What Is An Assignment Fee — The Complete Investors Guide

Justin dossey.

- July 20, 2022

Whether you’re new to wholesaling , a real estate investor or agent looking to learn more about the “assignment business”, or even a homeowner asking…

… We want to give you a complete guide to understanding the assignment contract and fee from all angles.

Here’s a list of all the questions we’ll be covering:

- What is an assignment fee?

- Reasons to use an assignment?

- How to assign a contract?

- Is it legal?

- Is it ethical?

- How much should a fee be?

- Who pays for it?

- Does the seller or buyer see the fee?

- Alternatives to an assignment?

- Assignment fees and agents?

- Where to get a contract?

- How to increase your assignment fees?

- How to find discounted properties to wholesale ?

1. What’s an assignment fee?

First and foremost we have to define the term.

An assignment fee is a payment from the “ assignor ” (wholesaler) to the “ assignee ” (cash buyer) when the assignee transfers their rights or interest of a property to the assignor during the close of a real estate transaction.

Most often, this term is used in the real estate investing strategy of “wholesaling”.

The business of a “wholesaler”, is grounded in the assignment fee: They negotiate to buy a property, then while in the close of escrow they find a cash buyer. They will then sell the rights to that contract to the cash buyer for a fee.

In practical terms, the “fee” is the difference between what you negotiated in price with the seller, and what you negotiated with the end buyer.

Real-life example:

You find a seller who’s willing to sell her property for $250,000 dollars to you, cash. While in escrow you find a cash buyer who’ll be willing to buy that property for $260,000 cash. When it closes, you make $10,000.

The contracts Typically, most real estate contracts are “assignable”, meaning they can be transferred to another party; you mind find it expressed as an “assignment clause” or simply stated: “This contract is assignable”.

You’ll often hear this term amongst wholesalers, but there are other practicable uses for it as well…

2. Reasons to use an assignment

We covered why wholesalers do it: to make money.

But there are other reasons someone might need to use their assignment provision.

For example…

Changing ownership title If the contract is in your own name… but then, while in escrow, you want to change the “owner” to a trust rather than your personal name, you can then use the “assignment” clause.

Finding a partner While in the closing process of buying a property, you might come across a partner who’d like to have his equity/investment protected as well. So in that case you and your partner create a new entity and assign the rights of the contract to the new entity.

3. How to assign a contract?

Assigning a contract and taking a fee is as simple as giving instructions to your escrow or closing attorney, as long as the contract allows for that provision of assignment.

But the hard part is getting the price right…

It’s not as simple as finding a property on the MLS, saying you’re a cash buyer, then finding a real cash buyer to buy it from you at a mark-up.

There has to be “meat on the bone” for everyone AND a price that’s good enough for the seller to say, ”YES!”.

Most cash buyers will not buy a property at full retail value. There needs to be a way for them to make money either in a flip or having some equity in it if they decide to rent it.

That means, you as the wholesaler—who’s collecting assignment fees—need to find good deals for these cash buyers; that’s essentially what your job is: to find discounted properties.

What seller in their right mind will sell at a discount?

Many do, and for all sorts of reasons.

Here at Ballpoint Marketing, we specialize in creating marketing material for off-market investors looking for properties at a discount. Some of the marketing material that wholesalers might purchase from us to find these good deals is our real handwritten door hangers that you can pick up for .45¢ a piece.

4. Is it legal?

“Wholesaling” is a hot topic on the web and a source of a lot of controversies.

However, assigning a contract for an assignment is not technically illegal as long as the contract and both parties agree to it. If a State makes “assigning” illegal, then that hurts other people who are using assignments to change the name of the buying entity or assign to their family and/or partners.

However, there are many states that are against wholesalers and creating laws against them. That’s why you should meet with a real estate attorney to find out what you can do, and what you can say when you’re a wholesaler collecting assignment fees, however, at the time of this writing they have not exactly made wholesaling “illegal” but place restrictions like for example:

- Saying “ I have a property to sell ” when you actually don’t because it’s still in closing. Rather, You have a “contract” for sale.

- Representing the buyer when you’re not a licensed real estate agent under a broker.

There’s a very fine line between what a wholesaler does and what agents do. You have to make sure what you say and do doesn’t cross those lines.

Here’s a great video on why wholesalers have a bad rep and what you can do differently:

5. Is it ethical

Now that we got the “ legal ” question out of the way…

What about “How ethical is it to wholesale”.

Type that into the web and you’ll get thrown into a black hole of comments and forums chatter you won’t ever be able to get out of.

Here’s the bottom line of why it gets so much controversy and what it has to do with assignment fees…

Wholesalers are going around marketing “We buy houses CASH” when in reality, they aren’t buying it cash… they’re assigning the contract for a fee.

This is where everyone gets their tights all tied up in a bunch (did I just make up a word?! Yes! I did). Because if you say you’re going to close it with cash, but you have to walk away from the seller because you can’t find a buyer… how would you feel leaving a seller (who seriously needed to close yesterday), hanging)?

Some with a conscious would feel pretty bad… others don’t care.

So it’s up to you how you feel about the ethics side of things.

Can you close the deal yourself if you can’t find a cash buyer , via a hard money lender or partner? Or will you feel comfortable walking away from the deal? Or will you be confident enough to go up to the seller and tell her the truth, that you intended on selling the contract to a cash buyer but it seems that your priced it too high, can we renegotiate?

The underlying problem with “walking away” from a buyer is not pricing it right.

If you have a good deal, cash buyers will be all over it and be HAPPY to pay you an assignment fee.

Here’s a video on ethical wholesaling:

6. How much should a fee be?

New wholesalers typically aren’t sure what they should charge. But it’s going to vary from deal-to-deal, and market to market.

A decent wholesaling fee can range from $10,000 to $30,000.

There are occasions when you hear about $100,000 assignment fees. And they do happen. It’s just a matter of negotiating a good deal.

While there isn’t a “set fee” that wholesalers should charge, it all depends on how good of a deal you can negotiate, and how high you can mark up the contract for an end buyer.

So there are two components that determine how much you can get paid for an assignment fee:

- Seller’s price.

- End buyers price.

Later, in another section, I talk about how you can increase your assignment fee… for now, let’s just cover how much your can charge.

Earlier I mentioned that your market might have an influence on how much you can charge. And that has more to do with how low of a discount, sellers are willing to take AND how competitive it is in your market.

Here’s an example:

If a seller talks to three wholesalers, one offers $200,000 while the others offer $180,000, she most likely will go with the higher offer. Well, now those wholesalers might enter into bidding wars in the market, by creeping up their MAOP (Max allowable offer price).

When wholesalers start raising their Max offers (because the market is demanding it), AND if the end buying price (what cash buyers are willing to pay for that deal) does move up with it…

Then you start seeing wholesalers’ assignment fees start shrinking down. We’ll go over later some techniques for helping with this natural occurrence in the market.

