Self-Employment: What You Need to Know to Be Your Own Boss

Published: May 03, 2023

You're setting your own hours. Being your own boss. Calling the shots in the workplace you’ve created. Sound appealing? These are some of the perks of being self-employed. According to the Bureau of Labor Statistics, over 16 million Americans are currently self-employed .

However, self-employment isn’t without its challenges. While being able to call your own shots sounds glamorous, being your own boss takes hard work, dedication, and incredible focus — with no guarantee of pay, benefits, or success in your field.

If you’re considering self-employment, continue reading to learn everything you need to know to be your own boss. And if you're short on time, jump to the information you need:

- Self-Employment Definition

- Self Employment Advantages

- Self Employment Disadvantages

- Business Owner

How to Become Self-Employed

First, let’s define what it means to be self-employed.

Self-Employment

Self-employment is the practice of earning income directly through one's own business or trade, rather than working as an employee for an employer. In self-employment, an individual is responsible for managing and financing their own business, including all aspects of marketing, sales, and financial management.

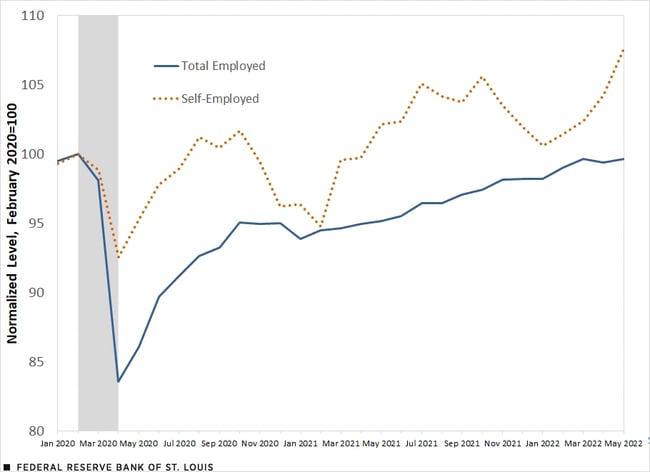

Growth opportunities for self-employed individuals vary greatly depending on the field of work and fluctuate according to how the economy is doing. For example, amidst Covid-19, self-employment was less susceptible to initial employment declines than other forms of employment and recovered more quickly to pre-pandemic levels than other forms of work.

Image Source

In particular industries like real estate and transportation industries have become more common sectors for the self-employed to work in, with the growth of transportation potentially being related to the growth in gig economy apps like Uber.

Is being self-employed for you?

Self-employment has advantages and disadvantages that should be heavily considered before starting this career.

Self-Employment Advantages

1. independence.

For most people who pursue self-employment as a career, the sense of independence and autonomy over how and when they work are among the greatest benefits. Depending on the nature of their work, self-employed individuals can often control their hours, where they work, and how to complete their work best.

2. Engagement

If you’re self-employed, you also probably wear many hats. You’re in charge of the products and services you’re selling and managing administrative tasks, marketing, and operational duties. In other words, you’ll rarely be bored if you're self-employed.

3. Earning Potential

Additionally, because they are not working for wages determined by a company and are only eligible to receive annual pay increases, self-employed workers don’t have a specific limit to how much money they can make. Between setting their own rate, and taking on as few or as many clients as they desire, self-employed workers typically have greater earning potential than hourly or salaried employees who have less control over how much money they bring home.

Self-Employment Disadvantages

1. inconsistent income.

As we mentioned earlier, with great power comes great responsibility. Self-employment can be challenging, with a lack of consistent income being a common concern. For those whose income depends on their ability to sign clients or sell products that don’t yet have a strong customer base, earnings can fluctuate greatly during a slow month or off-season.

2. Self-Managed Benefits

Additionally, self-employed workers are often responsible for securing and managing their benefits like healthcare, retirement savings, and paid time off. This can become incredibly complicated for business owners responsible for managing these benefits for their employees.

3. Overwhelm

Along with inconsistent income and the lack of guaranteed benefits, the demands of managing various business areas (outside of simply completing tasks related to a particular skill or trade) can feel overwhelming for self-employed individuals.

Self-employment can look like many different roles, so let's discuss the big three.

Types of Self-Employment

Many self-employed individuals choose the entrepreneurship path, opting to operate their own business. Instead of focusing on a set of tasks or statements of work like an employee, business owners often create businesses to solve some sort of problem.

Self-Employed Business Owner Example: Billie

Georgina Gooley founded Billie when she realized prices for women’s shave products were significantly marked up due to pink tax .

As a business owner, you're your own boss and are responsible for operating a company. Here are two essential things you will need to do to establish and begin operating your business:

A business plan is a guiding document that outlines all of the major details of your business. A thorough business plan will explain your business model, address how your company will make money, document your company's structure, and include detailed financial and marketing plans. For help writing your business plan, download this template .

Next, you’ll need to legally establish your business. How you do this can vary depending on your state (for those in the U.S.). For small business owners, these are the most common business structures:

- Sole proprietorship — This is usually the preferred business filing for individual contributors and solopreneurs. Under a sole proprietorship, an individual owns the business, and legally there is no separation between the business and the person who owns it. A sole proprietorship can be a good option for the entrepreneur who does not plan to take on partners or employees and works in a field where they offer a specific range of services (i.e. graphic design or consulting).

- Limited liability company (LLC) — In an LLC, business owners have limited liability, and are not personally responsible for the company’s debts. This can be a good option for small businesses that are more complex or offer a wider range of goods and services than a sole proprietorship. In many states, individuals can own a "single member" LLC, so solo business owners can consider filing as an LLC depending on where they live.

- Partnership — In a partnership, two or more owners manage and share responsibility for a business. With this type of business structure, profits, and losses are shared and paid among partners. This type of structure is popular among businesses such as law firms, real estate groups, and medical offices, where multiple practices can run from one establishment.

A career in freelancing can be a positive self-employment option for those who highly value flexibility and have a specific skill they specialize in. As a freelancer, you provide contract services to as many companies and clients as you would like to take on.

Freelance roles are popular in fields including writing, photography, consulting, graphic design, and administrative assistance. It’s important to note that working freelance, your potential earning has no maximum, however, work (and thus pay) can be inconsistent.

Here is a recommended course of action if you want to pursue freelance work.

As you work to book clients, you want to make sure you can provide examples of your work. Unlike a traditional job where you apply with a resumé, potential clients want to see your prior projects that showcase your skills and testimonials from previous clients. The most straightforward way to do this is to have a portfolio to showcase your best work.

You can create a portfolio by linking to your previous bodies of work on your website or using an online portfolio tool. Popular online portfolio sites include:

- Behance — This website has a portfolio creation tool for freelancers in the creative fields including graphic and UX/UI designers, illustrators, and video editors. Behance can be licensed through an Adobe Creative Cloud membership .

- Clippings.me — Designed for writers and journalists looking to create an online portfolio, Clippings.me offers a free tier perfect for displaying small clips. Paid plans start at $9.99 per month and for robust online portfolio hosting.

- Carbon Made — For visual artists, Carbon Made offers a beautiful interface to host online portfolios. Plans start at $8 per month and offer unlimited video and image hosting.

The beauty of freelance work is determining how much you charge for your work. However, deciding how much to charge can be challenging. When choosing your rates as a freelancer, factor in the following considerations:

- Your overall income goals — How much money will you earn this year? How many projects can you reasonably complete? Divide the total amount of money you would like to earn by the number of projects you can reasonably complete to give you a ballpark range for how much you should be bringing in for each project.

- Business expenses — How much will it cost you to complete the work? Do you have to purchase any equipment (i.e., a new computer or new software) to complete your jobs? If so, factor in how much it may cost you to complete the work and build this into your rates. For example, if you spend roughly 10% of your income on expenses related to completing your work, you may want to add an additional 10% to your rates to offset this value.

- Average rates for writers and editors

- Average rates for digital designers and developers

- Hourly vs. project — How you charge clients (i.e., work by the hour, or a lump sum for the project) will depend on your preferences and the nature of work. Being paid by the hour for freelance work emphasizes the time it takes to complete a project. Receiving a lump-sum payment for completion of a project emphasizes the end result.

Once you determine what work you want to provide and how much you want to charge, it is time to start booking clients. For most freelancers, this includes applying for open job listings and pitching work to potential clients. Popular websites for freelance job listings include:

- Fiverr — Website for quick-turn creative projects including logo design, and audio/visual editing jobs.Creating a profile and listing services is free, and you walk away with 80% of earnings from each transaction.

- UpWork — Currently the internet’s largest freelance job posting site. Upwork offers listings for most major freelance niches, and is a good place to get started for beginner freelancers. For freelancers, service fees range between 5-20% of earnings.

- CloudPeeps — This website is geared towards more experienced freelancers, with opportunities primarily in the fields of social media, content creation, and marketing. You can create a free account to be listed in their online directory, with paid plans starting at $9 per month for additional features.

