besides being a good model for mapping the (potential) performance of your various product lines, the BCG Matrix also has some criticisms:

- Market share does not guarantee profitability.

- Market growth can be influenced by the company (by boosting).

- The matrix leaves out competition.

- Some products are very interdependent in practice.

- Declining / collapsing markets are not taken into account.

- Both axes are assigned the same prioritization, in practice this need not be so and depends on the business strategy.

The model is easy to use, but needs context to ultimately base decisions on it.

BCG Matrix example

Download the BCG Matrix here:

Good choice! Check your e-mail for the resources...

How do you complete the BCG Matrix?

Start by identifying your own products or services. Which products do you want to include in the portfolio analysis?

To determine your own market share and the market share of your biggest competitor you will need to know how big the total market is.

Based on the size of the total market, calculate your own market share.

Based on the total size of the market, calculate the market share of your competitor so that the relative market share can be calculated.

Determine how much the market is going to grow in the coming period.

To fill in the size of the circles you need to indicate how much sales you do per product category.

Taking Apple as an example…

| Name product group | Own market share | Market share largest competitor | Relative market share | Market growth | Revenu in € |

| Macbook | 30% | 20% | 1,5 | 5% | €23.000.000 |

| iPhone | 28% | 35% | 0,8 | 11% | €30.000.000 |

| Apple TV | 12% | 25% | 0,48 | 3% | €6.000.000 |

| Airpods | 25% | 18% | 1,39 | 20% | €18.000.000 |

If we enter that into the BCG Matrix we get the following visualization:

Getting started…

If all goes well, you are now armed with enough knowledge to formulate your portfolio strategy….

Now I want to know from you, what do you think is the most effective method of measuring product performance?

Let me know in a comment.

P.S. should you want additional help please let me know at [email protected]

Frequently Asked Questions

The BCG Matrix, also known as the Boston Consulting Group Growth-Share Matrix, is a model that helps organizations analyze their product portfolios and make resource allocation decisions. The matrix plots strategic business units (SBUs) on a graph to help organizations assess their competitive position in the marketplace and identify potential opportunities.

A BCG portfolio analysis is a way to measure how well a company is performing by looking at its various activities and products. It can help a company decide where to invest its money and which products to stop with.

Market growth is calculated by determining the percentage increase in sales from one year to the next. This figure is then multiplied by the total value of sales from the previous year to determine the market value.

A cash cow is a product or service that generates a large amount of stable, ongoing revenue. A cash cow is usually not the most innovative product or service, but it is reliable and profitable.

The BCG matrix is a strategic marketing model used to help a company decide where to allocate its resources. The matrix is divided into four quadrants: -Stars: high market share and high growth -Questrels: high market share but low growth -Cash Cows: low market share but high growth -Dogs: low market share and low growth. An example of how the BCG matrix can be used would be two companies competing in the same industry. Company A has a large market share but is not growing as fast as Company B. Company B has a small market share but is growing fast. In this case, Company A is considered a cash cow and Company B is considered a star.

I try to help business surpass their growth ceiling with my content.

Sounds interesting?

Let’s connect on LinkedIn!

BCG Matrix | Business Strategy | Customer Development Process | Market Research | Marketing and Sales | Marketing Strategy | Product-market Fit | Value Proposition Canvas

Gust’s Must-Reads 👇🏼

- TAM SAM SOM

- Value Proposition

- Decision Making Unit

- Product-Market Fit

- North Star Metric

- Market Research

- Customer Development

- Growth Hacking

- Brand Identity

- Customer Journey

- Account-Based Marketing

![bcg matrix case study Customer Journey Map (2024): How-to & Examples [+ Template]](https://gustdebacker.com/wp-content/uploads/2023/11/Customer-Journey-Map.png)

Customer Journey Map (2024): How-to & Examples [+ Template]

The Customer Journey is the process your customers go through with your company. This then covers the first to last interaction someone has with your company. Many companies do not have a map of how their customers orient, what they care about or when the company...

![bcg matrix case study Cognitive Biases (2024): Complete List of 151 Biases [Psychology]](https://gustdebacker.com/wp-content/uploads/2023/11/151-Cognitive-Biases.png)

Cognitive Biases (2024): Complete List of 151 Biases [Psychology]

Cognitive biases, there are so many of them... Decisions we make based on emotion, cognitive biases are irrational 'errors' that are programmed into people's brains and affect the decision-making process. Plenty of different articles have been written and an entire...

What is Growth Hacking? (2024): Best Strategy to Grow Your Business

The popularity of Growth Hacking is increasing rapidly, but what is Growth Hacking? Many companies lack a clear strategy for achieving growth and don't know how to manage a (marketing) team in it... Many marketers and entrepreneurs find Growth Hacking the best way to...

12 Comments

This is very good explanation. May Allah increase your knowledge.

Thank you, Kiran!

the example given by your explanation is wrong as you have mentioned as the company A would become the question or questol and the Company B shall become the cash cow

Thank you for the comment! I have adjusted it.

Cash Cows are units with high market share and low market growth, not the other way round.

Thanks for the comment Babatola! Where do you see this mistake?

=> I think this one is not right. Please double-check. It generate low revenue.

Thanks for your comment! Why would it generate low revenue? It should have a high market share with low market growth and thus (in general) generate a stable amount of revenue.

I really find this helpful

Thank you, Alinafe!

Thank for helping me ,I have really understood the matrix

Thank you, Deborah!

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Submit Comment

You have Successfully Subscribed!

Proven (marketing) management tactics 12x / year.

✔ Discover the secrets of successful companies.

✔ Make better decisions and avoid bad choices.

✔ Never miss out on any growth for your company.

Function Owner C-Level Manager Marketer Sales Student

Thank you! You have successfully subscribed.

- Revolutionizing Digital Communication: The Power of Olly and AI

- AI-Powered Video Editing with Snapy.ai: The Future of Content Creation is Here

- Dawn of AI-Powered Video Editing: Transform Your Videos with Silence Remover Online

- The Dawn of Generative AI: Why and How to Adopt it for your Business

- Harnessing the Power of Generative AI for Business Innovation: An Exclusive Consultancy Approach

Original content with a single minded focus on value addition.

BCG Matrix with examples of 4 popular brands