Selling a Debt: The Legalities, The Contract and the Forbidden

Many businesses struggle with bad debts. Unpaid debts can financially cripple a business, and the time and/or cost of recovering that debt may exceed the value of the debt itself. Often creditors take the risk of paying lawyers and/or debt collectors a significant amount of fees without the assurance of success.

If creditors are not paid, they face paying debt collectors and/or lawyers to collect the debt. But here is an alternative, that is to both write off the debt (and get the tax advantage of doing so) and avoid legal costs (but still get all the advantages of using lawyers).

The solution is through the sale of debt to us. At 90 Nine, when we buy a debt, we engage specialist lawyers to collect the debt and use the Court process to do so. We completely fund this process at no risk to the creditor.

While a relatively new debt enforcement process for New Zealanders, debt buying has been common in Europe and the USA for a while. Debt buying is an arrangement where a debt is purchased from the original creditor by a debt buyer for a percentage of the face value of the debt, based on the potential collectability of the debt.

From a legal perspective, sale of debt is achieved through an assignment.

The assignment of debt

The idea that a contractual right cannot be transferred is an archaic view that has been rejected by equity.

In the 17th century, the English Court of Chancery recognised and enforced the assignment of a contractual right, including the right to receive a debt.

Even though a right to receive a debt is intangible, the Courts regarded a debt as property and an asset capable of being dealt with like any other asset, including being assigned.

The English laws have consequently been adopted in New Zealand and the right to assign “a thing in action” (i.e. a contractual right) is presently recognised by Subpart 5 of the Property Law Act 2007 (“ the Act ”).

Section 48 of the Act expressly confirms that the ‘thing in action’ includes a right to receive payment of a debt.

Section 50 of the Act provides that a thing in action can be subject to an absolute assignment assuming the proper method and form of assignment is satisfied. This means that personal rights to property such as the right to receive a debt may be assigned from the original creditor to the debt buyer.

When assigning a debt, all rights and remedies of the original creditor over the debt are transferred to the assignee. It is not necessary to provide valuable consideration for the assignment meaning that debts can be bought for zero dollars. Further, it is possible to assign an amount or debt that will or may be payable in the future.

The laws of equity in relation to assignment continue operating concurrently with the statutory provisions and can be of benefit in limited circumstances where the statutory requirements of assignment have not been satisfied. However, practically, enforcing an equitable assignment might be more challenging, and for this reason, it is always advisable to assign a debt through statutory assignment under the Act.

Proper method and form of assignment

Under s 50 of the Act, for an absolute assignment of a thing in action to occur, at the minimum, the assignment needs to be in writing and signed by the assignor.

In addition to the minimum requirements, we recommend the best practice is to assign a debt through a deed, to reduce risk of future challenge to the assignment. A deed is a legal document which, in accordance with s 9 of the Act, needs to:

- Be in writing;

- Be signed by all parties;

- Have signatures witnessed in accordance with the Act (unless the party is a body corporate with no fewer than 2 directors);

- Include the locality of the place of residence and the occupation or description of the witnesses.

The deed will become binding once the above is done and when it is delivered by the person to be bound by it or their agent. This can be done through physical delivery or through fax/email.

Generally, the deed should make it clear who the parties are and what it is that is being assigned with as much certainty and clarity as possible.

Pursuant to s 51 of the Act, once a debt has been assigned, the notice of assignment needs to be provided to the debtor. That means informing the debtor, preferably in writing, that the debt is now payable to the debt buyer. If actual notice is not given to the debtor and the debtor pays the debt to the original creditor, this discharges the debtor’s liability to pay to the debt buyer. Although, the original creditor must now pay those funds to the debt buyer. In the case of joint debtors, only one needs to be given actual notice of the assignment.

Rights that cannot be assigned

Some contractual rights are incapable of assignment, whether under equity or under the Act.

A common example of such right is the right pursuant to the contract which expressly prohibits the assignment, either entirely or without the consent of all parties.

Another right that cannot be assigned is the bare right to a cause of action, which is not attached to a property interest such as a debt.

The Act addresses the assignment of rights, including right to a debt, but not the assignment of the burden of obligation. Assignment of contractual liabilities is generally not possible, unless limited exceptions apply.

- Insights & events

Assigning debts and other contractual claims - not as easy as first thought

Harking back to law school, we had a thirst for new black letter law. Section 136 of the Law of the Property Act 1925 kindly obliged. This lays down the conditions which need to be satisfied for an effective legal assignment of a chose in action (such as a debt). We won’t bore you with the detail, but suffice to say that what’s important is that a legal assignment must be in writing and signed by the assignor, must be absolute (i.e. no conditions attached) and crucially that written notice of the assignment must be given to the debtor.

When assigning debts, it’s worth remembering that you can’t legally assign part of a debt – any attempt to do so will take effect as an equitable assignment. The main practical difference between a legal and an equitable assignment is that the assignor will need to be joined in any legal proceedings in relation to the assigned debt (e.g. an attempt to recover that part of the debt).

Recent cases which tell another story

Why bother telling you the above? Aside from our delight in remembering the joys of debating the merits of legal and equitable assignments (ehem), it’s worth revisiting our textbooks in the context of three recent cases. Although at first blush the statutory conditions for a legal assignment seem quite straightforward, attempts to assign contractual claims such as debts continue to throw up legal disputes:

- In Sumitomo Mitsui Banking Corp Europe Ltd v Euler Hermes Europe SA (NV) [2019] EWHC 2250 (Comm), the High Court held that a performance bond issued under a construction contract was not effectively assigned despite the surety acknowledging a notice of assignment of the bond. Sadly, the notice of assignment failed to meet the requirements under the bond instrument that the assignee confirm its acceptance of a provision in the bond that required the employer to repay the surety in the event of an overpayment. This case highlights the importance of ensuring any purported assignment meets any conditions stipulated in the underlying documents.

- In Promontoria (Henrico) Ltd v Melton [2019] EWHC 2243 (Ch) (26 June 2019) , the High Court held that an assignment of a facility agreement and legal charges was valid, even though the debt assigned had to be identified by considering external evidence. The deed of assignment in question listed the assets subject to assignment, but was illegible to the extent that the debtor’s name could not be deciphered. The court got comfortable that there had been an effective assignment, given the following factors: (i) the lender had notified the borrower of its intention to assign the loan to the assignee; (ii) following the assignment, the lender had made no demand for repayment; (iii) a manager of the assignee had given a statement that the loan had been assigned and the borrower had accepted in evidence that he was aware of the assignment. Fortunately for the assignee, a second notice of assignment - which was invalid because it contained an incorrect date of assignment - did not invalidate the earlier assignment, which was found to be effective. The court took a practical and commercial view of the circumstances, although we recommend ensuring that your assignment documents clearly reflect what the parties intend!

- Finally, in Nicoll v Promontoria (Ram 2) Ltd [2019] EWHC 2410 (Ch), the High Court held that a notice of assignment of a debt given to a debtor was valid, even though the effective date of assignment stated in the notice could not be verified by the debtor. The case concerned a debt assigned by the Co-op Bank to Promontoria and a joint notice given by assignor and assignee to the debtor that the debt had been assigned “on and with effect from 29 July 2016”. A subsequent statutory demand served by Promontoria on the debtor for the outstanding sums was disputed on the basis that the notice of assignment was invalid because it contained an incorrect date of assignment. Whilst accepting that the documentation was incapable of verifying with certainty the date of assignment, the Court held that the joint notice clearly showed that both parties had agreed that an assignment had taken place and was valid. This decision suggests that mistakes as to the date of assignment in a notice of assignment may not necessarily be fatal, if it is otherwise clear that the debt has been assigned.

