What is a Management Representation Letter?

Getting through financial audits can be frustrating for companies, especially when asked to provide management representation letters.

This article will clarify exactly what a management representation letter is, why auditors request them, what should be included, and provide examples to make the process smooth and compliant.

You'll learn the purpose of these letters, see template examples, understand international audit standards, and gain key takeaways to improve financial reporting at your organization.

Introduction to Management Representation Letters

A management representation letter is a formal document signed by a company's senior management that is provided to external auditors. It contains certain written representations that auditors require in order to complete an audit and form an opinion on the company's financial statements.

Defining the Management Representation Letter in Audit Context

The management representation letter serves an important role within the financial statement audit process. Auditors use it as audit evidence to support their assessment of whether the financial statements are free of material misstatement. Specifically, auditors request written confirmation from management regarding the accuracy and completeness of information provided during the audit. This includes representations related to:

- The financial statements and adequacy of disclosures

- Proper recording of transactions and account balances

- Internal controls over financial reporting

- Compliance with laws and regulations

By obtaining these written representations from management, auditors gain additional audit evidence to complete their testing and analysis. The management representation letter also outlines management's responsibilities under the audit engagement.

Essential Components of a Management Representation Letter

A standard management representation letter contains certain key statements that auditors rely upon. These include:

- Financial statement disclosures : Confirmation that management has provided the auditors with all relevant information and access needed to perform the audit.

- Recognition, measurement and disclosure : Assertion that the financial statements comply with the applicable financial reporting framework and standards.

- Non-compliance : Disclosure of any non-compliance with laws and regulations.

- Litigation and claims : Details of any actual, pending or threatened litigation and claims that could impact the financial statements.

The letter will also typically list areas of significant estimates and judgments made by management in preparing the financial statements. For example, allowances for doubtful accounts, asset impairment assessments , and assumptions used in valuation models.

By obtaining written representation on these matters, auditors gain evidence to issue their audit opinion. The management representation letter should be signed by the CEO and CFO or equivalent members of senior management.

Legal and Ethical Implications of Management Representations

Signing a management representation letter has legal and ethical implications. Management must ensure representations made to the auditors are accurate and made in good faith. Intentionally misrepresenting information or omitting relevant details could constitute fraud and result in legal liability.

Auditors also have a duty to assess the reasonableness of management representations and corroborate them with other audit evidence. Relying solely on management representations without further verification could call into question the quality of the audit.

Overall, the management representation letter facilitates open and transparent communication between management and auditors. It serves as a legally binding confirmation of management's fulfillment of its financial reporting responsibilities.

What is the main purpose of a management representation letter?

The main purpose of a management representation letter is to obtain written confirmation from management that they have fulfilled their responsibility for the fair presentation of the financial statements. This letter documents that management has provided the auditors with all relevant information and access needed to conduct the audit.

Some key purposes of the management representation letter include:

Confirming management's responsibility for the preparation and fair presentation of the financial statements in accordance with the applicable financial reporting framework (e.g. GAAP or IFRS).

Affirming that management has provided the auditors with all relevant information and access to records, documentation and personnel that is necessary for the audit.

Disclosing any instances of fraud involving management, employees with significant internal control roles, or those that cause a material misstatement of the financial statements.

Presenting details on matters that impact the financial statements - such as plans or intentions that may affect asset/liability carrying values, information about related parties, contingencies, subsequent events, etc.

Stating that all transactions have been recorded and are reflected in the financial statements. This helps confirm completeness and cut-off assertions.

So in summary, the management representation letter serves as important audit evidence that validates information provided by management to the auditors. It also formally documents management's responsibilities and representations concerning the financial statements.

What is the meaning of management representation?

Management representation refers to written confirmation provided by management of an entity to the auditors regarding the accuracy and completeness of financial statements and adequacy of internal controls.

The management representation letter is a key audit evidence prepared at the completion of the audit process. It contains management's assertions regarding:

- Fair presentation of financial statements

- Completeness of information provided to auditors

- Proper accounting policies used

- Reasonableness of significant estimates made

Essentially, through this letter, management takes responsibility for the fair presentation of the financial statements. They confirm to the auditors that they have fulfilled their financial reporting responsibilities.

The management representation letter covers all periods encompassed by the audit report and is dated the same date as the completion of audit fieldwork. It is addressed to the engagement partner and signed by those with appropriate responsibilities for the financial statements, usually the Chief Executive Officer and Chief Financial Officer.

By obtaining written representations from management, the auditors demonstrate they have obtained sufficient appropriate audit evidence to support their audit opinion. The representations serve as necessary supplementary corroboration of management's oral assertions made during the audit.

In summary, the management representation letter is a written statement from management provided to the auditors as part of the audit evidence. It confirms management's compliance with financial reporting responsibilities to enable auditors to form their audit opinion.

What is an example of a management representation letter?

We are providing this letter in connection with your audit of the cost representation statement of USAID resources managed by (Client Name) under Contract No. XXX “Project Name” for the period MM/DD/YY to MM/DD/YY.

We confirm, to the best of our knowledge and belief, the following representations made to you during your audit:

- We have made available to you all financial records and related data, including service auditor reports.

- There have been no communications from regulatory agencies concerning noncompliance with or deficiencies on financial reporting practices.

- We have no knowledge of any known or suspected fraudulent financial reporting or misappropriation of assets involving management or employees with significant roles in internal control.

- We have disclosed to you the results of our assessment of risk that the cost representation statement may be materially misstated as a result of fraud.

- There are no material transactions that have not been properly recorded in the accounting records.

- We believe the effects of any uncorrected financial statement misstatements aggregated by you are immaterial.

- We have disclosed all liabilities, both actual and contingent.

- There are no violations or possible violations of laws or regulations whose effects should be considered.

We confirm that the representations we have made to you during your audit are complete, truthful, and accurate.

Sincerely, [Signature] [Client Representative Name and Title]

What is the difference between management letter and management representation letter?

The key differences between a management letter and a management representation letter in an audit are:

Focus : The management letter focuses on identifying weaknesses and areas of improvement in the company's financial reporting process and internal controls. Management representation, on the other hand, focuses on providing evidence of management's understanding and support of the audit process.

Purpose : The purpose of a management letter is to communicate deficiencies in internal control and make suggestions for improvements. The purpose of a management representation letter is to confirm certain information that the auditors have requested from management.

Content : A management letter contains comments and recommendations from the auditor about issues encountered during the audit. A management representation letter contains specific statements by management regarding matters such as the fairness of financial statements.

Timing : A management letter is typically issued after the audit report while a management representation letter is obtained during the audit.

In summary, while both letters relate to the audit process, the management letter aims to provide suggestions for improvement while the management representation letter serves as audit evidence regarding management's assertions. The management representation letter supports the audit by confirming the accuracy of the financial statements.

sbb-itb-beb59a9

The purpose and importance of management representation letters.

Management representation letters serve several key purposes in the audit process. Most importantly, they provide additional audit evidence to support the auditor's opinion on the financial statements.

