Module 5: Job Order Costing

Introduction to accumulating and assigning costs, what you will learn to do: assign costs to jobs.

Financial and managerial accountants record costs of production in an account called Work in Process. The total of these direct materials, direct labor, and factory overhead costs equal the cost of producing the item.

In order to understand the accounting process, here is a quick review of how financial accountants record transactions:

Let’s take as simple an example as possible. Jackie Ma has decided to make high-end custom skateboards. She starts her business on July 1 by filing the proper forms with the state and then opening a checking account in the name of her new business, MaBoards. She transfers $150,000 from her retirement account into the business account and records it in a journal as follows:

| Date | Account/Explanation | Debit | Credit |

|---|---|---|---|

| Jul 01 | Checking Account | 150,000 | |

| Owner’s Capital | 150,000 | ||

For purposes of this ongoing example, we’ll ignore pennies and dollar signs, and we’ll also ignore selling, general, and administrative costs.

After Jackie writes the journal entry, she posts it to a ledger that currently has only two accounts: Checking Account, and Owner’s Capital.

Debits are entries on the left side of the account, and credits are entries on the right side.

Here is a quick review of debits and credits:

You can view the transcript for “Colin Dodds – Debit Credit Theory (Accounting Rap Song)” here (opens in new window) .

Also, this system of debits and credits is based on the following accounting equation:

Assets = Liabilities + Equity.

- Assets are resources that the company owns

- Liabilities are debts

- Equity is the amount of assets left over after all debts are paid

Let’s look at one more initial transaction before we dive into recording and accumulating direct costs such as materials and labor.

Jackie finds the perfect building for her new business; an old woodworking shop that has most of the equipment she will need. She writes a check from her new business account in the amount of $2,500 for July rent. Because she took managerial accounting in college, she determines this to be an indirect product expense, so she records it as Factory Overhead following a three-step process:

- Analyze transaction

Because her entire facility is devoted to production, she determines that the rent expense is factory overhead.

2. Journalize transaction using debits and credits

If she is using QuickBooks ® or other accounting software, when she enters the transaction into the system, the software will create the journal entry. In any case, whether she does it by hand or computer, the entry will look much like this:

| Date | Account/Explanation | Debit | Credit |

|---|---|---|---|

| Jul 03 | Factory Overhead | 2,500 | |

| Checking Account | 2,500 | ||

3. Post to the ledger

Again, her computer software will post the journal entry to the ledger, but we will follow this example using a visual system accountants call T-accounts. The T-account is an abbreviated ledger. Click here to view a more detailed example of a ledger .

Jackie posts her journal entry to the ledger (T-accounts here).

She now has three accounts: Checking Account, Owner’s Capital, and Factory Overhead, and the company ledger looks like this:

In a retail business, rent, salaries, insurance, and other operating costs are categorized into accounts classified as expenses. In a manufacturing business, some costs are classified as product costs while others are classified as period costs (selling, general, and administrative).

We’ll treat factory overhead as an expense for now, which is ultimately a sub-category of Owner’s Equity, so our accounting equation now looks like this:

Assets = Liabilities + Owner’s Equity

147,500 = 150,000 – 2,500

Notice that debits offset credits and vice versa. The balance in the checking account is the original deposit of $150,000, less the check written for $2,500. Once the check clears, if Jackie checks her account online, she’ll see that her ledger balance and the balance the bank reports will be the same.

Here is a summary of the rules of debits and credits:

Assets = increased by a debit, decreased by a credit

Liabilities = increased by a credit, decreased by a debit

Owner’s Equity = increased by a credit, decreased by a debit

Revenues increase owner’s equity, therefore an individual revenue account is increased by a credit, decreased by a debit

Expenses decrease owner’s equity, therefore an individual expense account is increased by a debit, decreased by a credit

Here’s Colin Dodds’s Accounting Rap Song again to help you remember the rules of debits and credits:

Let’s continue to explore job costing now by using this accounting system to assign and accumulate direct and indirect costs for each project.

When you are done with this section, you will be able to:

- Record direct materials and direct labor for a job

- Record allocated manufacturing overhead

- Prepare a job cost record

Learning Activities

The learning activities for this section include the following:

- Reading: Direct Costs

- Self Check: Direct Costs

- Reading: Allocated Overhead

- Self Check: Allocated Overhead

- Reading: Subsidiary Ledgers and Records

- Self Check: Subsidiary Ledgers and Records

- Introduction to Accumulating and Assigning Costs. Authored by : Joseph Cooke. Provided by : Lumen Learning. License : CC BY: Attribution

- Colin Dodds - Debit Credit Theory (Accounting Rap Song). Authored by : Mr. Colin Dodds. Located at : https://youtu.be/j71Kmxv7smk . License : All Rights Reserved . License Terms : Standard YouTube License

- What the General Ledger Can Tell You About Your Business. Authored by : Mary Girsch-Bock. Located at : https://www.fool.com/the-blueprint/general-ledger/ . License : All Rights Reserved . License Terms : Standard YouTube License

Privacy Policy

- Cost Classifications

- Relevant Cost of Material

- Manufacturing Overhead Costs

- Conversion Costs

- Quality Costs

- Revenue Expenditure

- Product Cost vs Period Cost

- Direct Costs and Indirect Costs

- Prime Costs and Conversion Costs

- Relevant vs Irrelevant Costs

- Avoidable and Unavoidable Costs

- Cost Allocation

- Joint Products

- Accounting for Joint Costs

- Service Department Cost Allocation

- Repeated Distribution Method

- Simultaneous Equation Method

- Specific Order of Closing Method

- Direct Allocation Method

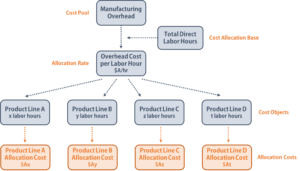

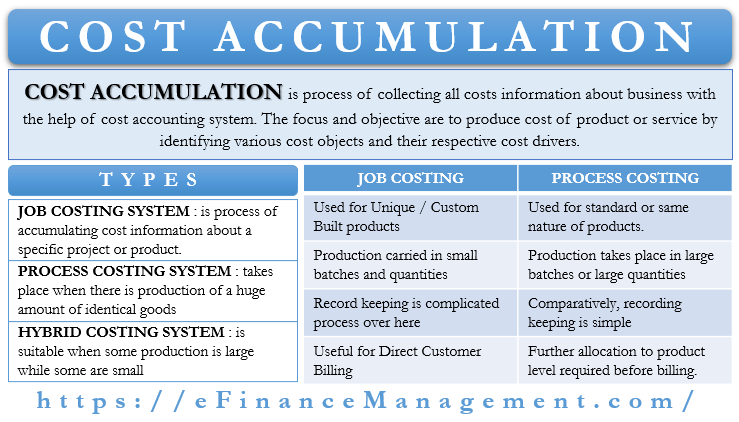

Cost allocation is the process by which the indirect costs are distributed among different cost objects such as a project, a department, a branch, a customer, etc. It involves identifying the cost object, identifying and accumulating the costs that are incurred and assigning them to the cost object on some reasonable basis.

