| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

Cost Accounting: What It Is And When To Use It

Updated: Jun 1, 2024, 2:12pm

Table of Contents

What is cost accounting, types of cost accounting, cost accounting vs. financial accounting, cost accounting software, frequently asked questions (faqs).

Knowing how much your business spends is a key component of accounting. After all, if you don’t have this information on hand, it will be difficult to determine whether you’re making a profit. That’s where cost accounting comes in. It revolves around the costs associated with running your business.

Cost accounting is a type of managerial accounting that focuses on the cost structure of a business. It assigns costs to products, services, processes, projects and related activities. Through cost accounting, you can home in on where your business is spending its money, how much it earns and where you might be losing money. Managers and employees may use cost accounting internally to improve your business’s profitability and efficiency.

Featured Partners

Reg. Price: $15 per month; Special Offer: 75% off all plans for 3 months until February 13

On Xero's Website

Sage Intacct

On Sage's Website

$15 per month (for the first 3-months, then $30 per month)

Expert help, Invoicing, maximize tax deductions, track mileage

On QuickBooks' Website

Elements of Cost Accounting

There are a few key elements of cost accounting, listed below.

Direct and Indirect Materials

Materials are usually divided into two groups: direct and indirect. Direct materials are directly integrated into a finished product. Cotton in clothing and wood in furniture are a few examples of direct materials. Meanwhile, indirect materials are used in the production process but can’t be tied to a specific product, such as glue, gloves and tape.

Direct Labor

Labor refers to any wages to employees which relate to a specific aspect of producing products or delivering services. Wages can include salaries, hourly rates, overtime, bonuses and employee benefits.

Overheads are costs that relate to ongoing business expenses that are not directly attributed to creating products or services. Office staff, utilities, the maintenance and repair of equipment, supplies, payroll taxes, depreciation of machinery, rent and mortgage payments and sales staff are all considered overhead costs.

There are several types of cost accounting. Find the breakdown of each type below.

Standard Cost Accounting

Standard cost accounting is a traditional method for analyzing business costs. It assigns an average cost to labor, materials and overhead evenly so that managers can plan budgets, control costs and evaluate the performance of cost management. Many small businesses prefer standard cost accounting due to its ease and simplicity.

Activity-based Cost Accounting

Activity-based accounting (ABC) assigns overhead costs to products and services to give you a better idea of what they cost. Compared to standard cost accounting, ABC dives deeper into the cost of manufacturing a product or providing a service. It can help explain which activities increase production costs.

Marginal Cost Accounting

Also known as marginal costing, marginal cost accounting reveals the incremental cost that comes with producing additional units of goods and services. With marginal cost accounting, you can identify the point where production is maximized and costs are minimized.

Lean Accounting

Lean accounting is designed to streamline accounting processes to maximize productivity and quality. It eliminates unnecessary transactions and systems, reducing time, costs and waste. You can use it to understand what creates the most value for your customers and how you can continuously improve.

Life Cycle Accounting

Life cycle accounting examines the cost of producing a product from start to finish so you know how much you’ll spend on it over its useful life. It can come in handy if you’d like to choose between two or more assets, understand the benefits of an asset and budget more accurately.

Cost accounting is specifically intended for managers and employees who are a part of your business and responsible for making important decisions. It can help them improve operations and increase profitability.

Financial accounting, on the other hand, is designed to help shareholders, lenders, regulators and other parties who don’t have access to your internal information. It takes a business’s financials and presents them in a way that showcases how it’s doing in terms of assets, liabilities and shareholders’ equity.

The reality is cost accounting is complex and tedious. By automating it with cost accounting software, you can save time and money. NetSuite is one example of software that offers cost accounting capabilities. It’s versatile, customizable and integrates easily with a variety of other tools your business may already be using. Learn more about it with our NetSuite review .

Bottom Line

No matter your industry, cost accounting is essential for your internal team. It will help you record and analyze the costs of products in services so that you can operate smoothly and grow your business. If you don’t have the time or expertise to handle your accounting manually, get the help you need with one of the best accounting platforms .

What is the purpose of cost accounting?

Cost accounting can give your business detailed insight into how your money is being spent. With this information, you can better budget for the future, reduce inefficiencies and increase profitability.

What is the main difference between cost accounting and financial accounting?

Financial accounting is governed by regulators and must comply with the generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS). Cost accounting, however, doesn’t have to abide by these regulations since it’s used internally.

Is QuickBooks the best accounting software?

QuickBooks is one of the most popular accounting software programs on the market and while it is one of the best options, it’s not necessarily the best for every business. For example, while QuickBooks is very robust, it may involve a steeper learning curve and come at a higher cost than competitors–especially for businesses that want to use its payroll features. For more information, check out our QuickBooks Online review .

- Best Accounting Software for Small Business

- Best Quickbooks Alternatives

- Best Online Bookkeeping Services

- Best Accounting Software for Mac

- Best Construction Accounting Software

- Best Free Accounting Software

- Best Accounting Software for Nonprofits

- Best Church Accounting Software

- Best Real Estate Accounting Software

- Best Receipt Scanner Apps

- FreshBooks Review

- Xero Review

- QuickBooks Online Review

- Kareo Review

- Zoho Books Review

- Sage Accounting Review

- Neat Review

- Kashoo Review

- QuickBooks Self-Employed Review

- QuickBooks For LLC Review

- FreshBooks vs. Quickbooks

- Quicken vs. Quickbooks

- Xero vs. Quickbooks

- Netsuite vs. Quickbooks

- Sage vs. Quickbooks

- Quickbooks Pro vs. Premier

- Quickbooks Online vs. Desktop

- Wave vs. Quickbooks

- Gusto vs. Quickbooks

- Zoho Books vs. Quickbooks

- What Is Accounting? The Basics

- How Much Does An Accountant Cost?

- How To Find A Small Business Accountant

- Bookkeeping vs. Accounting

- Small Business Bookkeeping for Beginners

- What is Bookkeeping?

- Accounts Payable vs. Accounts Receivable

- What is a Balance Sheet?

Next Up In Business

- Best Accounting Software For Small Business

- Best QuickBooks Alternatives

- Quicken Review

- NeatBooks Review

- Gusto vs Quickbooks

- Quickbooks Online Vs. Desktop: What’s The Difference?

Best West Virginia Registered Agent Services Of 2024

Best Vermont Registered Agent Services Of 2024

Best Rhode Island Registered Agent Services Of 2024

Best Wisconsin Registered Agent Services Of 2024

Best South Dakota Registered Agent Services Of 2024

B2B Marketing In 2024: The Ultimate Guide

Anna Baluch is a freelance writer from Cleveland, Ohio. She enjoys writing about a variety of health and personal finance topics. When she's away from her laptop, she can be found working out, trying new restaurants, and spending time with her family. Connect to her on LinkedIn.

