- Youth Program

- Wharton Online

ESG Case Studies

The esg initiative at the wharton school, the environmental, social and governance initiative seeks to advance academic research on esg topics. , we drive innovative research in the field of esg to investigate when, where, and how esg factors impact business value., esg integration in finance, esg integration in strategy, esg and organizational change.

Parnassus Investments and Wells Fargo & Co.: Balancing Morals, Metrics and Materiality

A look at the efforts of Ben Allen, CEO of Parnassus, to invest in Wells Fargo while advancing the financial welfare of the firm’s investors and the ESG values so important to many of them and to the staff of the firm.

Engine No. 1: An ESG Upstart Challenges Fund-Industry Assumptions About Organizing An ETF and Everyone’s Assumptions About Proxy Fights

A look into Engine No. 1’s efforts to combine a new ETF that both met a need in the market for active ownership and satisfied gatekeepers with a hedge fund that occasionally pursued activist campaigns needing the support of the Big Three to succeed.

Striking a Balance Between Valuation and Values: Investment Managers Weigh Whether Investments in a Major Oil Company and an Ethanol Producer Serve their Dual Mandate

A look at the decisions Michelle Dunstan and Jeremy Taylor, co-managers of the Alliance Bernstein Global ESG Improvers Strategy, had to make in their effort to buy stocks they believed had the best chance to deliver excellent long-term financial results and improve their ESG performance.

Calculating the Net Present Value of Sustainability Initiatives at Newmont’s Ahafo Mine in Ghana

This case study examines the value and strategy of estimating the net present value of sustainability at Newmont’s Ahafo Mine in Ghana.

Choppies’ Waters: Retailing in Botswana and Sub-Saharan Africa

This case study looks at the impact of Choppies, under the guidance of CEO Ramachandran (“Ram”) Ottapathu, on Botswana and Sub-Saharan Africa.

Designing and Implementing an Integrated Project Management System at Minas-Rio

This case study examines the design and implementation of an Integrated Project Management System to achieve the ultimate goal of First Ore on Ship (FOOS) by November 30, 2014, by Paulo Castellari, CEO of the Anglo American subsidiary Iron Ore Brazil.

Glenmede: How to Credibly Bring an ESG Lens to Investing and Secure Buy-in from Analysts and Clients

A look at Amy Wilson’s efforts to direct ESG investing within the Glenmede Investment Firm credibly and effectively.

Abraaj Group’s Integration of ESG Policies into the Turnaround of K-Electric

This case study explores the efficacy of the Abraaj Group’s strategy in changing the K-Electric company’s direction, with the aim of transforming it into a sustainable, growth-oriented, private sector utility.

Kerovka simulation

The Kerovka simulation is a highly innovative software tool that is used as part of an organised workshop, either in a classroom or in remote format, to deliver an intense experience that helps participants with a wide variety of experience levels to develop skills for dealing with challenges such as managing crisis scenarios, and leading responsibly & sustainably.

About the Environmental, Social and Governance Initiative

The Environmental, Social and Governance Initiative conducts academically rigorous and practically relevant research with industry partners and across all Wharton departments that investigates when, where, and how ESG factors impact business value. Informed by research, we offer 30+ courses that MBA and undergraduate students can assemble into a major or concentration, over a dozen co-curricular experiences, and three Executive certificate programs. Led by Vice Dean Witold Henisz, the ESG Initiative advances Wharton’s best-in-class education of current and future leaders, enabling them to serve a world undergoing tremendous change.

[email protected]

- Directory Global directory

- Logins Product logins

- Support Support & training

- Contact Contact us

Talent Insights

Based on empirical research with more than 2,400 stand-out lawyers around the world, firms can now examine what action needs to be taken to nurture, retain and attract top talent.

Featured event

Jan 23, 2023

The 30th Annual Marketing Partner Forum

Related posts.

The growing role of chief information officers in sustainability

How the EU and UK regulatory approaches to sustainability vary

How to use financial channels to embed sustainability into core company operations

More insights.

For family offices, reputational due diligence is critical for making direct investments

ILTACON 2023: How 5 law firms are putting their data to work in new ways

Stellar Performance 2023: The state of lawyer engagement

KPMG Personalization

- ESG stories

Client stories unlocked through sustainable strategies and solutions.

- Share Share close

- 1000 Save this article to my library

- View Print friendly version of this article Opens in a new window

- Go to bottom of page

- Home ›

- Insights ›

KPMG professionals help clients develop responsible and sustainable strategies, business and operating models, and investments. Learn how KPMG firms leverage the latest research, skills, influence and resources to help build and deliver solutions for clients’ unique business needs. Here are some of their stories.

KPMG is creating a Blue Economy Accelerator program to support local business growth and preserve the health of ocean ecosystems.

KPMG is creating a Blue Economy Accelerator program to support local business growth and..

Video: How we helped global asset manager Apollo embed a comprehensive strategy to manage climate risks and opportunities.

Pushing the boundaries of corporate reporting, while preserving natural capital.

Video: A case study on inclusion, diversity and equity.

Simply Blue Group harnesses the power of the ocean to drive the blue economy.

Making a positive impact on billions of people.

Creating a more sustainable seafood sector by building resilience to the impacts of climate change.

Creating a more sustainable seafood sector by building resilience.

Rethinking the reduction of food waste

Creating positive social impact and sustainable business value through innovation.

KPMG: Our Impact Plan on supporting ocean, fresh water and wetland ecosystems for a more sustainable future.

Supporting ocean, fresh water and wetland ecosystems for a more sustainable future.

How can emerging economies achieve growth in a post-COVID era?

Powering the future

Building trust into a contact tracing program.

A better tomorrow starts with a good breakfast.

Related content

Unlock the power of ESG to transform your business and build a more sustainable future.

KPMG. Make the Difference.

Short podcasts addressing the opportunities and challenges of ESG.

Transformative, sustainable insight to help prepare your organization for what’s next.

John McCalla-Leacy

Head of global esg, kpmg international, stay up to date with what matters to you.

Gain access to personalized content based on your interests by signing up today

Browse articles, set up your interests , or View your library .

You've been a member since

Connect with us

KPMG firm leaders employ leading practices, research and trusted client solutions to help you navigate the biggest issues facing our planet.

ESG insights

ESG-related content straight to your inbox.

The email address you've entered is already tied to an existing account. Please enter your password to log in.

KPMG thought leadership is always available to our registered users

Log in with your social media account

You’ve successfully logged in.

Please close this pop-up to return to the page.

Please provide the following information to register.

Please tick the box if you consent to KPMGI sending you insights, event invitations and other benefits via email.

By checking this box you consent to KPMGI sharing your personal data with its member firms for marketing purposes, including direct outreach regarding KPMG services.

Note : You will receive an email after registration to verify and activate your account. Also you will have options to self-serve to set your preferences for content personalization, subscription to newsletter, opt-in and opt-out from email communication and delete your account any time after registration.

- Work & Careers

- Life & Arts

- Currently reading: Business school teaching case study: Unilever chief signals rethink on ESG

- Business school teaching case study: can green hydrogen’s potential be realised?

- Business school teaching case study: how electric vehicles pose tricky trade dilemmas

- Business school teaching case study: is private equity responsible for child labour violations?

Business school teaching case study: Unilever chief signals rethink on ESG

- Business school teaching case study: Unilever chief signals rethink on ESG on x (opens in a new window)

- Business school teaching case study: Unilever chief signals rethink on ESG on facebook (opens in a new window)

- Business school teaching case study: Unilever chief signals rethink on ESG on linkedin (opens in a new window)

- Business school teaching case study: Unilever chief signals rethink on ESG on whatsapp (opens in a new window)

Gabriela Salinas and Jeeva Somasundaram

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

In April this year, Hein Schumacher, chief executive of Unilever, announced that the company was entering a “new era for sustainability leadership”, and signalled a shift from the central priority promoted under his predecessor , Alan Jope.

