Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Please guide me on selecting research titles

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

151+ Good Banking And Finance Research Topics For Students [2024 Updated]

Are you curious about Banking and Finance Research Topics? In this blog, we explore various banking and finance-related research topics. What drives the banking sector’s resilience in the face of challenges? How do financial markets influence our economic well-being?

Let’s find the good topics of personal finance, corporate decision-making, risk management, and more. From the fundamental principles of accounting to the latest trends in fintech, this collection of research topics spans various fields, offering a comprehensive view of the ever-evolving finance domain.

Discover the impact of digital currencies, the role of central banks, and the effectiveness of credit scoring models. Explore the importance of real estate finance and know the behavioral aspects influencing investment decisions. We also examine the intersection of finance with emerging technologies and its role in sustainable development.

Whether you are a student researching finance or the banking sector with good research ideas about economic difficulties. These Banking and Finance Research Topics provide a gateway to understanding the pivotal role finance plays in our global society. Let’s know all about them here.

Table of Contents

What Is Banking And Finance Research Topics?

Banking and finance research topics refer to specific questions that researchers investigate related to financial systems and institutions. These topics help explore how banks, investments, financial markets, and economic policies work.

Some examples of banking and finance research topics include:

- How new technologies like mobile apps are changing banking

- What causes stock market prices to rise and fall

- How government regulations impact financial institutions

- Why do people make certain financial decisions?

- Ways to improve risk management for banks

- The future of cryptocurrencies as an investment

- How fintech companies are competing with traditional banks

Researching these topics aims to gain a deeper understanding of the financial world. The knowledge can then be used to inform better policies, practices, and decisions related to banking and finance.

How To Find Banking And Finance Research Topics For Students?

Here are some tips for students on finding good banking and finance research topics:

- Look at current events in the banking and finance industries for inspiration. Pay attention to what’s happening with major banks, new technologies, economic policies, financial crises, and industry trends.

- Review finance publications, academic journals, magazines, and websites to discover recent research studies related to banking and see what knowledge gaps they identify that require further investigation.

- Browse research paper databases for sample banking and finance essays to find potential topics or note areas requiring additional up-to-date research.

- Align topics with your existing interests and course curriculum. If you enjoy technology, explore fintech questions. If macroeconomics fascinates you, investigate the implications of monetary policies.

- Consider meaningful real-life research questions, like how underprivileged groups are financially underserved or how developing nations can gain affordable banking access.

- Brainstorm ideas and get input from professors who will guide you in refining topics based on viability, available data sources, analytical methods, and relevance to the current finance field.

List of Good Banking And Finance Research Topics

Here are the most interesting banking and finance research topics:

Good Banking And Finance Research Topics For Students

- Comparative analysis of traditional banking vs. online banking.

- The impact of mergers and acquisitions on bank performance.

- Assessing the role of central banks in ensuring financial stability.

- Investigating the effectiveness of bank stress tests in predicting financial crises.

- Analyzing the factors influencing customer satisfaction in banking services.

- The role of blockchain technology in enhancing banking security.

- Examining the impact of interest rate fluctuations on bank profitability.

- Evaluating the role of government intervention in preventing bank failures.

- Analyzing the challenges and opportunities of Islamic banking.

- The impact of Basel III regulations on banking risk management.

Best Banking And Finance Sector Research Topics For MBA Students

- The role of the stock market in economic development.

- Examining the factors affecting stock market volatility.

- Impact of high-frequency trading on financial markets.

- Exploring the relationship between corporate governance and stock prices.

- The role of derivatives in managing financial market risks.

- Analyzing the impact of macroeconomic indicators on stock prices.

- The role of insider trading in financial markets.

- Investigating the efficiency of emerging financial markets.

- The impact of market sentiment on stock prices.

- Analyzing the role of financial analysts in shaping market perceptions.

Personal Finance-Related Research Topics

- The impact of financial literacy on personal finance management.

- Evaluating the effectiveness of budgeting tools in personal finance.

- The role of behavioral economics in understanding individual investment decisions.

- Investigating the factors influencing retirement savings decisions.

- The impact of socio-economic factors on household debt levels.

- Assessing the effectiveness of financial planning in achieving financial goals.

- The role of technology in personal financial management.

- Analyzing the impact of tax policies on personal savings.

- The relationship between education and income levels in personal finance.

- Investigating the role of psychological biases in personal investment decisions.

Corporate Banking And Finance Research Topics

- The impact of capital structure on firm profitability.

- Evaluating the role of financial leverage in corporate decision-making.

- Analyzing the factors influencing dividend payout policies.

- The impact of corporate governance on firm performance.

- Investigating the relationship between CEO compensation and firm performance.

- The role of working capital management in corporate finance.

- Analyzing the impact of exchange rate fluctuations on multinational corporations.

- The influence of financial disclosure on investor decisions.

- Evaluating the impact of corporate social responsibility on shareholder value.

- The role of venture capital in financing innovation and startups.

Risk Management Research Topics For College Students

- The impact of credit risk on financial institutions.

- Analyzing the role of derivatives in hedging financial risks.

- Evaluating the effectiveness of value-at-risk (VaR) models in risk management.

- The impact of operational risk on financial institutions.

- Exploring the relationship between risk-taking and financial performance.

- Analyzing the role of insurance in managing financial risks.

- The impact of climate change on financial risk assessment.

- Evaluating the role of stress testing in assessing systemic risk.

- The influence of cyber threats on financial institutions’ risk management.

- The role of artificial intelligence in enhancing risk management practices.

Accounting and Auditing Research Topics

- Analyzing the impact of International Financial Reporting Standards (IFRS) on financial reporting quality.

- Evaluating the role of forensic accounting in fraud detection.

- The impact of audit quality on financial statement reliability.

- Investigating the role of auditor independence in ensuring financial transparency.

- Analyzing the effectiveness of fair value accounting in financial reporting.

- The influence of accounting conservatism on financial decision-making.

- Evaluating the impact of accounting information on investment decisions.

- The role of big data analytics in modern accounting practices.

- Analyzing the challenges and opportunities of sustainability reporting.

- The impact of earnings management on financial statement reliability.

Financial Regulation and Policy Research Topics

- The role of government intervention in preventing financial crises.

- Evaluating the impact of Dodd-Frank Wall Street Reform and Consumer Protection Act.

- Analyzing the effectiveness of Basel III in regulating global banking.

- The role of regulatory bodies in promoting financial market integrity.

- Investigating the impact of tax policies on corporate financial decisions.

- Analyzing the challenges and opportunities of cross-border financial regulation.

- The role of ethics in financial decision-making and regulation.

- Evaluating the impact of monetary policy on inflation and economic growth.

- The influence of political factors on financial regulation.