Cost allocation is important for both pricing and planning and control decisions. If costs are not accurately calculated, a business might never know which products are making money and which ones are losing money. If cost are mis-allocated, a business may be charging wrong price to its customers and/or it might be wasting resources on products that are wrongly categorized as profitable.

Cost allocation is a sub-process of cost assignment , which is the overall process of finding total cost of a cost object. Cost assignment involves both cost tracing and cost allocation. Cost tracing encompasses finding direct costs of a cost object while the cost allocation is concerned with indirect cost charge.

Steps in cost allocation process

Typical cost allocation mechanism involves:

- Identifying the object to which the costs have to be assigned,

- Accumulating the costs in different pools,

- Identifying the most appropriate basis/method for allocating the cost.

Cost object

A cost object is an item for which a business need to separately estimate cost.

Examples of cost object include a branch, a product line, a service line, a customer, a department, a brand, a project, etc.

A cost pool is the account head in which costs are accumulated for further assignment to cost objects.

Examples of cost pools include factory rent, insurance, machine maintenance cost, factory fuel, etc. Selection of cost pool depends on the cost allocation base used. For example if a company uses just one allocation base say direct labor hours, it might use a broad cost pool such as fixed manufacturing overheads. However, if it uses more specific cost allocation bases, for example labor hours, machine hours, etc. it might define narrower cost pools.

Cost driver

A cost driver is any variable that ‘drives’ some cost. If increase or decrease in a variable causes an increase or decrease is a cost that variable is a cost driver for that cost.

Examples of cost driver include:

- Number of payments processed can be a good cost driver for salaries of Accounts Payable section of accounting department,

- Number of purchase orders can be a good cost driver for cost of purchasing department,

- Number of invoices sent can be a good cost driver for cost of billing department,

- Number of units shipped can be a good cost driver for cost of distribution department, etc.

While direct costs are easily traced to cost objects, indirect costs are allocated using some systematic approach.

Cost allocation base

Cost allocation base is the variable that is used for allocating/assigning costs in different cost pools to different cost objects. A good cost allocation base is something which is an appropriate cost driver for a particular cost pool.

T2F is a university café owned an operated by a student. While it has plans for expansion it currently offers two products: (a) tea & coffee and (b) shakes. It employs 2 people: Mr. A, who looks after tea & coffee and Mr. B who prepares and serves shakes & desserts.

Its costs for the first quarter are as follows:

| Mr. A salary | 16,000 |

| Mr. B salary | 12,000 |

| Rent | 10,000 |

| Electricity | 8,000 |

| Direct materials consumed in making tea & coffee | 7,000 |

| Direct raw materials for shakes | 6,000 |

| Music rentals paid | 800 |

| Internet & wi-fi subscription | 500 |

| Magazines | 400 |

Total tea and coffee sales and shakes sales were $50,000 & $60,000 respectively. Number of customers who ordered tea or coffee were 10,000 while those ordering shakes were 8,000.

The owner is interested in finding out which product performed better.

Salaries of Mr. A & B and direct materials consumed are direct costs which do not need any allocation. They are traced directly to the products. The rest of the costs are indirect costs and need some basis for allocation.

Cost objects in this situation are the products: hot beverages (i.e. tea & coffee) & shakes. Cost pools include rent, electricity, music, internet and wi-fi subscription and magazines.

Appropriate cost drivers for the indirect costs are as follows:

| Rent | 10,000 | Number of customers |

| Electricity | 8,000 | United consumed by each product |

| Music rentals paid | 800 | Number of customers |

| Internet & wifi subscription | 500 | Number of customers |

| Magazines | 400 | Number of customers |

| 19,700 |

Since number of customers is a good cost driver for almost all the costs, the costs can be accumulated together to form one cost pool called manufacturing overheads. This would simply the cost allocation.

Total manufacturing overheads for the first quarter are $19,700. Total number of customers who ordered either product are 18,000. This gives us a cost allocation base of $1.1 per customer ($19,700/18,000).

A detailed cost assignment is as follows:

| Tea & Coffee | Shakes | |

| Revenue | 50,000 | 60,000 |

| Costs: | ||

| Salaries | 16,000 | 12,000 |

| Direct materials | 7,000 | 6,000 |

| Manufacturing overheads allocated | 11,000 | 8,800 |

| Total costs | 34,000 | 26,800 |

| Profit earned | 16,000 | 33,200 |

Manufacturing overheads allocated to Tea & Cofee = $1.1×10,000

Manufacturing overheads allocated to Shakes = $1.1×8,000

by Irfanullah Jan, ACCA and last modified on Jul 22, 2020

Related Topics

- Cost Behavior

All Chapters in Accounting

- Intl. Financial Reporting Standards

- Introduction

- Accounting Principles

- Business Combinations

- Accounting Cycle

- Financial Statements

- Non-Current Assets

- Fixed Assets

- Investments

- Revenue Recognition

- Current Assets

- Receivables

- Inventories

- Shareholders' Equity

- Liability Accounts

- Accounting for Taxes

- Employee Benefits

- Accounting for Partnerships

- Financial Ratios

- Cost Accounting Systems

- CVP Analysis

- Relevant Costing

- Capital Budgeting

- Master Budget

- Inventory Management

- Cash Management

- Standard Costing

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

This device is too small

If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience.

- Small Business

- The Top 10 Accounting Software for Small Businesses

Why Allocating Costs Is Important for Your Small Business

See Full Bio

Our Small Business Expert

Business owners use cost allocation to assign costs to specific cost objects. Cost objects include products, departments, programs, and jobs. Cost allocation is necessary for any type of business, but it's more frequently used in manufacturing businesses that incur a wider variety of costs.

Overview: What is cost allocation?

Part of doing business is incurring costs. To ensure accurate financial reporting, it’s vital these costs are allocated to the appropriate cost object.

While bookkeepers and accounting clerks may need some guidance in properly allocating expenses, using accounting software can help to automate and simplify the entire process considerably.

To track and allocate costs, the cost needs to first be associated with a specific cost object. For example, your company pays $3500 property insurance annually for two buildings you currently own.

One building is 4,000 square feet, while the other building is 8,000 square feet. Your cost object is the square footage of each building, which will be used to allocate the cost to the correct building.

3 types of costs

Most businesses incur a variety of costs while doing business. These costs can range from the cost of materials needed to produce a finished product, to the direct labor wages paid to the employee running the machine used to assemble the product, to the overhead costs you incur every day simply by opening your doors.

