- Reviews / Why join our community?

- For companies

- Frequently asked questions

User Experience (UX) Surveys: The Ultimate Guide

Imagine you're a business owner eager to improve your website's user experience. You want to know what's working, what's not, and where you need improvements. While you have various research methods (such as user interviews , usability tests, A/B testing , etc.) available, a user experience (UX) survey helps gather valuable insights and pinpoint the areas for enhancement.

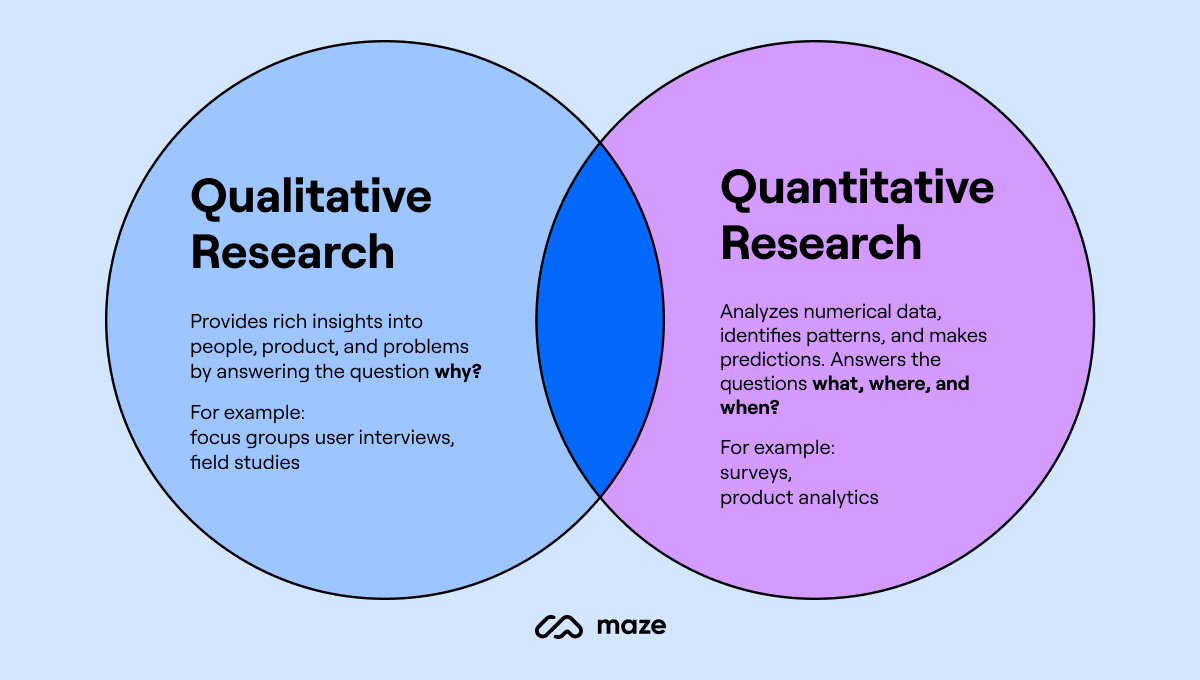

UX surveys can offer actionable insights , presenting qualitative data that informs decisions.

- Transcript loading…

Through this piece, you'll learn everything about user experience surveys. From market research professionals and business owners to website developers, anyone aiming for customer satisfaction will find this helpful.

You'll learn about UX survey best practices and the right questions to help identify pain points and understand different question types.

What are UX Surveys?

UX Surveys, or User Experience Surveys, gather information about users' feelings, thoughts, and behaviors related to UX design , product, or service. These online surveys form a part of the broader field of usability surveys. They focus on understanding how users interact with a system, application, or website to create a user-centered design .

© Interaction Design Foundation, CC BY-SA 4.0

1. Customer Effort Score Surveys (CES)

CES surveys assess how simple it is for customers to complete tasks with your company. Think of it like this: It's a score that tells you if using your product or getting help from your service team was a breeze or a struggle for the customer.

Many people value quick, straightforward answers to their questions. Time is precious, so spending less effort resolving issues is better. Ease of experience can be more revealing than overall satisfaction. Experts now use the Customer Effort Score.

For instance, after a customer service interaction, the question could be:

"How easy was resolving your issue with our customer support?"

Very Difficult

This format helps companies understand the ease of interaction from the customer's viewpoint. It can be an excellent tool for identifying areas for improvement.

2. Customer Satisfaction Surveys (CSAT)

A CSAT survey measures how happy customers are with your company.

The main question is, "How satisfied are you with our service?"

Answers range from 1, meaning "very dissatisfied," to 5, indicating "very satisfied."

CSAT surveys focus on individual interactions, like purchasing or using customer support. They use numeric scales to track satisfaction levels over time. These surveys help you understand your customers’ needs and pinpoint issues with your products or services. They also allow you to categorize customers based on their satisfaction levels, which helps with targeted improvements.

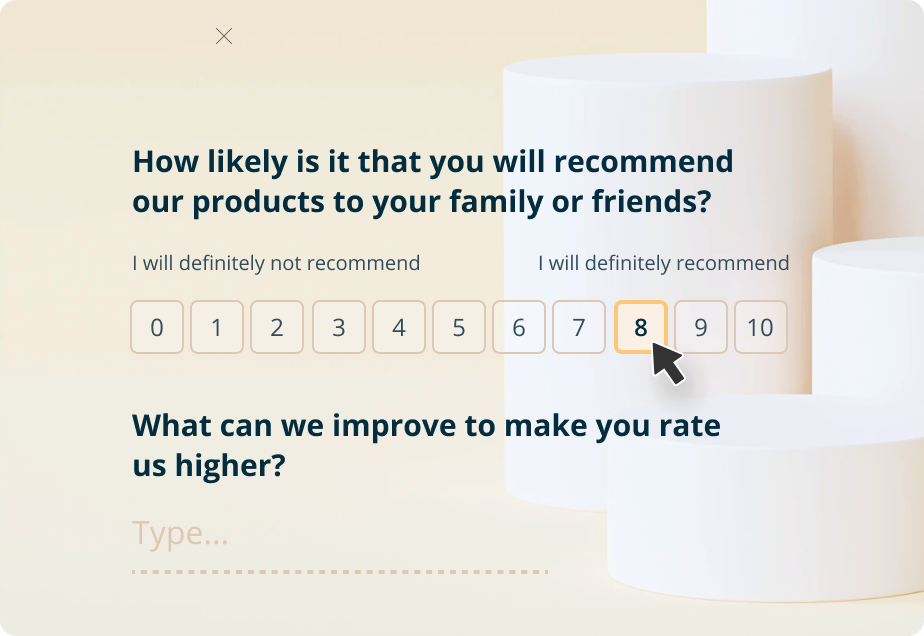

3.Net Promoter Score Surveys (NPS)

NPS surveys are simple and quick since they use just one question: “On a scale from 0 to 10, how likely are you to recommend this product/company to a friend or colleague?”. Based on the score, you can do respondent segmentation into one of three categories:

Promoters (Score 9-10): These are your biggest fans, and they are likely to recommend your product.

Passives (Score 7-8): These folks find your product/service satisfactory but could easily switch to competitors.

Detractors (Score 0-6): These unhappy customers could harm your brand through negative word-of-mouth.

You can calculate the NPS score by subtracting the Detractors' percentage from the Promoters'. This gives a snapshot of customer loyalty and areas for improvement.

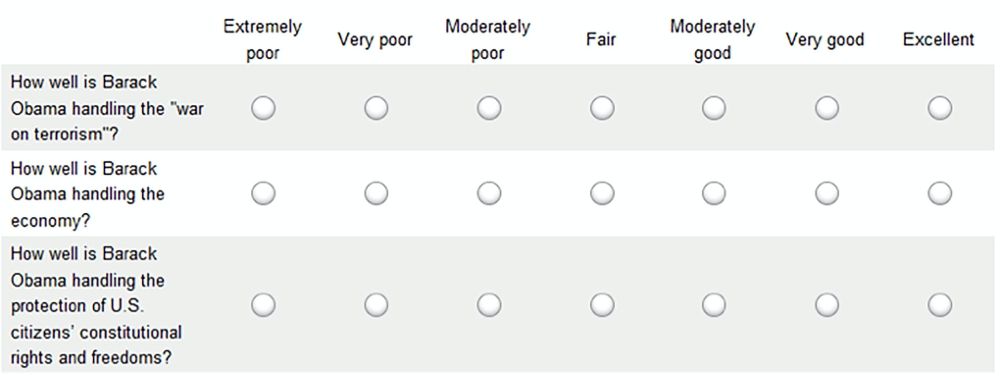

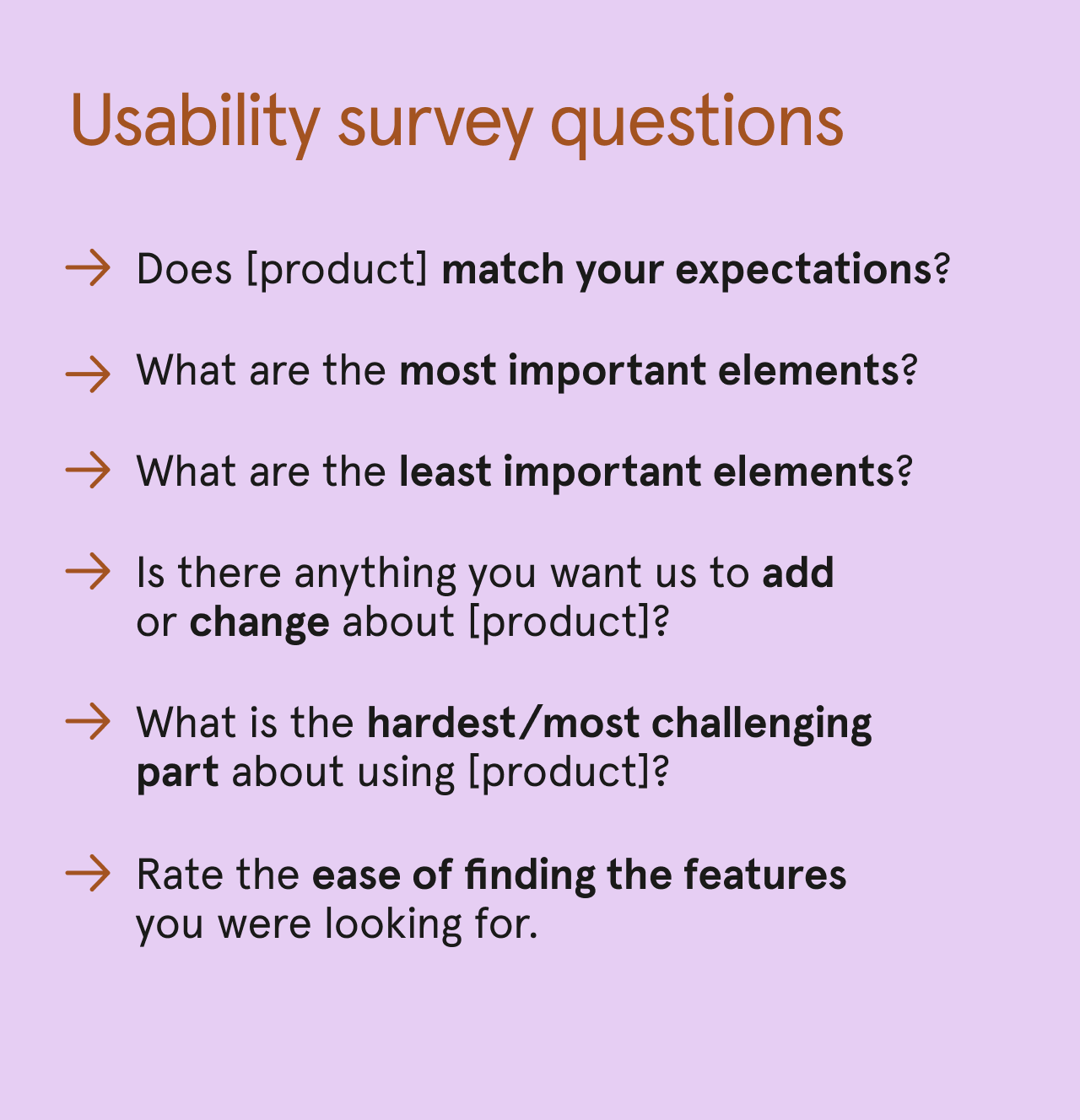

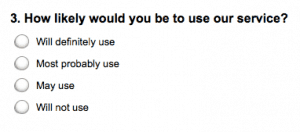

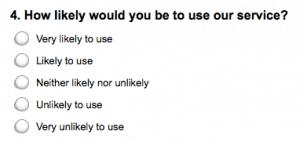

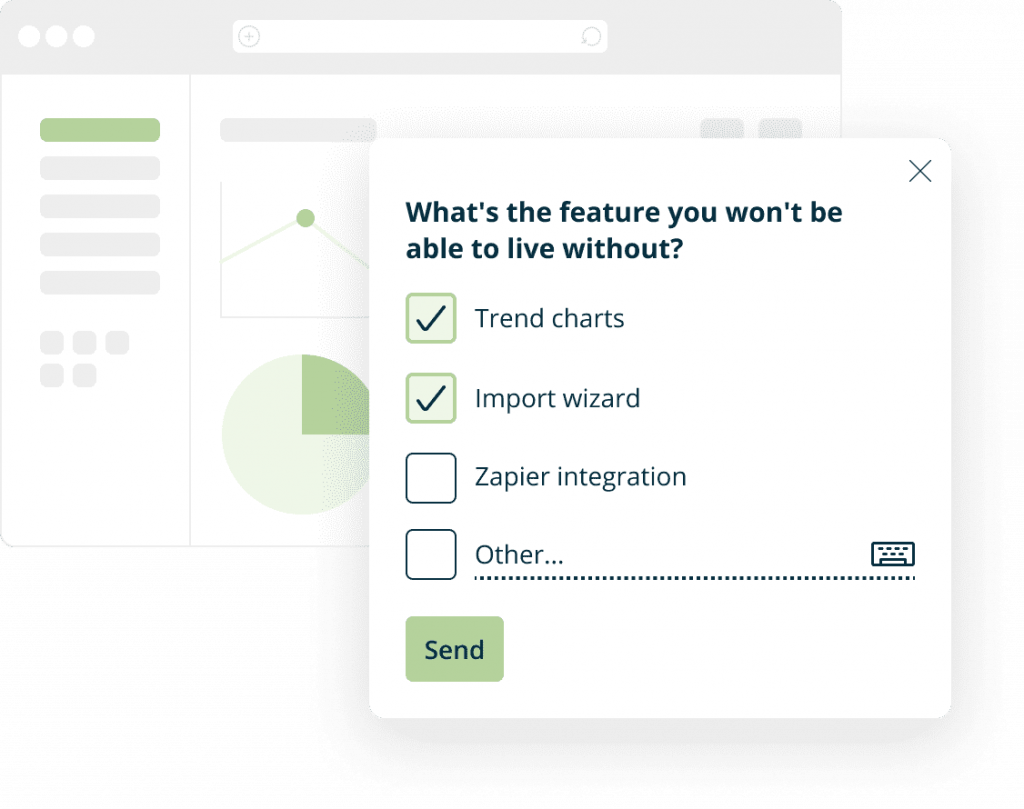

4. Close-ended Questions for Quantitative Research

Well-designed, close-ended questions are easy to answer. Users pick from predefined options like checkboxes, scales, or radio buttons. These surveys are suitable for gathering data. You'll see these in exit surveys asking users about their shopping experience. The answers provide actionable data, like customer preferences or standard problems.

