- Return to Main Site

888-890-7447

Passages The International Trade Blog

The hidden expiration date on every export letter of credit.

However, another date equal in importance is referred to as the last date for presentation. The presentation period—the window of time in which the exporter must present documents—is tied to the ship date as indicated in the original transport document.

Letter of Credit Presentation Period

A letter of credit includes terminology similar to “documents must be presented within 10 days after the bill of lading date but within the validity of the letter of credit.” For example, if the shipment took place on January 1, documents must be presented no later than January 11 or the expiration date if earlier. If the expiration date is January 5, documents must be presented by January 5, not the 11th.

Some letters of credit require a presentation period of seven days, some 15, etc. If the letter of credit does not state a presentation date, the exporter has 21 days according to UCP Article 14c. Exporters should be aware of this requirement and feel confident they can work within the stated time period. If not, they should request an amendment.

Why does a letter of credit include these time requirements? The importer stipulates them because a delay in presentation can create problems. When the goods arrive at the customs entry point, the importer needs the documents to clear the goods. If not cleared in a timely manner, the goods will go into storage and incur daily charges.

With a short presentation period, the importer can force the exporter to deliver the documents to the bank quickly. Once the documents enter banking channels, they will find their way to the importer in due time for customs clearance.

An alert exporter, however, must ask several key questions:

- How quickly after shipment can the documents be assembled and presented to the bank?

- Can unusual situations cause delays?

- Can the consular's signature be obtained (for a specific country) within the time limit?

Some consulates are located in distant cities and only sign documents once a week. If the appointed day for signing documents falls on a holiday, in either country involved in the transaction, then one more week must be added to the time frame. While 10, 15 or even 21 days may seem like adequate time, it can slip away quickly.

Like what you read? Subscribe today to the International Trade Blog to get the latest news and tips for exporters and importers delivered to your inbox.

This article was first published in December 2014 and has been updated to include current information, links and formatting.

About the Author: Roy Becker

Roy Becker was President of Roy Becker Seminars based in Centennial, Colorado. His company specialized in educating companies how to mitigate the financial risk of importing and exporting. Previous to starting the training company, Roy had over 30 years experience working in the international departments of several banks where he assisted many importers and exporters with the intricate banking needs associated with international trade.

Roy served as adjunct faculty in the International MBA programs at the University of Denver and University of Colorado in Denver. He conducted seminars at the World Trade Center Denver and The Center for Financial Training Western States, and was a guest lecturer at several Denver area Universities.

Roy retired in 2021.

Subscribe to the Newsletter

Trade Finance Guide: A Quick Reference for U.S. Exporters

Learn the fundamentals of trade finance so you can turn your export opportunities into actual sales. This concise, easy-to-understand ebook was designed to help small and medium-sized U.S. exporters learn the most effective ways to facilitate payments from foreign customers.

Subscribe to the Newsletter!

Join the 33,143 other exporters and importers who get the latest news, tips and insights from international trade professionals.

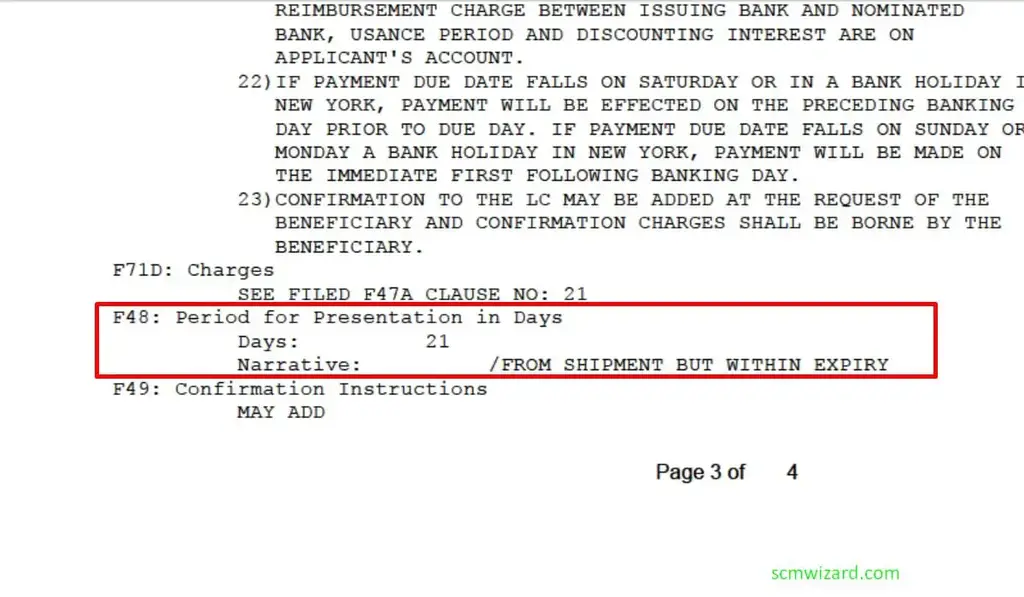

Field 48 (‘Period for presentation in days’) in Letter of Credit (L/C)

F48 is an optional field in MT700 swift message of Documentary letter of credit.

From the F44C(Latest Date of Shipment) , the countdown will start. Normally the period is up to the LC expiry date mentioned in F31D(Date and Place of Expiry).

Within this presentation period, the beneficiary submits negotiable documents mentioned in 46A(Documents Required) to the presenting bank as per instruction in F41D or F41A(Available With..By…)

The presentation can be both Electronic records or paper documents.

Do you have any thoughts about this? let me know in the comments.

You may like these posts

Field 44c latest date of shipment in lc, field 32b currency code, amount, field 43t transhipment in letter of credit, field 31c date of issue in letter of credit, field 49 confirmation instructions in letter of credit, 3 thoughts on “ field 48 (‘period for presentation in days’) in letter of credit (l/c) ”, leave a reply cancel reply.

- Bill of Lading

- Incoterms 2020

- Indian Customs Manual 2023

Difference between LC expiry and shipment date expiry

The information provided here is part of Online export import training guide

Some of you in the export import trade may get confused about the date of expiry of Letter of Credit and the date of expiry of shipment under LC transactions. What is date of expiry of Letter of Credit? What does shipment date under LC mean? Let us discuss the difference between LC expiry date and shipment expiry date under Letter of Credit transactions.

What is Shipment date expiry under Letter of Credit?

In a Letter of Credit, there will be a date of shipment of goods and date of expiry of LC. The date of shipment of goods means, the consignment has to be shipped out from seller’s place on or before the last date of shipment of letter of credit. So, the Bill of Lading date should be on or before the date of shipment mentioned on Letter of Credit as 'Shipment Date'. If letter of credit says, ‘ON BOARD’ Bill of lading, the date of ‘on board’ bill of lading should be on or before the date of ‘ON BOARD’ shipment date mentioned in the letter of credit. If letter of credit (LC) just says shipment date, then the BL date can be the date on or before the completion of export customs formalities. What is expiry date of Letter of Credit?

LC expiry date means the last date to submit the exported documents with bank for negotiation of documents. Here, the exporter need to submit all required documents with bank after export as per the guidelines mentioned in the letter of credit. Means, Letter of Credit is void if shipped goods before the date mentioned in LC for shipment, but not submitted documents for negotiation within the validity period of Letter of Credit.

Here, we have discussed about the difference between date of expirty of Letter of Credit and date of expiry of shipment date under LC transactions in international business. Do you wish to add more information about LC expiry and shipment expiry under Letter of Credit? Share below your experience in handling LC about shipment date expiry and LC expiry. Comment below your thoughts about this article - Date of expiry of LC and Date of expiry of shipments under Letter of Credit.

The above information is a part of Import Export course online

What is LC Letter of Credit in export import business

Is Received for shipment Bill of Lading sufficient for LC negotiation?

5 Tips to exporters while booking LCL shipments with a Freight Forwarder

Is Letter of Credit (LC) a safe mode of payment for an Exporter?

Is Letter of Credit LC safe for an Importer?

