- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Consumer Research: Examples, Process and Scope

What is Consumer Research?

Consumer research is a part of market research in which inclination, motivation and purchase behavior of the targeted customers are identified. Consumer research helps businesses or organizations understand customer psychology and create detailed purchasing behavior profiles.

It uses research techniques to provide systematic information about what customers need. Using this information brands can make changes in their products and services, making them more customer-centric thereby increasing customer satisfaction. This will in turn help to boost business.

LEARN ABOUT: Market research vs marketing research

An organization that has an in-depth understanding about the customer decision-making process, is most likely to design a product, put a certain price tag to it, establish distribution centers and promote a product based on consumer research insights such that it produces increased consumer interest and purchases.

For example, A consumer electronics company wants to understand, thought process of a consumer when purchasing an electronic device, which can help a company to launch new products, manage the supply of the stock, etc. Carrying out a Consumer electronics survey can be useful to understand the market demand, understand the flaws in their product and also find out research problems in the various processes that influence the purchase of their goods. A consumer electronics survey can be helpful to gather information about the shopping experiences of consumers when purchasing electronics. which can enable a company to make well-informed and wise decisions regarding their products and services.

LEARN ABOUT: Test Market Demand

Consumer Research Objectives

When a brand is developing a new product, consumer research is conducted to understand what consumers want or need in a product, what attributes are missing and what are they looking for? An efficient survey software really makes it easy for organizations to conduct efficient research.

Consumer research is conducted to improve brand equity. A brand needs to know what consumers think when buying a product or service offered by a brand. Every good business idea needs efficient consumer research for it to be successful. Consumer insights are essential to determine brand positioning among consumers.

Consumer research is conducted to boost sales. The objective of consumer research is to look into various territories of consumer psychology and understand their buying pattern, what kind of packaging they like and other similar attributes that help brands to sell their products and services better.

LEARN ABOUT: Brand health

Consumer Research Model

According to a study conducted, till a decade ago, researchers thought differently about the consumer psychology, where little or no emphasis was put on emotions, mood or the situation that could influence a customer’s buying decision.

Many believed marketing was applied economics. Consumers always took decisions based on statistics and math and evaluated goods and services rationally and then selected items from those brands that gave them the highest customer satisfaction at the lowest cost.

However, this is no longer the situation. Consumers are very well aware of brands and their competitors. A loyal customer is the one who would not only return to repeatedly purchase from a brand but also, recommend his/her family and friends to buy from the same brand even if the prices are slightly higher but provides an exceptional customer service for products purchased or services offered.

Here is where the Net Promoter Score (NPS) helps brands identify brand loyalty and customer satisfaction with their consumers. Net Promoter Score consumer survey uses a single question that is sent to customers to identify their brand loyalty and level of customer satisfaction. Response to this question is measured on a scale between 0-10 and based on this consumers can be identified as:

Detractors: Who have given a score between 0-6.

Passives: Who have given a score between 7-8.

Promoters: Who have given a score between 9-10.

Consumer market research is based on two types of research method:

1. Qualitative Consumer Research

Qualitative research is descriptive in nature, It’s a method that uses open-ended questions , to gain meaningful insights from respondents and heavily relies on the following market research methods:

Focus Groups: Focus groups as the name suggests is a small group of highly validated subject experts who come together to analyze a product or service. Focus group comprises of 6-10 respondents. A moderator is assigned to the focus group, who helps facilitate discussions among the members to draw meaningful insights

One-to-one Interview: This is a more conversational method, where the researcher asks open-ended questions to collect data from the respondents. This method heavily depends on the expertise of the researcher. How much the researcher is able to probe with relevant questions to get maximum insights. This is a time-consuming method and can take more than one attempt to gain the desired insights.

LEARN ABOUT: Qualitative Interview

Content/ Text Analysis: Text analysis is a qualitative research method where researchers analyze social life by decoding words and images from the documents available. Researchers analyze the context in which the images are used and draw conclusions from them. Social media is an example of text analysis. In the last decade or so, inferences are drawn based on consumer behavior on social media.

Learn More: How to conduct Qualitative Research

2.Quantitative Consumer Research

In the age of technology and information, meaningful data is more precious than platinum. Billion dollar companies have risen and fallen on how well they have been able to collect and analyze data, to draw validated insights.

Quantitative research is all about numbers and statistics. An evolved consumer who purchases regularly can vouch for how customer-centric businesses have become today. It’s all about customer satisfaction , to gain loyal customers. With just one questions companies are able to collect data, that has the power to make or break a company. Net Promoter Score question , “On a scale from 0-10 how likely are you to recommend our brand to your family or friends?”

How organic word-of-mouth is influencing consumer behavior and how they need to spend less on advertising and invest their time and resources to make sure they provide exceptional customer service.

LEARN ABOUT: Behavioral Targeting

Online surveys , questionnaires , and polls are the preferred data collection tools. Data that is obtained from consumers is then statistically, mathematically and numerically evaluated to understand consumer preference.

Learn more: How to carry out Quantitative Research

Consumer Research Process

The process of consumer research started as an extension of the process of market research . As the findings of market research is used to improve the decision-making capacity of an organization or business, similar is with consumer research.

LEARN ABOUT: Market research industry

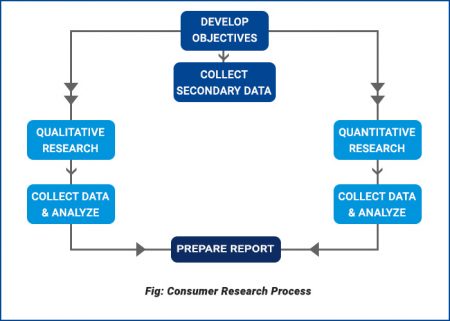

The consumer research process can be broken down into the following steps:

- Develop research objectives: The first step to the consumer research process is to clearly define the research objective, the purpose of research, why is the research being conducted, to understand what? A clear statement of purpose can help emphasize the purpose.

- Collect Secondary data: Collect secondary data first, it helps in understanding if research has been conducted earlier and if there are any pieces of evidence related to the subject matter that can be used by an organization to make informed decisions regarding consumers.

- Primary Research: In primary research organizations or businesses collect their own data or employ a third party to collect data on their behalf. This research makes use of various data collection methods ( qualitative and quantitative ) that helps researchers collect data first hand.

LEARN ABOUT: Best Data Collection Tools

- Collect and analyze data: Data is collected and analyzed and inference is drawn to understand consumer behavior and purchase pattern.

- Prepare report: Finally, a report is prepared for all the findings by analyzing data collected so that organizations are able to make informed decisions and think of all probabilities related to consumer behavior. By putting the study into practice, organizations can become customer-centric and manufacture products or render services that will help them achieve excellent customer satisfaction.

LEARN ABOUT: market research trends

After Consumer Research Process

Once you have been able to successfully carry out the consumer research process , investigate and break paradigms. What consumers need should be a part of market research design and should be carried out regularly. Consumer research provides more in-depth information about the needs, wants, expectations and behavior analytics of clients.

