Bank Business Plan Template

Written by Dave Lavinsky

Bank Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their banks.

If you’re unfamiliar with creating a bank business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a bank business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Bank Business Plan?

A business plan provides a snapshot of your bank as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Bank Business

If you’re looking to start a bank or grow your existing bank, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bank to improve your chances of success. Your bank business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Banks

With regards to funding, the main sources of funding for a bank are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for banks.

Finish Your Business Plan Today!

How to write a business plan for a bank.

If you want to start a bank or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your bank business plan.

Executive Summary

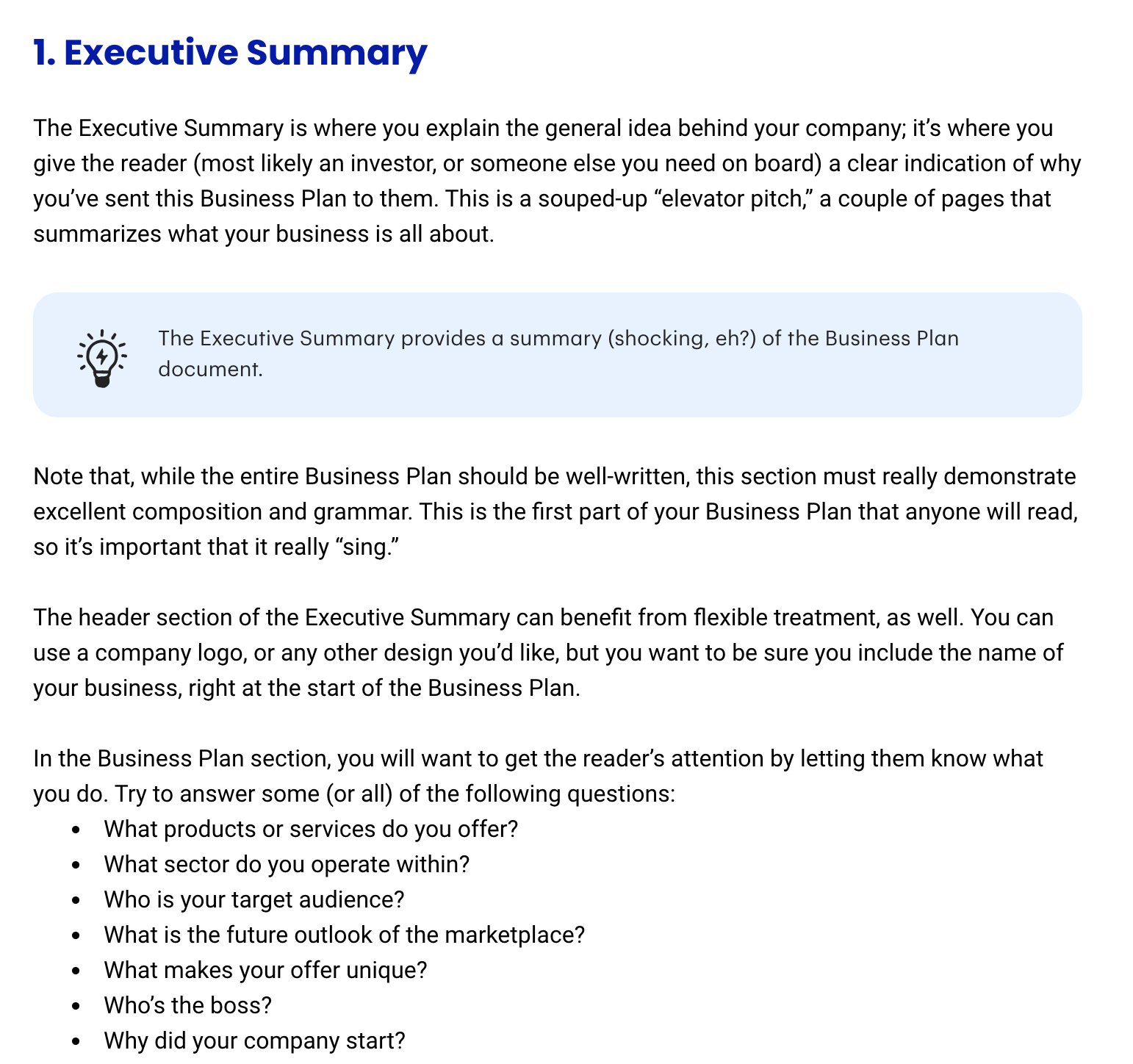

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of bank you are running and the status. For example, are you a startup, do you have a bank that you would like to grow, or are you operating a chain of banks?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the bank industry.

- Discuss the type of bank you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of bank you are operating.

For example, you might specialize in one of the following types of banks:

- Commercial bank : this type of bank tends to concentrate on supporting businesses. Both large corporations and small businesses can turn to commercial banks if they need to open a checking or savings account, borrow money, obtain access to credit or transfer funds to companies in foreign markets.

- Credit union: this type of bank operates much like a traditional bank (issues loans, provides checking and savings accounts, etc.) but banks are for-profit whereas credit unions are not. Credit unions fall under the direction of their own members. They tend to serve people affiliated with a particular group, such as people living in the same area, low-income members of a community or armed service members. They also tend to charge lower fees and offer lower loan rates.

- Retail bank: retail banks can be traditional, brick-and-mortar brands that customers can access in-person, online, or through their mobile phones. They also offer general public financial products and services such as bank accounts, loans, credit cards, and insurance.

- Investment bank: this type of bank manages the trading of stocks, bonds, and other securities between companies and investors. They also advise individuals and corporations who need financial guidance, reorganize companies through mergers and acquisitions, manage investment portfolios or raise money for certain businesses and the federal government.

In addition to explaining the type of bank you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of clients with positive reviews, reaching X number of clients served, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the bank industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bank industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your bank business plan:

- How big is the bank industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your bank? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your bank business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, small businesses, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bank you operate. Clearly, corporations would respond to different marketing promotions than individuals, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Bank Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other banks.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes trust accounts, investment companies, or the stock market. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of bank are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide loans and retirement savings accounts?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bank business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of bank company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide savings accounts, auto loans, mortgage loans, or financial advice?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your bank. Document where your company is situated and mention how the site will impact your success. For example, is your bank located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your bank marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bank, including reconciling accounts, customer service, accounting, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to sign up your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your bank to a new city.

Management Team

To demonstrate your bank’s potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing banks. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a bank or successfully running a small financial advisory firm.