- Guru — On Guru, you can create a profile to showcase your work and connect with potential clients. Creating an account as a freelancer is free, and you pay a 2.5% transaction fee for each paid invoice.

- 99Designs — Designed to be a platform for visual creatives to find work, 99Designs has opportunities for designers to create logos, websites, and visual identities for growing brands. Freelancers can create a profile for free to bid for design jobs through their site.

Contract work can be a good middle-ground for those seeking more consistent work but not wanting to be tied to a single company long-term. Contractors are hired to complete a statement of work for a specific time. In these roles, workers are often paid hourly from the companies they are contracted to work for and do not receive benefits.

Employment contracts can range in length from a few days to multiple years, depending on the nature of work. Typical contract roles are project-based (for example, a company may hire a contract project manager to implement a new process) or are a temporary backfill for full-time employees who will eventually return to work (for example, many contractors provide support while employees are on parental leave).

Self-Employed Contractor Example: Gig worker

In recent years, we have seen a rise in the "gig economy" with the creation of independent jobs from modern services. These types of jobs include driving for ridesharing services such as Uber or Lyft. Many people take on these roles to supplement other sources of income, the creation of more ways of doing work has the potential to reshape the future job market .

Now, let's discuss how to successfully navigate the world of self-employment.

- Determine the type of self-employment you want to pursue.

- Create a schedule.

- Develop processes.

- Establish boundaries.

- Delegate tasks where you can.

- Seek out mentorship or coaching.

- Prioritize self-care.

1. Determine the type of self-employment you want to pursue.

The path to self-employment is not one size fits all. And as we previously discussed, various options are available for creating self-governed work.

Once you've chosen the right path for you, and done the preliminary steps for it, you can move on to more hands-on work.

2. Create a schedule.

For many, the biggest appeal of self-employment is flexibility. While it can be tempting to work anywhere, anytime, creating a consistent schedule can be helpful for many self-employed workers. Creating a schedule helps you maintain a better work-life balance so you aren’t always "on." It also improves your communication with potential clients and customers, because they must set hours for getting a hold of you, creating a sense of routine and professionalism.

3. Develop processes.

As you settle into the groove of self-employment, developing standard processes can help you work smarter, better, and faster. Look at your statement of work to identify tasks that can be automated or simplified. Often, the best place to start is with tasks that are done repeatedly, such as administrative tasks that can be automated. Here are suggestions to help you scale and automate your work.

- Implement a CRM — A customer relationship management platform ( CRM ) can be a valuable tool for keeping track of client information. You can use a CRM to manage all client communication without manually tracking correspondence from a spreadsheet or your inbox.

- Inquiries process — If a potential client sees your work and wants to hire you, do you have a process to support inquiries? A simple process could be having a specific email inbox project inquiries go to so they don’t get lost in your inbox, allowing you to batch responses easier. Or it could be setting up a "work with me" page on your website, having a web form specifically for project inquiries so people can contact you directly for work. Ideally, you will have this process in place before you truly need it to prepare you for success.

- Project management — How are you currently tracking how client or customer work is managed? With a project management system in place, your job as a self-employed worker will be easier, and your clients and customers will likely receive the same positive experience. You can use a tool such as Asana to help you manage your client projects and integrate them with your CRM.

- Budgeting — When you’re self-employed, you need a solid plan to help you manage your business finances. When managing your own pay (and the pay of your employees) you have to understand where your money is coming from. Using a system like QuickBooks Self-Employed is a good way to automate your finances so you don’t have to track everything manually.

4. Establish boundaries.

When you are your own boss, it can be tempting to feel like you need to work all of the time. In a traditional job, there are often set working hours or physical space you go to and leave from each day to establish boundaries. When you work for yourself, you must create those boundaries. Helpful boundaries for the self-employed can include:

- Creating a designated workspace for yourself that is for work only — This establishes a boundary between recreational and professional space. When you are in your workspace, that is a time for work and focus.

- Communication expectations with clients — Create norms around client communication. Determine what communication channels you prefer to use with clients (such as Slack , or a designated email address instead of your personal email address or phone number) so clients know when and how to get a hold of you. Additionally, you may want to consider communicating to clients what a normal response time is (for example, making it clear that you respond to emails within 24 hours).

- Out-of-office procedure — When you work for yourself, you won’t have a structured PTO plan or designated backup to handle inquiries if you are out of the office. To protect your time away from work, communicate to clients and stakeholders when you’ll be away and for how long, and set up autoresponders so inquiring clients know when you’ll return and when they can expect to hear from you.

5. Delegate tasks where you can.

Even if you are a solopreneur who does not have employees, you can still delegate business tasks. Stay in your zone of genius and focus on the work you truly love to do, whether it's writing, designing, or consulting by outsourcing tasks that are not your strong suit. Here are a few business tasks you may want to consider outsourcing if you’re self-employed:

- Bookkeeping — As a self-employed person, you want to ensure your finances are handled correctly. Hiring professionals to handle your financial tasks including invoicing, tracking profit and expenses, and helping prepare your taxes helps free up your time to focus on work and ensures these tasks are done correctly.

- Social media posting — If social media marketing is on your task list, you need a strategy to streamline your posts. This could be as simple as creating a social media schedule and pre-planning content so you’re not stuck wondering what to post next, or you can use an automated tool to publish content for you.

- Administrative tasks — Are you pinned down by repetitive administrative tasks such as inbox management or reporting? There are several options available to help you delegate these tasks. If you aren’t ready to make your first hire, use the Personal Assistant listings on Task Rabbit to bring in hourly support when you truly need it. If you’re looking for a more long-term solution or support for a specific project, bringing on a contracted virtual assistant can be an affordable way to delegate administrative tasks.

- Time tracking — If you track your billable hours manually, it's time to automate. Numerous time-tracking apps available can integrate directly with your favorite tools including Gmail, Google Calendar, and QuickBooks for invoicing at the click of a button. Check out some of our favorite time-tracking apps here.

6. Seek out mentorship or coaching.

In a traditional work environment, you usually have a manager you report directly to who can provide guidance, mentorship, and coaching. When you are your own boss, you have to seek out this type of support by yourself. Even when working for yourself, developing your skills should be a top priority to help you grow and evolve in your career, and having a trusted mentor or career coach is a great way to get this type of support.

Find a mentor by networking with people who have the experience you want to learn from (and who you may be able to offer valuable insight from as well). Before approaching a potential mentor for advice, clarify your goals and what you hope to gain from mentorship. You may also find that having a business or career coach to keep you accountable is a helpful option.

7. Prioritize self-care.

Last but certainly not least, make self-care a top priority. When you are your own boss and your livelihood depends on your ability to produce, you have to take care of yourself so you can continue to feel your best. Self-employment takes stamina, and self-care can help you keep up. Here are some ways to incorporate self-care in your routine:

- Stay on top of your health — A balanced diet, coupled with regular exercise, is one of the best things you can do to improve focus, boost creativity, and improve overall health. Aim for 30 minutes of movement each day. Even a lunch break walk to get away from your desk can work wonders.

- Build quiet time into your schedule — Having quiet time to reflect is essential for everyone, especially the self-employed. Build time into your schedule each day to meditate, journal, or just sit and be present with yourself.

- Make time for hobbies and recreation — Everyone should have activities they do purely for enjoyment that don’t involve work. Taking intentional, recreational breaks from work can help you feel refreshed and inspired when you do work. Whether you have a creative hobby, like to explore the outdoors, or enjoy reading fiction, keep activities in your schedule that are purely for enjoyment.

- Get enough rest — Sleep is essential for high-performers. When you are well-rested you can think critically, make better decisions, and you are less likely to make time-consuming mistakes in your work.

Understanding Self-Employment

Embarking on a self-employed career can be incredibly rewarding. A self-led career can offer you flexibility and opportunities beyond more traditional jobs, but it isn't without risks. We hope you found this post useful as you prepare to pursue a career of your own.

Editor's note: This article was originally published in October 2019 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

What Is a Mentor in the Workplace?

Coaching vs. Mentoring for Entrepreneurs

How Peer Coaching Can Help Your Business

Reverse Mentoring for Businesses

Transferable Skills That Take You From 0 to 100 as an Entrepreneur

2 Essential Templates For Starting Your Business

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

Simple Business Plan Templates

By Joe Weller | April 2, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve compiled a variety of simple business plan templates, all of which are free to download in PDF, Word, and Excel formats.

On this page, you’ll find a one-page business plan template , a simple business plan for startups , a small-business plan template , a business plan outline , and more. We also include a business plan sample and the main components of a business plan to help get you started.

Simple Business Plan Template

Download Simple Business Plan Template

This simple business plan template lays out each element of a traditional business plan to assist you as you build your own, and it provides space to add financing information for startups seeking funding. You can use and customize this simple business plan template to fit the needs for organizations of any size.

