- Wealth Management

- IT Services

- Client Login

- (847) 247-8959

February 27, 2024

How to create a business budget: 8 simple steps.

No matter the size of your business, a business budget is vital to planning and guiding your business’s growth. By understanding the fixed expenses of a company and accounting for the ebb and flow of work, a proper business budget can help your business maintain itself through the year and create protection around unplanned expenses through well allocated funds. In this guide, we'll walk you through the process of creating a business budget, outlining essential steps to help you manage your finances effectively.

What Is a Business Budget?

A business budget is a financial plan outlining projected revenues and expenses for a business during a specific period of time (most typically a year, though there are often monthly or quarterly reexaminations). Although there are variables throughout the year, a complete and accurate budget will serve as a blueprint for businesses in managing income and expenditures, guiding decision-making processes, and ensuring financial stability.

What Should a Business Budget Include?

A comprehensive business budget’s purpose is to provide a business a holistic view of their financial health. When looking through bank statements, take note of those expenses that reoccur throughout the year and note those—as well as those unexpected expenses your company should instead anticipate. Key components to include are:

- Revenue Forecast: Anticipated income from sales, services, or other sources after deducting costs, taxes, and other fees.

- Fixed Operating Expenses: Costs associated with running the business, such as rent, utilities, salaries, and supplies.

- Capital Expenditures: Investments in assets like equipment, machinery, or property.

- Debt Service: Payments towards loans, credit lines, or other forms of debt.

- Taxes: Estimated tax liabilities, including income tax, sales tax, and payroll taxes.

- Contingency Funds: Reserves set aside for unexpected expenses or emergencies.

- Profit Targets: Desired levels of profitability, indicating the financial performance you aim to achieve.

Why Is Budgeting Important to a Business?

Budgeting plays a crucial role in the financial management of a business for several reasons:

- Resource Allocation: Helps allocate resources efficiently to prioritize essential activities and investments.

- Financial Control: Provides a framework for monitoring and controlling expenses to prevent overspending.

- Performance Evaluation: Facilitates performance measurement against predetermined targets, enabling timely corrective actions.

- Decision Making: Guides decision-making processes by providing insights into the financial implications of various options.

- Risk Management: Identifies potential risks and allows for proactive mitigation strategies to safeguard financial stability.

How Does Budgeting Help a Business?

Effective budgeting contributes to the success and sustainability of a business in numerous ways:

- Improved Cash Flow Management: Helps maintain adequate cash reserves to meet financial obligations and fund growth initiatives.

- Enhanced Profitability: Enables businesses to identify opportunities for revenue growth and cost optimization, leading to higher profitability.

- Better Resource Utilization: Ensures optimal utilization of resources by aligning expenditures with strategic priorities and operational needs.

- Increased Financial Transparency: Provides stakeholders with a clear understanding of the company's financial health and performance.

- Long-term Planning: Facilitates long-term planning by forecasting future financial requirements and setting achievable goals.

How to Create a Business Budget

Now that we’ve gone over the importance of a business budget, it’s time to understand the steps you need to take in order to create a comprehensive plan.

Gather Financial Information

Start by compiling relevant financial data, including past income statements, balance sheets, and cash flow statements. Analyze historical trends to identify patterns and make informed projections for the upcoming period.

Determine Your Financial Goals

Define clear, measurable financial goals aligned with your business objectives. Whether it's increasing revenue, reducing costs, or improving profitability, setting specific targets will provide a roadmap for your budgeting process.

Identify Revenue Sources

Identify all potential sources of revenue, including sales, services, investments, and other income streams. Estimate the expected revenue for each source based on market trends, historical data, and sales forecasts.

Estimate Expenses

Next, list all anticipated expenses, categorizing them into fixed and variable costs. Fixed expenses, such as rent and salaries, remain constant regardless of business activity, while variable expenses, like supplies and utilities, fluctuate based on demand.

Factor in Contingencies & Emergency Funds

Allocate a portion of your budget for contingencies and emergency funds to cover unforeseen expenses or revenue shortfalls. Building a financial cushion will provide stability and resilience during challenging times.

Balance Your Budget

Balance your budget by ensuring that projected revenues exceed estimated expenses. If there's a deficit, identify areas where you can reduce costs or increase revenue to achieve equilibrium.

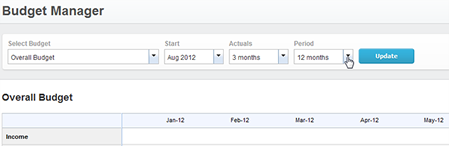

Monitor & Track Your Budget

Regularly monitor and track your budget against actual financial performance to identify variances and deviations. Use accounting software or spreadsheets to update your budget and make adjustments as needed to stay on course.

Review & Adjust Budget Regularly

Review your budget periodically, ideally on a quarterly or annual basis, to assess its effectiveness and relevance. Adjust your budget as necessary based on changing market conditions, business priorities, and performance trends.

Contact Mowery & Schoenfeld for Help with Business Budgeting

Creating and managing a business budget requires expertise and strategic planning. At Mowery & Schoenfeld, we specialize in helping businesses develop robust financial strategies to achieve their financial goals. Contact us today to learn how our team of experienced professionals can assist you with business budgeting and financial management.

What is Budgeting?

Translating strategy into targets and budgets, goals of the budgeting process, types of budgets, the process, additional resources.

The tactical implementation of a business plan

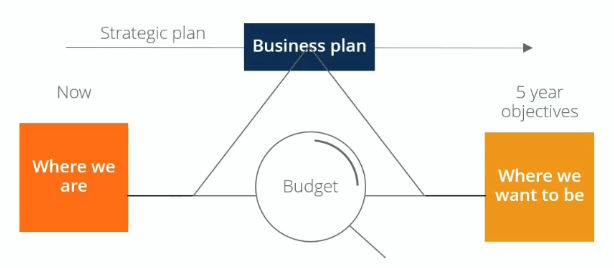

Budgeting is the tactical implementation of a business plan. To achieve the goals in a business’s strategic plan , we need a detailed descriptive roadmap of the business plan that sets measures and indicators of performance. We can then make changes along the way to ensure that we arrive at the desired goals.

There are four dimensions to consider when translating high-level strategy, such as mission, vision, and goals, into budgets.

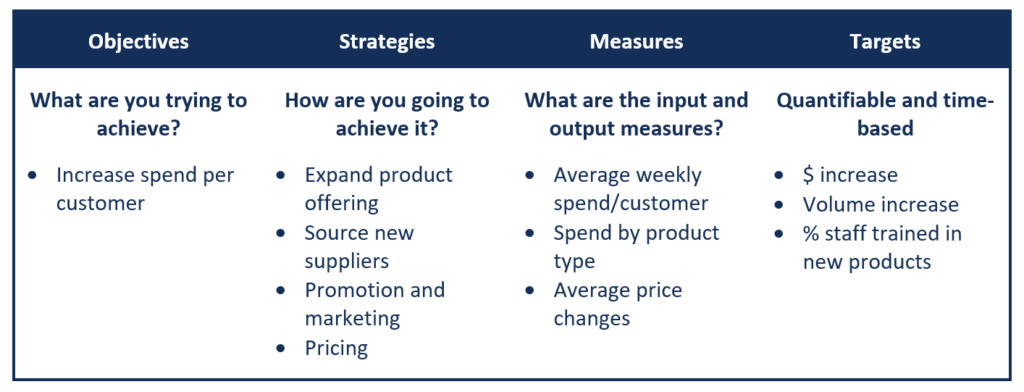

- Objectives are basically your goals, e.g., increasing the amount each customer spends at your retail store.

- Then, you develop one or more strategies to achieve your goals. The company can increase customer spending by expanding product offerings, sourcing new suppliers, promotion , etc.

- You need to track and evaluate the effectiveness of the strategies, using relevant measures . For example, you can measure the average weekly spending per customer and average price changes as inputs.

- Finally, you should set targets that you would like to reach by the end of a certain period. The targets should be quantifiable and time-based , such as an increase in the volume of sales or an increase in the number of products sold by a certain time.

Budgeting is a critical process for any business in several ways.

1. Aids in the planning of actual operations

The process gets managers to consider how conditions may change and what steps they need to take, while also allowing managers to understand how to address problems when they arise.

2. Coordinates the activities of the organization

Budgeting encourages managers to build relationships with the other parts of the operation and understand how the various departments and teams interact with each other and how they all support the overall organization.

3. Communicating plans to various managers

Communicating plans to managers is an important social aspect of the process, which ensures that everyone gets a clear understanding of how they support the organization. It encourages communication of individual goals, plans, and initiatives, which all roll up together to support the growth of the business. It also ensures appropriate individuals are made accountable for implementing the budget.

4. Motivates managers to strive to achieve the budget goals

Budgeting gets managers to focus on participation in the budget process. It provides a challenge or target for individuals and managers by linking their compensation and performance relative to the budget.

5. Control activities

Managers can compare actual spending with the budget to control financial activities.

6. Evaluate the performance of managers

Budgeting provides a means of informing managers of how well they are performing in meeting targets they have set.

