Jim Chanos: A Short Thesis on Data Centers Business Breakdowns

Compound248 is back to host another episode of Business Breakdowns. His most recent podcasts have focused on digital infrastructure and today we continue with that theme, but with a twist. Our guest is Wall Street Legend Jim Chanos, famed for bringing a skeptical eye to a credulous world. Together, we walked through his short thesis on the US Data Center REITs, his bear case for commercial real estate, and some broader wisdom on how management can thoughtfully respond to short sellers. Let's get started. For the full show notes, transcript, and links to the best content to learn more, check out the episode page here. ----- Business Breakdowns is a property of Colossus, LLC. For more episodes of Business Breakdowns, visit joincolossus.com/episodes. Stay up to date on all our podcasts by signing up to Colossus Weekly, our quick dive every Sunday highlighting the top business and investing concepts from our podcasts and the best of what we read that week. Sign up here. Follow us on Twitter: @JoinColossus | @patrick_oshag | @jspujji | @zbfuss | @ReustleMatt | @domcooke Show Notes (00:03:30) - (First question) - His counter-narrative thesis of shorting traditional data centers (00:09:34) - How data center hyperscalers have been shifting the industry since 2016 (00:12:14) - The size, margins, and depreciation profile of the data center industry (00:16:14) - The cash burn problem with digital REITs (00:18:30) - How he thinks about interest rates, liquidity, and leverage in the space (00:20:25) - More on why the value of these data centers is so elusive (00:21:57) - The extent to which macro tech slowdowns intersect with his thesis (00:23:13) - What investors see in these businesses that he discounts (00:26:59) - Risks for the short and the bull case for data centers (00:29:04) - Big concerns about the broader commercial real estate market (00:36:34) - The best way for operators to handle a short thesis about their company (00:39:49) - Critical mistakes he recommends managers avoid

- Episode Website

- More Episodes

More by Colossus

- Work & Careers

- Life & Arts

Will the cloud kill the data centre? Jim Chanos thinks so

- Will the cloud kill the data centre? Jim Chanos thinks so on x (opens in a new window)

- Will the cloud kill the data centre? Jim Chanos thinks so on facebook (opens in a new window)

- Will the cloud kill the data centre? Jim Chanos thinks so on linkedin (opens in a new window)

- Will the cloud kill the data centre? Jim Chanos thinks so on whatsapp (opens in a new window)

Anna Gross in London

Simply sign up to the Technology sector myFT Digest -- delivered directly to your inbox.

Veteran short seller Jim Chanos has a new target in his sight: the humble data centre.

In June, Chanos — who won big bets on the downfall of US energy group Enron and the German payments company Wirecard — announced that his eponymous investment firm is raising several hundred million dollars for a fund that will take short positions in US-listed data centre groups.

He argues that the move towards the cloud , predominantly driven by Big Tech groups such as Microsoft, Amazon and Google, is the “enemy” of bricks-and-mortar real estate investment trusts such as Equinix and Digital Realty.

These players buy large swaths of land, build vast complexes, source major energy contracts and allow companies to lease space in their centres to process their data.

The Big Tech groups, by contrast, utilise their own equipment and process clients’ data for them in the “public cloud”. Dubbed “hyperscalers”, they either store their hardware and server equipment in real estate investment trusts, such as Equinix — or increasingly build their own supersized centres to meet ballooning demand for their services. One Microsoft data centre in Chicago spans 700,000 sq ft, the size of 52 Olympic swimming pools.

Chanos, who has also been hurt by a longstanding bet against Tesla, believes the tech behemoths, which he says account for around two-thirds of data centre demand, will increasingly move towards building and running their own real estate. He argues they will do this because the technology used by legacy groups is becoming old and redundant and because cash-rich Big Tech groups can build more cheaply. This will render the independent real estate investment trusts redundant.

But other investors argue the data centre and specialist operators have life in them yet. Nathan Luckey, senior managing director of digital infrastructure at Macquarie Asset Management, who has spearheaded several recent investments in data centre assets, said the best companies are those sitting on prime real estate in strategic locations.

“Hyperscalers are looking for trusted partners where they can house more and more compute power,” he argued. “If there is someone who already has land and a property in a market they want to expand into, that’s a very relevant factor.”

Billions of dollars in private equity capital have poured into the industry, with bulls arguing that traditional data centre groups will remain indispensable given their strong position in top locations and expertise in procuring resources such as power, land and labour. They also cite their privileged position as so-called “carrier hotels”, an industry term meaning they connect lots of different businesses.

These groups and their PE cheerleaders are wagering that data demand will continue to grow, and a wide range of customers — from cloud service providers to banks and government departments — will continue to store at least some of their workloads in traditional data centres.

You are seeing a snapshot of an interactive graphic. This is most likely due to being offline or JavaScript being disabled in your browser.

Last year, the world’s biggest private equity firm Blackstone acquired Kansas-headquartered QTS Realty Trust for $10bn while KKR and GI Partners purchased Texas-based CyrusOne for $15bn. Earlier this month, Macquarie bought a significant minority stake in British data centre provider Virtus for an undisclosed sum, betting that Big Tech groups will be forced to lease as they expand into Europe.

Chanos derided these transactions as “rash”, with valuations that were “stretched by any measure”, and predicted a “post-takeover hangover” in a presentation.

Cloud business has been the engine of growth for groups such as Amazon, Microsoft and Google over the past year. In the first quarter of 2022, Amazon Web Services’ revenue was up 37 per cent year on year to $18.4bn, while revenue at Microsoft’s Azure platform increased by 40 per cent.

“The compute workloads for Google and Meta are just unimaginable,” said Martijn Blanken, chief executive of EXA Infrastructure, which supplies networking infrastructure for the hyperscalers. “It’s a scale game, and there’s no enterprise that can compete with them.”

By contrast, listed US data centre groups have posted healthy — but less impressive — growth. Yet those in the data centre industry argue Chanos’s thesis is dated, given that the same arguments have emerged several times over the past 15 years, including a highly publicised short position taken against Digital Realty by Highfields Capital Management in 2013. Highfields made money, but Digital Realty is still in business.

“There’s a fallacy in the argument that we’re not growing as fast as the cloud providers, which means we are threatened by them,” said Andy Power, president and chief financial officer at Digital Realty. He added that “co-location” groups such as Digital Realty — where one party provides the real estate and customers provide the tech — “enable” the transition to the cloud and have seen an increase in leasing from many hyperscalers in recent years, rather than a dip.

Tech groups have made a noticeable shift towards greater leasing over the past six months driven by a handful of key companies, including Meta, Microsoft, ByteDance and Twitter. This uptick has reversed a previous trend towards greater in-house construction.

“I don’t think [hyperscalers] can keep up with the pace of their business on their own,” said Charles Meyers, chief executive officer of Equinix.

Power added: “These cloud service providers are blessed with lots of capital, yes, but they have better uses for it, honestly.”

Brendan Lynch, an analyst at Barclays, pointed out that in many metropolitan areas of the US, Equinix is the first- or second-largest data centre provider, giving the company a higher degree of pricing power. “That’s why we still like Equinix even though we realise there are some risks to our thesis,” he said.

One key risk is that should the land, labour and energy supply crunches ease, Big Tech groups may shift to constructing more of their own data centres.

For independent operators to maintain their appeal, differentiation is key, argue analysts. Most big businesses use a suite of different services, from Gmail to Workday, all hosted on different clouds. For all of these software applications to run smoothly together there need to be physical locations where data can pass quickly and seamlessly from one to the other.

Equinix’s “secret sauce” is this networking capability, according to Meyers, given it is nearly impossible for hyperscalers to replicate.

“Cloud service providers have spent billions building their own data centres,” said Nick Del Deo, an analyst at MoffettNathanson. “They have not spent a single dollar trying to replicate what Equinix has built.”

So-called “interconnection” constitutes around 35 per cent of Equinix’s earnings, as compared to 14 per cent of Digital Realty’s, according to MoffettNathanson calculations — though the latter has sought to expand in this market.

By contrast, Digital Realty, along with private groups CyrusOne and CloudHQ, have focused heavily on the bricks-and-mortar business. This segment is more vulnerable to increased competition from the big cloud service providers as well as smaller data centre groups that are being pumped with billions of capital from private equity firms and infrastructure investment funds.

“I do think there may be a glut at some point because everyone and their uncle is building data centres at the moment,” said David Friend, chief executive of Wasabi, a cloud storage company that leases from several data centre groups. “Right now there is an undersupply, but it’s going to be like oil prices: everyone is going to drill, drill, drill — and then it will force prices down until there’s greater consolidation in the market.”

Additional reporting by Harriet Agnew

Promoted Content

Follow the topics in this article.

- US & Canadian companies Add to myFT

- Big Tech Add to myFT

- Technology sector Add to myFT

- Cloud computing Add to myFT

- Financials Add to myFT

International Edition

A Short Thesis on Data Centers

Posted by Colossus Business Breakdown Podcast | Data Processing, Hosting Services

Source: Business Breakdowns Podcast (43:05)

Compound248 is back to host another episode of Business Breakdowns. His most recent podcasts have focused on digital infrastructure and today we continue with that theme, but with a twist. Our guest is Wall Street Legend Jim Chanos , famed for bringing a skeptical eye to a credulous world.

Together, we walked through his short thesis on the US Data Center REITs, his bear case for commercial real estate, and some broader wisdom on how management can thoughtfully respond to short sellers. Let’s get started.

For the full show notes, transcript, and links to the best content to learn more, check out the episode page here .

