Private Equity Case Study: Example, Prompts, & Presentation

Private equity case studies are an important part of the private equity recruiting process because they allow firms to evaluate a candidate’s analytical, investing, and presentation abilities.

In this article, we’ll look at the various types of private equity case studies and offer advice on how to prepare for them.

This guide will help you ace your next private equity case study, whether you’re a seasoned analyst or new to the field.

Types Of Private Equity Case Studies

Case studies are very common in private equity interviews, and they are a key part of the overall recruiting process.

While you’re extremely likely to encounter a case study of some kind during your recruiting process, there is considerable variety in the types of case studies you might face.

Below I cover the major types:

Take-home assignment

In-person lbo modeling assignment.

For this case study, you’ll get some company information (e.g. a 10-K or a CIM) and be asked to assess whether or not you’re likely to invest.

Generally, you’ll get between 2-7 days to prepare a full presentation or investment memo with your recommendations that you’ll present to the interviewer. To support your investment recommendation, you’ll be expected to complete a full LBO model . The prompt may give certain details or assumptions to include in the model.

This type of test is most common during “off-cycle” hiring throughout the year, since firms have more time to allow you to complete the assignment.

This is pretty similar to the take-home assignment. You’re given company materials, will build a financial model, and decide whether you would invest.

The difference here is the time you’re given to complete the case. You’ll generally get between two to three hours, and you’ll typically complete the case study in the firm’s office, though some firms are becoming newly open to completing the assignment remotely.

In this case, you’ll typically only complete an LBO model. There is usually no presentation or investment memo. Rather, you’ll do the model and then have a short discussion afterward.

This is a shorter, more condensed version of an LBO model. You can complete a paper LBO with a piece of paper and a pen. Alternatively, you may be asked to discuss it verbally with the interviewer.

Rather than using an Excel spreadsheet, you use an actual sheet of paper to show your calculations. You don’t go into all the detail but focus on the essence of the model instead.

In this article, we’ll be focusing on the first two types of case studies because they are the most widely used. But if you’re interested, here is a deep dive on Paper LBOs .

Private Equity Case Study Prompt

Regardless of the type of case study you’re asked to do, the prompt from the interviewer will ultimately ask you to answer: “would you invest in this company?”

To answer this question you’ll need to take on the provided materials about the company and complete a leveraged buyout model to determine whether there is a high enough return. Generally, this is 20% or higher.

Usually, prompts also provide you with certain assumptions that you can use to build your LBO model. For example:

- Pro forma capital structure

- Financial assumptions

- Acquisition and exit multiples

Some private equity firms provide you with the Excel template needed for an LBO model, while others prefer you to make one from scratch. So be ready to do that.

Private Equity Case Study Presentation

As you’ve seen above, if you get a take-home assignment as a case study, there’s a good chance you’re going to have to present your investment memo in the interview.

There will usually be one or two people from the firm present for your presentation.

Each PE firm has a different interview process, some may expect you to present first and then ask questions, or the other way around. Either way, be prepared for questions. The questions are where you can stand out!

While private equity recruitment is there to assess your skills, it’s not all about your findings or what your model says. The interviewers are also looking at your communication skills and whether you have strong attention to detail.

Remember, in the private equity interview process, no detail is too small. So, the more you provide, the better.

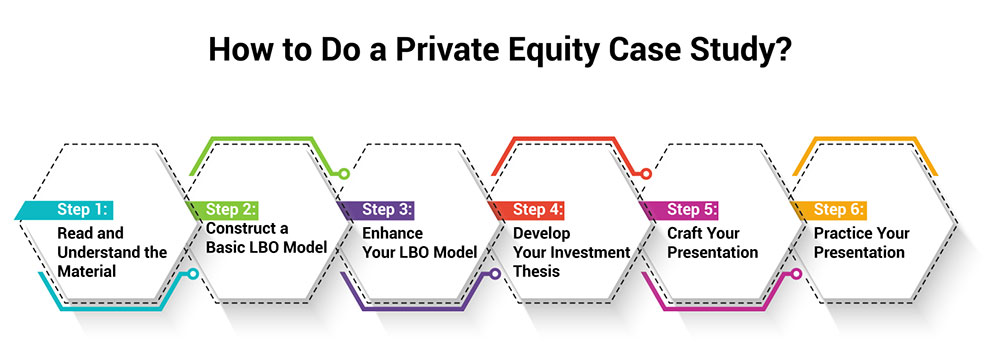

How To Do A Private Equity Case Study

Let’s look at the step-by-step process of completing a case study for the private equity recruitment process:

- Step 1: Read and digest the material you’ve been given. Read through the materials extensively and get an understanding of the company.

- Step 2: Build a basic LBO model. I recommend using the ASBICIR method (Assumptions, Sources & Uses, Balance Sheet, Income Statement, Cash Flow Statement, Interest Expense, and Returns). You can follow these steps to build any model.

- Step 3: Build advanced LBO model features, if the prompts call for it, you can jump to any advanced features. Of course, you want to get through the entire model, but your number 1 priority is to finish the core financial model. If you’re running out of time, I would skip or reduce time on advanced features.

- Step 4: Take a step back and form your “investment view”. I would try to answer these questions:

- What assumptions need to be present for this to be a good deal?

- Under what circumstances would you do the deal?

- What is the biggest risk in the deal? (e.g. valuation, growth, and margins).

- What is the biggest driver of returns in the deal? (e.g. valuation, growth, and debt paydown).

- 12+ video hours

- Excels & templates

PREMIUM COURSE

Become a Private Equity Investor

How To Succeed In A Private Equity Case Study

Here are a few of my tips for getting through the private equity fund case study successfully.

Get the basics down first

It’s very easy to want to jump into the more complex things first. If you go in and they start asking you to complete complex LBO modeling features like PIK preferred equity, getting to that might be on the top of your list.

But I recommend taking a step back and starting with the fundamentals. Get that out the way before moving on to the complicated stuff.

The fundamentals ground you, getting you through the things you know you can do easily. It also gives you time to really think about those complex ideas.

Show nuanced investment judgment; don’t be too black-and-white

When giving your investment recommendation for a private equity fund you shouldn’t be giving a simple yes or no.

It’s boring and gives you no space to elaborate. Instead, go in with what price would make you interested in investing and why. Don’t be shy to dig in here.

Know where there is a value-creation opportunity in the deal, and mention the key assumptions you need to believe to create that value.

Additionally, if you are recommending that the investment move forward then bring up things you would want to know before closing a deal. You can highlight the key risks of the investment, or key things you’d want to ask management if you could meet with them.

At the end of the day, financial modeling is a commodity skill. Every investor can do it. What will really set you apart is how you think about the deals, and the nuance you bring to analyzing them.

You win by talking about the model

Along those lines, you don’t win by building the best model. Modeling is just a check-the-box thing in the interview process to show you can do it. The interviewers need to know you can do the basics with no glaring errors.

What matters is showing that you can discuss the investment intelligently. It’s about bringing a sensible recommendation to the table with the information to back it up.

How Do I Prepare For A Private Equity Case Study?

There is no one-size-fits-all when it comes to preparing for a private equity case study. Everyone is different.

However, the best thing you can do is PRACTICE, PRACTICE, and more PRACTICE!

I know of a recent client that successfully obtained an offer from multiple mega funds . She practiced until she was able to build 10 LBO models from scratch without any errors or help … yes, that’s 10 models!

Now, whether it takes 5 or 20 practice case studies doesn’t matter. The whole point is to get to a stage where you feel confident enough to do an LBO model quickly while under pressure.

