Impossible to find just got easier

Industry leading turn-around times, document delivery.

We can be your primary or supplementary research team.

HAVE QUESTIONS?

Our frequently asked questions page may have the quick answer you’re looking for.

WHO IS TRI?

Founded in 1997, we have built a large network of global research specialists.

WE DIG DEEPER.

Obscure subject? Unsure which research tools are needed? Challenging project design? For more than 25 years, our researchers have been the “design/build” business and market research experts for more than 1,800 companies throughout the world. We have earned recognition for our vertically integrated approach, selecting and combining appropriate tools and methods to provide very specific data to R&D groups, law firms, marketers, the merger and acquisition industry, entrepreneurs and a wide range of other business professionals.

- 25+ YEARS IN BUSINESS

- 50x FASTER THAN IN-HOUSE

- NETWORK OF OVER 75 WORLDWIDE SOURCES

- 100% CUSTOMER SATISFACTION

OUR LEADERSHIP

AMANDA PHIPPS

KATE VRANICH

SANDY COVITCH

Testimonials, let's get started..

- Find a Branch

- Schwab Brokerage 800-435-4000

- Schwab Password Reset 800-780-2755

- Schwab Bank 888-403-9000

- Schwab Intelligent Portfolios® 855-694-5208

- Schwab Trading Services 888-245-6864

- Workplace Retirement Plans 800-724-7526

... More ways to contact Schwab

Chat

- Schwab International

- Schwab Advisor Services™

- Schwab Intelligent Portfolios®

- Schwab Alliance

- Schwab Charitable™

- Retirement Plan Center

- Equity Awards Center®

- Learning Quest® 529

- Mortgage & HELOC

- Charles Schwab Investment Management (CSIM)

- Portfolio Management Services

- Open an Account

Our award-winning investment research can help you make informed investment decisions.

- In-depth investment research from third-party providers and Schwab experts

- Specialized tools, support, and solutions for investors

Access stock market research with timely, fact-based insights from Schwab and leading independent providers.

Indices - View the latest movements of the most popular domestic and international indices, or dive in for a closer look.

Sectors & industries - See how sectors are trending at a glance with heat maps based on your chosen time frame.

Breaking news - See the latest headlines to help you stay on top of the markets.

Schwab insights and commentary - Receive timely market and economic analysis from our specialists so you can make more informed investing decisions. View our latest market insights .

Market reports - Get a balanced perspective with premium, independent research from third-party firms, including Morningstar ® and Argus. See a sample report .

Find and analyze possible opportunities with investment research tools that help you filter out the noise.

These convenient features can help you quickly find potential trade opportunities.

Schwab Stock List™

These lists offer a convenient way to find top-ranked companies based on factors like Analyst Ratings, Price Performance, and more.

Select Lists

ETFs and mutual funds on our Select Lists have been screened to provide a basic standard of liquidity, viability, and structural stability to help you make more informed investing decisions.

Use pre-defined screens or customize your own to find trade candidates that fit your criteria.

Once you have a trade idea in mind, these easy-to-use and customizable tools can help you conduct detailed analysis on a wide range of data and information.

Analyze price movement, volume, and more with interactive price charts and an array of overlaid indicators and comparisons.

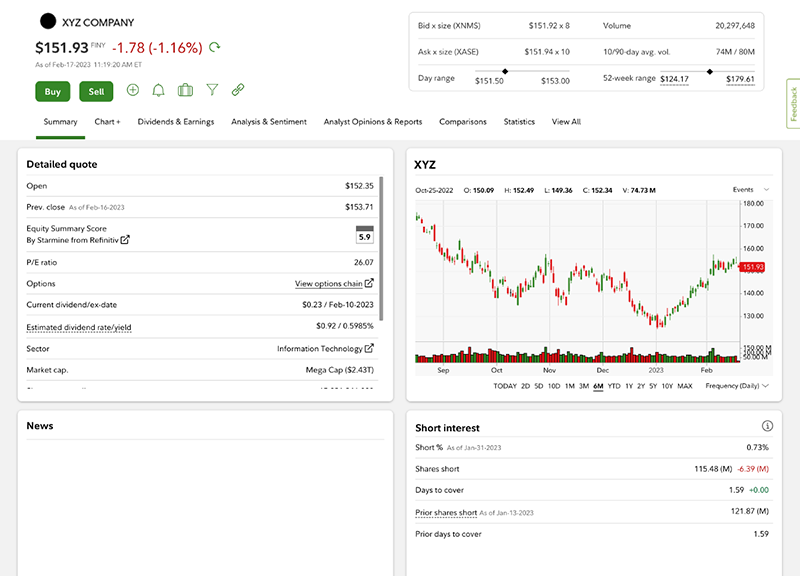

Access the latest pricing information, historical performance data, and other critical financial metrics of any potential trade or investment, such as dividends, expected earnings, and more.

Access data-driven resources and support to help inform your decisions.

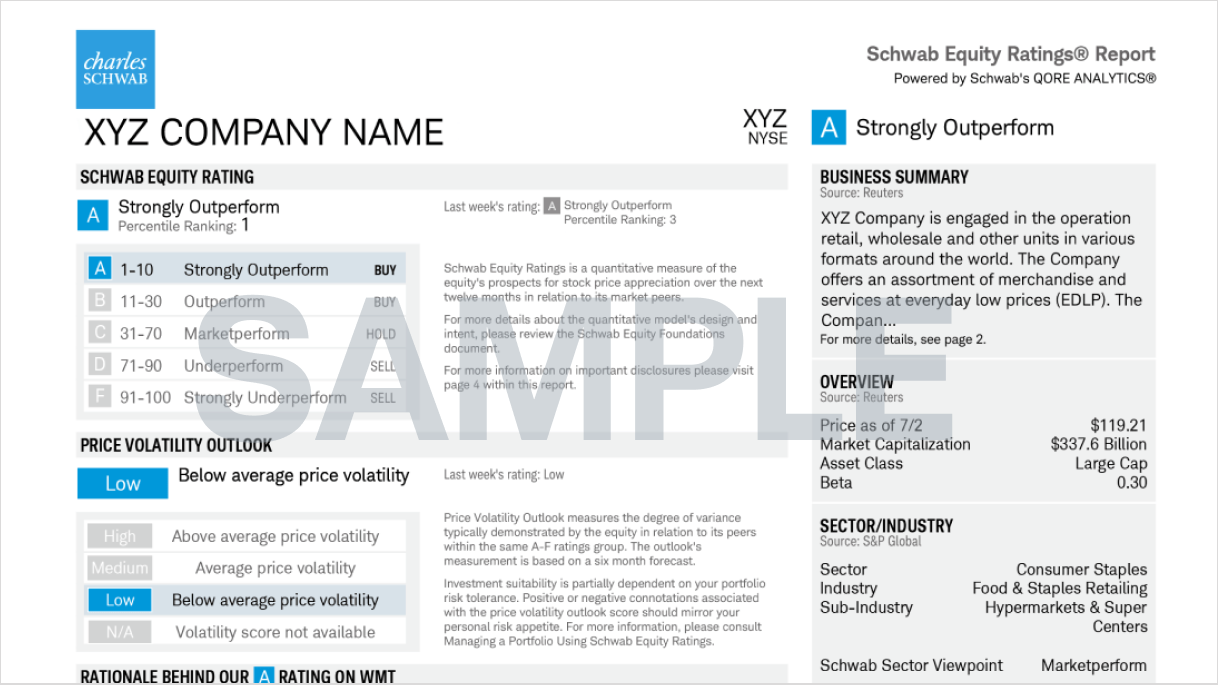

Schwab Equity Ratings®

Schwab assigns an A–F grade to approximately 3,000 U.S.-traded stocks to provide you with a quick assessment of our 12-month outlook.