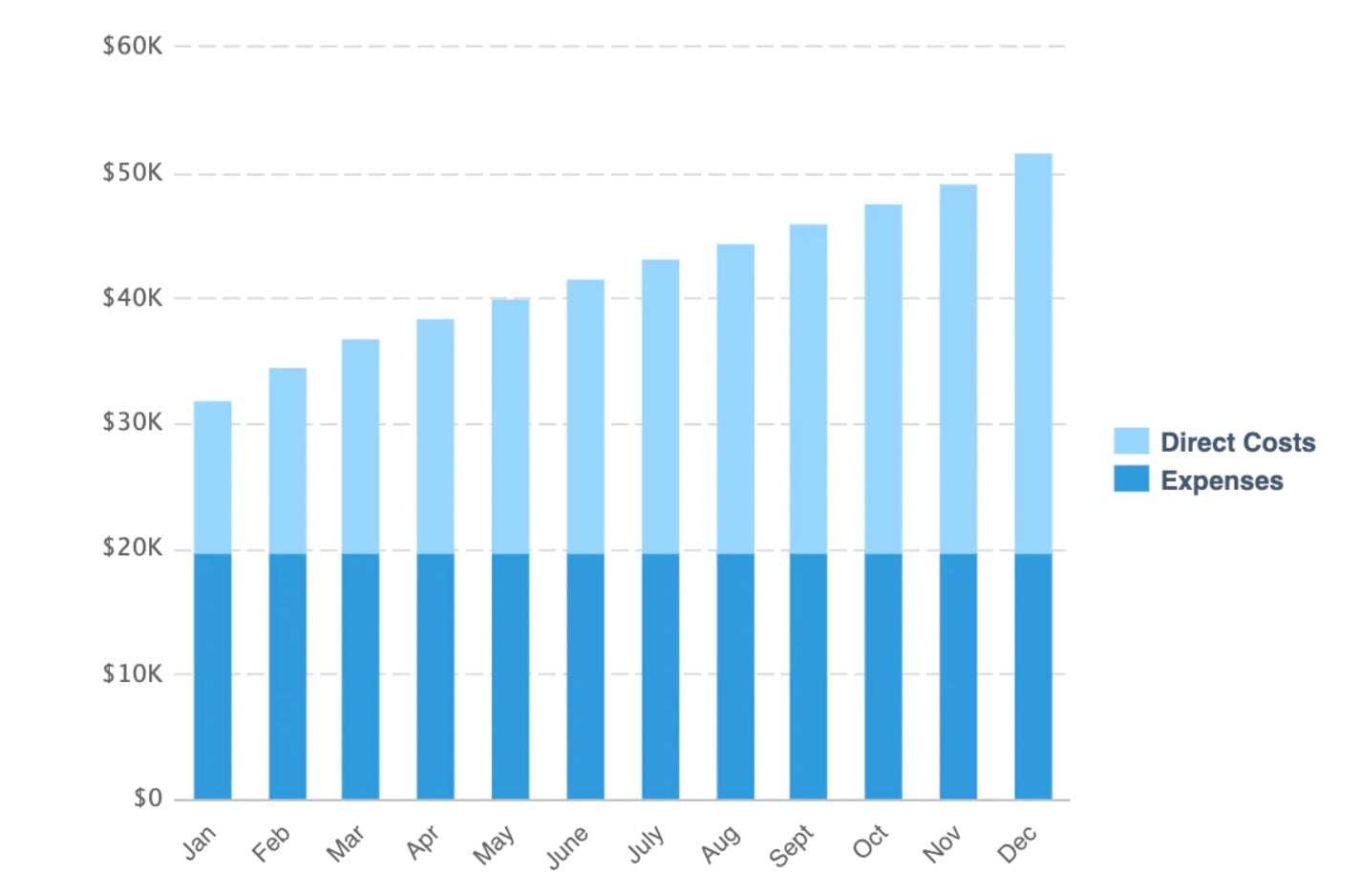

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer sign up bonuses? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your bank, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bank:

- Cost of furniture and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your bank location lease or a list of accounts and loans you plan to offer.

Writing a business plan for your bank is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the bank industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful bank.

Bank Business Plan Template FAQs

What is the easiest way to complete my bank business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your bank business plan.

How Do You Start a Bank Business?

Starting a bank business is easy with these 14 steps:

- Choose the Name for Your Bank Business

- Create Your Bank Business Plan

- Choose the Legal Structure for Your Bank Business

- Secure Startup Funding for Your Bank Business (If Needed)

- Secure a Location for Your Business

- Register Your Bank Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Bank Business

- Buy or Lease the Right Bank Business Equipment

- Develop Your Bank Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Bank Business

- Open for Business

Don’t you wish there was a faster, easier way to finish your Bank business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Business Research

- Getting Started

- Choosing a Business

- Business Planning and Organization

- Laws, Regulations, and Trade

- Industry Analysis

- Products / Services

- Target Market

- Operating Plan

- Balance Sheet; Income; Cash Flow

- Databases & Data Repositories

- Business Source Complete (database) This link opens in a new window

Business Plans

Print and electronic resources.

- OneSearch OneSearch - the Library's main resource locator finds print and electronic resources in the Library, tens of thousands of EBSCOhost ebooks and journals, industry reports, news articles, and more. Search for 'business plans' or 'business planning' to find everything, regardless of format, relevant to your needs. You can also search our databases individually; See Choosing a Business for links to relevant databases.

- Red River College Library - Articles/Databases List (A-Z): Business & Management View the most relevant business and management databases RRC Library offers. Find articles, industry reports, and more.

- Futurpreneur - Business Plan Writer Start a business, Mentor an entrepreneur, How-tos and Templates, Build your network (instructor recommended)

- How to write a business plan (ebook) McKeever, M. P. (2018). How to Write a Business Plan: Vol. 14th edition. NOLO.

- How to Write a Business Plan : A Step-by-Step Guide to Creating a Plan That Gets Results (ebook) Griffin, M. P. (2015). How to Write a Business Plan : A Step-by-Step Guide to Creating a Plan That Gets Results: Vol. Fifth edition. AMA Self-Study.

Business Plan Templates

- Business Development Bank of Canada : Business Plan Template Downloadable 11-page template.

- Business Plan Template - RBC Royal Bank Opens a Word document with a business plan guide and template

- FedDev Ontario - Small Business Services Business plan guide and useful links.

- Futurpreneur Canada - An Insider’s Look: Business Plan Example A MSWord example of a business plan.

- Scotiabank Scotia Plan Writer for Business Online business planning guide.

Examples of Business Plans

- B.C. Credit Union Business Planner Savings and Credit Unions of British Columbia business plan template as provided by Spruce Credit Union.

- BPlans sample business plans While this link is to an for profit website, there are numerous examples of business plans in a variety of sectors.

- The Cat Clinic (Scotiabank) Sample business plan for veterinarian, 2005

- Upright Construction General Contracting Inc. (Scotiabank) Sample business plan, 2006

Business Organization

- Choose the Right Structure for your Business - BDC.ca When starting a company, it's essential to select the business structure that best supports your goals. Business structures are chosen for the most part to comply with tax law, which treats each type of structure differently. There are three types of legal structures for a business: Sole proprietorship, partnership (which is a form of proprietorship) and incorporation.

- Choose Your Business Structure - Economic Development and Training Manitoba Explore the types of legal organization for your business which can affect how much you pay in taxes, the type of reporting required, and your exposure to personal liability.

- Setting up Your Business - Government of Canada The type of structure you choose for your business has a significant effect on the way you report your income. The business structure impacts the type of tax returns you file each year, and many other matters.

Make a recommendation

Do you have a title to recommend for our collection? Use the Suggest a Purchase form to suggest a book, video or journal.

Are you an RRC Polytech staff or student with suggestions or feedback that can help improve this guide? Please contact this guide's author on the "Getting Started" page.

Business Plans - Examples

- << Previous: Choosing a Business

- Next: Laws, Regulations, and Trade >>

- Last Updated: Mar 5, 2024 2:32 PM

- Submit Feedback | URL: https://library.rrc.ca/business_guide

How to Write a Successful Bank Business Plan (+ Template)

Creating a business plan is essential. Still, it can be beneficial for bank s that want to improve their strategy or raise funding.

A well-crafted business plan outlines your company’s vision and documents a step-by-step roadmap of how you will accomplish it. To create an effective business plan, you must first understand the components essential to its success.

This article provides an overview of the key elements that every bank business owner should include in their business plan.

Download the Ultimate Business Plan Template

What is a Bank Business Plan?

A bank business plan is a formal written document describing your company’s business strategy and feasibility. It documents the reasons you will be successful, your areas of competitive advantage, and it includes information about your team members. Your business plan is a critical document that will convince investors and lenders (if needed) that you are positioned to become a successful venture.

Why Write a Bank Business Plan?

A bank business plan is required for banks and investors. The document is a clear and concise guide of your business idea and the steps you will take to make it profitable.

Entrepreneurs can also use this as a roadmap when starting their new company or venture, especially if they are inexperienced in starting a business.

Writing an Effective Bank Business Plan

The following are the key components of a successful bank business plan:

Executive Summary

The executive summary of a bank business plan is a one- to two-page overview of your entire business plan. It should summarize the main points, which will be presented in full in the rest of your business plan.

- Start with a one-line description of your bank company

- Provide a summary of the key points in each section of your business plan, which includes information about your company’s management team, industry analysis, competitive analysis, and financial forecast, among others.

Company Description

This section should include a brief history of your company. Include a short description of how your company started and provide a timeline of milestones your company has achieved.

You may not have a long company history if you are just starting your bank business. Instead, you can include information about your professional experience in this industry and how and why you conceived your new venture. If you have worked for a similar company or been involved in an entrepreneurial venture before starting your bank firm, mention this.

You will also include information about your chosen bank business model and how, if applicable, it is different from other companies in your industry.

Industry Analysis

The industry or market analysis is an essential component of a bank business plan. Conduct thorough market research to determine industry trends and document the size of your market.

Questions to answer include:

- What part of the bank industry are you targeting?

- How big is the market?

- What trends are happening in the industry right now (and if applicable, how do these trends support your company’s success)?

You should also include sources for your information, such as published research reports and expert opinions.