Reinforcing the Auditor's Collection of Audit Evidences

Management representation letters reinforce the audit evidence the auditor has already obtained throughout the audit. As outlined in ISA 500 Audit Evidence, auditors must obtain sufficient appropriate evidence to support their opinion. The letter serves as written representation from management on important assertions related to the financial statements. This includes the completeness and accuracy of information provided to the auditor.

Management's Accountability for Financial Reporting

Additionally, the letter highlights management's responsibilities over financial reporting. Management, not the auditor, is responsible for the preparation and fair presentation of the financial statements. The representation letter formally documents that management has fulfilled these duties, a key assertion needed to issue an audit opinion.

Assurance on Contingent and Off-Balance-Sheet Liabilities

Auditors also rely on management's representations on significant estimates and disclosures. This includes assurance from management that the financial statements appropriately reflect contingent liabilities and off-balance-sheet liabilities in accordance with the applicable financial reporting framework.

In summary, representation letters serve as a final confirmation from management that they have fulfilled their financial reporting responsibilities. The letters provide key audit evidence and accountability to support the auditor's work in accordance with auditing standards.

Drafting a Management Representation Letter: Best Practices

A management representation letter is an important part of the audit process. It documents certain written representations made by management to the auditors regarding the company's financial statements.

Drafting an effective management representation letter requires following several best practices:

Management Representation Letter Template: A Starting Point

When creating a management representation letter, it's best to start with a template. This ensures all relevant topics are covered such as:

- Management's responsibility for the preparation and fair presentation of the financial statements

- Availability of all financial records and related data

- Completeness of information provided regarding transactions and events

- Disclosure of all liabilities, both actual and contingent

- Non-existence of any fraud or illegal acts

Tailor the template to the specific circumstances and transactions of the business. But the template establishes a solid foundation.

Who Should Sign the Management Representation Letter

Typically the management representation letter should be signed by:

- The CEO or Managing Director

- The CFO or Financial Controller

This demonstrates the company's overall governance has reviewed the representations and attests to their validity and completeness.

In some cases, representation from heads of divisions or departments may also be necessary regarding transactions or activities under their specific purview.

Customizing Representations to Reflect Unique Organizational Circumstances

While a template is useful, each management representation letter must be customized to reflect the distinct transactions and activities of the organization. Specifically call out areas the auditors have highlighted as potential risks or requiring further representations.

For example, if the company underwent a major acquisition, restructuring, or system implementation, representations would be needed to address the associated impacts and risks regarding financial reporting.

The management representation letter is not a mere formality. It serves as an indispensable record of the critical dialogue between management and auditors. Following these best practices helps craft letters that clearly communicate important representations.

Management Representation Letter Samples and Examples

Management representation letters are important documents in the financial audit process. They contain written confirmation from management about the accuracy and completeness of financial statements and disclosures. Reviewing examples can help companies understand what to include in their own letters.

Analyzing a Management Representation Letter Sample

Here is an excerpt from a sample management representation letter:

We acknowledge our responsibility for the fair presentation in the financial statements of financial position, results of operations, and cash flows in conformity with U.S. generally accepted accounting principles (GAAP). We have provided you with unrestricted access to persons within the Company...

This excerpt demonstrates several key elements:

- Acknowledgment of management's responsibility for financial statements conforming to GAAP

- Confirmation that auditors had full access to people and information

Other standard inclusions are statements around contingent liabilities, litigation matters, plans or intentions that may affect assets or liabilities, and confirmation that appropriate disclosures have been made.

Analyzing examples helps identify customary terms to include.

Management Representation Letter PDF: Accessibility and Format

Management representation letters are often provided to auditors as PDF files. This locked, uneditable format:

- Facilitates easy sharing of the definitive final version

- Allows clear version control with digital signatures

- Enables reliable long-term archival storage

PDF format removes ambiguity around which representation letter version was relied upon.

Real-World Examples: Complex Issues

Consider these excerpts from real-world representation letters:

"The restructuring provision of $20 million represents our best estimate of costs to complete the plant closure based on current plans..."

"We confirm that we have properly recorded and disclosed the acquisition of Company XYZ in the financial statements..."

These excerpts demonstrate how companies transparently address complex real situations like restructurings or major transactions in the representation letter.

Real examples provide assurance that the company has appropriately considered complex accounting matters.

Comparing Management Letters and Management Representation Letters

Management letters and management representation letters serve important but distinct purposes in the audit process.

Management Letter vs Management Representation Letter: Clarifying the Distinction

A management letter communicates deficiencies or recommendations for improvement identified by the auditor during the audit. These may relate to internal controls, processes, or compliance issues that could be made more effective.

In contrast, a management representation letter obtained near the end of an audit contains specific written representations from management about the accuracy and completeness of the financial statements and disclosures. Common representations confirm that:

- Financial statements are fairly presented

- Significant assumptions used by management are reasonable

- All relevant information has been provided to the auditor

- There are no undisclosed side agreements or contingencies

While management letters offer suggestions, representation letters confirm critical facts underlying the audit.

The Role of the Auditor in Relation to Management Representations

Auditors use both tools to fulfill their responsibilities:

Management letters reflect the auditor's duty to communicate control deficiencies to those charged with governance. This allows the entity to take timely remedial action.

Representation letters provide audit evidence as part of the auditor's risk assessment procedures under auditing standards. They represent a form of documentary evidence about management's intents, knowledge and accuracy of the financial statements.

If management were unwilling to sign the representation letter, the auditor would need to reconsider their audit opinion.

Impact on Audit Opinions and Auditor's Reports

The management letter has no direct bearing on the auditor's opinion, unless the issues it raises cast doubt on the fairness of the financial statements.

However, matters raised in the representation letter directly relate to the audit evidence obtained. If management refuses to sign the letter, the auditor would likely issue a qualified opinion or disclaimer of opinion on the financial statements due to the limitation on audit scope and evidence.

In summary, while management letters offer helpful recommendations, representation letters provide the auditor written confirmation of critical information pertinent to the audit itself. Both play key roles in the audit process.

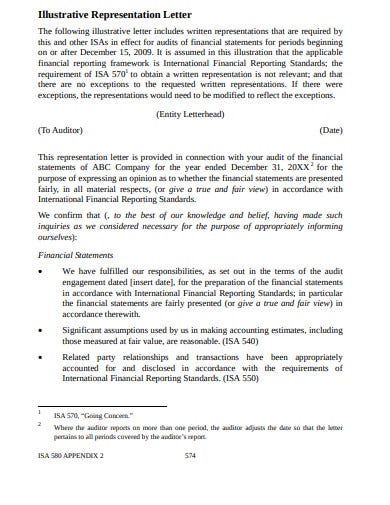

International Standards on Auditing: ISA 580 Management Representations

The International Standards on Auditing (ISA) provide a framework for conducting high quality external audits. ISA 580 specifically focuses on obtaining appropriate written representations from management to support the audit evidence gathered.

