| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

- Best Online Ph.D. In Finance Programs

Best Online Ph.D. In Finance Programs Of 2024

Updated: Mar 28, 2024, 12:10pm

A Ph.D. in finance can prepare you for various specialized, high-level roles in financial management , business management, financial analysis and academia. Schools of business often offer finance as a concentration within a broader business management or business administration doctoral program .

Finance doctoral programs explore investment analysis, strategic financial planning, advanced accounting and corporate finance. In addition to coursework, students must research, write and defend a dissertation.

This page lists all four schools that meet our ranking criteria and offer online Ph.D. in finance programs. Learn how to choose and what to expect from a Ph.D. in finance program.

Why You Can Trust Forbes Advisor Education

Forbes Advisor’s education editors are committed to producing unbiased rankings and informative articles covering online colleges, tech bootcamps and career paths. Our ranking methodologies use data from the National Center for Education Statistics , education providers, and reputable educational and professional organizations. An advisory board of educators and other subject matter experts reviews and verifies our content to bring you trustworthy, up-to-date information. Advertisers do not influence our rankings or editorial content.

- 6,290 accredited, nonprofit colleges and universities analyzed nationwide

- 52 reputable tech bootcamp providers evaluated for our rankings

- All content is fact-checked and updated on an annual basis

- Rankings undergo five rounds of fact-checking

- Only 7.12% of all colleges, universities and bootcamp providers we consider are awarded

Our Methodology

We ranked four accredited, nonprofit colleges offering online Ph.D. in finance programs in the U.S. using 14 data points in the categories of student experience, credibility, student outcomes and affordability. We pulled data for these categories from reliable resources such as the Integrated Postsecondary Education Data System ; private, third-party data sources; and individual school and program websites.

Data is accurate as of February 2024. Note that because online doctorates are relatively uncommon, fewer schools meet our ranking standards at the doctoral level.

We scored schools based on the following metrics:

Student Experience :

- Student-to-faculty ratio

- Socioeconomic diversity

- Availability of online coursework

- Total number of graduate assistants

- Portion of graduate students enrolled in at least some distance education

Credibility :

- Fully accredited

- Programmatic accreditation status

- Nonprofit status

Student Outcomes :

- Overall graduation rate

- Median earnings 10 years after graduation

Affordability :

- In-state graduate student tuition and fees

- Alternative tuition plans offered

- Median federal student loan debt

- Student loan default rate

We listed all four schools that met our ranking criteria.

- Best Online Accounting Degrees

- Best MBA In Finance Online

- Best Online Finance Degrees

- Best Online Master’s In Accounting Degrees

- Best Online Master’s In Finance

Online Ph.D. in Finance Options

How to find the right online finance ph.d. program for you, should you enroll in an online ph.d. in finance program, accreditation for online ph.d.s in finance, frequently asked questions (faqs) about online ph.d.s in finance, university of the cumberlands, texas tech university, kansas state university, national university.

Program Tuition Rate

$749/credit

Percentage of Grad Students Enrolled in Distance Education

Overall Graduation Rate

The University of the Cumberlands in Williamsburg, Kentucky, offers a hybrid executive Ph.D. in business with a specialty in finance. Learners develop leadership, research and teaching skills that can help them excel in business.

The curriculum includes core, professional research and specialty area coursework. The program also requires an applied learning practicum every semester, which lets students apply knowledge in real-world settings and gain professional experience. Learners must also attend an intensive in-person residency weekend each semester.

Admission requirements include a minimum 3.0 GPA and a master’s degree in a relevant field.

- Our Flexibility Rating: Learn on your schedule

- School Type: Private

- Application Fee: $30

- Degree Credit Requirements: 66 credits

- Program Enrollment Options: Full-time

- Notable Major-Specific Courses: Managerial ethics and social responsibility, comparative economics

- Concentrations Available: N/A

- In-Person Requirements: Yes, for residency weekends and applied learning practicums

$9,518/year (in-state)

Texas Tech University claims to offer the first Ph.D. in financial planning, a 60-credit program that equips students for careers in financial planning research and academia. Texas Tech delivers the Ph.D. both on campus and online.

Students in the program must complete a dissertation in addition to 60 credits of graduate coursework. The degree prepares students to become Certified Financial Planners™ (CFPs), and learners who have not yet completed a CFP board-registered financial planning program may have to complete additional classes. The degree program requires an entrance exam and field experience.

- Our Flexibility Rating: Learn around your 9-to-5

- School Type: Public

- Application Fee: $75

- Degree Credit Requirements: 60 credits

- Example Major-Specific Courses: Security industry essentials for financial planning professionals, legal and regulatory aspects of personal financial planning

- In-Person Requirements: Yes, for field experience

$661/credit

Kansas State University features a Ph.D. in personal financial planning available in a hybrid format, with some degree requirements taking place on the school’s Manhattan, Kansas, campus. K-State claims to offer the first predominantly online personal financial planning doctorate, one of only three programs registered with the CFP Board. The program is designed with working professionals in mind.

Learners take online courses during the winter and spring semesters. During summer terms, students complete residency sessions and 10-day intensives on campus. The final summer term involves international travel to explore how global markets impact financial planning in the United States.

- Application Fee: $65

- Degree Credit Requirements: 90 credits

- Example Major-Specific Courses: Retirement planning for families, introduction to financial therapy

- In-Person Requirements: Yes, for on-campus residencies and cohort travel

$442/quarter credit

You can earn a fully online Ph.D. in business administration degree with a concentration in financial management from National University , based in San Diego, California. The program explores financial analysis, strategic planning, and research and development. Coursework focuses on international financial issues, accounting for nonprofit organizations and investment analysis. Students also complete dissertation research.

You can start working on your degree whenever it’s most convenient for you, with start dates every Monday. The program requires 20 courses and takes 40 months to complete. For direct entry into the program, you’ll need a master’s degree in a general business area or a master’s in any field and an undergraduate business degree.