Get more insights on quantitative research in this course on Data-driven Design .

You may ask,

"How satisfied are you with our delivery speed?"

The options could be:

Very Satisfied

Dissatisfied

Very Dissatisfied

Here, users don't need to type out their thoughts. They select an option that best describes their feelings. It's quick for the user and easy for the company to analyze.

5. Open-ended Questions for Qualitative User Research

While closed-ended questions offer fixed options for quick responses, open-ended questions allow for more detailed, free-form answers. These questions ask for written responses. They dig deeper into how users feel and what they expect.

It may take more time to analyze the responses you gather from this type of survey. But they're valuable because they offer nuanced insights.

For example, questions like "What feature do you wish we had?" can lead to ideas for product enhancements that meet users' needs .

When and Why Should One Conduct a UX Survey?

Conducting a UX survey is a strategic decision to understand various aspects of user interaction with a product or service. Here are vital scenarios and reasons for implementing them:

1. Feature Evaluation and Enhancement

You may find UX surveys better suited to assess existing products than development ones. These surveys can gather insights on how well your target audience receives a feature or service. Feedback from such surveys can guide adjustments or additions to your product.

For instance, if customers believe an existing feature lacks functionality, you can focus on enhancing it. UX surveys offer valuable data to refine a product to better align with customer needs and expectations.

2. Identifying Pain Points

Spotting pain points is essential for creating a user-friendly experience. UX surveys provide direct feedback from users about what's troubling them. These could be issues you're unaware of that make the customer experience less enjoyable or efficient.

For example, users might point out that they find your checkout process too complicated or that they have trouble finding specific information on your website. These insights are like gold; they give you specific areas to focus your improvement efforts. Addressing these issues helps you fix problems and show users you value and act upon their feedback.

3. Assessing Customer Satisfaction

Customer satisfaction is crucial for any business. A well-timed UX survey can gauge how well you meet customer expectations after a critical interaction, such as a purchase or customer service call.

Positive feedback helps identify vital areas, while negative feedback highlights issues that need attention.

4. Evaluating Customer Loyalty

Long-term success hinges on customer loyalty. NPS surveys, a type of UX survey, help gauge this.

Identifying promoters, passives, and detractors can help you tailor customer retention and referral strategies. If you see a dip in loyalty scores, it's an alert to dig deeper into potential issues.

5. Journey Mapping

Journey mapping visually represents a user's interactions with your product or service. It tracks the entire experience, from the first touchpoint to the final interaction. A well-designed UX survey can provide insights at multiple stages of this journey.

For example, you can use CES surveys at various checkpoints to measure ease of use . Are customers finding it simple to navigate from one section of your website to another? CSAT surveys can check satisfaction at critical touchpoints like purchase or support.

Open-ended questions can offer qualitative insights into why users make specific choices. These answers fill gaps in the journey map that analytics data might lack.

6. During Major Transitions or Updates

If you're planning a significant change, such as a rebrand or major update, a UX survey becomes invaluable. It helps assess customer sentiment and expectations before you roll out the differences.

Collecting survey data allows for adjustments that align with customer needs. This way, you can reduce the risk of negative backlash.

7. Continuous Improvement

The need for improvement never stops. Regular UX surveys create a feedback loop to help you track user sentiment and performance metrics. They allow for ongoing adjustments based on real-world usage.

For example, if you notice a slight dip in satisfaction scores related to app usability, you can investigate and make adjustments before it becomes a significant issue.

Continuous improvement through regular UX surveys keeps your product aligned with users’ needs and expectations. It helps you sustain your success.

6 UX Survey Best Practices From Experts

Conducting a UX survey requires careful planning and execution to achieve actionable insights. Here are five best practices from experts in the field:

1. Make it Quick

People value their time, and long surveys can deter participation. A quick and concise survey ensures that the participant remains engaged. Focus on the essential questions and remove any unnecessary ones.

Steps you can take:

Limit your survey to 5-10 essential questions

Use clear and concise language

Preview the survey with a friend or colleague to get feedback on the length.

2. Keep It Relevant

Ensuring relevance in your survey questions is crucial for collecting valuable data. If questions stray off-topic, they risk irritating or baffling participants. Keep questions focused to ensure you get the insights for your goals.

Define your target audience and goals before writing questions

Avoid generic questions that don't relate to the product or service

Focus on specific user experiences that align with your objectives.

Provide not applicable/don’t know answers for all closed questions.

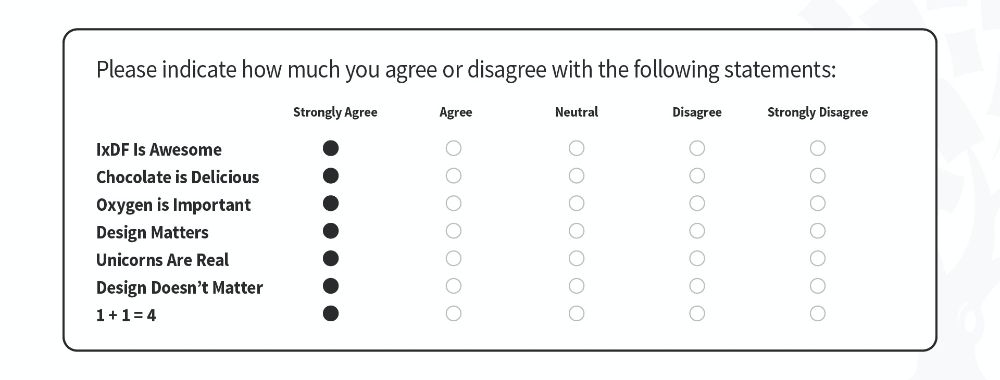

3. Avoid Bias

Bias can distort the results and lead to misguided conclusions. The objective framing of questions helps in collecting unbiased responses. Some of the common biases include:

Question order bias: Affects responses based on the sequence of questions.

Confirmation bias: Only ask questions that affirm what you already believe.

Primacy bias: People choose the first options given.

Recency bias: People are more influenced by their last experience.

Hindsight bias: Respondents say events were foreseeable.

Assumption bias: Assumes respondents know certain information.

Clustering bias: People see patterns where none exist.

Avoid leading questions

Use neutral language

Consider asking an expert to review your questions for potential bias

Test the survey on a small group before launching it.

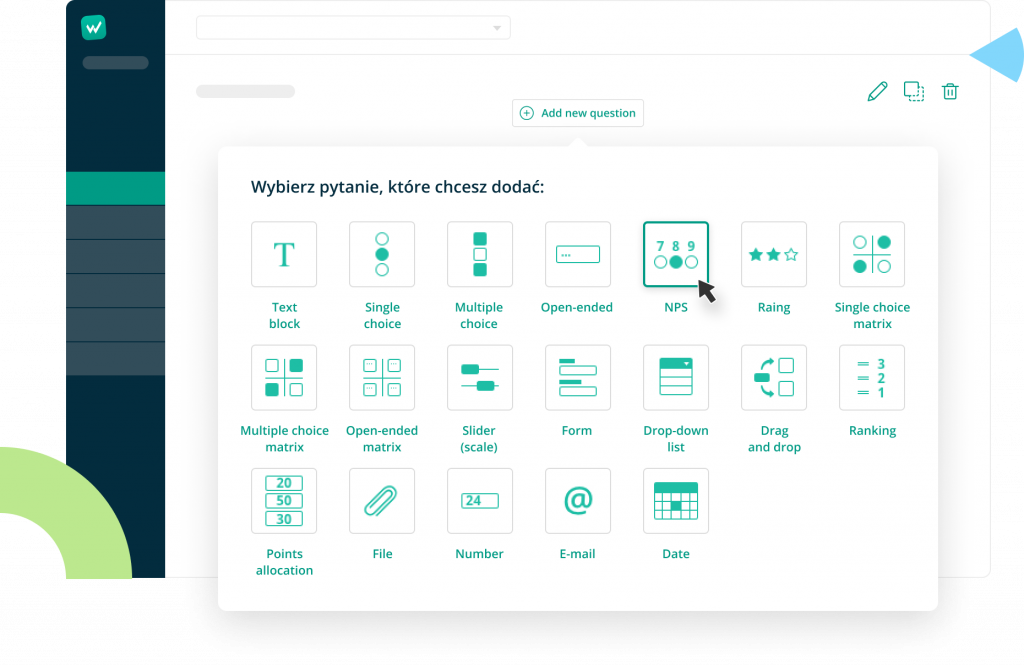

4. Mix Up Your Question Types

While multiple-choice and rating scales excel at gathering numerical data, open-ended questions offer rich, qualitative insights. The blend can give you a more comprehensive view of customer sentiment.

Use a mixture of types of questions according to the information you need

Utilize open-ended questions for in-depth insights and multiple-choice for quick feedback

Consider using scale questions to gauge user satisfaction or preferences

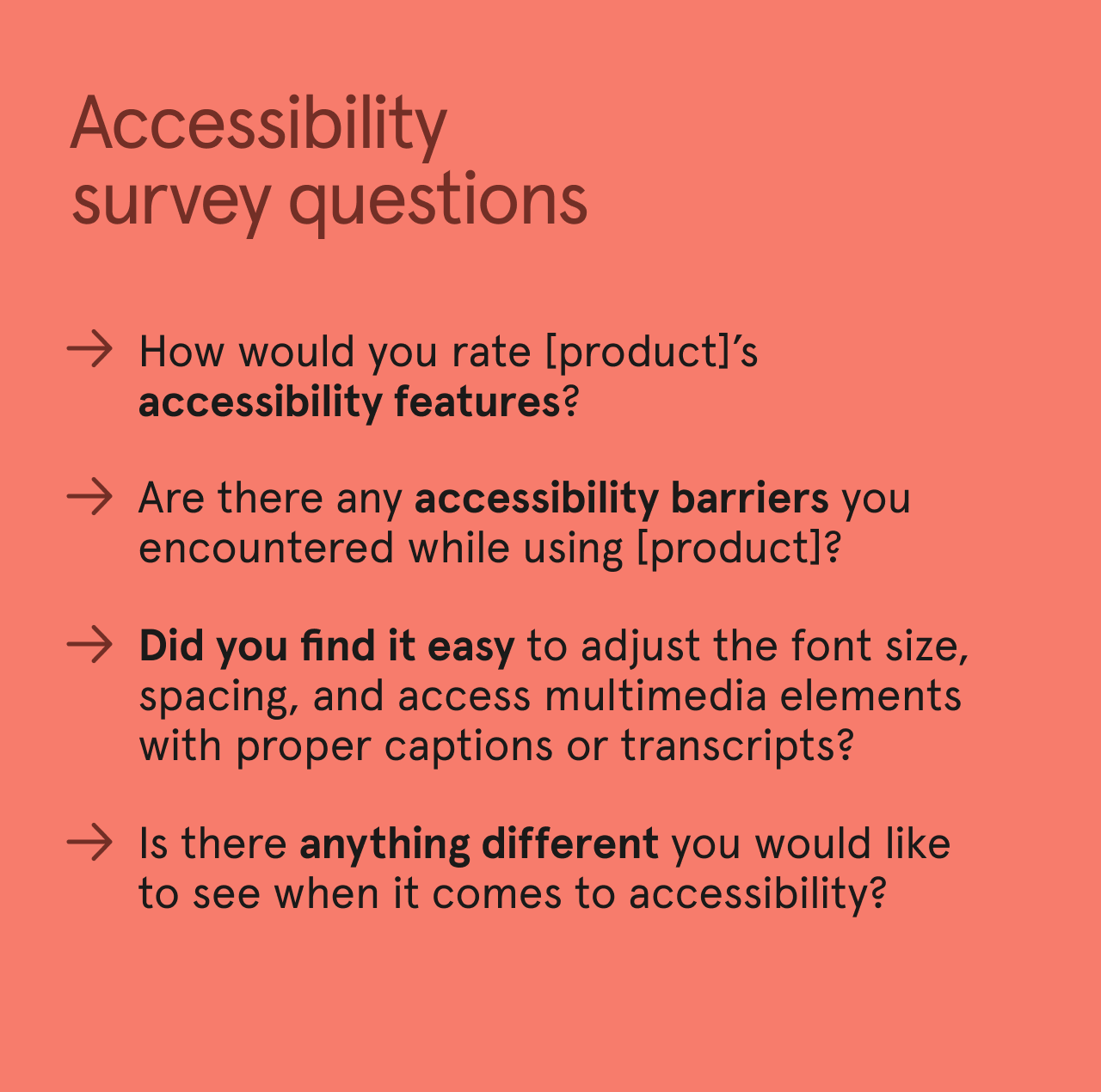

5. Ensure Accessibility

Making your survey accessible helps you capture a wide range of perspectives. If you create an accessible survey for everyone, including those with reduced abilities, you'll get a more complete and diverse set of insights. This comprehensive view can enhance the quality of your data and decision-making.

Utilize easy-to-read fonts and adequate color contrast

Provide alternative text for images

Ensure that users can navigate the survey using keyboard controls

Test the survey's accessibility features

Avoid complex layouts and matrix-style questions

See the W3’s Web Content Accessibility Guidelines for more details.

6.Maintain Privacy

Prioritizing participants' privacy is critical to building trust. When people feel confident that their data is safe, they're more likely to engage fully in your survey. A strong privacy policy meets legal standards and boosts participation rates. It enriches the quality of your insights.

State your privacy policy at the start of the survey

Use secure platforms for conducting the survey

Assure participants that their responses will remain confidential

Put sensitive or personal questions towards the end

Following these best practices, you can make UX surveys effective for gathering insights and improving the user experience. The actionable steps outlined above make creating an engaging, unbiased, and insightful survey possible.

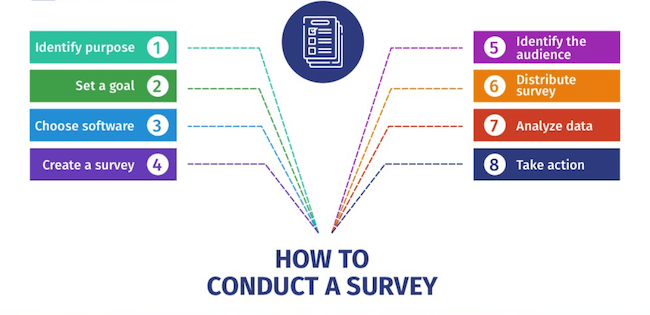

The Ultimate Guide to Conduct a UX Survey

Conducting UX surveys is essential for understanding user interaction with your product. Follow these steps to design, distribute, and analyze surveys for actionable insights.