While Jope saw lack of social purpose or environmental sustainability as the way to prune brands from the portfolio, Schumacher has adopted a more balanced approach between purpose and profit. He stresses that Unilever should deliver on both sustainability commitments and financial goals. This approach, which we dub “realistic sustainability”, aims to balance long- and short-term environmental goals, ambition, and delivery.

As a result, Unilever’s refreshed sustainability agenda focuses harder on fewer commitments that the company says remain “very stretching”. In practice, this entails extending deadlines for taking action as well as reducing the scale of its targets for environmental, social and governance measures.

Such backpedalling is becoming widespread — with many companies retracting their commitments to climate targets , for example. According to FactSet, a US financial data and software provider, the number of US companies in the S&P 500 index mentioning “ESG” on their earnings calls has declined sharply : from a peak of 155 in the fourth quarter 2021 to just 29 two years later. This trend towards playing down a company’s ESG efforts, from fear of greater scrutiny or of accusations of empty claims, even has a name: “greenhushing”.

Test yourself

This is the fourth in a series of monthly business school-style teaching case studies devoted to the responsible business dilemmas faced by organisations. Read the piece and FT articles suggested at the end before considering the questions raised.

About the authors: Gabriela Salinas is an adjunct professor of marketing at IE University; Jeeva Somasundaram is an assistant professor of decision sciences in operations and technology at IE University.

The series forms part of a wider collection of FT ‘instant teaching case studies ’, featured across our Business Education publications, that explore management challenges.

The change in approach is not limited to regulatory compliance and corporate reporting; it also affects consumer communications. While Jope believed that brands sold more when “guided by a purpose”, Schumacher argues that “we don’t want to force fit [purpose] on brands unnecessarily”.

His more nuanced view aligns with evidence that consumers’ responses to the sustainability and purpose communication attached to brand names depend on two key variables: the type of industry in which the brand operates; and the specific aspect of sustainability being communicated.

In terms of the sustainability message, research in the Journal of Business Ethics found consumers can be less interested when product functionality is key. Furthermore, a UK survey in 2022 found that about 15 per cent of consumers believed brands should support social causes, but nearly 60 per cent said they would rather see brand owners pay taxes and treat people fairly.

Among investors, too, “anti-purpose” and “anti-ESG” sentiment is growing. One (unnamed) leading bond fund manager even suggested to the FT that “ESG will be dead in five years”.

Media reports on the adverse impact of ESG controversies on investment are certainly now more frequent. For example, while Jope was still at the helm, the FT reported criticism of Unilever by influential fund manager Terry Smith for displaying sustainability credentials at the expense of managing the business.

Yet some executives feel under pressure to take a stand on environmental and social issues — in many cases believing they are morally obliged to do so or through a desire to improve their own reputations. This pressure may lead to a conflict with shareholders if sustainability becomes a promotional tool for managers, or for their personal social responsibility agenda, rather than creating business value .

Such opportunistic behaviours may lead to a perception that corporate sustainability policies are pursued only because of public image concerns.

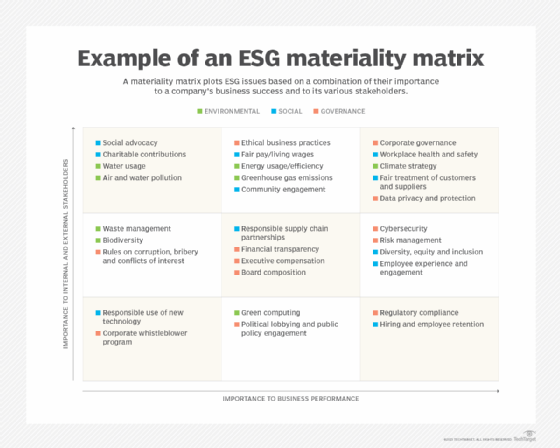

Alison Taylor, at NYU Stern School of Business, recently described Unilever’s old materiality map — a visual representation of how companies assess which social and environmental factors matter most to them — to Sustainability magazine. She depicted it as an example of “baggy, vague, overambitious goals and self-aggrandising commitments that make little sense and falsely suggest a mayonnaise and soap company can solve intractable societal problems”.

In contrast, the “realism” approach of Schumacher is being promulgated as both more honest and more feasible. Former investment banker Alex Edmans, at London Business School, has coined the term “rational sustainability” to describe an approach that integrates financial principles into decision-making, and avoids using sustainability primarily for enhancing social image and reputation.

Such “rational sustainability” encompasses any business activity that creates long-term value — including product innovation, productivity enhancements, or corporate culture initiatives, regardless of whether they fall under the traditional ESG framework.

Similarly, Schumacher’s approach aims for fewer targets with greater impact, all while keeping financial objectives in sight.

Complex objectives, such as having a positive impact on the world, may be best achieved indirectly, as expounded by economist John Kay in his book, Obliquity . Schumacher’s “realistic sustainability” approach means focusing on long-term value creation, placing customers and investors to the fore. Saving the planet begins with meaningfully helping a company’s consumers and investors. Without their support, broader sustainability efforts risk failure.

Questions for discussion

Read: Unilever has ‘lost the plot’ by fixating on sustainability, says Terry Smith

Companies take step back from making climate target promises

The real impact of the ESG backlash

Unilever’s new chief says corporate purpose can be ‘unwelcome distraction ’

Unilever says new laxer environmental targets aim for ‘realism’

How should business executives incorporate ESG criteria in their commercial, investor, internal, and external communications? How can they strike a balance between purpose and profits?

How does purpose affect business and brand value? Under what circumstances or conditions can the impact of purpose be positive, neutral, or negative?

Are brands vehicles by which to drive social or environmental change? Is this the primary role of brands in the 21st century or do profits and clients’ needs come first?

Which categories or sectors might benefit most from strongly articulating and communicating a corporate purpose? Are there instances in which it might backfire?

In your opinion, is it necessary for brands to take a stance on social issues? Why or why not, and when?

Climate Capital

Where climate change meets business, markets and politics. Explore the FT’s coverage here .

Are you curious about the FT’s environmental sustainability commitments? Find out more about our science-based targets here

Promoted Content

Explore the series.

Follow the topics in this article

- Sustainability Add to myFT

- Impact investing Add to myFT

- Corporate governance Add to myFT

- Corporate social responsibility Add to myFT

- Business school case Add to myFT

International Edition

The New Equation

Executive leadership hub - What’s important to the C-suite?

Tech Effect

Shared success benefits

Loading Results

No Match Found

Bristol Myers Squibb’s leadership in global diversity & inclusion

/content/dam/pwc/us/en/library/case-studies/assets/bms-case-study-logo.png

Pharmaceutical

Helping Bristol Myers Squibb achieve its Global Diversity & Inclusion goals

Purpose <br> Transparency

Leading the journey with transparency

As one of the world’s largest biopharmaceutical companies, Bristol Myers Squibb (BMS) doesn’t just develop life-saving medicines. The company is also a leader in global diversity and inclusion (GD&I) initiatives, committing itself to advancing diversity and inclusion (D&I) efforts and improving health equity for better patient outcomes. And the hope is that these actions will inspire other companies in the pharmaceutical industry to do the same.

For nearly two decades, GD&I—a critical pillar in environmental, social and governance (ESG) strategies—has been a top priority for BMS. In fact, in 2015, the company evolved its employee resource groups to People and Business Resource Groups (PBRGs) to focus on GD&I initiatives and build a workforce that better reflected the diversity of its patients and communities. The groups aimed to create a culture of inclusion and belonging and, ultimately, drive innovation and business results. In addition, CEO Giovanni Caforio signed the CEO Action pledge for Diversity and Inclusion .

