How to Write a Underwriter Cover Letter (With Example)

Learn practical steps for writing a strong underwriter cover letter. This guide helps you highlight your skills and experiences, making a lasting impression on employers. Includes a clear example for reference. Ideal for anyone looking to enhance their job application.

A cover letter is a key part of applying for an underwriter job. It's your chance to show why you're a good fit for the role. An underwriter looks at risks for insurance companies or banks. They decide if it's safe to give someone insurance or a loan.

Writing a good cover letter takes time and effort. It's not just about listing your skills. You need to explain why you're the right person for the job. A strong cover letter can help you stand out from other people who want the same job.

In this article, we'll talk about how to write a cover letter for an underwriter position. We'll cover what to include and what to avoid. We'll also give you an example to help you get started.

Remember, your cover letter should be short and to the point. It should make the person reading it want to learn more about you. Think of it as your first impression on paper. You want to come across as professional, skilled, and eager to work.

We'll go through each part of a good cover letter step by step. By the end, you'll have a clear idea of how to write your own. Whether you're new to the field or have years of experience, these tips will help you create a cover letter that gets noticed.

Underwriter Cover Letter Example

Dear Kaylee Hunt,

I am writing to express my strong interest in the Underwriter position at The Hartford. With my keen analytical skills, attention to detail, and passion for risk assessment, I believe I would be a valuable asset to your esteemed organization.

As an aspiring underwriter, I have developed a comprehensive understanding of insurance principles, financial analysis, and risk management techniques. My academic background in finance and economics, coupled with my natural aptitude for numbers, has prepared me well for the challenges of this role. I am particularly drawn to The Hartford's reputation for innovation in the insurance industry and your commitment to providing tailored solutions to clients.

Throughout my studies and internships, I have honed my ability to evaluate complex financial data, assess risk factors, and make informed decisions. I am proficient in using industry-standard underwriting software and have a keen eye for identifying potential red flags in insurance applications. My strong communication skills enable me to effectively collaborate with agents, brokers, and clients to gather necessary information and explain underwriting decisions clearly and professionally.

I am impressed by The Hartford's long-standing history and its position as a leader in the insurance market. Your company's focus on sustainability and commitment to helping individuals and businesses prevail through unexpected circumstances aligns perfectly with my personal values and career aspirations. I am excited about the prospect of contributing to your team and helping to maintain The Hartford's excellent reputation in risk assessment and policy underwriting.

My adaptability, eagerness to learn, and strong work ethic make me an ideal candidate for this position. I am committed to staying current with industry trends and regulations, and I am confident in my ability to quickly become a productive member of your underwriting team.

Thank you for considering my application. I look forward to the opportunity to discuss how my skills and enthusiasm can contribute to The Hartford's continued success. Please feel free to contact me at your convenience to arrange an interview.

Tommy Price

How to Write & Format a Cover Letter Header

The header of your underwriter cover letter is the first thing a hiring manager sees, making it a crucial element in creating a positive first impression. A well-structured header provides essential contact information and sets a professional tone for the rest of your letter.

Key Components of a Cover Letter Header

Your header should include:

- Your full name

- Phone number

- Email address

- City and state (optional)

- LinkedIn profile or professional website (optional)

Formatting Tips

Keep your header clean and easy to read. Use a professional font and ensure proper spacing between elements. Align the header to the left or center of the page, matching the formatting of your resume for consistency.

Professional Email Address

Ensure your email address is professional, ideally using some variation of your name. Avoid using nicknames or humorous email addresses that may appear unprofessional.

Optional Elements

Consider including your LinkedIn profile or professional website if they showcase relevant experience or accomplishments. However, only include these if they are up-to-date and reflect positively on your candidacy.

By crafting a clear, concise, and professional header, you set the stage for a compelling cover letter that highlights your qualifications as an underwriter.

Greeting Your Potential Employer

After crafting a professional header for your underwriter cover letter, it's time to focus on the greeting. This seemingly small detail can set the tone for your entire letter and make a significant first impression on the hiring manager.

Research the recipient

Whenever possible, address your cover letter to a specific person. Take the time to research the company's website or LinkedIn profile to find the name of the hiring manager or department head. This personal touch demonstrates initiative and attention to detail.

Use a professional salutation

If you know the recipient's name, use "Dear Mr./Ms./Dr. [Last Name]:" If you're unsure about the recipient's gender or preferred title, use their full name: "Dear [First Name] [Last Name]:"

When the recipient is unknown

In cases where you can't find a specific name, opt for a general but professional greeting such as "Dear Hiring Manager:" or "Dear Underwriting Team:" Avoid outdated salutations like "To Whom It May Concern" as they can come across as impersonal.

Double-check for accuracy

Before sending your cover letter, ensure that you've spelled the recipient's name correctly. A misspelled name can immediately create a negative impression and suggest a lack of attention to detail – a crucial skill for an underwriter.

Introducing Yourself in a Cover Letter

The introduction of your underwriter cover letter sets the tone for your application and provides a brief overview of your qualifications. This section should immediately grab the hiring manager's attention and entice them to continue reading.

Start with a Strong Opening Statement

Begin your cover letter with a compelling statement that highlights your relevant experience or passion for the underwriting field. Mention the specific position you're applying for and how you learned about the opportunity.

Briefly Summarize Your Qualifications

In a sentence or two, outline your key qualifications that make you an ideal candidate for the underwriter position. Focus on your most relevant skills, certifications, or achievements that align with the job requirements.

Express Your Interest in the Company

Demonstrate your knowledge of the company by mentioning something specific about their reputation, recent accomplishments, or values that resonate with you. This shows that you've done your research and are genuinely interested in the organization.

Transition to the Body of the Letter

End your introduction with a brief statement that leads into the main content of your cover letter. This can be a sentence that hints at the skills and experiences you'll elaborate on in the following paragraphs.

Strong Example

As a seasoned underwriter with over 8 years of experience in the insurance industry, I was thrilled to come across the Senior Underwriter position at Apex Insurance Group. My proven track record of accurately assessing risks, implementing data-driven underwriting strategies, and consistently exceeding profitability targets aligns perfectly with Apex's commitment to excellence in risk management. I am excited about the opportunity to bring my expertise in both personal and commercial lines underwriting to contribute to your team's continued success.

Why is this a strong example?

This is a strong cover letter introduction for several reasons. First, it immediately establishes the candidate's relevant experience and expertise in the field. The specific mention of '8 years of experience' gives a clear indication of the level of seniority. Second, it demonstrates knowledge of the company by mentioning 'Apex Insurance Group' by name, showing that the applicant has done their research. Third, it highlights key skills that are crucial for an underwriter, such as risk assessment and data-driven strategies. Finally, it expresses enthusiasm for the role and company, while also indicating how the candidate's skills could benefit the organization. The introduction is concise yet informative, making it likely to capture the reader's attention and encourage them to read further.

Weak Example

Hello, I am writing to apply for the Underwriter position at your company. I saw the job posting online and thought I would be a good fit. I have some experience in finance and I'm looking for a new opportunity.

Why is this a weak example?

This introduction is weak for several reasons. First, it lacks specificity and enthusiasm, failing to grab the reader's attention. The applicant doesn't mention the company name or demonstrate any knowledge about the organization, which suggests a lack of research and genuine interest. The statement about seeing the job posting online is vague and doesn't add value. Additionally, the claim of having 'some experience in finance' is too general and doesn't highlight any relevant skills or qualifications specific to underwriting. The closing sentence about looking for a new opportunity focuses on the applicant's needs rather than what they can offer the company. Overall, this introduction fails to make a strong first impression or convey the applicant's qualifications and passion for the role.