Live, personalized support

Talk one-on-one with experienced trading specialists who share your passion for trading.

Continue your trading and investing journey.

Preview our research tools, learn about trading stocks, explore our investment products, have more questions we're here to help., morningstar.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Stock Research: How to Do Your Due Diligence in 4 Steps

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Stock research involves investigating a company's financials, leadership team and competition to figure out if you want to invest.

When doing stock research, it's helpful to know terms such as revenue, earnings per share and price-earnings ratio.

A good stock research site can help you find lots of information quickly and may even offer stock analysis.

Stock research is a lot like shopping for a car. You can base a decision solely on technical specs, but it’s also important to consider how the ride feels on the road, the manufacturer’s reputation and whether the color of the interior will camouflage dog hair.

What is stock research?

Stock research is a method of analyzing stocks based on factors such as the company’s financials, leadership team and competition. Stock research helps investors evaluate a stock and decide whether it deserves a spot in their portfolio.

» Looking for a lesson in how to buy stocks instead? We have a full guide to that here .

| Charles Schwab | Robinhood | Interactive Brokers IBKR Lite |

|---|---|---|

| 4.9 | 4.3 | 5.0 |

| $0 per online equity trade | $0 per trade | $0 per trade |

| $0 | $0 | $0 |

| None no promotion available at this time | 1 Free Stock after linking your bank account (stock value range $5.00-$200) | None no promotion available at this time |

4 steps to research stocks

One note before we dive in: Stocks are considered long-term investments because they carry quite a bit of risk; you need time to weather any ups and downs and benefit from long-term gains. That means investing in stocks is best for money you won't need in at least the next five years. (Elsewhere we outline better options for short-term savings .)

1. Gather your stock research materials

Start by reviewing the company's financials. This is called quantitative research, and it begins with pulling together a few documents that companies are required to file with the U.S. Securities and Exchange Commission (SEC):

Form 10-K: An annual report that includes key financial statements that have been independently audited. Here you can review a company’s balance sheet, its sources of income and how it handles its cash, and its revenues and expenses.

Form 10-Q: A quarterly update on operations and financial results.

Best stock research websites

The SEC’s Electronic Data Gathering, Analysis and Retrieval (EDGAR) website provides a searchable database of the forms named above. It’s a valuable resource for learning how to research stocks.

Short on time? You’ll find highlights from the above filings and important financial ratios on your brokerage firm ’s website or on major financial news websites. (If you don't have a brokerage account, here's how to open one .) This information will help you compare a company’s performance against other candidates for your investment dollars.

» View our picks: The best online brokers for stock trading

2. Narrow your focus

These financial reports contain a ton of numbers and it's easy to get bogged down. Zero in on the following line items to become familiar with the measurable inner workings of a company:

Revenue: This is the amount of money a company brought in during the specified period. It’s the first thing you’ll see on the income statement, which is why it’s often referred to as the “top line.” Sometimes revenue is broken down into “operating revenue” and “nonoperating revenue.” Operating revenue is most telling because it’s generated from the company’s core business. Nonoperating revenue often comes from one-time business activities, such as selling an asset.

Net income: This “bottom line” figure — so called because it’s listed at the end of the income statement — is the total amount of money a company has made after operating expenses, taxes and depreciation are subtracted from revenue. Revenue is the equivalent of your gross salary, and net income is comparable to what’s left over after you’ve paid taxes and living expenses.

Earnings and earnings per share (EPS). When you divide earnings by the number of shares available to trade, you get earnings per share. This number shows a company’s profitability on a per-share basis, which makes it easier to compare with other companies. When you see earnings per share followed by “(ttm)” that refers to the “trailing twelve months.”

Earnings is far from a perfect financial measurement because it doesn’t tell you how — or how efficiently — the company uses its capital. Some companies take those earnings and reinvest them in the business. Others pay them out to shareholders in the form of dividends.

Price-earnings ratio (P/E): Dividing a company’s current stock price by its earnings per share — usually over the last 12 months — gives you a company’s trailing P/E ratio . Dividing the stock price by forecasted earnings from Wall Street analysts gives you the forward P/E. This measure of a stock’s value tells you how much investors are willing to pay to receive $1 of the company’s current earnings.

Keep in mind that the P/E ratio is derived from the potentially flawed earnings per share calculation, and analyst estimates are notoriously focused on the short term. Therefore it’s not a reliable stand-alone metric.

Return on equity (ROE) and return on assets (ROA): Return on equity reveals, in percentage terms, how much profit a company generates with each dollar shareholders have invested. The equity is shareholder equity. Return on assets shows what percentage of its profits the company generates with each dollar of its assets. Each is derived from dividing a company’s annual net income by one of those measures. These percentages also tell you something about how efficient the company is at generating profits.

Here again, beware of the gotchas. A company can artificially boost return on equity by buying back shares to reduce the shareholder equity denominator. Similarly, taking on more debt — say, loans to increase inventory or finance property — increases the amount in assets used to calculate return on assets.

» Want to make sense of stock charts? Learn how to read stock charts and interpret data

3. Turn to qualitative stock research

If quantitative stock research reveals the black-and-white financials of a company’s story, qualitative stock research provides the technicolor details that give you a truer picture of its operations and prospects.

Warren Buffett famously said: “Buy into a company because you want to own it, not because you want the stock to go up.” That’s because when you buy stocks, you purchase a personal stake in a business.

Here are some questions to help you screen your potential business partners:

How does the company make money? Sometimes it’s obvious, such as a clothing retailer whose main business is selling clothes. Sometimes it’s not, such as a fast-food company that derives most of its revenue from selling franchises or an electronics firm that relies on providing consumer financing for growth. A good rule of thumb that’s served Buffett well: Invest in common-sense companies that you truly understand.

Does this company have a competitive advantage? Look for something about the business that makes it difficult to imitate, equal or eclipse. This could be its brand, business model, ability to innovate, research capabilities, patent ownership, operational excellence or superior distribution capabilities, to name a few. The harder it is for competitors to breach the company’s moat, the stronger the competitive advantage.

How good is the management team? A company is only as good as its leaders’ ability to plot a course and steer the enterprise. You can find out a lot about management by reading their words in the transcripts of company conference calls and annual reports. Also research the company’s board of directors, the people representing shareholders in the boardroom. Be wary of boards comprised mainly of company insiders. You want to see a healthy number of independent thinkers who can objectively assess management’s actions.

What could go wrong ? We’re not talking about developments that might affect the company’s stock price in the short-term, but fundamental changes that affect a business’s ability to grow over many years. Identify potential red flags using “what if” scenarios: An important patent expires; the CEO’s successor starts taking the business in a different direction; a viable competitor emerges; new technology usurps the company’s product or service.

4. Put your stock research into context

As you can see, there are endless metrics and ratios investors can use to assess a company’s general financial health and calculate the intrinsic value of its stock. But looking solely at a company's revenue or income from a single year or the management team's most recent decisions paints an incomplete picture.

Before you buy any stock, you want to build a well-informed narrative about the company and what factors make it worthy of a long-term partnership. And to do that, context is key.

For long-term context, pull back the lens of your research to look at historical data. This will give you insight into the company's resilience during tough times, reactions to challenges, and ability to improve its performance and deliver shareholder value over time.

Then look at how the company fits into the big picture by comparing the numbers and key ratios above to industry averages and other companies in the same or similar business. Many brokers offer research tools on their websites. The easiest way to make these comparisons is by using your broker's educational tools, such as a stock screener. (Learn how to use a stock screener .) There are also several free stock screeners available online.