But BMS’ extensive efforts continue to grow. In 2020, the company and the Bristol Myers Squibb Foundation each made $150 million commitments to accelerate and expand diversity, inclusion and health equity efforts, including workforce representation. Internally, the company pledged to advance leadership representation by the end of 2022 by achieving gender parity at the executive level and doubling executive representation of Black/African American and Latino/Hispanic employees in the US.

What was BMS’ next step? To tell the world. And to share the GD&I strategy in the company’s first Global Diversity and Inclusion report , which provides transparency into a broad set of metrics and brings the stats to life with authentic stories from employees.

Writing chapter one of an evolving story

To ensure companies are truly accountable to diversity, equity and inclusion goals, they need to question everything—including their data. BMS’ leadership understood that, and knew the company needed help to enable high-quality data processes as well as framing, qualifying and quantifying its story and aspirations. The goal? To produce a comprehensive report with insights that identify which initiatives are working well and which ones need to be improved—and to provide context that creates an emotional connection with readers.

Aligning strategy, culture and context

The same team members who brought PwC’s inaugural Diversity & Inclusion Transparency Report to life in 2020 tapped into the lessons they learned on that project, including how to communicate with authenticity and consistency, and the importance of a far-reaching communication and socialization plan. The BMS and PwC teams worked collaboratively to connect themes and storylines to the data—putting the report’s metrics in context by illustrating the real-world value of the actions. They also applied the data quality approaches PwC uses with many of its clients to help confirm the accuracy of the quantitative metrics in the report.

While teaming to identify representation benchmarks, the biopharma company crystallized key messages around its GD&I journey by integrating diverse employee stories and qualitative examples that would resonate with readers. These efforts included cultural dexterity training and helping to curb the spread of COVID-19 through education and outreach campaigns in underserved communities throughout the world.

Rolling out the first report

BMS strongly believes that GD&I initiatives require much more than simply reporting workforce data: They also should outline what a company stands for—and why.

The teams assembled one of the most robust narratives of GD&I efforts in the biopharmaceutical industry to date. BMS’ commitments to addressing health disparities, clinical trial diversity, supplier diversity, increased employee giving and workforce representation—all in service to patients—has served as the North Star.

Working together, the multifaceted, multidisciplinary teams crafted a data framework and an actionable publishing timeline. They went through multiple iterations to get alignment with leaders across various functions. In the process, they uncovered additional insights and data points to help guide future initiatives, such as amplifying Everybody Counts (the company’s self-identification campaign) with leader messages and employee videos that breathe life and authenticity into these efforts.

Turning ideas into actions

Working hand in hand, PwC helped BMS develop a landscape analysis to understand how to aggregate, calculate and determine how the company’s efforts compared to the benchmark analysis. This was a complex process that had to be performed on an aggressive timeline.

While some members of the multidisciplinary teams tackled numbers, others focused on structure, messaging, insight generation and storyline—a task that’s as complex as data analysis. PwC helped BMS achieve an intricate balance between embedding relevant metrics and providing a compelling narrative with qualitative proof points and illustrative examples. PwC oversaw and helped to guide the whole process, ensuring that all stakeholders were on the same page and working toward the same goals—including meeting very tight deadlines.

Throughout the process, the stakeholders put their heads together to think through their GD&I story, align on the most important elements, find answers to the "so what?" questions, identify areas for growth and improvement—and communicate all of this to employees, customers, shareholders, the industry and the public in an authentic way. While the discussions weren’t always comfortable or easy, they were essential to finding answers and curating the company’s GD&I efforts.

Adding context to the data

BMS leaders had been tracking GD&I data for decades, but needed to provide context to tell a holistic story that employees, clients, healthcare networks and other stakeholders could relate to and easily understand. PwC helped prioritize the stories the company wanted to tell and documented the process, making it more rigorous and disciplined. BMS and PwC worked collaboratively with other agencies to create a meaningful report that married impressive business outcomes with a positive impact on individual people.

The integrated teams aligned on messaging and storylines and produced the robust Global Diversity and Inclusion report , including within it many employee stories. These narratives, many of which were provided by the PBRGs, breathed life into the detailed metrics that document the company's efforts. Putting the statistics into context helped readers connect emotionally with the report, and BMS’ typical social media benchmarks were exceeded twofold.

Putting a stake in the ground

BMS’ report was inclusive and transparent, painting a clear picture of the company’s diversity, equity and inclusion initiatives. These GD&I efforts put an initial virtual stake in the ground, inspiring employee engagement and helping to position BMS as a leader in the biopharma industry.

Other benefits included a deeper understanding of the data in the report, as well as a workable timeline for future reports and guidance to assist with ongoing efforts.

Building trust and goodwill

The transparency and context of the report contributed to a culture shift. Supported by these efforts and others, such as the Everybody Counts self-identification campaign, managers felt more encouraged to have honest, sometimes difficult conversations with their teams regarding diversity, equity and inclusion topics. That, in turn, often empowered employees to share their thoughts and personal stories about their life experiences with their colleagues and managers.

Reactions to the GD&I report have been positive, and BMS leaders expect that to continue, while acknowledging that the report represents just the first steps in an ongoing journey. The company continues to promote the GD&I dialogue within its industry and has made long-term commitments to gender parity, better representation of Black/African American and Latino/Hispanic individuals in the executive ranks, supplier diversity, employee giving, health equity and clinical trials. Further, BMS will continue to tell the world what it stands for, how it intends to achieve its ambitious GD&I and health equity goals and what pioneering efforts it plans for the future.

Bristol Myers Squibb’s commitment to GD&I produced a groundbreaking report

The biopharma company’s discussions aligned stakeholders on messaging and timelines., “this important effort is the beginning of an ongoing gd&i conversation and is our foundation going forward. pwc challenged our team to think about what is most important and how we can continue to make progress.” .

Linda Leonard Global Diversity & Inclusion Lead, Bristol Myers Squibb

“We’re proud to be part of Bristol Myers Squibb’s journey to address diversity and inclusion and health equity imperatives. This report is a critical step in helping to build trust.”

Luna Corbetta Principal, PwC

Ready to measure, report and communicate a compelling DEI story? PwC can help.

Get started

Explore PwC's case study library

Share this case study.

Hello, instant ordering. Learn how Bristol Myers Squibb told the world about their Global Diversity and Inclusion efforts and the lessons they learned along the way #ESG.

{{filterContent.facetedTitle}}

{{item.publishDate}}

{{item.title}}

{{item.text}}

Luna Corbetta

Principal, Workforce Transformation, Pharma & Life Sciences, PwC US

Sheri Wyatt

Sustainability and Deals Partner, PwC US

Thank you for your interest in PwC

We have received your information. Should you need to refer back to this submission in the future, please use reference number "refID" .

Required fields are marked with an asterisk( * )

Please correct the errors and send your information again.

By submitting your email address, you acknowledge that you have read the Privacy Statement and that you consent to our processing data in accordance with the Privacy Statement (including international transfers). If you change your mind at any time about wishing to receive the information from us, you can send us an email message using the Contact Us page.

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Data Privacy Framework

- Cookie info

- Terms and conditions

- Site provider

- Your Privacy Choices

- Contributors

The Business Case for ESG

Brandon B. Boze is partner at ValueAct Capital; David F. Larcker is James Irvin Miller Professor of Accounting at Stanford Graduate School of Business; and Eva T. Zlotnicka is Vice President at ValueAct Capital. This post is based on a recent paper by Mr. Boze, Professor Larcker, Ms. Zlotnicka, Margarita Krivitski , and Brian Tayan . Related research from the Program on Corporate Governance includes Socially Responsible Firms by Alan Ferrell, Hao Liang, and Luc Renneboog (discussed on the Forum here ).

