Jet Airways Case Study: Reasons for Shutdown & its Upcoming Revival

Lakshya Singh , Anik Banerjee

The Jet Airways case study is now so popular that it is mentioned in almost every Business School's curriculum due to the airline's unimaginable debacle. Founder Naresh Goyal has been investigated by the Enforcement Directorate (ED) and a large number of ex-employees have remained jobless after the airline shut down its operations in April 2019. April 2020 reports revealed that around 4000 employees were still on the rolls of Jet Airways, and these employees were facing tough times in the absence of any regular source of income.

Jet Airways' shutdown is often considered one of the biggest organizational failures to have occurred in India. A lesson for many, this post covers the journey of Jet Airways and digs deep into the reasons for its failure. However, if you are wondering "is Jet Airways coming back?" then you would be glad to know that it is indeed, as far as the recent May 2022 reports reveal.

After its collapse, Jet Airways declared bankruptcy, and on 17 April 2019, it decided to shut down operations temporarily. Some of its assets have gone to other airlines while a few aircraft remain parked till the bankruptcy proceedings are completed. However, with the recent advancements that proved positive for the airline company, the popular airline service provider may see a revival in 2022 itself.

In this Jet Airways case study, we will delve into the Jet Airways insolvency case, which will cover the Jet Airways introduction, its history of Jet Airways, its downfall of Jet Airways, and the resuming of its operations that is due. So, let's get started!

Indian Aviation Industry Jet Airways History The Consequences of the Downfall of Jet Airways Similar Cases In Aviation Industry The Common Link In All Of These Cases Reasons Behind Jet Airways Bankruptcy Buying Proposals Jet Airways, All Set for the Revival In 2022 The Future Plans of Jet Airways

Indian Aviation Industry

Aviation is an under-saturated sector in India. As more and more Indians choose flight as the best means of travel, the availability of aircraft is yet to catch up with this growing trend. For the numbers, India has 565 commercial aircraft for a population of 1.3 billion.

The United States, on the other hand, has 7,309 commercial aircraft for a population of 328 million. To add to the aviation industry's woes, the majority of Indian airports are not up to the mark in terms of infrastructure. For instance, most of the airports in India have only a single operational runway, whereas countries like the US have no less than 5 runways.

Jet Airways History

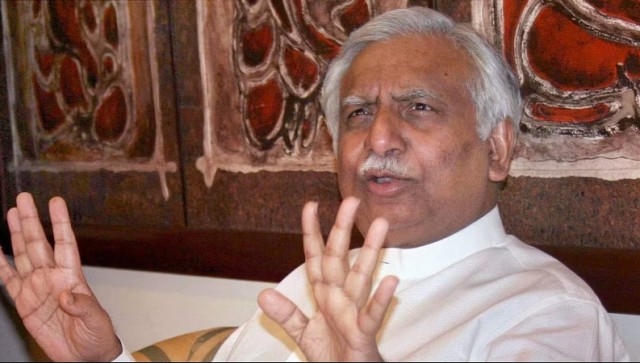

Naresh Goyal started Jet Airways with 4 leased Boeing 737 aircraft in 1993. The airline was the paragon of success for domestic carriers in India. There were rumblings of trouble brewing within Jet Airways in August of 2018 when the company deferred the second quarter results of that year.

The government watchdogs got a sniff of discrepancies in the airline's financials. In the same month, the DGCA (Directorate General of Civil Aviation) conducted a financial audit of Jet Airways. It was based on the reasoning that the deferment of employees’ salaries ought to affect their morale and attitude.

The same month, Jet Airways posted a loss of INR 1323 crores.

In September of 2018, the Income Tax department surveyed the Delhi and Mumbai offices of Jet Airways. The company was then alleged of financial misappropriation. Naresh Goyal, who was then the Founder-Chairman of Jet Airways, also came under the radar of the government and its law enforcement agencies. He and his wife, Anita Goyal stepped down from the Jet Airways' operations on March 25th, 2019, after the financial crisis that the airline company was in, came in front of everyone.

Jet Airways founder Naresh Goyal and his wife Anita, were stopped from leaving India by immigration authorities at Mumbai airport. They were offloaded from a Dubai-bound Emirates flight, which was called back after it had reached the taxiway at Mumbai airport on May 25, 2019, since then, he was stopped from flying out of India.

There were charges of money laundering and foreign exchange violation against Naresh, and this led the Enforcement Directorate to question him in September 2019. He was detained and questioned again by the ED in 2020. As far as the recent reports dated April 22, 2022 go, the Central Bureau of Investigation (CBI) would likely file a First Information Report (FIR) against Naresh Goyal for defrauding banks and misappropriating the bank-sanctioned loans. The banks and their officials who granted him the loan, also came under the scanner this way.

The Consequences of the Downfall of Jet Airways

Jet Airways shut down its operations temporarily on 17 April 2019. The last flight was from Amritsar to Mumbai . The shutting down of the company affected 20,000 employees and more than 60,000 people indirectly. The company is reportedly in a debt of a billion dollars. NAG (National Aviator’s Guild) appealed to the PMO (Prime Minister’s office) and then-Civil Aviation Minister Suresh Prabhu to help the company and its employees.

The government on the other hand reportedly asked the banks to save the company without pushing it to bankruptcy. With unemployment being a major electoral issue for the government, an addition of 20000 to the list of jobless Indians will only give more substance to the opposition. The Government is therefore pulling out all the stops to prevent Jet Airway's insolvency.

Consequences have been of such an unprecedented level that an employee of Jet Airways committed suicide in Mumbai. Shailesh Singh was a cancer patient and was on a break from his job as a senior technician at Jet Airways. He jumped from his building due to depression on 27 April 2019.

Similar Cases

It is not the first time that an airline company has fallen from grace. Many companies before Jet Airways have seen a similar fate. Some of them are:

- Kingfisher Airlines

- Air Deccan

- Air India Cargo

- Indian Airlines

- Sahara Airlines

The Common Link In All Of These Cases

The common link in all of the above examples is that they all were, at some point, involved in a merger.

Kingfisher Airlines bought Air Deccan . Kingfisher was a full-service airline, whereas Air Deccan was a low-cost airline. When Kingfisher bought Air Deccan, it incorporated some changes in Air Deccan’s fleet and we all know what happened after that. Both the companies faced a downfall.

Before Air India and Indian Airlines merged, both of them were doing reasonably well. After coming together, the crown jewels of Indian airspace remain in the red. Air India has a debt north of INR 50,000 crores and nothing positive has come out of the government's efforts to revive the national carrier.

Jet Airways merged with Sahara Airlines and Jet rebranded Sahara as “Jet Lite”. Sahara Airlines is now lost in oblivion and Jet Airways is heading on the same path.

Therefore, it won't be wrong to say that mergers and acquisitions in the case of airlines are a risky bet. A successful airline establishes a unique identity of its own, and meddling with its brand and presence usually ends on a negative note.

Reasons Behind Jet Airways Bankruptcy

There are many reasons behind the failure of Jet Airways :

The merger between Sahara Airlines and Jet Airways was a mistake on Jet Airways' part. Sahara was acquired by Jet Airways for $500 million which was way above what the airline was actually worth.

Rebranding Sahara Airlines

Jet Airways renamed Sahara Airways as JetLite. Sahara at the time was a powerhouse with its name on every Indian's tongue. The rebranding cost Jet Airways a major chunk of its customers; flyers who were attracted towards the Sahara brand image couldn't resonate with JetLite.

Mismanagement

Every company and organization rests on the abilities of its management board; there are no second opinions to this school of thought. Naresh Goyal , the founder of Jet Airways, decided to become a one-man army for Jet Airways and did not hire a sound management committee to assist him in running the airline. Insiders often talk about his poor financial acumen. He relied on a single management team for handling all the operations related to Jet. Understanding that specialized teams are needed to run different departments is no rocket science. And when you acquire one more airline, you can't rely on your existing management board that's already burdened to take up additional responsibilities!

Full-Service Airline

Full-service airlines offer passengers the choices of economy, business class, premium economy, and first class on their flights. The company was operating as a full-service airline. Operating as a full-service airline in India is not an easy task. One needs formidable financial support and customer relationships. Catering to the wealthy, the middle class, and the lower sections of the Indian society requires strategy and operational excellence beyond imagination. That is why most of the companies focus on the middle-class segment and keep the prices as low as possible. Jet Airways was biting off more than it could chew.