Step 1: Define Your Objectives

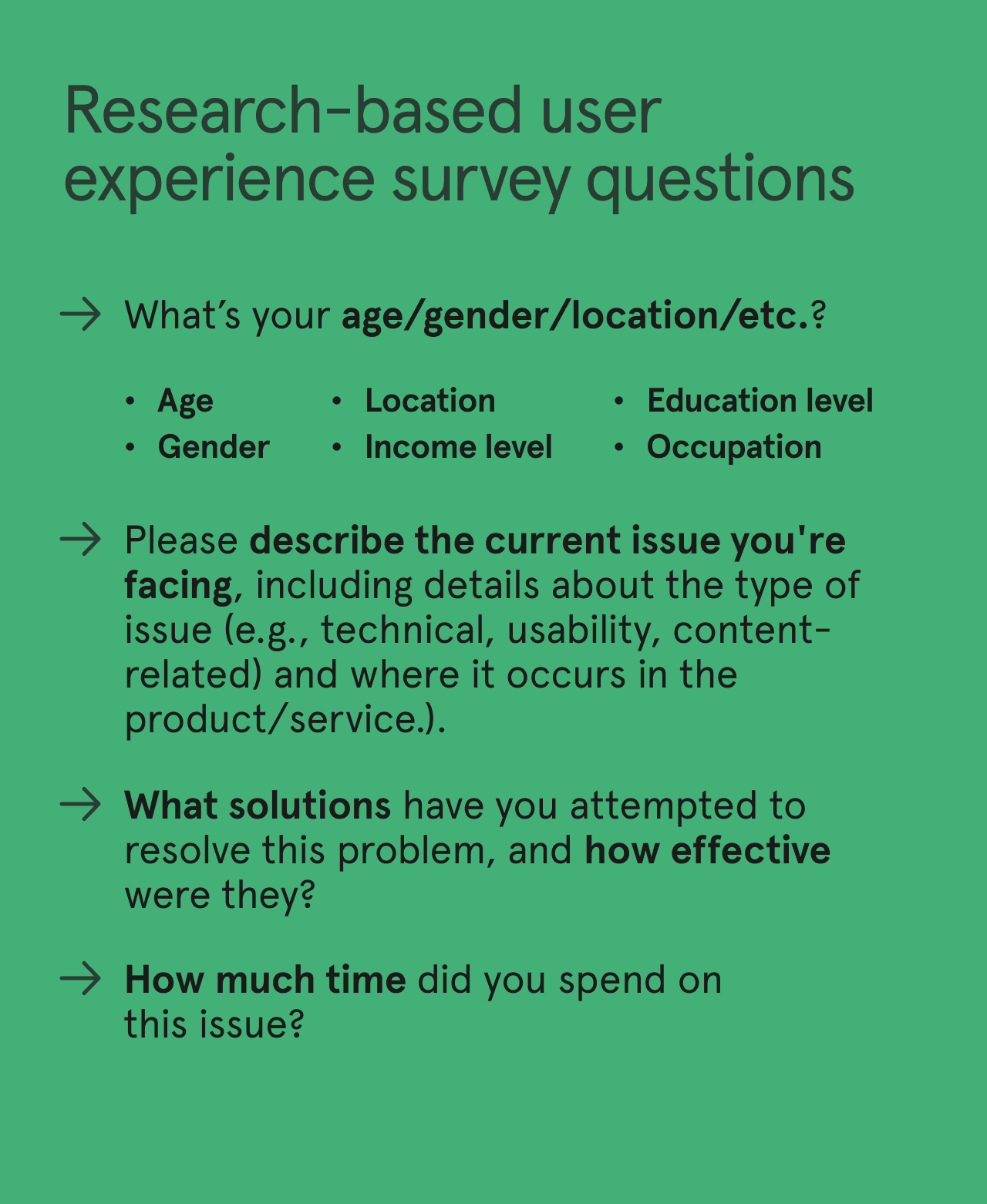

Defining clear objectives sets the stage for a successful UX survey. It helps you understand the key insights you are seeking. To zero in on what you're aiming to discover, consider these questions:

What is the main goal? Understand if you want to measure user satisfaction or you want to focus on something else.

Which user behaviors are relevant? Is the survey targeting frequent users, new users, or both?

What are the key metrics? Do you want to look at completion rates, time spent, or other indicators?

New feature opinions : Are you seeking input on new rolled-out features?

Pain points : Are you trying to identify user frustrations and roadblocks?

Clarity in the objectives will guide every next step and ensure you align the results with your project goals. Well-defined goals will streamline the survey's structure and help craft relevant questions. The sharper focus also helps in analyzing the data you collect later on.

Step 2: Identify Your Target Audience

Identifying your target audience is a pivotal step in creating a survey. Here's why:

Product awareness: Gauge how much your audience knows about your product. This shapes the depth and detail of questions.

Interests : Understand what topics engage your audience. Use that insight to make questions interesting.

Language : A professional audience may understand industry jargon. A general audience may not. Choose words carefully.

Region : Geography can affect preferences and opinions. Localize questions if needed.

Understanding your target audience helps you write questions that they can relate to. It leads to higher engagement and more accurate data in user research . You can also create customer personas and a user journey around them.

Step 3: Craft Engaging Questions for the Questionnaire

Questions are the heart of your survey. Writing engaging, clear, and unbiased questions will provide the insights you need.

Learn the art of writing good questions for surveys

So, here’s what you can do to craft engaging questions:

Use different types, such as multiple-choice for quick feedback or open-ended for deeper insights.

Use simple language, avoid jargon, and ensure each question serves a clear purpose.

Be mindful of potential biases and keep the questions neutral.

Your questions must captivate the user's interest and guide them through the survey.

Step 4: Select a Tool For the UX Research Survey

Selecting the right tool for your UX survey is crucial for data collection and analysis. A Google Form provides a quicker way to get started with UX surveys. Here’s why:

Ease of use : Google Forms is user-friendly. Even if you're not tech-savvy, you can create a survey quickly.

Customization : It offers various themes and allows question branching based on prior answers.

Integration : Google Forms integrates with other Google services like Google Sheets for real-time data tracking.

Free : For basic features, it's free of charge.

Data analysis : Offers basic analytics like pie charts and bar graphs for quick insights.

You can also use specialized UX research tools like SurveyMonkey with more advanced features. Consider what your objectives and target audience need. Then, choose a tool that best serves those needs.

Step 5: Pilot the Survey

Pilot testing is an invaluable step in refining the UX survey. It provides an opportunity to uncover unforeseen issues with the survey design, questions, or technology.

Recruit participants in small numbers to test the survey. You can ask internal team members for help or contact professionals via LinkedIn. Use this test survey to understand their experience and make necessary adjustments. This can make the difference between a good survey and a great one. It helps iron out the kinks and ensures a smoother product experience for the primary audience.

Step 6: Launch the Survey

Launching the survey is more than making it live. It involves choosing the proper channels, timing, and even incentives. Promoting the survey ensures that it reaches your intended audience and encourages participation.

Consider the time of day, week, and even platform that aligns with your audience. You must plan every aspect of the launch to maximize participation.

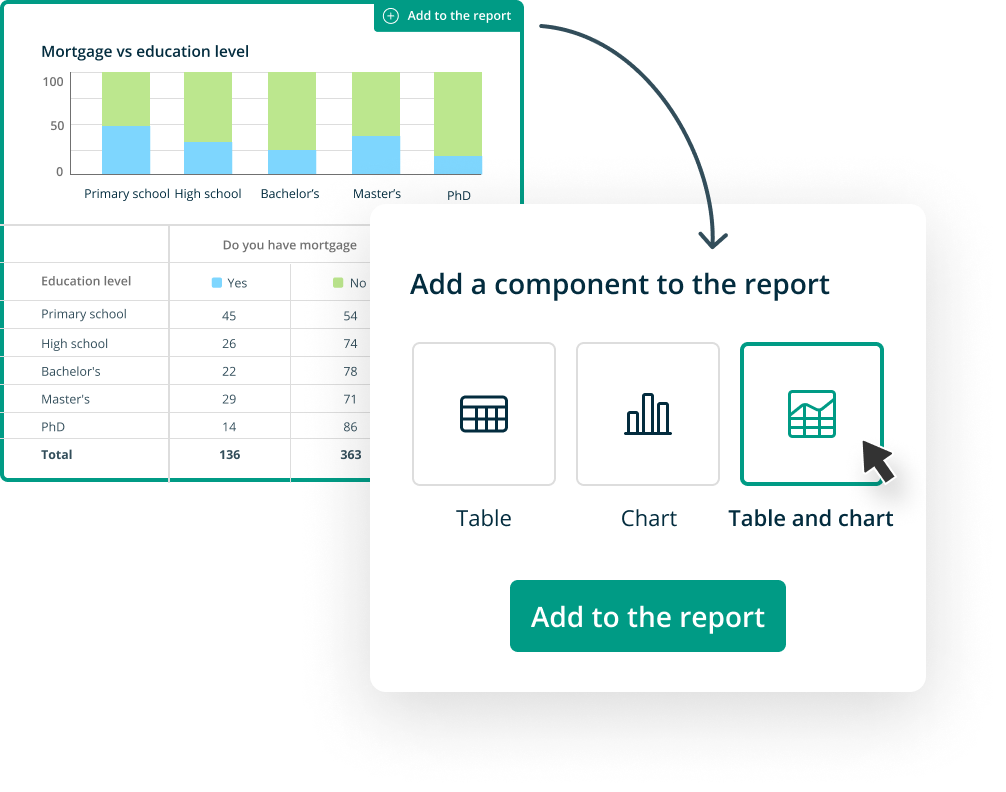

Step 7: Analyze and Interpret the Results

Data analysis transforms raw data into valuable insights. Use analytical tools to sort, filter, and interpret the data in the context of your objectives. Look for patterns and correlations but also for unexpected discoveries.

Your interpretation should lead to actionable insights that guide product or service improvement. This step transforms the effort of surveying real value for your project.

Step 8: Share Insights and Implement Changes

Finally, sharing your findings and implementing changes completes the process. Create comprehensive reports and engage stakeholders with the insights. Sharing fosters a shared understanding and sets the stage for informed decisions.

Plan and iterate on improvements based on the insights and use the learnings for continuous enhancement.

Each step is a building block that contributes to a successful and insightful user experience survey. Following this roadmap helps ensure that you create an engaging, relevant, and actionable UX research survey.