We recently published a paper on SSRN, The Business Case for ESG , that examines the potential for corporate managers, boards of directors, and institutional investors around how best to incorporate ESG (environmental, social, governance) factors into strategic and investment decision-making processes. Central to the topic is the premise that both companies and investors have become too short-term oriented in their investment horizon, leading to decisions that increase near-term reported profits at the expense of the long-term sustainability of those profits. The costs of those decisions are assumed to manifest themselves as externalities, borne by members of the workforce or society at large.

Prominent investors such as Larry Fink at BlackRock adopt this viewpoint:

To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society. Companies must benefit all of their stakeholders, including shareholders, employees, customers, and the communities in which they operate. Without a sense of purpose, no company, either public or private, can achieve its full potential. It will ultimately lose the license to operate from key stakeholders. It will succumb to short-term pressures to distribute earnings, and, in the process, sacrifice investments in employee development, innovation, and capital expenditures that are necessary for long-term growth.

Similarly, Martin Lipton of law firm Wachtell, Lipton, Rosen & Katz has urged corporate clients to adopt what he calls “The New Paradigm,” a more stakeholder-centric orientation that emphasizes a long-term investment horizon:

In essence, the New Paradigm recalibrates the relationship between public corporations and their major institutional investors and conceives of corporate governance as a collaboration among corporations, shareholders and other stakeholders working together to achieve long-term value and resist short-termism.

Evaluating claims such as these on a national or macro-level would require an accurate measurement of the time horizons of business managers today and the degree to which, if any, they ignore or underestimate long-term environmental or social costs in the pursuit of near-term profits.

Boards can improve their analysis of ESG risks and opportunities at a practical level by considering how long-term investors integrate ESG factors into their decision-making process. To do so, we examine a framework informed by the experience of ValueAct Capital. ValueAct is a long-term investor which aims to work constructively with portfolio company management teams and boards in a variety of ways, including at times having a ValueAct representative serve on the board.

Broad Integration of ESG Factors

In many ways, a focus on the durability of earnings and downside risk inherently incorporates many concepts commonly associated with ESG. To that end, ValueAct has also adopted an approach to evaluate ESG-related factors as part of its decision-making process and has deepened engagement with its portfolio companies around these issues. It does so because analysis of ESG factors can:

- Provide an effective risk management framework

- Provide a new lens for strategy development and growth opportunities

- Address the demands of stakeholders such as customers, employees, and investors

As such, ValueAct generally incorporates ESG factors into its process by identifying relevant stakeholders and factors, isolating and evaluating potential risks, and supporting companies as they invest in their businesses to increase returns.

Identifying Relevant Factors. The first step is to map the ecosystem of stakeholders associated with the company and analyze their interests (i.e., their incentives, values, viewpoints, etc.). These stakeholders typically include customers, suppliers, employees, regulators, the general public (including environmental impact), shareholders, and competitors. Once this ecosystem is mapped, it is easier to understand which ESG factors are most relevant to a particular company. Certain factors such as governance and human capital might be applicable broadly, while others such as environmental footprint might be more limited.

As an example of this process, ValueAct created an ecosystem map as part of its diligence of the private student loan industry, including the leading provider Sallie Mae. The map identifies students and their parents, colleges and their financial aid officers, government regulators, U.S. taxpayers, and shareholders as key stakeholders and summarizes the goals of each.

Isolating and Evaluating Potential Risks. Once the relevant factors have been identified, one can evaluate and quantify (to the extent possible) the company’s position and associated risk in each area. The active engagement of an investor with a significant stake and long-term perspective can elevate a company’s discussion of risk at the C-suite and board level, encourage corporate investment to mitigate risk if needed (even at the expense of near-term profit), and provide support for the management team as it justifies its decisions to the broader investment community.

In the example of the student loan industry above, the federal government is an important focal point given its dual role as lender and policy maker. This suggests several questions:

- Can private student loans provide better value to students than federal programs?

- How might policy changes impact the competitive dynamic between private and federal programs?

- What impact do various sources of student loans have on both school and student outcomes?

In attempting to answer these questions from an investor’s perspective, ValueAct was better able to evaluate how private student loan providers could play a positive role in any higher education policy focused on access, quality and affordability, and therefore serve as an important part of the long-term solution to fund higher education.

Investing to Increase Returns. Beyond risk reduction, ESG factor analysis can lead to the identification of investments or activities by the company that increase long-term returns. For example, a company’s investment in a more sustainable supply chain can deepen relationships with customers (thereby promoting volume growth and premium pricing), attract talent to the organization, and perhaps reduce costs. In the private student loan ecosystem, investments behind improving student outcomes can significantly reduce default risk while also improving the brand in the eyes of customers, employees and regulators. These positive effects can build on one another and create a powerful flywheel effect. To identify and capitalize on opportunities such as these, senior business leadership must consider material ESG factors as core inputs into their strategy development.

Beyond ESG: Investing Behind Business Models and Transitions Integral to Solving Global Problems

Integration of ESG-related factors is broadly applicable across all companies. In ValueAct’s experience, there is also an opportunity for institutional investors to identify and invest behind companies where sustainability is at the center of the investment thesis, or whose business models are core to the ultimate solution for specific environmental and social problems (increasingly referred to as “impact investing”). These global problems can include carbon emissions, waste recovery, access to education, affordability of healthcare, and biodiversity loss, to name a few.

Below we explore two of those problems—carbon emissions and access to education—and provide an example of companies that are transitioning their business models to address these problems.

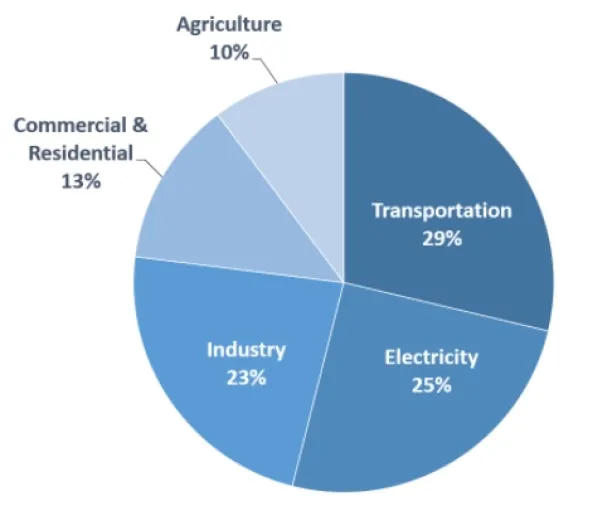

Carbon Emissions

Electricity production accounts for over a quarter (27.5 percent) of greenhouse gas emissions in the U.S. Approximately 64 percent of electricity production comes from fossil fuels such as coal and natural gas, 19 percent from nuclear and 17 percent from renewables such as wind and solar. Renewables have steadily gained share as they have become more cost competitive with fossil fuels in certain geographies. Increased investment can accelerate this transition and pull forward the benefits from a climate change perspective.

Global power company AES has a 38-year history of owning and operating contracted generating capacity to utilities around the world. By early 2018, AES was addressing the environmental cost of its reliance on coal as an energy source and was in the process of repositioning its portfolio to renewable sources. The company subsequently made a series of changes to accelerate the transition of its business model. In early 2018, AES announced a broad reorganization, including asset divestitures primarily related to coal plants. The company also committed to a target of decreasing reliance on coal from 41 percent of supply in 2015 to 29 percent by 2020. It publicly set a carbon intensity reduction target of 70 percent by 2030. Through joint ventures with Siemens and others, it built capacity for energy storage and development of renewables. In November 2018, the company voluntarily released a Climate Scenario Report, claiming to be the first U.S. publicly listed energy-related business to do so in accordance with guidelines set by the Task Force for Climate-related Financial Disclosures (TCFD). The company also modified its mission statement to emphasize its commitment to transformation to: “Improve lives by accelerating a safer and greener energy future.”