By identifying this information successfully, strategies that are used to attract consumers can be made better and businesses can make a profit by knowing what consumers want exactly. It is also important to understand and know thoroughly the buying behavior of consumers to know their attitude towards brands and products.

The identification of consumer needs, as well as their preferences, allows a business to adapt to new business and develop a detailed marketing plan that will surely work. The following pointers can help. Completing this process will help you:

- Attract more customers

- Set the best price for your products

- Create the right marketing message

- Increase the quantity that satisfies the demand of its clients

- Increase the frequency of visits to their clients

- Increase your sales

- Reduce costs

- Refine your approach to the customer service process .

LEARN ABOUT: Behavioral Research

Consumer Research Methods

Consumers are the reason for a business to run and flourish. Gathering enough information about consumers is never going to hurt any business, in fact, it will only add up to the information a business would need to associate with its consumers and manufacture products that will help their business refine and grow.

Following are consumer research methods that ensure you are in tandem with the consumers and understand their needs:

The studies of customer satisfaction

One can determine the degree of satisfaction of consumers in relation to the quality of products through:

- Informal methods such as conversations with staff about products and services according to the dashboards.

- Past and present questionnaires/ surveys that consumers might have filled that identify their needs.

T he investigation of the consumer decision process

It is very interesting to know the consumer’s needs, what motivates them to buy, and how is the decision-making process carried out, though:

- Deploying relevant surveys and receiving responses from a target intended audience .

Proof of concept

Businesses can test how well accepted their marketing ideas are by:

- The use of surveys to find out if current or potential consumer see your products as a rational and useful benefit.

- Conducting personal interviews or focus group sessions with clients to understand how they respond to marketing ideas.

Knowing your market position

You can find out how your current and potential consumers see your products, and how they compare it with your competitors by:

- Sales figures talk louder than any other aspect, once you get to know the comparison in the sales figures it is easy to understand your market position within the market segment.

- Attitudes of consumers while making a purchase also helps in understanding the market hold.

Branding tests and user experience

You can determine how your customers feel with their brands and product names by:

- The use of focus groups and surveys designed to assess emotional responses to your products and brands.

- The participation of researchers to study the performance of their brand in the market through existing and available brand measurement research.

Price changes

You can investigate how your customers accept or not the price changes by using formulas that measure the revenue – multiplying the number of items you sold, by the price of each item. These tests allow you to calculate if your total income increases or decreases after making the price changes by:

- Calculation of changes in the quantities of products demanded by their customers, together with changes in the price of the product.

- Measure the impact of the price on the demand of the product according to the needs of the client.

Social media monitoring

Another way to measure feedback and your customer service is by controlling your commitment to social media and feedback. Social networks (especially Facebook) are becoming a common element of the commercialization of many businesses and are increasingly used by their customers to provide information on customer needs, service experiences, share and file customer complaints . It can also be used to run surveys and test concepts. If handled well, it can be one of the most powerful research tools of the client management . I also recommend reading: How to conduct market research through social networks.

Customer Research Questions

Asking the right question is the most important part of conducting research. Moreover, if it’s consumer research, questions should be asked in a manner to gather maximum insights from consumers. Here are some consumer research questions for your next research:

- Who in your household takes purchasing decisions?

- Where do you go looking for ______________ (product)?

- How long does it take you to make a buying decision?

- How far are you willing to travel to buy ___________(product)?

- What features do you look for when you purchase ____________ (product)?

- What motivates you to buy_____________ (product)?

See more consumer research survey questions:

Customer satisfaction surveys

Voice of customer surveys

Product surveys

Service evaluation surveys

Mortgage Survey Questions

Importance of Consumer Research

Launching a product or offering new services can be quite an exciting time for a brand. However, there are a lot of aspects that need to be taken into consideration while a band has something new to offer to consumers.

LEARN ABOUT: User Experience Research

Here is where consumer research plays a pivotal role. The importance of consumer research cannot be emphasized more. Following points summarizes the importance of consumer research:

- To understand market readiness: However good a product or service may be, consumers have to be ready to accept it. Creating a product requires investments which in return expect ROI from product or service purchases. However, if a market is mature enough to accept this utility, it has a low chance of succeeding by tapping into market potential . Therefore, before launching a product or service, organizations need to conduct consumer research, to understand if people are ready to spend on the utility it provides.

- Identify target consumers: By conducting consumer research, brands and organizations can understand their target market based on geographic segmentation and know who exactly is interested in buying their products. According to the data or feedback received from the consumer, research brands can even customize their marketing and branding approach to better appeal to the specific consumer segment.

LEARN ABOUT: Marketing Insight

- Product/Service updates through feedback: Conducting consumer research, provides valuable feedback from consumers about the attributes and features of products and services. This feedback enables organizations to understand consumer perception and provide a more suitable solution based on actual market needs which helps them tweak their offering to perfection.

Explore more: 300 + FREE survey templates to use for your research

MORE LIKE THIS

When You Have Something Important to Say, You want to Shout it From the Rooftops

Jun 28, 2024

The Item I Failed to Leave Behind — Tuesday CX Thoughts

Jun 25, 2024

Feedback Loop: What It Is, Types & How It Works?

Jun 21, 2024

QuestionPro Thrive: A Space to Visualize & Share the Future of Technology

Jun 18, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Tuesday CX Thoughts (TCXT)

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

- Guide to consumer research

An Introductory Guide to Consumer Research And How to Conduct One

Consumer research is used across industries in order to gain key insights into consumer behavior and needs. In this article, we will explore the key aspects of consumer research, namely what it is and how to do it.

What Is Consumer Research?

Consumer research is research undertaken to gain an idea of customers' preferences, attitudes, motivations, and buying behaviors. This information can enable you to categorize customers into groups or segments, and tailor marketing efforts (or other aspects of the business, such as product development) to those who are most likely to spend their money on your product or service.

Research can take many different forms - such as surveys, questionnaires, and interviews. All of which enable you to gain answers to questions that your business is struggling to find through other means.

For example, most businesses have some kind of customer service department. Through consumer research, you can find out what methods of customer service are most preferred by your customers and invest more in these methods resulting in greater customer satisfaction.

Consumer research enables you to group customers into customer segments. A customer segment is simply a collection of individuals with similar consumer data - possibly in terms of the personal demographics such as age, gender, or location, or it could be that their spending habits, AOV , and preferences are similar.

These customer segments can be targeted in different ways, enabling you to maximize revenue from each individual.

2 Types of Consumer Research

There are two basic types of research, both of which apply to consumer research.

Quantitative Research

Quantitative research produces quantifiable data. This means that it can be considered directly in numbers and percentages and, as a result, is usually easier to analyze.

