Customer lifetime value: The customer compass

Traditional brand owners and retailers are increasingly encroaching into the e-commerce channel—and for good reason. After all, digital engagement with customers provides companies with valuable data on consumer behavior that allows them to optimize marketing and product development. In addition, by operating their own sales channel, providers retain control over user experience and brand image. Enter COVID-19, and suddenly the Internet is rapidly becoming the shopping channel of choice for more and more consumers, a trend that is likely to persist beyond the pandemic.

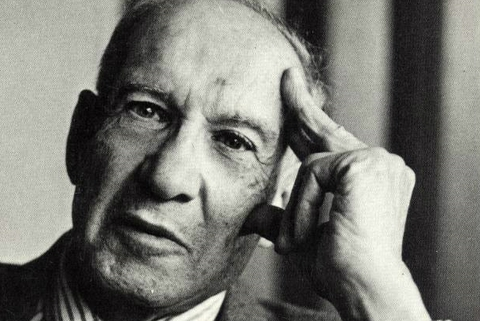

About the authors

This article was a collaborative effort by Max Ackermann , Karel Dörner , Fabian Frick, Marcus Keutel , and Philipp Kluge.

That said, the new e-commerce players also face a challenge: winning and retaining customers is an expensive affair. That is why it is crucial for success to invest primarily in those customers who are lucrative for the company in the long run. It is important to understand these customers intimately, to engage them with the right channels, and to tailor offers to their context and needs. This can only be achieved by drawing on customer-related metrics—of which customer lifetime value (CLV) is first among equals—and by interlinking them intelligently as the foundation for effective and efficient marketing.

“CLV is our core steering metric” Four questions for Emmanuel Thomassin, Chief Financial Officer of Delivery Hero

Just how important is clv for delivery hero.

Customer lifetime value is one of our core metrics. It’s a topic we’re driving intensively at all levels of the organization and we have set clear goals from which we can only deviate in exceptional cases. We use CLV to support our strategic and operational decisions, such as whether to enter a new market or whether to continue or end a marketing campaign.

So how do you go about that?

We have a standardized approach for all our markets. CLV monitoring is directly linked to our operational marketing systems and thus directly influences our investments. It is crucial to continuously adapt and improve the calculation of CLV and the corresponding operationalization in marketing. Initially, for example, we only calculated the cost of customer acquisition; meanwhile, we also know what it costs us to retain customers. Over time, we have learned an enormous amount, especially through monitoring in new markets and with the introduction of new business models.

Do you see a trend among your customers?

Perhaps the most important KPI-based analysis is breaking down customers into cohorts to fine-tune the targeting of marketing drives. Over the years, we have seen CLVs rising steadily across all our cohorts, even before Covid. Today, they are many times higher than the investments in customer acquisition and retention. This shows that our marketing measures, among them personalization, have a direct impact on the KPIs and thus on Delivery Hero’s success.

Do you still see untapped potential in the way you use CLV?

A major challenge is responding directly to improvements in the KPIs with measures designed for pinpoint accuracy, especially in marketing, and then evaluating these with precision. That’s something we are working on, aside from further refining our analytics and increasing their granularity to the level of geographical micro-cells.

Digitally aligned companies and start-ups have long been successfully applying and refining this approach (see sidebar, “‘CLV is our core steering metric,’ Four questions for Emmanuel Thomassin, Chief Financial Officer of Delivery Hero”). Many traditional manufacturers and retailers, on the other hand, still have some catching up to do. To make the most of the CLV approach and use it to manage their e-commerce business, they should adopt a long-term strategy and proceed systematically in three steps: collect data, determine true customer value, and target investments to the most valuable customers.

Collect data throughout the customer journey

To estimate the current and future value of customers and keeping privacy regulations in mind, companies need to collect relevant data points on as many customers and their behavior as possible over multiple years. This is because the corresponding analytical models are dependent on the availability of sufficient amounts of information to identify relevant patterns. The greater the volume of data available, the more meaningful and accurate the analyses. Three categories of data are required:

- Transaction data such as shopping timeline, product information, prices, method of payment, delivery, or returns are supplied by the e-commerce platform and the connected financial systems.

- Demographic data such as gender, age, occupation, and place of residence are condensed into customer profiles in order to better predict future shopping behavior and personalize marketing actions.