Drowning in Debt

Jet Airways was never good with money. It kept on incurring debt and spending more than its revenue. The employees were paid lavishly when compared to the industry standards. For the sake of providing comfort and luxury, the Naresh Goyal-backed airline compromised with finances.

Buying Proposals

Jason Unsworth, a British Entrepreneur, and CEO of Atmosphere Intercontinental Airline, expressed his interest in buying a controlling stake in Jet Airways.

However, Jason was told by Jet Airways to sit down with SBI Caps Limited, which was leading the resolution plan for the carrier.

Jason claims to have written to Jet Airways’ lenders but never receiving any reply in return. He later wrote to Jet Airways’ CEO, Vinay Dube, about the proposal to purchase a stake in the airline. Jason said he was provided with contacts of SBI to get in touch with. He is also in talks with other Indian entrepreneurs and investors for financing his bid for a controlling stake in Jet Airways.

The winner of the Jet Airways bid was the Kalrock and Jalan consortium, which has proposed a total cash infusion of INR 1375 crore, which includes INR 475 crore that will go to meet the stakeholders' payments and of the other financial creditors.

Jet Airways, All Set for the Revival In 2022

If everything goes as per the resolution plan and the consortium receives the NCLT and Regulatory approvals, then Jet Airways will start its operations by the summer of 2021 , mentioned an official statement released by Jet Airways . Though 2021 wasn't the year that we saw the Jet Airways flight take off again, 2022 will not disappoint all those who were awaiting a Jet Airways comeback. The Union Home Ministry has already granted security clearance to Jet Airways, as per the news dated May 8, 2022, and the Delhi-based Indian Internation airline operator would be relaunching its commercial flight operations in the next few months. Jet Airways is now promoted by the Jalan-Kalrock consortium, which was earlier operated by Naresh Goyal, under whom it operated its last flight on April 17, 2019.

The new promoters of Jet Airways (Murari Lal Jalan and Kalrock Capital) considered starting a new airline but ultimately decided to go with the Jet brand; mainly because of its brand value and customer connections. As per the insolvency resolution plan, Jet Airways intends to operate all of its historic domestic slots in India and restart international operations.

On 18 October 2020, the lenders of Jet Airways approved the resolution plan submitted by UK-based Kalrock Capital and UAE-based entrepreneur Murari Lal Jalan to revive and operate Jet Airways.

The new management of the grounded airline has reached out to top executives in the aviation sector to run daily operations. Apart from passenger operations, the new management will focus on the cargo operations to improve the airline.

“The Consortium's vision is to regain lost ground, set new benchmarks for the airline industry with the tag of being the best corporate full-service airline operating on domestic and international routes. The Jet 2.0 hubs will remain Delhi, Mumbai, and Bengaluru like before. The revival plan proposes to support Tier 2 and Tier 3 cities by creating sub-hubs in such cities," the official statement noted.

The new management’s vision for Jet 2.0 is inclined towards increasing the cargo services to include dedicated freighter service (An underserved market Indian carrier). "Given, India’s position as a leading center for global vaccine manufacture, cargo services have never been more required," the statement added.

“Jet Airways has been a brand with a glorious history of over 25 years, and it is the vision of the consortium to put Jet Airways back in the skies at the earliest opportunity. We aim to re-energize the brand by infusing energy, warmth, and vibrancy into it while making it bigger and better," said Manoj Narender Madnani, board member of the Jalan Kalrock consortium.

Jet Airways is looking to resume its domestic flights in the first quarter of the next year, after March 2022 in the light of new promoters for the defunct airline. The shares of the airline surged by 5% on September 13, 2021, bringing in a fresh wave of hope for the airline. Jet Airways is currently headed by Murari Lal Jalan, a businessman based in the United Arab Emirates, and the London-based Kalrock Capital, the new owners of the airline company.

The Civil Aviation Ministry sent a letter to the airlines on 6th May 2022 , which informed Jet Airways about the grant of security clearance by the Union Home Ministry . Jet Airways operated with a test flight on May 5, 2022 , to prove to the aviation regulator DGCA that the aircraft and its components are up and running . Jet Airways, now, is pending to prove the Directorate General of Civil Aviation (DGCA) with other proving flights , before it gets the air operator certificate . These proving flights will have the DGCA officials and airline officials as passengers and cabin crew members on board and will be the same as commercial flights.

Jet Airways has been grounded since April 2019 , after two decades of flying successfully because it failed to gather funds enough for running its operations . This left around 20,000 people jobless . The flight operator had a partnership with Etihad Airways. Due to the lack of operating cash , the airline company initially started cancelling flights, cutting routes, grounding planes, and handing pink slips to employees. The insolvency proceedings for Jet Airways were then initiated in June 2019.

It was in 2020 that UK’s Kalrock Capital and the UAE-based entrepreneur Murari Lal Jalan came up with their plans. The Committee of Creditors of Jet Airways approved the resolution plan of the consortium in October 2020, of Kalrock and Jalan. The National Company Law Tribunal also approved the resolution plan in June 2021.

Boeing B777-300(ER), one of Jet Airways' airplanes that were seized in the Netherlands due to unpaid dues has not been sold off. Punjab National Bank, one of the lenders of Jet Airways that had approved the resolution plan earlier has eventually appealed against the same for which it has approached the National Company Law Appellate Tribunal (NCLAT), citing irregularities. However, this couldn't hold back Jet Airways, it seems.

The Future Plans of Jet Airways

Jet Airways appointed Sanjiv Kapoor as its new CEO on March 4th, 2022, which certainly means that the popular airline company that went defunct in 2019, would again be resuming its operations under the ownership of the Kalrock-Jalan consortium. It is currently going through a court-monitored restructuring and plans to return with a hybrid of premium and no-frills services. The flights of the revived Jet Airways, which will be helmed by Kalrock and Jalan, would have a two-class configuration where the business class passengers would be offered premium services including free meals, whereas the economy class of Jet Airways would be operating similar to the low-cost carriers, where the passengers would pay for their own meals.

As reported in March of 2020, the bidders who issued Express of Interest (EoI) to buy Jet Airways did not submit any resolution plan adhering to the requirements. As confirmed, the grounded airline did not find any buyer till 9 March 2020.

By March 2020, around 20,000 claims were made on Jet Airways which amounted to around INR 37,000 crores. Of this, while workmen and employees have claimed over INR 14000 crores, creditors are claiming over INR 11,000 crores from Jet Airways.

While looking at this scenario, it did not seem like the Jet Airways saga will come to an end anytime soon. The Indian Government's role was pivotal in deciding the course this crisis ultimately takes. However, with the recent advancement, powered by the Kalrock-Jalan consortium, things seem to be looking up at last for Jet Airways.

Jet Airways was on the verge of bankruptcy. Many entrepreneurs have come forward to employ people who lost their jobs due to the Jet Airways crisis, and many have been absorbed by competitors too, like SpiceJet. Now, with the Jet Airways' revival at nigh, there's hope for a whole lot of employees. Besides, the ex-employees of the bankrupt airline might also find some solace just by seeing the airline company raise its head up again, if not join the airline once again. Nevertheless, the successful revival of Jet Airways would certainly be no less than a historic event not only in the history of the airline industry but among the Indian companies that survived the worst of fates.

Stay tuned for more updates on the Case Study of Jet Airways!

What is Jet Airways?

Jet Airways is an Indian International airline service provider that was founded on April 1, 1992, and headquartered in Delhi NCR. It commenced its operations on May 5, 1993.

Who founded Jet Airways?

The NRI Indian businessman, Naresh Goyal founded Jet Airways, who was also the Chairman of the airline company.

Why did Jet Airways shut down?

There are numerous reasons that propelled the downfall of Jet Airways but the most prominent reason for the Jet Airways shut down is the lack of funds, and mounting debt.

What is the Jet Airways insolvency case?

Jet Airways, which started off as an air taxi operator in 1993, was under insolvency for nearly 2 years after which it ceased its operations in April 2019, when it revealed the huge debt that it was in. The insolvency resolution plan was eventually brought up by UK-based Kalrock Capital and the UAE-based entrepreneur Murari Lal Jalan, which looked promising enough, and it is the same consortium that is finally proving promising enough for Jet Airways today.

Is Jet Airways coming back?

Yes, the news is true, for Jet Airways is coming back indeed for operations. Jet Airways has already got the security clearance from the Union Home Ministry on May 6, 2022, after it successfully operated a test flight on 5th May, which has proven that the aircraft and all of its components are in good condition and working well to convince the aviation regulator DGCA.