For example, perhaps you want to evaluate your quality assurance strategies . In order to gain quantitative data for this, you might ask yes/no questions or ask customers to rank statements on a scale from 1 to 10, such as “I frequently come across bugs in X software”. 10 would indicate all the time, and 1 would be never. The responses can then be added together to create a percentage.

Qualitative Research

Qualitative research is often more in-depth, and questions enable responders to explore their answers in full detail. In 2021, 67% of researchers agreed that online or virtual qualitative research is helpful to consumer research. Qualitative research enables a much deeper understanding of the customer experience and opinion but is harder to analyze.

For example, returning to our example of experiencing bugs in software, a qualitative researcher may approach this question as follows:

Q: How often do you experience bugs when using our software? Explain in detail when and where this occurs.

A: I only experience bugs when using the accounting tool of the application. Whenever I try to export a report of my accounts, the app glitches and deletes my data.

This answer provides specific examples to the researcher and would make solving the problem much simpler. This is reflected in how business practices and software development intersect, as business needs are shaping new technology, a response that is driven through research.

However, if you are dealing with hundreds of responses, getting through them all can be challenging.

3 Benefits of Consumer Research

1. provides valuable market insight.

Consumer research provides insights that you cannot get from analytics alone, as it gives you insight into the thoughts and feelings of the consumers. These insights are extremely valuable, as if you know how to use customer analytics , you can apply these skills to implementing the data gathered from your consumer research.

2. Improve Marketing and Business Decisions

Once you have gained these insights, consumer research can actually be used to inform your marketing and business decisions and can even help the creation of brand marketing reports . For example, your research could suggest that your business lacks organization across its teams. This could lead to your business investing in WFM tools and ultimately revolutionizing its reputation.

3. Assists in Determining Market Position

Another benefit of consumer research is that it can provide insights into where your business sits within the market. You can find out whether you are preferred to your competition or vice versa, and why. It helps your business define its market position and make adjustments to improve this or solidify its brand identity.

5 Methods of Consumer Research

There are many different methods of conducting customer research. In this section, we will go through some of the key options available.

Interviews are a great way to conduct consumer research. The nature of spoken conversation often enables previously unconsidered ideas to come up naturally and opens up opportunities for discussions that reveal deeper insights. Furthermore, if you have access to software offering a free video call online , these interviews no longer need to be done in person.

- Focus Groups

Interviews can be conducted in focus groups where a select group of individuals discuss and offer their opinions on a matter together. These individuals might be from the same customer sectors or may represent different perspectives. How you choose to structure these is up to you.

- One-on-one Interviews

Alternatively, you may prefer to approach these with one-on-one interviews. This form of interview can often lead to a more in-depth conversation but, for logical reasons, are less time-efficient and can miss out on the group dynamic spurring new ideas.

Surveys are a written alternative to interviews and do not require a researcher to be present at the time of research. They can also be sent to a much larger group of respondents (meaning a more detailed set of data) and can be a combination of quantitative and qualitative responses.

Analytics is nothing new to anyone working in marketing, and it can be an excellent tool for conducting consumer research. Analytics will provide quantitative insights into consumer behavior, such as conversion rates and average sale values, and can contribute to consumer research.

Review Mining

Review mining can be a great way to gain consumer insights, and it doesn’t involve actively pursuing new research.

Previous reviews can often provide a mixture of quantitative and qualitative research through written descriptions and “star” system reviews. However, this method limits you to what is already available, and these reviews may not specifically target areas you are keen to research.

Secondary Research

Secondary research refers to looking at previously created research in your industry. Lots of this can be accessed online, and even if this isn’t the method you primarily choose to use, it can be a great starting point to guide your own research.

5 Steps to Conduct Consumer Research

1. set smart research goals and objectives.

SMART goals should be set before any business pursuit. Standing for specific, measurable, agreed, realistic, and time-bounded, these goals can help guide your research and avoid going off topic.

2. Determine the Research Methodology and Audience

As previously mentioned, there are several different methods of conducting consumer research. Choosing from the list above (and you are not limited to only one method), you should cover both quantitative and qualitative data for the best insight.

Develop a Buyer Persona

Develop a buyer persona in order to determine who your audience will be for the research. Buyer personas can be seen somewhat like “characters” in a story. They have certain wants, motivations, and behavior patterns. They make up your customer segments and who the research will target.

3. Conduct Research and Compile Data Findings

Put the research into action: send out surveys, schedule interviews, review your google analytics. Put all your findings into a spreadsheet, and begin to group responses logically. With qualitative data, it may be useful to identify “themes” in responses and categorize them according to these.

Once data is compiled, it is recommended to present it in a visually effective report , including charts or graphs depending on the content.

4. Analyze and Interpret Data Results

Take your data and consider what the information is telling you. Are you seeing frequent negative responses in one area? Do customers feel like you are overpricing your service? Interpret the data and come to conclusions as to what your business may need to do.

5. Take Action in Response to the Findings

Put your findings into action! If you are seeing consistent weaknesses in one area, this is a great time to bring the team together and brainstorm ideas to work around this and improve your business. When you implement changes that benefit the customers, you will see results coming back around to you in the form of increased engagement.

Key Takeaway

Consumer research is a brilliant way to ensure the success of any business. Enabling you to see how your customers view your company and gain key insights into how your business can improve. Provided your research has clear goals and gathers in-depth data, there is no reason your research shouldn’t be a raging success!

Grace Lau is the Director of Growth Content at Dialpad , an AI-powered cloud communication platform that fosters better team collaboration and boosts lead generation strategies . She has over 10 years of experience in content writing and strategy. Currently, she is responsible for leading branded and editorial content strategies, partnering with SEO and Ops teams to build and nurture content. Here is her LinkedIn .

Ready to automate your reporting?

8 marketing analytics platforms to simplify your data analysis processes

Don’t miss out!

Follow us on social media to stay tuned!

Automate your reports!

Bring all your marketing data into one automated report.

Get Started Today!

Made in Canada

DashThis is a brand owned by Moment Zero inc

Copyright © 2011-2024

8 Key Stages in the Consumer Research Strategy

July 8 2022

- Table of content

What Is Consumer Insights Research And Why It's Important For Any Brand?

Consumer research process and steps, how does peekage run market research, how to optimize the process of conducting consumer research.

If you want to catch and keep your consumer's attention , you really need to peruse the options available on your menu and give them something smart based on their preferences.

Your marketing strategy should not be based on your hunch but solid verifiable facts. In order to grow as a business, you need to know how your products & services are performing with your target audiences, how those consumers are responding to your campaigns, and how these customers feel about your brand.

Customer research can provide you with the missing information.

In today's consumer-centric world, research is key to personalization of products & services, and consistently delivering an excellent experience to your customers comes with a number of benefits, such as:

- Increased purchase frequency

- Higher average order values

- Better referrals and cheaper acquisitions

Additionally, acquiring insights on consumer needs gives you a strategic position over the race on delivering customers what they want -more personalized products and experiences. This way you stay ahead of your competitors and remain in line with consumers' needs.

