Debt Assignment: Understanding the Mechanics, Risks, and Benefits with Real-world Examples

Last updated 03/19/2024 by

Fact checked by

What is debt assignment?

How debt assignments work, special considerations, criticism of debt assignment.

- Enhanced liquidity for creditors.

- Risk reduction by divesting high-risk loans.

- Quick injection of capital for urgent financial needs.

- Opportunity to free up resources from aging debts.

- Potential for unethical practices by debt collectors.

- Allegations of harassment and threats towards debtors.

- Risk of pursuing debts that have already been settled.

Frequently asked questions

Is debt assignment legal, can a debtor reject a debt assignment, how does debt assignment impact the debtor’s credit score, what recourse do debtors have if faced with unethical debt collection practices, key takeaways.

- Debt assignment involves the legal transfer of debt and associated rights to a third party.

- Notification to the debtor is crucial to prevent unintentional default and ensure proper payment channels.

- Third-party debt collectors operate under the Fair Debt Collection Practices Act (FDCPA).

- Creditors may assign debt to improve liquidity, reduce risk exposure, or deal with aging debts.

- Debt assignment has faced criticism for unethical practices by some debt buyers.

Show Article Sources

You might also like.

Assignment Of Debt Agreement

Jump to section, what is an assignment of debt agreement.

An assignment of debt agreement is a legal document between a debtor and creditor that outlines the repayment terms. An assignment of debt agreement can be used as an alternative to bankruptcy, but several requirements must be met for it to work.

In addition, if obligations are not met under a debt agreement, it might still be necessary to file for bankruptcy later on. Therefore, consulting with an attorney specializing in debt agreements is always recommended before entering into one of these contracts.

Assignment Of Debt Agreement Sample

Reference : Security Exchange Commission - Edgar Database, EX-10 5 exhibit1024f10qsbmay04.htm EXHIBIT 10.24 , Viewed December 20, 2021, View Source on SEC .

Who Helps With Assignment Of Debt Agreements?

Lawyers with backgrounds working on assignment of debt agreements work with clients to help. Do you need help with an assignment of debt agreement?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignment of debt agreements. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Assignment Of Debt Agreement Lawyers

McGhee at Law is a purpose-driven law firm located in Indiana. We are focused on assisting Clients with creating opportunities of advancement. Our strategy is to assist, advise and support our Clients in fulfilling their vision for their personal lives and businesses through the practice of law.

I was born and raised in Wayne, New Jersey and attended Seton Hall University, graduating cum laude. I followed my family down to Florida to attend Ave Maria School of Law where I graduated cum laude. I was admitted to the Florida Bar in 2018. During law school, I participated in the Certified Legal Internship program with the State Attorney's Office of the 20th Judicial Circuit and litigated 5 jury trials, 1 non jury trial and argued various motions before the court under the supervision of an Assistant State Attorney. I was an Assistant States Attorney for Collier County from 2018 to 2020 before moving into private practice in the areas of real estate and first party property from 2020 to 2021. As of November 2021, I started my own law practice that focuses on business planning, real estate and estate planning.

I work with private tech companies on entity formation, corporate governance, and commercial agreements. I was an in-house counsel for a unicorn fintech startup and am currently associated with a startup boutique while operating my solo practice. I received my JD from Berkeley Law, and served in the US Navy for 5 years as a combat linguist. I am fluent in Korean.

I have been an attorney for 30 years. I am a Colorado native with many years in Alaska. I have a Bachelors in Biology, Chemistry and French, JD from Seattle University and Masters in Environmental Science and Law from Vermont Law School. I have traveled extensively, mostly in Europe, and speak several languages with more or less proficiency. I practiced law in Alaska and Colorado, much of it in remote areas but also large cities. I have taught in an environmental masters program and run large environmental nonprofits and a hot springs resort. I have worked with and run business incubators, a process I love. Empowering people to build their own futures is a passion.

Whitney L. Smith's journey from entrepreneur to advocate is fueled by a profound understanding of the business world. With a decade of firsthand entrepreneurial experience, she entered law school driven by a mission to protect others' businesses. However, her passion for real estate law blossomed as she recognized the tremendous benefits rental property ownership offers to individuals seeking passive income and community development. Blending her deep understanding of transactional law with zealous courtroom advocacy, she empowers landlords to thrive. Born and raised in St. Petersburg, Florida, she is a proud graduate of Stetson College of Law and cherishes her role as a devoted parent to two children and a beloved pit bull companion.

Business, Real Estate, Tax, Estate Planning and Probate attorney with over 20 years experience in private practice in Colorado. Currently owner/operator of John M. Vaughan, Attorney at Law solo practitioner located in Boulder, CO. My practice focuses on transactional matters only.

I have 20-plus years of experience as a corporate general counsel, for public and private corporations, domestic and international. I have acted as corporate secretary for a publicly-held corporation and have substantial experience in corporate finance, M&A, corporate governance, incorporations, corporate maintenance, complex transactions, corporate termination and restructuring, as well as numerous aspects of regulatory and financial due diligence. In my various corporate roles, I have routinely drafted complex corporate contracts and deal-related documents such as stock purchase agreements, option and warrant agreements, MSAs, SOWs, term sheets, joint venture agreements, tender agreements purchase and sale agreements, technology licensing agreements, vendor agreements, service agreements, IP and technology security agreements, NDAs, etc. and have managed from both a legal and business perspective many projects in the financial, technology, energy and venture capital fields.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Financial lawyers by top cities

- Austin Financial Lawyers

- Boston Financial Lawyers

- Chicago Financial Lawyers

- Dallas Financial Lawyers

- Denver Financial Lawyers

- Houston Financial Lawyers

- Los Angeles Financial Lawyers

- New York Financial Lawyers

- Phoenix Financial Lawyers

- San Diego Financial Lawyers

- Tampa Financial Lawyers

Assignment Of Debt Agreement lawyers by city

- Austin Assignment Of Debt Agreement Lawyers

- Boston Assignment Of Debt Agreement Lawyers

- Chicago Assignment Of Debt Agreement Lawyers

- Dallas Assignment Of Debt Agreement Lawyers

- Denver Assignment Of Debt Agreement Lawyers

- Houston Assignment Of Debt Agreement Lawyers

- Los Angeles Assignment Of Debt Agreement Lawyers

- New York Assignment Of Debt Agreement Lawyers

- Phoenix Assignment Of Debt Agreement Lawyers

- San Diego Assignment Of Debt Agreement Lawyers

- Tampa Assignment Of Debt Agreement Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

- Insights & events

Assigning debts and other contractual claims - not as easy as first thought

Harking back to law school, we had a thirst for new black letter law. Section 136 of the Law of the Property Act 1925 kindly obliged. This lays down the conditions which need to be satisfied for an effective legal assignment of a chose in action (such as a debt). We won’t bore you with the detail, but suffice to say that what’s important is that a legal assignment must be in writing and signed by the assignor, must be absolute (i.e. no conditions attached) and crucially that written notice of the assignment must be given to the debtor.

When assigning debts, it’s worth remembering that you can’t legally assign part of a debt – any attempt to do so will take effect as an equitable assignment. The main practical difference between a legal and an equitable assignment is that the assignor will need to be joined in any legal proceedings in relation to the assigned debt (e.g. an attempt to recover that part of the debt).

Recent cases which tell another story

Why bother telling you the above? Aside from our delight in remembering the joys of debating the merits of legal and equitable assignments (ehem), it’s worth revisiting our textbooks in the context of three recent cases. Although at first blush the statutory conditions for a legal assignment seem quite straightforward, attempts to assign contractual claims such as debts continue to throw up legal disputes:

- In Sumitomo Mitsui Banking Corp Europe Ltd v Euler Hermes Europe SA (NV) [2019] EWHC 2250 (Comm), the High Court held that a performance bond issued under a construction contract was not effectively assigned despite the surety acknowledging a notice of assignment of the bond. Sadly, the notice of assignment failed to meet the requirements under the bond instrument that the assignee confirm its acceptance of a provision in the bond that required the employer to repay the surety in the event of an overpayment. This case highlights the importance of ensuring any purported assignment meets any conditions stipulated in the underlying documents.