Is ON BOARD CERTIFICATE required for LC negotiation

Other details on how to import export

Spelling error in LC? Is wrong spelling a discrepancy under Letter of credit. Disadvantages of LC (letter of Credit) to Importer. Disadvantages of Letter of credit (LC) for Exporter Advantages of LC - letter of credit – to Importers. Advantages of Letter of Credit (LC) for exporters How Letter of Credit (LC) works Can a Bill of Lading (BL) be predated for LC negotiation? Procedures for negotiation of export documents Difference between Bank Release Order and Bank Delivery Order Excise and Customs - Click here to read complete notification under Budget 2014 How to get Export Orders? How to settle dispute in Exports and Imports? Click here to know India Trade Classification(ITC) Pre shipment bank finance to suppliers for exports through other agencies Types of export containers Measurement of export containers Export Import Policy of India 2015-20 MEIS, Merchandise Exports from India Scheme SEIS, Service Exports from India Scheme Merge your Commercial Invoice and Packing List for all your future exports Export procedures and documentation

Refund of Input Tax Credit (ITC) of GST, FAQ Migration procedures for existing VAT payers to GST online in India Refund of GST paid in India, FAQ 4 Conditions when applying for refund of Input Tax Credit (ITC) under GST Enrolling an existing VAT taxpayers at the GST Common Portal Difference between types of goods and services and types of GST 4 types of Goods and Services in India for GST rate Difference between IGST on International goods and IGST on domestic goods. Navigation controls to enroll with GST in India for existing VAT payers in India How is IGST calculated under Imports? How is IGST rate on imports treated? How to register a Digital Signature Certificate under GST in India. GST and e-Commerce Business, FAQ Definition of E-Commerce under GST How to identify the steps in enrolment process of a tax payer at the GST common portal. TDS under GST, Frequently Asked Questions Does Interest attract on GST Tax payment delay? Step by step procedure to login with GST common portal in India Mechanism of Payment of GST tax in India Levy of late fee for GST Tax returns filing in India I pay Service Tax on my services. But I am not sure how do I pay the new GST? Notice to GST return filing defaulters

Dear Sir. I have found very interesting your site. Congratulations. Please I have a question. Is about triangular business, and for LC. Let's say that A reseeves purchase order by B, who is willing to pay by LC. A pass the purchase order to C, supplier of goods. Does A, has also to issue a LC for C? As A will get paid by B's, LC. How A pays the C, supplier? Thank you in advance. |

Hi, Both contracts holds separate entity and can finalize as per mutually agreed terms either under LC,DA,DP or Advance payment. |

dear sir I am fully aware of Bill of lading expiry and LC expiry date. shall I ask one doubt ? but in the case of usance LCs , say 90 days or 150 days, what is the LC expiry date in the books of banks ? |

Irrevoable LC payment terms are as follows. 90% of total order value against the presentation of documents and balance 10% of total order value is payable within 7 days from issuance of acceptance certificate OR 90 days from the date of Transport Documents, whichever occurs first. Therefore, if the machines supplied is successfully commissioned and completion certificate is issued say on 40 days from shipment date, we can draw the balance 10% payment by say 50 days from shipment date. However, for this to happen it is necessary that the LC is valid for submission of completion certificate. In case the LC is not valid till the 90th day , we will have to wait for receipt of balance payment till the end of 90 days from shipment date even if the completion certificate is issued earlier than this date. so the expiry date of LC has got a link to the colletion of balance 10% or since the clause is there , can we get the payment evenbefore the 90th day??? |

i need your held for following question. IF ANY SHIPMENT MADE AFTER LAST DATE OF SHIPMENT AS PER LC AND DOCUMENTS SUBMITTED AT BANK WITH LC BEFORE EXPIRED DATE THEN CAN WE SAY IT IS EXPIRED LC |

Dear sir, Your website is very useful for beginners, i have a question that if there is sight LC 60 days expiry and there are three 4 shipments to be made each after fifteen days and we ship the the first shipment in time then do we get payment of first shipment? Or the payment will be done after four shipment? Thanks and regards Ali |

Hi Ali, Based on terms and conditions agreed mutually, seller is paid amount of export sales. The terms of payment agreed mutually is reflected on LC. |

my supplier requested to extend the period of presentation from 15 to 25 days. the same has been done with the change in shipment date i.e. from 15 days to 25 days from expiry of LC now the supplier requested to reverse the shipment date to 15 days from expiry.Will this possible. |

If I am submitting a l/c documents to the bank, after the latest date of shipment (NOT LC EXPIRY DATE), is it a descrepency ? Please help |

Hi Moidu, Yes, Its an LC descrepency. However, you can get approval from buyer in writing on the subject matter and proceed shipment |

Hi Moidu, Yes, Its an LC descrepency. However, you can get approval from buyer in writing on the subject matter and proceed shipment |

Dear sir, What happens in case of goods has not been reached within the expiry period of LC though the documents received. |

Please sir, what is the bill of lading expiry date, and who determine the expiry date is it the bank or the shipping company? Thanks |

Dear Sir, The article written is precise enough to understand the subject. Sir, we have received one usance letter of credit for 150 days from date of Bill of lading. My understanding is such that date of expiry of such LC can be 21 days from last date of shipment. Request to correct, if anywhere required. Regards, Himanshu |

Dear Sir, After the LC is issued, shipment can only happen after Last date of shipment on LC application, what to do ? |

Once LC is issued, shipping possible after the Last Date of Shipment mentioned? What should be done? |

Can the date between latest shipment date and LC expiry date excess more then 21 days ? |

Dear sir, please advise if applicant are agree to expiry date excess more than 21 days? |

Can you please tell maximum date of submission of documents for LC ? how many days we can receive from customer |

Dear Sir/Madam, Latest shipment date on 30/01/2016 Expiry date for LC on 21/02/2016 OBL shipped on board date is 17/02/2016. Documents submit to bank for negotiation is on 21/02/2016. Is it LC still valid or void? |

Is there a any maximum or minimum period between latest shipment date and LC expiry date. If so, what is the period. |

Dolphy, if the Letter of Credit requires presentation period of 21 days, and latest shipment date is April 1, 2016, then LC Expiry date is April 22, 2016. |

Why sellers required Lc at sight always |

Dear Sir , I shall appreciate receiving your views & advise on the below questions :--- 1. Assuming I submit all my export shipment original docs on the last day of expiry of the L/c and later bank finds some discrepancy . Can I correct the discrepancy and can my bank treat the docs submitted within the validity of L/c or after submission of corrected documents , it will be treated as documents submitted after L/c expiry ? what would be the case if I Re-submit corrected documents before expiry of the L/c ? In both cases , can the docs as presented will be treated as clean negotiation ? 2. Under a C&F Contract , I make shipment meeting all the contractual terms and obtain Original Bills of Ladings and present to the BYR under L/c or DP terms . Due to unforeseen circumstances , the cargo is not shipped to the destination from trans-shipment port by shipping line to the destination for a long time and arrival of cargo gets delayed beyond a reasonable time . Can the Buyer refuses to make payment of the shipment on this ground that cargo not arrived destination in a reasonable time or shipping line divert the cargo to another destination due to non-availability of service to final destination from trans-shipment port ? From load port the shipping line issues thru' bills of ladings . What are the option available to sellers & Buyers in those situation ? Your valuable views & advise please . Thanks & Regards Vimal Jain DUBAI - UAE |

Dear Sir, pls say exact perid of date of shipment & date of Expaire. Regards, Deepak |

Dear Sir With regards to deferred L/C, 60 days after BOL date: must the expiry date of the L/C be within the payment due date. for example expiry date of L/C is 15.12.2016, BOL date is 30.11.2016, payment due 29.01.2017. can the expiry date of the L/C be 31.12.2016? Thank you Preggie |