What is Cost Structure?

Fixed vs. variable costs, fixed costs, variable costs, direct vs. indirect costs, direct costs, indirect costs, cost allocation, example of cost allocation, the importance of cost structures and cost allocation, additional resources, cost structure.

The different types of cost structures incurred by a business

Cost structure refers to the various types of expenses a business incurs and is typically composed of fixed and variable costs . Costs may also be divided into direct and indirect costs. Fixed costs are costs that remain unchanged regardless of the amount of output a company produces, while variable costs change with production volume.

Direct costs are costs that can be attributed to a specific product or service, and they do not need to be allocated to the specific cost object. Indirect costs are costs that cannot be easily associated with a specific product or activity because they are involved in multiple activities.

Operating a business must incur some kind of costs, whether it is a retail business or a service provider. Cost structures differ between retailers and service providers, thus the expense accounts appearing on a financial statement depend on the cost objects, such as a product, service, project, customer or business activity. Even within a company, cost structure may vary between product lines, divisions or business units, due to the distinct types of activities they perform.

Key Highlights

- Cost structure refers to the various types of expenses a business incurs and is typically composed of fixed and variable costs, or direct and indirect costs.

- Fixed costs are incurred regularly and are unlikely to fluctuate over time. Variable costs are expenses that vary with production output.

- Direct costs are costs that are directly related to the creation of a product and can be directly associated with that product. Direct costs are usually variable costs, with the possible exception of labor costs. Indirect costs are costs that are not directly related to a specific cost object. Indirect costs may be fixed or variable.

- Having a firm understanding of the difference between fixed and variable and direct and indirect costs is important because it shapes how a company prices the goods and services it offers.

Fixed costs are incurred regularly and are unlikely to fluctuate over time. Examples of fixed costs are overhead costs such as rent, interest expense, property taxes, and depreciation of fixed assets. One special example of a fixed cost is direct labor cost. While direct labor cost tends to vary according to the number of hours an employee works, it still tends to be relatively stable and, thus, may be counted as a fixed cost, although it is more commonly classified as a variable cost where hourly workers are concerned.

Variable costs are expenses that vary with production output. Examples of variable costs may include direct labor costs, direct material cost , and bonuses and sales commissions. Variable costs tend to be more diverse than fixed costs. For businesses selling products, variable costs might include direct materials, commissions, and piece-rate wages. For service providers, variable expenses are composed of wages, bonuses, and travel costs. For project-based businesses, costs such as wages and other project expenses are dependent on the number of hours invested in each of the projects.

As alluded to earlier, direct costs are costs that are directly related to the creation of a product and can be directly associated with that product. Direct material is an example of a direct cost.

Direct costs are almost always variable because they are going to increase when more goods are produced. As discussed earlier, an exception to this is labor. Employee wages may be fixed and unlikely to change over the course of a year. However, if the employees are hourly and not on a fixed salary then the direct labor costs can increase if more products are manufactured.

Indirect costs are costs that are not directly related to a specific cost object like a function, product or department. They are costs that are needed for the sake of the company’s operations and health. Some other examples of indirect costs include overhead , security costs, administration costs, etc. The costs are first identified, pooled, and then allocated to specific cost objects within the organization.

Indirect costs may be either fixed or variable costs. An example of a fixed cost is the salary of a project supervisor assigned to a specific project. An example of a variable indirect cost would be utilities expense. This expense may fluctuate depending on production (for example, there would be an increase in utility expense if a manufacturing plant is running at a higher capacity utilization ).

Having a firm understanding of the difference between fixed and variable and direct and indirect costs is important because it shapes how a company prices the goods and services it offers. Knowing the actual costs of production enables the company to price its products efficiently and competitively.

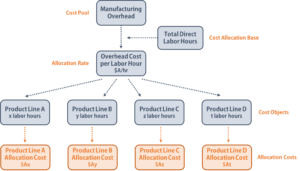

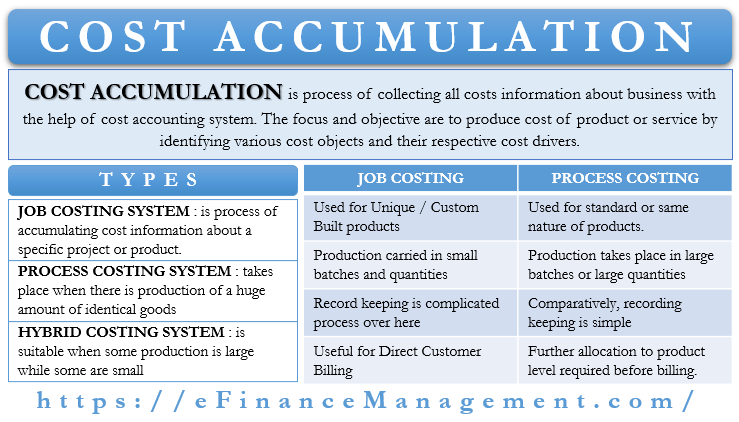

Cost allocation is the process of identifying costs incurred, and then accumulating and assigning them to the right cost objects (e.g. product lines, service lines, projects, departments, business units, customers, etc.) on some measurable basis. Cost allocation is used to distribute costs among different cost objects in order to calculate the profitability of different product lines.

A cost pool is a grouping of individual costs, from which cost allocations are made later. Overhead cost, maintenance cost and other fixed costs are typical examples of cost pools. A company usually uses a single cost-allocation basis, such as labor hours or machine hours, to allocate costs from cost pools to designated cost objects.

A company with a cost pool of manufacturing overhead uses direct labor hours as its cost allocation basis. The company first accumulates its overhead expenses over a period of time (for example, a year) and then divides the total overhead cost by the total number of labor hours to find out the overhead cost “per labor hour” (the overhead allocation rate ). Finally, the company multiplies the hourly cost by the number of labor hours spent to manufacture a product to determine the overhead cost for that specific product line.

To maximize profits , businesses must find every possible way to minimize costs. While some fixed costs are vital to keeping the business running, a financial analyst should always review the financial statements to identify possible excessive expenses that do not provide any additional value to core business activities.

When an analyst understands the overall cost structure of a company, they can identify feasible cost-reduction methods without affecting the quality of products sold or service provided to customers. The financial analyst should also keep a close eye on the cost trend to ensure stable cash flows and no sudden cost spikes occurring.

Cost allocation is an important process for a business because if costs are misallocated, then the business might make wrong decisions, such as over/underpricing a product, or invest unnecessary resources in non-profitable products. The role of a financial analyst is to make sure costs are correctly attributed to the designated cost objects and that appropriate cost allocation bases are chosen.