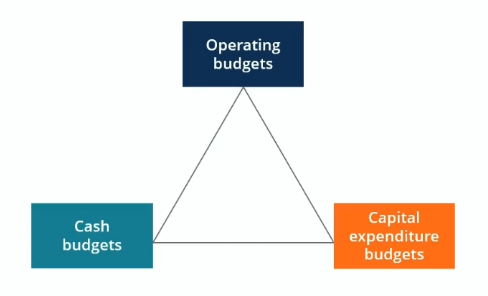

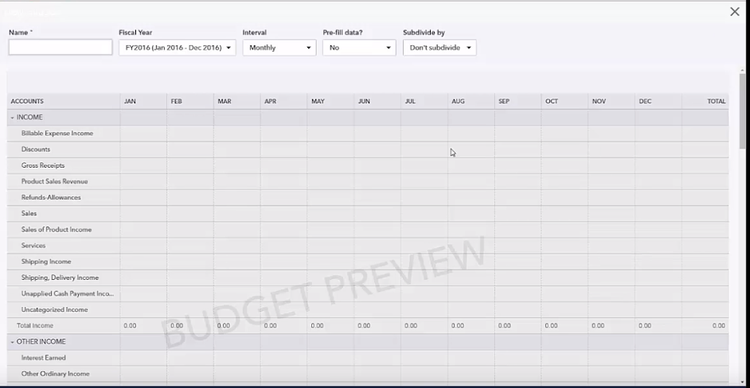

A robust budget framework is built around a master budget consisting of operating budgets, capital expenditure budgets, and cash budgets. The combined budgets generate a budgeted income statement, balance sheet, and cash flow statement.

1. Operating budget

Revenues and associated expenses in day-to-day operations are budgeted in detail and are divided into major categories such as revenues, salaries, benefits, and non-salary expenses.

2. Capital budget

Capital budgets are typically requests for purchases of large assets such as property, equipment, or IT systems that create major demands on an organization’s cash flow. The purposes of capital budgets are to allocate funds, control risks in decision-making, and set priorities.

3. Cash budget

Cash budgets tie the other two budgets together and take into account the timing of payments and the timing of receipt of cash from revenues. Cash budgets help management track and manage the company’s cash flow effectively by assessing whether additional capital is required, whether the company needs to raise money, or if there is excess capital.

The budgeting process for most large companies usually begins four to six months before the start of the financial year, while some may take an entire fiscal year to complete. Most organizations set budgets and undertake variance analysis on a monthly basis.

Starting from the initial planning stage, the company goes through a series of stages to finally implement the budget. Common processes include communication within executive management, establishing objectives and targets, developing a detailed budget, compilation and revision of budget model, budget committee review, and approval.

Budget Head

Operating Budget

Projecting Balance Sheet Items

See all FP&A resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

A How-To Guide for Creating a Business Budget

Amanda Smith

Reviewed by

September 23, 2022

This article is Tax Professional approved

Most business owners know how important a business budget is when it comes to managing expenses and planning for the future—but in a challenging economic environment like the one we’ve been experiencing, your business budget takes on even greater significance.

With inflation running rampant and the possibility of a recession looming, business owners need to be able to forecast their cash flow, manage their expenses, and plan for the future. Creating a detailed business budget is the first step.

Whether you want to revamp your budgeting method, or you’ve never created a business budget before, this guide will walk you through the process.

I am the text that will be copied.

What is a business budget?

A budget is a detailed plan that outlines where you’ll spend your money monthly or annually.

You give every dollar a “job,” based on what you think is the best use of your business funds, and then go back and compare your plan with reality to see how you did.

A budget will help you:

- Forecast what money you expect to earn

- Plan where to spend that revenue

- See the difference between your plan and reality

What makes a good budget?

The best budgets are simple and flexible. If circumstances change (as they do), your budget can flex to give you a clear picture of where you stand at all times.

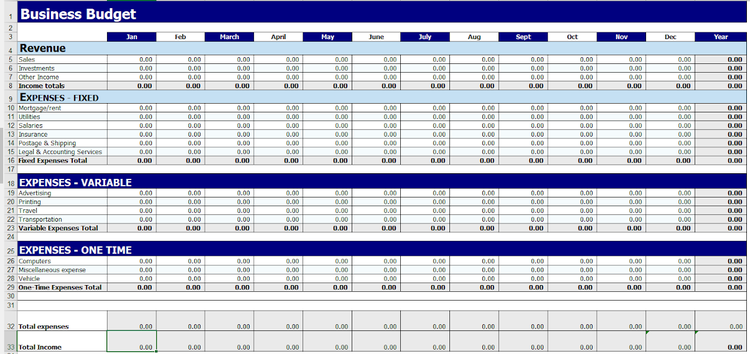

Every good budget should include seven components:

1. Your estimated revenue

This is the amount you expect to make from the sale of goods or services. It’s all of the cash you bring in the door, regardless of what you spent to get there. This is the first line on your budget. It can be based on last year’s numbers or (if you’re a startup ), based on industry averages.

2. Your fixed costs

These are all your regular, consistent costs that don’t change according to how much you make—things like rent, insurance, utilities, bank fees, accounting and legal services, and equipment leasing.

Further reading: Fixed Costs (Everything You Need to Know)

3. Your variable costs

These change according to production or sales volume and are closely related to “ costs of goods sold ,” i.e., anything related to the production or purchase of the product your business sells. Variable costs might include raw materials, inventory, production costs, packaging, or shipping. Other variable costs can include sales commission, credit card fees, and travel. A clear budget plan outlines what you expect to spend on all these costs.

The cost of salaries can fall under both fixed and variable costs. For example, your core in-house team is usually associated with fixed costs, while production or manufacturing teams—anything related to the production of goods—are treated as variable costs. Make sure you file your different salary costs in the correct area of your budget.

Further reading: Variable Costs (A Simple Guide)

4. Your one-off costs

One-off costs fall outside the usual work your business does. These are startup costs like moving offices, equipment, furniture, and software, as well as other costs related to launch and research.

5. Your cash flow

Cash flow is all money traveling into and out of a business. You have positive cash flow if there is more money coming into your business over a set period of time than going out. This is most easily calculated by subtracting the amount of money available at the beginning of a set period of time and at the end.

Since cash flow is the oxygen of every business, make sure you monitor this weekly, or at least monthly. You could be raking it in and still not have enough money on hand to pay your suppliers.

6. Your profit

Profit is what you take home after deducting your expenses from your revenue. Growing profits mean a growing business. Here you’ll plan out how much profit you plan to make based on your projected revenue, expenses, and cost of goods sold. If the difference between revenue and expenses (aka “ profit margins ”) aren’t where you’d like them to be, you need to rethink your cost of goods sold and consider raising prices .

Or, if you think you can’t squeeze any more profit margin out of your business, consider boosting the Advertising and Promotions line in your budget to increase total sales.

7. A budget calculator

A budget calculator can help you see exactly where you stand when it comes to your business budget planning. It might sound obvious, but getting all the numbers in your budget in one easy-to-read summary is really helpful.

In your spreadsheet, create a summary page with a row for each of the budget categories above. This is the framework of your basic budget. Then, next to each category, list the total amount you’ve budgeted. Finally, create another column to the right—when the time period ends, use it to record the actual amounts spent in each category. This gives you a snapshot of your budget that’s easy to find without diving into layers of crowded spreadsheets.

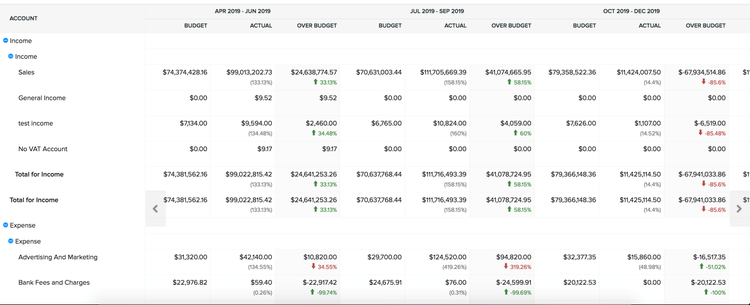

See the sample below.

| Income | Budget | Actual | Under/Over |

|---|---|---|---|

| Sales - Product 1 | $25,000 | $22,000 | -$3,000 |

| Sales - Product 2 | $34,000 | $36,000 | +$2,000 |

| Revenue - Coaching | $9,000 | $8,900 | $-100 |

| Revenue - Sublease | $13,000 | $13,000 | $0 |

| Total | $81,000 | $79,900 | -$1,100 |

| Expenses | Budget | Actual | Under/Over |

|---|---|---|---|

| Cost of Goods Sold | $12,000 | $13,243 | +$1,243 |

| Rent | $36,000 | $36,000 | $0 |

| Wages | $15,423 | $15,200 | -$223 |

| Office Move | $3,000 | $3,300 | -$300 |

| Total | $66,423 | $67,743 | +$720 |

| Profit | Budget | Actual | Under/Over |

|---|---|---|---|

| Total | $14,577 | $12,157 | $2,420 |

Pro tip: link the totals on the summary page to the original sums in your other budget tabs . That way when you update any figures, your budget summary gets updated at the same time. The result: your very own budget calculator.

You can also check out this simple Startup Cost Calculator from CardConnect. It lays out some of the most common expenses that you might not have considered. From there, you can customize a rough budget for your own industry.

Small business budgets for different types of company

While every good budget has the same framework, you’ll need to think about the unique budgeting quirks of your industry and business type.

Seasonal businesses

If your business has a busy season and a slow season, budgeting is doubly important.

Because your business isn’t consistent each month, a budget gives you a good view of past and present data to predict future cash flow . Forecasting in this way helps you spot annual trends, see how much money you need to get you through the slow months, and look for opportunities to cut costs to offset the low season. You can use your slow season to plan for the next year, negotiate with vendors, and build customer loyalty through engagement.

Don’t assume the same thing will happen every year, though. Just like any budget, forecasting is a process that evolves. So start with what you know, and if you don’t know something—like what kind of unexpected costs might pop up next quarter— just give it your best guess . Better to set aside money for an emergency that doesn’t happen than to be blindsided.