- In Promontoria (Henrico) Ltd v Melton [2019] EWHC 2243 (Ch) (26 June 2019) , the High Court held that an assignment of a facility agreement and legal charges was valid, even though the debt assigned had to be identified by considering external evidence. The deed of assignment in question listed the assets subject to assignment, but was illegible to the extent that the debtor’s name could not be deciphered. The court got comfortable that there had been an effective assignment, given the following factors: (i) the lender had notified the borrower of its intention to assign the loan to the assignee; (ii) following the assignment, the lender had made no demand for repayment; (iii) a manager of the assignee had given a statement that the loan had been assigned and the borrower had accepted in evidence that he was aware of the assignment. Fortunately for the assignee, a second notice of assignment - which was invalid because it contained an incorrect date of assignment - did not invalidate the earlier assignment, which was found to be effective. The court took a practical and commercial view of the circumstances, although we recommend ensuring that your assignment documents clearly reflect what the parties intend!

- Finally, in Nicoll v Promontoria (Ram 2) Ltd [2019] EWHC 2410 (Ch), the High Court held that a notice of assignment of a debt given to a debtor was valid, even though the effective date of assignment stated in the notice could not be verified by the debtor. The case concerned a debt assigned by the Co-op Bank to Promontoria and a joint notice given by assignor and assignee to the debtor that the debt had been assigned “on and with effect from 29 July 2016”. A subsequent statutory demand served by Promontoria on the debtor for the outstanding sums was disputed on the basis that the notice of assignment was invalid because it contained an incorrect date of assignment. Whilst accepting that the documentation was incapable of verifying with certainty the date of assignment, the Court held that the joint notice clearly showed that both parties had agreed that an assignment had taken place and was valid. This decision suggests that mistakes as to the date of assignment in a notice of assignment may not necessarily be fatal, if it is otherwise clear that the debt has been assigned.

The conclusion from the above? Maybe it’s not quite as easy as first thought to get an assignment right. Make sure you follow all of the conditions for a legal assignment according to the underlying contract and ensure your assignment documentation is clear.

Contact our experts for further advice

Necessary cookies . These are cookies which are necessary for the operation of our website. We set these cookies so that they are always on.

Analytics and other third-party cookies . We would like to use analytics and limited other third-party cookies to improve our website and your experience using it. These cookies collect and report information to us about your browsing activity on our website. If you are happy to allow us to use these cookies, please click “all cookies” or you can turn individual cookies on by clicking "manage cookies". You can change your preferences at any time by visiting our cookie details page.

We use cookies on our website, details of which are set out below.

Necessary cookies

These are cookies which are necessary for the operation of our website. We set these cookies so that they are always on, although you may be able to disable these cookies via your browser if you wish. Please note that if these cookies are disabled then you may not be able to use some or all of the functionality of our website.

Ideally over time we would like to be able to improve our website and your experience using it. We would like to deploy analytics cookies to enable us to do this, which would collect and report information to us about your browsing activity on our website. However, we will only use these cookies with your consent and these cookies are switched off until you opt to turn them on. Click here for a full list of analytics cookies used on our website.

Third-party cookies are set by our partners and help us to improve your experience of the website. Click here for a full list of third-party plugins used on our website.

Search our site

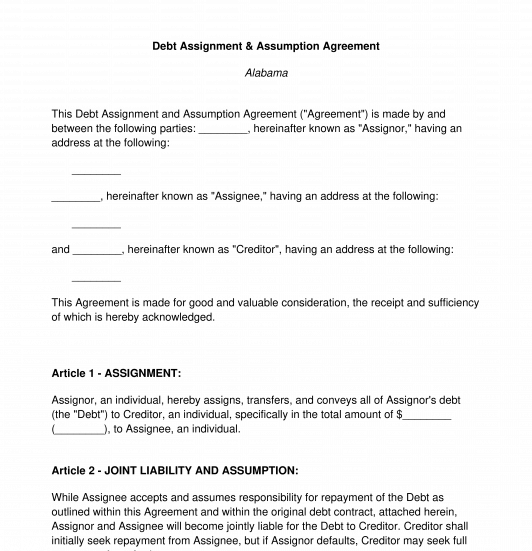

Debt Assignment and Assumption Agreement

Create a high-quality document now!

Thank you for downloading!

How would you rate your free form.

Updated June 22, 2023

A debt assignment agreement allows a person who owes money to assign the debt to someone else who assumes its obligation. This is common when a person takes possession of an asset where the seller still owes money. The buyer will purchase the asset and assume the debt.

Lender’s Approval

In most loan agreements and notes, the lender will be required to approve the new debtor. This can be done with a signed waiver or statement by the lender.

Sample Debt Assignment Agreement

Download: PDF , MS Word , OpenDocument

ASSIGNMENT AND ASSUMPTION OF DEBT WITH RELEASE

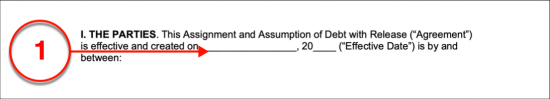

I. THE PARTIES. This Assignment and Assumption of Debt with Release (“Agreement”) is effective and created on [ DATE ] (“Effective Date”) is by and between:

Debtor : [ DEBTOR’S NAME ], with a mailing address of [ DEBTOR’S MAILING ADDRESS ] (“Debtor”),

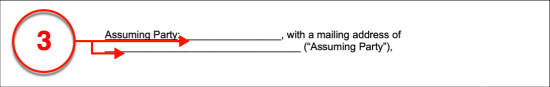

Assuming Party : [ ASSUMING PARTY’S NAME ], with a mailing address of [ ASSUMING PARTY’S ADDRESS ] (“Assuming Party”),

Creditor : [ CREDITOR’S NAME ], with a mailing address of [ CREDITOR’S NAME ] (“Creditor”),

The Debtor, Assuming Party, and Creditor shall each be referred to herein as a “Party” and collectively as the “Parties.”

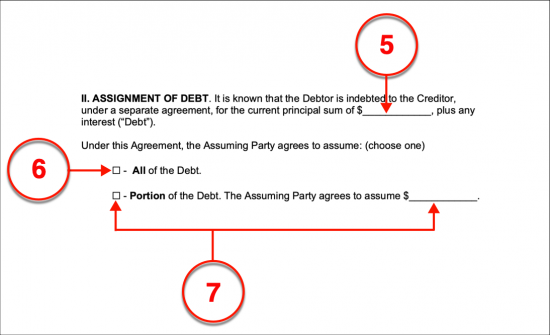

II. ASSIGNMENT OF DEBT. It is known that the Debtor is indebted to the Creditor, under a separate agreement, for the current principal sum of $[ CURRENT DEBT AMOUNT ], plus any interest (“Debt”).

Under this Agreement, the Assuming Party agrees to assume: (choose one)

☐ – All of the Debt.

☐ – Portion of the Debt. The Assuming Party agrees to assume $[ PORTION OF DEBT AMOUNT ].

The Debt shall continue its repayment in accordance with the terms located in a separate agreement between the Debtor and Creditor.

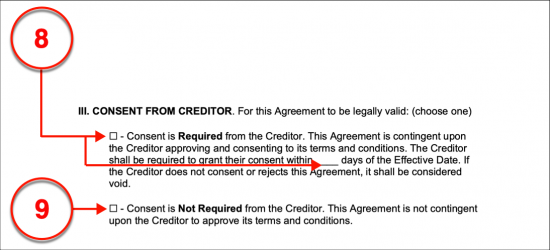

III. CONSENT FROM CREDITOR. For this Agreement to be legally valid: (choose one)

☐ – Consent is Required from the Creditor. This Agreement is contingent upon the Creditor approving and consenting to its terms and conditions. The Creditor shall be required to grant their consent within [ # ] days of the Effective Date. If the Creditor does not consent or rejects this Agreement, it shall be considered void.

☐ – Consent is Not Required from the Creditor. This Agreement is not contingent upon the Creditor to approve its terms and conditions.