- Marketing data such as search behavior, response to campaigns, and external online data help to flesh out the respective customer profile and, in turn, deepen customer knowledge, including as regards preferences or purchasing behavior.

Despite ample data, it is often difficult to clearly identify customers throughout the entire customer journey. This is partly due to purchases made across different channels, for instance, in the company’s own online and offline stores or perhaps through third-party suppliers such as retail partners, which often do not require registration (with an e-mail address, etc.) for identification.

Successful providers solve this problem with an integrated customer database (customer data platform) that can recognize customers even when they do not sign in. For this purpose, profiles comprising as many attributes as possible are created for visitors to the various channels (based on browser data, among other things). Then, returning visitors (including to different channels) are identified by matching them against the full array of profiles compiled. Aside from linking different data sources and formats, the customer data platform also enables the integration of suitable external systems as well as customer segmentation according to behavior and demographic data. Key steps in this context include anchoring the system’s continuous improvement, but also data use by the organization’s departments from the outset.

Would you like to learn more about Leap , our business-building practice?

Determining the true value of customers.

What happens to the data collected? Here, in the second step, is where customer lifetime value (CLV) comes into play. This is because it can be used to measure a customer’s value, in the long term, over their entire time as a customer of the company. This value is compared with the customer acquisition/ retention costs (CAC), i.e. the marketing investments made or planned that are necessary to acquire and retain the customer. Finally, both indicators are linked to derive recommendations for action with regard to strategic and operational decisions (Exhibit 1).

A distinction is made between three levels of complexity when modeling CLV and CAC:

The descriptive model calculates CLV using historical consumer data and identifies behavioral patterns of customer groups mostly through simple manual analysis. This comparatively simple method yields rapid results, but they are merely hypotheses and therefore of limited value; they can only serve as an initial indicator of CLV for potential decisions.

The predictive model uses historical data patterns to determine future CLV. Consequently, the results are more accurate and meaningful as the customer’s individual profile is factored into the equation along with their remaining time as a customer. Backed by this knowledge, CLV managers can make more effective decisions. However, this model requires more comprehensive advanced analytics capabilities, such as customer identification across multiple channels. For a 360-degree view, it is worth having complete historical customer data as well as regular updates of sales and cost data.

The operative model goes one step further: it automatically predicts CLVs using machine learning and makes initial recommendations for decisions, amplifying the CLV effect. In addition, predictive accuracy and decision making improve with each update. For the operational teams, this means that rather than elaborating decision recommendations, their primary job is to review and continuously monitor them. Yet, creating such models is a much more complex endeavor that can take months, if not years.

For all three models, continuous updating data and calculations is indispensable. For example, CLV must be adjusted after each customer purchase, but the CAC value must also be increased if, for instance, a marketing campaign is launched for a specific customer group. This is essential so that the data and the associated analytics results can be used for future campaigns.

Targeted investment in high-value customers

The last and most important step is to evaluate the CLV and CAC computations in such a way that the company can derive strategic and operational recommendations for action and decisions from them. It is essential to consistently measure the impact of the respective decisions, for example, the increase in CLV as a result of certain marketing measures.

With regard to the depth of evaluation, a distinction can be made between three levels. At the first level, only the average of all customers is considered, although this can already be very helpful when making decisions about expansion into new markets, channels or brands, for example. As a rule of thumb, expansion is advisable as soon as the estimated CLV exceeds the CAC by a multiple—even if profitability has not yet been reached. In practice, mature digital business models should display CLV-to-CAC ratios ranging between at least 2:1 and up to 8:1 or more. At this level, CLV can also be used as a metric to measure and improve the performance of organizational units such as country branches, or to gain a more customer-focused perspective on the business (rather than a purely sales- and profit-centric view).

The next analytical level focuses on cohorts of customers clustered on the basis of their CLV and CAC values in order to improve operational decisions in particular. Demographic data, such as gender, age, place of residence, but also behavioral data such as purchase frequency, brand loyalty, and returns are typically taken into account.

These data sets help marketing and sales teams identify indicators of high CLV and low CAC respectively, and tailor marketing campaigns to individual cohorts. Exhibit 2 illustrates an example of such a cohort analysis: in addition to the distribution of customers among the various CLV levels, it shows the characteristics of less lucrative and particularly valuable customers, as well as the recommended actions that can be derived from them.