Cost allocation allows an analyst to calculate the per-unit costs for different product lines, business units, or departments, and, thus, to find out the per-unit profits. With this information, a financial analyst can provide insights on improving the profitability of certain products, replacing the least profitable products, or implementing various strategies to reduce costs.

- Cost Behavior Analysis

- Marginal Cost Formula

- Cost Method

- See all accounting resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Classification of Cost

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on March 07, 2023

Get Any Financial Question Answered

Table of contents.

The idea of cost accounting is to collect, classify, record, and suitably allocate expenditures to determine the costs of products or services.

After collecting costs, these are classified to ensure their identification with cost centers or cost units.

Costs have different features or characteristics, and they are grouped or classified based on their common characteristics.

The process of grouping costs based on their common characteristics is known as the classification of cost .

Different Classes of Cost

The groups that costs are classified into are known as classes .

Costs can be classified using different bases or characteristics, including element, nature, variability, controllability , normality, and function. The main classes of cost are shown in the image below.

Classification of Cost by Element

In this class, costs are categorized based on the factors they are incurred for. Based on their elements, costs may be grouped as:

- Material cost

Material cost refers to the cost of commodities supplied to an undertaking (e.g., in the case of a textile mill, the cost of cotton or yarn, the cost of cotton waste to clean the machinery, the cost of dyes, the cost of finishing material, and so on).

Labor cost refers to the cost of paying employees in an undertaking, which includes salary, wages, and commission.

Expenses refer to the cost of services provided to an undertaking and include the notional cost of owned assets (e.g., rent for a building, telephone expenses, depreciation of the owned factory building, depreciation of delivery van, and so on).

Classification of Cost by Nature

In this class, costs are classified based on their identifiability with cost centers or cost units. Costs can be grouped as follows based on their nature:

- Direct costs

- Indirect costs

Direct costs are costs that can be directly and easily traced to (or identified with) a product, process, or department.

Common examples of direct costs include the materials used and labor employed in manufacturing an article or in a production process.

Indirect costs , on the other hand, are costs that are not traceable to any particular product, process, or department, but which are common in a number of products, processes, or departments.

Examples of indirect costs are factory rent, factory insurance, and the salary of the factory manager.

Classification of Cost by Variability or Behavior

Costs (both direct and indirect) can also be classified into the following groups based on their behavior relative to changes in the volume of activity:

- Variable costs

- Fixed costs

- Semi-variable or semi-fixed costs

Variable costs are costs that vary in a directly proportional way to changes in the volume of output or sales.

These costs tend to increase or decrease with the rise and fall in production or sales. Variable costs vary in total but their per-unit cost stays the same.

Examples of variable costs are direct material cost, direct wages, direct expenses, consumable stores, and commission on sales.

Fixed costs are costs that generally remain unaffected by changes in sales volume/output. Fixed costs remain unchanged when output or sales increase or decrease.

These costs remain fixed in total but their per-unit cost changes with output or sales.

These costs depend mainly on the passage of time and do not vary directly with the changes in the volume of output or sales.

Typical examples of fixed costs include rent, rates, taxes, insurance charges, and salaries for managers.

It is worth remembering that fixed costs are not absolutely fixed for all of time. In fact, fixed costs are fixed only in relation to a particular level of production capacity.

Semi-variable costs are costs that tend to vary with changes in the volume of output or sales, but which do not vary in a directly proportional way relative to such changes. These costs have the characteristics of both fixed and variable costs.

One part of semi-variable costs remains constant irrespective of changes in the volume of output or sales. By contrast, the other part varies in proportion to changes in the volume of output or sales.

Typical examples of semi-variable costs include repairs and maintenance costs for plants, machinery, and buildings and supervisor salaries.

Cost Classification by Controllability

Under this category, costs are classified based on whether or not they are influenced by the action of a given member of an undertaking. The classes of costs are:

- Controllable costs

- Uncontrollable costs

Controllable costs are costs that an entity in an undertaking can influence through their action.

An undertaking is usually divided into several departments or cost centers that are placed under the direct control and supervision of specified persons.

The person in charge of a particular department or cost center can control only those costs that come directly under their control.

Uncontrollable costs , on the other hand, are costs that cannot be influenced by the action of a specified member of an undertaking.

Costs that are controllable for one person may be uncontrollable for another person.

Therefore, the issue of whether a cost is controllable or uncontrollable is determined by the individual or level of management in question.

Cost Classification by Normality

In this category, costs are classified based on whether they are normally incurred at a particular level of output under the conditions for which that level of output is normally attained.

Based on normality, costs may be classified as:

- Normal or unavoidable costs

- Abnormal or avoidable costs

Normal or unavoidable costs are normally incurred at a given level of output under the conditions for which that level of output is normally attained. Costs of this kind cannot be avoided at all.

The cost of normal spoilage of materials and the cost of normal idle time are typical examples of normal costs.

Abnormal or avoidable costs are costs that are not normally incurred at a given level of output under the conditions for which that level of output is attained.

It is possible to avoid such costs if proper care is taken. The cost of spoilage of material over and above the normal limit is an example of an abnormal cost.

Cost Classification by Function

Costs can also be classified based on their perceived function. The following types of cost exist by function:

- Production costs

- Administration costs

- Selling costs

- Distribution costs

Production costs refer to costs that arise in the course of acquiring, processing, and using raw materials.

Production costs include the cost of materials, cost of labor, other factory expenses, and the cost of primary packing.

Administration costs are the costs incurred in formulating business policies, directing the organization, and controlling the operations of an undertaking.

Administration costs are not related to research, development, production, distribution, or selling activities.

Selling costs are incurred to create and stimulate demand and secure orders. As such, these costs are incurred in connection with the marketing of products.

Distribution costs are associated with the sequence of operations. This sequence starts with dispatch preparations for the packed product and ends by facilitating the availability of the reconditioned, returned, and empty packages for re-use.

Classification by Time

From the view of time, costs can be classified as:

- Historical costs

- Predetermined costs

Historical costs are costs that are identified after they have been incurred. That is to say, they are determined after goods have been manufactured or services have been rendered.

Historical costs simply represent a post-mortem of past events, and they are useful in ascertaining profitability but not in exercising cost control.

Predetermined costs are computed in advance of production based on a specification of all the factors affecting them. Predetermined costs can be further divided into:

- Estimated costs

- Standard costs

Estimated costs are costs that, according to investigation and analysis, are most likely to be incurred.

They are estimated in advance based on the following assumptions: firstly, that costs are more or less free to move; and secondly, that what is made is the best estimate of the cost conditions that will apply when the cost is incurred.

Standard costs refer to a predetermined cost that is calculated from the management's standards of efficient operation and the relevant necessary expenditure.

Standard cost is established based on the assumption that costs will not be allowed to move freely but will be controlled as far as possible.