IV. ASSUMPTION OF LIABILITIES. The Assuming Party agrees to assume the Debt, which may or may not include, further legal or financial liability. If the Debtor is subject to legal or financial liability, the Assuming Party shall assume its liability, including but not limited to, attorney’s fees and damages.

V. DEBTOR’S RELEASE. This Agreement shall release the Debtor from all liabilities in relation to the Debt, the Creditor, and the Assuming Party.

VI. SEVERABILITY. If any term, covenant, condition, or provision of this Agreement is held by a court of competent jurisdiction to be invalid, void, or unenforceable, the remainder of the provisions shall remain in full force and effect and shall in no way be affected, impaired, or invalidated.

VII. PARTIES’ REPRESENTATIONS. This Agreement can be considered void, at any time, if evidence is presented that any Party was not honest, untruthful, or did not negotiate in good faith (“Fraudulent Practices”). Furthermore, if any Party’s actions are considered Fraudulent Practices, they may be subject to legal and financial penalties to the fullest of the law.

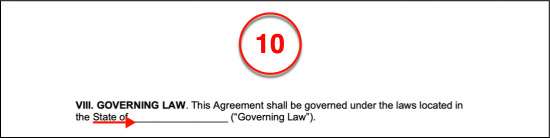

VIII. GOVERNING LAW. This Agreement shall be governed under the laws located in the State of [ STATE ] (“Governing Law”).

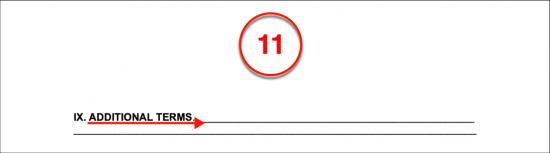

IX. ADDITIONAL TERMS. [ ADDITIONAL TERMS & CONDITIONS ]

X. ENTIRE AGREEMENT. This Agreement constitutes the entire Agreement between the Parties. No modification or amendment of this Agreement shall be effective unless in writing and signed by both Parties.

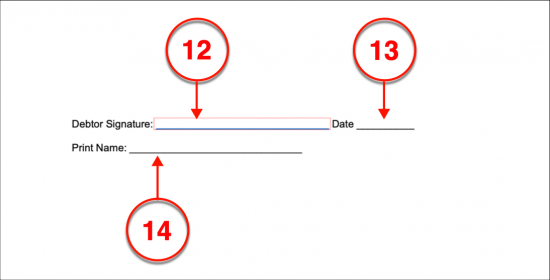

Debtor Signature: ______________________________ Date __________

Print Name: ______________________________

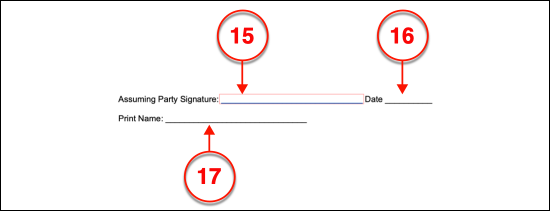

Assuming Party Signature: ______________________________ Date __________

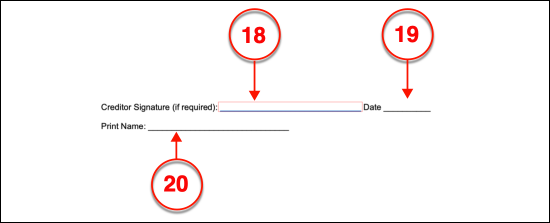

Creditor Signature (if required): ______________________ Date __________

How to Write

Section 1 the parties.

(1) Effective Assignment Date. This agreement must clearly establish the calendar date when the assignment of the debt to the Assuming Party becomes active.

(2) Debtor Name And Mailing Address. The current Holder of the debt should be identified as the Debtor in this agreement. To this end, record the Debtor’s name and address.

(3) Assuming Party. The name of the Party that will be charged with paying the debt will be the Assuming Party. Furnish the Assuming Party’s entire name and mailing address.

(4) Creditor Name And Address . Naturally, it will be important that the debt is properly defined. This requires that the Creditor is named and that his or her mailing address is presented. If this is a Business then its legal Company Name must be used to identify the Creditor properly.

Section 2 Assignment Of Debt

(5) Sum Of Debt. The amount of money required by the debt being discussed is needed to complete the statement made in Section 2. This must be the total dollar amount that the Creditor expects the Debtor to pay.

(6) Assuming All Debt. The debt that is being transferred requires definition. If the total amount of the debt owed by the Debtor will be transferred to the Assuming Party, then the “All Of The Debt” checkbox should be selected.

(7) Assignment Of Portion Of Debt . If the Assuming Party will only take on part of the concerned debt then select the “Portion” checkbox. In addition to this selection, supply the dollar amount that the Assuming Party will pay to the Creditor to satisfy the part of the debt held by Debtor.

Section III Consent From Creditor

(8) Creditor Consent Required. In some cases, the Creditor must be informed of this assignment and provide consent for the Debtor and Assuming Party’s actions in this document. If so, then select the first checkbox statement from Section III. Additionally, supply the number of days before the effective date when the Creditor consent must be provided.

(9) No Consent Of Creditor Required. Select the “Not Required” checkbox to indicate that the Creditor’s consent is not needed for this contract’s execution.

Section VIII Governing Law

(10) Governing Law. Identify the State where this agreement will be effective and be enforceable.

Section IX. Additional Terms

(11) Additional Terms. Any agreements between the Debtor and the Assuming Party or conditions placed by the Creditor that should be considered part of this assignment should be documented in Section IX.

(12) Debtor Signature . The Debtor must approve of the information defining this assignment. For this task, he or she must sign and date this document upon satisfactory review. The Debtor should attend the first line presented in the signature area by signing his or her name on it.

(13) Debtor Signature Date.

(14) Debtor Printed Name .

(15) Assuming Party Signature. The Assuming Party must submit his or her signature to participate in this contract.

(16) Signature Date Of Assuming Party. The date when the Assuming Party signed this agreement must be noted.

(17) Printed Name Of Assuming Party.

(18) Creditor Signature And Date. In order for the Creditor to approve of this agreement, he or she must sign it or a Signature Representative appointed by the Creditor must supply this approving signature.

(19) Creditor Signature Date. Upon the signing, the Creditor’s Signature Party must define the current date.

(20) Printed Name Of Creditor . The printed name of the Creditor’s Signature Party is expected.

Assignment Involves Transfer of Rights to Collect Outstanding Debts

What is an assignment of debt, debt can be bought and sold or otherwise transferred from a creditor who is owed money to another person who then becomes the assignee creditor with the right to collect the outstanding debt., understanding what constitutes as a legally binding assignment of creditor rights to collect a debt.

Right to Collect on Debts

In Ontario, the Court of Appeal case of Clark v. Werden , 2011 ONCA 619 confirmed the right to assign debts per the Conveyancing and Law of Property Act , R.S.O. 1990, c. C.34 , whereas such statute prescribes the conditions and requirements for the transfer of rights involving monies, among other things, whereas it was said:

Clark v. Werden , 2011 ONCA 619 at paragraph 13

[13] The ability to assign a debt or legal chose in action is codified in s. 53 of the Conveyancing and Law of Property Act , which provides that a debt is assignable subject to the equities between the original debtor and creditor and reads as follows:

53 (1) Any absolute assignment made on or after the 31st day of December, 1897, by writing under the hand of the assignor, not purporting to be by way of charge only, of any debt or other legal chose in action of which express notice in writing has been given to the debtor, trustee or other person from whom the assignor would have been entitled to receive or claim such debt or chose in action is effectual in law, subject to all equities that would have been entitled to priority over the right of the assignee if this section had not been enacted, to pass and transfer the legal right to such debt or chose in action from the date of such notice, and all legal and other remedies for the same, and the power to give a good discharge for the same without the concurrence of the assignor.

Partially Assigned

It is notable that the statute makes mention of " absolute assignment " without clearly addressing the rights and method of treatment for a partial assignment of a debt. In this circumstance, where more than one assignee may obtain or assume the rights of the creditor (or earlier assignee), a partial assignee is required to join all assignees when bringing legal action against the debtor. This view was stated by the Court of Appeal in DiGuilo v. Boland , 1958 CanLII 92 where it was said:

DiGuilo v. Boland , 1958 CanLII 92

The main reason why an assignee of a part of a debt is required to join all parties interested in the debt in an action to recover the part assigned to him is in my opinion because the Court cannot adjudicate completely and finally without having such parties before it. The absence of such parties might result in the debtor being subjected to future actions in respect of the same debt, and moreover might result in conflicting decisions being arrived at concerning such debt.