Must have tools for startups - Recommended by StartupTalky

- Manage your business smoothly- Google Workspace

Cars24 Business Model | How Cars24 Make Money

The world of used cars, which is full of doubt and mistrust, has been waiting a long time for a game-changer. The game-changing factor was the arrival of Cars24, a pioneering eCommerce platform that revolutionized the used automobile market. Join us as we dive into a comprehensive analysis of the

Blinkit Business Model | How Blinkit Makes Money

Putting in an order for groceries was once considered the most difficult task. Shopping for groceries is becoming more pleasurable because of the development of "smart grocery stores" like Nature's Basket, Dmart, Reliance Mart, and others. But now that technology is driving more solutions, online grocery shopping is becoming increasingly

Lenskart Business Model | How Lenskart Makes Money

Approximately 64 percent of adults around the world need corrective lenses to see clearly, according to recent studies. Envisioning a society where selecting the ideal eyewear is both a vital must and a truly enjoyable activity. This ambition has come true thanks to Lenskart, an industry pioneer. Both customers' perception

Top 22 Courier & Delivery Franchise Businesses in India

The growth of the e-commerce industry impacted the courier business. Due to more shopping in the eCommerce platform courier business is becoming one of the fastest-growing markets in India nowadays. Courier and delivery companies provide various services starting from the online courier and cargo marketplace and finishing with logistics. There

To read this content please select one of the options below:

Please note you do not have access to teaching notes, fall of a titan: understanding the jet airways crisis.

Publication date: 18 August 2021

Issue publication date: 12 October 2021

Teaching notes

Theoretical basis.

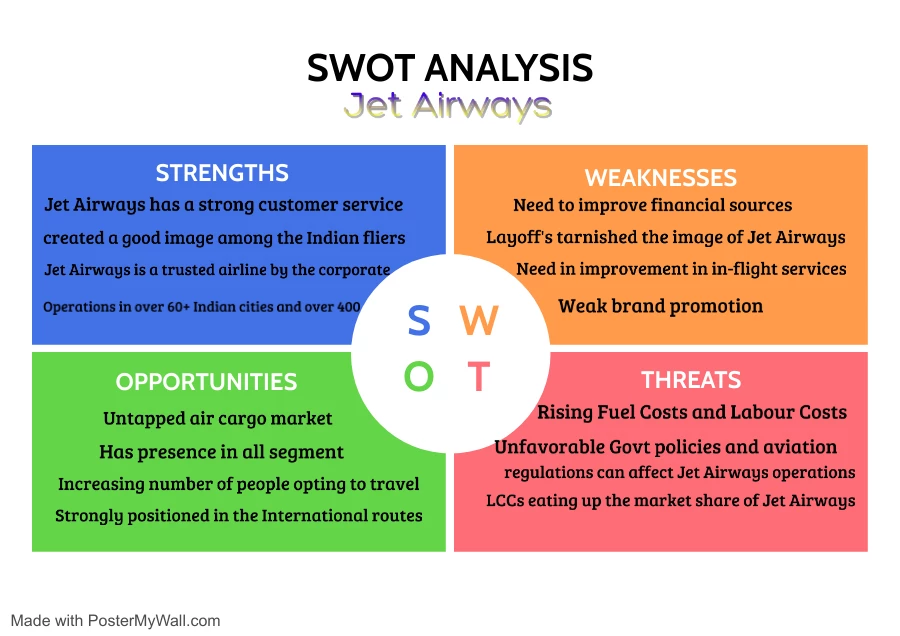

The competitive environment of the Indian aviation industry is studied using Porter's five forces model. The SWOT analysis is used to examine the competitive position of Jet Airways. The role of Merger & Acquisition in the current Jet Airways crisis is also examined. Relevant texts studied are as follows: Kazmi, A. and Kazmi A. (1992). Strategic Management. McGraw-Hill Education; and Porter, M. (2008). The Five Competitive Forces That Shape Strategy. Harvard business review. 86. 78–93, 137.

Research methodology

This data for this case was extracted from secondary sources. These sources comprise newspaper articles, reports from the industry, reports of the company and the company's website. For gaining clarity over concepts, strategic management book by Azhar Kazmi and Adela Kazmi was referred. This case also uses websites such as moneycontrol.com to analyze financial health of the company. In the end, this case also uses some existing reports from the sources like World Bank and plane spotters to analyze the status of Jet Airways and also Indian aviation industry. This case has been tested in the classroom with MBA students in a class of Business Policy and Strategic management.

Case overview/synopsis

The Jet Airways, which once had the largest market share in the Indian aviation industry, has reached bankruptcy. Mr. Naresh Goyal, known for his aggressive expansion strategies, has already filed for bankruptcy. This case presents how buying aircrafts' obsession with poor choices on Mergers/Acquisitions could result in bankruptcy. The same could be substantiated from the fact that Goyal had many (197) of his fleet's latest aircraft. Goyal was also criticized for buying Sahara Airlines, which was performing poorly in the market. Spending a large portion of the budget in capital expenditure in an industry where operational cost is very high, only the cost of turbine fuel amounts to 50% of total operational expense. The high expenditure on capital budget and increasing operational cost weaken the financial position of Jet Airways. Despite earning decent revenue and having the highest market share in 2010, Jet Airways made losses in three consecutive years, i.e. from 2009 to 2011. After 2011, when the Indian aviation industry witnessed a high level of competition and growth in low-cost carriers (LCC), Jet Airways' survival was up for a toss. Despite the desperate measures of cost-cutting and attracting potential investors, Jet Airways reached the verge of bankruptcy. The current case emphasized the need to balance safe and riskier options, even for the market leaders like Jet Airways could fail due to poor strategic choices. This case presents some harsh realities on funds allocation. In 2010, where Jet Airways secure the highest market share and decent total revenue, it realized net losses. The case study also explains the need to adapt to the dynamics of the industry. After 2011, when LCC started dominating the Indian aviation industry, Jet Airways did not change its operation strategy and facing severe consequences. The case was about the poor strategic decisions taken by the founder of Jet Airways, Mr. Naresh Goyal, which adversely affected the health of the airline. The case also explores the possible strategic choices that Goyal could have taken to ensure Jet Airways' survival. Through this case, an attempt had been made to highlight the importance of various concepts that we need to understand while making a strategic decision for any organization. In the end, this case emphasized the role of strategy in managing an organization successfully.

Complexity academic level

The case study's target group should be Undergraduate and Postgraduate students of the Management discipline who study Strategic Management as a specialization or as the subject. This case can also be used in the Management Development Program for senior executives taking any vocational course or workshop on Business Strategy. The case focuses on one of the fastest emerging markets, i.e. India, and could be proven valuable for many multinationals companies. The case presents the changing competitive dynamics of the Indian aviation industry. The central theme on which the case revolves is the importance of sound strategic choices in a dynamic market or industry. After analyzing the case, the students would understand the complex nature of strategic decision-making and any poor strategic decisions ripple effect. This case could teach essential strategic management concepts like "SWOT analysis" and "PESTEL analysis." This case should be used to teach strategic management concepts only and not act as a judgment tool for any organization.

- Jet airways

- Strategic management

- Porter’s five forces model

- SWOT analysis

- Merger & acquisition

- PESTEL analysis

Acknowledgements

Disclaimer. This case is intended to be used as the basis for class discussion rather than to illustrate either effective or ineffective handling of a management situation. The case was compiled from published sources.

Kathpal, S. and Akhtar, A. (2021), "Fall of a Titan: understanding the Jet Airways crisis", , Vol. 17 No. 4, pp. 569-587. https://doi.org/10.1108/TCJ-04-2020-0041

Emerald Publishing Limited

Copyright © 2021, Emerald Publishing Limited

You do not currently have access to these teaching notes. Teaching notes are available for teaching faculty at subscribing institutions. Teaching notes accompany case studies with suggested learning objectives, classroom methods and potential assignment questions. They support dynamic classroom discussion to help develop student's analytical skills.

Related articles

All feedback is valuable.