Understanding ISA 580 and Its Relevance to Management Representation Letters

ISA 580 outlines the auditor's responsibilities for obtaining written representations from management to confirm certain matters or to support other audit evidence. Some key points:

- Requires auditors to obtain written representations from management that they have fulfilled their financial reporting responsibilities

- Covers areas like recognition, measurement, presentation, and disclosure of information as per the financial reporting framework

- Helps auditors obtain confirmation on matters material to the financial statements, like the completeness of information provided

- Allows for detection of material misstatements due to fraud

By adhering to ISA 580, auditors can ensure management representation letters align with the necessary audit evidence requirements.

Compliance with International Standards on Auditing

It is critical that management representation letters comply with ISA guidelines, including:

- Obtaining representations from appropriate individuals : Those with overall responsibility for financial reporting, such as the CEO and CFO

- Written format : Printed on the organization's letterhead and signed by hand

- Date : No earlier than the date of the audit report

- Wording : Clear acknowledgement of responsibilities, accuracy of information provided, etc.

Strict compliance ensures the representations constitute valid and appropriate audit evidence as per ISA 500.

Case Studies: Adherence to ISA 580 in Practice

Company A - Drafted a management representation letter that was vague, unsigned, and outdated. By not adhering to ISA 580, they had to invest additional time and resources to obtain proper representations.

Company B - Carefully followed ISA 580 requirements. The CFO and CEO signed off on a letter confirming completeness of information and awareness of responsibilities. This aligned smoothly with the audit process.

As exemplified, non-compliance ultimately wastes time and resources. Whereas alignment with ISA 580 standards helps streamline external audits.

Conclusion and Key Takeaways

Management representation letters are important, standard audit evidence that reduce risk. They signify management's representations concerning the financial statements and accountability for internal controls, fraud, and information provided to auditors.

Summarizing the Role of Management Representation Letters in Audits

Management representation letters summarize key information and representations from management to auditors. They serve several key functions:

- Confirm management's responsibility for the preparation and fair presentation of the financial statements

- Disclose any issues or deficiencies in internal controls

- Affirm that all relevant information has been provided to auditors

- Highlight any fraud, illegal acts, or noncompliance with laws and regulations

By obtaining these written representations, auditors reduce engagement risk and confirm their understanding of management's views and positions.

Final Thoughts on Best Practices and Compliance

It is critical that management representation letters adhere to regulations and professional standards. Key best practices include:

- Ensuring the letter is dated as of the date of the auditor's report

- Having the letter signed by those with appropriate responsibilities and authority

- Disclosing all relevant issues completely and accurately

- Following the guidelines and requirements outlined in ISA 580 and other applicable standards

Diligent compliance promotes accuracy, transparency, and accountability.

Encouraging Diligence and Transparency in Financial Reporting

At their core, management representation letters aim to foster diligent, truthful, and transparent financial reporting. By eliciting key written representations from management, auditors promote an environment of responsibility, compliance, and ethical practice. This ultimately supports the accuracy and reliability of financial statements for all stakeholders.

Related posts

- What is Transfer Pricing?

- Statutory Audit vs Internal Audit

- Related Party Disclosures in Financial Statements

- Financial Statement Presentation: Structure and Requirements

How to Address a Contractor Directly in a Termination Letter

Payables Turnover Formula: Finance Explained

Asset Retirement Obligations: Accounting Practices

We've received your job requirements, and our team is working hard to find the perfect candidate for you. If you have more job openings available, feel free to submit another job description, and we'll be happy to assist you.

- Submit a New Job Description

Unlock the Talent Your Business Deserves

Hire Accounting and Finance Professionals from South America.

- Start Interviewing For Free

Management Representation Letter: Format, Content, Signature

Home » Bookkeeping » Management Representation Letter: Format, Content, Signature

As of 2019, the FASB requires publicly traded companies to prepare financial statements following the Generally Accepted Accounting Principles (GAAP). Auditors are required by professional standards to report, in writing, internal control matters that they believe should be brought to the attention of those charged with governance (the board). Generally, if your auditor is going to put an internal control matter in a letter, they have assessed that the matter was the result of a deficiency in internal controls. This is an important part of that audit that the profession does not take lightly.

One common example of a deficiency in internal control that’s severe enough to be considered a material weakness or significant deficiency is when an organization lacks the knowledge and training to prepare its own financial statements, including footnote disclosures. The “SAS 115” letter is usually issued when any significant deficiencies or material weaknesses would have been discussed with management during the audit, but are not required to be communicated in written form. In performing an audit of your Plan’s internal controls and plan financials, your auditors are required to obtain an understanding of the Plan’s operations and internal controls.

A management representation letter is a form letter written by a company’s external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis. The CEO and the most senior accounting person (such as the CFO) are usually required to sign the letter. The letter is signed following the completion of audit fieldwork, and before the financial statements are issued along with the auditor’s opinion. External auditors follow a set of standards different from that of the company or organization hiring them to do the work.

In doing so, they may become aware of matters related to your Plan’s internal control that may be considered deficiencies, significant deficiencies, or material weaknesses. Audits performed by outside parties can be extremely helpful in removing any bias in reviewing the state of a company’s financials. Financial audits seek to identify if there are any material misstatements in the financial statements. An unqualified, or clean, auditor’s opinion provides financial statement users with confidence that the financials are both accurate and complete. External audits, therefore, allow stakeholders to make better, more informed decisions related to the company being audited.

The representation should reaffirm your client’s understanding of all significant terms in the engagement letter. A relevant assertion is a financial statement assertion that has a reasonable possibility of containing a misstatement or misstatements that would cause the financial statements to be materially misstated.

The purpose of an internal audit is to ensure compliance with laws and regulations and to help maintain accurate and timely financial reporting and data collection. It also provides a benefit to management by identifying flaws in internal control or financial reporting prior to its review by external auditors.

Depending on materiality and other qualitative factors, the auditors will consider the deficiency to be an “other” matter, significant deficiency, or material weakness. The auditor has discretion on which category the deficiency falls into, but are otherwise required to use the standard wording and definitions in the letter.

It serves to document management’s representations during the audit, reducing misunderstandings of management’s responsibilities for the financial statements. The definition of good internal controls is that they allow errors and other misstatements to be prevented or detected and corrected by (the nonprofit’s) employees in the normal course of performing their duties.

Material weaknesses or significant deficiencies may exist that were not identified during the audit, and auditors are required to disclose this in their written communication. The auditor’s report contains the auditor’s opinion on whether a company’s financial statements comply with accounting standards. The results of the internal audit are used to make managerial changes and improvements to internal controls.

What is a management representation letter?

A management representation letter is a form letter written by a company’s external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis.

A control objective provides a specific target against which to evaluate the effectiveness of controls. Management representation is a letter issued by a client to the auditor in writing as part of audit evidences. The representations letter must cover all periods encompassed by the audit report, and must be dated the same date of audit work completion.