There is no way around the pressure in a private equity interview. The heat will be on. So, you need to prepare yourself for that. You need to feel confident in yourself and your capabilities.

You’d be surprised how pressure can leave you stumped for an answer to a question that you definitely know.

It’s also a good idea to think about the types of questions the private equity interviewer might ask you about your investment proposal. Prepare your answers as far as possible. It’s important that you stick to your guns too when the situation calls for it, because interviewers may push back on your answers to see how you react..

You need to have your answer to “would you invest in this company?” ready, and also how you got to that answer (and what new information might change your mind).

Another thing that gets a lot of people is limited time. If you’re running out of time, double down on the fundamentals or the core part of the model. Make sure you nail those. Also, you can make “reasonable” assumptions if there’s information you wish you had, but don’t have access to. Just make sure to flag it to your interviewer

How important is modeling in a private equity case study?

Modeling is part and parcel of private equity case studies. Your basics need to be correct and there should be no obvious mistakes. That’s why practicing is so important. You want to focus on the presentation, but your calculations need to be correct first. They do, after all, make up your final decision.

How can I stand out from other candidates?

Knowing your stuff covers the basics. To stand out, you need to be an expert in showing how you came to a decision, a stickler for details, and inquisitive. Anyone can do the calculations with practice, but someone who thinks clearly and brings nuance to their discussion of the investment will thrive in interviews.

Private equity case studies are a difficult but necessary part of the private equity recruiting process . Candidates can demonstrate their analytical abilities and impress potential employers by understanding the various types of case studies and how to approach them.

Success in private equity case studies necessitates both technical and soft skills, from analyzing financial statements to discussing the investment case with your interviewer.

Anyone can ace their next private equity case study and land their dream job in the private equity industry with the right preparation and mindset. If you’re looking to learn more about private equity, you can read my recommended Private Equity Books.

- Articles in Guide

- More Guides

DIVE DEEPER

The #1 online course for growth investing interviews.

- Step-by-step video lessons

- Self-paced with immediate access

- Case studies with Excel examples

- Taught by industry expert

Get My Best Tips on Growth Equity Recruiting

Just great content, no spam ever, unsubscribe at any time

Copyright © Growth Equity Interview Guide 2023

HQ in San Francisco, CA

Phone: +1 (415) 236-3974

Growth Equity Industry & Career Primer

Growth Equity Interview Prep

How To Get Into Private Equity

Private Equity Industry Primer

Growth Equity Case Studies

SaaS Metrics Deep Dive

Investment Banking Industry Primer

How To Get Into Investment Banking

How To Get Into Venture Capital

Books for Finance & Startup Careers

Growth Equity Jobs & Internships

Mike Hinckley

Growth stage expertise.

Coached and assisted hundreds of candidates recruiting for growth equity & VC

with Mike Hinckley

Premium online course

- Private equity recruiting plan

- LBO modeling & financial diligence

- Interview case studies

Register for Waitlist

FREE RESOURCES

Get My Best Growth Equity Interview Tips

No spam ever, unsubscribe anytime

Username or Email Address

Remember Me

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

Private Equity Interviews 101: How to Win Offers

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Private equity interviews can be challenging, but for most candidates, winning interviews is much tougher than succeeding in those interviews.

You do not need to be a math genius or a gifted speaker; you just need to understand the recruiting process and basic arithmetic.

Still, there is more to PE interviews than “2 + 2 = 4,” so let’s take a detailed look at the process:

How to Network and Win Private Equity Interviews

The Private Equity recruiting process differs dramatically depending on your current job and location.

Here are the two extremes:

- Investment Banking Analyst at a Bulge Bracket or Elite Boutique in New York: The process will be highly structured, and interviews will finish at warp speed. In some ways, your bank, group, and academic background matter more than your skill set or deal experience. This one is known as the “on-cycle” process.

- Non-Banker in Another Part of the U.S. or World: The process will be far less structured, it may extend over many months, and your skill set and deal/client experience will matter a lot more. This one is known as the “off-cycle” process.

If you’re in between these categories, the process will also be in between these extremes.

For example, if you’re at a smaller bank in NY, you may complete some on-cycle interviews, but you will almost certainly also go through the off-cycle process at smaller firms.

If you’re in London, there will also be a mix of on-cycle and off-cycle processes, but they tend to start later and move more slowly than the ones in NY.

We have covered PE recruiting previously ( overall process and what to expect in the on-cycle process ), so I am not going to repeat everything here.

Interviews in both on-cycle and off-cycle processes test similar topics , but the importance of each topic varies.

The timing of interviews and start dates, assuming you win offers, also differs.

The Overall Private Equity Interview Process

Regardless of whether you recruit in on-cycle or off-cycle processes, or a combination of both, almost all PE interviews have the following characteristics in common:

- Multiple Rounds: You’ll almost always go through at least 2-3 rounds of interviews (and sometimes many more!) where you speak with junior to senior professionals at the firm.

- Topics Tested: You’ll have to answer fit/background questions, technical questions, deal/client experience questions, questions about the firm’s strategies and portfolio, market/industry questions, and complete case studies and modeling tests.

The differences are as follows:

- Timing and Time Frame: If you’re at a BB/EB bank in NY, and you interview with mega-funds, the process starts and finishes within several months of your start date at the bank (!), and it moves up earlier each year. Interviews at the largest firms start and finish in 24-48 hours, with upper-middle-market and middle-market firms beginning after that.

By contrast, interviews start later at smaller PE firms, and the entire process may last for several weeks up to several months.

- Importance of Topics Tested: At large funds and in the on-cycle process, you need to complete modeling tests quickly and accurately and spin your pitches and early-stage deals into sounding like real deals; at smaller funds and in off-cycle interviews, the reasoning behind your case studies/modeling tests and your real experience with clients and deals matter more.

Firm-specific knowledge and fitting your investment recommendations to the firm’s strategies are also more important.

- Start Date: You interview far in advance if you complete the on-cycle process, and if you win an offer, you might start 1.5 – 2.0 years later. With the off-cycle process, you start right away or soon after you win the offer.

Private Equity Interview Topics

There is not necessarily a correlation between the stage of interviews and the topics that will come up.

You could easily get technical questions early on, and you’ll receive fit/background and deal experience questions throughout the process.

Case studies and modeling tests tend to come up later in the process because PE firms don’t want to spend time administering them until you’ve proven yourself in previous rounds.

However, there are exceptions even to that rule: For example, many funds in London start the process with modeling tests because there’s no point interviewing if you can’t model.

Here’s what to expect on each major topic:

Fit/Background Questions: “Why Private Equity?”

The usual questions about “ Why private equity ,” your story , your strengths/weaknesses , and ability to work in a team will come up, and you need answers for them.

We have covered these in previous articles, so I’ve linked to them above rather than repeating the tips here.

Since on-cycle recruiting takes place at warp speed, you’ll have to draw on your internship experience to come up with stories for these questions, and you’ll have to act as if PE was your goal all along.

By contrast, if you’re interviewing for off-cycle roles, you can use more of your current work experience to answer these questions.

While these questions will always come up, they tend to be less important than in IB interviews because:

- In on-cycle processes, it’s tough to differentiate yourself – everyone else also did multiple finance internships and just started their IB roles.

- They care more about your deal experience, whether real or exaggerated, in both types of interviews.

Technical Questions For PE

The topics here are similar to the ones in IB interviews: Accounting, equity value and enterprise value , valuation/DCF, merger models, and LBO models.

If you’re in banking, you should know these topics like the back of your hand.

And if you’re not in banking, you need to learn these topics ASAP because firms will not be forgiving.