Customer Analysis

This section should include a list of your target audience(s) with demographic and psychographic profiles (e.g., age, gender, income level, profession, job titles, interests). You will need to provide a profile of each customer segment separately, including their needs and wants.

For example, a bank business’ customers may include small businesses, large corporations, and individuals. Each customer segment will have different requirements that your bank company will need to cater to.

You can include information about how your customers decide to buy from you and what keeps them buying from you.

Develop a strategy for targeting those customers who are most likely to buy from you, as well as those that might be influenced to buy your products or bank services with the right marketing.

Competitive Analysis

The competitive analysis helps you determine how your product or service will differ from competitors, and what your unique selling proposition (USP) might be that will set you apart in this industry.

For each competitor, list their strengths and weaknesses. Next, determine your areas of competitive advantage; that is, in what ways are you different from and ideally better than your competitors.

Below are sample competitive advantages your bank business may have:

- Proven track record with a focus on customer service.

- Superior technology that makes banking easier and more convenient for customers.

- Range of products and services to meet the needs of different customer segments.

- Sound financial position with a commitment to responsible lending practices.

- Extensive branch and ATM network.

Marketing Plan

This part of the business plan is where you determine and document your marketing plan. . Your plan should be laid out, including the following 4 Ps.

- Product/Service : Detail your product/service offerings here. Document their features and benefits.

- Price : Document your pricing strategy here. In addition to stating the prices for your products/services, mention how your pricing compares to your competition.

- Place : Where will your customers find you? What channels of distribution (e.g., partnerships) will you use to reach them if applicable?

- Promotion : How will you reach your target customers? For example, you may use social media, write blog posts, create an email marketing campaign, use pay-per-click advertising, or launch a direct mail campaign. Or you may promote your bank business via PR or events.

Operations Plan

This part of your bank business plan should include the following information:

- How will you deliver your product/service to customers? For example, will you do it in person or over the phone?

- What infrastructure, equipment, and resources are needed to operate successfully? How can you meet those requirements within budget constraints?

You also need to include your company’s business policies in the operations plan. You will want to establish policies related to everything from customer service to pricing, to the overall brand image you are trying to present.

Finally, and most importantly, your Operations Plan will outline the milestones your company hopes to achieve within the next five years. Create a chart that shows the key milestone(s) you hope to achieve each quarter for the next four quarters, and then each year for the following four years. Examples of milestones for a bank business include reaching $X in sales. Other examples include expanding to new markets, launching new products and services, and hiring key personnel.

Management Team

List your team members here, including their names and titles, as well as their expertise and experience relevant to your specific bank industry. Include brief biography sketches for each team member.

Particularly if you are seeking funding, the goal of this section is to convince investors and lenders that your team has the expertise and experience to execute on your plan. If you are missing key team members, document the roles and responsibilities you plan to hire for in the future.

Financial Plan

Here, you will include a summary of your complete and detailed financial plan (your full financial projections go in the Appendix).

This includes the following three financial statements:

Income Statement

Your income statement should include:

- Revenue : how much revenue you generate.

- Cost of Goods Sold : These are your direct costs associated with generating revenue. This includes labor costs and the cost of any equipment and supplies used to deliver the product/service offering.

- Net Income (or loss) : Once expenses and revenue are totaled and deducted from each other, this is the net income or loss.

Sample Income Statement for a Startup Bank

| Revenues | $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 |

| $ 336,090 | $ 450,940 | $ 605,000 | $ 811,730 | $ 1,089,100 | |

| Direct Cost | |||||

| Direct Costs | $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 |

| $ 67,210 | $ 90,190 | $ 121,000 | $ 162,340 | $ 217,820 | |

| $ 268,880 | $ 360,750 | $ 484,000 | $ 649,390 | $ 871,280 | |

| Salaries | $ 96,000 | $ 99,840 | $ 105,371 | $ 110,639 | $ 116,171 |

| Marketing Expenses | $ 61,200 | $ 64,400 | $ 67,600 | $ 71,000 | $ 74,600 |

| Rent/Utility Expenses | $ 36,400 | $ 37,500 | $ 38,700 | $ 39,800 | $ 41,000 |

| Other Expenses | $ 9,200 | $ 9,200 | $ 9,200 | $ 9,400 | $ 9,500 |

| $ 202,800 | $ 210,940 | $ 220,871 | $ 230,839 | $ 241,271 | |

| EBITDA | $ 66,080 | $ 149,810 | $ 263,129 | $ 418,551 | $ 630,009 |

| Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| EBIT | $ 60,880 | $ 144,610 | $ 257,929 | $ 413,351 | $ 625,809 |

| Interest Expense | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 | $ 7,600 |

| $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 | |

| Taxable Income | $ 53,280 | $ 137,010 | $ 250,329 | $ 405,751 | $ 618,209 |

| Income Tax Expense | $ 18,700 | $ 47,900 | $ 87,600 | $ 142,000 | $ 216,400 |

| $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 | |

| 10% | 20% | 27% | 32% | 37% | |

Balance Sheet

Include a balance sheet that shows your assets, liabilities, and equity. Your balance sheet should include:

- Assets : Everything you own (including cash).

- Liabilities : This is what you owe against your company’s assets, such as accounts payable or loans.

- Equity : The worth of your business after all liabilities and assets are totaled and deducted from each other.

Sample Balance Sheet for a Startup Bank

| Cash | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

| Other Current Assets | $ 41,600 | $ 55,800 | $ 74,800 | $ 90,200 | $ 121,000 |

| Total Current Assets | $ 146,942 | $ 244,052 | $ 415,681 | $ 687,631 | $ 990,278 |

| Fixed Assets | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 | $ 25,000 |

| Accum Depreciation | $ 5,200 | $ 10,400 | $ 15,600 | $ 20,800 | $ 25,000 |

| Net fixed assets | $ 19,800 | $ 14,600 | $ 9,400 | $ 4,200 | $ 0 |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

| Current Liabilities | $ 23,300 | $ 26,100 | $ 29,800 | $ 32,800 | $ 38,300 |

| Debt outstanding | $ 108,862 | $ 108,862 | $ 108,862 | $ 108,862 | $ 0 |

| $ 132,162 | $ 134,962 | $ 138,662 | $ 141,662 | $ 38,300 | |

| Share Capital | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Retained earnings | $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 |

| $ 34,580 | $ 123,690 | $ 286,419 | $ 550,170 | $ 951,978 | |

| $ 166,742 | $ 258,652 | $ 425,081 | $ 691,831 | $ 990,278 | |

Cash Flow Statement

Include a cash flow statement showing how much cash comes in, how much cash goes out and a net cash flow for each year. The cash flow statement should include cash flow from:

- Investments

Below is a sample of a projected cash flow statement for a startup bank business.

Sample Cash Flow Statement for a Startup Bank

| Net Income (Loss) | $ 34,580 | $ 89,110 | $ 162,729 | $ 263,751 | $ 401,809 |

| Change in Working Capital | $ (18,300) | $ (11,400) | $ (15,300) | $ (12,400) | $ (25,300) |

| Plus Depreciation | $ 5,200 | $ 5,200 | $ 5,200 | $ 5,200 | $ 4,200 |

| Net Cash Flow from Operations | $ 21,480 | $ 82,910 | $ 152,629 | $ 256,551 | $ 380,709 |

| Fixed Assets | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Net Cash Flow from Investments | $ (25,000) | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Equity | $ 0 | $ 0 | $ 0 | $ 0 | $ 0 |

| Cash from Debt financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow from Financing | $ 108,862 | $ 0 | $ 0 | $ 0 | $ (108,862) |

| Net Cash Flow | $ 105,342 | $ 82,910 | $ 152,629 | $ 256,551 | $ 271,847 |

| Cash at Beginning of Period | $ 0 | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 |

| Cash at End of Period | $ 105,342 | $ 188,252 | $ 340,881 | $ 597,431 | $ 869,278 |

You will also want to include an appendix section which will include:

- Your complete financial projections

- A complete list of your company’s business policies and procedures related to the rest of the business plan (marketing, operations, etc.)

- Any other documentation which supports what you included in the body of your business plan.

Writing a good business plan gives you the advantage of being fully prepared to launch and grow your bank company. It not only outlines your business vision but also provides a step-by-step process of how you will accomplish it.

Now that you know how to write a business plan for your bank, you can get started on putting together your own.

Finish Your Business Plan in 1 Day!

Wish there was a faster, easier way to finish your business plan?

