You are using an unsupported browser ×

You are using an unsupported browser. This web site is designed for the current versions of Microsoft Edge, Google Chrome, Mozilla Firefox, or Safari.

Site Feedback

The Office of the Federal Register publishes documents on behalf of Federal agencies but does not have any authority over their programs. We recommend you directly contact the agency associated with the content in question.

If you have comments or suggestions on how to improve the www.ecfr.gov website or have questions about using www.ecfr.gov, please choose the 'Website Feedback' button below.

If you would like to comment on the current content, please use the 'Content Feedback' button below for instructions on contacting the issuing agency

Website Feedback

- Incorporation by Reference

- Recent Updates

- Recent Changes

- Corrections

- Reader Aids Home

- Using the eCFR Point-in-Time System

- Understanding the eCFR

- Government Policy and OFR Procedures

- Developer Resources

- My Subscriptions

- Sign In / Sign Up

Hi, Sign Out

The Electronic Code of Federal Regulations

Enhanced content :: cross reference.

Enhanced content is provided to the user to provide additional context.

Navigate by entering citations or phrases (eg: suggestions#fillExample" class="example badge badge-info">1 CFR 1.1 suggestions#fillExample" class="example badge badge-info">49 CFR 172.101 suggestions#fillExample" class="example badge badge-info">Organization and Purpose suggestions#fillExample" class="example badge badge-info">1/1.1 suggestions#fillExample" class="example badge badge-info">Regulation Y suggestions#fillExample" class="example badge badge-info">FAR ).

Choosing an item from citations and headings will bring you directly to the content. Choosing an item from full text search results will bring you to those results. Pressing enter in the search box will also bring you to search results.

Background and more details are available in the Search & Navigation guide.

- Title 48 —Federal Acquisition Regulations System

- Chapter 1 —Federal Acquisition Regulation

- Subchapter H —Clauses and Forms

- Part 52 —Solicitation Provisions and Contract Clauses

- Subpart 52.2 —Text of Provisions and Clauses

Enhanced Content - Table of Contents

The in-page Table of Contents is available only when multiple sections are being viewed.

Use the navigation links in the gray bar above to view the table of contents that this content belongs to.

Enhanced Content - Details

40 U.S.C. 121(c) ; 10 U.S.C. chapter 4 and 10 U.S.C. chapter 137 legacy provisions (see 10 U.S.C. 3016 ); and 51 U.S.C. 20113 .

48 FR 42478 , Sept. 19, 1983, unless otherwise noted.

Enhanced Content - Print

Generate PDF

This content is from the eCFR and may include recent changes applied to the CFR. The official, published CFR, is updated annually and available below under "Published Edition". You can learn more about the process here .

Enhanced Content - Display Options

The eCFR is displayed with paragraphs split and indented to follow the hierarchy of the document. This is an automated process for user convenience only and is not intended to alter agency intent or existing codification.

A separate drafting site is available with paragraph structure matching the official CFR formatting. If you work for a Federal agency, use this drafting site when drafting amendatory language for Federal regulations: switch to eCFR drafting site .

Enhanced Content - Subscribe

Subscribe to: 48 CFR 52.210-1

Enhanced Content - Timeline

- 12/06/2021 view on this date view change introduced

- 11/04/2021 view on this date view change introduced compare to most recent

- 6/05/2020 view on this date view change introduced compare to most recent

- 5/06/2020 view on this date view change introduced compare to most recent

Enhanced Content - Go to Date

Enhanced content - compare dates, enhanced content - published edition.

View the most recent official publication:

- View Title 48 on govinfo.gov

- View the PDF for 48 CFR 52.210-1

These links go to the official, published CFR, which is updated annually. As a result, it may not include the most recent changes applied to the CFR. Learn more .

Enhanced Content - Developer Tools

This document is available in the following developer friendly formats:

- Hierarchy JSON - Title 48

- Content HTML - Section 52.210-1

- Content XML - Section 52.210-1

Information and documentation can be found in our developer resources .

eCFR Content

The Code of Federal Regulations (CFR) is the official legal print publication containing the codification of the general and permanent rules published in the Federal Register by the departments and agencies of the Federal Government. The Electronic Code of Federal Regulations (eCFR) is a continuously updated online version of the CFR. It is not an official legal edition of the CFR.

52.210-1 Market Research.

As prescribed in 10.003, insert the following clause:

Market Research (NOV 2021)

(a) Definition. As used in this clause—

Commercial product, commercial service, and nondevelopmental item have the meaning contained in Federal Acquisition Regulation (FAR) 2.101.

(b) Before awarding subcontracts for other than commercial acquisitions, where the subcontracts are over the simplified acquisition threshold, as defined in FAR 2.101 on the date of subcontract award, the Contractor shall conduct market research to—

(1) Determine if commercial products, commercial services, or, to the extent commercial products suitable to meet the agency's needs are not available, nondevelopmental items are available that—

(i) Meet the agency's requirements;

(ii) Could be modified to meet the agency's requirements; or

(iii) Could meet the agency's requirements if those requirements were modified to a reasonable extent; and

(2) Determine the extent to which commercial products, commercial services, or nondevelopmental items could be incorporated at the component level.

(End of clause)

[ 76 FR 14565 , Mar. 16, 2011, as amended at 85 FR 27092 , May 6, 2020; 86 FR 61032 , Nov. 4, 2021]

Reader Aids

Information.

- About This Site

- Legal Status

- Accessibility

- No Fear Act

- Continuity Information

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

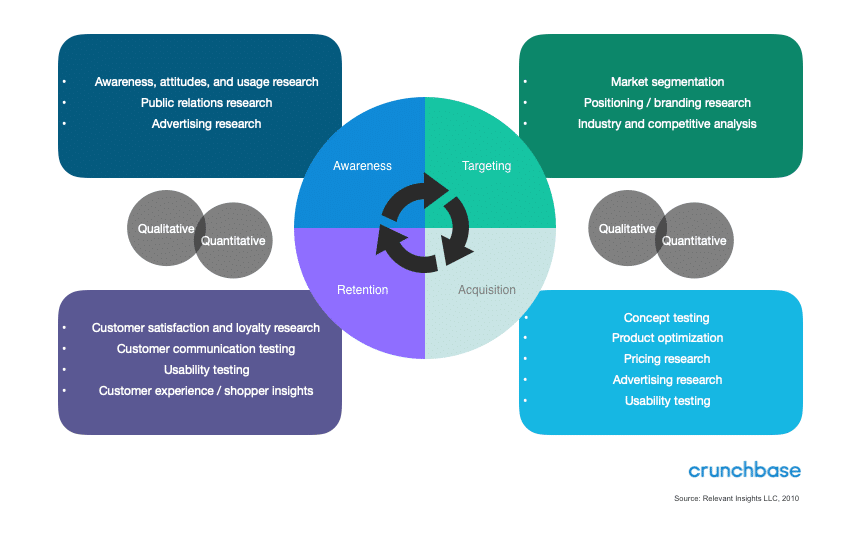

Market research definition

Market research – in-house or outsourced, market research in the age of data, when to use market research.

- Types of market research

Different types of primary research

How to do market research (primary data), how to do secondary market research, communicating your market research findings, choose the right platform for your market research, try qualtrics for free, the ultimate guide to market research: how to conduct it like a pro.

27 min read Wondering how to do market research? Or even where to start learning about it? Use our ultimate guide to understand the basics and discover how you can use market research to help your business.

