Market Share

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on November 29, 2023

Are You Retirement Ready?

Table of contents, define market share in simple terms.

Market share represents the portion of a specific market or industry that is controlled or held by a business, product, or brand. Expressed as a percentage, it provides a snapshot of a company's competitiveness and dominance in a particular segment.

Understanding market share offers insights not just into a company's current standing but also into market trends, consumer preferences, and potential areas for growth or improvement.

Market share is complementary with a company growing or shrinking. When the market share of a company increases or decreases, it gives analysts information on how competitive that company's goods or services are at that particular time.

If the total market for a product or service grows, and a company maintains its market share, it means it is growing revenues at the same rate as the total market.

If it is growing its market share, its revenue is growing faster than the total market revenue.

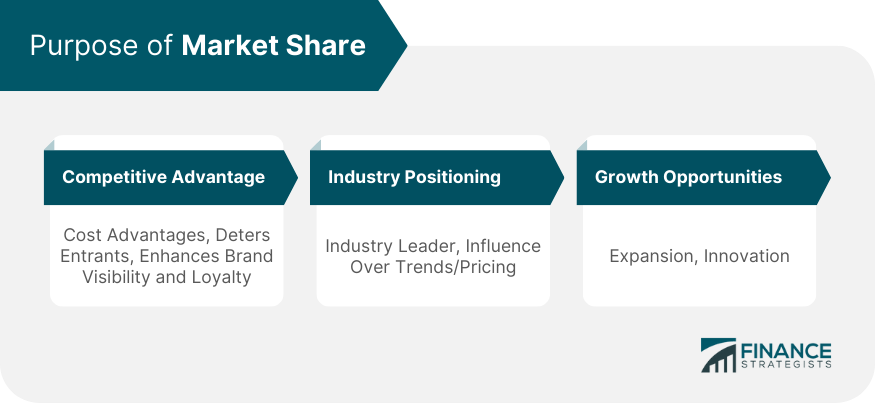

The Purpose of Market Share

The purpose of this metric is to give a general idea of the size of a company relative to its direct competitors .

Additionally, investors use market share data when assessing the opportunity of a business for growth.

Competitive Advantage

Market share can provide a distinct competitive advantage. Companies with a higher market share often benefit from economies of scale , which can reduce production costs and bolster profit margins .

Moreover, a significant market share can serve as a deterrent for new entrants eyeing the same market segment, since establishing a foothold becomes challenging against well-entrenched competitors.

Furthermore, a dominant market position can enhance brand visibility and recognition, leading to increased consumer trust and loyalty – crucial assets in fiercely competitive markets.

Industry Positioning

Those with significant market shares are often seen as industry leaders or giants, wielding considerable influence over market trends, pricing, and even regulatory matters.

Such positioning can lead to preferential treatment from suppliers, better negotiation leverage, and increased investor confidence.

Conversely, companies with declining market shares might face skepticism from stakeholders and be viewed as less influential or relevant in their industry.

Growth Opportunities

A company's market share directly correlates with its growth opportunities. With a higher market share, businesses have a clearer path to expand, innovate, and diversify.

They have a proven track record, which can be instrumental in securing partnerships , collaborations, and investments .

On the other hand, companies with smaller market shares, while facing challenges, aren’t without growth opportunities.

They can identify market niches, innovate, and challenge industry norms to carve out a space for themselves.