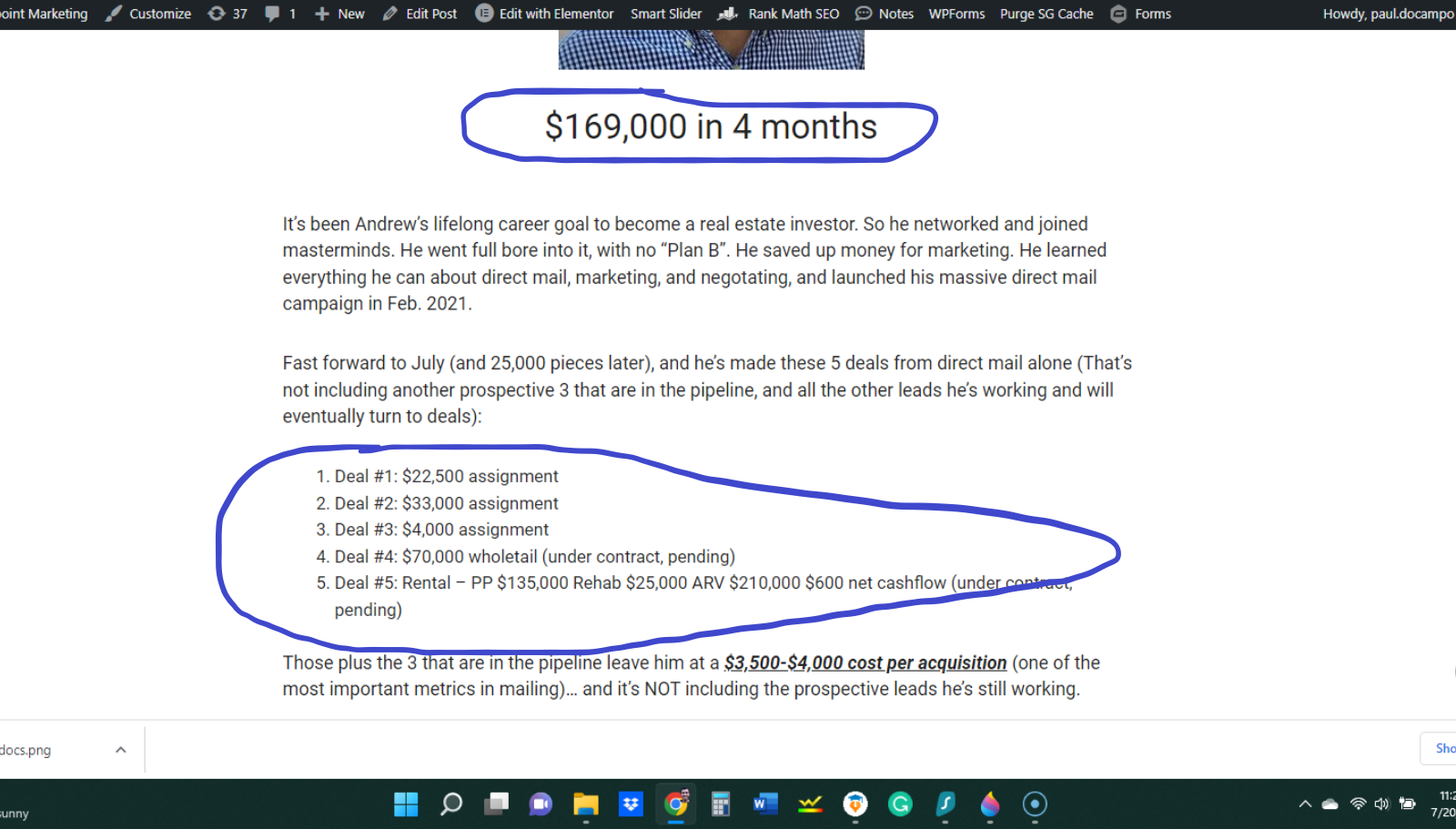

Here’s an example of a real wholesaler using our handwritten mailers, in a case study where he made anywhere from $4k fees to $22,500

7. Who pays for it?

Typically, in a traditional real estate wholesaling model, the end buyer (the cash buyer) is paying for your assignment fee.

For example: You negotiate with the seller to buy the property for $100,000. And the end buyer agrees to buy this deal for $120,000. He enters into escrow and pays the $120,000. You get the difference between the seller price and the end buyer price.

8. Does the seller or buyer see the fee?

In a typical assignment transfer, yes your assignment fee will be inside the closing statements.

After a property closes escrow, every party involved will get “closing statements” that look might look like this (depending on your state and the companies you use):

One of the line items may show up as “Assignment Fee” (or something similar), and show the amount.

Buyers will see these, as well as sellers.

However, a cash buyer (usually) understands that wholesaling is A LOT of work and that you should get paid for it. A good cash buyer understands that.

Sellers, most likely, won’t understand what an “assignment fee” is when they see this doc (they most likely won’t even read it).

On the rare occasion that they actually do ask what that line item is, you can tell the truth like this: “We work with partners and lenders all the time, and sometimes we end up selling the property during escrow to these partners, instead of keeping it ourselves. In this case we ended up selling to them”.

There’s a way to circumvent this potential problem of an assignment fee showing up on the closing documents…

And that’s by doing a double close instead of an assignment.

Let me explain in the next section…

9. Alternatives to an assignment?

As mentioned in the previous section, an assignment fee can have some cons to it. The primary being that sellers AND buyers can see how much you’re getting paid.

However, there is another “tool” you can use that hides this from both parties, and that’s called the “double close” (sometimes referred to as a “simultaneous closing” or “back to back” closing. As the name implies, there are 2 separate closings, not 1 (like our assignment fee transaction).

Here’s an explanation:

- The homeowner (party A) agrees to sell to a wholesaler (Party B) for $100,000

- They enter escrow

- While in escrow, Party B finds a cash buyer (Party C)

- Party C agrees to buy that property for $150,000

- They enter a second escrow agreement (different from the first)

- Party C funds the escrow account to buy the property at $150,000

- Party B uses those funds (minus his “assignment fee”) to pay the purchase from Party A

A little confusing?

Maybe this infographic helps:

We won’t go into too much detail about this as this is an article on the assignment fee… But just know that there is an alternative to hiding your fee but using a double close.

The con to this is that you pay a little more because you’re in fact doing 2 closes, not 1. So the times you might want to a double close vs an assignment fee is when you negotiated a very good deal and want to conceal the big check you’ll be getting.

10. Assignment fees and agents?

Anyone can get paid an assignment fee for this kind of “wholesaling” transaction. There’s no law that says agents can’t. However, that agent/broker needs to pay careful attention to their State RE commission laws as they’re put under serious scrutiny if they walk any fine lines.

For instance, if you’re buying the property and wholesaling it AND you’re licensed… in most states, you have to express to the seller that you are a licensed real estate agent but you are NOT representing them, and instead the principle of the transaction.

If you’re an agent wondering if you can (or should) do this, first contact your broker or RE Commission office to find out more.

Secondly, you might want to reconsider doing this as in some markets agent commission fees are higher than typical wholesaling fees. This is rare, but there are some hot markets where wholesalers have to keep raising their prices to win the deal, and therefore lower their assignment fee.

11. How to increase your assignment fees?

As mentioned in a previous section, your fee is greatly dependent on the kind of deal you negotiate.

So if you get a deal at $100,000 and another investor (cash buyer) is willing to pay $150,000 for it, you walk with a $50,000 assignment fee (assuming no closing costs are removed from this).

There are 4 factors to increasing your assignment fees…

- Become a better marketer If you improve your knowledge and skill set in marketing, you can essentially get to motivated sellers before anyone else.In the next section, we cover how to find these properties, which has everything to do with marketing, but one way (that we specialize in) is using handwritten mail to gain the best response rates from sellers.

- Become a better negotiator If you study and practice good salesmanship you can effectively win deals even if you’re offer is “low” . If you have no experience in sales, this will take time, but there are loads of resources available online (free and paid) that you can take advantage of. But, if you’re planning to stay in this entrepreneurship game for the long haul I HIGHLY suggest you study sales on a regular basis.

- Know you numbers Getting better and better at knowing what your market demands in terms of prices, rehab costs , etc… will help determine a more accurate price at a faster rate. Why does this matter to getting paid a higher assignment fee? It’s 2 reasons: First, if you know that cash buyers are willing to pay X, you can raise your asking price from end buyers, or on the flip side of that if, you know that a house needs some major repairs you can use that negotiated a lower price with the seller…Secondly, if you are really good with numbers, you can give an offer faster than your competition who has to take 1-2 days to send an offer in. In competitive markets “ Speed to lead ” wins and the person who can act fastest is usually the one who takes the trophy.