Before you get started, familiarize yourself with the various types of costs your business is likely to incur.

1. Direct costs

A direct cost is anything that your business can directly connect to a cost object. Tied directly to production, direct costs are the only costs that need not be allocated, but instead are used when calculating cost of goods sold.

The most common direct costs that a business incurs include direct labor, direct materials, and manufacturing supplies. An employee working the assembly line is considered direct labor, a direct cost.

Same goes for the plastic needed to manufacture a toy, or the glue that holds pieces of the toy together. Direct costs are almost always variable because they vary based on production levels. However, if production remains constant, direct costs may remain constant as well.

2. Indirect costs

Indirect costs are costs incurred in the day to day operations of your business. Indirect costs cannot be tied back to one particular product, but are still considered necessary for production to occur or services to be delivered.

Indirect costs, such as utilities and line supervisor salaries are considered necessary for production, but are not tied to a specific product or service, so they’ll need to be allocated accordingly.

3. Overhead costs

Overhead costs, also known as operating costs are the everyday cost of doing business. Overhead costs are never tied to production, either directly or indirectly, but instead are the costs that your business incurs whether or not they’re producing goods or providing services.

For example, rent, insurance, and office supplies are considered overhead costs, which are costs incurred regardless of production levels.

Some overhead costs such as supplies and printing can be variable, while others, such as rent, insurance, and management salaries are all fixed costs, since the cost does not change from month to month. Like indirect costs, overhead costs will need to be allocated regularly in order to determine actual product cost.

Cost allocation examples

Cost allocation isn’t only necessary for manufacturing companies. There are plenty of reasons other companies may need to allocate costs.

Allocating an employee’s salary between two departments, allocating a utility bill between administrative and manufacturing facilities, or a nonprofit that needs to allocate costs between various programs are just a few reasons almost any business may need to regularly allocate costs.

When allocating costs, there are four allocation methods to choose from.

- Direct labor

- Machine time used

- Square footage

- Units produced

In the examples below, we used the square footage and the units produced methods to calculate the appropriate cost allocation.

Cost allocation example 1

Ken owns a small manufacturing plant, with administrative offices housed on the second floor. The square footage of the plant is 5,000 square feet, while the administrative offices are 2,500 square feet, with rent for the entire facility $15,000 per month. Rent must be allocated between the two departments.

The calculation would be:

$15,000 (rent) ÷ 7,500 (square feet) = $2 per square foot

Next, Ken, will calculate the rental cost for the plant:

$2 x 5,000 = $10,000

That means that Ken can allocate $10,000 to overhead expenses for the factory.

Next, Ken will calculate the rental cost for the administrative offices:

$2 x 2,500 = $5,000

The balance of the rent, $5,000, will be allocated to the administrative offices.

Cost allocation example 2

Carrie’s manufacturing company manufactures backpacks. In July, Carrie produced 2,000 backpacks with direct material costs of $5.50 per backpack, and $ 2.25 direct labor costs per backpack.

She also had $7,250 in overhead costs for the month of July. Using the number of units produced as the allocation method, we can calculate overhead costs using the following overhead cost formula:

$7,250 ÷ 2,000 = $3.63 per backpack

When added to Carrie’s direct costs, the cost to produce each backpack is $11.38, calculated as follows:

- Direct Materials: $ 5.50 per backpack

- Direct Labor: $ 2.25 per backpack

- Overhead: $ 3.63 per backpack

- Total Cost: $11.38 per backpack

If Carrie did not allocate the overhead costs, she probably would have underpriced the backpacks, resulting in a loss of income.

No, cost allocation is necessary for any business including service businesses and nonprofit organizations.

To track and allocate costs, the cost needs to be identified with a cost object, which costs are assigned to. Cost objects can include:

- Departments

Almost anything can be considered a cost object if you’re able to assign a cost to it.

Yes. While larger companies may have a greater need to allocate costs, smaller businesses can also benefit from allocating costs properly.

For example, even a small car repair shop will need to allocate parts and labor costs properly, while a small consulting business will need to allocate travel costs to the appropriate customer.

Why you should be allocating costs

Cost allocation is important for any business, large or small. How can you determine how much to charge for goods or services if you have no idea how much it costs to produce the goods or services you currently offer your customers?

Properly allocating costs is also essential for accurate financial reporting. Business owners rely on financial statements to make management decisions, and if the reports are inaccurate, it’s likely the decisions made will negatively affect the business.

Finally, allocating costs properly can help you identify profitable areas of your business and products or services that may be losing money, enabling you to make proactive decisions regarding both.

There’s no good reason not to allocate your business costs, so why not get started today?

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Copyright © 2018 - 2024 The Ascent. All rights reserved.

What is Cost Assignment?

Share This...

Cost assignment.

Cost assignment is the process of associating costs with cost objects, such as products, services, departments, or projects. It encompasses the identification, measurement, and allocation of both direct and indirect costs to ensure a comprehensive understanding of the resources consumed by various cost objects within an organization. Cost assignment is a crucial aspect of cost accounting and management accounting, as it helps organizations make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

There are two main components of cost assignment:

- Direct cost assignment: Direct costs are those costs that can be specifically traced or identified with a particular cost object. Examples of direct costs include direct materials, such as raw materials used in manufacturing a product, and direct labor, such as the wages paid to workers directly involved in producing a product or providing a service. Direct cost assignment involves linking these costs directly to the relevant cost objects, typically through invoices, timesheets, or other documentation.

- Indirect cost assignment (Cost allocation): Indirect costs, also known as overhead or shared costs, are those costs that cannot be directly traced to a specific cost object or are not economically feasible to trace directly. Examples of indirect costs include rent, utilities, depreciation, insurance, and administrative expenses. Since indirect costs cannot be assigned directly to cost objects, organizations use various cost allocation methods to distribute these costs in a systematic and rational manner. Some common cost allocation methods include direct allocation, step-down allocation, reciprocal allocation, and activity-based costing (ABC).

In summary, cost assignment is the process of associating both direct and indirect costs with cost objects, such as products, services, departments, or projects. It plays a critical role in cost accounting and management accounting by providing organizations with the necessary information to make informed decisions about pricing, resource allocation, budgeting, and performance evaluation.

Example of Cost Assignment

Let’s consider an example of cost assignment at a bakery called “BreadHeaven” that produces two types of bread: white bread and whole wheat bread.

BreadHeaven incurs various direct and indirect costs to produce the bread. Here’s how the company would assign these costs to the two types of bread:

- Direct cost assignment:

Direct costs can be specifically traced to each type of bread. In this case, the direct costs include:

- Direct materials: BreadHeaven purchases flour, yeast, salt, and other ingredients required to make the bread. The cost of these ingredients can be directly traced to each type of bread.