Finally, at the third level with maximum analytical depth, the model targets individual customers. However, this only makes sense if the company is operating advanced, automated marketing platforms. Otherwise, individual marketing efforts would be prohibitively expensive and the cost of acquiring and retaining customers would skyrocket.

In a nutshell, CLV offers both established and new players in the e-commerce space the opportunity to better understand, target, and serve their customers in order to engage them in an effective and efficient manner, and create value for them. However, the operationalization of CLV and CAC can also set in motion entirely new developments. For example, successful e-commerce companies are moving to build a network of physical stores to operate in tandem with their online business. Take, for instance, Mr. Spex, Europe’s largest online eyewear retailer, which is opening more and more stores in German cities to attract new customers and create an omnichannel experience. A response to the rising cost of customer acquisition and retention in the online channel in recent years, this trend capitalizes on the fact that it is often cheaper and more efficient to strike the desired CLV-to-CAC ratio in conjunction with offline channels.

Max Ackermann is an associate partner in McKinsey’s Berlin office; Karel Dörner is a senior partner in the Munich office, where Dr. Philipp Kluge is an associate partner; Marcus Keutel is a partner in the Cologne Office; and Fabian Frick is a project manager in the Frankfurt office.

Explore a career with us

Related articles.

Five traps to avoid: The long game of DTC and e-commerce

How tech will revolutionize retail

How Telkomsel transformed to reach digital-first consumers

9 inspiring case studies of Customer Lifetime Value (CLV)

- Marketing: How much should I spend to acquire a customer?

- Product: How can I offer products and services tailored for my best customers?

- Customer Support: How much should I spend to service and retain a customer?

- Sales: What types of customers should sales reps spend the most time on trying to acquire?

- Design: What type of graphic designs are required to attract customers? Which tool is used to design logos, Color palettes, and Icons?

To calculate Customer Lifetime Value, here is how to do it. If you want examples of brands that are making the most of it, here are 9 inspiring case studies of Customer Lifetime Value (CLV).

- AMAZON : Consumer Intelligence Research Partners estimates that Amazon Kindle owners spend approximately $1,233 per year buying stuff from Amazon, compared to $790 per year for other customers. So Amazon pays close attention to Customer Lifetime Value (CLV). Amazon Prime has been developed to enable Amazon to efficiently compete on price and to increase customer lifetime value. According to a 2013 study by the Consumer Intelligence Research Partners, Amazon Prime members spend $1,340 annually. And that was 3 year ago. It’s more now. By applying Customer Lifestyle Value (CLV) to the development of Amazon Prime, Amazon knows how to get the most out of their most profitable customer segments.

- BONOBOS : Is a leading e-commerce driven men’s apparel brand focused on delivering great fit, a fun approach to style, and superb customer experience . Bonobos has always been a data-driven, customer-focused retailer. With Guideshops, Bonobos has service-oriented e-commerce stores that enable men to try on Bonobos clothing in person before ordering online. Bonobos discovers that Guideshops bring in customers with the highest lifetime value across all of its marketing channels. Insights into which channels are attracting Bonobos’ highest-value shoppers has helped Bonobos increase the predicted lifetime value of its new customers by 20% .

- CROCS : has always had a data-driven, customer-centric approach to marketing. When the marketing team is given a mandate to transform Crocs’ online business by becoming less reliant on promotions and discounts, the team is excited by the opportunity to improve Crocs’ profitability. The team tests to optimize promotions aimed at customers who are predicted to churn, and expands programs to coordinate a “no discount” experience across site, email and display for customers with the lowest price sensitivity. Crocs realizes 10X and 2X lift in revenue.

- HEAR AND PLAY MUSIC : A provider of music lesson products, uses automated lead nurturing and scoring to turn prospects into customers and repeat customers. Many of the company’s products cost less than $100. With automated messages that have a personalized tone to high value prospect, the company has seen: 1) 416% increase in Customer Lifetime Value, 2) 67% increase in click through rate from the best prospects (increased from 24.73% to 41.28% for subscribers with the highest lead scores) and 3) 18.4% improvement in lead-to-purchase time.