With our Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Other Helpful Articles

Commercial Bank Business Plan

Investment Bank Business Plan

Digital Bank Business Plan

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

Simple Business Plan Template (2024)

Updated: May 4, 2024, 4:37pm

Table of Contents

Why business plans are vital, get your free simple business plan template, how to write an effective business plan in 6 steps, frequently asked questions.

While taking many forms and serving many purposes, they all have one thing in common: business plans help you establish your goals and define the means for achieving them. Our simple business plan template covers everything you need to consider when launching a side gig, solo operation or small business. By following this step-by-step process, you might even uncover a few alternate routes to success.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

On LegalZoom's Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

Whether you’re a first-time solopreneur or a seasoned business owner, the planning process challenges you to examine the costs and tasks involved in bringing a product or service to market. The process can also help you spot new income opportunities and hone in on the most profitable business models.

Though vital, business planning doesn’t have to be a chore. Business plans for lean startups and solopreneurs can simply outline the business concept, sales proposition, target customers and sketch out a plan of action to bring the product or service to market. However, if you’re seeking startup funding or partnership opportunities, you’ll need a write a business plan that details market research, operating costs and revenue forecasting. Whichever startup category you fall into, if you’re at square one, our simple business plan template will point you down the right path.

Copy our free simple business plan template so you can fill in the blanks as we explore each element of your business plan. Need help getting your ideas flowing? You’ll also find several startup scenario examples below.

Download free template as .docx

Whether you need a quick-launch overview or an in-depth plan for investors, any business plan should cover the six key elements outlined in our free template and explained below. The main difference in starting a small business versus an investor-funded business is the market research and operational and financial details needed to support the concept.

1. Your Mission or Vision

Start by declaring a “dream statement” for your business. You can call this your executive summary, vision statement or mission. Whatever the name, the first part of your business plan summarizes your idea by answering five questions. Keep it brief, such as an elevator pitch. You’ll expand these answers in the following sections of the simple business plan template.

- What does your business do? Are you selling products, services, information or a combination?

- Where does this happen? Will you conduct business online, in-store, via mobile means or in a specific location or environment?

- Who does your business benefit? Who is your target market and ideal customer for your concept?

- Why would potential customers care? What would make your ideal customers take notice of your business?

- How do your products and/or services outshine the competition? What would make your ideal customers choose you over a competitor?

These answers come easily if you have a solid concept for your business, but don’t worry if you get stuck. Use the rest of your plan template to brainstorm ideas and tactics. You’ll quickly find these answers and possibly new directions as you explore your ideas and options.

2. Offer and Value Proposition

This is where you detail your offer, such as selling products, providing services or both, and why anyone would care. That’s the value proposition. Specifically, you’ll expand on your answers to the first and fourth bullets from your mission/vision.

As you complete this section, you might find that exploring value propositions uncovers marketable business opportunities that you hadn’t yet considered. So spend some time brainstorming the possibilities in this section.

For example, a cottage baker startup specializing in gluten-free or keto-friendly products might be a value proposition that certain audiences care deeply about. Plus, you could expand on that value proposition by offering wedding and other special-occasion cakes that incorporate gluten-free, keto-friendly and traditional cake elements that all guests can enjoy.

3. Audience and Ideal Customer

Here is where you explore bullet point number three, who your business will benefit. Identifying your ideal customer and exploring a broader audience for your goods or services is essential in defining your sales and marketing strategies, plus it helps fine-tune what you offer.

There are many ways to research potential audiences, but a shortcut is to simply identify a problem that people have that your product or service can solve. If you start from the position of being a problem solver, it’s easy to define your audience and describe the wants and needs of your ideal customer for marketing efforts.

Using the cottage baker startup example, a problem people might have is finding fresh-baked gluten-free or keto-friendly sweets. Examining the wants and needs of these people might reveal a target audience that is health-conscious or possibly dealing with health issues and willing to spend more for hard-to-find items.

However, it’s essential to have a customer base that can support your business. You can be too specialized. For example, our baker startup can attract a broader audience and boost revenue by offering a wider selection of traditional baked goods alongside its gluten-free and keto-focused specialties.

4. Revenue Streams, Sales Channels and Marketing

Thanks to our internet-driven economy, startups have many revenue opportunities and can connect with target audiences through various channels. Revenue streams and sales channels also serve as marketing vehicles, so you can cover all three in this section.

Revenue Streams

Revenue streams are the many ways you can make money in your business. In your plan template, list how you’ll make money upon launch, plus include ideas for future expansion. The income possibilities just might surprise you.

For example, our cottage baker startup might consider these revenue streams:

- Product sales : Online, pop-up shops , wholesale and (future) in-store sales

- Affiliate income : Monetize blog and social media posts with affiliate links

- Advertising income : Reserve website space for advertising

- E-book sales : (future) Publish recipe e-books targeting gluten-free and keto-friendly dessert niches

- Video income : (future) Monetize a YouTube channel featuring how-to videos for the gluten-free and keto-friendly dessert niches

- Webinars and online classes : (future) Monetize coaching-style webinars and online classes covering specialty baking tips and techniques

- Members-only content : (future) Monetize a members-only section of the website for specialty content to complement webinars and online classes

- Franchise : (future) Monetize a specialty cottage bakery concept and sell to franchise entrepreneurs

Sales Channels

Sales channels put your revenue streams into action. This section also answers the “where will this happen” question in the second bullet of your vision.

The product sales channels for our cottage bakery example can include:

- Mobile point-of-sale (POS) : A mobile platform such as Shopify or Square POS for managing in-person sales at local farmers’ markets, fairs and festivals

- E-commerce platform : An online store such as Shopify, Square or WooCommerce for online retail sales and wholesale sales orders

- Social media channels : Facebook, Instagram and Pinterest shoppable posts and pins for online sales via social media channels

- Brick-and-mortar location : For in-store sales , once the business has grown to a point that it can support a physical location

Channels that support other income streams might include:

- Affiliate income : Blog section on the e-commerce website and affiliate partner accounts

- Advertising income : Reserved advertising spaces on the e-commerce website

- E-book sales : Amazon e-book sales via Amazon Kindle Direct Publishing

- Video income : YouTube channel with ad monetization

- Webinars and online classes : Online class and webinar platforms that support member accounts, recordings and playback

- Members-only content : Password-protected website content using membership apps such as MemberPress

Nowadays, the line between marketing and sales channels is blurred. Social media outlets, e-books, websites, blogs and videos serve as both marketing tools and income opportunities. Since most are free and those with advertising options are extremely economical, these are ideal marketing outlets for lean startups.

However, many businesses still find value in traditional advertising such as local radio, television, direct mail, newspapers and magazines. You can include these advertising costs in your simple business plan template to help build a marketing plan and budget.

5. Structure, Suppliers and Operations

This section of your simple business plan template explores how to structure and operate your business. Details include the type of business organization your startup will take, roles and responsibilities, supplier logistics and day-to-day operations. Also, include any certifications or permits needed to launch your enterprise in this section.

Our cottage baker example might use a structure and startup plan such as this:

- Business structure : Sole proprietorship with a “doing business as” (DBA) .

- Permits and certifications : County-issued food handling permit and state cottage food certification for home-based food production. Option, check into certified commercial kitchen rentals.

- Roles and responsibilities : Solopreneur, all roles and responsibilities with the owner.

- Supply chain : Bulk ingredients and food packaging via Sam’s Club, Costco, Amazon Prime with annual membership costs. Uline for shipping supplies; no membership needed.

- Day-to-day operations : Source ingredients and bake three days per week to fulfill local and online orders. Reserve time for specialty sales, wholesale partner orders and market events as needed. Ship online orders on alternating days. Update website and create marketing and affiliate blog posts on non-shipping days.

Start A Limited Liability Company Online Today with ZenBusiness

Click to get started.

6. Financial Forecasts

Your final task is to list forecasted business startup and ongoing costs and profit projections in your simple business plan template. Thanks to free business tools such as Square and free marketing on social media, lean startups can launch with few upfront costs. In many cases, cost of goods, shipping and packaging, business permits and printing for business cards are your only out-of-pocket expenses.

Cost Forecast

Our cottage baker’s forecasted lean startup costs might include:

| Business Need | Startup Cost | Ongoing Cost | Source |

|---|---|---|---|

Gross Profit Projections

This helps you determine the retail prices and sales volume required to keep your business running and, hopefully, earn income for yourself. Use product research to spot target retail prices for your goods, then subtract your cost of goods, such as hourly rate, raw goods and supplier costs. The total amount is your gross profit per item or service.