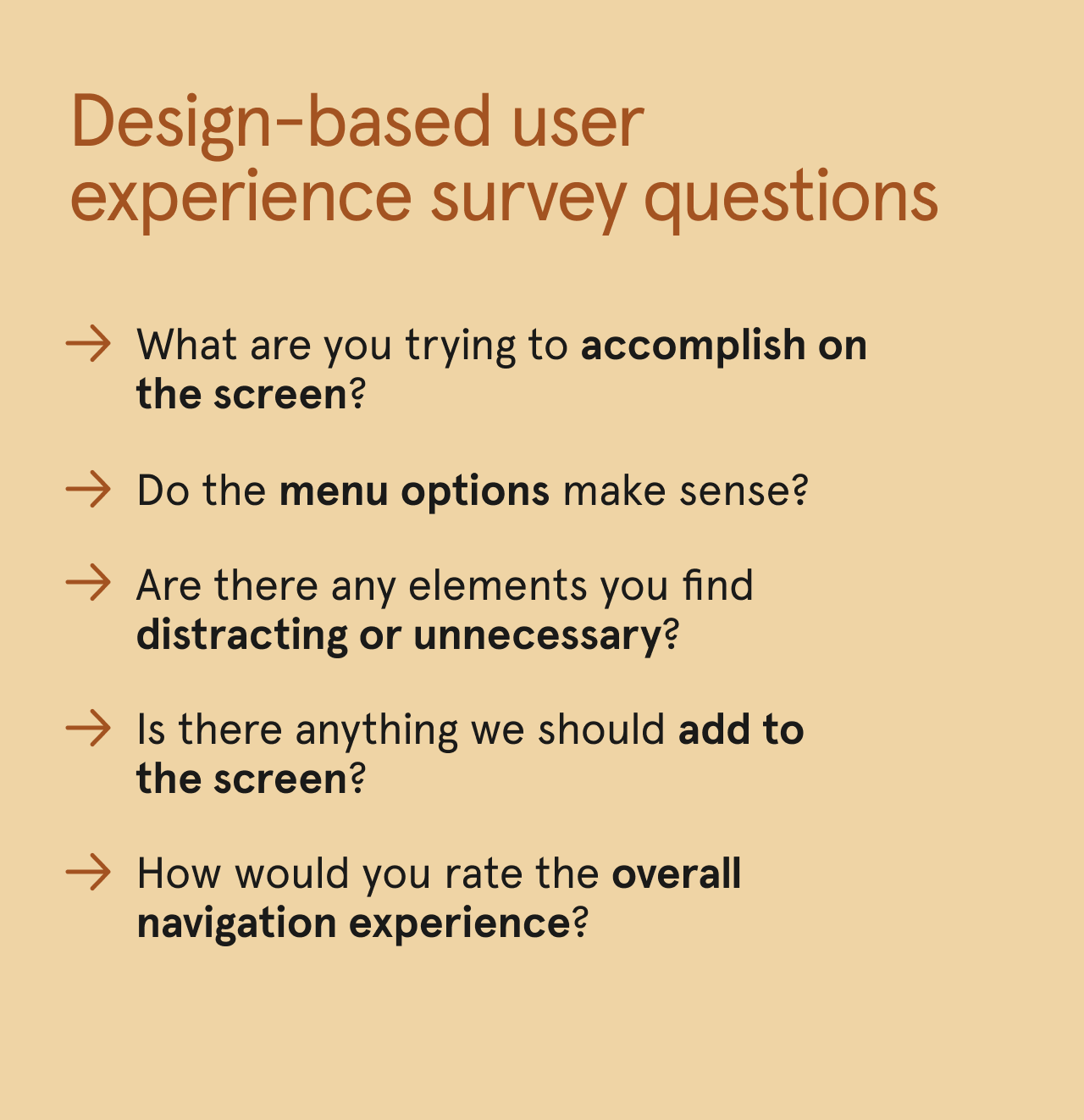

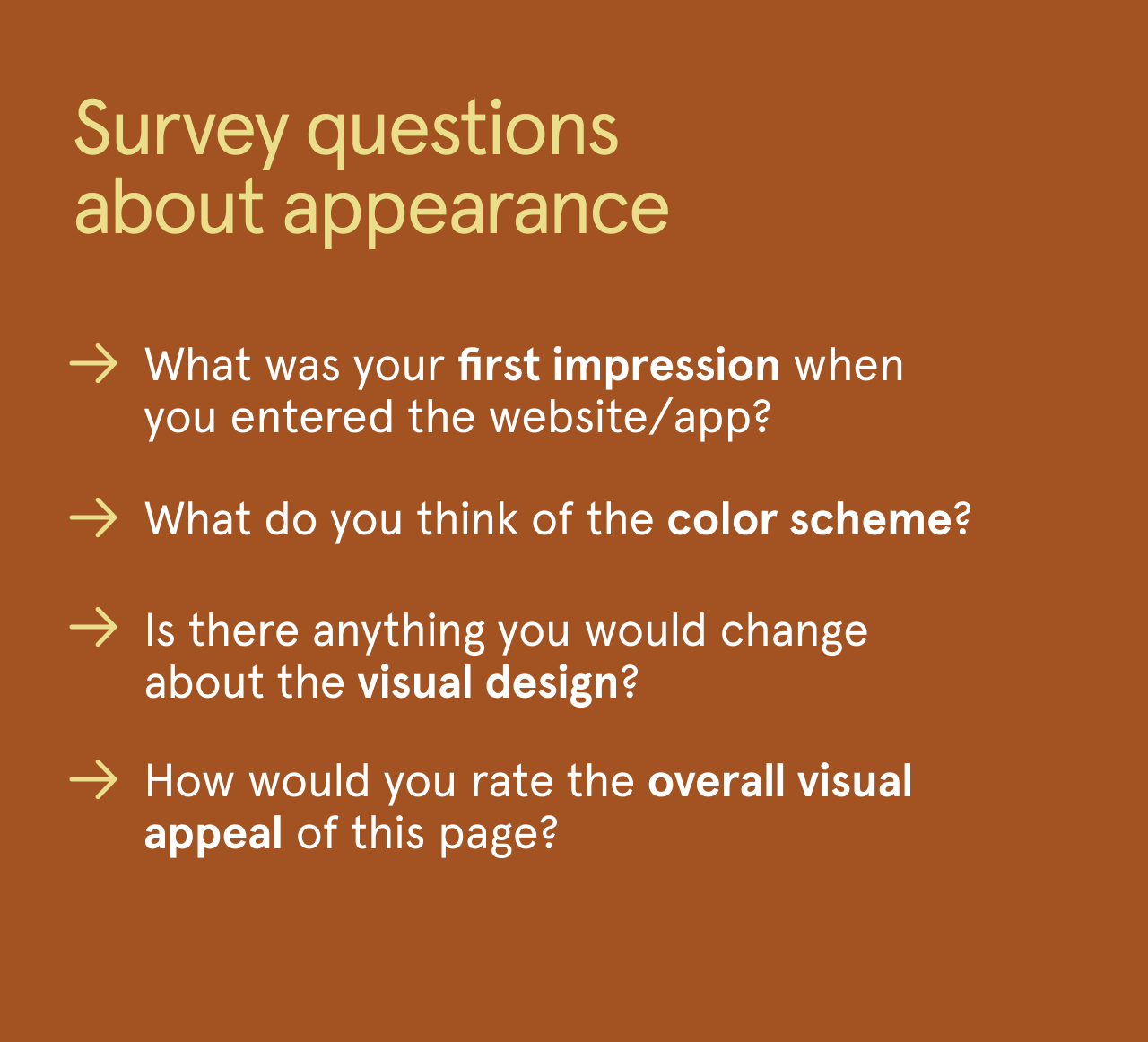

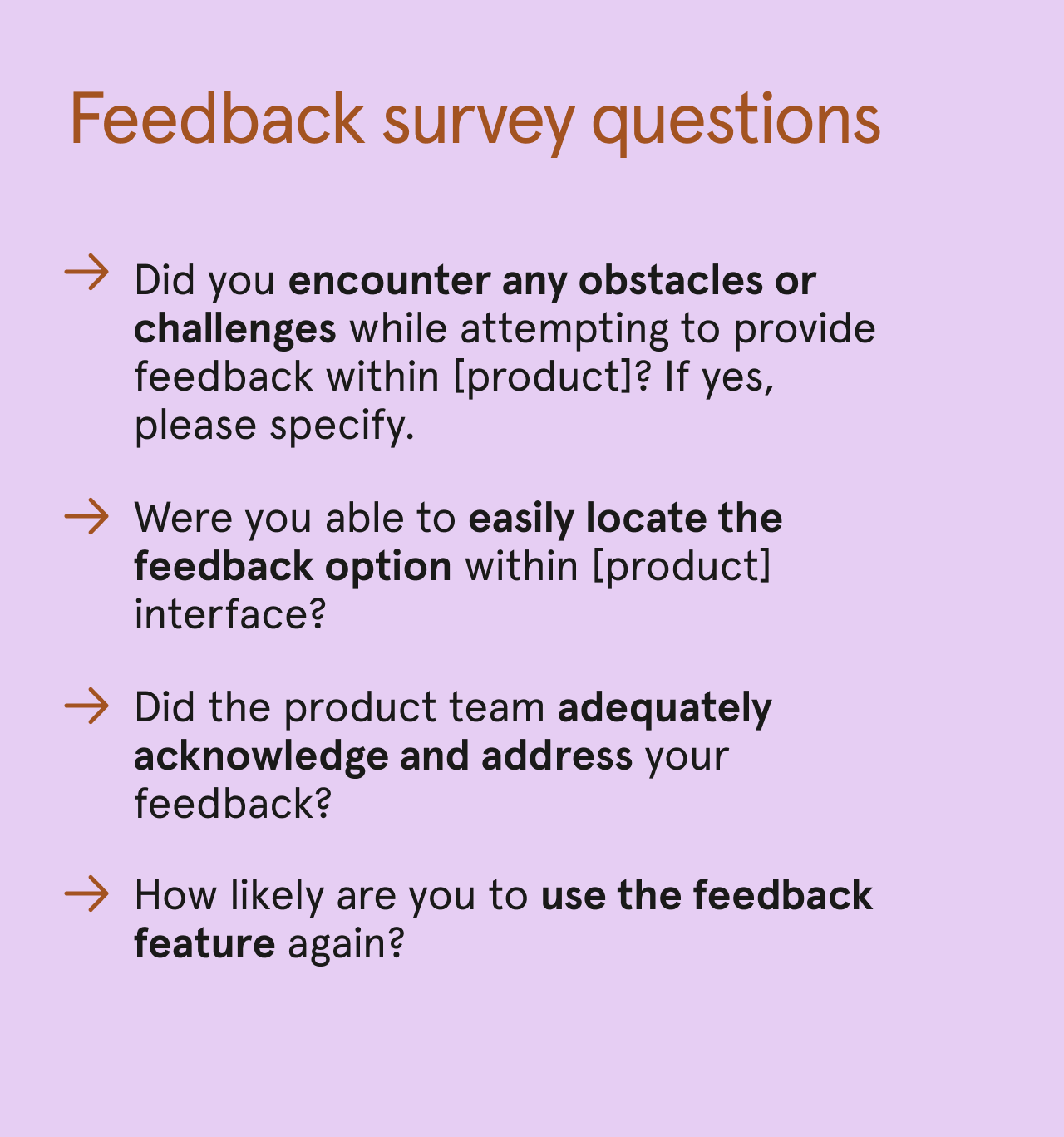

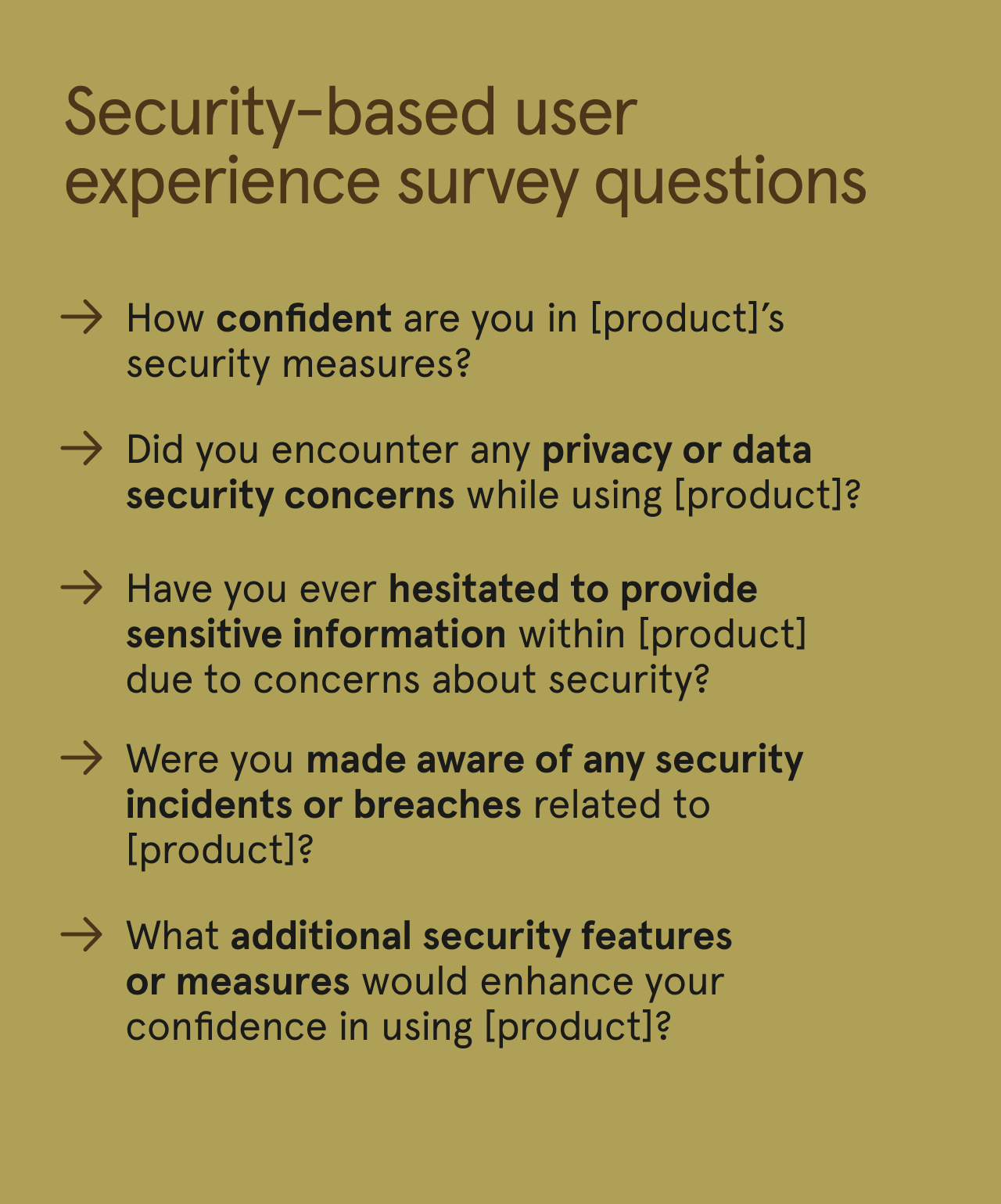

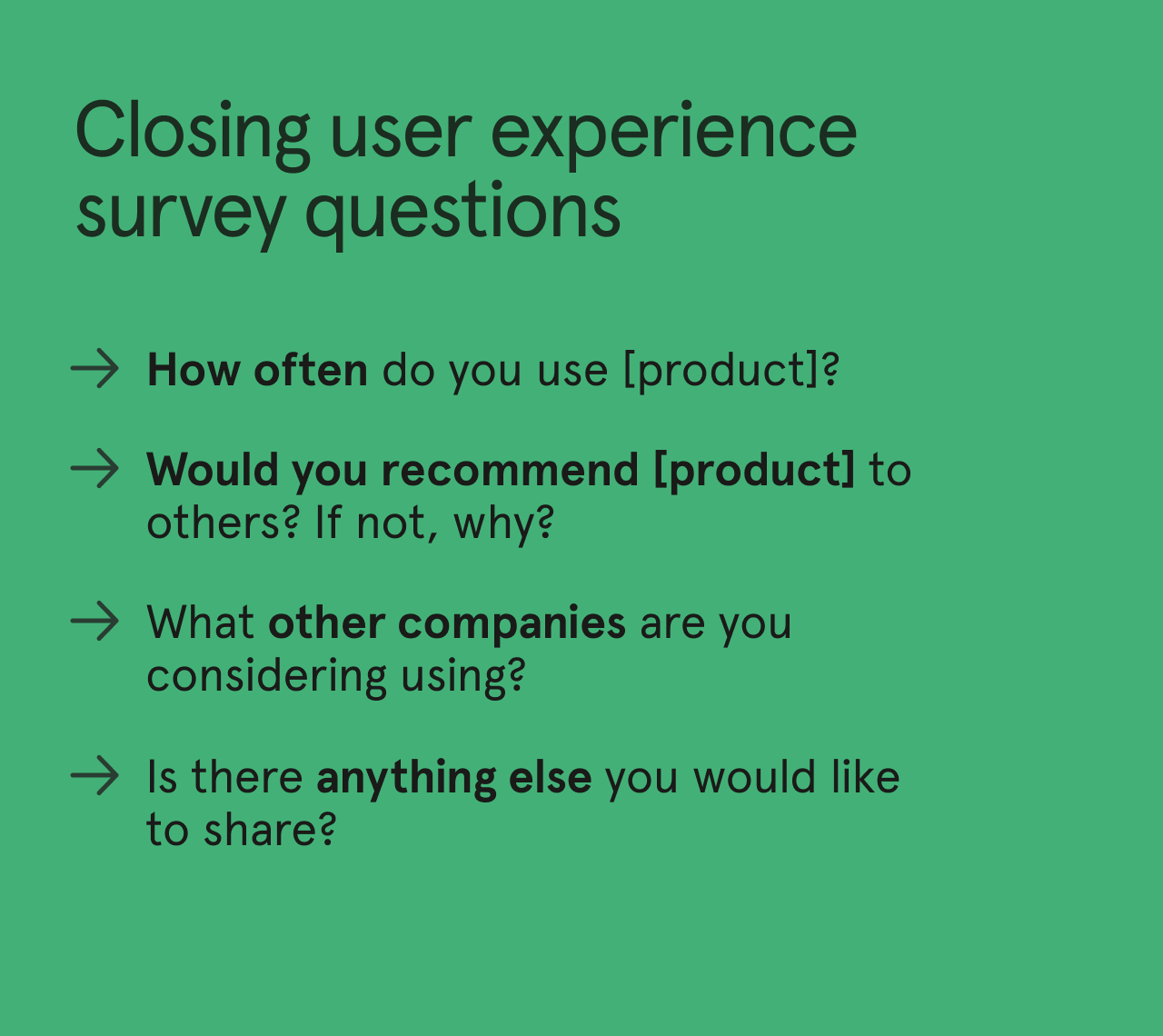

The 20 Best User Experience Survey Questions

These questions form a comprehensive framework for understanding various aspects of the user experience. Remember to use only a few of these to keep response rates high.

How did you find our website/app?

This question helps assess the effectiveness of your marketing channels. It shows you where people first encounter your brand. While Google Analytics reveals traffic from specific sources like AdWords or Facebook, it needs to track direct traffic. Knowing this can fine-tune your marketing strategy.

What was your primary goal in visiting our site today? Did you achieve it?

Focuses on why users visit and if the site meets their needs. It helps identify gaps in content or functionality.

How easy was it to navigate our site?

This question examines the effectiveness of your website. You're on the right track if people find it easy to navigate. If not, it's a red flag. Your site's layout or functionality may need tweaks.

What features did you use most?

This question identifies which parts of your product or service are most valuable to customers. If the majority say they often use a specific feature, that's a pivotal strength to highlight in marketing.

Were there any features that needed to be clarified or easier to use?

This question zeroes in on potential weak spots in your product design or functionality. A feature consistently labeled as confusing or complicated to use needs improvement.

How would you rate your overall experience?

Provides a general impression of user satisfaction.

What would you change about our website or app?

This question invites suggestions for improving your digital solution. It gives users a voice in the development process.

How likely are you to recommend our product to a friend or colleague?

Recommendations measure customer satisfaction and loyalty. Pop-up surveys commonly use this question based on a widely used metric called the Net Promoter Score (NPS). A high likelihood to recommend means customers are happy and likely to become brand advocates.

What other products or services would you like us to offer?

This question taps into unmet customer needs and wants. Responses can reveal gaps in your current offerings and inspire new products or services.