- KIMBERLY-CLARK : According to Nielsen, the typical family spends over $1,000 on diapers and baby wipes during the two-and-a-half years their children are in diapers. A Nielsen study was able to quantify the dollar value of key consumer segments, the critical nature of brand selection at various points in the consumer lifecycle and distinct differences in channel choices through key points in the baby care lifecycle. Kimberly-Clark has a clearer picture of its target market and where its greatest marketing and promotional opportunities exist to extend and expand their market share. “Nielsen’s lifetime.

- NETFLIX : An average Netflix subscriber stays on board for 25 months. According to Netflix, the lifetime value of a Netflix customer is $291.25. Netflix knows that customers are impatient and some customers cancel because they don’t like waiting for movies to arrive in the mail. Due to this they’ve added a feature where you can stream movies on the web, which not only satisfies your movie urge, but it keeps you busy while you are waiting. By tracking these stats and behavior, Netflix has reduced their churn to 4%.

- STARBUCKS : One of the most effective ways to boost Customer Lifetime Value (CLV) is to increase customer satisfaction. Bain & Co has found a 5% increase in customer satisfaction can increase by 25% to 95%. The same study shows it costs 6 to 7 times more to acquire a new customer than keep an existing one. Starbucks’ customer satisfaction has been reported as high as 89%. Due to high customer satisfaction, Starbucks’ Customer Lifetime Value has been calculated at $14,099.

- U.S. AUTO PARTS : Realizes the competitive advantage of loyalty and decided to invest. The company debuted the Auto Parts Warehouse loyalty program, known as APW Rewards. U.S. Auto Parts began to leverage capabilities such as increased rewards for high-margin products, personalized post-purchase enrollment offers, a status tier, and triggered email campaigns based off of a person’s repurchase history to maximize customer lifetime value. U.S. Auto parts increased its spend per member by 20%, its repurchase rate by 14%, and its enrollment rate by 45% after updating the loyalty program of its flagship brand,

- ZAPPOS : Has found people who regularly return items can be some of your best customers. It says that clients buying its most expensive shoes have a 50% return rate. Placing a priority on Customer Lifetime Value, Zappos has identified their best customers have the highest returns rates. They are also the ones that spend the most money and their most profitable customers. That’s why Zappos has a 365-day returns policy, free two-way shipping and doesn’t charge for returns.

Do the way these companies pay attention to Customer Lifetime Value inspire you with ideas for your company. Do you want to learn more about making the most of out of CLV.

Rob Petersen

Related posts.

10 best customer loyalty metrics and how experts measure them

6 straightforward steps to calculate Customer Lifetime Value

12 big business benefits of customer lifetime value, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Calculating Customer Lifetime Value (CLV): Theory and Practice

Cite this chapter.

- Paul Andon 2 ,

- Jane Baxter 2 &

- Graham Bradley 2

759 Accesses

7 Citations

This paper examines the calculation of customer lifetime value (CLV). Two case studies from Australasian practice are used to describe how CLV is calculated. These case studies reveal that customer retention rates, customer acquisition costs and the present value of future expected base profits are incorporated into the calculation of CLV. Other drivers of CLV, such as revenue growth, cost savings, referrals and price premiums, were not significant in this examination of practice. Practitioners indicated that these other drivers were not used for two reasons: first, they were unable to readily quantify them; and second, they expressed doubts as to their significance. In brief, it appears that practitioners are developing simple and feasible representations of CLV to use in business decision-making.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or eBook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

- Available as PDF

- Read on any device

- Instant download

- Own it forever

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Unable to display preview. Download preview PDF.

Andon, P. (1997): Customer Valuation & the Role of Accounting in the Loyalty Context, Honours Thesis, University of New South Wales, Australia.

Google Scholar

Atkinson, A.A./Banker, R.D./Kaplan, R.S./Young, S.M. (1997): Management Accounting, 2nd ed., New Jersey.

Bellis-Jones, R. (1989): Customer Profitability Analysis, in: Management Accounting, February, pp. 26-28.

Berry, S./ Britney, K. (1996): Market Segmentation: Key to Growth in Small-Business Marketing, in: Bank Management, Vol. 72, No. 1, pp. 36–41.

Costanzo, C. (1995): Getting Serious About Customer Profitability, in: United States Banker, Vol. 105, No. 5, pp. 79–80.