- Application Fee: Free

- Degree Credit Requirements: 60 quarter credits

- Notable Major-Specific Courses: Investment portfolio analysis, advanced financial statement analysis

- In-Person Requirements: No

Not sure where to start in your college search? Let’s explore your options.

Consider Your Future Goals

An online doctorate in finance can help you obtain the knowledge and credentials you need to qualify for an advanced, research-based career in finance . But each program is unique, so you’ll need to do some research to find the one that best matches your career goals.

For example, find out if your prospective online Ph.D. in finance requires an internship or another form of field experience. Real-world experience can round out your education and help you make valuable connections for when you graduate. However, it can also add time to your degree and make it more difficult to work your learning around a full-time job.

Understand Your Expenses and Financing Options

Our guide includes four online Ph.D. in finance programs. Though tuition rates vary widely among programs, total tuition for the best online Ph.D. in finance programs on our list averages around $45,000.

To help fund your degree, you can apply for federal student aid, including scholarships, grants and loans, by filling out the Free Application for Federal Student Aid . You can also ask about funding opportunities like scholarships, grants, fellowships, and graduate research and teaching assistantships offered directly by your university or department.

Online learning can make a graduate-level education more accessible in many ways, but distance learning doesn’t necessarily work for everyone. Weigh the following when deciding whether to enroll in an in-person or online finance Ph.D.

- What’s your learning style? Online programs work best for students who don’t have a problem staying on task, managing deadlines and motivating themselves. If you think you’d do better with the structure and support that comes with attending scheduled in-person classes, consider an on-campus program.

- What’s your budget? If you’re looking to earn your Ph.D. in finance at a lower cost, online programs can provide savings. While out-of-state students usually pay higher tuition rates to attend in-person programs at public universities, online learners often receive discounted rates regardless of where they live. Distance learners can also save money by avoiding high costs associated with relocation, housing and transportation.

- What’s your schedule? If you need flexibility to manage a job or other time-consuming responsibilities while in school, an online program might be your best bet. Asynchronous programs in particular allow you to complete coursework on your schedule through pre-recorded lectures and online discussion boards.

Any school you consider for your online finance Ph.D. should hold institutional accreditation. You’ll need to attend an accredited school if you want to qualify for federal financial aid. Plus, employers and credentialing bodies often recognize degrees only from accredited institutions.

Institutional accreditation comes from third-party agencies that assess colleges to ensure they meet minimum quality standards related to faculty, academic programs, student outcomes and educational resources.

Accrediting bodies in the U.S. receive approval from the U.S. Department of Education or the Council for Higher Education Accreditation.

Programmatic accreditation offers a similar stamp of approval for individual degree programs or departments within universities. You may need a programmatically accredited degree to qualify for certain jobs and professional certifications.

An online Ph.D. in finance might hold programmatic accreditation from an accrediting agency that evaluates business-related programs, such as the Accreditation Council for Business Schools and Programs, the Association to Advance Collegiate Schools of Business or the International Accreditation Council for Business Education.

You can look up school and program accreditation information on CHEA’s website .

What is a Ph.D. in finance?

A Ph.D. in finance is a terminal business degree that develops advanced knowledge and skills in investing, corporate finance and economics. This diploma can prepare for finance-related roles in research and academia.

How long is a Ph.D. in finance?

The time it takes to earn a Ph.D. in finance varies depending on your program and enrollment status. It typically takes four to eight years to complete a doctorate, but you may be able to graduate from an online finance Ph.D. program in a little less than four years.

Is a Ph.D. worth it financially?

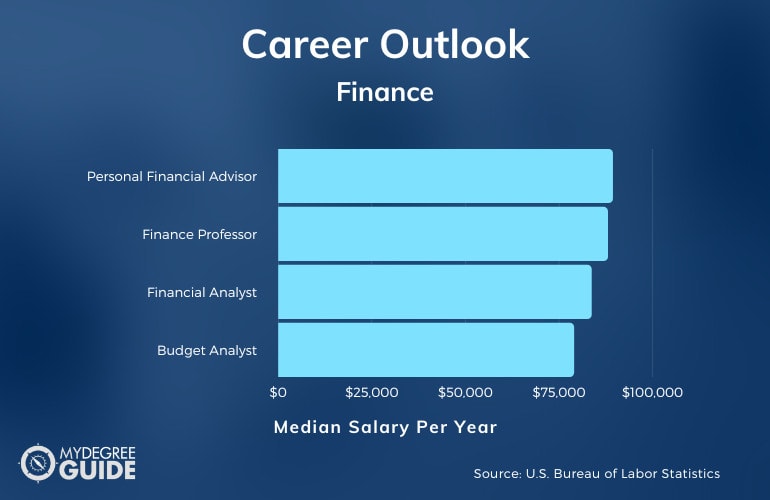

It depends on how much your degree costs and how much you can expect to make after you graduate, but a doctoral degree in finance can be well worth the investment. The U.S. Bureau of Labor Statistics (BLS) reports that workers employed in business and financial occupations earned a median annual wage of $76,850 in May 2022. If you pursue one of the higher-paying roles in this field, like financial analyst, you can earn a median salary of $96,220 per year.

How much does a Ph.D. in finance make in the U.S.?

How much you can expect to make with a Ph.D. in finance depends on your job, employer, geographic location and experience level. Ph.D. holders commonly work in academia; the BLS reports that business professors, including finance professors, earn a median annual salary of $88,790.

Liz Simmons has been writing for various online publications about career development, higher education and college affordability for nearly a decade. Her articles demystify the college application process and help prospective students figure out how to choose a major or career path.

- Youth Program

- Wharton Online

PhD Program

- Program of Study

Wharton’s PhD program in Finance provides students with a solid foundation in the theoretical and empirical tools of modern finance, drawing heavily on the discipline of economics.

The department prepares students for careers in research and teaching at the world’s leading academic institutions, focusing on Asset Pricing and Portfolio Management, Corporate Finance, International Finance, Financial Institutions and Macroeconomics.