The bottom line on how to research stocks

Stock research is just a matter of gathering the right materials from the right websites, looking at some key numbers (quantitative stock research), asking some important questions (qualitative stock research) and looking at how a company compares to its industry peers — as well as how it compares to itself in years past.

Following these four steps can help you gain a deeper understanding of how to research stocks.

Colloquially, yes — "due diligence" or "DD" is a synonym for stock research.

Some professional investors, such as financial advisors, have a duty to act in their clients' best interest and are legally required take care, or exercise "due diligence," to not harm them financially — for example, by thoroughly researching an investment before buying it on behalf of a client.

Paid subscriptions and tools may streamline the research process, and may have more obscure types of stock data that aren't easy to find for free. But all of the types of data we've discussed in this article, such as SEC filings and valuation metrics, are available for free on websites such as EDGAR and Yahoo Finance .

Some professional investors, such as

financial advisors,

have a duty to act in their clients' best interest and are legally required take care, or exercise "due diligence," to not harm them financially — for example, by thoroughly researching an investment before buying it on behalf of a client.

Paid subscriptions and tools may streamline the research process, and may have more obscure types of stock data that aren't easy to find for free. But all of the types of data we've discussed in this article, such as SEC filings and valuation metrics, are available for free on websites such as

Yahoo Finance

More reading for active investors

Stock Market Outlook

Short Selling: 5 Steps to Shorting a Stock

» Who offers the best research? View our list of the best online brokers for beginners .

On a similar note...

Find a better broker

View NerdWallet's picks for the best brokers.

on Robinhood's website

Get a professional review of your investment strategy and unlimited access to a Certified Financial Planner™ for just $49/month.

NerdWallet Advisory LLC

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

How To Research Stocks

Updated: Apr 5, 2022, 9:28am

No matter if you’re a DIY investor or just someone who wants to know more about your investments, you don’t need to work on Wall Street to understand how to research stocks.

While researching stocks may sound complicated—and let’s be honest, there’s a lot of jargon—it’s a process that can be mastered with patience and some help from the following stock research guide.

A Few Things to Know about Researching Stocks

If you’re looking for a silver bullet, that one piece of information about a company that will tell you whether a stock is a winner or not, you’re going to be disappointed. That’s not the way this works.

Researching stocks requires gathering and analyzing multiple data points in order to find the equity investment that meets your needs. But you’re doing so to build a case for or against a stock, rather than a specific right answer to whether you should buy or sell.

“Equity research is an art, not a science,” said Asher Rogovy, a registered investment adviser ( RIA ) and chief investment officer of advisory firm Magnifina.

Every public company operates differently, and every stock investor has their own unique financial goals and interests. For Rogovy, that means researching stocks is as much about your particular investing strategy as it is about the market data you’re looking at.

To put that another way, stock research helps you build a story about a public company’s finances and business practices, and how those things might make the stock a good fit for you.

Start by Gathering Research Data on Stocks

The first step in building the story is to gather data. Here are easy-to-access resources that you can use to get started.

Equity Analyst Reports

Equity analysts are highly trained professionals who research stocks for a living. You should definitely be using their reports to your advantage.

If you have an online brokerage account , you can find analyst reports for most stocks on your brokerage platform. Navigate to an individual stock’s ticker page on the site, and see what sort of reports are available.

Equity analyst reports typically rate stocks as buy, sell or hold, based on their independent research. These terms are pretty straightforward, as the analyst is just telling you that a stock is worth buying (if you don’t already own it) or selling (if you already own it). Hold generally means the company should continue to perform in line with the market.

Some of the major analyst reports to follow are issued by Thomson Reuters, MarketEdge and Argus. You can also find consensus reports by companies like TipRanks , which gathers research from multiple analysts and gives a broader view of how the industry views a stock.

One of the best parts about a consensus report is that you can see opinions of multiple individual analysts, get a view of their overall ratings as analysts—yep, analysts are rated, too—and their track record for accuracy.

Take analyst ratings with a grain of salt, though, since they have a documented conflict of interest and research shows they can be too optimistic.

Dig into the Fundamentals

When researching stocks, the term “fundamentals” refers to data on a company’s financial performance. This includes things like revenue, profitability, assets and liabilities, and growth potential. Fundamental analysis helps you understand the financial health of a stock.

All publicly traded companies are required to file information about their finances with the U.S. Securities and Exchange Commission (SEC). You can find these annual (10-K) and quarterly earnings reports (10-Q) on every company’s investor relations page or by searching for a company’s records at the SEC’s EDGAR database online.

If you have an online brokerage account, you can also use the platform to find similar data. Log in and search by ticker to review company fundamentals like dividends and earnings per share (EPS), along with a stock’s historical and year-to-date performance. Some online brokerages also link to current news about the stock as well on the ticker page, making it easy to see news about a stock.

Online Stock Research Websites

There are plenty of online stock research websites that can get you plenty of information on the stock of your choice:

- Yahoo! Finance

- Seeking Alpha

- Motley Fool

While many of the sites listed above have paid subscription services, you can generally find the basics that you need to know about a company from the free side of the service.

Understand the Numbers

Once you’ve gathered the research on your stock, you can dig into the stock’s financials. A company’s financial health has everything to do with how analysts rate its stock and should play a role in any decisions you need to make about adding the stock to your portfolio.

Here are the key financial criteria you’re going to be looking for:

- P/E Ratio (price-to-earnings ratio). Also known as a stock’s earnings multiple or price multiple or, the P/E ratio is a number that measures a company’s current stock price (P) against its earnings per share (E). A P/E ratio is either forward-looking (uses estimated earnings) or backwards-looking (earnings that already occured).

- PEG Ratio (price-to-earnings-growth ratio). While it sounds like a mouthful, a company’s PEG ratio expresses a company’s P/E ratio divided by its annual earnings per share growth.

- P/B Ratio (price-to-book ratio). This ratio shows the relationship of a stock’s current price to the book value of the company. The book value is what a company could expect to get if it shut down tomorrow (yikes) and sold off all its assets.

- Return on Assets (ROA) and Return on Equity (ROE). ROA is how efficiently a company uses its assets to create revenue. ROE is all about how much profit a company creates for every dollar that shareholders invest.

These figures help you make comparisons between different companies, or between a company and a basket of similar companies. They give you a sense of how expensive a particular stock is trading compared to its peers, and how much it might grow.

Learn About The Company

After getting the numbers down, continue to research a stock by learning about the leaders who run the company. Even if you’re a fan of the folks who make your laptop or your favorite sneakers, there’s more about a company that impacts whether a stock should be an addition to your portfolio.

- Leadership. Who is leading the company? What’s their management philosophy? Where did they work prior to running this company and how did they help their previous company succeed?

- Culture. How does the company rank on best places to work lists and additional lists that speak to equity, diversity and inclusion like the Corporate Equality Index.

- ESG. How does the company prioritize environmental, sustainability and governance ( ESG ) initiatives in how it operates and generates revenue? Use MSCI’s tool for an ESG deep dive into thousands of companies.

- Trends. Does the company have a strategy to remain competitive? Does it have business in multiple verticals and profit centers? And speaking to recent events, if the world shuts down because of a global pandemic, does the company still have ways to serve its customers and generate revenue? Much of this information can be found in the analysts notes you’ve compiled.

While some investors would consider these to be “feel good” criteria, there’s no downside to companies with solid, proven leadership. Also, a 2019 study from McKinsey found that companies with executive teams that ranked in the top quartile for gender diversity were “25 percent more likely to have above-average profitability than companies in the fourth quartile—up from 21 percent in 2017 and 15 percent in 2014.”