Market research is the practice of gathering information about the needs and preferences of your target audience – potential consumers of your product.

When you understand how your target consumer feels and behaves, you can then take steps to meet their needs and mitigate the risk of an experience gap – where there is a shortfall between what a consumer expects you to deliver and what you actually deliver. Market research can also help you keep abreast of what your competitors are offering, which in turn will affect what your customers expect from you.

Market research connects with every aspect of a business – including brand , product , customer service , marketing and sales.

Market research generally focuses on understanding:

- The consumer (current customers, past customers, non-customers, influencers))

- The company (product or service design, promotion, pricing, placement, service, sales)

- The competitors (and how their market offerings interact in the market environment)

- The industry overall (whether it’s growing or moving in a certain direction)

Free eBook: 2024 market research trends report

Why is market research important?

A successful business relies on understanding what like, what they dislike, what they need and what messaging they will respond to. Businesses also need to understand their competition to identify opportunities to differentiate their products and services from other companies.

Today’s business leaders face an endless stream of decisions around target markets, pricing, promotion, distribution channels, and product features and benefits . They must account for all the factors involved, and there are market research studies and methodologies strategically designed to capture meaningful data to inform every choice. It can be a daunting task.

Market research allows companies to make data-driven decisions to drive growth and innovation.

What happens when you don’t do market research?

Without market research, business decisions are based at best on past consumer behavior, economic indicators, or at worst, on gut feel. Decisions are made in a bubble without thought to what the competition is doing. An important aim of market research is to remove subjective opinions when making business decisions. As a brand you are there to serve your customers, not personal preferences within the company. You are far more likely to be successful if you know the difference, and market research will help make sure your decisions are insight-driven.

Traditionally there have been specialist market researchers who are very good at what they do, and businesses have been reliant on their ability to do it. Market research specialists will always be an important part of the industry, as most brands are limited by their internal capacity, expertise and budgets and need to outsource at least some aspects of the work.

However, the market research external agency model has meant that brands struggled to keep up with the pace of change. Their customers would suffer because their needs were not being wholly met with point-in-time market research.

Businesses looking to conduct market research have to tackle many questions –

- Who are my consumers, and how should I segment and prioritize them?

- What are they looking for within my category?

- How much are they buying, and what are their purchase triggers, barriers, and buying habits?

- Will my marketing and communications efforts resonate?

- Is my brand healthy ?

- What product features matter most?

- Is my product or service ready for launch?

- Are my pricing and packaging plans optimized?

They all need to be answered, but many businesses have found the process of data collection daunting, time-consuming and expensive. The hardest battle is often knowing where to begin and short-term demands have often taken priority over longer-term projects that require patience to offer return on investment.

Today however, the industry is making huge strides, driven by quickening product cycles, tighter competition and business imperatives around more data-driven decision making. With the emergence of simple, easy to use tools , some degree of in-house market research is now seen as essential, with fewer excuses not to use data to inform your decisions. With greater accessibility to such software, everyone can be an expert regardless of level or experience.

How is this possible?

The art of research hasn’t gone away. It is still a complex job and the volume of data that needs to be analyzed is huge. However with the right tools and support, sophisticated research can look very simple – allowing you to focus on taking action on what matters.

If you’re not yet using technology to augment your in-house market research, now is the time to start.

The most successful brands rely on multiple sources of data to inform their strategy and decision making, from their marketing segmentation to the product features they develop to comments on social media. In fact, there’s tools out there that use machine learning and AI to automate the tracking of what’s people are saying about your brand across all sites.

The emergence of newer and more sophisticated tools and platforms gives brands access to more data sources than ever and how the data is analyzed and used to make decisions. This also increases the speed at which they operate, with minimal lead time allowing brands to be responsive to business conditions and take an agile approach to improvements and opportunities.

Expert partners have an important role in getting the best data, particularly giving access to additional market research know-how, helping you find respondents , fielding surveys and reporting on results.

How do you measure success?

Business activities are usually measured on how well they deliver return on investment (ROI). Since market research doesn’t generate any revenue directly, its success has to be measured by looking at the positive outcomes it drives – happier customers, a healthier brand, and so on.

When changes to your products or your marketing strategy are made as a result of your market research findings, you can compare on a before-and-after basis to see if the knowledge you acted on has delivered value.

Regardless of the function you work within, understanding the consumer is the goal of any market research. To do this, we have to understand what their needs are in order to effectively meet them. If we do that, we are more likely to drive customer satisfaction , and in turn, increase customer retention .

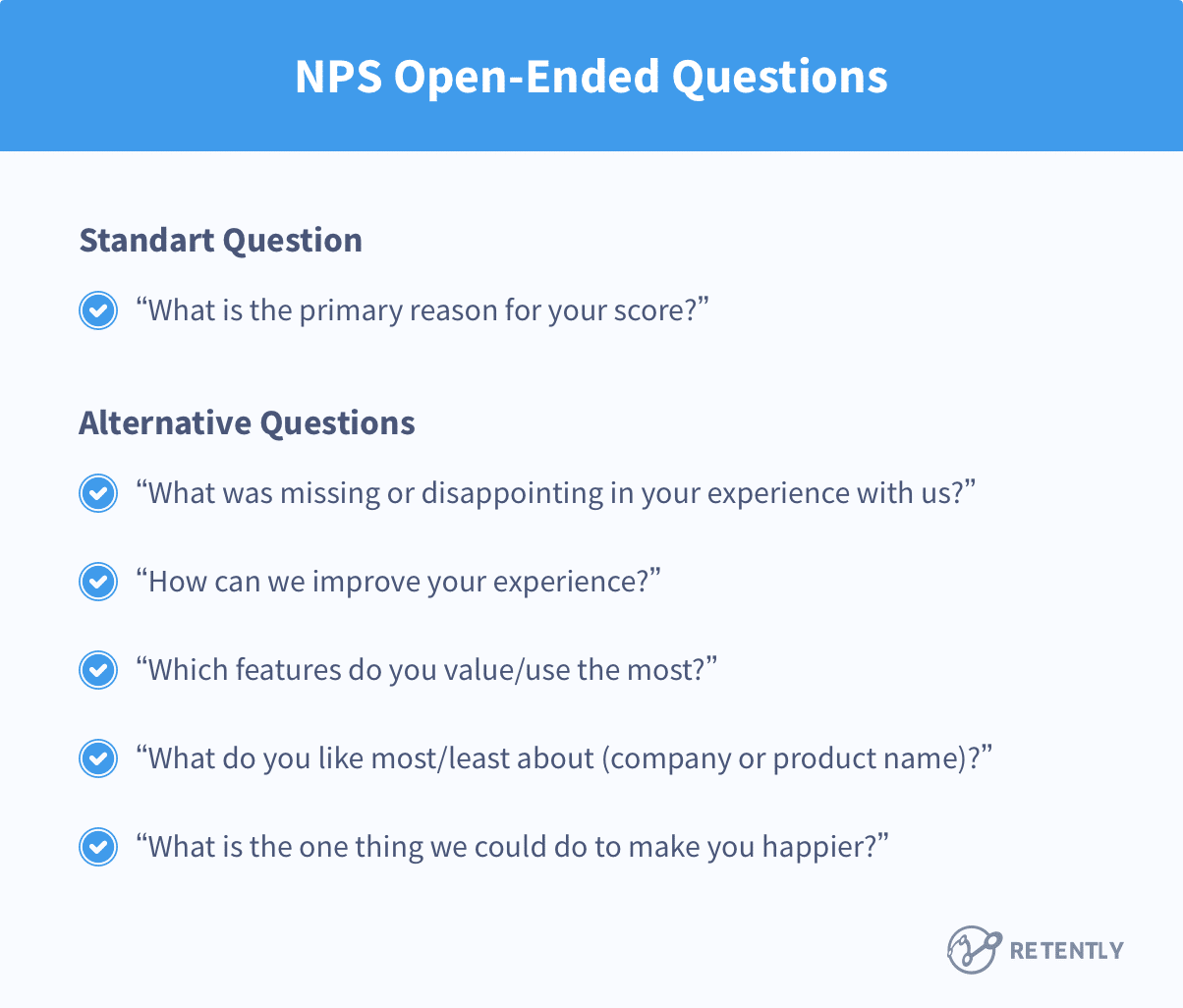

Several metrics and KPIs are used to gauge the success of decisions made from market research results, including