Wharton’s Finance faculty, widely recognized as the finest in the world, has been at the forefront of several areas of research. For example, members of the faculty have led modern innovations in theories of portfolio choice and savings behavior, which have significantly impacted the asset pricing techniques used by researchers, practitioners, and policymakers. Another example is the contribution by faculty members to the analysis of financial institutions and markets, which is fundamental to our understanding of the trade-offs between economic systems and their implications for financial fragility and crises.

Faculty research, both empirical and theoretical, includes such areas as:

- Structure of financial markets

- Formation and behavior of financial asset prices

- Banking and monetary systems

- Corporate control and capital structure

- Saving and capital formation

- International financial markets

Candidates with undergraduate training in economics, mathematics, engineering, statistics, and other quantitative disciplines have an ideal background for doctoral studies in this field.

Effective 2023, The Wharton Finance PhD Program is now STEM certified.

- Course Descriptions

- Course Schedule

- Dissertation Committee and Proposal Defense

- Meet our PhD Students

- Visiting Scholars

More Information

- Apply to Wharton

- Doctoral Inside: Resources for Current PhD Students

- Wharton Doctoral Program Policies

- Transfer of Credit

- Research Fellowship

About Stanford GSB

- The Leadership

- Dean’s Updates

- School News & History

- Commencement

- Business, Government & Society

- Centers & Institutes

- Center for Entrepreneurial Studies

- Center for Social Innovation

- Stanford Seed

About the Experience

- Learning at Stanford GSB

- Experiential Learning

- Guest Speakers

- Entrepreneurship

- Social Innovation

- Communication

- Life at Stanford GSB

- Collaborative Environment

- Activities & Organizations

- Student Services

- Housing Options

- International Students

Full-Time Degree Programs

- Why Stanford MBA

- Academic Experience

- Financial Aid

- Why Stanford MSx

- Research Fellows Program

- See All Programs

Non-Degree & Certificate Programs

- Executive Education

- Stanford Executive Program

- Programs for Organizations

- The Difference

- Online Programs

- Stanford LEAD

- Seed Transformation Program

- Aspire Program

- Seed Spark Program

- Faculty Profiles

- Academic Areas

- Awards & Honors

- Conferences

Faculty Research

- Publications

- Working Papers

- Case Studies

Research Hub

- Research Labs & Initiatives

- Business Library

- Data, Analytics & Research Computing

- Behavioral Lab

Research Labs

- Cities, Housing & Society Lab

- Golub Capital Social Impact Lab

Research Initiatives

- Corporate Governance Research Initiative

- Corporations and Society Initiative

- Policy and Innovation Initiative

- Rapid Decarbonization Initiative

- Stanford Latino Entrepreneurship Initiative

- Value Chain Innovation Initiative

- Venture Capital Initiative

- Career & Success

- Climate & Sustainability

- Corporate Governance

- Culture & Society

- Finance & Investing

- Government & Politics

- Leadership & Management

- Markets and Trade

- Operations & Logistics

- Opportunity & Access

- Technology & AI

- Opinion & Analysis

- Email Newsletter

Welcome, Alumni

- Communities

- Digital Communities & Tools

- Regional Chapters

- Women’s Programs

- Identity Chapters

- Find Your Reunion

- Career Resources

- Job Search Resources

- Career & Life Transitions

- Programs & Webinars

- Career Video Library

- Alumni Education

- Research Resources

- Volunteering

- Alumni News

- Class Notes

- Alumni Voices

- Contact Alumni Relations

- Upcoming Events

Admission Events & Information Sessions

- MBA Program

- MSx Program

- PhD Program

- Alumni Events

- All Other Events

- Requirements

- Requirements: Behavioral

- Requirements: Quantitative

- Requirements: Macro

- Requirements: Micro

- Annual Evaluations

- Field Examination

- Research Activities

- Research Papers

- Dissertation

- Oral Examination

- Current Students

- Entering Class Profile

- Education & CV

- GMAT & GRE

- International Applicants

- Statement of Purpose

- Letters of Recommendation

- Reapplicants

- Application Fee Waiver

- Deadline & Decisions

- Job Market Candidates

- Academic Placements

- Stay in Touch

- Fields of Study

- Student Life

The field of finance covers the economics of claims on resources. Financial economists study the valuation of these claims, the markets in which they are traded, and their use by individuals, corporations, and the society at large.

At Stanford GSB, finance faculty and doctoral students study a wide spectrum of financial topics, including the pricing and valuation of assets, the behavior of financial markets, and the structure and financial decision-making of firms and financial intermediaries.

Investigation of issues arising in these areas is pursued both through the development of theoretical models and through the empirical testing of those models. The PhD Program is designed to give students a good understanding of the methods used in theoretical modeling and empirical testing.

Preparation and Qualifications

All students are required to have, or to obtain during their first year, mathematical skills at the level of one year of calculus and one course each in linear algebra and matrix theory, theory of probability, and statistical inference.

Students are expected to have familiarity with programming and data analysis using tools and software such as MATLAB, Stata, R, Python, or Julia, or to correct any deficiencies before enrolling at Stanford.

The PhD program in finance involves a great deal of very hard work, and there is keen competition for admission. For both these reasons, the faculty is selective in offering admission. Prospective applicants must have an aptitude for quantitative work and be at ease in handling formal models. A strong background in economics and college-level mathematics is desirable.

It is particularly important to realize that a PhD in finance is not a higher-level MBA, but an advanced, academically oriented degree in financial economics, with a reflective and analytical, rather than operational, viewpoint.

Faculty in Finance

Anat r. admati, juliane begenau, jonathan b. berk, greg buchak, antonio coppola, peter m. demarzo, darrell duffie, steven grenadier, benjamin hébert, arvind krishnamurthy, hanno lustig, matteo maggiori, paul pfleiderer, joshua d. rauh, claudia robles-garcia, ilya a. strebulaev, vikrant vig, jeffrey zwiebel, emeriti faculty, robert l. joss, george g.c. parker, myron s. scholes, william f. sharpe, kenneth j. singleton, james c. van horne, recent publications in finance, expectations and the neutrality of interest rates, real effects of supplying safe private money, how credit cycles across a financial crisis, recent insights by stanford business, your summer 2024 podcast playlist, why the “venture mindset” is not just for tech investors, how to: reject pitches like a venture capitalist.