Failed Notice

Of potentially grave concern to creditors, and potentially with great relief to debtors, for an assignee to retain the right to pursue the debtor, express written notice of the assignment is required. This requirement was stated in 1124980 Ontario Inc. v. Liberty Mutual Insurance Company and Inco Ltd. , 2003 CanLII 45266 as part of the four part test to establish the right to pursue an assigned debt:

1124980 Ontario Inc. v. Liberty Mutual , 2003 CanLII 45266 at paragraph 44

[44] Accordingly, for there to be a valid legal assignment under section 53(1) of the CLPA , four requirements must be met:

a) there must be debt or chose in action;

b) the assignment must be absolute;

c) the assignment must be written; and

d) written notice of the assignment must be given to the debtor.

Where there is a failure of notice, and therefore failure to comply with the Conveyancing and Law of Property Act , it is said that the right to assign fails in law; however, relief in equity, via an equitable assignment may be available to an assignee affected by failure of notice. Generally, in equity, when failure of notice occurs, the assignee is unable, in law, to bring an action in the name of the assignee and may do so only in the name of the creditor; however, even in the absence of proper notice as results in failure of assignment in law, and failure ot enjoin the creditor in an action pursued as an equitable assignment, the court may remain prepared to waive such a requirement whereas such occurred in the matter of Landmark Vehicle Leasing Corporation v. Mister Twister Inc. , 2015 ONCA 545 wherein it was stated:

Landmark v. Mister Twister , 2015 ONCA 545 at paragraphs 10 to 16

[10] Section 53(1) requires “ express notice in writing ” to the debtor. Although there is some ambiguity in her reasons, it would appear that the trial judge found that Mr. Blazys had express notice of the assignment, but not notice in writing. Ross Wemp Leasing therefore did not assign the leases to Landmark in law: see 80 Mornelle Properties Inc. v. Malla Properties Ltd. , 2010 ONCA 850 (CanLII) , 327 D.L.R. (4th) 361, at para. 22 . Ross Wemp Leasing did, however, assign the leases to Landmark in equity. An equitable assignment does not require any notice, let alone written notice: Bercovitz Estate v. Avigdor , [1961] O.J. No. 20 (C.A.), at paras. 16, 25.

[11] The appellants, relying on DiGuilo v. Boland , 1958 CanLII 92 (ON CA), [1958] O.R. 384 (C.A.), aff’d, [1961] S.C.C.A. vii, argue that as the appellants did not have written notice of the assignment, Landmark could not sue on its own. Instead, Landmark had to join Ross Wemp Leasing in the action. The appellants argue that the failure to join Ross Wemp Leasing requires that the judgment below be set aside.

[12] DiGuilo does in fact require that the assignor of a chose in action be joined in the assignee’s claim against the debtor when the debtor has not received written notice of the assignment. The holding in DiGuilo tracks rule 5.03(3) of the Rules of Civil Procedure , R.R.O. 1990, Reg. 194 : In a proceeding by the assignee of a debt or other chose in action, the assignor shall be joined as a party unless,

(a) the assignment is absolute and not by way of charge only; and

(b) notice in writing has been given to the person liable in respect of the debt or chose in action that it has been assigned to the assignee. [Emphasis added.]

[13] Yet the assignee’s failure to join the assignor does not affect the validity of the assignment or necessarily vitiate a judgment obtained by the assignee against the debtor. Rule 5.03(6) reads:

The court may by order relieve against the requirement of joinder under this rule.

[14] The joinder requirement is intended to guard the debtor against a possible second action by the assignor and to permit the debtor to pursue any remedies it may have against the assignor without initiating another action: DiGuilo , at p. 395. Where the assignee’s failure to join the assignor does not prejudice the debtor, the court may grant the relief in rule 5.03(6) : see Gentra Canada Investments Inc. v. Lipson , 2011 ONCA 331 (CanLII), 106 O.R. (3d) 261, at paras. 59 - 65 , leave to appeal refused, [2011] S.C.C.A. No. 327.

[15] In this case, the trial judge found that Mr. Blazys, and effectively all of the appellants, gained actual notice of the lease assignments very shortly after the assignments were made and well before Landmark sued. Armed with actual, albeit not written, notice of the assignment, the appellants could fully protect themselves against any prejudice from Landmark’s failure to join Ross Wemp Leasing. Had the appellants seen any advantage in joining Ross Wemp Leasing, either to defend against Landmark’s claim or to advance a claim against Ross Wemp Leasing, the appellants could have moved for joinder under rule 5.03(4). The appellants’ failure to bring a motion to add Ross Wemp Leasing speaks loudly to the absence of any prejudice caused by Landmark’s failure to join the assignor.

[16] Ross Wemp Leasing perhaps should have been a party to the proceeding. Landmark’s failure to join Ross Wemp Leasing, however, did not prejudice the appellants and should have had no impact on the trial judgment. If requested, this court will make a nunc pro tunc order relieving Landmark from the requirement of joining Ross Wemp Leasing in the action.

Summary Comment

The rights to collect on a debt can be sold and transferred from the original creditor to a substitute creditor or assignee who then takes on the rights of the original creditor. Indeed, the selling and buying of individual debts, or debts within an entire portfolio debts is common within business. The entire collection services industry is based on the concept of buying outstanding debt and then standing in the shoes of the original creditor and pursuing the payment of the debt. Other forms of buying and selling debt includes mortgage swaps, among other things.

Need Help? Let's Get Started Today

Send a Message Directly to SFG Paralegal Services LLP

Just one word Amazing service! Dan always answered my questions promptly and I wouldn't have got what I wanted without him and his team! Thank you again for your amazing service!

~ Jonathan Ber

Samantha goes out of her way to support people even if they are not clients. Once you ARE a client you know you are in the best hands possible!

~ Tonie Ogilvie

I retained Samantha on two related landlord and tenant matters. Samantha resolved the issues to my complete satisfaction. I highly recommend Samantha and SFG Paralegal Services.

~ Ira Smith

I definitely recommend SFG Paralegal Services. Samantha Glass was very warm and easy to talk too. She remained attentive and very supportive. She was available to me at her office and even responded to my calls at home. I recommend Samantha Glass ...

~ Carmela Sorbara

I spoke to Samantha in regard to a potential matter against me, and I was filled with anxiety and dread as I have never encountered such an issue before. As a law-abiding citizen, I just could not understand how this could happen to me. ...

A goal of SFG Paralegal Services LLP is to provide each client with noteworthy service in effort to earn client opinions that SFG Paralegal Services LLP is the best Paralegal in Richmond Hill, Orangeville, Pickering, Whitby, and surrounding areas.

A goal of SFG Paralegal Services LLP is to provide each client with noteworthy service in effort to earn client opinions that SFG Paralegal Services LLP is the best Paralegal in Richmond Hill, Windsor, York Region, Stouffville, and surrounding areas.

SFG Paralegal Services LLP

10265 Yonge Street, Suite 200 Richmond Hill, Ontario, L4C 4Y7 P: (888) 398-0121 E: [email protected]

Business Hours:

09:00AM - 05:00PM 09:00AM - 05:00PM 09:00AM - 05:00PM 09:00AM - 05:00PM 09:00AM - 05:00PM Mon day : Tue sday : Wed nesday : Thu rsday : Fri day :

By appointment only. Call for details. Messages may be left anytime.

Richmond Hill Etobicoke Kitchener Stouffville Oakville Cambridge

Napanee Ajax Newmarket Scarborough Vaughan and near you.