- Brand awareness within the target market

- Share of wallet

- CSAT (customer satisfaction)

- NPS (Net Promoter Score)

You can use market research for almost anything related to your current customers, potential customer base or target market. If you want to find something out from your target audience, it’s likely market research is the answer.

Here are a few of the most common uses:

Buyer segmentation and profiling

Segmentation is a popular technique that separates your target market according to key characteristics, such as behavior, demographic information and social attitudes. Segmentation allows you to create relevant content for your different segments, ideally helping you to better connect with all of them.

Buyer personas are profiles of fictional customers – with real attributes. Buyer personas help you develop products and communications that are right for your different audiences, and can also guide your decision-making process. Buyer personas capture the key characteristics of your customer segments, along with meaningful insights about what they want or need from you. They provide a powerful reminder of consumer attitudes when developing a product or service, a marketing campaign or a new brand direction.

By understanding your buyers and potential customers, including their motivations, needs, and pain points, you can optimize everything from your marketing communications to your products to make sure the right people get the relevant content, at the right time, and via the right channel .

Attitudes and Usage surveys

Attitude & Usage research helps you to grow your brand by providing a detailed understanding of consumers. It helps you understand how consumers use certain products and why, what their needs are, what their preferences are, and what their pain points are. It helps you to find gaps in the market, anticipate future category needs, identify barriers to entry and build accurate go-to-market strategies and business plans.

Marketing strategy

Effective market research is a crucial tool for developing an effective marketing strategy – a company’s plan for how they will promote their products.

It helps marketers look like rock stars by helping them understand the target market to avoid mistakes, stay on message, and predict customer needs . It’s marketing’s job to leverage relevant data to reach the best possible solution based on the research available. Then, they can implement the solution, modify the solution, and successfully deliver that solution to the market.

Product development

You can conduct market research into how a select group of consumers use and perceive your product – from how they use it through to what they like and dislike about it. Evaluating your strengths and weaknesses early on allows you to focus resources on ideas with the most potential and to gear your product or service design to a specific market.

Chobani’s yogurt pouches are a product optimized through great market research . Using product concept testing – a form of market research – Chobani identified that packaging could negatively impact consumer purchase decisions. The brand made a subtle change, ensuring the item satisfied the needs of consumers. This ability to constantly refine its products for customer needs and preferences has helped Chobani become Australia’s #1 yogurt brand and increase market share.

Pricing decisions

Market research provides businesses with insights to guide pricing decisions too. One of the most powerful tools available to market researchers is conjoint analysis, a form of market research study that uses choice modeling to help brands identify the perfect set of features and price for customers. Another useful tool is the Gabor-Granger method, which helps you identify the highest price consumers are willing to pay for a given product or service.

Brand tracking studies

A company’s brand is one of its most important assets. But unlike other metrics like product sales, it’s not a tangible measure you can simply pull from your system. Regular market research that tracks consumer perceptions of your brand allows you to monitor and optimize your brand strategy in real time, then respond to consumer feedback to help maintain or build your brand with your target customers.

Advertising and communications testing

Advertising campaigns can be expensive, and without pre-testing, they carry risk of falling flat with your target audience. By testing your campaigns, whether it’s the message or the creative, you can understand how consumers respond to your communications before you deploy them so you can make changes in response to consumer feedback before you go live.

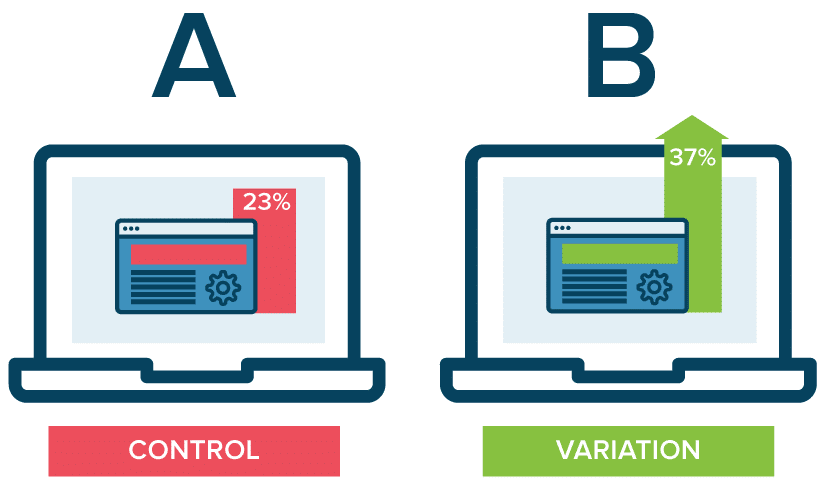

Finder, which is one of the world’s fastest-growing online comparison websites, is an example of a brand using market research to inject some analytical rigor into the business. Fueled by great market research, the business lifted brand awareness by 23 percent, boosted NPS by 8 points, and scored record profits – all within 10 weeks.

Competitive analysis

Another key part of developing the right product and communications is understanding your main competitors and how consumers perceive them. You may have looked at their websites and tried out their product or service, but unless you know how consumers perceive them, you won’t have an accurate view of where you stack up in comparison. Understanding their position in the market allows you to identify the strengths you can exploit, as well as any weaknesses you can address to help you compete better.

Customer Story

See How Yamaha Does Product Research

Types of market research

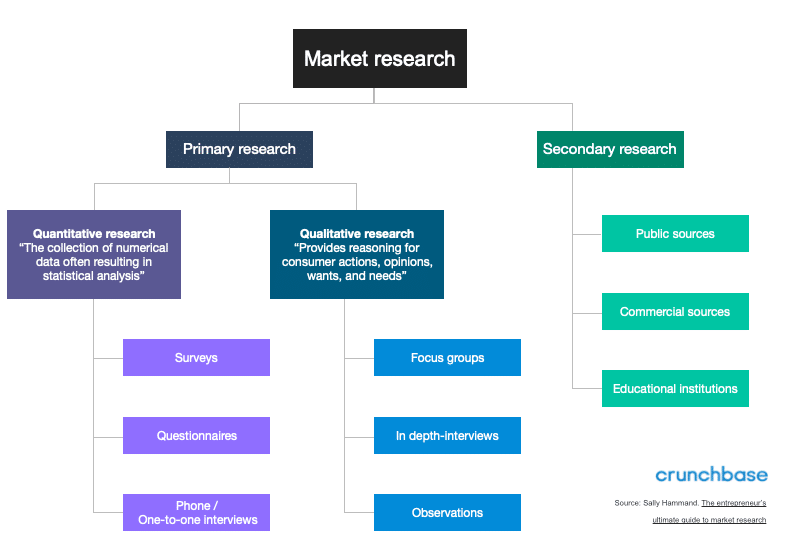

Although there are many types market research, all methods can be sorted into one of two categories: primary and secondary.