Ecommerce businesses

The main budgeting factor for ecommerce is shipping. Shipping costs (and potential import duties) can have a huge impact.

Do you have space in your budget to cover shipping to customers? If not, do you have an alternative strategy that’s in line with your budget—like flat rate shipping or real-time shipping quotes for customers? Packaging can affect shipping rates, so factor that into your cost of goods sold too. While you’re at it, consider any international warehousing costs and duties.

You’ll also want to create the best online shopping experience for your customers, so make sure you include a good web hosting service, web design, product photography, advertising, blogging, and social media in your budget.

Inventory businesses

If you need to stock up on inventory to meet demand, factor this into your cost of goods sold. Use the previous year’s sales or industry benchmarks to take a best guess at the amount of inventory you need. A little upfront research will help ensure you’re getting the best prices from your vendors and shipping the right amount to satisfy need, mitigate shipping costs, and fit within your budget.

The volume of inventory might affect your pricing. For example, if you order more stock, your cost per unit will be lower, but your overall spend will be higher. Make sure this is factored into your budget and pricing, and that the volume ordered isn’t greater than actual product demand.

You may also need to include the cost of storage solutions or disposal of leftover stock.

Custom order businesses

When creating custom ordered goods, factor in labor time and cost of operations and materials. These vary from order to order, so make an average estimate.

Budgeting is tricky for startups—you rarely have an existing model to use. Do your due diligence by researching industry benchmarks for salaries, rent, and marketing costs. Ask your network what you can expect to pay for professional fees, benefits, and equipment. Set aside a portion of your budget for advisors—accountants, lawyers, that kind of thing. A few thousand dollars upfront could save you thousands more in legal fees and inefficiencies later on.

This is just scratching the surface, and there’s plenty more to consider when creating a budget for a startup. This business startup budget guide from The Balance is a great start.

Service businesses

If you don’t have a physical product, focus on projected sales, revenue, salaries, and consultant costs. Figures in these industries—whether accounting, legal services, creative, or insurance—can vary greatly, which means budgets need flexibility. These figures are reliant on the number of people required to provide the service, the cost of their time, and fluctuating customer demand.

Small business budgeting templates

A business budget template can be as simple as a table or as complex as a multi-page spreadsheet. Just make sure you’re creating something that you’ll actually use.

Create your budget yearly—a 12-month budget is standard fare—with quarterly or monthly updates and check-ins to ensure you’re on track.

Here are some of our favorite templates for you to plug into and get rolling.

- The Balance has a clear table template that lists every budget item, the budgeted amount, the actual amount, and the difference between the two. Use this one if you’re looking to keep it simple.

- Capterra has both monthly and annual breakdowns in their Excel download. It’s straightforward, thorough, and fairly foolproof.

- Google Sheets has plenty of budget templates hiding right under your nose. They’re easy to use, and they translate your figures into clear tables and charts on a concise, visual summary page.

- Smartsheet has multiple resources for small businesses, including 12-month budget spreadsheets, department budget templates, projection templates, project-by-project templates, and startup templates. These templates are ideal if you’re looking for a little more detail.

- Scott’s Marketplace is a blog for small businesses. Their budget template comes with step-by-step instructions that make it dead simple for anyone.

- Vertex42 focuses on Excel spreadsheets and offers templates for both product-based and service-based businesses, as well as a business startup costs template for anyone launching a new business.

Budgeting + bookkeeping = a match made in heaven

Making a budget is kind of like dreaming: it’s mostly pretend. But when you can start pulling on accurate historical financials to plan the upcoming year, and when you can check your budget against real numbers, that’s when budgets start to become useful.

The only way to get accurate financial data is through consistent bookkeeping.

Don’t have a regular bookkeeping process down pat? Check out our free guide, Bookkeeping Basics for Entrepreneurs . We’ll walk you through everything you need to know to get going yourself, for free.

If you need a bit more help, get in touch with us. Bookkeeping isn’t for everyone, especially when you’re also trying to stay on top of a growing business—but at Bench, bookkeeping is what we do best.

Related Posts

Statement of Retained Earnings: A Complete Guide

Understanding the statement of retained earnings can help you evaluate your business’s profitability and help you plan for future growth.

The Top Trucking Accounting Software

Find the best trucking accounting software for your business with our comparison guide. Read about features, pricing, and more to make the best decision for your company.

Form 1099-K and Ecommerce Merchant Fees

Have an ecommerce business? Here’s what you need to know about merchant fees and Form 1099-K.

Join over 140,000 fellow entrepreneurs who receive expert advice for their small business finances

Get a regular dose of educational guides and resources curated from the experts at Bench to help you confidently make the right decisions to grow your business. No spam. Unsubscribe at any time.

The Ultimate Guide to Budgeting for Small Businesses

By Andy Marker | March 4, 2022

- Share on Facebook

- Share on LinkedIn

Link copied

Creating a budget for your small business can be daunting, but doing so is essential for any successful company. We’ve rounded up expert tips and created a step-by-step guide for designing a strong small business budget.

Included on this page, you’ll learn why a budget is necessary for small businesses and how to create a budget using Excel . Plus, you’ll find a free, downloadable small business budget starter kit .

What Is a Small Business Budget?

A small business budget is a detailed outline of your financial status and projection, based on your historical financial data. It includes your projected income and expenses and is used to determine where your money is best spent.

Ahmet Yüzbaşıoğlu, the Co-Founder of Peak Plans , explains the importance of budgeting for small businesses: “The success of your business is determined by the quality of your decisions. If you want to make informed decisions, you must have a budget. A budget can help you create a plan for the future, whether it's for your company as a whole or for smaller departments. More importantly, [a budget] gives you guidelines with which to make decisions. If budgeting is not yet a part of your business strategy, it may be worth considering it as an option to provide you with insights that can help you to better plan for all aspects of your company.”

Do Small Businesses Need a Budget?

All businesses should have a budget, especially small ones with less room for errors. A small business can better weather periods of low income by knowing exactly where its money is going, forecasting sales, and identifying what can be cut when needed.

Stephen Light, the Co-Owner of Nolah Mattress , gives his take on why all small businesses should have a budget in place: “For small businesses, creating an effective budget is one of the most important tools to carve a successful path to profitability. Budgets are crucial for allocating funds efficiently and curbing any unnecessary or wasteful spending, [which is] an easy trap to fall into if you don’t have a framework or goalposts to stay within. Budgets are especially important to small business owners who might be using their personal funds.”

How Much Should a Small Business Budget Be?

Your budget should be based on historical financial data and not exceed what you expect to make in the budgeted period. Be realistic with your numbers and projections so that you do not find yourself in a position you cannot recover from.

Your budget should take into account all of your sources of revenue and all of your expenses, as well as an additional percentage for any emergencies or surprises.

“Small businesses should absolutely be sure to pad their budget with contingency funds for unseen expenses,” suggests Light.

Larger businesses tend to make budgets annually , but for a small business, especially at first, it is a good idea to break down your budget monthly. To get started and identify a realistic monthly budget for your business check out our small business monthly budget templates for Google Sheets.

Importance of Budgeting in a Small Business

A budget helps a small business anticipate challenges, achieve and track financial targets, and secure investment opportunities. A well-considered budget should help a small business to encounter fewer unforeseen expenses and more opportunities.

Below are some benefits of having a strong budget:

- Make Informed Decisions: A company can make more informed decisions more efficiently when they have a budget. A good budget is built on historical data and allows you to learn from your experience. “Budgeting is a great strategy for maintaining informed control of your business. You can use data insights to plan with greater clarity and organize all of your finances in one place. This allows your leadership team to have the necessary information to drive their decision-making processes more efficiently, which is a great way for your business to act on its data,” explains Yüzbaşıoğlu.

- Identify Growth Opportunities: With a budget in place, you can identify the most profitable projects for your company. Use your budget data over time to see where current resource allocation provides the most payoff. As Yüzbaşıoğlu says, “You can use budgeting to create assumptions about your business projections by measuring the effects of different investments on your business. For example, you can make conclusions about how much revenue an investment in sales will bring in with the information gathered from your marketing efforts. By evaluating different scenarios, you can consider your options for best achieving your goals. Observing different scenarios will soon help you find which strategies work best for your business.”

- Weather Leaner Business Times: All businesses should expect to encounter lean times. Having a budget in place can help you stay afloat by tracking which times are historically slow and by establishing an emergency fund. Knowing when to spend your money can be just as important as what you spend it on.

- Manage Risk: A well-crafted budget can help you to identify potential risks by gaining visibility into your spending. If you don’t track your money, it is easy to spend much more than you had planned (on an unsound investment). “Looking ahead is important for risk management ,” says Yüzbaşıoğlu. “Budgeting is a good way of looking ahead and contains similar methodologies as risk management. A budget allows you to look ahead and see how your activities in different areas will affect the company’s cash flow, earnings, and profitability.”

- Measure Performance: Having access to current and historical financial data from your business allows you to measure financial performance year over year. Without tracking this information, you cannot know which goals you are meeting. “Budgets are the most important tools that managers use to measure how well an organization is doing. Although budgets are commonly perceived to exist for financial purposes only, they can also be key tools to provide insight into how an organization and its departments are performing. Identifying variances — such as differences in expenses and costs and increase or decrease in sales and profits — will give a good overview to management about the performance of the company and its departments,” explains Yüzbaşıoğlu.