The conclusion from the above? Maybe it’s not quite as easy as first thought to get an assignment right. Make sure you follow all of the conditions for a legal assignment according to the underlying contract and ensure your assignment documentation is clear.

Contact our experts for further advice

Necessary cookies . These are cookies which are necessary for the operation of our website. We set these cookies so that they are always on.

Analytics and other third-party cookies . We would like to use analytics and limited other third-party cookies to improve our website and your experience using it. These cookies collect and report information to us about your browsing activity on our website. If you are happy to allow us to use these cookies, please click “all cookies” or you can turn individual cookies on by clicking "manage cookies". You can change your preferences at any time by visiting our cookie details page.

We use cookies on our website, details of which are set out below.

Necessary cookies

These are cookies which are necessary for the operation of our website. We set these cookies so that they are always on, although you may be able to disable these cookies via your browser if you wish. Please note that if these cookies are disabled then you may not be able to use some or all of the functionality of our website.

Ideally over time we would like to be able to improve our website and your experience using it. We would like to deploy analytics cookies to enable us to do this, which would collect and report information to us about your browsing activity on our website. However, we will only use these cookies with your consent and these cookies are switched off until you opt to turn them on. Click here for a full list of analytics cookies used on our website.

Third-party cookies are set by our partners and help us to improve your experience of the website. Click here for a full list of third-party plugins used on our website.

Search our site

New Zealand Legal Documents

People who can help in ChristchurchHelp yourself - select a legal category. This range of New Zealand debt documents provide for deeds of assignment, transfer of debt, forgiveness and collection. Statutory demand form and notes: service on a company or LLPOfficial statutory demand forms, examples and notes. Simple and effective debt collecting device. Complies with relevant New Zealand legislation.

recover debt from a companyHow to recover a debt from a nz company, introduction. The NZ COMPANIES ACT 1993 provides a quick procedure for ensuring payment, or at least of knowing if the payment is possible. First, serve a "statutory demand" on the companyTo recover money from a company you must serve a "statutory demand" for the debt. This demand must be in writing and should be served on the debtor company's registered office. The demand must require the company to pay the debt, or to secure the debt or settle it in some way. The company has 15 working days after being served to comply with the notice. What if the company disputes the debt?If the company disputes the debt it has 10 days after being served with the statutory demand to apply to the court to have the demand set aside. If the company does apply to have it set aside, the Court can decide at that hearing if the company should be liquidated. What if the company hasn't paid after 15 days?If the company hasn't paid the debt after 15 days, and it has not disputed the debt, then it is deemed unable to pay its debts, and you can therefore apply to the court for the company to be placed in liquidation. If the company wishes to defend the liquidation, it has 14 days to file and serve a Statement of Defence. You must advertise in the local newspaper and in the New Zealand Gazette that liquidation proceedings have been started, including the place, date and time set for the hearing. The advertisement must be published at least seven clear days before the hearing date. The company can pay the debt any time up until the court hearing. However, costs would be paid to the party applying to place the company in liquidation. Appointment of a liquidatorIf the company's defence of your liquidation application is unsuccessful, or if it does not file a Statement of Defence, the court will appoint a liquidator to take control of the company and to try to satisfy its creditors. The liquidator must ensure that all moneys that are recoverable are in fact recovered and that the payments are made in order of preference (see the Cautionary Notes below). For more on liquidation, see related article How to liquidate a company. Order of preference for creditorsIf you are attempting to recover a debt from a company, you should know where you are in the order of preference for creditors should the company be liquidated. The order is as follows:

Note that creditors are paid after the costs of the liquidation have been met. Cautionary notes

recover a debt from an individualHow to recover a debt from an individual within new zealand, first, give notice of the debt. To recover a debt from a New Zealand individual you must first give the person notice of the debt owed, what it is owed for, and when payment is required. If the person does not pay the debt then you should proceed with court action. Which court do I apply to recover the debt?

How do I start proceedings in the court?There are two procedures that can be used to obtain a court judgment for a debt:

How much will it cost me to go to court?Be aware that the costs of court action will include the court filing fees, other costs such as service fees (possibly up to $100), and solicitor's costs. If you've used the summary judgment procedure and the debtor has not disputed your application, costs between $500 and $1,000 may be awarded by the court, and these will go towards your lawyer's fees when paid by the debtor. What will I be awarded if the court decides in my favour?If the judgment is in your favour then the court order will include the following:

How do I enforce the judgment if the debtor still doesn't pay?If the debtor still does not pay after the court has given you a judgment for the debt, you can use the court to enforce payment of the debt. The most common methods of enforcement are:

exercise a creditor's right of repossessionHow to exercise a nz creditor's right to repossession. In exercising a right of repossession as a New Zealand creditor you must comply with the requirements set out in the CREDIT (REPOSSESSION) ACT 1997 . The Act applies to all "credit agreements", which means hire-purchase agreements and other security instruments, such as chattel mortgages (secured loans) and security interests over motor vehicles. The Act sets out the procedure for repossession and places restrictions on when and how you can repossess, but it does not in itself grant a right to repossess. Whether or not you have that right will be determined by the agreement itself. Under the Act, you may not repossess unless:

Creditor must first send a pre-possession noticeBefore you can take steps to repossess, you must first send the debtor a "pre-possession notice". This must be in writing; a standard form is set out in Schedule 1 of the CREDIT (REPOSSESSION) ACT 1997. The notice must:

If you do not follow these requirements:

The notice must also be sent to any guarantors of the debt. It is not necessary to send a pre-possession notice if you are repossessing because the goods are at risk. When and how must the repossession be carried out?The repossession must be carried out in a reasonable manner, and only between 6 am and 9 pm, Monday to Saturday. The debtor can, however, consent to the goods being repossessed outside those hours, provided the consent is given after the default in payment has occurred and before you or your agent arrive at the debtor's premises to take the goods. The following documents must be produced when repossession takes place:

What if the debtor isn't home?If the occupier of the premises isn't home when the entry takes place, you or your agent must leave a notice specifying:

This notice must be accompanied by copies of the documents referred to above. People who are disqualified from carrying out repossessionsCertain people are disqualified from carrying out repossessions, whether as agents or as the creditor:

Anyone who repossesses property in contravention of these restrictions commits an offence and is liable to a fine of up to $10,000. Post-possession noticeWithin 21 days after repossessing, you must send a "post-possession notice" to the debtor and any guarantors. The form for the notice is set out in Schedule 2 of the CREDIT (REPOSSESSION) ACT 1997. The notice states that the debtor is entitled to get back the repossessed property if, within 15 days of receiving the notice, the debtor either:

The notice must contain your estimate of the value of the goods. If you don't send a post-possession notice, you are not entitled to recover the costs of repossession from the debtor or the guarantor. Selling the goodsIf the debtor hasn't reinstated or settled within 15 days of the post-possession notice, you may sell or dispose of the goods. You are under a positive duty to make reasonable efforts to obtain the best price. Within 10 days after selling the goods, you must send the debtor a third notice (a "statement of account"), showing:

If there is money left over from the sale, the debtor has six months to begin court proceedings to recover the money from you.

recover a debt from a bankruptHow to recover debt from a bankrupt within new zealand. If a person who owes you money (a debtor) is adjudicated bankrupt under the NZ INSOLVENCY ACT 1967 , you will need to work in conjunction with the Official Assignee to attempt to recover the money owed. It is the Official Assignee's role to sell the assets of the bankrupt estate and distribute the proceeds to the bankrupt's creditors. Lodging your Proof of Debt formIf the bankrupt identifies you as a creditor, you will be notified of the bankruptcy and be sent a report outlining the bankrupt's financial position. (Bankruptcies are also advertised in local newspapers and in the New Zealand Gazette .) If payments are likely to be paid to creditors, a Proof of Debt form will be included with the report for you to complete. It is in your best interests to complete the form correctly and include documents supporting your claim as soon as possible to avoid any later delays. This is because once the debtor is adjudicated as bankrupt the standard procedures available for recovering debt are prohibited (see How to recover a debt from a company and How to recover a debt from an individual). If you do not receive the Proof of Debt form you should make the appropriate enquiries with the Insolvency and Trustee Service, which is part of the new Ministry of Economic Development. What can I claim for?The Insolvency and Trustee Service will also advise you as to what you may claim for. You may be unable to recover:

What rights do I have as a creditor?You as a creditor have certain rights that you are able to enforce, especially if you are concerned about your position. These are:

In what order are the proceeds of the estate distributed?Once the bankrupt's estate has been sold, there is an order of priority that the Official Assignee must follow when distributing the funds:

All the money available for unsecured creditors (if any) is distributed proportionately and the debt is then discharged. Can I appeal a decision made by the Official Assignee?As a creditor you have the right to appeal to the High Court against a decision made by the Official Assignee. Obtaining information on bankruptcies: the National Insolvency DatabaseThe Ministry of Economic Development has established a National Insolvency Database that each office of the Insolvency and Trustees Service has access to. Through this you can search for:

You can also access and search this database through the Ministry's website The New Zealand Government website Insolvency is an additional useful guide. Cautionary notes

Deed of assignment of debtA deed of assignment is used to transfer the right to be paid a debt from one person to another. Complies with relevant New Zealand legislation.

Deed of assignment of debt with consentTransfer of debt. A deed that provides for one person to take over a debt owed by another, with the consent of the creditor, so that the debtor/ creditor relationship is replaced and the debt is owing between the creditor and replacement debtor. Complies with relevant New Zealand legislation. Full forgiveness of debtA deed to record a Gift by way of forgiveness of part of a debt owing from one person to another where the maker of the Gift has natural love and affection for the recipient. Complies with relevant New Zealand legislation. Partial forgiveness of debtFinal release of balance of debt, novation agreement: transfer debt to new creditor. Transfer the right to receive a debt repayment from creditor to his transferee. Complies with relevant New Zealand legislation. Novation agreement: transfer debt to new debtorTransfer a debt obligation from one party to another with the creditor's permission, for example when restructuring debt or when selling a business and its obligations. Complies with relevant New Zealand legislation. Not legal advice DisclaimerHowToLaw includes links to other websites. These links are provided for your convenience to provide further information and educational purposes only. They do not signify that we endorse the website(s). We have no responsibility for the content of the linked website(s). These links to other websites not controlled by HowToLaw. You should be aware that these sites will have their own privacy policies and that these may differ from our own. Any links on HowToLaw to any document does not constitute legal advice and is not a substitute for legal advice. HowToLaw gives you no legal advice as to the suitability of any document to your specific circumstances nor as to what provisions contained in a document might be suitable to your specific circumstances. The basis on which you view or purchase any document through any website links is that it is suitable to be used only together with legal advice as to how the document should be applied and adapted to your specific circumstances. For legal advice for your specific situation, you should consult a lawyer. HowToLaw is not liable for any loss or damage that results from the use of or reliance on a purchased document or that is caused by you not obtaining legal advice for your specific circumstances, or that results from any action you take with any document that is provided through any links on the HowToLaw site.

New Zealand LegislationList of access keys.

Quick searchMy recent searches, property law act 2007.

50 How thing in action assignedThe absolute assignment in writing of a legal or equitable thing in action, signed by the assignor, passes to the assignee— all the rights of the assignor in relation to the thing in action; and all the remedies of the assignor in relation to the thing in action; and the power to give a good discharge to the debtor. Subsection (1) applies whether or not the assignment is given for valuable consideration. Subsection (1) applies subject to— section 51 ; and any equities in relation to the thing in action that arise before the debtor has actual notice of the assignment and would, but for subsection (1), have priority over the rights of the assignee. The priority of an assignment to which subsection (1) applies and which is not given for valuable consideration is to be determined as if the assignment had been given for valuable consideration. A legal or equitable thing in action is to be treated as having been assigned in equity (whether the assignment is oral or in writing) if— the assignee has given valuable consideration for the assignment; or the assignment is complete. Subsection (5)— prevails over any rule of equity to the contrary; but applies subject to sections 24 and 25 . An assignment to which subsection (5) applies is complete when the assignor has done everything that needs to be done by the assignor to transfer to the assignee (whether absolutely, conditionally, or by way of charge) the rights of the assignor in relation to the thing in action. Subsection (7) applies even though some other thing may remain to be done, without the intervention or assistance of the assignor, in order to confer title to the rights on the assignee. Compare: 1952 No 51 s 130

Ministry of Justice

About Civil Debt When the court makes a decision about a private disagreement over money or property, it becomes a civil debt. The court decision is known as an order or judgment and tells one party (the debtor) that they must pay the other (the creditor). Creditors can ask the court to help them collect the debt if the debtor does not pay. This is called civil enforcement. The creditor may have to pay fees; usually the fees can be added to the debt. Collecting your debt: information for civil creditorsYou can ask the court to help you collect your civil debt if the debtor does not pay. This is called civil enforcement. You may have to pay fees. Managing your debt: information for civil debtorsThe creditor can ask the court to take action against you to encourage you to pay your debt. This is called civil enforcement. Find out what the court can do and what your options are.

Civil enforcement fees have to be paid when you file an application. To apply for enforcement against more than one debtor, the creditor must file an application form & pay fees for each debtor.

Civil enforcement application forms for creditors, debtors and third parties. Learn about taking a civil debt to courtCivil enforcement happens after the court has made a civil order or judgment. If you have a disagreement about money and want to take someone to court, you can learn more on the courts and tribunals section of our website. This page was last updated: 26th June 2023

Debt Assignment: How They Work, Considerations and BenefitsDaniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle. :max_bytes(150000):strip_icc():format(webp)/daniel_liberto-5bfc2715c9e77c0051432901.jpg) Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University. :max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg) Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications. :max_bytes(150000):strip_icc():format(webp)/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg) Investopedia / Ryan Oakley What Is Debt Assignment?The term debt assignment refers to a transfer of debt, and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt . In most cases, a debt assignment is issued to a debt collector who then assumes responsibility to collect the debt. Key Takeaways

How Debt Assignments WorkWhen a creditor lends an individual or business money, it does so with the confidence that the capital it lends out—as well as the interest payments charged for the privilege—is repaid in a timely fashion. The lender , or the extender of credit , will wait to recoup all the money owed according to the conditions and timeframe laid out in the contract. In certain circumstances, the lender may decide it no longer wants to be responsible for servicing the loan and opt to sell the debt to a third party instead. Should that happen, a Notice of Assignment (NOA) is sent out to the debtor , the recipient of the loan, informing them that somebody else is now responsible for collecting any outstanding amount. This is referred to as a debt assignment. The debtor must be notified when a debt is assigned to a third party so that they know who to make payments to and where to send them. If the debtor sends payments to the old creditor after the debt has been assigned, it is likely that the payments will not be accepted. This could cause the debtor to unintentionally default. When a debtor receives such a notice, it's also generally a good idea for them to verify that the new creditor has recorded the correct total balance and monthly payment for the debt owed. In some cases, the new owner of the debt might even want to propose changes to the original terms of the loan. Should this path be pursued, the creditor is obligated to immediately notify the debtor and give them adequate time to respond. The debtor still maintains the same legal rights and protections held with the original creditor after a debt assignment. Special ConsiderationsThird-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA). The FDCPA, a federal law overseen by the Federal Trade Commission (FTC), restricts the means and methods by which third-party debt collectors can contact debtors, the time of day they can make contact, and the number of times they are allowed to call debtors. If the FDCPA is violated, a debtor may be able to file suit against the debt collection company and the individual debt collector for damages and attorney fees within one year. The terms of the FDCPA are available for review on the FTC's website . Benefits of Debt AssignmentThere are several reasons why a creditor may decide to assign its debt to someone else. This option is often exercised to improve liquidity and/or to reduce risk exposure. A lender may be urgently in need of a quick injection of capital. Alternatively, it might have accumulated lots of high-risk loans and be wary that many of them could default . In cases like these, creditors may be willing to get rid of them swiftly for pennies on the dollar if it means improving their financial outlook and appeasing worried investors. At other times, the creditor may decide the debt is too old to waste its resources on collections, or selling or assigning it to a third party to pick up the collection activity. In these instances, a company would not assign their debt to a third party. Criticism of Debt AssignmentThe process of assigning debt has drawn a fair bit of criticism, especially over the past few decades. Debt buyers have been accused of engaging in all kinds of unethical practices to get paid, including issuing threats and regularly harassing debtors. In some cases, they have also been charged with chasing up debts that have already been settled. Federal Trade Commission. " Fair Debt Collection Practices Act ." Accessed June 29, 2021. Federal Trade Commission. " Debt Collection FAQs ." Accessed June 29, 2021. :max_bytes(150000):strip_icc():format(webp)/GettyImages-540532052-018275dbb23241a185697a7081c6fb15.jpg)