There are a few differences compared with banking interviews:

- Technical questions tend to be framed in the context of your deal experience – instead of asking generic questions about the WACC formula , they might ask how you calculated it in one specific deal.

- More critical thinking is required. Instead of asking you to walk through the financial statements when Depreciation changes, they might describe companies with different business models and ask how the financial statements and valuation would differ.

- They focus more on LBO models, quick IRR math , and your ability to judge deals quickly.

Most interviewers use technical questions to weed out candidates , so poor technical knowledge will hurt your chances, but exceptional knowledge won’t necessarily get you an offer.

Talking About Deal/Client Experience

This category is huge, and it presents different challenges depending on your background.

If you’re an Analyst at a large bank in New York, and you’re going through on-cycle recruiting, the key challenge will be spinning your pitches and early-stage deals into sounding like actual deals.

If you’re at a smaller bank, and you’re going through off-cycle recruiting, the key challenge will be demonstrating your ability to lead, manage, and close deals .

And if you’re not in investment banking, the key challenge will be spinning your experience into sounding like IB-style deals.

Regardless of your category, you’ll need to know the numbers for each deal or project you present, and you’ll need a strong “investor’s view” of each one.

That’s quite a bit to memorize, so you should plan to present, at most, 2-3 deals or projects.

You can create an outline for each one with these points:

- The company’s industry, approximate revenue/EBITDA, and multiples (or, for non-deals, estimated costs and benefits).

- Whether or not you would invest in the company’s equity/debt or acquire it (or, for non-deals, whether or not you’d pursue the project).

- The qualitative and quantitative factors that support your view.

- The key risk factors and how you might mitigate them.

If you just started working, pick 1-2 of your pitches and pretend that they have progressed beyond pitches into early-stage deals.

Use Capital IQ or Internet research to generate potential buyers or investors, and use the company-provided pitch materials to come up with your projections for the potential stumbling blocks in the transaction.

For your investment recommendation, imagine that each deal is a potential LBO, and build a quick, simple model to determine the rough numbers, such as the IRR in the baseline and downside cases.

For the risk factors, reverse each model assumption (such as the company’s revenue growth and margins) and explain why your numbers might be wrong.

If you’re in the second or third categories above – you need to show evidence of managing/closing deals or evidence of working on IB-style deals – you should still follow these steps.

But you need to highlight your unique contributions to each deal, such as a mistake you found, a suggestion you made that helped move the financing forward, or a buyer you thought of that ended up making an offer for the seller.

If you’re coming in with non-IB experience, such as internal consulting , still use the same framework but point out how each project you worked on was like a deal.

You had to win buy-in from different parties, get information from groups at the company, and justify your proposals by pointing to the numbers and qualitative factors and addressing the risk factors.

Firm Knowledge

Understanding the firm’s investment strategies, portfolio, and exits is very important at smaller firms and in off-cycle processes, and less important in on-cycle interviews at mega-funds.

If you have Capital IQ access, use it to look up the firm.

If not, go to the firm’s website and do extensive Google searches to find the information.

Finding this information should not be difficult, but the tricky point is that firms won’t necessarily evaluate your knowledge by directly asking about it.

Instead, if they give you a take-home case study, they might judge your responses based on how well your investment thesis lines up with theirs.

For example, if the firm makes offline retailers more efficient via cost cuts and store divestitures, you should not present an investment thesis based on overseas expansion or roll-ups of smaller stores.

If they ask for an investor’s view of one of your deals, they might judge your answer based on your ability to frame the deal from their point of view.

For example, if the firm completes roll-ups in fragmented industries, you should not look at a standard M&A deal you worked on and say that you’d acquire the company because the IRR is between XX% and YY% in all scenarios.

Instead, you should point out that with several roll-ups, the IRR would be between XX% and YY%, and even in a downside case without these roll-ups, the IRR would still be at least ZZ%, so you’d pursue the deal.

Market/Industry

In theory, private equity firms should care about your ability to find promising markets or industries.

In practice, open-ended questions such as “Which industry would you invest in?” are unlikely to come up in traditional PE interviews.

If they do come up, they’ll be in response to your deal discussions, and the interviewer will ask you to explain the upsides and downsides of your company’s industry.

These questions are more likely in growth equity and venture capital interviews, so you shouldn’t spend too much time on them if your goal is traditional PE (for more on these fields, see our coverage of venture capital interview questions and the venture capital case study ).

And even if you are interviewing for growth equity or VC roles, you can save time by linking your industry recommendations to your deal experience.

Case Studies and Modeling Tests

You will almost always have to complete a case study or modeling test in PE interviews, but the types of tests span a wide range.

Here are the six most common ones, ranked by rough frequency:

Type #1: “Mental” Paper LBO

This one is closer to an extended technical question than a traditional case study.

To answer these questions, you need to know how to approximate IRR, and you need practice doing the mental math.

The interviewer might ask something like, “A PE firm acquires a $150 EBITDA company for a 10x multiple using 60% Debt. The company’s EBITDA increases to $200 by Year 3, $225 by Year 4, and $250 by Year 5, and it pays off all its Debt by Year 3.

The PE firm sells its stake evenly over Years 3 – 5 at a 10x EBITDA multiple. What’s the approximate IRR?”

Here, the Purchase Enterprise Value is $1.5 billion, and the PE firm contributes 40% * $1.5 billion = $600 million of Investor Equity.

The “average” amount of proceeds is $225 * 10 = $2,250, and the “average” Exit Year is Year 4 (no need to do the full math – think about the numbers – and all the Debt is gone).

So, the PE firm earns $2,250 / $600 = 3.75x over 4 years. Earning 3x in 3 years is a ~45% IRR, so we’d expect the IRR of a 3.75x multiple in 4 years to be a bit less than that.

To approximate a 4x scenario, we could take 300%, divide by 4 years, and multiply by ~55% to account for compounding.

That’s ~41%, and the actual IRR should be a bit lower because it’s a 3.75x multiple rather than a 4.00x multiple.

In Excel, the IRR is just under 40%.

Type #2: Written Paper LBO

The idea is similar, but the numbers are more involved because you can write them down, and you might have 30 minutes to come up with an answer.

You can get a full example of a paper LBO test, including the detailed solutions, here .

You can also check out our simple LBO model tutorial to understand the ropes.

With these case studies, you need to start with the end in mind (i.e., what multiple do you need for an IRR of XX%) and round heavily so you can do the math.

Type #3: 1-3-Hour On-Site or Emailed LBO Model

These case studies are the most common in on-cycle interviews because PE firms want to finish quickly.

And the best way to do that is to give all the candidates the same partially-completed template and ask them to finish it.

You may have to build the model from scratch, but it’s not that likely because doing so defeats the purpose of this test: efficiency.

You’ll almost always receive several pages of instructions and an Excel file, and you’ll have to answer a few questions at the end.

The complexity varies; if it’s a 1-hour test, you probably won’t even build a full 3-statement model .

They might also ask you to use a cash-free debt-free basis or a working capital adjustment to tweak the Sources & Uses slightly.

If it is a 3-hour test, a 3-statement model is more likely (the other parts of the model will be simpler in this case).

Here’s a free example of a timed LBO modeling test ; we have many other examples in the IB Interview Guide and Core Financial Modeling course .

IB Interview Guide

Land investment banking offers with 578+ pages of detailed tutorials, templates and sample answers, quizzes, and 17 Excel-based case studies.

Type #4: Take-Home LBO Model and Presentation

These case studies are open-ended, and in most cases, you will not get a template to complete.

The most common prompts are:

- Build a model and make an investment recommendation for Portfolio Company X, Former Portfolio Company Y, or Potential Portfolio Company Z.