- Set Company Goals: A budget is a great place to start goal setting. Whether you aim to spend less over time or drive more sales, a budget gives you concrete numbers on which to base your financial goals. “When all parties are on the same page about the strategic goals of the company and the means of attaining them, it is much simpler to monitor success and work together to keep the organization on track to achieve its goals,” suggests Mains.

What Should a Small Business Budget Include?

A small business budget should include all income and expenses the business accrues over a given period. These numbers may change month to month, so it is important to either use an average, or to overestimate expenses and underestimate income.

Linn Atiyeh, the CEO and Founder of Bemana , highlights some major small business budget expenses that may not be immediately obvious. “[The expenses] need to include everything, from the employees themselves to the office spaces that they work in. They need to include technology, software, onboarding, training, client acquisition, insurance payments, marketing, product development, employee compensation, and any other anticipated costs,” she says.

The following bullets outline what to include in your budget:

- All Income and Expenses: Your budget should consider the entirety of your income and expenses. Note fixed and variable costs. It may also be beneficial to keep track of which expenses you can easily cut during lean times.

- Small Business Financial Plan: When creating your budget, consult your financial plan. If you do not have one, create an income statement and a cash flow statement . “You must incorporate your cash flow in your projections. Cash flow refers to the total amount of money that flows into and out of a firm. If you have positive cash flow in your firm over a certain period of time, this means that more money is flowing into your business than is leaving it,” says Mains. To learn more, read our how-to guide on creating a small business financial plan.

- Historical Sales Numbers: If you have them, use your historical sales numbers to project your income during the same time period in the future. If you don’t have historical data, start tracking it. As you continue to track this information, you will get a better idea of how much money your company is making and spending at different times of the year.

- Sales Forecasts: Create a sales forecast and use it to estimate your projected income. This information will help give you a target number for your budget.

- Emergency Fund: Any strong budget will include some wiggle room for emergencies and surprise expenses. Most sources recommend keeping three to six months’ worth of business expenses in an emergency fund — but remember that some money saved is better than none at all.

- Seasonal and Industry Trend Information: Most industries have slow seasons and busy seasons, and it is important to know when those times are. If you don’t have this information from your own business, a quick Google search can often tell you the answer.

- Growth Projections: Factor any expectations for major growth into your budget, such as opening a new storefront, buying new equipment, or hiring and training a new department.

How to Create a Budget for a Small Business

To create a budget for your small business, determine how much money your company spends and makes, and estimate how it will do so in the future. We’ve outlined how to create a budget in the steps below:

1. Gather Your Financial Information

This includes all income and expense information from previous years and any previous budget information you may have.

“To begin with, collect financial data, predictions, and market analysis to aid in the development of your small company's budget planning,” suggests Lattice Hudson, Business Coach and Owner of Lattice and Co . “To design your budget, consider the company's overall business and overall strategy in addition to the crucial financial data and analytics.”

2. Add Up Your Income

Use a small business budget template or spreadsheet to itemize and add up your income. Consider using a tool that tracks itemized income monthly so that you can more easily note changes over time.

3. Subtract Fixed Costs

Your fixed costs won’t change month to month, so they are the easiest to subtract from your income. Fixed costs might include rent, salaried employees, and non-variable utilities.

4. Determine and Subtract Variable Expenses

Not all costs are fixed, so you may need to do a little digging to determine some of your expenses. Calculate how much the company spent on hourly employees, variable utilities, and break room snacks and business lunches.

“Variable costs are those that change from month to month depending on your company's success, [such as] consumption-based utilities, delivery charges, transport costs, and sales commissions. When your earnings are greater, you may spend more on variable costs, but when your earnings are lower, you should aim to cut back where you can,” says Hudson.

5. Profit and Loss Statement

Prepare a profit and loss statement from the data you’ve collected. Outline how much your company made and spent in a given time period. This will be the first indicator of what your budget numbers should look like.

6. Outline a Forward-Looking Budget

Create your budget using the numbers from historical profit and loss statements. Your income and expenses may grow or shrink over time, so it is important to calculate an average or to add a buffer to your expenses. Your budget should always have money left over for incidentals, as well as allocation to an emergency fund.

Hays Bailey, the CEO and Founder of Sheqsy , recommends that you also include allocations for expansions or growth if you can see either on the horizon.

7. Review on a Schedule

Review your budget periodically. Track your income and expenses monthly, and update your budget as things change. “Over time, you will gain a better understanding of your company's operations and will be able to make more informed decisions regarding your budgeting plan,” says Hudson.

How to Create a Small Business Budget Spreadsheet in Excel

Microsoft Excel makes it easy to organize and chart your small business budget over time. The following tutorial lays out step by step how to use a template in Excel to add up your income and expenses and determine your business’s cash flow.

Gather and Organize All Relevant Financial Information for Your Business

To start your budget, you will need to gather and organize all of your financial information for the previous period. This includes income statements, expense reports, cash flow documentation, and any other relevant documents. If this is your first budget and you do not have these items, organize your bank statements, invoices, payroll information, and receipts.

By organizing your data into these documents, each month becomes easier to track than the last. The more you stay organized, the simpler it will be to maintain your budget.

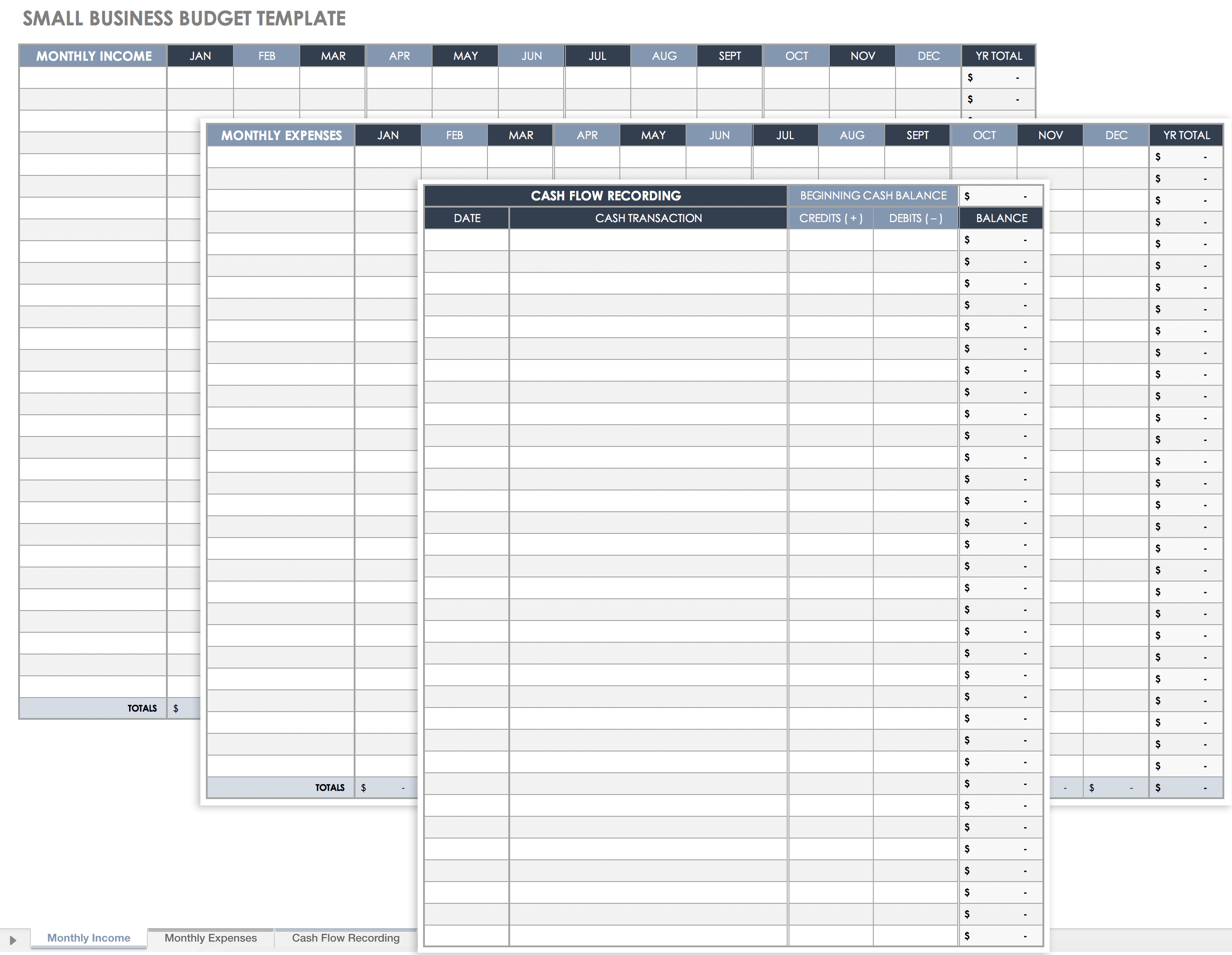

Download a Small Business Budget Template

- Download the small business budget template for Microsoft Excel.

Record Your Monthly Income

Record Your Monthly Expenses

Record Your Cash Flow

Save and Update Your Budget Regularly

Store your budget template on an accessible drive and update it regularly. Small businesses should update their budget and cash flow as often as possible to stay up to date.