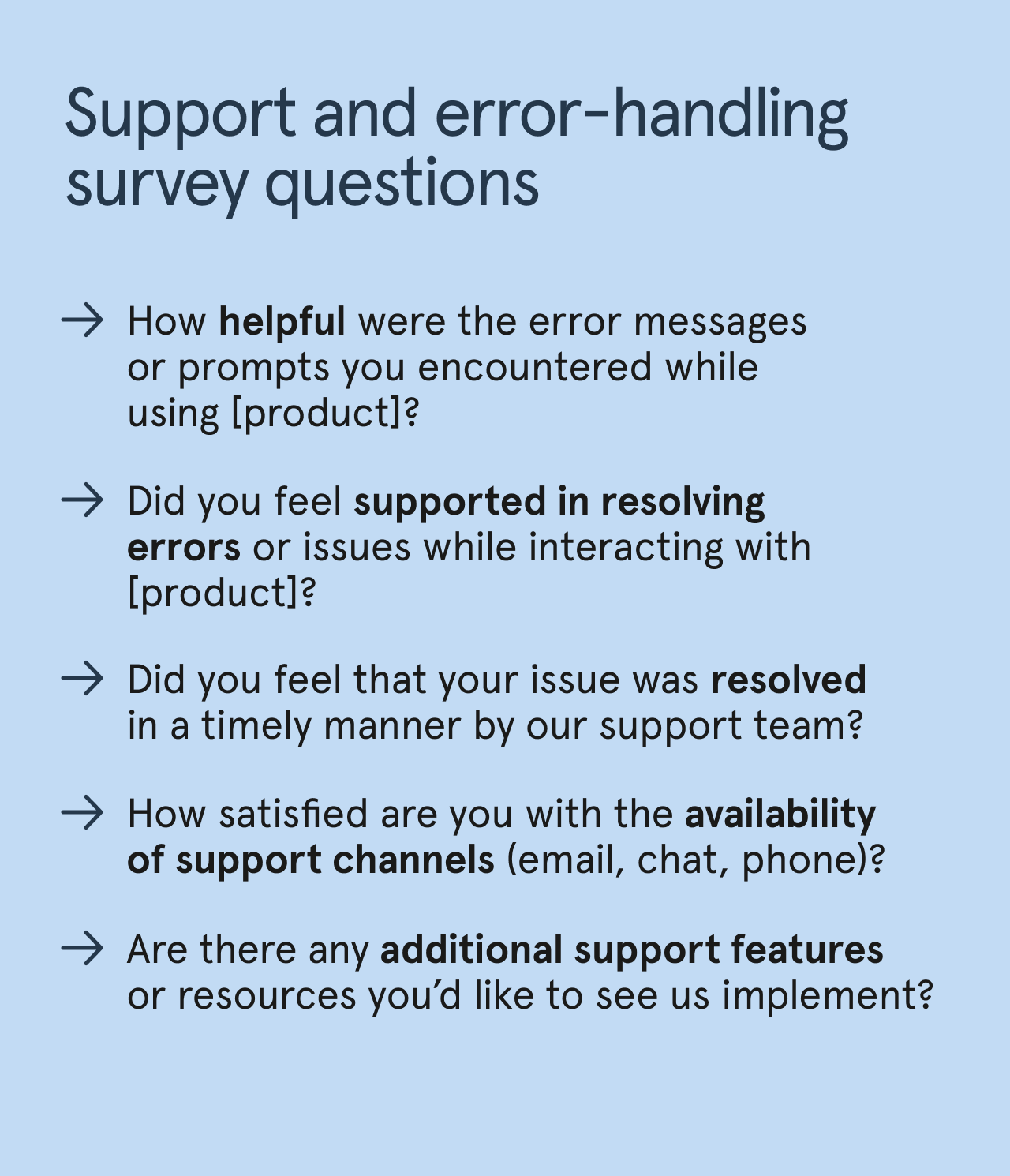

Did you encounter any technical issues?

Technical issues, like bugs, error messages, or crashes, can affect customer satisfaction.

What is your preferred payment/delivery method?

It may seem trivial, but some customers will only buy if their preferred payment method is available. So, you must understand the popular payment options that resonate with your target audience.

What is your preferred method of contact for support?

This question seeks to know how customers prefer to reach out for help. Understanding this helps businesses optimize their customer service channels.

How would you describe our product in one sentence?

This question aims to capture a concise customer impression of your product. The one-sentence descriptions can reveal key strengths or weaknesses.

How does our product compare to similar ones in the market?

This question seeks to understand your product's competitive edge or shortcomings. Responses can tell you where you excel or lag behind rivals.

Were our support resources (FAQs, live chat) helpful?

You need to understand the effectiveness of your customer support tools, like FAQs and live chat. If most people find these resources helpful, they validate your support strategy. If not, it's a cue to improve these areas. Understanding this aspect ensures that you offer assistance that benefits your customers.

How could our product better meet your needs in the future?

This question aims to collect suggestions for future improvements. Whether adding new features or refining existing ones, the feedback helps roadmap planning. If multiple customers highlight the same issue (like with pricing), that's a vital sign that needs attention.

How did you find the speed of the site?

This question evaluates how site speed impacts user satisfaction. Slow loading can frustrate users and may even lead them to abandon the site. If multiple people report this issue, it signals a need for optimization.

What language options would you prefer for our website/app?

This question identifies the language preferences of your user base. If a significant portion prefers another language, it makes sense to offer that option. Adding new languages can broaden your reach and make your platform more inclusive.

Would you like a follow-up from our team regarding your feedback?

This question gauges interest in further communication. A 'yes' suggests the respondent is engaged and open to dialogue, indicating higher loyalty or interest. A 'no 'means they provided feedback but aren't looking for a discussion.

Would you be interested in future updates or newsletters?

This question gauges customer interest in staying connected with your brand. A 'yes' indicates a satisfied customer likely to engage with future offerings. A 'no' could suggest they're not fully satisfied or not interested in long-term engagement.

UX Survey Templates

Here’s a list of the eight best user experience survey templates that are free to use:

Client Feedback Form

Find out what clients think about your business. Use this form as a case study to gather thoughts on customer service and more. Make changes to the template to focus on specific aspects of customer interaction

NPS-Enhanced Software Survey

Experts have made this ready-to-use template to improve your software's Net Promoter Score (NPS). Gather critical insights to elevate your product.

Basic NPS Inquiry Template

Easily gauge customer loyalty with this template. Customers rate their likelihood of recommending you from 0 to 10. Adapt the template to explore additional areas.

Support Team Feedback Form

Assess the performance of your customer service team. Adapt the survey to delve into aspects you are particularly interested in.

Quick Response Customer Survey

Send this brief survey to understand customer perceptions . It encourages customers to elaborate on their answers. Make adjustments to fit your needs.

Product Feedback Survey

Use this template to collect comments on your products. It aims to identify issues and suggest resolutions.

Snapshot Product Assessment

Collect rapid feedback on your products. Use this form to get concise and actionable comments from customers.

Comprehensive Client Feedback Form

Capture detailed information on how your customers feel about your products and services. This is useful for pinpointing specific areas for improvement.

Final Thoughts

And there you have it. We have provided an in-depth guide to creating a successful UX survey. It covers all the essential aspects, from defining objectives to crafting engaging questions, ensuring accessibility, analyzing results, and implementing changes.

We’ve included a curated list of 20 UX survey questions and eight templates, each serving a unique purpose in understanding the user experience.

Two major takeaways from this content include:

Align the survey with clear objectives : Understanding what you want to achieve with the survey sets the foundation for success. It guides every subsequent step.

Asking relevant and engaging questions : Crafting clear, interesting, and unbiased questions that cover various facets of the user experience is vital. It helps in capturing genuine feedback and insights.

You can follow these guidelines to uncover profound insights that drive success in your product or service.

Data-Driven Design: Quantitative Research for UX

Get Weekly Design Tips

Topics in this article, what you should read next, how to moderate user interviews.

- 4 years ago

Data Analysis: Techniques, Tools, and Processes

Writing Good Questions for Surveys

- 3 years ago

Why and When to Use Surveys

Ensuring Quality

Revolutionize UX Design with VR Experiences

Open Access—Link to us!

We believe in Open Access and the democratization of knowledge . Unfortunately, world-class educational materials such as this page are normally hidden behind paywalls or in expensive textbooks.

If you want this to change , cite this article , link to us, or join us to help us democratize design knowledge !

Privacy Settings

Our digital services use necessary tracking technologies, including third-party cookies, for security, functionality, and to uphold user rights. Optional cookies offer enhanced features, and analytics.

Experience the full potential of our site that remembers your preferences and supports secure sign-in.

Governs the storage of data necessary for maintaining website security, user authentication, and fraud prevention mechanisms.

Enhanced Functionality

Saves your settings and preferences, like your location, for a more personalized experience.

Referral Program

We use cookies to enable our referral program, giving you and your friends discounts.

Error Reporting

We share user ID with Bugsnag and NewRelic to help us track errors and fix issues.

Optimize your experience by allowing us to monitor site usage. You’ll enjoy a smoother, more personalized journey without compromising your privacy.

Analytics Storage

Collects anonymous data on how you navigate and interact, helping us make informed improvements.

Differentiates real visitors from automated bots, ensuring accurate usage data and improving your website experience.

Lets us tailor your digital ads to match your interests, making them more relevant and useful to you.

Advertising Storage

Stores information for better-targeted advertising, enhancing your online ad experience.

Personalization Storage

Permits storing data to personalize content and ads across Google services based on user behavior, enhancing overall user experience.

Advertising Personalization

Allows for content and ad personalization across Google services based on user behavior. This consent enhances user experiences.

Enables personalizing ads based on user data and interactions, allowing for more relevant advertising experiences across Google services.

Receive more relevant advertisements by sharing your interests and behavior with our trusted advertising partners.

Enables better ad targeting and measurement on Meta platforms, making ads you see more relevant.

Allows for improved ad effectiveness and measurement through Meta’s Conversions API, ensuring privacy-compliant data sharing.

LinkedIn Insights

Tracks conversions, retargeting, and web analytics for LinkedIn ad campaigns, enhancing ad relevance and performance.

LinkedIn CAPI

Enhances LinkedIn advertising through server-side event tracking, offering more accurate measurement and personalization.

Google Ads Tag

Tracks ad performance and user engagement, helping deliver ads that are most useful to you.

Share Knowledge, Get Respect!

or copy link

Cite according to academic standards

Simply copy and paste the text below into your bibliographic reference list, onto your blog, or anywhere else. You can also just hyperlink to this article.

New to UX Design? We’re giving you a free ebook!

Download our free ebook The Basics of User Experience Design to learn about core concepts of UX design.

In 9 chapters, we’ll cover: conducting user interviews, design thinking, interaction design, mobile UX design, usability, UX research, and many more!

New to UX Design? We’re Giving You a Free ebook!

Are you an agency specialized in UX, digital marketing, or growth? Join our Partner Program

Learn / Guides / UX design

Back to guides

How to use UX surveys to gain product experience insights

UX surveys collect customer feedback to help you make sense of user behavior—they give you insight into how people are experiencing your product, in their own words, so you can learn what works and what doesn't and prioritize changes to improve UX.

But where do you start? What tools do you need? And most importantly, what do you ask?

Last updated

Reading time.

What is a UX survey?

A user experience (UX) survey collects quantitative and qualitative data about a user’s interactions and experience with a website or digital product. UX survey data supports and complements website analytics and UX metrics collected through methods like A/B testing, heatmaps , usability testing, and session recordings

5 UX survey best practices

If you want to know how users really feel about their interactions and experience with your product so you can address specific pain points and prioritize product changes , a UX survey can give you the useful, actionable user data you need.

But here are five things to keep in mind before you launch your survey:

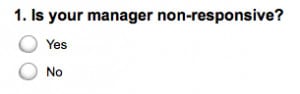

1. Avoid bias and leading questions

Before you launch your survey, check that you're avoiding bias. Here are a few things to look out for as you state your survey objectives and write your questions:

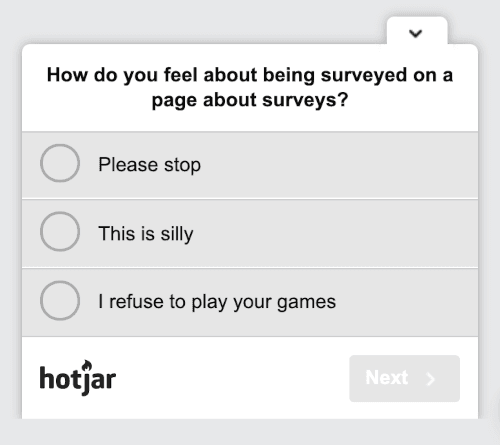

Confirmation bias: seeking only the data that confirms your beliefs. For example, "Would you be more likely to click this button if it were bigger and brighter?"

Framing effect (aka asking leading questions ): asking questions in a way that prompts a specific answer from your users. For example, "What did you love the most about your experience in our product?"

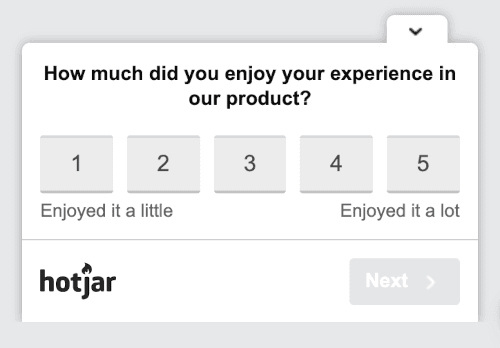

Unbalanced scales: similar to the framing effect, unbalanced scales will sway answers by limiting users' choices. For example, "How much did you enjoy your experience on a scale of 1 (enjoyed it a little) to 5 (enjoyed it a lot)?"

2. Ask the right questions

To get the data and user insights you need, focus your UX survey questions on the problem you’re trying to solve . If you don't know what the problem is yet, ask questions to help you identify your users' pain points so you can discover the blockers they're experiencing (and then remove them).

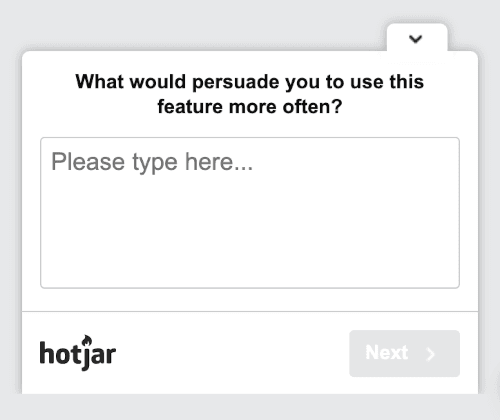

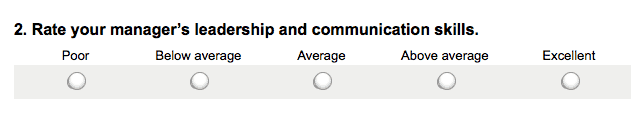

It's helpful to ask closed-ended questions early on, then—if you're using a survey tool like Hotjar—use Survey Logic to follow up with open-ended questions that explore the subject on a deeper level.

For example, let's say you want to find out how users feel about a new tool or feature. Some closed-ended questions you could ask are:

Have you used [new tool/feature]?

How easy was it to use [new tool/feature] on a scale of 1 (very difficult) to 5 (very easy)?

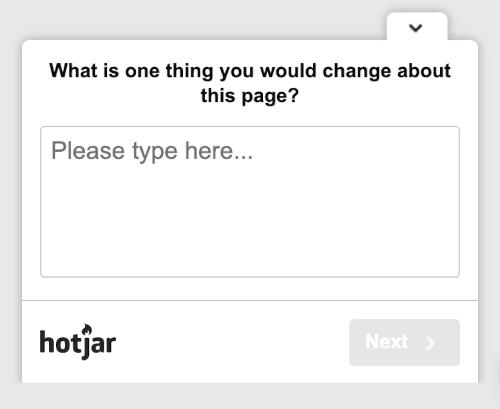

And you could follow up with open-ended questions like:

What are your first impressions of [new tool/feature]?

What is one thing you would change about [new tool/feature]?

3. Make it quick, keep it relevant

Make on-site surveys —surveys that pop up or slide onto the page—as relevant, quick, and easy-to-complete as possible. Start by asking one or two closed-ended questions to get quantitative data or to segment by user cohorts. If you follow up with open-ended questions, keep them simple.