- The impact of regulatory changes on financial innovation.

Real Estate Finance Related Research Topics

- Analyzing the factors influencing real estate prices and investment.

- The impact of interest rate changes on real estate markets.

- Evaluating the role of mortgage-backed securities in real estate finance.

- The influence of housing policies on real estate market dynamics.

- The role of real estate crowdfunding in property financing.

- Analyzing the impact of urbanization on real estate development.

- The role of sustainability in real estate investment decisions.

- Evaluating the impact of economic downturns on real estate values.

- The influence of demographic trends on real estate market dynamics.

- Analyzing the challenges and opportunities of real estate finance in emerging markets.

Behavioral Finance Research Paper Topics

- Investigating the role of behavioral biases in investment decisions.

- The impact of overconfidence on financial decision-making.

- Analyzing the influence of social networks on investment behavior.

- Evaluating the role of emotions in financial decision-making.

- The impact of financial news and media on investor sentiment.

- Investigating the role of heuristics in shaping financial perceptions.

- Analyzing the impact of market bubbles on investor behavior.

- The influence of framing effects on investment choices.

- Evaluating the role of financial education in mitigating behavioral biases.

- The impact of cultural factors on individual investment decisions.

Financial Technology (Fintech) Research Topics

- Analyzing the impact of robo-advisors on traditional investment advisory services.

- The role of blockchain in reshaping payment systems.

- Evaluating the potential of cryptocurrencies as a mainstream means of exchange.

- The impact of artificial intelligence on credit scoring models.

- Analyzing the challenges and opportunities of regulating fintech startups.

- The role of big data analytics in personalized financial services.

- Evaluating the impact of open banking on financial innovation.

- The influence of cybersecurity threats on fintech adoption.

- Analyzing the role of regulatory sandboxes in fostering fintech innovation.

- The impact of fintech on financial inclusion in developing economies.

Economics and Finance Sector Related Research Topics

- Investigating the relationship between economic indicators and financial markets.

- The impact of trade policies on exchange rates and international finance.

- Analyzing the role of economic sanctions in shaping financial landscapes.

- Evaluating the impact of globalization on financial stability.

- The role of monetary policy in addressing economic inequality.

- Analyzing the impact of economic recessions on financial decision-making.

- The influence of political instability on financial markets.

- The impact of demographic trends on economic and financial dynamics.

- Evaluating the role of economic forecasting in financial decision-making.

- The relationship between economic growth and financial development.

Sustainable Banking And Finance Research Topics

- Analyzing the impact of environmental, social, and governance (ESG) factors on investment decisions.

- The role of green finance in promoting sustainable development.

- Evaluating the impact of carbon pricing on financial markets.

- The influence of sustainable investing on corporate decision-making.

- Analyzing the challenges and opportunities of integrating sustainability into financial reporting.

- The role of impact investing in addressing social and environmental issues.

- Evaluating the impact of climate change on financial risk assessment.

- The influence of corporate sustainability on shareholder value.

- The role of green bonds in financing environmentally friendly projects.

- Analyzing the effectiveness of sustainable finance policies in achieving global goals.

Recent Banking And Finance Research Topics

- Investigating the potential of decentralized finance (DeFi) in traditional banking services.

- The impact of quantum computing on financial modeling and risk management.

- Analyzing the challenges and opportunities of central bank digital currencies (CBDCs).

- The role of augmented reality (AR) and virtual reality (VR) in financial services.

- The impact of 5G technology on financial transactions and services.

- Evaluating the potential of tokenization in transforming financial markets.

- Analyzing the role of artificial intelligence in credit scoring and lending decisions.

- The influence of geopolitical factors on global financial markets.

- The impact of regulatory technology (RegTech) in compliance and risk management.

- The role of smart contracts in streamlining financial transactions.

Cross-Border Finance Research Paper Topics

- Investigating the impact of exchange rate fluctuations on cross-border investments.

- The role of currency unions in promoting cross-border trade and investments.

- Analyzing the challenges and opportunities of cross-border banking operations.

- Evaluating the impact of trade agreements on cross-border financial flows.

- The influence of political and economic integration on cross-border finance.

- Analyzing the role of international financial institutions in cross-border finance.

- The impact of capital controls on cross-border investments.

- The role of cross-border financial services in promoting global economic integration.

- Evaluating the impact of cross-border financial regulations on multinational corporations.

- The influence of cross-border financial crimes on international cooperation.

Financial Education and Literacy Research Topics

- Investigating the impact of financial education programs on students’ financial literacy.

- The role of technology in enhancing financial education and literacy.

- Evaluating the effectiveness of workplace financial wellness programs.

- Analyzing the impact of cultural factors on financial literacy levels.

- The influence of family background on financial literacy.

- The impact of early financial education on long-term financial behavior.

- Analyzing the relationship between financial literacy and retirement planning.

- The role of schools and universities in promoting financial literacy.

- The influence of gender on financial literacy and decision-making.

- Evaluating the impact of online resources on improving financial literacy.

Banking and Finance in Developing Economies

- Analyzing the challenges and opportunities of financial inclusion in developing economies.

- The role of microfinance in poverty alleviation and economic development.

- Evaluating the impact of foreign aid on financial stability in developing countries.

- The influence of corruption on financial development in developing economies.

- Analyzing the role of remittances in shaping economic landscapes in developing countries.

- The impact of informal financial services on rural communities.

- Evaluating the role of government policies in promoting financial development.

- The influence of economic and political instability on financial systems in developing countries.

- The role of international financial institutions in supporting economic growth in developing economies.

- Analyzing the impact of technology adoption on financial inclusion in developing regions.

What Are Some Good Topics In The Area Of Finance And Accounting For A Ph.D. Research?

Here are some current Banking And Finance research topics for students:

| Finance Topics | Accounting Topics |

|---|---|

| 1. Impact of Cryptocurrencies on Financial Markets | 1. Analysis of Accounting Information Systems |

| 2. Role of Behavioral Finance in Investment Decision-Making | 2. Forensic Accounting and Fraud Detection |

| 3. Corporate Governance and Firm Performance | 3. The Role of Auditing in Corporate Governance |

| 4. Financial Regulation and Market Stability | 4. Environmental, Social, and Governance (ESG) Reporting |

| 5. Asset Pricing Models and Risk Management | 5. Accounting for Business Combinations and Mergers |

| 6. Venture Capital and Innovation Financing | 6. International Financial Reporting Standards (IFRS) vs. Generally Accepted Accounting Principles (GAAP) |

| 7. Islamic Finance and Banking | 7. Corporate Social Responsibility (CSR) Reporting |

| 8. Impact of Central Bank Policies on Financial Markets | 8. Management Accounting in Decision-Making |