- Direct labor: BreadHeaven employs bakers who are directly involved in making the bread. The wages paid to these bakers can be directly traced to each type of bread based on the time spent working on each bread type.

For example, if BreadHeaven spent $2,000 on direct materials and $1,500 on direct labor for white bread, and $3,000 on direct materials and $2,500 on direct labor for whole wheat bread, these costs would be directly assigned to each bread type.

- Indirect cost assignment (Cost allocation):

Indirect costs, such as rent, utilities, equipment maintenance, and administrative expenses, cannot be directly traced to each type of bread. BreadHeaven uses a cost allocation method to assign these costs to the two types of bread.

Suppose the total indirect costs for the month are $6,000. BreadHeaven decides to use the number of loaves produced as the allocation base , as it believes that indirect costs are driven by the production volume. During the month, the bakery produces 3,000 loaves of white bread and 2,000 loaves of whole wheat bread, totaling 5,000 loaves.

The allocation rate per loaf is:

Allocation Rate = Total Indirect Costs / Total Loaves Allocation Rate = $6,000 / 5,000 loaves = $1.20 per loaf

BreadHeaven allocates the indirect costs to each type of bread using the allocation rate and the number of loaves produced:

- White bread: 3,000 loaves × $1.20 per loaf = $3,600

- Whole wheat bread: 2,000 loaves × $1.20 per loaf = $2,400

After completing the cost assignment, BreadHeaven can determine the total costs for each type of bread:

- White bread: $2,000 (direct materials) + $1,500 (direct labor) + $3,600 (indirect costs) = $7,100

- Whole wheat bread: $3,000 (direct materials) + $2,500 (direct labor) + $2,400 (indirect costs) = $7,900

By assigning both direct and indirect costs to each type of bread, BreadHeaven gains a better understanding of the full cost of producing each bread type, which can inform pricing decisions, resource allocation, and performance evaluation.

Other Posts You'll Like...

REG CPA Exam: Example Scenarios of Calculating State Taxable Income Using Applicable Apportionment Factors

REG CPA Exam: Understanding the Concept and Rationale of Apportionment and Allocation in Regard to State and Local Taxation

REG CPA Exam: Understanding the Concept and Rationale of Nexus in Regard to State and Local Taxation

REG CPA Exam: How to Calculate Allowable Tax Credits to Reduce Taxable Income for a C Corporation

REG CPA Exam: How to Calculate a Corporation’s Current Year Capital Loss, and Limitations on Using It in the Current Year

REG CPA Exam: How to Calculate a Corporation’s Current Year Net Operating Loss, and Limitations on Using It in the Current Year

Helpful links.

- Learn to Study "Strategically"

- How to Pass a Failed CPA Exam

- Samples of SFCPA Study Tools

- SuperfastCPA Podcast

How Jamie Passed Her CPA Exams by Constantly Improving Her Study Process

“I Shouldn’t Be Able to Do This”: How Colbi Passed Her CPA Exams

The 5 Biggest Myths About CPA Exam Study

From 8 Hours a Day to 8 Hours a Week, How Branden Passed His CPA Exams

5 High Impact CPA Study Strategies

How Melodie Passed Her CPA Exams by Making Every Morning Count

Want to pass as fast as possible, ( and avoid failing sections ), watch one of our free "study hacks" trainings for a free walkthrough of the superfastcpa study methods that have helped so many candidates pass their sections faster and avoid failing scores....

Make Your Study Process Easier and more effective with SuperfastCPA

Take Your CPA Exams with Confidence

- Free "Study Hacks" Training

- SuperfastCPA PRO Course

- SuperfastCPA Review Notes

- SuperfastCPA Audio Notes

- SuperfastCPA Quizzes

Get Started

- Free "Study Hacks Training"

- Read Reviews of SuperfastCPA

- Busy Candidate's Guide to Passing

- Subscribe to the Podcast

- Purchase Now

- Nate's Story

- Interviews with SFCPA Customers

- Our Study Methods

- SuperfastCPA Reviews

- CPA Score Release Dates

- The "Best" CPA Review Course

- Do You Really Need the CPA License?

- 7 Habits of Successful Candidates

- "Deep Work" & CPA Study

What is Cost Structure?

Fixed vs. variable costs, fixed costs, variable costs, direct vs. indirect costs, direct costs, indirect costs, cost allocation, example of cost allocation, the importance of cost structures and cost allocation, additional resources, cost structure.

The different types of cost structures incurred by a business

Cost structure refers to the various types of expenses a business incurs and is typically composed of fixed and variable costs . Costs may also be divided into direct and indirect costs. Fixed costs are costs that remain unchanged regardless of the amount of output a company produces, while variable costs change with production volume.

Direct costs are costs that can be attributed to a specific product or service, and they do not need to be allocated to the specific cost object. Indirect costs are costs that cannot be easily associated with a specific product or activity because they are involved in multiple activities.

Operating a business must incur some kind of costs, whether it is a retail business or a service provider. Cost structures differ between retailers and service providers, thus the expense accounts appearing on a financial statement depend on the cost objects, such as a product, service, project, customer or business activity. Even within a company, cost structure may vary between product lines, divisions or business units, due to the distinct types of activities they perform.

Key Highlights

- Cost structure refers to the various types of expenses a business incurs and is typically composed of fixed and variable costs, or direct and indirect costs.

- Fixed costs are incurred regularly and are unlikely to fluctuate over time. Variable costs are expenses that vary with production output.

- Direct costs are costs that are directly related to the creation of a product and can be directly associated with that product. Direct costs are usually variable costs, with the possible exception of labor costs. Indirect costs are costs that are not directly related to a specific cost object. Indirect costs may be fixed or variable.

- Having a firm understanding of the difference between fixed and variable and direct and indirect costs is important because it shapes how a company prices the goods and services it offers.

Fixed costs are incurred regularly and are unlikely to fluctuate over time. Examples of fixed costs are overhead costs such as rent, interest expense, property taxes, and depreciation of fixed assets. One special example of a fixed cost is direct labor cost. While direct labor cost tends to vary according to the number of hours an employee works, it still tends to be relatively stable and, thus, may be counted as a fixed cost, although it is more commonly classified as a variable cost where hourly workers are concerned.

Variable costs are expenses that vary with production output. Examples of variable costs may include direct labor costs, direct material cost , and bonuses and sales commissions. Variable costs tend to be more diverse than fixed costs. For businesses selling products, variable costs might include direct materials, commissions, and piece-rate wages. For service providers, variable expenses are composed of wages, bonuses, and travel costs. For project-based businesses, costs such as wages and other project expenses are dependent on the number of hours invested in each of the projects.

As alluded to earlier, direct costs are costs that are directly related to the creation of a product and can be directly associated with that product. Direct material is an example of a direct cost.