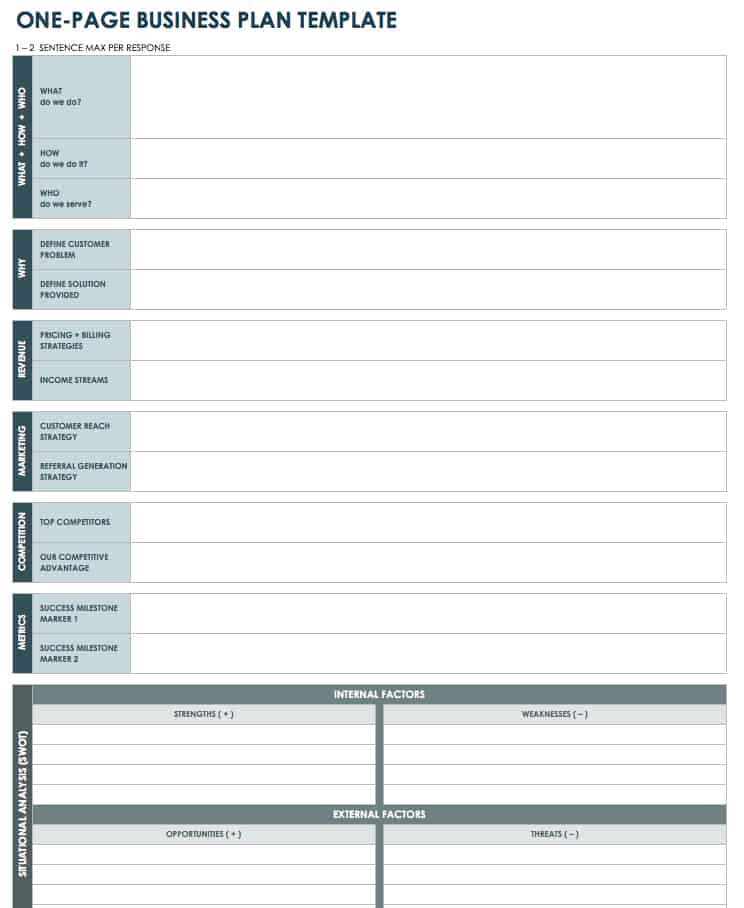

One-Page Business Plan Template

Download One-Page Business Plan Template

Excel | Word | PDF | Smartsheet

Use this one-page business plan to document your key ideas in an organized manner. The template can help you create a high-level view of your business plan, and it provides easy scannability for stakeholders. You can use this one-page plan as a reference to build a more detailed blueprint for your business.

For additional single page plans, take a look at " One-Page Business Plan Templates with a Quick How-To Guide ."

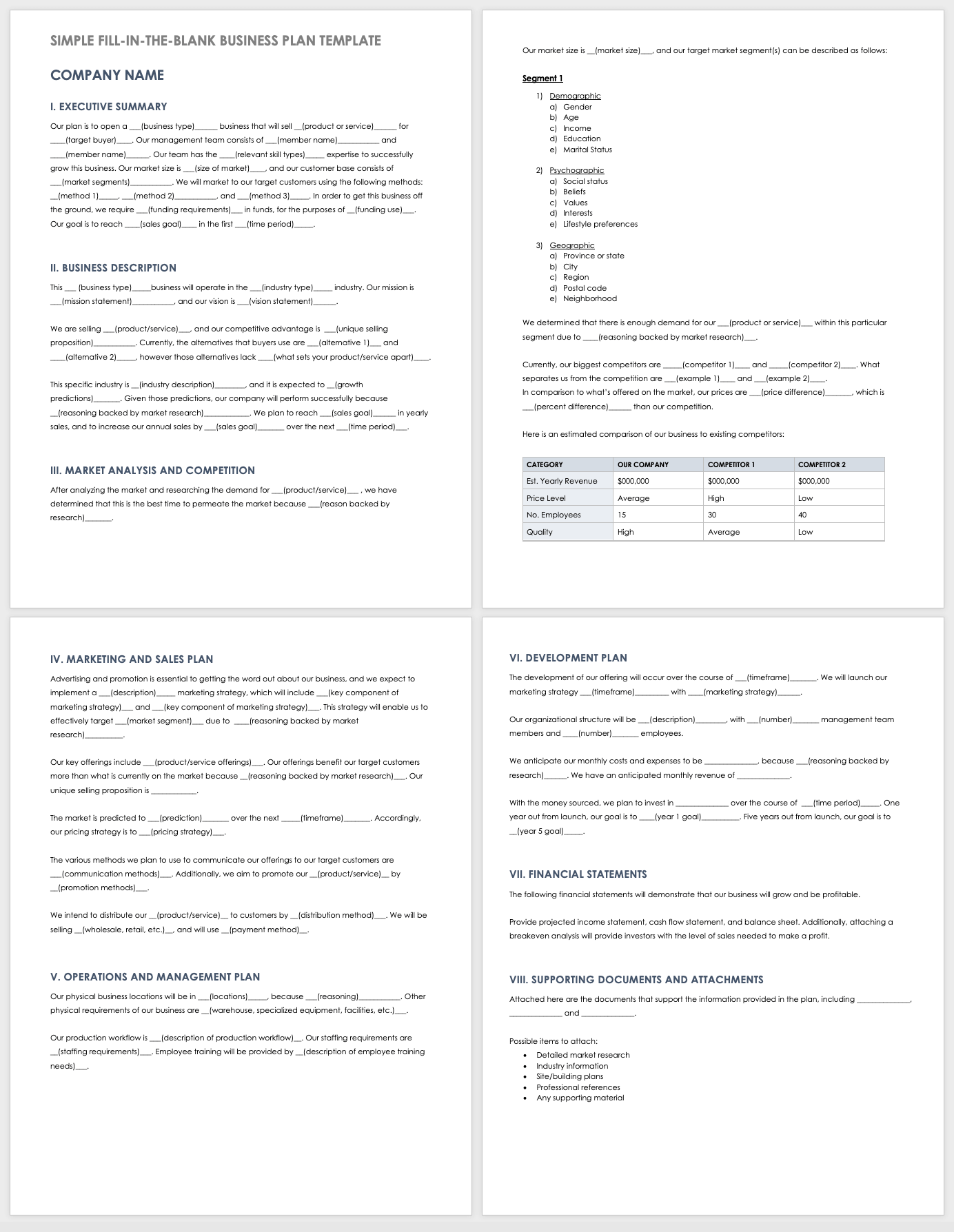

Simple Fill-in-the-Blank Business Plan Template

Download Simple Fill-in-the-Blank Business Plan Template

Use this fill-in-the-blank business plan template to guide you as you build your business plan. Each section comes pre-filled with sample content, with space to add customized verbiage relevant to your product or service.

For additional free, downloadable resources, visit " Free Fill-In-the-Blank Business Plan Templates ."

Simple Business Plan for Startup

Download Startup Business Plan Template — Word

This business plan template is designed with a startup business in mind and contains the essential elements needed to convey key product or service details to investors and stakeholders. Keep all your information organized with this template, which provides space to include an executive summary, a company overview, competitive analysis, a marketing strategy, financial data, and more. For additional resources, visit " Free Startup Business Plan Templates and Examples ."

Simple Small-Business Plan Template

Download Simple Small-Business Plan Template

This template walks you through each component of a small-business plan, including the company background, the introduction of the management team, market analysis, product or service offerings, a financial plan, and more. This template also comes with a built-in table of contents to keep your plan in order, and it can be customized to fit your requirements.

Lean Business Plan Template

Download Lean Business Plan Template

This lean business plan template is a stripped-down version of a traditional business plan that provides only the most essential aspects. Briefly outline your company and industry overview, along with the problem you are solving, as well as your unique value proposition, target market, and key performance metrics. There is also room to list out a timeline of key activities.

Simple Business Plan Outline Template

Download Simple Business Plan Outline Template

Word | PDF

Use this simple business plan outline as a basis to create your own business plan. This template contains 11 sections, including a title page and a table of contents, which details what each section should cover in a traditional business plan. Simplify or expand this outline to create the foundation for a business plan that fits your business needs.