Please share your general feedback

Report an issue or find answers to frequently asked questions

Contact Customer Support

30 years ago: How a jet flown by King Charles overran a Scottish runway in 1994

Developers raise $2.55 billion in bond placement for JFK Airport’s New Terminal One

Emirates Airbus A380 dons Wimbledon-inspired livery in official new partnership

Emirates unveils ‘Exclusive Eight’ champagne collection, extends ties with LVMH

- ZeroAvia hydrogen-powered aircraft

- zero-emissions

- Zero emission

- Yeti Airlines

- AeroTime Extra

Why Did Jet Airways Fail? Will The Airline Fly Again? Crisis Explained

Why Did Jet Airways Fail? Will Jet Airways Ever Fly Again? Crisis Explained

As the deadline for the bids to buy Jet Airways looms, the $1.2 billion debt-stricken airline is likely to go down into the history books.

At one time, Jet Airways was the biggest and arguably, the best airline in India. With the rapidly expanding aviation market and more Indians choosing air travel as their primary way of reaching their destination, Jet Airways seemed like it was destined for success.

The privately owned carrier enjoyed very high highs. With over 120 aircraft flying to almost 1000 destinations, it seemed like Jet Airways had overcome the odds. Previous to this, privately owned airlines in India did not fare well. For example, Vijay Mallya’s Kingfisher Airlines went down in a very similar, but different fashion. While Jet Airways ran profitably for a number of years, Kingfisher Airlines on the other hand, never enjoyed a profitable year.

But while Jet Airways enjoyed the highs, it also stumbled to very low lows.

And today, with the window of opportunity to save Jet Airways closing, and no company putting out a serious bid for the troubled airline, it seems like this is the end.

So, the question on everyone’s mind is: Why did it fail, when it seemed like success was the only option for Jet Airways?

Let’s go down the rabbit hole and try to understand the reasons behind the bankruptcy.

Not the first time

Firstly, this is not the first time that the airline is in trouble. When the 2008 financial crisis hit, the still growing Indian Aviation market declined. Passenger numbers dropped and airlines were forced to either drop the prices, which they did at first or to raise them when fuel prices soared.

Jet Airways was not any different. The company did the same as everybody else and Indian passengers were on a price rollercoaster.

But Jet Airways had two more problems. The airline recently acquired Air Sahara, which cost a hefty sum of money.

Secondly, Low-cost carriers were starting to dominate India‘s skies. With the financial crisis impacting traveler numbers, Jet Airways did not make any decisions to soften the hit. Passengers started to prefer low-cost airlines like IndiGo because of their lower ticket prices and Jet Airways was in even more trouble. But the problem was, that Air Sahara was not a low-cost carrier. The airline ran the same business model as Jet, so essentially Jet Airways just paid a lot of money for additional aircraft, routes and parking slots.

Instead of trying to change the way the airline operates, the chairman of Jet Airways, Naresh Goyal told the world to hold his beer.

The company fired 1900 employees. Just like that. Sure, you could understand the move – the airline was in debt, it needed to reduce running costs to keep flying. However, instead of reducing operating costs, Jet Airways set themselves up for another crisis.

Employees of Jet Airways did not take the news well and went to the streets to protest the decision. After a few days of protests, Naresh Goyal caved in and re-hired the workers. Everything seemed okay for a while, at least in the Human Resource department. The airline was still losing money.

Jet Airways employee protest

But in 2009, Naresh Goyal asked the world to hold his glass once more.

No union for you

Jet Airways’ pilots formed a union called the National Aviators Guild. Two pilots from Jet Airways played a key role in the formation of the union.

That fact did not go down well within the company. Subsequently, to joining the union, the two pilots were sacked.

This time, the pilots went on strike. Instead of meeting the protests with empathy and re-hiring the pilots, Naresh Goyal expressed a lot of anger. Speaking to “The Times Of India” in 2009 , he said: “I will not hesitate to close down the airline […]. I have no disagreement with pilots. However, I cannot tolerate any breach of the basic principle of discipline.”

Subsequently, Jet Airways canceled numerous flights and left thousands of passengers stranded. 3 more pilots heard the decision that they are laid off.

And just as a reminder, the world was still amidst a financial crisis. By no means was the financial situation of Jet Airways healthy.

So, pilots going on strike just added to the difficulties. After adopting a hard stance, Jet Airways eventually caved in and talked with the pilots.

Yet finally, the airline also stopped bleeding money. While Kingfisher and Air India , the national flag carrier of India, were accumulating losses, Jet Airways met 2010 with a smile. The company‘s books were again in the green.

The airline optimized routes improved the efficiency of the company, added more routes, reduced operational costs (such as fuel) and started using their aircraft more.

One more Jet Airways subsidiary

Jet Airways used some innovative methods to save money. It looked at passenger consumption habits and basically reduced flight weight, by reducing the number of amenities carried on board. As a result, Jet Airways started to save a lot of money on fuel alone.

In addition, Jet Airways did something that shocked a lot of people. They already owned JetLite (formerly Air Sahara), which the company converted into a low-cost carrier. But in 2009, Jet Airways launched one more subsidiary and called it Jet Konnect. At the time the move baffled aviation experts, as now Jet Airways owned 2 subsidiaries that operated under the same, low-cost, model.

In the short-term, the moves seemed to work out great. Jet Airways started to gain traction and with the financial crisis fading away, the airline flourished. The group (Jet Airways and its two subsidiaries) operated more than a fifth (20%) of flights in India.

But in the long-term? The moves were not the best. Just 3 years later, in 2012, Jet Airways merged the two low-cost subsidiaries. 2 years down the line, in 2014, Jet Konnect as a brand stopped existing.

Nevertheless, more great news followed. In 2012, the Indian government allowed foreign airlines to take up a share package in Indian carriers. Etihad lined up to buy 24% of Jet Airway’s shares, a move which the two parties finally agreed to on November of 2013.

Naresh Goyal and Jet Airways were destined for a bright future.

However, Jet Airways had still one more problem that was left over from the past. Low-cost carriers.

As passenger numbers in India dropped in the early 2010s, the company decided to combat that in a rather unusual way. In 2013, the full-service carrier Jet Airways decided to enter a price war with two of its biggest domestic competitors – SpiceJet and IndiGo. For one thing, those two airlines were already offering cheap flights, as that was their business model.

In contrast, Jet Airways was not. Offering cheap flights was not a smart idea, as the airline kept the high running costs. But the company somehow thought that was a good decision.

If the financial year of 2012 – 2013 was a fairly successful one, as Jet Airways reduced the amount of money they lost and posted a net loss of ₹4.8 million, 2013 – 2014 was a disaster. The airlines’ financial situation was terrible, as it posted a loss of ₹36.7 million.

Subsequently, Jet Airways ended the Jet Konnect brand and the carrier made the commitment to only offer full-service flights domestically in 2014.

Now, I’m no economics expert, but IATA has done an analysis of the Indian domestic passenger traffic. The analysis, which IATA published in 2018, indicates that ever since after the 2010 – 2013 slump in traveler numbers, the demand for air travel had risen once again since 2014 and has been steadily growing.

However, the same analysis posted a chart, that around 5% of the Indian households were classified as middle-class.

You add the two together and the conclusion is very clear – the demand for low-cost travel at the time (and still now) is very high. Simply put, not a lot of people can afford to travel domestically or internationally on full-service carriers, as tickets are expensive.

This has allowed low-cost carriers, namely IndiGo, to capture a lot of the domestic market.

A shroud of success

The next year, Jet Airways managed to reduce its losses significantly. Everything seemed to work out fine for the privately owned airline and it looked like the carrier will dominate the Indian market yet again.

So much so, that for the first time in 6 years, the airline made an actual profit! If Jet Airways enjoyed the sunshine of success in 2016, 2017 brought out the first clouds in the sky, as profits took a slight hit.

This is where the trouble began, as IndiGo started to dominate the local market. Slowly, but surely, Jet Airways’ position as the number one airline in India eroded. As they lost the domestic battle, the international skies provided absolutely no chance for the airline. Jet Airways simply could not compete with Emirates , Singapore Airlines ( SIA1 ) ( SINGY ) or the likes.

Essentially, they put themselves in the corner. Their domestic demand crumbled and they had no chance to squeeze in between the big players in aviation.

Meanwhile, while Jet Airways operated on very thin margins, fuel prices surged massively. As time went on, the company yet again started bleeding money. Massively.

Buying out Jet Airways is a very lucrative idea for a lot of investors, including Etihad, which indicated that they want to increase their stake at the airline from 24% to 49%. (The Indian law prevents a foreign airline holding a majority in an Indian carrier.)

But there is one more problem – the chairman of the airline, Naresh Goyal. Multiple investors, as well as Etihad, have said that if Goyal does not step down, no deal will come through.