How importer calculate expiry date and shipment expiry date from PI? thank you so much. |

i need your held for following question. IF ANY SHIPMENT MADE AFTER LAST DATE OF SHIPMENT AS PER LC AND DOCUMENTS SUBMITTED AT BANK WITH LC BEFORE EXPIRED DATE THEN CAN WE SAY IT IS EXPIRED LC |

What happens in case if we miss the latest date of shipment and can submit the documents before LC expiry date? |

hello i have a set of document presented to bank 24th August on board date on bill of lading was 10th August the lc had one discrepency that the certificate from shipping line to be singed only by carrier and not agent we asked applicant t o delete this clause 46B the amendment was received 31st August the expiry of LC is 21st September clause 48 was not shown on lc so the bank acted on UCP 21 days from sailing the bank now calim since the amendment was received on day 22 document are stale and rejected the LC DOCUMENTS WHAT DATE IS THE LEGAL DATE OF ACCEPTANCE? |

keep it up |

Hello sir, what is meaning of Lc expiry date? this time before we have submitted documents our bank or buyer bank?, and 2nd que if we submit documents after expiry date then what should do? |

Discussion Forum

lcviews CoronAdvice #7: Dates and timelines under LCs

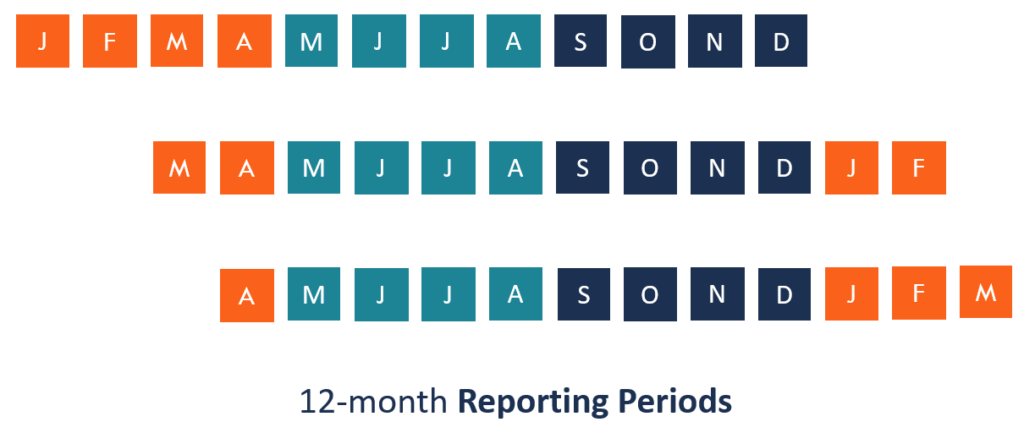

The new blogpost in the segment “lcviews CoronAdvice” aims to address one of the questions frequently asked during the clovid-19 crises: Is it possible to amend the dates and timelines applicable to a documentary credit – this in order to allow for more time; thereby contemplating delays caused by the fact that many banks work based on their contingency plans and that many countries are in different phases of lockdown.

Initially, it must be mentioned that most of the challenges facing the Trade Finance industry right now relate to LCs already issued. This means that the content of the LC – as well as the UCP 600 provisions will apply. Therefore, in order to change the applicable dates and timelines, there must be made an amendment to the LC. (For new LCs the “correct” dates and timelines can simply be inserted).

According to UCP 600 article 10(a) in order to amend an LC, agreement is required by the issuing bank, the confirming bank (if any) and the beneficiary.

This means that any date or timeline in the LC or the UCP 600 can simply be changed by way of an amendment – given the relevant parties agree to it. However, it must be stressed that although the LC; by its nature is a separate transaction from the sale or other contract (UCP 600 article 4(a)); the LC is of course based upon the agreement between the buyer and the seller. It would be common for contracts to include dates and timelines (e.g. in respect of the agreed delivery date). The dates and timelines in the LC would normally be based upon – and correspond with the dates and timelines in the agreement. This means that when considering amending dates and timelines in the LC, the content of the underlying agreement must of course be considered.

With that said, the dates and timelines potentially in scope for this are the following:

Date of expiry

UCP 600 article 10 addresses the issue of expiry; which must be read in context with how the LC is available. The outset is that an LC must state an expiry date for presentation. The expiry date is the latest date a presentation must be made – at the place where the LC is available. I.e. at the counters of the bank with which the LC is available. There are two basic scenarios:

1: Where there is a nominate bank (either specified by name – or simply “any bank”)

In such case the place for presentation is at the counters of the (or “a”) nominated bank OR at the counters of the issuing bank.

The date of expiry is the same regardless if the beneficiary makes the presentation to the nominated bank or to the issuing bank.

An example:

Issuing Bank: Bank ISS in India

Nominated Bank: Bank NOM in the UK

Applicant: IMP Trader in India

Beneficiary: EXP Trader in the UK

LC Available with Bank NOM and expires 1 May 2020 in the UK.

In such case EXP Trader (in the UK) must present the documents EITHER to Bank NOM (UK) OR to Bank ISS (India). Regardless to whom the beneficiary chooses to present, the latest date a presentation must be made is 1 May 2020.

Of course, the normal course of action would be for EXP Trader to present to Bank NOM. However, if that – for some reason – is not possible EXP Trader may need to make a direct presentation to Bank ISS. In such case, there could be a need to extend the expiry date.

Also, as mentioned above there may well be other reasons to consider extending the LC expiry date. For example, that it is not possible for EXP Trader to deliver the goods as originally agreed. However, such amendment to the LC should be aligned with the existing agreement, and there may well be a need to change the contract accordingly.

2: Where the LC is only available with the issuing bank

In such case, the place for presentation is at the counters of the issuing bank (only), and the presentation must be made to the issuing bank no later than 1 May 2020. This applies even when there is an advising bank (that is not a nominated bank) involved.

Advising Bank: Bank ADV in the UK

LC Available with Bank ISS and expires 1 May 2020 in India.

In such case the presentation must be made to Bank ISS (India). The latest date a presentation must be made is 1 May 2020.

The normal course of action would be for EXP Trader to “present” the documents to Bank ADV in due time before the expiry date, allowing Bank ADV to forward the documents (on their behalf) to Bank ISS.

As indicated, the fact that there is an advising bank does not change the fact that the presentation must be presented at the issuing bank no later than 1 May 2020.

Again, it may not possible for EXP Trader to deliver the goods as originally agreed, and therefore an amendment extending the expiry date may be considered. However, such amendment to the LC should be aligned with the existing agreement, and there may well be a need to change the agreement accordingly.

For both examples above, it is also important to consider that an extension of the expiry date could incur extra charges (e.g. issuance commission and amendment commission).

