Home › Blog › Online Market Research Methods to Take Your Products to the Next Level

Online Market Research Methods to Take Your Products to the Next Level

- by Mushegh Hakobjanyan

- June 26, 2023

Conducting online market research can be a very effective tool for better understanding your target audience, how people feel about your products, and how you should shape your future marketing strategy. In fact, 53% of consumers do online research on a regular basis, and studies have shown that 95% of people read online reviews before making a purchase.

In this article, we will examine market research methods and the different forms they take, as well as the advantages and disadvantages of different types.

What Is Online Market Research?

Online market research is market research that uses online data – both your own and that of other companies – to learn more about your target audience and scale your offerings appropriately.

Successful online market research can help your business grow faster and more effectively. It holds several advantages over in-person research, including:

- Much lower costs. Surveys conducted by email, for example, can cost between $3000-5000, as opposed to offline surveys that can cost $100,000 or more. This includes saved costs on facilities, and saved time for participants as they do not have to travel to take part.

- Greater potential representation of people from different time zones or geographical areas.

- Ease of data storage. Asking questions online automatically allows answers to be stored and filed for analysis and archival purposes.

- A greater degree of anonymity and honesty from respondents. Regardless of whether questions are open-ended, multiple choice, or of other sorts, people can feel more comfortable being honest knowing that they can be anonymous.

There are also some disadvantages to conducting market research online, which people should keep in mind:

- People might not place sufficient emphasis on questions to read them carefully if they don’t have a distinct “event” to go to. They could be distracted by other things and simply check off answers for the sake of doing so.

- There is a risk of some participants not fully understanding certain questions. When this happens, people have no recourse to clarify or ask follow-up questions.

Despite the limitations, online market research certainly has enough benefits that it can provide very useful insights into business trends and facts for businesses who conduct it. It can be an effective way of generating behavioral targeting ideas to better understand your consumer base.

Online Market Research Methods

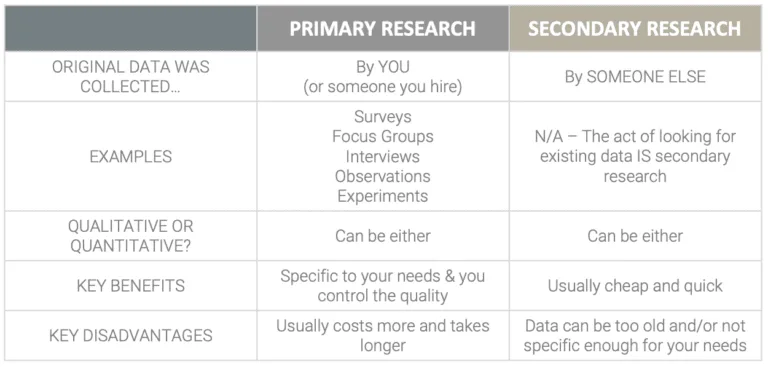

Online market research consists of two different types of approaches depending on whether a company is conducting its own research or using research that has already been conducted by others. They are referred to as primary and secondary methods.

Primary Market Research

Primary market research is research that involves the collection and analysis of a company’s own data. The data that is used in analyses is only visible to the company itself. Primary market research involves the use of methods such as market research surveys, online focus groups, and interviews. Offline primary resear ch also includes the use of observation groups.

In conducting primary market research, you are aiming to gather information about your target audience and their preferences in order to refine your offerings more appropriately.

One of the distinguishing features of primary research is that the groups you collect information from are ones that reflect your target audience. That is, they have similar characteristics in common, and the data that you collect is likely to match that, which will apply to your company.

The advantages of primary market research are the following:

- The research you conduct in using primary research methods is fully your own. You do not have to share it with people outside your company, and in conducting future analyses, you have reliable bases to work from in that you will already be familiar with your existing data.

- In conducting primary research, you have control over how you want to formulate processes, whether they be surveys, interviews, or other methods. The data that you receive will reflect precisely the initial purpose of your research.

- You have the opportunity to focus on your own business’ goals and concerns, as opposed to looking at broader business concerns within your industry, your geographical area, etc. You can delve as deep into your chosen research areas as you want.

There are also some disadvantages to doing this type of research that you should keep in mind:

- There is a significant amount of time involved in planning, carrying out, and analyzing primary research. Some companies don’t have the resources necessary to do this. Although online tools have made it easier in recent years, conducting your own research is still more time consuming than accessing secondary research.

- Having the skill base to know how to conduct a proper research experiment can be complicated. You need to have a thorough understanding of how to carry research out and how to analyze results in order for it to be truly effective.

- Primary research only allows for a narrow sampling of any given group. Even if you choose a target group that you think represents your interests, you still only have your own chosen sample of people/categories/indicators to work with. And this doesn’t necessarily give you an accurate representation of your larger potential audience.

Secondary Market Research

Secondary market research is research that has already been conducted by other groups that you access for your own purposes. For companies that do not have the time, resources, and money to conduct their own research, secondary market research can be useful in illustrating industry trends, demographic information, or other information that affects different aspects of industries.

Secondary market research includes studies conducted by government agencies, trade associations, or larger businesses in a given industry that have sufficient resources to carry out large-scale research themselves.

There are advantages to doing secondary research, rather than primary research:

- Many reports, studies, and other types of articles that have already been concluded are open to the public. This means that you can often access them without excessive difficulty and without having to pay. Many research studies are available online, and you can contact associations or government offices if you see references to studies that you would like to investigate further. Although private companies might require payments to access their information, doing so will still likely be cheaper and easier than conducting the same research yourself.

- Reading and analyzing research studies that have already come out can be beneficial in not only providing data, but bringing to light trends or issues that you might not have been aware of in your industry. They can also help shed light on shifts in industry leaders, changing demographics within your target group, or other valuable information.

There are some disadvantages to relying on this type of research, of course. They include:

- Using other entities’ work as a basis for determining your own strategy can provide an inaccurate foundation for you.

- There could be any number of variables that are different between your company and the ones whose research you review.

- This type of research doesn’t allow you to focus on single products or particular aspects of your business.

Qualitative and Quantitative Market Research

Market research can also be broken down into two types based upon the style of methods that researchers use. They are known as qualitative and quantitative methods, and we will provide an overview of both of them.

Qualitative Market Research

Qualitative market research is a research method that involves asking open-ended questions to groups of people in order to collect their thoughts and opinions on products and services. This type of research usually involves smaller groups of people in online focus groups or interviews.

Both qualitative and quantitative research have distinct advantages to them. In order to really gain a solid understanding of your audience’s feelings about products, you should conduct both types of research.

Qualitative market research can be instrumental in understanding how people feel about different aspects of your business. In other words, you can gain insight into why people prefer certain types of things over others, rather than simply the numbers of them that they consume.

The advantages of using qualitative research methods over quantitative ones include:

- Using smaller groups of people allows for greater depth of answers. If you are looking to refine a product line or understand why your product might be falling in the market, you can learn more through a qualitative research study.

- You have the opportunity to choose a particular group that represents a narrow set of interests if you want to control the number of factors involved.

- Asking open-ended questions not only provides additional insight, but can serve as a basis for future discussions and research projects.

There are also disadvantages to using qualitative research methods:

- Because groups are limited in size, they might not accurately represent the opinions of the larger population.