Note: sometimes you need more detailed product experience insights, in which case you can invite users to participate in an external link survey . External surveys give users more time and space to thoughtfully answer more specific questions about the user experience.

4. Sample continuously and share your findings

Your team is never really finished building and improving your product, so you should never stop asking for feedback. But keep in mind that survey results can be impacted by external factors, like a disproportionate number of new or inexperienced users or failure to distribute representative cohorts to both versions of an A/B test. By sampling over a long period, you can reduce the risk of your UX survey being skewed by unique events.

🔥 If you're using Hotjar

It's easy to share insights with your team: whether you have new targets, you’re going through a redesign, or you’re prioritizing product changes, it's easy to get the conversation flowing in Slack :

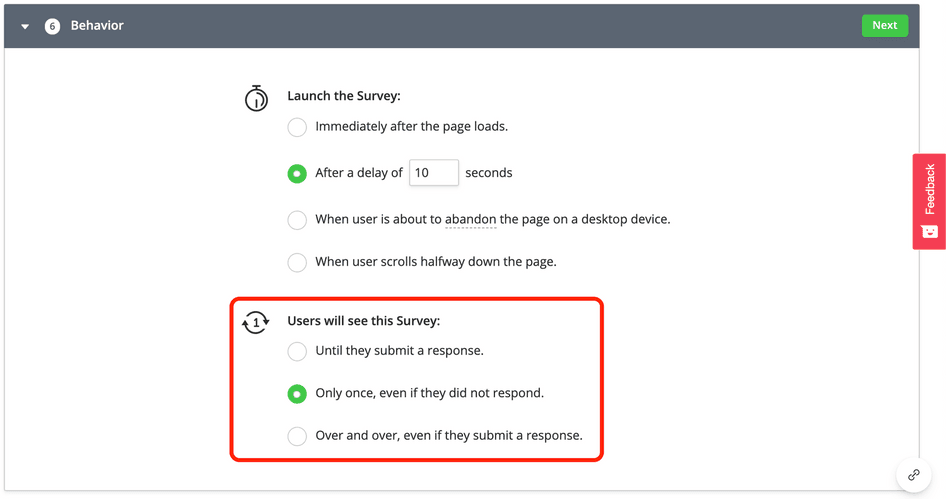

5. Ensure survey cool-off periods

On-site surveys can distract users from their usual experience with your website or product, and multiple invitations to external surveys can become irritating. Plan cool-off periods between surveys to avoid interfering with the user experience and repeatedly re-surveying individual users.

To build in survey cool-off periods, change the frequency of individual on-site Surveys so users stop seeing a survey after they respond; or so they only see it once, even if they don't respond.

How to conduct UX surveys: the Lean approach

It might be tempting to address every topic or pain point in one survey, but a targeted approach will give you relevant, actionable user insights at each stage of product development, helping you prioritize UX changes and improvements.

As we have with other pages in this UX guide , we'll use the Lean UX model to… guide us:

UX survey questions for the THINK phase

The THINK phase is about generating ideas and uncovering qualitative insights, which is a great time to ask open-ended questions:

Question: If you could improve one thing about this product, what would it be?

Why it’s useful: Get ideas for improvements and uncover possible user pain points.

Question: What is one thing you wish this product could do that it doesn’t do already?

Why it’s useful: Get ideas for new tools or features to add to your product roadmap.

Question: If you knew that we would make one change to our product the next time you logged in, what would you want it to be?

Why it’s useful: Get ideas for improvements, uncover possible user pain points, and prioritize changes.

UX survey questions for the MAKE phase

Using UX surveys in the MAKE phase can help you prioritize aspects of your product roadmap:

Question: On a scale of 1-10, how would your use of our product be impacted by [feature/change]?

Why it’s useful: Understand the potential impact of changes from the users' perspective.

Question: Please state your agreement with the following: "[feature/change] would make my job easier."

Why it’s useful: Understand how users perceive potential additions or changes to your product in terms of their goals and objectives.

UX survey questions for the CHECK phase

The CHECK phase helps you understand whether product changes have improved the user experience. You can use a mixture of closed- and open-ended questions during this phase:

Question: Rate your agreement with the following: "[feature/change] has made my job easier."

Why it’s useful: Assess the performance of a new feature or product update in terms of users' goals and objectives.

Question: How has [feature/change] affected the way you use our product?

Why it’s useful: Get voice of the customer (VoC) feedback that directly relates to a recent change or update to your product.

Question: Is there anything you would change about how [feature/change] works?

Why it’s useful: Gain product experience insights about new features and changes that can lead into the next THINK phase of the Lean UX cycle.

Improve UX with product experience insights from Hotjar

Use Hotjar to understand how real users are experiencing your website or app—then improve it for them!

FAQs about UX surveys

What is the ideal length of a ux survey.

There's no 'ideal' survey length: keep it relevant, quick, and easy to complete. Ask simple, straightforward questions that are directly related to your survey objectives, and use Survey Logic to segment user cohorts.

📚 Read more: learn how product teams can conduct online surveys to get actionable insights.

What is the purpose of a UX survey?

UX surveys give product teams valuable, direct feedback to help them improve the user experience, reduce churn, and turn users into product evangelists by generating quantitative and qualitative data about how users feel about their interactions and experience with your product or service.

What kind of questions should a UX survey ask?

Instead of addressing every topic or pain point in one survey, a targeted approach will give you relevant, actionable user insights at each stage of product development so you can prioritize UX changes and improvements.

See the How to conduct UX surveys: the Lean approach section of this guide to learn more.

UX analysis

Previous chapter

Next chapter

Product Design Bundle and save

User Research New

Content Design

UX Design Fundamentals

Software and Coding Fundamentals for UX

- UX training for teams

- Hire our alumni

- Student Stories

- State of UX Hiring Report 2024

- Our mission

- Advisory Council

Education for every phase of your UX career

Professional Diploma

Learn the full user experience (UX) process from research to interaction design to prototyping.

Combine the UX Diploma with the UI Certificate to pursue a career as a product designer.

Professional Certificates

Learn how to plan, execute, analyse and communicate user research effectively.

Master content design and UX writing principles, from tone and style to writing for interfaces.

Understand the fundamentals of UI elements and design systems, as well as the role of UI in UX.

Short Courses

Gain a solid foundation in the philosophy, principles and methods of user experience design.

Learn the essentials of software development so you can work more effectively with developers.

Give your team the skills, knowledge and mindset to create great digital products.

Join our hiring programme and access our list of certified professionals.

Learn about our mission to set the global standard in UX education.

Meet our leadership team with UX and education expertise.

Members of the council connect us to the wider UX industry.

Our team are available to answer any of your questions.

Fresh insights from experts, alumni and the wider design community.

Success stories from our course alumni building thriving careers.

Discover a wealth of UX expertise on our YouTube channel.

Latest industry insights. A practical guide to landing a job in UX.

How to design effective user surveys for UX research: A step-by-step guide

User surveys are an excellent method for conducting quick, affordable, and scalable UX research. With some carefully-crafted questions and the right survey tool, you can gather feedback and insights from a huge pool of participants—enabling you to make data-driven decisions for better UX.

Free course: Introduction to UX Design

What is UX? Why has it become so important? Could it be a career for you? Learn the answers, and more, with a free 7-lesson video course.

User surveys are a quick, affordable, and scalable UX research method. Learn how to design effective user surveys in this step-by-step guide.

It sounds simple enough. But, if you want to get the most out of user surveys, it’s important to employ them in the right context—and to master the art of survey design.

In this guide, you’ll find everything you need to know about user surveys. Keep reading to learn:

What are user surveys?

When and why should you conduct user surveys as part of your ux research, what are the pros and cons of user surveys, how to design effective user surveys (step-by-step).

- User survey best practices

- User survey tools

This guide is for UX designers, UX researchers, and anyone else who wants to leverage user surveys as part of a research project. Let’s begin!

[GET CERTIFIED IN USER RESEARCH]

User surveys are used in UX research to gather direct input and feedback from actual or target users.

They are unmoderated, which means you don’t supervise or observe participants as they complete them. You simply create the survey and send it out, allowing users to work through it in their own time.

The anatomy of a user survey is pretty simple. It contains a series of questions which the user responds to, either by selecting from a range of possible answers or by typing out their own unique answer. This depends on whether the survey questions are open or closed.

Open vs. closed questions in user surveys

Open questions give the user complete freedom and flexibility in how they respond, allowing them to answer in their own words without being restricted by a fixed set of options. Open questions are used to gather qualitative data; they cannot be answered with a simple “Yes” or “No”, so they elicit more detailed elaboration and insight.

Here are some examples of open-ended questions:

- What was your first impression of the [XYZ] app?

- How would you improve the experience of booking transport with the [XYZ] app?

- What are your main priorities when it comes to booking transport?

Closed questions have predefined responses which the user must choose from. They require less thought and effort from participants, and they allow you to collect quantitative (i.e. countable) data.

Examples of closed questions include:

- How would you rate your first impression of the [XYZ] app on a scale of 1-10?

- Would you recommend the [XYZ] app to your friends?

- Do you order takeaway more than once a week?

That’s user surveys in a nutshell. Next, let’s consider when and why you might choose this UX research method.

[GET CERTIFIED IN UX]

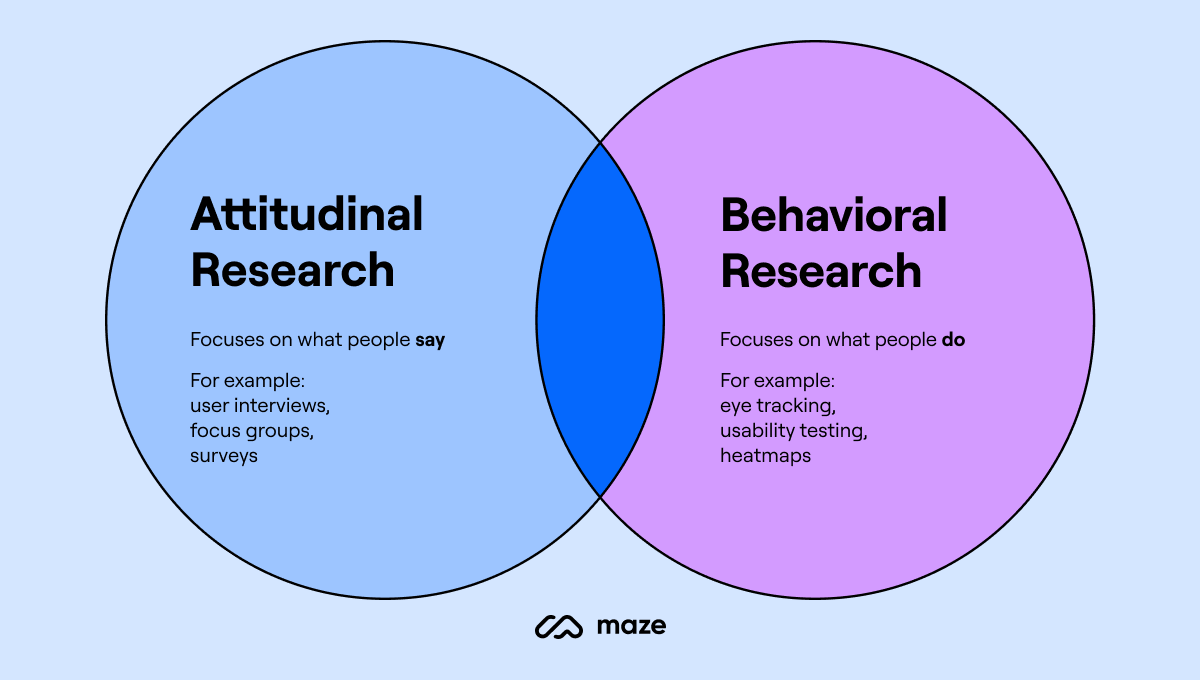

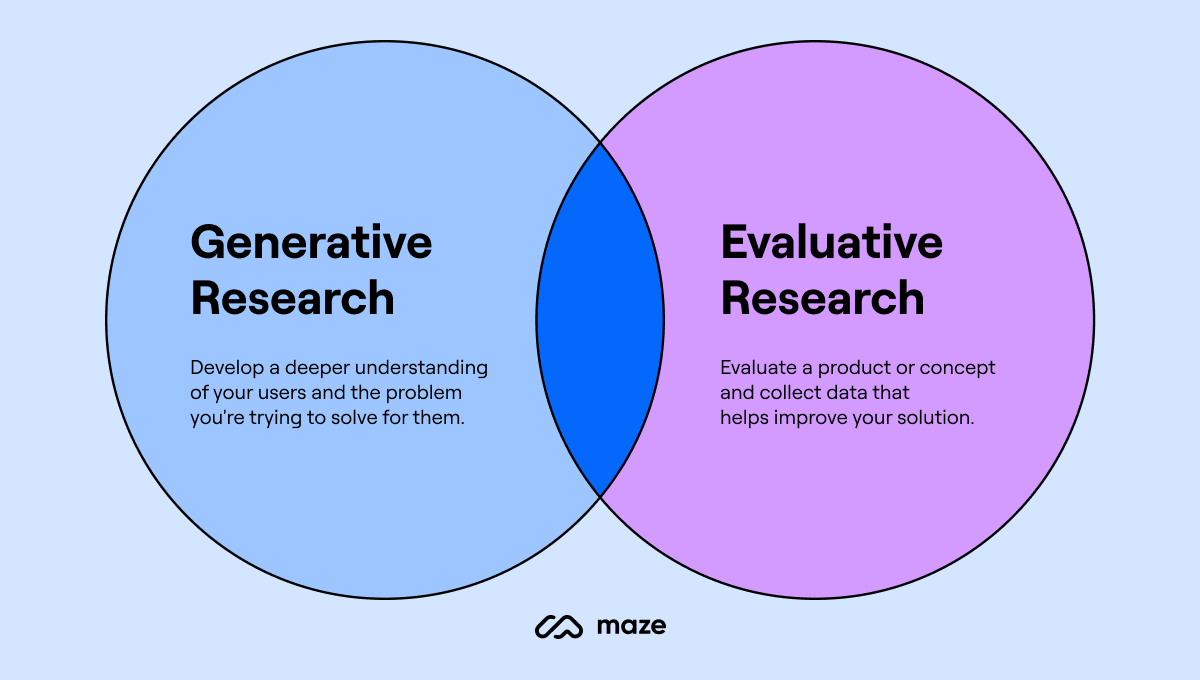

User surveys are typically used in evaluative research—that is, research you conduct to evaluate (i.e. validate or invalidate) existing ideas, concepts, directions, or designs. This is different to exploratory research where the goal is to figure out what problem you need to solve before coming up with ideas.

You might send out user surveys periodically to monitor user/customer satisfaction and to identify pain-points and areas for improvement within your existing product/service/solution.

Perhaps you’ve got some ideas for a new product, or an iteration of an existing product. User surveys will enable you to validate those ideas with a large sample of target users before you go ahead with design and development.

Surveys are also useful for backing up other research you’ve done. For example, if you’ve conducted user interviews with a small number of participants and now want to test your findings on a larger pool of users, surveys could be the next step.

The main advantage of user surveys is that they are affordable and scalable. You can reach lots of people, and therefore gather a large amount of data, without spending much money—ideal for UX research on a budget.

The main drawback is that, while they’re great for quantity, user surveys don’t always guarantee quality. Participants may complete your survey but that doesn’t automatically mean that they’re providing accurate or honest feedback. Survey data is also susceptible to bias, especially if the questions are written in a way that subtly leads or influences participants.