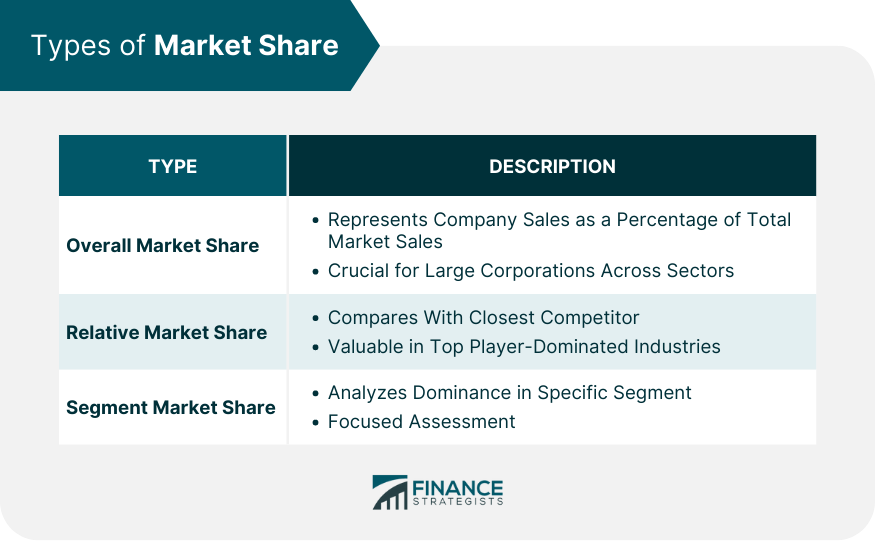

Types of Market Share

Overall market share.

Overall market share pertains to the total sales of a company as a percentage of the sales of the entire market.

It gives a broad perspective of the company's position in the entire industry landscape. It’s an essential metric for large corporations and conglomerates operating in multiple sectors.

Relative Market Share

Relative market share is a more specific measure, comparing a company's market share to that of its nearest competitor.

It offers a more refined understanding of competitive positioning, especially in industries where the top two or three players dominate.

Segment Market Share

Segment market share narrows the focus even further, analyzing a company's dominance in a specific segment of the market.

For instance, a tech company might examine its market share in the tablet segment, independent of its performance in other device categories.

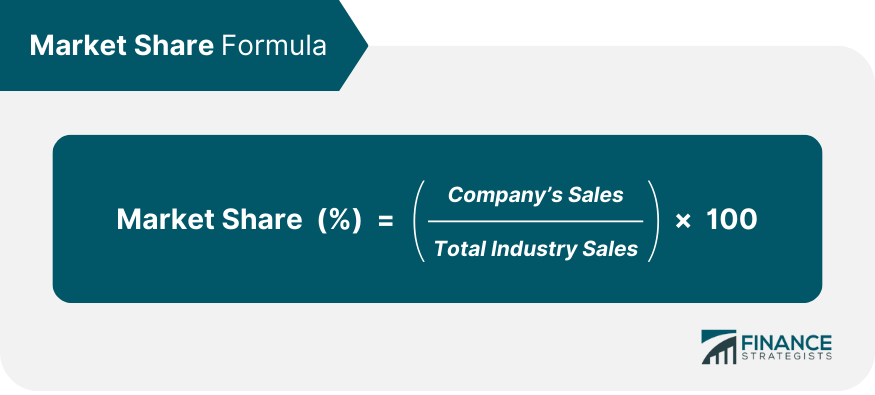

Formula for Market Share Calculation

This metric is calculated by taking the company's sales over a specified period of time and dividing it by the total sales of the industry over the same period of time.

The formula is:

This straightforward calculation provides a percentage that indicates the company's share of the market.

Imagine a company, Brand X, which sold 500,000 units of its product last year. If the total sales in the industry for that year were 5 million units, the market share for Brand X would be:

Market Share (%) = (500,0005,000,000) x 100

Market Share = 10%

Thus, Brand X holds 10% of the market share in that industry.