| 9. Real Estate Finance and Investment | 9. Taxation and its Impact on Financial Statements |

| 10. Financial Derivatives and Hedging Strategies | 10. Corporate Governance in Family-Owned Businesses |

| 11. Private Equity and Leveraged Buyouts | 11. Accounting for Intangible Assets |

| 12. Behavioral Aspects of Credit Risk Assessment | 12. Governmental Accounting and Financial Reporting |

| 13. FinTech Innovations in Banking and Finance | 13. Internal Controls and Risk Management |

| 14. Cross-Border Mergers and Acquisitions | 14. Fair Value Accounting and its Implications |

| 15. Impact of Macroeconomic Factors on Stock Prices | 15. Accounting for Derivatives and Hedge Accounting |

| 16. Green Finance and Sustainable Investment | 16. Accounting for Revenue Recognition |

| 17. Evaluating the Effectiveness of Corporate Hedging | 17. Performance Measurement and Balanced Scorecard |

| 18. Behavioral Finance in Corporate Finance | 18. Accounting Information and Market Efficiency |

| 19. Sovereign Wealth Funds and Portfolio Management | 19. Corporate Disclosure and Transparency |

| 20. Initial Coin Offerings (ICOs) and Startup Funding | 20. Accounting for Leases and Lease Financing |

Recent Project Topics On Banking And Finance PDF

Here are the most recent project topics on banking and finance pdf:

These Are the best Banking and Finance Research Topics. These topics serve as gateways to understanding the nature of banking, finance, and other research topics. As you find a good research topic, consider your interests and the current trends shaping the financial domain. Whether it’s the impact of technology on banking, the dynamics of stock markets, or the role of sustainable finance.

Engage with your coursework, delve into academic journals, and attend seminars to find the latest understandings and potential research questions. Consulting with professors and advisors offers valuable guidance, helping refine your focus. Keep an eye on industry reports and financial news for inspiration, considering contemporary challenges and emerging trends.

Remember, your research can contribute to understanding financial systems and inform real-world practices. Choose a topic that not only captivates your interest but also addresses relevant issues, and you’ll find yourself good banking and finance research topics. Happy exploring!

Related Posts

151+ Best Sociology Research Topics on Mental Health [2024 Revised]

149+ Most Interesting Civil Engineering Research Topics For Undergraduates

Leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- How it works

Useful Links

How much will your dissertation cost?

Have an expert academic write your dissertation paper!

Dissertation Services

Get unlimited topic ideas and a dissertation plan for just £45.00

Order topics and plan

Get 1 free topic in your area of study with aim and justification

Yes I want the free topic

Banking and Finance Dissertation Topics – Selected for Business Students

Published by Owen Ingram at January 2nd, 2023 , Revised On August 16, 2023

Looking for an interesting banking and finance research idea for your dissertation? Your search for the best finance and banking dissertation topics ends right here because, a t ResearchProspect, we help students choose the most authentic and relevant topic for their dissertation projects.

Bank taxes, financial management, financial trading, credit management, market analysis for private investors, economic research methods, the economics of money and banking, international trade and multinational business, the wellbeing of people and society, principles and practices of banking, management and cost accounting, governance and ethics in banking, investment banking, introductory econometrics, and capital investment management are among the many topics covered in banking and finance.

Without further ado, here is our selection of the besting banking and finance thesis topics and ideas.

Other Useful Links:

- Law Dissertation Topics

- Human Rights Law Dissertation Topics

- Business Law Dissertation Topics

- Employmeny Law Dissertation Topics

- Contract Law Dissertation Topics

- Commercial Law Dissertation Topics

- EU Law Dissertation Ideas

- Sports Law Dissertation Topics

- Medical Law Dissertation Topics

- Maritime Law Dissertation Topics

The following dissertation topics for banking will assist students in achieving the highest possible grades in their dissertation on banking finance:

List of Banking and Finance Dissertation Topics

- A Comprehensive Analysis of the Economic Crisis as It Relates to Banking and Finance

- A Critical Review of Standard Deviation in Business

- The Political and Economic Risks Involving National Bank Transactions

- A Study of Corporate Developments in European Countries Regarding Banking and Finance

- Security Measures Implemented in Financial Institutions Around the World

- Banking and Finance Approaches from Around the World

- An in-depth study of the World Trade Organization’s role in banking and finance

- A Study of the Relationship Between Corporate Strategy and Capital Structures

- Contrasting global, multinational banks with regional businesses

- Preventing Repetitive Economic Collapse in National and Global Finances

- The Motivations for Becoming International Expats All Over the World

- The Difference Between Islamic Banking and Other Religious Denominations in Banking and Financial Habits

- How Can Small-Scale Industries Survive the Global Banking Demands?

- A Study of the Economic Crisis’s Impact on Banking and Finance

- The Impact of the International Stock Exchange on Domestic Bank Transactions

- A 2025 Projected Report on World Trade and Banking Statistics

- How Can We Address the Issue of the Government’s Financial Deficit in Banking?

- A Comparison of Contemporary and Classic Business Models and Companies’ Banking and Financial Habits

- Which of the following should be the principal area of money investment that has arrived at the bank in the form of deposits?

- How to strike a balance between investing money in various plans to generate a profit and managing depositor trust

- What are banks’ responsibilities to their depositors, and how may such liabilities be managed without jeopardising depositor trust?

- How the new banking financing laws enacted by governments throughout the world are better protecting depositors’ rights?

- What is the terminology related to banking finance, which oversees the investment of deposited funds as well as the banks’ responsibilities to depositors?

- Explain the most recent developments in research related to the topic of banking finance

- How research in the banking finance industry assists governments and banking authorities in properly managing their finances?

- What is the most recent credit rating software that assists in determining the rewards and dangers of investing bank funds in the stock market?

- How banking finance assists the world’s top banks in managing consumer expectations and profit?

- The negative impact of a manager’s poor management of a bank’s banking financing

- Is it feasible to conduct a banking firm without the assistance of banking finance management?

- What are the most significant aspects of banking financing that allow businesses to develop without constraints?

The importance of banking finance cannot be overstated. These are only a few of the most extensive subjects on which you may write a banking and finance dissertation. Remember that if you want to succeed in your studies, you must be able to offer reliable numbers and facts on the history and current state of banking and finance throughout the world. Otherwise, you will very certainly be unable to justify your study effectively. We hope you can take some inspiration and ideas from the above banking and finance dissertation topics .

Need professional dissertation help? Click here .

Free Dissertation Topic

Phone Number

Academic Level Select Academic Level Undergraduate Graduate PHD

Academic Subject

Area of Research

Frequently Asked Questions

How to find banking and finance dissertation topics.

To find banking and finance dissertation topics:

- Follow industry news and trends.