Here are some examples of projected gross profits for our cottage baker:

| Product | Retail Price | (Cost) | Gross Profit |

|---|---|---|---|

Bottom Line

Putting careful thought and detail in a business plan is always beneficial, but don’t get so bogged down in planning that you never hit the start button to launch your business . Also, remember that business plans aren’t set in stone. Markets, audiences and technologies change, and so will your goals and means of achieving them. Think of your business plan as a living document and regularly revisit, expand and restructure it as market opportunities and business growth demand.

Is there a template for a business plan?

You can copy our free business plan template and fill in the blanks or customize it in Google Docs, Microsoft Word or another word processing app. This free business plan template includes the six key elements that any entrepreneur needs to consider when launching a new business.

What does a simple business plan include?

A simple business plan is a one- to two-page overview covering six key elements that any budding entrepreneur needs to consider when launching a startup. These include your vision or mission, product or service offering, target audience, revenue streams and sales channels, structure and operations, and financial forecasts.

How can I create a free business plan template?

Start with our free business plan template that covers the six essential elements of a startup. Once downloaded, you can edit this document in Google Docs or another word processing app and add new sections or subsections to your plan template to meet your specific business plan needs.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best LLC Services

- Best Registered Agent Services

- Best Trademark Registration Services

- Top LegalZoom Competitors

- Best Business Loans

- Best Business Plan Software

- ZenBusiness Review

- LegalZoom LLC Review

- Northwest Registered Agent Review

- Rocket Lawyer Review

- Inc. Authority Review

- Rocket Lawyer vs. LegalZoom

- Bizee Review (Formerly Incfile)

- Swyft Filings Review

- Harbor Compliance Review

- Sole Proprietorship vs. LLC

- LLC vs. Corporation

- LLC vs. S Corp

- LLP vs. LLC

- DBA vs. LLC

- LegalZoom vs. Incfile

- LegalZoom vs. ZenBusiness

- LegalZoom vs. Rocket Lawyer

- ZenBusiness vs. Incfile

- How To Start A Business

- How to Set Up an LLC

- How to Get a Business License

- LLC Operating Agreement Template

- 501(c)(3) Application Guide

- What is a Business License?

- What is an LLC?

- What is an S Corp?

- What is a C Corp?

- What is a DBA?

- What is a Sole Proprietorship?

- What is a Registered Agent?

- How to Dissolve an LLC

- How to File a DBA

- What Are Articles Of Incorporation?

- Types Of Business Ownership

Next Up In Company Formation

- Best Online Legal Services

- How To Write A Business Plan

- Member-Managed LLC Vs. Manager-Managed LLC

- Starting An S-Corp

- LLC Vs. C-Corp

- How Much Does It Cost To Start An LLC?

How To Start A Print On Demand Business In 2024

HR For Small Businesses: The Ultimate Guide

How One Company Is Using AI To Transform Manufacturing

Not-For-Profit Vs. Nonprofit: What’s The Difference?

How To Develop an SEO Strategy in 2024

How To Make Money On Social Media in 2024

Krista Fabregas is a seasoned eCommerce and online content pro sharing more than 20 years of hands-on know-how with those looking to launch and grow tech-forward businesses. Her expertise includes eCommerce startups and growth, SMB operations and logistics, website platforms, payment systems, side-gig and affiliate income, and multichannel marketing. Krista holds a bachelor's degree in English from The University of Texas at Austin and held senior positions at NASA, a Fortune 100 company, and several online startups.

- Start free trial

Start selling with Shopify today

Start your free trial with Shopify today—then use these resources to guide you through every step of the process.

Free Business Plan Template for Small Businesses (2024)

Use this free business plan template to write your business plan quickly and efficiently.

A good business plan is essential to successfully starting your business — and the easiest way to simplify the work of writing a business plan is to start with a business plan template.

You’re already investing time and energy in refining your business model and planning your launch—there’s no need to reinvent the wheel when it comes to writing a business plan. Instead, to help build a complete and effective plan, lean on time-tested structures created by other entrepreneurs and startups.

Ahead, learn what it takes to create a solid business plan and download Shopify's free business plan template to get started on your dream today.

What this free business plan template includes

- Executive summary

- Company overview

- Products or services offered

- Market analysis

- Marketing plan

- Logistics and operations plan

- Financial plan

This business plan outline is designed to ensure you’re thinking through all of the important facets of starting a new business. It’s intended to help new business owners and entrepreneurs consider the full scope of running a business and identify functional areas they may not have considered or where they may need to level up their skills as they grow.

That said, it may not include the specific details or structure preferred by a potential investor or lender. If your goal with a business plan is to secure funding , check with your target organizations—typically banks or investors—to see if they have business plan templates you can follow to maximize your chances of success.

Our free business plan template includes seven key elements typically found in the traditional business plan format:

1. Executive summary

This is a one-page summary of your whole plan, typically written after the rest of the plan is completed. The description section of your executive summary will also cover your management team, business objectives and strategy, and other background information about the brand.

2. Company overview

This section of your business plan will answer two fundamental questions: “Who are you?” and “What do you plan to do?” Answering these questions clarifies why your company exists, what sets it apart from others, and why it’s a good investment opportunity. This section will detail the reasons for your business’s existence, its goals, and its guiding principles.

3. Products or services offered

What you sell and the most important features of your products or services. It also includes any plans for intellectual property, like patent filings or copyright. If you do market research for new product lines, it will show up in this section of your business plan.

4. Market analysis

This section includes everything from estimated market size to your target markets and competitive advantage. It’ll include a competitive analysis of your industry to address competitors’ strengths and weaknesses. Market research is an important part of ensuring you have a viable idea.

5. Marketing plan

How you intend to get the word out about your business, and what strategic decisions you’ve made about things like your pricing strategy. It also covers potential customers’ demographics, your sales plan, and your metrics and milestones for success.

6. Logistics and operations plan

Everything that needs to happen to turn your raw materials into products and get them into the hands of your customers.

7. Financial plan

It’s important to include a look at your financial projections, including both revenue and expense projections. This section includes templates for three key financial statements: an income statement, a balance sheet, and a cash-flow statement . You can also include whether or not you need a business loan and how much you’ll need.

Business plan examples

What do financial projections look like on paper? How do you write an executive summary? What should your company description include? Business plan examples can help answer some of these questions and transform your business idea into an actionable plan.

Professional business plan example

Inside our template, we’ve filled out a sample business plan featuring a fictional ecommerce business .

The sample is set up to help you get a sense of each section and understand how they apply to the planning and evaluation stages of a business plan. If you’re looking for funding, this example won’t be a complete or formal look at business plans, but it will give you a great place to start and notes about where to expand.

Lean business plan example

A lean business plan format is a shortened version of your more detailed business plan. It’s helpful when modifying your plan for a specific audience, like investors or new hires.

Also known as a one-page business plan, it includes only the most important, need-to-know information, such as:

- Company description

- Key members of your team

- Customer segments

💡 Tip: For a step-by-step guide to creating a lean business plan (including a sample business plan), read our guide on how to create a lean business plan .

Benefits of writing a solid business plan

It’s tempting to dive right into execution when you’re excited about a new business or side project, but taking the time to write a thorough business plan and get your thoughts on paper allows you to do a number of beneficial things:

- Test the viability of your business idea. Whether you’ve got one business idea or many, business plans can make an idea more tangible, helping you see if it’s truly viable and ensure you’ve found a target market.

- Plan for your next phase. Whether your goal is to start a new business or scale an existing business to the next level, a business plan can help you understand what needs to happen and identify gaps to address.

- Clarify marketing strategy, goals, and tactics. Writing a business plan can show you the actionable next steps to take on a big, abstract idea. It can also help you narrow your strategy and identify clear-cut tactics that will support it.

- Scope the necessary work. Without a concrete plan, cost overruns and delays are all but certain. A business plan can help you see the full scope of work to be done and adjust your investment of time and money accordingly.

- Hire and build partnerships. When you need buy-in from potential employees and business partners, especially in the early stages of your business, a clearly written business plan is one of the best tools at your disposal. A business plan provides a refined look at your goals for the business, letting partners judge for themselves whether or not they agree with your vision.

- Secure funds. Seeking financing for your business—whether from venture capital, financial institutions, or Shopify Capital —is one of the most common reasons to create a business plan.