These actions appear to have had a number of ripple effects. According to AES, the updated mission statement galvanized the company’s culture, helping it to attract talent, increase workforce productivity, and further innovation. The company also received recognition from external parties for its reporting efforts. Shareholders who had pressured the company to conduct a climate-change risk assessment voluntarily withdrew their proxy resolution, and according to AES, some foreign and domestic investors, who previously would not invest in AES because of its exposure to coal, made new investments. During this time of investment in a less carbon intensive business, the company’s price-to-earnings (P/E) multiple expanded from approximately 9x in January 2018 to 14x by March 2019 and its stock price outpaced industry indexes (see Exhibit 2).

Access to Education

Higher education is a critical determinant of future wages, with college graduates earnings approximately 80 percent more per year than those with only a high school degree. The cost of college education, however, has been rising significantly for many years, and student loans become the fastest growing category of consumer debt, rising to $1.6 trillion by the end of 2018. Addressing the problems of access and affordability while maintaining quality offers substantial potential benefits for U.S. citizens and the economy.

The for-profit education industry has long had the potential to provide this solution by offering a less expensive educational experience focused on occupational training. By and large, however, the industry had not achieved this objective. By the early 2010s, poor student outcomes and high student loan default rates led to regulatory scrutiny. The federal government began to enforce punitive performance requirements and cut off funding to those institutions whose graduates could not find well-paying jobs. These actions led to the collapse of several companies in the industry, such as ITT Educational and Corinthian Colleges. Meanwhile, the survivors experienced precipitous declines in revenue and profits. In the case of Strategic Education (formerly Strayer Education), one of the largest for-profit education companies in the United States whose history dates back to 1892, operating margins, which exceeded 35 percent prior to the change, fell into the teens. The company’s stock price declined from a high of $254.50 In April 2010 to a low of $34 per share in December 2013 (see Exhibit 3).

Since mid-2015, Strategic Education made a series of changes to reposition itself for durable growth, based on a business model that contributes to positive societal change. The company reduced tuition rates to increase affordability. It made investment in machine learning and artificial intelligence to lower its costs and improve student outcomes, passing on the savings as lower tuition. It also increased its efforts to measure student outcomes and take the learnings to foster continuous innovation in the education experience. Recently, it merged with Capella University—an online graduate school education company—to build scale and further its competency-based learning. Strategic Education has also expanded non-degree educational offerings for employed workforce members, with corporate partnerships representing approximately a quarter of enrollment and growing.

Subsequently, student experience and retention improved, leading to higher unit economics. Operating margins and profits increased. In 2018 alone, enrollment at Strayer University increased by 8 percent to nearly 48,000 students while the continuation rate and number of students completing the requirements for graduation also rose. Importantly, the company has positioned itself as a contributor to positive social outcomes by improving education and training for students and adults at lower cost.

Concluding Remarks

The examples of AES and Strategic Education illustrate how some companies can benefit from a foundational shift in their business model to explicitly address stakeholder concerns, leading to more sustainable long-term economics. In some cases, it requires that management and the board be amenable to collaborating with stakeholders to determine how to achieve those changes or with a significant shareholder to champion this decision among the broader shareholder base. Ultimately, certain incumbents whose industry faces significant environmental or social challenges can create value and generate returns by more centrally focusing on addressing those challenges.

Why This Matters

- The examples included in this Closer Look involve companies that appear to have a long-term investment horizon and are willing to bear the cost of an up-front investment in order to increase long-term value. How prevalent are companies with a long-term perspective? How many companies miss long-term opportunities because they are excessively focused on short-term profits? What does this say about the quality of corporate governance and board oversight in companies today?

- This paper offers two case studies of companies transitioning “beyond ESG” to solve global problems. Both are traditional businesses whose executives and board members recast their business models to try to solve environmental and/or social problems and improve long-term profit opportunities. Just how widespread are such opportunities? Can every company achieve such a transition and do so profitably?

- The approach described in this Closer Look suggests that opportunities exist for investors to earn competitive risk-adjusted returns with a favorable ESG focus. How large is this opportunity? How does this compare to the total universe of publicly traded companies?

The complete paper is available here .

Supported By:

Subscribe or Follow

Program on corporate governance advisory board.

- William Ackman

- Peter Atkins

- Kerry E. Berchem

- Richard Brand

- Daniel Burch

- Arthur B. Crozier

- Renata J. Ferrari

- John Finley

- Carolyn Frantz

- Andrew Freedman

- Byron Georgiou

- Joseph Hall

- Jason M. Halper

- David Millstone

- Theodore Mirvis

- Maria Moats

- Erika Moore

- Morton Pierce

- Philip Richter

- Marc Trevino

- Steven J. Williams

- Daniel Wolf

HLS Faculty & Senior Fellows

- Lucian Bebchuk

- Robert Clark

- John Coates

- Stephen M. Davis

- Allen Ferrell

- Jesse Fried

- Oliver Hart

- Howell Jackson

- Kobi Kastiel

- Reinier Kraakman

- Mark Ramseyer

- Robert Sitkoff

- Holger Spamann

- Leo E. Strine, Jr.

- Guhan Subramanian

- Roberto Tallarita

Sustainability drives automotive market cap

How Volkswagen is driving clarity and confidence in their sustainability strategy.

Call for change

Having a bold Environmental, Social and Governance (ESG) strategy matters to investors, employees and the public—but not if they don’t understand it. Despite having launched the most ambitious decarbonization and digitalization initiative in automotive history, the Volkswagen Group (VW), the world’s largest automaker by volume, had a market cap well below that of its rivals. VW realized they needed to better articulate their ESG strategy.

To address this, the auto major wanted to implement a more cohesive sustainability narrative—from environmental to diversity to human rights and resource efficiency—that would resonate with its culture and its individual brands. VW also wanted to sharpen its overall ESG focus, defining the initiatives, responsibilities and KPIs that would make sustainability synonymous with the corporate strategy.

Achieving this would clarify its sustainability strategy—to become an emission-free, digitally-connected leader in mobility—and drive greater awareness among stakeholders, including the investment community.

When tech meets human ingenuity

Accenture broke the project into three phases. Phase one involved determining where VW stood in relation to its peers. Since investors trust S-Ray, a machine learning platform that generates ESG ratings of companies based on millions of data points for over 7,000 listed companies, the team identified the data needed to generate an S-Ray score and ESG rating in line with VW’s industry-leading efforts.

Next, the team conducted C-level workshops to develop support for the company’s ESG vision, emphasizing decarbonization, circular business models, workforce transformation and human rights in supply chain. The third phase saw the team help articulate VW’s ESG narrative, which included key initiatives, responsibilities, KPIs and a plan to communicate all the company’s efforts.

A valuable difference

In six months, the team consolidated VW’s ESG narrative from 18 sustainability topics to just four major topics, with easily understandable ambitions and KPIs for each area so the company can measure its progress more efficiently. Targets were set in areas such as decarbonization, circular economy, human rights in business and workforce transformation.

With ESG objectives woven into its operational and functional processes, there’s now a clear connection between VW’s S-Ray score and the overall corporate strategy, integrating the NEW AUTO plan to pivot VW to a global software-driven mobility provider that powers the future of EVs and fully networked transportation.

Customers are already on board—in December 2020 VW’s electric ID.3 was the second best-selling car in Europe and by 2021, the Volkswagen Group was being seen as the market leader in e-mobility.

With ESG analysis and real-world ESG performance becoming clearer, VW is able to accelerate its sustainability strategy. Its overall growth ambitions are reflected in its market cap rise, which is becoming consistent with that of other global enterprises. VW’s roadmap is set for further growth as investors look to make smarter bets on how we’ll all get where we want to go—together, and for the planet.