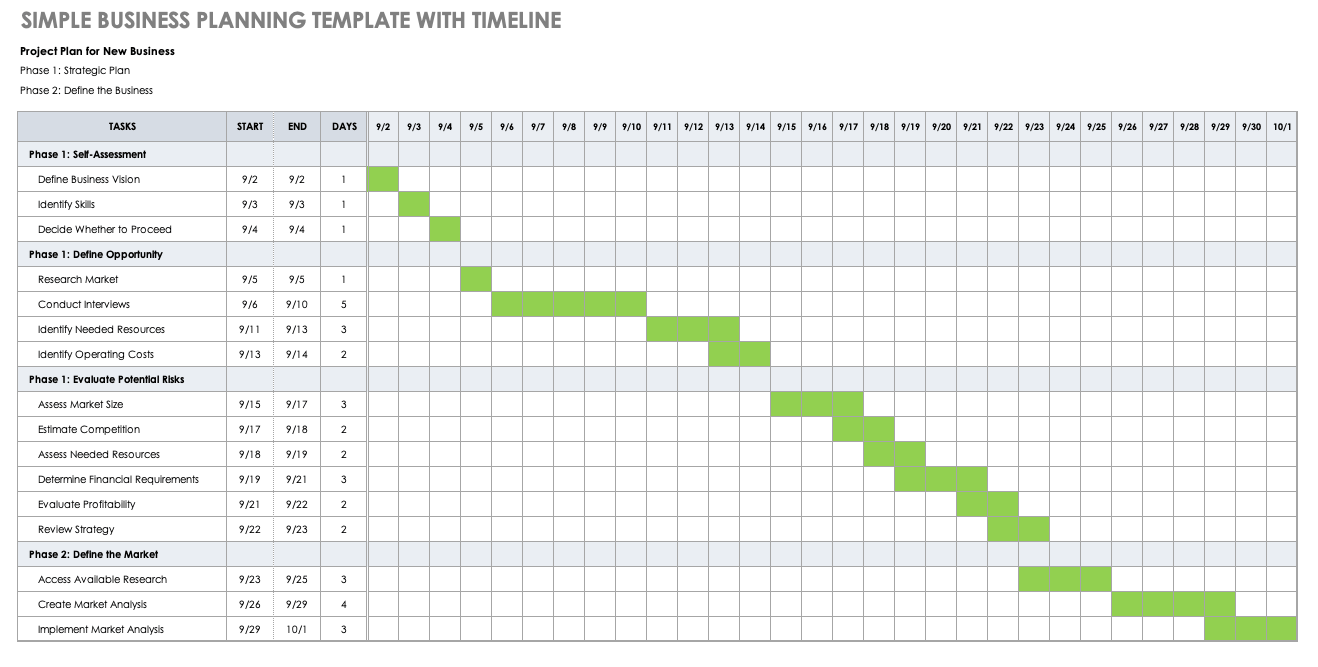

Simple Business Planning Template with Timeline

Download Simple Business Planning Template with Timeline

Excel | Smartsheet

This template doubles as a project plan and timeline to track progress as you develop your business plan. This business planning template enables you to break down your work into phases and provides room to add key tasks and dates for each activity. Easily fill in the cells according to the start and end dates to create a visual timeline, as well as to ensure your plan stays on track.

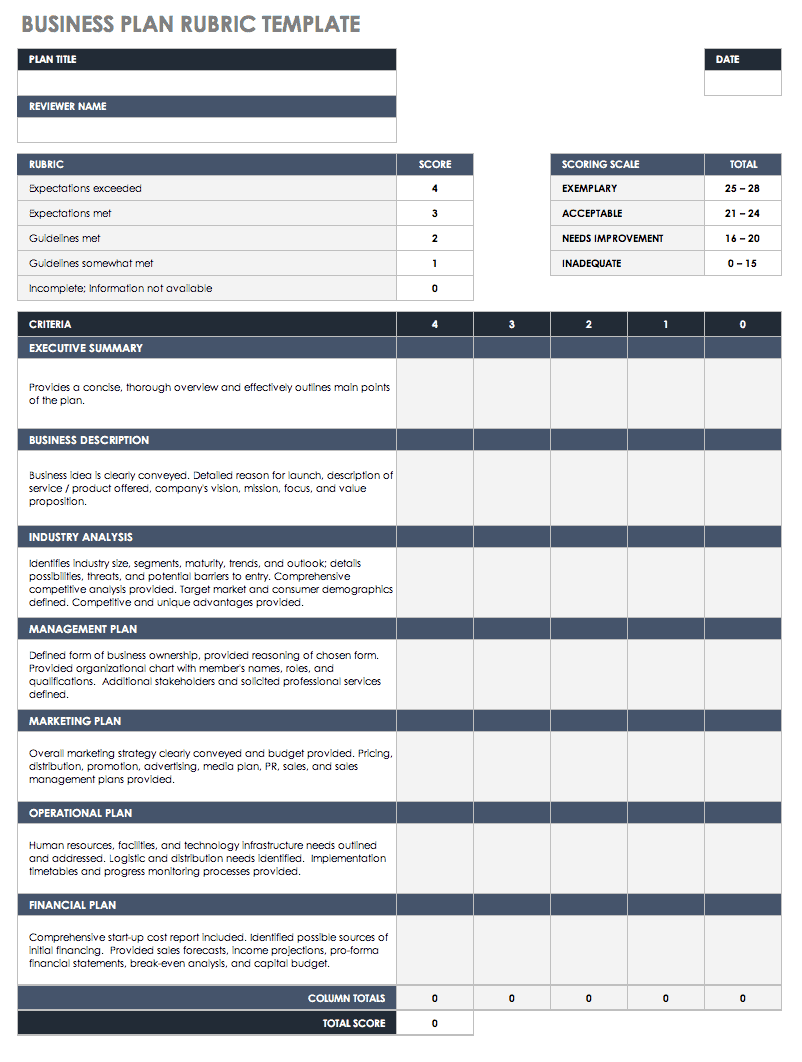

Simple Business Plan Rubric Template

Download Simple Business Plan Rubric

Excel | Word | PDF | Smartsheet

Once you complete your business plan, use this business plan rubric template to assess and score each component of your plan. This rubric helps you identify elements of your plan that meet or exceed requirements and pinpoint areas where you need to improve or further elaborate. This template is an invaluable tool to ensure your business plan clearly defines your goals, objectives, and plan of action in order to gain buy-in from potential investors, stakeholders, and partners.

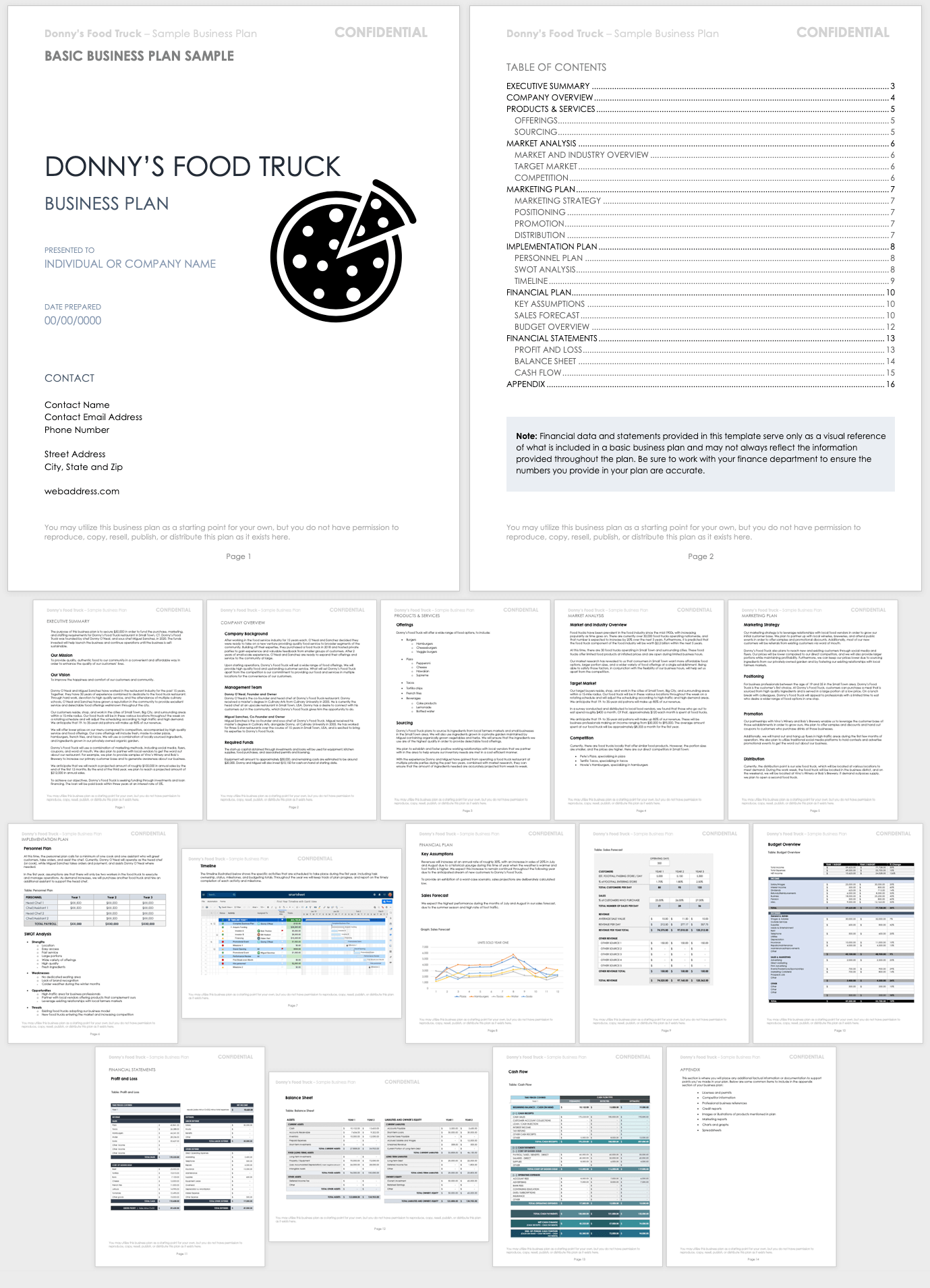

Basic Business Plan Sample

Download Basic Business Plan Sample

This business plan sample serves as an example of a basic business plan that contains all the traditional components. The sample provides a model of what a business plan might look like for a fictional food truck business. Reference this sample as you develop your own business plan.