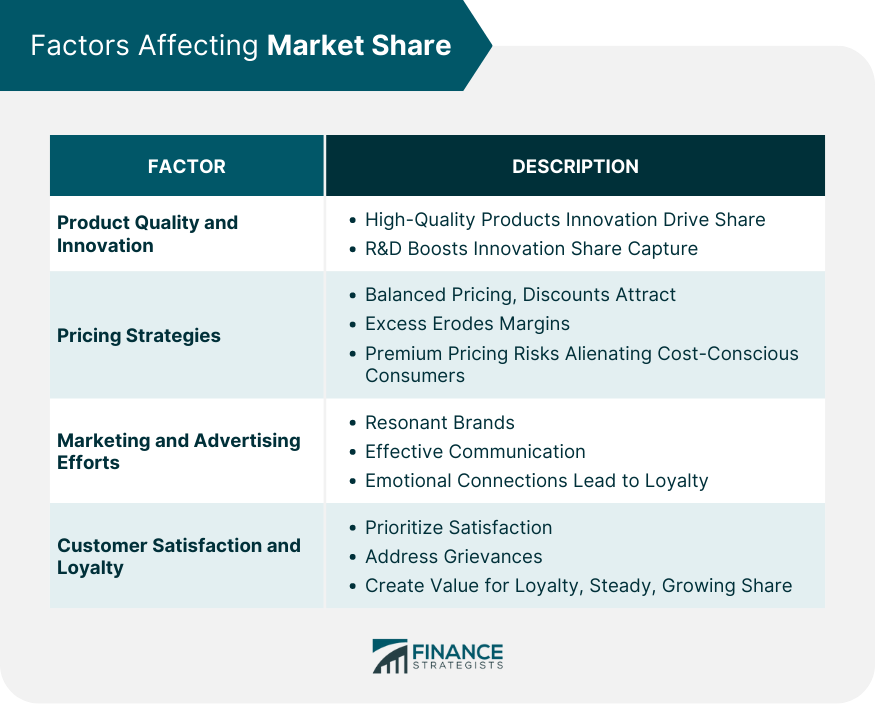

Factors Affecting Market Share

Product quality and innovation.

A primary driver for market share is product quality and innovation. Companies that consistently produce high-quality products that meet or exceed consumer expectations are likely to command a higher market share.

Additionally, businesses that invest in research and development to introduce innovative products can capture more market share.

Pricing Strategies

Competitive pricing, discounts, and promotions can attract customers, but if done excessively, it can also erode profit margins.

Conversely, premium pricing can establish a product as high-end but might alienate cost-conscious consumers.

Marketing and Advertising Efforts

Brands that resonate with consumers, communicate their value proposition effectively, and build strong emotional connections typically enjoy higher market loyalty and, by extension, market share.

Customer Satisfaction and Loyalty

Happy customers are repeat customers. Companies that prioritize customer satisfaction, address grievances promptly, and create value can foster loyalty, ensuring a stable and potentially growing market share.

Growing a Company's Market Share

When a company increases its market share, they have more room to improve operations and profitability.

Market shares assume a fixed market size but can be grown.

Some tactics that companies use to grow their market size include advertising, lowering prices, adding new products, or appealing to unique and specific demographics.

Expansion and Penetration

Tapping into new geographies or enhancing presence in existing markets can boost market share.

This might involve setting up new retail outlets, expanding online sales channels, or even entering international markets.

Product Diversification

Diversifying the product range to cater to a broader audience or meet varying consumer needs can attract a larger customer base.

However, diversification should be done after thorough market research to ensure demand.

Mergers and Acquisitions

Acquiring or merging with other companies can be a swift way to increase market share.

This strategy not only brings in the acquired company's customer base but also its resources, technologies, and expertise.

Competitive Pricing

Strategically pricing products, offering discounts, or introducing loyalty programs can entice customers.

While it's essential to ensure profitability, competitive pricing can be a useful tool to capture a larger share of the market.

International Market Share

Market share is usually calculated within specific countries, however investors can obtain market share data from other independent sources, and often from the companies themselves.

In some industries, it can be difficult to accurately measure when comparing across countries.

Market Share is the percentage of a market controlled by a business or brand, reflecting competitiveness and dominance. It offers insights into trends, preferences, and growth potential.

A growing or shrinking market share indicates a company's competitiveness. A company maintaining share while the market grows shows proportional growth; exceeding it implies faster expansion.

Market share's purpose is gauging a company's size relative to competitors and aiding investor assessments. It yields a competitive advantage, influencing economies of scale, brand visibility, and trust.