These types of auditors are used when an organization doesn’t have the in-house resources to audit certain parts of their own operations. The assertion of completeness is an assertion that the financial statements are thorough and include every item that should be included in the statement for a given accounting period. The assertion of completeness also states that a company’s entire inventory, even inventory that may be temporarily in the possession of a third party, is included in the total inventory figure appearing on a financial statement. The compilation standards do not require practitioners to obtain a management representation letter, but this does not mean that it’s not a prudent thing to do. Obtaining a representation letter helps to ensure your client understands the services that you have provided, the limitations on the work you have completed, and that they are ultimately responsible for their financial statements.

The biggest difference between an internal and external audit is the concept of independence of the external auditor. When audits are performed by third parties, the resulting auditor’s opinion expressed on items being audited (a company’s financials, internal controls, or a system) can be candid and honest without it affecting daily work relationships within the company. Auditors evaluate each internal control deficiency noted during the audit to determine whether the deficiency, or a combination of deficiencies, is severe enough to be considered a material weakness or significant deficiency. In assessing the deficiency, auditors consider the magnitude of potential misstatements of your financial statements as well as the likelihood that internal controls would not prevent or detect and correct the misstatements.

Representation to Management

- In an audit of financial statements, professional standards require that auditors obtain an understanding of internal controls to the extent necessary to plan the audit.

- written confirmation from management to the auditor about the fairness of various financial statement elements.

- Auditors use this understanding of internal controls to assess the risk of material misstatement of the financial statements and to design appropriate audit procedures to minimize that risk.

The idea behind a management representation letter is to take away some of the legal burdens of delivering wrong financial statements from the auditor to the company. A material weakness is a deficiency, or combination of deficiencies, in internal control, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected on a timely basis. Internal auditors are employed by the company or organization for whom they are performing an audit, and the resulting audit report is given directly to management and the board of directors. Consultant auditors, while not employed internally, use the standards of the company they are auditing as opposed to a separate set of standards.

If the auditors detect an unexpected material misstatement during your audit, it could indicate that your internal controls are not functioning properly. Conversely, lack of an actual misstatement doesn’t necessarily mean that your internal controls are working.

The determination of whether an assertion is a relevant assertion is based on inherent risk, without regard to the effect of controls. Financial statements and related disclosures refers to a company’s financial statements and notes to the financial statements as presented in accordance with generally accepted accounting principles (“GAAP”). References to financial statements and related disclosures do not extend to the preparation of management’s discussion and analysis or other similar financial information presented outside a company’s GAAP-basis financial statements and notes.

External audits can include a review of both financial statements and a company’s internal controls. When a company’s financial statements are audited, the principal element an auditor reviews is the reliability of the financial statement assertions. In the United States, the Financial Accounting Standards Board (FASB) establishes the accounting standards that companies must follow when preparing their financial statements.

In an audit of financial statements, professional standards require that auditors obtain an understanding of internal controls to the extent necessary to plan the audit. Auditors use this understanding of internal controls to assess the risk of material misstatement of the financial statements and to design appropriate audit procedures to minimize that risk. written confirmation from management to the auditor about the fairness of various financial statement elements. The purpose of the letter is to emphasize that the financial statements are management’s representations, and thus management has the primary responsibility for their accuracy.

Expert Social Media Tips to Help Your Small Business Succeed

This letter is useful for setting the expectations of both parties to the arrangement. Almost all companies receive a yearly audit of their financial statements, such as the income statement, balance sheet, and cash flow statement. Lenders often require the results of an external audit annually as part of their debt covenants. For some companies, audits are a legal requirement due to the compelling incentives to intentionally misstate financial information in an attempt to commit fraud.

Management representation letter

As long as there’s a reasonable possibility for material misstatement of account balances or financial statement disclosures, your internal controls are considered to be deficient. An auditor typically will not issue an opinion on a company’s financial statements without first receiving a signed management representation letter. An audit engagement is an arrangement that an auditor has with a client to perform an audit of the client’s accounting records and financial statements. The term usually applies to the contractual arrangement between the two parties, rather than the full set of auditing tasks that the auditor will perform. To create an engagement, the two parties meet to discuss the services needed by the client.

As a result of the Sarbanes-Oxley Act (SOX) of 2002, publicly traded companies must also receive an evaluation of the effectiveness of their internal controls. As noted above, an internal control letter is usually the result of a deficiency in internal controls discovered during the audit, most commonly from a material audit adjustment. The letter includes required language regarding the severity of the deficiency.

Real Business Owners,

The parties then agree on the services to be provided, along with a price and the period during which the audit will be conducted. This information is stated in an engagement letter, which is prepared by the auditor and sent to the client. If the client agrees with the terms of the letter, a person authorized to do so signs the letter and returns a copy to the auditor. By doing so, the parties indicate that an audit engagement has been initiated.

Also, the letter provides supplementary audit evidence of an internal nature by giving formal management replies to auditor questions regarding matters that did not come to the auditor’s attention in performing audit procedures. Some auditors request written representations of all financial statement items. All auditors require representations regarding receivables, inventories, plant and equipment, liabilities, and subsequent events. The letter is required at the completion of the audit fieldwork and prior to issuance of the financial statements with the auditor’s opinion.

Auditors spend a lot of time assessing how material audit adjustments and immaterial adjustments that have the potential to be material will be communicated in the internal control letter. The Representation Letter is issued with the draft audit and is required by auditing standards to finalize the audit. The Representation Letter is a letter from the Association to our firm confirming responsibilities of the board and management for the financial statements, as well as confirming information provided to us during the audit. The President or Treasurer and Management need to sign the Representation Letter and return it back to our office within 60 days from the date the draft audit was issued. Representation Letters received after the 60-day mark may result in additional auditing procedures in order to finalize the audit and comply with auditing standards at an additional expense to the Association.

Understanding the Management Letter on Internal Control

Article authors.

You have engaged independent auditors to perform an audit of your financial statements, which is required by one or more of your funding sources. The auditors have provided you with the audited financial statements and have issued an unmodified opinion, meaning that your financial statements are not materially misstated, which is what you expected.

However, they also provide you with a management letter on internal control (internal control letter) that appears to list in detail everything they found wrong with your internal control during the audit. You do a great job making sure all of the accounting transactions are properly recorded and immediately become defensive; you did not ask for this letter, so why was it prepared? What will your funding sources think if they receive this letter? Will they stop funding your organization? What does this letter mean? What is the difference between a material weakness and a significant deficiency? What do you need to do to make sure that you do not receive another letter in the future?

This article will address these questions and hopefully, show you the benefits of the internal control letter to your organization.

Why did the auditor prepare this letter? Auditing standards require auditors to communicate in writing to management about material weaknesses and or significant deficiencies in internal controls discovered in an audit. The auditor is required to gain an understanding of internal control as part of the planning process; however, that does not mean that internal control is required to be tested in all audits. In most cases, auditors use walkthrough procedures to gain this understanding. They will review the organization’s procedures, noting the internal controls that are implemented, and then follow specific transactions through the process to make sure that it appears that the internal controls are working properly.