Primary research

Primary research is market research data that you collect yourself. This is raw data collected through a range of different means – surveys , focus groups, , observation and interviews being among the most popular.

Primary information is fresh, unused data, giving you a perspective that is current or perhaps extra confidence when confirming hypotheses you already had. It can also be very targeted to your exact needs. Primary information can be extremely valuable. Tools for collecting primary information are increasingly sophisticated and the market is growing rapidly.

Historically, conducting market research in-house has been a daunting concept for brands because they don’t quite know where to begin, or how to handle vast volumes of data. Now, the emergence of technology has meant that brands have access to simple, easy to use tools to help with exactly that problem. As a result, brands are more confident about their own projects and data with the added benefit of seeing the insights emerge in real-time.

Secondary research

Secondary research is the use of data that has already been collected, analyzed and published – typically it’s data you don’t own and that hasn’t been conducted with your business specifically in mind, although there are forms of internal secondary data like old reports or figures from past financial years that come from within your business. Secondary research can be used to support the use of primary research.

Secondary research can be beneficial to small businesses because it is sometimes easier to obtain, often through research companies. Although the rise of primary research tools are challenging this trend by allowing businesses to conduct their own market research more cheaply, secondary research is often a cheaper alternative for businesses who need to spend money carefully. Some forms of secondary research have been described as ‘lean market research’ because they are fast and pragmatic, building on what’s already there.

Because it’s not specific to your business, secondary research may be less relevant, and you’ll need to be careful to make sure it applies to your exact research question. It may also not be owned, which means your competitors and other parties also have access to it.

Primary or secondary research – which to choose?

Both primary and secondary research have their advantages, but they are often best used when paired together, giving you the confidence to act knowing that the hypothesis you have is robust.

Secondary research is sometimes preferred because there is a misunderstanding of the feasibility of primary research. Thanks to advances in technology, brands have far greater accessibility to primary research, but this isn’t always known.

If you’ve decided to gather your own primary information, there are many different data collection methods that you may consider. For example:

- Customer surveys

- Focus groups

- Observation

Think carefully about what you’re trying to accomplish before picking the data collection method(s) you’re going to use. Each one has its pros and cons. Asking someone a simple, multiple-choice survey question will generate a different type of data than you might obtain with an in-depth interview. Determine if your primary research is exploratory or specific, and if you’ll need qualitative research, quantitative research, or both.

Qualitative vs quantitative

Another way of categorizing different types of market research is according to whether they are qualitative or quantitative.

Qualitative research

Qualitative research is the collection of data that is non-numerical in nature. It summarizes and infers, rather than pin-points an exact truth. It is exploratory and can lead to the generation of a hypothesis.

Market research techniques that would gather qualitative data include:

- Interviews (face to face / telephone)

- Open-ended survey questions

Researchers use these types of market research technique because they can add more depth to the data. So for example, in focus groups or interviews, rather than being limited to ‘yes’ or ‘no’ for a certain question, you can start to understand why someone might feel a certain way.

Quantitative research

Quantitative research is the collection of data that is numerical in nature. It is much more black and white in comparison to qualitative data, although you need to make sure there is a representative sample if you want the results to be reflective of reality.

Quantitative researchers often start with a hypothesis and then collect data which can be used to determine whether empirical evidence to support that hypothesis exists.

Quantitative research methods include:

- Questionnaires

- Review scores

Exploratory and specific research

Exploratory research is the approach to take if you don’t know what you don’t know. It can give you broad insights about your customers, product, brand, and market. If you want to answer a specific question, then you’ll be conducting specific research.

- Exploratory . This research is general and open-ended, and typically involves lengthy interviews with an individual or small focus group.

- Specific . This research is often used to solve a problem identified in exploratory research. It involves more structured, formal interviews.

Exploratory primary research is generally conducted by collecting qualitative data. Specific research usually finds its insights through quantitative data.

Primary research can be qualitative or quantitative, large-scale or focused and specific. You’ll carry it out using methods like surveys – which can be used for both qualitative and quantitative studies – focus groups, observation of consumer behavior, interviews, or online tools.

Step 1: Identify your research topic

Research topics could include:

- Product features

- Product or service launch

- Understanding a new target audience (or updating an existing audience)

- Brand identity

- Marketing campaign concepts

- Customer experience

Step 2: Draft a research hypothesis

A hypothesis is the assumption you’re starting out with. Since you can disprove a negative much more easily than prove a positive, a hypothesis is a negative statement such as ‘price has no effect on brand perception’.

Step 3: Determine which research methods are most effective

Your choice of methods depends on budget, time constraints, and the type of question you’re trying to answer. You could combine surveys, interviews and focus groups to get a mix of qualitative and quantitative data.

Step 4: Determine how you will collect and analyze your data.

Primary research can generate a huge amount of data, and when the goal is to uncover actionable insight, it can be difficult to know where to begin or what to pay attention to.

The rise in brands taking their market research and data analysis in-house has coincided with the rise of technology simplifying the process. These tools pull through large volumes of data and outline significant information that will help you make the most important decisions.

Step 5: Conduct your research!

This is how you can run your research using Qualtrics CoreXM

- Pre-launch – Here you want to ensure that the survey/ other research methods conform to the project specifications (what you want to achieve/research)

- Soft launch – Collect a small fraction of the total data before you fully launch. This means you can check that everything is working as it should and you can correct any data quality issues.

- Full launch – You’ve done the hard work to get to this point. If you’re using a tool, you can sit back and relax, or if you get curious you can check on the data in your account.

- Review – review your data for any issues or low-quality responses. You may need to remove this in order not to impact the analysis of the data.

A helping hand

If you are missing the skills, capacity or inclination to manage your research internally, Qualtrics Research Services can help. From design, to writing the survey based on your needs, to help with survey programming, to handling the reporting, Research Services acts as an extension of the team and can help wherever necessary.

Secondary market research can be taken from a variety of places. Some data is completely free to access – other information could end up costing hundreds of thousands of dollars. There are three broad categories of secondary research sources:

- Public sources – these sources are accessible to anyone who asks for them. They include census data, market statistics, library catalogs, university libraries and more. Other organizations may also put out free data from time to time with the goal of advancing a cause, or catching people’s attention.

- Internal sources – sometimes the most valuable sources of data already exist somewhere within your organization. Internal sources can be preferable for secondary research on account of their price (free) and unique findings. Since internal sources are not accessible by competitors, using them can provide a distinct competitive advantage.

- Commercial sources – if you have money for it, the easiest way to acquire secondary market research is to simply buy it from private companies. Many organizations exist for the sole purpose of doing market research and can provide reliable, in-depth, industry-specific reports.

No matter where your research is coming from, it is important to ensure that the source is reputable and reliable so you can be confident in the conclusions you draw from it.

How do you know if a source is reliable?

Use established and well-known research publishers, such as the XM Institute , Forrester and McKinsey . Government websites also publish research and this is free of charge. By taking the information directly from the source (rather than a third party) you are minimizing the risk of the data being misinterpreted and the message or insights being acted on out of context.

How to apply secondary research

The purpose and application of secondary research will vary depending on your circumstances. Often, secondary research is used to support primary research and therefore give you greater confidence in your conclusions. However, there may be circumstances that prevent this – such as the timeframe and budget of the project.