Dominant shares position companies as industry leaders, influencing trends and negotiations. A larger share expands growth opportunities through partnerships and innovation.

Factors like quality, pricing, marketing, and customer satisfaction impact share. Growing strategies encompass diversification, expansion, mergers, competitive pricing, and international presence.

Market share data, though mainly country-specific, can provide valuable insights for investors.

Market Share FAQs

What is market share.

Market share is the percent of total sales in an industry generated by a given company or product.

What is the formula to calculate a company's Market Share?

This metric is calculated by taking the company’s sales over a specified period of time and dividing it by the total sales of the industry over the same period of time.

What is the purpose of the Market Share metric?

The purpose of this metric is to give a general idea of the size of a company relative to its direct competitors.

Why do investors look at a company's Market Share?

Is market share domestic only.

Market share is usually calculated within specific countries, however, investors can obtain market share data from other independent sources and often from the companies themselves. In some industries, it can be difficult to accurately measure when comparing across countries.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Business Continuity Planning (BCP)

- Business Exit Strategies

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Capital Planning

- Change-In-Control Agreements

- Corporate Giving Programs

- Corporate Philanthropy

- Cross-Purchase Agreements

- Crowdfunding Platforms

- Employee Retention and Compensation Planning

- Employee Volunteer Programs (EVPs)

- Endorsement & Sponsorship Management

- Enterprise Resource Planning (ERP)

- Entity-Purchase Agreements

- Equity Crowdfunding

- Family Business Continuity

- Family Business Governance

- Family Business Transition Planning

- Family Limited Partnerships (FLPs) and Buy-Sell Agreements

- Human Resource Planning (HRP)

- Jumpstart Our Business Startups (JOBS) Act

- Request for Information (RFI)

- Request for Proposal (RFP)

- Revenue Sharing

- SEC Regulation D

- Sale of Business Contract

- Security Token Offerings (STOs)

- Shareholder Engagement and Proxy Voting

- Social Engagements

Ask a Financial Professional Any Question

Discover wealth management solutions near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch, submit your info below and someone will get back to you shortly..

Market Share Essays

Airbnb’s international expansion: a critical evaluation of growth strategies, accc vs. peters ice cream report, marketing plan for ritamon: a novel ptsd treatment, popular essay topics.

- American Dream

- Artificial Intelligence

- Black Lives Matter

- Bullying Essay

- Career Goals Essay

- Causes of the Civil War

- Child Abusing

- Civil Rights Movement

- Community Service

- Cultural Identity

- Cyber Bullying

- Death Penalty

- Depression Essay

- Domestic Violence

- Freedom of Speech

- Global Warming

- Gun Control

- Human Trafficking

- I Believe Essay

- Immigration

- Importance of Education

- Israel and Palestine Conflict

- Leadership Essay

- Legalizing Marijuanas

- Mental Health

- National Honor Society

- Police Brutality

- Pollution Essay

- Racism Essay

- Romeo and Juliet

- Same Sex Marriages

- Social Media

- The Great Gatsby

- The Yellow Wallpaper

- Time Management

- To Kill a Mockingbird

- Violent Video Games

- What Makes You Unique

- Why I Want to Be a Nurse

- Send us an e-mail

- Search Search Please fill out this field.

What Is Market Share?

Calculating market share, benefits of market share, market share impact.

- How to Increase Market Share

Market Share Example

- Market Share FAQs

The Bottom Line

- Business Essentials

Market Share: What It Is and the Formula for Calculating It

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

:max_bytes(150000):strip_icc():format(webp)/E7F37E3D-4C78-4BDA-9393-6F3C581602EB-2c2c94499d514e079e915307db536454.jpeg)

Market share is the percent of total sales in an industry generated by a particular company. Market share is calculated by dividing the company's sales over the period by the industry's total sales over the same period. This metric is used to give a general idea of the size of a company in relation to its market and competitors. The market leader in an industry is the company with the largest market share.