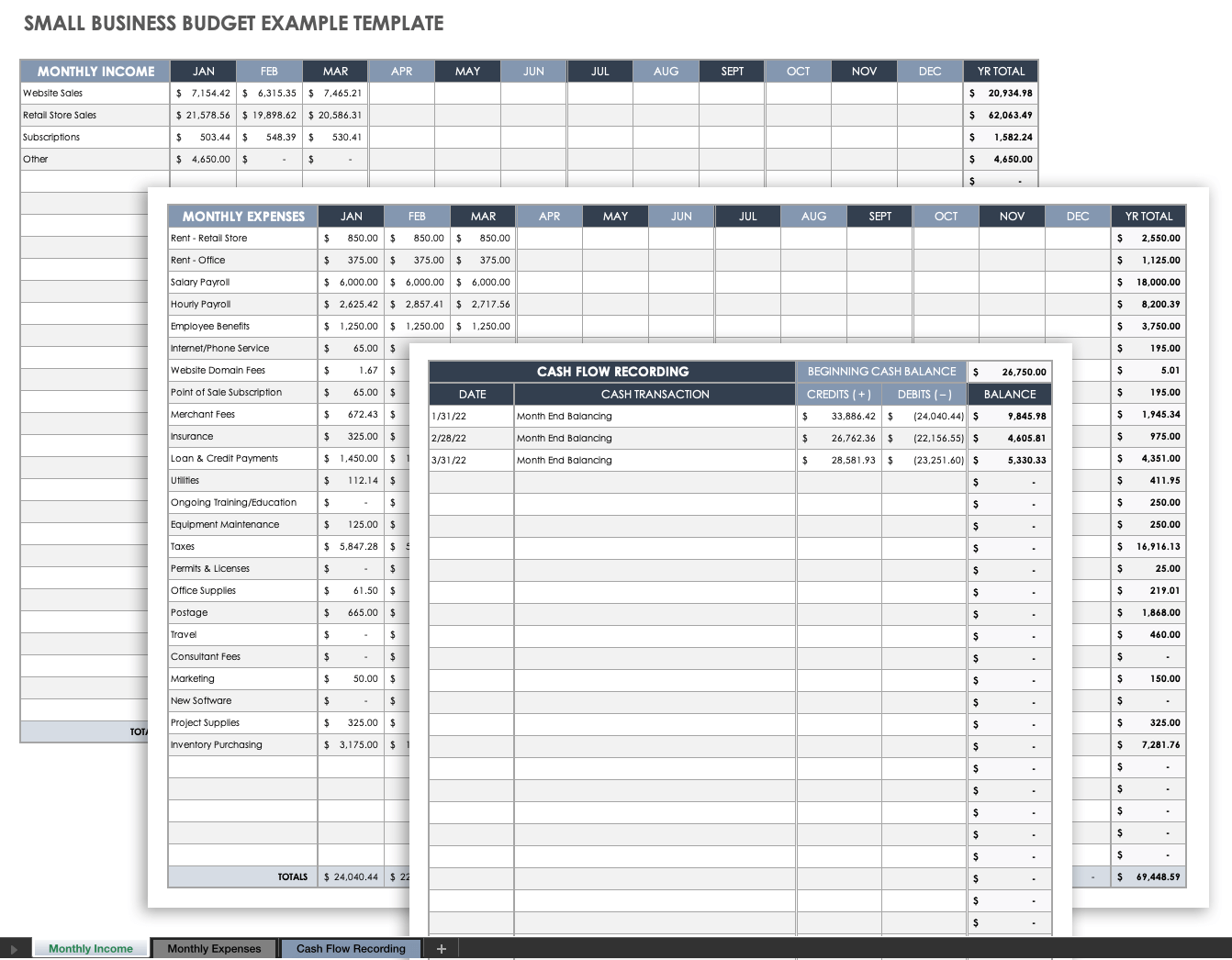

Small Business Budget Example

Download Small Business Budget Example Microsoft Excel | Google Sheets

In this example of a small business budget, we’ve listed sample income, expense, and cash flow information using categories that are relevant to a small retail business. This template is fully customizable and can be used for a small business in any industry. You can also download a blank version of this template in the small business budget starter kit below.

Tips for Creating a Small Business Budget

Creating a budget for your small business can be daunting. To help you get started, we’ve gathered expert tips, from finding a mentor to setting realistic goals.

- Be Realistic: Keep all financial estimates in the realm of reality. Use historical financial data from your own past whenever possible. “My best tip is to avoid any wishful thinking or dreaming about best-case scenarios because it’s always better to use the real data from years past and to be realistic — you’ll avoid disappointment and tricky financial situations that way,” suggests Light.

- Note Changing Costs: Products and services don’t always cost the same amount every year. Be sure that the expenses listed in your budget are accurate at all times. “Be very mindful of the rapid rate at which prices can change and to get as many quotes as possible to inform your budget,” says Atiyeh. “On the first of these points, you may incorrectly assume that the amount you paid for a service in the past is still a good indicator of how much it would cost today. However, services are priced based on a multitude of factors, such as demand and market circumstances. Keep this in mind when creating a budget.”

- Find a Mentor: Doing so can cut down on the time it might take you to learn about business budgeting on your own. “Find someone who has experience in making budgets. Making a budget is technical and it requires experience if you want it to be done right. Of course, you are also allowed to do it on your own, but expect that it is going to take time and that you are in for lots of revisions,” warns Bailey.

- Overestimate Your Costs: Overestimating your costs helps ensure that your finances aren’t threatened when surprises come up or projects go over budget. You will be much better equipped to weather financial hardship if you’ve made room in your budget to respond to unexpected changes. “If your company works on a project-by-project basis, you are well aware that every customer is unique and no two projects will be precisely the same in their outcome. It is often impossible to forecast when a project may run over budget,” says Mains. “So much of running a company is about anticipating and responding to the unexpected. For small company owners, failure to predict an expenditure or its scale may be devastating and may cause the organization to become crippled before it has had a chance to mature and develop. Company owners must overestimate their costs to protect themselves from financial risk. This is a survival strategy that will assist business owners to protect themselves against danger and failure.”

What Specific Types of Businesses Should Consider when Budgeting for a Small Business

Budgeting for any business involves adding up income, subtracting expenses, and identifying where to spend and save money. Because different industries require different strategies, we’ve created a list of things to consider for specific small business types.

“One thing that is unique to small businesses as a whole is that there are so many different types of businesses. This means that there is no one-size-fits-all budget plan for small businesses. Each business should tailor its budget plan to its own specific needs and circumstances,” explains Lindsey Hyland, Founder of Urban Organic Yield .

- Seasonal Businesses: Some small businesses, such as those based around holidays or gardening, operate at a much higher business volume at certain times of the year. These businesses need to consider that their busy season will bring in much more income than their slow season(s). One way to tackle this is to take an average of your monthly income for the year and use that as your monthly operating budget. Don’t project based on the biggest numbers — use the smaller numbers or an average. For these businesses, it is especially important to establish an emergency fund so that a surprise expense during the slow season doesn’t become a catastrophe.

- Recruitment and Staffing: Businesses that deal with recruitment and staffing need to have a finger on the pulse of the businesses they work with. Do outside research into the growth or downscaling of other businesses to determine budget numbers for a given period. “Since my company is in the industrial and equipment recruiting industry, one unique challenge that we face is having to incorporate the needs of other businesses into our budget. For instance, it's important that we stay mindful of how much these businesses are upscaling or downscaling their operations at any given time, as that directly impacts the provision of our services,” says Atiyeh.

- E-commerce: Online businesses may have fewer fixed costs, such as rent, but may have more variable ones. Shipping costs, shipping zones, import taxes, and shipping supplies will change based on sales volume, so find an average or inflated number that works for these budget items. Companies that operate exclusively online should also invest in a well-made, working website and have a system in place for potential returns. These two things will help improve remote customer service, which can lead to more sales — and a larger budget — in the future.

- Nonprofits: Not-for-profit businesses are funded in a variety of ways, including through grants, donations, and dues. For these businesses, it is even more important to keep the budget as realistic as possible at all times, as there is commonly less money to move around. For more information and to help keep your budget balanced, peruse our list of free nonprofit budget templates .

- Inventory Business: Remember that it can be very expensive to keep large amounts of inventory on hand. Buying more of a product to sell can sometimes be cheaper because of the economy of scale, but ensure you have the space and capacity to hold on to things that don’t sell right away. Consider that you may need to spend more on rent and temperature control for a place to store these items.

- Custom Orders: The price of a custom order is not only the cost of the finished product, but a combination of factors. Determine a cost for your time and labor for conception, execution, materials, and delivery, and factor those into your expenses.

- Startups: Budgeting for a company with no existing financial history can be tough. Company owners will need to do research on the industry and use those numbers to create a rough estimate for their budget. When you are estimating a budget from scratch, be sure to overestimate your costs to mitigate risks. It is always a good idea to ask professionals and people with experience. Visit this list of free customizable startup budget templates to get started.

- Construction: Construction companies need to factor in the cost of all associated permits and insurance on top of all of the general costs of doing business. Permits and insurances may change based on the specific job you are doing, so it is critical to factor those costs into the relevant monthly budget. To help keep you organized, check out this list of free construction budget templates .

- Service: Businesses based on service need to put a larger portion of their budget toward staff training and retention. Better employees mean better service, and much of an employee's ability comes from their training. Additionally, you do not want to lose the valuable employees you spend time and money training, so these businesses need to factor in rising pay scales for more qualified staff.

- All Small Businesses: Do not forget to factor in taxes and fees involved in running your business. If you don’t know what they are, ask a professional for help. “There are a shocking number of people that do not make any self-employment tax payments to the IRS for lack of fear or know-how,” says Stevenson.

How to Manage a Small Business Budget

Manage your small business budget by spending within your means and saving money where you can. Make sure your budget is as realistic as possible, and update and revise it on a regular basis.