Gloy, B./ Akridge, A./ Preckel, P.V. (1997): Customer Lifetime Value: An Application in the Rural Petroleum Market, in: Agribusiness, Vol. 13, No. 3, pp. 335–347.

Article Google Scholar

Henry, J. (1994): It Pays to Rate Retention, in: Advertising Age, Vol. 65, No. 13, p. S32.

Horngren, C.T./Foster, G./Datar, S.M. (1997): Cost Accounting: A Managerial Emphasis, 9th ed., New Jersey.

Jackson, D. (1989): Insurance Marketing: Determining A Customer’s Lifetime Value (Part 1), in: Direct Marketing, Vol. 51, No. 11, pp. 60–62, 123.

Jackson, D. (1989): Insurance Marketing: Determining A Customer’s Lifetime Value (Part 2), in: Direct Marketing, Vol. 51, No. 13, pp. 25–32.

Jackson, D. (1989): Insurance Marketing: Determining A Customer’s Lifetime Value (Part 3), in: Direct Marketing, Vol. 51, No. 15, pp. 28–30.

Keane, T.J./ Wang, P. (1995): Applications for the Lifetime Value Model in Modern Newspaper Publishing, in: Journal of Direct Marketing, Vol. 9, No. 7, pp. 59–66.

Kidder, L./Judd, C. (1986): Research Methods in Social Relations, 5th ed., New York.

Pearson, S. (1996): Building Brands Directly: Creating Business Value from Customer Relationships, New York.

Peppers, D./Rogers, M. (1997): The One to One Future: Building Relationships one Customer at a Time, New York.

Pritchard, H.O., Jr. (1991): A Member’s Lifetime Value: Seeing Member Acquisition as an Investment in Your Organization’s Future, in: Association Management, Vol. 36, No. 6, pp. 35–39.

Reichheld, F.F. (1996): The Loyalty Effect: The Hidden Force Behind Growth, Profits and Lasting Value, Boston.

Reichheld, F.F. (1993): Loyalty-Based Management, in: Harvard Business Review, Vol. 71, No. 2, pp. 64–73.

Reichheld, F.F./ Sasser, W.E., Jr. (1990): Zero Defections: Quality Comes to Services, in: Harvard Business Review, Vol. 68, No. 5, pp. 105–111.

Smith, M./ Dikolli, J. (1995): Customer Profitability Analysis: An Activity-Based Costing Approach, in: Managerial Auditing Journal, Vol. 10, No. 7, pp. 3–7.

Stauss, B. (1997): Regaining Service Customers-Costs and Benefits of Regain Management, paper from the EIASM workshop (Quality Management Services VII), Agder College Kristiansand, Norway.

Tauhert, C. (1996): First United Raises Customer Profitability with Database System, in: Bank Systems & Technology, Vol. 33, No. 5, p. 67.

Download references

Author information

Authors and affiliations.

University of New South Wales, Australia

Paul Andon, Jane Baxter & Graham Bradley

You can also search for this author in PubMed Google Scholar

Editor information

Editors and affiliations.

Lehrstuhl für BWL, insbes. Marketing, Heinrich-Heine-Universität, Universitätsstraße 1, 40225, Düsseldorf, Deutschland

Bernd Günter & Sabrina Helm &

Rights and permissions

Reprints and permissions

Copyright information

© 2003 Betriebswirtschaftlicher Verlag Dr. Th. Gabler GmbH, Wiesbaden

About this chapter

Andon, P., Baxter, J., Bradley, G. (2003). Calculating Customer Lifetime Value (CLV): Theory and Practice. In: Günter, B., Helm, S. (eds) Kundenwert. Gabler Verlag, Wiesbaden. https://doi.org/10.1007/978-3-322-99328-1_12

Download citation

DOI : https://doi.org/10.1007/978-3-322-99328-1_12

Publisher Name : Gabler Verlag, Wiesbaden

Print ISBN : 978-3-322-99329-8

Online ISBN : 978-3-322-99328-1

eBook Packages : Springer Book Archive

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Download Free PDF

Estimating customer lifetime value based on RFM analysis of customer purchase behavior: Case study