- Study regulatory changes.

- Explore emerging technologies.

- Analyze financial markets.

- Investigate risk management.

- Consider ethical and global aspects.

You May Also Like

Need interesting and manageable Mental Health dissertation topics or thesis? Here are the trending Mental Health dissertation titles so you can choose the most suitable one.

Need interesting and manageable HRM dissertation topics or thesis? Here are the trending HRM dissertation titles so you can choose the most suitable one.

Here is a list of Research Topics on Philosophy to help you get started with the process of findings related dissertation idea of philosophy.

USEFUL LINKS

LEARNING RESOURCES

COMPANY DETAILS

- How It Works

Home » Blog » Dissertation » Topics » Finance » Banking and Finance » Banking and Finance Dissertation Topics (28 Examples) For Research

Banking and Finance Dissertation Topics (28 Examples) For Research

Mark May 26, 2020 Jun 5, 2020 Banking and Finance , Finance No Comments

Are you searching for banking and finance dissertation topics? We understand that selecting a dissertation topic is one of the biggest challenges. So, we offer a wide range of banking and finance dissertation topics and project topics on banking and finance. You can also visit our site for corporate finance dissertation topics and other business […]

Are you searching for banking and finance dissertation topics? We understand that selecting a dissertation topic is one of the biggest challenges. So, we offer a wide range of project topics on banking and finance.

Our team of writers can provide quality work on your selected banking and finance research topics. Once you select from the research topics on banking and finance, we will provide an outline, which can provide guidance on how the study should be carried out .

If you have come to this post after searching for corporate finance or finance topics, following are the seperate posts made on these topics.

- Finance Research Topics

- Corporate Finance Research Topics

Banking and finance dissertation topics

Role of micro-loans in the modern financial industry.

Online currencies like Bitcoin brought changes in the concept of fiat currencies.

Identifying the forces causing American retail banking centres to change.

Analysing the treatment of off-balance sheet activities.

Examining the role of internet banking in society.

Evaluating how the modern economy prevents a run on the banks from happening.

To find out whether the technology can replace the role of retail banking centre.

Relationship between housing loans and the 2008 recession.

Impact of foreign direct investment on the emerging economies.

Identifying the best capital structure for a retail bank.

To study the effect of mergers and acquisition on employee’s morale and performance in the case of banks.

Evaluating the credit management and issues of bad debts in commercial banks in the UAE.

To what extent the electronic banking has affected customer satisfaction.

Portfolio management and its impact on the profitability level of banks.

Impact of interest rate on loan repayment in microfinance banks.

An appraisal of operational problems facing micro-finance banks in delta state.

Studying the impact of risk management on the profitability of banks.

Evaluation of bank lending and credit management.

Role of automated teller machine on customer satisfaction and retention.

Examining the impact of bank consolidation on operational efficiency.

Competitive strategies and changes in the banking industry.

Development of rural banking in the case of developed countries.

The effect of electronic payment systems on the behaviour and satisfaction level of customers.

How does the organisational structure affect the commercial banks and their performance?

How can banks use ratio analysis as a bank lending tool?

Evaluating the relationship between e-banking and cybercrime.

Studying the importance of credit management in the banking industry.

Problems related to loan granting and recovery.

Topic With Mini-Proposal (Paid Service)

Along with a topic, you will also get;

- An explanation why we choose this topic.

- 2-3 research questions.

- Key literature resources identification.

- Suitable methodology with identification of raw sample size, and data collection method

- View a sample of topic consultation service

Get expert dissertation writing help to achieve good grades

- Writer consultation before payment to ensure your work is in safe hands.

- Free topic if you don't have one

- Draft submissions to check the quality of the work as per supervisor's feedback

- Free revisions

- Complete privacy

- Plagiarism Free work

- Guaranteed 2:1 (With help of your supervisor's feedback)

- 2 Instalments plan

- Special discounts

Other Posts

- Corporate Finance Dissertation Topics (29 Examples) For Your Research December 28, 2019 -->

- Finance Dissertation Topics Examples List (37 Ideas) For Research Students May 29, 2017 -->

Message Us On WhatsApp

- Open access

- Published: 18 June 2021

Financial technology and the future of banking

- Daniel Broby ORCID: orcid.org/0000-0001-5482-0766 1

Financial Innovation volume 7 , Article number: 47 ( 2021 ) Cite this article

45k Accesses

56 Citations

5 Altmetric

Metrics details

This paper presents an analytical framework that describes the business model of banks. It draws on the classical theory of banking and the literature on digital transformation. It provides an explanation for existing trends and, by extending the theory of the banking firm, it illustrates how financial intermediation will be impacted by innovative financial technology applications. It further reviews the options that established banks will have to consider in order to mitigate the threat to their profitability. Deposit taking and lending are considered in the context of the challenge made from shadow banking and the all-digital banks. The paper contributes to an understanding of the future of banking, providing a framework for scholarly empirical investigation. In the discussion, four possible strategies are proposed for market participants, (1) customer retention, (2) customer acquisition, (3) banking as a service and (4) social media payment platforms. It is concluded that, in an increasingly digital world, trust will remain at the core of banking. That said, liquidity transformation will still have an important role to play. The nature of banking and financial services, however, will change dramatically.

Introduction

The bank of the future will have several different manifestations. This paper extends theory to explain the impact of financial technology and the Internet on the nature of banking. It provides an analytical framework for academic investigation, highlighting the trends that are shaping scholarly research into these dynamics. To do this, it re-examines the nature of financial intermediation and transactions. It explains how digital banking will be structurally, as well as physically, different from the banks described in the literature to date. It does this by extending the contribution of Klein ( 1971 ), on the theory of the banking firm. It presents suggested strategies for incumbent, and challenger banks, and how banking as a service and social media payment will reshape the competitive landscape.

The banking industry has been evolving since Banca Monte dei Paschi di Siena opened its doors in 1472. Its leveraged business model has proved very scalable over time, but it is now facing new challenges. Firstly, its book to capital ratios, as documented by Berger et al ( 1995 ), have been consistently falling since 1840. This trend continues as competition has increased. In the past decade, the industry has experienced declines in profitability as measured by return on tangible equity. This is partly the result of falling leverage and fee income and partly due to the net interest margin (connected to traditional lending activity). These trends accelerated following the 2008 financial crisis. At the same time, technology has made banks more competitive. Advances in digital technology are changing the very nature of banking. Banks are now distributing services via mobile technology. A prolonged period of very low interest rates is also having an impact. To sustain their profitability, Brei et al. ( 2020 ) note that many banks have increased their emphasis on fee-generating services.