This ensures that the actual cost will be as close to the standard cost as possible, and that any disparity between actual and standard cost can be reasonably explained.

The basic difference between an estimated cost and a standard cost is that an estimated cost is a more or less reasonable assessment of what a cost will be when it is incurred.

A standard cost, on the other hand, is a specification of what a cost ought to be when it is incurred.

Cost Classification by Relevance to Decision-making and Control

In this category, costs are classified based on whether they are relevant to managerial decisions. These costs are as follows:

Marginal Cost: Marginal cost is defined as "the amount at any given volume of output by which aggregate costs are changed if the volume of output is increased or decreased by one unit."

Marginal cost refers to the increase in total cost that results from an increase in output by one unit.

Marginal cost is denoted by variable cost, and it consists of direct material cost, direct labor cost, direct expenses, and variable overheads.

Sunk Costs: Sunk costs refer to costs that have already been incurred and cannot be changed by a future decision. These costs become irrelevant costs for later decisions.

For example, if a manager decides to replace an existing machine with a new one, the amount of capital invested in the existing machine (less scrap value) will be irrecoverable and, as a result, is known as a 'sunk cost'.

Out-of-pocket Costs: These costs represent the present or future case expenditure regarding decisions, which vary based on the nature of the decision.

Management decisions are directly affected by such costs because they give rise to cash expenditure.

For example, consider a firm that has its own fleet for transporting raw materials and finished goods from one place to another.

It seeks to replace these vehicles by employing public carriers.

In making this decision, the depreciation of the vehicles is not to be considered but the management must take into account the present expenditure on fuel, maintenance, and driver salaries. Such costs are treated as out-of-pocket costs.

Opportunity Costs: The opportunity cost of a product or service is measured in terms of revenue that could have been earned by applying the resources to some other use. Opportunity cost can be defined as the cost of foregoing the best alternative.

Thus, the opportunity cost of yarn produced by a composite spinning and weaving mill, which is used in the weaving section, would be the price that could have been obtained by selling the yarn in the market.

Imputed Costs: Imputed costs are costs that are not included in costs but are considered for making management decisions. These costs are hypothetical in character.

For example, interest on capital, though not actually payable, must often be included to judge the relative profitability of two products involving unequal outlays of cash .

Differential Costs: Differential costs refer to the difference in total costs between two alternatives.

When choosing an alternative increases total costs, such increased costs are known as incremental costs .

On the other hand, if the choice results in a decrease in total costs, such decreased costs are called decremental costs .

Shut-down Costs: Shut-down costs are costs that will still be incurred when a plant is shut down temporarily.

Sometimes, the normal operations of a business must be suspended temporarily due to unfavorable market conditions, strikes, or other forces.

During the suspension of production or other activities, certain costs may still need to be incurred, and these are considered 'shut-down costs'.

Examples of shut-down costs include rent for factory premises, salaries of top management, and so on.

Postponable Costs: These are the costs that can be postponed or shifted to the future with little or no effect on the efficiency of current operations. These costs are postponable but not avoidable and must be incurred at a later stage.

The concept of a postponable cost is highly significant in the railway and transport business, where it’s possible to delay the cost of repairs and maintenance for a certain period.

In manufacturing, economic crises can also be averted by postponing certain costs. This strategy was used during the depression period.

Replacement Cost: Replacement cost is the cost of replacing an asset in the current market or at the current price.

Thus, the replacement cost of an asset is the cost that would be incurred if the asset were purchased at the current market price and not at the original purchase price.

Abandonment Costs: Abandonment refers to the complete retirement or withdrawal of a fixed asset from service or use. Fixed assets are abandoned when they are no longer serviceable.

Abandonment cost refers to the cost incurred in abandoning a fixed asset (i.e., the cost that cannot be recovered or salvaged from the abandoned asset). It is also known as abandonment loss.

Other Types of Cost

Research Cost: This refers to the cost of searching for new or improved products, new applications of materials, or new or improved methods of production.

Development Cost: This refers to the cost of the process that begins with making the decision to produce a new/improved product/method and ends with the commencement of formal production of that product/method.

Pre-production Cost: This refers to the part of the overall development cost that is incurred in making a trial production run before beginning formal production.

Conversion Cost: This refers to the costs incurred to convert raw materials into finished goods, and it consists of direct labor cost, direct expenses, and factory overhead .

Classification of Cost FAQs

What is classification of cost.

Classification of Cost is the process of organizing costs into categories for better understanding and analysis. It involves dividing costs into fixed, variable, direct, indirect, and semi-variable to help in better decision-making.

What are examples of costs that can be classified?

Examples of costs that can be classified include raw materials, labor costs, administrative expenses, marketing expenses, overhead costs, etc.

What are the advantages of classifying cost?

The advantages of classifying costs include obtaining an accurate assessment of cost performance; increased efficiency in managing costs; improved accuracy when estimating future costs; enhanced ability to identify areas for potential savings; and improved forecasting and budgeting capabilities.

How can costs be classified?

Costs can be classified based on several criteria such as nature of cost, elements of cost, controllability of cost, function or department from where the cost is incurred, etc.

What are the different categories of cost classification?

The different categories of cost classification include fixed costs, variable costs, direct costs, indirect costs, and semi-variable costs. Each category has its characteristics that help in understanding the cost structure and making more informed decisions.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Account Analysis Method

- Committed vs Discretionary Fixed Cost

- Cost Center and Cost Unit

- Cost of Production Report (CPR) Questions and Answers

- Difference Between Controllable and Uncontrollable Costs

- Difference Between Direct Costs and Indirect Costs

- Difference Between Product Costs and Period Costs

- Dual-Rate Method

- Fixed Costs

- Period Expenses

- Process Costing

- Semi-Variable Costs

- Variable Cost

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch, submit your info below and someone will get back to you shortly..

What is Cost Assignment?

Share This...

Cost assignment.

Cost assignment is the process of associating costs with cost objects, such as products, services, departments, or projects. It encompasses the identification, measurement, and allocation of both direct and indirect costs to ensure a comprehensive understanding of the resources consumed by various cost objects within an organization. Cost assignment is a crucial aspect of cost accounting and management accounting, as it helps organizations make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

There are two main components of cost assignment:

- Direct cost assignment: Direct costs are those costs that can be specifically traced or identified with a particular cost object. Examples of direct costs include direct materials, such as raw materials used in manufacturing a product, and direct labor, such as the wages paid to workers directly involved in producing a product or providing a service. Direct cost assignment involves linking these costs directly to the relevant cost objects, typically through invoices, timesheets, or other documentation.