2011, Procedia Computer Science

Related papers

Nowadays companies increasingly derive revenue from the creation and sustenance of long-term relationships with their customers. In such an environment, marketing serves the purpose of maximizing customer lifetime value (CLV) and customer equity, which is the sum of the lifetime values of the company’s customers. A frequently-encountered difficulty for companies wishing to measure customer profitability is that management accounting and reporting systems have tended to reflect product profitability rather than customer profitability. But in spite of these difficulties, Companies looking for methods to know how calculate their customers's CLV. In this paper, we used K-Mean clustering approach to determine customers's CLV and segment them based on recency, frequency and monetary (RFM) measures. We also used Discriminant analysis to approve clustering results. Data required applying this method gathered from one branch of an Iranian private bank which is established newly. Fina...

Procedia Computer Science, 2019

Expert Systems with Applications, 2006

The more a marketing paradigm evolves, the more long-term relationship with customers gains its importance. CRM, a recent marketing paradigm, pursues long-term relationship with profitable customers. It can be a starting point of relationship management to understand and ...

Expert systems with applications, 2004

International Letters of Social and Humanistic Sciences, 2015

The more a marketing paradigm evolves, the more long-term relationship with customers gains its importance. Nowadays most of corporations and firms in the world, including manufacturers and servicers, increasingly gain their incomes and profits through constructing and maintaining long-term relationship with customers. The move towards a customer-centered approach to marketing, coupled with the increasing availability of customer transaction data, has led to an interest in understanding and estimating customer lifetime value (CLV). Furthermore as marketing endeavours to be more accountable, the need of tools and models for measuring and evaluating efforts and investments that accomplish in marketing extent, is felt. This research aimed to present a framework to analysis customer lifetime value in order to strategic marketing practices.

Academia Mental Health and Well-Being, 2024

Purpose The paper explores the prevalence of alcohol use problems, depression, anxiety symptoms and suicidal ideation among the patients of the Opioid Agonist Treatment programs in Ukraine and their co-occurrence. Design/methodology/approach For measuring mental health conditions, AUDIT, GAD-7 and PHQ-9 were used. In addition, the number of missed visits on site for substitute medication for the last month was counted, and blood alcohol levels were recorded with the breath-alcohol measuring instrument (Drager Alcotest 6820). Data were collected from October 2021 to January 2022 (before the full-scale Russian invasion) based on Opioid Agonist Treatment centres in Kyiv, Sumy and Lviv. All the data collection was done by the staff of OAT centres using individual screenings during patients’ appointed visits for medication. Findings For alcohol-related problems, 16,4 % of the participants had harmful drinking (one-month prevalence). Depression from moderate to severe was found in 26,73% of cases, and generalised anxiety, from moderate to severe levels, was reported by 14,71% of patients (two-week prevalence). The 2-week suicide ideation prevalence is 24,9% (a quarter of all OAT patients). Nearly every day, 3,3% of patients had suicidal ideation. General co-occurrence of depression and anxiety was equal to 13,31% of all patients who participated in the study (32,13% of all patients having depression or anxiety symptoms). There was a tendency to increase the general co-occurrence ratio with an increase in the severity of alcohol-related problems from 10,66% to 54,55% of general co-occurrence. The depression level significantly elevated as the level of alcohol-related problems increased, from 6,98 (SD 5,114) for the absence of problems to 13,864 (SD 6,081) for severe levels of problems. The same situation was observed for anxiety (elevation of the means from 4,663 (SD 4,073) to 10,636 (SD 5,123)). The number of missed visits increased to 2,5 (SD 4,262) at the most severe levels of alcohol use problems. Originality The paper is original in terms of its topic and content.

REGIO, 2017

Atti del V Convegno di Archeologia Il Fucino e le aree limitrofe nell'Antichità, Avezzano 6-7 novembre 2021, Avezzano 2022.