- Qualitative research only examines particular aspects of the products being discussed, so they do not provide an overall assessment of attitudes towards products as a whole.

- In being asked open-ended questions, people might be reluctant to give honest answers.

Quantitative Research Methods

The other major type of market research is quantitative research. Qualitative research is research that aims to obtain larger-scale information from people using surveys, polls, or questionnaires to uncover trends and larger public sentiment about products or services .

Quantitative research methods offer distinctly different advantages for your business. The distinctive features of quantitative research include the following:

- Larger numbers of respondents. If you have a larger pool of people from whom you can receive responses, your results will likely be more reflective of the population as a whole.

- Quantitative research often involves the use of random samples of the population. Random samples provide a wider representation of society. Also, it reduces the amount of bias that is often present in qualitative studies as open-ended question formation can often be skewed in favor of certain types of answers.

- Quantitative research allows for anonymity. By simply being one of many respondents in a large-scale survey or other research, participants don’t feel as if they are divulging potentially controversial or offensive opinions.

There are also some disadvantages to using quantitative methods:

- Answers might be limited or inaccurate. By not allowing people to complete open-ended questions, and therefore allowing for the inclusion of context, you might be getting skewed or inaccurate results.

- You don’t get the depth of answers that you would get using qualitative methods.

- People might pay less attention as answers are simply easy to check off and they want to get the survey (questionnaire, etc) over with.

How to Do Market Research Online

Let’s now take a closer look at some of the distinct practices involved in online market research. As we will explain, each of these types has particular advantages to it.

Online Surveys

Online surveys are surveys that are conducted online for the purpose of gaining insight or information about your target customers in order to better refine your products to conform to their needs.

Conducting online surveys can be useful for various purposes, from assessing the potential popularity of new products to better understanding customer needs regarding existing ones, and learning more about your brand popularity overall.

There are a set of steps that you should follow in conducting an online market survey:

- Figure out what you want to learn. Are you working with new products? Do you want to gauge customer satisfaction levels with a particular existing product or line of products? Do you want to improve the customer experience in general?

- Decide who you want to survey. This will be related to your goals:

- Obviously, if you’re assessing satisfaction with a particular type of toy, for example, your target group will consist of parents.

- If you’re trying to get information on anti-aging cream, you will target women of a certain age group who tend to use these types of creams.

- Determine as accurately as possible other factors related to your potential respondents: geographic location, income bracket, etc. This will help you hone your marketing strategy once you’ve completed the survey, and also give you more accurate results.

3. As surveys usually involve quantitative methodology , you could ask different types of questions to your participants, including: Multiple choice questions:

a. “How satisfied are you with producing X?”

- A. Very satisfied

- B. Somewhat satisfied

- C. Not satisfied

b. Numerical scale questions: “How satisfied are you with this product on a scale of 1-5?”

4. Take circumstances into consideration. With in-person surveys, this would involve things like time of day, location, etc., but of course online surveys don’t include these kinds of factors. So instead you should focus on things like platforms. What are the preferred social media of your target group? If you’re sending your survey out by email, think about whether this is really the best way to reach the group you want. If you determine that your target group is people aged 30-40 who use Facebook more than other platforms, you should consider sending out your survey via a paid post on people’s Facebook pages.

5. Calculate your results. The types of results that you want should be part of your initial design and the goals you set out from the beginning. There are many different kinds of results that you could look for, depending on your goals:

- You could look for the highest number of any given type of response. For example, if you’re trying to find out how the majority of customers feel about a particular product, you could assess what the most popular responses are.

- You could assess how many people either really like or really dislike a given product (how many rate it a 1 or a 5).

- You could rank your respondents’ results against those of the respondents in a secondary research project to compare how a similar demographic feels about a particular product type to yours.

These are just a few of the types of outcomes that you can have as research goals. What you look for all depends on your larger strategic plans and what you want to accomplish in your marketing efforts.

6. Analyze how your results fit into your overall product line and goals. Your results will influence your larger marketing strategy, and possibly individual product lines, as well.

Explore Industry Reports

A secondary research method that you can use to obtain more wide-scale information about your industry as a whole is to explore industry reports. Unlike surveys, industry reports give you information about numerous different aspects of your industry, including:

- large-scale trends in your industry over time

- detailed financial statistics that help you better understand things like consumer spending habits, typical operating costs, etc.

- Information about industry leaders and their individual statistics

- How market share is divided according to different metrics

Although obtaining industry reports can be complicated, as well as expensive, there are places that you can look for them that might save money and effort:

- The Bureau of Economic Analysis

- Dun & Bradstreet

- Trade associations for your industry in particular

Although industry reports might be expensive to obtain copies of (you might pay $3000 or more to access a given report), the costs are far lower than those of conducting your own research.

Using a combination of the broader information to be gained from industry reports, as well as your own primary and secondary research, will together give you a much more complete picture of the particulars of your business, as well as where you stand vis-a-vis the competition and the industry in general.

Start Conversations with Focus Groups

Finally, focus groups are a way to collect potentially even more in-depth qualitative information than any of the above methods. Focus groups generally include up to ten people and involve a series of open-ended questions intended to gain insight into people’s feelings about products, services, or other aspects of business. If you’re looking to gain a deep understanding of what people like or dislike about your products, and why they feel that way, focus groups can be a very effective way to do this.

In conducting a focus group session , it is the job of the moderator to steer the conversation as he or she sees fit. Initial questions could include things like the following:

- “How do you feel about product X?”

- “How often do you use it?”

- “Is there anything you don’t like about this product?”

An effective moderator is one that asks probing follow-up questions to gain additional insight into questions, and to try to include group members that might be reluctant to speak out. Follow-up questions could include things like the following:

- “Is there anything else you’d like to add about the product?”

- “What would need to change for you to buy product X?”

- “We discussed product X in detail, but product Y less so. Is there anything about the product Y you’d like to add?”

Advantages and Disadvantages of Having Focus Groups Online

Although focus groups have traditionally been conducted in person, technology has made it possible for them to be done online by participants logging in from their own locations. This widens the possibilities for participation geographically and saves costs on facilities, transportation, etc.

However, one of the advantages of having in-person focus groups is that group members form a dynamic with each other, and the conversation is one that builds on itself. Members get ideas from other members, and the conversation ends up being a group effort in the end. This can still happen online, although some researchers believe that the lack of in-person contact can limit the natural flow of conversation.

Analysis of Results

Once you’ve completed your research, it will be time for you to analyze it. A careful analysis can provide insights into not only your original questions, but it can also reveal other aspects of your business and/or wider industry that you hadn’t considered before.

Regardless of whether your research is qualitative or quantitative, the results that you obtain can be useful to your product line development overall. Even if you have focused a study on one particular product, for example, answers can give you insight into your larger business.

Research projects can build upon one another. Once you’ve completed a research project on a given subject, you can use the results as a foundation for further studies. And in this way, you can build your products to new levels.

Market research can help your company in innumerable ways. Whether you are a new company, or a more established one, conducting market research can help you grow, understand and resolve problems, and gain a better understanding of your products and your industry overall. Once you have the online market research tools to carry projects out, you will be better equipped to undertake studies yourself.