At its core, consumer research focuses on understanding your consumers by exploring their attitudes, needs, motivations, and behavior as they relate to your brand & products. This helps you to better identify, understand, investigate and hold your customers.

It's nothing unexpected that the majority of professional advertisers make their strategic decisions after a phase of extensive consumer research process.

Read also: Differences Between Market Research and Consumer Insights Research

Consumer insights research is the process of recognizing the inclinations, attitudes, inspirations, and purchasing behavior of the targeted consumers. Utilizing consumer research strategies on this data, shared characteristics among consumer groups are distinguished and classified into client segments and buyer personas. This information then used to make promoting campaigns focusing on a particular fragment or persona.

Consumer research is the key to enhancing your products & services and effectively advertising to clients who want to do commercial enterprise with you. Interviews, surveys, and other consumer research techniques are your dearest companions with regards to aiding your organization reliably to increment its income year on year.

Consumer research strategy is the procedure of gathering facts to first identify the target audiences and afterward focus on their inclinations, insights, attitudes, and shopping drivers for an item, service, or brand.

The main purposes of consumer research are:

- Formalize the ideal customer personas

- Upgrade brand positioning

- Discover new or similar consumers

- Get feedback on current products & services

- Mapping the customer decision-making procedure

Customer research is a part of market research that uses research techniques to provide actionable information about what clients need. Utilizing this data businesses can make changes in their items and services, making them more client-centric thereby expanding consumer loyalty.

Consumer research helps brands understand consumer psychology and create purchasing behavior profiles for them.

A business that has an in-depth comprehension of the client decision-making process is most likely to design an item, decide on a certain price for it, establish a distribution path and promote a product based on customer research insights such that it produces increased consumer satisfaction and loyalty.

The ultimate goal of consumer research is to make a more profound understanding of your target client. You need to know what they care about and what impacts them to make purchasing decisions. This helps you to target them with more customized and significant brand experiences.

Consumers are now inundated with various options & choices and they have boundless data about these products readily available. In fact, they have power over their choices and want only the best.

So how do you make an unforgettable customer experience? By research!

By identifying the needs and inclinations of your clients, you can develop effective methods and strategies to use in your marketing plan. This will help you:

- Leverage your brand positioning compared to the competitors

- Help empower your marketing and product strategy

- Exclude weak points and lessen redundancies

- Remain in line with client opinion ahead of new product launches

- Draw in more clients

- Set the optimized price for your products

- Produce the proper marketing message

- Increase how much your clients spend

- Increase how frequently your clients spend

- Increase your sales

- Decrease your costs

- Refine your approach to customer support.

Now that you know what consumer research is and you understand its importance in developing your business, let's take a closer look at how it's done; the process & steps of conducting consumer insight research.

Also read: How Consumer Insights Help Your Business Grow

The consumer research process began as an extension of the market research process. Just as the results of market research are used to further develop the decision-making potential of a brand or business, so is consumer research.

Consumer research is a sequential procedure. It must be well organized, tied together by the proper method, and upheld by supporting facilities and tools. Without these considerations, you may get into research chaos.

Therefore, you need a framework for conducting consumer research. The consumer research process can be divided into the following steps:

1. Develop research goals

Developing research goals is actually answering the question; "why is the research being conducted? to find out what?" A statement of consumer research objectives can help emphasize the purpose.

2. Define your research personas

A target consumer addresses the specific client segments and ideal buyer personas you wish to analyze.

3. Select your research methods and tools

Before you jump into the research phase, you should create a supporting "foundation". That is to distinguish your key method for gathering information and data.

Consumer data comes in two structures:

Quantitative - data, in the form of numbers

Quantitative consumer research includes extracting facts and statistics from customer opinions. By posing questions like, "how many", "how often", or "how likely", you can record customer needs and inclinations as specific numbers.

Utilizing a qualitative research method, you can gather information around measures such as duration, price, amount, length, etc. You can then utilize this information to shape your product's marketing.

Qualitative - non-numerical data that describe and characterize

A qualitative consumer research strategy gathers the conversational voice of customers (VOC), making sense of the inspirations behind customer behaviors. Open-ended questions, conversations, and observations can help us answer the whats, whys, and hows of consumers' decisions. Furthermore, develop a better comprehension of the consumers' attitudes, beliefs, and values.

Also read: Seven Consumer Research Methods; 2022 Version

4. Collect secondary data

Secondary research tries to interpret your audience's behaviors by utilizing internal and external data. CRM or social media analytics, and different kinds of BI tools come to use here. Utilizing external information such as trend reports, market statistics, and public polls can also help obtain a more accurate image of your target clients.

Secondary research is a strong method to analyze the competition, understand your actual position in the market, and discover new secondary consumers.

Collect secondary data as the earliest stage of your research, it helps finding out if the research has been conducted before and if there is any information that can be used by your business to make informed decisions regarding customers.

Secondary research adds additional background information to your brand strategy. By discovering what your competitors do and finding out what other factors and variables affect the demand on the market, you can refine your brand differentiation on the market.

Thus, as part of customer research, you need to assess the competition. Specifically, collect data about:

- Competition market positioning

- Brand differentiators

- Macro market trends

- Niche market trends

5. Primary research

Primary research can be an exploratory and explicit phase of your consumer research. In the principal case, you are projecting a wider net to comprehend the general customer opinion and market trends. Exploratory research is helpful for consumer segmentation and buyer persona development.

Explicit consumer research plans put the magnifying lens on distinguished areas of interest like brand preference or product usability. For this situation, it's a good idea to work with a specific consumer segment and ask questions related to a specific issue.

In primary research brands or businesses collect their own information or employ a third party to gather information for them. This kind of research utilizes different data collection methods (qualitative and quantitative).

6. Collect and analyze information

Data is gathered and analyzed and inference is drawn to comprehend client behavior and purchase pattern.

7. Prepare a report

At the final stages of your consumer research process, a report is prepared based on all the findings by analyzing information collected so that businesses are able to make informed decisions and think of all probabilities related to customer behavior. By incorporating the study, businesses can become more customer-centric and provide products or services that will help them achieve customer satisfaction.

8. Put consumer research to action

The ultimate objective of consumer research is to illuminate your actions. There are numerous excellent ways of utilizing customer research information:

- Refine your brand positioning and brand statement

- Develop strategies for engaging with secondary clients

- Foster new creative and collateral for advertisement campaigns

- Refine your advertisement targeting to lessen promotion waste

- Expand into new markets with more confidence

Utilizing its app-based platform, Peekage conducts market research by product sampling .

Clients share their information through the application and then the Peekage team discovers the right users to test your product or services and provide you feedback. This strategy is the most efficient way to invest the market research budget and gain actionable insights from your target market.

Read Also: Ultimate guide: product sampling strategies, methods & techniques

By providing proper consumer research insight, strategies that are utilized to draw in customers can be improved and brands can make a profit by knowing what customers need exactly. It is also important to understand the buying behavior of customers to know their attitude towards businesses and products.