Popular Searches

Your previous searches, recently visited pages.

Content added to Red Folder

Removed from Red Folder

- Global Private Equity Report

The Expanding Case for ESG in Private Equity

Customers, employees and limited partners are demanding more sustainable, socially conscious corporate behavior. PE firms that can deliver are reaping the rewards.

By Axel Seemann, Dale Hardcastle, Deike Diers, and Jacqueline Han

- March 01, 2021

At a Glance

- ESG investing continues to face skepticism in the private equity industry, especially in the US.

- But proactive firms aren’t waiting for ROI studies to pan out before incorporating sustainability and social responsibility into how they invest and operate.

- ESG isn’t just a nice thing to do. It is becoming a critical element in gaining market share, engaging employees and raising capital.

This article is part of Bain's 2021 Global Private Equity Report.

Until there is consistent data establishing a positive link between ESG investing and financial returns, there will always be skepticism among private equity investors. That’s just the way the industry is wired.

We’ve all seen the anecdotal evidence that companies can actually “do well by doing good” when they adhere to environmental, social and corporate governance (ESG) standards. But no matter the ownership model, there is reluctance to dive in headfirst, and PE firms face a unique mandate to produce substantial returns quickly.

ESG is broad and amorphous, notoriously hard to define. We lack time-tested standards for measuring either results or impact. That, not surprisingly, leads to muted enthusiasm among some firms and check-the-box efforts among others. Very often, it seems, firms skew toward the “E,” putting new labels on cost or efficiency initiatives that they would have implemented anyway. As Institutional Investor put it in a June 2020 headline , “Private Equity Makes ESG Promises. But Their Impact Is Often Superficial.”

This clearly isn’t always the case. TPG, for instance, has enthusiastically adopted ESG principles both internally and within its portfolios. It is also a leader in launching impact funds and made a high-profile announcement in January that former US Treasury Secretary Hank Paulson would join the firm as executive chairman of TPG Rise Climate, a new fund focused on climate-related investments. At the same time, signatories to the United Nations’ Principles for Responsible Investment (PRI) jumped 28% last year and now number more than 3,000 institutional investors and PE firms, representing a staggering $103 trillion of assets under management.

Yet a closer look at the numbers suggests that real commitment to ESG is less monolithic. While the PRI signatory list includes 431 PE firms from around the world, only 16 of them disclose ESG’s impact on financial returns, according to Institutional Investor , and only half use ESG principles in monitoring more than 90% of their portfolio companies.

There’s also a wide gap in adoption between the PE industry in North America and that in Europe. While 80% of the top 20 EU-based institutional investors have committed to either the PRI, the UN’s Net-Zero Asset Owner Alliance or the Task Force on Climate-related Financial Disclosures, less than half of the top 20 North American institutions have done so, and many of those are based in Canada (see Figure 1).

Limited partners in Europe lead the world in committing to global standards for responsible and sustainable investment

An analysis of ESG performance among PE firms by EcoVadis, a leading global supplier of business sustainability ratings, shows that portfolio companies owned by US-based firms trail those owned by EU-based firms by 12 points. Yet even in Europe there is ample room to grow. Looking at sustainability factors only, the great majority of EU-owned portfolio companies haven’t launched meaningful initiatives (see Figure 2). And the broader corporate world isn’t much further along. EcoVadis data shows that PE-owned companies and corporations are pretty much neck and neck when it comes to ESG maturity scores in both the US and Europe.

European LPs have embraced ESG much more eagerly than those in North America, but there’s still room to grow

A building wave of change.

So is ESG one of those particularly persistent investment fads that will eventually fade away? We wouldn’t bet on that any more than we’d bet against the historic groundswell of global concern around climate change, social upheaval and corporate responsibility. What’s made the PE industry successful in the past is its ability to anticipate future currents of value creation and to think more broadly about how they will reveal themselves. We believe this is one of those moments.

Sensing that broader economic forces are rapidly changing behaviors and attitudes, many firms aren’t waiting for ROI studies to prove out before banking on ESG. A growing segment of the industry believes that investments in sustainability, social welfare and good governance require a different calculus for now—at least if they want to get ahead of the game.

In the few short years since ESG appeared on the scene, the industry has tended to view it as a sideshow—something good to do in addition to a fund’s normal business of buying and shepherding companies. Some firms have actually segregated these efforts into discrete funds wholly devoted to impact investing, where the goal is to generate social or environmental impact at market-rate returns (see Figure 3).

Leading firms see ESG investing as a core part of creating value and mitigating risk

As ESG matures, however, the firms leading the charge—mostly in Europe—talk less about discrete, segregated ESG initiatives and more about delighting customers, gaining market share, engaging employees and creating the best work environment. As with sector expertise or technology acumen, they have come to consider ESG a core part of what differentiates them as competitors, baking ESG principles into sharpening due diligence, building stronger value-creation plans and preparing the most compelling exit stories.

Private equity has always focused on governance risk and increasingly sees the value in cutting costs through sustainability. What’s changing is firms’ growing awareness that environmental, social and governance issues are highly interrelated and that the biggest benefits over time accrue to companies that balance efforts between all three.

The desire to contribute to a better world is certainly a motivator, but the rationale is all business. These firms recognize that consumers, regulators, employees and sources of capital are energized by the notion that investors can and should use their economic clout to address the many existential crises we face as a society. Each of these groups is ramping up demands for change and, in many cases, rewarding it (see Figure 4).

Stakeholders of all kinds want companies to be more sustainable, socially conscious and well governed

Consumers. Survey after survey shows that consumers—especially the surging wave of millennials and post-millennials—are flocking to companies that they believe act responsibly. “Doing the right thing” may be an imprecise concept, but consumers clearly know it when they see it. Increasingly, it is becoming a critical element of customer loyalty, as measured by Net Promoter Scores.

A 2020 Capgemini survey of 7,500 consumers and 750 executives globally found that 79% of buyers were changing their preferences based on sustainability. At the same time, only 36% of organizations believed consumers were willing to make these changes. This disconnect is surprising given that companies clearly see a payoff when they buy into the shift in behaviors. A full 77% said sustainability initiatives increased customer loyalty, and 63% have seen a revenue uptick.

What’s clear from the data is that capturing the favor of these ESG-minded consumers has enormous upside. Nielsen estimates that, in the US alone, buyers will spend up to $150 billion on consumer packaged goods viewed as sustainable by 2021.

CVC is one of the firms that speaks less about ESG in isolation and more about using it to create value. As managing partner Jean-Rémy Roussel said in a recent episode of Bain’s Dry Powder podcast , “It’s not a trade-off, it’s not a risk management/litigation issue, it is not conformance to regulation. It is a unique opportunity.”

CVC has developed a systematic approach to embedding ESG and corporate social responsibility initiatives into its value-creation plans, with the specific goal of improving market share and increasing deal multiples. The approach is rooted in the belief that private equity’s traditional focus on boosting EBITDA is actually less effective than focusing on customer loyalty and employee satisfaction, which ultimately generate more value and therefore higher multiples. When CVC buys a company, one of the first things it does is collect hard data on customer and employee satisfaction. It then helps management figure out how to target six key areas—customer focus, simplification, human capital, communities, environment and governance—to improve performance.

A good example of how this works is CVC’s 2017 acquisition of Żabka, a Polish chain of franchised convenience stores. In diligence, CVC identified a number of ESG-related efficiencies and savings. It replaced refrigerants in 2,200 stores and took other measures to reduce annual carbon dioxide production. It reduced the weight of the packaging for one of the chain’s sandwich brands, eliminating three tons of plastic waste. At the end of 2020, it launched a more comprehensive program to reduce CO 2 by at least 5% per year and reach net zero by 2050. It is currently investigating the most credible way to offset CO 2 production at the company level.