Direct costs are almost always variable because they are going to increase when more goods are produced. As discussed earlier, an exception to this is labor. Employee wages may be fixed and unlikely to change over the course of a year. However, if the employees are hourly and not on a fixed salary then the direct labor costs can increase if more products are manufactured.

Indirect costs are costs that are not directly related to a specific cost object like a function, product or department. They are costs that are needed for the sake of the company’s operations and health. Some other examples of indirect costs include overhead , security costs, administration costs, etc. The costs are first identified, pooled, and then allocated to specific cost objects within the organization.

Indirect costs may be either fixed or variable costs. An example of a fixed cost is the salary of a project supervisor assigned to a specific project. An example of a variable indirect cost would be utilities expense. This expense may fluctuate depending on production (for example, there would be an increase in utility expense if a manufacturing plant is running at a higher capacity utilization ).

Having a firm understanding of the difference between fixed and variable and direct and indirect costs is important because it shapes how a company prices the goods and services it offers. Knowing the actual costs of production enables the company to price its products efficiently and competitively.

Cost allocation is the process of identifying costs incurred, and then accumulating and assigning them to the right cost objects (e.g. product lines, service lines, projects, departments, business units, customers, etc.) on some measurable basis. Cost allocation is used to distribute costs among different cost objects in order to calculate the profitability of different product lines.

A cost pool is a grouping of individual costs, from which cost allocations are made later. Overhead cost, maintenance cost and other fixed costs are typical examples of cost pools. A company usually uses a single cost-allocation basis, such as labor hours or machine hours, to allocate costs from cost pools to designated cost objects.

A company with a cost pool of manufacturing overhead uses direct labor hours as its cost allocation basis. The company first accumulates its overhead expenses over a period of time (for example, a year) and then divides the total overhead cost by the total number of labor hours to find out the overhead cost “per labor hour” (the overhead allocation rate ). Finally, the company multiplies the hourly cost by the number of labor hours spent to manufacture a product to determine the overhead cost for that specific product line.

To maximize profits , businesses must find every possible way to minimize costs. While some fixed costs are vital to keeping the business running, a financial analyst should always review the financial statements to identify possible excessive expenses that do not provide any additional value to core business activities.

When an analyst understands the overall cost structure of a company, they can identify feasible cost-reduction methods without affecting the quality of products sold or service provided to customers. The financial analyst should also keep a close eye on the cost trend to ensure stable cash flows and no sudden cost spikes occurring.

Cost allocation is an important process for a business because if costs are misallocated, then the business might make wrong decisions, such as over/underpricing a product, or invest unnecessary resources in non-profitable products. The role of a financial analyst is to make sure costs are correctly attributed to the designated cost objects and that appropriate cost allocation bases are chosen.

Cost allocation allows an analyst to calculate the per-unit costs for different product lines, business units, or departments, and, thus, to find out the per-unit profits. With this information, a financial analyst can provide insights on improving the profitability of certain products, replacing the least profitable products, or implementing various strategies to reduce costs.

- Cost Behavior Analysis

- Marginal Cost Formula

- Cost Method

- See all accounting resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

In order to continue enjoying our site, we ask that you confirm your identity as a human. Thank you very much for your cooperation.

- Accounting Tutorials

- Accounting Articles

- Accounting Tests

- Accounting Dictionary

- My Studyboard

Cost objects and cost assignment in accounting

In this article, we will define cost objects and discuss how the choice of a cost object affects the cost assignment process and hence outcome.

- 1. Cost object definition

A cost object is anything we want to determine the cost of.

Examples of cost objects are: a product, a product line, a brand category, a service, a project, an activity or task, a process, a department, a business segment, a channel, a customer, a supplier, a geographic area, etc.

For reporting purposes, organizations usually have to determine the cost of their products or services. But, internally the organizations can create additional reports where they try to measure costs of various cost objects (e.g., departments, product lines, segments, suppliers) in order to get more insights into operations, performance, risks, and opportunities.

- 2. Cost object choice and cost assignment

The choice of the cost object impacts whether a specific cost can be directly traced to it or not. For example, raw materials that are part of a product usually can be traced to specific products via materials requisition forms. But, it might be more challenging to trace the same information (about raw materials used) to product lines when different products use the same raw materials. The ability to trace specific costs to cost objects in an economically feasible (i.e., cost effective) way determines whether a specific cost is a “direct cost” or “indirect cost”.

Direct costs of a cost object can be traced to that cost object in an economically feasible (cost-effective) way.

Indirect costs of a cost object cannot be traced to that cost object in an economically feasible (cost-effective) way. As the result, indirect costs are allocated to cost objects using some kind of allocation rule.

The ability to (directly) trace costs to cost objects usually depends on:

- The design of operations

- The availability of technology for information gathering and processing

- The materiality of the cost

Complex operations make it more challenging to trace costs to cost objects. The lack of information gathering and processing technology or poorly organized information systems (e.g., accounting, operations) also make it more difficult to trace costs to cost objects. Finally, immaterial costs (e.g., relatively small costs) are often not directly traced to cost objects because the benefit from tracing immaterial costs is lower than the cost associated with tracing that information. We have to remember that in a reporting process the benefits from reporting should outweigh the costs associated with preparing those reports.

Ideally, we want to be able to directly trace costs to the cost objects. But in practice, often available data does not allow cost tracing, and the result, organizations need to allocate costs to cost objects. The issue with cost allocation is that it is less accurate and can be subjective depending on the allocation process and rules.

- About Us

- Contact Us

- Privacy Policy

- Site Map

- Terms of Service

Classification of Cost

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on March 07, 2023

Get Any Financial Question Answered

Table of contents.

The idea of cost accounting is to collect, classify, record, and suitably allocate expenditures to determine the costs of products or services.

After collecting costs, these are classified to ensure their identification with cost centers or cost units.

Costs have different features or characteristics, and they are grouped or classified based on their common characteristics.

The process of grouping costs based on their common characteristics is known as the classification of cost .

Different Classes of Cost

The groups that costs are classified into are known as classes .

Costs can be classified using different bases or characteristics, including element, nature, variability, controllability , normality, and function. The main classes of cost are shown in the image below.

Classification of Cost by Element

In this class, costs are categorized based on the factors they are incurred for. Based on their elements, costs may be grouped as:

- Material cost

Material cost refers to the cost of commodities supplied to an undertaking (e.g., in the case of a textile mill, the cost of cotton or yarn, the cost of cotton waste to clean the machinery, the cost of dyes, the cost of finishing material, and so on).

Labor cost refers to the cost of paying employees in an undertaking, which includes salary, wages, and commission.

Expenses refer to the cost of services provided to an undertaking and include the notional cost of owned assets (e.g., rent for a building, telephone expenses, depreciation of the owned factory building, depreciation of delivery van, and so on).