Put It All In Context

With this sizable amount of information about a stock, you can start to assess whether it’s a fit for your investing goals. Here are a few scenarios that can help spark ideas to decide what sort of investing goals you want to pursue.

- Income investing. If a particular stock has buy ratings across the board, solid financials and sound leadership but cut its dividends to zero during the pandemic, you might consider a different well-rated stock in the same asset class with a long history of consistent dividends.

- Growth investing. If your favorite sneaker company consistently puts out new products but doesn’t show signs of long-term financial growth, you could consider this stock for a different part of your portfolio or skip it since it’s not going to meet the growth you need to meet your financial goals.

- Value investing. Value investors look for underpriced stocks. They believe the stock market overreacts to events that impact individual companies, and that short-term developments drive moves in stock prices that don’t always reflect a company’s long-term fundamentals.

- Socially responsible investing. If your research into an agricultural company demonstrates that they’re not proactive with watershed protection and don’t have plans to build out an overall EGS strategy, a well-rated stock with an excellent returns history might not make the cut.

You also don’t want to fall in love with a company just because they seem like an innovative force, said Robert R. Johnson, CFA and professor of finance at Heider College of Business at Creighton University. He cites the example of automakers and how they would go on to change transportation.

“In the early part of the last century, there were 2,000 auto companies,” he said. But as of the late 1990s, only three of those companies survived. “While auto had a tremendous impact on society, investors weren’t duly rewarded.”

The Bottom Line On How To Research Stocks

Researching stocks gives you a better feeling for a company’s financial health and whether it’s an attractive choice for your financial goals. Be sure to leverage the research that’s already out there because you don’t have to go it alone. Analysts are paid to research stocks for a living and their work shouldn’t be ignored, even if you don’t buy every word.

The biggest decision you’ll have to make after researching stocks is whether you want to continue to do all the heavy lifting, or instead, explore other strategies like exchange-traded funds ( ETFs ), mutual funds or robo-advisors that do the hard work of deciding what belongs in your portfolio at any given time. It truly comes down to a matter of preference, time and enthusiasm for the research process.

Featured Partner Offers

SoFi Automated Investing

On Sofi's Website

On Acorn's Secure Website

Wealthfront

On WealthFront's Website

- Best Investment Apps

- Best Robo-Advisors

- Best Crypto Exchanges

- Best Crypto Staking Platforms

- Best Online Brokers

- Best Money Market Mutual Funds

- Best Investment Portfolio Management Apps

- Best Low-Risk Investments

- Best Fixed Income Investments

- What Is Investing?

- What Is A Brokerage Account?

- What Is A Bond?

- What Is the P/E Ratio?

- What Is Leverage?

- What Is Cryptocurrency?

- What Is Inflation & How Does It Work?

- What Is a Recession?

- What Is Forex Trading?

- How To Buy Stocks

- How To Invest In Stocks

- How To Buy Apple (AAPL) Stock

- How To Buy Tesla (TSLA) Stock

- How to Buy Bonds

- How To Invest In Real Estate

- How To Invest In Mutual Funds

- How To Calculate Dividend Yield

- How To Find a Financial Advisor Near You

- How To Choose A Financial Advisor

- How To Buy Gold

- Gold Price Today

- Silver Price Today

- Investment Calculator

- ROI Calculator

- Retirement Calculator

- Business Loan Calculator

- Cryptocurrency Tax Calculator

- Empower Review

- Acorns Review

- Betterment Review

- SoFi Automated Investing Review

- Wealthfront Review

- Masterworks Review

- Webull Review

- TD Ameritrade Review

- Robinhood Review

- Fidelity Review

8 Best Commodity ETFs of June 2024

8 Best Leveraged ETFs of June 2024

Best Inverse ETFs Of 2024

9 Best Real Estate ETFs Of June 2024

7 Best Volatility ETFs Of June 2024

5 Best Currency ETFs Of June 2024

E. Napoletano is a former registered financial advisor and award-winning author and journalist.

Ben is the Retirement and Investing Editor for Forbes Advisor. With two decades of business and finance journalism experience, Ben has covered breaking market news, written on equity markets for Investopedia, and edited personal finance content for Bankrate and LendingTree.

What is Investment Research?

History of investment research, why is investment research important, the role of investment research analysts, what does a buy-side research analyst do, what does a sell-side research analyst do, what do research analysts focus on, do you need a cfa charter to be a research analyst, benefits of investment research, informed decision-making, mitigation of risks, maximizing returns, building a diversified portfolio, investment trends and ai, the intersection of technology and finance, data scientists and investment decision-making, credit risk assessment, industry trends and future performance, navigating the future with informed decisions, additional resources, the comprehensive guide to investment research.

Investment research is the bedrock of informed financial analysis. It involves a detailed examination and analysis of various financial instruments, markets, and economic trends to aid investors in making investment decisions. This process empowers investors and institutions alike to allocate their capital effectively, maximize returns, and mitigate risks.

Investment research analyst is a broad term, and the exact nature of the role can differ significantly. However, all roles involve working as a financial detective, using financial statements, economic indicators, and financial market and industry trends to generate comprehensive research reports. These reports serve as valuable guides for investors, helping them make informed decisions about allocating their funds.

Key Highlights

- Investment research involves a detailed examination and analysis of various financial instruments, markets, and trends to aid investors in making investment decisions.

- Investment research analysts are usually divided into two groups: buy-side analysts and sell-side analysts.

- Benefits of investment research include more informed decision marking and risk mitigation.

- Artificial intelligence, machine learning, and data science are empowering investment research analysts to process vast amounts of data rapidly and derive actionable insights.

The roots of investment research can be traced back centuries. The Dutch East India Company, established in the 17th century, is often considered the precursor to modern corporations, marking the beginning of institutional investments. However, formalized investment research gained momentum in the 20th century with the advent of stock exchanges and the increasing complexity of financial markets.

Over time, investment research evolved to incorporate various disciplines such as economics, statistics, and behavioral psychology. In the mid-20th century, the establishment of the Chartered Financial Analyst ( CFA ) designation brought a standardized framework for professional excellence in investment analysis.

Investment research analysts play a pivotal role in the financial services industry. These professionals are responsible for conducting extensive research on equity and fixed income markets, companies, industries, and economic trends. By leveraging their analytical skills, investment research analysts provide insights into potential investment opportunities and risks.

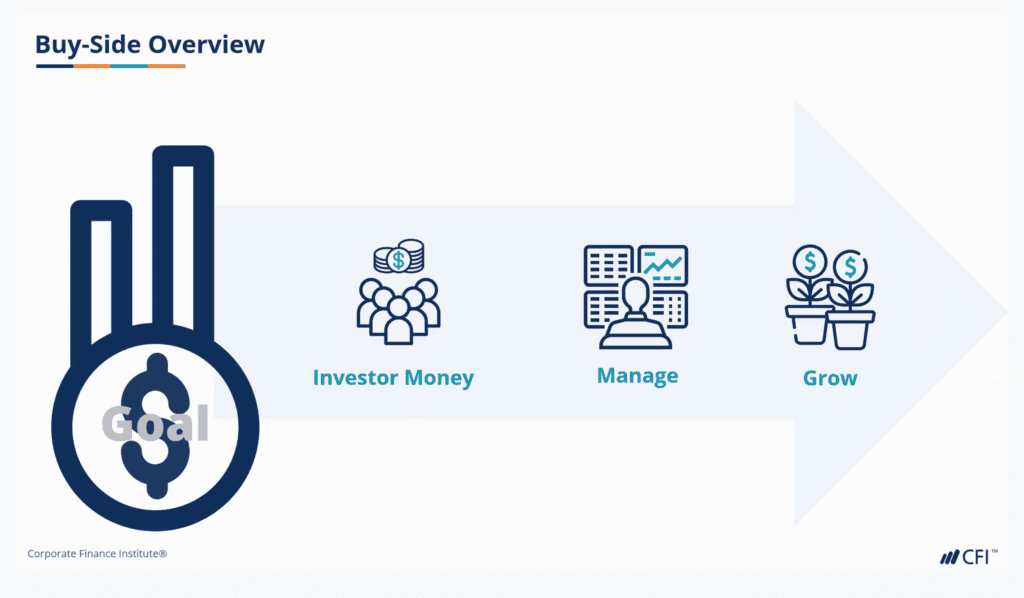

Investment research analysts, often abbreviated to just research analyst, are usually divided into two groups, based on the type of institution they work for. These two groups are referred to as the buy side and the sell side .