Assignments for the Benefit of Creditors – an often-overlooked state law alternative to Chapter 7 bankruptcy

For some folks the three letters ABC are a reminder of elementary school and singing a song to learn the alphabet. For others, it is a throw back to the early 70’s when the Jackson Five and its lead singer Michael, still with his adolescent high voice, sang a catchy love song. Then there is a select group of people in the world of corporate workouts, liquidations and bankruptcies, who know those three letters to stand for the A ssignment for the B enefit of C reditors – a voluntary state law liquidation process that may arguably offer a hospitable and friendly alternative to federal bankruptcy. This article is a brief summary of this potentially attractive alternative to bankruptcy.

The Assignment for the Benefit of Creditors (“ABC”), also known as a General Assignment, is a state law procedure governed by state statute or common law. Over 30 states have codified statutes, and the remainder of states rely on common law. See Practical Issues in Assignments for the Benefit of Creditors , by Robert Richards & Nancy Ross, ABI Law Review Vol. 17:5 (2009) at p. 6 (listing state statutes). In some states, the statutory authority and common law can coexist. At its most basic, the ABC process involves the transfer of all assets by a financially distressed debtor (the assignor) to an individual or entity (the assignee) with fiduciary obligations who then liquidates the assets and pays creditors. The assignment agreement is essentially a contract involving the transfer and control of property, in trust, to a third party. In some states that have enacted a statute, state courts may supervise the process (and at different levels of involvement depending on the statute). The statutory scheme in other states such as California and Nevada, and in states where common law govern, do not provide for judicial oversight..

ABCs are promoted as less expensive and more flexible than a chapter 7 liquidation and may proceed substantially faster than bankruptcy liquidation. See generally Practical Issues in Assignments for the Benefit of Creditors , ABI Law Review Vol. 17:5 (2009) at p. 8 (citations omitted). In addition, the ABC process may provide four other noteworthy benefits not available in a bankruptcy. First, the liquidating company chooses the assignee, there is no appointment of a random trustee or formal election required like in a bankruptcy. This freedom of choice allows the assignor to evaluate the reputation and experience of proposed assignees, as well as select an assignee with familiarity in the nature of the assignor’s business and/or with more expansive contacts in the industry to facilitate the sale/liquidation. Second, the ABC process generally falls under the radar of the media (particularly in states that do not require court supervision), and the assignor may avoid publicity, often negative, that can be associated with bankruptcy proceedings. Third, with an ABC, the assignee has the ability to sell the assets without the imposition of potentially cumbersome requirements of Section 363 of the Bankruptcy Code, and in some cases, can conduct a sale the same day as the general assignment. Finally, the ABC process generally authorizes the sale of assets free of unsecured creditor debt. In essence, in an ABC, a company buying assets from a distressed business does not acquire the debt of the assignor.

On the down side, ABCs do not provide the protection of the automatic stay that is triggered upon the filing of a bankruptcy petition. In some situations, the debtor entity needs to stop the pursuit of creditors immediately, and a bankruptcy proceeding will supply this relief. Unlike bankruptcy, the sale through an ABC: i) is not free and clear of liens; ii) unexpired leases cannot be assumed and assigned without the consent of the contract counter-party; and iii) insolvency can trigger a default under an unexpired lease or executory contract. See generally Practical Issues in Assignments for the Benefit of Creditors , ABI Law Review Vol. 17:5 (2009) at p. 20. In general, an ABC is not a good choice for debtors that have secured creditors that do not consent because there is no mechanism for using cash collateral or transferring assets free and clear of liens without the secured creditors’ consent. In cases where junior lienholders are out of the money, there is no incentive for those creditors to voluntarily release their liens. In addition, while unsecured creditors do not have to consent to the general assignment for it to be valid, choosing this alternative forum may cause concern for creditors (particularly those used to the transparency of a court-supervised bankruptcy or receivership proceeding) and invite the filing of an involuntary bankruptcy. Therefore, it is prudent to involve major creditors in the process, and perhaps even in the pre-assignment planning. In addition, if an involuntary petition is filed, the assignee could request that the bankruptcy court abstain in order to proceed with the ABC.

Using the ABC state process in lieu of filing for bankruptcy in federal court may result in a more streamlined, efficient liquidation process that is less expensive and likely completed quicker than a federal bankruptcy proceeding. In some jurisdictions, such as New Jersey, workout professionals note anecdotally that corporate clients fare better under this state law alternative rather than the lengthy, more complicated federal bankruptcy proceedings.

Many bankruptcy professionals are unfamiliar with the procedures of ABC and are reluctant to recommend it as a method for liquidating assets and administering claims. This lack of familiarity may be a disservice to potential clients.

[ View source .]

Related Posts

- The More Things Change, The More They Stay The Same? Survival Of Small Businesses Again Dependent On Action From Congress

- Mediation in Bankruptcy: A Glimpse

- In re The Hacienda Company, LLC – Round 2: Bankruptcy Courts May be Available to Non-Operating Cannabis Companies to Liquidate Assets

- PAGA Dischargeable in Bankruptcy?

Latest Posts

- California Supreme Court Holds Good Faith Defense Precludes Penalties for Wage Statement Noncompliance

See more »

DISCLAIMER: Because of the generality of this update, the information provided herein may not be applicable in all situations and should not be acted upon without specific legal advice based on particular situations.

Refine your interests »

Written by:

PUBLISH YOUR CONTENT ON JD SUPRA NOW

- Increased visibility

- Actionable analytics

- Ongoing guidance

Published In:

Fox rothschild llp on:.

"My best business intelligence, in one easy email…"

What Is an Assignment of Debt?

George Simons | December 02, 2022

Co-Founder of SoloSuit George Simons, JD/MBA

George Simons is the co-founder and CEO of SoloSuit. He has helped Americans protect over $1 billion from predatory debt lawsuits. George graduated from BYU Law school in 2020 with a JD-MBA. In his spare time, George likes to cook, because he likes to eat.

Edited by Hannah Locklear

Editor at SoloSuit Hannah Locklear, BA

Hannah Locklear is SoloSuit’s Marketing and Impact Manager. With an educational background in Linguistics, Spanish, and International Development from Brigham Young University, Hannah has also worked as a legal support specialist for several years.

Summary: Have a debt collection agency coming after you for a past due account? Not convinced that they have the right to sue you? Learn about the assignment of debt and how you can beat a debt collector in court.

Assignment of debt means that the debt has been transferred, including all obligations and rights, from the creditor to another party. The debt assignment means there has been a legal transfer to another party, who now owns the debt. Usually, the debt assignment involves a debt collector who takes the responsibility to collect your debt.

How does a debt assignment work?

When the creditor lends you money, it does so thinking that what it lends you as well as interest will be paid back according to the legal agreement. The lender will wait to get the money back according to the contract.

When the debt is assigned to another party, you must be notified when it happens so you know who owns the debt and where to send your payments. If you send payments to the previous creditor, the payments probably will be rejected and you could default.

When the debtor gets this notice, it's wise for them to check that the creditor has the right balance and the payment that you should pay each month. Sometimes, you may be able to offer changes to the terms of the loan. If you decide to try this, the creditor must respond.

Respond to debt collection lawsuit in 15 minutes with SoloSuit.

Why creditors assign debts

Note that debt assignments and debt collectors must adhere to the Fair Debt Collection Practices Act . This is a law overseen by the FTC that restricts when the debtor can contact you and how. For example, they only can call you between 8 am and 9 pm and they cannot call you at work if you tell them not to do so.

If the FDCPA is broken by the debt collector, you can file a countersuit and may get them to pay damages and your attorney fees.

There are many reasons why the creditor may assign a debt. The most common reason is to boost their liquidity and reduce risk. The creditor could need capital, so they'll sell off some of their debts to debt collection companies.

Also, the creditor may have many higher-risk loans and they could be worried they could have a lot of defaults. In these situations, the creditor may be ok with selling debts for pennies on the dollar if it enhances their financial outlook and reassures investors.

Or, the creditor may think the debt is too old to worry about and may not assign it at all.

Different perspectives on debt assignment

Debt assignment is often criticized, especially in the past 30 years. Debt buyers often engage in shady practices. For example, some debt collectors may call consumers in the middle of the night and harass them to pay debts. Or, they may call friends and family looking for you. Some debt collectors even use foul language with consumers and threaten them.