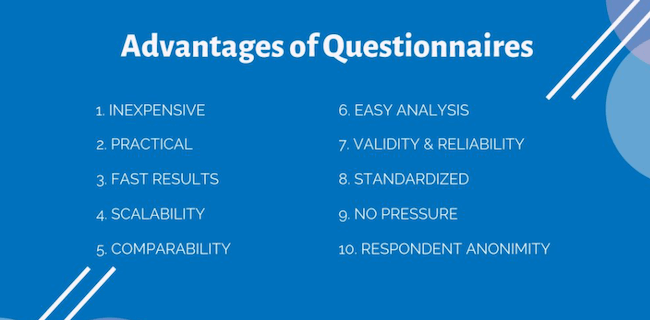

Here are all the pros and cons of user surveys at a glance.

User survey pros:

- Inexpensive to run

- Quick and uncomplicated; all you need is a survey tool

- Scalable—you can easily reach lots of participants and gather a large sample of data

- You can reach users and customers anywhere as they’re done online and unmoderated

- Usually fairly quick and easy for users to complete, encouraging a high participation rate

User survey cons:

- Users may not provide honest or accurate answers

- Data gathered may be susceptible to bias (especially if survey questions are leading or ambiguous)

- Surveys are at risk of sampling bias—based on the likelihood that people who choose to complete your survey in the first place typically fall into one of two categories: either very happy customers or very dissatisfied customers

As long as you understand the limitations of user surveys and take care to design them well, you can confidently include them in your UX research toolkit. On that note, let’s explore how to create an effective user survey.

Want to design an effective user survey? Here’s what you need to do:

- Define your research objective

- Choose your survey tool

- Design your survey

- Test and iterate

- Recruit participants and deploy!

Let’s go through each step in detail.

1. Define your research objective

This first step applies to all kinds of UX research. Before you can start designing your survey, you need to come up with a clearly defined research objective.

What do you want to learn from your user survey? What data and insights do you hope to gather?

Perhaps you released a product update a few months ago and your goal is to gather feedback from existing customers. Maybe you’re planning some product improvements and want to hear from your users about what features and functionality they’d like to see next.

Your research goal will determine the type of survey you design—i.e. whether you’ll include open or closed questions (or both) in order to gather qualitative data, quantitative data, or a mixture.

2. Choose your survey tool

Next, decide which tool you’ll use to create and distribute your user survey. If this is your first ever user survey, spend some time getting to know your chosen tool before you start designing your survey.

This way, you’ll get an idea of what’s possible with your tool—for example, how many questions you can include per survey, what options you have for distributing your survey, as well as any design/formatting specifications or limitations.

Once you’ve got the lay of the land, you can design your survey accordingly. We share some of the best user survey tools later on in this guide—check them out before you commit.

3. Design your survey

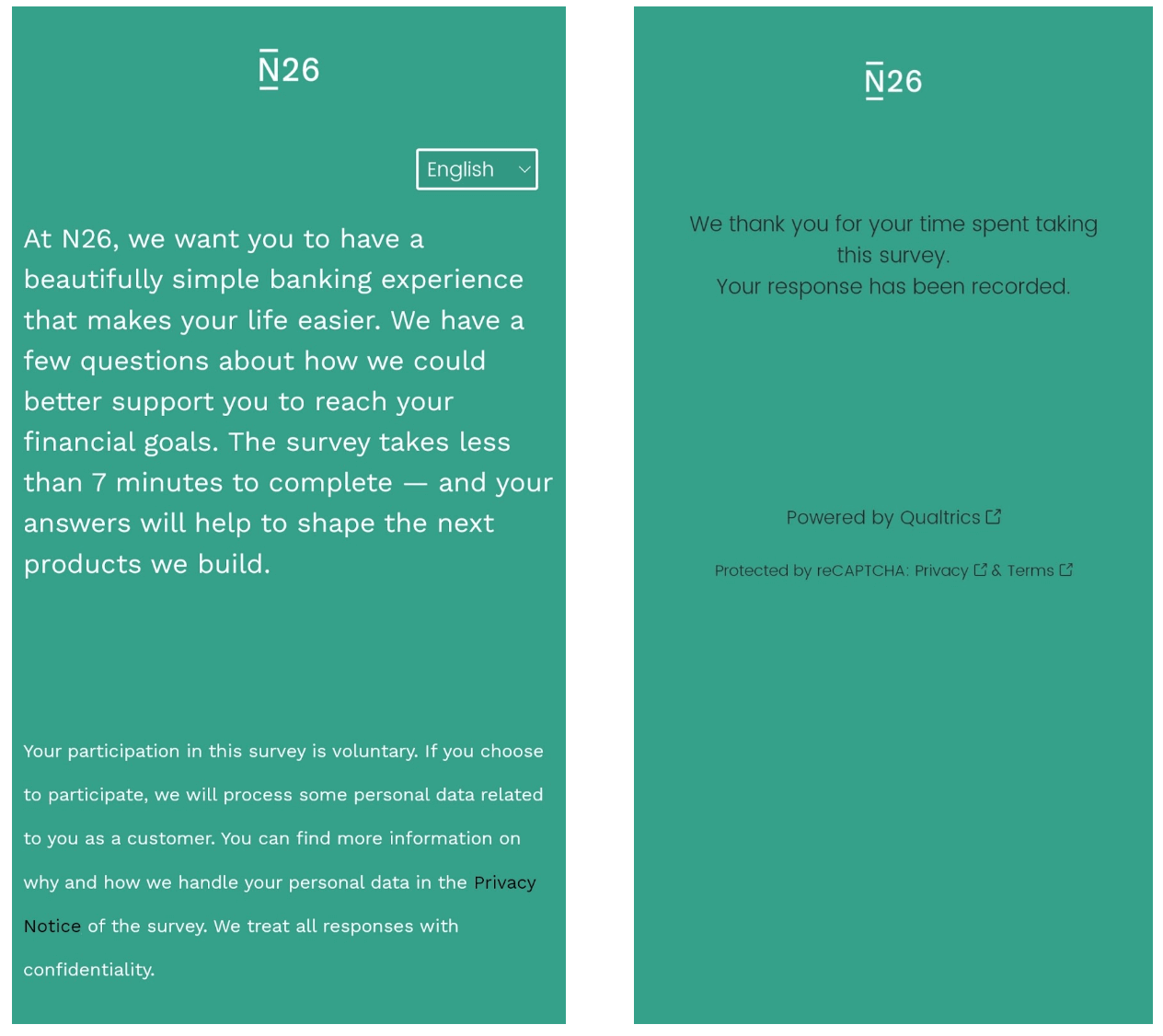

Now for the survey itself! When creating your survey, you’ll need to write:

- An introduction welcoming the user to the survey and providing some context. What is the survey about and why are you conducting it? How long will the survey take? What can the user expect? Here you should also include information about how the user’s data will be processed, and state whether or not the survey is anonymous/confidential.

- Your survey questions . These must be clear and easy to understand, and as bias-free as possible. You can learn more about writing effective survey questions in the “best practices” section of this guide.

- Answer choices . If you’re asking closed questions that require the user to select a predefined answer, you’ll need to write out all possible options they can choose from.

- A closing statement . At the end of the survey, it’s good practice to let the user know they have successfully completed the survey—and to thank them for doing so.

Here is an example of an introduction and closing screen taken from a user survey conducted by N26 bank:

Before you go live with your survey, it’s worth having someone else (or a few people) review it.

This step isn’t just about checking for typos. Critically, it’s about making sure that the survey questions are clear and easy to understand, that they follow a logical order, and that the answer options make sense.

If necessary, iterate on your survey and run another quick round of QA before you release it to your users.

5. Recruit participants and deploy your survey!

You’re almost ready to launch! Just one more thing: recruiting participants to complete your survey.

Your approach to finding participants will depend on the nature of your survey and your research goal. If you’re targeting existing customers, you might embed your survey within the product itself—think in-app surveys that pop up after you’ve completed a task. Otherwise, you might send your survey out via email to your customer base.

If you’re not limiting your audience to existing users and just want to reach as large a representative sample as possible, consider using an agency to distribute your survey. Many user research tools also have a participant database you can access.

Now, set your survey free and await that data!

3 best practices for effective user surveys

If you can design your user surveys to be quick, simple, and user-friendly, you’ll have the best possible shot of capturing quality data. Here are three best practices to ensure your user surveys are a joy to complete.

1. Make sure your questions are crystal-clear

The key to effective user surveys is asking the right questions—and making sure they’re crystal-clear for the user. Use plain, jargon-free language and avoid over-complicated or ambiguous wording.

And, importantly, keep your survey questions as neutral as possible. You don’t want to subtly influence the user’s answer in any way, or include questions that make an assumption about the user’s behaviour, goals, and preferences.

2. Use skip logic to create a logical flow

Completing your survey should be a seamless experience for the user. If necessary, use skip logic to customise the flow of the survey depending on the user’s answers.

For example, if you ask the user “Which of the following best describes how you use the [XYZ] app?”, you could then present them with a follow-up question which is relevant to their choice. Likewise, if they answer “None”, you’ll want to skip the follow-up question altogether.

This helps to ensure that the questions flow in a logical and sensical order, encouraging the user to stick with your survey right through to the end.

3. Keep your survey short (and include a progress bar)

If we’re honest, completing user surveys can quickly get tiresome. You want to keep your users engaged for the duration and avoid them “falling off” halfway through—so keep your survey as short and sweet as possible.

It’s also worth including a progress bar to reassure the user that the end is in sight. You might even have some fun with your in-survey messaging, for example, “Stick with it! Just three more questions left.”

If it’s really necessary to create longer, more time-consuming surveys, consider rewarding participants for their time with a voucher or discount code.

What are the best user survey tools?

Some of the most popular user survey tools include:

- SurveyMonkey

- SurveySparrow

- OptimalWorkshop

- GetFeedback

For more tools, check out this guide: The 9 Best UX Research Tools for Designers and Researchers .

In this guide, you learnt how to design effective user surveys. Once you’ve created and distributed your survey, the next step is to analyse the data you’ve gathered and use it to inform your design decisions. You can learn how to analyse and synthesise your user research data in this guide . And, once you’re ready to present your findings, check out this post on how to write a UX research report .

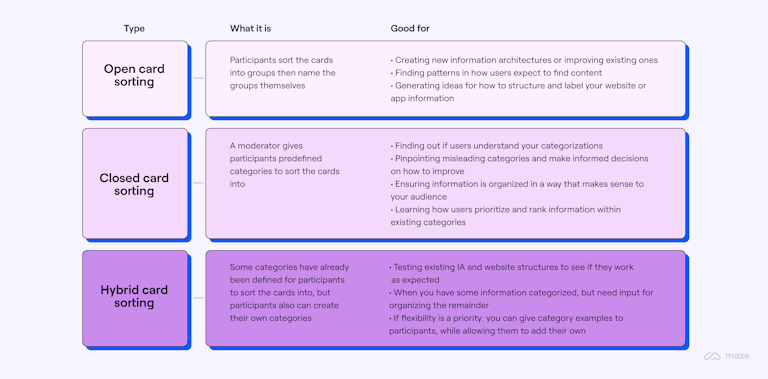

And remember: User surveys are just one of many UX research methods. Effective user research relies on a variety of techniques—from user interviews to card sorting to A/B testing . Do your research on UX research and be sure to choose the most appropriate method for your goals!

- user research

- user survey

Subscribe to our newsletter

Get the best UX insights and career advice direct to your inbox each month.

Thanks for subscribing to our newsletter

You'll now get the best career advice, industry insights and UX community content, direct to your inbox every month.

Upcoming courses

Professional diploma in ux design.

Learn the full UX process, from research to design to prototyping.

Professional Certificate in UI Design

Master key concepts and techniques of UI design.

Certificate in Software and Coding Fundamentals for UX

Collaborate effectively with software developers.

Certificate in UX Design Fundamentals

Get a comprehensive introduction to UX design.

Professional Certificate in Content Design

Learn the skills you need to start a career in content design.

Professional Certificate in User Research

Master the research skills that make UX professionals so valuable.

Upcoming course

Build your UX career with a globally-recognised, industry-approved certification. Get the mindset, the skills and the confidence of UX designers.

You may also like

7 programming languages that UX designers should know about in 2024

Designing for the internet of things (IoT): UX challenges and solutions

What is Perplexity AI and how can you use it in the design process?

Build your UX career with a globally recognised, industry-approved qualification. Get the mindset, the confidence and the skills that make UX designers so valuable.

6 August 2024

Skip to main content

COVID-19 update: Google is prioritizing everyone's health and safety, this may impact UX Research. Learn More

- English (United Kingdom)

- Español (Latinoamérica)

- Português (Brasil)

- Português (Portugal)

Jump to Content

Help shape the future of Google

Your feedback is important to us.

We’d love to know your thoughts, so we can keep making Google products that fit your needs. You’ll get to influence things millions of people use every day, from email and productivity apps to tools for developers and educators.

Even if you don’t currently use Google products, you can still sign up for a chance to participate in our research. If one of our studies is a good fit for you, we’ll get in touch with details and next steps. Most participants will get a thank-you gift.

Every study opportunity is:

Open - Whether you are a newbie or an experienced Google product user, anyone can sign up to participate.

Secure - You can trust us to never share your data with third parties.

Flexible - Participation can be remote or in person. It’s up to you.

Beneficial - After you participate you may receive a small gift, like a Visa or a retailer-specific gift card.

Valuable - Your feedback will help us build better products for everyone.

Tell us a little bit about yourself by filling out a form . It’ll help us determine if any of the upcoming UX research studies would be a good match.

Join a research session

If a study is a good fit for you, you’ll get a follow-up questionnaire and details about what the study involves, including next steps and location.

Accept our thanks

After completing the study, most participants will get a giftcard to thank them for their time.

Your feedback will make it possible for us to continue our mission of building a more helpful Google for everyone – no matter who they are, where they live, or what they want to accomplish.

For more information, take a look at our FAQ .

- (855) 776-7763

All Products

BIGContacts CRM

Survey Maker

ProProfs.com

- Get Started Free

FREE. All Features. FOREVER!

Try our Forever FREE account with all premium features!

How to Conduct User Experience Surveys: Templates & Best Practices

Author & Editor at ProProfs

Shivani Dubey specializes in crafting engaging narratives and exploring Customer Experience Management intricacies. She writes on vital topics like customer feedback, emerging UX and CX trends, and sentiment analysis.

User experience or UX surveys are your best bet to get actionable insights that can help you create a rich customer experience.

But do you or your customers look forward to filling out UX surveys on any given day?

Can you do something about it? Yes, you can!

The key here is designing delightful user experience surveys that can fetch you deep insights into customer behavior, trends, demographics, and preferences. And this should come naturally into your process.

If it hasn’t, it’s never too late to do right by your business.

So, let’s get straight to the point and discuss how you can conduct UX surveys, followed by the types of UX surveys, the steps involved, and best practices to create a kickass user experience.

Conducting UX Surveys: 9 Pro Steps for Understanding Your Users

Here are a few simple steps you can follow to create and conduct flawless UX surveys. By the end of it, you’ll know how to build and deploy UX surveys that can get you actionable customer insights.

Step 1: Set Outcome Expectations for Your UX Survey

Begin by identifying what purpose you want to fulfill by conducting UX surveys, i.e., “What to Ask.”

- Is it gauging customer loyalty?

- Do you want to measure customer satisfaction ?

- Want to know how your customer support is performing?