Artificial intelligence helped advertisers & marketers with accomplishing precise targeting, effective optimizations, better analysis, and so much more. However, before these items come into play, understanding the customer is on top of any advertiser's list.

Optimizing consumer research can really make the entire procedure more effective, saving businesses tons of time assembling and analyzing data that is of little worth.

There are 4 different ways AI can optimize the consumer research process.

Recruitment Efficiency

Your customer base is expanded. Panel recruitment parameters that expanded properly in one place may not function admirably in an alternate situation. And with steadily developing markets, checking only a couple of fundamental parameters like age, ethnicity, and education is hard enough for a team of staff to work on for weeks or even months.

businesses need niche parameters. For example, interests, work profiles, income level, language proficiency, and more to draw significant insights that give them an upper hand in the market. This kind of information uncovers sweet spots in the target clients that have a high chance of a conversion.

Panel Relevancy Map

Words usually can't do a picture justice. In advertising, this image is worth thousands of hours of man work. In fact, we are discussing the times when advertisers analyze various segments and try to find similar client bases that can be clustered together. AI can do this in a matter of seconds, if not real-time. It analyzes millions of psychographic and demographic elements alongside other incidental factors and makes a relevancy map. This helps the advertiser with building panels of relevant clients based on the targeting variables that the research requests.

Statistically Accurate Panel

You can simply not include all of your clients for research purposes. Yes, you can do it by taking a representative sample of your consumer's society. This means your panel will contain at least one or more clients from each segment of your overall target client. This way you have a panel that is statistically the most accurate representation of your clients.

Engagement Efficiency

While a statistically accurate panel is of importance, the research can only be called effective and successful if the optimal number of consumers take part in the research. Here, the AI helps the advertiser get the maximum number of research respondents at the minimum cost. Engagement patterns help the AI to rank the quality of client segments. The higher the engagement with the research, the higher the quality of the client.

Research that creates impact

In fact, finding out what the client is thinking is technically impossible. businesses can still be very accurate by using the agility and scalability of AI. Making accurate and reliable client panels, running AI-led agile research, and developing strategies based on them is the guaranteed plan for successful consumer research.

Consumer research is a significant endeavor; however, the payoffs are extravagant too. Learning who your consumers are, how they think, and what prompts them to buy your products or services is essential to improving your market presence, growing brand value, and of course income numbers.

Utilizing the above eight steps, you can figure out how to coax clarity out of the tumultuous pile of analytics data and spoken customer insights. Keep in mind: a clear and optimal research method, succinct hypothesis, and supporting tools are the frameworks you need to run effective consumer research.

What customers need should be a part of market research and ought to be carried out routinely. Consumer research provides you with in-depth data about the needs, wants, expectations, and behavior of consumers.

Like the article? Spread the word

Ready to see what we’re building?

More from Peekage

40 Most Practical Market Research Survey Questions

Market research refers to the practice of collecting factual information about a target market and its performance until today. It answers specific business questions and is conducted on a macro level. Running market research is…

How Consumer Insights Help Your Business Grow

Collecting consumer insights is no easy job, nor is it a cheap one. Many brands dedicate a team and a substantial budget to run consumer insights research campaigns. But the act of insight collection is…

Peekage CPG Insights: Everything you need to know about cereals!

During covid pandemic, breakfast had a resurgence and became a standard part of the morning routine for most Americans. A lot of on-the-go consumers switched to in-home options like cereals. In fact, more than 80%…

Blind Taste Test: What You Need to Know

What is a blind taste test? Before a product is introduced to the market or before a significant recipe or formula change, it is strongly advised to have a taste test of the product. This…

The Complete Guide to Consumer Research for Beginners

What is Consumer Research?

When answering this question, it is important to first understand that consumers are not just customers. The concept of a customer often views individuals as mere monetary values, rendering them valueless by quantifying them. Consumer research does not solely focus on individuals; rather, it examines and addresses the communities and groups in which these individuals are involved. In this regard, the concept of sales alone is meaningless. When conducting consumer research, "sales" brings along concepts such as accessibility, usage, experience, and thought. You should not only focus on marketing the product and brand but also on what happens to your product after it is used.

Consumer Research Question Bank

Questions are invaluable for consumer research. Starting with who begins the research journey, you should also incorporate why, how, when, where questions along the way. Expanding your questions is a crucial step on the path to success. Continuing with the car analogy, this is a race, and learning the meaning consumers attach to your product, a crucial aspect brought along by "sales," will put you ahead on the track. Understanding the significance consumers attribute to your product will tether you to them invisibly.

Content Directory

On this blog post, I'm going to cover all steps of consumer research, types of consumer research and why it matters. Here is the content directory;

1- Methods of Discovering Consumers 2- The Art of Understanding the Consumer 3- The Iceberg Effect of Consumer Behaviors: The Unseen Part of Purchase Decisions 4- Setting Methodology in Consumer Research: Finding the Right Path 5- Research Methods: Qualitative and Quantitative from the Tative Family 6- Memorable Cookie Information 7- Social Research - Capture Quality Effectively With Social Research 8- Exploring the Consumer World: Target Audience Analysis

Now, let's start!

Methods of Discovering Consumers

Journey into the consumer's world.

For marketers, entering the consumer's world and understanding their desires, what they value, what they talk about, their motivations, why they want or don't want something, is crucial. A marketer who solves these questions moves one step ahead of their competitors. Because for the consumer, shopping is not just about buying a product; it's also about the impact of that product on our identity and how it makes us feel.

Ways of Understanding the Consumer: Rational or Emotional?

When a consumer makes a purchase, sometimes they act based on logic , and other times, they act on more emotional impulses .This situation alters their purchasing tendency. The key point for a marketer lies in recognizing these tendencies. If a marketer has deciphered the consumer's world, their job becomes much easier. Because a marketer who knows the consumer well provides better service and satisfies the consumer.

Following the Consumer

Understanding and keeping up with the consumer's world is extremely important for marketers. It's necessary to understand what consumers want, what they value, what makes them happy, their motivations, and what they talk about. At the same time, paying attention to trends and keeping up with new developments is also crucial. The consumer's world is constantly changing. Therefore, marketers must be able to adapt to this change.

The Art of Understanding the Consumer

Today, we'll explore some ways to discover and better understand the magical world of consumers. If you're ready, let's begin!

To understand the consumer, we can utilize "conventional methods and social listening." To delve deeper:

Conventional methods are more classical and traditional. You ask questions and receive answers. They can be costly and not very fast. Here are some conventional methods:

Surveys explore the world of consumers by asking them questions either on paper or online. They seek answers to questions like which product is useful to the consumer and why they make purchases.

- Focus Groups and Group Discussions

These are group studies conducted by bringing together consumers with similar tastes. The purpose of gathering groups of 6-12 people is to understand consumers' emotions, thoughts, and preferences.