Writing the Body of Your Cover Letter

The body of your underwriter cover letter is where you can truly shine and demonstrate your qualifications. This section should highlight your relevant skills, experience, and achievements that make you an ideal candidate for the position.

Highlight Relevant Skills

Emphasize your technical skills, such as risk assessment, financial analysis, and underwriting software proficiency. Showcase your soft skills like attention to detail, communication, and decision-making abilities.

Demonstrate Industry Knowledge

Display your understanding of the insurance or lending industry, depending on the specific underwriting role. Mention any certifications or specialized training you have completed.

Provide Specific Examples

Use concrete examples from your past experience to illustrate how you've successfully applied your skills in real-world situations. Quantify your achievements whenever possible to provide tangible evidence of your capabilities.

Address Company Needs

Research the company and tailor your letter to address their specific needs or challenges. Explain how your skills and experience can contribute to their goals and add value to their team.

Show Enthusiasm

Express your genuine interest in the position and the company. Explain why you're passionate about underwriting and how this role aligns with your career aspirations.

Remember to keep the body of your cover letter concise and focused, typically two to three paragraphs. Each paragraph should have a clear purpose and contribute to building a compelling case for your candidacy.

As a seasoned underwriter with over 8 years of experience in the insurance industry, I am excited to apply for the Senior Underwriter position at ABC Insurance. Throughout my career at XYZ Insurance, I have consistently demonstrated my ability to assess risks accurately, make sound decisions, and contribute to the company's profitability.

In my current role, I have successfully:

• Evaluated and underwrote complex commercial property and casualty risks, resulting in a 15% increase in premium volume while maintaining a loss ratio below industry average. • Implemented a new risk assessment model that improved efficiency by 20% and reduced turnaround time for quote generation. • Mentored junior underwriters, leading to a 30% improvement in their performance and accuracy.

I am particularly drawn to ABC Insurance's commitment to innovation and your focus on emerging risks in the cyber insurance market. My experience in developing tailored insurance solutions for technology companies aligns perfectly with your strategic goals.

I am confident that my strong analytical skills, attention to detail, and passion for the underwriting profession would make me a valuable addition to your team. I look forward to the opportunity to discuss how I can contribute to ABC Insurance's continued success.

This is a strong example of a cover letter body for an Underwriter position for several reasons:

Relevance: The content directly addresses the job of an underwriter and highlights specific, relevant experience.

Quantifiable achievements: The letter includes concrete examples of the candidate's accomplishments, supported by numerical data (e.g., 15% increase in premium volume, 20% improvement in efficiency).

Alignment with company goals: The applicant demonstrates knowledge of the company (ABC Insurance) and explains how their experience aligns with the company's focus on cyber insurance and innovation.

Specific skills: The letter highlights key skills for an underwriter, such as risk assessment, decision-making, and attention to detail.

Professional growth: It shows the candidate's ability to mentor others, indicating leadership potential.

Clear structure: The letter is well-organized, making it easy for the hiring manager to quickly grasp the candidate's qualifications.

Enthusiasm: The tone conveys genuine interest in the position and the company.

This example effectively showcases the candidate's qualifications and potential value to the company, making it a strong cover letter body.

I am writing to apply for the Underwriter position at your company. I have some experience in financial services and I think I would be a good fit for this role. I am a hard worker and I am willing to learn new things. I have attached my resume for your review. Please let me know if you have any questions. Thank you for your time and consideration.

This is a weak example of a cover letter body for an Underwriter position for several reasons. First, it lacks specificity and fails to demonstrate a deep understanding of the underwriting role or the company. The applicant mentions 'some experience in financial services' without providing any concrete details or achievements. There's no mention of specific underwriting skills, risk assessment abilities, or relevant industry knowledge. The language used is generic and could apply to almost any job, failing to showcase the applicant's unique qualifications for this particular position. Additionally, the body is too brief and doesn't take the opportunity to elaborate on how the applicant's skills and experience align with the job requirements. It also lacks enthusiasm and fails to convey a compelling reason why the company should consider the applicant. Overall, this weak example does little to differentiate the applicant or demonstrate their suitability for an Underwriter role.

How to Close Your Cover Letter

To conclude your underwriter cover letter on a strong note, craft a compelling closing paragraph that leaves a lasting impression. This final section should reinforce your enthusiasm for the position, summarize your key qualifications, and include a clear call to action.

Begin by reiterating your interest in the role and the company. Express your excitement about the possibility of contributing to the organization's success. Briefly remind the reader of your most relevant skills or experiences that make you an ideal candidate for the underwriter position.

Next, thank the hiring manager for their time and consideration. This gesture of appreciation demonstrates your professionalism and courtesy.

Finally, include a call to action that encourages the reader to take the next step. This could be a request for an interview or a statement indicating that you'll follow up on your application. Close the letter with a professional sign-off, such as "Sincerely" or "Best regards," followed by your full name.

Remember to keep your closing paragraph concise and impactful. It should leave the reader with a positive impression and a clear understanding of your enthusiasm for the opportunity.

Thank you for considering my application. I am excited about the opportunity to contribute my underwriting expertise to XYZ Insurance Company and help maintain its reputation for excellence in risk assessment. I look forward to discussing how my skills and experience align with your team's needs. Please feel free to contact me at your convenience to arrange an interview.

This is a strong cover letter closing for several reasons. First, it expresses gratitude for the reader's consideration, which is polite and professional. It then reiterates enthusiasm for the specific position and company, demonstrating genuine interest. The closing also highlights the applicant's relevant expertise (underwriting) and connects it to the company's goals (maintaining a reputation for excellence in risk assessment). This shows the applicant has done research on the company and understands its values. The closing ends with a clear call to action, inviting further discussion and an interview, which shows confidence and proactivity. Overall, this closing is concise yet impactful, leaving a positive final impression on the hiring manager.

Thanks for considering me. I hope to hear from you soon. Have a nice day!

This closing is weak for several reasons. First, it's overly casual and lacks professionalism, which is crucial for an Underwriter position. The phrase 'Thanks for considering me' doesn't convey confidence or enthusiasm about the role. 'I hope to hear from you soon' is passive and doesn't prompt action. 'Have a nice day' is too informal for a business letter. The closing fails to reiterate interest in the position, doesn't include a call to action, and doesn't thank the reader for their time. It also misses an opportunity to summarize key qualifications or express eagerness to contribute to the company. Overall, this closing doesn't leave a strong, lasting impression and could potentially harm the applicant's chances of securing an interview.

Cover Letter FAQs for Underwriter

What is the ideal format and length for an underwriter cover letter.

An underwriter cover letter should follow a standard business letter format and be no longer than one page. It should include your contact information, the date, the employer's contact information, a formal salutation, 3-4 concise paragraphs highlighting your qualifications, a closing paragraph, and your signature. Aim for 250-400 words to keep it focused and impactful.

What key skills should I emphasize in my underwriter cover letter?

In your underwriter cover letter, emphasize skills such as risk assessment, financial analysis, attention to detail, strong communication, decision-making abilities, and knowledge of industry regulations. Also highlight your proficiency with underwriting software and your understanding of various insurance or loan products relevant to the position.

How can I make my underwriter cover letter stand out?

To make your underwriter cover letter stand out, tailor it to the specific job and company, use concrete examples of your achievements in previous roles, demonstrate your knowledge of the industry and company's products, and show enthusiasm for the position. Include any relevant certifications or specialized training you've completed in underwriting.

Should I include quantifiable achievements in my underwriter cover letter?

Yes, including quantifiable achievements in your underwriter cover letter can significantly strengthen your application. For example, mention specific metrics like the number of applications processed, approval rates, or any improvements in efficiency or accuracy you've achieved. This provides concrete evidence of your skills and impact in previous roles.

How should I address any gaps in experience in my underwriter cover letter?