- Pick any company you’re interested in, build a model, and make an investment recommendation.

With these case studies, you must fit your recommendation to the firm’s strategy rather than building a needlessly complex model.

You might have 3-7 days to complete this type of case study and present your findings.

You might be tempted to use that time to build a complex LBO model, but that’s a mistake for three reasons:

- The smaller firms that give open-ended case studies tend not to use that much financial engineering.

- No one will have time to review or appreciate your work.

- Your time would be better spent on industry research and coming up with a sold investment thesis, risk factors, and mitigants.

If you want an example of an open-ended exam like this, see our private equity case study article and follow the video walkthrough or article text.

Your model could be shorter, and your presentation could certainly be shorter, but this is a good example of what to target if you have more time/resources.

Type #5: 3-Statement/Growth Equity Model

At operationally-focused PE firms, growth equity firms, and PE firms in emerging markets such as Brazil , 3-statement projection modeling tests are more common.

The Atlassian case study is a good example of this one, but I would change a few parts of it (we ignored Equity Value vs. Enterprise Value for simplicity, but that was a poor decision).

Also, you’ll never have to answer as many detailed questions as we did in that example.

If you think about it, a 3-statement model is just an LBO model without debt repayment – and the returns are based on multiple expansion, EBITDA growth, and cash generation rather than debt paydown .

You can easily practice these case studies by picking companies you’re interested in, downloading their statements, projecting them, and calculating the IRR and multiples.

Type #6: Consulting-Style Case Study

Finally, at some operationally-focused PE firms, you could also get management consulting-style case studies, where the goal is to advise a company on an expansion strategy, a cost-cutting initiative, or pricing for a new product.

We do not teach this type of case study, so check out consulting-related sites for examples and exercises.

And keep in mind that this one is only relevant at certain types of firms; you’re highly unlikely to receive a consulting-style case study in standard PE interviews.

A Final Word On Case Studies

I’ve devoted a lot of space to case studies, but they are not as important as you might think.

In on-cycle processes, they tend to be a “check the checkbox” item: Interviewers use them to verify that you can model, but you won’t stand out by using fancy Excel tricks.

Arguably, they matter more in off-cycle interviews since you can present unique ideas more easily and demonstrate your communication skills in the process .

What NOT to Worry About In PE Interviews

The topics above may seem overwhelming, so it’s worth pointing out what you do not need to know for interviews.

First, skip super-complex models.

As a specific example, the LBO models on Macabacus are overkill; they’re way too complicated for interviews or even the job itself.

You should aim for Excel files with 100-300 rows, not 1,000+ rows, and skip points like circular references unless they specifically ask for them (for more, see our tutorial on how to remove circular references in Excel )

Next, skip brain teasers; if an interviewer asks them, you should drop discussions with the firm.

Finally, you don’t need to know about the history of the private equity industry or much about PE fund economics beyond the basics.

Your time is better spent learning about a firm’s specific strategy and portfolio.

PE Interview X-Factor(s)

Besides the topics above, competitive tension can make a huge difference in interviews.

If you tell Firm X that you’ve already received an offer from Firm Y, Firm X will immediately become far more likely to give you an offer as well.

Even at the networking stage, competitive tension helps because you always want to tell recruiters that you’re also speaking with Similar Firms A, B, and C.

Also, leverage your group alumni and the 2 nd and 3 rd -year Analysts.

You can read endless articles online about interview prep, but nothing beats real-life conversations with others who have been through the process.

These alumni and older Analysts will also have example case studies they completed, and they can explain how to spin your deal experience effectively.

PE Interview Preparation

The #1 mistake in PE interviews is to focus excessively on modeling tests and technical questions and neglect your deal discussions.

You can avoid this, or at least resist the temptation, by turning your deals into case studies.

If you follow my advice to create simplified LBO models for your deals, you can combine the two topics and get modeling practice while you’re preparing your “investor’s views.”

If you’re working full-time in banking, use your downtime in between tasks to do this , outline your story , and review technical questions.

If you only have 10-15-minute intervals of downtime, break case studies into smaller chunks and aim to finish a specific part in each period.

Finally, start preparing before your full-time job begins .

You’ll have far more time before you start working, and you should use that time to tip the odds in your favor.

The Ugly Truth About PE Interviews

You can read articles like this one, memorize PE interview guides, and get help from dozens of bank/group alumni, but much of the process is still outside of your control.

For example, if you’re in a group like ECM or DCM , it will be tough to win on-cycle interviews at large firms and convert them into offers no matter what you do.

If the mega-funds decide to kick off recruiting one day after you start your full-time job in August, and you’re not prepared, too bad.

If you went to a non-target school and earned a 3.5 GPA, you’ll be at a disadvantage next to candidates from Princeton with 3.9 GPAs no matter what you do.

So, start early and prepare as much as you can… but if you don’t receive an offer, don’t assume it’s because you made a major mistake.

So You Get An Offer: What Next?

If you do receive an offer, you could accept it on the spot, or, if you’re speaking with other firms, you could shop it around and use it to win offers elsewhere.

If you’re not in active discussions with other firms, you’re crazy if you do not accept the offer right away.

If You Get No Offer: What Next?

If you don’t get an offer, follow up with your interviewers, ask for feedback, and ask for referrals to other firms that might be hiring.

If you did reasonably well but came up short in a few areas, you could easily get referrals elsewhere .

If you did not receive an offer because of something that you cannot fix, such as your undergraduate GPA or your previous work experience, you might have to consider other options, such as a Master’s, MBA, or another job first.

But if it was something fixable, you could take another pass at recruiting or keep networking with smaller firms.

To PE Or Not to PE?

That is the question.

And the answer is that if you have the right background, you understand the process, and you start preparing far in advance, you can get into the industry and win a private equity career .

And if not, there are other options, even if you’re an older candidate .

You may not reach the promised land, but at least you can blame it on someone else.

Additional Reading

You might be interested in:

- The Search Fund Internship: Perfect Pathway into Investment Banking and Private Equity Roles?

- Private Equity Analyst Roles: The Best Way to Skip Investment Banking?

- On-Cycle Private Equity Recruiting : Will PE Firms Start Recruiting 10-Year-Old Children Soon?

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

49 thoughts on “ Private Equity Interviews 101: How to Win Offers ”

Brian, What about personality tests? What is their importance in the overall hiring process eg if you get them as the last stage?

They’re not that important, and even if you do get them, you can’t really “prepare” in any reasonable way (barring a brain transplant to replace your personality and make it more suitable for the firm). It’s also highly unusual to get one in the final stage – a firm doing that is probably just paranoid that you are secretly a serial killer and they want to rule out that possibility.

Hey- for the Fromageries Bel case study, can’t quite make sense of the Tier 4 management incentive returns, what’s the calculation for each tier? Would think it’s Tier 2 less tier 1 * tier 1 marginal profit

Tier 4 is based on a percentage of all profits *above* a 2.5x equity multiple. Each tier below it is based on a percentage of profits between specific multiples, which correspond to specific EUR proceeds amounts.

I have an accounting background (CPA & several years removed from school) and a small amount of finance experience through internships. I’m interviewing for a PE analyst position and managed to get through the first round of interviews. The firm itself doesnt just hire guys with a few years of banking, their team is very diverse with some backgrounds similar to mine.

The first round interview was a mix of technical questions plus a lot about myself and my experience. No behavioral questions. The first round was with an associate for 30 minutes, the second round is an hour with a partner. I managed to answer a lot of the questions about LBO models and what types of companies are good LBO candidates. Thanks to your website for that.