- Observation

Observation involves directly observing the attitudes and behaviors of consumers as a means of understanding them.

- Purchase Data Analysis

In this method, sales data in businesses is examined to analyze consumer purchasing habits.

- Social Media Analysis

Consumer behavior is analyzed by examining their social media posts and interactions.

- Customer Feedback

Direct feedback is obtained from consumers through methods like online surveys and comments.

- Prototype Testing

Products or services are tested with consumers in the early stages.

The other method, "social listening," is akin to detective work, aiming to understand the consumer's interactions, likes, what they talk about, and what they follow on social media. Here are the steps of social listening:

- Tracking Trends: Trends are followed by tracking popular topics and viral content.

- Customer Feedback: Feedback from consumers on social media is analyzed.

- Brand Monitoring: Reactions are monitored by searching for products, brands, etc., on social media.

The Unseen Part of Purchase Decisions

If we start from the everyday part of our lives, the shopping process, we actually see that it is a complex psychological experience. When consumers purchase a product or service, they consciously or unconsciously evaluate many factors. Some of these factors are clearly visible, like the tip of the iceberg, while others are the unseen part of the iceberg at the bottom of the ocean.

The iceberg analogy can be a highly effective metaphor for analyzing consumer purchasing decisions. The visible part represents consumers' logical thoughts and clearly expressed preferences. However, the unseen part, which constitutes the majority of the real decision-making process, includes emotions, biases, experiences, and many other factors.

For example, when a consumer considers buying a cell phone, there are some visible factors they take into account, such as price, technical specifications, brand reputation, etc. However, beneath these factors lie deeper ones that actually influence the decision. Perhaps the consumer feels an affinity towards a brand they've known since childhood. Maybe the opinions of people around them have shaped their perception of the brand. Or perhaps previous positive or negative experiences have shaped their preference.

The consumer's unconscious thoughts and emotional responses are determinants of the purchasing decision. Therefore, as a marketing expert or brand, you should strive to understand and influence these deep factors of the consumer, rather than just focusing on the physical features of the product.

Understanding consumer purchasing decisions requires more than just focusing on the visible part of the iceberg. Understanding the emotional, social, and psychological factors lying beneath the surface of the iceberg will help you develop more effective strategies and better respond to consumers' real needs.

Setting Methodology in Consumer Research

Research plays a critical role in understanding target audiences for brands and providing products and services tailored to their needs. However, it's important to determine the methodology for effective consumer research.

The first step is to clearly define the purpose of the research. What questions are you trying to answer? Once these objectives are identified, the research design will take shape.

There are various types of data that can be used in consumer research. Would quantitative or qualitative data be more suitable for your study? Do you need numerical data or comprehensive descriptions? You should decide on this first, which will depend on your objectives and target group. You should also carefully decide which methods to use to collect your data. Among different methods such as surveys, focus groups, observation, etc., which one or ones will be more suitable for your research purpose, and you should also determine how to analyze the data after collecting it. The analysis of collected data will determine the quality of the research, and analyzing the data accurately is necessary to draw meaningful conclusions and make informed decisions. You can use statistical methods, data mining techniques, and qualitative analysis in analyzing your data. You should also ensure that the sample for your research accurately reflects the population it represents. Presenting the results of the research effectively is also as important as the other stages. Because, we know that an effective presentation can change everything!

Research Methods

1.qualitative research.

Qualitative research methods are used to gain in-depth understanding and focus on better understanding consumers' emotions, attitudes, and behaviors.

Focus groups are a method where a small group of people discusses a specific topic in-depth. These groups typically consist of 6 to 12 participants and are facilitated by a moderator.

- In focus groups: the aim is for participants to express their opinions openly and share their thoughts with each other.

- In-depth interviews: a method where the researcher conducts one-on-one interviews with a participant and obtains in-depth information. These interviews are used to explore consumers' personal experiences.

- Ethnographic studies: typically involve the researcher physically going to the research field and collecting data through observation, interviews, focus groups, and personal interactions. Researchers use this method to understand the daily lives, interactions, behaviors, rituals, and beliefs of a specific community or group of people.

2.Quantitative Research

Quantitative research methods provide comprehensive information through the collection and analysis of numerical data.

- Surveys: sets of questions administered to participants to answer specific questions. Surveys are typically applied to large samples and include standardized questions. Surveys can be conducted in various ways: face-to-face, by phone, online...

- Neuroresearch: a research area that examines brain activity to understand consumers' behaviors and preferences. This method goes beyond traditional consumer research to focus on understanding the subconscious impulses, responses, and emotions underlying consumers' decisions.

Cookie Information

Market research plays a critical role in helping brands better understand their target audiences and shape their marketing strategies. However, the reliability and effectiveness of these research efforts rely heavily on proper sampling. Representativeness stands out as one of the most crucial elements in market research, increasingly becoming the key to successful brand management.

Representativeness simply refers to the inclusion of a sample group in research that accurately represents the entire market. Incorrect sampling can lead to erroneous results, which in turn can result in misguided actions and failed brand management. Therefore, representativeness holds critical importance in market research.

- Gender: Ensuring accurate representation of gender distribution in market research is important, as consumer behaviors often vary by gender.

- Age: Representing different age groups allows market research to encompass a wide demographic range and understand the preferences of different generations.

- Region: Geographic representativeness is crucial to understanding consumer behaviors and market dynamics in different regions. Ensuring representation across national or international markets is important.

- SES (Socio-Economic Status): The socio-economic status of consumers is a significant factor influencing purchasing behaviors. Therefore, it's important to include participants from different income levels and socio-economic groups.

- Market Share: Market research utilizes market share metrics to determine brands' shares in the overall market. Adjusting the sample based on market share serves as an indicator of proper sampling.

In the world of marketing, one of the highest goals for brands is to become the top-of-mind brand for consumers. At this point, the importance of generic brands gains significant momentum. Generic brands are those that represent a product category as if it were their own brand and symbolize the products in that category in the minds of consumers. Brands like Selpak, Gillette, and Aygaz are examples of generic brands.

Survey Flow Example:

- Demographic Information: The survey begins by collecting demographic information from participants (such as age, gender, income level, etc.). These details are important for better understanding and analyzing the results.

- Awareness: Participants are presented with a list of brands related to a specific product category. This list includes the names of brands, and participants are asked to indicate whether they recognize these brands or not.

- Usage: Participants are asked whether they use the brands they recognize. This step goes beyond awareness to measure whether brands are actually preferred by consumers.

- Image: Finally, participants are asked to provide comments on the image of brands they do not use. This section is important for understanding the perceived value of brands and consumers' emotional thoughts about the brand.

- 5-Point Scale: The most commonly used question type in market research is the 5-point scale. It is particularly popular for measuring satisfaction and preference.

How satisfied are you with the …………. brand product you used?