If you have gaps in your underwriting experience, address them proactively in your cover letter. Focus on transferable skills you've gained from other experiences, any relevant training or education you've pursued during the gap, and your enthusiasm for returning to or entering the field. Be honest but positive, emphasizing your current qualifications and readiness for the role.

- Aerospace Overview

- Light Aircraft

- Construction

- Entertainment

- Financial Institutions

- Food and Agriculture

- Higher Education

- Life Sciences

- Manufacturing

- Nonprofit Overview

- Affordable Housing Insurance and Consulting for Nonprofits

- Human Services Consulting

- Showguard™ Event Insurance

- PEO and Temporary Staffing

- Private Equity and M&A

- Public Sector & K-12 Education

- Real Estate and Hospitality

- Restaurants

- Senior Living

- Transportation

- Alternative Risk & Captives

- Business Continuity Planning and Resiliency Services

- Claims Overview

- Commercial Lines Claims Contacts

- Small Business Lines Claims Contacts

- Home and Property Lines Claims Contacts

- Claims Management & Advocacy

- Claims Management and Third Party Administration

- Commercial Surety Bonds

- Construction Bonds

- Credit and Political Risk

- Crisis Resilience Insurance & Consulting

- Data and Analytics

- Enterprise Risk Management

- Environmental

- Executive and Financial Risk

- Global Risk Management

- Loss Control

- Multinational Services Overview

- Asia Pacific

- Personal Lines

- Product Recall

- Reinsurance

- Small Business

- Supplier Diversity

- Workers Compensation

- Insurance and Risk Management Webinars

- Compensation Consulting and Total Rewards Programs

- Compensation Survey Reports

- Compliance Consulting Overview

- Healthcare Reform Toolkit

- Defined Benefit Pension Plans

- Defined Contribution Retirement Plan Consulting

- Diversity, Equity and Inclusion (DEI) Consulting

- Employee Benefits Consulting

- Employee Communications Consulting

- Engagement Solutions

- ESG Consulting

- Executive Benefits

- Executive Compensation Consulting

- Executive Search Overview

- Executive Career Opportunities

- Financial and Retirement Services

- Human Resources and Compensation Consulting Overview

- Meet the Human Resource Compensation Consulting Team

- Human Resources Consulting

- Human Resources Technology Consulting

- Individual Life and Wealth Consulting

- Institutional Investment Consulting and Fiduciary Services

- Leadership Advisors

- Multinational Benefits and HR Consulting

- People Data & Analytics

- Pharmacy Benefit Management Consulting

- Physical and Emotional Wellbeing Consulting

- Physician Compensation and Valuation

- Research and Insights

- Voluntary Benefits Consulting

- News & Insights

- Investor Relations

- Our Purpose

- Executive Team

- The Gallagher Way

- Gallagher Companies

- Recognition & Awards

- How We Work Overview

- Mission Statement

- Gallagher Better Works

- Tools and Applications

- Merge with Gallagher

- Gallagher Global Network

- Office Locations

- Partnerships

- Inclusion and Diversity

- Global Standards

- Compensation Disclosure

Uncover the Secrets of a Well-Crafted Cover Letter for Underwriting Success

There is a prevailing misconception that underwriters don't pay attention to cover letters. However, this belief couldn't be further from the truth. In fact, a cover letter serves as the foundation of an applicant's risk assessment, providing valuable insights to the carrier underwriter. It offers a glimpse into how the case was sold, the purpose of coverage, your relationship with the applicant, and key details about the client's risk. By establishing transparency and providing comprehensive information, a cover letter plays a crucial role in the application process.

To ensure an efficient and effective cover letter, it is essential to focus on four key areas:

- State the purpose

- Share your history with the client

- Present client's history

- Communicate desired outcome

Let's explore each of these components in detail.

Step 1: State the purpose

Begin by clearly stating the purpose of the coverage. This section is an opportunity to highlight the client's needs and goals. For instance, if the aim is to protect their business interests, emphasize this point in the cover letter. Additionally, it's important to include calculations that justify the chosen coverage amount, aligning with carrier financial guidelines.

Step 2: Share your history with the client

Take this opportunity to explain your connection or relationship with the client. Avoid using exaggerated terms like "best friend" or "neighbor" unless they accurately reflect the situation. Underwriters can easily detect insincere claims, so it's crucial to provide an authentic account of your association with the client.

Step 3: Present the client's history

Provide a comprehensive overview of the client's medical, financial and personal history. Showcase your thorough field underwriting, including details such as medical records, test results, daily activities, community involvement and overall lifestyle. Paint a clear picture of the client's health from a clinical perspective, which can help the underwriter assess mortality risks.

Step 4: Communicate your desired outcome

In this section, clearly state your expectations and desired rate class, if applicable. However, it's important to manage expectations realistically. Underwriters understand that not every client will qualify for the best rate class, especially if the case presents higher risks. Be transparent and provide accurate information to foster a productive partnership with the carrier.

Remember, the relationship between you, your client and the carrier is a collaborative partnership. Transparency, attention to detail and active involvement from all parties are crucial. As the first point of contact, it's your responsibility to present your client's information in a positive and accurate manner. By providing a comprehensive cover letter that effectively communicates the case to the underwriter, you enhance the chances of a successful policy issuance for life, disability or long-term care insurance. It's a tactical strategy that anticipates and addresses potential concerns in advance, ultimately leading to a placed policy that empowers your clients to face their future with confidence.

Author Information

Vice President of Underwriting, Gallagher Life & Annuity Brokerage

- Los Angeles, CA

For Financial Professional Use Only. Not for Public Distribution.

GBS Insurance and Financial Services, Inc., does not provide investment, tax, or legal advice. The information presented here is not specific to any individual's personal circumstances. To the extent that this material concerns tax matters, it's not intended or written to be used, and cannot be use, by a taxpayer for the purpose of avoiding penalties that may be imposed by law. Each taxpayer should seek independent advice from a tax professional based on his or her individual circumstances. These materials are provided for general information and educational purposes based upon publicly available information from sources believed to be reliable — we cannot ensure the accuracy or completeness of these materials. You should not treat any opinion expressed as a specific inducement to make a particular investment or follow a particular strategy. The information in these materials may change at any time and without notice. Although we may promote insurance products and strategies offered by insurance companies, financial professionals are ultimately responsible for the use of any materials or services and agree to comply with the compliance requirements of their broker/dealer and registered investment advisor, if applicable, and the insurance carriers they represent.

People Also Viewed

Shifting Dynamics in the Life Insurance and Annuities US Market

Individual Life and Wealth

Navigating Business Succession Planning in the Connelly Era

Privacy preference center

We care about your privacy

When you visit our website, we will use cookies to make sure you enjoy your stay. We respect your privacy and we’ll never share your resumes and cover letters with recruiters or job sites. On the other hand, we’re using several third party tools to help us run our website with all its functionality.

But what exactly are cookies? Cookies are small bits of information which get stored on your computer. This information usually isn’t enough to directly identify you, but it allows us to deliver a page tailored to your particular needs and preferences.

Because we really care about your right to privacy, we give you a lot of control over which cookies we use in your sessions. Click on the different category headings on the left to find out more, and change our default settings.

However, remember that blocking some types of cookies may impact your experience of our website. Finally, note that we’ll need to use a cookie to remember your cookie preferences.

Without these cookies our website wouldn’t function and they cannot be switched off. We need them to provide services that you’ve asked for.

Want an example? We use these cookies when you sign in to Kickresume. We also use them to remember things you’ve already done, like text you’ve entered into a registration form so it’ll be there when you go back to the page in the same session.

Thanks to these cookies, we can count visits and traffic sources to our pages. This allows us to measure and improve the performance of our website and provide you with content you’ll find interesting.