- Build a thriving buyers list The second component of the assignment fee and wholesaling business is selling the contract to a cash buyer.And, if you can build a list of buyers who will pay more for a good deal than most of the other “bottom of the barrel” buyers who demand very steep prices.Where do find buyers willing to pay more? It’s usually among high w-2 earners (doctors, lawyers, etc) who like to flip houses on the side. Or high-income business owners looking to park their cash somewhere to earn 15%+ annual ROI by doing so occasional flips.If you can find them, network with them, and add them to your list you can essentially raise your property raise to increase your assignment fee

12. How to find discounted properties to wholesale?

Finally our last section in this article which is probably at the top of some people’s minds:

“ Assignments sound great, but how do you FIND discounted properties!?!?”

Wholesaling is probably one of the toughest occupations in real estate.

You have to be well-rounded in almost every aspect of the industry. And you have to be top-notch in your selling and marketing capabilities.

But with that, there are foundational techniques to help you find these properties on your own. I’m going to give you 2 resources to start below.

First, is our article “ 8 ways to find 100 sellers for under $500”

Second is our eBook on Direct mail

You can get the Ebook for free by subscribing below to our newsletter, where we give lessons, stories, and value every week to real estate investors like you…

Spread the Word. Share this post!

Subscribe to our Newsletter

Sign up for news, updates, and more from BPM. It’s time to ZAG!

Please fill out the form below and a team member will reach out to you within 24 hrs to begin your order.

Understanding the Concept of an Assignment Fee in Real Estate

Table of contents, what is assignment in real estate, what is an assignment fee in real estate, factors that determine the amount of assignment fees, pros and cons of assignment fees, legal and ethical considerations.

Navigating the realm of real estate transactions can often feel like deciphering a complex puzzle, especially for those who are early on their property journey. A concept that can confuse professionals and individuals involved in transactions alike is the idea of an assignment fee in real estate—something that comes into play in various scenarios. In the context of real estate, an assignment fee is an essential concept to grasp, bridging the gap between creative financing and the traditional purchase and sale of properties.

To understand an assignment fee in real estate, you first have to understand what an assignment is. An assignment contract is essentially the document that gives someone the right to purchase a property. The assignment fee refers to the payment made to an individual, generally known as an assignor, for transferring their rights and obligations under a pre-existing real estate assignment contract to another party, known as the assignee.

This transaction is particularly prevalent in the practice of real estate wholesaling . In these transactions, an individual will secure a contract to purchase a property and then assign that same contract to an end buyer, charging a fee for the convenience and the opportunity they present.

A contract assignment fee is a strategic tool for those looking to leverage lucrative opportunities within the market without needing a significant capital investment. It allows for flexibility in the investment realm, enabling professionals to generate income from real estate deals without the traditional barriers of entry. This means people can make headway in their careers without having to obtain mortgage loans or conduct extensive renovations.

In essence, the assignment fee is the financial reflection of the value that the assignor brings to the table in a transaction. The assignor is a useful party for both buyers and sellers, helping the process along by identifying a potentially profitable deal, negotiating terms, and then passing on the right to execute the deal to a suitable party. Understanding this concept is crucial for real estate investors at all stages of their careers, especially those interested in using wholesale strategies and creative financing options.

The assignment fee in real estate is a concept rooted in the overarching principle of a contractual rights transfer. It represents the price that an assignee, someone interested in purchasing property, pays to the assignor for the rights to acquire said property under the terms the assignor has already negotiated with the seller. To make sure you get the right fee for the assignment of a contact, you need to understand the mechanics of how they work.

This section expands on how assignment fees function in real estate transactions and delves into the factors that influence their amounts.

Explanation of How Assignment Fees Work in Real Estate

When an investor or a wholesaler, known in this case as the assignor, enters into a purchase agreement with a property seller, they acquire the legal right to buy the property at some negotiated, agreed-upon terms. However, instead of completing the purchase themselves, the assignor then finds another buyer, known as the assignee, who is interested in taking over the contract to eventually own the property. This is when assignment fees come into play.

The assignee must pay an assignment fee to the assignor for the right to purchase the property. Only once this fee is paid can the assignee step into the shoes of the original buyer, then proceed to close the deal with the seller. The original contract to buy is thus “assigned” from the assignor to the assignee, who from then on becomes responsible for fulfilling its terms.

The amount, or monetary value, of the assignment fee can vary greatly from deal to deal, being influenced by a range of factors, which we’ve broken down below:

Property Value and Equity: Appropriately, the value and equity of the property will inform the assignment fee. A property with high value or substantial equity typically commands a higher assignment fee and vice versa.

Market Demand: Consider overarching market trends when ascertaining an appropriate assignment fee. For example, in a seller’s market with higher demand for properties, assignment fees can increase because of plentiful competition among buyers.

Deal Profitability: Even in the cases of lower-value properties, the nature of the deal itself will impact the assignment fee. This means that the more profitable a deal appears to be, the higher the fee that an assignor can command.

Negotiation Skills: In a similar vein to the impact that profitability can have, negotiation skills can also change the shape of an assignment fee. The ability of the assignor to negotiate deals on both ends can directly impact their fee amount, with skilled negotiators often being able to secure higher fees.

Timeframe: Time is money, and in the case of a wholesale assignment contract, this can be especially true. If the assignor negotiates the situation and closes the deal quickly, they might be able to command a higher fee for the increased convenience of a speedy transaction.

Comparison of Assignment Fees with Other Real Estate Transaction Costs

Assignment fees differ from the costs associated with various other real estate transactions in a variety of ways:

Earnest Money vs. Assignment Fee: Earnest money is a kind of deposit made to demonstrate the buyer’s seriousness about acquiring a property. This fee can typically be refunded under certain conditions or applied to the purchase at closing. On the other hand, an assignment fee is a non-refundable payment made to the assignor, specifically for the right to take over the contract.

Closing Costs vs. Assignment Fee: Closing costs can encompass a variety of fees that buyers and sellers pay at the end of a real estate transaction. These fees can include things such as those associated with title searches, real estate attorney’s fees, and credit report charges. Assignment fees are separate from these, only ever being paid to the assignor for the contract rights.

Commission vs. Assignment Fee: Real estate agents earn their living through commissions based on the property’s sale price, paid by the seller, generally from their earnings through making the sale. In contrast, an assignment fee is paid by the assignee to the assignor and is not related to the sale price or commission.

Understanding the nature of assignment fees, such as when they’re applicable, how they are calculated in relation to a transaction, and how they compare to other common transaction costs, is essential for anyone involved in real estate investing. This level of understanding is particularly vital in strategies such as wholesaling, where such fees are part and parcel of the process.

Assignment fees in real estate can be positive elements of transactions for sellers and investors while posing some notable challenges depending on the perspective of all parties involved, including the buyer. Below, we explore the advantages and disadvantages for the enactors of these transactions, as well as the risks and challenges that come with assignment fees.

Advantages for Sellers and Investors

For sellers:.

Quick Sales: Sellers benefit from the existence of assignment fees as they can do wonders for speeding up the transaction. Wholesaling and the assignment fees that come with it are especially viable solutions when a seller wants to shift their asset quickly. Investors or fellow wholesalers who offer to pay these fees often aim to close deals rapidly.

Fewer Hurdles: Sellers might avoid some traditional selling hurdles when embracing the nature of wholesaling and assignment fees. In the standard selling cycle, sellers might have to go through various stages, such as multiple showings or a buyer’s own financial approval process. These processes can be skipped altogether when dealing with investors ready to pay an assignment fee.

For Investors:

Profitability: Investors or wholesalers can use assignment fees as their primary source of income. As it sidesteps the traditional processes of investing and reselling properties, wholesalers stand to make a profit through the assignment fee without having to close on the property themselves. By embracing this system, they also avoid closing costs and the need for financing.

Less Capital: Wholesaling is a great method for generating income, without needing the same level of seed investment. Since the investor doesn’t need to purchase the property outright, they generally just have to pay a small (often refundable) deposit for the contract; there is less capital required upfront compared to traditional real estate investments.