- Spend Within Your Means: Whenever possible, do not spend more money than you make. Use loans and credit wisely so as not to dig yourself into a hole. “Make do with what you have, start small with the free versions of software before you upgrade. Save for equipment. Make room in the budget later if you can’t afford it now,” advises Stevenson.

- Get Multiple Quotes: When you work with other businesses, it is in your best interest to get multiple quotes. You can use these quotes to negotiate the prices of goods or services that you need to run your own business, and save money in your budget. “By getting as many quotes as possible, you can build a more accurate understanding of the true prices of what you'll need throughout the period of time that you're budgeting for. By getting quotes from several sources rather than just one or two, you can make sure that your estimates are fair and accurate,” suggests Atiyeh.

- Revisit Your Budget Regularly: Circumstances can easily change from month to month or year to year. “The best way to stay on budget is to revisit the budget regularly. Budgets shouldn’t be set and then put away, they should be consistently reassessed and adjusted. If you’re committed to tweaking and allowing your budget to evolve with a watchful eye, you’re far more likely to stay within its bounds,” says Light.

- Be Realistic from the Outset: It is easy to get carried away with lofty goals and underestimated expenses. The closer your budget reflects reality, the easier it will be to stick to the plan. “Don’t underestimate expenses just to make your budget look conservative, because a budget that’s unrealistic is so much worse than not having a budget at all. It is misleading and it can cause lots of problems in the long run,” warns Bailey.

How to Do a Small Business Budget Efficiently

There are three key ways to help ensure that you manage your small business’s budget efficiently: Use the tools that are available to you, review your financial data on a schedule, and seek help when you need it.

- Use Software Tools: There are many software tools that can help you to create a budget. Many offer free trials so that you can find the one that works best for you. You may also find that a template suits your needs.

- Hire Help: Consider using the professional services of a financial advisor, or hire an accountant to manage your budget. For many businesses, hiring someone to manage the money is an inevitability that should be considered sooner than later.

- Create a Review Schedule: Small businesses should record budgets monthly. Track and store your monthly budget data so that you can reference it for future months and make changes as needed.

Small Business Budget Starter Kit

Download Small Business Budget Starter Kit

We’ve created this small business budget starter kit to help you get started creating and maintaining a budget. We’ve included a blank budget template from the example above, plus powerful cash flow and income statement templates to help keep you organized and on track. We’ve also included a customizable budget checklist so that you can ensure you’re tracking all of the information you need, every time.

Small Business Budget Template

Download Small Business Budget Template Microsoft Excel | Google Sheets | Smartsheet

Use this blank small business template to calculate your income, expenses, and a simplified cash flow. This powerful template adds up your itemized income and expenses each month, giving you a running total while in progress and a yearly total once completed.

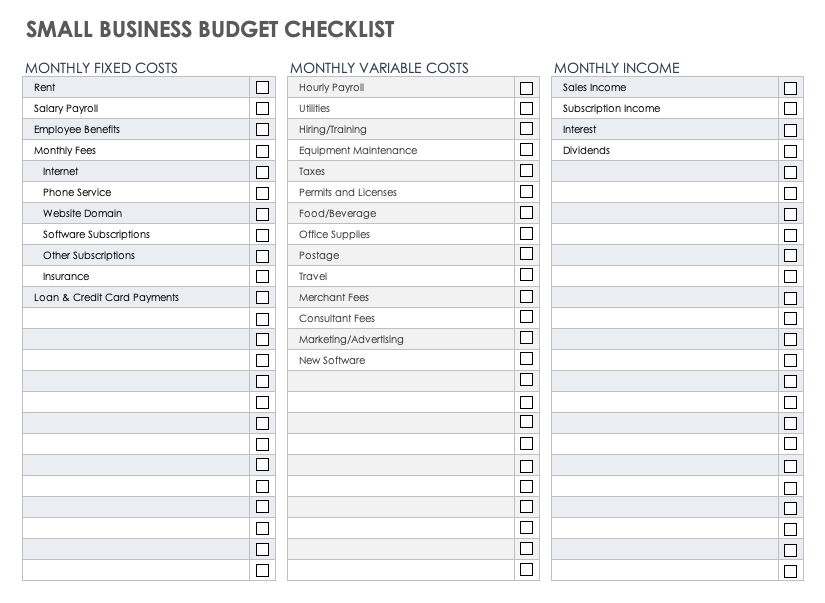

Small Business Budget Checklist

Download Small Business Budget Checklist Microsoft Excel | Adobe PDF | Google Sheets

This customizable small business budget checklist will help ensure that you’ve included all income and expenses in your monthly budget. The checklist includes a list of some of the most common business expenses, but you can edit it as needed.

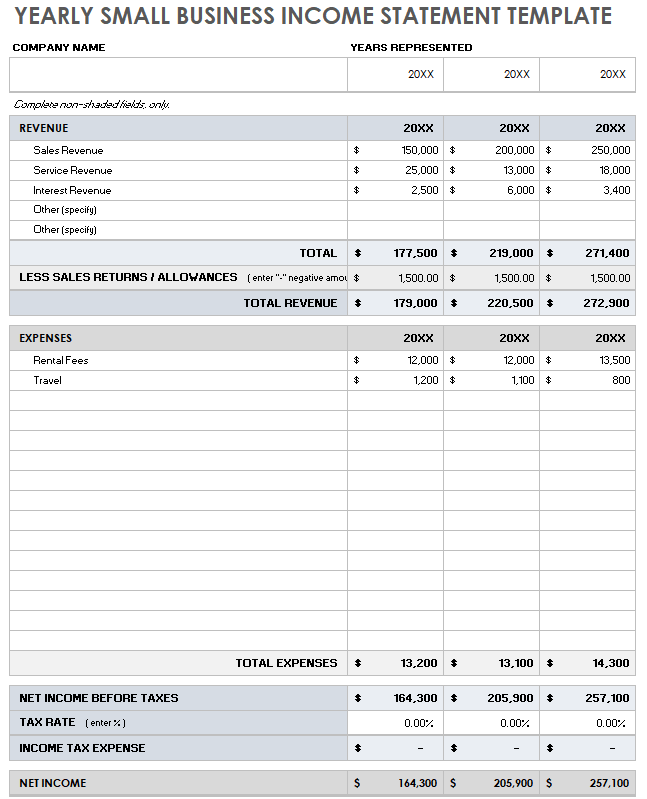

Small Business Income Statement Template

Download Small Business Income Statement Template Microsoft Excel | Google Sheets

Use this small business income statement template to track your company’s total income and expenses over time. Customize it to track by month, quarter, or year, and use it to complete the income and expense information on your budget template.

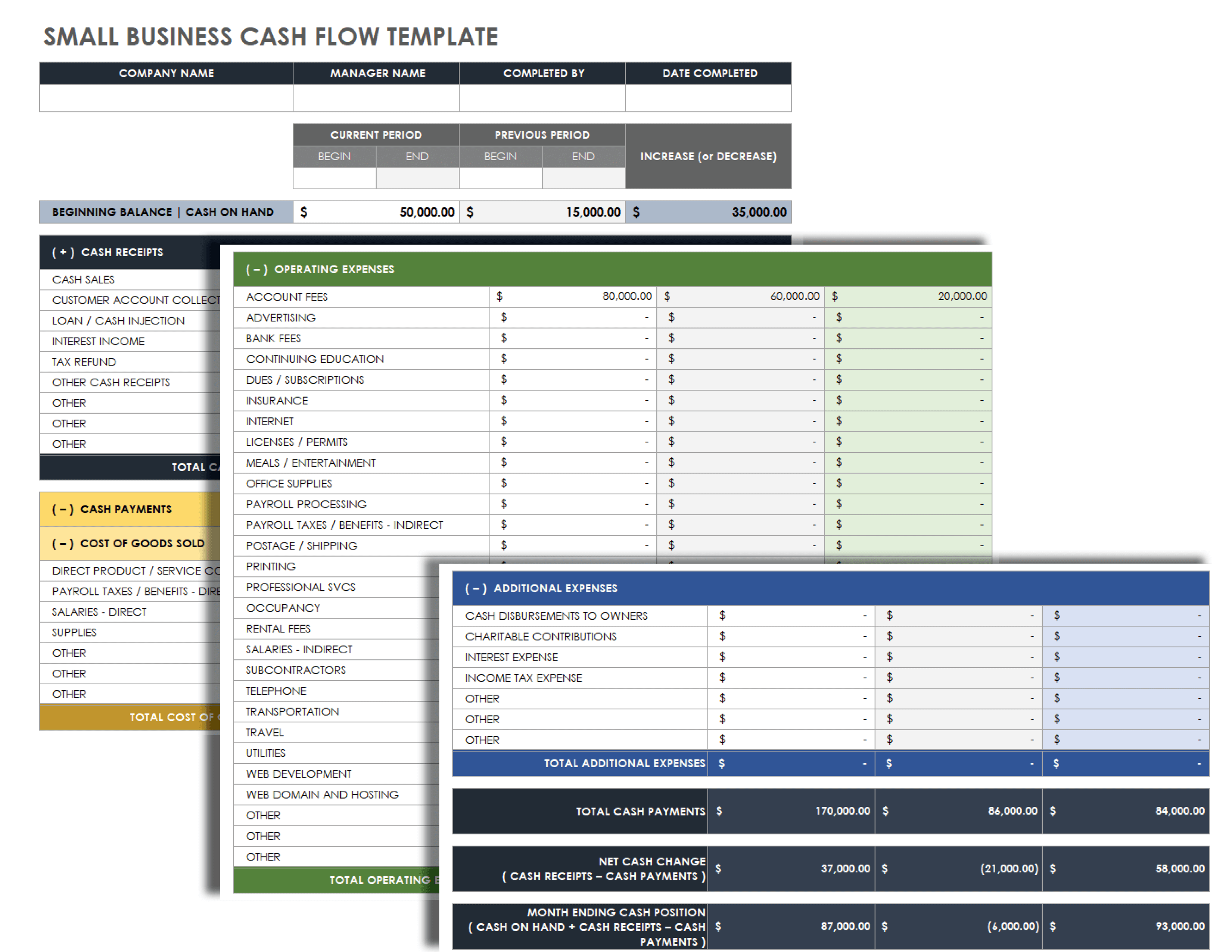

Small Business Cash Flow Statement Template

Download Small Business Cash Flow Statement Template Microsoft Excel | Google Sheets

Use this small business cash flow statement template to follow your cash income and expenses. Input your cash flow in the appropriate cell, and compare the current to the previous time period. The template will generate your total cash payments and ending cash position, which will help you fill in your budget template.