(00:03:30) – (First question) – His counter-narrative thesis of shorting traditional data centers

(00:09:34) – How data center hyperscalers have been shifting the industry since 2016

(00:12:14) – The size, margins, and depreciation profile of the data center industry

(00:16:14) – The cash burn problem with digital REITs

(00:18:30) – How he thinks about interest rates, liquidity, and leverage in the space

(00:20:25) – More on why the value of these data centers is so elusive

(00:21:57) – The extent to which macro tech slowdowns intersect with his thesis

(00:23:13) – What investors see in these businesses that he discounts

(00:26:59) – Risks for the short and the bull case for data centers

(00:29:04) – Big concerns about the broader commercial real estate market

(00:36:34) – The best way for operators to handle a short thesis about their company

(00:39:49) – Critical mistakes he recommends managers avoid

Related Posts

Meeting AI’s Data and Power Demands

How OpenWiFi will create opportunities for large wireless deployments

Recycling the world’s hard drive waste

Can we make the internet less power-thirsty?

- Graduate School of Design

- GSD Theses and Dissertations

- Communities & Collections

- By Issue Date

- FAS Department

- Quick submit

- Waiver Generator

- DASH Stories

- Accessibility

- COVID-related Research

Terms of Use

- Privacy Policy

- By Collections

- By Departments

DataHub: Data Centers for Cities and People

Citable link to this page

Collections.

- GSD Theses and Dissertations [392]

Contact administrator regarding this item (to report mistakes or request changes)

Show Statistical Information

Legacy Data Centers: A Short Thesis on Data Centers

Jim Chanos is the president and founder of Kynikos Associates. We cover his short thesis on the US Data Center REITs, his bear case for commercial real estate, and some broader wisdom on how management can thoughtfully respond to short sellers.

- Trends Summit

White Papers

- Continuing Education

- Sustainability

The Big Short and The Data Center Sector: What History Tells Us

For the past two weeks, data center investors, analysts and operators have been debating a headline-making prediction from Jim Chanos, a high-profile investor known for his prowess as a short seller. Chanos’ latest target for short selling – a strategy where an investor benefits as a stock declines – is the data center industry.

“This is our big short right now,” Chanos said in an interview with the Financial Times. “The story is that although the cloud is growing, the cloud is their enemy, not their business. Value is accruing to the cloud companies, not the bricks-and-mortar legacy data centers.”

The Chanos prediction has received widespread coverage in the financial press, as well as significant pushback from leading data center REITs and securities analysts. We’re not financial advisors here at DCF, and past performance is no guarantee of future results. That said, from a news perspective, we thought it might be instructive to look at the history of market forecasters who have gone public with bets against the data center sector.

There have been several examples of high-profile investment personalities urging investors to sell or short the shares of data center providers, anticipating that these companies’ stock prices would head lower. But betting against the data center sector has been a tricky business, especially during a huge societal shift to digital delivery of products and services.

Jim Cramer: “Sell, Sell, Sell”

On Oct. 22, 2009, CNBC personality Jim Cramer warned his legions of viewers that the data center industry was ready for a fall. “Get out of the data center stocks,” Cramer told viewers. “I think the data center industry is in decline. I see an industry that’s about to be brought low by new technology, so I think you should sell, sell, sell.”

This was a time when Cramer’s calls regularly moved markets. I found the rationale for his prediction to be imbued with goofiness, and said so on DCK.

Cramer doubled down on that call in January 2011, focusing on colocation provider Equinix. “I would be a seller of EQIX because I don’t think the data centers, the physical space, is going to grow the way people think,” Cramer opined during the “Lightning Round” segment of his show. We updated the track record of that call, along with Cramer’s 2009 sell signal, in a March 2012 article titled “The Hugeness of Jim Cramer’s Data Center Miss.”

Short version: Cramer’s “Sell, Sell, Sell” was Wrong, Wrong, Wrong. Investors who followed his advice missed out on a historic rally in data center stocks, with Equinix gaining 88 percent in value during that period, and looking like a laggard compared to industry rivals Terremark (up 172%), NaviSite (up 151%), Rackspace (up 139%) and Savvis (up 122%). Digital Realty, DuPont Fabros and Akamai were all between 50 and 65 percent higher.

” I see an industry that’s about to be brought low by new technology, so I think you should sell, sell, sell.” Jim Cramer on data centers in 2009

Cramer seemingly didn’t understand the historic relationship between faster chips and data center demand. He noted strong sales for Intel’s new family of Nehalem DP processors, one of which can “take the place of eight to nine older-generation servers.” Cramer did some math, and concluded that data centers will soon be seven-eighths empty.

Nehalem was the latest in a series of regular technology updates from Intel, each of which introduced faster and more powerful processors, and none of which emptied out data centers. Here, history could have been an aid to Cramer. It would have been simple to compare the launch of faster Intel chips and data center growth to test his thesis.

Cramer later came around on the power of cloud computing, and began to feature CEOs of data center REITs on his”Mad Money” show.

Highfields’ Short Call on DLR

On May 8, 2013, hedge fund executive Jonathon Jacobson of Highfields Capital Management asserted that investors should short shares of Digital Realty Trust, saying the huge data center developer relied on the capital markets to fund its dividend and was understating the future investment in facilities that would be required to support its enterprise customers.

Digital Realty shares fell 7% in the next trading session, to about $64. Jacobson said the fair value of Digital Realty should be about $20 a share. Digital Realty responded publicly, saying Highfields was “mischaracterizing and drawing inaccurate conclusions” from its disclosures.

Data center maintenance may not seem like a sexy topic for Wall Street. But the Highfields short call made data center maintenance expenses a hot topic in earnings calls . Digital Realty sought to put the issue to rest by updating its accounting, saying it would no longer account for maintenance costs below $10,000 as capital expenditures, rather than operating expenses, as had previously been the case.

The issues Highfields raised about maintenance costs brought changes to industry best practices, and ultimately more transparency for data center investors.

A year later, in May 2014, shares of Digital Realty traded at $54.50 – about 20 percent lower than before the Highfields short call. At one point in Dec. 2013, shares of DLR fell to $44.12, or about about 36% lower.

That price represented a meaningful possible gain for a short seller, but remained nearly twice Jacobson’s predicted fair value. By 2015, Digital Realty was back in the mid-60s, and would soar to $117 a share by 2017.

Although Jacobson’s prediction of a $20 share price was a miss, the shares did indeed head lower and offer a modest gain for short sellers. Perhaps more importantly, the issues Highfields raised about maintenance costs brought changes to industry best practices, and ultimately more transparency for data center investors.

Taking Stock of Chanos ‘Big Short’ Prediction

So what should data center observers make of Chanos’ “big short” call? Institutional Investor recently called Chanos “arguably the most well-known short seller in the world.” He gained prominence from a high-profile short call on Enron a year before the energy company collapsed in fraud and disgrace. He has also some high-profile misses, including a short call on Tesla .

In a recent appearance on the Bloomberg Odd Lots podcast , Chanos said that he believes sustained higher interest rates will be bad for real estate investment trusts (REITs), the corporate structure used by most public data center operators. He also said that investment sectors fueled by excess liquidity and speculation have a tough road ahead.

In the Financial Times article, Chanos noted that much of the data center sector’s growth has been fueled by hyperscale customers, which includes cloud platforms and social networks. Chanos predicted that this apparent strength could become their undoing.

“The real problem for data center REITs is technical obsolescence,” Chanos told the FT. “Their three biggest customers are becoming their biggest competitors. And when your biggest competitors are three of the most vicious competitors in the world, then you have a problem.”

The key question is how well Chanos understands the relationship between the hyperscalers and data center REITs. Are they competitors? That would be true if hyperscalers were bringing more of their data center construction in-house. There’s evidence the opposite is happening, and the cloud platforms are working more closely with data center REITs on build-to- suits as a way to cope with construction supply chain challenges. That’s what the blockbuster 1Q leasing seems to indicate.

Here are some stories that present context and feedback to Chanos’ commentary:

- Digital Realty CEO: Data Center Demand Has Never Been Stronger (Data Center Dynamics): “I think Jim (Chanos) maybe isn’t aware that demand has never been stronger in our space,” said Bill Stein, the CEO of Digital Realty. “He refers to cloud service providers as our competitors, but we view them as our partners, and they view us as partners. We enable their growth around the world.”

- Betting Against Data Center REITs is a Very Dangerous Short (CNBC YouTube) : Jeff Richards, GGV Capital managing partner, said that over the long term. enterprise customers are not likely to abandon data centers to go all-cloud.

- Jeffries Opposes Chanos; Arguments, Backs Data Center REITs (Yahoo Finance) : Analyst Jonathan Peterson of Jefferies said he expects data center REITs to thrive for the foreseeable future and “should continue to benefit from the post-pandemic occupancy recovery.”

- Will Cloud Giants Really Drive Colos off a Financial Cliff? (The Register) : This analysis notes that Chanos’ thesis “appears to overlook several important factors,” including strong demand coming out of the pandemic and the growing service diversification of the largest public players, especially Equinix and Digital Realty.

- “I wouldn’t Take This Bet” : For a broader cross-section of industry opinions, check out this LinkedIn post and thread by Mark Thiele, which includes comments from many executives with lengthy experience in the cloud and data center sector.

That’s not to say that other market watchers haven’t expressed reservations about the sector. Securities analysts have been scrutinizing profit margins amid the market entry of large investors armed with low-cost capital, who have either launched or bought data center development platforms.

In October 2021, Credit Suisse analyst Sami Badri downgraded Equinix and Digital Realty to “neutral,” citing supply chain pressures, higher interest rates and tough year-over-year earnings comparisons, but noting that he “continues to view hyperscalers and data center developers as partners rather than competitors.”

That was a brave call in October, prior to a meaningful selloff in data center shares and the broader market. By the time Chanos spoke to the FT on June 28, shares of Equinix were 11 percent lower than at the time of Badri’s Oct. 7 downgrade.