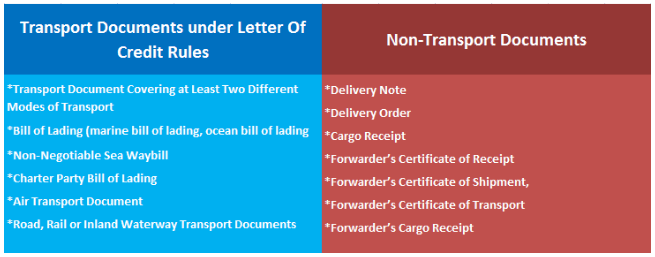

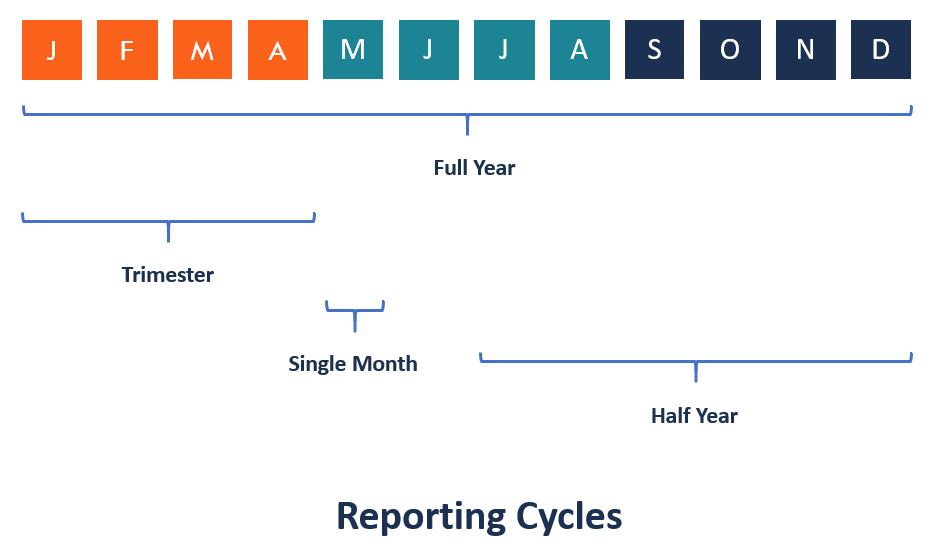

Period for presentation

UCP 600 article 14(c) addresses the period for presentation. Basically, this sub-article applies when the presentation includes a “transport document” (i.e. one of the transport documents described in UCP 600 articles 19, 20, 21, 22, 23, 24 or 25). In such case, the presentation by (or on behalf of) the beneficiary must be made not later than 21 calendar days after the date of shipment, however, not later than the expiry date of the LC (see above).

As can be seen, the default period for presentation according to UCP 600 article 14(c) is 21 days. This period is commonly modified (often reduced) in the LC. In such case it is the number of days mentioned in the LC that apply.

In a situation where there are delays, it may well take longer time than normally to obtain the documents needed to be presented under the LC. For that reason, there may well be a need, to have a longer period for presentation. In such case, there are 2 issues to consider

* The documents may potentially have a longer transit time between the seller and the buyer – and there is the risk that the goods arrive before the documents, and it may be challenging for the buyer to obtain release of the goods (e.g. because the bill of lading has not arrived timely).

* Normally an LC is structured so that the date of expiry, latest date of shipment and period for presentation are aligned. I.e.:

“Latest date of shipment” + “period for presentation” = “date of expiry”

This means that changing the “period for presentation” may trigger changes to “latest date of shipment” and “date of expiry”.

Latest date of shipment

As such the “latest date of shipment” is not defined in the UCP 600. There are, however, different places throughout the UCP 600 where “latest date of shipment” is mentioned, i.e.:

* Sub-article 29(c); latest date for shipment will not be extended as a result of the expiry date or the last day for presentation falls on a day when the bank to which presentation is to be made is closed.

* Sub-article 31(b); if the presentation consists of more than one set of transport documents, the latest date of shipment as evidenced on any of the sets of transport documents will be regarded as the date of shipment.

* Sub-article 38(g); the latest shipment date or given period for shipment is part of the data that may be changed when transferring the LC.

However, where it is primarily important in the context of this “lcviews CoronAdvice” is that all of the UCP 600 transport articles (i.e. articles 19, 20, 21, 22, 23, 24 or 25) in one form or the other define “shipment”.

Most LCs issued include a latest shipment date, which is the latest date (based on the presented transport document) that goods covered by the LC must be shipped.

LC information (excerpts):

:31D: DATE AND PLACE OF EXPIRY

200501 IN UNITED KINGDOM

:44E: PORT OF LOADING

:44F: PORT OF DISCHARGE

CHINESE PORT

:44C: LATEST DATE OF SHIPMENT

:46A: DOCUMENTS REQUIRED

+ FULL SET ON BOARD MARINE BILLS OF LADING ISSUED TO ORDER OF ISSUING BANK NOTIFY APPLICANT MARKED FREIGHT PREPAID

:48: PERIOD FOR PRESENTATION

Presentation information:

Documents presented by the beneficiary to the nominated bank: 24 April 2020

Goods shipped on board (bill of lading): 6 April 2020

The goods are shipped on board 6 April 2020, which is acceptable because the LC indicates 10 April 2020 as latest date of shipment.

As the period for presentation is 21 days, the presentation must be made no later than 27 April 2020 (i.e. 6 April 2020 + 21 days).

There may well be good reasons to consider extending “latest date of shipment”, as it may not be possible for the beneficiary to ship the goods as originally agreed. However, such amendment to the LC should be aligned with the existing underlying agreement, and there may well be a need to change the agreement accordingly. Likewise, such amendment could also trigger amendments to the date of expiry (see above).

Maturity/due date

According to UCP 600 article 6(b) an LC must state whether it is available by sight payment , deferred payment , acceptance or negotiation .

For the purpose of deferred payment and acceptance, it will apply that the payment is due a fixed period of time after a determinable date (e.g. shipment or sight).

For the purpose of negotiation, the LC may both be payable at sight – or at a future date (as determined by the LC).

For the scenarios where the LC is payable at a future date – that later date will be determined by the wording of the LC. ISBP 745 section B offers guidance in that respect.

:41A: AVAILABLE WITH

BY DEF PAYMENT

:42P: DEFERRED PAYMENT DETAILS

90 DAYS AFTER SHIPMENT

Following that, payment is due 5 July 2020 (i.e. 6 April 2020 + 90 days).

It is possible to change the deferred payment period in the LC via an amendment. However, such amendment to the LC should be aligned with the underlying agreement, and there may well be a need to change the agreement accordingly.

Timeline to determine if a presentation is complying

According to UCP 600 article 14(b) the bank (nominated bank (acting on its nomination), confirming bank and issuing bank) each have a maximum of five banking days following the day of presentation to determine if a presentation is complying. This provision is further qualified by UCP 600 article 16(d) which states that the notice of refusal (if any), must be given by telecommunication or, if that is not possible, by other expeditious means no later than the close of the fifth banking day following the day of presentation .

It is important to understand that this provision is relevant for the banks; I.e. the rationale for changing the “five days period” is for example that the involved banks have activated their contingency planes; and (as an example) the bank officers are working from home – and therefore need more time to examine the presentation and send the notice of refusal. In that respect it is important to understand that the “five days period” is actually a “ maximum of five days period”. I.e. in reality the period could be shorter. In any case, if the timeline to determine if a presentation is complying is to be changed (for the specific LC) then that is possible via an amendment.

In summing up the above, it is possible to change all timelines and dates in an LC and the UCP 600 – but it must be done using the normal way of amending LCs.

Also, it is important to bear in mind that the LC is based upon the underlying agreement between the buyer and the seller, meaning that amendments to the LC should reflect amendments to the underlying agreement.

* In order to change the applicable dates and timelines, there must be made an amendment to the LC.

* Any date or timeline in the LC or the UCP 600 can simply be changed by way of an amendment – given the relevant parties agree to it.

* When considering amending dates and timelines in the LC, the content of the underlying agreement must of course be considered.

* Changing a date or timeline, for example the “period for presentation” may trigger changes to other timelines or dates, for example “latest date of shipment” and “date of expiry”

Look out; more “lcviews CoronAdvice” to come.

Meanwhile – as always, take care of the LC – but take special care of each other during these difficult times.

Kind regards

What's Inside

Login To LCViews

Password Remember Forgot Password

Latest Blog Post

Latest single window questions.

Mr. Old Man For those who eat, sleep and breathe Letters of Credit & Cycling

How to determine the presentation period when multiple sets of bills of lading are presented.

- Share on Facebook

- Share on Twitter

- Share on Google+

- Share on Reddit

- Share on Pinterest

- Share on Linkedin

- Share on Tumblr

Dear Mr. Old Man,

Let me go straight to the point and ask you this question.

Regarding The Tenor of L/C, ISBP Paragraph 43(e) and (f) stated that:

– If more than one set of BoL is presented under one draft, the date of the LAST BoL will be used for the calculation of the maturity date.

– If a BoL showing more than one on board notation, …, the EARLIEST of these on board dates would be used for calculation of the evidences on board vessel

Correspondingly, on calculating of the latest date of shipment, ISBP Paragraph 105 stated that:

– … In the event that more than one set of BoLs are presented and incorporate different dates of shipment, the LATEST of these dates of shipment will be taken for the calculation of any presentation period.