As Fama ( 1980 ) explains, a bank is an intermediary. The Internet is, however, changing the way financial service providers conduct their role. It is fundamentally changing the nature of the banking. This in turn is changing the nature of banking services, and the way those services are delivered. As a consequence, in order to compete in the changing digital landscape, banks have to adapt. The banks of the future, both incumbents and challengers, need to address liquidity transformation, data, trust, competition, and the digitalization of financial services. Against this backdrop, incumbent banks are focused on reinventing themselves. The challenger banks are, however, starting with a blank canvas. The research questions that these dynamics pose need to be investigated within the context of the theory of banking, hence the need to revise the existing analytical framework.

Banks perform payment and transfer functions for an economy. The Internet can now facilitate and even perform these functions. It is changing the way that transactions are recorded on ledgers and is facilitating both public and private digital currencies. In the past, banks operated in a world of information asymmetry between themselves and their borrowers (clients), but this is changing. This differential gave one bank an advantage over another due to its knowledge about its clients. The digital transformation that financial technology brings reduces this advantage, as this information can be digitally analyzed.

Even the nature of deposits is being transformed. Banks in the future will have to accept deposits and process transactions made in digital form, either Central Bank Digital Currencies (CBDC) or cryptocurrencies. This presents a number of issues: (1) it changes the way financial services will be delivered, (2) it requires a discussion on resilience, security and competition in payments, (3) it provides a building block for better cross border money transfers and (4) it raises the question of private and public issuance of money. Braggion et al ( 2018 ) consider whether these represent a threat to financial stability.

The academic study of banking began with Edgeworth ( 1888 ). He postulated that it is based on probability. In this respect, the nature of the business model depends on the probability that a bank will not be called upon to meet all its liabilities at the same time. This allows banks to lend more than they have in deposits. Because of the resultant mismatch between long term assets and short-term liabilities, a bank’s capital structure is very sensitive to liquidity trade-offs. This is explained by Diamond and Rajan ( 2000 ). They explain that this makes a bank a’relationship lender’. In effect, they suggest a bank is an intermediary that has borrowed from other investors.

Diamond and Rajan ( 2000 ) argue a lender can negotiate repayment obligations and that a bank benefits from its knowledge of the customer. As shall be shown, the new generation of digital challenger banks do not have the same tradeoffs or knowledge of the customer. They operate more like a broker providing a platform for banking services. This suggests that there will be more than one type of bank in the future and several different payment protocols. It also suggests that banks will have to data mine customer information to improve their understanding of a client’s financial needs.

The key focus of Diamond and Rajan ( 2000 ), however, was to position a traditional bank is an intermediary. Gurley and Shaw ( 1956 ) describe how the customer relationship means a bank can borrow funds by way of deposits (liabilities) and subsequently use them to lend or invest (assets). In facilitating this mediation, they provide a service whereby they store money and provide a mechanism to transmit money. With improvements in financial technology, however, money can be stored digitally, lenders and investors can source funds directly over the internet, and money transfer can be done digitally.

A review of financial technology and banking literature is provided by Thakor ( 2020 ). He highlights that financial service companies are now being provided by non-deposit taking contenders. This paper addresses one of the four research questions raised by his review, namely how theories of financial intermediation can be modified to accommodate banks, shadow banks, and non-intermediated solutions.

To be a bank, an entity must be authorized to accept retail deposits. A challenger bank is, therefore, still a bank in the traditional sense. It does not, however, have the costs of a branch network. A peer-to-peer lender, meanwhile, does not have a deposit base and therefore acts more like a broker. This leads to the issue that this paper addresses, namely how the banks of the future will conduct their intermediation.