Streamline Small Business Budgeting Real-Time Work Management in Smartsheet

Discover a better way to connect your people, processes, and tools with one simple, easy-to-use platform that empowers your team to get more done, faster.

With Smartsheet, you can align your team on strategic initiatives, improve collaboration efforts, and automate repetitive processes, giving you the ability to make better business decisions and boost effectiveness as you scale.

When you wear a lot of hats, you need a tool that empowers you to get more done in less time. Smartsheet helps you achieve that. Try free for 30 days, today .

Connect your people, processes, and tools with one simple, easy-to-use platform.

How to Master the Fine Art of Business Planning and Budgeting

Updated on: 5 January 2023

Starting a business is a challenging thing: you have to work hard and do your best to ensure its success. However, the work doesn’t end even when your business actually becomes operational. You still have to do so much more to ensure that it will keep on track.

Of course, it could be hard, especially for the beginners. It seems that you have to keep an eye on so many things and focus on so many urgent tasks every day that there isn’t any time left for business planning and budgeting. However, it is very important to find that time, because business planning and budgeting are actually one of the most important things for business success.

Why so? Because a plan allows you to get a better understanding of how you see your business, how you want to develop it, and so on. When you create a plan, you set targets that you want to achieve as well as define the ways of evaluating the success of your business.

Basically, planning gives you all the necessary tools that you can use to improve your business in the nearest future. However, this happens only when planning is done correctly.

What to Include in Your Annual Plan?

If you want to create a perfect business plan, you have to know what has to be included in it and how big it will be. Of course, there are no strict limitations to a size of a business plan as each business is different. However, if you are doing it for the first time, I recommend starting with a yearly plan: it is not too big and not too short.

A good annual plan has to include the following things:

- an executive summary

- a list of products and services you offer (or plan to offer this year)

- a detailed description of your target market

- a financial plan

- a marketing plan as well as a sales plan

- milestones and metrics

- a description of your management team

In order to write it in the best way possible, you need to spend some time thinking about the current status of your company as well as how it should look like by the end of the year. Describe your target market, think about the goals that have to be achieved this year, about the products and services that have to be launched.

Visualize the information to make it easier for you to see the whole picture (this is especially important for those, who don’t have much experience in planning). You can use charts, and different diagram types such as mind maps to visualize and organize your ideas and plans.

Try choosing a few main goals for your company and add them to the annual plan being as specific as possible: for example, if you want to increase your earnings, you should specify by how much (10%, 15%, etc.). It’s also good to think about the obstacles you might face and come up with some ways to minimize the potential risks that could occur.

Remember that while a business plan has to be specific and detailed when you write it, it shouldn’t remain static by the end of the year. No business is predictable enough for this to happen: you should understand it and prepare to act quickly, adding changes to a business plan if something unexpected happens.

Business Planning Cycle

As I said, typical business planning isn’t a static thing – actually, it’s a cycle that usually looks like this:

- You take some time to evaluate the effectiveness of your business. In order to do so, you should compare its current performance with the last year’s one – or with targets set earlier this year.

- Then you have to think about opportunities that might appear as well as the threats you might face.

- Remember about both successes and failures your business experienced throughout last year. Analyze them and think what can be done to repeat/avoid them.

- Think of the main business goals you would like to achieve and be sure to add them to the new annual plan (or edit the old one according to them).

- Create a budget.

- Come up with budget targets.

- Complete the plan.

- Be sure to review it regularly (every month, every three months, etc.), making changes if necessary.

Repeat the whole cycle.

Business Planning and Budgeting

When a business is still small and growing, it might seem unnecessary to plan its budget. However, it’s crucial if you want to avoid financial risks and be able to invest in opportunities when they appear.

Moreover, with the rapid growth of your business, you might find yourself in a situation where you aren’t able to control all the money anymore. Expansion of the business usually includes the creation of different departments responsible for different things – and each of these departments needs to have its own budget.

As you see, the bigger your business becomes, the more complicated it gets. While it’s okay to not control every cent by yourself, it is still up to you to make sure that your business keeps growing instead of becoming unprofitable. That’s why it’s so important to create a budget plan that allows you to understand the exact income your business brings by the end of the month and the amount of it, you are able to save or spend on different things.

It is important to remember that a business plan is not a forecast in any way. It doesn’t predict how much money you’ll make by the end of the year. Instead, it’s a tool for ensuring that your business will remain profitable even after covering all the necessary expenses.

Moreover, a business plan also ensures that you’ll have the opportunity to invest money into future projects, fund everything that has to be funded this year, and meet all of the business objectives.

Benefits of a Business Budget

The whole budget planning has a lot of benefits:

It allows you to evaluate the success of your business: when you know exactly how much profit your business gave you at the beginning of the year, you are able to compare it with the profit by the end of the year, understanding whether your financial goals have been met or not.

It allows managing money effectively: for example, if you save money for predicted one-time spends, you won’t be caught by surprise by them.

It helps identify the problems before they actually happen: for example, if you evaluate your budget and see that the income left after covering all the expenses is quite small, you’ll understand that you need to make more profit this year.

It helps make smarter decisions, by only investing money that you can afford to invest.

It allows you to manage your business more effectively, allocating more resources to the projects that need them the most.

It helps in increasing staff motivation.

Basically, when you have a budget plan ready, you have your back covered.

How to Create a Budget?

There are so many articles written on how to create a perfect business budget, but most of them narrow down to these 5 simple things:

- Evaluate your sources of income. You have to find out how much money your business brings on a daily basis in order to understand how much money you can afford to invest and spend.

- Make a list of your fixed expenses. These ones repeat every month and their amount doesn’t change. Some people forget to exclude the sum needed to cover these expenses from the monthly income, but it’s important to do so in order to get a clear understanding of your budget.

- Don’t forget about variable expenses. These ones don’t have a fixed price but still have to be paid every month. Come up with an approximate sum you’ll have to pay and include it in your budget.

- Predict your one-time expenses. Every business needs them from time to time, but if you plan your budget forgetting about these expenses, spending money on them could affect it greatly and not in a positive way.

- When you list all the income and expense sources, it’s time to pull them all together. Evaluate how much money you’ll have each month after you cover all these expenses. Then think of what part of that sum you could afford to invest into something.

While a whole process of budget creation might seem too complicated, you still should find time to do it. It’s totally worth the effort – moreover, such a plan could help you not only throughout the next month but also throughout the next year (if your expense and income sources won’t change much).

Of course, it’s still important to review it from time to time, making changes when necessary. However, the review process won’t be as complicated as the creation of a budget plan from scratch.

Key Steps in Drawing up a Budget

If you’ve never created a budget plan before, you could make some budgeting mistakes . However, when it comes to financial planning, the smallest mistake could have a negative impact. The following tips can help you easily avoid most mistakes, making your budget plan more realistic.

- Try to take it slow

The more time you spend on budgeting, the better it is for you. It’s hard to create a flawless budget plan quickly: there’s a big chance you might miss something. That’s why it’s vital to make sure that you’ve listed all the sources of your income and expenses, and are prepared well.

- You can use last year’s data

Last year’s data could help you see the whole picture better: you can compare it with this year’s data, finding out whether your income has increased or decreased. However, you should use it only for comparing and as a guide. You have new goals and resources this year, and the environment you’re working in has changed too, so your current planning and strategies should differ from the ones you used last year.

- Make sure that a budget is realistic

The most important thing about a budget plan is that it has to cover not only predictable expenses but also less predictable ones. Of course, making predictions is hard but using previous data along with some other business plans as examples could make the whole process easier.

A budget also has to be detailed: the information it contains has to allow you to monitor all the key details of your business, be it sales, costs, and so on. You could also use some accounting software for more effective management.

- It’s okay to involve people

If your business is big enough, you probably have some employees responsible for a part of the financial operations. It’s good to involve them in a budget creation process too, using their knowledge and experience to predict some expenses, for example. If the people you involve are experienced enough, the combination of their professionalism and your knowledge will make a budget more realistic and effective.

- Visualizing helps

Various charts and diagrams are so popular in business for a reason: they allow tracking your incomes and expenses easily. For example, you can create one chart based on your plan and another chart based on an actual budget and compare them during planned revisions to see whether your budget plan works just as expected or not.

As I mentioned above, it’s easier to control finances when you are running a small business. Such business needs only one budget that is created for a certain period – in most cases, for a year. Larger businesses, however, require something else. They have various departments, so it is better to create several budgets at once, tailoring each of them to a certain department’s needs.

Don’t Forget to Review!