Any advice for a second round interview for a guy like me who doesnt have deal making experience or much experience in finance? Will the subsequent interviews after the first round be more technical-based questions? Or do they lean more on technical questions in round 1 to weed out candidates?

They will usually become more fit-based if they’ve already asked a lot of technical questions in earlier rounds. I would focus on your story and answers to the Why PE / Why This Firm / Are you sure you want to switch?-type questions.

Is it likely too difficult to access the on-cycle process from the CLT office of an In-Between-a-Bank that it would make more sense to focus one’s energy on the MM/LMM? Is the new era of Zoom making geography/distance less of a factor or is the perceived prestige of NY still an obstacle?

Location is somewhat less of a factor now, but it still matters, and working from home will not continue indefinitely into the future. It will be very difficult to participate in on-cycle recruiting at the mega-funds if you’re working in Charlotte at Wells Fargo if that’s your question, but plenty of MM funds are realistic.

What are some of the larger funds that you would consider realistic?

There are dozens of funds out there (it’s not like bulge bracket banks or mega-fund PE firms where there’s only a defined set of 5-10), so I can’t really give you a specific answer. My recommendation would be to look up people who worked at WF on LinkedIn and see the types of funds they are now working at.

I remember I saw a video of yours (might have been YouTube) where you explained the PE process. You talked about do pe firms really add value and then you went over how when a pe firm buys a company, they do a little “trick” where they create a shell company to acquire the target so the debt isn’t on the pe firms books. I’ve been looking all over for this video. Do you know which video I’m referring to?

Yes, that is no longer in video form. It’s still in the written LBO guide but the video from the old course was removed because it was way too long and boring for a video and was better explained in text.

Hi Brian, can you elaborate more on ‘Understanding the firm’s investment strategies, portfolio, and exits’ when you talk about smaller firm and off-cycle processes, simliar point came up under *Type 5*: you must fit your recommendation to the firm’s strategy rather than building a needlessly complex model. What exactly should I pay attention on? I felt funds I checked their investment strategy descirption are pretty broad, and they invest in various type of deals, say even in one industry, they do different purchase range. Also, when talking about growth equity, you mentioned you can practice case by picking companies you’re interested in, downloading their statements, projecting them. What if they are not public companies, how can I get those information? Are you recommending only those companies with 20F available? Or can you just elaborate more on how can I follow your instruction? Thanks

All you can do is go off their website and possibly a Capital IQ description if you have access. See if they focus on growth, leverage for mature companies, operational improvements, or add-on acquisitions and pick something that fits one of those.

You can pick public companies for growth equity or find a public company that is similar to a private one the firm has.

Hey Brian! I have an interview with a family office for a private equity analyst position. The firm is small and not much about it online. I haven’t had much time to prepare as it was not an interview I was expecting. What would you say the most important elements to focus on are for the interview considering the time constraint? I am an undergrad, third year, second internship. (first internship was for a large construction/developer as project coordinator, not finance based)

Focus on your story, the firm’s portfolio companies and strategies, and a few investment ideas you have for specific sectors. Technical questions are fine, but you probably won’t have much time to prepare at the last minute.

How would PE interviews / Technical questions look like for straight out of undergrad PE role look like

e.g Blackstone internships, Goldman Merchant Banking internships etc

Similar to IB ones, with a focus on LBOs?

Largely the same, but less emphasis on deal experience and deal-related questions at the undergraduate level. They may ask slightly more questions on LBOs, but at the undergrad level, they assume you know very little, so questions will span a wide range of topics.

Have you written or seen similar articles on PE operating partner interviews?

No, sorry. There’s hardly any information on that level of interview online because you can’t really make an interview guide or other product to prepare for it, and most people at that level would need 1-on-1 coaching more than a guide. My guess is that they will focus almost exclusively on your past experience turning around and growing businesses and assess how well you can do it for their portfolio companies. They’re not going to give you LBO modeling tests or case studies.

“Next, skip brain teasers; if an interviewer asks them, you should drop discussions with the firm”

Could you please elaborate on this? Almost every IB interview includes brain teasers so I am wondering why a PE interview shouldn’t?

Brain teasers are not that common in IB interviews in most regions unless you count any math/accounting/finance question as a brain teaser. They are far more common in S&T, quant fund, and prop trading interviews.

The point of this statement is that it’s OK if an occasional brain teaser comes up, but if the interviewer asks you brain teasers for 30 minutes, which have exactly 0% correlation to the real work in PE, you should leave because it’s a sign that the people working at the firm are idiots who don’t know how to conduct proper interviews or test candidates.

This is helpful. I find myself at a fix, I do not think I have had the right exposure, although in a BB I support teams with standard materials in a particular industry group in M&A. However I have interviews with a top global PE next month. Any guidance on how should I prepare for it ?

Thanks in advance

Follow everything in this article… practice spinning/discussing your deals… practice LBO questions and simple case studies.

Brian – thank you for your concise and candid remarks. do you have any insights or advice for someone with 5yrs of BB ECM & DCM experience now at a top full-time MBA program looking to break in?

It’s going to be very difficult if you just have capital markets experience and you’re already in business school. You should probably move to an M&A or strong industry team at a large bank (BB or EB) after business school and then go into private equity from there. It’s tough, but still easier than trying to move into PE directly out of an MBA program with only capital markets experience.

My next interview will highly likely involve a statement/growth equity modeling case. I tried to find the Atlassian Case interview but i am unable to open the link.

Would it be possible to share an example case or more information on that topic?

Many thanks,

The Atlassian case study is all we have. I don’t know why you can’t open the files, but I just tried and they seemed to work. Maybe try again or use a different browser.

Hi M&I team,

I have an opportunity to interview for an Analyst level opening at a boutique PE fund. This is a shop that has just started operations so I am directly communicating with the Partner. I doubt they have any structured recruitment process at this stage of their existence. He asked me to send some written work (memos and spreadsheets) on any public listed co that demonstrates my understanding of investing (basic balance sheet analysis, ratio analysis, valuation multiples).

So I am just wondering what to do? Should I work on projections and prepare a DCF model or do something simpler? I’d really appreciate your guidance on this.

Thanks again for the amazing work you’ll have been doing!

Yes, just create simple projections, a simple valuation/DCF, and maybe a simple LBO model since it is a PE fund that intends to buy and sell companies.

Could you provide some advice for preparing interviews for principal investing role ?

Thank you in advance Laura

We don’t really focus on that, but the articles on private equity and funds of funds on this site might be helpful.

Just wanted to say thank you! After reading everything on this site including all the CV and interview material I have managed to transition from a second year engineering undergrad with no prior experience/spring weeks/insight days, into an intern at Aviva Investors (UK buy side) within the space of one year.

The information you have posted is invaluable and “breaking in” is definitely doable with the right mindset and appetite for rejections!

Thanks again.

Thanks! Congrats on your internship offer.

Hi Brian/Nicole – Im an Economics student from the UK in 3rd year out of a 4 year course at a semi-target college, with 2 finance internships done up until now(not FO). I plan on doing a Msc Finance when I finish and eventually break into IB or Sales/Trading (I know I still haven’t decided which one I really want more). Through a family friend I have an offer to do a short internship this summer in NY in a post-trade regulatory commission. As this isn’t actually sitting at a trading desk experience, or anything related to IB should I decide to go down that road, would this add genuine value to my CV ? How are internships in regulatory commissions looked at for students looking to break into sales/trading? Surely even having any NY Finance experience on the CV will add more substance over here in London when going for internships compared to the majority of UK students who don’t? Appreciate any advice on this matter, Thanks!