– Nonetheless, there is NO article/paragraph stipulating how to determine the presentation date for BoL showing more than one board notations.

On Frequently asked questions under UCP 600 of Gary Collyer, the same issue has been raised but the suggested answer cannot be considered comprehensive enough.

I want to ask your opinion on this situation?

Thanks and best regards.

Thomas —————–

Dear Thomas,

I would like to note that ICC has just published a new ISBP version called ISBP 745 paragraph E19 of which can answer your question. Please find below herewith paragraph E19 ISBP 745:

a. When a credit prohibits partial shipment, and more than one set of original bills of lading are presented covering shipment from one or more ports of loading (as specifically allowed, or within a geographical area or range of ports stated in the credit), each set is to indicate that it covers the shipment of goods on the same vessel and same journey and that the goods are destined for the same port of discharge.

b. When a credit prohibits partial shipment, and more than one set of original bills of lading are presented in accordance with paragraph E19 (a) and incorporate different dates of shipment, the latest of these dates is to be used for the calculation of any presentation period and must fall on or before the latest shipment date stated in the credit.

c. When partial shipment is allowed, and more than one set of original bills of lading are presented as part of a single presentation made under one covering schedule or letter and incorporate different dates of shipment, on different vessels or the same vessel for a different journey, the earliest of these dates is to be used for the calculation of any presentation period, and each of these dates must fall on or before the latest shipment date stated in the credit.

So, I wish to answer your questions as follows:

In line with paragraphs E19 (a) and (b) ISBP 745, the latest date shall be used for calculation of the presentation period for both situations.

As ISBP 745 is silent as to the situation where a bill of lading shows more than one dated on board notation, my answer had to be based on paragraphs E19 (a) and (b). I thought the principle applied to the situation in E19 (a) and (b) could apply to the situation in question. In my opinion, paragraph E19 should have included this situation.

I hope you are now quite satisfied with my answer.

Kind regards, Mr. Old Man

- Related Articles

- More By Mr Old Man

- More In Uncategorized

D/P AT XXX DAYS AFTER BL DATE

Questions regarding bpo, negotiation with or without recourse, whether a confirming bank is a nominated bank and…, whether documents can be presented directly to the issuing bank, why is field 46a optional, where a mmtd cannot be issued in negotiable form, documents are to be presented within xx days from/after shipment date, claims payable, settling agent, franchise, excess (deductible), reimbursement claim, insurance document issued to order of the issuing bank, changing payment terms of the lc, amount of cover, lc with special payment condition, abbreviations, tolerance applicable against individual quantities, lc is transferable, another case of assignment of proceeds, authentication of corrections on bill of lading and invoice, domestic lc, why available by payment instead of available by negotiation, assignment in favour of the nominated bank, invoice not issued by the beneficiary, address of the beneficiary, certificate of origin indicating a quantity greater than that stated in the credit, lc confirmed by the first advising bank, a full set of bills of lading means a full set of original bills of lading, the name of the country need not be stated, cargo to be released with more than one bill of lading to be surrendered, counter guarantee, stamp in a language other than that required in the credit, correction and alteration, a certificate must be issued by the entity stated in the credit, documents presented directly to the issuing bank, bl and bl rider signed with different signatures, need the name of the country be stated, where original bills of lading are not required to be presented, shipped on board the pre-carriage vessel, place of availability vs place of expiry, place of presentation, when lc requires presentation of less than a full set of original bills of lading, express bill of lading, where documents under d/p are not paid, where the bl date is referred to as the date of issuance, whether sub-article 14 (c) is applicable, bill of lading dated prior to lc issuance date, căn cứ để icc quy đinh số tiền bảo hiểm tối thiểu phải là 110% trị giá cif, lc xác nhận và những tình huống xác nhận không có trong sách giáo khoa, revocable lc vs irrevocable lc, consignee on documents other than certificate of origin (updated with isbp 821), đường tranh bích họa yên khê, đừng vội vàng chia sẻ những tin tức “pha ke”.

August 5, 2013 at 11:08 pm

chippink writes:Dear Mr.Old Man,First of all, i am so sorry if i make a question to you in a wrong place, because i can not find where i can make a new article in your blog. i got the problem that the quantity shown as follows: + Invoice : 1,500 MT+ Packing list : 1,500 MT+ B/L: 1.500 MT the problem here is decimal mark. The true number here is one thousand five hundred MT and B/L also means one thousand five hundred MT. However, Based on decimal mark, if we call quantity on invoice and packing list to be one thousand five hundred MT, the B/L will read it as one point five MT. I also met another case, L/C stipulates:quanity: 15.200 MTunit price: USD2,000/MTamount: USD30,400Invoice showed quanity: 15,2 MTunit price: USD2,000/MTamount: USD30,400In this case, we can see the quantity should be 15.2 I/O 15,2, but we also can understand that is fifteen point two. Should i ignore those mistake? i haven't seen this subject on UCP. Thank you so much! And have a nice week, Mr.Old Man. ^^

mroldmanvcb

August 6, 2013 at 10:08 am

I would classify these errors as misspelling or typing errors. If they do not affect the meaning of the figure or make us misunderstanding, then they do not make the document discrepant.

April 21, 2016 at 11:06 pm

Please help us to clarify the issue relating to determine the presentation period: In case LC prohibits partial shipment, however, more than one set of BL presented as part of a single presentation made under one covering letter show the discrepancy – partial shipment. It means: different date of shipment, on different vessel. How can we determine the presentation period

April 22, 2016 at 3:39 pm

As indicated in the covering schedule you can refuse the documents stating the discrepancy “partial shipment”. What if LC prohibits partial shipment and more than one set of original bills of lading are presented as part of a single presentation made under one covering schedule or letter and incorporate different dates of shipment, on different vessels or the same vessel for a different journey?

This situation is not covered in ISBP, but I think ISBP 745 para. 19 (c) can be applied, i.e. the earliest of these dates is to be used for the calculation of presentation period.

June 22, 2016 at 10:51 am

Revisiting the issue – determining the latest presentation date in case of multiple bill of ladings, we have concerns: 1. LC prohibits partial shipment, multiple bill of ladings show: different date of shipment, different vessels. We know that in this case late shipment is effected–> this is a discrepancy. But which date we define the latest presentation date: earliest or latest date.

2. lc allows partial shipment, multiple bill of ladings show: different date of shipment, same vessels, same destination. which date we define the latest presentation date: earliest or latest date.

In my opinion which date to calculate is based on terms and conditions of lc which allows partial shipment or no. In case lc prohibit partial shipment, even multiple bill of lading shows partial shipment effected, we still use the latest date of shipment to calculate???. Similiar to second case, it will be the earliest date. Is it correct

Can you advise any ICC commission relating to the issue

Thanks and best regards

June 23, 2016 at 10:39 am

Your question makes me think much!!!

My view is as follows:

1. Shipment on more than one vessel is a partial shipment. Case No. 1 is not covered by ISBP E19. So in addition to the discrepancy “partial shipment”, you may cite the discrepancy “late presentation” based on the any shipment date which constitutes late presentation. I don’t think the presenter can reject the discrepancy.

2. Shipment on different dates but on the same vessel is not a partial shipment. So, based on ISBP E19 (b), the latest of the shipment dates is to be used for calculation of the presentation period.

I don’t think ISBP E19 (b) is apopropriate for Case No. 2.

Vivek Singh

May 17, 2017 at 7:08 am

Hi Mr. Old Man,

Further to your comment on CASE 2 above, since LC allows partial shipment ISBP 745 para E19 (c) will apply, the earliest date will be used for calculation of maturity date.