Keep an open mind when collecting all the relevant research so that there isn’t any collection bias. Then begin analyzing the conclusions formed to see if any trends start to appear. This will help you to draw a consensus from the secondary research overall.

Market research success is defined by the impact it has on your business’s success. Make sure it’s not discarded or ignored by communicating your findings effectively. Here are some tips on how to do it.

- Less is more – Preface your market research report with executive summaries that highlight your key discoveries and their implications

- Lead with the basic information – Share the top 4-5 recommendations in bullet-point form, rather than requiring your readers to go through pages of analysis and data

- Model the impact – Provide examples and model the impact of any changes you put in place based on your findings

- Show, don’t tell – Add illustrative examples that relate directly to the research findings and emphasize specific points

- Speed is of the essence – Make data available in real-time so it can be rapidly incorporated into strategies and acted upon to maximize value

- Work with experts – Make sure you’ve access to a dedicated team of experts ready to help you design and launch successful projects

Trusted by 8,500 brands for everything from product testing to competitor analysis, Our Strategic Research software is the world’s most powerful and flexible research platform . With over 100 question types and advanced logic, you can build out your surveys and see real-time data you can share across the organization. Plus, you’ll be able to turn data into insights with iQ, our predictive intelligence engine that runs complicated analysis at the click of a button.

Related resources

Market intelligence 10 min read, marketing insights 11 min read, ethnographic research 11 min read, qualitative vs quantitative research 13 min read, qualitative research questions 11 min read, qualitative research design 12 min read, primary vs secondary research 14 min read, request demo.

Ready to learn more about Qualtrics?

How To Do Market Research: Definition, Types, Methods

Jan 2, 2024

11 min. read

Market research isn’t just collecting data. It’s a strategic tool that allows businesses to gain a competitive advantage while making the best use of their resources. Research reveals valuable insights into your target audience about their preferences, buying habits, and emerging demands — all of which help you unlock new opportunities to grow your business.

When done correctly, market research can minimize risks and losses, spur growth, and position you as a leader in your industry.

Let’s explore the basic building blocks of market research and how to collect and use data to move your company forward:

Table of Contents

What Is Market Research?

Why is market research important, market analysis example, 5 types of market research, what are common market research questions, what are the limitations of market research, how to do market research, improving your market research with radarly.

Market Research Definition: The process of gathering, analyzing, and interpreting information about a market or audience.

Market research studies consumer behavior to better understand how they perceive products or services. These insights help businesses identify ways to grow their current offering, create new products or services, and improve brand trust and brand recognition .

You might also hear market research referred to as market analysis or consumer research .

Traditionally, market research has taken the form of focus groups, surveys, interviews, and even competitor analysis . But with modern analytics and research tools, businesses can now capture deeper insights from a wider variety of sources, including social media, online reviews, and customer interactions. These extra layers of intel can help companies gain a more comprehensive understanding of their audience.

With consumer preferences and markets evolving at breakneck speeds, businesses need a way to stay in touch with what people need and want. That’s why the importance of market research cannot be overstated.

Market research offers a proactive way to identify these trends and make adjustments to product development, marketing strategies , and overall operations. This proactive approach can help businesses stay ahead of the curve and remain agile as markets shift.

Market research examples abound — given the number of ways companies can get inside the minds of their customers, simply skimming through your business’s social media comments can be a form of market research.

A restaurant chain might use market research methods to learn more about consumers’ evolving dining habits. These insights might be used to offer new menu items, re-examine their pricing strategies, or even open new locations in different markets, for example.

A consumer electronics company might use market research for similar purposes. For instance, market research may reveal how consumers are using their smart devices so they can develop innovative features.

Market research can be applied to a wide range of use cases, including:

- Testing new product ideas

- Improve existing products

- Entering new markets

- Right-sizing their physical footprints

- Improving brand image and awareness

- Gaining insights into competitors via competitive intelligence

Ultimately, companies can lean on market research techniques to stay ahead of trends and competitors while improving the lives of their customers.

Market research methods take different forms, and you don’t have to limit yourself to just one. Let’s review the most common market research techniques and the insights they deliver.

1. Interviews

3. Focus Groups

4. Observations

5. AI-Driven Market Research

One-on-one interviews are one of the most common market research techniques. Beyond asking direct questions, skilled interviewers can uncover deeper motivations and emotions that drive purchasing decisions. Researchers can elicit more detailed and nuanced responses they might not receive via other methods, such as self-guided surveys.

Interviews also create the opportunity to build rapport with customers and prospects. Establishing a connection with interviewees can encourage them to open up and share their candid thoughts, which can enrich your findings. Researchers also have the opportunity to ask clarifying questions and dig deeper based on individual responses.

Market research surveys provide an easy entry into the consumer psyche. They’re cost-effective to produce and allow researchers to reach lots of people in a short time. They’re also user-friendly for consumers, which allows companies to capture more responses from more people.

Big data and data analytics are making traditional surveys more valuable. Researchers can apply these tools to elicit a deeper understanding from responses and uncover hidden patterns and correlations within survey data that were previously undetectable.

The ways in which surveys are conducted are also changing. With the rise of social media and other online channels, brands and consumers alike have more ways to engage with each other, lending to a continuous approach to market research surveys.

3. Focus groups

Focus groups are “group interviews” designed to gain collective insights. This interactive setting allows participants to express their thoughts and feelings openly, giving researchers richer insights beyond yes-or-no responses.

One of the key benefits of using focus groups is the opportunity for participants to interact with one another. They spark discussions while sharing diverse viewpoints. These sessions can uncover underlying motivations and attitudes that may not be easily expressed through other research methods.

Observing your customers “in the wild” might feel informal, but it can be one of the most revealing market research techniques of all. That’s because you might not always know the right questions to ask. By simply observing, you can surface insights you might not have known to look for otherwise.

This method also delivers raw, authentic, unfiltered data. There’s no room for bias and no potential for participants to accidentally skew the data. Researchers can also pick up on non-verbal cues and gestures that other research methods may fail to capture.

5. AI-driven market research

One of the newer methods of market research is the use of AI-driven market research tools to collect and analyze insights on your behalf. AI customer intelligence tools and consumer insights software like Meltwater Radarly take an always-on approach by going wherever your audience is and continuously predicting behaviors based on current behaviors.

By leveraging advanced algorithms, machine learning, and big data analysis , AI enables companies to uncover deep-seated patterns and correlations within large datasets that would be near impossible for human researchers to identify. This not only leads to more accurate and reliable findings but also allows businesses to make informed decisions with greater confidence.

Tip: Learn how to use Meltwater as a research tool , how Meltwater uses AI , and learn more about consumer insights and about consumer insights in the fashion industry .

No matter the market research methods you use, market research’s effectiveness lies in the questions you ask. These questions should be designed to elicit honest responses that will help you reach your goals.

Examples of common market research questions include:

Demographic market research questions

- What is your age range?

- What is your occupation?

- What is your household income level?

- What is your educational background?

- What is your gender?

Product or service usage market research questions

- How long have you been using [product/service]?

- How frequently do you use [product/service]?

- What do you like most about [product/service]?

- Have you experienced any problems using [product/service]?

- How could we improve [product/service]?

- Why did you choose [product/service] over a competitor’s [product/service]?

Brand perception market research questions

- How familiar are you with our brand?

- What words do you associate with our brand?

- How do you feel about our brand?