Is Chanos correct in predicting more pain ahead? Only time will tell. Eventually the market will be able to assess whether Chanos’ “big short” did any better than Cramer or Highfields.

Rich Miller

Continue reading.

Data Center Listening: Insights from Chris Malone, KC Mares, Mark Monroe

The Changing Data Center Landscape: Legacy Vs. Digital

Sponsored recommendations.

Get Utility Project Solutions

Guide to Environmental Sustainability Metrics for Data Centers

The AI Disruption: Challenges and Guidance for Data Center Design

A better approach to boost data center capacity – Supply capacity agreements

Voices of the industry.

Considerations for Selecting a Row-Based CDU for your Data Center

Latest in cloud.

Northern Virginia's Loudoun County Looks to Slow Data Center Development

If You Can’t Beat Them: Oracle Cloud Infrastructure Joins with Azure AI, OpenAI, Google Cloud

Suburban Chicago Welcomes Compass Datacenters' Major Hyperscale Development on Legacy Sears HQ Site

2022 Data Center & Infrastructure Report

The NFPA 70B Standard Just Got an Overhaul. Is Your System Still in Compliance?

Vapor IO’s Edge Data Centers Power a Network of Drones

American Tower Adds Stonepeak as Investor in its Cloud-to-Edge Data Center Strategy

Jim Chanos Takes Aim at Data Centers and Their High Valuations

The celebrated bear is aiming at data centers, the IT backbone of big corporations. Their high valuations make them vulnerable.

Celebrated contrarian Jim Chanos has a mixed record. Although his prediction of Enron’s demise brought renown, his bet against Tesla Inc. has proved painful. When it comes to data centers — the gigantic hangars that house racks of computer servers for major corporations — he’s making a credible challenge.

The bear case isn’t immediately obvious. We’re creating ever more data. And as private equity funds have been making rich bids for these assets, the listed players are risky to “short” (selling borrowed stock in the hope of buying it back cheaper). Only the industry giants are viable targets – Equinix Inc., capitalized at $57 billion, and Digital Realty Trust Inc., with a market value of $35 billion. Most major Wall Street brokerages rate them “buy” or “neutral.”

Legendary investor Jim Chanos is raising over $200 million for a 'big short' against data centers

- Jim Chanos is raising more than $200 million to bet against REITs that own data centers.

- The short seller expects them to be disrupted by their key tenants: Amazon, Alphabet, and Microsoft.

- "This is our big short right now," he told the Financial Times.

Jim Chanos is raising more than $200 million for a fund that will bet against US-listed real estate investment trusts (REITs), the Financial Times reported this week .

The famed short seller is deeply bearish on REITs that own legacy data centers, as he expects them to be disrupted by their biggest tenants: Amazon, Alphabet, and Microsoft. Those three technology giants dominate cloud computing, an industry powered by vast arrays of computers and servers stored in sprawling warehouses.

Chanos, best known for predicting and profiting from the collapse of Enron in the early 2000s, expects the tech trio will shift to designing and building their own data centers, instead of leasing or buying existing ones, he told the FT.

The cloud titans also aren't the most lucrative tenants, and REITs strike him as overvalued and poised for slower revenue and profit growth, he added.

"This is our big short right now," Chanos told the newspaper. "Their three biggest customers are becoming their biggest competitors. And when your biggest competitors are three of the most vicious competitors in the world then you have a problem."

Chanos teased his thesis during a recent episode of Bloomberg's "Odd Lots" podcast. "The whole cross section of REITs just seems absurd to us," he said, asserting the industry makes bets that earn a paltry 3% rate of return before capital spending and taxes. He predicted they would struggle as cheap financing dries up, interest rates climb to 4% or 5%, and the economy weakens, as many experts expect.

The veteran fund manager also told the FT that stocks are hugely overvalued, and many public companies have faulty business models, yet few investors have taken steps to protect their portfolios.

"One of the things that amazes me is how sanguine investors are," he said.

Chanos, who recently rebranded his Kynikos Associates firm as Chanos & Company, disclosed that his short-only Ursus fund has gained about 30% this year — a sharp contrast to the tech-heavy Nasdaq's 30% decline. Ursus has benefited from short positions in Coinbase and Carvana, he noted.

The investor told the FT he expects the fund's success to continue. "We'll be feasting on the returns of these stock ideas for years — very similar to the post-dotcom era," he said.

Chanos didn't immediately respond to a request for comment from Insider.

Read more: Here are the 4 most attractive stocks in the beaten-down tech sector to buy, according to Goldman Sachs, and where to put your money if a recession does unfold

- Main content

Get the Reddit app

Jim chanos: a short thesis on data centers.

- Investment / M&A

Short seller Jim Chanos bets against data center REITs

Says cloud hyperscalers will squeeze out companies like Digital Realty

Investment manager Jim Chanos is taking large short positions against data center real estate investment trusts (REIT), betting that cloud providers will take their business.

Short selling is when you borrow a security and sell it on the open market, and then purchase it at a later date for a lower price - keeping the difference after repaying the initial loan. The more a share price collapses, the more a short seller makes - however, if the price rises, they will lose money.

Chanos rose to prominence for successfully shorting Enron, and profited off of the fall of Luckin Coffee, Wirecard AG, and The Hertz Corporation. However, he has lost money betting on the collapse of the Chinese real estate market and the fall of Tesla.

DCD Explainer: What is a data center REIT?

“This is our big short right now,” Chanos told the Financial Times about his bet against data center REITs.

REITs are companies that own, and usually operate, income-producing real estate - in this case, data centers. To qualify, companies must invest at least 75 percent of their capital in real estate assets, must get at least 75 percent of their income from those real estate assets, must have at least 100 shareholders, and must distribute at least 90 percent of their taxable income to shareholders.

In return, they receive tax breaks and other benefits.

Data center companies like Digital Realty, CyrusOne, Equinix, Iron Mountain, Coresite, QTS, and Keppel DC are all REITs, with JLL estimating that more than 70 percent of the world's data centers are REIT-owned. More than 72 million square feet (6.7m sq m) of data center space is owned by publicly-listed data center REITs.

But Chanos, and his investment group Chanos & Company, are betting that data center REITs' market domination is set to come to an end.

“The story is that although the cloud is growing, the cloud is their enemy, not their business," he told the FT. "Value is accruing to the cloud companies, not the bricks-and-mortar legacy data centers.”

He continued: “The real problem for data center REITs is technical obsolescence. Their three biggest customers are becoming their biggest competitors. And when your biggest competitors are three of the most vicious competitors in the world then you have a problem.”

Those three customers - Amazon Web Services, Google Cloud, and Microsoft Azure - are all aggressively building out their own data center infrastructure.

But the hyperscalers cannot build fast enough to support their growth, turning to data center firms to either help them develop sites, or to lease wholesale space. It is this latter business opportunity that REITs often point to as evidence that they can benefit from the rise of the cloud.

Chanos argues that as the hyperscalers grow more powerful, the margins they will offer will grow ever lower. He added that REITs are overvalued and are in for a period of declining revenue and earnings growth.

Subscribe to our daily newsletters

More in investment / m&a.

Xavier Niel's NJJ Capital eyes Ukrainian telco champion following regulatory approval to snap up Datagroup-Volia

Chemical and material suppliers for TSMC and Intel pause Arizona construction plans, citing rising costs

Discussion panel: strategic investment opportunities - flap-d vs tier 2 markets and beyond, more in colocation & wholesale.

Rethinking modern data center design and construction trends

Maincubes signs first solar PPA for Frankfurt data center

Episode Charting a course to sustainable energy in data centers

- Digital Realty

- Data center REIT

- Chanos & Company

Google is falling short of an important climate target. Why? Data centers and AI

- Updated: Jul. 02, 2024, 9:54 a.m. |

- Published: Jul. 02, 2024, 9:52 a.m.

A Google data center in The Dalles. Google photo

- Alexa St. John | The Associated Press

Three years ago, Google set an ambitious plan to address climate change by going “net zero,” meaning it would release no more climate-changing gases into the air than it removes, by 2030.

But a report from the company Tuesday shows it is nowhere near meeting that goal.

More data centers

- Former Oregon officials will pay $2,000 each to settle ethics complaint over Amazon deals

- Amazon scraps plan to use fuel cells, powered by natural gas, to run Oregon data centers

- Google spinout lands in Oregon to suck carbon out of the air, fight climate change

If you purchase a product or register for an account through a link on our site, we may receive compensation. By using this site, you consent to our User Agreement and agree that your clicks, interactions, and personal information may be collected, recorded, and/or stored by us and social media and other third-party partners in accordance with our Privacy Policy.

Amazon wins contract to store 'top-secret' Australian military intelligence

Three data centres will be built in secret locations to host Australia's military secrets.

Amazon has won the $2 billion contract to store the classified intelligence.

What's next?

The massive project will roll out over several years, and is expected to create more than 2,000 jobs

American technology giant Amazon will establish a "top-secret" data cloud to store classified Australian military and intelligence information under a $2 billion partnership with the federal government.

Three highly secure data centres will be built in secret locations across the country to support the purpose-built Top Secret (TS) Cloud which will be run by a local subsidiary of Amazon Web Services (AWS).

The massive new project is expected to harness cutting-edge artificial intelligence (AI) technology and scheduled to be in operation by 2027, with the government insisting Australia will have complete sovereignty over the cloud.

Similar data clouds have already been established in the US and UK allowing the sharing of "vast amounts of information", with intelligence figures highlighting that potential adversaries were also investing heavily in similar technology.