%20(1).webp) View all InsightsWhat is the Difference Between Assignment and Novation?Assignment of contracts is a fairly common practice in the business world. In an assignment, the person assigning the contract - the "Assignor" - assigns the benefits of the contract the Assignor holds to a new person (the "Assignee") who takes the benefit of that contract "the Assignee". Some contracts may expressly prohibit assignment and some contracts provide that a contract may not be assigned without the consent of the other party. If a contract has no provision relating to assignment, then the general rule is that it may be assigned, with a few exceptions. 1 Usually, a contractual party will want to ensure that if a contract is assigned, then the Assignee has sufficient skill and financial backing to continue to perform the contract and, if this is the case, it is important to make sure an assignment provision in a contract takes account of that so consent can be withheld if an Assignee does not fulfil those criteria. Critically, in an assignment, the general law states that the Assignee takes the benefit but not the burden of the contract. This means that if the Assignee does not perform the contract, the Assignor remains liable. This can sometimes leave the other contractual party with a remedy if the Assignee is insolvent and does not perform. 2 However, as noted earlier, the best way of dealing with an assignment request is to complete due diligence on the Assignee, since it may be that if you later need to make a demand on the Assignor (particularly if they are a company), the Assignor may no longer be able to meet that demand under the assigned contract if the Asignee fails to perform it. For example, a company selling its business to an Assignee may liquidate following the sale (after paying all creditors at that time and returning a final dividend to shareholders), which makes it very difficult to make any later claim against it if the Assignee does not perform the contract. An assignment is fundamentally different from a novation. In a novation, a new contract is entered into between the new party (the "Novatee") and the other continuing contracting party/parties and the original party (the "Novator") is released from all of their obligations (usually from the date the novation takes effect). For this reason, a novation poses a greater risk to the continuing contract party or parties than an assignment since they have no recourse against the Novator if the Novatee fails to perform the contract. If someone makes a request to you for novation, you should treat the request very seriously. You should consider obtaining consideration for the consent or some form of guarantee and will need to complete very rigorous due diligence on the new party to make sure they can perform the contract. You should also check when you enter into a new contract with anyone that the contract does not allow the other party to novate the contract, particularly without your consent and a rigorous agreed process in place for that consent to allow you to assure yourself the party that takes novation can perform the contract. Assignment and novation can be a tricky area of law. As always, if you have an issue with assignment or novation or encounter an unusual clause in a new contract concerning assignment or novation, you should take legal advice – we are happy to help! For any enquiries contact: Andrew Knight on (09) 306 6730 ( [email protected] ) See our Expertise pages Contract Law ____________________________ 1 Exceptions include "personal" contracts where the particular skill, identity or characteristics of a party are fundamental to the contract. Bare rights of litigation are also not assignable. 2 Note that Section 241 of the Property Law Act 2007 has special provisions in respect of leases that make assignors liable for payment of rent and obligation under the lease, but not for increased obligations the assignee and landlord might agree to on a variation of lease unless the lease provided for that variation. © McVeagh Fleming 2020 This article is published for general information purposes only. Legal content in this article is necessarily of a general nature and should not be relied upon as legal advice. If you require specific legal advice in respect of any legal issue, you should always engage a lawyer to provide that advice. Recent PostsRelated topics, subscribe to receive updates.