I don’t think it would help much because you already have 2 non-FO internships, and a regulatory internship would be yet another non-FO internship. If it’s your best option, you can take it, but you would be better off getting something closer to a real front-office role.

Hey Brian. I am graduating after this semester going into Management consulting (Deliote, AT Kearny, Accenture)but I’m hoping to make a switch into either IB or PE after a couple years. I have one search fund internship which was enough to get me a few 1st and second round ib/pe FT interviews but no offers.My plan is to get into the best online MSF program I can and switch into Finance once I’m done. Do you think, given how close I was to getting in my 1st try, a high GPA from a reputable MSF and good experience in consulting will be enough or should I try to somehow get an IB internship before I apply?

I think you will probably need another internship just before the MSF starts or while it is in progress, not necessarily in IB, but something closer to it. Otherwise you’ll get a lot of questions about why you went from the search fund to consulting.

Thanks. As far as my story is concerned, is it better to do another finance internship before consulting so it’s search fund->ib->consulting->MSF (or MBA not sure)? I only ask because I may be able to get on some m&a projects with the consulting firm and my story could be when exposed to those deals, I realized how big my passion for finance was and that’s when I decided to get my MSF and switch to IB.

No, I think that would make less sense because then you would have to explain why you went from IB to consulting… and are now trying to go back to IB. Saying that you got exposed to M&A deals during the consulting experience would be a better story (and you would still ideally pair it with a transaction-related internship before/during the MSF).

Got it, thanks!

Probably missing something here, but for the first example, where does the 300% and 55% come from?

300% = 4x multiple. If compounding did not exist, we could just say 300% / 4 = 75% annual return. Because of compounding, however, the actual return does not need to be 75% per year in order for us to earn 300% by the end of 4 years. Instead, it can be a fair amount less than that, and we’ll still end up with 300% at the end.

To estimate the impact of compounding, you can multiply this 300% / 4 figure by a “compounding factor,” which varies based on the multiple and time period, but which is around 55% for a 4x return over a standard holding period.

Do you mind explaining how you can estimate a “compounding factor” such as with the 55% here?

There’s no easy-to-calculate-using-mental-math way to get this for all scenarios, but you can memorize quick rules of thumb (based on actual numbers and looking at the ratios) for 3 and 5-year periods and extrapolate from there. I don’t really think it’s worth doing that in-depth, though, because you just have to be roughly correct with these answers.

Do you think you will do a hedge fund interview guide similar to the one you have here?

Potentially, yes, but it’s much harder to give general guidelines for HF interviews because they’re completely dependent on your investment pitches. Also, interest in HFs has declined over the years (we no longer receive as many questions about them).

On that mental paper LBO question, how is the company able to pay off 900 of debt by year 3? It sounds like proceeds from the sale will have to be used in order to fully pay off the debt because EBITDA alone only adds up to 525, and that’s assuming there’s no interest.

Favorable working capital… NOLs… asset sales… the Konami code or other cheat codes. The point is not the numbers but the thought process.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Ace Your Private Equity Interviews

Our Interview Guide has 120+ pages of LBO instruction, deal discussions, LBO practice tests, personal pitch templates, and more.

Faculty & Research

Private Equity in Action: Case Studies from Developed and Emerging Markets

Private Equity in Action takes you on a tour of the private equity investment world through a series of case studies written by INSEAD faculty and taught at the world's leading business schools. The book is an ideal complement to Mastering Private Equity and allows readers to apply core concepts to investment targets and portfolio companies in real-life settings. The 19 cases illustrate the managerial challenges and risk-reward dynamics common to private equity investment.

The case studies in this book cover the full spectrum of private equity strategies, including:

Carve-outs in the US semiconductor industry (LBO) Venture investing in the Indian wine industry (VC) Investing in SMEs in the Middle East Turnaround situations in both emerging and developed markets. Written with leading private equity firms and their advisors and rigorously tested in INSEAD's MBA, EMBA and executive education programmes, each case makes for a compelling read.

As one of the world's leading graduate business schools, INSEAD offers a global educational experience. The cases in this volume leverage its international reach, network and connections, particularly in emerging markets.

Claudia Zeisberger

Senior Affiliate Professor of Entrepreneurship and Family Enterprise

Our website has a lot of features which will not display correctly without Javascript.

Please enable Javascript in your browser

Here how you can do it: http://enable-javascript.com

- Education Requirement

- Experience Requirement

- Learning Resources

- CPEP™ Journey

- Register for CPEP™

- Examination

- Careers in Private Equity

Our commitment to fostering the growth of private equity professionals is reflected in the introduction of Private Equity Central, a virtual community that serves as your comprehensive resource and networking platform for success in this ever-evolving industry.

- myUSPEC

- Career in Private Equity

- Private Equity Central

- Help Center

Don't Have an Account?

Start your CPEP™ journey and manage your profile conveniently by creating your myUSPEC Account today.

Sign In to Your my USPEC Account

- Remember Password

- Forgot Password?

Create myUSPEC Account >

Reset Your Password

Please enter the Email ID you use to sign-in to your account:

Private Equity Case Study: Tips, Prompt & Presentation

Private equity case studies serve as a pivotal stage in recruitment. They offer firms a window to assess candidates' analytical, investing, and presentation skills. Understanding the nuances of these case studies can significantly enhance your preparation and success rate.

This comprehensive guide provides insights into the types of case studies, preparation strategies, and key aspects of presentation and analysis. Whether you're new to private equity or a seasoned professional, mastering these case studies is essential for succeeding in a competitive industry.

What Should You Expect in a Private Equity Case Study?

Private equity case studies are a critical component of the recruitment process, offering firms a valuable opportunity to assess candidates' analytical, investing, and presentation skills. Understanding what to expect in a private equity case study can significantly enhance your preparation and improve your chances of success.

What are the Types of Private Equity Case Studies?

Private equity case studies can take various forms, each presenting its unique set of challenges. Candidates can anticipate encountering one of the following formats.

- Candidates are provided with company information and tasked with evaluating the feasibility of an investment. This type of case study typically involves preparing a comprehensive presentation or investment memo, supported by a detailed LBO (leveraged buyout) model, within a specified timeframe.

- Candidates are granted several days to a week to research a company, develop a model, and formulate a recommendation for or against an acquisition. This type of case study necessitates critical thinking and external research.

- Similar to the take-home assignment, but completed on-site at the firm's office within a few hours. Candidates must construct a financial model and make an investment decision based on the provided information.

- A 1-3-hour test, either conducted on-site or remotely, where candidates must swiftly build an LBO model. Proficiency in Excel shortcuts and familiarity with modelling tests are crucial for success.

- A condensed version of an LBO model completed either on paper or verbally. This type of case study focuses on the fundamental aspects of the model and requires candidates to demonstrate their understanding without the use of Excel.

- Candidates construct a simple leveraged buyout model using pen-and-paper or mental calculations, estimating the internal rate of return (IRR) using rounded figures.

Preparation Strategies

To prepare effectively for a private equity case study, focus on developing your investment thesis, honing your presentation skills, and enhancing your ability to respond to questions thoughtfully. Remember, the complexity of your model is secondary to your capacity to construct a compelling argument for or against the investment.

How to Present a Private Equity Case Study?

Presenting a private equity case study requires a strategic and thorough approach to effectively convey your analysis and recommendations. Whether you're preparing for a take-home assignment or an in-person presentation, mastering the art of presentation is crucial for success in the private equity recruitment process.

The core question you'll encounter in any private equity case study is whether you would invest in the company under consideration. To answer this, you'll need to analyze the provided materials and construct a leveraged buyout (LBO) model to assess the potential return on investment. Typically, a return of 20% or higher is sought.