Initially, the government will invest at least $2 billion into the project being run by the Australian Signals Directorate (ASD) and AWS, but it's expected to cost billions more in operating costs over the coming years.

Details of the massive project were first revealed in a speech to an American audience last year by the director-general of national intelligence Andrew Shearer, who emphasised the benefits it presented for collaboration for partner nations.

Prime Minister Anthony Albanese says the project will create 2,000 jobs and "bolster our defence and national intelligence community to ensure they can deliver world-leading protection for our nation".

"We face a range of complex and serious security challenges and I am incredibly proud of the work our national security agencies undertake on a daily basis to keep Australians safe," Mr Albanese said.

ASD director-general Rachel Noble said the project would provide a "state-of-the-art collaborative space for our intelligence and defence community to store and access top secret data".

"For ASD, this capability is a vital part of our REDSPICE program which is lifting our intelligence and offensive and defensive cyber capabilities."

AWS' managing director in Australia, Iain Rouse, says his company is "uniquely positioned, as a trusted, long-term partner to the Australian government to deliver on this important partnership".

"This critical national security initiative allows AWS to demonstrate our commitment to not just deliver a fixed set of requirements, but to continuously adapt, enhance and innovate together over the years to come."

- X (formerly Twitter)

Related Stories

Australia developing 'top secret' intelligence cloud computing system.

- Defence Forces

- Defence Industry

- Federal Government

- Security Intelligence

- Bahasa Indonesia

- Eastern Europe

- Moscow Oblast

Elektrostal

Elektrostal Localisation : Country Russia , Oblast Moscow Oblast . Available Information : Geographical coordinates , Population, Area, Altitude, Weather and Hotel . Nearby cities and villages : Noginsk , Pavlovsky Posad and Staraya Kupavna .

Information

Find all the information of Elektrostal or click on the section of your choice in the left menu.

- Update data

| Country | |

|---|---|

| Oblast |

Elektrostal Demography

Information on the people and the population of Elektrostal.

| Elektrostal Population | 157,409 inhabitants |

|---|---|

| Elektrostal Population Density | 3,179.3 /km² (8,234.4 /sq mi) |

Elektrostal Geography

Geographic Information regarding City of Elektrostal .

| Elektrostal Geographical coordinates | Latitude: , Longitude: 55° 48′ 0″ North, 38° 27′ 0″ East |

|---|---|

| Elektrostal Area | 4,951 hectares 49.51 km² (19.12 sq mi) |

| Elektrostal Altitude | 164 m (538 ft) |

| Elektrostal Climate | Humid continental climate (Köppen climate classification: Dfb) |

Elektrostal Distance

Distance (in kilometers) between Elektrostal and the biggest cities of Russia.

Elektrostal Map

Locate simply the city of Elektrostal through the card, map and satellite image of the city.

Elektrostal Nearby cities and villages

Elektrostal Weather

Weather forecast for the next coming days and current time of Elektrostal.

Elektrostal Sunrise and sunset

Find below the times of sunrise and sunset calculated 7 days to Elektrostal.

| Day | Sunrise and sunset | Twilight | Nautical twilight | Astronomical twilight |

|---|---|---|---|---|

| 8 July | 02:53 - 11:31 - 20:08 | 01:56 - 21:06 | 01:00 - 01:00 | 01:00 - 01:00 |

| 9 July | 02:55 - 11:31 - 20:08 | 01:57 - 21:05 | 01:00 - 01:00 | 01:00 - 01:00 |

| 10 July | 02:56 - 11:31 - 20:07 | 01:59 - 21:04 | 23:45 - 23:17 | 01:00 - 01:00 |

| 11 July | 02:57 - 11:31 - 20:05 | 02:01 - 21:02 | 23:57 - 23:06 | 01:00 - 01:00 |

| 12 July | 02:59 - 11:31 - 20:04 | 02:02 - 21:01 | 00:05 - 22:58 | 01:00 - 01:00 |

| 13 July | 03:00 - 11:32 - 20:03 | 02:04 - 20:59 | 00:12 - 22:51 | 01:00 - 01:00 |

| 14 July | 03:01 - 11:32 - 20:02 | 02:06 - 20:57 | 00:18 - 22:45 | 01:00 - 01:00 |

Elektrostal Hotel

Our team has selected for you a list of hotel in Elektrostal classified by value for money. Book your hotel room at the best price.

| Located next to Noginskoye Highway in Electrostal, Apelsin Hotel offers comfortable rooms with free Wi-Fi. Free parking is available. The elegant rooms are air conditioned and feature a flat-screen satellite TV and fridge... | from | |

| Located in the green area Yamskiye Woods, 5 km from Elektrostal city centre, this hotel features a sauna and a restaurant. It offers rooms with a kitchen... | from | |

| Ekotel Bogorodsk Hotel is located in a picturesque park near Chernogolovsky Pond. It features an indoor swimming pool and a wellness centre. Free Wi-Fi and private parking are provided... | from | |

| Surrounded by 420,000 m² of parkland and overlooking Kovershi Lake, this hotel outside Moscow offers spa and fitness facilities, and a private beach area with volleyball court and loungers... | from | |

| Surrounded by green parklands, this hotel in the Moscow region features 2 restaurants, a bowling alley with bar, and several spa and fitness facilities. Moscow Ring Road is 17 km away... | from | |

Elektrostal Nearby

Below is a list of activities and point of interest in Elektrostal and its surroundings.

Elektrostal Page

| Direct link | |

|---|---|

| DB-City.com | Elektrostal /5 (2021-10-07 13:22:50) |

- Information /Russian-Federation--Moscow-Oblast--Elektrostal#info

- Demography /Russian-Federation--Moscow-Oblast--Elektrostal#demo

- Geography /Russian-Federation--Moscow-Oblast--Elektrostal#geo

- Distance /Russian-Federation--Moscow-Oblast--Elektrostal#dist1

- Map /Russian-Federation--Moscow-Oblast--Elektrostal#map

- Nearby cities and villages /Russian-Federation--Moscow-Oblast--Elektrostal#dist2

- Weather /Russian-Federation--Moscow-Oblast--Elektrostal#weather

- Sunrise and sunset /Russian-Federation--Moscow-Oblast--Elektrostal#sun

- Hotel /Russian-Federation--Moscow-Oblast--Elektrostal#hotel

- Nearby /Russian-Federation--Moscow-Oblast--Elektrostal#around

- Page /Russian-Federation--Moscow-Oblast--Elektrostal#page

- Terms of Use

- Copyright © 2024 DB-City - All rights reserved

- Change Ad Consent Do not sell my data

IELTS Exam Preparation: Free IELTS Tips, 2024

- elektrostal'

Take IELTS test in or nearby Elektrostal'

There is no IELTS test center listed for Elektrostal' but you may be able to take your test in an alternative test center nearby. Please choose an appropriate test center that is closer to you or is most suitable for your test depending upon location or availability of test.

Closest test centers are:

Make sure to prepare for the IELTS exam using our Free IELTS practice tests .

Moscow, Russia

British council bkc-ih moscow, students international - moscow cb, students international - moscow, vladimir, vladimir oblast, russia, students international vladimir, obninsk, kaluga oblast, russia, british council bkc-ih obninsk, nizhny novgorod, nizhny novgorod oblast, russia, students international - nizhny novgorod, british council bkc-ih nizhny novgorod, voronezh, voronezh oblast, russia, british council bkc-ih voronezh, veliky novgorod, novgorod oblast, russia, lt pro - veliky novgorod, kazan, tatarstan, russia, students international - kazan, british council bkc-ih kazan, st petersburg, russia, lt pro - saint petersburg, students international - st petersburg, saratov, saratov oblast, russia, students international - saratov, british council bkc-ih saratov, petrozavodsk, republic of karelia, russia, lt pro - petrozavodsk, students international - petrozavodsk, kirov, kirov oblast, russia, students international - kirov, samara, samara oblast, russia, students international - samara, british council bkc-ih samara, volgograd, volgograd oblast, russia, british council bkc-ih volgograd, students international - volgograd, rostov-on-don, rostov oblast, russia, students international - rostov-on-don, syktyvkar, komi republic, russia, students international - syktyvkar, perm, perm krai, russia, students international - perm, british council bkc-ih perm, ufa, republic of bashkortostan, russia, students international - ufa, british council bkc-ih ufa, kaliningrad, kaliningrad oblast, russia, students international - kaliningrad, lt pro - kaliningrad, krasnodar, krasnodar krai, russia, students international - krasnodar, stavropol, stavropol krai, russia, students international - stavropol, astrakhan, astrakhan oblast, russia, students international - astrakhan, magnitogorsk, chelyabinsk oblast, russia, ru069 students international - magintogorsk, yekaterinburg, sverdlovsk oblast, russia, british council bkc-ih ekaterinburg, students international - ekaterinburg, chelyabinsk, chelyabinsk oblast, russia, students international - chelyabinsk, british council bkc-ih chelyabinsk, murmansk, murmansk oblast, russia, students international - murmansk, tyumen, tyumen oblast, russia, students international - tyumen, omsk, omsk oblast, russia, students international - omsk, novosibirsk, novosibirsk oblast, russia, british council bkc-ih novosibirsk, students international - novosibirsk, tomsk, tomsk oblast, russia, british council bkc-ih tomsk, students international - tomsk, barnaul, altai krai, russia, students international - barnaul, other locations nearby elektrostal'.

- Zheleznodorozhnyy

- Orekhovo-Zuyevo

- Sergiyev Posad

- Podol'sk

- Novo-Peredelkino

- Ryazan'

An Overview of the IELTS

The International English Language Testing System (IELTS) is designed to measure English proficiency for educational, vocational and immigration purposes. The IELTS measures an individual's ability to communicate in English across four areas of language: listening , reading , writing and speaking . The IELTS is administered jointly by the British Council, IDP: IELTS Australia and Cambridge English Language Assessment at over 1,100 test centres and 140 countries. These test centres supervise the local administration of the test and recruit, train and monitor IELTS examiners.