I’ve already mentioned that a review is an important process of every business planning and budgeting. No matter how good your plan is, it is impossible to predict everything with 100 percent accuracy. Your business will grow and the environment around it will change, so the quicker you’ll react to such changes, the better it is for you.

That’s why you should schedule budget reviews from time to time. I recommend starting with reviewing it every month and then switching to a more comfortable schedule. Every month review can help you notice the flaws of your plan (which is especially important if you don’t have much experience in this kind of thing) as well as understand how stable your business is.

If you see that you don’t have to make changes often, you could start reviewing your plan every three or six months (however, I recommend doing it more often).

You can use various common diagrams to help you . The best thing about diagrams is that they help visualize data well, which is very important when you need to see the whole picture more clearly – and this happens often during budget planning. For example, a diagram or a chart of your company’s income can show you how much your finances have grown during a certain period. Moreover, if you notice certain downfalls in a chart (that aren’t predicted), you’ll be able to react to it quickly, fixing things that went wrong.

What do you need to consider during the whole review process? First, your actual income. Probably it will be different each month: every business has its own peak sales periods and drop sales ones, and you have to find them and remember them for more effective planning next year. It is important to check whether the income matches the one you predicted or not: if not, you have to find out why it happened.

Second, you have to evaluate your actual expenses. See if they differ from your budget, how much do they affect it, why they exceed your expectations (if they do), and so on.

Probably the best thing about reviewing is that it allows you to react to all the unexpected situations quickly, saving your business from the potential troubles and downfalls. So be sure not to skip it.

As you see, writing a business plan is a complex process. You have to be very attentive, to plan everything, starting with your goals and ending with your expenses, to consider so many things and to involve other people in planning if possible. Moreover, you also have to learn all the time, reviewing your plans, making changes, finding the ways to react to unexpected situations.

But while this might look like a tough thing to do, it is very convenient for everyone who wants to manage their business successfully. The planning takes a lot off your shoulders and makes the whole business running process easier. You are able to evaluate the effectiveness of your business by looking at the monthly income increase, at the goals you wanted to achieve, and so on. You are also able to predict the potential downfalls of your business and to use the tools you have to minimize all the risks.

You are able to evaluate the effectiveness of your business by looking at the monthly income increase, at the goals you wanted to achieve, and so on. You are also able to predict the potential downfalls of your business and to use the tools you have to minimize all the risks.

I hope that this guide will help you create strong and realistic budget and business plans, and successfully implement them in running your business. If you have some tips on business and budget planning that you want to share, please do so in the comment section below!

Author’s Bio:

Kevin Nelson started his career as a research analyst and has changed his sphere of activity to writing services and content marketing. Apart from writing, he spends a lot of time reading psychology and management literature searching for the keystones of motivation ideas. Feel free to connect with him on Facebook , Twitter , Google+ , Linkedin .

Join over thousands of organizations that use Creately to brainstorm, plan, analyze, and execute their projects successfully.

More Related Articles

Leave a comment Cancel reply

Please enter an answer in digits: 11 + 2 =

Download our all-new eBook for tips on 50 powerful Business Diagrams for Strategic Planning.

Get expert insights delivered straight to your inbox.

How to Create a Basic Business Budget

8 Min Read | May 16, 2024

You’d never intentionally set your business up to fail, right? But if you don’t know your numbers and how to make a business budget, that’s exactly what you’re doing. Money problems and bad accounting are two reasons why many small businesses don’t make it past their first five years. 1

Talking about budgets can feel overwhelming. We get it. For a lot of business leaders, it’s a lot more comfortable dreaming up big ideas and getting stuff done than digging into numbers. But you can’t set yourself up for steady growth until you have a handle on the money flowing in and out of your company. You also can’t enjoy financial peace in your business.

Not a numbers person? That’s okay. Follow the simple steps below to learn how to create a budget for a business and manage your finances with confidence. We’ll even give you a link to an easy-to-use small-business budget template in the EntreLeader’s Guide to Business Finances .

But before we get to that, let’s unpack what a budget is and why you need one.

Don't Let Your Numbers Intimidate You

With the EntreLeader’s Guide to Business Finances, you can grow your profits without debt—even if numbers aren’t your thing. Plus, get a free business budget template as part of the guide!

What Is a Business Budget?

A business budget is a plan for how you’ll use the money your business generates every month, quarter and year. It’s like looking through a windshield to see the expenses, revenue and profit coming down the road. Your business budget helps you decide what to do with business profit, when and where to cut spending and grow revenue, and how to invest for growth when the time comes. Leadership expert John Maxwell sums it up: “A budget is telling your money where to go instead of wondering where it went.”

But here’s what a business budget is not: a profit and loss (P&L) report you read at the end of the month. Your P&L is like a rearview mirror—it lets you look backward at what’s already happened. Your P&L statement and budget are meant to work together so you can see your financial problems and opportunities and use those findings to forecast your future, set educated goals, and stay on track.

Why Do I Need to Budget for My Business?

Creating a budget should be your very first accounting task because your business won’t survive without it. Sound dramatic? Check this out: There are 33.2 million small businesses in the United States. Out of the small businesses that opened from 1994 to 2020, 67.7% survived at least two years. But less than half survived past five years. 2 The top reasons these businesses went under? They hit a wall with cash-flow problems, faced pricing and cost issues, and failed to plan strategically . 3

As a business owner, one of the worst feelings in the world is wondering whether you’ll be able to make payroll and keep your doors open. That’s why we can’t say it enough: Make a business budget to stay more in control and have more financial peace in running your business.

A budget won’t help you earn more money, but it will help you:

- Maximize the money you’ve got

- Manage your cash flow

- Spend less than your business earns

- Stay on top of tax payments and other bills

- Know if you’re hitting your numbers so you can move at the true speed of cash

How to Create a Budget for a Business

Your ultimate goal is to create a 12–18-month business budget—and you will get there! But start by building out your first month. Don’t even worry about using a fancy accounting program yet. Good ol’ pen and paper or a simple computer document is fine. Just start! Plus, setting up a monthly budget could become a keystone habit that helps kick-start other smart business habits.

Here’s how to create your first budget for business:

1. Write down your revenue streams.

Your revenue is the money you earn in exchange for your products or services. You’ll start your small- business budget by listing all the ways you make money. Look at last month’s P&L—or even just your checking account statement—to help you account for all your revenue streams. You’re not filling in numbers yet. Just list what brings in revenue.

For example, if you run an HVAC business, your revenue streams could be:

- Maintenance service calls

- Repair services and sales

- New unit installation

- Insulation installation

- Air duct cleaning

2. Write down the cost of goods sold (if you have them).

Cost of goods is also called inventory. These expenses are directly related to producing your product or service. In the HVAC example, your cost of goods would be the price you pay for each furnace and air conditioning unit you sell and install. It could also include the cost of thermostats, insulation and new ductwork.

3. List your expense categories.

It’s crazy how much money can slip through the cracks when we’re not careful about putting it in the budget. Think through all your business expenses—down to the last shoe cover your technicians wear to protect your customers’ flooring during house calls. Here’s a list of common business budget categories for expenses to get you started:

- Office supplies and equipment

- Technology services

- Training and education

Related articles : Product Launch: 10 Questions to Ask Before You Launch a New Product New Product Launch: Your 10-Step Checklist

4. Fill in your own numbers.

Now that you have a solid list of revenue and expense categories, plug in your real (or projected) numbers associated with them. It’s okay if you’re not sure how much you’ll sell just yet or exactly how much you’ll spend. Make an educated guess if you’re just starting out. If your business has been earning money for a while, use past P&L statements to guide what you expect to bring in. Your first budget is about combining thoughtful guesswork with history and then getting a more realistic picture month over month.

5. Calculate your expected profit (or loss).

Now, number nerds and number haters alike—buckle in. We’re about to do some basic accounting so you know whether you have a profit or loss. This is your chance to figure out exactly how much you’re spending and making in your business.

Take your gross revenue (the total amount of money you expect to make this month) and subtract your expenses and cost of goods sold to find your profit or loss. Here’s what that calculation looks like:

Revenue - Expenses - Cost of Goods Sold = Profit or Loss

Don’t freak out if your first budget shows a loss. That actually happens a lot with your first few monthly budgets. You’re learning and getting context on what’s coming in and going out so you can make adjustments. Keep doing your budget, and before you know it, you’ll be a rock star at telling your money where to go, planning for emergencies , investments and opportunities , and building momentum.

6. Review your budget often.

Whew! Once you get that first business budget under your belt, take a deep breath and celebrate. You’ve just done something huge for your business! (You’ll also be happy to know, budgeting gets easier from here since you can copy and paste your first one and tweak your income and expenses each month.)

But here’s the thing: Your budget can’t just sit in a drawer or on your computer. You’ve got to look at it consistently to make sure you’re actually following it.

Weekly Review

At least once a week, someone in your business (whether it’s you, a qualified team member or a bookkeeper) needs to track your transactions so you know what’s happening with your money all month. Then you can make adjustments before you have more month than money.

Every time you review your budget, ask yourself these three questions:

- Are we on target to hit our revenue goal this month?

- If not, what we can change to get there?

- Are there any expenses we can cut or minimize?

Monthly Review

You also need to review your business budget when you close your books every month to compare it to your actuals—your P&L. Otherwise, how can you know how you’re doing?

7. Work toward a 12–18-month budget.

Now that you’ve created your first month’s budget, move on to the next one. You’ve got this! The more budget-building reps you get in, the better you’ll be at looking forward and planning for growth. In no time, you’ll reach that ultimate goal of a 12–18-month budget. Just keep adjusting as you go based on all you’re learning about getting an accurate road map for your finances.