The former Jet Airways chairman, Naresh Goyal

But after stubbornly holding on for his chair, at the end of March he finally stepped down.

And this is the moment where we land today – On May 10, 2019.

The current situation of Jet Airways

As of now, we all know what the situation at the airline is.

After consistently missing payments, one by one, lessors began withdrawing their aircraft from Jet Airways’ fleet. In addition, the Indian Oil Corporation refused to serve any fuel to the airlines‘ aircraft for the same reason.

Jet Airways grounded fleet

In December 2018, the airline operated 123 aircraft. Not even a year later, the airline departed for its last flight (for now) on April 18th, 2019.

Riddled with massive debts and no emergency funds, the airline is looking for a hero to save them. Question is, is it too late?

The Indian government already allocated the airlines‘ aircraft and slots to rival airlines, which means that the airline has virtually no assets and it‘s value crumbles by the day.

However, Jet Airways‘ staff are the saving grace here, as they are committed to continuing working for the airline. The staff met an Indian politician, Devendra Fadnavis. He assured that the government of Maharashtra (a state in India) will also make a move if nobody puts out a bid.

If I were to predict the outcome of the whole ordeal, I‘d say that Jet Airways is destined to bankruptcy. The fact that the Indian government gave away the company‘s aircraft and slots, coupled with Jet Airways‘ debt of $1.2 billion, makes it a pretty unattractive package.

But whatever the 6 PM deadline will bring to the table, Jet Airways will always be engrained in India‘s history of aviation. The airline absolutely rocked the aviation market in the 90s and raised the quality of passenger experience in the country.

And while the heroic efforts of the employees are truly remarkable, this might be the end for the most successful private airline in India.

Recent developments

UPDATE: As of May 13th, only Etihad Airways have submitted a proper bid. However, the problem is that Etihad is currently suffering massive financial losses and is looking for a majority partner to help them with the take-over. The Abu Dhabi based carrier is looking to remain a minority stakeholder. Eithad Airways have had their fair share of bad luck in the investment department recently, as they had to pull out from the bankrupt Italian carrier Alitalia . Air Berlin ( AB1 ) was an unsuccessful investment as well, as the German airline ceased operations in 2017.

With these developments in mind, the future of Jet Airways has become even grimmer. Leasing companies are deregistering more and more of the Indian carrier’s aircraft and time is running out to save the troubled Jet Airways.

- Jet Airways

Sign Up for Our Newsletters

Related posts.

A brief history of the Boeing 737 family and its enduring success

IATA and ICAO: a guide to airline and airport codes

What is a microburst and how do pilots respond to them?

The different types of transponders used in aviation

AeroTime is on YouTube

Subscribe to the AeroTime Hub channel for exclusive video content.

- Search Menu

Sign in through your institution

- Browse content in Arts and Humanities

- Browse content in Archaeology

- Anglo-Saxon and Medieval Archaeology

- Archaeological Methodology and Techniques

- Archaeology by Region

- Archaeology of Religion

- Archaeology of Trade and Exchange

- Biblical Archaeology

- Contemporary and Public Archaeology

- Environmental Archaeology

- Historical Archaeology

- History and Theory of Archaeology

- Industrial Archaeology

- Landscape Archaeology

- Mortuary Archaeology

- Prehistoric Archaeology

- Underwater Archaeology

- Urban Archaeology

- Zooarchaeology

- Browse content in Architecture

- Architectural Structure and Design

- History of Architecture

- Residential and Domestic Buildings

- Theory of Architecture

- Browse content in Art

- Art Subjects and Themes

- History of Art

- Industrial and Commercial Art

- Theory of Art

- Biographical Studies

- Byzantine Studies

- Browse content in Classical Studies

- Classical History

- Classical Philosophy

- Classical Mythology

- Classical Literature

- Classical Reception

- Classical Art and Architecture

- Classical Oratory and Rhetoric

- Greek and Roman Epigraphy

- Greek and Roman Law

- Greek and Roman Papyrology

- Greek and Roman Archaeology

- Late Antiquity

- Religion in the Ancient World

- Social History

- Digital Humanities

- Browse content in History

- Colonialism and Imperialism

- Diplomatic History

- Environmental History

- Genealogy, Heraldry, Names, and Honours

- Genocide and Ethnic Cleansing

- Historical Geography

- History by Period

- History of Emotions

- History of Agriculture

- History of Education

- History of Gender and Sexuality

- Industrial History

- Intellectual History

- International History

- Labour History

- Legal and Constitutional History

- Local and Family History

- Maritime History

- Military History

- National Liberation and Post-Colonialism

- Oral History

- Political History

- Public History

- Regional and National History

- Revolutions and Rebellions

- Slavery and Abolition of Slavery

- Social and Cultural History

- Theory, Methods, and Historiography

- Urban History

- World History

- Browse content in Language Teaching and Learning

- Language Learning (Specific Skills)

- Language Teaching Theory and Methods

- Browse content in Linguistics

- Applied Linguistics

- Cognitive Linguistics

- Computational Linguistics

- Forensic Linguistics

- Grammar, Syntax and Morphology

- Historical and Diachronic Linguistics

- History of English

- Language Acquisition

- Language Evolution

- Language Reference

- Language Variation

- Language Families

- Lexicography

- Linguistic Anthropology

- Linguistic Theories

- Linguistic Typology

- Phonetics and Phonology

- Psycholinguistics

- Sociolinguistics

- Translation and Interpretation

- Writing Systems

- Browse content in Literature

- Bibliography

- Children's Literature Studies

- Literary Studies (Asian)

- Literary Studies (European)

- Literary Studies (Eco-criticism)

- Literary Studies (Romanticism)

- Literary Studies (American)

- Literary Studies (Modernism)

- Literary Studies - World

- Literary Studies (1500 to 1800)

- Literary Studies (19th Century)

- Literary Studies (20th Century onwards)

- Literary Studies (African American Literature)

- Literary Studies (British and Irish)

- Literary Studies (Early and Medieval)

- Literary Studies (Fiction, Novelists, and Prose Writers)

- Literary Studies (Gender Studies)

- Literary Studies (Graphic Novels)

- Literary Studies (History of the Book)

- Literary Studies (Plays and Playwrights)

- Literary Studies (Poetry and Poets)

- Literary Studies (Postcolonial Literature)

- Literary Studies (Queer Studies)

- Literary Studies (Science Fiction)

- Literary Studies (Travel Literature)

- Literary Studies (War Literature)

- Literary Studies (Women's Writing)