- Indirect cost assignment (Cost allocation): Indirect costs, also known as overhead or shared costs, are those costs that cannot be directly traced to a specific cost object or are not economically feasible to trace directly. Examples of indirect costs include rent, utilities, depreciation, insurance, and administrative expenses. Since indirect costs cannot be assigned directly to cost objects, organizations use various cost allocation methods to distribute these costs in a systematic and rational manner. Some common cost allocation methods include direct allocation, step-down allocation, reciprocal allocation, and activity-based costing (ABC).

In summary, cost assignment is the process of associating both direct and indirect costs with cost objects, such as products, services, departments, or projects. It plays a critical role in cost accounting and management accounting by providing organizations with the necessary information to make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

Example of Cost Assignment

Let’s consider an example of cost assignment at a bakery called “BreadHeaven” that produces two types of bread: white bread and whole wheat bread.

BreadHeaven incurs various direct and indirect costs to produce the bread. Here’s how the company would assign these costs to the two types of bread:

- Direct cost assignment:

Direct costs can be specifically traced to each type of bread. In this case, the direct costs include:

- Direct materials: BreadHeaven purchases flour, yeast, salt, and other ingredients required to make the bread. The cost of these ingredients can be directly traced to each type of bread.

- Direct labor: BreadHeaven employs bakers who are directly involved in making the bread. The wages paid to these bakers can be directly traced to each type of bread based on the time spent working on each bread type.

For example, if BreadHeaven spent $2,000 on direct materials and $1,500 on direct labor for white bread, and $3,000 on direct materials and $2,500 on direct labor for whole wheat bread, these costs would be directly assigned to each bread type.

- Indirect cost assignment (Cost allocation):

Indirect costs, such as rent, utilities, equipment maintenance, and administrative expenses, cannot be directly traced to each type of bread. BreadHeaven uses a cost allocation method to assign these costs to the two types of bread.

Suppose the total indirect costs for the month are $6,000. BreadHeaven decides to use the number of loaves produced as the allocation base , as it believes that indirect costs are driven by the production volume. During the month, the bakery produces 3,000 loaves of white bread and 2,000 loaves of whole wheat bread, totaling 5,000 loaves.

The allocation rate per loaf is:

Allocation Rate = Total Indirect Costs / Total Loaves Allocation Rate = $6,000 / 5,000 loaves = $1.20 per loaf

BreadHeaven allocates the indirect costs to each type of bread using the allocation rate and the number of loaves produced:

- White bread: 3,000 loaves × $1.20 per loaf = $3,600

- Whole wheat bread: 2,000 loaves × $1.20 per loaf = $2,400

After completing the cost assignment, BreadHeaven can determine the total costs for each type of bread:

- White bread: $2,000 (direct materials) + $1,500 (direct labor) + $3,600 (indirect costs) = $7,100

- Whole wheat bread: $3,000 (direct materials) + $2,500 (direct labor) + $2,400 (indirect costs) = $7,900

By assigning both direct and indirect costs to each type of bread, BreadHeaven gains a better understanding of the full cost of producing each bread type, which can inform pricing decisions, resource allocation, and performance evaluation.

Other Posts You'll Like...

REG CPA Exam: Understanding the Levels of the Judicial Process as it Related to Tax Matters

REG CPA Exam: Understanding the Tax Audit and Appeals Process

REG CPA Exam: Understanding the Role and Authority of State Boards of Accountancy

REG CPA Exam: Example Situations Resulting in Tax Return Preparer Penalties

REG CPA Exam: Understanding the Definition of a Tax Return Preparer or TRP

REG CPA Exam: Understanding the Regulations Governing Practice Before the IRS

Helpful links.

- Learn to Study "Strategically"

- How to Pass a Failed CPA Exam

- Samples of SFCPA Study Tools

- SuperfastCPA Podcast

“I Shouldn’t Be Able to Do This”: How Colbi Passed Her CPA Exams

The 5 Biggest Myths About CPA Exam Study

From 8 Hours a Day to 8 Hours a Week, How Branden Passed His CPA Exams

5 High Impact CPA Study Strategies

How Melodie Passed Her CPA Exams by Making Every Morning Count

Inconsistent CPA Study? Try These 4 Strategies

Want to pass as fast as possible, ( and avoid failing sections ), watch one of our free "study hacks" trainings for a free walkthrough of the superfastcpa study methods that have helped so many candidates pass their sections faster and avoid failing scores....

Make Your Study Process Easier and more effective with SuperfastCPA

Take Your CPA Exams with Confidence

- Free "Study Hacks" Training

- SuperfastCPA PRO Course

- SuperfastCPA Review Notes

- SuperfastCPA Audio Notes

- SuperfastCPA Quizzes

Get Started

- Free "Study Hacks Training"

- Read Reviews of SuperfastCPA

- Busy Candidate's Guide to Passing

- Subscribe to the Podcast

- Purchase Now

- Nate's Story

- Interviews with SFCPA Customers

- Our Study Methods

- SuperfastCPA Reviews

- CPA Score Release Dates

- The "Best" CPA Review Course

- Do You Really Need the CPA License?

- 7 Habits of Successful Candidates

- "Deep Work" & CPA Study

Module 5: Job Order Costing

Introduction to accumulating and assigning costs, what you will learn to do: assign costs to jobs.

Financial and managerial accountants record costs of production in an account called Work in Process. The total of these direct materials, direct labor, and factory overhead costs equal the cost of producing the item.

In order to understand the accounting process, here is a quick review of how financial accountants record transactions:

Let’s take as simple an example as possible. Jackie Ma has decided to make high-end custom skateboards. She starts her business on July 1 by filing the proper forms with the state and then opening a checking account in the name of her new business, MaBoards. She transfers $150,000 from her retirement account into the business account and records it in a journal as follows:

| Date | Account/Explanation | Debit | Credit |

|---|---|---|---|

| Jul 01 | Checking Account | 150,000 | |

| Owner’s Capital | 150,000 | ||

For purposes of this ongoing example, we’ll ignore pennies and dollar signs, and we’ll also ignore selling, general, and administrative costs.

After Jackie writes the journal entry, she posts it to a ledger that currently has only two accounts: Checking Account, and Owner’s Capital.

Debits are entries on the left side of the account, and credits are entries on the right side.

Here is a quick review of debits and credits:

You can view the transcript for “Colin Dodds – Debit Credit Theory (Accounting Rap Song)” here (opens in new window) .

Also, this system of debits and credits is based on the following accounting equation:

Assets = Liabilities + Equity.

- Assets are resources that the company owns

- Liabilities are debts

- Equity is the amount of assets left over after all debts are paid

Let’s look at one more initial transaction before we dive into recording and accumulating direct costs such as materials and labor.