Regards, Vivek

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Mr. Old Man trả lời câu hỏi liên quan đến số tiền bảo hiểm. Căn cứ nào để ICC quy định tai…

Recent Posts

Open confirmation vs silent confirmation, ucp 600 articles 30 and 31, field 72 (sender to receiver information) of mt 103, transferring bank s liability under transferred lc, to order bill of lading and endorsement, mr old man: hi, i must say that the lc stipulation with regard to period for presentation is..., iqbal moolla: dear mr old man. i find your comments most valuable. we are having a debate and..., faisal zaheer: hi mr. old man. can we call 2nd confirmation as silent confirmation or not..., mr old man: hi, what i understand from your description is that bafl india added its confirm..., popular posts, partial shipments under sub-article 31 (b), whether mt999 is an authenticated swift message, payment lc vs negotiation lc, early presentation.

QUESTION Dear Mr Old Man, I am Dang from Vietnam Prosperity bank. I know …

NỮ CUA RƠ ĐẦU TIÊN CỦA VIỆT NAM HOÀN THÀNH 549 KM SAU 24 GIỜ ĐẠP XE LIÊN TỤC

Bắt được quái vật sông hoài, where 1/3 original bill of lading is to be sent directly to the issuing bank, signed by handwriting v. manually signed, where the draft is drawn on the confirming bank, can banks in vietnam issue standby l/cs.

- Board index

Presentation Period "Within the validity of the LC"

Post by CSNg » Sun May 27, 2012 8:58 am

Presentation Period

Post by Sabrina » Sun May 27, 2012 10:23 am

Return to “Letter of Credit Forum”

- All times are UTC+06:00

- Delete cookies

Ideas and insights from Harvard Business Publishing Corporate Learning

Powerful and Effective Presentation Skills: More in Demand Now Than Ever

When we talk with our L&D colleagues from around the globe, we often hear that presentation skills training is one of the top opportunities they’re looking to provide their learners. And this holds true whether their learners are individual contributors, people managers, or senior leaders. This is not surprising.

Effective communications skills are a powerful career activator, and most of us are called upon to communicate in some type of formal presentation mode at some point along the way.

For instance, you might be asked to brief management on market research results, walk your team through a new process, lay out the new budget, or explain a new product to a client or prospect. Or you may want to build support for a new idea, bring a new employee into the fold, or even just present your achievements to your manager during your performance review.

And now, with so many employees working from home or in hybrid mode, and business travel in decline, there’s a growing need to find new ways to make effective presentations when the audience may be fully virtual or a combination of in person and remote attendees.

Whether you’re making a standup presentation to a large live audience, or a sit-down one-on-one, whether you’re delivering your presentation face to face or virtually, solid presentation skills matter.

Even the most seasoned and accomplished presenters may need to fine-tune or update their skills. Expectations have changed over the last decade or so. Yesterday’s PowerPoint which primarily relied on bulleted points, broken up by the occasional clip-art image, won’t cut it with today’s audience.

The digital revolution has revolutionized the way people want to receive information. People expect presentations that are more visually interesting. They expect to see data, metrics that support assertions. And now, with so many previously in-person meetings occurring virtually, there’s an entirely new level of technical preparedness required.

The leadership development tools and the individual learning opportunities you’re providing should include presentation skills training that covers both the evergreen fundamentals and the up-to-date capabilities that can make or break a presentation.

So, just what should be included in solid presentation skills training? Here’s what I think.

The fundamentals will always apply When it comes to making a powerful and effective presentation, the fundamentals will always apply. You need to understand your objective. Is it strictly to convey information, so that your audience’s knowledge is increased? Is it to persuade your audience to take some action? Is it to convince people to support your idea? Once you understand what your objective is, you need to define your central message. There may be a lot of things you want to share with your audience during your presentation, but find – and stick with – the core, the most important point you want them to walk away with. And make sure that your message is clear and compelling.

You also need to tailor your presentation to your audience. Who are they and what might they be expecting? Say you’re giving a product pitch to a client. A technical team may be interested in a lot of nitty-gritty product detail. The business side will no doubt be more interested in what returns they can expect on their investment.

Another consideration is the setting: is this a formal presentation to a large audience with questions reserved for the end, or a presentation in a smaller setting where there’s the possibility for conversation throughout? Is your presentation virtual or in-person? To be delivered individually or as a group? What time of the day will you be speaking? Will there be others speaking before you and might that impact how your message will be received?

Once these fundamentals are established, you’re in building mode. What are the specific points you want to share that will help you best meet your objective and get across your core message? Now figure out how to convey those points in the clearest, most straightforward, and succinct way. This doesn’t mean that your presentation has to be a series of clipped bullet points. No one wants to sit through a presentation in which the presenter reads through what’s on the slide. You can get your points across using stories, fact, diagrams, videos, props, and other types of media.

Visual design matters While you don’t want to clutter up your presentation with too many visual elements that don’t serve your objective and can be distracting, using a variety of visual formats to convey your core message will make your presentation more memorable than slides filled with text. A couple of tips: avoid images that are cliched and overdone. Be careful not to mix up too many different types of images. If you’re using photos, stick with photos. If you’re using drawn images, keep the style consistent. When data are presented, stay consistent with colors and fonts from one type of chart to the next. Keep things clear and simple, using data to support key points without overwhelming your audience with too much information. And don’t assume that your audience is composed of statisticians (unless, of course, it is).

When presenting qualitative data, brief videos provide a way to engage your audience and create emotional connection and impact. Word clouds are another way to get qualitative data across.

Practice makes perfect You’ve pulled together a perfect presentation. But it likely won’t be perfect unless it’s well delivered. So don’t forget to practice your presentation ahead of time. Pro tip: record yourself as you practice out loud. This will force you to think through what you’re going to say for each element of your presentation. And watching your recording will help you identify your mistakes—such as fidgeting, using too many fillers (such as “umm,” or “like”), or speaking too fast.

A key element of your preparation should involve anticipating any technical difficulties. If you’ve embedded videos, make sure they work. If you’re presenting virtually, make sure that the lighting is good, and that your speaker and camera are working. Whether presenting in person or virtually, get there early enough to work out any technical glitches before your presentation is scheduled to begin. Few things are a bigger audience turn-off than sitting there watching the presenter struggle with the delivery mechanisms!

Finally, be kind to yourself. Despite thorough preparation and practice, sometimes, things go wrong, and you need to recover in the moment, adapt, and carry on. It’s unlikely that you’ll have caused any lasting damage and the important thing is to learn from your experience, so your next presentation is stronger.

How are you providing presentation skills training for your learners?

Manika Gandhi is Senior Learning Design Manager at Harvard Business Publishing Corporate Learning. Email her at [email protected] .

Let’s talk

Change isn’t easy, but we can help. Together we’ll create informed and inspired leaders ready to shape the future of your business.

© 2024 Harvard Business School Publishing. All rights reserved. Harvard Business Publishing is an affiliate of Harvard Business School.

- Privacy Policy

- Copyright Information

- Terms of Use

- About Harvard Business Publishing

- Higher Education

- Harvard Business Review

- Harvard Business School

We use cookies to understand how you use our site and to improve your experience. By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

Cookie and Privacy Settings

We may request cookies to be set on your device. We use cookies to let us know when you visit our websites, how you interact with us, to enrich your user experience, and to customize your relationship with our website.

Click on the different category headings to find out more. You can also change some of your preferences. Note that blocking some types of cookies may impact your experience on our websites and the services we are able to offer.

These cookies are strictly necessary to provide you with services available through our website and to use some of its features.

Because these cookies are strictly necessary to deliver the website, refusing them will have impact how our site functions. You always can block or delete cookies by changing your browser settings and force blocking all cookies on this website. But this will always prompt you to accept/refuse cookies when revisiting our site.

We fully respect if you want to refuse cookies but to avoid asking you again and again kindly allow us to store a cookie for that. You are free to opt out any time or opt in for other cookies to get a better experience. If you refuse cookies we will remove all set cookies in our domain.

We provide you with a list of stored cookies on your computer in our domain so you can check what we stored. Due to security reasons we are not able to show or modify cookies from other domains. You can check these in your browser security settings.