Flexibility: Because of the nature of deals that use assignment fees, investors can back out of a particular deal at any time. This can be achieved by offering and assigning the contract to another, more suitable buyer if the deal doesn’t fit their investment strategy or if they cannot secure financing.

Disadvantages for Buyers and Sellers

For buyers:.

Increased Cost: Assignment fees do often increase the overall cost for the end buyer, as it becomes their responsibility to cover both the property’s agreed-upon price and the assignment fee. In some cases, the assignment fee can be taken from the overall sale price, but this isn’t common, meaning the speedier sale usually comes with an inflated price tag.

Transparency Issues: Buyers in these situations can often find it challenging to get full transparency regarding the property’s conditions or the original contract terms if not properly disclosed by the assignor. This shouldn’t be an issue, as long as the wholesaler or assignor does their job properly, but buyers should make sure to vet any collaborators carefully.

Potential for Overextension: Sellers may encounter issues if they work with the wrong wholesaler or investor. In some cases, an inexperienced investor can overextend and find it difficult to find a buyer to whom they can assign the contract, slowing down the transaction process and possibly reversing it.

Market Misrepresentation: Sellers could face the challenges of market misrepresentation if the assignor markets the property incorrectly or unethically, leading to potential legal challenges. For example, if the assignor lies about the property’s amenities, uses unrealistic photography , or overvalues it, buyers might respond with legal action.

Potential Risks and Challenges with Assignment Fees

Legal and Ethical Considerations: The legality of assignment fees, much like many other aspects of the real estate market, varies from region to region . Along with the legal side of things, there may also be ethical considerations to consider if parties are not fully informed of the contract terms and fees involved.

Market Fluctuations: Market conditions can change rapidly—need we remind you of what happened to the housing market in 2008? This means that if the property value decreases or interest rates increase, it will likely become more challenging for the assignor to find a buyer willing to pay the fee on top of the existing property price.

Contractual Risks: If the assignee fails to close the deal, the assignor might end up legally obligated to purchase the property under the original contract terms. Considering the reasons that most investors choose to embrace wholesaling and assignment fees, this could pose a significant financial risk that they’re not ready to incur.

Reputational Risks: Assignors who consistently charge unnecessarily high assignment fees might gain a negative reputation in the real estate community among potential clients and fellow professionals alike. It’s important to consider what a fair, mutually beneficial fee should be to avoid potentially negatively affecting future business.

Complexity in Transactions: Assignment fees add a level of complexity to real estate transactions, which are already fairly complicated at the best of times. There may be misunderstandings or disputes between the involved parties over the terms of the contract, the condition of the property, or the responsibilities each party has.

Both sellers and investors involved in wholesaling and assignment in real estate need to weigh the potential for quick and profitable transactions against the complexities and risks assignment fees introduce. It is crucial for every party involved to conduct suitable due diligence, operate transparently, and possibly seek professional legal counsel to ensure the process is conducted legally and ethically.

The use of assignment fees in real estate transactions is full of potential, being a viable part of a strategic investment plan. However, while assignment fees and the deals they’re attached to can be highly lucrative, they also come with the potential for legal and ethical quandaries. Here, we delve into the legal regulations and ethical considerations that assignors should consider, highlighting potential issues that could arise from the misuse of assignment fees.

Legal Regulations and Requirements

Regulatory landscape:.

Disclosure Requirements: Many jurisdictions require the full disclosure of an assignment fee to all parties involved in a transaction, ensuring no one feels like they’ve missed out on any vital information. Failure to clearly express the assignment fee to the buyer can often lead to legal penalties or complications.

Contractual Rights: There are some contractual points to consider when handling an assignment fee in real estate. The original purchase agreement must expressly allow for the assignment of the contract without the need for repeat consent of the seller, or the investor must obtain written permission from the seller to assign the contract.

Licensing Laws: Some regions may require an individual enacting a wholesale deal or receiving an assignment fee to have a professional real estate license, as the transaction could be considered as engaging in real estate brokerage without a license. This is worth considering if you want to pursue a career as a wholesaler or investor in general.

State and Local Laws: Both assignment fee legality and the ability to assign a contract can vary greatly between the different states and localities of the US. It’s crucial to understand the specific regulations of the area where you’re working and or where the property is located. It’s always important to tailor your approach to real estate for the area that you operate within.

Ethical Considerations:

Fairness to All Parties: Ethically, the fee should always reflect the value that’s actually been added by the assignor in finding the deal and should not be exploitative. If you’re working as a real estate wholesaler or receiving an assignment fee in any other way, make sure that you’re offering real value without overstating your contribution to the transaction.

Transparency: Assignors must be totally transparent about the property’s condition, the original contract terms, and the assignment fee’s size at every stage of the transaction. Remember, you’re not just trying to avoid legal implications with your honesty; you’re looking to build positive professional relationships built on trust.

Conflict of Interest: Ethically, an assignor should avoid any conflicts of interest in all transactions and should not misrepresent the potential value or investment benefits to the assignee. For example, if the assignor knows that an area is losing steam in the market, they should make that clear to their assignee.

Examples of Potential Legal and Ethical Issues

Non-Disclosure: Failing to disclose one’s assignment fee openly and clearly to the end buyer or seller can lead to lawsuits, as it may be considered a fraudulent practice. It’s absolutely essential that a wholesaler makes it clear what they stand to gain from a deal so everyone understands the transaction from top to bottom.

Predatory Practices: Charging exorbitant assignment fees, especially in distressed markets or from vulnerable sellers, which are often hubs for real estate wholesaling, can be seen as unethical and might lead to legal challenges. This is why offering real value and making your fees reasonable is crucial.

Misrepresentation: An assignor could face serious legal action if they misrepresent the terms of the original contract or the property’s condition for the purpose of securing a higher fee. It goes hand in hand with all of the other aspects of transparency—assignors must be clear and honest at every stage to avoid legal and ethical complications.

Violation of Licensing Laws: If an assignor acts as a de facto real estate broker by frequently assigning contracts for fees without a professional license, they might face legal penalties, including fines and injunctions. These laws vary from state to state, meaning it’s best to have a license in place, ensuring you can work in as many areas as possible.

Breach of Contract: If the original contract does not allow for the assignment of the property and the assignor proceeds without consent, they are highly likely to be sued for breach of contract. It should go without saying, but every real estate transaction needs to be enacted with the utmost professionalism, ensuring every party is fully aware of its nature.

It’s essential for every party involved in the assignment of real estate contracts to be aware of the legal and ethical implications. The complex nature of these transactions often warrants the involvement of a dedicated legal professional to navigate the potential minefield of legal regulations and ethical considerations. Moreover, maintaining transparency and integrity throughout the process not only helps assignors avoid legal troubles but also builds a reputation that can lead to more successful deals in the future.

In this exploration of assignment fees in real estate, we’ve navigated their many complexities and nuances. From definition to application, assignment fees are a pivotal mechanism for investors, particularly in the realm of wholesaling.

There are many advantages and disadvantages associated with assignment fees. For sellers and investors, they can represent an expedient route to liquidity and profit. Conversely, for buyers, they can often introduce additional layers of cost and complexity.

The discussion of legal and ethical considerations illuminated the tightrope walked by those who engage in these transactions. The importance of adhering to disclosure norms, maintaining transparency, and aligning practices with the legal stipulations of the local and state jurisdictions cannot be overstated in this particular vein of real estate.

While the concept of assignment fees may appear straightforward, its application is often fraught with potential legal and ethical pitfalls. Those involved in real estate transactions must have a clear understanding of these fees and the corresponding regulations that govern their use.

By engaging in thorough research and due diligence and enlisting expert guidance, navigating the complex world of real estate can be achieved with confidence. The strategic use of assignment fees can indeed unlock opportunities and foster successful transactions, but only when managed with suitable care and consideration of all the variables at play.

For more insightful pieces about the real estate industry, visit our blog today .