- What makes you trust our brand?

- What sets our brand apart from competitors?

- What would make you recommend our brand to others?

Buying behavior market research questions

- What do you look for in a [product/service]?

- What features in a [product/service] are important to you?

- How much time do you need to choose a [product/service]?

- How do you discover new products like [product/service]?

- Do you prefer to purchase [product/service] online or in-store?

- How do you research [product/service] before making a purchase?

- How often do you buy [product/service]?

- How important is pricing when buying [product/service]?

- What would make you switch to another brand of [product/service]?

Customer satisfaction market research questions

- How happy have you been with [product/service]?

- What would make you more satisfied with [product/service]?

- How likely are you to continue using [product/service]?

Bonus Tip: Compiling these questions into a market research template can streamline your efforts.

Market research can offer powerful insights, but it also has some limitations. One key limitation is the potential for bias. Researchers may unconsciously skew results based on their own preconceptions or desires, which can make your findings inaccurate.

- Depending on your market research methods, your findings may be outdated by the time you sit down to analyze and act on them. Some methods struggle to account for rapidly changing consumer preferences and behaviors.

- There’s also the risk of self-reported data (common in online surveys). Consumers might not always accurately convey their true feelings or intentions. They might provide answers they think researchers are looking for or misunderstand the question altogether.

- There’s also the potential to miss emerging or untapped markets . Researchers are digging deeper into what (or who) they already know. This means you might be leaving out a key part of the story without realizing it.

Still, the benefits of market research cannot be understated, especially when you supplement traditional market research methods with modern tools and technology.

Let’s put it all together and explore how to do market research step-by-step to help you leverage all its benefits.

Step 1: Define your objectives

You’ll get more from your market research when you hone in on a specific goal : What do you want to know, and how will this knowledge help your business?

This step will also help you define your target audience. You’ll need to ask the right people the right questions to collect the information you want. Understand the characteristics of the audience and what gives them authority to answer your questions.

Step 2: Select your market research methods

Choose one or more of the market research methods (interviews, surveys, focus groups, observations, and/or AI-driven tools) to fuel your research strategy.

Certain methods might work better than others for specific goals . For example, if you want basic feedback from customers about a product, a simple survey might suffice. If you want to hone in on serious pain points to develop a new product, a focus group or interview might work best.

You can also source secondary research ( complementary research ) via secondary research companies , such as industry reports or analyses from large market research firms. These can help you gather preliminary information and inform your approach.

Step 3: Develop your research tools

Prior to working with participants, you’ll need to craft your survey or interview questions, interview guides, and other tools. These tools will help you capture the right information , weed out non-qualifying participants, and keep your information organized.

You should also have a system for recording responses to ensure data accuracy and privacy. Test your processes before speaking with participants so you can spot and fix inefficiencies or errors.

Step 4: Conduct the market research

With a system in place, you can start looking for candidates to contribute to your market research. This might include distributing surveys to current customers or recruiting participants who fit a specific profile, for example.

Set a time frame for conducting your research. You might collect responses over the course of a few days, weeks, or even months. If you’re using AI tools to gather data, choose a data range for your data to focus on the most relevant information.

Step 5: Analyze and apply your findings

Review your findings while looking for trends and patterns. AI tools can come in handy in this phase by analyzing large amounts of data on your behalf.

Compile your findings into an easy-to-read report and highlight key takeaways and next steps. Reports aren’t useful unless the reader can understand and act on them.

Tip: Learn more about trend forecasting , trend detection , and trendspotting .

Meltwater’s Radarly consumer intelligence suite helps you reap the benefits of market research on an ongoing basis. Using a combination of AI, data science, and market research expertise, Radarly scans multiple global data sources to learn what people are talking about, the actions they’re taking, and how they’re feeling about specific brands.

Our tools are created by market research experts and designed to help researchers uncover what they want to know (and what they don’t know they want to know). Get data-driven insights at scale with information that’s always relevant, always accurate, and always tailored to your organization’s needs.

Learn more when you request a demo by filling out the form below:

Continue Reading

What Are Consumer Insights? Meaning, Examples, Strategy

How Coca-Cola Collects Consumer Insights

Market Intelligence 101: What It Is & How To Use It

9 Top Consumer Insights Tools & Companies

Free! 5-Day Challenge - Find & Validate Your Ecommerce Idea!

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, the complete guide to market research: what it is, why you need it, and how to do it.

Written by Mary Kate Miller | June 1, 2021

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Market research is a cornerstone of all successful, strategic businesses. It can also be daunting for entrepreneurs looking to launch a startup or start a side hustle . What is market research, anyway? And how do you…do it?

We’ll walk you through absolutely everything you need to know about the market research process so that by the end of this guide, you’ll be an expert in market research too. And what’s more important: you’ll have actionable steps you can take to start collecting your own market research.

What Is Market Research?

Market research is the organized process of gathering information about your target customers and market. Market research can help you better understand customer behavior and competitor strengths and weaknesses, as well as provide insight for the best strategies in launching new businesses and products. There are different ways to approach market research, including primary and secondary research and qualitative and quantitative research. The strongest approaches will include a combination of all four.

“Virtually every business can benefit from conducting some market research,” says Niles Koenigsberg of Real FiG Advertising + Marketing . “Market research can help you piece together your [business’s] strengths and weaknesses, along with your prospective opportunities, so that you can understand where your unique differentiators may lie.” Well-honed market research will help your brand stand out from the competition and help you see what you need to do to lead the market. It can also do so much more.

The Purposes of Market Research

Why do market research? It can help you…

- Pinpoint your target market, create buyer personas, and develop a more holistic understanding of your customer base and market.

- Understand current market conditions to evaluate risks and anticipate how your product or service will perform.

- Validate a concept prior to launch.

- Identify gaps in the market that your competitors have created or overlooked.

- Solve problems that have been left unresolved by the existing product/brand offerings.

- Identify opportunities and solutions for new products or services.

- Develop killer marketing strategies .

What Are the Benefits of Market Research?

Strong market research can help your business in many ways. It can…

- Strengthen your market position.

- Help you identify your strengths and weaknesses.

- Help you identify your competitors’ strengths and weaknesses.

- Minimize risk.

- Center your customers’ experience from the get-go.

- Help you create a dynamic strategy based on market conditions and customer needs/demands.

What Are the Basic Methods of Market Research?

The basic methods of market research include surveys, personal interviews, customer observation, and the review of secondary research. In addition to these basic methods, a forward-thinking market research approach incorporates data from the digital landscape like social media analysis, SEO research, gathering feedback via forums, and more. Throughout this guide, we will cover each of the methods commonly used in market research to give you a comprehensive overview.

Primary vs. Secondary Market Research

Primary and secondary are the two main types of market research you can do. The latter relies on research conducted by others. Primary research, on the other hand, refers to the fact-finding efforts you conduct on your own.

This approach is limited, however. It’s likely that the research objectives of these secondary data points differ from your own, and it can be difficult to confirm the veracity of their findings.

Primary Market Research

Primary research is more labor intensive, but it generally yields data that is exponentially more actionable. It can be conducted through interviews, surveys, online research, and your own data collection. Every new business should engage in primary market research prior to launch. It will help you validate that your idea has traction, and it will give you the information you need to help minimize financial risk.

You can hire an agency to conduct this research on your behalf. This brings the benefit of expertise, as you’ll likely work with a market research analyst. The downside is that hiring an agency can be expensive—too expensive for many burgeoning entrepreneurs. That brings us to the second approach. You can also do the market research yourself, which substantially reduces the financial burden of starting a new business .