Why you should you use a template for a business plan

A business plan can be as informal or formal as your situation calls for, but even if you’re a fan of the back-of-the-napkin approach to planning, there are some key benefits to starting your plan from an existing outline or simple business plan template.

No blank-page paralysis

A blank page can be intimidating to even the most seasoned writers. Using an established business planning process and template can help you get past the inertia of starting your business plan, and it allows you to skip the work of building an outline from scratch. You can always adjust a template to suit your needs.

Guidance on what to include in each section

If you’ve never sat through a business class, you might never have created a SWOT analysis or financial projections. Templates that offer guidance—in plain language—about how to fill in each section can help you navigate sometimes-daunting business jargon and create a complete and effective plan.

Knowing you’ve considered every section

In some cases, you may not need to complete every section of a startup business plan template, but its initial structure shows you you’re choosing to omit a section as opposed to forgetting to include it in the first place.

Tips for creating a successful business plan

There are some high-level strategic guidelines beyond the advice included in this free business plan template that can help you write an effective, complete plan while minimizing busywork.

Understand the audience for your plan

If you’re writing a business plan for yourself in order to get clarity on your ideas and your industry as a whole, you may not need to include the same level of detail or polish you would with a business plan you want to send to potential investors. Knowing who will read your plan will help you decide how much time to spend on it.

Know your goals

Understanding the goals of your plan can help you set the right scope. If your goal is to use the plan as a roadmap for growth, you may invest more time in it than if your goal is to understand the competitive landscape of a new industry.

Take it step by step

Writing a 10- to 15-page document can feel daunting, so try to tackle one section at a time. Select a couple of sections you feel most confident writing and start there—you can start on the next few sections once those are complete. Jot down bullet-point notes in each section before you start writing to organize your thoughts and streamline the writing process.

Maximize your business planning efforts

Planning is key to the financial success of any type of business , whether you’re a startup, non-profit, or corporation.

To make sure your efforts are focused on the highest-value parts of your own business planning, like clarifying your goals, setting a strategy, and understanding the target market and competitive landscape, lean on a business plan outline to handle the structure and format for you. Even if you eventually omit sections, you’ll save yourself time and energy by starting with a framework already in place.

- How to Start an Online Boutique- A Complete Playbook

- How To Source Products To Sell Online

- The Ultimate Guide To Dropshipping (2024)

- How to Start a Dropshipping Business- A Complete Playbook for 2024

- 6 Creative Ways to Start a Business With No Money in 2024

- What is Shopify and How Does it Work?

- What Is Affiliate Marketing and How to Get Started

- How to Price Your Products in 3 Simple Steps

- 10 Common Small Business Mistakes to Avoid

- How to Turn a Hobby into a Business in 8 Steps

Business plan template FAQ

What is the purpose of a business plan.

The purpose of your business plan is to describe a new business opportunity or an existing one. It clarifies the business strategy, marketing plan, financial forecasts, potential providers, and more information about the company.

How do I write a simple business plan?

- Choose a business plan format, such as a traditional or a one-page business plan.

- Find a business plan template.

- Read through a business plan sample.

- Fill in the sections of your business plan.

What is the best business plan template?

If you need help writing a business plan, Shopify’s template is one of the most beginner-friendly options you’ll find. It’s comprehensive, well-written, and helps you fill out every section.

What are the 5 essential parts of a business plan?

The five essential parts of a traditional business plan include:

- Executive summary: This is a brief overview of the business plan, summarizing the key points and highlighting the main points of the plan.

- Business description: This section outlines the business concept and how it will be executed.

- Market analysis: This section provides an in-depth look at the target market and how the business will compete in the marketplace.

- Financial plan: This section details the financial projections for the business, including sales forecasts, capital requirements, and a break-even analysis.

- Management and organization: This section describes the management team and the organizational structure of the business.

Are there any free business plan templates?

There are several free templates for business plans for small business owners available online, including Shopify’s own version. Download a copy for your business.

Keep up with the latest from Shopify

Get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

By entering your email, you agree to receive marketing emails from Shopify.

popular posts

The point of sale for every sale.

Subscribe to our blog and get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

Unsubscribe anytime. By entering your email, you agree to receive marketing emails from Shopify.

Latest from Shopify

Jun 10, 2024

Learn on the go. Try Shopify for free, and explore all the tools you need to start, run, and grow your business.

Try Shopify for free, no credit card required.

We are sorry an error has occurred, please try again later.

We are currently working to fix the problem and should have it resolved shortly.

You can still log in to your Internet Banking as usual:

[Error 1007 ID: 18.7dd6dd58.1718040052.283f4d7b]

General Banking Queries

0345 300 0000

From abroad:

+44(0)1733 347 007.

Calls may be monitored and recorded in case we need to check we have carried out your instructions correctly and to help us improve our quality of service.

0345 072 5555

+44(0) 1733 347 338

From a textphone:

0345 601 6909

Our automated system is available 24 hours a day. 7 days a week. Our Business Advisers are available Monday to Friday 7am to 8pm, and Saturday 9am to 2pm.

- Lloyds Banking Group

- Rates and Charges

- Build your business

Business Tools

- Profit Margin Calculator

- Business Name Generator

- Slogan Generator

- Traffic Calculator

- Ecommerce Statistics

- Ecommerce Wiki

Free business tools

Start a business and design the life you want – all in one place.

- © 2015-2024 Oberlo

The 7 Best Business Plan Examples (2024)

As an aspiring entrepreneur gearing up to start your own business , you likely know the importance of drafting a business plan. However, you might not be entirely sure where to begin or what specific details to include. That’s where examining business plan examples can be beneficial. Sample business plans serve as real-world templates to help you craft your own plan with confidence. They also provide insight into the key sections that make up a business plan, as well as demonstrate how to structure and present your ideas effectively.

Example business plan

To understand how to write a business plan, let’s study an example structured using a seven-part template. Here’s a quick overview of those parts:

- Executive summary: A quick overview of your business and the contents of your business plan.

- Company description: More info about your company, its goals and mission, and why you started it in the first place.

- Market analysis: Research about the market and industry your business will operate in, including a competitive analysis about the companies you’ll be up against.

- Products and services: A detailed description of what you’ll be selling to your customers.