- Priorities for the GSB's Future

- See the Current DEI Report

- Supporting Data

- Research & Insights

- Share Your Thoughts

- Search Fund Primer

- Teaching & Curriculum

- Affiliated Faculty

- Faculty Advisors

- Louis W. Foster Resource Center

- Defining Social Innovation

- Impact Compass

- Global Health Innovation Insights

- Faculty Affiliates

- Student Awards & Certificates

- Changemakers

- Dean Jonathan Levin

- Dean Garth Saloner

- Dean Robert Joss

- Dean Michael Spence

- Dean Robert Jaedicke

- Dean Rene McPherson

- Dean Arjay Miller

- Dean Ernest Arbuckle

- Dean Jacob Hugh Jackson

- Dean Willard Hotchkiss

- Faculty in Memoriam

- Stanford GSB Firsts

- Class of 2024 Candidates

- Certificate & Award Recipients

- Dean’s Remarks

- Keynote Address

- Teaching Approach

- Analysis and Measurement of Impact

- The Corporate Entrepreneur: Startup in a Grown-Up Enterprise

- Data-Driven Impact

- Designing Experiments for Impact

- Digital Marketing

- The Founder’s Right Hand

- Marketing for Measurable Change

- Product Management

- Public Policy Lab: Financial Challenges Facing US Cities

- Public Policy Lab: Homelessness in California

- Lab Features

- Curricular Integration

- View From The Top

- Formation of New Ventures

- Managing Growing Enterprises

- Startup Garage

- Explore Beyond the Classroom

- Stanford Venture Studio

- Summer Program

- Workshops & Events

- The Five Lenses of Entrepreneurship

- Leadership Labs

- Executive Challenge

- Arbuckle Leadership Fellows Program

- Selection Process

- Training Schedule

- Time Commitment

- Learning Expectations

- Post-Training Opportunities

- Who Should Apply

- Introductory T-Groups

- Leadership for Society Program

- Certificate

- 2024 Awardees

- 2023 Awardees

- 2022 Awardees

- 2021 Awardees

- 2020 Awardees

- 2019 Awardees

- 2018 Awardees

- Social Management Immersion Fund

- Stanford Impact Founder Fellowships

- Stanford Impact Leader Prizes

- Social Entrepreneurship

- Stanford GSB Impact Fund

- Economic Development

- Energy & Environment

- Stanford GSB Residences

- Environmental Leadership

- Stanford GSB Artwork

- A Closer Look

- California & the Bay Area

- Voices of Stanford GSB

- Business & Beneficial Technology

- Business & Sustainability

- Business & Free Markets

- Business, Government, and Society Forum

- Get Involved

- Second Year

- Global Experiences

- JD/MBA Joint Degree

- MA Education/MBA Joint Degree

- MD/MBA Dual Degree

- MPP/MBA Joint Degree

- MS Computer Science/MBA Joint Degree

- MS Electrical Engineering/MBA Joint Degree

- MS Environment and Resources (E-IPER)/MBA Joint Degree

- Academic Calendar

- Clubs & Activities

- LGBTQ+ Students

- Military Veterans

- Minorities & People of Color

- Partners & Families

- Students with Disabilities

- Student Support

- Residential Life

- Student Voices

- MBA Alumni Voices

- A Week in the Life

- Career Support

- Employment Outcomes

- Cost of Attendance

- Knight-Hennessy Scholars Program

- Yellow Ribbon Program

- BOLD Fellows Fund

- Application Process

- Loan Forgiveness

- Contact the Financial Aid Office

- Evaluation Criteria

- English Language Proficiency

- Personal Information, Activities & Awards

- Professional Experience

- Optional Short Answer Questions

- Application Fee

- Reapplication

- Deferred Enrollment

- Joint & Dual Degrees

- Event Schedule

- Ambassadors

- New & Noteworthy

- Ask a Question

- See Why Stanford MSx

- Is MSx Right for You?

- MSx Stories

- Leadership Development

- How You Will Learn

- Admission Events

- Personal Information

- GMAT, GRE & EA

- English Proficiency Tests

- Career Change

- Career Advancement

- Daycare, Schools & Camps

- U.S. Citizens and Permanent Residents

- Faculty Mentors

- Current Fellows

- Standard Track

- Fellowship & Benefits

- Group Enrollment

- Program Formats

- Developing a Program

- Diversity & Inclusion

- Strategic Transformation

- Program Experience

- Contact Client Services

- Campus Experience

- Live Online Experience

- Silicon Valley & Bay Area

- Digital Credentials

- Faculty Spotlights

- Participant Spotlights

- Eligibility

- International Participants

- Stanford Ignite

- Frequently Asked Questions

- Operations, Information & Technology

- Organizational Behavior

- Political Economy

- Classical Liberalism

- The Eddie Lunch

- Accounting Summer Camp

- Videos, Code & Data

- California Econometrics Conference

- California Quantitative Marketing PhD Conference

- California School Conference

- China India Insights Conference

- Homo economicus, Evolving

- Political Economics (2023–24)

- Scaling Geologic Storage of CO2 (2023–24)