The big upside was reengaging with customers to grab market share in a largely stagnant industry. As Żabka studied how to optimize the assortment in its stores, it saw that consumer tastes had shifted dramatically away from typical convenience store fare. The company worked with suppliers to source healthier and more responsible ingredients for its products. It became the first retailer in Poland to use 100% recycled plastic bottles in its branded beverages. It started taking the market lead in selling plant-based food products, hailing their “triple benefits”: customer health, environmental friendliness and animal welfare.

Corporate social responsibility also became increasingly core to the company’s ethos. Żabka now trains employees and franchisees to sell alcohol more responsibly and to recycle more effectively. It has set up programs to eliminate food waste by transferring surpluses to food banks. The company runs career development programs for employees, and it funds scholarships and internships for children from disadvantaged backgrounds.

The results have been impressive: Loyalty and satisfaction scores have soared among customers, employees and franchisees. That led to 20% annual revenue growth from 2017 to 2020, while gross margins increased by 3.9 percentage points. The chain added 652 new stores in 2019, and employment has risen sharply. Social responsibility initiatives have raised the company’s profile across Poland, and a broad corporate campaign to communicate these values and successes has embedded a new sense of purpose throughout the organization.

Employees. As Żabka has discovered, a commitment to sustainability and social responsibility is rapidly becoming essential to attracting and retaining key talent. Research shows that employee loyalty increasingly hinges on a belief that they are working for a company with a nobler mission than just churning out quarterly earnings. A global HP survey of 20,000 workers in 2019 found that 61% believe sustainability is mandatory for companies (on par with diversity and inclusion), and nearly 50% said they would only work for a company with sustainable business practices.

At Unilever, which has made a major public commitment to sustainability, about half of all new employees entering from college say the company’s ethical and sustainability policies are the main reason they wanted to hire on. A sense of mission leads to greater satisfaction, which in turn leads to higher productivity.

Limited partners. One reason ESG is top of mind for PE firms around the world is that a growing number of LPs are demanding it. According to the 2020 Edelman Trust Barometer Special Report: Institutional Investors , 88% of LPs globally use ESG performance indicators in making investment decisions, and 87% said they invest in companies that have reduced their near-term return on capital so they can reallocate that money to ESG initiatives. As noted above, European LPs have demonstrated more commitment to ESG than their counterparts in North America, but the biggest institutions in the US and Canada, including the CPP Investment Board, CDPQ, CalPERS and the California State Teachers’ Retirement System, are firmly on board.

For general partners, this means that ESG is fast becoming a central factor in raising money. CVC’s Roussel, for instance, said that one-fifth of the LPs invested in the firm’s recently closed Fund VIII required an audit showing evidence that ESG was part of the firm’s decision making during both due diligence and ownership. CVC has commissioned EcoVadis to undertake annual assessments of its portfolio companies to demonstrate how ESG maturity has improved under its ownership.

Bankers. Despite the lack of evidence linking ESG to returns, a growing slice of the financial world assumes that sustainable, socially responsible companies are less risky. As a result, PE firms are finding ways to monetize their ESG strategies by lowering their cost of capital. EQT, for instance, launched two ESG-linked subscription credit facilities in 2020 worth €5 billion, with interest rates that decline if the firm performs well against a set of ESG indicators. Firms like Investindustrial and KKR have developed other financing vehicles with ESG incentives or targeted uses. In late 2019, Jeanologia, a Carlyle-owned company that creates clean technologies for jeans manufacturing, agreed to a loan with a rate tied to water savings.

Per Franzén, cohead of the EQT Private Equity Advisory Team, calls the shift to credit-linked facilities “a game-changing moment” for the private equity industry: “By linking sustainability objectives to hard incentives, we are really challenging ourselves and the portfolio companies to fully embrace the potential of sustainability.”

Regulators. If ESG-linked credit facilities are the carrot, regulation is the stick. One reason European firms are addressing ESG more urgently than their US counterparts is that EU regulators are on the case. The EU Taxonomy, a landmark initiative aimed at channeling private capital into sustainable assets, will take effect in December 2021. It will force asset managers in the EU to disclose their share of taxonomy-aligned assets under management, inevitably creating an incentive to raise that share to remain competitive.

By contrast, US regulators are headed the other direction—at least for now. The US Department of Labor in November 2020 issued a rule discouraging fiduciaries from using nonfinancial (read: ESG) principles in screening pension investments.

Taking the lead

This push and pull between skeptics and believers is typical of game-changing moments. The market, of course, will eventually decide the case, but momentum is building in powerful places. While the top 20 LPs in the US on average may be less inclined or incented to join their global counterparts in committing to ESG, fund-raising is a global business, and GPs still face firm pressure from investors to show progress on these issues. Meanwhile, the firms in the lead are building ESG investing into a differentiating capability. They are convinced it will give them an edge in a PE market that has never been more competitive.

What does it look like to build ESG into the value-creation cycle from beginning to end? Consider EQT’s approach in 2016 when it bought AutoStore, a Norwegian maker of warehousing robots that is headquartered on a remote fjord, a six-hour drive from Oslo. The warehouse industry had limited focus on environmental or workplace issues at the time. But the firm and management saw an opportunity to change the conversation with AutoStore’s flagship robot, which automates retail warehouses by wandering through a compact shelving system, picking and packing.

EQT anticipated two ways it could create value at AutoStore. First, the firm would encourage the company to address its own footprint with a series of cost-saving initiatives aimed at decreasing consumption and reducing carbon emissions. Second, it would focus the company’s marketing on sustainability and workplace quality. AutoStore’s robot already used less energy and was significantly quieter than any other product on the market. But the management team and salesforce weren’t hitting those value arguments in their sales pitch.

EQT’s perspective came from the top of the firm―one of its primary investment themes is that sustainability attributes are increasingly becoming key purchasing criteria in any industry, and the AutoStore deal team was convinced warehousing was no different. To bring the company’s leadership on board, it launched a set of value-creation initiatives linked to sustainability and put a regular reporting function on the board agenda, tying environmental concerns to governance. The company also launched a project to determine if the robot’s sustainability features were a point of differentiation among customers. The answer was yes.

Leadership directed the company’s R&D lab to make its robot even more sustainable and worker friendly. By switching from a lead-acid to lithium-ion battery and increasing the share of recyclable components, engineers significantly reduced the carbon footprint of the product while maintaining its remarkable energy efficiency. (The robot uses one-tenth the energy of a vacuum cleaner.) By running in the dark, it also reduces energy usage within the warehouse.

Armed with a much improved next-generation product, the company then retooled its communication strategy to focus on sustainability and savings alongside the robot’s impressive technical abilities. The new message resonated loudly with customers globally. During EQT’s ownership, its global installations grew by 2.5 times, the number of installed robots tripled, revenues quadrupled and EBITDA increased by 4.5 times. And the social impact was significant: During ownership, global employment doubled, including in the small village where the company has its headquarters and is an important contributor to the local economy.

ESG isn’t about doing good for good’s sake; it’s about recognizing what customers really want and turning that into a strategy that creates tangible value.

EQT’s insight was that, even in a hard-bitten B2B industry like warehousing, sustainability matters. ESG isn’t about doing good for good’s sake; it’s about recognizing what customers and other stakeholders really want and turning that into a strategy that creates tangible value. Funds are finding that ESG issues that weren’t necessarily a factor commercially a few years ago are now front and center. And Covid-19 has only accelerated the pace of change. A Bain survey of more than 12,000 consumers in the US and EU showed that 44% agree or strongly agree that sustainability will be even more important in the wake of the pandemic (see Figure 5).