What will your funding sources think if they receive this letter? Will they stop funding your organization? This letter is prepared for and intended for management and those charged with governance, i.e., the board of directors, the audit committee, etc. This is a tool to assist management in improving the organization’s internal control and should not be provided to anyone other than these specified parties. This letter is not intended to and should not play a role in the future funding of your organization by those requesting the audit.

“ Other matters” in internal control – this could be a deficiency or simply another matter that the auditor wants to bring to the attention of management and those charged with governance. For example, the organization does not have formal job descriptions for the accountant that has been employed by the organization for more than ten years. If the accountant becomes ill and is unable to work for several weeks, it is likely that some of the accountant’s job responsibilities will not be done that could result in late tax filings, noncompliance with grants, etc. The auditor may want to inform management and those charged with governance of the matter.

The internal control letter breaks the deficiencies in internal control into the different types, material weaknesses, significant deficiencies, and other matters, as noted above. The internal control letter means that during the audit, it was noted that an internal control did not exist or the internal control was not working properly and did or could result in errors. The letter is a tool provided to management and those charged with governance to assist them in improving the internal control of the organization.

What do you need to do to make sure that you do not receive another letter in the future? The obvious answer would be to correct all of the deficiencies in internal controls that are provided by the auditor and make sure all existing internal controls are followed. The auditors are required to report on material weaknesses and significant deficiencies; if they do not exist, a letter is not required. However, with many small to medium-sized organizations, the costs to implement proper internal controls could be very costly. Therefore, I recommend that you start with eliminating the material weaknesses, those that have the greatest risk of a material misstatement. When analyzing the recommendations, try to find other lower-cost ways to improve the internal control.

However, should you be trying to avoid another internal control letter next year? The auditors have already done the work as required by professional standards; don’t you want to know what they have found and documented in their audit files? The letter should be used as a tool for ways to improve the internal controls within the organization. The organizations that are constantly analyzing and improving their internal controls are typically those that have fewer errors and misstatements noted during the audit.

You may think that the organization’s internal control is finally perfect, but then changes occur, you have accounting staff turnover, the organization changes their accounting software, the organization goes paperless, etc. When significant changes like this occur, typically, the organization is trying to quickly adapt to the change but forgets to adapt its internal controls. For example, an organization has decided to implement a paperless work environment. The organization’s accountant previously took the bank statement that was received by the bank, performed a reconciliation, printed it, and provided it to a supervisor to review and approve, which was done by initialing the reconciliation.

In the paperless environment, the bank statement is obtained online, an electronic reconciliation process is done, and then the supervisor is emailed that it has been completed and is ready for review. The supervisor opens the file, reviews it, and then closes it. Now, there is no documentation that the reconciliation has been reviewed. You may think that the review has been performed; therefore, internal control still exists.

However, how do you know that it has been done? Now, let us assume that the supervisor got behind on work after taking a few days off and forgot about reviewing the bank reconciliation. Now the control procedure has not been performed. If it is not documented, are we sure that it was done? It is important to include some form of sign-off procedure, even if it is in an electronic format. Therefore, an internal control letter is extremely important in years in which changes have occurred in the accounting or finance department or the organization itself to make sure that internal control procedures are adapted for those changes.

As you can see, if used properly, a management letter on internal control is a great tool to ensure that your internal control procedures are properly working and assist you in making improvements to prevent, detect, and correct misstatements that may occur.

Read the full Fall issue of Insights, the HBK Nonprofit Solutions quarterly newsletter.

Speak to one of our professionals about your organizational needs

" * " indicates required fields

Your Ask Joey ™ Answer

What is a management representation letter?

A “rep” letter is the audit teams’ formal evidence that management understands their responsibilities and that management has performed all of their responsibilities.

Management should provide the auditor with a representation letter in writing that outlines the following characteristics:

A) Managements acceptance for its responsibility in the establishment and maintenance of an effective internal control systems.

B) Managements performance of its assessment of the effectiveness of its internal control systems.

C) A statement of management’s assessment and the criteria that has been used and implemented as of a specified period in time.

D) A statement that management has disclosed all deficiencies both in design and operation of its system of internal controls.

E) A statement that management confirms that all significant deficiencies and material weaknesses have been disclosed to the independent external auditor.

F) A statement the management confirms whether or not previously identified deficiencies have been resolved or remain unresolved.

G) Illustrates all fraudulent activities that result in material misstatements specifically involving senior management or other employees that have a significant role in ICFR.

H) Illustrates whether or not there are any significant changes to internal controls after the “as of” date of the report as well as any corrective action that has been taken by management in regard to significant deficiencies and material weaknesses that have been identified.

I) Any failure to obtain written representations for management will result in scope limitations which might include the auditor’s withdrawal from the engagement altogether.