- A Resilient Pacific: Building Connections, Envisioning Solutions

- Adaptation and Innovation

- Changing Climate

- Civil Society

- Climate Impact Summit

- Climate Science

- Corporate Carbon Disclosures

- Earth’s Seafloor

- Environmental Justice

- Operations and Information Technology

- Organizations

- Sustainability Reporting and Control

- Taking the Pulse of the Planet

- Urban Infrastructure

- Watershed Restoration

- Junior Faculty Workshop on Financial Regulation and Banking

- Ken Singleton Celebration

- Marketing Camp

- Quantitative Marketing PhD Alumni Conference

- Presentations

- Theory and Inference in Accounting Research

- Stanford Closer Look Series

- Quick Guides

- Core Concepts

- Journal Articles

- Glossary of Terms

- Faculty & Staff

- Researchers & Students

- Research Approach

- Charitable Giving

- Financial Health

- Government Services

- Workers & Careers

- Short Course

- Adaptive & Iterative Experimentation

- Incentive Design

- Social Sciences & Behavioral Nudges

- Bandit Experiment Application

- Conferences & Events

- Reading Materials

- Energy Entrepreneurship

- Faculty & Affiliates

- SOLE Report

- Responsible Supply Chains

- Current Study Usage

- Pre-Registration Information

- Participate in a Study

- Founding Donors

- Location Information

- Participant Profile

- Network Membership

- Program Impact

- Collaborators

- Entrepreneur Profiles

- Company Spotlights

- Seed Transformation Network

- Responsibilities

- Current Coaches

- How to Apply

- Meet the Consultants

- Meet the Interns

- Intern Profiles

- Collaborate

- Research Library

- News & Insights

- Program Contacts

- Databases & Datasets

- Research Guides

- Consultations

- Research Workshops

- Career Research

- Research Data Services

- Course Reserves

- Course Research Guides

- Material Loan Periods

- Fines & Other Charges

- Document Delivery

- Interlibrary Loan

- Equipment Checkout

- Print & Scan

- MBA & MSx Students

- PhD Students

- Other Stanford Students

- Faculty Assistants

- Research Assistants

- Stanford GSB Alumni

- Telling Our Story

- Staff Directory

- Site Registration

- Alumni Directory

- Alumni Email

- Privacy Settings & My Profile

- Success Stories

- The Story of Circles

- Support Women’s Circles

- Stanford Women on Boards Initiative

- Alumnae Spotlights

- Insights & Research

- Industry & Professional

- Entrepreneurial Commitment Group

- Recent Alumni

- Half-Century Club

- Fall Reunions

- Spring Reunions

- MBA 25th Reunion

- Half-Century Club Reunion

- Faculty Lectures

- Ernest C. Arbuckle Award

- Alison Elliott Exceptional Achievement Award

- ENCORE Award

- Excellence in Leadership Award

- John W. Gardner Volunteer Leadership Award

- Robert K. Jaedicke Faculty Award

- Jack McDonald Military Service Appreciation Award

- Jerry I. Porras Latino Leadership Award

- Tapestry Award

- Student & Alumni Events

- Executive Recruiters

- Interviewing

- Land the Perfect Job with LinkedIn

- Negotiating

- Elevator Pitch

- Email Best Practices

- Resumes & Cover Letters

- Self-Assessment

- Whitney Birdwell Ball

- Margaret Brooks

- Bryn Panee Burkhart

- Margaret Chan

- Ricki Frankel

- Peter Gandolfo

- Cindy W. Greig

- Natalie Guillen

- Carly Janson

- Sloan Klein

- Sherri Appel Lassila

- Stuart Meyer

- Tanisha Parrish

- Virginia Roberson

- Philippe Taieb

- Michael Takagawa

- Terra Winston

- Johanna Wise

- Debbie Wolter

- Rebecca Zucker

- Complimentary Coaching

- Changing Careers

- Work-Life Integration

- Career Breaks

- Flexible Work

- Encore Careers

- Join a Board

- D&B Hoovers

- Data Axle (ReferenceUSA)

- EBSCO Business Source

- Global Newsstream

- Market Share Reporter

- ProQuest One Business

- Student Clubs

- Entrepreneurial Students

- Stanford GSB Trust

- Alumni Community

- How to Volunteer

- Springboard Sessions

- Consulting Projects

- 2020 – 2029

- 2010 – 2019

- 2000 – 2009

- 1990 – 1999

- 1980 – 1989

- 1970 – 1979

- 1960 – 1969

- 1950 – 1959

- 1940 – 1949

- Service Areas

- ACT History

- ACT Awards Celebration

- ACT Governance Structure

- Building Leadership for ACT

- Individual Leadership Positions

- Leadership Role Overview

- Purpose of the ACT Management Board

- Contact ACT

- Business & Nonprofit Communities

- Reunion Volunteers

- Ways to Give

- Fiscal Year Report

- Business School Fund Leadership Council

- Planned Giving Options

- Planned Giving Benefits

- Planned Gifts and Reunions

- Legacy Partners

- Giving News & Stories

- Giving Deadlines

- Development Staff

- Submit Class Notes

- Class Secretaries

- Board of Directors

- Health Care

- Sustainability

- Class Takeaways

- All Else Equal: Making Better Decisions

- If/Then: Business, Leadership, Society

- Grit & Growth

- Think Fast, Talk Smart

- Spring 2022

- Spring 2021

- Autumn 2020

- Summer 2020

- Winter 2020

- In the Media

- For Journalists

- DCI Fellows

- Other Auditors

- Academic Calendar & Deadlines

- Course Materials

- Entrepreneurial Resources

- Campus Drive Grove

- Campus Drive Lawn

- CEMEX Auditorium

- King Community Court

- Seawell Family Boardroom

- Stanford GSB Bowl

- Stanford Investors Common

- Town Square

- Vidalakis Courtyard

- Vidalakis Dining Hall

- Catering Services

- Policies & Guidelines

- Reservations

- Contact Faculty Recruiting

- Lecturer Positions

- Postdoctoral Positions

- Accommodations

- CMC-Managed Interviews

- Recruiter-Managed Interviews

- Virtual Interviews

- Campus & Virtual

- Search for Candidates

- Think Globally

- Recruiting Calendar

- Recruiting Policies

- Full-Time Employment

- Summer Employment

- Entrepreneurial Summer Program

- Global Management Immersion Experience

- Social-Purpose Summer Internships

- Process Overview

- Project Types

- Client Eligibility Criteria

- Client Screening

- ACT Leadership

- Social Innovation & Nonprofit Management Resources

- Develop Your Organization’s Talent

- Centers & Initiatives

- Student Fellowships

- Work & Careers

- Life & Arts

Is it worth doing a PhD to secure a job in finance?