IELTS tests are available on 48 fixed dates each year, usually Saturdays and sometimes Thursdays, and may be offered up to four times a month at any test centre, including Elektrostal' depending on local needs. Go to IELTS test locations to find a test centre in or nearby Elektrostal' and to check for upcoming test dates at your test centre.

Test results are available online 13 days after your test date. You can either receive your Test Report Form by post or collect it from the Test Centre. You will normally only receive one copy of the Test Report Form, though you may ask for a second copy if you are applying to the UK or Canada for immigration purposes - be sure to specify this when you register for IELTS. You may ask for up to 5 copies of your Test Report Form to be sent directly to other organisations, such as universities.

There are no restrictions on re-sitting the IELTS. However, you would need to allow sufficient time to complete the registration procedures again and find a suitable test date.

SHARE THIS PAGE

The reading, writing and listening practice tests on this website have been designed to resemble the format of the IELTS test as closely as possible. They are not, however, real IELTS tests; they are designed to practise exam technique to help students to face the IELTS test with confidence and to perform to the best of their ability.

While using this site, you agree to have read and accepted our terms of use, cookie and privacy policy.

Intel: Why The Dip Is Not Fair

- INTC is extremely attractively valued for a company with such solid AI and data center exposure and the potential to become the biggest beneficiary of the AI transition in PCs.

- The company spends on R&D approximately the same amount as Nvidia and AMD combined.

- My intrinsic value calculations suggest that INTC's target price is $37.

JHVEPhoto/iStock Editorial via Getty Images

Intel Corporation's ( NASDAQ: INTC ) stock is very attractively valued for a stock with such solid exposure to AI and data centers. The intrinsic value of the stock is 18% higher than Intel's market capitalization, which means that the target price is $37.

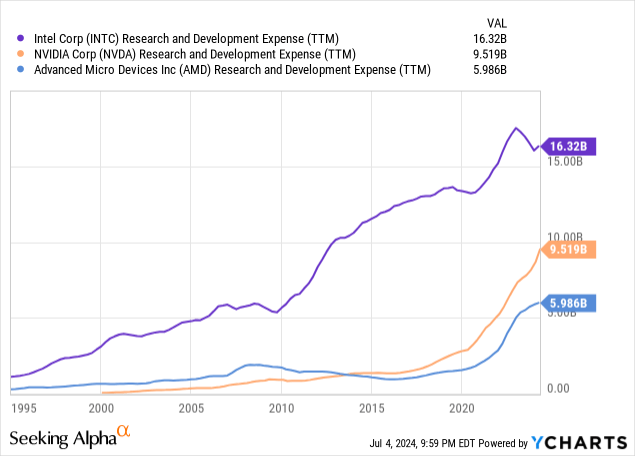

Intel generates notably more Data Center revenue compared to wildly overvalued Advanced Micro Devices, Inc. ( AMD ). The company spends much more on R&D than NVIDIA Corporation ( NVDA ) and AMD and released its Gaudi 3 accelerator, which is more powerful than Nvidia's H100, according to the company. Nvidia and AMD are fierce competitors, but Intel is well-positioned to get solid gains from the accelerating spending on data centers and AI.

Considering Intel's strong exposure to AI and data centers and its very attractive valuation, I think that INTC is a Strong Buy.

INTC stock analysis

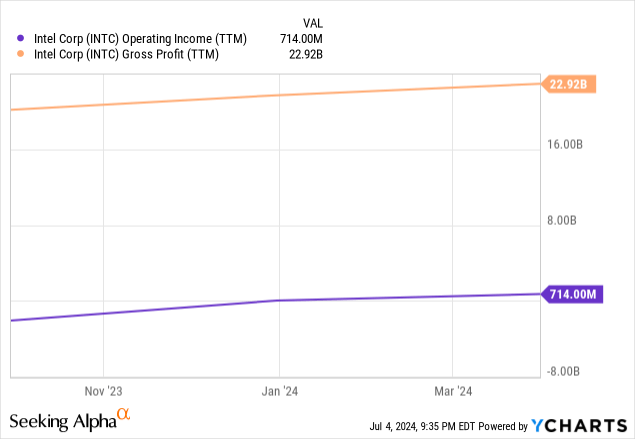

Sentiment around INTC is weak in 2024 since the stock lost 38% of its value YTD. However, financial performance in Q1 tells me that the market's reaction should be the opposite. Revenue grew by 8.6% compared to the same quarter last year. Profitability is also steadily improving.

The reason for the latest INTC sell-off was softer-than-expected guidance from the management for the remainder of 2024. However, it appears to be a shortsighted reaction because as investors we should pay more attention to longer-term horizons.

AI is a big elephant in the room because INTC's AI exposure is solid. Intel's Gaudi 3 AI accelerator is a direct competitor to Nvidia's H100 series. During the Vision 2024 event, Intel's management stated that Gaudi 3 delivers a 50% on average better inference and 40% on average better power efficiency than Nvidia H100. With a more attractive price compared to H100, Gaudi is positioned well to become a popular alternative to H100 series. Moreover, the previous generation, Gaudi 2 proved itself appealing as it powers Meta Platforms, Inc.'s ( META ) Llama large-language model (LLM).

Nvidia and AMD are unlikely to be the ones standing by as Intel's Gaudi 3 potentially captures their market share. For example, Nvidia's new generation of accelerators called Blackwell is expected to be much more powerful than H100. The AI battle will be fierce, but what I want to underline is that Intel's R&D budget is $7 billion larger than Nvidia's and about $10 billion higher compared to AMD's. Therefore, I believe there is a high probability that Intel can reply to Nvidia's Blackwell with "Gaudi 4" soon.

Intel also has a solid presence in data centers, with a $3 billion Q1 revenue from its "Data Center and AI" business. For example, AMD's "Data Center" segment's revenue was $2.3 billion in Q1 2024. Intel's XEON processors are also quite popular in the data center field. Their processors are deployed by Amazon Web Services , a subsidiary of Amazon.com, Inc. ( AMZN ), the world's leading cloud company. Intel also partners with Microsoft Corporation's ( MSFT ) Azure and Alphabet Inc. ( GOOG ), ( GOOGL ) Cloud . Having partnerships with all the largest cloud players means that Intel is extremely well-positioned to benefit from accelerating the data center spending of these giants. Amazon plans to invest $150 billion in data centers over the next 15 years. Such a horizon of 15 years means that the trend is not temporary but secular. The main competitors of AWS have similar ambitions and plans.

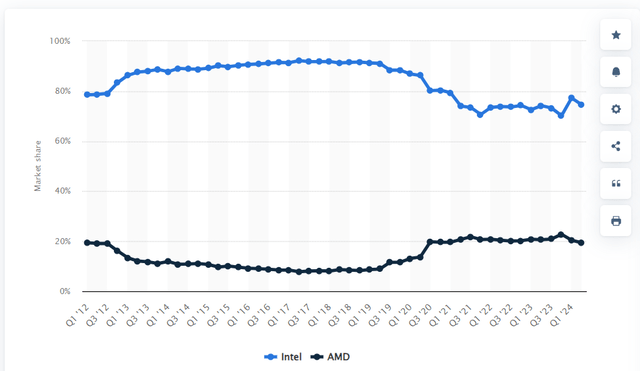

Firm AI and data center potential are not the only strengths of INTC. The company dominates the x86 laptop CPUs market with a 75% market share, according to statista.com . AMD's market share is more than three times lower and Nvidia is not even in the discussion. Such dominance makes INTC well-positioned to create a new industry of AI laptops , which could also unlock new growth drivers for the company.

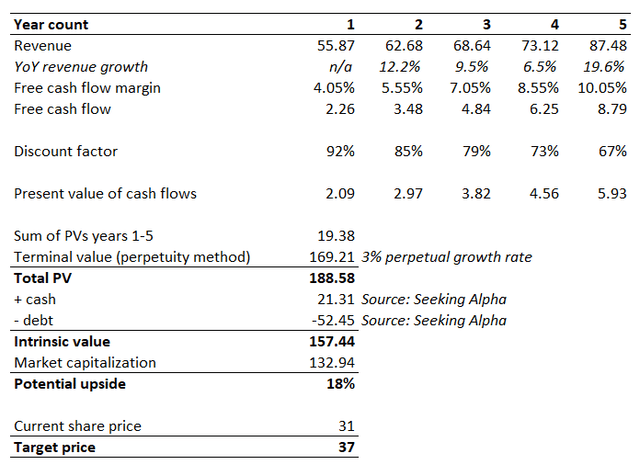

Intrinsic value calculation

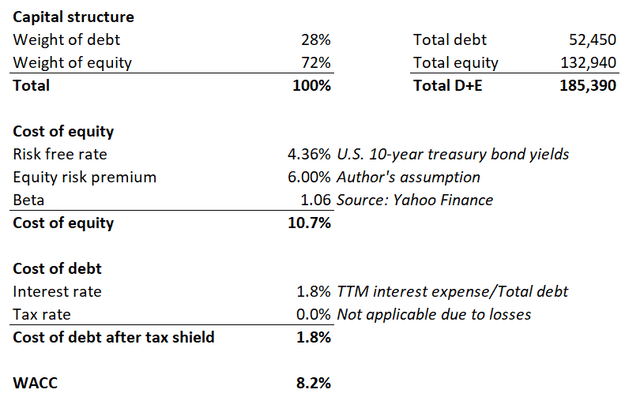

Calculating the discount rate for a discounted cash flow (DCF) model is crucial because it affects the present value of future cash flows. Intel's weighted average cost of capital (WACC) is 8.2%, which was estimated using the capital asset pricing model (CAPM). My calculations are outlined in the below model, and all assumptions are shown.