- Literary Theory and Cultural Studies

- Mythology and Folklore

- Shakespeare Studies and Criticism

- Browse content in Media Studies

- Browse content in Music

- Applied Music

- Dance and Music

- Ethics in Music

- Ethnomusicology

- Gender and Sexuality in Music

- Medicine and Music

- Music Cultures

- Music and Religion

- Music and Media

- Music and Culture

- Music Education and Pedagogy

- Music Theory and Analysis

- Musical Scores, Lyrics, and Libretti

- Musical Structures, Styles, and Techniques

- Musicology and Music History

- Performance Practice and Studies

- Race and Ethnicity in Music

- Sound Studies

- Browse content in Performing Arts

- Browse content in Philosophy

- Aesthetics and Philosophy of Art

- Epistemology

- Feminist Philosophy

- History of Western Philosophy

- Metaphysics

- Moral Philosophy

- Non-Western Philosophy

- Philosophy of Science

- Philosophy of Language

- Philosophy of Mind

- Philosophy of Perception

- Philosophy of Action

- Philosophy of Law

- Philosophy of Religion

- Philosophy of Mathematics and Logic

- Practical Ethics

- Social and Political Philosophy

- Browse content in Religion

- Biblical Studies

- Christianity

- East Asian Religions

- History of Religion

- Judaism and Jewish Studies

- Qumran Studies

- Religion and Education

- Religion and Health

- Religion and Politics

- Religion and Science

- Religion and Law

- Religion and Art, Literature, and Music

- Religious Studies

- Browse content in Society and Culture

- Cookery, Food, and Drink

- Cultural Studies

- Customs and Traditions

- Ethical Issues and Debates

- Hobbies, Games, Arts and Crafts

- Natural world, Country Life, and Pets

- Popular Beliefs and Controversial Knowledge

- Sports and Outdoor Recreation

- Technology and Society

- Travel and Holiday

- Visual Culture

- Browse content in Law

- Arbitration

- Browse content in Company and Commercial Law

- Commercial Law

- Company Law

- Browse content in Comparative Law

- Systems of Law

- Competition Law

- Browse content in Constitutional and Administrative Law

- Government Powers

- Judicial Review

- Local Government Law

- Military and Defence Law

- Parliamentary and Legislative Practice

- Construction Law

- Contract Law

- Browse content in Criminal Law

- Criminal Procedure

- Criminal Evidence Law

- Sentencing and Punishment

- Employment and Labour Law

- Environment and Energy Law

- Browse content in Financial Law

- Banking Law

- Insolvency Law

- History of Law

- Human Rights and Immigration

- Intellectual Property Law

- Browse content in International Law

- Private International Law and Conflict of Laws

- Public International Law

- IT and Communications Law

- Jurisprudence and Philosophy of Law

- Law and Politics

- Law and Society

- Browse content in Legal System and Practice

- Courts and Procedure

- Legal Skills and Practice

- Primary Sources of Law

- Regulation of Legal Profession

- Medical and Healthcare Law

- Browse content in Policing

- Criminal Investigation and Detection

- Police and Security Services

- Police Procedure and Law

- Police Regional Planning

- Browse content in Property Law

- Personal Property Law

- Study and Revision

- Terrorism and National Security Law

- Browse content in Trusts Law

- Wills and Probate or Succession

- Browse content in Medicine and Health

- Browse content in Allied Health Professions

- Arts Therapies

- Clinical Science

- Dietetics and Nutrition

- Occupational Therapy

- Operating Department Practice

- Physiotherapy

- Radiography

- Speech and Language Therapy

- Browse content in Anaesthetics

- General Anaesthesia

- Neuroanaesthesia

- Browse content in Clinical Medicine

- Acute Medicine

- Cardiovascular Medicine

- Clinical Genetics

- Clinical Pharmacology and Therapeutics

- Dermatology

- Endocrinology and Diabetes

- Gastroenterology

- Genito-urinary Medicine

- Geriatric Medicine

- Infectious Diseases

- Medical Toxicology

- Medical Oncology

- Pain Medicine

- Palliative Medicine

- Rehabilitation Medicine

- Respiratory Medicine and Pulmonology

- Rheumatology

- Sleep Medicine

- Sports and Exercise Medicine

- Clinical Neuroscience

- Community Medical Services

- Critical Care

- Emergency Medicine

- Forensic Medicine

- Haematology

- History of Medicine

- Browse content in Medical Dentistry

- Oral and Maxillofacial Surgery

- Paediatric Dentistry

- Restorative Dentistry and Orthodontics

- Surgical Dentistry

- Browse content in Medical Skills

- Clinical Skills

- Communication Skills

- Nursing Skills

- Surgical Skills

- Medical Ethics

- Medical Statistics and Methodology

- Browse content in Neurology

- Clinical Neurophysiology

- Neuropathology

- Nursing Studies

- Browse content in Obstetrics and Gynaecology

- Gynaecology

- Occupational Medicine

- Ophthalmology

- Otolaryngology (ENT)

- Browse content in Paediatrics

- Neonatology

- Browse content in Pathology

- Chemical Pathology

- Clinical Cytogenetics and Molecular Genetics

- Histopathology

- Medical Microbiology and Virology

- Patient Education and Information

- Browse content in Pharmacology

- Psychopharmacology

- Browse content in Popular Health

- Caring for Others

- Complementary and Alternative Medicine

- Self-help and Personal Development

- Browse content in Preclinical Medicine

- Cell Biology

- Molecular Biology and Genetics

- Reproduction, Growth and Development

- Primary Care

- Professional Development in Medicine

- Browse content in Psychiatry

- Addiction Medicine

- Child and Adolescent Psychiatry

- Forensic Psychiatry

- Learning Disabilities

- Old Age Psychiatry

- Psychotherapy

- Browse content in Public Health and Epidemiology

- Epidemiology

- Public Health

- Browse content in Radiology

- Clinical Radiology

- Interventional Radiology

- Nuclear Medicine

- Radiation Oncology

- Reproductive Medicine

- Browse content in Surgery

- Cardiothoracic Surgery

- Gastro-intestinal and Colorectal Surgery

- General Surgery

- Neurosurgery

- Paediatric Surgery

- Peri-operative Care

- Plastic and Reconstructive Surgery

- Surgical Oncology

- Transplant Surgery

- Trauma and Orthopaedic Surgery

- Vascular Surgery

- Browse content in Science and Mathematics

- Browse content in Biological Sciences

- Aquatic Biology

- Biochemistry

- Bioinformatics and Computational Biology

- Developmental Biology

- Ecology and Conservation

- Evolutionary Biology

- Genetics and Genomics

- Microbiology

- Molecular and Cell Biology

- Natural History

- Plant Sciences and Forestry

- Research Methods in Life Sciences

- Structural Biology

- Systems Biology

- Zoology and Animal Sciences

- Browse content in Chemistry

- Analytical Chemistry

- Computational Chemistry

- Crystallography

- Environmental Chemistry

- Industrial Chemistry

- Inorganic Chemistry

- Materials Chemistry

- Medicinal Chemistry

- Mineralogy and Gems

- Organic Chemistry

- Physical Chemistry

- Polymer Chemistry

- Study and Communication Skills in Chemistry

- Theoretical Chemistry

- Browse content in Computer Science

- Artificial Intelligence

- Computer Architecture and Logic Design

- Game Studies

- Human-Computer Interaction

- Mathematical Theory of Computation

- Programming Languages

- Software Engineering

- Systems Analysis and Design

- Virtual Reality

- Browse content in Computing

- Business Applications

- Computer Security

- Computer Games

- Computer Networking and Communications

- Digital Lifestyle

- Graphical and Digital Media Applications

- Operating Systems

- Browse content in Earth Sciences and Geography

- Atmospheric Sciences

- Environmental Geography

- Geology and the Lithosphere

- Maps and Map-making

- Meteorology and Climatology

- Oceanography and Hydrology

- Palaeontology

- Physical Geography and Topography

- Regional Geography

- Soil Science

- Urban Geography

- Browse content in Engineering and Technology

- Agriculture and Farming

- Biological Engineering

- Civil Engineering, Surveying, and Building

- Electronics and Communications Engineering

- Energy Technology

- Engineering (General)

- Environmental Science, Engineering, and Technology

- History of Engineering and Technology

- Mechanical Engineering and Materials

- Technology of Industrial Chemistry

- Transport Technology and Trades

- Browse content in Environmental Science

- Applied Ecology (Environmental Science)

- Conservation of the Environment (Environmental Science)

- Environmental Sustainability

- Environmentalist Thought and Ideology (Environmental Science)

- Management of Land and Natural Resources (Environmental Science)

- Natural Disasters (Environmental Science)

- Nuclear Issues (Environmental Science)

- Pollution and Threats to the Environment (Environmental Science)

- Social Impact of Environmental Issues (Environmental Science)