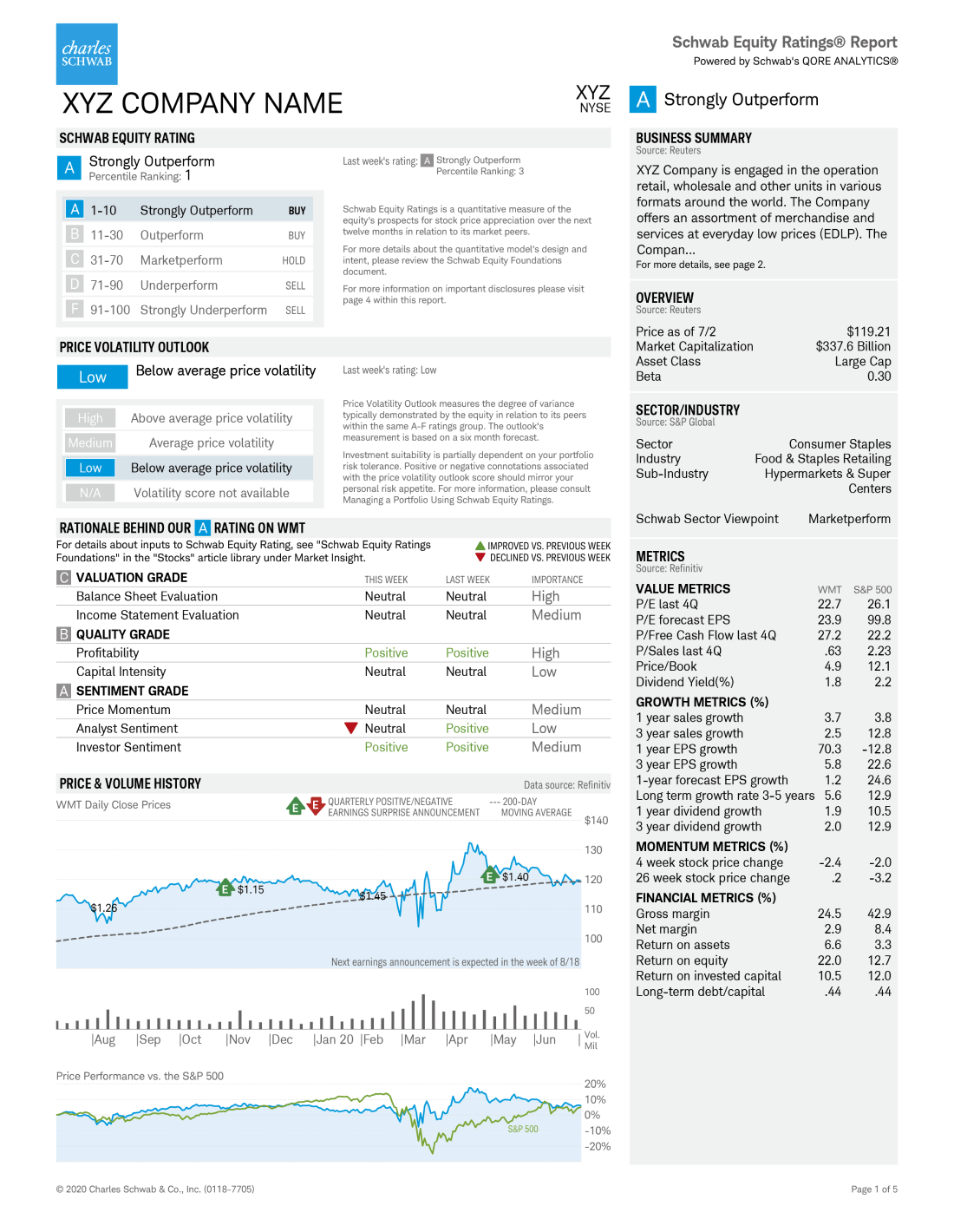

The primary distinction between a buy-side and sell-side research analyst lies in their clientele and objectives. Buy-side analysts focus on optimizing their firm’s investment portfolio performance, while sell-side analysts cater to external clients.

Buy-side analysts work for institutional investors, asset managers, hedge funds, pension funds, and mutual funds. Buy-side firms are actively involved in buying and selling securities such as stocks and bonds on behalf of their clients or shareholders, who are the ultimate asset owners. While portfolio managers will ultimately make the decision to invest in or sell a security, they rely on the detailed information provided to them by their research analysts to achieve their investment objectives.

Buy-side analysts conduct in-depth research to identify promising investment opportunities aligned with their fund’s strategy and objectives. These funds may invest in the equity markets or fixed income markets, or they may invest in alternative markets, such as the commodities markets. Their research reports may also be focused on macroeconomic analysis, industry analysis, or portfolio construction, in order to help their portfolio managers to stay ahead of the competition.

Sell-side research analysts, on the other hand, work for institutions such as investment banks and brokerages . Their primary role is to communicate ideas in a detailed research report to either their buy side clients, their own salespeople, or to specialist groups within the finance industry, such as M&A advisory groups.

One of the key functions of sell-side analysts is to issue recommendations on whether to buy, hold, or sell particular securities, such as a stock or a bond. These recommendations carry weight within the market, influencing a broad range of investors. Sell-side analysts also play a critical role in investment banking activities, by researching and providing analysis that is then used for initial public offerings ( IPO s).

A research analyst will have a specific area of expertise that they focus on, known as their “coverage.” This allows them to become experts in that particular area and add value to any investor that uses their research. Typical areas of coverage include:

- Sector Coverage means the research analyst covers any one of a number of specific sectors or industries, such as technology, healthcare, media, or consumer goods. These sector specialists undertake deep dives into the dynamics of their particular sector, evaluating company financials, and providing research reports and recommendations on individual companies within that sector or industry.

- Geographic Coverage allows a research analyst to focus on companies within a specific region, country, or group of countries. This is especially relevant for investment banks that provide access across various global markets.

- Company Coverage means that a research analyst focuses on one (or a select few) specific company. This can happen when that company is a large, widely invested in, and influential company, such as Apple or Microsoft. These analysts become experts on the specific business they cover, providing detailed financial analysis, earnings forecasts, and investment recommendations for those companies.

- Product Coverage refers to research analysts, typically on the sell side, who specialize in specific financial products or services, such as stocks, bonds, commodities, and derivatives.

- Macro Coverage refers to research analysts that undertake independent economic research at a macro level, using data on interest rates, inflation, economic activity, and employment that ultimately helps investors with their investing strategies.