For additional resources to help support your business planning efforts, check out “ Free Strategic Planning Templates .”

Main Components of a Business Plan

The elements you include in your business plan will depend on your product or service offerings, as well as the size and needs of your business.

Below are the components of a standard business plan and details you should include in each section:

- Company name and contact information

- Website address

- The name of the company or individual viewing the presentation

- Table of Contents

- Company background and purpose

- Mission and vision statement

- Management team introduction

- Core product and service offerings

- Target customers and segments

- Marketing plan

- Competitive analysis

- Unique value proposition

- Financial plan (and requirements, if applicable)

- Business and industry overview

- Historical timeline of your business

- Offerings and the problem they solve

- Current alternatives

- Competitive advantage

- Market size

- Target market segment(s)

- Projected volume and value of sales compared to competitors

- Differentiation from competitors

- Pricing strategy

- Marketing channels

- Promotional plan

- Distribution methods

- Legal structure of your business

- Names of founders, owners, advisors, etc.

- Management team’s roles, relevant experience, and compensation plan

- Staffing requirements and training plans

- Physical location(s) of your business

- Additional physical requirements (e.g., warehouse, specialized equipment, facilities, etc.)

- Production workflow

- Raw materials and sourcing methods

- Projected income statement

- Projected cash flow statement

- Projected balance sheet

- Break-even analysis

- Charts and graphs

- Market research and competitive analysis

- Information about your industry

- Information about your offerings

- Samples of marketing materials

- Other supporting materials

Tips for Creating a Business Plan

It’s easy to feel overwhelmed at the thought of putting together a business plan. Below, you’ll find top tips to help simplify the process as you develop your own plan.

- Use a business plan template (you can choose from the variety above), or refer to the previous section to create a standard outline for your plan.

- Modify your outline to reflect the requirements of your specific business. If you use a standard business plan outline, remove sections that aren’t relevant to you or aren’t necessary to run your business.

- Gather all the information you currently have about your business first, and then use that information to fill out each section in your plan outline.

- Use your resources and conduct additional research to fill in the remaining gaps. (Note: It isn’t necessary to fill out your plan in order, but the executive summary needs to be completed last, as it summarizes the key points in your plan.)

- Ensure your plan clearly communicates the relationship between your marketing, sales, and financial objectives.

- Provide details in your plan that illustrate your strategic plan of action, looking forward three to five years.

- Revisit your plan regularly as strategies and objectives evolve.

- What product or service are we offering?

- Who is the product or service for?

- What problem does our product or service offering solve?

- How will we get the product or service to our target customers?

- Why is our product or service better than the alternatives?

- How can we outperform our competitors?

- What is our unique value proposition?

- When will things get done, and who is responsible for doing them?

- If you need to obtain funding, how will you use the funding?

- When are payments due, and when do payments come in?

- What is the ultimate purpose of your business?

- When do you expect to be profitable?

To identify which type of business plan you should write, and for more helpful tips, take a look at our guide to writing a simple business plan .

Benefits of Using a Business Plan Template

Creating a business plan can be very time-consuming, especially if you aren’t sure where to begin. Finding the right template for your business needs can be beneficial for a variety of reasons.

Using a business plan template — instead of creating your plan from scratch — can benefit you in the following ways:

- Enables you to immediately write down your thoughts and ideas in an organized manner

- Provides structure to help outline your plan

- Saves time and valuable resources

- Helps ensure you don’t miss essential details

Limitations of a Business Plan Template

A business plan template can be convenient, but it has its drawbacks — especially if you use a template that doesn’t fit the specific needs of your business.

Below are some limitations of using a business plan template:

- Each business is unique and needs a business plan that reflects that. A template may not fit your needs.

- A template may restrict collaboration with other team members on different aspects of the plan’s development (sales, marketing, and accounting teams).

- Multiple files containing different versions of the plan may be stored in more than one place.

- You still have to manually create charts and graphs to add to the plan to support your strategy.

- Updates to the plan, spreadsheets, and supporting documents have to be made in multiple places (all documents may not update in real time as changes are made).

Improve Your Business Plan with Real-Time Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

Business Plan For Self Employed

Congratulations on taking the first step in creating a business plan for self employed. This is an essential step towards entrepreneurial success and a well-crafted business plan will provide a solid foundation for your business venture!

Whether you're a budding entrepreneur with a brilliant idea or a seasoned business owner looking to expand, a thoughtfully constructed business plan will help you plan and navigate towards business prosperity.

In this comprehensive guide, we will walk you through the essential elements of creating a business plan for self employed that captures your vision as well as attracting investors, partners, and customers alike. From defining your mission and identifying your target market to formulating financial projections and developing a robust marketing strategy, our aim is to empower you with the knowledge and tools needed to turn your aspirations into a reality.

So whether you're just starting out or you're looking to revamp your existing business plan, read on for everything you need to know.

Why is a business plan important?

A business plan is an essential tool that will revolutionise the way you think about your self employed business. It provides a structured approach to help you clarify your long-term goals and objectives, allowing you to develop effective strategies and marketing campaigns to achieve them.

One of the key benefits of creating a business plan is gaining a deep understanding of your customers. By analysing their wants, needs, and preferences, you can identify where they spend their time and how to effectively target them. This valuable insight will enable you to tailor your products or services to meet their demands.

Moreover, if you are seeking external funding, a well-crafted business plan demonstrates your commitment and professionalism. It shows potential investors or lenders that you are serious about your construction business and have a comprehensive plan of action to ensure success.

A Business Plan For Self Employed - The Key Parts

The executive summary, your company description, market analysis, products and services.

- Marketing Strategy

- Operational Plan

- Financial Projections

Risk Analysis

- Funding Request and Use of Funds (if applicable)

- Additional Information

An executive summary of your business plan for self employed is a brief overview of your business plan.

This is the first thing that potential investors or lenders will see, so it is crucial that you make a good impression. Keep this section short and highlight the key points of your plan.

What should an executive summary include?

- Overview of the Business

- Mission Statement

- Key Objectives

- Summary of Products/Services

- Financial Highlights and Funding Requirements (if applicable)

Remember potential investors don’t always have huge amounts of time to read your document so make sure that you condense the critical information, enabling the reader to make quick and well-informed judgments. Tips for the Executive Summary

Wait until you’ve written the whole business plan and then come back and complete the executive summary. This way you will know your business plan for self employed inside and out so you can highlight the key elements of the document. Remember the Executive Summary will shape the reader's initial perception of the business and whether they continue reading the document.

If you are looking for any tips on how to improve any section of your business plan, check out our Learning Zone , which has several in-depth guides on each section of the business plan.

The Company Description section of your self employed business plan is crucial as it offers a comprehensive overview of your business. This section provides essential information about your company's history, mission, vision, legal structure, location, and key milestones. It allows readers to gain a clear understanding of your company's fundamental characteristics and the context in which it operates.

When crafting your company description, make sure to include the following key elements:

- Business Name and Legal Structure: Clearly state the legal name of the company and its legal structure.

- Business History: Provide a brief overview of how the business came into existence. Highlight key milestones or events that shaped the company's growth and development.

- Mission and Vision Statements: Present the company's mission statement, which outlines its purpose and primary goals. Additionally, share the vision statement, which describes the long-term vision and objectives for your business.

- Products and Services: Briefly explain the products or services your business offers, emphasising their unique selling points and how they address customer needs.

- Competitive Advantages: Clearly state the competitive advantages that differentiate your business from others in the market. This could include unique features, patents, proprietary technology, or a strong brand presence.

- Location and Facilities: Provide details about the physical location of your business and any facilities required to operate successfully.

Tips for writing the company description section:

- Interweave storytelling into the company's history, tell the reader about your passion for the business and the journey you’ve been on to get to this point.

- Include strong visuals and infographics.

- Avoid jargon and keep the writing style clear and concise.

- Focus on your company's unique selling point (USP) and how that makes you stand out in the marketplace.

- Back up this information with customer testimonials if possible.