Sometimes the debt is sold several times, so the consumer is chased for a debt she doesn't owe. Or, the debt amount could be different than what the debt collector claims.

Don't let debt collectors harass you. Respond with SoloSuit.

What to do if a debt collector comes after you

If you owe a debt and the debt has been assigned to a debt collector, you may be getting a lot of phone calls at all hours to get you to pay what you allegedly owe. This can continue for months or even years.

Sometimes, you can just ignore the phone calls and nothing happens. However, if enough money is involved, the debt collector could file a lawsuit against you. The worst thing you can do in this situation is to ignore the lawsuit.

What you should do is use the debt assignment game against them. What happens is this: The debt was probably sold a few times. You want to make the debt collector prove that the debt is yours and that you owe what they say you owe.

When the debt has been sold several times, it can be difficult for them to track down all that paperwork. You need to respond to the lawsuit by filing an answer with your clerk of court and then mail that answer to the debt collector by certified mail.

If you are being pursued for a debt that has been purchased by a third party debt buyer, there is a good chance you can get the issue resolved fairly easily. For example, in many instances, you may be able to negotiate a fairly low settlement on the debt, if you prefer to do so. This is because many companies who specialize in debt assignments actually purchased the debt for pennies on the dollar and are not actually looking to collect on the full amount owed.

Even if you cannot negotiate a settlement, make sure to log all of your interaction with the debt buyer since the collection agents they employ are notorious for routinely violating provisions contained within the FDCPA, which means you may have grounds to file a counterclaim and demand compensatory damages.

What is SoloSuit?

SoloSuit makes it easy to respond to a debt collection lawsuit.

How it works: SoloSuit is a step-by-step web-app that asks you all the necessary questions to complete your answer. Upon completion, you can either print the completed forms and mail in the hard copies to the courts or you can pay SoloSuit to file it for you and to have an attorney review the document.

Respond with SoloSuit

"First time getting sued by a debt collector and I was searching all over YouTube and ran across SoloSuit, so I decided to buy their services with their attorney reviewed documentation which cost extra but it was well worth it! SoloSuit sent the documentation to the parties and to the court which saved me time from having to go to court and in a few weeks the case got dismissed!" – James

>>Read the FastCompany article: Debt Lawsuits Are Complicated: This Website Makes Them Simpler To Navigate

>>Read the NPR story on SoloSuit: A Student Solution To Give Utah Debtors A Fighting Chance

How to answer a summons for debt collection in your state

Here's a list of guides for other states.

All 50 states .

| ; |

Guides on how to beat every debt collector

Being sued by a different debt collector? We're making guides on how to beat each one.

- Waypoint Resource Group

Win against credit card companies

Is your credit card company suing you? Learn how you can beat each one.

- Wells Fargo

Going to Court for Credit Card Debt — Key Tips

How to Negotiate Credit Card Debts

How to Settle a Credit Card Debt Lawsuit — Ultimate Guide

Get answers to these FAQs

Need more info on statutes of limitations? Read our 50-state guide.

Why do debt collectors block their phone numbers?

How long do debt collectors take to respond to debt validation letters?

What are the biggest debt collector companies in the US?

Is Zombie Debt Still a Problem in 2019?

SoloSuit FAQ

If a car is repossessed, do I still owe the debt?

Is Portfolio Recovery Associates Legit?

Is There a Judgment Against Me Without my Knowledge?

Should I File Bankruptcy Before or After a Judgment?

What is a default judgment?— What do I do?

Summoned to Court for Medical Bills — What Do I Do?

What Happens If Someone Sues You and You Have No Money?

What Happens If You Never Answer Debt Collectors?

What Happens When a Debt Is Sold to a Collection Agency

What is a Stipulated Judgment?

What is the Deadline for a Defendant's Answer to Avoid a Default Judgment?

Can a Judgement Creditor Take my Car?

Can I Settle a Debt After Being Served?

Can I Stop Wage Garnishment?

Can You Appeal a Default Judgement?

Do I Need a Debt Collection Defense Attorney?

Do I Need a Payday Loans Lawyer?

Do student loans go away after 7 years? — Student Loan Debt Guide

Am I Responsible for My Spouse's Medical Debt?

Should I Marry Someone With Debt?

Can a Debt Collector Leave a Voicemail?

How Does Debt Assignment Work?

What Happens If a Defendant Does Not Pay a Judgment?

Can You Serve Someone with a Collections Lawsuit at Their Work?

What Is a Warrant in Debt?

How Many Times Can a Judgment be Renewed in Oklahoma?

Can an Eviction Be Reversed?

Does Debt Consolidation Have Risks?

What Happens If You Avoid Getting Served Court Papers?

Does Student Debt Die With You?

Can Debt Collectors Call You at Work in Texas?

How Much Do You Have to Be in Debt to File for Chapter 7?

What Is the Statute of Limitations on Debt in Washington?

How Long Does a Judgment Last?

Can Private Disability Payments Be Garnished?

Can Debt Collectors Call From Local Numbers?

Does the Fair Credit Reporting Act Work in Florida?

The Truth: Should You Never Pay a Debt Collection Agency?

Should You Communicate with a Debt Collector in Writing or by Telephone?

Do I Need a Debt Negotiator?

What Happens After a Motion for Default Is Filed?

Can a Process Server Leave a Summons Taped to My Door?

Learn More With These Additional Resources:

Need help managing your finances? Check out these resources.

How to Make a Debt Validation Letter - The Ultimate Guide

How to Make a Motion to Compel Arbitration Without an Attorney

How to Stop Wage Garnishment — Everything You Need to Know

How to File an FDCPA Complaint Against Your Debt Collector (Ultimate Guide)

Defending Yourself in Court Against a Debt Collector

Tips on you can to file an FDCPA lawsuit against a debt collection agency

Advice on how to answer a summons for debt collection.

Effective strategies for how to get back on track after a debt lawsuit

New Hampshire Statute of Limitations on Debt

Sample Cease and Desist Letter Against Debt Collectors

The Ultimate Guide to Responding to a Debt Collection Lawsuit in Utah

West Virginia Statute of Limitations on Debt

What debt collectors cannot do — FDCPA explained

Defending Yourself in Court Against Debt Collector

How to Liquidate Debt

Arkansas Statute of Limitations on Debt

You're Drowning in Debt — Here's How to Swim

Help! I'm Being Sued by My Debt Collector

How to Make a Motion to Vacate Judgment

How to Answer Summons for Debt Collection in Vermont

North Dakota Statute of Limitations on Debt

ClearPoint Debt Management Review

Indiana Statute of Limitations on Debt

Oregon Eviction Laws - What They Say

CuraDebt Debt Settlement Review

How to Write a Re-Aging Debt Letter

How to Appear in Court by Phone

How to Use the Doctrine of Unclean Hands

Debt Consolidation in Eugene, Oregon

Summoned to Court for Medical Bills? What to Do Next

How to Make a Debt Settlement Agreement

Received a 3-Day Eviction Notice? Here's What to Do

How to Answer a Lawsuit for Debt Collection

Tips for Leaving the Country With Unpaid Credit Card Debt

Kansas Statute of Limitations on Debt Collection

How to File in Small Claims Court in Iowa

How to File a Civil Answer in Kings County Supreme Court

Roseland Associates Debt Consolidation Review

How to Stop a Garnishment

Debt Eraser Review

It only takes 15 minutes. And 50% of our customers' cases have been dismissed in the past.

"Finding yourself on the wrong side of the law unexpectedly is kinda scary. I started researching on YouTube and found SoloSuit's channel. The videos were so helpful, easy to understand and encouraging. When I reached out to SoloSuit they were on it. Very professional, impeccably prompt. Thanks for the service!" – Heather

Not sued yet? Use our Debt Validation Letter.

Our Debt Validation Letter is the best way to respond to a collection letter. Many debt collectors will simply give up after receiving it.

Business Law Today

November 2015

Assignment for the Benefit of Creditors: Effective Tool for Acquiring and Winding Up Distressed Businesses

David s kupetz.

Nov 15, 2015

12 min read

- Assignments for the benefit of creditors are an alternative to the formal burial process of a Chapter 7 bankruptcy.