Very satisfied Satisfied Neither satisfied nor dissatisfied Dissatisfied Very dissatisfied

(NPS) Net Promoter Score: Net Promoter Score, a customer loyalty metric that calculates the likelihood of customers recommending brands based on a single question and shows it with a score between -100 to +100.

Question: Would you recommend the brand …… to others? Rate on a scale of 0 to 10. 10 stands for "Definitely recommend", while 0 stands for "Would never recommend".

Calculation of NPS:

0 – 6 = Detractors

7 – 8 = Passives

9 – 10 = Promoters

NPS = (Number of Promoters – Number of Detractors) / (Number of Respondents) x 100

“No one uses a brand they don't know, and they can't comment on the image of a brand they don't know.”

Read more on how Kimola Cognitive calculates (NPS) Net promoter Score.

Social Research

Draw behavior profiles..

Marketing research has evolved in many areas. Changing consumer behaviors have led to new marketing strategies at some point. Consumer behaviors are variable. These variations will be reflected in the interactions between consumers as much as they need for communication, and community models in which individuals interact can be determined from here. Indeed, communication is part of our social reality, and considering the digital world we are facing will also affect it entirely.

Determine research techniques to provide systematic information about what consumers need.

Consumers may compare the image of the products they purchase with their own image. Image perception studies for products can be conducted through email marketing strategies, digital marketing strategies; these are also fast and effective techniques widely used in the social media pool.

Collect consumer opinions on digital platforms. How is market research done via social networks?

The increase in mobile usage over time, consumers starting to turn to online shopping, and fluctuations in the performance of social platforms have begun to increase the conversion of ads to sales, which has become our focus while following the changing world.

Social media are becoming a collective element of monetization for many businesses with renewed products, and they are increasingly used by consumers to provide information about their needs, service experiences, share and file consumer complaints. It can also be used to conduct surveys and test concepts. When used well, consumer research management can be one of the most powerful research tools.

By collecting related data with social listening tools and uploading the data to text analysis tools, you can analyze social media data easily.

Target Audience Analysis

Target Audience Analysis is a fantastic method for marketers to understand the consumer world. With this analysis, it is possible to determine the characteristics, needs, motivations and behaviors of the target audience that the marketer is aiming for. Target audience analysis examines consumers' lifestyles, what they like, and their interests. It generally includes demographic (age, gender, income, etc.), psychographic (interests, lifestyle, attitudes, etc.), and behavioral characteristics.

Methods in Analysis

1. customer feedback analysis.

Our machine learning and artificial intelligence-supported platform helps to analyze customer reviews, conversational data, customer-agent conversations, call-center conversations and more.

If you're looking for a tool to analyze customer feedback, Kimola Cognitive offers a free trial for 7 days.

2.Demographic Analysis

It involves examining demographic characteristics such as age, gender, income level.

3.Behavioral Analysis

It involves examining how a consumer uses a product and their purchasing habits. This analysis is used to understand how the consumer responds to a product or service.

4.Focus Groups

Conducted with small groups of consumers to determine consumer thoughts and needs.

Through this method, questions are asked to consumers to analyze general trends. You can also analyze survey responses with Kimola Cognitive.

6.Social Media Data Analysis

Consumers' social media interactions are analyzed, and these data are used in target audience analysis. Kimola Cognitive covers social media data analysis too; it can analyze up to billions of conversations of any text based data.

We gather global consumer research news and share them with 3,000+ marketing and research professionals worldwide.

TOP 10 Tools for Market Researchers for Every Step of Market Research

Transform your market research with handpicked selection of top 10 tools, optimizing every step from data collection to analysis.

The Ultimate Toolkit for Product Managers (List)

Elevate your planning, collaboration, and analysis processes with the product management tools we've selected for you. Boost your...

The Evolution of Market Research: A Historical Perspective!

Market research is like playing Jenga in business—placing consumer insights strategically is crucial for a solid foundation and...

Access all your Kimola products with a single credential.

Join 3,000+ marketing and research professionals from 80+ countries.

Fill out the form and one of our team members will contact you soon.

Hyderabad, India

[email protected]

040-40103771.

- Case Studies

- Let's Talk

- Market Research

- Consumer Research

Team Research-city

Have you ever wondered what goes into making a really successful product or campaign? The answer is consumer research.

Consumer research is a technique used by marketers and product developers to understand the needs, wants and behaviour of their target audiences. It involves collecting data about customers, analyzing it and using it to create strategies that will yield the most successful results.

Whether you are a marketer planning an advertising campaign or a product developer creating a new product, understanding your customers is essential for success. Consumer research can give you detailed insights into your customers’ behavior, preferences and motivations, which can be used to make better decisions about how to serve them in the most effective way possible.

In this article, we will provide an overview of what consumer research is and how it works. We will also discuss how businesses can benefit from using consumer research in their marketing and product development efforts.

What Is Consumer Research?

Consumer research is a process used to understand the behavior of consumers and their preferences. It helps businesses get an accurate understanding of their target audience. This research focuses on understanding why people choose certain products and services, what drives their decisions and how they feel about different aspects of a product or service.

The research process includes analyzing customer data, conducting interviews, collecting survey responses and observing consumer behaviour. This allows businesses to identify issues in their target markets, uncover new opportunities and measure customer satisfaction with products or services.

Overall, consumer research is an essential tool for gaining insights into the market trends, customer needs and preferences that allow businesses to understand their existing customers better while identifying new customers they can acquire. By conducting this type of research, they can ensure that they are providing the right solutions to meet the demands of their target audience.

Types of Consumer Research

Consumer research is a broad term encompassing a variety of techniques used to glean information about buyers and the marketplace. Depending on the data being sought, there are several different types of consumer research that can be employed.

Surveys: Surveys are one of the most popular methods for gathering consumer data. Surveys typically consist of a series of questions posed to participants, which can be administered online, in person or by phone. The responses from these surveys can provide valuable insights into consumer attitudes, preferences and behaviours.

Focus Groups: Focus groups typically feature moderated discussions with a small number of participants about a particular product or service. This type of research allows organizations to gain feedback on products or services before they reach the market and get a better understanding of how users perceive and interact with their offerings.

Observation Studies: Observation studies involve watching participants use products or services in real-world environments and recording their activities. This allows researchers to observe how people use products in different contexts and gain insights into user experience.

Overall, consumer research is an important tool for understanding buying behaviour and driving successful marketing initiatives. By using the right techniques for gathering data, companies can gain valuable insight into their target audience’s needs and preferences, helping them make informed decisions about their product offerings and marketing strategies.

The Consumer Research Process

Consumer research is the process of gathering, analyzing and using consumer data to make decisions about how to best serve the needs and interests of customers.

The consumer research process typically involves five steps:

- Defining the research objectives

- Developing a research plan

- Collecting data

- Analyzing the data

- Developing conclusions and recommendations

At each step, specialists in consumer research methods use quantitative and qualitative methodologies to gain insights into consumer behaviours, attitudes, needs and preferences. This data can be used to develop strategies for marketing campaigns, product development initiatives and other activities that help companies meet their goals of providing products and services that resonate with their customers.