A DCF model also needs revenue and free cash flow assumptions. Consensus estimates are the ones that are usually priced in by the market, so I use consensus for my years 1-5 horizon. Taking a TTM levered FCF margin will not work for INTC because it is negative. At the same time, consensus expects Intel's EPS to demonstrate strong growth over the next five years.

Seeking Alpha

Therefore, my FCF margin assumption for year one will be INTC's historical average of 4.05%. Due to the expected aggressive EPS growth, I incorporate a 1.5 percentage points yearly FCF improvement. A 3% perpetual growth rate is in line with current inflation levels. Cash is added and total debt is subtracted when I finalize my intrinsic value calculation. My target price is $37 because INTC's intrinsic value is 18% higher than its market capitalization.

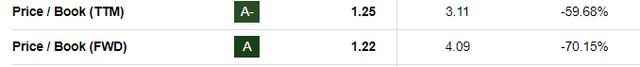

In addition, Intel's current market value is only 25% higher than the book value. It is considered very low when we compare it to an average of 3 from industry averages.

What can go wrong with my thesis?

The competition is intense across all products offered by the company. INTC competes with Nvidia and AMD in the CPU/GPU field, both of them are known for their aggressive growth profiles and their fabless business model makes these players more flexible. New technologies in the industry emerge, which creates new opportunities for previously less-known companies. For example, Arm Holdings plc ( ARM ) looks like an under-the-radar player compared to Intel's well-known brand, or even NVDA and AMD. However, this business is thriving, and its market cap is higher compared to Intel. Fierce competition is the most significant factor that can make my thesis look bad over time.

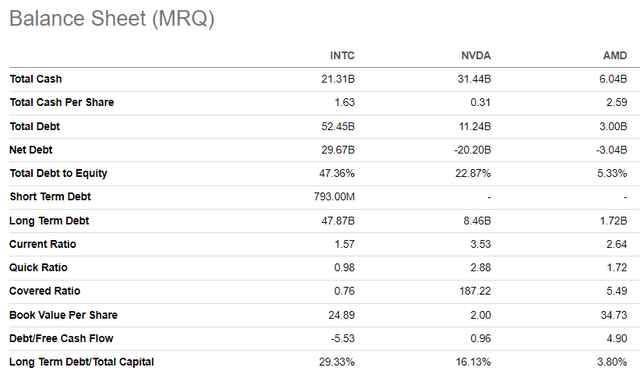

Intel's highly leveraged balance sheet, especially compared to NVDA and AMD, might be an obstacle to the company's success. High debt levels weigh on profitability and limit any company's flexibility in allocating its financial resources. From the perspective of the balance sheet, NVDA and AMD have a competitive advantage over INTC.

The semiconductor industry is cyclical and heavily depends on the broader economic environment. Since interest rates remain high in the U.S., some analysts believe that the U.S. will enter a recession either this year or in 2025. The recession will highly likely lead to overall spending softening, which will also affect semiconductors. Moreover, the potential recession might also lead to investors selling off risky assets like stocks and reallocating capital to fixed-income instruments. This will also not be beneficial for my thesis.

Intel's firm exposure to thriving AI and data center domains together with its compelling 18% upside potential makes it a Strong Buy.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

About intc stock.

| Symbol | Last Price | % Chg |

|---|

More on INTC

Related stocks.

| Symbol | Last Price | % Chg |

|---|---|---|

| INTC | - | - |

| INTC:CA | - | - |

Trending Analysis

Trending news.

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

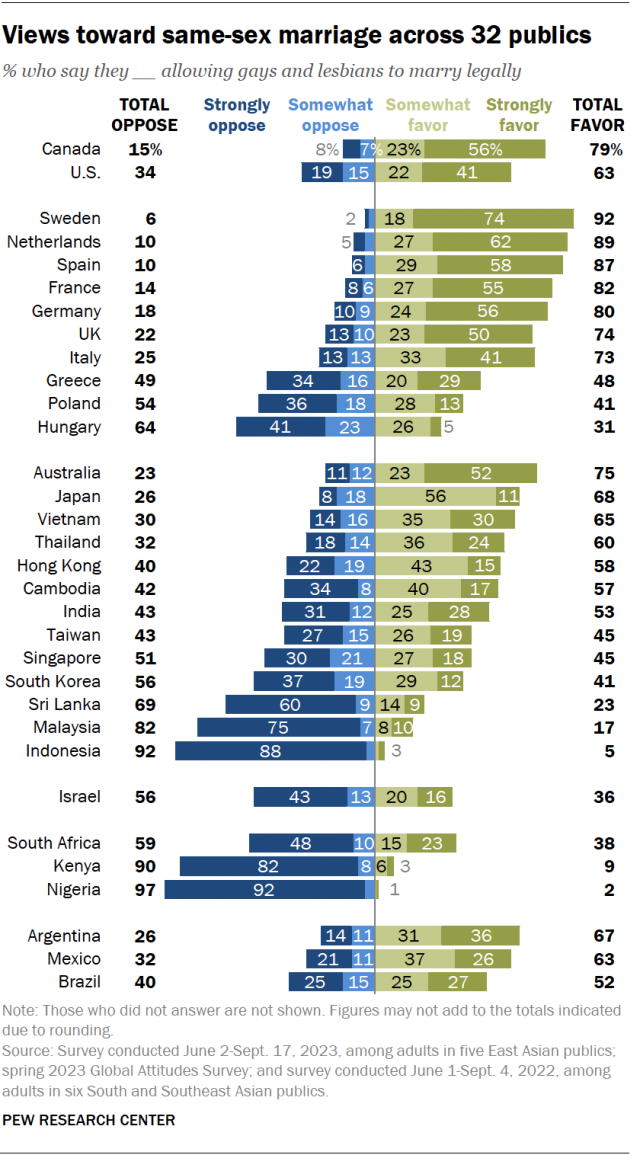

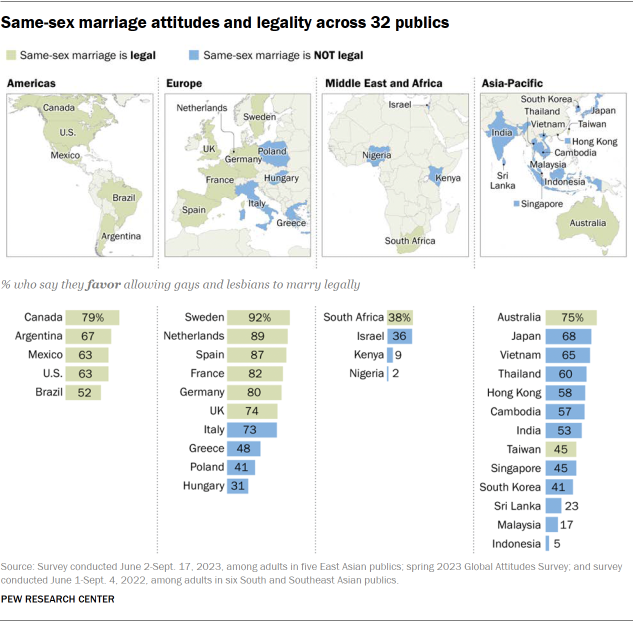

How people around the world view same-sex marriage

Attitudes about same-sex marriage vary widely around the world, according to several Pew Research Center surveys fielded in 32 places in the last two years. Among the surveyed publics, support for legal same-sex marriage is highest in Sweden, where 92% of adults favor it, and lowest in Nigeria, where only 2% back it.

In the United States, where the Supreme Court legalized same-sex marriage nationally in 2015, 63% of adults support it and 34% oppose it. But views are highly fractured along political and demographic lines.

For example, Democrats and independents who lean toward the Democratic Party are nearly twice as likely as Republicans and Republican leaners to support same-sex marriage rights (82% vs. 44%). Similarly, nearly three-quarters (73%) of Americans under the age of 40 say they favor allowing gays and lesbians to marry legally – 16 percentage points higher than the share of Americans 40 and older who agree (57%).

Related : In places where same-sex marriages are legal, they account for a small share of all marriages

Below is a closer look at how attitudes about same-sex marriage differ around the world, based on our surveys. This analysis looks at how attitudes vary by geography, demographic factors, political ideology and religion, as well as how views have changed over time.

This Pew Research Center analysis focuses on public opinion of the legality of same-sex marriage in 32 places in North America, Europe, the Middle East, Latin America, Africa and the Asia-Pacific region. This is the first year since 2019 that the Global Attitudes Survey has included publics from Africa and Latin America, which were not included more recently due to the coronavirus outbreak .

For non-U.S. data, this analysis draws from three nationally representative surveys conducted across 31 publics. In 21 publics, we conducted a survey of 24,546 adults from Feb. 20 to May 22, 2023. All interviews were conducted over the phone in Canada, France, Germany, Greece, Italy, the Netherlands, Spain, Sweden and the United Kingdom. Interviews were conducted face-to-face in Hungary, Poland, India, Indonesia, Israel, Kenya, Nigeria, South Africa, Argentina, Brazil and Mexico. In Australia, we used a mixed-mode probability-based online panel.

Data for Hong Kong, Japan, South Korea, Taiwan and Vietnam draws on another survey of 10,390 adults conducted in five Asian publics from June 2 to Sept. 17, 2023. All interviews in Hong Kong, Japan, South Korea and Taiwan were conducted over the phone. Interviews were conducted face-to-face in Vietnam.