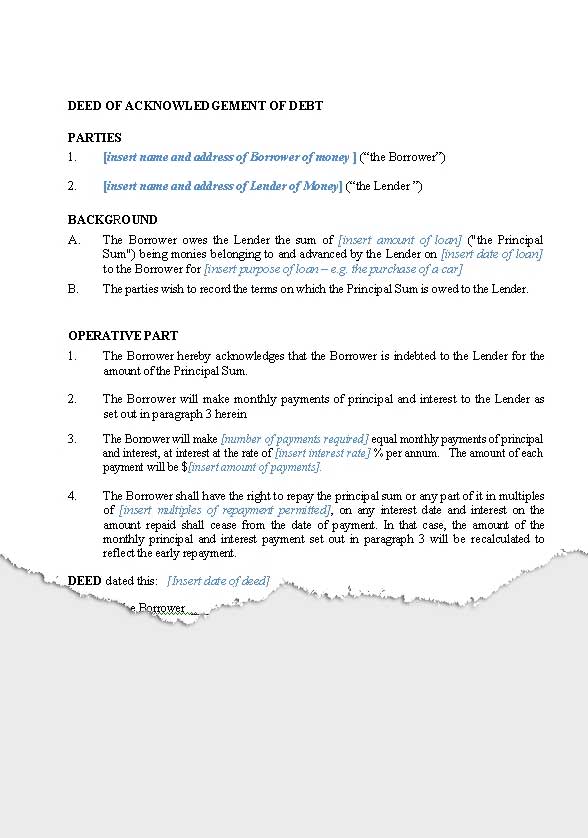

Deed of DebtRecord a loan of money or assets to protect yourself in the future..  A Deed of Debt (also known as a “Deed of Acknowledgement of Debt”) is a great way to formalise a loan of money or assets to another person. A Deed of Debt is particularly useful for recording a loan between parents and children for the purpose of purchasing a home. Get an online Deed of Debt with Agreeable, and you’ll have a strong reference point to return to in the future. Once you’ve filled out our short questionnaire, our Agreeable team can help you edit the Deed to fully reflect your intentions.  How it works → About the Deed → Frequently asked questions → Get started →  How it worksPurchase the deed. Pay only $89 for a customisable loan agreement you can complete yourself. Purchase the Deed → Work through the DeedWork through the Deed document. The Agreeable team is available to answer any questions along the way and to ensure your Deed achieves exactly what you require. Get professional legal adviceOptional: receive professional legal advice on the implications of your Deed. We can arrange a lawyer to assist and advise you. Our fixed price system ensures no financial surprises! Enquire now → 1. Purchase the DeedClick the button below to sign up to our platform, complete the questionnaire and download your Deed: Sign Up To Get Started 2. Work through the DeedOur document creation tool will guide you step-by-step through everything you need to cover. In our experience, it takes fewer than 15 minutes. The staff at Agreeable are only a phone call or email away if any issues or questions arise. 3. Get professional legal adviceOptional: receive professional legal advice on the implications of your Deed if you wish. We can arrange a lawyer for a fixed fee. Enquire now for a fixed fee quote. If you have any questions, please email us or call us on 0800 9 AGREEWhat is a deed of debt. A Deed of Debt is a document for recording a loan from one person to another. The Deed helps make it clear that the person receiving the loan must pay back the money or return the property at a chosen time. The person who loans money or property is called the Creditor, and the person who receives the loan is called the Debtor. Deeds of Debt are particularly useful when someone loans money or property to a trust or where parents help one of their children purchase their first home by loaning them money for their deposit. These types of agreements are most effective when the lending party does not intend to recover interest on the loan. Do I need a Deed of Debt?A Deed of Debt allows parties to document a loan. A Deed of Debt records who is involved, the amount being transferred, whether the loan is interest free, and how the loan is to be repaid. In our experience, a Deed of Debt is an important tool where parents are wanting to help their adult child, often either married or de-facto, purchase a family home. A Deed of Debt will record the loan to the child. The Deed of Debt can then function as an effective record of the loan for any future relationship property or separation agreement between the child and their partner. Where parents help their child purchase a home and the child is in a relationship, we recommend seeking a relationship property agreement to protect that child’s equity (and debt) by reference to the loan from his or her parents.  What are the benefits of a Deed of Debt?If someone refuses to repay money that you have loaned to them, having a valid, enforceable legal document can make recovering a loan easier. Things to keep in mind when getting a Deed of DebtIt is important to ensure that you fully identify the people involved, and who is giving and receiving the loan. The amount to be repaid is also crucial. Anyone entering into a Deed of Debt should always be aware of any tax or financial consequences that may follow (for example, whether interest applies and how it is to be repaid). We recommend that you seek legal and tax advice before entering into a Deed of Debt. Agreeable would be happy to help connect you with a lawyer who could provide that advice. We look forward to working with you!If you’re ready to work some magic and start drafting your own Deed of Debt, get started ! If you have any questions about how the process works, feel free to give us a call on 0800 9 AGREE.

Law Manual Online

Community Law Free Legal Help throughout New Zealand

Home | Browse Topics | Consumer rights & money | Credit and debt | Disputing that you owe a debt

Chapters in this topic Credit and debt

Disputing that you owe a debt

What can I do if I disagree that I owe the money?You should tell the lender or debt collection agency as soon as possible that you dispute the debt and tell them why. Do this in writing and keep a copy of the letter. If the debt is $30,000 or less, you can take a claim to the Disputes Tribunal, where you ask them to make an order that you don’t owe the disputed amount (see: “ The Disputes Tribunal ”). All lenders who use credit contracts must be registered as financial service providers and be members of an approved dispute resolution scheme. Therefore, if the disputed debt arises out of a credit contract, you can complain to the dispute resolution scheme the lender belongs to (see: “ Other legal protections when you get credit ”). If you simply do nothing, the lender might take enforcement action against you. If you dispute the debt, the lender or debt collection agency might:

If you need help, get support from your local budget advice service (see: “ Where to go for more support ” at the bottom of this page). Did this answer your question? Give us your feedback --> Yes No Where to go for more supportLegal information and support groups Community Law Your local Community Law Centre can provide you with free initial legal advice. Consumer Protection The Consumer Protection website has useful information on a range of consumer topics. Consumer Protection is part of the Ministry of Business, Innovation, and Employment (MBIE). Consumer NZ The Consumer NZ website provides a wide range of information on consumer issues and template letters you can use to write to traders to enforce your rights. Website: www.consumer.org.nz Email: [email protected] Phone: 0800 226 786 (0800 CONSUMER) Commerce Commission The Commerce Commission enforces the laws against misleading and deceptive conduct by traders (the Fair Trading Act) and the consumer credit legislation (the Credit Contracts and Consumer Finance Act). The Commission provides information on these areas on its website. Website: www.comcom.govt.nz Email: [email protected] Phone: 0800 943 600 To make a complaint online: comcom.govt.nz/make-a-complaint Citizens Advice Bureau (CAB) CAB provides free, confidential and independent information and advice. See CAB’s website for valuable information on a range of topics. Website: www.cab.org.nz Phone: 0800 367 222 Facebook: www.facebook.com/citizensadvicenz FinCap and Money Talks FinCap is a non-government organisation providing free financial mentoring services. Website: www.fincap.org.nz Email: [email protected] Phone: 04 471 1420 MoneyTalks is a financial capability helpline operated by FinCap. The Financial Mentors offer free, confidential advice by phone, text, email and live chat. Insolvency and Trustee Service (ITS) The ITS deals with bankruptcies, no-asset procedures, summary instalment orders and some company liquidations. Information about those processes is available on its website. The ITS is part of the Ministry of Business, Innovation and Employment (MBIE). Website: www.insolvency.govt.nz Phone: 0508 INSOLVENCY (0508 467 658) Dispute Resolution Schemes There are four dispute resolution schemes for consumers dealing with lenders and other credit providers. Contact the scheme your service provider has registered with. 1. Financial Services Complaints Website: fscl.org.nz Phone: 0800 347 257 2. Insurance & Financial Services Ombudsman Website: www.ifso.nz Phone: 0800 888 202 3. Banking Ombudsman Website: www.bankomb.org.nz Phone: 0800 805 950 4. Financial Dispute Resolution Service Credit Reporting Your credit record There are three credit reporting companies that operate nationally in New Zealand. To check your record or correct any information, you’ll need to contact them all. You’re entitled to a free copy of your credit record. You should make sure you choose the free option when you contact each company. 1. Centrix – www.centrix.co.nz – 0800 236 874 2. Illion – www.illion.co.nz – 0800 733 707 3. Equifax – www.equifax.co.nz – 0800 698 332 Personal Properties Securities Register (PPSR) Search the PPSR register to see if there is any security interest registered against a vehicle. This can be done for a small fee by registering to check online. Website: www.ppsr.companiesoffice.govt.nz Privacy Commissioner The Privacy Commissioner has information on your rights in relation to credit reporting and how to complain if you feel your rights have been breached. Website: www.privacy.org.nz Email: [email protected] Phone: 0800 803 909 Also available as a bookThe community law manual. The Manual contains over 1000 pages of easy-to-read legal info and comprehensive answers to common legal questions. From ACC to family law, health & disability, jobs, benefits & flats, Tāonga Māori, immigration and refugee law and much more, the Manual covers just about every area of community and personal life. Buy The Community Law Manual Help the manualWe’re a small team that relies on the generosity of all our supporters. You can make a one-off donation or become a supporter by sponsoring the Manual for a community organisation near you. Every contribution helps us to continue updating and improving our legal information, year after year. Donate Become a Supporter Find the Answer to your Legal Question  © Community Law, 2024

Our Local centres - (Overview)

Specialist centres

What happens to your debt when you die?Does your debt disappear when you die, or are your family obliged to pay your debts when you pass away?Generally all of your debt – mortgages, credit card debts and car loans – will need to be paid back when you die. The executor you appoint in your will to act for your estate will sell sufficient of your assets to pay all of your debts. For bank mortgages over your land, the executor of your will uses the assets in your estate to pay off the mortgage. If there is enough money within your estate to pay off the mortgage, the executor may distribute the property which is mortgaged to the beneficiaries of your will , depending on the instructions in your will. A mortgage could also be paid out from proceeds of a life insurance policy. If your estate can’t pay off the mortgage and the beneficiaries can’t afford to do so either, then the executors of your will have to sell the property, pay off the debt using the proceeds of the sale and distribute the balance according to the instructions in your will. Will your executor or beneficiaries have to pay any unpaid debts?Your executor and beneficiaries are not responsible for debts that cannot be paid by your estate. If someone else has co-signed on a credit card debt or loan, they will be liable to pay it off even after your death. ‘Authorised users’ on credit cards are not responsible for paying the card holder’s outstanding debts. If you co-own a property with someone as a “Joint Tenant” rather than as a tenants in common, then the surviving Joint Tenant/s acquire the whole property automatically independent of your will because the property held in joint tenancy does not form part of the estate of the tenant who dies. If my estate can’t pay off my debts, what happens?If there are not enough assets or money in the estate to pay all of your debt, then the remaining debts are not required to be paid by your executor, relatives or beneficiaries. If collection agencies still contact relatives about paying these debts, they should consult a lawyer. If you have a question regarding what could happen with your own estate, or are working through the estate of a relative, please contact our estates team for further information and advice. Our thanks to Tony Savage for writing this article RELATED SERVICESRelationship & family property. Make sure your personal matters are in order. More Info Wills, estates & life planningPlan ahead to take care of yourself and your loved ones. More Info RELATED PEOPLE Andrew EasterbrookOffice: Whangarei Read Full Bio  Vanessa Crosby Patrick SteuartOffice: Warkworth  Chloe DavenportOffice: Kerikeri View our Wills, Estates & Life Planning team RELATED ARTICLESWhere there’s a will, there’s peace of mind, keep the diy on the deck this summer, when should a gift really be a loan (and the paper more than just wrapping).