Lo studio ricostruisce sul lungo periodo forme e dinamiche della transumanza in un’ara cruciale per la pastorizia in Abruzzo, quella lungo il tratto iniziale del grande tratturo Celano-Foggia, fra Celano e piana subito a nord del Fucino. Il fenomeno si manifesta, probabilmente sin dalla protostoria, attraverso forme di transumanza sia verticale fra pascoli Sirente-Velino e l’Altopiano delle Rocche, perpetuatesi sino al basso Medioevo, che di transumanza verticale con le aree adriatiche della Penisola sino alla Puglia, sia nell’antichità che a partire dal XIV-XV secolo, quando troviamo attestato uno dei cinque grandi tratturi, quello Celano-Foggia, documentato per la prima volta nel 1533. Alle fasi antiche del fenomeno si lega probabilmente la presenza, a monte di Celano verso la montagna, della grande villa romana in località S. Potito – Abbazia di Ovindoli, di dimensioni particolarmente estese e notevole nobiltà, con impianto originario realizzato nei primi decenni del I sec. d.C. Mentre la grande transumanza andò interrompendosi intorno al VI secolo singolare appare la sistematica persistenza anche in età altomedievale dei percorsi verticali fra vicina montagna e coste del lago Fucino, legata ad un’ampia persistenza del quadro insediativo antico e tardoantico, lago lungo il quale lo svernamento delle greggi nel periodo invernale andò sopravvivendo sino al XIV secolo. Fra IX e XIV secolo in particolare lo sfruttamento delle risorse della montagna, ampiamente perseguito nell’area dalle grandi abbazie di Farfa, S. Angelo ad Barregium e Montecassino, dovette essere favorito dalle particolari condizioni climatiche, con questo periodo caratterizzato nell’intera area dell’Atlantico del nord ed in particolare in Europa da un clima insolitamente caldo, tanto da essere definito «Periodo caldo medievale-PCM» o anche «Optimum climatico medievale». Proprio il deciso peggioramento del clima fu probabilmente una delle cause della regolamentazione della grande transumanza, avviata già dal XII secolo, ma poi ben più organicamente nel 1423 e nel 1425 con le norme emanate da Giovanna II, dopo la sua morte nel 1435 subito disattese, ed infine con la grande riforma di Re Alfonso II del 1443 che istituiva la Grande Dogana di Foggia ed organizzava la transumanza Abruzzo-Puglia come andò poi conservandosi sino all’età moderna. Degli estremi del clima in questa difficile fase e delle conseguenze su pastorizia e transumanza è un eloquente esempio il gran freddo dell’inverno 1612, quando di 1.851.460 pecore che transumavano dall’Abruzzo verso la Puglia, ne rimasero in vita solo 570.400, tanto che venne eccezionalmente rimborsata ai pastori larga parte della fida da essi pagata per la sosta delle greggi nei pascoli del Tavoliere.

International Journal of Advances in Soft Computing and its Applications

Zeitschrift für Arbeits- und Organisationspsychologie A&O, 2001

Le migrazioni in Europa UE, Stati terzi e outsourcing migration, 2015

Global Byzantium Papers from the Fiftieth Spring Symposium of Byzantine Studies, ed. Leslie Brubaker, Rebecca Darley, Daniel Reynolds, 2022

China Central Radio & TV University Press, 2019

F1000Research

Roman Pottery and Glass Manufactures Production and trade in the Adriatic region and beyond, Archaeopress Roman Archaeology, 2022

Rumbos TS, 2024

Animal Science Reporter, 2013

Jurnal Kolaboratif Sains

ArXiv, 2013

Arthritis & rheumatology, 2022

Dil və ədəbiyyat jurnalı , 2017

Forestry Studies, 2015

Mathématiques et sciences humaines, 2001

Water Science and Technology, 2012

RePEc: Research Papers in Economics, 2008

Related topics

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

IMAGES

VIDEO

COMMENTS

For example, Total Retail Credit balances were $6.1 billion, or an average of $17,126 per customer. The average loan yield was 3.91% and the average 2021 USD 12-month LIBOR rate was 0.30%. This yields an average margin or 3.61%, or $618 per customer. Any fee income is added directly to the overall margin to yield an average margin of $948 per ...

We present the case study of how IBM used customer lifetime value (CLV) as an indicator of customer profitability and allocated marketing resources based on CLV. CLV was used as a criterion for determining the level of marketing contacts through direct mail, telesales, e-mail, and catalogs for each customer. In a pilot study implemented for ...