Copy short link

What is an Assignment Fee? The Ultimate Wholesaler’s Guide

In real estate investing, an assignment fee is the fee paid by the end buyer to the real estate wholesaler at the time of closing.

What is an assignment fee?

How do you assign a real estate contract?

How can you increase your assignment fee as a real estate wholesaler?

Those are just some of the questions we're going to answer in this ultimate assignment fee guide.

Let's dive in!

Part 1. Answering Common Questions About Assignment Fees

To start, we're going to answer some of the most commonly asked questions about assignment fees.

In real estate investing, an assignment fee is the fee paid by the end buyer to the real estate wholesaler at the time of closing.

This is the part of the process where the real estate wholesaler makes their money -- after finding a great deal and getting the property under contract, they then flip (i.e. assign) that contract to a cash buyer for a profit.

How are assignment fees calculated?

Assignment fees are calculated by taking the difference between what the seller was promised and what the buyer is paying.

For example, if a wholesaler has a contract to purchase a property for $100,000 and they assign that contract to a cash buyer for $120,000, then their assignment fee would be $20,000.

Who pays the assignment fee?

The assignment fee is paid by the cash buyer at closing.

And, critically, you -- the wholesaler -- are the person who gets to decide what that assignment fee is... it's only a matter of getting the cash buyer to agree (assuming you're not doing a double closing; more on that later).

What is the average wholesaler’s assignment fee?

The average assignment fee for a real estate wholesaler is between $2000 and $7000.

Of course, this number will depend on the market you're in as well as the level of experience that you have.

Many wholesalers charge upwards of $10,000 or even $20,000 for their assignment fee. Later in this guide, we'll show you how to systematically increase your assignment fee.

REISift users, on average, pull more money per deal than non-members. Here are some testimonials from our members and Sift Dojo attendees.

Are assignment fees taxable?

Yes, assignment fees are considered taxable income.

Be sure to speak with your accountant or tax advisor about the specific rules in your state.

What is a real estate assignment contract?

A real estate assignment contract is the contract between the wholesaler and the cash buyer that assigns (or transfers) the rights of the original purchase agreement to the cash buyer.

This contract will include all of the terms of the original purchase agreement, including:

- The price that was agreed to between the wholesaler and seller

- The property address

- The closing date

- Any contingencies that were in the original contract (i.e. financing, inspections, etc.)

Once the assignment contract is signed by both parties, the cash buyer will take over all responsibilities under the original purchase agreement and will be responsible for closing on the property.

What is a double close?

A double close is a type of real estate transaction where the wholesaler sells the property to the cash buyer and then immediately purchases the property from the seller.

In other words, there are two closings -- one for the sale of the property from wholesaler to cash buyer and another for the purchase of the property from seller to wholesaler.

In terms of assignment fees, double closings are often used when the wholesaler wants to keep their assignment fee confidential.

Subscription implies consent to our privacy policy

Part 2. How To Assign a Real Estate Contract

Next, we're going to discuss the process for assigning a real estate contract -- from finding a great deal and building your buyers list to acquiring an assignment contract and collecting your assignment fee.

Step 1. Find a Great Deal

The first step in wholesaling real estate -- and thus assigning property contracts -- is finding a great real estate deal.

This is where your marketing efforts will come into play. You'll need to generate a steady stream of leads in order to find the best possible deals on properties that fit your criteria.

There are a number of ways to generate leads, but the most effective method is to use a combination of online and offline marketing.

This could include everything from direct mail campaigns and cold calling to driving for dollars and door knocking.

Check out our complete real estate investor marketing plan to learn more about this part of the process.

Step 2. Build Your Buyers List

A fundamental part of wholesaling real estate is flipping property contracts to cash buyers who have the funds to purchase your deals within just a couple of weeks.

A buyers list is a database of cash buyers (other real estate investors) who are interested in buying your deals.

You can find cash buyers by networking with other investors, attending real estate meetups and seminars, or searching online.

Here are 10 more ways to find cash buyers .

Step 3. Acquire an Assignment Contract

Once you've found a great real estate deal and got under contract with the seller, it's time to acquire an assignment contract.

You can do this by searching online for assignment contract templates or hiring a local lawyer to put the contract together for you. The assignment contract will pass the purchasing power and obligations from you to the new buyer.

Step 4. Collect Your Assignment Fee

After the new buyer has closed on the property, it's time for you to collect your assignment fee. This is typically done by wire transfer or check at the closing table via a title company.

And that's it! You've now successfully assigned a real estate contract and collected your assignment fee.

Part 3. The Pros & Cons of Assignment Contracts

Now let's take a moment to look at the pros and cons of assignment contracts.

- It's Cheaper Than Double Closing: Double closings can be more expensive (in terms of both time and money) than assignment contracts.

- It's Simple: Assignment contracts are relatively simple compared to other types of real estate transactions.

- It's Fast: Assignment contracts can be completed in as little as a week or two.

- It's Transparent: Unlike double closings, there is no need for two sets of escrow accounts, two sets of title insurance policies, or two sets of closing costs.

- Your Assignment Fee is Visible: Because your assignment fee is paid at closing, it will be visible to everyone involved in the transaction.

- It's Not Always Allowed: Some states have laws that prohibit or restrict the use of assignment contracts.

Part 4. 10 Ideas For Increasing Your Assignment Fee as a Wholesaler

To close out this guide, we're going to share 10 different ways that you -- the real estate wholesaler -- can increase your assignment fee.

1. Start With Great Deals

The better the deal, the higher your assignment fee will be.

This is why finding great deals -- and double-checking your math as well as your due diligence -- is absolutely critical to increasing your assignment fee.

So how do you find great real estate deals?

We have a detailed guide on finding great real estate deals over here .

2. Learn to Negotiate (With Sellers)

If you want to increase your assignment fee, you need to be able to negotiate with sellers.

The better you are at negotiating and sales — which in large part, just depends upon being an empathetic and helpful person — the better deals you’ll be able to get and the higher your assignment fee will be.

After all, if the seller agrees to a lower price, then that means you make a bigger profit.

The caveat here would be that you should always do right by your sellers. Don’t be afraid to negotiate (start lower than your max offer)... but also don’t try to screw anyone over.

3. Follow Up

It’s very rare that you’re going to turn someone from a lead into a deal with just a single phone call.

The nature of wholesaling real estate is that it requires a consistent and systematic follow-up process with seller leads to be successful.

Following up will help you close more deals… and closing more deals will give you the confidence, experience, and volume you need to increase your assignment fee.

4. Find Your Offer Min & Max

Good real estate deals are just a result of good due diligence and good math.

Determine how much money your cash buyer is going to want to pull, factor in your assignment fee, consider repair costs and holding costs… and calculate your max offer on the property.

Do this before you negotiate with the seller.

And make sure that when negotiations begin, you start well below your max offer so that you have room to adjust based on their response to your initial offer — this is your minimum offer.

You might find your max offer by using the popular 70% rule — which states that a real estate investor should pay no more than 70% of a property’s ARV (After Repair Value) — but you can find your starting offer by decreasing that to 50% or lower.

5. Qualify Your Cash Buyers

The amount of your assignment fee — as well as the efficiency with which your business operates — depends upon high-quality cash buyers.

Most wholesalers are a little over-eager to add email addresses to their cash buyer list.

But remember: quality over quantity.

You might have 500 cash buyers on your list… but only 20 or 30 of those are actually high-quality buyers.

Before adding buyers to your list, get proof of funds and make sure they’ve bought properties via assignment before.

Those buyers are going to move faster, pay the asking price for your properties, and return for more properties to buy.

6. Identify Cohorts of Cash Buyers

The instinct for most wholesalers is to send every deal to every cash buyer… but that actually wastes a lot of time.

It’s not in your interest to have to help every potential buyer determine whether or not they’re the right buyer for this deal.

It’s far more efficient to learn about your buyers upfront and determine what type of cash buyers they are — rehabbers, landlords, etc.