Classification of Cost by Nature

In this class, costs are classified based on their identifiability with cost centers or cost units. Costs can be grouped as follows based on their nature:

- Direct costs

- Indirect costs

Direct costs are costs that can be directly and easily traced to (or identified with) a product, process, or department.

Common examples of direct costs include the materials used and labor employed in manufacturing an article or in a production process.

Indirect costs , on the other hand, are costs that are not traceable to any particular product, process, or department, but which are common in a number of products, processes, or departments.

Examples of indirect costs are factory rent, factory insurance, and the salary of the factory manager.

Classification of Cost by Variability or Behavior

Costs (both direct and indirect) can also be classified into the following groups based on their behavior relative to changes in the volume of activity:

- Variable costs

- Fixed costs

- Semi-variable or semi-fixed costs

Variable costs are costs that vary in a directly proportional way to changes in the volume of output or sales.

These costs tend to increase or decrease with the rise and fall in production or sales. Variable costs vary in total but their per-unit cost stays the same.

Examples of variable costs are direct material cost, direct wages, direct expenses, consumable stores, and commission on sales.

Fixed costs are costs that generally remain unaffected by changes in sales volume/output. Fixed costs remain unchanged when output or sales increase or decrease.

These costs remain fixed in total but their per-unit cost changes with output or sales.

These costs depend mainly on the passage of time and do not vary directly with the changes in the volume of output or sales.

Typical examples of fixed costs include rent, rates, taxes, insurance charges, and salaries for managers.

It is worth remembering that fixed costs are not absolutely fixed for all of time. In fact, fixed costs are fixed only in relation to a particular level of production capacity.

Semi-variable costs are costs that tend to vary with changes in the volume of output or sales, but which do not vary in a directly proportional way relative to such changes. These costs have the characteristics of both fixed and variable costs.

One part of semi-variable costs remains constant irrespective of changes in the volume of output or sales. By contrast, the other part varies in proportion to changes in the volume of output or sales.

Typical examples of semi-variable costs include repairs and maintenance costs for plants, machinery, and buildings and supervisor salaries.

Cost Classification by Controllability

Under this category, costs are classified based on whether or not they are influenced by the action of a given member of an undertaking. The classes of costs are:

- Controllable costs

- Uncontrollable costs

Controllable costs are costs that an entity in an undertaking can influence through their action.

An undertaking is usually divided into several departments or cost centers that are placed under the direct control and supervision of specified persons.

The person in charge of a particular department or cost center can control only those costs that come directly under their control.

Uncontrollable costs , on the other hand, are costs that cannot be influenced by the action of a specified member of an undertaking.

Costs that are controllable for one person may be uncontrollable for another person.

Therefore, the issue of whether a cost is controllable or uncontrollable is determined by the individual or level of management in question.

Cost Classification by Normality

In this category, costs are classified based on whether they are normally incurred at a particular level of output under the conditions for which that level of output is normally attained.

Based on normality, costs may be classified as:

- Normal or unavoidable costs

- Abnormal or avoidable costs

Normal or unavoidable costs are normally incurred at a given level of output under the conditions for which that level of output is normally attained. Costs of this kind cannot be avoided at all.

The cost of normal spoilage of materials and the cost of normal idle time are typical examples of normal costs.

Abnormal or avoidable costs are costs that are not normally incurred at a given level of output under the conditions for which that level of output is attained.

It is possible to avoid such costs if proper care is taken. The cost of spoilage of material over and above the normal limit is an example of an abnormal cost.

Cost Classification by Function

Costs can also be classified based on their perceived function. The following types of cost exist by function:

- Production costs

- Administration costs

- Selling costs

- Distribution costs

Production costs refer to costs that arise in the course of acquiring, processing, and using raw materials.

Production costs include the cost of materials, cost of labor, other factory expenses, and the cost of primary packing.

Administration costs are the costs incurred in formulating business policies, directing the organization, and controlling the operations of an undertaking.

Administration costs are not related to research, development, production, distribution, or selling activities.

Selling costs are incurred to create and stimulate demand and secure orders. As such, these costs are incurred in connection with the marketing of products.

Distribution costs are associated with the sequence of operations. This sequence starts with dispatch preparations for the packed product and ends by facilitating the availability of the reconditioned, returned, and empty packages for re-use.

Classification by Time

From the view of time, costs can be classified as:

- Historical costs

- Predetermined costs

Historical costs are costs that are identified after they have been incurred. That is to say, they are determined after goods have been manufactured or services have been rendered.

Historical costs simply represent a post-mortem of past events, and they are useful in ascertaining profitability but not in exercising cost control.

Predetermined costs are computed in advance of production based on a specification of all the factors affecting them. Predetermined costs can be further divided into:

- Estimated costs

- Standard costs

Estimated costs are costs that, according to investigation and analysis, are most likely to be incurred.

They are estimated in advance based on the following assumptions: firstly, that costs are more or less free to move; and secondly, that what is made is the best estimate of the cost conditions that will apply when the cost is incurred.

Standard costs refer to a predetermined cost that is calculated from the management's standards of efficient operation and the relevant necessary expenditure.

Standard cost is established based on the assumption that costs will not be allowed to move freely but will be controlled as far as possible.

This ensures that the actual cost will be as close to the standard cost as possible, and that any disparity between actual and standard cost can be reasonably explained.

The basic difference between an estimated cost and a standard cost is that an estimated cost is a more or less reasonable assessment of what a cost will be when it is incurred.

A standard cost, on the other hand, is a specification of what a cost ought to be when it is incurred.

Cost Classification by Relevance to Decision-making and Control

In this category, costs are classified based on whether they are relevant to managerial decisions. These costs are as follows:

Marginal Cost: Marginal cost is defined as "the amount at any given volume of output by which aggregate costs are changed if the volume of output is increased or decreased by one unit."

Marginal cost refers to the increase in total cost that results from an increase in output by one unit.

Marginal cost is denoted by variable cost, and it consists of direct material cost, direct labor cost, direct expenses, and variable overheads.

Sunk Costs: Sunk costs refer to costs that have already been incurred and cannot be changed by a future decision. These costs become irrelevant costs for later decisions.

For example, if a manager decides to replace an existing machine with a new one, the amount of capital invested in the existing machine (less scrap value) will be irrecoverable and, as a result, is known as a 'sunk cost'.

Out-of-pocket Costs: These costs represent the present or future case expenditure regarding decisions, which vary based on the nature of the decision.

Management decisions are directly affected by such costs because they give rise to cash expenditure.

For example, consider a firm that has its own fleet for transporting raw materials and finished goods from one place to another.

It seeks to replace these vehicles by employing public carriers.

In making this decision, the depreciation of the vehicles is not to be considered but the management must take into account the present expenditure on fuel, maintenance, and driver salaries. Such costs are treated as out-of-pocket costs.