Conducting market research used to be a time consuming and costly undertaking, but thanks to technological advancements and the growth of online methods, it has become faster, cheaper, and more accessible for a much greater range of companies.

Mushegh Hakobjanyan

Table of contents.

Ready to experience hypergrowth?

Your Name *

Your e-mail *

$1000-$2500 $2500-$5000 $5000-$10000 $10000+

Select Service(s)

Organic Search Digital Advertising Social Media Marketing Email Marketing Web Development Web Design Local SEO & Marketing SaaS Marketing eCommerce Marketing Other

How can we help?

E-mail: [email protected]

Los Angeles, California, USA

201 N Brand Blvd, Suite 200, Glendale, CA, 91203

(818) 649-3949

Yerevan, Armenia

4 Hrachya Kochar St, Yerevan, Armenia 0053

+374 95 744733

26 Tools & Resources for Conducting Market Research

Published: April 30, 2024

Conducting market research pulls details together to help you choose new products or services to launch. They also help identify your audiences and best marketing strategies so you are ready to act without the guesswork.

Businesses use market research software to minimize risk and make more data-driven choices.

I own a small business, and by gathering facts and opinions, I can better predict whether new products or features — and for more prominent companies, even locations — will succeed before investing.

Here are 25 of the best tools for conducting market research, including a few recommendations directly from HubSpot market researchers and bloggers who use them.

![market research online → Download Now: Market Research Templates [Free Kit]](https://no-cache.hubspot.com/cta/default/53/6ba52ce7-bb69-4b63-965b-4ea21ba905da.png)

Helpful Market Research Tools & Resources

1. similarweb.

Image Source

Similarweb is probably the highest quality, most well-known, and most convenient way to get and compare traffic information about any website you land on — short of having an expert analyst whispering in your ear, which could get awkward. Their free suite of products — including the Chrome extension — is worth exploring and gives you useful, high-level information. The deep insights come from taking advantage of their database of real-world information on global website performance gathered over time, which they’ve already been building for over 10 years. They have their finger on the pulse of online business worldwide, from sales to sites to stocks.

Microsoft, Amazon, and even Google use Similarweb and the insights they provide on other enterprise-level operations down to small businesses. If you want to know how your company stacks up and then initiate a robust research and marketing campaign, these are serious tools that can help you grow.

What I like: One of their add-ons is called App Intelligence, and it can benchmark your growth and track your progress against millions of apps — for both iOS and Android — and provide daily insights on app rankings, engagement, retention, and more.

Pricing : Starter plans cost $125 per month paid annually; professional plans cost $333 per month billed annually; team and enterprise plans have custom pricing.

For Max Iskiev , market research analyst at HubSpot, one research tool stands out from the rest: Glimpse.

He told me, “Glimpse is my favorite research tool. It’s quick and easy to use, allowing me to design and launch short surveys for real-time insights on trending topics.”

Writers for the HubSpot Marketing Blog have also used Glimpse to run short, 100-person surveys for articles (case in point: Are Sales Reps Rushing Back to the Office? ).

Not only is Glimpse valuable for doing quick pulse-checks on the latest trends, but it also leverages the power of AI for even deeper insights.

“Glimpse really shines when it comes to open-ended questions, using natural language processing and AI to analyze emotion and sentiment, saving time, and offering invaluable insights,” Iskiev shared.

Best for: Those who can invest in AI tools for their businesses but don’t need a decade’s deep dive like users of Similarweb might.

Pricing : Starter Plan - Free; Professional - $500/month; Advanced - $1,000/month; Enterprise - custom pricing.

3. BuzzSumo

BuzzSumo offers several highly useful tools that work best as a content research tool for mid-size businesses and up. If you need many ideas for a whole lot of content, BuzzSumo is likely a good fit for your company.

Their monitoring tools can alert you to new content that relates to your keywords of choice.

This is smart for writers, content strategists, and those who manage writers and content strategists to stay on top of trends in what consumers want to know more about within your industry — so you’re right there to provide it.

BuzzSumo also gives you access to reporting tools that stream various sources of information to your dashboard, making it easy to keep up with developments and build visual assets to communicate about them.

You can find major influencers — worldwide — through BuzzSumo that fit your brand to sponsor and collaborate with.

Unfortunately, BuzzSumo doesn’t integrate well with Instagram, so you’ll want to focus on influencers that use other social channels unless you’re willing to do IG work on the side.

What I like: Their Chrome extension is a nice addition to their offerings for companies that work with freelancers and remote workers to take the work on the move.

Pricing: Free 30-day trials are available. Content creation plans cost $199 per month; PR and comms plans cost $299 per month; suite plans cost $499 per month; and Enterprise plans cost $999 per month.

4. Answer the Public

Answer the Public is a sister product to UberSuggest, both being brainchildren of Neil Patel.

Answer: the Public watches what people are searching for and lets you keep track of how things change over time. By studying the changes, you can be at the front of trends — positive or negative — so you can respond to the changes quickly.

It’s billed as an excellent tool for public relations professionals to give them a heads-up on how their company is faring in the public eye.

If you fall on the wrong side of public sentiment, you can be right on top of salvaging the situation and making improvements to regain trust.

If you’re doing something right and see gains in positive engagement, you know to keep up what you’re doing and may even want to expand upon it.

Great examples of what organizations have done with information like this include Wendy’s ongoing roasts and savage clapbacks on social media.

The Oklahoma Department of Wildlife Conservation’s hilarious insistence on not bringing mountain lions in the house also nabbed engagement by the truckloads (of corgis).

What I like: I like that Masterclass videos are available. They make sure to include lots of opportunities to learn how to best use their products and get maximum value from the suite.

Pricing : Individual plans cost $9 per month; pro plans cost $99 per month; expert plans cost $199 per month. Lifetime Pricing is available. Individual lifetime plans cost $99, pro lifetime plans cost $199; and expert lifetime plans cost $1,990.

5. GrowthBar SEO

GrowthBar SEO is all-in for AI. If your leadership wants a slice of the AI action at work in the company’s market research, this might be the tool to reach for.

It uses ChatGPT-4, and the peer-to-peer review site G2 ranked it the #1 AI writing tool for SEO in 2022 and 2023.

What sets it apart is that the AI writing assistant doesn’t just compile and give word to information it finds online.

It offers selections of relevant keywords, titles, headings, industry standard word counts, and link suggestions that you can choose from as you move through the outline.

They also include tools for keyword research, keyword ranking, and information about your keyword competitors. And because Google search is incorporated into the suite, you can do most, if not all, of your writing work on one screen.

Pro tip: As with all AI content, you’ll need a writer to bring the content to life by fact-checking information, adding unique or inside perspectives, meaningful quotes, and many other values that make the content rich to read.

GrowthBar SEO knows this, and you can source freelance writers there as well!

Pricing : A seven-day free trial is available. Standard plans cost $36 per month; pro plans cost $74.25 per month; and agency plans cost $149.25 per month.

6. Statista

Statista is a data visualization website that takes data from reputable reports across the web and makes them easy and digestible for researchers, marketers, and product creators just like you.

“Statista is like my market research sidekick, giving me all the data I need without the endless search. No more digging through the haystack. With Statista, I can spot trends and make informed decisions with ease," Icee Griffin , market researcher at HubSpot, told me.