Performance cookies let us see which pages are the most and least popular, and how you and other visitors move around the site.

All information these cookies collect is aggregated (it’s a statistic) and therefore completely anonymous. If you don’t let us use these cookies, you’ll leave us in the dark a bit, as we won’t be able to give you the content you may like.

We use these cookies to uniquely identify your browser and internet device. Thanks to them, we and our partners can build a profile of your interests, and target you with discounts to our service and specialized content.

On the other hand, these cookies allow some companies target you with advertising on other sites. This is to provide you with advertising that you might find interesting, rather than with a series of irrelevant ads you don’t care about.

Insurance Underwriter Cover Letter Example

Kick-start your career & get inspiration for your own cover letter with this outstanding Insurance Underwriter cover letter example. Make a copy of this cover letter sample at no cost or rewrite it directly in our easy-to-use cover letter maker.

Related resume guides and samples

How to write an appealing accountant resume

How to build the perfect auditor resume

How to build a great bookkeeper resume

Ultimate tips for the perfect finance analyst resume

Five great tips for your insurance agent resume

How to write an appealing investment advisor resume?

Create the perfect resume for a role in tax services

Insurance Underwriter Cover Letter Example (Full Text Version)

Iwan jachowski.

Dear Hiring Manager,

I am writing to express my interest in the Insurance Underwriter position at YYT Financial Services, Ltd. After reviewing your job posting, I am confident that my qualifications align well with the requirements of the role. I believe that my background and experience make me a strong candidate for this opportunity to further advance my career.

I am a Certified Insurance Counselor and a graduate from the University of Southampton with a bachelor's degree in Economics & Finance. During my time at university, I was actively involved in various extracurricular activities and received the Dean's Award for academic excellence.

With over three years of experience as an Insurance Underwriter at QBE Insurance Group, Ltd., I have a proven track record of success in reviewing applications, conducting risk assessments, and maintaining accurate records. I have also been recognized for my outstanding performance by company executives.

I possess excellent communication skills and proficiency in the software programs required for this role. I am excited about the opportunity to contribute to YYT Financial Services, Ltd. and look forward to the possibility of discussing my qualifications in more detail.

Thank you for considering my application. I look forward to the opportunity to speak with you further.

Sincerely, Iwan Jachowski

Milan Šaržík, CPRW

Milan’s work-life has been centered around job search for the past three years. He is a Certified Professional Résumé Writer (CPRW™) as well as an active member of the Professional Association of Résumé Writers & Careers Coaches (PARWCC™). Milan holds a record for creating the most career document samples for our help center – until today, he has written more than 500 resumes and cover letters for positions across various industries. On top of that, Milan has completed studies at multiple well-known institutions, including Harvard University, University of Glasgow, and Frankfurt School of Finance and Management.

Edit this sample using our resume builder.

Don’t struggle with your cover letter. artificial intelligence can write it for you..

Similar job positions

Accountant Insurance Agent Tax Services Auditor Bookkeeper Finance Analyst Investment Advisor

Related accounting / finance resume samples

Related accounting / finance cover letter samples

Let your resume do the work.

Join 5,000,000 job seekers worldwide and get hired faster with your best resume yet.

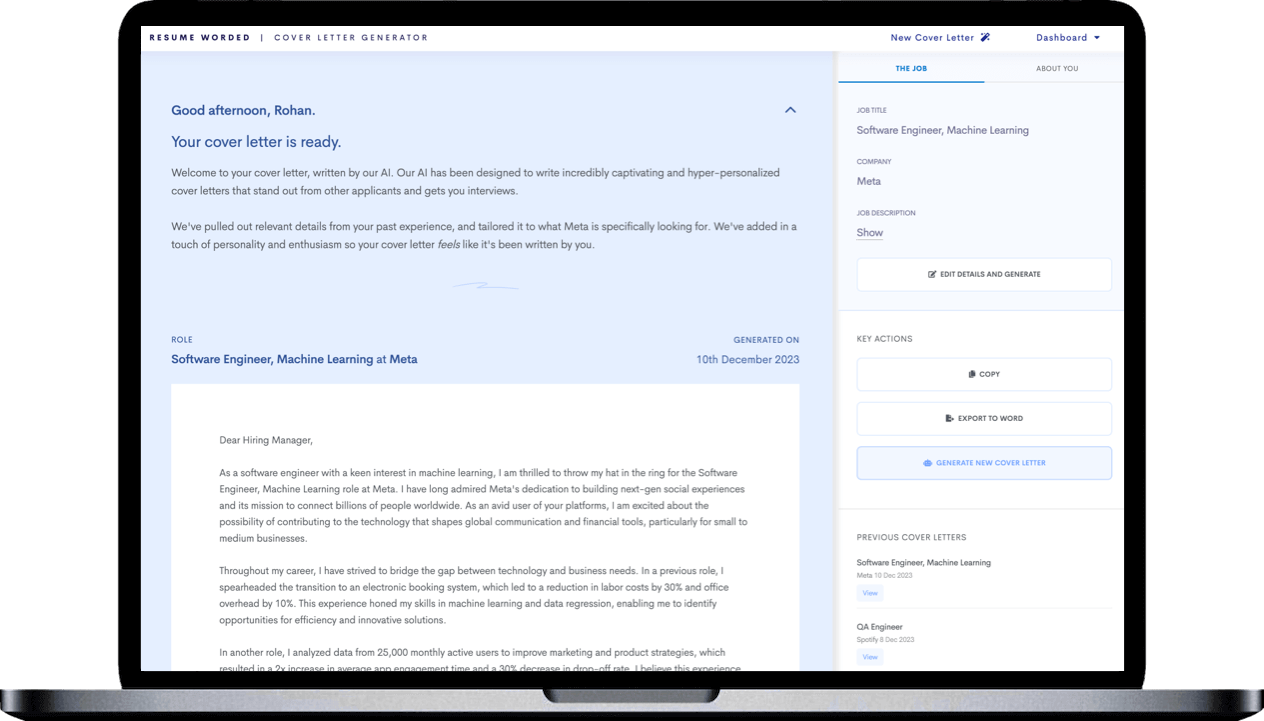

Resume Worded | Career Strategy

14 credit underwriter cover letters.

Approved by real hiring managers, these Credit Underwriter cover letters have been proven to get people hired in 2024. A hiring manager explains why.

Table of contents

- Credit Underwriter

- Senior Credit Underwriter

- Senior Credit Analyst

- Credit Risk Analyst

- Senior Mortgage Underwriter

- Mortgage Loan Processor

- Alternative introductions for your cover letter

- Credit Underwriter resume examples

Credit Underwriter Cover Letter Example

Why this cover letter works in 2024, connection to the company.

Starting with a personal connection to the company shows the applicant's familiarity and interest in the organization. Job seekers should try to connect their experiences with the company's values or culture.

Highlighting Relevant Skills and Accomplishments

By mentioning specific accomplishments with quantifiable results, the applicant demonstrates their ability to make a positive impact on the company. Job seekers should always use concrete examples to illustrate their skills and experience.

Expressing Genuine Excitement for the Role

Showing enthusiasm for the role and its specific challenges helps convey the applicant's passion for the industry and job. Job seekers should aim to express their excitement about the opportunity in a genuine and engaging way.

Highlight Significant Achievements

You've done an excellent job showcasing your significant accomplishments. The fact that you implemented a risk assessment model that increased loan approval accuracy by 30% is a big deal. It not only shows your ability to take initiative and problem-solve, but it also gives a clear picture of the impact you had at your previous job. This is a great way to demonstrate your skills in a concrete, measurable way.

Showcase Industry Knowledge

When you mention working with a diverse portfolio of clients, it portrays your understanding of various industries' risk profiles. This is compelling as it demonstrates your breadth of experience and adaptability, which are crucial assets in a Credit Underwriter role. Keep it up!