Data for Cambodia, Malaysia, Singapore, Sri Lanka and Thailand draws on a third survey of 10,551 adults conducted in five South and Southeast Asian publics from June 1 to Sept. 4, 2022. All interviews in Malaysia and Singapore were conducted over the phone. Interviews were conducted face-to-face in Cambodia, Sri Lanka and Thailand. Both the survey in East Asia and the one in South and Southeast Asia are part of the Pew-Templeton Global Religious Futures project , which analyzes religious change and its impact on societies around the world.

In the United States, we surveyed 3,576 U.S. adults from March 20 to 26, 2023. Everyone who took part in this survey is a member of the Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way nearly all U.S. adults have a chance of selection. Read more about the ATP’s methodology .

Respondents for all surveys were selected using probability-based sample designs. In Thailand, we conducted additional interviews in the Southern region, which has larger shares who are Muslim. The data in all publics is weighted to account for different probabilities of selection among respondents and to align with demographic benchmarks for adult populations.

This post is an update of one published June 13, 2023. This new post includes more publics surveyed. It also uses a different rounding procedure to generate the “total” figures, so results may differ slightly from previously published estimates. The accompanying topline figures are unchanged.

Here are the questions used for the analysis , along with responses, and the survey methodology .

How attitudes about same-sex marriage vary geographically

People in Western Europe stand out as staunch supporters of same-sex marriage. At least eight-in-ten adults support it in Sweden (92%), the Netherlands (89%), Spain (87%), France (82%) and Germany (80%). In each of these places, the practice is legal .

In Italy, where issues of LGBTQ+ rights have been in the headlines , 73% of adults favor same-sex marriage rights, though it is not legal there.

Around three-quarters (74%) of adults in the United Kingdom also support same-sex marriage. The practice is legal in England, Wales, Scotland and Northern Ireland, although those laws were approved at various times over the past decade.

At the other end of the spectrum in Europe, just 41% of adults in Poland and 31% in Hungary support same-sex marriage. In both places, same-sex marriage is not legal, and LGBTQ+ rights are a political and social flashpoint .

In North America, around eight-in-ten Canadians (79%) support same-sex marriage, as do 63% in both the U.S. and Mexico. Same-sex marriage is legal in all three places.

Related : About six-in-ten Americans say legalization of same-sex marriage is good for society

In South America, 67% of Argentines and 52% of Brazilians support the right of gay and lesbian people to marry. Both places have also legalized the practice.

Asia-Pacific

In the Asia-Pacific region, support for same-sex marriage is highest in Australia and Japan. Three-quarters of adults in Australia and nearly seven-in-ten (68%) in Japan favor legal same-sex marriage. But while many Australians who favor same-sex marriage say they strongly support it (52%), support is weaker in Japan , where a 56% majority somewhat favor legal same-sex marriage. Australia has legalized same-sex marriage, but Japan has not .

Views toward legalizing same-sex marriage are similarly favorable in Vietnam, where 65% say they support it.

In India , 53% of adults say same-sex marriage should be legal, while 43% oppose it. The Indian Supreme Court recently rejected a petition to legalize same-sex marriage. (The survey there was conducted prior to the ruling.)

And in Taiwan, roughly equal shares say they support (45%) and oppose (43%) same-sex marriage, with the remainder providing no answer. Taiwan is the only place in Asia where same-sex marriage is legal .

In South Korea, same-sex marriage is not legal, though some lawmakers have proposed changing this . Among South Koreans, 41% favor legal same-sex marriage and 56% oppose it.

Indonesians are highly opposed to same-sex marriage legalization. Roughly nine-in-ten (92%) oppose allowing gays and lesbians to marry, including 88% who say they strongly oppose it. Just 5% of Indonesians support same-sex marriage.

Related : Asian views of same-sex marriage

Africa and Middle East

South Africa remains the only place in Africa where same-sex marriage is legal, having codified it in 2006. Nevertheless, 59% of South Africans oppose the practice.

Nigerians and Kenyans are the least supportive of same-sex marriage rights among the places in Africa surveyed. In Nigeria, where homosexuality is illegal, only 2% of adults say they support allowing gays and lesbians to marry. And in Kenya, just 9% favor it.

In the Middle East, 56% of Israelis are also opposed to making same-sex marriage legal. Religious affiliation and political leanings heavily shape views of same-sex marriage rights in Israel .

How attitudes about same-sex marriage vary by demographic factors

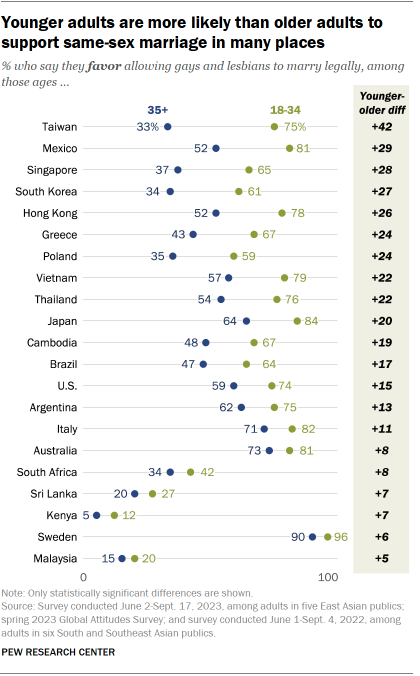

In 21 of the places surveyed, adults under the age of 35 are more likely than their older counterparts to say they favor allowing gays and lesbians to marry legally. And in some places, older adults are less likely to provide a response than younger adults.

The age gap is greatest in Taiwan. Three-quarters of Taiwanese adults under 35 express support for same-sex marriage, compared with roughly a third of those 35 and older.

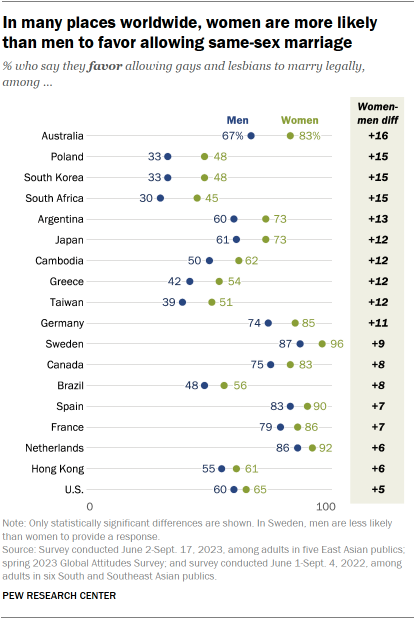

In 19 of the surveyed places, women are more likely than men to say they support allowing gays and lesbians to marry legally.

For example, in Australia, 83% of women favor it, compared with 67% of men.

There are similar gender differences in Argentina, Cambodia, Germany, Greece, Japan, Poland, South Africa, South Korea, Sri Lanka and Taiwan.

Education and income

In 22 of the surveyed places, people with more education are more likely than those with less education to support allowing gays and lesbians to marry. In some places, those with less education are less likely to provide a response than those with more education.

Similarly, in 10 places, people with incomes over the national average are more likely than those with incomes at or below the median to support same-sex marriage. In one of these places – Poland – those with lower incomes were less likely to provide a response.

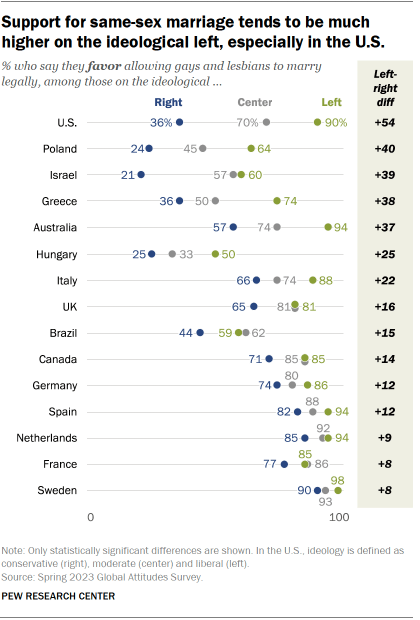

How attitudes about same-sex marriage vary by political ideology

Views on same-sex marriage are related to political ideology in 15 of the 18 places where we asked about respondents’ ideology this year. In these places, those on the ideological left are significantly more likely than those on the right to favor allowing gays and lesbians to marry legally.

The ideological difference is greatest in the U.S., where liberals are 54 points more likely than conservatives to support same-sex marriage (90% vs. 36%). Still, in nine surveyed places, majorities of those on both the right and left say they support same-sex marriage.

How attitudes about same-sex marriage vary by religion

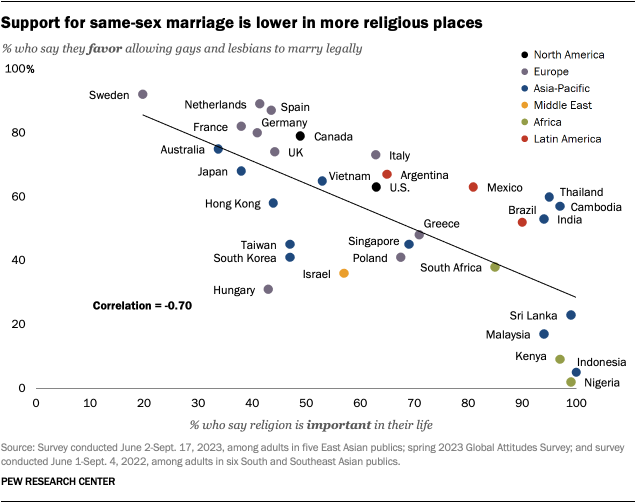

Support for legal same-sex marriage tends to be lower in places where more people say religion is somewhat or very important in their lives. Support is higher in places where fewer people consider religion important.