One neat aspect of using Statista is that the same chart is updated as the years pass. Say that you want to allude to the value of the beauty market in your proposal.

If your investor accesses that same graph a year from now, it will reflect updated numbers. Statista finds the most recent research to update their visualizations.

Pro tip: Statista doesn’t carry out original research, but does have around 100 analysts who seek out gaps in their resources to provide ever more useful, trending data.

Pricing : Basic plans are free. Starter plans cost $199 per month, billed annually. Professional plans cost $959 per month, billed annually.

7. Think With Google Research Tools

Wish you had information on your product’s likelihood of success?

Think With Google’s marketing research tools offer interesting insights on whether anyone is looking for your product ( Google Trends ), which markets to launch to ( Market Finder ), and what retail categories rise as the months and seasons pass ( Rising Retail Categories ).

If you’d like to market your product through YouTube, the Find My Audience tool allows you to investigate what your potential viewers are interested in and what you should discuss on your brand’s YouTube channel.

What I like: Free and incredibly useful in my experience, small and newer businesses really benefit from having tools like this to conduct market research and get their growth rolling.

Pricing : Free

8. Census Bureau

The Census Bureau offers a free resource for searching U.S. census data.

You can filter by age, income, year, and location. You can also use some of its shortcuts to access visualizations of the data, allowing you to see potential target markets across the country.

If you’re considering a highly competitive product or service, you can easily find out where your target industry is most popular — or where the market has been oversaturated.

Another helpful tool is the Census Bureau Business and Economy data , where you can also target premade tables depending on your industry.

Pro tip: The text information on each screen can be overwhelming, so here’s a shortcut for you. One of the best ways to use this tool is by finding the NAICS code for your business.

Then, access the " Tables “ tool, click ”Filter" on the sidebar, and search for your industry.

9. Make My Persona

HubSpot’s Make My Persona tool allows you to create a buyer persona for your potential new product. In this tool, you pick a name for the persona, choose their age, identify their career characteristics, and identify their challenges.

This allows you to pinpoint both demographic and psychographic information.

Creating a buyer persona is an early step in the marketing process but an important one to avoid scope creep.

If you’re unsure about details like these and how to use market research tools for your business, let me recommend Hubspot’s Market Research Kit .

It’s completely free and helps you build a strong foundation for data-driven decision-making in your future marketing strategies.

Best for: Make My Persona is best suited to B2B product launches because you’ll be prompted to document your buyer persona’s career objectives and role-specific challenges.

Ideally, your product would solve a problem for them in the workplace or help their company achieve revenue goals.

10. Tableau

Tableau is a business intelligence suite of products that allows you to “connect to virtually any data source.” But the data isn’t presented in unreadable tables.

Rather, Tableau helps you visualize this data in a way that helps you glean insights, appeal to external stakeholders, and communicate the feasibility of your product to potential investors.

You can visualize data on anything from corn production in tropical climate zones to office product sales in North America. With Tableau’s tools, you can take as granular or as general a look you’d like into potential marketplaces and supplier regions.

What I like: Visual information for humans and pure data for the machines all in one. Tableau integrates well with spreadsheets and databases so that you can export Tableau data to Excel , back up records in Amazon Redshift, and more.

Pricing : Tableau Viewer plans cost $14 per user each month when billed annually. Tableau Explorer plans cost $42 per user each month when billed annually. Tableau Creator plans cost $75 per user each month when billed annually.

11. Mentionlytics

Mentionlytics is a web and social media monitoring tool that allows businesses to discover people's thoughts about their brands, campaigns, products, or services. Users can create and customize reports and get data-driven insights that will help them make informed decisions. They can also filter results by language, location, and social media channel to personalize results. Analyzing sentiment and emotion lets you easily understand what will work for your brand and industry and what you should avoid. The Share of Voice report allows you to benchmark against your direct competitors and industry. You can also identify trends and discover influencers in your niche and area to boost your next steps.

Best for: Mentionlytics is great for competitor analysis and crisis detection. Their Social Intelligence Advisor (SIA) turns large volumes of data into understandable knowledge to offer custom advice on crisis detection and brand growth.

Pricing: A 14-day free trial is available for most plans. Basic plans cost $69 per month; Essential plans cost $139 per month; Advanced plans cost $249 per month; Pro plans cost $399 per month; Agency plans cost $599 per month; Enterprise plans cost $950 per month. Annual billing options offer discounts.

12. Paperform

A market research survey is an effective way to better understand your target audience and their needs by asking them directly.

This step is integral to understanding your dream customers’ problems, so you want to ensure the process is as interactive as possible and gathers objective, accurate responses.

With its free-text interface, Paperform is as simple as writing a Word document. You can make your survey stand out by customizing colors, fonts, layouts, and themes to create your unique look and feel.

There are 27+ question field types, such as ranking, matrix, or scale fields. Use several to create visually engaging surveys that collect more information and see higher completion stats.

If you’re unsure where to start, you can use one of their expertly-made questionnaires or market research survey templates to get you started.

Best for: In my experience, Paperform is able to efficiently incorporate multiple customer personas. It uses conditional logic to show or hide questions or whole sections of content to create fully personalized paths.

These interactive forms lower drop-off rates and boost customer interaction.

Pricing: Essentials plans cost $29 per month. Pro plans cost $59 per month. Business plans cost $199 per month. For enterprise pricing, contact Paperform’s sales team.

GWI is an on-demand consumer research platform that makes audience research a breeze. Powered by the world’s largest study on the online consumer base, GWI provides insights into the lives of over 2.8 billion consumers across 50+ markets.

With 250k+ profiling points, you can find your unique customers and learn everything you need to know about who they are, what’s on their minds, and what they’re up to.

One user-friendly platform makes it quick and easy to become an expert on your audience and capture the answers you need to succeed.

Pro tip: GWI even has features to compare markets and create customized and shareable charts in seconds, helping you distribute critical information as quickly as you find it.

Pricing : Explore Interactive Demo for free; Flexible and custom pricing with discounts available.

14. SurveyMonkey

SurveyMonkey is a powerful tool for creating in-depth market research surveys that will help you understand your market and consumer preferences.

With this tool, you can create targeted, uber-specific surveys that help you collect answers that pertain specifically to your product.

While using a data source can give you a general overview of your target audience and market, SurveyMonkey can help you get more granular insights from real consumers.

SurveyMonkey offers dedicated market research solutions and services and a reporting dashboard option that allows you to easily parse through the results.

What I like: I like that SurveyMonkey is a good fit for exploring markets beyond your shores. It includes a global survey panel and survey translation service for international research.

- Individual plans: Advantage annual plans cost $39 per month. Premier annual plans cost $119 a month. Monthly plans cost $99 per month.

- Team plans: Team advantage plans cost $29 per person each month. Team premier plans cost $75 per person each month.

- Enterprise pricing is available upon request.

15. Typeform

Like SurveyMonkey, Typeform allows you to run research surveys to get direct answers from your target consumers. It’s an easy-to-use, mobile-optimized form-builder that’s great for market research.

Typeform’s distinguishing factor is that it shows viewers one form field at a time. In its templates, Typeform encourages a more conversational, casual approach (like in its market research survey template ).

You can create a wide range of question types, and other features include the ability to recall answers from previous questions and create logic jumps.