While not mandatory, many investment research analysts pursue the Chartered Financial Analyst (CFA) designation to enhance their credibility and expertise. The CFA program covers a broad spectrum of financial topics, including ethics, economics, and portfolio management. Earning a CFA charter signals a commitment to high professional standards and can open doors to advanced career opportunities in investment research.

The primary benefit of investment research is the ability to make well-informed decisions based on financial data. Investors armed with thorough research can better navigate the complexities of financial markets, identify profitable trading strategies, and steer clear of potential market pitfalls.

Investing always carries inherent risks, but investment research serves as a risk management tool. By thoroughly understanding the market dynamics and individual assets, investors can mitigate potential risks and navigate market volatility, safeguarding their capital.

A well-researched investment strategy increases the likelihood of maximizing returns. Investment research analysts aim to uncover undervalued assets and predict market trends, enabling investors to capitalize on opportunities for growth.

Diversification is a cornerstone of many investment strategies. Investment research aids in identifying a diverse range of assets, spreading risk, and optimizing the balance between potential returns against potential risk.

The integration of artificial intelligence (AI) into investment research has revolutionized the research landscape. Emerging technologies, including machine learning tools and data science, have empowered analysts to process vast amounts of data rapidly and derive actionable insights.

Data scientists play a pivotal role in investment research. By employing advanced analytics, they uncover patterns, correlations, and predictive models that traditional methods might overlook. This enhances the accuracy of investment decisions and contributes to more robust portfolio management.

AI has proven particularly valuable in assessing credit risk . Machine learning algorithms can analyze an array of factors to evaluate the creditworthiness of individuals, companies, and even countries. This assists investment professionals in making more nuanced and precise credit-related decisions.

Staying ahead of industry trends is critical for anticipating future performance. AI algorithms excel at identifying patterns within large amounts of data and predicting potential market shifts. Investment research, enhanced by AI, empowers analysts to explore emerging markets, predict sector trends, and position portfolios for future success.

In conclusion, investment research helps to guide investors through the ever-changing landscape of financial markets. From the historical roots of market analysis to the current integration of AI, the evolution of investment research reflects the continuous need for deeper insights from data and more accurate predictions.

Thank you for reading this article on investment research. To learn more, see these additional relevant resources below:

Investing: A Beginner’s Guide

Economic Forecasting

Market Risk

Technical Analyst

See all capital markets resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Great, you have saved this article to you My Learn Profile page.

Clicking a link will open a new window.

4 things you may not know about 529 plans

Important legal information about the email you will be sending. By using this service, you agree to input your real email address and only send it to people you know. It is a violation of law in some juristictions to falsely identify yourself in an email. All information you provide will be used solely for the purpose of sending the email on your behalf. The subject line of the email you send will be “Fidelity.com”.

Thanks for you sent email.

5 stock research tools

Some investors prefer to let experts manage their money. Others like to take a more hands-on approach. And many employ a combination—investing most of their portfolio in professionally managed products, and setting aside a portion to make their own investments. If you like to make some, or all, of your own investing decisions, there are a number of tools that can help you do so.

Here are 5 ways you can research stocks and manage your investments using online tools—many of which you might already have at your disposal.

To view this video please enable JavaScript, and consider upgrading to a web browser that supports HTML5 video.

1. Research platform

One of the most helpful, do-it-yourself resources for investors is a research platform. A research platform can provide you with a wealth of information, such as quotes for individual stocks, company financial statements, key company statistics, and much more. Even experienced, advanced investors and traders may be surprised to discover how extensive the tools and resources are that can be found in a particular platform.

If you go to the home page of Fidelity.com , you will find a powerful research platform within the News & Research tab at the top of the page. This is where you can get access to a lot of information on not only stocks but also sectors and industries , exchange-traded funds (ETFs) , mutual funds , bonds , options , IPOs , and annuities .

You can also enter a company/security or its ticker symbol in the search bar on the top-right corner of the page. This will bring you to a specific company’s snapshot page. Here, you can find a plethora of information that can help you research publicly traded companies or financial securities.

Suppose you were considering investing in a stock. On its snapshot page, you can find a detailed quote containing vital information such as the current stock price, average daily volume, and annual yield (see the image below). You’ll also be able to look at a chart of the stock’s price, find the latest news and research reports, and see other key statistics (more on all this information shortly).

Once you've made your investment choices, managing them is critical to being successful. You can use all the tools mentioned above to monitor and research your open positions. There are also ways to determine whether the stocks you’ve researched and chosen are a good mix when looked at as a whole.

Fidelity offers a Planning & Guidance Center , a guidance tool that compares your current portfolio with your target asset mix so you can evaluate areas that may need adjustment. This portfolio-level review can be a great way to see whether the stocks that you've researched are collectively meeting your investing objectives. You may also want to consider Fidelity's Guided Portfolio Summary SM Log In Required which can help you break down the investments in your portfolio and identify areas that may need more attention.

Research stocks, ETFs, or mutual funds

Get our industry-leading investment analysis, and put our research to work.

More to explore

5-step trading guide, read more viewpoints, subscribe to fidelity viewpoints ®, looking for more ideas and insights, thanks for subscribing.

- Tell us the topics you want to learn more about

- View content you've saved for later

- Subscribe to our newsletters

We're on our way, but not quite there yet

Oh, hello again, thanks for subscribing to looking for more ideas and insights you might like these too:, looking for more ideas and insights you might like these too:, fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. fidelity viewpoints ® timely news and insights from our pros on markets, investing, and personal finance. (debug tcm:2 ... decode crypto clarity on crypto every month. build your knowledge with education for all levels. fidelity smart money ℠ what the news means for your money, plus tips to help you spend, save, and invest. active investor our most advanced investment insights, strategies, and tools. insights from fidelity wealth management ℠ timely news, events, and wealth strategies from top fidelity thought leaders. women talk money real talk and helpful tips about money, investing, and careers. educational webinars and events free financial education from fidelity and other leading industry professionals. done add subscriptions no, thanks. analyzing stock fundamentals investing for beginners finding stock and sector ideas using technical analysis advanced trading strategies trading for beginners using margin etfs mutual funds investing for income stocks options trading entails significant risk and is not appropriate for all investors. certain complex options strategies carry additional risk. before trading options, please read characteristics and risks of standardized options . supporting documentation for any claims, if applicable, will be furnished upon request. past performance is no guarantee of future results. technical analysis focuses on market action — specifically, volume and price. technical analysis is only one approach to analyzing stocks. when considering which stocks to buy or sell, you should use the approach that you're most comfortable with. as with all your investments, you must make your own determination as to whether an investment in any particular security or securities is right for you based on your investment objectives, risk tolerance, and financial situation. past performance is no guarantee of future results. the equity summary score is provided for informational purposes only, does not constitute advice or guidance, and is not an endorsement or recommendation for any particular security or trading strategy. the equity summary score is provided by starmine from refinitiv, an independent company not affiliated with fidelity investments. for more information and details, go to fidelity.com. the fidelity security screener is a research tool provided to help self-directed investors evaluate these types of securities. the criteria and inputs entered are at the sole discretion of the user, and all screens or strategies with preselected criteria (including expert ones) are solely for the convenience of the user. expert screens are provided by independent companies not affiliated with fidelity. information supplied or obtained from these screeners is for informational purposes only and should not be considered investment advice or guidance, an offer of or a solicitation of an offer to buy or sell securities, or a recommendation or endorsement by fidelity of any security or investment strategy. fidelity does not endorse or adopt any particular investment strategy or approach to screening or evaluating stocks, preferred securities, exchange-traded products, or closed-end funds. fidelity makes no guarantees that information supplied is accurate, complete, or timely, and does not provide any warranties regarding results obtained from their use. determine which securities are right for you based on your investment objectives, risk tolerance, financial situation, and other individual factors, and reevaluate them on a periodic basis. fidelity ® guided portfolio summary (fidelity® gps) is provided for informational purposes only and is not intended to provide legal, tax, investment, or insurance advice, nor should it be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security by fidelity or any third party. you are solely responsible for determining whether any investment, investment strategy, security, or related transaction is appropriate for you based on your personal investment objectives, financial circumstances, and risk tolerance. you should consult your legal or tax professional regarding your specific situation. stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. for the social sentiment indicator, this independent information provider applies a proprietary methodology to data from public social media sites to analyze what is being said about specific stocks. data from social media sites is often from anonymous sources, may not be verified for accuracy or completeness, and may reflect only limited activity. use of this information is not a substitute for investment research regarding a particular security. this information is provided by social market analytics, an unaffiliated third party vendor which uses its own proprietary methodology to analyze data from public social media sites to provide information about specific stocks, and fidelity has not validated the integrity of this data. important: the projections or other information generated by fidelity’s planning & guidance center retirement analysis regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. results may vary with each use and over time. investment decisions should be based on an individual's own goals, time horizon, and tolerance for risk. fidelity brokerage services llc, member nyse, sipc , 900 salem street, smithfield, ri 02917 718281.6.0 mutual funds etfs fixed income bonds cds options active trader pro investor centers stocks online trading annuities life insurance & long term care small business retirement plans 529 plans iras retirement products retirement planning charitable giving fidsafe , (opens in a new window) finra's brokercheck , (opens in a new window) health savings account stay connected.