Opportunity Costs: The opportunity cost of a product or service is measured in terms of revenue that could have been earned by applying the resources to some other use. Opportunity cost can be defined as the cost of foregoing the best alternative.

Thus, the opportunity cost of yarn produced by a composite spinning and weaving mill, which is used in the weaving section, would be the price that could have been obtained by selling the yarn in the market.

Imputed Costs: Imputed costs are costs that are not included in costs but are considered for making management decisions. These costs are hypothetical in character.

For example, interest on capital, though not actually payable, must often be included to judge the relative profitability of two products involving unequal outlays of cash .

Differential Costs: Differential costs refer to the difference in total costs between two alternatives.

When choosing an alternative increases total costs, such increased costs are known as incremental costs .

On the other hand, if the choice results in a decrease in total costs, such decreased costs are called decremental costs .

Shut-down Costs: Shut-down costs are costs that will still be incurred when a plant is shut down temporarily.

Sometimes, the normal operations of a business must be suspended temporarily due to unfavorable market conditions, strikes, or other forces.

During the suspension of production or other activities, certain costs may still need to be incurred, and these are considered 'shut-down costs'.

Examples of shut-down costs include rent for factory premises, salaries of top management, and so on.

Postponable Costs: These are the costs that can be postponed or shifted to the future with little or no effect on the efficiency of current operations. These costs are postponable but not avoidable and must be incurred at a later stage.

The concept of a postponable cost is highly significant in the railway and transport business, where it’s possible to delay the cost of repairs and maintenance for a certain period.

In manufacturing, economic crises can also be averted by postponing certain costs. This strategy was used during the depression period.

Replacement Cost: Replacement cost is the cost of replacing an asset in the current market or at the current price.

Thus, the replacement cost of an asset is the cost that would be incurred if the asset were purchased at the current market price and not at the original purchase price.

Abandonment Costs: Abandonment refers to the complete retirement or withdrawal of a fixed asset from service or use. Fixed assets are abandoned when they are no longer serviceable.

Abandonment cost refers to the cost incurred in abandoning a fixed asset (i.e., the cost that cannot be recovered or salvaged from the abandoned asset). It is also known as abandonment loss.

Other Types of Cost

Research Cost: This refers to the cost of searching for new or improved products, new applications of materials, or new or improved methods of production.

Development Cost: This refers to the cost of the process that begins with making the decision to produce a new/improved product/method and ends with the commencement of formal production of that product/method.

Pre-production Cost: This refers to the part of the overall development cost that is incurred in making a trial production run before beginning formal production.

Conversion Cost: This refers to the costs incurred to convert raw materials into finished goods, and it consists of direct labor cost, direct expenses, and factory overhead .

Classification of Cost FAQs

What is classification of cost.

Classification of Cost is the process of organizing costs into categories for better understanding and analysis. It involves dividing costs into fixed, variable, direct, indirect, and semi-variable to help in better decision-making.

What are examples of costs that can be classified?

Examples of costs that can be classified include raw materials, labor costs, administrative expenses, marketing expenses, overhead costs, etc.

What are the advantages of classifying cost?

The advantages of classifying costs include obtaining an accurate assessment of cost performance; increased efficiency in managing costs; improved accuracy when estimating future costs; enhanced ability to identify areas for potential savings; and improved forecasting and budgeting capabilities.

How can costs be classified?

Costs can be classified based on several criteria such as nature of cost, elements of cost, controllability of cost, function or department from where the cost is incurred, etc.

What are the different categories of cost classification?

The different categories of cost classification include fixed costs, variable costs, direct costs, indirect costs, and semi-variable costs. Each category has its characteristics that help in understanding the cost structure and making more informed decisions.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Account Analysis Method

- Committed vs Discretionary Fixed Cost

- Cost Center and Cost Unit

- Cost of Production Report (CPR) Questions and Answers

- Difference Between Controllable and Uncontrollable Costs

- Difference Between Direct Costs and Indirect Costs

- Difference Between Product Costs and Period Costs

- Dual-Rate Method

- Fixed Costs

- Period Expenses

- Process Costing

- Semi-Variable Costs

- Variable Cost

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch, submit your info below and someone will get back to you shortly..

- Search Search Please fill out this field.

What Is Cost Accounting?

Understanding cost accounting.

- Cost vs. Financial Accounting

- Cost Accounting FAQs

The Bottom Line

- Corporate Finance

Cost Accounting: Definition and Types With Examples

:max_bytes(150000):strip_icc():format(webp)/Office2-EbonyHoward-8b4ada1233ed44aca6ef78c46069435d.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

- Accounting Explained With Brief History and Modern Job Requirements

- Accounting Equation

- Current and Noncurrent Assets

- Accounting Theory

- Accounting Principles

- Accounting Standard

- Accounting Convention

- Accounting Policies

- Principles-Based vs. Rules-Based Accounting

- Accounting Method

- Accrual Accounting

- Cash Accounting

- Accrual Accounting vs. Cash Basis Accounting

- Financial Accounting Standards Board (FASB)

- Generally Accepted Accounting Principles (GAAP)

- International Financial Reporting Standards (IFRS)

- IFRS vs. GAAP

- US Accounting vs. International Accounting

- Understanding the Cash Flow Statement

- Breaking Down The Balance Sheet

- Understanding the Income Statement

- Financial Accounting

- Financial Accounting and Decision-Making

- Financial vs. Managerial Accounting

- Cost Accounting CURRENT ARTICLE

- Certified Public Accountant (CPA)

- Chartered Accountant (CA)

- Accountant vs. Financial Planner

- Tax Accounting

- Forensic Accounting

- Chart of Accounts (COA)

- Double Entry

- Closing Entry

- Introduction to Accounting Information Systems

- Inventory Accounting

- Last In, First Out (LIFO)

- First In, First Out (FIFO)

- Average Cost Method

Cost accounting is a form of managerial accounting that aims to capture a company's total cost of production by assessing the variable costs of each step of production as well as fixed costs, such as a lease expense.

Cost accounting is not GAAP-compliant , and can only be used for internal purposes.

Key Takeaways

- Cost accounting is used internally by management in order to make fully informed business decisions.

- Unlike financial accounting, which provides information to external financial statement users, cost accounting is not required to adhere to set standards and can be flexible to meet the particular needs of management.

- As such, cost accounting cannot be used on official financial statements and is not GAAP-compliant.

- Cost accounting considers all input costs associated with production, including both variable and fixed costs.

- Types of cost accounting include standard costing, activity-based costing, lean accounting, and marginal costing.