In the wake of the Covid-19 pandemic, consumers are embracing sustainability more than ever

The message is gradually sinking in across the PE industry. During a recent refresh of its value-creation plan for a paper company, a PE firm identified a potential 3- to 5-point EBITDA uplift tied to a series of sustainability initiatives, including revamping its product lineup in a sustainable way. Responding to consumer demands for products easier on the environment, the company plans to rapidly expand its 100% recycled products and those made from alternative fibers like cotton. That will give it time to tap a set of lucrative new markets by developing paper-based alternatives to plastics in products like transparent-window envelopes and composite packaging.

Sustainability is becoming a central theme in its marketing and changing the company’s positioning globally. The plan anticipates that revenue growth—and avoided revenue loss—will be the biggest contributors to improved results (see Figure 6).

One PE owner plans to use ESG initiatives to boost cash flow at a recently acquired paper company

The opportunity even exists in industries you wouldn’t expect. ESG value creation seems obvious in “clean” or socially conscious sectors—electric vehicles, alternative energy, education, healthcare and so on. But GPs are recognizing that the next buyer will often pay a higher multiple for a company in an environmentally questionable industry that has become more sustainable and responsible than its competitors.

Investindustrial has developed a potent franchise in sustainable investing partly by finding—and fixing—companies like Polynt-Reichhold, a specialty chemicals player with some 40 manufacturing facilities globally. Through various sustainability measures, the company reduced its carbon intensity to a level approximately 40% below its best-performing peers. A global shift to LED lighting shaved 400 megawatt-hours of electricity usage per year. Improving insulation on its storage tanks in Norway saved 800 megawatt-hours annually.

The quest for a winning ESG formula

While ESG investing has crawled out of its infancy, it remains early days. Even the leading firms are still figuring out where to play and how to win. One thing is already clear, though—making it work takes the same level of commitment and ambition firms devote to developing any new differentiated capability.

In our experience, the firms getting it right have a few things in common:

- Clear definition, alignment and ambition. ESG can mean a lot of things, so it is critical that firms define what it means for them and build on that. Winning firms also go well beyond lip service by securing alignment around their chosen ambition, starting with the investment committee and extending to individual portfolio and deal teams. Setting up a central ESG team and hoping for the best is not a recipe for success.

- Focused execution. Different companies in different industries need to apply ESG differently. What’s important is to pick a few things that really matter and move the needle in those areas. Increasing diversity or reducing the carbon footprint are good places to start, but it takes real commitment and execution to produce results. It’s also important to build on early wins to communicate success and expand the scope.

- Full integration. Capturing the true value of ESG requires embedding it along the entire PE value chain, from due diligence through ownership to exit. While it might not be an investable theme in all deals, it certainly should be a consideration in every diligence. The most effective firms treat it as a capability. They strive to make ESG second nature—an integral part of value creation. Simply tracking random KPIs isn’t enough. Firms need to have a value-creation strategy specific to their industry and customer base.

- Capability investment. Most firms that have adopted ESG have started with risk mitigation and compliance issues. Taking the next step to value creation requires adding capabilities to identify, track and manage ESG risks and opportunities effectively. Firms also need to learn how to take advantage of sector-level ESG experts, partners and other ecosystem resources to support value-creation plans.

- Measurement of results and continuous improvement. As with anything else, getting better at ESG investing relies on continuous learning and not waiting for the perfect answer. Firms that have built a track record of ESG value creation have been willing to experiment and then develop winning approaches into playbooks and repeatable models that lead to consistent results. That means establishing clear measures of year-over-year continuous improvement and setting up processes to roll up and monitor ESG performance across the portfolio.

Skepticism around ESG will persist as long as we lack empirical evidence that it pays off. Devising the right measures will take time and creativity. That said, ESG is rapidly moving to the center of how many firms view the value-creation process as they pick up and follow what the market is telling them.

More from the report

Letter from Hugh MacArthur

2020: Escape from the Abyss

The Expanding Case for ESG

A Left-Brained Approach to Portfolio Company Talent Decisions

Capturing the True Value of Virtual Selling and Sales Plays

SPACs: Tapping an Evolving Opportunity

Have Classic Buyout Funds Run Their Course?

Read our 2021 Global Private Equity Report

- ESG in Private Equity

- Private Equity

- Sustainability

- Transformation

How We've Helped Clients

Sustainability a powerful carbon accounting platform helps industrialco optimize its esg strategy, an asian sovereign wealth fund expands its tech investing, sustainability how an asian state-linked investment fund became a sustainability leader, ready to talk.

We work with ambitious leaders who want to define the future, not hide from it. Together, we achieve extraordinary outcomes.

Contact Bain

How can we help you?

- Business inquiry

- Career information

- Press relations

- Partnership request

- Speaker request

Your browser is not supported

Sorry but it looks as if your browser is out of date. To get the best experience using our site we recommend that you upgrade or switch browsers.

Find a solution

We use cookies to improve your experience on this website. To learn more, including how to block cookies, read our privacy policy .

- Skip to main content

- Skip to navigation

- Collaboration Platform

- Data Portal

- Reporting Tool

- PRI Academy

- PRI Applications

- Back to parent navigation item

- What are the Principles for Responsible Investment?

- PRI 2021-24 strategy

- A blueprint for responsible investment

- About the PRI

- Annual report

- Public communications policy

- Financial information

- Procurement

- PRI sustainability

- Diversity, Equity & Inclusion for our employees

- Meet the team

- Board members

- Board committees

- PRI Board annual elections

- Signatory General Meeting (SGM)

- Signatory rights

- Serious violations policy

- Formal consultations

- Signatories

- Signatory resources

- Become a signatory

- Get involved

- Signatory directory

- Quarterly signatory update

- Multi-lingual resources

- Espacio Hispanohablante

- Programme Francophone

- Reporting & assessment

- R&A Updates

- Public signatory reports

- Progression pathways

- Showcasing leadership

- The PRI Awards

- News & events

- The PRI podcast

- News & press

- Upcoming events

- PRI in Person 2024

- All events & webinars

- Industry events

- Past events

- PRI in Person 2023 highlights

- PRI in Person & Online 2022 highlights

- PRI China Conference: Investing for Net-Zero and SDGs

- PRI Digital Forums

- Webinars on demand

- Investment tools

- Introductory guides to responsible investment

- Principles to Practice

- Stewardship

- Collaborative engagements

- Active Ownership 2.0

- Listed equity

- Passive investments

- Fixed income

- Credit risk and ratings

- Private debt

- Securitised debt

- Sovereign debt

- Sub-sovereign debt

- Private markets

- Private equity

- Real estate

- Climate change for private markets

- Infrastructure and other real assets

- Infrastructure

- Hedge funds

- Investing for nature: Resource hub

- Asset owner resources

- Strategy, policy and strategic asset allocation

- Mandate requirements and RfPs

- Manager selection

- Manager appointment

- Manager monitoring

- Asset owner DDQs

- Sustainability issues

- Environmental, social and governance issues

- Environmental issues

- Circular economy

- Social issues

- Social issues - case studies

- Social issues - podcasts

- Social issues - webinars

- Social issues - blogs

- Cobalt and the extractives industry

- Clothing and Apparel Supply Chain

- Human rights

- Human rights - case studies

- Modern slavery and labour rights

- Just transition

- Governance issues

- Tax fairness

- Responsible political engagement

- Cyber security

- Executive pay

- Corporate purpose

- Anti-corruption

- Whistleblowing

- Director nominations

- Climate change

- The PRI and COP28

- Inevitable Policy Response

- UN-convened Net-Zero Asset Owner Alliance

- Sustainability outcomes

- Sustainable Development Goals

- Sustainable markets

- Sustainable financial system

- Driving meaningful data

- Private retirement systems and sustainability

- Academic blogs

- Academic Seminar series

- Introduction to responsible investing academic research

- The Reynolds & Gifford PRI Grant

- Our policy approach

- Policy reports

- Consultations and letters

- Global policy

- Policy toolkit

- Policy engagement handbook