- News Releases

- About Fidelity

- International

- Terms of Use

- Accessibility

- Contact Us , (Opens in a new window)

- Disclosures , (Opens in a new window)

Morningstar Investment Research

Morningstar’s independent research is only biased in favor of investors. Dig into expert analysis from 100+ global researchers on securities, funds, markets, and portfolios. With transparent insights, investors can make more confident investment decisions.

Trending Investment Research

2024 us financial health report, q2 2024 markets observer, q1 2024 apparel industry pulse, morningstar's guide to us active etfs, global equity fund flows, climate action 100+ departures put proxy voting in the spotlight, active etfs in europe: small, shy, and on the rise, u.s. drug distribution landscape, h1 2024 u.s. housing outlook, biopharma landscape, q2 2024 stock market outlook, target-date funds and annuities, 2024 target-date strategy landscape, 2024 diversification landscape, financial services observer, mining industry landscape, u.s. renewable energy pulse, u.s. active/passive barometer, q1 2024 oil and gas industry pulse, small-cap equities and funds, q1 2024 u.s. economic outlook, motors and markets 2024, u.s. e&ps landscape, 2023 model portfolio landscape, software landscape report, mutual fund manager stock hit rates, 2024 utilities outlook, what motivates clients to stay with their financial advisors, dividend funds landscape report, q4 2023 digital & analog semiconductors pulse, 2023 retirement withdrawal strategies report, luxury goods landscape report, cybersecurity landscape report, a global guide to strategic-beta exchange-traded products, compare robo-advisor performance & assess the best options, a simple framework for structured products, fund managers switching firms - should investors tag along, can asset managers take direct indexing to the masses, why money is important to investors, large growth stocks: hurdles and risks for fund managers, intended and unintended crypto exposures, beware of overconfidence in “outlook season”, 2022 health savings account landscape, morningstar's cryptocurrency landscape, morningstar’s global automotive observer:, 2022 u.s. interest rate & inflation forecast, morningstar's guide to tax managed investing, thematic fund handbook, sustainable investing, global sustainable fund flows report, us annual sustainable funds landscape, sfdr article 8 and article 9 funds, investing in times of climate change, esg proxy-voting insights: blackrock, vanguard, state street, us sustainable fund flows, esg landscape on commercial air travel, proxy-voting insights: voting on politics, morningstar sustainability atlas, esg landscape on biopharma, esg commitment level landscape, 2022 carbon credits landscape, esg landscape on oil and gas, proxy-voting insights: 2022 in review, water, water everywhere. how are asset managers responding, esg landscape on consumer packaged goods, net zero asset managers initiative, cop15: a turning point for investor approaches to biodiversity, esg landscape on telecommunication services, the hidden esg risks of feel-good companies, how to talk to investors about sustainable investing, esg landscape on autos, investment strategies, emerging-equities market pulse, liquid alternatives observer, momentum inflection factor, morningstar’s primer on defined outcome etfs, global thematic funds landscape, morningstar prospects, the reasons behind fund closures, financial well-being, q2 2024 us asset manager pulse, 2024 target-date funds and cits landscape, morningstar's annual 529 college-savings plan landscape, us asset manager landscape report, mind the gap: a report on investor returns in the u.s., morningstar's robo-advisor landscape, morningstar's u.s. fund fee study, global investor experience: fees and expenses report.

How To Do Investment Research

- The investment research process is one of constant refinement and improvement.

- Whether you're just starting out or you're a seasoned veteran, there's always something to learn.

- Here, the Seeking Alpha editors have compiled a set of perspectives and best practices based on their evaluation of hundreds of thousands of article submissions.

By Mike Taylor

When I started reading and writing about the stock market in the summer of 2007, I had little background in financial research and analysis. I'd studied poetry in college, and I'd moved to New York to become a fiction writer. But when my laptop full of mediocre short stories was stolen from my apartment during a raucous late-bull-market housewarming party, it was time for plan B.

When I joined TheStreet.com that October to copy edit investment commentary, I was both mystified by and skeptical about the world of finance. How could anyone predict what would happen among the seemingly random events of a given market day? Was everyone who pretended to know what was going on a complete fraud and a liar?

As I spent the first year of my career watching the Great Financial Crisis unfold, my skepticism seemed increasingly warranted. But as I learned more about the investment research process, I also gained confidence that a smart and enterprising writer could publish informative work that would help investors make better decisions - or at least avoid some of the stock market's most dangerous traps.

It was a steep climb up that first section of the learning curve for me, and I imagine it's the same for many aspiring analysts and portfolio managers when they're getting started. To provide an orientation to those beginning their education and to offer a brush-up for veterans, we've compiled here a guide to the Seeking Alpha Author Experience's treatment of the investment research process.

Put Your Investment Research In Context

The universal right way to invest may not exist - everyone has different preferences for risk, cognitive strengths and weaknesses, future cash needs, and time horizons. But you can convince readers that you have useful insight (and confront some of your own imperfections with honesty) by being transparent about your own circumstances , and explaining those circumstances to your audience.

Remember, whether you're discussing your own portfolio decisions or analyzing a particular company, context is the lifeblood of investment research . Make sure you're situating the evidence you've unearthed so that someone who's new to the story can incorporate the discussion into his or her own decision process.

We believe that sound research forms the basis from which all success at Seeking Alpha follows.

If you're writing about an individual company, it never hurts to start by reading the most recent 10-K filing . This annual report gives highly detailed insight into company business models, recent performance, and key risks.

Don't stop with the 10-K. Use Seeking Alpha's SEC filing database to get more key primary source information. Make sure you know the benefits of going directly to the filings vs. relying on third-party data sources.

Armed with many of the details regulators have decided companies need to share with investors, it can help to contrast what you know with what the company management says in its press releases . If the narrative the company is feeding to the press differs from what it's disclosing to the SEC, there's usually a big opportunity to inform investors - the basis of a successful Seeking Alpha article.

How To Write Investment Analysis

Investment analysts need to know the difference between factual information/data and their reasoned opinions and inferences. Successful Seeking Alpha articles provide a balance of fact and opinion . Avoid rants and screeds that are heavy on opinion and light on fact; conversely, avoid recaps and overviews that gather readily available information without injecting your own independent perspective.