The case study prompt often includes specific assumptions to guide your LBO model construction, such as the pro forma capital structure, financial assumptions, and acquisition and exit multiples. Some firms may provide an Excel template for the LBO model, while others may expect you to create one from scratch.

Presentation

In a take-home assignment scenario, you'll likely be required to present your investment memo during the interview. This presentation is typically conducted in front of one or two representatives from the private equity firm.

The presentation format may vary among firms, with some expecting you to present first and then field questions, while others may prefer the reverse. Regardless of the format, be prepared to articulate your findings and respond to inquiries.

While technical proficiency is important in private equity recruitment, communication skills and attention to detail are equally critical. Interviewers will assess your ability to convey complex ideas clearly and concisely, as well as your meticulousness in addressing all aspects of the case study.

In the private equity interview process, every detail matters. Therefore, strive to provide a comprehensive and well-structured presentation, demonstrating your analytical rigour and ability to communicate effectively.

How to Do a Private Equity Case Study?

When tackling a private equity case study, a structured approach is crucial to deliver a comprehensive analysis and recommendations.

Step 1: Read and Understand the Material

Begin by thoroughly reading and understanding the provided materials. Gain insights into the company's background, industry dynamics, and financials.

Step 2: Construct a Basic LBO Model

Build a fundamental leveraged buyout (LBO) model using the ASBICIR method (Assumptions, Sources & Uses, Balance Sheet, Income Statement, Cash Flow Statement, Interest Expense, and Returns). This foundational model will underpin your analysis.

Step 3: Enhance Your LBO Model

Incorporate advanced features into your LBO model as required by the case study prompts. While it's essential to cover all aspects, prioritize completing the core financial model to ensure thoroughness.

Step 4: Develop Your Investment Thesis

Step back and formulate your investment view based on your analysis. Consider critical assumptions, conditions for proceeding with the investment, key risks, and primary drivers of returns.

Step 5: Craft Your Presentation

Organize your insights and analysis into a structured presentation. Clearly articulate your investment thesis, supporting analysis, and key findings.

Step 6: Practice Your Presentation

Rehearse your presentation to ensure clarity and confidence. Be prepared to engage in a discussion and defend your investment thesis.

Approaching a private equity case study with this methodical approach demonstrates your analytical prowess and strategic thinking.

How to Succeed in a Private Equity Case Study?

Succeeding in a private equity case study demands a strategic blend of analytical prowess, strategic acumen, and effective communication.

- Master the Fundamentals: Start by focusing on the foundational aspects of the case study before delving into the complexities. Build a solid understanding of financial modelling principles and investment analysis basics. This will provide you with a strong grounding to tackle more intricate tasks with confidence.

- Demonstrate Nuanced Investment Judgment: Avoid simplistic yes or no answers when presenting your investment recommendation. Instead, offer a nuanced analysis that considers the price point at which you would consider investing and the key assumptions driving your decision. Highlight potential avenues for value creation in the deal and discuss the primary risks and uncertainties involved.

- Engage in Meaningful Dialogue: While the ability to build complex financial models is important, what truly sets you apart is your capacity to think critically and engage in intelligent discussion about the investment. Focus on presenting a well-considered recommendation supported by solid reasoning and analysis. Be prepared to discuss your model and elaborate on your investment thesis clearly and concisely.

- Prioritize Substance Over Complexity: While showcasing your proficiency in financial modelling is essential, the goal is not to build the most intricate model. Concentrate on constructing a model that is accurate, logical, and well-structured. The true measure of success lies in your ability to derive meaningful insights from the model and utilize them to make informed investment decisions.

- Highlight Value-Creation Opportunities: In addition to identifying risks, emphasize the potential opportunities for value creation in the deal. Discuss how you would leverage these opportunities to enhance the company's performance and generate returns for investors.

By following these strategies, you can significantly enhance your prospects of success in a private equity case study. Demonstrating your ability to think critically, analyze investments, and communicate effectively will showcase your thought leadership and analytical prowess.

How Do I Prepare for a Private Equity Case Study?

Preparing for a private equity case study requires a structured approach and a solid understanding of the fundamentals of financial analysis and investment evaluation.

- Understand the Case Study Objective: Begin by understanding the objective of the case study, which is typically to evaluate the investment potential of a company. Familiarize yourself with the key concepts and methodologies used in private equity investing.

- Review Financial Modeling Basics: Brush up on your financial modelling skills, focusing on key concepts such as revenue forecasting, expense modelling, and valuation techniques. Practice building and analyzing financial models to prepare for the case study.

- Familiarize Yourself with LBO Modeling: Since leveraged buyout (LBO) modelling is a common aspect of private equity case studies, make sure you are comfortable with building LBO models. Understand the key components of an LBO model, such as debt structure, cash flow projections, and exit strategies.

- Practice Case Studies: Practice solving case studies to hone your analytical skills and improve your ability to think critically. Look for case studies online or create your own based on real-world scenarios to simulate the interview experience.

- Stay Updated on Industry Trends: Keep yourself informed about the latest trends and developments in the industries you are interested in. This will help you make informed assumptions and recommendations during the case study.

- Develop a Structured Approach: Develop a structured approach to solving case studies, including how you will analyze the company's financials, identify key risks and opportunities, and formulate your investment thesis.

- Seek Feedback: Seek feedback from mentors, peers, or professionals in the field to improve your case study skills. Consider participating in case study competitions or workshops to gain practical experience.

FAQs (Frequently Asked Questions)

1. How do you approach a private equity case study? Approach a private equity case study by understanding the objective, reviewing financial basics, practicing LBO modelling, staying updated on industry trends, and developing a structured analysis approach.

2. How can I stand out from other candidates? Stand out by demonstrating nuanced investment judgment, engaging in meaningful dialogue, prioritizing substance over complexity in modelling, and highlighting value-creation opportunities.

3. What is the role of modelling in a private equity case study? Modelling plays a crucial role in a private equity case study as it helps evaluate investment potential, assess risks, and determine the feasibility of an acquisition.

Most Popular

Brought to you by USPEC

Never miss an insight!

Keep reading valuable insights when you sign up for our newsletter.

Stay Updated!

Get the latest in Private Equity with USPEC Newsletter straight to your inbox.

This website uses cookies to enhance website functionalities and improve your online experience. By browsing this website, you agree to the use of cookies as outlined in our privacy policy .

Corporate governance and corporate social responsibility interface: a case study of private equity

- Corporate Governance

- University of Tartu

Abstract and Figures

Discover the world's research

- 25+ million members

- 160+ million publication pages

- 2.3+ billion citations

- Int J Organ Anal

- Hemant Manuj

- Suwarno Suwarno

- Firdaus Amyar

- M. John Foster

- DISCRETE DYN NAT SOC

- Hayder Dhahir Mohammed

- Neda Fallah

- Hakimeh Morabbi Heravi

- J Int Account Audit Taxat

- Victoria Krivogorsky

- Rocky J. Dwyer

- John Lessing

- David Morrison

- Maria Nicolae

- Yuexin Shao

- María Eugenia López-Pérez

- Gunnar Friede

- Int Rev Econ Finance

- Christo Ferreira

- Udomsak Wongchoti

- Corp Govern

- Daniëlle A. M. Melis

- Igor Filatotchev

- William H. Meckling

- Recruit researchers

- Join for free

- Login Email Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google Welcome back! Please log in. Email · Hint Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google No account? Sign up

The business case for diversity, equity and inclusion

Despite decades of research and multiple studies documenting the benefits, people continue to push back against diversity, equity and inclusion initiatives at public and private institutions.