Showcase Adaptability to New Techniques

It's not just about stating your experience, but showing how you've adapted and contributed to emerging trends in your field. By mentioning how you've integrated machine learning into a traditional process, you demonstrate your ability to evolve and innovate in the face of change. This is crucial for a field like credit underwriting that's increasingly being digitized.

Highlight Improvements Made

Outlining improvements you've made in past roles is a great way to demonstrate your impact. Mentioning a specific achievement like increasing loan approvals by 15% without compromising risk quality instantly grabs attention. It shows that you can find a balance between risk and opportunity, a key skill for this job.

Connect with the Company Culture

Showing that you've taken time to understand the company's culture and values is impressive. You've done well to highlight your alignment with their dedication to innovation and excellence. It's not just about what you can do, but how well you fit into their ethos.

Maintain Professional Courtesy

The last impression can be as important as the first. Closing your cover letter with a sincere sign-off and expressing interest in further discussion maintains a positive tone and keeps the conversation open.

Show your enthusiasm for the credit underwriter role

Your excitement about the position and the company sets a positive tone right from the start. This helps me see that you're not just looking for any job, but you are interested in this specific role at our company.

Highlight your credit analysis experience

Talking about your past experience in credit risk shows me you have the skills needed for this job. It's good to see examples of your work, like improving the underwriting process.

Demonstrate critical thinking in credit underwriting

When you mention identifying areas for improvement, it shows you're not just doing the job but thinking about how to do it better. This is a valuable trait in the field of credit underwriting.

Express eagerness to innovate in credit underwriting

Stating your excitement to work with a company known for innovation tells me you're ready to bring new ideas to the table, which is always welcome in our team.

Close with a strong call to action

Ending your letter by looking forward to a discussion about your fit for the role is a good way to prompt a response from us. It's clear and direct, showing your genuine interest in the position.

Does writing cover letters feel pointless? Use our AI

Dear Job Seeker, Writing a great cover letter is tough and time-consuming. But every employer asks for one. And if you don't submit one, you'll look like you didn't put enough effort into your application. But here's the good news: our new AI tool can generate a winning cover letter for you in seconds, tailored to each job you apply for. No more staring at a blank page, wondering what to write. Imagine being able to apply to dozens of jobs in the time it used to take you to write one cover letter. With our tool, that's a reality. And more applications mean more chances of landing your dream job. Write me a cover letter It's helped thousands of people speed up their job search. The best part? It's free to try - your first cover letter is on us. Sincerely, The Resume Worded Team

Want to see how the cover letter generator works? See this 30 second video.

Connect your values with the credit underwriter position

Mentioning how the company's mission resonates with you personally sets a strong foundation for your application, hinting at a cultural fit.

Showcase your history of balancing risk and customer needs

Illustrating your ability to manage credit risk while focusing on the customer emphasizes your holistic understanding of the underwriter role.

Demonstrate innovation in credit product development

Your collaboration in creating new credit products highlights your initiative and ability to work in teams for market growth.

Share your appreciation for diverse and inclusive environments

Valuing diversity and inclusion aligns you with modern workplace values, suggesting you'll thrive in collaborative settings.

Express eagerness to align with the company’s goals

Conveying your readiness to discuss how you can support the company's vision shows genuine interest and initiative.

Show your passion for the finance and real estate intersection

When you express excitement about the industry, it tells me you have a genuine interest. This makes you more likely to enjoy and stay committed to your job.

Quantify your achievements in loan underwriting

Telling me about the $10M in loans and a 98% approval rate gives solid proof of your skills. It's compelling when I can see your direct impact in numbers.

Highlight your drive for innovation in mortgage processes

Your eagerness to improve processes and contribute to industry evolution shows me you're not just looking for a job but to make a difference.

Emphasize compatibility with dynamic team environments

Stating that you thrive in fast-paced, collaborative settings assures me you'll fit in with our team dynamic and culture.

Express eagerness for a personal meeting

Asking for the opportunity to discuss your potential contributions signals strong interest and proactiveness.

Senior Credit Underwriter Cover Letter Example

Quantify your impact.

I'm impressed by your underwriting process that reduced loan defaults by 25%. This concrete metric gives weight to your achievements and makes it evident that you're results-oriented. It's a fantastic way to convey the scale of your impact and your expertise at minimizing risk.

Highlight Leadership and Mentorship

You've effectively communicated your leadership skills by mentioning the training sessions you conducted for junior underwriters. This demonstrates your capability to guide others, an important trait for a Senior Credit Underwriter role. And your commitment to staying updated on industry trends shows your dedication and proactive attitude.

Express Enthusiasm and Commitment

Your closing paragraph strikes the right note, expressing your enthusiasm for the role and your eagerness to contribute to the team. It's important to leave a positive and lasting impression, and a closing statement like yours does just that. It gives a sense of your dedication and readiness to contribute, which is an appealing trait to hiring managers.

Convey confidence in your senior credit underwriter abilities

Starting with your confidence in your ability to contribute significantly is compelling. It makes me interested in seeing how your experience could benefit our team.

Showcase leadership in credit underwriting

Describing your role in leading a team and implementing new frameworks demonstrates strong leadership and initiative, qualities we value in a senior position.

Align with the company's credit underwriting vision

By showing that you value the company's innovative approach, you're telling me that you not only fit the job requirements but also the company culture and vision.

Appreciate the review of your credit underwriting application

Expressing gratitude for the time taken to review your application is courteous and shows good professional etiquette. It reflects well on you as a candidate.

Invite further discussion on your credit underwriting fit

Ending with an invitation for further discussion is a proactive move. It suggests you're open and eager to explore how your skills can match the job's demands.

Align your values with the company's

When you say that Discover's focus on risk management and customer service matches your professional values, it shows you're not just looking for any job, but the right fit. This is key in a senior credit underwriter role where understanding the company's core values can make a big difference.

Show your senior credit underwriter impact

Mentioning a specific achievement, like reducing processing time by 30%, paints a clear picture of how you can bring value to the role. This example not only shows your ability to improve processes but also your focus on maintaining quality in credit decisions.

Express excitement for the role

Stating your excitement about bringing your skills in risk assessment and customer service to the company shows enthusiasm. It's important to convey that you're not just able but eager to contribute to the company's goals, especially in a role as crucial as a senior credit underwriter.

Close with eagerness to contribute

Ending your letter with a statement of eagerness to learn more and contribute to the company's success shows you're forward-thinking and ready to be part of the team. This positive closure can leave a lasting impression on the hiring manager.

Use a professional closing

Sign off with 'Sincerely' followed by your name to maintain the professional tone of your application. This simple yet effective closing reaffirms your respect and seriousness towards the application process.

Senior Credit Analyst Cover Letter Example

Focus on your unique approach.

Instead of merely stating your duties, you've highlighted how you approached them differently. Your ability to see beyond numbers and understand the stories they tell about a business isn't something everyone can do. This unique perspective can be a significant differentiator for you.

Showcase Your Impact

Detailing how you developed a risk assessment model that led to substantial savings is brilliant. It showcases not only your capabilities but also your impact. It's this kind of tangible achievement that can set you apart.

Highlight Relevant Experience

Pointing out your experience in areas the company is focusing on demonstrates you've done your homework. It shows you understand where they're heading and have the relevant skills to help them get there.

End on a Positive Note

Ending with an offer to discuss your qualifications further is always a good idea. It signals your enthusiasm and keeps the dialogue open. Also, "warm regards" gives a nice personal touch to your professional letter.

Credit Risk Analyst Cover Letter Example

Show your motivation for the credit risk analyst role.