Benefits of Consumer Research

Consumer research is an invaluable tool for organizations striving to gain insights into the opinions and behaviours of their target audience. By using consumer research, businesses can discover what their customers want, how they make decisions, and how they view the organization’s products or services.

The benefits of opting to conduct consumer research are numerous. Here are just a few:

Improved Product Development

Conducting consumer research enables organizations to find out what their customers desire in a product or service, enabling them to create offerings that meet these exact needs. This helps to reduce the risk involved with launching new products by ensuring they are tailored to meet customer demands.

Enhanced Marketing Efforts

By learning more about target audiences, marketers can use this information to devise more effective marketing strategies. This could include developing more personalized messaging that resonates with customers and attracts them to your business.

Increased Customer Retention Rates

Insights gleaned from consumer research can help organizations identify any customer pain points and work towards creating better experiences for their clients. This leads to higher customer satisfaction and loyalty rates, resulting in increased customer retention rates over time.

Challenges With Conducting Consumer Research

Conducting consumer research can be a tricky business. Despite its fundamental importance in improving the customer experience, there are many common challenges that make it more difficult for organizations to get the data they need.

Among the most typical challenges with consumer research are:

Data collection – Gathering data from consumers can be time-consuming and expensive, especially in a global context. It involves designing surveys, questionnaires or other research tools, managing sample selection, and conducting field research.

Data accuracy – It’s difficult to ensure the accuracy of data collected through consumer research, as responses may be affected by various external factors such as moods or personal opinions.

Data analysis – Analyzing large amounts of data collected through consumer research takes specialized skills and knowledge in order to draw meaningful insights from it.

Data implementation – Once the data has been collected and analyzed, it is necessary to implement the insights across all departments within an organization in order to make strategic changes based on customer feedback. This requires close collaboration between departments and a clear understanding of how different teams can leverage the information for their benefit.

These challenges demonstrate why consumer research is not only necessary but also complex; without it, organizations will struggle to understand their customers’ needs and develop effective strategies for growth and success.

Best Practices for Effective Consumer Research

Consumer research is an invaluable tool for any business looking to stay competitive and grow. There are strategies you can use to ensure that your consumer research is effective:

Choose Your Methodology Carefully

When conducting consumer research, it’s important to choose the correct methodology for your project. Different methods may be more effective in different situations and industries, so take the time to plan and select the most appropriate one for your goals.

Gather Data From Multiple Sources

To gain a complete picture of how consumers think and feel about your product or service, you need to collect data from multiple sources. This includes online surveys, focus groups, interviews, and observation.

Keep Up With Emerging Trends

Technology is constantly evolving, so it’s important to keep up with emerging trends in consumer research. Utilizing new tools such as Artificial Intelligence (AI) and machine learning can help you gain insight into customer behaviour faster than ever before.

Analyze The Data Accurately

Once you have gathered all the data, it’s essential that you analyze it accurately. Use data visualization software or statistical analysis tools to quickly spot patterns or trends in the data that could be useful for your business decision-making process.

In summary, consumer research is a critical part of any business strategy. It can help companies identify and target the right consumers, understand their behaviour, and develop effective marketing campaigns. From identifying the needs and wants of customers to determining the best ways to communicate with them, consumer research is an essential component for any business that wants to remain competitive and successful. Additionally, companies can use consumer research to assess their current strategies, as well as to acquire their customers’ overall level of satisfaction. Through these insights, businesses are able to provide a better overall customer experience and drive profitable growth.

We help you make intelligent and data-driven business decisions. Our problem-solving approach delivers action-oriented research, enabling a deeper understanding of market factors and accelerates your organization to rise to the next opportunity.

Free Consultation

Get in touch.

Hyderabad, India.

Quick Links

Your message (optional)

We help you make intelligent and data-driven business decisions. Our problem-solving approach delivers action-oriented research, enabling a deeper understanding of market factors and accelerating your organization to rise to the next opportunity.

Latest Blog

Just one more step to your free trial.

.surveysparrow.com

Already using SurveySparrow? Login

By clicking on "Get Started", I agree to the Privacy Policy and Terms of Service .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Enterprise Survey Software

Enterprise Survey Software to thrive in your business ecosystem

NPS® Software

Turn customers into promoters

Offline Survey

Real-time data collection, on the move. Go internet-independent.

360 Assessment

Conduct omnidirectional employee assessments. Increase productivity, grow together.

Reputation Management

Turn your existing customers into raving promoters by monitoring online reviews.

Ticket Management

Build loyalty and advocacy by delivering personalized support experiences that matter.

Chatbot for Website

Collect feedback smartly from your website visitors with the engaging Chatbot for website.

Swift, easy, secure. Scalable for your organization.

Executive Dashboard

Customer journey map, craft beautiful surveys, share surveys, gain rich insights, recurring surveys, white label surveys, embedded surveys, conversational forms, mobile-first surveys, audience management, smart surveys, video surveys, secure surveys, api, webhooks, integrations, survey themes, accept payments, custom workflows, all features, customer experience, employee experience, product experience, marketing experience, sales experience, hospitality & travel, market research, saas startup programs, wall of love, success stories, sparrowcast, nps® benchmarks, learning centre, apps & integrations, testimonials.

Our surveys come with superpowers ⚡

Blog Best Of

Customer Research 101: Definition, Types, and Methods

Last Updated:

30 May 2024

Table Of Contents

What is Customer Research?

Why is customer research important, types of customer research.

- 6 Customer Research Methods

- How SurveySparrow Can Help

Do you want to improve your marketing or product? Then, customer research can help.

Your customer is at the heart of all your business decisions. In fact, everything revolves around a customer. A business is about having a paying customer, and it wouldn’t exist without one.

The effectiveness of your product or marketing depends on how well you know your customers. When you know your customers better, you can make better product or marketing decisions.

In this article, we break down:

- What customer research is

- Why it’s valuable for your business

- Different types of customer research

- Six customer research methods you can use to refine and grow your business

Customer research (or consumer research ) is a set of techniques used to identify the needs, preferences, behaviors, and motivations of your current or potential customers.

Simply put, the consumer research process is a way for businesses to collect information and learn from their customers so they can serve them better.

Businesses typically conduct customer research to uncover new insights on their customers. They then use these newly uncovered insights to improve their product, craft an effective marketing strategy, and more.

Here are 2 key questions customer research helps you answer:

- Who are my ideal customers? Who is the best fit (or worst fit) for our product?

- What channels can I use to find and communicate with my ideal customers?

Online survey tools like SurveySparrow can help you answer these questions. With omnichannel survey distribution, snazzy data visualization, and 1,500+ integrations with your favorite tools, SurveySparrow simplifies customer research for your GTM and product teams.

Looking for a Full-Fledged Customer Research Tool?