Secondary Market Research

Secondary research includes resources like government databases and industry-specific data and publications. It can be beneficial to start your market research with secondary sources because it’s widely available and often free-to-access. This information will help you gain a broad overview of the market conditions for your new business.

Identify Your Goals and Your Audience

Before you begin conducting interviews or sending out surveys, you need to set your market research goals. At the end of your market research process, you want to have a clear idea of who your target market is—including demographic information like age, gender, and where they live—but you also want to start with a rough idea of who your audience might be and what you’re trying to achieve with market research.

You can pinpoint your objectives by asking yourself a series of guiding questions:

- What are you hoping to discover through your research?

- Who are you hoping to serve better because of your findings?

- What do you think your market is?

- Who are your competitors?

- Are you testing the reception of a new product category or do you want to see if your product or service solves the problem left by a current gap in the market?

- Are you just…testing the waters to get a sense of how people would react to a new brand?

Once you’ve narrowed down the “what” of your market research goals, you’re ready to move onto how you can best achieve them. Think of it like algebra. Many math problems start with “solve for x.” Once you know what you’re looking for, you can get to work trying to find it. It’s a heck of a lot easier to solve a problem when you know you’re looking for “x” than if you were to say “I’m gonna throw some numbers out there and see if I find a variable.”

How to Do Market Research

This guide outlines every component of a comprehensive market research effort. Take into consideration the goals you have established for your market research, as they will influence which of these elements you’ll want to include in your market research strategy.

Secondary Data

Secondary data allows you to utilize pre-existing data to garner a sense of market conditions and opportunities. You can rely on published market studies, white papers, and public competitive information to start your market research journey.

Secondary data, while useful, is limited and cannot substitute your own primary data. It’s best used for quantitative data that can provide background to your more specific inquiries.

Find Your Customers Online

Once you’ve identified your target market, you can use online gathering spaces and forums to gain insights and give yourself a competitive advantage. Rebecca McCusker of The Creative Content Shop recommends internet recon as a vital tool for gaining a sense of customer needs and sentiment. “Read their posts and comments on forums, YouTube video comments, Facebook group [comments], and even Amazon/Goodreads book comments to get in their heads and see what people are saying.”

If you’re interested in engaging with your target demographic online, there are some general rules you should follow. First, secure the consent of any group moderators to ensure that you are acting within the group guidelines. Failure to do so could result in your eviction from the group.

Not all comments have the same research value. “Focus on the comments and posts with the most comments and highest engagement,” says McCusker. These high-engagement posts can give you a sense of what is already connecting and gaining traction within the group.

Social media can also be a great avenue for finding interview subjects. “LinkedIn is very useful if your [target customer] has a very specific job or works in a very specific industry or sector. It’s amazing the amount of people that will be willing to help,” explains Miguel González, a marketing executive at Dealers League . “My advice here is BE BRAVE, go to LinkedIn, or even to people you know and ask them, do quick interviews and ask real people that belong to that market and segment and get your buyer persona information first hand.”

Market research interviews can provide direct feedback on your brand, product, or service and give you a better understanding of consumer pain points and interests.

When organizing your market research interviews, you want to pay special attention to the sample group you’re selecting, as it will directly impact the information you receive. According to Tanya Zhang, the co-founder of Nimble Made , you want to first determine whether you want to choose a representative sample—for example, interviewing people who match each of the buyer persona/customer profiles you’ve developed—or a random sample.

“A sampling of your usual persona styles, for example, can validate details that you’ve already established about your product, while a random sampling may [help you] discover a new way people may use your product,” Zhang says.

Market Surveys

Market surveys solicit customer inclinations regarding your potential product or service through a series of open-ended questions. This direct outreach to your target audience can provide information on your customers’ preferences, attitudes, buying potential, and more.

Every expert we asked voiced unanimous support for market surveys as a powerful tool for market research. With the advent of various survey tools with accessible pricing—or free use—it’s never been easier to assemble, disseminate, and gather market surveys. While it should also be noted that surveys shouldn’t replace customer interviews , they can be used to supplement customer interviews to give you feedback from a broader audience.

Who to Include in Market Surveys

- Current customers

- Past customers

- Your existing audience (such as social media/newsletter audiences)

Example Questions to Include in Market Surveys

While the exact questions will vary for each business, here are some common, helpful questions that you may want to consider for your market survey. Demographic Questions: the questions that help you understand, demographically, who your target customers are:

- “What is your age?”

- “Where do you live?”

- “What is your gender identity?”

- “What is your household income?”

- “What is your household size?”

- “What do you do for a living?”

- “What is your highest level of education?”

Product-Based Questions: Whether you’re seeking feedback for an existing brand or an entirely new one, these questions will help you get a sense of how people feel about your business, product, or service:

- “How well does/would our product/service meet your needs?”

- “How does our product/service compare to similar products/services that you use?”

- “How long have you been a customer?” or “What is the likelihood that you would be a customer of our brand?

Personal/Informative Questions: the deeper questions that help you understand how your audience thinks and what they care about.

- “What are your biggest challenges?”

- “What’s most important to you?”

- “What do you do for fun (hobbies, interests, activities)?”

- “Where do you seek new information when researching a new product?”

- “How do you like to make purchases?”

- “What is your preferred method for interacting with a brand?”

Survey Tools

Online survey tools make it easy to distribute surveys and collect responses. The best part is that there are many free tools available. If you’re making your own online survey, you may want to consider SurveyMonkey, Typeform, Google Forms, or Zoho Survey.

Competitive Analysis

A competitive analysis is a breakdown of how your business stacks up against the competition. There are many different ways to conduct this analysis. One of the most popular methods is a SWOT analysis, which stands for “strengths, weaknesses, opportunities, and threats.” This type of analysis is helpful because it gives you a more robust understanding of why a customer might choose a competitor over your business. Seeing how you stack up against the competition can give you the direction you need to carve out your place as a market leader.

Social Media Analysis

Social media has fundamentally changed the market research landscape, making it easier than ever to engage with a wide swath of consumers. Follow your current or potential competitors on social media to see what they’re posting and how their audience is engaging with it. Social media can also give you a lower cost opportunity for testing different messaging and brand positioning.

SEO Analysis and Opportunities

SEO analysis can help you identify the digital competition for getting the word out about your brand, product, or service. You won’t want to overlook this valuable information. Search listening tools offer a novel approach to understanding the market and generating the content strategy that will drive business. Tools like Google Trends and Awario can streamline this process.

Ready to Kick Your Business Into High Gear?

Now that you’ve completed the guide to market research you know you’re ready to put on your researcher hat to give your business the best start. Still not sure how actually… launch the thing? Our free mini-course can run you through the essentials for starting your side hustle .

About Mary Kate Miller

Mary Kate Miller writes about small business, real estate, and finance. In addition to writing for Foundr, her work has been published by The Washington Post, Teen Vogue, Bustle, and more. She lives in Chicago.