Lifetime Value a case study » 14 25.50 25 39 18 avg. customer value per week (expenditures × visits, in usd) customer 1 customer 2 customer 3 customer 4 customer 5 3.50 8.50 5 6.50 6 customer 1 customer 2 customer 3 customer 4 customer 5 4 3 5 6 3 customer 1 customer 2 customer 3 customer 4 customer 5 customer expenditures per visit

Here, in the second step, is where customer lifetime value (CLV) comes into play. This is because it can be used to measure a customer's value, in the long term, over their entire time as a customer of the company. This value is compared with the customer acquisition/ retention costs (CAC), i.e. the marketing investments made or planned that ...

of customer lifetime value (e.g. Borle, Singh, and Jain 2008; Lewis 2005 ... Narayandas, and Humby 2002; Reinartz and Kumar 2000); study of the drivers of customer value (e.g. Rust, Lemon, and Zeithaml 2004; Magi 2003; Berger, Bolton, Bowman ... "lost-for-good" case customers remain in business with the firm until they defect and once they ...

Starbucks' customer satisfaction has been reported as high as 89%. Due to high customer satisfaction, Starbucks' Customer Lifetime Value has been calculated at $14,099. U.S. AUTO PARTS: Realizes the competitive advantage of loyalty and decided to invest. The company debuted the Auto Parts Warehouse loyalty program, known as APW Rewards.

Customer Lifetime Value Opportunities and Challenges Mohamad Hindawi, PhD, FCAS March 11, 2015 Background How to build a successful CLV roadmap Case Study: The mechanics of modeling CLV

This paper examines the calculation of customer lifetime value (CL V). Two case studies from Australasian practice are used to describe how CL V is calculated. These case stud ies reveal that customer retention rates, customer acquisition costs and the present value of future expected base profits are incorporated into the calculation of CLV.

The results of the study also give researchers and managers an idea of the factors that control customer lifetime value, and It recommends further research. View Show abstract

The Customer Centricity Playbook will guide you through the spe-cifics of many customer centricity success stories, providing you with a 360- degree analy sis of all the ele ments that support customer cen-tricity in an organ ization. You will learn to. develop a customer- centric strategy for your organ ization;

Estimating Customer Lifetime Value Based on RFM Analysis of Customer Purchase Behavior: Case Study.pdf Available via license: CC BY-NC-ND 3.0 Content may be subject to copyright.

The analysis of customer value in direct marketing typically combines customer timing and quantity data into a single statistic that is used to compute lifetime values, rank-order customers for ...

1 Case Study Customer lifetime value modelling for an automotive company Introduction Customer lifetime value is the total value that a customer delivers to a company over the course of their relationship with the brand. It includes a customer's whole economic contribution, including purchases, repeat transactions, and prospective referrals ...

The concept called Customer Lifetime Value (CLV) in CRM is the present value of all future profits generated from a customer [3]. Calculating CLV has had lots of applications and several authors have developed models for the applications such as performance measurement [4], targeting customers [5], marketing resources allocation [6,7], product ...

The concept called Customer Lifetime Value (CLV) in CRM is the present value of all future profits generated from a customer [3]. Calculating CLV has had lots of applications and several authors have developed models for the applications such as performance measurement [4], targeting customers [5], marketing resources allocation [6,7], product ...

Request PDF | Customer segmentation and strategy development based on customer lifetime value: A case study | The more a marketing paradigm evolves, the more long-term relationship with customers ...

Customer Lifetime Value. This chapter indicates the prospect of customer lifetime value (CLV) and the importance of CLV in global marketing. CLV is the total of the financial profit, calculated from the existing period to the future. CLV develops the optimal strategies for customer engagement, promotes the understanding of potential value of a ...

Predicting customer lifetime value ... equity and lifetime management (CELM) Finnair case study. Marketing Sci. 26(4):553-565. [3] Kumar V (2008) Customer Lifetime Value: The Path to Profitability (Now Publishers, Hanover, MA). [4] Kumar V, Venkatesan R, Bohling T, Beckmann D (2008) The power of CLV: Managing

PDF | This article explores the transformative impact of Artificial Intelligence (AI) on Customer Lifetime Value (CLV) modeling in marketing. AI-driven... | Find, read and cite all the research ...

Customer lifetime value (CLV) is a well-known metric for client valuation in North-American studies. This article presents one way of computing this metric on a Romanian exampl . The formula is presented as well as different elements of input. Monica, Talaba, Customer Lifetime Value (CLV) Estimation - Case Study (April 19, 2012).