- The ABC process may allow the parties to avoid the delay and uncertainty of formal federal bankruptcy court proceedings.

- ABCs can be particularly useful when fast action and distressed transaction and/or industry expertise is needed in order to capture value from the liquidation of the assets of a troubled enterprise.

An assignment for the benefit of creditors (ABC) is a business liquidation device available to an insolvent debtor as an alternative to formal bankruptcy proceedings. In many instances, an ABC can be the most advantageous and graceful exit strategy. This is especially true where the goals are (1) to transfer the assets of the troubled business to an acquiring entity free of the unsecured debt incurred by the transferor and (2) to wind down the company in a manner designed to minimize negative publicity and potential liability for directors and management.

The option of making an ABC is available on a state-by-state basis. During the meltdown suffered in the dot-com and technology business sectors in the early 2000s, California became the capital of ABCs. In discussing assignments for the benefit of creditors, this article will focus primarily on California ABC law.

Assignment Process

The process of an ABC is initiated by the distressed entity (assignor) entering an agreement with the party which will be responsible for conducting the wind-down and/or liquidation or going concern sale (assignee) in a fiduciary capacity for the benefit of the assignor’s creditors. The assignment agreement is a contract under which the assignor transfers all of its right, title, interest in, and custody and control of its property to the third-party assignee in trust. The assignee liquidates the property and distributes the proceeds to the assignor’s creditors.

In order to commence the ABC process, a distressed corporation will generally need to obtain both board of director authorization and shareholder approval. While this requirement is dictated by applicable state law, the ABC constitutes a transfer of all of the assignor’s assets to the assignee, and the law of many states provides that the transfer of all of a corporation’s assets is subject to shareholder approval. In contrast, shareholder approval is not required in order for a corporation to file a petition commencing a federal bankruptcy case. In some instances, the shareholder approval requirement for an ABC can be an impediment to the quick action ordinarily available in the context of an ABC, especially when a public company is involved as the assignor.

The board of directors of an insolvent company (a company with debt exceeding the value of its assets) should be particularly attentive to avoiding harm to the value of the enterprise and the interests of creditors. Under Delaware law, for example, the obligation is to maximize the value of the enterprise, which should result in protecting the interests of creditors.

It is not unusual for the board of a troubled company to determine that a going concern sale of the company’s business is in the best interests of the company and its creditors. However, generally the purchaser will not acquire the business if the assumption of the company’s unsecured debt is involved. Further, often the situation is deteriorating rapidly. The company may be burning through its cash reserves and in danger of losing key employees who are aware of its financial difficulties, and creditors of the company are pressing for payment. Under these circumstances, the company’s board may conclude than an ABC is the most appropriate course of action.

The Alternative of Voluntary Federal Bankruptcy Cases

Chapter 7 bankruptcy provides a procedure for the orderly liquidation of the assets of the debtor and the ultimate payment of creditors in the order of priority set forth in the U.S. Bankruptcy Code. Upon the filing of a Chapter 7 petition, a trustee is appointed who is charged with marshaling all of the assets of the debtor, liquidating the assets, and eventually distributing the proceeds of the liquidation to the debtor’s creditors. The process can take many months or even years and is governed by detailed statutory requirements.

Chapter 11 of the Bankruptcy Code provides a framework for a formal, court-supervised business reorganization. While the primary goals of Chapter 11 are rehabilitation of the debtor, equality of treatment of creditors holding claims of the same priority, and maximization of the value of the bankruptcy estate, Chapter 11 can be used to implement a liquidation of the debtor. Unlike the traditional common law assignment for the benefit of creditors (assignments are governed by state law and may differ from state to state), Chapter 7 and Chapter 11 bankruptcy cases are presided over by a federal bankruptcy judge and are governed by a detailed federal statute.

Advantages of an ABC

The common law assignment by simple transfer in trust, in many cases, is a superior liquidation mechanism when compared to using the more cumbersome statutory procedures governing a formal Chapter 7 bankruptcy liquidation case or a liquidating Chapter 11 case. Compared to bankruptcy liquidation, assignments may involve less administrative expense and are a substantially faster and more flexible liquidation process. In addition, unlike a Chapter 7 liquidation, where generally an unknown trustee will be appointed to administer the liquidation process, in an ABC the assignor can select an assignee with appropriate experience and expertise to conduct the wind-down of its business and liquidation of its assets. In prepackaged ABCs, where an immediate going concern sale will be implemented, the assignee will be involved prior to the ABC going effective. Further, in states that have adopted the common law ABC process, court procedures, requirements, and oversight are not involved. In contrast, in bankruptcy cases, the judicial process is invoked and brings with it additional uncertainty and complications, including players whose identity is unknown at the time the bankruptcy petition is filed, expense, and likely delay.

In situations where a company is burdened with debt that makes a merger or acquisition infeasible, an ABC can be the most efficient, effective, and desirable means of effectuating a favorable transaction and addressing the debt. The assignment process enables the assignee to sell the assignor’s assets free of the unsecured debt that burdened the company. Unlike bankruptcy, where the publicity for the company and its officers and directors will be negative, in an assignment, the press generally reads “assets of Oldco acquired by Newco,” instead of “Oldco files bankruptcy” or “Oldco shuts its doors.” Moreover, the assignment process removes from the board of directors and management of the troubled company the responsibility for and burden of winding down the business and disposing of the assets.

From a buyer’s perspective, acquiring a going concern business or the specific assets of a distressed entity from an Assignee in an ABC sale transaction provides some important advantages. Most sophisticated buyers will not acquire an ongoing business or substantial assets from a financially distressed entity with outstanding unsecured debt, unless the assets are cleansed either through an ABC or bankruptcy process. Such buyers are generally unwilling to subject themselves to potential contentions that the assets were acquired as part of a fraudulent transfer and/or that they are a successor to or subject to successor liability for claims against the distressed entity. Buying a going concern or specified assets from an assignee allows the purchaser to avoid these types of contentions and issues and to obtain the assets free of the assignor’s unsecured debt. Creditors of the assignor simply must submit proofs of claim to the assignee and will ultimately receive payment by the assignee from the proceeds of the assignment estate. Moreover, compared to a bankruptcy case, where numerous unknown parties (e.g., the bankruptcy trustee, the bankruptcy judge, the U.S. trustee, an unsecured creditors’ committee, and possibly others) will become part of the process and where court procedures and legal requirements come into play, a common law ABC allows for flexibility and quick action.

From the perspective of a secured creditor, in certain circumstances, instead of being responsible for conducting a foreclosure proceeding, the secured creditor may prefer to have an independent, objective third party with expertise and experience liquidating businesses of the type of the distressed entity act as an assignee. There is nothing wrong with an assignee entering into appropriate subordination agreements with the secured creditor and liquidating the assignor’s assets and turning the proceeds over to the secured creditor to the extent that the secured creditor holds valid, perfected liens on the assets that are sold.

As a common law liquidation vehicle that has been around for a very long time, ABCs have been used over the years for all different types of businesses. In the early 2000s, in particular, ABCs became an especially popular method for liquidating troubled dot-com, technology, and health-care companies. In large part, this was simply a reflection of the distressed nature of those industries. At the same time, ABCs allow for quick and flexible action that frequently is necessary in order to maximize the value that might be obtained for a business that is largely dependent on the know-how and expertise of key personnel. An ABC may provide a vehicle for the implementation of a quick transaction which can be implemented before key employees jump from the sinking ship.

The liquidation process in an ABC can take many different forms. In some instances, negotiations between the buyer and the assignee commence before the assignment is made and a prepackaged transaction is agreed on and implemented contemporaneously with the execution of the assignment. This type of turnkey sale can effectively allow the purchaser of a business to acquire the business without assuming the former owner’s unsecured debt in a manner where the business operations continue uninterrupted.

In certain instances, the assignee may operate the assignor’s business post-ABC with the intent of selling the business as a going concern even if an agreement has not been reached with a purchaser. However, the assignee must weigh the risks and costs of continuing to operate the business against the anticipated benefits to be received from a going concern sale.