How to Reply to a Discussion Post: Tips for Students

Level up your responses to discussion posts. This article will equip you with the key strategies to write effective and engaging replies that will spark conversation. A key component of most virtual courses is writing discussion posts. For this task, students are expected to engage with peers by sharing their perspectives and insights on the core topics of the course and the provided discussion prompts. In contrast to the classroom environment, where in-person conversations are common, interactions within an online course tend to occur primarily through discussion board activities. To optimize these exchanges, consider implementing these tactics to reply to discussion posts in a way that promotes continuous involvement and active participation among learners. Additionally, if you find yourself struggling with creating comprehensive references, you can always seek assistance from professional services with requests like “write annotated bibliography for me” to ensure your work is properly cited and well-organized. Active Participation is Key Students tend to mimic the same engagement patterns that their course instructors demonstrate. As a teacher, take on an involved role in the conversation platform – whether by contributing comments, guiding, directing, or overseeing – and remember the significant impact of using the @ symbol to address others directly. Using mentions to solicit student input is an effective and straightforward method to maintain lively conversations. Think about applying mentions to engage students who are less vocal or beginning to lose interest. You can find and monitor them with the help of engagement insights to draw them back into the dialogue. Whenever you contribute to an online course’s discussion board, keep in mind that your comment can be seen by all participants and will be available throughout the course’s duration. Make certain that your discussion post response is professional in tone. Verify that all information and facts you share are consistent with the course content, including materials found in textbooks or other resources provided for the class. Use your posts to reinforce key concepts of the course. Assume that whatever you post, whether positive or negative, has the potential to be widely shared. If it goes viral, screenshots of your post could be circulated to an unrestricted audience across various platforms. Find Meaningful Ways to Respond to a Discussion Post Maintaining a professional and scholarly tone in academic discussions is essential. But this doesn’t mean your replies must be dull or formulaic. On the contrary, don’t hesitate to infuse your contributions with your unique character and a touch of wit. In virtual classroom settings, we lack the non-verbal cues such as facial expressions, vocal tone, and body language that give spoken language a clear context. While punctuation can help convey meaning to an extent, adding a generous sprinkle of your own flair, a bit of humor here and there, and incorporating multimedia elements like pictures and personal videos can foster engagement in the classroom. This approach strengthens the connection between students and instructors and keeps students more actively involved in the conversations. Similarly to how you would inspire students to contribute through different platforms, your own updates should be diverse. Incorporate a mix of text, videos, audio clips, and pictures when providing your insights. This approach with multimedia usage brings energy to what might otherwise be tedious discussions and captivates students by catering to their preferred methods of communication. Discover methods to incorporate personal experiences or anecdotes when you respond. Students appreciate gaining insights into their instructor’s personal life. Sharing small portions of your personal experiences can undoubtedly make you appear more personable and accessible—just ensure that the examples you share effectively highlight and strengthen the principles you teach in the course. Evaluation: Questions and Feedback A significant benefit of virtual learning is that the involvement in online discussion forums can encourage introverted students to engage more than they might in a traditional classroom setting. To achieve this, you can interact with a student’s post using at least one of three strategies: asking a subsequent question, expressing agreement, or providing additional feedback. It’s essential to reply often to your pupils, regardless of whether it’s in a personal message or a public forum. To motivate the student to think more critically about the subject, consider posing an additional question in response to their initial comment. Below are a few examples of discussion responses: Responses of this nature are rooted in transformational learning, which suggests that students are not just receiving new knowledge but also re-evaluating their previous beliefs and perspectives, fundamentally altering how they view the world. This approach solidifies learning and demonstrates appreciation for student input, allowing you to identify those who may be struggling to grasp the material fully. Furthermore, you can acknowledge the strong points raised by your students. By affirming their contributions, you motivate them to contribute more frequently and maintain active participation. Using discussion rubrics and automated grading tools can make marking student participation more efficient. Yet, it is essential to offer private feedback to individual students as well. Such feedback could range from a brief praise for an excellent contribution to more detailed guidance. Reserve this personalized, qualitative feedback for students who have exceeded the standard requirements or those with difficulties. Remember, this is a formative evaluation. Students might need time to reach the level you desire for their discussion contributions. Ensure your feedback specifies what they need to work on or what you expect from them in future posts. Also, allow them ample opportunity to apply your suggestions for improvement. It’s easy to fall into the pattern of replying just to those who post first. Maintaining a weekly updated list of individuals you’ve responded to might be beneficial. Ensure that you engage with all participants consistently throughout the course. Keep the Dialogue Going A discussion board is designed to foster interactive conversation. The best way to respond to a discussion post is to broaden the conversation. Where relevant, draw upon course content, lectures, or personal experiences. Posed either as part of the original topic or in subsequent replies, asking insightful questions...

The Role of Mobile Apps in Simplifying Small Business Accounting

Many business owners would agree that manually tracking finances is tedious and time-consuming. Luckily, mobile accounting apps are transforming how small and medium-sized businesses (SMBs) operate. Automation is taking over bookkeeping, offering real-time financial insights, and allowing business owners to focus on growth. Let’s explore how these apps revolutionize business workflows: You will find even more advantages of business accounting via the mobile app below. Benefits of Mobile Apps For Small Business Accounting Real-Time Data Syncing for Agile Decision-Making Mobile accounting apps automatically link to bank accounts, credit cards, and other financial sources, offering continuous visibility into cash flow. Real-time data syncing helps categorize transactions, reconcile accounts, and generate on-demand financial reports. Intuitive Interfaces Boosting Productivity Featuring user-friendly interfaces, mobile accounting apps come equipped with powerful automation capabilities. By managing repetitive tasks automatically, these apps help accounting teams reduce manual work. You can also use Cleanup App – Phone Cleaner robust security features to ensure data privacy and protection. The intuitive design also minimizes training needs and data entry errors. Specialization for Industry-Specific Needs Specialized mobile accounting platforms address the unique workflows and compliance requirements of industries like healthcare, retail, and nonprofits. Custom features simplify tasks such as inventory management, fundraising, and patient billing. Can Accounting Software Help Grow Your Business? Automated Invoicing and Cash Flow Imagine a world where invoicing is effortless. Accounting software does just that by automating the billing process, ensuring you get paid on time and maintain a steady cash flow. You can set up recurring invoices to bill clients consistently and receive mobile payment alerts for instant tracking. Plus, integrations make online payments seamless, speeding up client remittances. With reliable cash flow, you’re free to invest in growth initiatives confidently. Actionable Insights Turn your financial data into powerful business insights with real-time reporting and user-friendly dashboards. Benchmark your performance and set informed growth targets to stay ahead of the competition. Efficiency and Scalability Cloud-based accounting platforms grow with your business. As your clientele, invoices, and payroll expand, these platforms scale effortlessly. Automate repetitive compliance tasks to boost productivity, and integrate with other business systems to minimize redundant data entry. Efficient operations today pave the way for tomorrow’s aggressive growth. Smart Decisions with the Right Tools With the right accounting tools, you gain the visibility and efficiency needed to make smart decisions. Expand your client base, improve profitability, and accelerate business growth with confidence. Benefits Transforming Accounting with Mobile Technology Real-Time Data for Faster Decisions Mobile accounting apps integrate financial data across various platforms, providing real-time cash flow visibility and up-to-date financial reporting. Managers no longer need to wait for month-end reports; they can access crucial metrics anytime to make informed, data-driven decisions: Lean Processes Saving Time and Money Digitizing workflows on user-friendly platforms, mobile accounting solutions eliminate manual processes, significantly boosting productivity. Key features such as automated reconciliations, mobile approvals, and integrated platforms offer substantial time and cost savings: Specialized Platforms Targeting Specific Needs Mobile technology enables customized accounting solutions tailored to industry-specific requirements, with niche apps designed to meet operational needs: Secure Mobile Access to Information Modern mobile accounting apps employ robust data protections to facilitate remote collaboration while safeguarding sensitive information. Secure work-from-anywhere capabilities include: Conclusion Mobile accounting transformation is no longer a future concept but an urgent business necessity to stay competitive and agile. Are you ready for the mobile accounting revolution? Stay ahead of the curve with cutting-edge solutions that empower your organization today and tomorrow. So why wait? Get started now! Keep your finances organized, efficient and accessible on-the-go with mobile accounting technology. Embrace digital transformation and take your business to new heights! Stay ahead of the curve with cutting-edge