We also use different external services like Google Webfonts, Google Maps, and external Video providers. Since these providers may collect personal data like your IP address we allow you to block them here. Please be aware that this might heavily reduce the functionality and appearance of our site. Changes will take effect once you reload the page.

Google Webfont Settings:

Google Map Settings:

Google reCaptcha Settings:

Vimeo and Youtube video embeds:

You can read about our cookies and privacy settings in detail on our Privacy Policy Page.

What Is The 10/20/30 Rule For Presentations And Why It's Important For Your Team

Presentations are an integral part of team workflow. From internal communications and reporting, to client-facing proposals and pitches, presentations keep everyone on the same page. Or in this case, on the same slide.

While collaboration is great, having too many cooks in the kitchen can make things messy. In regards to presentations, it’s important to have brand guidelines and rules in place to ensure all company decks are consistent and professional. In Beautiful.ai, our Team plan helps team members collaborate with content management and branding control settings in place so that less design-savvy departments can’t make a mess of a deck. But still, your team might need additional rules to help them achieve the most effective (and efficient) deck possible.

One of our favorite standards to follow is Guy Kawasaki’s 10/20/30 presentation rule . Not sure what we’re talking about? Let us elaborate.

What is the 10/20/30 rule for presentations?

The ever-popular 10/20/30 rule was coined by Guy Kawasaki, a Silicon-Valley based author, speaker, entrepreneur, and evangelist. Kawasaki suffers from Ménière’s disease which results in occasional hearing loss, tinnitus (a constant ringing sound), and vertigo— something that he suspects can be triggered by boring presentations (among other medically-proven things). While he may have been kidding about presentations affecting his Ménière’s, it did inspire him to put an end to snooze-worthy pitches once and for all. As a venture capitalist, he’s no stranger to entrepreneurship, pitches, and everything in between. We’d be willing to bet that he’s heard his fair share of pitches that have fallen on deaf ears (almost literally, in his case).

To save the venture capital community from death-by-PowerPoint, he evangelized the 10/20/30 rule for presentations which states that “a presentation should have ten slides, last no more than twenty minutes, and contain no font smaller than thirty points.”

Why it’s important

Because we’re passionate about our own stories, we’d like to think that our audience will feel the same way. Unfortunately, that’s not always the case. You could be presenting the most groundbreaking topic, to the most interested audience, and you still might lose people to distractions or boredom. Kawasaki’s 10/20/30 rule ensures that your presentation is legible and concise, making it more retainable, resulting in bigger wins for your team.

You’ve heard us say that less is more when it comes to presentations, and Kawasaki’s rule really drives that point home. You can’t expect your audience to comprehend (and remember) more than 10 concepts from one meeting, so keeping your presentation to 10 slides is the sweet spot. Each slide should focus on its own key takeaway, and it should be clear to the audience what you want them to learn from the presentation. While Kawasaki applies this to the venture capitalist world— and the 10 slides you absolutely need in your pitch — this is a good rule of thumb for internal meetings, proposals, and sales decks, too.

When was the last time you sat through a 90-minute presentation and thought, “this is great, I’m going to remember everything.” That’s a rhetorical question, but it’s probably safe to assume the answer is never. It’s normal for people to lose focus, get distracted, or run through their to-do list in their head while watching a presentation, and it has nothing to do with you or your topic. To keep your audience engaged and interested, keep it short and sweet. Regardless of the time you have blocked out for the meeting, your team should aim to keep their presentation under 20 minutes. If there’s time leftover, use that for discussion to answer questions and drive your point home.

30 Point font

If your audience has to strain their eyes to read your slides, they probably won’t bother to read them at all. Regardless of the age of your audience, no one wants to squint their way through a 20-minute presentation. Kawasaki’s rule of thumb is to keep all text to 30 point font or bigger. Of course, the bigger the font, the less text you’ll be able to fit. This is a good exercise to decide what information you really need on the slide, and what you can do without. By making your slides more legible for your audience, you’re encouraging them to follow along. Additionally, being intentional about what your team includes on each slide helps the audience know exactly what you want them to pay attention to in the presentation.

Applying the 10/20/30 presentation rule in Beautiful.ai

Now that you know what Guy Kawasaki’s 10/20/30 rule is, let’s apply it to your next team presentation.

In Beautiful.ai, our pre-built presentation templates make it easy for you to start inspired. Simply browse our inspiration gallery, curated by industry experts, pick the template that speaks to you and customize it with your own content. Most of our deck templates are well within the 10 slide standard, so you’ll be on the right track (the Kawasaki way).

Once you’re in the deck, our Smart Slides handle the nitty gritty design work so that you don’t have to. Changing the font size is easy, and our design AI will let you know if the size is too big or too long for the space on the slide. You can choose your favorite (legible) font when customizing your presentation theme, and that font will be applied to each slide throughout the deck for a cohesive and consistent look.

Of course, it’s all for naught if you don’t practice. We recommend doing a few dry runs in the mirror, or in front of your dog, to get the timing of your presentation right. Remember, 20 minutes is the magic number here.

Jordan Turner

Jordan is a Bay Area writer, social media manager, and content strategist.

Recommended Articles

Effective use of presenter notes to improve the flow of your presentations, six things you might not think about when presenting (but you should), a virtual meetings specialist shares how to pitch yourself in a remote world, 6 creative presentation tools to make your presentation more engaging.

Presentation Tips

How to Manage Your Time During a Presentation

You’ve been offered a 60-minute timeslot to present to a group of stakeholders but have 90 minutes of content you want to cover — or worse yet, only 30 minutes. How do you make your message resonate with your audience while not feeling rushed or pressed for time? We offer our best tips for managing your time during a presentation while keeping your audience engaged and talking points heard.

Rehearse and then rehearse again

At a minimum, you should be practicing your presentation between five and 10 times. The goal is not to repeat the same dialogue word for word each time but rather find ways to say something differently or more succinctly each time. You’ll want to not only figure out how long each slide will take to cover, but also when and where to pivot if things don’t go as planned. Stick to the rule of thirds: Spend one-third of your time planning, one-third designing, and one-third rehearsing.

Be ready to cut it short

Life happens, especially when others are in control. Maybe participants are late getting back from a session break, the presenter before you runs long, or the inevitable technical issue happens. If you outline your presentation with key points and sub-points, you should be able to skip along more quickly by only covering the key points when short on time. What’s more, it’s better to engage your audience and encourage questions throughout than finish the presentation. By coming across as the expert in the room, you open the door to scheduling time at a later date with those who want to discuss points not covered during the allotted time.

Arrive early

The best way to avoid the unavoidable is to show up early to your designated location so setup doesn’t factor into your presentation time, and if it doesn’t take that long, give that time to the next presenter for their setup. Simply put, if you’re arriving or finishing on time, you’re running late. Plus, the added bonus of arriving early is you get to know your audience a little bit and find out what’s at the top of their mind. These are golden moments you can integrate into your presentation.

Be realistic

During rehearsal, you’ll quickly get a sense if your presentation is too long or too short. Be realistic about your personal speaking habits. Do you tend to speed up when you’re actually presenting? Do you pause a lot? Do you know if this audience loves to ask questions? Consider those real-world situations as you try to edit your deck. Some extra tips: Don’t linger on a slide for too long; make your point and move on to keep your energy high. Along the same lines, don’t try and cram everything you know into the presentation. Stick to your key points and anecdotes to make sure people are really absorbing the content. Think quality, not quantity.

Never count on a clock being in the room to manage your time in the moment of your presentation. Have your phone (silenced, of course) on the podium ready to glance at, appoint someone in the back of the room to give you cues when you are running out of time, or even discretely glance at your watch while taking a sip of water. Even though you’ve rehearsed enough to know how the time will pan out, taking an obvious break to check the time can be a big distraction.

What time constraints do you run into when making a presentation?

presentation period

- + Create New Flashcard

immediate famil...

Payment terms, accounting conc..., financial manag..., letter of credi..., private limited....