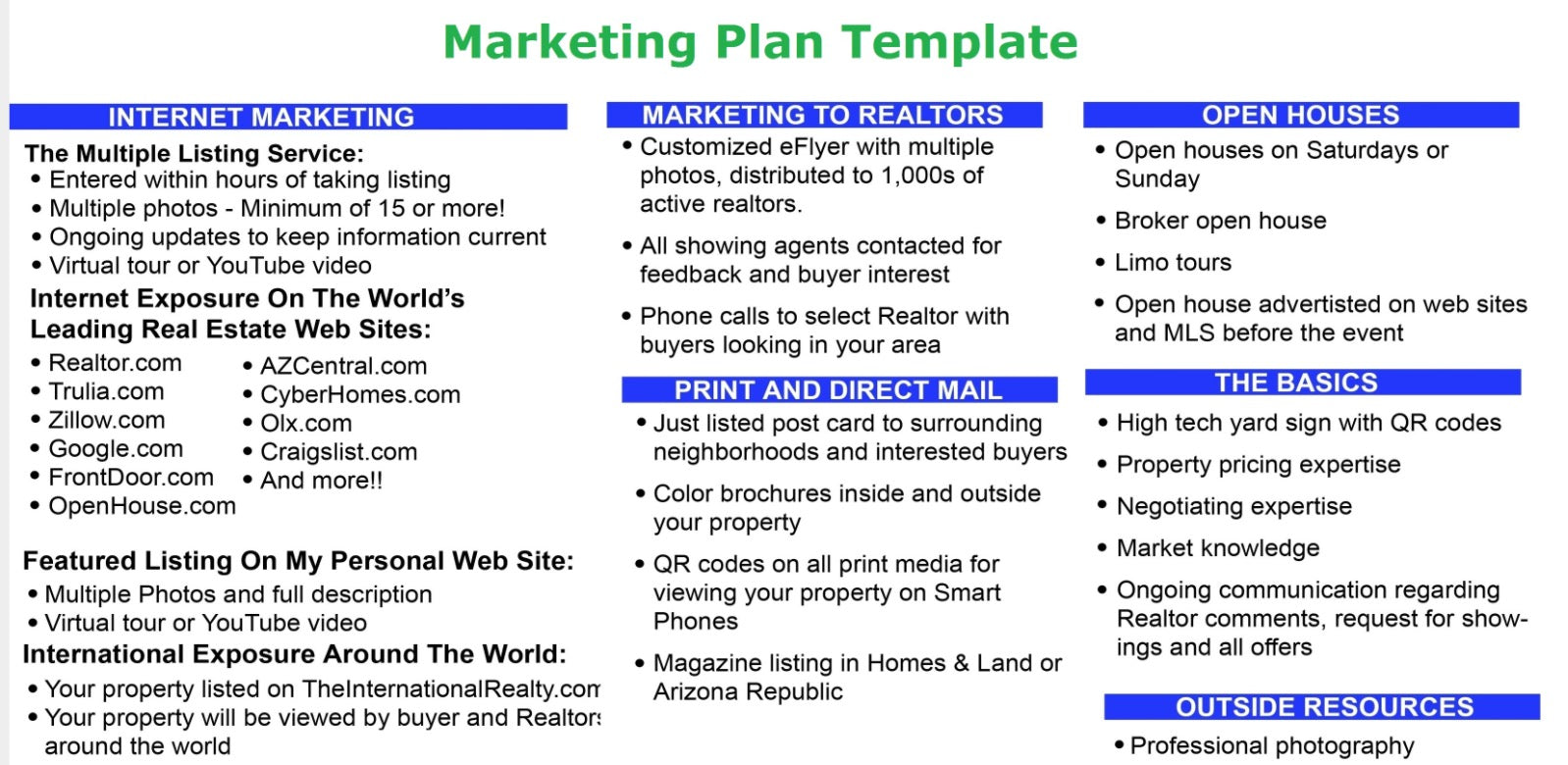

- Marketing plan: A strategic outline of how you plan to market and promote your business before, during, and after your company launches into the market.

- Logistics and operations plan: An explanation of the systems, processes, and tools that are needed to run your business in the background.

- Financial plan: A map of your short-term (and even long-term) financial goals and the costs to run the business. If you’re looking for funding, this is the place to discuss your request and needs.

7 business plan examples (section by section)

In this section, you’ll find hypothetical and real-world examples of each aspect of a business plan to show you how the whole thing comes together.

- Executive summary

Your executive summary offers a high-level overview of the rest of your business plan. You’ll want to include a brief description of your company, market research, competitor analysis, and financial information.

In this free business plan template, the executive summary is three paragraphs and occupies nearly half the page:

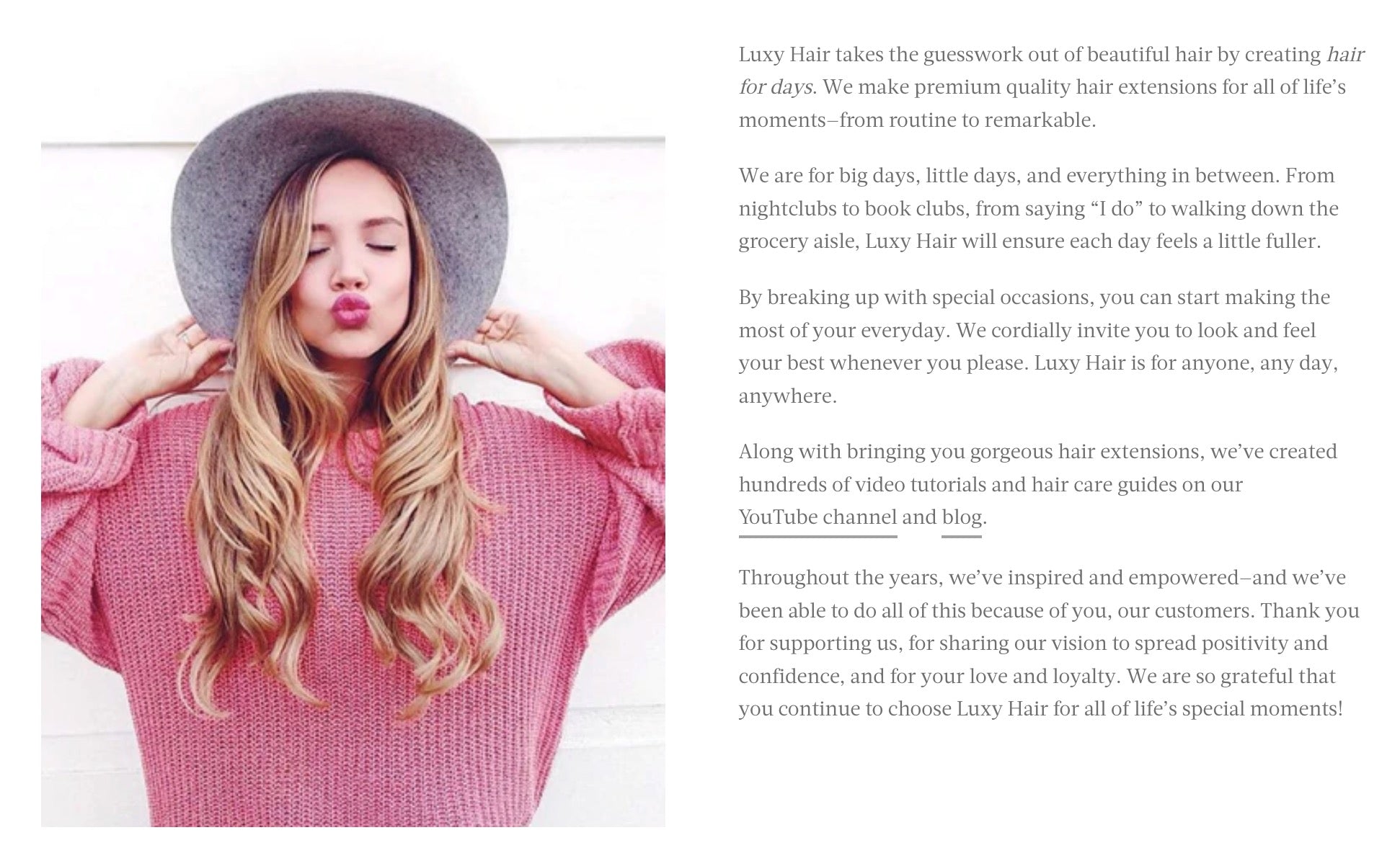

- Company description

You might go more in-depth with your company description and include the following sections:

- Nature of the business. Mention the general category of business you fall under. Are you a manufacturer, wholesaler, or retailer of your products?

- Background information. Talk about your past experiences and skills, and how you’ve combined them to fill in the market.

- Business structure. This section outlines how you registered your company —as a corporation, sole proprietorship, LLC, or other business type.

- Industry. Which business sector do you operate in? The answer might be technology, merchandising, or another industry.

- Team. Whether you’re the sole full-time employee of your business or you have contractors to support your daily workflow, this is your chance to put them under the spotlight.

You can also repurpose your company description elsewhere, like on your About page, Instagram page, or other properties that ask for a boilerplate description of your business. Hair extensions brand Luxy Hair has a blurb on it’s About page that could easily be repurposed as a company description for its business plan.