Effortless Document Conversion for CPAs with Image to Word Converter

Certified public accountants (CPAs) manage and review financial records. They prepare, review, and advise on financial statements, taxes, and budgets. They help businesses and individuals make smart financial decisions. Financial analysis and reporting require accurate, editable data. CPAs ensure accurate and legal financial data. Paperwork and manual data extraction from scanned documents are time-consuming tasks for CPAs. This process can also be annoying and mistakes happen a lot. Accurate documentation is very important for certified public accountants. However, the traditional process is slow and susceptible to mistakes. This process can be made very quick and accurate by using an Image to Word converter. It offers a simple and efficient solution. It improves CPAs efficiency by simplifying document conversion and management. Let’s have a detailed look at it. What is an Image to Word Converter? An image to word converter is a tool that converts images (like JPGs and PNGs) into editable Word documents. This tool converts scanned documents and screenshots into editable, formatted text. Then it can be copied and pasted anywhere you need to. Instead of typing by hand, you can use image to word converter to create editable and selectable text. How Does Image to Word Converter Work? An image to word converter is an OCR-based digital detector. It works in a series of steps. At first, the converter looks at the image. It differentiates the light areas as background and the dark areas as text. Then it separates text from the background. It separates the hints, much like an investigator investigating a situation. After that, the OCR engine extracts the text from the image. It does this by comparing the font of the image to a large character database. Once it has recognised them, it arranges the letters and figures into lines and paragraphs exactly like the original paper. Finally, the text that was extracted is put into a new Word document. It can now be easily edited and formatted within your writing projects. Benefits of the Image to Word Converter for CPAs Here are some important benefits of an image to word converter for CPAs: Effortless Conversion Image to Word Converter creates editable formats like Microsoft Word from scanned documents, receipt photos, and other image files in a few clicks. It eliminates annoying manual data extraction. Improve Accuracy There’s always a chance of making mistakes or missing essential details while manually copying text from images. When there is a large amount of data to convert, the machine rarely makes mistakes, while human error is possible. So accuracy can be improved with an image to text converter for CPAs. This converter uses advanced OCR technology, which ensures accurate data extraction. It improves the accuracy of your financial analysis and reporting. Easy Storage CPAs deal with a huge amount of paperwork every day. Hard-copy record-keeping is out of date and tough. It takes up a lot of space. Document storage is hard to track. Thus, the space will run out soon. But with the image to word converter, a document does not require a lot of storage space. Data security Data security is the main reason for using an image to word converter. Paper documents are known to be less safe. Anyone can use or destroy the documents in hard copy. So converting them to soft copy with an image to word converter is an excellent option. It can be saved from any destruction and password protection can also be applied to it. Improved Efficiency CPAs can quickly digitise large amounts of paper documents with image to word converters. It quickly and accurately analyses the text and turns it into editable Word format. It eliminates the need for manual typing or copy-pasting. It saves time. This efficiency allows CPAs to focus on their core responsibilities, such as analysing financial data and advising clients Enhanced Organisation It is easier to find, organise, and get digital files than paper files. An image-to word converter helps CPAs organise and access their documents, simplifying auditing and reporting. Converted files are searchable and editable in Word. This makes things more organised and makes it easier to find and use certain information later. Searchability Another important benefit of an image to word converter is searchability. When images are converted to a digital format like Word. These are simpler to save, manage, access, and share with others. Converted Word documents can be easily accessed and viewed on various devices, including smartphones, tablets, and computers. Instead of wasting valuable time looking over each image, CPAS can use an image to word converter to get more done. Use of Image to Word Converter by CPAs Certified public accountants can make use of this technology in the following ways: Onboarding Clients CPAs scan client IDs, tax documents, and bank statements into editable Word documents with the help of an image to word converter. This will make filing and retrieval easier. CPAs can use the image to word converter to quickly extract important information from these documents, such as client names, account numbers, and financial data. This can simplify the onboarding process and ensure that all necessary information is accurately captured. Receipt Processing An image-to-word converter helps CPAs quickly turn client travel, meals, and other expense receipts into expense reports and records. This eliminates the need for manual data entry, reduces the risk of errors and speeds up the payment process for clients. CPAs can easily organize and keep track of expenses with this technology, with the assurance that nothing is missed or forgotten. This more efficient way of processing receipts leads to more accurate financial reports and satisfied customers over time. Managing Tax Documents CPAs scan and convert tax forms like W-2s, 1099s, and others so that they can be easily used with tax software. This digital transformation allows CPAs to quickly input necessary information, reducing the time spent on manual data entry. By turning tax forms into digital files, CPAs can easily get to the data and change it as needed, which speeds up the tax...

START A FREE 7-DAY TRIAL TODAY!

Universal CPA is a visual learning platform that was developed by CPA's to teach future CPA's!

© 2022 Universal CPA Review. All Rights Reserved.

- Submit Post

- Budget 2024

- CA, CS, CMA

Format of Management Representation Letter (MRL) for Audit

In this article author has shared the format of the Management Representation Letter or Written Representation (MRL/WR) to be obtained from the management during various professional engagements:

M/s XYZ & Co.

Gurgaon, Haryana

Sub: Management Representation in course of Statutory Audit for F.Y. 2021-22 .

This representation letter is provided in connection with your audit of the financial statements of M/s Private Limited, Delhi for the year ended March 31, 20XX for the purpose of expressing an opinion as to whether the financial statements are presented fairly, in all material respects, (or give a true and fair view) in accordance with the applicable accounting standards in India.

We confirm that (to the best of our knowledge and belief, having made such inquiries as we considered necessary for the purpose of appropriately informing ourselves):

Financial Statements

- We have fulfilled our responsibilities, as set out in the terms of the audit engagement, for the preparation of the financial statements in accordance with Financial Reporting Standards; in particular the financial statements are fairly presented (or give a true and fair view) in accordance with the applicable accounting standards in India.

- Significant assumptions used by us in making accounting estimates, including those measured at fair value, are reasonable.

- Related party relationships and transactions have been appropriately accounted for and disclosed in accordance with the requirements of applicable accounting standards in India.

- All events subsequent to the date of the financial statements and for which applicable accounting standards in India require adjustment or disclosure have been adjusted or disclosed.

- The effects of uncorrected misstatements are immaterial, both individually and in the aggregate, to the financial statements as a whole.

Information Provided

- We have provided you with:

Access to all information of which we are aware that is relevant to the preparation of the financial statements such as records, documentation and other matters;

Additional information that you have requested from us for the purpose of the audit; and

Unrestricted access to persons within the entity from whom you determined it necessary to obtain audit evidence.

- All transactions have been recorded in the accounting records and are reflected in the financial statements.

- We have disclosed to you the results of our assessment of the risk that the financial statements may be materially misstated as a result of fraud.

- We have disclosed to you all information in relation to fraud or suspected fraud that we are aware of and that affects the entity and involves:

Management;

Employees who have significant roles in internal control; or

Others where the fraud could have a material effect on the financial statements.

- We have disclosed to you all information in relation to allegations of fraud, or suspected fraud, affecting the entity’s financial statements communicated by employees, former employees, analysts, regulators or others.

- We have disclosed to you all known instances of non-compliance or suspected non-compliance with laws and regulations whose effects should be considered when preparing financial statements.

- We have disclosed to you the identity of the entity’s related parties and all the related party relationships and transactions of which we are aware.

For and on Behalf Board of Directors

For any inquiry you may write us on: [email protected]

Disclaimer: The information provided by the author in the article is for general informational purposes only. All information provided is in the good faith, however we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability or completeness of any information in the article.

- « Previous Article

- Next Article »

Name: CA. Ramanujan Sharma

Qualification: ca in practice, company: n k r s and co. (chartered accountants), location: gurugram, haryana, india, member since: 25 apr 2022 | total posts: 18, my published posts, join taxguru’s network for latest updates on income tax, gst, company law, corporate laws and other related subjects..