The market analysis section of your self employed business plan is essential for understanding the competitive landscape and the overall business environment. It is crucial to execute this section effectively as it demonstrates your in-depth knowledge of the market dynamics. This process will enable you, as an entrepreneur, to identify opportunities, mitigate risks, and develop strategies for success.

To conduct a good market analysis, it is important to have a deep understanding of the industry you are operating in. This information will help you make informed decisions about your product or service offerings, marketing strategies, and pricing.

Key elements to include in your market analysis section:

- Industry Overview: Provide a general overview of your industry. Describe the industry's size, growth rate, major players, and key trends. Include relevant statistics and data to support your claims.

- Target Market and Customer Segmentation: Clearly define your target market and outline the specific customer segments you aim to serve. Identify the needs, preferences, and behaviours of each segment.

- Competitor Analysis: Identify direct and indirect competitors in the market. Analyse their strengths, weaknesses, market share, and strategies. Highlight areas where your business differentiates itself from competitors.

- Market Trends and Opportunities: Explore current and future trends in the industry and market. Assess how these trends can impact your business positively and identify potential opportunities for growth.

- SWOT Analysis (optional): Consider including a SWOT analysis specific to your market. This can help you understand your business's strengths, weaknesses, opportunities, and threats in the context of the market.

How to nail the market analysis section?

- Differentiation: Focus on highlighting how your business differentiates itself from competitors, really try to drum home this point.

- Market Surveys or Interviews: Adding surveys or interviews and adding the key findings and quotes in the Market Analysis to support your claims will help reinforce the plans in your document.

- Competitive Matrix: a competitive matrix visually comparing your business against key competitors based on factors such as price, features, and customer service. This matrix is a great visual method highlighting your competitive advantages.

- Emerging Technologies or Trends: Identifying potential disruptions and how your company is prepared for them shows a great understanding of market dynamics and trends.

Looking for more inspiration on how to make your market analysis section even better, then check out our in-depth business market analysis guide.

In this section, we will highlight the core products and services that make your self employed business unique and valuable. It is essential to showcase what sets you apart from the competition and why your offerings are exceptional. This information is especially important for potential investors, partners, and customers who are keen to understand what sets your business apart in the market.

When describing your products and services ensure you include the following information:

- Description of Products/Services: Provide a clear and concise description of each product or service your business offers. Explain their primary function and how they address customer needs.

- Unique Selling Proposition (USP): Highlight the unique features or benefits that make your products or services stand out from competitors. Clearly state why customers should choose your offerings over alternatives.

- Product/Service Life Cycle: Describe where each product or service stands in its life cycle (e.g., introduction, growth, maturity, decline) and outline plans for updates or new offerings in the future.

- Intellectual Property (if applicable): If your business has any intellectual property (e.g., patents, trademarks, copyrights) related to your products or services, mention them in this section.

Extra elements to make this section stand out:

- Customer Use Cases: Present real-life customer use cases or success stories that illustrate how your products or services have solved specific problems for customers. Use compelling narratives to engage readers.

- Product Roadmap: If applicable, include a product roadmap that outlines future updates, enhancements, or new offerings. This showcases your business's commitment to innovation and continuous improvement.

- Quality and Testing Standards: Discuss the quality standards your business adheres to and any testing processes you conduct to ensure the reliability and performance of your offerings.

- Pricing Strategy: Integrate your pricing strategy into this section. Explain how you've determined the pricing of your products or services, considering factors like production costs, competition, and value to customers.

- Environmental and Social Impact: If your products or services have positive environmental or social implications, highlight them in this section. Increasingly, customers appreciate businesses that contribute positively to society.

The Marketing Strategy Section

Key Information to Include Within the Marketing Strategy Section:

- Marketing Goals and Objectives: Clearly state the marketing goals you aim to achieve. Focus on how you will increase brand awareness and drive customer conversions or leads.

- Target Market Strategy: Describe the specific strategies you will use to reach and engage with your target customers. This could involve digital marketing, traditional advertising, or other channels.

- Pricing Strategy: Explain how your pricing will attract the target market and how it compares to competitors' pricing.

- Promotion and Advertising Plan: Outline the promotional activities and advertising campaigns you plan to execute. Include details about social media marketing, content marketing, email campaigns, and other promotional tactics.

- Sales Strategy: Describe your sales process and how you plan to convert leads into paying customers. Mention any sales team structure and their responsibilities if applicable.

- Customer Relationship Management (CRM) Approach: Discuss how you intend to build and maintain strong relationships with your customers to encourage repeat business and loyalty.

Getting Creative with the Market Strategy Section

- Create a visual marketing timeline.

- Outline influencer or brand ambassador partnerships if applicable.

- Detail key metrics and KPIs.

By infusing creativity and innovative marketing ideas with sound fundamental marketing, you can really make this section stand out and impress potential investors and partners.

The Operation Plan Section

While marketing activities may seem more exciting, operational planning is essential for the success of your self employed business. This section focuses on the day-to-day operations and internal processes that drive your business forward. By providing a comprehensive roadmap of your resources, workflows, and procedures, you can instill confidence in potential investors that your business is well-equipped for growth.

Here are some key items to include in your operational plan:

- Organisational Structure: Describe the organisational structure of the company, including key roles and responsibilities.

- Key Personnel and Team: Introduce key team members and their qualifications. Highlight how their expertise contributes to the success of the business.

- Operational Workflow and Processes: Provide a high-level step-by-step overview of delivering your product or service, from production to delivery or distribution.

- Resource Requirements: Outline the key resources required to run the business, such as equipment, technology, facilities, and human resources.

- Quality Control and Assurance: Explain how the company ensures the quality and consistency of its products or services, and how it addresses any potential issues.

- Supply Chain Management (if applicable): If the business involves sourcing materials or products from suppliers, describe the supply chain management process.

- Legal and Regulatory Compliance: Discuss any legal or regulatory requirements specific to the industry and how the company ensures compliance.

How to add value to the Operation Plan section:

- Use visuals to outline organisation structures and workflows.

- Outline contingency plans, for example how the company is prepared for supply chain shortages or price shocks.

- Efficiency, efficiency, efficiency. Describe how you have driven efficiency gains for the business.

- Have you considered your business's environmental impact? If so, mention within this section.

The operational section of a business plan does have the potential to be dryer than more exciting elements such as marketing, however, by incorporating creative elements and forward-thinking workflows you can help keep reader engagement high.

The Financial Projections

The Financial Projections section can make or break a business plan. Always include well-researched and accurate projections to avoid undermining your business plan and losing out on potential investment. What to include in the financial projections section:

- Sales Forecast: Provide a detailed projection of the company's sales revenues for each product or service category over the forecast period.

- Expense Projections: Outline the expected operating expenses, including costs related to production, marketing, salaries, rent, utilities, and any other significant expenses.

- Profit and Loss (P&L) Statement: Present a comprehensive Profit and Loss statement that summarizes the business's revenue, cost of goods sold (COGS), gross profit, operating expenses, and net profit or loss for each year of the forecast.

- Cash Flow Projection: Include a cash flow statement that outlines the inflows and outflows of cash over the forecast period. This will help identify potential cash flow gaps.

- Break-Even Analysis: Perform a break-even analysis to determine the point at which the business's total revenue equals total costs, indicating when it becomes profitable.

How to add value to your financial projections section:

- Be prepared to defend your assumptions with data. If you are planning for a high-growth % make sure you can justify this assumption. If in doubt the more conservative the better.

- Include visuals that help readers quickly grasp the trends and patterns in revenue, expenses, and profits.

- Offer different scenarios based on varying assumptions. For example, present a conservative, moderate, and aggressive growth scenario.

- Include key financial ratios like gross margin, net profit margin, and return on investment (ROI).

The Funding Request and Use of Funds Section

This section outlines the financial requirements of the company and how the requested funds will be utilised to support its growth and operations. Providing potential investors or lenders with a clear picture of how their money will be used will improve the business case for the funds and provide further confidence to investors. What to include in this section?

- Funding Request Amount: State the specific amount of funding you are seeking to obtain from investors, lenders, or other sources.

- Use of Funds: Provide a detailed breakdown of how the requested funds will be allocated across different aspects of the business. Common categories include product development, marketing, operational expenses, hiring, equipment, and working capital.

- Timeline of Funds Utilisation: Outline the timeline for utilising the funds. Specify when and how the funds will be disbursed and the expected milestones or deliverables associated with each funding phase.

- Expected Return on Investment (ROI): If applicable, include information on the expected ROI for investors. Highlight the potential for financial gains or equity appreciation over time.

- Repayment Plan (if applicable): If seeking a loan, provide a clear repayment plan that outlines the repayment period, interest rate, and the proposed schedule for repayment.

How to maximise this section?

- Create a visual timeline for key milestones such as the initial investment and key payback periods.

- Outline risk mitigation plans to instil confidence.

- Reiterate the company's long-term vision and how the funds can help achieve these goals.