Using simple software, you can then create cohorts of cash buyers and send the right deal to the right people to get faster turn-around-times, less questions, and bigger assignment fees.

7. Text Your Buyers

Email is easy and popular… but it’s not necessarily the best channel when promoting deals to your list of cash buyers.

In fact, SMS or text messaging has some clear advantages.

Just consider these stats from ManyChat …

- 269 billion emails are sent every day with roughly 50% of them ending up in spam folders.

- SMS has a click-through rate of 19% and email has a click-through rate of 3.2%

The point is, if you want to get the attention of your high-quality buyers, then it’s probably worth sending both emails and text messages.

The faster you reach the right buyer, the easier it’ll be to get the assignment fee you want.

8. Don’t Negotiate (With Buyers)

As the wholesaler, realize that you determine your assignment fee.

No one else gets to decide what your assignment fee is going to be — now if you can’t get the buyer to agree to pay it, then that’s another problem… but you can always walk away and find another buyer.

If you’re going to raise your assignment fee, then it’s important to understand that all you have to do is… well, raise it. And see what happens.

High-quality buyers aren’t going to care about how much you’re making so long as they’re also making a good chunk of money.

9. Work With Real Estate Agents

Real estate agents control a huge part of every real estate market.

So if you exclude working with real estate agents to find cash buyers, then you’re ignoring a huge portion of the market’s revenue and potential.

Plain and simple.

Good real estate agents who work with cash buyers will understand your business model and be more than willing to coordinate the deal for you.

You will have to pay a bit of commission — or at least, the buyer will — but you’ll get to remove all the drama from the equation by working with agents. They understand how assignments work, and they negotiate on the behalf of the cash buyer.

It might not drastically increase your assignment fee, but it will help you dispose of deals far more efficiently.

10. Require a Nonrefundable Fee

When it comes to wholesaling, time really is money — the faster you can find a high-quality cash buyer, the more likely you are to get the assignment fee you want.

And one of the worst things that can happen is that your buyer will back out of the deal and you’ll have to restart the entire process.

That’s why you should make the buyer have skin in the game.

Require a nonrefundable fee from cash buyers who are ready to take action — this fee should be upwards of $3,000 and it can contribute to your total assignment fee.

If a buyer refuses to pay this to secure the deal as they’re own, then you probably want to find a different buyer anyway.

Final Thoughts on Real Estate Assignment Fees

We hope this guide has helped clear up any confusion you had about assignment fees and how they work in wholesaling real estate.

Remember: if you want to increase your assignment fee, focus on finding (and negotiating) great deals, following up with leads, qualifying cash buyers, and being systematic in your business.

Do those things, and you’ll be well on your way to making more money per deal.

Listen on other platforms

Join our ninja newsletter, trending post, a2p / 10dlc: read this before you send real estate sms campaigns, wholesaling real estate contracts, 7 mailing lists most real estate investors ignore, 5 top real estate wholesaling online courses in 2023, wholesaling real estate salary: how much can you make, visit our store to see all the courses available, popular tags, looking for more leads get it with reisift.

Related posts

Ready for more?

Subscription implies consent to our privacy policy.

Follow us here

Big and Small Properties is your trusted partner in wholesale real estate, specializing in both buying and selling investment properties. With a keen eye for value and a deep understanding of market trends, we help investors of all levels find lucrative opportunities to grow their portfolios.

CONTACT US! (877) 260-5566 or (910) 430-6022

What is a fair assignment fee best practices for wholesalers.

In the world of real estate wholesaling, an assignment fee is a key piece of the puzzle. But what exactly is it, and how do you make sure you're charging a fair amount? Whether you're a seasoned wholesaler or just getting started, understanding what makes a fair assignment fee can make or break your business. In this post, we'll cover what assignment fees are, how to calculate them, and best practices for making sure you're staying fair to both sellers and buyers.

What is an Assignment Fee in Wholesaling?

In simple terms, an assignment fee is the money a wholesaler earns for acting as the middleman between a seller and a buyer. Here's how it works:

The wholesaler finds a distressed property (one that’s often priced below market value).

The wholesaler gets the property under contract at a set price with the seller.

The wholesaler assigns that contract to a buyer (usually an investor), who pays the original price plus the assignment fee.

The assignment fee is essentially the wholesaler’s profit for finding the deal. So, how much is fair? That’s what we’re here to figure out!

How Much is a Fair Assignment Fee?

The exact amount can vary widely based on several factors, but most assignment fees range between $5,000 and $20,000. However, it's not uncommon for the fee to be lower in some markets or higher in others. The key is making sure both the buyer and the seller feel the fee is reasonable for the value you're providing.

Factors That Influence Assignment Fees:

Location : In high-demand areas, assignment fees can be higher because there’s more competition and properties cost more.

Deal Size : Larger deals often command larger assignment fees, but not always. If you're assigning a multi-million-dollar property, a fee of $20,000 or more might be considered reasonable.

Complexity of the Deal : If a deal involves more complexity, such as multiple parties or legal issues, a higher fee might be justified.

Market Conditions : When the real estate market is booming, assignment fees tend to increase because wholesalers bring more value by locating good deals in a competitive environment.

Another way to consider what is fair is:

The 10% Rule: Many wholesalers aim for about 10% of the purchase price as their assignment fee. So if you've got a house under contract for $100,000, you might shoot for a $10,000 assignment fee.

The $5,000 Minimum: Some wholesalers have a minimum fee they'll accept, often around $5,000. This helps ensure that even smaller deals are worth their time and effort.

The Spread Method: This involves looking at the difference between what you've got the property under contract for and its actual value. You might aim to keep about 30-50% of that spread as your fee.

The Value-Added Approach: Consider how much work you've put into the deal. Did you spend weeks negotiating? Did you solve complex title issues? The more value you've added, the more you can justify charging.

Remember, the key word here is "fair." You want to make sure you're compensated for your hard work, but you also want to leave enough meat on the bone for your end buyer to make a profit too. It's all about finding that sweet spot!

How to Calculate a Fair Assignment Fee

A fair assignment fee should reflect the value of the deal you're bringing to the table. But how do you know what’s fair? Here are a few guidelines to help you calculate your fee:

1. Keep it Proportional to the Property Price

A good rule of thumb is that your assignment fee should be proportional to the price of the property. For example, if you’re wholesaling a $100,000 home, a fee between $5,000 and $10,000 might be fair. However, for a $500,000 property, a higher fee (such as $20,000) could be justified.

2. Consider the Time and Effort Involved

If you’ve spent weeks negotiating, solving problems, and working through paperwork, it’s fair to charge a higher assignment fee. On the other hand, if the deal was quick and straightforward, a lower fee might be appropriate.

3. Check the Local Market

Take a look at what other wholesalers in your area are charging for similar deals. Staying competitive is important if you want to maintain good relationships with buyers and sellers.

Best Practices for Setting a Fair Assignment Fee

Charging a fair assignment fee isn't just about getting the most money possible. It's also about maintaining a good reputation and building trust with both sellers and buyers. Here are some best practices to keep in mind:

1. Be Transparent

Always disclose your assignment fee upfront. If the buyer or seller feels blindsided by a fee they weren’t expecting, it could hurt your credibility and cost you future deals. Being transparent from the beginning sets the stage for a smooth transaction.

2. Justify Your Fee

When possible, explain the value you’re bringing to the deal. If you found an incredible property at a steep discount or navigated a complex situation, make sure the buyer understands why your fee is worth it.

3. Build Long-Term Relationships

Repeat business is key to success in wholesaling. By charging reasonable assignment fees and providing value to both buyers and sellers, you’ll build a reputation as someone people want to work with. This can lead to more deals and referrals in the future.

4. Adjust Based on the Deal

Not every deal is the same, and your assignment fee shouldn’t be either. For smaller deals, consider lowering your fee to ensure the deal closes smoothly. On larger, more complex deals, a higher fee may be warranted.