Try unlimited access only $1 for 4 weeks.

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, ft professional, weekend print + standard digital, weekend print + premium digital.

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Global news & analysis

- Exclusive FT analysis

- FT App on Android & iOS

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

- 20 monthly gift articles to share

- Lex: FT's flagship investment column

- 15+ Premium newsletters by leading experts

- FT Digital Edition: our digitised print edition

- Weekday Print Edition

- Videos & Podcasts

- Premium newsletters

- 10 additional gift articles per month

- FT Weekend Print delivery

- Everything in Standard Digital

- Everything in Premium Digital

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

- 10 monthly gift articles to share

- Everything in Print

- Make and share highlights

- FT Workspace

- Markets data widget

- Subscription Manager

- Workflow integrations

- Occasional readers go free

- Volume discount

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

- Majors & Careers

- Online Grad School

- Preparing For Grad School

- Student Life

The 10 Best PhD Programs in Finance

In essence, finance is the study of economics and the claims on resources. The best PhD programs in finance help you develop professionally so you can make difficult decisions around fund allocation, financial planning, and corporate financial management. This qualification will also equip you for a career in teaching or research at top universities.

Which of the 10 best finance PhDs is best for you?

Read on to learn everything you need to know.

Table of Contents

Why Get a Doctorate in Finance?

According to the Bureau of Labor Statistics (BLS), finance managerial professionals have an average salary of $131,710 per year, and jobs are estimated to grow by 17% from 2020 to 2030. This is much more than the average across all occupations. With a PhD in finance, you may work as a finance manager or even become a CEO of a large corporation.

Jobs and Salaries for Doctors of Finance

After earning a PhD in finance, you can find well-paid jobs as a professor or in various corporate finance roles.

Here are some of the most common finance professions with the average annual salaries for each:

- Financial Manager ( $96,255 )

- Financial Analyst ( $63,295 )

- Finance Professor ( $73,776 )

- Chief Financial Officer ( $140,694 )

- Investment Analyst ( $67,730 )

Read More: The Highest Paying PhD Programs

What’s the average cost of a phd program in finance.

The tuition for a PhD in finance can vary depending on the university, with public institutions generally being much more affordable than private ones.

Across all schools, the average tuition is around $30,000 per year.

However, on top of this, you need to factor in other expenses, which could add up to another $30,000 a year. Some top universities offer full funding, including tuition and a stipend for all students who are successfully admitted to the program.

Read Next: The Average Cost of a Master’s Degree in Finance

Top finance phd programs and schools, stanford university, graduate school of business.

PhD in Finance

Stanford University is one of the most prestigious business schools in the world. Its PhD in finance programs has an emphasis on theoretical modeling and empirical testing of financial and economic principles.

- Courses include: Financial markets, empirical asset pricing, macroeconomics, and financial markets.

- Duration: 5 years

- Tuition : Full funding

- Financial aid: Research & teaching assistantship, grants, outside employment, and outside support.

- Delivery: On-campus

- Acceptance rate: 5%

- Location: Stanford, California

The University of Pennsylvania, The Wharton School

The University of Pennsylvania’s renowned Wharton School of Business is home to faculty who are well-known in the field of business research. The school boasts a low student-faculty ratio in an atmosphere that allows you to work with faculty members as peers. This doctor of finance program emphasizes subjects like asset pricing, corporate finance, and portfolio management. This helps students become experts in research and teaching in these areas.

- Courses include: Topics in asset pricing, financial economics, and international finance.

- Credits: 18 courses

- Financial aid: Fellowships, grants, student employment, health insurance, stipend, and loans.

- Acceptance rate: 9%

- Location: Philadelphia, Pennsylvania

The University of Chicago, Booth School of Business

Booth School of Business is a major center for finance education because its faculty includes Eugene F. Fama, Nobel laureate and the father of modern empirical finance. This finance doctoral degree has an option for a joint PhD in collaboration with the university’s economics department.

- Courses: Financial economics, financial markets in the macroeconomy, and behavioral finance.

- Tuition : Refer tuition page

- Financial aid: Grants, stipends, health insurance, scholarships, fellowships, teaching assistantships, research assistantships, and loans.

- Acceptance rate: 7%

- Location: Chicago, Illinois

The University of Illinois at Urbana-Champaign, Gies College of Business

The University of Illinois at Urbana Champaign is one of the best places for studying and conducting research in finance. Its finance research faculty was ranked #4 in the UTD Top 100 Business School Research Rankings between 2016-2019. In this PhD in finance program, students can take the qualifying examination at the end of the first year and, if successful. They’ll be able to start their research project earlier and complete the degree sooner.

- Courses include: Empirical analysis in finance, corporate finance, and statistics & probability.

- Duration: 4-5 years

- Financial aid: Full tuition waiver, stipends, scholarships, grants, student employment, and loans.

- Acceptance rate: 63%

- Location: Champaign, Illinois

Massachusetts Institute of Technology, Sloan School of Management

The Sloan School is one of the top research centers in the world, which aims to transform students into experts who can handle real-world problems in a wide range of spheres, from business and healthcare to climate change. This PhD program in finance gives students the flexibility to choose between a wide range of electives and even study some courses at Harvard.

- Courses include: Current research in financial economics, statistics/applied econometrics, and corporate finance.

- Duration: 6 years

- Financial aid: Full tuition, stipend, teaching assistantships, research assistantships, health insurance, fellowships, scholarships, and loans.

- Location: Cambridge, Massachusetts

Northwestern University, Kellogg School of Management

The Kellogg School of Management allows students to conduct independent research under the supervision of faculty who’ve made significant contributions to the field and have earned numerous prestigious awards. This doctorate of finance program’s admission process has a dual application option. You can also apply to the Economics PhD simultaneously, so if you are not selected for the finance program, you may be considered for economics.

- Courses include: Econometrics, corporate finance, and asset pricing.