- Is it exploring the effectiveness of your onboarding process ?

Develop a clear understanding of the information you need to resolve a particular issue. You need to choose which type of survey you will primarily use and focus on at this stage.

Pro Tip: Do not try to fulfill multiple purposes with one UX survey . That is, you shouldn’t ask too many different things in one survey. Doing so will only give you mixed and unclear responses.

Step 2: Find Your Targeted Audience

If you want accurate insights, you need to have an answer to “Who to Ask.” If you choose an unsuitable target audience to collect customer insights, the data you’ll get will be good for nothing.

For example, if you want to ask customers about their onboarding experience, then conduct UX surveys targeting only the customers who went through the onboarding process and not those who opted for the ‘Skip’ option.

UX Survey Tip: We will give you a peek into one in-house UX survey example.

To ensure we collect our NPS data from the right customers, Qualaroo shows its NPS surveys to customers when they are on the dashboard and using the tool.

This way, we can make sure we are only asking customers who are actively using our tool.

Step 3: Create UX Survey Questions

When you know why you want to collect customer data and from whom you should collect it, you can easily decide your approach for “How to Ask.”

Now is the time to ask the right questions. But don’t forget to ask in the right way. Do not frame leading questions , and keep the focus on your UX issues.

If you want to create flawless UX research surveys, keep reading to discuss the best practices later in the article.

[A Read You Won’t Regret: 26 Common Types of Survey Errors and How to Correct Them]

Step 4: Set the Order of UX Survey Questions

If you order the questionnaire incorrectly while conducting your UX survey, it will be subjected to order bias (refer to the above-recommended article for a detailed explanation).

Here’s an apt example:

Suppose you first ask your customers what they like about Feature A and then ask them their favorite feature of your product/service.

Then, customers are more likely to answer in favor of Feature A since the first question indicated your priority for it.

Wrong question orders will also prevent respondents from completing the UX survey. Additionally, keep in mind to maintain a logical UX questionnaire flow when using branching and skip logic in your surveys.

Useful Read: Skip Logic Survey – A Complete Guide on How to Design Branching Surveys

Step 5: Ace Your UX Survey UI

Besides ensuring you ask the right questions in the proper order, don’t forget to make the UI of your UX design surveys friendly and practical.

The placement of the survey options, the submit button, and even how you present your question play a significant role in the users’ engagement with your surveys.

Related read: 16 Best UX/UI Tools for Designers and Researchers In 2023

Step 6: Target the Right Users

The whole point of this exercise is to collect reliable and relevant user feedback. So, if you don’t ask the RIGHT QUESTIONS to the RIGHT PEOPLE; all will be for nothing.

It is where advanced targeting comes into play. You can start by showing your survey to the relevant audience. For that, you can set survey triggers based on user behavior on the site, browsers, and devices used or set custom properties.

Here’s a detailed video on how you can zero in on specific customer segments and glean precise insights from your UX surveys.

Understanding the Qualaroo Targeting Section for Desktop

You can use branching logic to collect qualitative and quantitative data . For example, if you ask customers to rate their satisfaction, you can add a follow-up question asking them the reason for their rating.

Step 7: Test and Iterate

Once you have successfully designed your user experience survey, it’s time for the test drive. We would suggest you target a small fraction of your targeted audience first while you conduct a UX survey to see what kind of responses you get.

If you think something isn’t adding up in your survey, you can always improvise it until you are sure of it.

Feedback survey tools like Qualaroo allow you to target the traffic on your website and control how many people you want to show your UX survey to and under what conditions.

Step 8: Analyze the Insights

When you reach this step, all you have to do is focus on studying data the right way and procure accurate insights. Different types of data require different ways to analyze it. Here are a few examples:

If you conduct an NPS survey , choose a survey tool that automatically calculates and displays your NPS on the dashboard.

If you added open-ended questions to your survey, then you can quickly analyze the responses using a Sentiment Analysis feature.

This feature analyzes each written response, highlights the most used words and phrases, and mentions what emotions customers feel towards your brand, services, or products.

For a CES survey, you can calculate the score using two formulas: Text-based and Numeric.

For a text-based survey like this:

Use this CES formula:

CES = % of responses as “Difficult” ― % of responses as “Easy”

For a numeric scale survey like this:

CES = Total sum of individual CES

Total number of customers who responded

Now that you know how to create engaging UX surveys, let’s discuss the best practices you can use to ensure a high response rate.

Step 9: Complete the Feedback Loop

Once you’re done analyzing all the feedback data from the UX surveys, it’s time for some action. For this, you need a UX survey tool like Qualaroo that helps you avoid data silos and promote collaboration on the feedback.

You can also create custom labels and tag each response to pass the feedback to respective departments, act on the insights, and close the feedback loop.

CASE STUDY- TWILIO

Twilio offers APIs for developers to create communication apps like SMS, video-calling, and messaging.

Since Twilio has a diverse product portfolio, its team wanted to refine the onboarding experience. Their customers have different onboarding needs, so the best thing at their disposal was to ask customers for their experience.

In the words of the Product Manager for Twilio’s Experimentation Platform, Laura Schaffer, “There are so many ways to approach this challenge. The hard part usually isn’t coming up with the hypotheses for what might work best – it’s knowing which are the right ones to try first.”

With Qualaroo, the team prioritized hypotheses for experimentation using customer insights.

“In less than 5 minutes, teams can go from having almost entirely opinion-backed ideas to having ones that are data-backed by targeted customer feedback.”

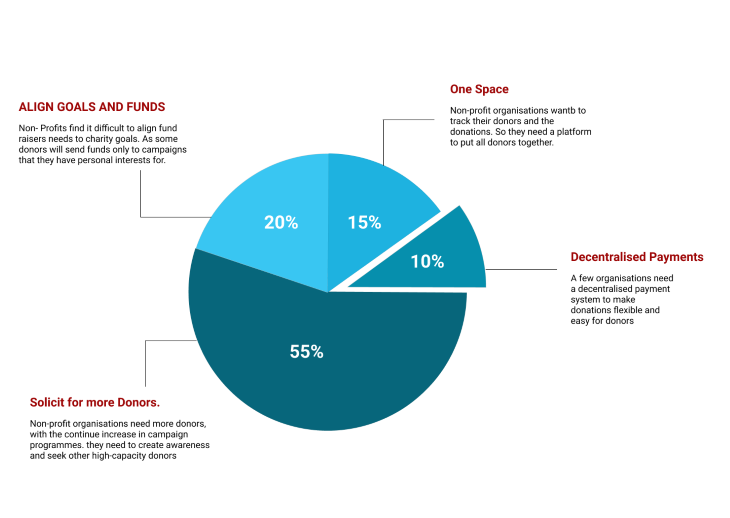

Types of UX Surveys

User or customer experience is an umbrella term with many different components. Because of this, there are different survey types catering to each purpose that comes under UX. Let’s start with the one you already anticipate.

[Related Read: What is Customer Experience Management? ]

Customer Satisfaction Surveys (CSAT): Conducting these UX surveys will help you measure how satisfied your customers are with your services and products.

Net Promoter Score Surveys : You can differentiate your loyal customers from dissatisfied customers on the brink of churn using NPS surveys.

The UX survey asks customers how likely they are to recommend your company to others. The higher the score, the more likely they are to recommend your brand.

User Journey Experience Surveys: These UX surveys aim to explore the elements customers approve of and what needs improvement throughout their journey .

You can deploy them at several customer journey touchpoints, such as the checkout process, product page, shopping cart, onboarding process, and so on. This process can help you create accurate customer journey maps .

Customer Effort Score Surveys : Better known as CES surveys, they gauge how easy it is for customers to interact with your brand , i.e., achieve a goal such as resolving issues with customer support. The higher the score, the easier it is for them to do something with low effort.

System Usability Surveys : System usability surveys aim to gauge your software product’s performance . It collects your customers’ feedback on components that account for usability.

Exit-intent Surveys : You can deploy these on the pages with high bounce rates to ask customers why they are leaving the website without completing the customer journey.

The insights from exit-intent UX surveys let you pinpoint elements on your website that drive away your visitors so that you can fix them and avoid a high bounce rate. You can set triggers for these surveys to appear at a specific time and after the visitor takes a specific action on the website.

To deploy these, you can use user experience and feedback survey software like Qualaroo , which helps create different types of user research surveys for feedback, and Picreel , which specializes in exit-intent pop-ups to make customers stay.

When Should You Conduct UX Surveys ?

You can conduct UX surveys across the user journey. We’ve divided the journey and shared the surveys you can conduct at each touch point:

This is when users first discover your brand or product.

You can conduct UX surveys for brand discovery, asking questions like “How did you first hear about us? Share your initial impressions!”

You can also explore at this stage what marketing channels are working for you in bringing traction. You can ask questions like this: “Tell us what caught your attention in our recent ad. Your feedback matters!”

Consideration

At this stage, users actively explore options and weigh different choices. You can collect user feedback on what influences their decisions and considerations, like “Did our content help you make informed decisions? Share your thoughts!”

Interest/Intent

Users express interest or intent to engage with your product or service. This is where you can start conducting UX surveys to collect feedback directly related to your user experience. For example, you can gauge their first impression of your website or products.

For this, you can ask questions like “How was your experience navigating our site? Any areas we can improve?” “What was the first thing that caught your attention?” or “What was your experience signing up? We’d love to make it even smoother.”

This is where the users decide to make a purchase or complete a desired action.

You can conduct customer satisfaction surveys , checkout process surveys, and website experience surveys to understand their specific and overall experience with your brand.

You can also conduct post-purchase UX surveys to collect the overall feedback using questions like “How was your overall experience after making a purchase? Your feedback matters!”

At the retention stage in the user journey, the focus is on maintaining and enhancing the customer relationship.

Besides gauging customer satisfaction at this stage, you can collect usability feedback using SUS and CES surveys to understand the challenges faced by your users while using your products or services.

For example, you can ask questions like “How easy or difficult was it for you to accomplish the ABC task with our product?” and “Tell us how you’re using our product! We’re eager to hear your experiences.”

This is where your satisfied customers become brand advocates and start recommending your brand. Here, you can conduct a UX survey like Net Promoter Score, asking one simple question “On a scale of 0-10, how likely are you to recommend our product/website/service to your family and friends? ”

10+ Best Practices for Delightful User Experience Surveys

Creating and conducting user experience surveys that can get you accurate insights isn’t as easy as it seems. But it becomes easier with the right UX survey tips. Here are some tips for UI/UX survey questions to keep in mind while framing your UX survey questionnaire.

Simple Language = Easy to Understand

Would you like to respond to a survey that uses this kind of language?

“Would you please enlighten us with your valuable experience with our digital product ABC?”

We hope not. At best, the language used is just an exaggeration of “How would you rate your experience with the product ABC?”

If you want to conduct UX surveys that are engaging, keep the questions’ language simple and easy to follow.

Also, avoid industry jargon and replace them with words that don’t require a Google search. For example-

Jargon: “Would you be interested in a Rapid app development platform?”

Simple language: “Are you looking for a platform that helps create an app without coding in a couple of hours?”

Don’t Ask Multiple Things in One Question

When designing UX survey questions, ensure you don’t ask multiple things at once. It confuses the respondents, and their answers become ambiguous. For example –

Wrong Question: “How satisfied are you with our features and user interface?”

Now, if customers rate 8, you don’t know if they rated your features or the UI.

Lookout for Biases

There are multiple types of survey biases based on questions, answers, and the order of the questions. Watch out for these biases when you conduct UX surveys –

- Question order bias: Refers to how you frame and order your questions that affect responses.

- Confirmation bias : This occurs when you only ask the questions that confirm your hypothesis.

- Primacy bias: Concerns with the preference of respondents to choose the options on the top.

- Recency bias: When people favor the options at the end, the recent ones.

- Hindsight bias: When respondents think the events that occurred were predictable.

- Assumption bias: Refers to the situation when a researcher frames questions assuming the respondents’ knowledge level.

- Clustering bias: Occurs when respondents find patterns in the questions when there are none.

Use Open-Text Questions Too

Although question types like MCQs and ratings are beneficial for collecting quantitative data, the open-ended questions fetch you qualitative insights.

Conducting UX surveys with open-ended answer types for questions allows your respondents to freely explain their experiences and obstacles so that you can take corrective actions.

Where to Ask: Target The Right Survey Channels

Besides the obvious platforms like websites and mobile apps, you can also conduct user experience surveys for prototype testing .

For existing products or services, you can use on-site and in-app surveys . And if you are preparing to launch a new product or service, you can add surveys to your prototype to make sensible iterations.

For conducting UX surveys, you can use these 29 Prototype Testing Questions to get the most elaborate insights.

For example, you can share your prototype with a sample target audience. You can ask the respondents UI survey questions to see how they like the interface and similar questions targeting different UX components.

You might like to read: 18 Best Prototyping Tools for UI/UX Designers in 2023

When to Ask: Choose Your Survey Touchpoint

UX comprises every element that customers interact with, affecting their experience with your company or product. So, you need to carefully consider the touchpoints where you’ll conduct UX surveys, depending on your goal.

For example, if you want to improve the traffic on your pricing page, ask your customers what information is missing that would help them when they are about to leave.

Keep Surveys Crisp and Relevant

Customers abandon the UX surveys in the middle that take forever to complete and aren’t relevant to them. An ideal survey only asks four to five questions.

As for the relevancy, you can use screening questions (screeners) to ensure the respondents who finally take your survey are qualified for it.

Screeners filter out the unsuitable candidates so that the UX surveys are relevant to the customers.

Survey at Intervals

Try not to bombard your customers and conduct your UX surveys at intervals. It’s also a good practice not to launch multiple UX surveys at the same time since you may disrupt your customers’ experience.

Allow Users to Opt Out Using Skip Logic

Your customers may not be comfortable answering every question. In this case, you need to ensure they can skip it by using the skip logic.

The user-centric approach not only respects individual preferences but also enhances the overall survey experience. This way, you can collect valuable insights from willing participants while respecting the autonomy of those who choose to opt-out.

Show Survey Progress

Want to increase customer engagement on your UX surveys? Start showing a progress bar at the top of your survey questions.

This way, customers know how many questions are left to answer, and they won’t feel anxious while taking the survey. You can try this functionality in the ProProfs Survey Maker software, which allows you to design surveys with progress bars.

Incentivize Your Surveys

You aren’t alone if you suffer from a high survey abandonment rate . Sometimes, even if your surveys are flawless, some customers may not go through with them since there is nothing for them in it.

So, why not give them something to look forward to?

You can incentivize your UX surveys with discounts, gift coupons, and deals so customers feel motivated to complete them to avail the benefits.

Related Read: 30+ Proven Ways to Reduce Shopping Cart Abandonment

Inside Udemy’s User Experience: How It Collects Critical User Insights

Udemy is an online learning platform offering free and paid online courses. Since the platform has users worldwide, their courses need to be sufficient for every student who speaks a different language.

Naturally, Udemy deployed machine learning algorithm-based captions, so the courses are accessible to everyone. To check on the user experience after this update and how effective it is, Udemy considered asking the users.

The company deployed Qualaroo’s UX survey on all their courses with auto-captioning, asking students if the captions are helpful and accurate so they can improve the service if need be.

With the feedback from the surveys, Udemy was able to make product optimizations that improved the caption editing capabilities for instructors. This feature made their content more accessible to people around the world.

UX Survey Examples: Templates & Questions

We have divided the UX survey examples based on survey types, making it easy for you to identify questions for every purpose.

Marketing Research Survey Template