In a survey, you’d want to collect both demographic and psychographic information on your customers to understand their purchasing behaviors and the problems they encounter.

The goal is to find out if your product is the solution to one of those problems — and whether, before launching, you should add more features or rethink your product positioning strategy .

Best for: I think Typeform is best for product launches that target a younger demographic.

If you’re targeting C-suite executives at established firms, consider a more formal option, such as SurveyMonkey, or keeping your tone more formal in your questions.

Pricing : Free plans are available. Basic plans cost $29 per month. Plus plans cost $59 per month. Business plans cost $99 per month. Enterprise plans are available upon request.

16. PureSpectrum Insights (Previously Upwave Instant Insights )

PureSpectrum acquired Upwave Instant Insights in 2021 and rebranded as PureSpectrum Insights.

As before, this platform is primarily a consumer research tool. While it isn’t advertised as a survey creation tool, it allows you to launch market research surveys specifically to get consumer insights.

PureSpectrum allows you to perform customer and market segmentation and also to visualize your data for easy scanning by key stakeholders and investors. They’ve grown to include A/B testing, brand tracking, and customer sentiment.

Pro tip: PureSpectrum distributes your survey to real people. Take a look at their marketplace profile to get a sense of where and from whom you can collect valuable data.

Pricing : Schedule a demo for more information.

17. Claritas MyBestSegment

Claritas MyBestSegment provides product researchers with tools to understand a specific area’s demographic information as well as the lifestyle habits of those who live there.

Their audience segments give you information gleaned from tens of thousands of data points, giving you insight into much more than just household income, employment, and education levels.

By finding out what a segment of the population does — without having to go out and survey them — you can find out which areas would be most receptive to a campaign or launch.

You can also discover which competitors are located nearby and which lifestyle trends have shifted or are on the rise.

What I like: I like that they are able to do some of the leg work for you. Syndicated Audiences is a tool available from Claritas for finding an organized audience of consumers who are more likely to be interested in your products or services.

Pricing : Pricing is available upon request.

Loop11 is a user experience testing platform that allows you to test the usability of your website, study user intent, test the information architecture of your site, and examine how the user experience changes based on the device they’re using.

Loop11 tests your site on any device by making users perform tasks. They then complete a short question about how easy or difficult the task was to complete.

Your product may be phenomenal, but unless consumers can actually buy it through your site, your launch won’t be successful.

You can use Loop11’s participants for niche demographics or bring in your own to learn more about your current customers.

Best for: Market research for your site development. You can find out whether your target consumers find your site easy to navigate and also identify snags that prevent conversions.

Pricing : Rapid Insights plans cost $199 monthly or $179 per month, billed annually. Pro plans cost $399 per month or $358 per month, billed annually. Enterprise plans cost $599 per month or $533 per month, billed annually.

19. Userlytics

Like Loop11, Userlytics allows you to test the usability of your website, mobile app, and site prototype. You can target different devices, define a buyer persona, and disqualify participants based on screening questions.

Testing is based on tasks that your test-takers carry out. They then answer a simple question about the difficulty of the task. You can structure the question in various ways:

You can leave it open-ended, provide multiple choices, or ask for a rating. Other formats you can use include System Usability Scale (SUS) questions, Net Promoter Score (NPS) questions, and Single Ease Questions (SEQ).

What I like: Userlytics performs both a webcam and a screen recording. You can compare the user’s answers with their reactions on video to understand how they feel when they’re interacting with your assets.

Pricing : Schedule a free demo for more information.

Sometimes, you need a no-frills test to take the pulse of consumers. Temper allows you to create a question and pop it onto your website, into your emails, etc.

The smiley face, “meh” face, and frowny face make it easy for viewers to share their feelings — and for you to read their minds.

You can also add it to a product page or a landing page, tailoring the questions to fit your offerings.

As for what you see, there are three options for receiving the feedback: in a tab on each page you are monitoring, embedded in the web page itself to narrow in on aspects within the page, or at the bottom of emails so you can get real-time information as the interaction unfolds.

Pro tip: One great way I’ve seen this used is by adding it to a blog post announcing the launch of a new product. You can find out general sentiment toward the product before it even launches!

Pricing : Hobby plans cost $12 per month. Pro plans cost $49 per month. Business plans cost $89 per month. White label plans cost $199 per month.

21. NielsenIQ (NIQ)

NielsenIQ (NIQ) is a retail and consumer intelligence consultant that works with you to collect consumer insights, identify the best distribution channels for your product, and create a range of products to address the needs of your target buyers.

This service helps you look at your product launch from all angles, delivering forecasting data that predicts how your sales will perform upon launch. NielsenIQ can also run consumer insights surveys on their list of panelists and partners.

NIQ now offers a service called Byzzer to help small businesses with fewer resources. It opens a door for market research reporting, in-person events, and consulting at a lower cost than the full NIQ suite.

Best for: I think Byzzer can be a helpful and affordable option for smaller businesses, but because NielsenIQ operates like a consultant and not as a self-service software, it is a better option for established firms with a bigger product launch budget.

Pricing : Pricing is available on request.

22. Ubersuggest

Don’t be intimidated by the visually text-heavy Ubersuggest. It really is an easy tool for doing keyword and content research. You just input a phrase, and it’ll create a list of keyword suggestions.

You can also see top-performing articles and pages to better understand the types of content that rank for those keywords.

This tool is useful for market research because you can see who your top competitors are, how often your product is searched for, and whether there’s enough space in the market for the type of product you’re launching.

You can also find out the questions your target audience asks in relation to the product. Each of these questions can be turned into an informative blog post that can guide your audience, increase your brand authority, and drive conversions.

Pro tip: If you want a quick look at the results you can get, head to their website and do a search — just know that you only get one glimpse before they make you register. Alternatives to Ubersuggest include Moz , Ahrefs , and SEMRush .

Pricing : Free seven-day trials are available for all three tiers. Individual plans cost $29 per month. Business plans cost $49 per month. Enterprise and agency plans cost $99 per month. Add-ons are available at $5 each. Lifetime memberships are also available.

23. Pew Research Center

From economic conditions to political attitudes, social media usage to food science, the Pew Research Center website has loads of free research that you can use to better understand your target markets.

Be careful with your curiosity, though. It’s a gorgeous trap of interesting information that can drain your day away — but so happily.

I that Pew Research Center integrates visual data directly into the text — and we’re not talking about a chart or image spliced in.

The site has hundreds of interactive articles that allow you to filter and sift through the data for more granular, targeted insights while also making dense information easier to understand.

Their research topic selection is delightfully vast. Click the top left tab for “ Research Topics.” Then, there is a link to their “ Full Topic List .” Once there, each topic cluster has a “ More ” option.

What I like: As a writer in digital marketing, I am always on the hunt for targeted and nutritious quotes and insights. I love that you have access to what research participants actually had to say below the Pew Research articles.

It’s a stellar feature for building compelling presentations. The quotes are tagged, too, so you can sort quotes more specifically on various concepts or groups related to the research.

Here’s an example article — scroll to the In Their Own Words section at the bottom to check it out.

24. SocialMention (Part of BrandMentions)

SocialMention is a part of BrandMentions focused on social media monitoring. The platform helps you understand what your prospective customers are buzzing about online.