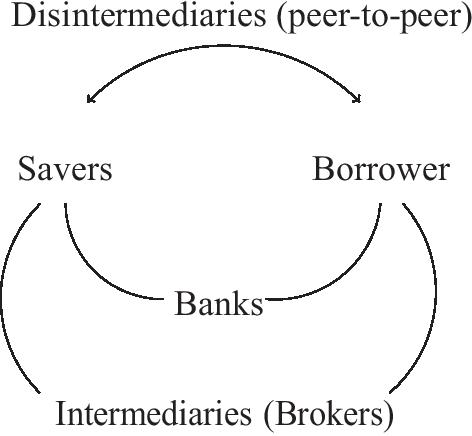

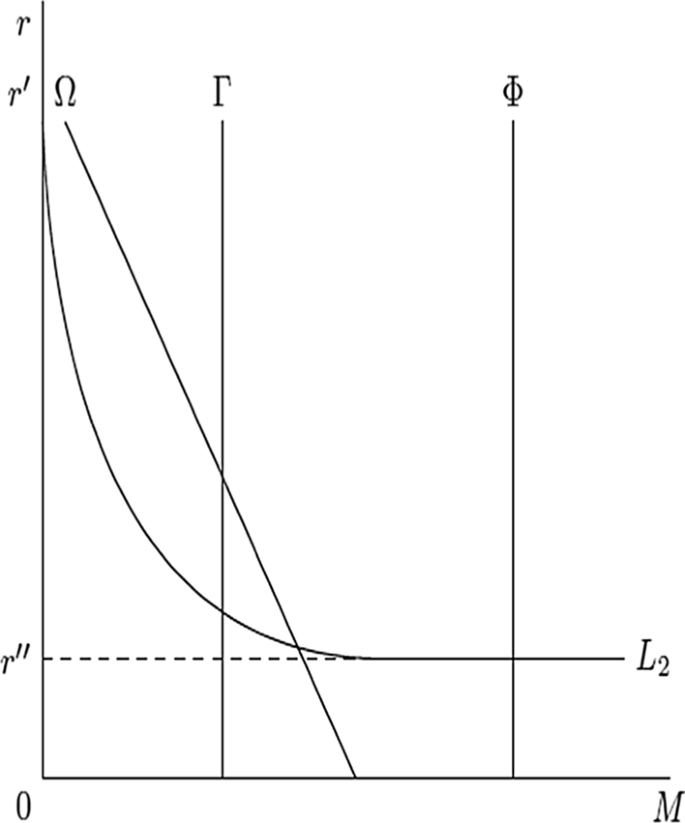

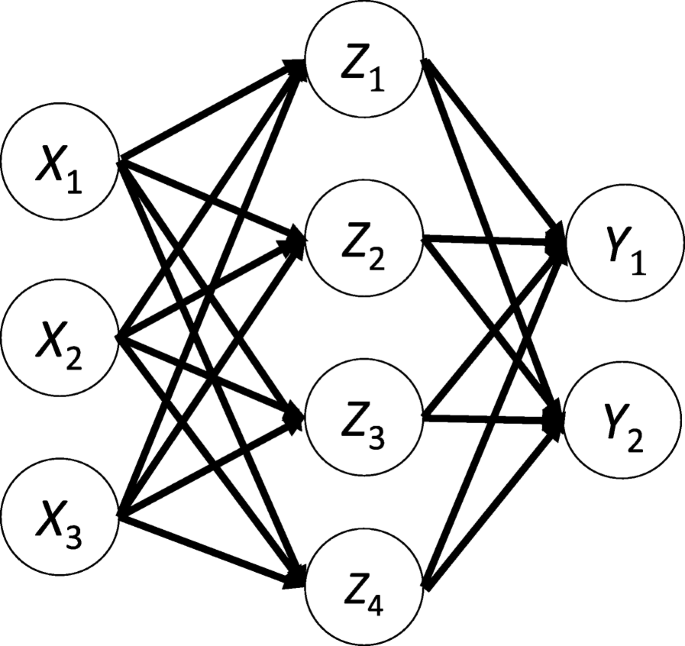

In order to understand what the bank of the future will look like, it is necessary to understand the nature of the aforementioned intermediation, and the way it is changing. In this respect, there are two key types of intermediation. These are (1) quantitative asset transformation and, (2) brokerage. The latter is a common model adopted by challenger banks. Figure 1 depicts how these two types of financial intermediation match savers with borrowers. To avoid nuanced distinction between these two types of intermediation, it is common to classify banks by the services they perform. These can be grouped as either private, investment, or commercial banking. The service sub-groupings include payments, settlements, fund management, trading, treasury management, brokerage, and other agency services.

How banks act as intermediaries between lenders and borrowers. This function call also be conducted by intermediaries as brokers, for example by shadow banks. Disintermediation occurs over the internet where peer-to-peer lenders match savers to lenders

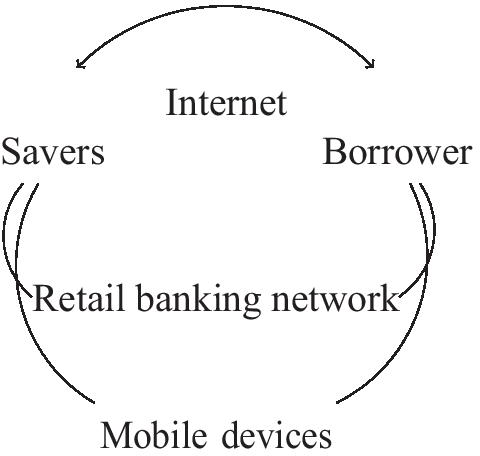

Financial technology has the ability to disintermediate the banking sector. The competitive pressures this results in will shape the banks of the future. The channels that will facilitate this are shown in Fig. 2 , namely the Internet and/or mobile devices. Challengers can participate in this by, (1) directly matching borrows with savers over the Internet and, (2) distributing white labels products. The later enables banking as a service and avoids the aforementioned liquidity mismatch.

The strategic options banks have to match lenders with borrowers. The traditional and challenger banks are in the same space, competing for business. The distributed banks use the traditional and challenger banks to white label banking services. These banks compete with payment platforms on social media. The Internet heralds an era of banking as a service

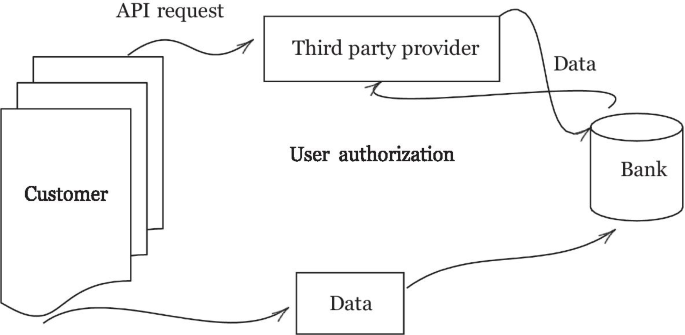

There are also physical changes that are being made in the delivery of services. Bricks and mortar branches are in decline. Mobile banking, or m-banking as Liu et al ( 2020 ) describe it, is an increasingly important distribution channel. Robotics are increasingly being used to automate customer interaction. As explained by Vishnu et al ( 2017 ), these improve efficiency and the quality of execution. They allow for increased oversight and can be built on legacy systems as well as from a blank canvas. Application programming interfaces (APIs) are bringing the same type of functionality to m-banking. They can be used to authorize third party use of banking data. How banks evolve over time is important because, according to the OECD, the activity in the financial sector represents between 20 and 30 percent of developed countries Gross Domestic Product.

In summary, financial technology has evolved to a level where online banks and banking as a service are challenging incumbents and the nature of banking mediation. Banking is rapidly transforming because of changes in such technology. At the same time, the solving of the double spending problem, whereby digital money can be cryptographically protected, has led to the possibility that paper money will become redundant at some point in the future. A theoretical framework is required to understand this evolving landscape. This is discussed next.

The theory of the banking firm: a revision

In financial theory, as eloquently explained by Fama ( 1980 ), banking provides an accounting system for transactions and a portfolio system for the storage of assets. That will not change for the banks of the future. Fama ( 1980 ) explains that their activities, in an unregulated state, fulfil the Modigliani–Miller ( 1959 ) theorem of the irrelevance of the financing decision. In practice, traditional banks compete for deposits through the interest rate they offer. This makes the transactional element dependent on the resulting debits and credits that they process, essentially making banks into bookkeeping entities fulfilling the intermediation function. Since this is done in response to competitive forces, the general equilibrium is a passive one. As such, the banking business model is vulnerable to disruption, particularly by innovation in financial technology.

A bank is an idiosyncratic corporate entity due to its ability to generate credit by leveraging its balance sheet. That balance sheet has assets on one side and liabilities on the other, like any corporate entity. The assets consist of cash, lending, financial and fixed assets. On the other side of the balance sheet are its liabilities, deposits, and debt. In this respect, a bank’s equity and its liabilities are its source of funds, and its assets are its use of funds. This is explained by Klein ( 1971 ), who notes that a bank’s equity W , borrowed funds and its deposits B is equal to its total funds F . This is the same for incumbents and challengers. This can be depicted algebraically if we let incumbents be represented by Φ and challengers represented by Γ:

Klein ( 1971 ) further explains that a bank’s equity is therefore made up of its share capital and unimpaired reserves. The latter are held by a bank to protect the bank’s deposit clients. This part is also mandated by regulation, so as to protect customers and indeed the entire banking system from systemic failure. These protective measures include other prudential requirements to hold cash reserves or other liquid assets. As shall be shown, banking services can be performed over the Internet without these protections. Banking as a service, as this phenomenon known, is expected to increase in the future. This will change the nature of the protection available to clients. It will change the way banks transform assets, explained next.