After the U.S. Supreme Court’s ruling on the Students for Fair Admission v. Harvard case last summer, race-conscious admission programs for colleges and universities across the country are now under fire. But how does this ruling regarding higher education have an effect on the business world?

“The court gave us a very clear window into how it thinks about issues of racial discrimination,” said David Glasgow, executive director of the Meltzer Center for Diversity, Inclusion, and Belonging at New York University’s School of Law. “And so, a lot of the anti-DEI activists have interpreted it as giving a green light to them to attack similar sorts of race-conscious programs in the workplace.”

In the crosshairs of the discourse around DEI in the workplace are chief diversity offices, or CDOs. A recent study by Center Focus International, Inc., lead by Dani Monroe, looked exclusively at the role and effectiveness of CDOs.

“What we began to learn from these 48 chief diversity officers from a large segment of the corporate world is that they were having an impact,” Monroe said. “They were actually acting as change catalysts. They were acting as strategic innovators, as bridge-builders, as storytellers in their organization.”

Recently a U.S. federal court of appeals suspended venture capital firm The Fearless Fund’s grant contest for Black women entrepreneurs.

“It’s important for us to talk about the value-add of diverse communities, but I think it’s also important that we balance that conversation with a conversation about repair and power,” said Malia Lazu, DEI strategist and lecturer at the MIT Sloan School of Management. “After the Civil War, there was an attempt to repair. That attempt was quickly thwarted. And we’ve been on this journey to repair ever since. And so this idea that things like the Fearless Fund go against anything but inclusion and diversity is disingenuous at best.”

These topics and more on this week’s DEI panel.

- Dani Monroe, president of Center Focus International, Inc., founder of the Martha’s Vineyard Chief Diversity Officer Summit, author of “Untapped Talent: Unleashing the Power of the Hidden Workforce”

- David Glasgow , executive director of the Meltzer Center for Diversity, Inclusion, and Belonging at New York University’s School of Law, co-author of “Say The Right Thing: How To Talk About Identity, Diversity, and Justice.”

- Malia Lazu , award-winning strategist in diversity and inclusion, lecturer at the MIT Sloan School of Management, author of “From Intention to Impact: A Practical Guide to Diversity, Equity, and Inclusion.”

More Local News

'Building Stuff with NOVA' brings STEM learning to Twitch with Dr. Nehemiah Mabry

Northern New England communities assess damage from devastating flash flooding

Police policy experts weigh in: Should a Boston Police officer be demoted for his role on an oversight body?

Why Cape Cod is a global hotspot for great white sharks

United States

Select a language

United states and the oecd.

The United States was one of the 20 founding member countries that signed the Convention of the OECD in 1960. Today it is one of 38 OECD Members.

Explore our data, policy advice and research to learn more.

Related publications

Selected indicators for United States

Latest insights.

Related events

Explore all our content on United States

IMAGES

VIDEO

COMMENTS

The private equity case study is an especially intimidating part of the private equity recruitment process.. You'll get a "case study" in virtually any private equity interview process, whether you're interviewing at the mega-funds (Blackstone, KKR, Apollo, etc.), middle-market funds, or smaller, startup funds.. The difference is that each one gives you a different type of case study ...

How To Do A Private Equity Case Study. Let's look at the step-by-step process of completing a case study for the private equity recruitment process: Step 1: Read and digest the material you've been given. Read through the materials extensively and get an understanding of the company. Step 2: Build a basic LBO model.

Here, the Purchase Enterprise Value is $1.5 billion, and the PE firm contributes 40% * $1.5 billion = $600 million of Investor Equity. The "average" amount of proceeds is $225 * 10 = $2,250, and the "average" Exit Year is Year 4 (no need to do the full math - think about the numbers - and all the Debt is gone).

This case study explores best practices for SWFs who invest in private equity. 3 Objectives •Review the history of SWF investment in private equity, the current landscape, and trends ... Private Equity Index, Global Large Cap is the MSCI All Country World Index, U.S. Small Cap is the Russell 2000 Index, and U.S. Large Cap is the ...

Private Equity in Action is the practical companion toMastering Private Equity— Transformation via Venture Capital, Minority Investments & Buyouts, a rigorous textbook providin g the theoretical foundations that the case studies brin g to life. While this case book can ver y well be read on a standalone basis, newcomers to the world of

On December 11, 2013, Hilton raised $2.34 billion in its IPO, selling 117.6 million shares for $20 each. The IPO was the second largest in the U.S. in 2013. The IPO gave Hilton a total equity value of $20 billion, more than 40% higher than the market capitalization of Marriott or Starwood.

Abstract. This book is a collection of cases and notes that have been used in Private Equity Finance, an advanced corporate finance course offered in the second year of the Harvard Business School's MBA curriculum, over several years. Our goal is to provide detailed insight into the sources of value creation as well as outline the process of ...

Private Equity and COVID-19. by Paul A. Gompers, Steven N. Kaplan, and Vladimir Mukharlyamov. Private equity investors are seeking new investments despite the pandemic. This study shows they are prioritizing revenue growth for value creation, giving larger equity stakes to management teams, and targeting somewhat lower returns.

Private Equity in Action takes you on a tour of the private equity investment world through a series of case studies written by INSEAD faculty and taught at the world's leading business schools. The book is an ideal complement to Mastering Private Equity and allows readers to apply core concepts to investment targets and portfolio companies in real-life settings.

Private equity case studies are a critical component of the recruitment process, offering firms a valuable opportunity to assess candidates' analytical, investing, and presentation skills. Understanding what to expect in a private equity case study can significantly enhance your preparation and improve your chances of success.

Background. Alpine Investors is a private equity firm focused on making investments in middle market privately held companies. Core Values: Unwavering Character, Persistence, Continuous Improvement, Performance, Intellectual Honesty, and Balanced Lives. Funds under Management: $900m of committed capital since inception (Fund V - $400m)

ng MarketsCase Study: KPR Mill Limited (India)KPR Mill's StoryFounded in 1984 by three brothers, KPR Mill began operations with four looms and four employees in a conv. rted barn in Coimbatore, a town in southern India's textile belt. Over the following 22 years, the business grew in size and scope, expanding into exports in 1989 and later ...

Preparation. Practice presenting your background and experience (i.e., take advantage of mock interviews offered by MBACM, PEVC club and friends) Develop concrete examples that illustrate what YOU did. Focus on 3 themes to get across: Relationship skills, Business judgment and Analytical skills/curiosity.

A type of private equity that involves the purchase of a controlling stake of the equities of a business - buying out the previous owners. Leverage is often used in these transactions. Commitment. The amount of dollars a limited partner agrees to invest in a fund and is legally obligated to contribute. Contributions.

activist investing. Private market cases cover venture capital in Asia and Africa, private equity in the US renewables market, as well as instruments involving the public sector, such as social impact bonds. Many cases require rigorous financial and investment analysis, building on and extending skills acquired in first year finance courses.

In this Bain and Company private equity case interview example, Management Consulted coach and former McKinsey Associate Partner Divya Agarwal leads a 4th-year PhD candidate (Biomedical Engineering at Georgia Tech and Emory University) through a case interview.. The case features a private equity company looking for insight into purchasing a pizza chain (Gumby's Pizza).

Case studiesC. al executionAchieved purchase price savings by testing high-impact deal drivers, specifically earnings and debt levels, and comfort on the out-turn balance. the year. Provided deep insights into the differences between cash flows and reported EBITDA o. e target. Discovered significant issues relating to financial reporting and ...