Related Posts

How to Find Influencers: 6 Ways to Discover Your Perfect Brand Advocate

How to Create a Marketing Plan In 2024 (Template + Examples)

What Is UGC and Why It’s a Must-Have for Your Brand

Ad Expert Phoenix Ha on How to Make Creative Ads without Breaking Your Budget

14 Punchy TikTok Marketing Strategies to Amplify Your Growth

How to Grow Your YouTube Channel and Gain Subscribers Quickly

How to Get More Views on Snapchat with These 12 Tactics

12 Instagram Growth Hacks For More Engaged Followers (Without Running Ads)

Create Viral Infographics That Boost Your Organic Traffic

How to Create a Video Sales Letter (Tips and Tricks from a 7-Figure Copywriter)

How to Write a Sales Email That Converts in 2024

What Is a Media Kit: How to Make One in 2024 (With Examples)

Namestorming: How to Choose a Brand Name in 20 Minutes or Less

10 Ways to Increase Brand Awareness without Increasing Your Budget

What Is a Content Creator? A Deep Dive Into This Evolving Industry

FREE TRAINING FROM LEGIT FOUNDERS

Actionable Strategies for Starting & Growing Any Business.

Don't Miss Out! Register Free For The 5-Day Challenge.

- 5 Days. 7-Figure Founders LIVE.

- Walk Away With A Winning Idea.

| ") --> | ||||||||||||||||||||||||||

AbilityOne.gov U.S. AbilityOne Commission An Independent Federal Agency |

| | | | ||||||||||||||||||||||||

| ||||||||||||||||||||||||||

:max_bytes(150000):strip_icc():format(webp)/dd453b82d4ef4ce8aac2e858ed00a114__alexandra_twin-5bfc262b46e0fb0026006b77.jpeg)

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1327127856-ce97892716b346b99dcf1d14af294a97.jpg)

IMAGES

VIDEO

COMMENTS

Market research, as defined in Federal Acquisition Regulation (FAR) Part 2, "Definitions," is the process of collecting and analyzing information about capabilities within the market to satisfy agency needs. To elaborate, market research is a continuous process of gathering data on business and industry trends, characteristics of products and services, suppliers' capabilities, and ...

52.210-1 Market Research. As prescribed in 10.003 , insert the following clause: Market Research (Nov 2021) (a) Definition. As used in this clause—. Commercial product, commercial service, and nondevelopmental item have the meaning contained in Federal Acquisition Regulation 2.101. (b) Before awarding subcontracts for other than commercial ...

This part prescribes policies and procedures for conducting market research to arrive at the most suitable approach to acquiring, distributing, and supporting supplies and services. This part implements the requirements of 41 U.S.C. 3306 (a) (1), 41 U.S. C. 3307, 10 U.S.C. 3453, and 6 U. S.C. 796.

Additional market research and planning guidance is available at AFARS PGI 5110.002 (b)-2. (e) The Assistant Secretary of the Army (Acquisition, Logistics and Technology) shall document the results of market research in a manner appropriate to the size and complexity of the acquisition as stated at FAR 10.002 (e). See Appendix GG for further ...

Market Research (NOV 2021) (a) Definition. As used in this clause—. Commercial product, commercial service, and nondevelopmental item have the meaning contained in Federal Acquisition Regulation (FAR) 2.101. (b) Before awarding subcontracts for other than commercial acquisitions, where the subcontracts are over the simplified acquisition ...

Learn the basics of market research, its role in marketing strategy, types, methods, and tools. Find out how to conduct market research for your business goals, problem-solving, or growth.

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry. What are your customers' needs? How does your product compare to the...

Market research can inform key business decisions by showing how customers will respond. Learn how to get the market insights you need to take action.

What is market research? Learn the power of market research to predict consumer behavior, understand industry trends, and identify potential customers.

Market research is the process of discovering target market insights with qualitative and quantitative methods. Learn its importance in deep analysis.

Market research is defined as the systematic collection, analysis, and interpretation of data about a specific market, industry, or consumer segment. Learn more about market research methods, types, process with examples and best practices.

What is market research? Here's the complete guide to conducting market research, including examples to help you validate your business idea.

AbilityOne Program Procurement List Pricing Policy (51.600 series) Supersedes Pricing Memorandum No. 1, Fair Market Pricing, dated April 1, 2007, in its entirety. Supersedes Pricing Memorandum No. 2, Fair Market Price Determination for AbilityOne Product Contracts, dated January 26, 2007, in its entirety.

Market research can help play a major role in developing your product, marketing, and overall business strategy. Understanding the different market research methods can be the difference between wasting months of engineering time or exceeding your ambitious revenue targets.

The market research industry includes any organized activity to gather information about a specific target market or group of customers. It includes traditional methods of information gathering ...

The global revenue of the market research industry exceeded 84 billion U.S. dollars in 2023 and has grown more than twofold since 2008. In 2022, North America generated the largest share of market ...

Market research is the process of assessing the viability of a new good or service through research conducted directly with the consumer which allows a company to ...

CNI Research, a microcap IT software company, has recently seen a surge in its stock price, reaching a 52-week high on July 12, 2024. The stock has been performing well in the market, outperforming its sector by 3.03% and gaining 26.89% in the last 5 days alone.

5 брендов. MOSCOW RETAIL MARKET REPORTQ1 2020Key findingsIn Q1 2020 there were openings of two The activity of new international retail shopping centers as a part of Mixed- operators is low. 4 new brands entered Use Complex «Kvartal West» (GLA - the Russian market, in Q1 2019 - 5. 58,000 sq m) and as a part of the theme Within Q1 ...

LPL Research's Weekly Market Performance for the week of July 8, 2024, highlights the latest inflation data, start of earnings season, and rate cut expectations.

(a) Market research (see 10.001) is an essential element of building an effective strategy for the acquisition of commercial products and commercial services and establishes the foundation for the agency description of need (see part 11 ), the solicitation, and resulting contract.

The stock market will crash 32% in 2025 as the Federal Reserve fails to prevent a recession, according to the most bearish strategist on Wall Street. Peter Berezin, chief global strategist at BCA ...

Investments from retailers in automation are poised to fuel significant industry growth: the warehouse-automation market is forecast to reach $51 billion by 2030, a CAGR of 23 percent. 3 David Edwards, "Revenues from robotics in warehouses to exceed $51 billion by 2030," Robotics and Automation News, August 19, 2021 ...

The increase in this category of deals is directly correlated with the market trend for the sale of the most ready-to-live housing. Thus, while about 31% of flats and apartments had final finishes at the end of 2018, the share of such lots rose to 43% over the past six months.

All Global Research articles can be read in 51 languages by activating the Translate Website button below the author's name (only available in desktop version). To receive Global Research's Daily Newsletter (selected articles), click here. Click the share button above to email/forward this article to your friends and colleagues. Follow us on Instagram and Twitter and subscribe to our ...

In 2020 the elite residential real estate market showed excellent results despite all the negative consequences of quarantine measures. The historically record-high sales during the last months (about 670 transactions during the fourth quarter) allowed not only to compensate the 'fail' of the second quarter, but to excess the results of ...

The strength and depth of my local and national market knowledge combined with the vast resources deployed on behalf of my clients, results in unparalleled results. ... As a recent graduate from the University of Nevada, I am well versed in marketing and research. Paired with a comprehensive knowledge of market trends in the Denver Metro area ...

(Reuters) - Global smartphone shipments rose 6.5% in the second quarter, driven by Samsung Electronics and Apple, preliminary data from IDC showed on Monday, but a full recovery in demand is yet ...

The second economic risk factor in 2024 is elevated interest rates. The Federal Reserve has taken an aggressive approach to combating inflation by raising interest rates to 23-year highs, and it ...

Earnings season has officially kicked off this week, and it could bring the most painful correction for stock prices since the 2022 bear market.. That's according to Ned Davis Research, which ...