Sharing why you're drawn to the company is a strong start. It shows you know what they stand for and that you've chosen them for a reason.

Quantify your achievements in risk management

By giving specific examples of your success, such as saving the company money, you make your skills in identifying and tackling problems very clear.

Highlight your excitement about bringing skills to a new team

Expressing eagerness to apply your expertise at American Express demonstrates both passion and confidence in your abilities.

Assure your alignment with the job requirements

Stating your confidence in matching the job's needs reassures the hiring manager of your potential fit within their team.

Express your desire to contribute to company success

Your anticipation to aid in the company's growth and risk management shows a forward-thinking attitude.

Connect your passion with the company's mission

Expressing your fascination with the finance and technology intersection and how it aligns with Capital One’s mission shows you've done your homework. It's crucial for a credit risk analyst role to understand and be excited about the company's direction.

Highlight innovation in your credit risk analyst experience

Describing your leadership in a project that utilized machine learning to improve credit decision accuracy demonstrates your innovative thinking and problem-solving skills. This is particularly appealing for a company known for its data-driven approach.

Emphasize your commitment to learning and innovation

Your attraction to Capital One's use of cutting-edge technology underlines your desire to be at the forefront of industry advancements. For a credit risk analyst, staying ahead with technology is key to addressing evolving risk landscapes.

Show enthusiasm for personal and company growth

Conveying your eagerness to learn more about how you can contribute to the company’s mission highlights your proactive attitude. It’s important for a credit risk analyst to be committed not just to personal growth but to advancing the company's objectives.

End with a professional and hopeful note

Choosing 'Best regards' as your closing, coupled with your name, strikes the right balance between professionalism and warmth. It leaves the hiring manager with a positive impression of your eagerness and respect for the opportunity.

Senior Mortgage Underwriter Cover Letter Example

Share your admiration for the company's innovation.

When you mention your respect for the company’s approach, it demonstrates that your values align with ours, making you a potentially good cultural fit.

Detail your senior mortgage underwriting success

Discussing your experience with high-value loans and perfect audit compliance provides clear evidence of your expertise and reliability.

Position yourself as ready for bigger challenges

Your enthusiasm to tackle greater challenges at our firm suggests you're ambitious and looking for growth, qualities we value in team members.

Highlight interest in technology-driven solutions

Showing your passion for leveraging technology indicates you're forward-thinking and ready to contribute to innovation, which is crucial in our field.

End with a strong call to action

Requesting a discussion about your role in our future endeavors shows you're eager and ready to make an impact, prompting me to consider your application seriously.

Mortgage Loan Processor Cover Letter Example

Connect your passion with the company’s mission.

Starting your cover letter by linking your personal enthusiasm and professional strengths to the employer's goals shows you're not just looking for any job—you want this job. It makes your application memorable and demonstrates you've researched the company.

Highlight your mortgage processing achievements

When you specify how many loan applications you've managed and mention a project that improved efficiency, it provides concrete proof of your ability to handle the responsibilities of a mortgage loan processor. This kind of detailed achievement reassures employers of your competence.

Show your drive for operational success

Expressing your desire to contribute to the company’s operational excellence not only shows you're goal-oriented but also that you understand the importance of your role within the larger company mission. It suggests you're someone who takes initiative to maintain high standards.

Emphasize your commitment to growth

Mentioning your eagerness to learn and grow within the company highlights your long-term potential. It tells the employer you’re looking to not just fill a position, but to evolve with the company and enhance its community.

Conclude with a forward-looking statement

Ending your cover letter on a note that looks towards a future discussion about how you can contribute posits you as proactive and confident in your ability to bring value. It subtly invites the hiring manager to envision you as part of their team.

Alternative Introductions

If you're struggling to start your cover letter, here are 6 different variations that have worked for others, along with why they worked. Use them as inspiration for your introductory paragraph.

Cover Letters For Jobs Similar To Credit Underwriter Roles

- Assistant Underwriter Cover Letter Guide

- Commercial Underwriter Cover Letter Guide

- Credit Underwriter Cover Letter Guide

- Loan Underwriter Cover Letter Guide

- Underwriter Cover Letter Guide

Other Legal Cover Letters

- Attorney Cover Letter Guide

- Contract Specialist Cover Letter Guide

- Lawyer Cover Letter Guide

Thank you for the checklist! I realized I was making so many mistakes on my resume that I've now fixed. I'm much more confident in my resume now.

Mortgage Underwriter Cover Letter Example

Cover letter examples, cover letter guidelines, how to format an mortgage underwriter cover letter, cover letter header, cover letter header examples for mortgage underwriter, how to make your cover letter header stand out:, cover letter greeting, cover letter greeting examples for mortgage underwriter, best cover letter greetings:, cover letter introduction, cover letter intro examples for mortgage underwriter, how to make your cover letter intro stand out:, cover letter body, cover letter body examples for mortgage underwriter, how to make your cover letter body stand out:, cover letter closing, cover letter closing paragraph examples for mortgage underwriter, how to close your cover letter in a memorable way:, pair your cover letter with a foundational resume, key cover letter faqs for mortgage underwriter.

Start your Mortgage Underwriter cover letter by addressing the hiring manager directly, if possible. Then, introduce yourself and state the position you're applying for. Mention where you found the job posting and if you were referred by someone. In the first paragraph, briefly highlight your most relevant experiences and skills that make you a strong candidate for the position. For example, you could say, "As a certified Mortgage Underwriter with over 5 years of experience in assessing and approving mortgage applications, I am confident in my ability to contribute to your team." This will immediately grab the reader's attention and make them want to learn more about you.

The best way for Mortgage Underwriters to end a cover letter is by summarizing their qualifications and expressing enthusiasm for the opportunity. They should also include a call to action, such as requesting an interview or expressing their intention to follow up. For example: "I am confident that my experience and skills make me a strong candidate for this position. I am eager to bring my expertise in risk assessment and regulatory compliance to your team. I look forward to the possibility of discussing this opportunity further. Thank you for considering my application." This ending is professional, assertive, and shows a proactive approach, which is crucial in the mortgage underwriting field.

In a cover letter, Mortgage Underwriters should include the following: 1. Contact Information: At the top of the letter, include your name, address, phone number, and email address. 2. Professional Greeting: Address the hiring manager by name if possible. If not, use a professional greeting such as "Dear Hiring Manager". 3. Introduction: Start with a strong opening paragraph that grabs the reader's attention. Mention the position you're applying for and where you found the job listing. 4. Relevant Skills and Experience: Highlight your most relevant skills and experiences that make you a suitable candidate for the job. As a Mortgage Underwriter, you should focus on your analytical skills, attention to detail, knowledge of property appraisals, credit and risk analysis, and understanding of mortgage loan products and guidelines. 5. Achievements: Mention any achievements or successes you've had in your previous roles as a Mortgage Underwriter. This could include instances where you've helped your company avoid risky investments, or times when you've successfully processed and approved a high volume of mortgage applications. 6. Knowledge about the Company: Show that you've done your research about the company and express why you're interested in working there. This could be something you admire about the company culture, their products, or their reputation in the industry. 7. Closing Paragraph: In your closing paragraph, reiterate your interest in the position and express your desire for an interview. Thank the hiring manager for considering your application. 8. Professional Closing: End your letter with a professional closing such as "Sincerely" or "Best Regards" followed by your name. Remember, your cover letter should complement your resume, not duplicate it. It's your chance to tell a story about your experiences and skills, and to show your personality. Keep it concise, professional, and focused on your qualifications for the job.

Related Cover Letters for Mortgage Underwriter

Commercial underwriter cover letter.