- History of Science and Technology

- Browse content in Materials Science

- Ceramics and Glasses

- Composite Materials

- Metals, Alloying, and Corrosion

- Nanotechnology

- Browse content in Mathematics

- Applied Mathematics

- Biomathematics and Statistics

- History of Mathematics

- Mathematical Education

- Mathematical Finance

- Mathematical Analysis

- Numerical and Computational Mathematics

- Probability and Statistics

- Pure Mathematics

- Browse content in Neuroscience

- Cognition and Behavioural Neuroscience

- Development of the Nervous System

- Disorders of the Nervous System

- History of Neuroscience

- Invertebrate Neurobiology

- Molecular and Cellular Systems

- Neuroendocrinology and Autonomic Nervous System

- Neuroscientific Techniques

- Sensory and Motor Systems

- Browse content in Physics

- Astronomy and Astrophysics

- Atomic, Molecular, and Optical Physics

- Biological and Medical Physics

- Classical Mechanics

- Computational Physics

- Condensed Matter Physics

- Electromagnetism, Optics, and Acoustics

- History of Physics

- Mathematical and Statistical Physics

- Measurement Science

- Nuclear Physics

- Particles and Fields

- Plasma Physics

- Quantum Physics

- Relativity and Gravitation

- Semiconductor and Mesoscopic Physics

- Browse content in Psychology

- Affective Sciences

- Clinical Psychology

- Cognitive Psychology

- Cognitive Neuroscience

- Criminal and Forensic Psychology

- Developmental Psychology

- Educational Psychology

- Evolutionary Psychology

- Health Psychology

- History and Systems in Psychology

- Music Psychology

- Neuropsychology

- Organizational Psychology

- Psychological Assessment and Testing

- Psychology of Human-Technology Interaction

- Psychology Professional Development and Training

- Research Methods in Psychology

- Social Psychology

- Browse content in Social Sciences

- Browse content in Anthropology

- Anthropology of Religion

- Human Evolution

- Medical Anthropology

- Physical Anthropology

- Regional Anthropology

- Social and Cultural Anthropology

- Theory and Practice of Anthropology

- Browse content in Business and Management

- Business Strategy

- Business Ethics

- Business History

- Business and Government

- Business and Technology

- Business and the Environment

- Comparative Management

- Corporate Governance

- Corporate Social Responsibility

- Entrepreneurship

- Health Management

- Human Resource Management

- Industrial and Employment Relations

- Industry Studies

- Information and Communication Technologies

- International Business

- Knowledge Management

- Management and Management Techniques

- Operations Management

- Organizational Theory and Behaviour

- Pensions and Pension Management

- Public and Nonprofit Management

- Strategic Management

- Supply Chain Management

- Browse content in Criminology and Criminal Justice

- Criminal Justice

- Criminology

- Forms of Crime

- International and Comparative Criminology

- Youth Violence and Juvenile Justice

- Development Studies

- Browse content in Economics

- Agricultural, Environmental, and Natural Resource Economics

- Asian Economics

- Behavioural Finance

- Behavioural Economics and Neuroeconomics

- Econometrics and Mathematical Economics

- Economic Systems

- Economic History

- Economic Methodology

- Economic Development and Growth

- Financial Markets

- Financial Institutions and Services

- General Economics and Teaching

- Health, Education, and Welfare

- History of Economic Thought

- International Economics

- Labour and Demographic Economics

- Law and Economics

- Macroeconomics and Monetary Economics

- Microeconomics

- Public Economics

- Urban, Rural, and Regional Economics

- Welfare Economics

- Browse content in Education

- Adult Education and Continuous Learning

- Care and Counselling of Students

- Early Childhood and Elementary Education

- Educational Equipment and Technology

- Educational Strategies and Policy

- Higher and Further Education

- Organization and Management of Education

- Philosophy and Theory of Education

- Schools Studies

- Secondary Education

- Teaching of a Specific Subject

- Teaching of Specific Groups and Special Educational Needs

- Teaching Skills and Techniques

- Browse content in Environment

- Applied Ecology (Social Science)

- Climate Change

- Conservation of the Environment (Social Science)

- Environmentalist Thought and Ideology (Social Science)

- Natural Disasters (Environment)

- Social Impact of Environmental Issues (Social Science)

- Browse content in Human Geography

- Cultural Geography

- Economic Geography

- Political Geography

- Browse content in Interdisciplinary Studies

- Communication Studies

- Museums, Libraries, and Information Sciences

- Browse content in Politics

- African Politics

- Asian Politics

- Chinese Politics

- Comparative Politics

- Conflict Politics

- Elections and Electoral Studies

- Environmental Politics

- Ethnic Politics

- European Union

- Foreign Policy

- Gender and Politics

- Human Rights and Politics

- Indian Politics

- International Relations

- International Organization (Politics)

- International Political Economy

- Irish Politics

- Latin American Politics

- Middle Eastern Politics

- Political Methodology

- Political Communication

- Political Philosophy

- Political Sociology

- Political Behaviour

- Political Economy

- Political Institutions

- Political Theory

- Politics and Law

- Politics of Development

- Public Administration

- Public Policy

- Qualitative Political Methodology

- Quantitative Political Methodology

- Regional Political Studies

- Russian Politics

- Security Studies

- State and Local Government

- UK Politics

- US Politics

- Browse content in Regional and Area Studies

- African Studies

- Asian Studies

- East Asian Studies

- Japanese Studies

- Latin American Studies

- Middle Eastern Studies

- Native American Studies

- Scottish Studies

- Browse content in Research and Information

- Research Methods

- Browse content in Social Work

- Addictions and Substance Misuse

- Adoption and Fostering

- Care of the Elderly

- Child and Adolescent Social Work

- Couple and Family Social Work

- Direct Practice and Clinical Social Work

- Emergency Services

- Human Behaviour and the Social Environment

- International and Global Issues in Social Work

- Mental and Behavioural Health

- Social Justice and Human Rights

- Social Policy and Advocacy

- Social Work and Crime and Justice

- Social Work Macro Practice

- Social Work Practice Settings

- Social Work Research and Evidence-based Practice

- Welfare and Benefit Systems

- Browse content in Sociology

- Childhood Studies

- Community Development

- Comparative and Historical Sociology

- Economic Sociology

- Gender and Sexuality

- Gerontology and Ageing

- Health, Illness, and Medicine

- Marriage and the Family

- Migration Studies

- Occupations, Professions, and Work

- Organizations

- Population and Demography

- Race and Ethnicity

- Social Theory

- Social Movements and Social Change

- Social Research and Statistics

- Social Stratification, Inequality, and Mobility

- Sociology of Religion

- Sociology of Education

- Sport and Leisure

- Urban and Rural Studies

- Browse content in Warfare and Defence

- Defence Strategy, Planning, and Research

- Land Forces and Warfare

- Military Administration

- Military Life and Institutions

- Naval Forces and Warfare

- Other Warfare and Defence Issues

- Peace Studies and Conflict Resolution

- Weapons and Equipment

- < Previous chapter

- Next chapter >

12 Jet Airways from ‘Rise’ to Steep ‘Fall’

- Published: August 2022

- Cite Icon Cite

- Permissions Icon Permissions

Jet Airways, a brainchild of visionary and excellent entrepreneur Naresh Goyal, incorporated in 1992, started taxi operations in 1993, began full operations by 1995 and got permission to fly international flights by aviation ministry to London in 2004. Naresh Goyal had vast experience in the field of aviation before entering the market. He availed the opportunity floored by the Government of India by liberalizing the Indian market and started Jet Airways and took various decisions at the correct point of time, which helped Jet Airways to lead the aviation market of India from 1997 to 2009. It was the leading airline of India, providing excellent services to its customers and making a strong, loyal customer base. It had a trained pilot and crew members to suit the needs of the concepts of the airline. Introduction of low—cost airline in the Indian airline industry, rising fuel prices and mechanism to handle its impact, understanding the norm of market and hesitation and inability to break the image of the airline as Luxury service provider made Jet Airways suffer and finally grounding its flights. The negligence of banks and regulators and their approach in the future towards debt—ridden companies would decide the future of Jet Airways.

Personal account

- Sign in with email/username & password

- Get email alerts

- Save searches

- Purchase content

- Activate your purchase/trial code

- Add your ORCID iD

Institutional access

Sign in with a library card.

- Sign in with username/password

- Recommend to your librarian

- Institutional account management

- Get help with access

Access to content on Oxford Academic is often provided through institutional subscriptions and purchases. If you are a member of an institution with an active account, you may be able to access content in one of the following ways:

IP based access

Typically, access is provided across an institutional network to a range of IP addresses. This authentication occurs automatically, and it is not possible to sign out of an IP authenticated account.

Choose this option to get remote access when outside your institution. Shibboleth/Open Athens technology is used to provide single sign-on between your institution’s website and Oxford Academic.

- Click Sign in through your institution.

- Select your institution from the list provided, which will take you to your institution's website to sign in.

- When on the institution site, please use the credentials provided by your institution. Do not use an Oxford Academic personal account.

- Following successful sign in, you will be returned to Oxford Academic.

If your institution is not listed or you cannot sign in to your institution’s website, please contact your librarian or administrator.

Enter your library card number to sign in. If you cannot sign in, please contact your librarian.

Society Members

Society member access to a journal is achieved in one of the following ways:

Sign in through society site

Many societies offer single sign-on between the society website and Oxford Academic. If you see ‘Sign in through society site’ in the sign in pane within a journal:

- Click Sign in through society site.

- When on the society site, please use the credentials provided by that society. Do not use an Oxford Academic personal account.

If you do not have a society account or have forgotten your username or password, please contact your society.

Sign in using a personal account

Some societies use Oxford Academic personal accounts to provide access to their members. See below.

A personal account can be used to get email alerts, save searches, purchase content, and activate subscriptions.