A bank’s deposits are said to be a function of the proportion of total funds obtained through the issuance of the ith deposit type and its total funds F , represented by α i . Where deposits, represented by Bs , are made in the form of Bs (i = 1 *s n) , they generate a rate of interest. It follows that Si Bs = B . As such,

Therefor it can be said that,

The importance of Eq. 3 is that the balance sheet can be leveraged by the issuance of loans. It should be noted, however, that not all loans are returned to the bank in whole or part. Non-performing loans reduce the asset side of a bank’s balance sheet and act as a constraint on capital, and therefore new lending. Clearly, this is not the case with banking as a service. In that model, loans are brokered. That said, with the traditional model, an advantage of financial technology is that it facilitates the data mining of clients’ accounts. Lending can therefore be more targeted to borrowers that are more likely to repay, thereby reducing non-performing loans. Pari passu, the incumbent bank of the future will therefore have a higher risk-adjusted return on capital. In practice, however, banking as a service will bring greater competition from challengers and possible further erosion of margins. Alternatively, some banks will proactively engage in partnerships and acquisitions to maintain their customer base and address the competition.

A bank must have reserves to meet the demand of customers demanding their deposits back. The amount of these reserves is a key function of banking regulation. The Basel Committee on Banking Supervision mandates a requirement to hold various tiers of capital, so that banks have sufficient reserves to protect depositors. The Committee also imposes a framework for mitigating excessive liquidity risk and maturity transformation, through a set Liquidity Coverage Ratio and Net Stable Funding Ratio.

Recent revisions of theory, because of financial technology advances, have altered our understanding of banking intermediation. This will impact the competitive landscape and therefor shape the nature of the bank of the future. In this respect, the threat to incumbent banks comes from peer-to-peer Internet lending platforms. These perform the brokerage function of financial intermediation without the use of the aforementioned banking balance sheet. Unlike regulated deposit takers, such lending platforms do not create assets and do not perform risk and asset transformation. That said, they are reliant on investors who do not always behave in a counter cyclical way.

Financial technology in banking is not new. It has been used to facilitate electronic markets since the 1980’s. Thakor ( 2020 ) refers to three waves of application of financial innovation in banking. The advent of institutional futures markets and the changing nature of financial contracts fundamentally changed the role of banks. In response to this, academics extended the concept of a bank into an entity that either fulfills the aforementioned functions of a broker or a qualitative asset transformer. In this respect, they connect the providers and users of capital without changing the nature of the transformation of the various claims to that capital. This transformation can be in the form risk transfer or the application of leverage. The nature of trading of financial assets, however, is changing. Price discovery can now be done over the Internet and that is moving liquidity from central marketplaces (like the stock exchange) to decentralized ones.

Alongside these trends, in considering what the bank of the future will look like, it is necessary to understand the unregulated lending market that competes with traditional banks. In this part of the lending market, there has been a rise in shadow banks. The literature on these entities is covered by Adrian and Ashcraft ( 2016 ). Shadow banks have taken substantial market share from the traditional banks. They fulfil the brokerage function of banks, but regulators have only partial oversight of their risk transformation or leverage. The rise of shadow banks has been facilitated by financial technology and the originate to distribute model documented by Bord and Santos ( 2012 ). They use alternative trading systems that function as electronic communication networks. These facilitate dark pools of liquidity whereby buyers and sellers of bonds and securities trade off-exchange. Since the credit crisis of 2008, total broker dealer assets have diverged from banking assets. This illustrates the changed lending environment.

In the disintermediated market, banking as a service providers must rely on their equity and what access to funding they can attract from their online network. Without this they are unable to drive lending growth. To explain this, let I represent the online network. Extending Klein ( 1971 ), further let Ψ represent banking as a service and their total funds by F . This state is depicted as,

Theoretically, it can be shown that,

Shadow banks, and those disintermediators who bypass the banking system, have an advantage in a world where technology is ubiquitous. This becomes more apparent when costs are considered. Buchak et al. ( 2018 ) point out that shadow banks finance their originations almost entirely through securitization and what they term the originate to distribute business model. Diversifying risk in this way is good for individual banks, as banking risks can be transferred away from traditional banking balance sheets to institutional balance sheets. That said, the rise of securitization has introduced systemic risk into the banking sector.

Thus, we can see that the nature of banking capital is changing and at the same time technology is replacing labor. Let A denote the number of transactions per account at a period in time, and C denote the total cost per account per time period of providing the services of the payment mechanism. Klein ( 1971 ) points out that, if capital and labor are assumed to be part of the traditional banking model, it can be observed that,

It can therefore be observed that the total service charge per account at a period in time, represented by S, has a linear and proportional relationship to bank account activity. This is another variable that financial technology can impact. According to Klein ( 1971 ) this can be summed up in the following way,

where d is the basic bank decision variable, the service charge per transaction. Once again, in an automated and digital environment, financial technology greatly reduces d for the challenger banks. Swankie and Broby ( 2019 ) examine the impact of Artificial Intelligence on the evaluation of banking risk and conclude that it improves such variables.

Meanwhile, the traditional banking model can be expressed as a product of the number of accounts, M , and the average size of an account, N . This suggests a banks implicit yield is it rate of interest on deposits adjusted by its operating loss in each time period. This yield is generated by payment and loan services. Let R 1 depict this. These can be expressed as a fraction of total demand deposits. This is depicted by Klein ( 1971 ), if one assumes activity per account is constant, as,

As a result, whether a bank is structured with traditional labor overheads or built digitally, is extremely relevant to its profitability. The capital and labor of tradition banks, depicted as Φ i , is greater than online networks, depicted as I i . As such, the later have an advantage. This can be shown as,

What Klein (1972) failed to highlight is that the banking inherently involves leverage. Diamond and Dybving (1983) show that leverage makes bank susceptible to run on their liquidity. The literature divides these between adverse shock events, as explained by Bernanke et al ( 1996 ) or moral hazard events as explained by Demirgu¨¸c-Kunt and Detragiache ( 2002 ). This leverage builds on the balance sheet mismatch of short-term assets with long term liabilities. As such, capital and liquidity are intrinsically linked to viability and solvency.

The way capital and liquidity are managed is through credit and default management. This is done at a bank level and a supervisory level. The Basel Committee on Banking Supervision applies capital and leverage ratios, and central banks manage interest rates and other counter-cyclical measures. The various iterations of the prudential regulation of banks have moved the microeconomic theory of banking from the modeling of risk to the modeling of imperfect information. As mentioned, shadow and disintermediated services do not fall under this form or prudential regulation.