Entry Level Underwriter Cover Letter

Insurance Underwriter Cover Letter

Loan Underwriter Cover Letter

Mortgage Underwriter Cover Letter

Senior Underwriter Cover Letter

Underwriter Cover Letter

Related Resumes for Mortgage Underwriter

Commercial underwriter resume example.

Entry Level Underwriter Resume Example

Insurance underwriter resume example, loan underwriter resume example, mortgage underwriter resume example, senior underwriter resume example, underwriter resume example, try our ai cover letter generator.

7 Mortgage Underwriter Cover Letter Examples

Introduction.

When it comes to applying for a job as a mortgage underwriter, a well-crafted cover letter can make all the difference. In today's competitive job market, it is essential to stand out from the crowd and showcase your skills and qualifications in a way that grabs the attention of hiring managers. A cover letter is your opportunity to do just that.

A cover letter allows you to go beyond the details listed on your resume and provide a more personalized introduction to who you are as a professional. It allows you to highlight your relevant experience, demonstrate your knowledge of the industry, and explain why you are the perfect fit for the position.

In this article, we will provide you with a variety of mortgage underwriter cover letter examples to help you craft your own compelling cover letter. Each example will showcase different approaches and highlight various skills and qualifications. By following these examples and incorporating the key takeaways, you will be able to create a cover letter that stands out and increases your chances of landing an interview.

So, whether you're an experienced mortgage underwriter looking for a new opportunity or a recent graduate looking to break into the field, read on to discover how to create a cover letter that will impress hiring managers and get you one step closer to your dream job.

Example 1: Senior Mortgage Underwriter Cover Letter

Key takeaways.

Alesha's cover letter effectively showcases her experience and qualifications as a Senior Mortgage Underwriter, positioning her as an ideal candidate for the role at CNN Mortgage.

When applying for a specialized position like a Senior Mortgage Underwriter, it is essential to highlight your experience and expertise in the industry. This shows that you have a deep understanding of underwriting guidelines and procedures, as well as the ability to make sound lending decisions.

She emphasizes her career progression, starting from a Mortgage Underwriter Trainee and working her way up to a Senior Mortgage Underwriter. This demonstrates her growth and development within the mortgage industry.

Highlighting your career progression can showcase your commitment to professional growth and your ability to handle increased responsibilities. This demonstrates your potential to excel in a senior-level role.

Alesha also highlights her accomplishments, such as consistently meeting or exceeding performance targets and effectively communicating with various stakeholders. These achievements demonstrate her ability to perform at a high level and contribute to the success of her previous employers.

Be sure to include specific examples of your achievements and contributions in previous roles. This helps to quantify your impact and gives potential employers confidence in your abilities.

Overall, Alesha's cover letter effectively presents her qualifications, industry knowledge, and achievements, making her a strong candidate for the Senior Mortgage Underwriter position at CNN Mortgage.

Example 2: FHA Mortgage Underwriter Cover Letter

Marcus's cover letter effectively highlights his experience and expertise in FHA mortgage underwriting, positioning him as a strong candidate for the position at JP Morgan Chase.

When applying for a niche role like FHA mortgage underwriter, it's crucial to clearly demonstrate your specialized knowledge and experience in the field. This showcases your ability to make accurate and informed decisions when evaluating loan applications.

He emphasizes his track record of success, including consistently meeting or exceeding quality and productivity goals as a Senior Mortgage Underwriter at PNC Mortgage. This demonstrates his ability to efficiently underwrite a high volume of FHA loans while maintaining a high level of accuracy.

Quantify your achievements and provide specific examples of how you have contributed to the success of your previous employers. This shows potential employers that you have a proven track record and can bring tangible results to their organization.

Marcus also highlights his alignment with JP Morgan Chase's values, particularly their commitment to exceptional customer service and innovative mortgage solutions. This indicates that he has taken the time to research the company and understands how his skills and experience can contribute to their goals.

Take the time to research the company you are applying to and tailor your cover letter to highlight how your skills and experience align with their values and objectives. This demonstrates your genuine interest in the organization and increases your chances of standing out as a candidate.

Example 3: Commercial Mortgage Underwriter Cover Letter

Emily's cover letter effectively showcases her relevant experience and highlights her achievements as a Commercial Mortgage Underwriter, making her a strong candidate for the position at Goldman Sachs.

When applying for a specialized role like a Commercial Mortgage Underwriter, it's important to emphasize your experience in the industry and your ability to analyze financial documents, assess risk, and make informed lending decisions.

Emily provides specific examples of her accomplishments, such as closing over 100 mortgage loans and consistently exceeding sales targets as a Mortgage Loan Officer at Citigroup. She also mentions her experience underwriting multimillion-dollar loans for various property types as a Commercial Mortgage Underwriter at Morgan Stanley.

Quantify your achievements whenever possible. These numbers help to demonstrate the scale of your impact and prove your ability to handle large loan volumes and complex transactions.

In her current role as a Senior Commercial Mortgage Underwriter at Barclays, Emily took the initiative to streamline the underwriting process and reduce turnaround time by 20%. This showcases her leadership skills and ability to drive process improvements.

Highlight any experience you have in leading teams or implementing process improvements. These skills demonstrate your ability to contribute to the efficiency and effectiveness of the underwriting process.

One area where Emily could have strengthened her cover letter is by specifically mentioning how her skills and experience align with Goldman Sachs' values and goals.

Research the company and customize your cover letter to highlight how your skills and experience make you an ideal fit for their organization. This shows your enthusiasm and dedication to the role.

Example 4: Conventional Mortgage Underwriter Cover Letter

Michael's cover letter effectively highlights his extensive experience and expertise as a conventional mortgage underwriter.

When applying for a specialized role like a conventional mortgage underwriter, it is crucial to emphasize your specific experience in the field. This demonstrates your in-depth knowledge of the underwriting process and your ability to assess risk accurately.

He mentions his previous roles as a Mortgage Processor, Conventional Mortgage Underwriter, and Senior Conventional Mortgage Underwriter, showcasing his progression and increasing responsibilities within the industry.

Highlighting your career progression and promotions within the mortgage industry emphasizes your ability to consistently deliver high-quality work and take on more complex underwriting responsibilities.

Michael emphasizes his ability to maintain a low rate of loan defaults and achieve high levels of customer satisfaction in his previous roles.

Emphasize your track record of success, such as maintaining low loan default rates and high customer satisfaction scores. This demonstrates your ability to make sound underwriting decisions and contribute to the overall success of the organization.

While Michael's cover letter effectively highlights his experience and achievements, he could further tailor his letter to Bank of America by referencing the company's specific values and initiatives.

Research the company's values and initiatives and incorporate them into your cover letter. This shows your genuine interest in the organization and your alignment with its goals.

Example 5: Government-Backed Mortgage Underwriter Cover Letter

Samantha's cover letter effectively showcases her experience and expertise in government-backed mortgage underwriting, positioning her as a strong candidate for the position at Wells Fargo Home Mortgage.

When applying for a specialized role like a government-backed mortgage underwriter, it's crucial to highlight your relevant experience and skills. This demonstrates your familiarity with the specific requirements and regulations of the role.

She emphasizes her experience as a Mortgage Loan Officer, Government-Backed Mortgage Underwriter, and Senior Government-Backed Mortgage Underwriter, showcasing her progression and depth of expertise in the field.

Highlighting your career progression and growth in the mortgage lending industry can help establish your credibility and expertise in the field. This shows that you have a comprehensive understanding of the mortgage lending process from multiple perspectives.

Samantha also mentions her ability to work efficiently and effectively in a fast-paced environment, demonstrating her capacity to handle a high-volume pipeline of loans while maintaining accuracy and quality.

Emphasizing your ability to manage a high volume of loans while maintaining attention to detail and meeting performance targets can demonstrate your capacity to handle the demands of the role effectively. This shows that you can balance speed and accuracy in underwriting government-backed mortgages.