As you near the end of your self employed business plan, it is crucial to dedicate a section to outlining potential risks. This section holds immense significance as it can greatly influence the confidence of potential investors. By demonstrating your market awareness and addressing challenges head-on, you can instill trust and credibility.

When conducting a risk analysis for your self employed car rental business plan, consider including the following:

- Identification of Business Risks: Enumerate the key risks and uncertainties that could affect the business. These risks can be internal (e.g., operational, financial) or external (e.g. market changes, regulatory changes, economic downturns).

- Impact Assessment: Analyse the potential impact of each identified risk on the business's operations, finances, and reputation. Rank the risks based on their severity and likelihood of occurrence.

- Risk Mitigation Strategies: Present specific strategies and action plans to mitigate each identified risk. Explain how you will proactively address challenges and reduce the negative impact of potential risks.

- Contingency Plans: Describe contingency plans for worst-case scenarios, outlining how the business will respond and recover from significant risks if they materialise.

How to make your risk analysis stand out?

- Add context with real-life examples. Are there similar businesses that have dealt with risks successfully in a similar manner to your strategy? This will add credibility to this section.

- Create adaptive strategies that demonstrate your business’s flexibility and adaptability.

- Outlining the responsible person for each risk and how they own it, giving further confidence in your risk management strategies.

Some additional information you may want to include in your business plan for self employed:

- Customer Surveys and Feedback

- Letters of Support or Intent

- Legal Documents (e.g., licenses, permits)

- Resumes of Key Team Members

A Business Plan For Self Employed Wrapping It All Up

A business plan is one of the most important documents that you will create about your business. It can literally be the difference between securing additional finance or missing out. Developing your business is not an easy task, however, the opportunity to think about your business in such detail will no doubt help you develop new and important insights along with new ideas and strategies. With all sections of your business plan and especially the financial plan, be prepared to defend your position to potential investors or lenders. This means that you should never publish anything that you can’t back up with additional data or rationale. Business Plans are not created overnight so take the time to research and think about each section properly, always try to support your claims and strategies with market insight and data. We hope you’ve enjoyed reading this guide, if you are looking for more tips on creating a business plan check out our learning centre .Good luck with your next business endeavour! Action Planr

Thank you! You’ll receive an email shortly.

Oops! Something went wrong while submitting the form :(

Learning ZoNe

Time To Be Your Own Boss: Business Plan For Self-Employed

Want to become self-employed? In this regard, you need to know a proper business plan for the self-employed. Without knowing a proper business plan, you can not sustain yourself in this business world. Moreover, a proper business plan can provide a visual infrastructure for your business. According to a statistic,

Till 2022, it was be an unstoppable increase in self-employment of about 2.76 million and female self-employment of about 1.5 million. And as time passes, it will continue to rise ever higher.

A self-employment business plan should be a solid guide, but not so complicated that you don't want to alter it, which is inevitable. If you want your business plan to stay relevant to your changing needs and priorities, you will need to update it as your company expands.

It is a very crucial factor to develop a complete business plan before starting a self-employment business. In this article, you can explore 7 essential steps to build an effective business plan for the self-employed . So, let’s deep dive into the core part of this article.

- 7 Steps to Develop a Business Plan for Self-Employed

(With Bonus One)

Offen job-holders dream of becoming self-employed , especially when they’re pissed of doing a 9 to 5 job for many years. But the reality is it’s not easy to build a business overnight, you need to follow some significant steps that will act as a roadmap to become self-employed or an entrepreneur. To start a self-employed business, you can follow the given steps.

- Business Executive Summary

- Detailed Business Description

- Offered Products and Services

- Conducted Competitor Analysis

- Design Marketing Plan

- Maintained Operations & Legal Considerations

- Illustrated Financial Narratives

Bonus:

8. Adopt Automation Software

Now, you can explore in detail the business plan for self-employed people.

- Step 1: Business Executive Summary

First, you need to explain the executive summary of your business. Executive summaries should be as brief as possible, according to the usual norm. Business executives should be written in easy language, try to avoid any type of jargon, so that any non technical person can understand the goal and objectives of your business.

Moreover, your audience is pressed for time and attention, and they want to learn as much as possible about your company plan. If at all feasible, keep your executive summary within two pages, however, it can be longer if required.

In your executive summary, you can enlist the following sections.

Write Your Business Plan

The executive summary will be a summary of the most essential themes covered in your business plan, writing the whole business plan before the executive summary is generally beneficial. Ensure that your executive summary solely includes facts and information from the business strategy.

Owner’s Introduction

Put a brief introduction of your business owner. It will build trustworthiness and you can enhance the reliability of your target audience. In this regard, a business plan should include the business owner’s introduction in the business executive summary of your self-employed business.

Mission Statement

To write a complete business plan for self employed, you need to clearly mention your mission statement. In this case, you have to write a mission statement within 30 words. Your mission statement should include your company’s goal, target audience, and service details.

Marketing Objectives

You need to define your marketing objective clearly. In your marketing objective, you have to provide the focusing point of your marketing team, clear direction for team members, and other significant information like support and marketing strategy.

Expected Outcomes

You can mention your expected outcomes based on the other factors of your planning. Though you will mention an estimated outcome in your self-employment business plan, it will motivate you to reach the goal and achieve your target.

Required Capital

In the executive summary, you need to calculate the overall estimated cost to start your business. According to the required estimated cost, you have to fix your budget. As a result, you will get an idea of your required capital to start your business.

- Step 2: Detailed Business Description

A company description gives a high-level summary of crucial components of your firm, such as what you do and what sets you apart. Anyone reading your business description should be able to figure out what your company does. Moreover, you need to include the following factors in your business description.

- Business name

- Business goal

- Competitive advantages

- Target customer

- Business location

- Business structure

Also, you have to fulfill 5 w's and h in your business description. In this regard, you have to require a clear understanding of the following questions.

- Who is your target audience?

- What is the goal of your business?

- Where is your business location?

- When will you implement your business plan?

- Why do you want to start this business?

- How do you achieve your goal?

If you fulfill all of the questions, you can properly explain your business description in your self-employment business plan.

- Step 3: Offered Products and Services

This part should provide a complete list of the items and services you will offer. One-on-one business coaching, career coaching, executive coaching, leadership development programs, team coaching, corporate training, workshops, seminars, coaching skills training, and a how-to book on recommendations for managers as coaches are just a few examples.

In your offered products and services list, you can include the following factors.

- A detailed description of the products and services

- Pricing list of your products and services

- Features and benefits of your listed products and services

- Production costs

- Production timeline

- Future products and services

- Step 4: Conducted Competitor Analysis

In this step, you need to research your target market and conduct competitor analysis.

Target Market

This part should include information about your ideal client. In my experience, most people who are new to self-employment require the most assistance in this area.

Moreover, they are adamant about not focusing on a single market since they like collaborating with people from various walks of life on a variety of projects. However, by attempting to sell to everyone, they dilute their message and, in doing so, end up appealing to no one.

Customer Segmentation

Customer segmentation is the process of identifying a group of customers. Moreover, this section is so crucial to conduct your marketing process. You can segment your targeted customers into these four categories.

- Geographic segmentation

- Demographic segmentation

- Psychographic segmentation

- Behavioral segmentation

- Step 5: Design Marketing Plan

To promote your business activities, you need to make a proper marketing plan. In this regard, you have to conduct a SWOT analysis to identify the strengths, weaknesses, opportunities, and threats. After conducting a SWOT analysis, you need to define your goal and target audience.

However, you have to analyze the following KPIs that will ensure the design of an effective marketing plan.

- Marketing goals and objectives

- Promotional strategies

- Unique selling advantages

- Pricing strategies

Most significantly, you have to choose your digital marketing method because various digital marketing methods are invented. These are:

Search Engine Optimization (SEO)

The goal of SEO is to optimize your website and increase organic traffic. To maintain high ranks, digital marketing managers typically pay attention to cross-connections and backlinks, keywords, and unique content. It improves the website's visibility. Remember that the more visible you are, the more customers you will be able to attract.

Content Marketing

Content marketing's main goal is to capture a customer's attention, educate newcomers, and nurture leads. Moreover, you can nurture and educate your potential consumers using this marketing technique by supplying them with relevant material, guiding them through the sales funnel, and finally convincing them to take the desired action.

Pay-per-click (PPC) Advertising

You can drive more traffic to your website through pay-per-click (PPC) advertising. This process allows you to conduct internet advertising and it is required to pay a fee each time one of their ads is clicked.

Email Marketing

Email marketing is another way to reach your targeted audience. This process can allow you to promote your products and services. Moreover, you can drive potential customers through the email marketing process.

Influencer Marketing

This one is another effective way to reach potential customers. Moreover, this process can allow you to work with someone who will act as an influencer as we as it helps to build credibility and trustworthiness. As a result, you can easily increase your brand awareness and enhance your sales.

Social Media Marketing

Social media marketing is one of the beneficial ways to reach a vast number of audiences. Also, it helps to increase brand awareness as well as improve search engine rankings. Moreover, social media marketing can be able to ensure higher conversion rates that will play a significant role to boost your business revenue.