- Duration: 5.5 years

- Financial aid: Tuition scholarship, stipends, health insurance, moving allowance, and subsidies.

- Location: Evanston, Illinois

The University of California Berkeley, Haas School of Business

The Haas School of Business in Berkeley is an innovative institution that questions the status quo, takes intelligent risks, and accepts sensible failures in its path to progress. This finance PhD program offers students opportunities to learn about cutting-edge research from faculty from around the world.

- Courses include: Corporate finance theory, stochastic calculus, and applications of psychology & economics.

- Tuition : Refer cost page

- Financial aid: Fellowships, grants, tuition allowance, stipends, teaching assistantships, and research assistantships.

- Acceptance rate: 17%

- Location: Berkeley, California

The University of Texas at San Antonio, Alvarez College of Business

The Alvarez College of Business is one of the forty largest business schools in the USA. It follows a comprehensive and practical approach to education that allows students to apply the knowledge they gain directly in the workplace. This PhD in finance encourages students to do collaborative research with the faculty, which helps them publish their own academic papers before they even complete the program.

- Courses include: Corporate finance, international financial markets, and microeconomic theory.

- Credits: 84 (post-bachelors)

- Financial aid: Scholarships, grants, work-study, teaching assistantships, research assistantships, research fellowships, and loans.

- Acceptance rate: 84%

- Location: San Antonio, Texas

Liberty University, School of Business

Doctor of Business Administration (DBA) in Finance

Liberty University is a non-profit institution among the top five online schools in the USA and has been offering fixed tuition fees for the past seven years. This is one of the best PhD in Finance programs you can do completely online. It aims to prepare students to address issues in business finance through research, best practices, and relevant literature.

- Courses: Managerial Finance, Investments & Derivatives, Business Valuation, etc.

- Credits: 60

- Duration: 3 years average

- Tuition : $595 per credit

- Financial aid: Grants, scholarships, work-study, veteran benefits, and loans.

- Delivery: Online

- Acceptance rate: 50%

- Location: Lynchburg, Virginia

Northcentral University

PhD in Business Administration (PhD-BA) – Finance Management

Northcentral University was founded with the objective of offering flexible, fully-online programs to working professionals around the world. This doctorate degree in finance online is flexible and allows you to design your own schedule. You will also get one-on-one personal mentoring from qualified faculty.

- Courses include: Business financial systems, business statistics, and business leadership & strategy.

- Duration: 84 months average

- Tuition: $1,105 per credit

- Financial aid: Grants, scholarships, and military scholarships.

- Acceptance rate: NA

- Location: Scottsdale, Arizona

Things To Consider When Choosing a Finance PhD Program

The right PhD program for you is a very personal decision and will depend on several individual factors.

However, these general questions will help you to make the right choice:

- Is the university properly accredited?

- Does the university conduct innovative and cutting-edge research?

- Are there renowned faculty members who you’ll want to work with?

- Do they offer subjects or specializations that match your career goals?

- What is the school’s placement history?

- What are the tuition fees, costs, and options for scholarships and financial aid?

- Does the program offer online study options?

It’s also important to consider if you want to pursue a career in academia or work in organizations as a senior finance professional. A PhD degree will generally set you up for a career in research or academia, while a DBA is more suited to a career in business or government.

Preparing for a Finance Doctorate Program

It’s important to start preparing early if you want to be selected for one of the best finance PhD programs.

These handy tips can help you put your best foot forward:

- Research the requirements of the best universities offering PhD in finance degrees, including pre-requisite subjects and qualifying grades. Keep these in mind when completing your bachelor’s or master’s degree.

- Understand your strengths and weaknesses in relation to the program’s requirements. Work on your weaknesses and continue to hone relevant skills.

- Read extensively in the field and keep up-to-date on regional and global developments.

- Join communities of finance professionals to build your network and be exposed to the latest knowledge in the discipline.

Skills You Gain from Earning a PhD in Finance

The most important skills you learn as a doctor of finance include:

- Communication skills, including writing and presentation skills

- Data analytical skills

- Economics and accounting skills

- Critical thinking skills

- Mathematical skills

- Analytical software skills

- Management and leadership skills

- Problem-solving skills

PhD Programs in Finance FAQs

How long does a phd in finance take.

PhD programs in finance usually take between three and eight years to complete.

Is It Worth Getting a PhD in Finance?

A PhD in Finance is a qualification that’s in high demand today. It is a terminal degree and can help you get top-level jobs with lucrative salaries in corporate or large organizations.

How Much Can You Make With a PhD in Finance?

With a finance doctorate, you can expect to earn a salary anywhere from around $45,000 to $150,000, depending on your experience, role, and the organization you work for. According to the BLS, the average salary for finance PhD holders is $131,710 .

What Do You Need To Get a PhD in Finance?

The admissions requirements vary depending on the program, but you’ll typically need a bachelor’s or master’s degree in finance. The programs can take three to eight years of coursework and research.

To apply, you’ll usually need to submit:

- Application

- Academic resume

- Academic transcripts

- Recommendation letters

- GRE or GMAT score

- Personal essay

Final Thoughts

With a doctorate in finance, you can build a rewarding career in academia, research, or the business sector. Like any doctorate, these programs ask for dedication and hard work. By planning early, you’ll set yourself up to pursue one of the best PhD programs in finance.

For more on how to build your career in the field, take a look at our guides to the best master’s degree in finance , the highest paying PhDs , and fully-funded PhD programs .

Lisa Marlin

Lisa is a full-time writer specializing in career advice, further education, and personal development. She works from all over the world, and when not writing you'll find her hiking, practicing yoga, or enjoying a glass of Malbec.

- Lisa Marlin https://blog.thegradcafe.com/author/lisa-marlin/ 12 Best Laptops for Computer Science Students

- Lisa Marlin https://blog.thegradcafe.com/author/lisa-marlin/ ACBSP Vs AACSB: Which Business Program Accreditations is Better?