What Happens if the Fee is Too High or Too Low?

Charging too much for an assignment fee can scare away buyers or leave them feeling like they’re not getting a good deal. On the flip side, charging too little can leave money on the table and undervalue the work you’ve put into the deal.

It’s all about finding a balance—one that reflects the value of the deal while keeping everyone happy.

The Do's and Don'ts of Assignment Fees

To wrap things up, let's go over some quick do's and don'ts:

Be fair and ethical in your pricing

Explain your fee clearly to buyers

Provide value that justifies your fee

Be willing to negotiate when necessary

Keep good records of all your transactions

Don't:

Try to hide or misrepresent your fee

Charge so much that your buyer can't profit

Undervalue your services

Forget to factor in your time and expenses

Ignore local laws and regulations about wholesaling

Final Thoughts

At the end of the day, determining a fair assignment fee comes down to understanding your market, providing value, and being transparent with all parties involved. Wholesaling can be an incredibly lucrative business when done right, and the assignment fee is just one part of the equation.

Want to learn more about how to succeed as a real estate wholesaler? SUBSCRIBE to our BLOG for insider info on the latest market trends and strategies!

Big and Small Properties is a group of real estate Investors who buy houses and land all over the United States. They specialize in buying, wholesaling, and flipping single, multi-family and commercial properties. They are CASH BUYERS creating a quick and easy selling process that moves with ease and efficiency from Offer to Closing. Big and Small Properties also partners with other experienced real estate investors in buying and selling property. Contact us at (877) 260-5566 or SUBSCRIBE to our blog to be added to our buyers list or to receive our latest blog posts.

Disclaimer: This article provides general information and should not be considered legal or financial advice. It's essential to consult with professionals for personalized guidance.

- Assignment of contract

Recent Posts

5 Common Mistakes to Avoid in a Real Estate Wholesale Contract

(205) 492-3425

Real Estate Assignment Fee: Your Guide to Earning Profit

Are you looking for a profitable investment opportunity in the real estate industry? If so, then real estate assignment fees may be worth exploring. This investment strategy involves assigning one’s rights to purchase a property to another buyer for a fee. With the right approach and knowledge, investors can earn a significant profit through real estate assignments.

To be successful in this field, it is important to have a solid understanding of real estate transactions, investing, and contracts. In this article, we will provide an overview of real estate assignment fees and how they work. We will also outline the steps an investor needs to take to maximize profit and mitigate potential risks.

- 0.1 Key takeaways:

- 1.1 How Real Estate Assignment Fees Work

- 1.2 The Risks and Challenges of Real Estate Assignment Fees

- 2 Steps to Earning Profit from Real Estate Assignment Fees

- 3 Maximizing Profit through Effective Real Estate Contracts

- 4.1 Conducting Thorough Market Research

- 4.2 Building a Network of Reliable Professionals

- 4.3 Staying Prepared for Potential Issues

- 5 Conclusion

- 6.1 Q: What is a real estate assignment fee?

- 6.2 Q: How does a real estate assignment fee work?

- 6.3 Q: What are the advantages of real estate assignment fees?

- 6.4 Q: What are the potential risks associated with real estate assignment fees?

- 6.5 Q: How can I earn profit from real estate assignment fees?

- 6.6 Q: What should I include in a real estate contract to maximize profit from assignment fees?

- 6.7 Q: How can I mitigate risks and challenges associated with real estate assignment fees?

Key takeaways:

- Real estate assignment fees involve assigning one’s rights to purchase a property to another buyer for a fee.

- A solid understanding of real estate transactions, investing, and contracts is crucial to success in this field.

- To maximize profit, investors need to find motivated sellers, analyze potential deals, negotiate contracts, and market the assignment opportunity to potential buyers.

- Effective real estate contracts can help investors protect their interests and ensure a smooth transaction.

- Investors should be aware of potential risks and challenges and take steps to mitigate them.

Understanding Real Estate Assignment Fees

If you’re looking to make a profit in real estate investing, it’s essential to understand the concept of real estate assignment fees. Simply put, an assignment fee in real estate refers to the fee charged by an investor to assign a contract for a property to another buyer . This strategy is commonly used in wholesaling real estate transactions.

Wholesaling real estate involves finding motivated sellers who are willing to sell their properties quickly and at a discount. The investor then enters into a contract to buy the property at a reduced price and assigns the contract to another buyer for a higher price, earning a profit through the assignment fee.

One of the advantages of real estate assignment fees is that they require less upfront capital compared to other real estate investing strategies. However, as with any investment, there are potential risks involved. It’s crucial to have a solid understanding of the process and the potential challenges to make informed decisions.

How Real Estate Assignment Fees Work

Real estate assignment fees work by allowing investors to essentially sell their contracts to other buyers. The process typically starts with the investor finding a motivated seller who is willing to sell their property at a discount. The investor then enters into a contract to buy the property at the agreed-upon price.

Once the contract is signed, the investor can then market the property to potential buyers and assign the contract to another buyer at a higher price, collecting the assignment fee. This fee is typically a percentage of the sale price or a flat fee agreed upon in the contract.

It’s important to note that real estate assignment fees are legal in most states, but it’s essential to check local regulations and laws before proceeding with this strategy. Some states have specific rules and requirements to follow, such as obtaining a real estate license or adhering to specific disclosure requirements.

The Risks and Challenges of Real Estate Assignment Fees

While real estate assignment fees can be a profitable strategy, there are potential risks and challenges that investors should be aware of. One of the biggest risks is the possibility of the buyer backing out of the deal, leaving the investor with the property and no buyer to assign the contract to.

Additionally, the investor may encounter challenges in finding a buyer willing to pay the assigned price, which could lead to decreased profits or even losses. It’s crucial to conduct proper due diligence and market research to mitigate these risks and ensure a successful transaction.

In the next section, we’ll discuss the steps to earning a profit from real estate assignment fees, including finding motivated sellers, analyzing potential deals, and negotiating contracts.

Steps to Earning Profit from Real Estate Assignment Fees

If you’re looking to earn profit through real estate assignment fees, here are some steps to guide you through the process:

- Finding motivated sellers: Look for distressed or motivated sellers who need to sell their properties quickly. This could include homeowners facing foreclosure, probate sales, or owners relocating for work.

- Analyzing potential deals: Once you’ve identified a potential seller, conduct market research to determine the property’s value and estimate the costs of any necessary repairs or renovations. Make sure the property is worth the investment.

- Negotiating contracts: Negotiate with the seller for a purchase contract with an assignment clause. This will allow you to assign the contract to another buyer for a fee.

- Marketing the assignment opportunity: Once you have the contract, market the assignment opportunity to potential buyers, such as other investors or homebuyers looking for a good deal. Be sure to explain the benefits of the property and the potential profit to be made.

It’s important to conduct due diligence throughout this process to ensure that the deal is worth the investment. Always make sure to have proper documentation and legal representation to protect your interests.

Maximizing Profit through Effective Real Estate Contracts

Real estate contracts play a crucial role in ensuring a smooth transaction and protecting the investor’s interests when dealing with assignment fees. To maximize profit, it is important to include key clauses and provisions in the contract that promote favorable terms and conditions. Here are some tips:

- Include an escape clause: This clause allows the investor to back out of the contract if they are unable to find a suitable buyer within a certain timeframe.

- Specify the assignment fee: Clearly define the fee that the investor will receive upon assignment, and ensure that it is fair and reasonable for the services provided.

- Include a non-compete clause: This clause prevents the seller from continuing to market the property while the investor is attempting to assign the contract, ensuring that the investor has exclusive rights to the deal.

- Ensure proper documentation: All contracts should be in writing and signed by all parties involved, and any agreements should be documented with written correspondence.

- Negotiate favorable terms: Work with a lawyer or real estate professional to negotiate terms that protect your interests and minimize risk.