There are different types of social media, using which you can promote your business, for instance Facebook marketing , Instagram, Medium, Quora, Twitter, Reddit, Pinterest and many more.

- Step 6: Maintained Operations & Legal Considerations

The most important step to build a business plan is to maintain operations and legal considerations. You can ensure your business's safety and security by maintaining operations and legal considerations. In this regard, you have to organize the following factors.

Agreement and contracts

You have to prepare a detailed and concise agreement and contracts in your self-employed business plan. It will ensure transparency and accuracy of your business as well as make a trust to invest in your organization.

Payment methods

You need to allow multiple payment methods for your organization. This payment method ensures a safe and secure transaction which will be essential for any organization. In this regard, you can integrate the following payment methods into your business.

- Cash payments

- Check payments

- Credit card payments

- Online payments

- Mobile payments

Permit & Registration

To start any self-employed business, you need to ensure all required permission and registration.

License & Regulations

According to your country’s law, you need to make all required licenses. Otherwise, you can not sustain in the marketplace. Also, you have to abide by all rules and regulations to conduct your business operations smoothly.

Insurance and Bonding

To write a complete self-employed business plan, you have to include insurance and bonding activities. It’s totally up to you whether you will provide insurance and bonding facilities or not. If you will provide it, you need to clearly mention them in your business plan.

- Step 7: Illustrated Financial Narratives

This one is the final step to make a self-employed business plan. In this step, you have to write a detailed financial statement. Moreover, business plans are an essential component of strategic financial decision-making.

They aid in the expression of ideas, the presentation of market data to support rhetoric, and the expression of the financial side of an argument. To make a complete financial statement, you have to include the following matrices in your financial statement.

- Profit and loss statement

- Cash flow analysis

- Break-even analysis

- Balance sheet

- Benefit analysis

- Step 8: Adopt Automation Software

You might think investing in some automation software might waste your money but this is completely a wrong thought, specially for start-up entrepreneurs. Firstly you have to understand your niche before you accommodate any automation software.

Automation software is absolutely a helping hand for your business, work as an instructor, simplifies your work and shows the easiest way to be more productive. Now, there are lots of variant automation software available in the envato market, so you choose one, whichever matches your niche or you can customize your own software , where you can personalize everything your business demands.

- Easy decision making

- Raise up the productivity

- Reliable data collection

- Gain loyal customers

- Improve the customer service

- Self-Employed Business Examples

- Independent business owner

- Food truck business owner

- Gig workers

- Partnerships

- How Necessary Is To Set- Up A Self-Employed Business Plan?

Of course, sketching a self-employed business plan assists you to glued yourself in the business plan you manifest to build. Without aiming any objectives, goals or deadlines, it becomes very difficult to stick to the problem you aimed to solve.

There’re lots of necessity to write a self employed business plan:

- Initial plan to reach at break-even point

- List down the strategies to reach the desired profit level

- List the desire industry to target and a pilot client list

- The rates you’ll charge

- List down the obstacles

Since this is completely your own business, there's no hurry to chase the deadline or the targets you aim for. There is another advantage of setting up a self employed business plan, for instance you can take every step in the aware mindset, understand the perspective of customers, trace down the uniqueness of your products, and strategies to regenerate the customers.

Having good self employed business ideas will not only help you to focus on the business plan, but also help to prioritize the project and task to reach the goal faster.

- Sketching a defined target helps you to have a clear objectives of your goal

- You’ll already about the financial boundaries and objectives

- A full-proof excuse to analyze your business, competitors, and different external activities.

- Help you to be focus and recognize your business opportunity

This is not only an article, but also it will act as the basement of your business. Though it will not be easy to become self-employed and write a business plan for the self-employed, this article provides you with a guideline. As a result, you will get a direction on how you can prepare yourself.

So, it’s time to become self-employed and inspire others to also become self-employed

through following a proper business plan.

- 10 Futuristic Ideas for a Successful Coffee Shop Business

- Cloud Kitchen Business Model: Everything You Need to Know!

- Fast Food Restaurant Business Plan Sample Guide

- Business to Customer(B2C) Business Model and Examples

Related Post

Thinking Hassle Free Software Development Service?

We provide custom software development services for business ERP solutions, blockchain, hospitality, e-commerce, e-learning & others.

For 30 Minutes Free Consultancy

Self Employment Checklist—Free Download

This form will load shortly, thanks for your patience.

Ready to become self employed? Fill out the form to download the free checklist and get started.

How to become self employed, fill out the form to download your free checklist today, and start working through the steps to become self employed.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Your download should begin immediately

If your download doesn't begin after 5 seconds, please click here .

View our entire gallery of free downloads

You might also enjoy:

The Small Business Toolkit

Access a free list of must–have resources for new and growing businesses in any industry.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Log in

- Site search

Writing a successful business plan

All successful businesses start with a strong business plan. Also known as a business proposal, this document helps attract investors and customers alike by demonstrating your knowledge, passion and drive

Writing a business plan is essential when starting your own business , but what is a business plan and why do you need one? Well, a business plan describes your company, what it aims to achieve and outlines how it'll achieve it. It helps you to clarify your ideas, identify potential problems with your business model, establish short and long-term goals and, over time, measure your company's progress.

A business plan is vital if you're looking to secure investment, but it can also convince customers and suppliers to support you. You should update your business plan regularly, tailoring it to its intended reader as you would a CV and cover letter. Here's a suggested business plan template to get you started.

Executive summary

After the title page - which includes the name and business address of the author, the date of publication, and details of the plan's circulation and level of confidentiality - you'll present your executive summary. Bear in mind that this is the last section of the business plan you'll write, because its job is to grab the reader's attention by summarising what will follow.

Over three to four pages, briefly highlight the key purpose of your business plan and summarise the capital requirements, financial projections, and management structure of your company. You should also provide details of your competitors.

When writing a business plan, your focus throughout should be on highlighting how your product or service takes advantage of a significant market opportunity.

The business

Begin this section by addressing your company's products and services, before going into greater detail about its aims and objectives. Expand on the history of your business and explain its ownership structure. You should also mention what type of business it is.

An overview and outlook of the industry should be included, covering details of any relevant regulations and specific markets of interest. However, this information will be expanded on in the market analysis section, so keep it brief.

Finally, address how your business can be developed to meet future needs or changes, and admit any weaknesses that it may have. Being open in this manner will inspire confidence.

Market analysis

Essentially a condensed marketing plan, this section focuses on several factors:

- Market research - It's vital to know that you've got a group of buyers for your product or service. Become familiar with the market and job sector as a whole, so the company can be positioned appropriately in terms of price and quality.

- Target audience - Discuss which market segments you're aiming to pursue, such as local customers or those of a particular age group. Indicate the key characteristics of your typical buyers.

- Competitors - Summarise your competitors' strengths and weaknesses and consider how you can prevent others from entering your market space.

- Existing customers and sales - Mention any customers that you've already lined up and address how you'll sell, whether it's over the phone, on your website, face-to-face or through an agent. In addition, if you have more than one product or service, consider the contribution of each to your turnover.

- Marketing strategy and goals - Address how you'll promote your product. This may be through means such as advertising, public relations (PR), direct mail or email. Examine likely sales, growth, profit margins and costs.

Management and operations

This section explains how your business will function. You should detail the:

- Background, experience, and training of the management team - Highlight individuals' roles and responsibilities, plus their relevant skills and experiences. You should also mention the financial contributions, salaries and company benefits of each member.

- Capital requirements - Discuss the company's needs in terms of equipment, facilities, insurance, and personnel, before highlighting any potential limitations to production.

- Logistics - Detail each division and their assigned tasks, addressing how you'll cover sales, finance, marketing, administration, stock control and quality control. You should describe the systems and procedures that will be involved in all aspects of production, from the customer's initial payment through to transport and delivery, including detailed information on your suppliers.

Financial forecasts

In this section, you must translate your company's aims and objectives into measurable goals. This means providing numbers including:

- the estimated costs of starting and running your business

- how much additional finance you require, plus what it will be used for

- sales forecasts for the first year

- profit and loss forecasts for the first three years

- cash flow forecasts, showing that you've considered key variable factors such as sales revenue and wages

- your budget and pricing strategy.

Be aware that you should justify any assumptions that you've made when reaching each forecast.

Risk management

Consider any risks associated with running your business, plus any legal obligations surrounding factors such as insurance, licences, and health and safety.

You should also create detailed 'what-if scenario' backup plans, documenting how you'll react to issues that may arise. Not only will this help you to minimise risk, but you'll enhance your credibility with potential investors by showing that you've thought about your business plan from every angle.

The appendix of a business plan features copies of essential supporting documents, such as:

- credit history information

- detailed cash flow plans

- detailed CVs of the management team

- market research results

- receipts and bank statements

- tax returns.