The relationship between leverage and insolvency risk crucially depends on the degree of banks total funds F and their liability structure L . In this respect, the liability structure of traditional banks is also greater than online networks which do not have the same level of available funds, depicted as,

Diamond and Dybvig ( 1983 ) observe that this liability structure is intimately tied to a traditional bank’s assets. In this respect, a bank’s ability to finance its lending at low cost and its ability to achieve repayment are key to its avoidance of insolvency. Online networks and/or brokers do not have to finance their lending, simply source it. Similarly, as brokers they do not face capital loss in the event of a default. This disintermediates the bank through the use of a peer-to-peer environment. These lenders and borrowers are introduced in digital way over the internet. Regulators have taken notice and the digital broker advantage might not last forever. As a result, the future may well see greater cooperation between these competing parties. This also because banks have valuable operational experience compared to new entrants.

It should also be observed that bank lending is either secured or unsecured. Interest on an unsecured loan is typically higher than the interest on a secured loan. In this respect, incumbent banks have an advantage as their closeness to the customer allows them to better understand the security of the assets. Berger et al ( 2005 ) further differentiate lending into transaction lending, relationship lending and credit scoring.

The evolution of the business model in a digital world

As has been demonstrated, the bank of the future in its various manifestations will be a consequence of the evolution of the current banking business model. There has been considerable scholarly investigation into the uniqueness of this business model, but less so on its changing nature. Song and Thakor ( 2010 ) are helpful in this respect and suggest that there are three aspects to this evolution, namely competition, complementary and co-evolution. Although liquidity transformation is evolving, it remains central to a bank’s role.

All the dynamics mentioned are relevant to the economy. There is considerable evidence, as outlined by Levine ( 2001 ), that market liberalization has a causal impact on economic growth. The impact of technology on productivity should prove positive and enhance the functioning of the domestic financial system. Indeed, market liberalization has already reshaped banking by increasing competition. New fee based ancillary financial services have become widespread, as has the proprietorial use of balance sheets. Risk has been securitized and even packaged into trade-able products.

Challenger banks are developing in a complementary way with the incumbents. The latter have an advantage over new entrants because they have information on their customers. The liquidity insurance model, proposed by Diamond and Dybvig ( 1983 ), explains how such banks have informational advantages over exchange markets. That said, financial technology changes these dynamics. It if facilitating the processing of financial data by third parties, explained in greater detail in the section on Open Banking.

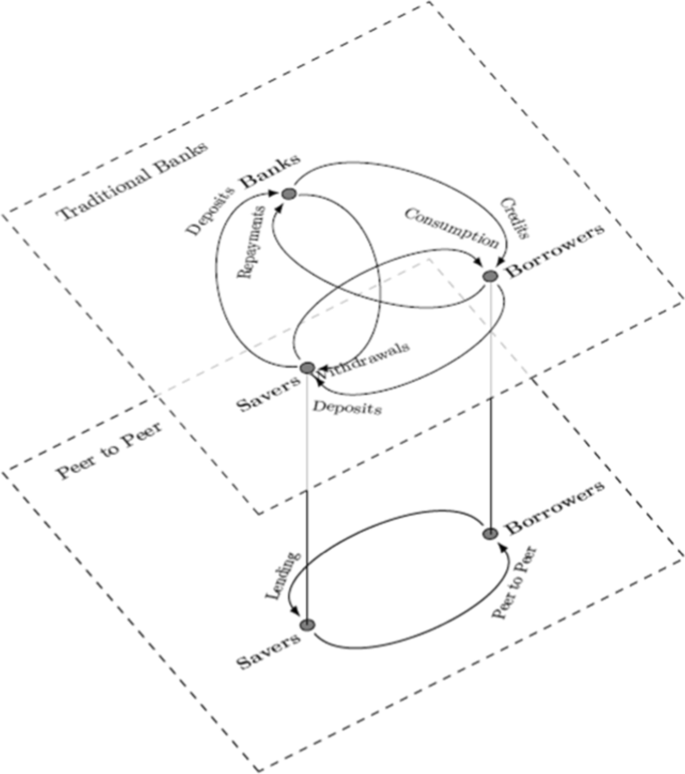

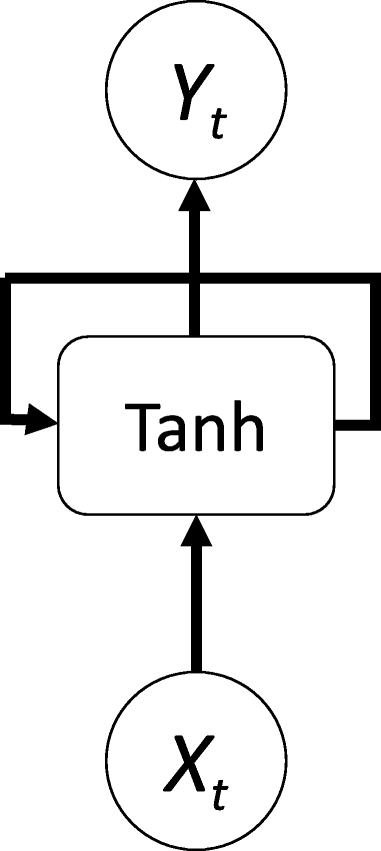

At the same time, financial technology is facilitating banking as a service. This is where financial services are delivered by a broker over the Internet without resort to the balance sheet. This includes roboadvisory asset management, peer to peer lending, and crowd funding. Its growth will be facilitated by Open Banking as it becomes more geographically adopted. Figure 3 illustrates how these business models are disintermediating the traditional banking role and matching burrowers and savers.

The traditional view of banks ecosystem between savers and borrowers, atop the Internet which is matching savers and borrowers directly in a peer-to-peer way. The Klein ( 1971 ) theory of the banking firm does not incorporate the mirrored dynamics, and as such needs to be extended to reflect the digital innovation that impacts both borrowers and severs in a peer-to-peer environment

Meanwhile, the banking sector is co-evolving alongside a shadow banking phenomenon. Lenders and borrowers are interacting, but outside of the banking sector. This is a concern for central banks and banking regulators, as the lending is taking place in an unregulated environment. Shadow banking has grown because of financial technology, market liberalization and excess liquidity in the asset management ecosystem. Pozsar and Singh ( 2011 ) detail the non-bank/bank intersection of shadow banking. They point out that shadow banking results in reverse maturity transformation. Incumbent banks have blurred the distinction between their use of traditional (M2) liabilities and market-based shadow banking (non-M2) liabilities. This impacts the inter-generational transfers that enable a bank to achieve interest rate smoothing.

Securitization has transformed the risk in the banking sector, transferring it to asset management institutions. These include structured investment vehicles, securities lenders, asset backed commercial paper investors, credit focused hedge and money market funds. This in turn has led to greater systemic risk, the result of the nature of the non-traded liabilities of securitized pooling arrangements. This increased risk manifested itself in the 2008 credit crisis.