Search for a keyword, and SocialMentions will show you recent social posts that contain that keyword, along with the context of its usage.

After subscribing to the platform, you’ll also get other metrics such as Reach (how many people view the keyword per day), Performance (how many people engage with the keyword per day), and Mentions by Weekday (when people mention the keyword).

One way to use this tool for market research is by finding out what time of day or night people are looking for your product on social media sites.

Let’s say you’ve developed a sleeping aid app and learn through SocialMention that most people look for sleeping aid apps at 2:00 AM. When you start announcing your product, you will need to schedule your post around 2:00 AM.

Pro tip: Another useful tool you’ll have access to is sentiment analysis on your keywords. It allows you to find out how people are generally feeling about the type of product you’re launching.

That way, you can refine the tone of your campaigns.

Pricing : Growing business plans cost $79 per month. Company plans cost $249 per month. Enterprise and agency plans cost $399 per month. All prices are billed annually.

25. Qualtrics Market Research Panels

Qualtrics takes away the hassle of finding respondents for your market research surveys. They provide an online sample service so you can access real, live human thoughts without having to actually manage any humans.

It’s an introverted marketer’s dream come true!

Once you’ve identified your target audience, head on over to Qualtrics and sign up to access a representative sample.

You can then use Qualtrics’ built-in platform to start gathering insights and information from the people whose pain points you might be able to help solve.

Pro tip: You can actually choose between Qualtrics’ built-in platform or using your own chosen survey software . Sometimes, you’re already familiar and comfy with one system or need to hustle with a program you know — Qualtrics lets you pick.

26. ProProfs Qualaroo

Qualaroo is an advanced user and market research tool that helps you understand your specific market with targeted surveys.

You can run surveys on over six channels at once — such as website, app, product, social media, and email — to get a 360-degree view of your existing and potential customers.

It comes packed with features like question branching, 12+ answer types, automatic survey language translation, in-depth audience targeting, pre-built survey templates, and an extensive repository of professionally designed questions.

You can create various market research surveys in minutes to collect data on the demographic, psychographic, and behavioral traits of your target audience.

It can help you map customers’ expectations and preferences, create customer personas, and perform audience segmentation.

Qualaroo also promotes quick feedback analysis. Its in-built AI-based sentiment analysis and text analytics engine automatically categorizes the responses based on user moods.

It also highlights the key phrases and words in real time, saving hours of manual work.

What we like: In my experience, you can get an awful lot done with just this one source for conducting market research. I like it for its rare combination of tool inclusivity and affordable pricing — it’s definitely a solid source to start with.

Pricing : Omni channel plans for up to 50 responses are free. Omni channel plans for businesses up to 100 responses cost $19.99 per month, billed annually. Email surveys up to 50 responses are free.

Email surveys for businesses up to 100 responses cost $9.99 per month, billed annually.

Conduct Market Research for a Successful Product Launch

Conducting market research is essential to a successful product launch to market.

With the tools I’ve just introduced you to, you can find out who’s looking for your product, why they need it, and how you can better market whatever you’re looking to launch.

Editor's note: This post was originally published in April 2016 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

What is a Competitive Analysis — and How Do You Conduct One?

Market Research: A How-To Guide and Template

![market research online SWOT Analysis: How To Do One [With Template & Examples]](https://www.hubspot.com/hubfs/marketingplan_20.webp)

SWOT Analysis: How To Do One [With Template & Examples]

TAM, SAM & SOM: What Do They Mean & How Do You Calculate Them?

![market research online How to Run a Competitor Analysis [Free Guide]](https://www.hubspot.com/hubfs/Google%20Drive%20Integration/how%20to%20do%20a%20competitor%20analysis_122022.jpeg)

How to Run a Competitor Analysis [Free Guide]

![market research online 5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]](https://www.hubspot.com/hubfs/challenges%20marketers%20face%20in%20understanding%20the%20customer%20.png)

5 Challenges Marketers Face in Understanding Audiences [New Data + Market Researcher Tips]

Causal Research: The Complete Guide

Total Addressable Market (TAM): What It Is & How You Can Calculate It

What Is Market Share & How Do You Calculate It?

![market research online 3 Ways Data Privacy Changes Benefit Marketers [New Data]](https://www.hubspot.com/hubfs/how-data-privacy-benefits-marketers_1.webp)

3 Ways Data Privacy Changes Benefit Marketers [New Data]

Free Guide & Templates to Help Your Market Research

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

How to Conduct Online Market Research

In 2011, when Ron Johnson became the CEO of JCPenney, he was already a veteran business executive.

For 15 years, he’d been vice president of merchandising at Target, then worked 11 more years as senior vice president of retail at Apple.

Naturally, JCPenney felt confident when Johnson decided to completely overhaul their business and eliminate all coupons, promotions and sales events.

But instead of growth, JCPenney started tanking. Sales numbers dropped. Customers were lost. Forbes eventually called this an “epic rebranding fail” .

Why did things go awry? Because Johnson didn’t understand the brand’s target audience. “I thought people were just tired of coupons and all this stuff,” he said in an interview. But it turned out that JCPenney customers loved coupons and sales!

The takeaway from this whole mess is that we shouldn’t assume we know what customers want.

Instead, we should use both quantitative and qualitative research to drive our decisions.

Moreover, we should aim to understand the market as a whole, especially the competitive landscape and emerging trends.

Fortunately, all this has never been easier, since now anyone can conduct market research online.

What is the Purpose of Online Market Research?

Conducting proper online market research requires time and money. But investing those resources into ecommerce research makes sense for the following reasons:

1. Get a deeper understanding of your target audience.

Knowing your target audience is critical for coming up with new product ideas , developing a winning marketing strategy and creating copy that converts .

Ecommerce personas also help ensure that you are speaking directly to the customer’s needs and satisfy all of their expectations.

Keep in mind that while knowing the demographics of your target market is important, it’s not enough in and of itself.

In addition to knowing who your target customers are, you should also understand what they think, feel and value.

Online market research, especially qualitative research, can help you delve into the internal motivators that prompt a purchase.

2. Learn customer behaviors.

Understanding how your target customers shop online can help you improve the usability of your website and provide a better customer experience . Every point of friction in the buyer’s journey reduces customer satisfaction and increases the likelihood of cart abandonment, lost up-sale or missed retention opportunity.

Online market research can help you identify those points of friction and common deal-breakers. Then, use this know-how to simplify navigation, facilitate product discovery and improve conversion rates .

3. Find new business opportunities.

Lots of ecommerce business opportunities are out there that can make your company more successful:

New product development

Cross-border sales

Subscription offerings

Or new business models

Doing online business research and looking at the market data can help you uncover those opportunities that lie hidden in plain sight.

2 Types of Market Research

The idea of doing “ecommerce market research” may be lofty. But when it comes to execution, you need to master just two research methods:

1. Primary research.

Primary research is data collection, done by you, using your internal resources.

Here are a few examples:

Online surveys and questionnaires.

In-person, in-depth interviews.

Online focus groups.

In other words, with primary research, you are the one doing the data collection, then analyzing that data to extract actionable business insights.

2. Secondary research.

Secondary research is using data and insights, produced by someone else.

Government statistics. For example, if you are in the healthcare industry, then the National Center for Health Statistics can be a valuable source of data.