Stale Bill of Lading – Meaning, Example, Importance, and More

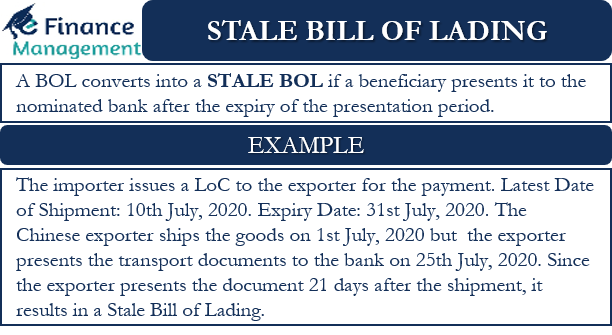

A Stale Bill of Lading is a unique type of bill of lading. As the name suggests, stale means expired, time period or date is over. Therefore, a normal Bill of Lading converts into a Stale Bill of Lading if a beneficiary presents it to the nominated bank after the expiry of the presentation period. The nominated bank could either be a Supplier’s Bank, Discounting Bank, Negotiating Bank, or Buyer’s Bank.

Stale Bill of Lading – More Details

As per the letter of credit (LoC) rules, a party must present the transport documents to a specific bank within 21 days from the date of shipment. Though the maximum time allowed is before the expiry date of LoC, the presentation time is usually 21 days. Even if the beneficiary presents the transport documents after the expiry date of LOC, then also the BOL will be called Stale BOL.

- Stale Bill of Lading – More Details

Example of Stale Bill of Lading

Importance of stale bill of lading, final words.

A Bill of Lading is part of the transport documents covering the transport of goods by sea. So, the beneficiary needs to present it to the nominated bank within 21 days of the shipment date. If the beneficiary fails to do so, it results in a late presentation discrepancy. And the Bill of Lading becomes the Stale Bill of Lading.

The presentation period usually is 21 days. Though the presentation period is usually 21 days, an importer may specify any other number of days. If an importer specifies the presentation days, then the exporter will have to comply with it. If not, the BOL will get Stale, and the bank may not accept it, and the payment is at stake.

Also Read: To Order Bill of Lading – Meaning, Importance, Types, and More

Let us understand the concept of Stale BOL with the help of a simple example.

Suppose a Chinese exporter enters into a contract with a U.S. importer for the sale of mobile chips. And the importer issues a LOC (Letter of Credit) in favor of the exporter towards the payment of those mobile chips .

The LoC includes the following details:

Latest Date of Shipment: 10 th July 2020. ( An exporter needs to ensure that goods or shipped on or before the Latest Date of Shipment)

Expiry Date: 31 st July 2020

Presentation Period: 21 days after shipment but within the LoC expiry date

The Chinese exporter ships the goods on 1 st July 2020, and the same date is there on the Bill of Lading. However, the exporter presents the transport documents to the bank on 25 th July 2020.

Since the exporter presents the document after 21 days of shipment, it results in a Stale Bill of Lading. This leads to late presentation discrepancies.

Now we know what a Stale BOL is, but what’s the importance of stale BOL, or why the bank won’t accept BOL after a set time period.

Also Read: Soiled Bill of Lading – Meaning, How to Prevent and More

As we know that a Stale BOL is one that reaches the bank late. It means the BOL reaches the bank so late that it gets impossible for the presenting bank to send the BOL to the importer’s place on or before the shipment reaches the final destination. Naturally, if the bank gets the BOL late, it would get even late by the time it reaches the importer’s destination.

So, a bank can reject the BOL in such a case.

A Stale BOL is not something that comes from the carrier but rather a normal BOL that converts into Stale due to the negligence of the exporter. Thus, it is important that the exporter is careful about the presentation date. And, the exporter must present the BOL before the expiry date so as to get the payment timely. And avoid BOL becoming stale.

Visit Bill of Lading and its Types for more details.

RELATED POSTS

- Bill of Lading and its Types

- Through Bill of Lading – Meaning, Benefits and More

- Straight Bill of Lading

- Clean Bill of Lading

- Types of Ocean Bill of Lading

Sanjay Bulaki Borad

MBA-Finance, CMA, CS, Insolvency Professional, B'Com

Sanjay Borad, Founder of eFinanceManagement, is a Management Consultant with 7 years of MNC experience and 11 years in Consultancy. He caters to clients with turnovers from 200 Million to 12,000 Million, including listed entities, and has vast industry experience in over 20 sectors. Additionally, he serves as a visiting faculty for Finance and Costing in MBA Colleges and CA, CMA Coaching Classes.

Leave a Comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Sign me up for the newsletter!

Prior Period Adjustments

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on April 01, 2024

Fact Checked

Why Trust Finance Strategists?

Table of Contents

Prior period adjustments are the transactions that relate to an earlier accounting period but that were not determinable by management in the earlier period.

Explanation

Under the all-inclusive concept of income , with a few exceptions, all items of profit and loss recognized during the period are included in net income for the period.

These exceptions mainly relate to prior period adjustments and are accounted for by an adjustment to the beginning balance of retained earnings .

There has been, however, considerable controversy about what causes an event to qualify as a prior period adjustment.

Only two events are considered prior period adjustments:

- Correction of an error in the financial statements of a prior period.

- Adjustments that result from the realization of income tax benefits of pre-acquisition operating loss carryforwards of purchased subsidiaries.

Because the realization of tax benefits is a specialized topic, we will examine only prior adjustments that relate to error corrections.

Occasionally, a firm will discover a material error in a prior year’s financial statements. However, material errors are very rare, especially when a firm’s financial statements are audited by a CPA firm.

When they do occur and are discovered, the manner in which the error is corrected depends on whether the firm publishes single-year or comparative financial statements and on the year in which the error was made.

When single-year statements are published, the error is corrected by adjusting the beginning balance of retained earnings on the retained earnings statement.

To demonstrate accounting for prior period adjustments in a single-year statement, we will assume that during the audit of its 2019 statements, the Mondrian Corporation discovered that depreciation in 2018 had been understated by $100,000, ignoring taxes .

Because this is a material error, a prior period adjustment is required. The following journal entry is made at year-end to correct this error:

The 2019 statement of retained earnings would appear as follows:

In addition, the prior period adjustment is explained in the footnotes to the financial statement.

When comparative financial statements are presented, the procedure is different.

If the error is in an earlier financial statement that is being presented for comparative purposes, that statement should be revised to correct the error.

As a result, net income will be corrected, and after that corrected net income figure is reflected on the retained earnings statement, no further adjustment is required.

If the error is in a year for which the financial statements are not being presented, the correction is made through a prior period adjustment to the earliest retained earnings balance presented.

Prior Period Adjustments FAQs

What is the purpose of a prior period adjustment.

A prior period adjustment is used to adjust financial statements from a previous accounting period to reflect changes or corrections that were not recorded in the original accounting period. This helps ensure that all financial information is reported accurately and consistently over time.

How are prior period adjustments classified?

Prior period adjustments are typically classified as either correcting adjustments or non-correcting adjustments, depending on the type of change being made. Correcting adjustments include changes related to errors or misstatements from prior periods, while non-correcting adjustments are typically related to new information or changes in estimates for existing transactions.

Who determines if a prior period adjustment is necessary?

Generally, the responsibility of determining if an adjustment is necessary falls to management or external auditors. They will review the financial statements and determine if any changes need to be made that were not reflected in the original accounting period.

How do prior period adjustments affect net income?

Prior period adjustments can either increase or decrease net income depending on the type of adjustment being made. Correcting adjustments typically result in a decrease in net income, while non-correcting adjustments usually increase net income.

What are some examples of prior period adjustments?

Examples of correcting prior period adjustments include changes related to errors or misstatements from past accounting periods, such as misclassifying an expense as a revenue item. Examples of non-correcting prior period adjustments include changes related to new information or changes in estimates for existing transactions, such as revising the estimated useful life of a fixed asset.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Our Services

- Financial Advisor

- Estate Planning Lawyer

- Insurance Broker

- Mortgage Broker

- Retirement Planning

- Tax Services

- Wealth Management

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.