In many cases, the distressed enterprise has already ceased operations prior to making the assignment or will cease its business operations at the time the ABC is entered. In these cases, the assignee may be selling the assets in bulk or may sell or license certain key assets and liquidate the other assets through auctions or other private or public liquidation sale methods. At all times, the assignee is guided by its responsibility to act in a reasonable manner designed to maximize value obtained for the assets and ultimate creditor recovery under the circumstances.

Disadvantages of an ABC

As discussed above, an ABC can be an advantageous means for a buyer to acquire assets and/or a business in financial distress. However, unlike in a bankruptcy case, because the ABC process in California is nonjudicial, there is no court order approving the sale transaction. As a result, a buyer who requires the clarity of an actual court order approving the sale will not be able to satisfy that desire through an ABC transaction. That being said, the assignee is an independent, third-party fiduciary who must agree to the transaction and is responsible for the ABC process. The buyer in an ABC transaction will have an asset purchase agreement and other appropriate ancillary documents that have been executed by the assignee.

Unlike in a formal federal bankruptcy case, executory contracts and leases cannot be assigned in an ABC without the consent of the counter party to the contract. Accordingly, if the assignment of executory contracts and/or leases is a necessary part of the transaction and, if the consent of the counter parties to the contracts and leases cannot be obtained, an ABC transaction may not be the appropriate approach. Further, ipso facto default provisions (allowing for termination, forfeiture, or modification of contract rights) based on insolvency or the commencement of the ABC are not unenforceable as they are in a federal bankruptcy case.

Secured creditor consent is generally required in the context of an ABC. There is no ability to sell free and clear of liens, as there is in some circumstances in a federal bankruptcy case, without secured creditor consent (unless the secured creditor will be paid in full from sale proceeds). Moreover, there is no automatic stay to prevent secured creditors from foreclosing on their collateral if they are not in support of the ABC. The lack of an automatic stay is generally not significant with respect to unsecured creditors since assets have been transferred to the assignee and unsecured creditors claims are against the assignor.

While there is a risk of an involuntary bankruptcy petition being filed against the assignor, experience has shown that this risk should be relatively small. Further, when an involuntary bankruptcy petition is filed, it is generally dismissed by the bankruptcy court because an alternative insolvency process (the ABC) is already underway. In the context of an out-of-court workout or liquidation, there is always the risk that an involuntary bankruptcy petition may be filed against the debtor. Such a risk is substantially less, however, in connection with an assignment for the benefit of creditors because the bankruptcy court is likely to abstain when a process (the assignment) is already in place to facilitate liquidation of the debtor’s assets and distribution to creditors. A policy is in place that favors allowing general assignments for the benefit of creditors to stand.

Distribution Scheme in ABCs

ABCs in California are governed by common law and are subject to various specific statutory provisions. In states like California, where common law (with specific statutory supplements) governs the ABC process, the process is nonjudicial. An assignee in an assignment for the benefit of creditors serves in a capacity that is analogous to a bankruptcy trustee and is responsible for liquidating the assets of the assignment estate and distributing the net proceeds, if any, to the assignor’s creditors.

Under California law, an assignee for the benefit of creditors must set a deadline for the submission of claims. Notice of the deadline must be disseminated within 30 days of the commencement of the assignment and must provide not less than 150 and not more than 180 days’ notice of the bar date. Once the assignee has liquidated the assets, evaluated the claims submitted, resolved any pending litigation to the extent necessary prior to making distribution, and is otherwise ready to make distribution to creditors, pertinent statutory provisions must be followed in the distribution process. Generally, California law ensures that taxes (both state and municipal), certain unpaid wages and other employee benefits, and customer deposits are paid before general unsecured claims.

Particular care must be taken by assignees in dealing with claims of the federal government. These claims are entitled to priority by reason of a catchall-type statute which entitles any agency of the federal government to enjoy a priority status for its claims over the claims of general unsecured creditors. In fact, the federal statute provides that an assignee paying any part of a debt of the person or estate before paying a claim of the government is liable to the extent of the payment for unpaid claims of the government. As a practical result, these payments must be prioritized above those owed to all state and local taxing agencies.

In California, there is no comprehensive priority scheme for distributions from an assignment estate like the priority scheme in bankruptcy or priority schemes under assignment laws in certain other states. Instead, California has various statutes which provide that certain claims should receive priority status over general unsecured claims, such as taxes, priority labor wages, lease deposits, etc. However, the order of priority among the various priority claims is not clear. Of course, determining the order of priority among priority claims becomes merely an academic exercise if there are sufficient funds to pay all priority claims. Secured creditors retain their liens on the collateral and are entitled to receive the proceeds from the sale of their collateral up to the extent of the amount of their claim. Thereafter, distribution in California ABCs is made in priority claims, including administrative expenses, obligations owing to the federal government, priority wage and benefit claims, state tax claims, including interest and penalties for sales and use taxes, income taxes and bank and corporate taxes, security deposits up to $900 for the lease or rental of property, or purchase of services not provided, unpaid unemployment insurance contribution, including interest and penalties, and general unsecured claims. Interest is paid on general unsecured claims only after the principal is paid for all unsecured claims submitted and allowed and only to the extent that a particular creditor is entitled under contract or judgment to assert such claim for interest.

If there are insufficient funds to pay the unsecured claims in full, then these claims will be paid pro rata. If unsecured claims are paid in full, equity holders will receive distribution in accordance with their liquidation rights. No distribution to general unsecured creditors should take place until the assignee is satisfied that all priority claims have been paid in full.

Assignments for the benefit of creditors are an alternative to the formal burial process of a Chapter 7 bankruptcy. Moreover, ABCs can be particularly useful when fast action and distressed transaction and/or industry expertise is needed in order to capture value from the liquidation of the assets of a troubled enterprise. The ABC process may allow the parties to avoid the delay and uncertainty of formal federal bankruptcy court proceedings. In many instances involving deteriorating businesses, management engages in last-ditch efforts to sell the business in the face of mounting debt. However, frequently the value of the business is diminishing rapidly as, among other things, key employees leave. Moreover, the parties interested in acquiring the business and/or assets will move forward only under circumstances where they will not be taking on the unsecured debt of the distressed entity along with its assets. In such instances, especially when the expense of a Chapter 11 bankruptcy case may be unsustainable, an assignment for the benefit of creditors can be a viable solution.

Sulmeyerkupetz

David Kupetz specializes in troubled transactions, crisis avoidance consultation, workouts, restructurings, reorganizations, bankruptcies, receiverships, assignments for the benefit of creditors, municipal debt adjustment and...

View Bio →

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Debt Assignment and Assumption Agreement

Rating: 4.7 - 23 votes

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor. The party that is assuming the debt is the new debtor; they are called the assignee.

The debt is owed to a creditor.

This document is different than a Debt Settlement Agreement , because there, the original debtor has paid back all of the debt and is now free and clear. Here, the debt still stands, but it will just be owed to the creditor by another party.

This is also different than a Debt Acknowledgment Form , because there, the original debtor is simply signing a document acknowledging their debt.

How to use this document

This document is extremely short and to-the-point. It contains just the identities of the parties, the terms of the debt, the debt amount, and the signatures. It is auto-populated with some important contract terms to make this a complete agreement.

When this document is filled out, it should be printed, signed by the assignor and the creditor, and then signed by the assignee in front of a notary. It is important to have the assignee's signature notarized, because that is the party that is taking on the debt.

Applicable law

Debt Assignment and Assumption Agreements are generally covered by the state law where the debt was originally incurred.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Other names for the document:

Agreement to Assign Debt, Agreement to Assume Debt, Assignment and Assumption of Debt, Assumption and Assignment of Debt Agreement, Debt Assignment Agreement

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Contract Assignment Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Other downloadable templates of legal documents

- Search Search Please fill out this field.

- Corporate Finance

- Corporate Debt

Assignment of Accounts Receivable: Meaning, Considerations

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Investopedia / Jiaqi Zhou

What Is Assignment of Accounts Receivable?

Assignment of accounts receivable is a lending agreement whereby the borrower assigns accounts receivable to the lending institution. In exchange for this assignment of accounts receivable, the borrower receives a loan for a percentage, which could be as high as 100%, of the accounts receivable.