Jackie finds the perfect building for her new business; an old woodworking shop that has most of the equipment she will need. She writes a check from her new business account in the amount of $2,500 for July rent. Because she took managerial accounting in college, she determines this to be an indirect product expense, so she records it as Factory Overhead following a three-step process:

- Analyze transaction

Because her entire facility is devoted to production, she determines that the rent expense is factory overhead.

2. Journalize transaction using debits and credits

If she is using QuickBooks ® or other accounting software, when she enters the transaction into the system, the software will create the journal entry. In any case, whether she does it by hand or computer, the entry will look much like this:

| Date | Account/Explanation | Debit | Credit |

|---|---|---|---|

| Jul 03 | Factory Overhead | 2,500 | |

| Checking Account | 2,500 | ||

3. Post to the ledger

Again, her computer software will post the journal entry to the ledger, but we will follow this example using a visual system accountants call T-accounts. The T-account is an abbreviated ledger. Click here to view a more detailed example of a ledger .

Jackie posts her journal entry to the ledger (T-accounts here).

She now has three accounts: Checking Account, Owner’s Capital, and Factory Overhead, and the company ledger looks like this:

In a retail business, rent, salaries, insurance, and other operating costs are categorized into accounts classified as expenses. In a manufacturing business, some costs are classified as product costs while others are classified as period costs (selling, general, and administrative).

We’ll treat factory overhead as an expense for now, which is ultimately a sub-category of Owner’s Equity, so our accounting equation now looks like this:

Assets = Liabilities + Owner’s Equity

147,500 = 150,000 – 2,500

Notice that debits offset credits and vice versa. The balance in the checking account is the original deposit of $150,000, less the check written for $2,500. Once the check clears, if Jackie checks her account online, she’ll see that her ledger balance and the balance the bank reports will be the same.

Here is a summary of the rules of debits and credits:

Assets = increased by a debit, decreased by a credit

Liabilities = increased by a credit, decreased by a debit

Owner’s Equity = increased by a credit, decreased by a debit

Revenues increase owner’s equity, therefore an individual revenue account is increased by a credit, decreased by a debit

Expenses decrease owner’s equity, therefore an individual expense account is increased by a debit, decreased by a credit

Here’s Colin Dodds’s Accounting Rap Song again to help you remember the rules of debits and credits:

Let’s continue to explore job costing now by using this accounting system to assign and accumulate direct and indirect costs for each project.

When you are done with this section, you will be able to:

- Record direct materials and direct labor for a job

- Record allocated manufacturing overhead

- Prepare a job cost record

Learning Activities

The learning activities for this section include the following:

- Reading: Direct Costs

- Self Check: Direct Costs

- Reading: Allocated Overhead

- Self Check: Allocated Overhead

- Reading: Subsidiary Ledgers and Records

- Self Check: Subsidiary Ledgers and Records

- Introduction to Accumulating and Assigning Costs. Authored by : Joseph Cooke. Provided by : Lumen Learning. License : CC BY: Attribution

- Colin Dodds - Debit Credit Theory (Accounting Rap Song). Authored by : Mr. Colin Dodds. Located at : https://youtu.be/j71Kmxv7smk . License : All Rights Reserved . License Terms : Standard YouTube License

- What the General Ledger Can Tell You About Your Business. Authored by : Mary Girsch-Bock. Located at : https://www.fool.com/the-blueprint/general-ledger/ . License : All Rights Reserved . License Terms : Standard YouTube License

Privacy Policy

- What is Accounting?

- What Is a General Ledger?

- What are Accounts Receivable?

- Balance Sheet vs Income Statement

- What are Real Accounts?

- What is Working Capital?

- Net Sales vs Gross Sales

- Overview of Financial Controls

- Financial Accounting

- Managerial Accounting

- Cost Accounting

- Cloud Accounting

- Project Accounting

- Best Accounting Software

- Free Accounting Software

- Nonprofit Accounting Software

- Cloud-Based Accounting Software

- Billing and Invoicing Software

- Payroll Software for Small Businesses

- QuickBooks Alternatives

- QuickBooks vs FreshBooks

- QuickBooks Time Pricing

- FreshBooks Pricing

- NetSuite Pricing

- Calculate Customer Acquisition Costs

- Calculate Accumulated Depreciation

- Accounts Receivable Turnover Ratio

- Calculate Cost of Goods Manufactured

- Calculate Cost of Goods Sold

- Calculate Job Order Costing

- Debt Service Coverage Ratio

- Calculate Unit Economics

Elements of Cost in Cost Accounting with Examples

In cost accounting , elements of cost refers to the components that make up the cost of manufacturing a product. The three main cost elements include material, labor, and expenses.

You can subdivide these elements into direct and indirect material, direct and indirect labor, and direct and indirect expenses. However, you can group the elements of costs into two categories: direct and indirect costs.

Direct costs include direct material, labor, and expense, which form the prime cost. Similarly, all the indirect costs, such as indirect material, labor, and expense, are also known as supplementary costs.

This article covers everything you need to know about the 4 elements of costs in cost accounting.

Let’s get started.

1. Material

Material refers to all the raw materials involved in creating a finished product, whether direct or indirect.

Types of Materials

1. direct materials.

Direct material cost includes all raw materials and goods a company requires to create its product. You can call them functional materials because, without these materials, there will be no production.

When considering direct material cost during production, remember that the overall cost depends on the company's output.

The most influential factor when considering the cost of direct materials is the output size. This direct cost comes in the form of process, stored, purchased primary packing, and production materials that’s integral to the success of every manufacturing process.

An example of a direct material is cotton in the production of clothing and textiles. Furniture-based organizations require direct materials like wood to execute production operations.

2. Indirect Materials

Indirect materials are resources or tools used in production that do not directly fluctuate with the output. In simple terms, indirect materials play a significant role in a company’s overall production process but are not integral to the furnished product.

A production company can function without these materials because the final product does not need them to be effective. Some examples of indirect materials include disposable gloves, personal protective equipment, tape, and nails.

Indirect material cost does not vary in direct proportion to the product. As a business owner, pay attention to the difference between these elements and their unique cost types to ensure you don't go overboard in costing and financial reporting.

Once you understand direct and indirect materials, you can seamlessly make informed decisions. For example, determining the total cost of production, setting selling prices, and analyzing the efficiency of the production process becomes easier and more accurate.

Your knowledge of direct and indirect materials is handy when making vital decisions like budgeting, cost control, and managerial decision-making regarding resource allocation.

Labor cost is vital in successfully executing an organization's production cycle. Human resources are among the most valuable resources that give a company an advantage regarding production. Without people, nothing happens in an organization.

The process of managing human resources requires proper cost allocation and informed decisions. In simple terms, labor cost refers to the amount an organization pays to workers involved in production. Labor in cost accounting includes direct and indirect labor.

Types of Labor

1. direct labor.