- Join Our whatsApp Group

- Join Our Telegram Group

Leave a Comment

Your email address will not be published. Required fields are marked *

Post Comment

Subscribe to Our Daily Newsletter

Latest posts, things to keep in mind while disclosing your f&o income at the time of filing taxes, step-by-step guidelines to report f&o losses in itr 3, concept of alternate director under companies act, 2013, telecom distributor discounts not subject to tds as commission: gujarat hc, gst interest applies from tax due date to deposit in electronic cash ledger, amended rule 108(3): appeal date would be online acknowledgment submission date, delhi hc denies tax exemption to trust charging capitation fee, non availability of legal consultant: kerala hc condones 11-day delay, cricket australia vs. acit: live transmission fee not taxable as royalty, बार काउंसिल ऑफ इंडिया ने अधिवक्ताओं के विज्ञापनों/ऑनलाइन प्लेटफॉर्म पर प्रतिबंध लगाया।, featured posts, section 115bac: summarized table of deductions or exemptions not available in new tax regime, common itr issues and faq’s for filing return for ay 2024-25, committee constituted by mca & fm recommends for major increase of scope of cost audit in india, audit committee non-constitution (section 177): mca imposes whopping ₹39 lakh penalty, what will happen if you file your itr wrongly to claim full refund, faqs on new vs. old tax regime (ay 2024-25), empanelment with bank of india for concurrent audit, may 2024 ca intermediate & final examination result on 11th july 2024, जीएसटी इनपुट क्रेडिट -ईमानदार व्यापारी की मुश्किलें – कथा, पटकथा एवं संवाद, popular posts, due date compliance calendar july 2024, july, 2024 tax compliance tracker: income tax & gst deadlines, empanelment -indian overseas bank for concurrent audit 2024-25, gst compliance calendar for july 2024, updated list of 28 banks for income tax payments on e-filing portal, monthly (july-2024) legal obligations + legal updates for india, pre budget memorandum 2024-25: tax base, avoidance, litigations, icai convocation july – 2024- for newly enrolled members – date & cities.

| M | T | W | T | F | S | S |

|---|---|---|---|---|---|---|

| 10 | 11 | 12 | 13 | 14 | ||

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

- Popular Courses

- More classes

- More Courses

Management Representation Letter (MRL) for Audit

In this article, the author has shared the format of the Management Representation Letter or Written Representation (MRL/WR) to be obtained from the management during various professional engagements:

M/s XYZ & Co. Gurgaon, Haryana

Sub: Management Representation in course of Statutory Audit for F.Y. 2021-22 .

This representation letter is provided in connection with your audit of the financial statements of M/s Private Limited, Delhi for the year ended March 31, 20XX for the purpose of expressing an opinion as to whether the financial statements are presented fairly, in all material respects, (or give a true and fair view) in accordance with the applicable accounting standards in India.

We confirm that (to the best of our knowledge and belief, having made such inquiries as we considered necessary for the purpose of appropriately informing ourselves):

Financial Statements

- We have fulfilled our responsibilities, as set out in the terms of the audit engagement, for the preparation of the financial statements in accordance with Financial Reporting Standards; in particular the financial statements are fairly presented (or give a true and fair view) in accordance with the applicable accounting standards in India.

- Significant assumptions used by us in making accounting estimates, including those measured at fair value, are reasonable.

- Related party relationships and transactions have been appropriately accounted for and disclosed in accordance with the requirements of applicable accounting standards in India.

- All events subsequent to the date of the financial statements and for which applicable accounting standards in India require adjustment or disclosure have been adjusted or disclosed.

- The effects of uncorrected misstatements are immaterial, both individually and in the aggregate, to the financial statements as a whole.

Information Provided

- We have provided you with:

Access to all information of which we are aware that is relevant to the preparation of the financial statements such as records, documentation and other matters;

Additional information that you have requested from us for the purpose of the audit; and

Unrestricted access to persons within the entity from whom you determined it necessary to obtain audit evidence.

- All transactions have been recorded in the accounting records and are reflected in the financial statements.

- We have disclosed to you the results of our assessment of the risk that the financial statements may be materially misstated as a result of fraud.

- We have disclosed to you all information in relation to fraud or suspected fraud that we are aware of and that affects the entity and involves:

Management;

Employees who have significant roles in internal control; or

Others where the fraud could have a material effect on the financial statements.

- We have disclosed to you all information in relation to allegations of fraud, or suspected fraud, affecting the entity’s financial statements communicated by employees, former employees, analysts, regulators or others.

- We have disclosed to you all known instances of non-compliance or suspected non-compliance with laws and regulations whose effects should be considered when preparing financial statements.

- We have disclosed to you the identity of the entity’s related parties and all the related party relationships and transactions of which we are aware.

For and on Behalf Board of Directors

Director (DIN:) Date: Place:

The author can also be reached at [email protected]

Disclaimer: The information provided by the author in the article is for general informational purposes only. All information provided is in the good faith, however we make no representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, availability or completeness of any information in the article.

Published by

CA Ramanujan Sharma (Proprietor) Category Audit Report

Related Articles

Popular articles.

- ICAI Conference Sparks Outcry Over Gender Restrictions

- 6 Welcome Amendments Recommended in Return Filing Process by 53rd GST Council Meeting

- Final Checklist before Filing ITR for FY 23-24

- Key Highlights of 53rd GST Council Meeting

- 7 Years of GST: My Experience

- FAQs on New Vs Old Tax Regime For AY 2024-25

- Common ITR Issues And FAQs For Filing Return For AY 2024-25

- Income Tax Compliance Due Dates - July 2024

Trending Online Classes

3 Days Certification Course on Tax Audit Under Income Tax Act 1961

Intricacies of Sec 44AD, 44ADA, 44AE while filing ITR

Certification Course on Chat GPT and AI Tools for Professionals

CCI Articles

You can also submit your article by sending to [email protected]

Browse by Category

- Corporate Law

- Info Technology

- Shares & Stock

- Professional Resource

- Union Budget

- Miscellaneous

Whatsapp Groups

Login at caclubindia, caclubindia.

India's largest network for finance professionals

Alternatively, you can log in using:

COMMENTS

2 An illustrative representation letter from management is contained in paragraph .16 of ap-pendix A, "Illustrative Management Representation Letter". ... internal control..09 The written representations should be addressed to the auditor. Be-cause the auditor is concerned with events occurring through the date of his

Obtaining Written Representations. .05 Written representations from management should be obtained for all financial statements and periods covered by the auditor's report. 2 For example, if comparative financial statements are reported on, the written representations obtained at the completion of the most recent audit should address all periods ...

A management representation letter is a form letter written by a company's external auditors, which is signed by senior company management. The letter attests to the accuracy of the financial statements that the company has submitted to the auditors for their analysis. The CEO and the most senior accounting person (such as the CFO) are usually ...