Key Takeaways

- Market share represents the percentage of an industry, or a market's total sales, earned by a particular company over a specified period.

- Market share is calculated by dividing a company's sales by the total sales of the industry over a period.

- This metric is used to give a general idea of the size of a company in relation to its market and competitors.

- A market leader is a company in an industry that has the highest market share and generally wields the most influence.

- Ways to increase market share include implementing new technologies, generating customer loyalty, and acquiring competitors.

Investopedia / Candra Huff

A company's market share is its portion of total sales in relation to the market or industry in which it operates. To calculate a company's market share, first determine a period you want to examine. It can be a fiscal quarter, year, or multiple years .

Next, calculate the company's total sales over that period. Then, find out the total sales of the company's industry. Finally, divide the company's total revenues by its industry's total sales. For example, if a company sold $100 million in tractors last year domestically, and the total amount of tractors sold in the U.S. was $200 million, the company's U.S. market share for tractors would be 50%.

The calculation for market share is usually done for specific countries or regions, e.g., North America or Canada. Investors can obtain market share data from various independent sources, such as trade groups and regulatory bodies, and often from the company itself; however, some industries are harder to measure accurately than others.

Formula for Market Share

Market Share = Total Company Sales / Total Industry Sales

Investors and analysts monitor increases and decreases in market share carefully, as this can be a sign of the relative competitiveness of the company's products or services. As the total market for a product or service grows, a company that is maintaining its market share is growing revenues at the same rate as the total market. A company that is growing its market share will be growing its revenues faster than its competitors.

Gains or losses in market share can have a significant impact on a company's stock performance , depending on industry conditions.

Market share increases can allow a company to achieve greater scale with its operations and improve profitability. A company can try to expand its market share by lowering prices, using advertising, or introducing new or different products. In addition, it can also grow the size of its market share by appealing to other audiences or demographics .

Changes in market share have a larger impact on the performance of companies in mature or cyclical industries where there is low growth. In contrast, changes in market share have less impact on companies in growth industries . In these industries, the total pie is growing, so companies can still be growing sales even if they are losing market share. For companies in this situation, the stock performance is affected more by sales growth and margins than other factors.

In cyclical industries , competition for market share is brutal. Economic factors play a larger role in the variance of sales, earnings, and margins, more than other factors. Margins tend to be low, and operations run at maximum efficiency due to competition. Since sales come at the expense of other companies, they invest heavily in marketing efforts or even loss leaders to attract sales.

In these industries, companies may be willing to lose money on products temporarily to force competitors to give up or declare bankruptcy . Once they gain greater market share and competitors are ousted, they attempt to raise prices. This strategy can work, or it can backfire, compounding their losses; however, this is the reason why many industries are dominated by a few big players, such as discount wholesale retail with stores including Sam's Club, BJ's Wholesale Club, and Costco.

How Can Companies Increase Market Share?

A company can increase its market share by offering its customers innovative technology, strengthening customer loyalty, hiring talented employees, and acquiring competitors.

New Technology

Innovation is one method by which a company may increase market share . When a firm brings to market a new technology its competitors have yet to offer, consumers wishing to own the technology buy it from that company, even if they previously did business with a competitor. Many of those consumers become loyal customers, which adds to the company's market share and decreases market share for the company from which they switched.

Customer Loyalty

By strengthening customer relationships, companies protect their existing market share by preventing current customers from jumping ship when a competitor rolls out a hot new offer. Better still, companies can grow market share using the same simple tactic, as satisfied customers frequently speak of their positive experiences to friends and relatives who become new customers. Gaining market share via word of mouth increases a company's revenues without concomitant increases in marketing expenses.

Talented Employees

Companies with the highest market share in their industries almost invariably have the most skilled and dedicated employees. Bringing the best employees on board reduces expenses related to turnover and training and enables companies to devote more resources to focus on their core competencies . Offering competitive salaries and benefits is one proven way to attract the best employees; however, employees in the 21st century also seek intangible benefits such as flexible schedules and casual work environments.