By following these tips, investors can ensure that their contracts are effective and maximize profit potential in real estate assignment fees.

Mitigating Risks and Challenges in Real Estate Assignment Fees

While real estate assignment fees can be a profitable investment strategy, there are also potential risks and challenges that investors should be aware of. By taking proactive measures, however, investors can minimize these risks and maximize their profits.

Conducting Thorough Market Research

One of the most important steps in mitigating risk is to conduct thorough market research. This involves analyzing market trends, property values, and other local factors that can affect the success of real estate assignments. Investors should also keep up-to-date with changing regulations that may impact their investments.

Building a Network of Reliable Professionals

Another important strategy for mitigating risk is to build a network of reliable professionals, such as attorneys, real estate agents, and contractors. These professionals can provide valuable advice and support, helping to ensure that assignments are successful and profitable.

Staying Prepared for Potential Issues

Despite careful planning and diligence, issues may arise during the assignment process. Investors can prepare for these potential issues by having contingency plans in place, such as backup buyers or alternative funding sources. It is also important to maintain clear and open communication with all parties involved in the transaction.

By taking these proactive measures, investors can mitigate the risks and challenges associated with real estate assignment fees, while maximizing their chances for success.

Real estate assignment fees can be a profitable investment strategy for those who are willing to put in the effort. With a solid understanding of real estate transactions, investing, and contracts, investors can earn significant profit by wholesaling properties and earning assignment fees.

Remember to conduct thorough due diligence, build a network of reliable professionals, and stay updated on local regulations to mitigate the risks associated with real estate assignment fees. By maximizing profit through effective real estate contracts and managing potential challenges, investors can create a successful real estate investing business.

If you’re interested in exploring this investment strategy further, don’t hesitate to take action and start your journey towards earning profit through real estate assignment fees.

Q: What is a real estate assignment fee?

A: A real estate assignment fee is a fee that an investor earns by assigning their rights to purchase a property to another buyer . It is a common practice in wholesaling real estate, where investors enter into contracts to buy properties and then assign those contracts to another buyer for a fee.

Q: How does a real estate assignment fee work?

A: To earn a real estate assignment fee, an investor typically finds a motivated seller, negotiates a contract to purchase the property, and then finds a buyer who is willing to pay a higher price. The investor assigns their contract to the buyer , who then proceeds with the purchase. The difference between the purchase price in the original contract and the price paid by the buyer becomes the assignment fee for the investor.

Q: What are the advantages of real estate assignment fees?

A: Real estate assignment fees offer several advantages for investors. They provide an opportunity to earn profit without the need for substantial capital or extensive renovations. Real estate assignment fees also allow investors to leverage their negotiation skills and market knowledge to secure favorable deals. Additionally, this strategy enables investors to participate in multiple transactions and diversify their investment portfolio.

Q: What are the potential risks associated with real estate assignment fees?

A: While real estate assignment fees can be lucrative, they do come with potential risks. One risk is the possibility of not finding a buyer for the assigned contract within the agreed-upon timeframe, which could result in the investor being responsible for purchasing the property themselves. Another risk is encountering legal complexities or disputes related to contract assignments. It is crucial for investors to conduct proper due diligence, consult legal professionals, and have a thorough understanding of local regulations to mitigate these risks.

Q: How can I earn profit from real estate assignment fees?

A: To earn profit from real estate assignment fees, you need to follow a few key steps. These include finding motivated sellers who are open to selling their properties at a discounted price, analyzing potential deals to ensure they are profitable, negotiating contracts that allow for assignment, and marketing the assignment opportunity to potential buyers. It is essential to conduct thorough due diligence, build a network of reliable professionals, and document the transaction properly to maximize your profit.

Q: What should I include in a real estate contract to maximize profit from assignment fees?

A: When drafting a real estate contract for assignment purposes, there are key clauses and provisions that can help maximize your profit. These may include provisions that protect your right to assign the contract, specify the assignment fee, outline the timeline for finding a buyer , and address potential contingencies. It is recommended to seek legal advice and negotiate favorable terms and conditions to protect your interests and ensure a smooth transaction.

Q: How can I mitigate risks and challenges associated with real estate assignment fees?

A: Mitigating risks and challenges in real estate assignment fees requires careful planning and research. Conduct thorough market research to understand the local market dynamics and demand for assigned contracts. Build a network of reliable professionals, such as real estate agents, attorneys, and contractors, who can provide guidance and support. Stay updated on local regulations to ensure compliance and manage any potential issues that may arise during the assignment process.

- Recent Posts

- Can you become a millionaire by investing in real estate? - November 7, 2023

- What form of AI is most commonly used in real estate? - November 5, 2023

- What is the AI real estate market forecast? - November 3, 2023

Assignment of Contract – Assignable Contract Basics for Real Estate Investors

What is assignment of contract? Learn about this wholesaling strategy and why assignment agreements are the preferred solution for flipping real estate contracts.

Beginners to investing in real estate and wholesaling must navigate a complex landscape littered with confusing terms and strategies. One of the first concepts to understand before wholesaling is assignment of contract, also known as assignment of agreement or “flipping real estate contracts.”

An assignment contract is the most popular exit strategy for wholesalers, and it isn’t as complicated as it may seem. What does assignment of contract mean? How can it be used to get into wholesaling? Here’s what you need to know.

What Is Assignment of Contract?

How assignment of contract works in real estate wholesaling, what is an assignment fee in real estate, assignment of agreement pros & cons, assignable contract faqs.

- Transactly Saves Time. Learn How Now!

Assignment of real estate purchase and sale agreement, or simply assignment of agreement or contract, is a real estate wholesale strategy that facilitates a sale between the property owner and the end buyer.

This strategy is also known as flipping real estate contracts because that’s essentially how it works:

- The wholesaler finds a property that’s already discounted or represents a great deal and enters into a contract with the seller,

- The contract contains an assignment clause that allows the wholesaler to assign the contract to someone else (if they choose to!), then

- The wholesaler can assign the contract to another party and receive an assignment fee when the transaction closes.

Assignment of contract in real estate is a popular strategy for beginners in real estate investment because it requires very little or even no capital. As long as you can find an interested buyer, you do not need to come up with a large sum of money to buy and then resell the property – you are only selling your right to buy it .

An assignment contract passes along your purchase rights as well as your contract obligations. After the contract assignment, you are no longer involved in the transaction with no right to make claims or responsibilities to get the transaction to closing.

Until you assign contract to someone else, however, you are completely on the hook for all contract responsibilities and rights.

This means that you are in control of the deal until you decide to assign the contract, but if you aren’t able to get someone to take over the contract, you are legally obligated to follow through with the sale .

Assignment of Contract vs Double Closing

Double closing and assignment of agreement are the two main real estate wholesaling exit strategies. Unlike the double closing strategy, an assignment contract does not require the wholesaler to purchase the property.

Assignment of contract is usually the preferred option because it can be completed in hours and does not require you to fund the purchase . Double closings take twice as much work and require a great deal of coordination. They are also illegal in some states.

Ready to see how an assignment contract actually works? Even though it has a low barrier to entry for beginner investors, the challenges of completing an assignment of contract shouldn’t be underestimated. Here are the general steps involved in wholesaling.

Step #1. Find a seller/property

The process begins by finding a property that you think is a good deal or a good investment and entering into a purchase agreement with the seller. Of course, not just any property is suitable for this strategy. You need to find a motivated seller willing to accept an assignment agreement and a price that works with your strategy. Direct mail marketing, online marketing, and checking the county delinquent tax list are just a few possible lead generation strategies you can employ.

Step #2: Enter into an assignable contract

The contract with the seller will be almost the same as a standard purchase agreement except it will contain an assignment clause.

An important element in an assignable purchase contract is “ and/or assigns ” next to your name as the buyer . The term “assigns” is used here as a noun to refer to a potential assignee. This is a basic assignment clause authorizing you to transfer your position and rights in the contract to an assignee if you choose.