Direct labor cost is remuneration paid to the individuals or staff producing goods and services. The amount you pay employees is directly proportional to the product output.

Most companies calculate the input these workers offer based on the overall output to pay them the amount due.

Direct labor cost refers to direct wages you can trace to specific products or services. Any form of salary paid to trainees or apprentices does not come under direct labor.

For example, in a food packaging production line, the workers assembling the food carry out direct labor. You can consider their wages as direct costs associated with the production of each food package.

2. Indirect Labor

An indirect laborer is an individual who supports the production process through supervision or monitoring but is not directly involved in producing goods or services.

Indirect labor costs are wages paid to dispensable workers in producing goods. Their work does not vary directly with the product output, which means a higher increase in production does not mean a pay increase.

An example of this indirect cost is the amount you pay interns for a particular job in a beverage company.

Remember that every manufacturing firm has key players, like maintenance staff, supervisors, and quality control inspectors. These staff members are not part of the production team, which means they do not get their hands dirty with the production process.

As long as they are staff members in a manufacturing firm, they will receive a salary, which is indirect labor costs.

A clear understanding of the difference between direct and indirect labor costs is your one-way ticket to accurate figures in cost accounting and financial analysis.

This information will make the process seamless when making managerial decisions concerning workforce allocation, productivity improvement, and cost control.

3. Expenses

Expenses are a vital element of cost in cost accounting. This type of cost centers around the amount an organization pays or spends during production.

In simple terms, expenses refer to costs incurred during production to generate more revenue, such as production costs.

Examples of expenses include payments to suppliers, employee wages, factory leases, and equipment depreciation. The prices of these expenses largely depend on the production level, whether on a large or small scale.

Types of Expenses

1. direct expenses.

Direct expenses are known as chargeable expenses. They refer to expenses incurred during an organization's production process. Examples include the cost of goods sold (COGS) , administrative fees, office supplies, direct labor, and rent.

Such expenses vary directly with the output, meaning the more you produce, the more money you spend. These expenses are specifically incurred and vital to the success of their production process. Without this manufacturing expense, the production of goods will not occur.

You must ensure you properly manage your direct expenses to seamlessly maximize profit without incurring loss.

2. Indirect Expenses

Indirect expenses refer to various costs incurred by an organization necessary for production. The difference between this form of expense and the direct expense is that there is no specificity to the indirect expense.

In most cases, the expenses occur outside the company's day-to-day activities and may be hard to track without proper assessment.

Indirect expenses do not vary with the output and are not easily identifiable. An example of indirect expense is the cost incurred for electricity during cloth manufacture, interest charges, and other costs associated with borrowing money.

4. Overhead

Overhead are indirect costs incurred in the production of goods in an organization. These costs are necessary for daily business operations.

You can define it as the summation of indirect material, labor, and expenses. In most cases, the cost and management accountants are responsible for running these costs.

Types of Overheads

1. factory or manufacturing overhead.

Factory or manufacturing overhead refers to a particular cost unit or indirect manufacturing costs incurred within an owned factory building.

Examples include factory rent, equipment depreciation, maintenance, taxes, and rates.

2. Administration Overhead

Administration overhead is a cost related to the administration of a company or organization . This overhead cost includes insurance, audit fees, stationery, and office salaries. Office cost is the summation of factory cost and administration overhead.

3. Selling and Distribution Overheads

Selling overhead refers to expenses in connection with sales in manufacturing operations. Examples are sales commissions, advertising costs, travel expenses, marketing materials, and customer entertainment.

4. Distribution Overhead

Distribution overhead refers to expenses involved from the time of the finished product to the time of delivery to consumers.

Examples are costs incurred during transportation, warehousing, packaging, and marketing. They are useful in calculating individual cost units.

Explore Further

- Variable Cost vs. Fixed Cost

- What Is an Expenditure?

- Business Cycle

- Working Capital vs Investing Capital

- What is Financial Accounting?

- What is Managerial Accounting?

Was This Article Helpful?

Martin luenendonk.

Martin loves entrepreneurship and has helped dozens of entrepreneurs by validating the business idea, finding scalable customer acquisition channels, and building a data-driven organization. During his time working in investment banking, tech startups, and industry-leading companies he gained extensive knowledge in using different software tools to optimize business processes.

This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions.

Cost Element: How to Define and Use Your Cost Elements

1. what is a cost element and why is it important for accounting and budgeting, 2. how to classify your costs into different categories based on their nature and behavior, 3. how to link your cost elements to your cost objects such as products, projects, activities, or orders, 4. how to use your cost elements to track and monitor your costs and performance indicators, 5. how to generate and interpret reports based on your cost elements and what insights to derive from them.

Cost elements are the basic building blocks of any accounting and budgeting system. They represent the different types of costs that a business incurs or generates in its operations. Cost elements can be classified into various categories, such as direct or indirect, fixed or variable, product or period, and so on. Understanding the nature and behavior of cost elements is crucial for managers and accountants, as they help them to plan, control, and evaluate the performance of the business . In this section, we will explore the following aspects of cost elements:

1. The definition and characteristics of cost elements. A cost element is a unit of measurement that describes the amount of resources consumed or produced by a specific activity, process, or output. Cost elements have two main characteristics: they have a monetary value and they can be traced to a cost object. A cost object is anything for which costs are measured and assigned, such as a product, a service, a department, a project, or a customer.

2. The purpose and benefits of cost elements. Cost elements serve several purposes and provide various benefits for accounting and budgeting. Some of the main ones are:

- They enable the allocation and apportionment of costs to different cost objects , based on the cause-and-effect relationship or the benefit received principle. This helps to determine the profitability and efficiency of each cost object and to make informed decisions about pricing , outsourcing, product mix, and resource utilization.

- They facilitate the analysis and comparison of costs across different periods, activities, processes, and outputs. This helps to identify the trends, patterns, and variances in costs and to take corrective actions if needed.

- They support the preparation and presentation of financial statements , such as the income statement, the balance sheet, and the cash flow statement . This helps to communicate the financial performance and position of the business to the stakeholders, such as the owners, the investors, the creditors, and the regulators.

3. The challenges and limitations of cost elements. Cost elements are not without challenges and limitations. Some of the common ones are:

- They may not capture the full cost of a cost object, as some costs may be difficult to measure or allocate, such as opportunity costs, sunk costs, or intangible costs. These costs may have a significant impact on the value and profitability of the cost object, but they may not be reflected in the cost elements.

- They may not reflect the true cost behavior of a cost object, as some costs may change due to factors other than the level of activity, such as inflation, technology, or market conditions. These costs may not follow the assumptions or the models used to classify and estimate the cost elements.

- They may not provide sufficient information for decision making , as some decisions may require more than just the cost information, such as the quality, the customer satisfaction, the environmental impact, or the strategic alignment of the cost object. These factors may not be captured or quantified by the cost elements.