Industry statistics. Statista is a great website for learning more about a particular market. The Big-4 accounting firms also conduct a ton of original industry research.

Industry reports. For example, HubSpot publishes an annual “State of Marketing Report” in which they share their online marketing research and provide an overview of the latest industry trends.

As such, with secondary research, someone else collects the data and then interprets it for you.

Source: My Market Research Methods

How to Conduct Market Research

Market research is essential for understanding the target demographics, market conditions and competition.

Here’s how to do market research for ecommerce to collect high-quality and relevant insights about your target market.

1. Conduct keyword research.

Keyword research can help you figure out whether there’s a demand for the product that you want to sell online.

Even though high search volumes don’t mean the product’s idea is profitable, they do indicate genuine interest among consumers.

Moreover, keyword research is also useful when you are working on your inbound marketing strategy since it allows you to pinpoint opportunities for generating organic traffic with search engine optimization (SEO) .

Some of the popular free keyword research tools are:

Google Keyword Planner .

Keyword Tool .

Ubersuggest .

However, a premium tool such as Ahrefs or SEMRush provides business owners with deeper level insights.

While Ahrefs is a sophisticated tool that might take time to master, you can learn how to do basic keyword research with it in just 10 minutes.

Simply watch the “Keyword Research Tutorial: From Start to Finish” video in which Sam Oh explains everything you need to know to get started.

This tutorial is particularly helpful for ecommerce entrepreneurs because Sam uses a new ecommerce store that sells computers, computer parts, computer accessories and software to show the ropes of research.

Here’s a quick summary:

Generate keyword ideas. Start by typing in a few broad keywords related to your business (e.g., “computer”), then go to “ Having same terms ” report to expand your list of ideas. Then filter those keyword ideas down, group them by search intent (informational, navigational, commercial, transactional) and evaluate their business potential.

Analyze Google’s top ten search results. See which websites already rank for the target keyword. Pay attention to the content format. Consider using a similar type of content, but look for opportunities to improve upon the published posts.

Assess how hard it will be to rank on Google for that keyword. Take a look at the number of referring domains and the domain ratings for the top ten search results. Competing with websites that have a similar domain rating (DR) to yours is the best strategy.

Analyze topical relevance. See how your website compares to those in the top ten search results. Are you in the same industry? Is it a commercial domain? Is it a niche publisher, covering the topic exclusively? Doing so will give you more insights into the difficulty of ranking for that particular keyword.

Reverse-engineer the topics that are driving traffic to your competitors’ websites. Go to Ahrefs Site Explorer, enter a competitor’s domain name and go to the top pages report. Then look at the traffic, the top keywords and the referring domains.

Sam Oh also emphasizes that keyword research isn’t about search volume alone. Your goal is to find topics that potential customers are searching for, create educational content around them and soft-pitch your offers.

At the end of the day, traffic quality beats traffic quantity. When you are considering a particular keyword, ask yourself whether ranking for it will lead to more sales, not just extra traffic.

2. Scope out the competition.

You can learn a lot about a market by analyzing the competition, so figure out who your main competitors are and scrutinize them.

Note that even though you are doing market research for ecommerce, you shouldn’t only look at ecommerce businesses.

For example, LARQ sells water bottles online, but they are also competing against online marketplaces as well as niche online stores. Before launching the business, Justin Wang did a lot of market research to verify that there isn’t a direct competitor with the same offering.

Once you have a list of the key players in your industry, you should look into their:

Business model. How are they sourcing their products? Are they dropshipping or carrying inventory? Do they use third-party logistics (3PL) services? What is their pricing strategy? What is their marketing strategy? What is their returns policy? Jot down all the answers.

Sales funnel. How do they attract potential customers to their website (content marketing, paid advertising, SEO, etc.)? How do they convert those site visitors into paying customers? Do they upsell? Cross-sell? Down-sell? Do they send automatic abandoned cart emails? You may want to go through their entire sales funnel to see how everything is set up.

Website. Which type of ecommerce platform do they have? How long does it take for their site to load? Does their online store design look professional? What branding elements do they use? How does their checkout flow work (the number of steps, the number of field forms, etc.)? Overall, do they provide a satisfying user experience?

Researching all this will help you determine:

What works. You shouldn’t outright copy your competitors. But there’s no need to reinvent the wheel either. Cherry-pick the best practices and apply those to your own business.

What doesn’t work. You might come across common frictions such as slow loading pages, confusing navigation, low-quality product images, etc. Take note of all that and make sure that you don’t make the same mistakes in your business.

What can be optimized. When you dig into the logistics of a competitor’s business, you might uncover optimization opportunities that can then help you offer better products, lower prices and faster shipping.

And don’t be intimidated by established companies.

Remember that even the largest corporations in the world, such as Google, Facebook and Amazon, were once fledgling startups.

You too can carve out a space for yourself in your industry. In fact, extensive market research is precisely what allows small businesses to compete against big companies. You just need to uncover something that will give you a competitive advantage.

3. Research current trends.

When you are doing product research for ecommerce, you should always look into the latest consumer trends. Use Google Trends to uncover those.

Here are the two questions that can help with online product research:

Is the interest in this product declining, stable or growing?

Is the interest in this product seasonal or does it remain the same all year?

Simply type in a relevant keyword and pick a time period.

For example, if you type in “artificial plants” and pick “Past 5 Years” as your timeframe, you will see that the interest in this keyword has been stable, with a noticeable increase in the last year.

A moderate but stable level of interest like that may indicate an opportunity for building a sustainable, long-lasting business.

Check your assumption with a quick google search for such businesses. And yes, we have Autograph Foliages — a company that has been selling artificial plants for over 40 years!

Also, when you see an upcoming trend, analyze it from different angles. For example, CBD is a promising new market with a diverse range of business opportunities . So rather than doing CBD-everything, consider niching down.

Also, be wary when a trend has a crazy upward trajectory at the moment. Because a real-time spike in interest might turn out to be a short-lived fad.

While it’s okay to capitalize on hot trends, you shouldn’t build your entire business around them. Make sure that your foundation is stable.

4. Utilize social media.

Social media is a treasure trove of consumer insights. It’s the place where people broadcast their complaints, wishes, preferences and aspirations. But to find those golden nuggets of wisdom, you need to go on a deep dive.

To avoid getting too deep down the internet rabbit hole, keep your online business research focused on:

Following influencers in your industry . Analyze their opinions, conversations and past partnerships with brands.

Monitor relevant hashtags . Identify the most relevant hashtags for your products and then make it a habit to monitor them regularly.

Analyze competitor sentiment. Keep an ear on what people are saying about your competitors. This is a great way to figure out what their strengths and weaknesses are. Note that the most valuable information often lies in posts that mention a competing company or their products but don’t tag them.

Text analysis can come in handy here. This machine learning technique helps analyze massive quantities of textual data and extract relevant information from it.

For example, text analytics software could analyze all tweets with a specific hashtag. Then let you know whether the overall sentiment was positive or negative, which words appeared most frequently, etc. Investing in text analytics software would give you a much more accurate picture of the market and analyze a wider range of ideas shared online.

Picking out the language your customers use — words, slang, metaphors — to express their preferences is a short-cut to writing better copy. By infusing the voice of customer data into your messaging, you make your pitches feel more personal and relevant.