The cover letter could further highlight any specific certifications or training Samantha has completed in government-backed mortgage underwriting, as well as any notable achievements or contributions she made in her previous roles.

Including details about relevant certifications, training, and achievements can add further credibility and reinforce your qualifications as a government-backed mortgage underwriter. This provides additional evidence of your expertise and commitment to professional development in the field.

Example 6: Wholesale Mortgage Underwriter Cover Letter Example

Daniel's cover letter effectively positions him as an ideal candidate for the Wholesale Mortgage Underwriter role at Quicken Loans.

When applying for a specialized position like Wholesale Mortgage Underwriter, it's crucial to highlight your relevant experience and knowledge of the industry. This demonstrates your understanding of the specific challenges and requirements of the role.

He emphasizes his ability to handle a high volume of mortgage loan applications and consistently meet underwriting targets, showcasing his strong attention to detail and ability to work efficiently under pressure.

Highlighting your ability to handle a high volume of work and meet targets demonstrates your capacity to handle the demanding workload of a Wholesale Mortgage Underwriter. It also shows your commitment to quality and efficiency.

Daniel also highlights his experience in implementing process improvements that reduced loan processing time by 20%. This demonstrates his proactive approach to problem-solving and his commitment to delivering exceptional customer service.

Highlighting your track record of process improvements and customer satisfaction can set you apart as a candidate who not only meets the requirements of the role but also contributes to the company's overall success.

While Daniel's cover letter effectively showcases his qualifications and experience as a Wholesale Mortgage Underwriter, he could further tailor his letter to align with Quicken Loans' specific values and initiatives.

Research the company's values, mission, and recent initiatives to tailor your cover letter accordingly. This shows your genuine interest in the company and your ability to align with its goals.

Example 7: Junior Mortgage Underwriter Cover Letter

Olivia's cover letter effectively showcases her relevant experience in the mortgage lending and underwriting industry, making her a strong candidate for the Junior Mortgage Underwriter position at U.S. Bank.

When applying for a specialized role like mortgage underwriter, it's important to highlight your experience in the industry and demonstrate your understanding of the lending process. This helps establish credibility and shows that you can hit the ground running.

She emphasizes her experience as a Mortgage Loan Officer Assistant, where she gained a deep understanding of the mortgage lending process and the importance of attention to detail. This demonstrates her knowledge of the industry and her ability to handle complex loan applications.

Highlight any relevant roles or experiences that demonstrate your understanding of the mortgage lending process. This could include positions such as loan officer assistant, loan processor, or any other roles that involve working closely with mortgage underwriters.

Olivia also mentions her current role as a Junior Mortgage Underwriter at Citigroup, where she has honed her underwriting skills and provided exceptional customer service. By showcasing her ability to make accurate and informed decisions while maintaining a high level of customer service, she positions herself as a valuable asset to U.S. Bank.

Highlight any specific achievements or skills that demonstrate your ability to make accurate underwriting decisions and provide exceptional customer service. These are highly sought-after qualities in the mortgage underwriting field.

Overall, Olivia's cover letter effectively highlights her relevant experience, industry knowledge, and dedication to exceptional customer service, making her a strong candidate for the Junior Mortgage Underwriter role at U.S. Bank.

Skills To Highlight

As a mortgage underwriter, your cover letter should highlight the unique skills that make you a strong candidate for the role. These key skills include:

Strong Analytical Abilities : Mortgage underwriters need to analyze financial documents, credit reports, and other relevant information to determine the creditworthiness of borrowers. Highlight your ability to evaluate complex financial data, identify potential risks, and make informed decisions based on your analysis.

Attention to Detail : Accuracy is crucial in mortgage underwriting as even a small error can have significant consequences. Emphasize your attention to detail and ability to meticulously review loan documents, ensuring that all necessary information is complete and accurate.

Knowledge of Mortgage Regulations : Mortgage underwriters must have a thorough understanding of mortgage regulations and guidelines set by regulatory bodies such as Fannie Mae and Freddie Mac. Showcase your knowledge of these regulations and your ability to apply them to ensure compliance throughout the underwriting process.

Excellent Communication Skills : Effective communication is essential for mortgage underwriters as they often need to collaborate with loan officers, borrowers, and other stakeholders. Highlight your ability to clearly and concisely communicate complex information, both in written reports and during verbal discussions.

Ability to Work Under Pressure : Mortgage underwriting can be a fast-paced and high-pressure environment, especially during peak periods. Demonstrate your ability to handle tight deadlines and work efficiently under pressure while maintaining a high level of accuracy and attention to detail.

Proficiency in Mortgage Underwriting Software : Familiarity with mortgage underwriting software is highly desirable in this role. Mention any software programs you are proficient in, such as Encompass, Calyx Point, or Mortgage Cadence. This shows your ability to navigate and effectively utilize industry-specific tools to streamline the underwriting process.

These skills are essential for success in the field of mortgage underwriting and should be emphasized in your cover letter to showcase your qualifications and suitability for the role.

Common Mistakes To Avoid In Cover Letters

When crafting your cover letter for a mortgage underwriter position, it's important to avoid these common mistakes to ensure your application stands out:

Not Tailoring the Letter to the Job Description : One of the biggest mistakes you can make is sending a generic cover letter that does not directly address the requirements and responsibilities outlined in the job description. Take the time to carefully read through the job posting and understand what the employer is looking for in a mortgage underwriter. Then, tailor your cover letter to highlight how your skills, qualifications, and experience align with those specific requirements.

Failing to Highlight Relevant Experience : As a mortgage underwriter, it's essential to showcase your relevant experience in the field. Don't make the mistake of simply listing your previous job titles and responsibilities. Instead, provide specific examples of how your experience has prepared you for the role of a mortgage underwriter. Highlight any accomplishments or achievements that demonstrate your ability to effectively analyze loan applications, assess risk, and make sound underwriting decisions.

Not Showcasing the Ability to Make Sound Underwriting Decisions Based on Thorough Analysis : Mortgage underwriters play a critical role in assessing the creditworthiness of borrowers and ensuring that loans meet the necessary criteria. It's important to demonstrate in your cover letter that you have the ability to make sound underwriting decisions based on thorough analysis of financial documents, credit reports, and other relevant information. Avoid the mistake of simply stating that you have this ability – instead, provide specific examples of how you have applied your analytical skills and attention to detail to make informed underwriting decisions.

Neglecting to Address any Employment Gaps or Career Changes : If you have any employment gaps or significant career changes in your work history, it's important to address these in your cover letter. Failure to do so may raise questions for the employer and could potentially harm your chances of being selected for an interview. Use your cover letter as an opportunity to explain any gaps in employment or career changes and emphasize how these experiences have contributed to your skills and qualifications as a mortgage underwriter.

Not Proofreading for Errors and Typos : One of the most common mistakes in cover letter writing is failing to proofread the document for errors and typos. A cover letter with grammatical errors and typos can give the impression that you lack attention to detail and professionalism – qualities that are essential for a mortgage underwriter. Before submitting your cover letter, take the time to carefully review it for any mistakes and ensure that it is error-free.

By avoiding these common mistakes, you can craft a strong and compelling cover letter that effectively highlights your qualifications and makes a positive impression on potential employers.

In conclusion, a well-crafted cover letter is an essential component of a successful job application for a mortgage underwriter position. By effectively highlighting your relevant skills, experience, and qualifications, you can set yourself apart from other candidates and demonstrate your potential value to prospective employers.

Throughout this article, we have provided several examples of cover letters for mortgage underwriters, each showcasing different approaches and strategies. From tailoring your letter to the specific job requirements to demonstrating your knowledge of the industry, these examples offer valuable insights into crafting a compelling cover letter.