Analysts have a variety of approaches, but it's important to be comprehensive along two dimensions: qualitative and quantitative information . Make sure you have a solid understanding of the fund or company's strategy and competitive position (qualitative) as well as how that strategy plays out in the financial statements (quantitative). When the connection between the qualitative and quantitative is strong, you have the beginnings of a very compelling investment analysis.

How To Credit Sources In Investment Analysis

In investment research, attention to detail is key. And nowhere is this more true than in the basic but absolutely critical matter of giving proper credit to one's sources . Know when to use direct quotes, paraphrases, and summaries when presenting material from outside sources.

How To Value A Stock

The investment community abounds with variations on the cliche that valuation models are never right, but they're often useful. To land closer to the "useful" side of things, it can help to understand how different models work and when/why to use one compared to another.

Get familiar with the classic discounted cash flow model . Then, as you're deploying it, make sure you're putting discounted cash flows in proper context . Understand that cash flow estimates can be refined and improved and that caveats apply.

Some analysts prefer to use EBITDA as a basis for financial decisions. But be careful using EBITDA - it's got some known flaws to go with its benefits. Check the inputs to your model - are you using traditional and often more conservative GAAP accounting, or are you making some adjustments ?

Maybe you're just going with a handy P/E ratio. If so, make sure you understand how the P/E ratio works .

More experienced authors may want to try their hand at writing for Seeking Alpha's PRO+ research offering. Before you embark on that journey, familiarize yourself with what PRO+ does , look for upcoming catalysts , and see if you can find a mispriced opportunity in the market . PRO is all about the asymmetric risk-reward .

Article Index

Investment Research In Context

- Tell Readers About Your Circumstances

- Financial Analysis And Context

Conducting Investment Research

- 'Other Guys Read Playboy, I Read Annual Reports': A Beginner's Guide To The 10-K

- Using SEC Filings

- More On Using SA's SEC Filings

Writing Investment Analysis

- Critiquing Earnings Press Releases

- Qualitative Vs. Quantitative Analysis

- Fact Vs. Opinion

- Properly Quoting Your Research Sources

- Improving Cash Flow Estimates

- Using Discounted Cash Flows - Context

- Modeling Discounted Cash Flows

- GAAP Vs. Non-GAAP Accounting

- Fundamental Analysis: PE ratios

- Seeking Alpha Author Experience #79: What SA PRO Covers

- Market Mispricing

- Asymmetric Risk/Reward

- What We Mean By 'Quantification'

This article was written by

Analyst’s Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given that any particular security, portfolio, transaction or investment strategy is suitable for any specific person. The author is not advising you personally concerning the nature, potential, value or suitability of any particular security or other matter. You alone are solely responsible for determining whether any investment, security or strategy, or any product or service, is appropriate or suitable for you based on your investment objectives and personal and financial situation. The author is an employee of Seeking Alpha. Any views or opinions expressed herein may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank.

Recommended For You

Related analysis, trending analysis, trending news.

5 ways to research stocks like the pros

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Our articles, interactive tools, and hypothetical examples contain information to help you conduct research but are not intended to serve as investment advice, and we cannot guarantee that this information is applicable or accurate to your personal circumstances. Any estimates based on past performance do not a guarantee future performance, and prior to making any investment you should discuss your specific investment needs or seek advice from a qualified professional.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Editorial disclosure

All reviews are prepared by our staff. Opinions expressed are solely those of the reviewer and have not been reviewed or approved by any advertiser. The information, including any rates, terms and fees associated with financial products, presented in the review is accurate as of the date of publication.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

- • Investing

- • Wealth management

- Connect with James Royal, Ph.D. on Twitter Twitter

- Connect with James Royal, Ph.D. on LinkedIn Linkedin

- Get in contact with James Royal, Ph.D. via Email Email

- Connect with Brian Beers on Twitter Twitter

- Connect with Brian Beers on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most — how to get started, the best brokers, types of investment accounts, how to choose investments and more — so you can feel confident when investing your money.

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Knowledge is power on Wall Street, and investing professionals have the reputation of being the most knowledgeable. But if you’re not a pro? Well, individual investors can still take advantage of many of the pros’ top techniques and turn some of their own knowledge into real investing success.

Individual investors have many advantages over the big institutional investors – especially the ability to invest with a long-term mentality and to buy out-of-the-way hidden gems. But they can also leverage information to identify some potentially high-flying stocks, too.

Here are a few of the best ways for individual investors to research stocks and get a leg up on their professional counterparts, as well as one way they can keep more of those gains.

How to research stocks like a pro

Here are five techniques that pros use to figure out what’s really going on in the market. Often these methods require a little more hustle than just reading the numbers on a screen or balance sheet, but you can also find out more that way than you could otherwise.

1. Use a stock screener

A stock screener is a great place to begin for investors on the hunt for new ideas. With a good stock screener, you can find stocks that are hitting 52-week lows, if you’re a value investor , or new highs, if you’re looking for momentum stocks that could continue their trend.

You can pair this information with other financial details that are available in the screener, such as a company’s revenue growth, profit margins, debt and many more. You’ll want to look for a high-quality screener so that you can get highly granular – and fully up to date – information.

You can find stock screeners at some of the top brokers , but you may want to hunt around for one that fits your exact needs and process best.

2. Talk to management teams

It may seem like the management teams are off-limits to individual investors, but not always. Sure, Meta Platforms CEO Mark Zuckerberg is not likely to take your call, but you have a real chance to ask questions at smaller firms, where execs will speak with current or future investors.

You’ll want to have pertinent questions lined up that show you know the business, and it can be a moment to ask insiders the finer points about the business. Even if you can’t get on the phone with the top brass, you can access a public company’s investor relations department. IR, as it’s known, can give you financial details or perspective on a press release, among other things.

It can also be helpful to ask a management team which other companies they respect most in the industry and why. This line of questioning can give you a good perspective on which rivals are worth watching – and they may even be worth investing in, too.

3. Do your own first-hand research

Getting out from behind the desk can be a great way to find out what’s actually going on before it breaks big. That’s classic advice from investing legend Peter Lynch , who recommends watching for new trends emerging with friends, whether it’s a new product or service.

Have you heard about a great new restaurant in the area? Check it out yourself and see what you like and whether its operation is running smoothly. Your neighbor likes a new tech gadget? See for yourself what it’s all about – and then assess if the company is worth an investment. (Are you a beginning investor? Here’s how to invest in stocks .)

This way is great for finding a hot new consumer brand, especially in the restaurant or retail spaces. Food fans could easily have picked up future high-flyers such as Chipotle and Panera before they became big household names. Even if investors didn’t get in at the bottom, these restaurants had years of attractive growth remaining in them after they were “discovered.”

4. Run your own channel checks

Especially for consumer or retail brands, you can do some of what Wall Street analysts call “channel checks.” A channel check is a fancy name for actually seeing what amount of product is moving through the system. A channel check can give you valuable information about what’s happening now before it shows up in the reported financial statements in three or six months.

For the pros, a channel check might involve calling up suppliers and customers of a target investment and seeing how much business the company is doing. In the case of individual investors, you can do much of the same with consumer brands, asking questions such as:

- Is that new product getting shelf space at your local grocery store?

- Is the product getting more space over time or less?

- Is the parking lot at that hot new chain restaurant or retail shop getting even more crowded?

- Or maybe the restaurant is getting less crowded or getting poor reviews?

You can run your own channel checks and see trends that might not show up in the results yet.

5. Subscribe to a newsletter