Assigning A Lease – How A Deed Of Assignment WorksWhen you’re entering or leaving a business premise as a tenant in New Zealand, it’s crucial to check if you need to transfer a lease. In other words, if the ownership of the business is changing, you need to make this official with your tenant. This is known as ‘assigning a lease’ or ‘transferring a lease’. It occurs when you’re selling your business and the buyer agrees to be bound by the existing lease, or you’ve decided to move premises and have found another business willing to take over your current lease. Essentially, when you assign your lease, you’ll be handing over the rights and obligations of that lease to another party . It’s important to ensure you’re not left liable for any part of the old lease! This is also known as a Deed of Assignment , which we’ve written about in more detail here . The Process Of Transferring A LeaseTransferring a lease in New Zealand doesn’t have to be a complicated process. Let’s simplify it. 1. Review The Existing LeaseFirstly, you’ll need to check that there aren’t any conditions in the lease that would prevent it from being transferred. Review the terms of your lease carefully, and consider consulting a lawyer to assist with this step! 2. Landlord’s ConsentOnce you’ve confirmed that the lease can be assigned, you’ll need the landlord’s written consent and understand any requirements for the transfer. Each landlord may have different stipulations, so clear communication is key. 3. Discuss The AssigneeNext, discuss with your landlord who will be taking over the lease, known as the incoming tenant. Gather their name, contact details, and any relevant documents needed for the transfer, such as evidence of their financial standing or business experience. Following this, the landlord confirms their consent to the transfer, and the incoming tenant agrees to it. This is formalised in a Deed of Consent to Assignment . The assignee will then agree to take on the rights under the existing lease from a specified date until the lease term concludes. All parties should review the terms of the Agreement to ensure they are satisfied with their obligations and the rights or interests they will hold in the lease. I’m The Outgoing Tenant – What Else Should I Do?With the landlord’s consent in place, you can proceed with creating a Deed of Transfer of Lease. This document will officially release you from any responsibilities or liabilities under the lease. However, until this is formalised, continue to fulfil your lease obligations. Retail LeasesIf you’re transferring a retail lease, the steps you need to take in New Zealand may differ. It’s advisable to review the Commercial Tenancies Act 1991 , which governs retail leases. Considerations may include:

Understanding your rights and obligations under the type of lease you hold is essential. More information about transferring leases can be found here . If you need a lease drafted or reviewed, we’re here to assist! Contact our friendly team on 0800 002 184 or [email protected] for a free, no-obligation consultation about your specific situation and the legal documents that suit your needs. We're an online legal provider operating in New Zealand, Australia and the UK. Our team services New Zealand companies and works remotely from all around the world. We'll get back to you within 1 business day.

Related ServicesDeed of assignment/transfer of lease, deed of assignment of contract, deed of assignment/transfer of lease review, ip assignment deed, deed of accession.

Download our Top 3 Legal Mistakes guide.  Book in a free consultation with us to discuss your legal needs. You're visiting Sprintlaw . Would you like to switch to Sprintlaw ?

Debt recovery and enforcement methods - What options do you have if a customer fails to pay their bills?Do you need help in recovering a debt clients often ask what options they have to recovery money owed by an individual or a business. this article outlines what options are available to you if you need to recover a debt..  If a company, other entity or person owes you money, you are creditor. The person owing you the money is a debtor. As a creditor, whether you are a business or an individual, there are various legal remedies available to you for recovering a debt owing to you where a debtor cannot or will not pay. Before you can exercise any remedies, you must establish that you have a claim against the debtor. For example, you must be able to show that there was an agreement between the parties to supply a service or a product in return for a payment of those services or products. Where the amount in claim is ascertained during the formation of the contract, this is considered a claim in liquidated damages. Alternatively, you may have an unliquidated claim for damages. For example, you may have a claim in contract for lost profits as a result of a breach of contract. In this circumstance, the amount owing cannot be ascertained by a simple calculation, and a judicial hearing is usually required. It is not uncommon, where a debtor fails to pay, for a creditor to have sent reminder letters and final warning notices putting the debtor on notice that they will take further action, but what happens next if the debtor ignores these notices, refuses to pay or denies it owes the debt? Starting Point Demand Letter Where a debtor owes you money, a good place to start is by formally demanding payment by way of a demand letter. A demand letter will briefly set out why you are entitled to payment and demand payment to be made by a certain date. A well composed demand letter may prompt a response and sometimes a settlement proposal, as a debtor may perceive that you are prepared to take the matter further and that the debtor may incur further legal costs if they do not pay what they owe. If the debtor disputes the debt after receiving the demand, this may assist you in making a decision about what method of recovery to use. Statutory Demand If the debtor is a company, a legal demand in the form of a “statutory demand” may be issued against the debtor company. The requirements for a statutory demand are set out in section 289 of the Companies Act 1993. A statutory demand must be in writing and served on a company where there is no dispute over the debt and the debt is greater than $1,000. A statutory demand is a useful tool in a creditor’s arsenal and may prompt payment from a debtor. However, a statutory demand is intended to be the first step in putting a company into liquidation and should be used to prove insolvency of a company rather than as a means to collect outstanding money. The use of statutory demands are a common and effective way of prompting payment from a debtor, but proper care must be exercised to ensure that it is issued and served in accordance with the requirements of the Companies Act 1993. Commencing Proceedings If a demand letter or a statutory demand does not prompt payment or settlement discussions, you will need to consider whether to seek judgment against a debtor by issuing proceedings in the appropriate forum. There are three potential forums in which you can seek judgment: the Disputes Tribunal, the District Court and the High Court. Before issuing proceedings, you will need to consider the implications, such as costs to do so and the ability of the debtor to satisfy the judgment (that is, does the debtor have any assets to pay the debt?) Alternatively, you may decide that issuing proceedings is the best way to put pressure on the debtor to pay, to avoid the further cost of litigation, the stigma of having a judgment against the debtor’s name and the impending threat of bankruptcy or liquidation. Disputes Tribunal Where the debt is disputed (and only when it is disputed), legal action can be taken to recover a debt in the Disputes Tribunal. The Disputes Tribunal hears claims up to the value of $30,000. The Tribunal offers a more informal setting with Referees presiding as decision makers rather than Judges. Parties must represent themselves and cannot be represented by lawyers at the Tribunal. However, lawyers may assist with applications to the Tribunal and with preparation for the hearing. Just like a Court Order, a decision made by Referee is called an “Order” and it will set out what the parties need to do and when it must be done. A Tribunal Order is legally binding and must be followed. District Court and High Court Proceedings A District Court has the jurisdiction to determine any proceeding where the debt is not more than $350,000. Any proceeding in respect of a debt in excess of $350,000 must be commenced in the High Court. The High Court also determines bankruptcy and liquidation proceedings. To recover debts through the District Court, general proceedings are commenced by filing a statement of claim, notice of proceeding and a list of documents relied on. The person commencing the proceedings is the plaintiff. Once these documents are filed with the Court, they are served on the other party (known as the defendant) who has 25 working days to file a statement of defence. If a statement of defence is not filed, and where the claim is for unliquidated damages, the plaintiff may apply for a judgment by default. There are other applications that may be made to the District Court, for example, an interlocutory application for summary judgment. This can be used as a “fast-track” approach for obtaining a judgment without the need for a trial. A summary judgment application is made in instances where the plaintiff asks the Court to grant judgment without trial because the defendant has no lawful defence. Time limits There are limits on how long you have to issue proceedings after the relevant event or debt arose. Generally, you must bring a claim within six years from the time of the event that the claim is based on. There are some exceptions to this rule and these are set out in the Limitation Act 2010. Enforcing the Judgment Once you have successfully obtained a judgment, you can apply for an order to enforce the judgment. The different methods of enforcement in the District Court include:

Warrant to seize property

Where it is unknown what assets the debtor holds, a financial assessment hearing is usually used as a first step to establish the debtor’s financial circumstances. At a financial assessment hearing, the debtor must make a declaration under oath outlining exactly what assets and debts they have, what they earn and the amount they can pay in instalments to repay the debt. Where the debtor is a company, then the relevant company officer is required to attend. You can also attend to examine and question the debtor on their finances. During a financial assessment hearing, a Court may also make an attachment order to enforce a judgment. If a debtor fails to attend, a warrant for their arrest may be issued. Attachment order An attachment order is designed to secure your right to the debtor’s earnings by requiring their employer to deduct money directly from the debtor’s salary or wages. Deductions can also be made from pensions, WINZ benefits and ACC payments. However, no more than 40% of the debtor’s net income can be deducted and both parties need to agree on how much can be deducted and how frequently the payments will be made. Charging orders You may also be able to obtain a charging order against the debtor’s assets (for example, land or personal property) which prevents the debtor from disposing of the assets that are identified in the order, until the debtor pays the judgment. A charging order operates as a “stop order”, preventing or restricting a debtor from dealing with or selling property. If the debtor owns land, a charging order allows for a caveat to be lodged against the title. A warrant to seize property enables a bailiff appointed by the Court to enter the premises of a debtor to seize their money or goods. The goods seized may then be sold to satisfy the judgment. The bailiff is authorized to seize goods of the debtor except for their:

If, after seizure and the debtor has not paid within five working days, the bailiff may sell the goods at public auction and the proceeds of the sale will be paid towards the judgment sum owing. A bailiff can also immobilise any motor vehicle belonging to the debtor, pending payment of the debt. This procedure is only available in the High Court. However, you may be able to apply to have a judgment transferred from the District Court to the High Court. As with a warrant to seize property, a sale order authorizes a bailiff to seize and sell property, and there are similar limitations to what can be sold, that is, a debtor is entitled to keep tools of trade and necessary household furniture. Garnishee Order A garnishee order enables you to recover the judgment sum from any debts owing to the judgment debtor by a third party. The court can make a garnishee order requiring the third party to pay money directly to you, for example, a bank may be ordered to pay money directly to you if there is money held in a debtor’s bank account. You may become aware of the debt owed by a third party at a financial assessment hearing, this is why a financial assessment hearing may be a useful first step to ascertain the debtor’s financial position. This article is only intended to provide a brief overview of the procedure for pursuing claims and enforcing judgments in the respective jurisdictions. Drafting court documents and appearing in court can be a complex, time consuming and confusing exercise for those not familiar with court processes. It is advisable (and often cost effective) to consult your legal advisor for advice before deciding what debt recovery option to take. If you are successful, costs such as legal fees and disbursements (filing fees and service fees) may be awarded against the unsuccessful party so that can help you cover the costs of obtaining legal advice. If you have any queries about your debt recovery or enforcement options, please contact one of our team for advice. This article is current as at the date of publication and is only intended to provide general comments about the law. Harkness Henry accepts no responsibility for reliance by any person or organisation on the content of the article. Please contact the author of the article if you require specific advice about how the law applies to you. For further information Sarah RawcliffeRelated posts.

Buy Self-help legal documents Deed of assignment of debt Deed of assignment of debtA deed of assignment is used to transfer the right to be paid a debt from one person to another. Complies with relevant New Zealand legislation.  Not Legal Advice Disclaimer: Nothing on this website constitutes legal advice. HowToLaw is not a law firm and provides legal information for educational purposes only. For legal advice, you should consult a lawyer. © 2024 How To Law | Website by eDIY Reload CartPlease login or order as a new customer. Please login using your existing account New customerWhen you've finished you'll have the option to create a password which will allow you to save your details and make your future purchases even faster. Confirm Log OutForm submitted. Please login to your account Please type your e-mail and we will send you a password reset link Member LoginYou'll have the option to register as a member which will save your details and make your future purchases even faster. Register an account.

Our Services

Assigning or subleasing – what is the difference?The terms assigning and subleasing are often used in a commercial leasing context, to refer to when a tenant transfers their rights under a commercial lease to another party. Assigning a LeaseA tenant may want to sell their business or move to other premises, but if their lease has not come up for expiry yet, they will not be able to terminate it. Instead, they might need to assign their lease to the party who buys the business, or to a new tenant. Landlord’s consentAssigning a lease requires the landlord’s written consent. A landlord is likely to want to know (and is entitled to know) all about the new tenant including their financial situation, the nature of their business, and conduct reference checks. Although they can conduct thorough due diligence on a prospective tenant, the landlord cannot unreasonably withhold their consent, nor can they ask for any extra payment in order to give their consent. To formalise the assignment, a written Deed of Assignment of Lease needs to be completed and signed by all parties including the landlord. Original tenant’s liabilityOn a day-to-day basis the new tenant takes on all of the lease obligations. However, the original tenant (and any guarantors to the lease) will remain liable under the terms of the lease until such time as it is terminated, varied, or renewed beyond the original renewal rights. This means that should the new tenant fail to meet any of their obligations (for example if they get behind in their rent payments), the landlord could come after the original tenant and/or their guarantors. A sublease differs from an assignment of lease in that the original tenant (the “head tenant”) continues to be responsible for all of the lease obligations, but a subtenant is occupying the premises and paying a contribution towards the rent. Subleasing is common where a head tenant is not using all of their leased premises, and wants to make some additional money by subleasing a portion of the leased premises to a third party without giving up their own lease (the “head lease”) altogether. By way of a Deed of Sublease, a subtenant agrees to pay rent for part of the premises, often a specific portion of a total area marked out on a floor plan, directly to the head tenant. A head lease will often specify that the landlord’s consent to a sublease is needed. If the subtenant is going to use the premises for a business use that differs from the head tenant’s as recorded in the head lease, then that new use must be disclosed to the landlord as part of obtaining their consent, and recorded in the Deed of Sublease as a variation of the head lease terms. Head tenant’s liabilityThe head tenant remains liable to the landlord for the entire premises, even if a portion of that has been subleased. The subtenant must comply with the terms of the head lease as well as their own sublease arrangement, so it is essential that they receive a copy of the head lease at the outset. A subtenant should not sign a subleasing agreement without having reviewed the head lease first, otherwise they may find themselves with obligations they cannot fulfill. Alan Knowsley Partner Wellington You are here:  If you are a New Zealand Super Gold Card Holder (Australian Senior Cards do not qualify) we will give you a 75% discount of the fee for one of our set fee 1 hour initial consultations. We will also give you a 17.5% discount off the first matter we handle for you and then 12.5% off any subsequent matters for you. These discounts relate to your personal matters only (i.e. not business, trust or organisational matters or the sale and purchase of investment properties). To receive the discount please let us know if you are a New Zealand Super Gold Card Holder. Your Resources Terms & Conditions Privacy Policy Our team of lawyers is comprised of a wide range of experienced and skilled barristers and solicitors, meaning we have experts in nearly all legal fields. We provide legal representation/advice in fields such as:

Our firm is a proud member of NZ Law Limited, a leading nationwide network of law firms who share knowledge and legal resources, which assists us to continue to develop the quality of our services. Rainey Collins Lawyers is one of New Zealand's top law firms comprised of a wide range of experienced and skilled barristers and solicitors, making us experts in nearly all legal fields. We provide litigation, legal representation and advice in fields such as employment law, buying and selling properties, setting up a family trust, commercial law, property law, Māori land, family law, relationship property, body corporates and construction. In addition to these legal services, we also provide highly efficient debt collection New Zealand wide for clients from large companies right through to small businesses and individuals. Based in New Zealand's capital, our firm has a prime position in taking on cases not only from Wellington, but from all over Aotearoa, having helped a wide range of clients for over 100 years. Level 19 113-119 The Terrace Wellington Phone: 04 473 6850 Email: [email protected]  Copyright © Rainey Collins Lawyers, 2015 | Designed by Expert and Powered by MoST Infrastructure Platform

Debt management plans and proposalsCombine your debts into a debt management plan. You may be able to combine all your debts into what's called a Debt Management Plan or Creditors’ Pool. You make repayments into this plan, and your creditors are paid from it. Your local Budget Advisory Service or Community Law Office can help you do this, or you could talk to someone like a lawyer, accountant, or insolvency specialist. Enter into a proposalA proposal is a formal agreement between you and your creditors about how and when they'll be paid. It needs to be approved by the court, but you don't have to involve the Official Assignee (unlike the formal insolvency options). Once it's approved, the creditors included in it can't chase you for their debts without the court’s permission. You'll need help from a lawyer or accountant to draft the agreement. Once your creditors have agreed to it, you'll need to have it approved by the court. If your creditors won't negotiate or you can't reach an agreementConsider a debt management plan or a proposal. Please click on the document category to access the documents below it.Partnerships.

Loan Agreements

Distribution

Confidentiality Agreements

Nominations & Assignments

Service Agreements

Sale Contracts

Non Competition/Restraints

Business Information LegalDocuments.co.nz is not a law firm and that you are not receiving any legal advice through this site. The use of any information, agreement, Document or user guide on this site does not create a lawyer client relationship of any kind between the user of the form and us, or any employee or person associated with us. Loan agreements

Nominations & Assignments

Power of Attorney

Personal Agreementswe will be releasing other Not for Profit soon Charitable Trust

Not for Profit Agreements

Wills and Trusts Can't find it?Search for it here. If you still can't find what you're looking for then contact us.  Over 20 years of legal experienceAll documents, forms, contracts, and agreements are prepared according to New Zealand law by accredited New Zealand lawyers. Document PreviewClick the images below to preview a document. All documents come with a user guide which includes an overview, practical tips, and step by step document instructions. PLEASE NOTE:Once you have purchased your document through paypal you will be redirected back to this website to the download link . you will also receive an email with your receipt and the download link. if you don't receive the email then please check your spam folder ., latest articles.

Personal – Loan Agreements LegalDocuments.co.nz is not a law firm and you are not receiving any legal advice through this site. The use of any information, agreement, document or user guide on this site does not create a lawyer client relationship of any kind between the user of the form and us, or any employee or person associated with us.

|

IMAGES

VIDEO

COMMENTS

Debt buying is an arrangement where a debt is purchased from the original creditor by a debt buyer for a percentage of the face value of the debt, based on the potential collectability of the debt. From a legal perspective, sale of debt is achieved through an assignment. The assignment of debt. The idea that a contractual right cannot be ...

Assigning debts and other contractual claims - not as easy as first thought. Harking back to law school, we had a thirst for new black letter law. Section 136 of the Law of the Property Act 1925 kindly obliged. This lays down the conditions which need to be satisfied for an effective legal assignment of a chose in action (such as a debt).

Assignment is the process where you, the assignor, transfer the rights and benefits under a contract to a new person, the assignee. You need to formalise this process in writing in some way, and you can use a deed of assignment to fulfil this requirement. There are a variety of situations you can use a deed of assignment in, so it is important ...

Transfer of debt. 29.00. A deed that provides for one person to take over a debt owed by another, with the consent of the creditor, so that the debtor/ creditor relationship is replaced and the debt is owing between the creditor and replacement debtor. Complies with relevant New Zealand legislation.

Payment of all or part of the debt to the assignor by a debtor who does not have actual notice of the assignment discharges the debtor to the extent of the payment. (3) The debt owing by a debtor who has actual notice of the assignment is payable to the assignee.

How to recover debt from a bankrupt within New Zealand Introduction. If a person who owes you money (a debtor) is adjudicated bankrupt under the NZ INSOLVENCY ACT 1967, you will need to work in conjunction with the Official Assignee to attempt to recover the money owed.It is the Official Assignee's role to sell the assets of the bankrupt estate and distribute the proceeds to the bankrupt's ...

With an assignment, the Assignee (the new creditor) pays the Assignor (the original creditor) for the Debt. The Assignor confirms the debt is current and enforceable. This can be useful to transfer debts amongst different entities, or persons, so one entity buys out a debt owed to another and can collect it in the future as it falls due.

Introduction. These Guidelines have been compiled by the Property Law Section of the New Zealand Law Society and replace the Property Transactions and E-Dealing Practice Guidelines published in July 2012 and updated in April 2015. The Guidelines have been endorsed by the Board of the New Zealand Law Society on 17 October 2019 and came into ...

Assigning Contracts. It is common for people to agree to an "assignment" a contract. However, at law, an "assignment" can only transfer the benefit of a contract and not the burden. The common use of the term "assignment" in these circumstances is not correct. A contractual benefit, such as a right to receive payment of a debt, can ...

The priority of an assignment to which subsection (1) applies and which is not given for valuable consideration is to be determined as if the assignment had been given for valuable consideration. (5) A legal or equitable thing in action is to be treated as having been assigned in equity (whether the assignment is oral or in writing) if—

About civil debt. About Civil Debt. When the court makes a decision about a private disagreement over money or property, it becomes a civil debt. The court decision is known as an order or judgment and tells one party (the debtor) that they must pay the other (the creditor). Creditors can ask the court to help them collect the debt if the ...

Debt Assignment: A transfer of debt, and all the rights and obligations associated with it, from a creditor to a third party . Debt assignment may occur with both individual debts and business ...

Assignment and novation can be a tricky area of law. As always, if you have an issue with assignment or novation or encounter an unusual clause in a new contract concerning assignment or novation, you should take legal advice - we are happy to help! For any enquiries contact: Andrew Knight on (09) 306 6730 ([email protected])

A Deed of Debt (also known as a "Deed of Acknowledgement of Debt") is a great way to formalise a loan of money or assets to another person. A Deed of Debt is particularly useful for recording a loan between parents and children for the purpose of purchasing a home. Get an online Deed of Debt with Agreeable, and you'll have a strong ...

Do this in writing and keep a copy of the letter. If the debt is $30,000 or less, you can take a claim to the Disputes Tribunal, where you ask them to make an order that you don't owe the disputed amount (see: " The Disputes Tribunal "). All lenders who use credit contracts must be registered as financial service providers and be members ...

Generally all of your debt - mortgages, credit card debts and car loans - will need to be paid back when you die. The executor you appoint in your will to act for your estate will sell sufficient of your assets to pay all of your debts. For bank mortgages over your land, the executor of your will uses the assets in your estate to pay off ...