In Nigeria, 99% of adults say religion is at least somewhat important in their lives and only 2% favor legal same-sex marriage. In Indonesia, where 100% of Indonesians say religion is important to them, 5% support legal same-sex marriage. In Sweden, by comparison, just 20% of adults consider religion important to them – and 92% favor allowing gay and lesbian people to wed.

Similarly, people who are not affiliated with a religion are much more likely to say they support same-sex marriage. In Australia, for example, 89% of religiously unaffiliated adults say they favor same-sex marriage, compared with 64% of adults with a religious affiliation.

Together, the most recent surveys show some additional patterns by religion:

- Religiously unaffiliated Americans (85%) – especially atheists (96%) – are the most likely to favor same-sex marriage legality. White, non-Hispanic evangelical Protestants are the least likely religious group to say they favor it (30%). Around two-thirds of U.S. Catholics (65%) favor same-sex marriage, as do 70% of White nonevangelical Protestants.

- In Brazil , Catholics (56%) are more likely than Protestants (32%) to support same-sex marriage.

- In Israel , Jewish adults (41%) are more likely than Muslims (8%) to support same-sex marriage. Among Israeli Jews, 4% of those who are Haredi (“ultra-Orthodox”) or Dati (“religious”) support legal same-sex marriage, compared with 29% of Masorti (“traditional”) Jews. Around three-quarters of Hiloni (“secular”) Jews support this policy.

- In Nigeria , Christians and Muslims are equally likely to oppose same-sex marriage (97% and 98%, respectively).

How attitudes about same-sex marriage have changed over time

It is difficult to directly compare these new survey findings with past surveys on whether people favor or oppose same-sex marriage. Earlier Center surveys focused more on religion and its influence in society, rather than political attitudes and international affairs. And in some places, the mode of the survey (e.g., face-to-face vs. phone vs. web) has changed over time.

However, a comparison with surveys conducted in Latin America in 2013-14 , in Europe in 2015-17 , and the long-term trend in the U.S. generally shows increased public support for the legalization of same-sex marriage over the past decade.

Note: This is an update of a post originally published June 13, 2023. Here are the questions used for the analysis , along with responses, and the survey methodology .

- International Affairs

- LGBTQ Acceptance

- LGBTQ Attitudes & Experiences

- Religion & LGBTQ Acceptance

- Same-Sex Marriage

Sneha Gubbala is a research assistant focusing on global attitudes research at Pew Research Center .

Jacob Poushter is an associate director focusing on global attitudes at Pew Research Center .

Christine Huang is a research associate focusing on global attitudes at Pew Research Center .

In some countries, immigration accounted for all population growth between 2000 and 2020

Nato seen favorably in member states; confidence in zelenskyy down in europe, u.s., in the uk, dissatisfaction with economy, democracy is widespread ahead of election, how israeli society has unified, and divided, in wartime, satisfaction with democracy has declined in recent years in high-income nations, most popular.

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

© 2024 Pew Research Center

IMAGES

VIDEO

COMMENTS

(00:20:25) - More on why the value of these data centers is so elusive (00:21:57) - The extent to which macro tech slowdowns intersect with his thesis (00:23:13) - What investors see in these businesses that he discounts (00:26:59) - Risks for the short and the bull case for data centers (00:29:04) - Big concerns about the broader commercial ...

The three biggest cloud providers, Amazon Web Services, Google Cloud and Microsoft Azure, are by far the largest tenants of data centres. Chanos's thesis is that these three "hyperscalers ...

Wall Street Legend Jim Chanos is famed for bringing a skeptical eye to a credulous world. In this episode, he delivers a compelling bear case for the legacy ...

UNIT is a fiber REIT, not a data center REIT. Iron Mountain only has recently acquired data centers with new lease rates, not legacy lease rates. Jim Chanos's short thesis was specifically ...

The short thesis has received significant pushback from data center REITs and the majority of the data center industry's sell-side analysts, who point out that while Chanos accurately ...

Compound248 is back to host another episode of Business Breakdowns. His most recent podcasts have focused on digital infrastructure and today we continue with that theme, but with a twist. Our guest is Wall Street Legend Jim Chanos, famed for bringing a skeptical eye to a credulous world. Together, we walked through his short thesis on the US ...

Yet those in the data centre industry argue Chanos's thesis is dated, given that the same arguments have emerged several times over the past 15 years, including a highly publicised short ...

Together, we walked through his short thesis on the US Data Center REITs, his bear case for commercial real estate, and some broader wisdom on how management can thoughtfully respond to short sellers. ... (00:26:59) - Risks for the short and the bull case for data centers (00:29:04) - Big concerns about the broader commercial real estate ...

Abstract. This thesis looks at how to design data centers for the urban context in a way that benefits cities and the people who live in them. COVID-19 has only reinforced the sentiment that our physical realm will require more and more room for the digital infrastructure that sustains it. Every day, the average person produces 15GB of data.

Our guest is Wall Street legend, Jim Chanos, famed for bringing a skeptical eye to a credulous world. Together, we walk through his short thesis on the U.S. data center REITs, his bear case for commercial real estate and some broader wisdom on how management can thoughtfully respond to short sellers. Let's get started. ‣

Data center maintenance may not seem like a sexy topic for Wall Street. But the Highfields short call made data center maintenance expenses a hot topic in earnings calls. Digital Realty sought to put the issue to rest by updating its accounting, saying it would no longer account for maintenance costs below $10,000 as capital expenditures ...

Together, we walked through his short thesis on the US Data Center REITs, his bear case for commercial real estate, and some broader wisdom on how management can thoughtfully respond to short sellers. Let's get started. Jim Chanos is the president and founder of Kynikos Associates. We cover his short thesis on the US Data Center REITs, his bear ...

The celebrated bear is aiming at data centers, the IT backbone of big corporations. Their high valuations make them vulnerable. September 6, 2022 at 12:00 AM EDT

Edge computing is estimated to grow to between $150 and $300+ billion by 2030. If we use fairly traditional IT spend distribution models, this means that data center specific spend will likely be between $10 and $20 billion. Keep in mind, this is only associated with expected Edge demand. Resource: IT Infrastructure Demand Requires a Rethink.

Jim Chanos is raising more than $200 million to bet against REITs that own data centers. The short seller expects them to be disrupted by their key tenants: Amazon, Alphabet, and Microsoft. "This ...

Ironically, just as Data Center REITs became a trendy "short" idea centered on a thesis of weak pricing power and competition from hyperscalers, rental rate trends have meaningfully improved.

For those that don't follow the sector, these operators always use EBITDA as a metric to cashflow as they disclose their maintenance capex as extremely low (maybe 2-5% of revenue).Their ebitda margin is 40%, while ebit margin is like 1-2%. So if chanos is right about m capex being 150-175% of d&a, then these operators do not generate any ...

More than 72 million square feet (6.7m sq m) of data center space is owned by publicly-listed data center REITs. But Chanos, and his investment group Chanos & Company, are betting that data center REITs' market domination is set to come to an end. "The story is that although the cloud is growing, the cloud is their enemy, not their business ...

Rescuing Data Center Processors by Tanvir Ahmed Khan ... 5.2 Why do existing I-cache miss mitigation techniques fall short?. . . . . . . . . .95 ... My thesis reexamines the boundary between hardware and software to enable efficient data center processing. I begin this chapter with an overview of the problem: processor inefficiency for data

Three years ago, Google set an ambitious plan to address climate change by going "net zero," meaning it would release no more climate-changing gases into the air than it removes, by 2030.

To help you plan your visit, here is our guide to the best places and shopping areas in Balashikha. Select from our best shopping destinations in Balashikha without breaking the bank. Read reviews, compare malls, and browse photos of our recommended places to shop in Balashikha on Tripadvisor.

In short: Three data centres will be built in secret locations to host Australia's military secrets. Amazon has won the $2 billion contract to store the classified intelligence.

Similarly, a CNBC regular named Jim Chanos issued a short thesis in June 2022 that data center owners such as DLR and EQIX would not be needed anymore because cloud companies such as Alphabet ...

And 6% say it was never possible, according to a recent Pew Research Center survey of 8,709 U.S. adults. While this is the first time the Center has asked about the American dream in this way, other surveys have long found that sizable shares of Americans are skeptical about the future of the American dream.

Resorts near Museum and Exhibition Center, Elektrostal on Tripadvisor: Find 1,354 traveller reviews, 1,942 candid photos, and prices for resorts near Museum and Exhibition Center in Elektrostal, Russia.

Elektrostal Geography. Geographic Information regarding City of Elektrostal. Elektrostal Geographical coordinates. Latitude: 55.8, Longitude: 38.45. 55° 48′ 0″ North, 38° 27′ 0″ East. Elektrostal Area. 4,951 hectares. 49.51 km² (19.12 sq mi) Elektrostal Altitude.

IELTS; Locations; russia; elektrostal' Take IELTS test in or nearby Elektrostal' There is no IELTS test center listed for Elektrostal' but you may be able to take your test in an alternative test center nearby. Please choose an appropriate test center that is closer to you or is most suitable for your test depending upon location or availability of test.

JHVEPhoto/iStock Editorial via Getty Images. My thesis. Intel Corporation's (NASDAQ:INTC) stock is very attractively valued for a stock with such solid exposure to AI and data centers.The ...

Attitudes about same-sex marriage vary widely around the world, according to several Pew Research Center surveys fielded in 32 places in the last two years. Among the surveyed publics, support for legal same-sex marriage is highest in Sweden, where 92% of adults favor it, and lowest in Nigeria, where only 2% back it.

A left-wing coalition unexpectedly surged and the far-right National Rally fell short of predictions. But no coalition captured a majority in Parliament, meaning months of gridlock could lie ahead.