- Market analysis

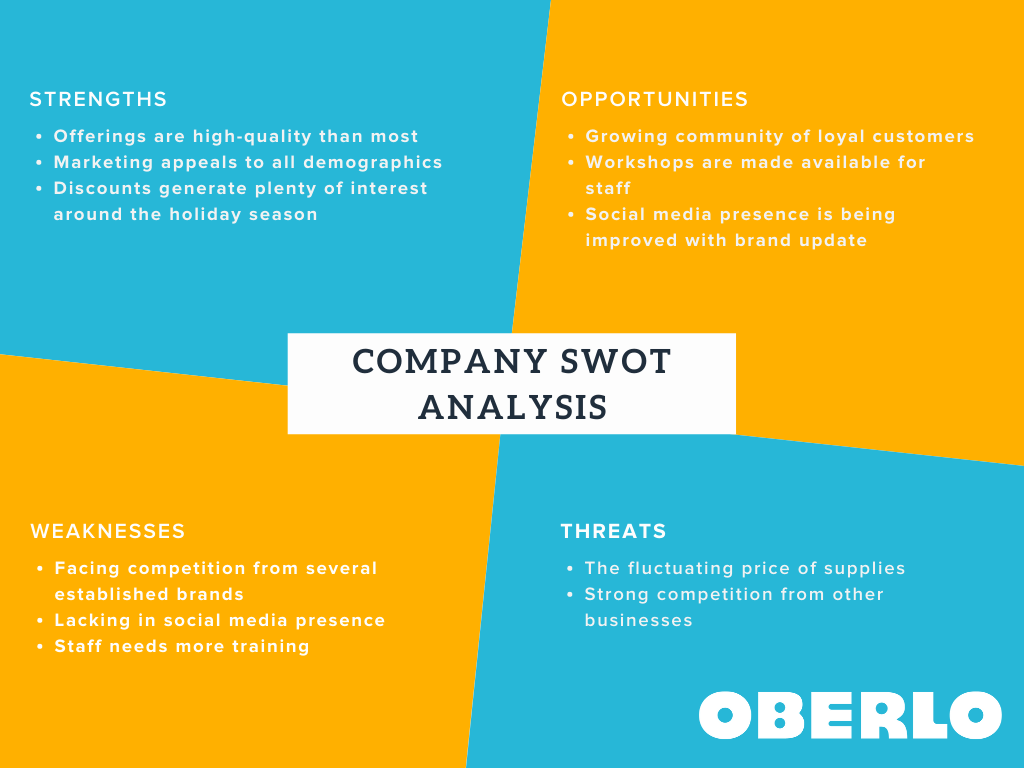

Market analysis comprises research on product supply and demand, your target market, the competitive landscape, and industry trends. You might do a SWOT analysis to learn where you stand and identify market gaps that you could exploit to establish your footing. Here’s an example of a SWOT analysis for a hypothetical ecommerce business:

You’ll also want to run a competitive analysis as part of the market analysis component of your business plan. This will show you who you’re up against and give you ideas on how to gain an edge over the competition.

- Products and services

This part of your business plan describes your product or service, how it will be priced, and the ways it will compete against similar offerings in the market. Don’t go into too much detail here—a few lines are enough to introduce your item to the reader.

- Marketing plan

Potential investors will want to know how you’ll get the word out about your business. So it’s essential to build a marketing plan that highlights the promotion and customer acquisition strategies you’re planning to adopt.

Most marketing plans focus on the four Ps: product, price, place, and promotion. However, it’s easier when you break it down by the different marketing channels . Mention how you intend to promote your business using blogs, email, social media, and word-of-mouth marketing.

Here’s an example of a hypothetical marketing plan for a real estate website:

Logistics and operations

This section of your business plan provides information about your production, facilities, equipment, shipping and fulfillment, and inventory.

Financial plan

The financial plan (a.k.a. financial statement) offers a breakdown of your sales, revenue, expenses, profit, and other financial metrics. You’ll want to include all the numbers and concrete data to project your current and projected financial state.

In this business plan example, the financial statement for ecommerce brand Nature’s Candy includes forecasted revenue, expenses, and net profit in graphs.

It then goes deeper into the financials, citing:

- Funding needs

- Project cash-flow statement

- Project profit-and-loss statement

- Projected balance sheet

You can use Shopify’s financial plan template to create your own income statement, cash-flow statement, and balance sheet.

Types of business plans (and what to write for each)

A one-page business plan is a pared down version of a standard business plan that’s easy for potential investors and partners to understand. You’ll want to include all of these sections, but make sure they’re abbreviated and summarized:

- Logistics and operations plan

- Financials

A startup business plan is meant to secure outside funding for a new business. Typically, there’s a big focus on the financials, as well as other sections that help determine the viability of your business idea—market analysis, for example. Shopify has a great business plan template for startups that include all the below points:

- Market research: in depth

- Financials: in depth

Your internal business plan acts as the enforcer of your company’s vision. It reminds your team of the long-term objective and keeps them strategically aligned toward the same goal. Be sure to include:

- Market research

Feasibility

A feasibility business plan is essentially a feasibility study that helps you evaluate whether your product or idea is worthy of a full business plan. Include the following sections:

A strategic (or growth) business plan lays out your long-term vision and goals. This means your predictions stretch further into the future, and you aim for greater growth and revenue. While crafting this document, you use all the parts of a usual business plan but add more to each one:

- Products and services: for launch and expansion

- Market analysis: detailed analysis

- Marketing plan: detailed strategy

- Logistics and operations plan: detailed plan

- Financials: detailed projections

Free business plan templates

Now that you’re familiar with what’s included and how to format a business plan, let’s go over a few templates you can fill out or draw inspiration from.

Bplans’ free business plan template

Bplans’ free business plan template focuses a lot on the financial side of running a business. It has many pages just for your financial plan and statements. Once you fill it out, you’ll see exactly where your business stands financially and what you need to do to keep it on track or make it better.

PandaDoc’s free business plan template

PandaDoc’s free business plan template is detailed and guides you through every section, so you don’t have to figure everything out on your own. Filling it out, you’ll grasp the ins and outs of your business and how each part fits together. It’s also handy because it connects to PandaDoc’s e-signature for easy signing, ideal for businesses with partners or a board.

Miro’s Business Model Canvas Template

Miro’s Business Model Canvas Template helps you map out the essentials of your business, like partnerships, core activities, and what makes you different. It’s a collaborative tool for you and your team to learn how everything in your business is linked.

Better business planning equals better business outcomes

Building a business plan is key to establishing a clear direction and strategy for your venture. With a solid plan in hand, you’ll know what steps to take for achieving each of your business goals. Kickstart your business planning and set yourself up for success with a defined roadmap—utilizing the sample business plans above to inform your approach.

Business plan FAQ

What are the 3 main points of a business plan.

- Concept. Explain what your business does and the main idea behind it. This is where you tell people what you plan to achieve with your business.

- Contents. Explain what you’re selling or offering. Point out who you’re selling to and who else is selling something similar. This part concerns your products or services, who will buy them, and who you’re up against.

- Cash flow. Explain how money will move in and out of your business. Discuss the money you need to start and keep the business going, the costs of running your business, and how much money you expect to make.

How do I write a simple business plan?

To create a simple business plan, start with an executive summary that details your business vision and objectives. Follow this with a concise description of your company’s structure, your market analysis, and information about your products or services. Conclude your plan with financial projections that outline your expected revenue, expenses, and profitability.

What is the best format to write a business plan?

The optimal format for a business plan arranges your plan in a clear and structured way, helping potential investors get a quick grasp of what your business is about and what you aim to achieve. Always start with a summary of your plan and finish with the financial details or any extra information at the end.

Want to learn more?

- Question: Are You a Business Owner or an Entrepreneur?

- Bootstrapping a Business: 10 Tips to Help You Succeed

- Entrepreneurial Mindset: 20 Ways to Think Like an Entrepreneur

- 101+ Best Small Business Software Programs

- Footer navigation

- What are IBANs and SWIFT codes?

- I know what the debit card payment is, but there’s a problem

- Find the address, opening hours or phone number of a branch

- How do I find my sort code and account number?

- What is the cheque clearing cycle and how long does it take?

- Find Barclays

Please upgrade your browser

To have the best experience using our site, please upgrade to one of the latest browsers.

- Business insights

Writing a business plan

Your guide to a successful business plan

A good business plan defines what you want to achieve and how you intend to achieve it. Our guide could help you write yours.

Define your business

It’s important that you define what type of small business you are so that everyone you work with understands what you’re trying to achieve. A comprehensive business plan is the best way to go about defining your business.

Your plan should include:

- What your business will do

- The products or services it will provide

- How customers will access your products or services (eg in a shop, online or by phone)

- Your approach to pricing

- Your long and short-term objectives – including a series of benchmarks if possible that you can check your progress against

Know your customers

Make sure you know as much as possible about who will be buying from you. For example, if you’re marketing to consumers, here are some questions you might want to ask. Knowing the answers will help you promote your business much more effectively:

- How old are they?

- What do they do for a living?

- What are their lifestyles like?

- Do they already buy the product or service?

- Why will they buy from you and no one else?

- How will you tell them about your business?

Naming your business

The name you choose for your business should reflect the image you want to project to your market. Pick one that’s easy to pronounce and remember, but do some research first. Make sure your chosen name is not already in use, it’s available as a web address and will work on your business stationery. You may also consider looking into the name’s meaning in different countries and languages – especially if you see yourself expanding internationally in the future.

If you have the facilities, you could test various names to see how people from your proposed customer base react. There are companies that provide this service, or you could do it informally by asking friends and family.

Taking on staff