Investopedia / Theresa Chiechi

Cost accounting is used by a company's internal management team to identify all variable and fixed costs associated with the production process. It will first measure and record these costs individually, then compare input costs to output results to aid in measuring financial performance and making future business decisions. There are many types of costs involved in cost accounting , each performing its own function for the accountant.

Types of Costs

- Fixed costs are costs that don't vary depending on the level of production. These are usually things like the mortgage or lease payment on a building or a piece of equipment that is depreciated at a fixed monthly rate. An increase or decrease in production levels would cause no change in these costs.

- Variable costs are costs tied to a company's level of production. For example, a floral shop ramping up its floral arrangement inventory for Valentine's Day will incur higher costs when it purchases an increased number of flowers from the local nursery or garden center.

- Operating costs are costs associated with the day-to-day operations of a business. These costs can be either fixed or variable depending on the unique situation.

- Direct costs are costs specifically related to producing a product. If a coffee roaster spends five hours roasting coffee, the direct costs of the finished product include the labor hours of the roaster and the cost of the coffee beans.

- Indirect costs are costs that cannot be directly linked to a product. In the coffee roaster example, the energy cost to heat the roaster would be indirect because it is inexact and difficult to trace to individual products.

Cost Accounting vs. Financial Accounting

While cost accounting is often used by management within a company to aid in decision-making, financial accounting is what outside investors or creditors typically see. Financial accounting presents a company's financial position and performance to external sources through financial statements , which include information about its revenues , expenses , assets , and liabilities . Cost accounting can be most beneficial as a tool for management in budgeting and in setting up cost-control programs, which can improve net margins for the company in the future.

One key difference between cost accounting and financial accounting is that, while in financial accounting the cost is classified depending on the type of transaction, cost accounting classifies costs according to the information needs of the management. Cost accounting, because it is used as an internal tool by management, does not have to meet any specific standard such as generally accepted accounting principles (GAAP) and, as a result, varies in use from company to company or department to department.

Cost-accounting methods are typically not useful for figuring out tax liabilities, which means that cost accounting cannot provide a complete analysis of a company's true costs.

Types of Cost Accounting

Standard costing.

Standard costing assigns "standard" costs, rather than actual costs, to its cost of goods sold (COGS) and inventory. The standard costs are based on the efficient use of labor and materials to produce the good or service under standard operating conditions, and they are essentially the budgeted amount. Even though standard costs are assigned to the goods, the company still has to pay actual costs. Assessing the difference between the standard (efficient) cost and the actual cost incurred is called variance analysis.

If the variance analysis determines that actual costs are higher than expected, the variance is unfavorable. If it determines the actual costs are lower than expected, the variance is favorable. Two factors can contribute to a favorable or unfavorable variance. There is the cost of the input, such as the cost of labor and materials. This is considered to be a rate variance.

Additionally, there is the efficiency or quantity of the input used. This is considered to be a volume variance. If, for example, XYZ company expected to produce 400 widgets in a period but ended up producing 500 widgets, the cost of materials would be higher due to the total quantity produced.

Activity-Based Costing

Activity-based costing (ABC) identifies overhead costs from each department and assigns them to specific cost objects, such as goods or services. The ABC system of cost accounting is based on activities, which refer to any event, unit of work, or task with a specific goal, such as setting up machines for production, designing products, distributing finished goods, or operating machines. These activities are also considered to be cost drivers , and they are the measures used as the basis for allocating overhead costs .

Traditionally, overhead costs are assigned based on one generic measure, such as machine hours. Under ABC, an activity analysis is performed where appropriate measures are identified as the cost drivers. As a result, ABC tends to be much more accurate and helpful when it comes to managers reviewing the cost and profitability of their company's specific services or products.

For example, cost accountants using ABC might pass out a survey to production-line employees who will then account for the amount of time they spend on different tasks. The costs of these specific activities are only assigned to the goods or services that used the activity. This gives management a better idea of where exactly the time and money are being spent.

To illustrate this, assume a company produces both trinkets and widgets. The trinkets are very labor-intensive and require quite a bit of hands-on effort from the production staff. The production of widgets is automated, and it mostly consists of putting the raw material in a machine and waiting many hours for the finished good. It would not make sense to use machine hours to allocate overhead to both items because the trinkets hardly used any machine hours. Under ABC, the trinkets are assigned more overhead related to labor and the widgets are assigned more overhead related to machine use.

Lean Accounting

The main goal of lean accounting is to improve financial management practices within an organization. Lean accounting is an extension of the philosophy of lean manufacturing and production, which has the stated intention of minimizing waste while optimizing productivity. For example, if an accounting department is able to cut down on wasted time, employees can focus that saved time more productively on value-added tasks.

When using lean accounting, traditional costing methods are replaced by value-based pricing and lean-focused performance measurements. Financial decision-making is based on the impact on the company's total value stream profitability. Value streams are the profit centers of a company, which is any branch or division that directly adds to its bottom-line profitability.

Marginal Costing

Marginal costing (sometimes called cost-volume-profit analysis ) is the impact on the cost of a product by adding one additional unit into production. It is useful for short-term economic decisions. Marginal costing can help management identify the impact of varying levels of costs and volume on operating profit. This type of analysis can be used by management to gain insight into potentially profitable new products, sales prices to establish for existing products, and the impact of marketing campaigns.

The break-even point —which is the production level where total revenue for a product equals total expense —is calculated as the total fixed costs of a company divided by its contribution margin. The contribution margin , calculated as the sales revenue minus variable costs, can also be calculated on a per-unit basis in order to determine the extent to which a specific product contributes to the overall profit of the company.

History of Cost Accounting

Scholars believe that cost accounting was first developed during the industrial revolution when the emerging economics of industrial supply and demand forced manufacturers to start tracking their fixed and variable expenses in order to optimize their production processes.

Cost accounting allowed railroad and steel companies to control costs and become more efficient. By the beginning of the 20th century, cost accounting had become a widely covered topic in the literature on business management.

How Does Cost Accounting Differ From Traditional Accounting Methods?

In contrast to general accounting or financial accounting, the cost-accounting method is an internally focused, firm-specific system used to implement cost controls . Cost accounting can be much more flexible and specific, particularly when it comes to the subdivision of costs and inventory valuation. Cost-accounting methods and techniques will vary from firm to firm and can become quite complex.

Why Is Cost Accounting Used?

Cost accounting is helpful because it can identify where a company is spending its money, how much it earns, and where money is being lost. Cost accounting aims to report, analyze, and lead to the improvement of internal cost controls and efficiency. Even though companies cannot use cost-accounting figures in their financial statements or for tax purposes, they are crucial for internal controls.

Which Types of Costs Go Into Cost Accounting?

These will vary from industry to industry and firm to firm, however certain cost categories will typically be included (some of which may overlap), such as direct costs, indirect costs, variable costs, fixed costs, and operating costs.

What Are Some Advantages of Cost Accounting?