Acquisitions

Lastly, one of the surest methods to increase market share is acquiring a competitor . By doing so, a company accomplishes two things. It taps into the newly acquired firm's existing customer base, and it reduces the number of firms fighting for a slice of the same pie. Shrewd executives, whether in charge of small businesses or large corporations, always have their eye out for a good acquisition deal when their companies are in a growth model.

All multinational corporations measure success based on the market share of specific markets. China has been an important market for companies, as it is still a fast-growing market for many products. Apple Inc., for example, uses its market share numbers in China as a key performance indicator for the growth of its business.

Apple's market share in China's smartphone market has varied over the years. For instance, in Q3 2022, it had 14% of the market. In Q4 of 2023, it controlled 21% of the market.

Market share shows the size of a company, a useful metric in illustrating a company’s dominance and competitiveness in a given field. Market share is calculated as the percentage of company sales compared to the total share of sales in its respective industry over a period. A company’s market share can influence its operations significantly, namely, its share performance, scalability, and prices that it asks for its products or services.

Why Is Market Share Important?

Simply put, market share is a key indicator of a company's competitiveness. When a company increases its market share, this can improve its profitability. This is because as companies increase in size, they can also scale, offering lower prices and limiting their competitors' growth .

In some cases, companies may go so far as operating at a loss in some divisions to push out the competitors or force them into bankruptcy. After this point, the company may increase its market share and further increase prices. In financial markets, market share can significantly affect stock prices, especially in cyclical industries when margins are narrow and competition is fierce. Any marked difference in market share may trigger weakness or strength in investor sentiment.

What Strategies Are Used to Gain Market Share?

To gain greater market share, a company may apply one of many strategies. First, it may introduce new technology to attract customers that may have otherwise purchased from its competitor. Second, nurturing customer loyalty is a tactic that can result in both a solid existing customer base and expansion through word of mouth. Third, hiring talented employees prevents costly employee turnover expenses, allowing the company to prioritize its core competencies instead. Finally, with an acquisition, a company can reduce the number of competitors and acquire their base of customers.

How Do You Measure Market Share?

To determine a company's market share, you divide its total sales by its industry's total sales over a given period. For example, if a company sold $2 million worth of dishwashing liquid and the industry's total sales were $15 million, the company would have a market share of 2/15 = 13.3%

What Is a Low Market Share?

A low market share is considered to be less than half of the market share of the industry leader. So if the industry leader has a market share of 40% and another company has a market share of 10%, that company would be considered to have a low market share as 10% is less than 20% (half of 40%).

Market share is the percent of total industry sales a company has. The higher the market share, the more sales a company has than its competitors in their industry. Market share indicates how large a company is and how much influence it has in its industry. It can also be an indicator of growth and success.

Companies generally seek to increase their market share. Ways to do this are implementing new technologies, delivering a higher quality product, implementing good marketing, acquiring competitors, and generating customer loyalty.

Counterpoint. " China Smartphone Market Share: By Quarter ."

:max_bytes(150000):strip_icc():format(webp)/majority-of-the-market-share-is-captured-and-dominated-by-one-person--while-the-minority-share-market-is-owned-by-many-people-pareto-principle--80-and-20-percent-rules-1132415831-5c9f0e0bebaa408e902a6093e827a543.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

IMAGES

VIDEO

COMMENTS

View our collection of market share essays. Find inspiration for topics, titles, outlines, & craft impactful market share papers. Read our market share papers today!

Market Share Essays. Airbnb’s International Expansion: A Critical Evaluation of Growth Strategies. Introduction Established in 2008 by the visionary trio of Brian Chesky, Nathan Blecharczyk, and Joe Gebbia, Airbnb has quickly developed into a groundbreaking power inside the hospitality area.

Market share is the percent of total industry sales a company has. The higher the market share, the more sales a company has than its competitors in their industry.