5. Build an online ecommerce store and test the waters.

At some point, it’s time to move from theory to practice. Once you’ve accumulated enough insights, test your business idea by presenting it to the market. Ultimately, the target market response is the only thing that matters.

Here’s how you should go about it:

Pick an ecommerce platform . Popular options include BigCommerce, Shopify, WooCommerce, Magento, etc. Do your research and pick a solution that suits your needs best.

Set up your ecommerce website. You will need to sort out web design, write the copy and create product pages. You can do all this yourself or hire agency partners to help.

Drive traffic to your online store. SEO, content marketing and social media are all great, but they are long-term strategies that require time to work. Meanwhile, if you want to put your products in front of your target customers quickly, your best bet is performance marketing .

Don’t wait until everything is “perfect” to launch your business.

In fact, doing so would be a mistake. Because without first hand feedback, you won’t be able to right-size your offer anyway.

At launch, you need to make an educated guess based on your market research as to what will resonate with potential customers and then put your products in front of them.

That way you will start learning what works and what doesn’t and will be able to adjust your approach accordingly as you grow your business.

6. Leverage forums and customer feedback.

Niche online forums are another leeway into learning about your customers’ preferences.

To get the best scoops, do the following:

Find out which online forums are the most popular in your niche.

Register to those and check back regularly.

Contribute to the discussions to build up your credibility.

Pose questions and engage in conversations to better understand your audience.

Alternatively, you can ask your current customers to provide feedback.

That’s even easier to do:

Send an online market survey using SurveyMonkey or Typeform to your most loyal buyers.

Conduct one-on-one customer interviews. Ask super-fans to jump on 15-minute calls with you. People love to express their opinions and want to feel heard. So getting some respondents might turn out to be easier than you think!

Send automated emails asking for feedback. After you buy something from Amazon, you probably get an email asking you to rate it. You can do the same in your ecommerce business. In addition to receiving feedback on your products, you’ll also generate customer reviews.

And yes, you can also use text analytics software to analyze customer feedback, too. An automated solution can be especially helpful if there’s a lot of data (e.g., you want to go through all the customer emails that you have ever received!).

Finally, pay special attention to unsolicited customer feedback, even if it’s negative. People voicing their opinions online must have felt that something was important if they decided to go through the trouble of reaching out to you.

Wrapping Up

We are tempted to think that we “just know” what our target customers want.

But that’s how biases kick into our thinking. Rather than “guesstimating” what your target market wants, do the fieldwork and prove your assumptions.

Use relevant quantitative and qualitative data to formalize what your target buyers like, dislike and miss. Then take action!

Online Market Research FAQs

1. what is online market research.

Online market research is a type of market research that leverages two types of data available online — the data you own and the data published by others. Collecting and analyzing this type of information can help you learn more about your target audience and right-size your offerings.

2. How do you do market research?

Market research consists of primary and secondary research. Primary research involves collecting data yourself through surveys, customer interviews and focus groups. Secondary research involves analyzing data that was collected by someone else, such as government statistics, industry statistics and industry reports.

3. Why does market research help ecommerce success?

Market research allows you to understand your target audience better. And the better you understand your potential customers, the easier it is to come up with viable product ideas, write compelling copy and launch effective marketing campaigns.

4. Can you conduct surveys to do market research?

Yes, surveys are a valuable market research tool. You can gather both quantitative and qualitative data that way, directly from your customers or prospects. Consider using survey software to streamline the process.

5. Is Quora a great place to start for research?

Quora can be a great place to conduct market research because it lets you know exactly what your customers think. Consider subscribing to the topics relevant to your niche and participating in discussions.

START YOUR ECOMMERCE BUSINESS FOR JUST $1

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, the complete guide to market research: what it is, why you need it, and how to do it.

Written by Mary Kate Miller | June 1, 2021

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Market research is a cornerstone of all successful, strategic businesses. It can also be daunting for entrepreneurs looking to launch a startup or start a side hustle . What is market research, anyway? And how do you…do it?

We’ll walk you through absolutely everything you need to know about the market research process so that by the end of this guide, you’ll be an expert in market research too. And what’s more important: you’ll have actionable steps you can take to start collecting your own market research.

What Is Market Research?

Market research is the organized process of gathering information about your target customers and market. Market research can help you better understand customer behavior and competitor strengths and weaknesses, as well as provide insight for the best strategies in launching new businesses and products. There are different ways to approach market research, including primary and secondary research and qualitative and quantitative research. The strongest approaches will include a combination of all four.

“Virtually every business can benefit from conducting some market research,” says Niles Koenigsberg of Real FiG Advertising + Marketing . “Market research can help you piece together your [business’s] strengths and weaknesses, along with your prospective opportunities, so that you can understand where your unique differentiators may lie.” Well-honed market research will help your brand stand out from the competition and help you see what you need to do to lead the market. It can also do so much more.

The Purposes of Market Research

Why do market research? It can help you…

- Pinpoint your target market, create buyer personas, and develop a more holistic understanding of your customer base and market.

- Understand current market conditions to evaluate risks and anticipate how your product or service will perform.

- Validate a concept prior to launch.

- Identify gaps in the market that your competitors have created or overlooked.

- Solve problems that have been left unresolved by the existing product/brand offerings.

- Identify opportunities and solutions for new products or services.

- Develop killer marketing strategies .

What Are the Benefits of Market Research?

Strong market research can help your business in many ways. It can…

- Strengthen your market position.

- Help you identify your strengths and weaknesses.

- Help you identify your competitors’ strengths and weaknesses.

- Minimize risk.

- Center your customers’ experience from the get-go.

- Help you create a dynamic strategy based on market conditions and customer needs/demands.

What Are the Basic Methods of Market Research?

The basic methods of market research include surveys, personal interviews, customer observation, and the review of secondary research. In addition to these basic methods, a forward-thinking market research approach incorporates data from the digital landscape like social media analysis, SEO research, gathering feedback via forums, and more. Throughout this guide, we will cover each of the methods commonly used in market research to give you a comprehensive overview.

Primary vs. Secondary Market Research

Primary and secondary are the two main types of market research you can do. The latter relies on research conducted by others. Primary research, on the other hand, refers to the fact-finding efforts you conduct on your own.

This approach is limited, however. It’s likely that the research objectives of these secondary data points differ from your own, and it can be difficult to confirm the veracity of their findings.

Primary Market Research

Primary research is more labor intensive, but it generally yields data that is exponentially more actionable. It can be conducted through interviews, surveys, online research, and your own data collection. Every new business should engage in primary market research prior to launch. It will help you validate that your idea has traction, and it will give you the information you need to help minimize financial risk.

You can hire an agency to conduct this research on your behalf. This brings the benefit of expertise, as you’ll likely work with a market research analyst. The downside is that hiring an agency can be expensive—too expensive for many burgeoning entrepreneurs. That brings us to the second approach. You can also do the market research yourself, which substantially reduces the financial burden of starting a new business .

Secondary Market Research

Secondary research includes resources like government databases and industry-specific data and publications. It can be beneficial to start your market research with secondary sources because it’s widely available and often free-to-access. This information will help you gain a broad overview of the market conditions for your new business.

Identify Your Goals and Your Audience