Some societies use Oxford Academic personal accounts to provide access to their members.

Viewing your signed in accounts

Click the account icon in the top right to:

- View your signed in personal account and access account management features.

- View the institutional accounts that are providing access.

Signed in but can't access content

Oxford Academic is home to a wide variety of products. The institutional subscription may not cover the content that you are trying to access. If you believe you should have access to that content, please contact your librarian.

For librarians and administrators, your personal account also provides access to institutional account management. Here you will find options to view and activate subscriptions, manage institutional settings and access options, access usage statistics, and more.

Our books are available by subscription or purchase to libraries and institutions.

| Month: | Total Views: |

|---|---|

| October 2022 | 3 |

| December 2022 | 2 |

| May 2023 | 1 |

| September 2023 | 3 |

| June 2024 | 1 |

- About Oxford Academic

- Publish journals with us

- University press partners

- What we publish

- New features

- Open access

- Rights and permissions

- Accessibility

- Advertising

- Media enquiries

- Oxford University Press

- Oxford Languages

- University of Oxford

Oxford University Press is a department of the University of Oxford. It furthers the University's objective of excellence in research, scholarship, and education by publishing worldwide

- Copyright © 2024 Oxford University Press

- Cookie settings

- Cookie policy

- Privacy policy

- Legal notice

This Feature Is Available To Subscribers Only

Sign In or Create an Account

This PDF is available to Subscribers Only

For full access to this pdf, sign in to an existing account, or purchase an annual subscription.

Simple Flying

The rise and fall of jet airways.

Your changes have been saved

Email Is sent

Please verify your email address.

You’ve reached your account maximum for followed topics.

Hong Kong's Legendary Kai Tak Airport: 5 Fast Facts

What happened to us-german carrier aeroamerica, ww2 douglas c-47 “that’s all, brother” returns to us after d-day european tour.

India's air travel market is a hyper-competitive environment at the best of times, even without the presence of a major global catastrophe. Last year, full-service carrier Jet Airways fell victim to this harsh environment and had to suspend its operations in the Spring of 2019. How did it go from a major Indian international airline to bankruptcy and near-collapse? Let's find out.

The rise of Jet Airways

According to the Economic Times of India, Jet Airways was incorporated on April 1st, 1992, as a private company. In 1993 it started as an Air Taxi Operator with four leased Boeing 737s and moved on to 'scheduled airline status' at the beginning of 1995.

Stay informed: Sign up for our daily aviation news digest .

By the early 2000s, the airline offered over 40 destinations in India and two destinations outside India, operating over 1,900 flights weekly. The airline's fleet grew from four aircraft in 1993 to 42 aircraft comprised of 34 Boeing 737s and eight ATR 72-500s.

The airline would go on to buy 10 777s in 2005-06 just after purchasing 10 Airbus A330s to expand its long-haul international flights. In fact, Jet Airways' long-haul operations took passengers as far away as Toronto, San Francisco, London, Johannesburg, and Singapore, among many other global cities.

In 2010, Jet Airways became the country's largest carrier by passenger volume, becoming a significant international airline. The airline even flirted with joining the Star Alliance, a deal that never went through.

Shifting ownership

The airline's ownership status repeatedly shifted, going back and forth between private and public numerous times. At one point, early on in the company's history, Bahrain's Gulf Air and Kuwait Airways were stakeholders in the airline.

One of Jet Airways' more significant status-changes took place in 1997. It was at this time that the Government of India ruled that no foreign companies were allowed to own part of India's domestic airlines. Thus, Mr Naresh Goyal acquired the 20% Equity Shares from each of Gulf Air and Kuwait Airways, respectively, and became the 100% owner of Tail Winds. Tail Winds was the holding company for Jet Airways.

Jet Airways would go on to list itself on the local stock exchange to raise funds for expansion. 20% of the company was offered to investors. When the government eventually allowed foreign airlines to buy up to 49% of Indian local carriers, Jet Airways sold off 24% of their firm to Etihad in 2013.

Jet Airways' spectacular fall

By 2018 it became clear that Jet's growth was coming to a stop. With fierce competition coming from India's low-cost carriers, the airline lost much of its market share and revenues. It was eventually forced to sell its widebody fleet, including its 777s and A330s, to reduce its mountain of debt.

By 2019 it became clear that without a huge investment, the airline would collapse. However, no investment came, and on April 17th, 2019, Jet Airways suspended all operations, shortly thereafter going into bankruptcy proceedings.

These days, Jet Airways still exists as a company with assets, as it is yet to officially "shut down". It remains in bankruptcy proceedings.

The airline is waiting for an investor to come through and buy the airline. In the past year, there have been expressions of interest and every so often names get thrown around in news articles. The latest rumors suggest UK and UAE-based consortiums are eyeing the airline.

Dealing with Cross-Border Insolvencies: An Analysis of the Jet Airways saga

[ By Shivam Bhattacharya & Naman Jain ]

The authors are students at the Gujarat National Law University.

The recent order of the Mumbai Bench of the NCLT approving the resolution plan for the revival of Jet Airways has marked the end of one of the earliest cases of cross-border insolvency determined under the Insolvency and Bankruptcy Code, 2016 (hereinafter “Code”). The final determination by the Court has in addition to providing insights into the working of the Code, also laid bare some of its limitations for resolving cross-border insolvency disputes. In pursuance of this, the authors intend to examine the entire case in light of the recent judgment by presenting the facts, orders and judgments passed. This article will also analyze the limitations of the Code in this regard and elaborate on how adopting some of the provisions of the UNCITRAL Model Law could help in dealing with similar insolvency disputes.

The present case begins with the initiation of ‘corporate insolvency proceedings’ against Jet Airways and concludes with the final approval of the resolution plan for its revival by the NCLT. It spans three different Court orders over a period of two years.

Company Petition No. 2205 (IB)/MB/2019 in NCLT, Mumbai Bench

Three petitions were filed against Jet Airways, the Corporate Debtor in this case, for the initiation of Corporate Insolvency Resolution Process (CIRP) against it for the huge outstanding debt is owed. During the first hearing, the NCLT Bench was apprised of the fact that insolvency proceedings against Jet Airways had already begun a month prior in the District Court of Netherlands . The Bench in this regard opined that conducting concurrent proceedings in the same matter would cause delay and vitiate the proceedings in the case. The reasoning put forth was that the two sections, Section 234 and 235 in the CODE for recognizing the orders of a foreign jurisdiction, mandate the requirement of the Indian Government to have reciprocal arrangements with the foreign country. However, the Court noted that in the instant case there were no reciprocal arrangements were made with the Dutch authorities.

Furthermore, the Bench also took into consideration that the registered office of ‘Jet Airways’ and their primary assets were located in India, and therefore the NCLT had the requisite jurisdiction in the instant matter. The Bench via its order dated 20 th June 2019 set aside the proceedings of the Dutch Court and declared it as a nullity. The initiation of the corporate insolvency resolution process in India against Jet Airways was accepted by the NCLT.

Company Appeal (AT) (Insolvency) No. 707 of 2019 in NCLAT, Delhi

The order passed by the NCLT bench on the aspect of non-recognition of the Dutch proceedings was challenged before the NCLAT by the Dutch Trustee. The NCLAT considered the appeal and directed the ‘Resolution Professional’ (hereinafter “RP”), appointed on behalf of Jet Airways, to consider the feasibility of having a joint ‘corporate insolvency resolution process in coordination with the Dutch Trustee. The RP along with the Dutch trustee reached an agreement for facilitating the resolution process through a ‘Proposed Cooperation’ model. Both the parties reached a final agreement on the proposed model and submitted it to the NCLAT for approval. The NCLAT accepted the model via its order dated 26th September. The Bench also allowed the Dutch Court Administration to attend the meetings of Jet Airways. Interlocutory Application No. 2081 of 2020 in NCLT, Mumbai Bench

An application for the final approval of the ‘Resolution Plan’ was filed before the Mumbai Bench of the NCLT. The Bench via its order dated 22 nd June 2021 accepted the ‘Resolution plan’ on a majority of the points, and gave a time period of 90 days to the consortium for taking the necessary regulatory approvals and permissions from the DGCA. The Bench ordered the formation of a Monitoring Committee for overseeing the entire process. Though the final determination by the Benchmarked the end of India’s first cross-border insolvency case settled under the Code, however, it raised some key concerns regarding the inadequacy of insolvency provisions in the Code.

Analysis and Suggestions