In the section "Types of cost elements: How to classify your costs into different categories based on their nature and behavior," we will explore the various ways to categorize costs based on their characteristics. Understanding the different types of cost elements is crucial for effective cost management and decision-making .

1. Fixed Costs: These are costs that remain constant regardless of the level of production or sales. Examples include rent, salaries, and insurance premiums. Fixed costs do not vary with changes in activity levels.

2. variable costs : Variable costs fluctuate in direct proportion to changes in production or sales volume. Raw materials, direct labor, and sales commissions are examples of variable costs. As production increases, variable costs increase , and vice versa.

3. semi-Variable costs : Also known as mixed costs, semi-variable costs have both fixed and variable components. They consist of a fixed portion that remains constant and a variable portion that changes with activity levels. Telephone bills with a fixed monthly fee and additional charges based on usage are an example of semi-variable costs.

4. direct costs : Direct costs are directly attributable to a specific product, service, or project. They can be easily traced to a particular cost object. For instance, the cost of raw materials used in manufacturing a product is a direct cost.

5. indirect costs : Indirect costs, also known as overhead costs, are not directly tied to a specific cost object. They support the overall operations of a business. Examples include rent for the entire facility, utilities, and administrative salaries.

6. Step Costs: Step costs exhibit a step-like pattern, where the cost remains constant within a certain range of activity levels and then jumps to a higher level when a threshold is crossed. For example, hiring additional staff when production reaches a certain level incurs a step cost.

7. opportunity costs : Opportunity costs represent the potential benefit or value that is foregone when choosing one alternative over another. It is the value of the next best alternative that is sacrificed. For instance, if a company decides to invest in Project A, the opportunity cost is the potential profit from Project B.

Remember, these are just a few examples of cost elements and their classifications. By understanding the nature and behavior of costs, businesses can make informed decisions , optimize resource allocation , and improve profitability.

How to classify your costs into different categories based on their nature and behavior - Cost Element: How to Define and Use Your Cost Elements

In the section "Cost element assignment: How to link your cost elements to your cost objects such as products, projects, activities, or orders?" we delve into the crucial aspect of connecting cost elements with various cost objects. This linkage plays a vital role in accurately allocating costs and understanding the financial impact of different activities within an organization.

From a managerial perspective, linking cost elements to cost objects enables better cost control and decision-making . By assigning cost elements to specific products, projects, activities, or orders, businesses can track and analyze the expenses associated with each entity. This information helps in evaluating profitability, identifying cost drivers , and optimizing resource allocation .

Now, let's explore some key insights on cost element assignment:

1. Understanding cost elements : Cost elements represent different categories of expenses incurred by an organization. Examples include direct materials, direct labor, overhead costs, marketing expenses, and administrative costs. Each cost element captures specific types of expenditures and contributes to the overall cost structure.

2. Mapping Cost Elements to Cost Objects: To link cost elements with cost objects, businesses need to establish a systematic framework. This involves identifying the relevant cost objects, such as products, projects, activities, or orders, and associating them with the appropriate cost elements. This mapping ensures that costs are allocated accurately and provides a clear picture of the cost distribution across different entities.

3. Cost Element Hierarchy: In some cases, cost elements can be organized hierarchically to reflect the underlying cost structure. This hierarchy helps in categorizing costs at different levels of granularity. For example, a cost element hierarchy may include high-level categories like "Direct Costs" and further break down into subcategories like "Direct Materials" and "Direct Labor." Such a hierarchy facilitates cost analysis and reporting.

4. Cost Element Assignment Methods: There are various methods to assign cost elements to cost objects. One common approach is direct assignment, where costs are directly attributed to specific objects based on a predetermined allocation basis. Another method is cost allocation , which involves distributing shared costs among multiple cost objects based on allocation keys or drivers. The choice of assignment method depends on the nature of costs and the desired level of accuracy.

5. Importance of Accurate Assignment: Accurate cost element assignment is crucial for reliable financial reporting , cost analysis, and decision-making. It ensures that costs are allocated in a fair and transparent manner, enabling businesses to assess the profitability of different products, projects, activities, or orders. Moreover, accurate assignment helps in identifying cost-saving opportunities , optimizing resource allocation, and improving overall cost management .

By following these insights and implementing effective cost element assignment practices, organizations can gain valuable insights into their cost structure, enhance cost control, and make informed business decisions .

How to link your cost elements to your cost objects such as products, projects, activities, or orders - Cost Element: How to Define and Use Your Cost Elements

cost element analysis is a process of identifying, categorizing, and evaluating the different types of costs that are involved in a project, a product, a service, or a business activity. By using cost elements, you can track and monitor how your costs are distributed, allocated, and controlled. You can also use cost elements to measure your performance indicators, such as profitability, efficiency, and return on investment. Cost element analysis can help you to:

- Understand the structure and composition of your costs

- Identify the sources and drivers of your costs

- Compare your costs with your budget, forecast, or benchmark

- optimize your costs and improve your margins

- Make informed decisions and plan for the future

To perform a cost element analysis, you need to follow these steps:

1. Define your cost elements. Cost elements are the basic units of cost that can be assigned to a cost object, such as a project, a product, a service, or a business activity. Cost elements can be classified into different categories, such as direct or indirect, fixed or variable, material or labor, etc. For example, the cost elements of a manufacturing project could include raw materials, labor, utilities, depreciation, etc.

2. Collect and organize your cost data . You need to gather and record the relevant cost data for each cost element. You can use various sources of data, such as invoices, receipts, timesheets, reports, etc. You also need to organize your cost data in a systematic and consistent way, such as by using a cost accounting system , a spreadsheet, or a database.

3. Analyze your cost elements. You need to calculate and evaluate the amount, proportion, and trend of each cost element. You can use various methods and tools, such as ratios, percentages, graphs, charts, etc. You also need to compare your cost elements with your budget, forecast, or benchmark, and identify any variances, deviations, or anomalies.

4. report and communicate your cost element analysis. You need to present and explain your cost element analysis to your stakeholders, such as managers, investors, customers, etc. You can use various formats and media, such as reports, dashboards, presentations, etc. You also need to provide recommendations and suggestions for improving your cost performance and achieving your goals.

Here is an example of a cost element analysis for a software development project:

| Cost Element | Amount | Percentage | Trend | Variance |

| Labor | $50,000 | 50% | ↑ | +$10,000 |

| Software | $20,000 | 20% | ↔ | -$5,000 |

| Hardware | $15,000 | 15% | ↓ | -$2,000 |

| Travel | $10,000 | 10% | ↑ | +$3,000 |

| Other | $5,000 | 5% | ↔ | -$1,000 |