- Lisa Marlin https://blog.thegradcafe.com/author/lisa-marlin/ BA vs BS: What You Need to Know [2024 Guide]

- Lisa Marlin https://blog.thegradcafe.com/author/lisa-marlin/ The 19 Best MBA Scholarships to Apply for [2024-2025]

The 7 Best Student Planner Apps

Most common industries to land a job out of college, related posts.

- How New Grads Research Companies to Find Jobs

- Experience Paradox: Entry-Level Jobs Demand Years in Field

Grad Trends: Interest in Artificial Intelligence Surges

Applying to Big Tech This Year? Here’s How to Ace It.

73% of job seekers believe a degree is needed for a well-paying role–but is it?

Tech Talent Crunch: Cities with More Jobs Than Workers

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Recent Posts

- The Sassy Digital Assistant Revolutionizing Student Budgeting

- Computer Science Graduate Admission Trends: Annual Results

- The Best Academic Planners for 2024/2025

© 2024 TheGradCafe.com All rights reserved

- Partner With Us

- Results Search

- Submit Your Results

- Write For Us

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Other Industries Forum OTH

Why Do a Ph.D in Finance?

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share via Email

As a sophomore undergrad, how can I best position myself to get into a good Ph.D. program? I plan on doing a masters beforehand, and I was wondering if it would be in my best interest to seek out work experience prior to applying to Ph.D. programs or if I should just do research and work towards publications at my University (which is a top 25 school).

What are the requirements for a Top 25 Ph.D. in Finance?

Getting into a top Ph.D. in Finance program is extremely competitive. A firm foundation in math is essential as is economics. To set yourself apart, a letter from a well-published professor is going to give you an edge. If you can get yourself an internship with this professor, even better.

Any and all experience you can get prior to your Ph.D. application will be useful. The most effective approach is getting published in a top finance publication, however with the limited research knowledge and experience received in an undergrad, this can prove difficult.

Finance related work experience and internships are valuable as they display your dedication and work ethic but they are not likely going to be enough for your Ph.D. application. What they will do is give you a better of an idea what a career in finance would be like and if you would prefer to be in a bank/corporate setting or academia post-graduation.

Finance Ph.D. Ranking

Take a look at some of the top-ranked business schools according to Bloomberg

teenagepirate: Top finance Ph.Ds are more competitive than any entry-level job within banking. A publication always helps. Research experience helps more than internships but competitive internships (top name bank etc.) have value because they're a signal that you're capable of working hard. Admission to the top 25 schools is essentially a lottery. Average GMAT for Chicago's finance Ph.D. was 760+ for instance. Work hard, do your math courses, do your economic courses, get good recommendation letters from well-published finance profs (try to do research internships with them). Independent research won't get you very far because as an undergrad, you're just not trained well enough to do it to a high level.

What do Finance Ph.Ds do after Graduating?

A Ph.D. in Finance will set you up for a position at a quantitive trading desk. They land fewer jobs with I-banks and more often work behind the scenes and are generally less involved directly with clients as their reputation tends to be that they are more academic and less business oriented. What it does set you up for, however, is a career in academia as a professor or researcher.

Schumacher: I-banks generally have economists and market strategists (not sure who gets these jobs and how) that generally most of these people carry PhDs. The trend at most quant trading desks seems to lean more towards the physics, mathematics, statistics PhDs. It's a great degree to have if you want to break into trading. To be honest, a Finance Ph.D. is basically only beneficial to people who want to become college professors, which has its perks (ridiculously short hours, low-stress environment, and great pay assuming you can get a job at a half-decent college).

https://www.youtube.com/watch?v=tnn4Ny67DY4

UES802: I was talking a bit ago with an MD at an MM I-bank and someone asked him a similar question. He responded with, while anything is possible, attaining a Ph.D. in Finance won't really help your chances to get into I-banking all that much. He personally felt that people who go this route tend to get too used to the culture and routine that is involved with school, and are better equipped to become a professor than to attempt to enter the business world.

Academic-based positions can be extremely lucrative and appealing due to the great benefits and hours but if you’re keen to work with clients and in the front end of things, it would probably be more book education than you need.

Read More about Finance Ph.Ds at Wall Street Oasis

- Ph.D. Yah or Nah?

- Finance Ph.D. vs. Finance MBA

- Any Value to a Summer Internship before doing a Ph.DProgram?

Decided to Pursue a Wall Street Career? Learn How to Network like a Master.

Inside the WSO Finance networking guide, you'll get a comprehensive, all-inclusive roadmap for maximizing your networking efforts (and minimizing embarrassing blunders). This info-rich book is packed with 71 pages of detailed strategies to help you get the most of your networking, including cold emailing templates, questions to ask in interviews, and action steps for success in navigating the Wall Street networking process.

Networking Guide

It's fairly difficult. Princeton admits 1-2 PhDs each year. Same with the other top ten schools.

My advice is to write a paper that gets published in a Big Three journal (Journal of Finance, Journal of Financial Economics, Review of Financial Studies.) If you can do that, you should get in just about anywhere.

IlliniProgrammer: It's fairly difficult. Princeton admits 1-2 PhDs each year. Same with the other top ten schools. My advice is to write a paper that gets published in a Big Three journal (Journal of Finance, Journal of Financial Economics, Review of Financial Studies.) If you can do that, you should get in just about anywhere.

Wow, are non-ivies (say, top 30 schools) a little easier? How about a publication in a good health economics journal? (I hope to get more involved in healthcare finance research)

Would my undergrad summers best be utilized by doing research or internships at F500 or investment banks ?

Top finance PhDs are more competitive than any entry level job within banking. A publication always helps. Research experience helps more than internships but competitive internships (top name bank etc.) have value because they're a signal that you're capable of working hard.

Admission to the top 25 schools is essentially a lottery. Average GMAT for Chicago's finance PhD was 760+ for instance. Work hard, do your math courses, do your econ courses, get good recommendation letters from well published finance profs (try to do research internships with them). Independent research won't get you very far because as an undergrad, you're just not trained well enough to do it to a high level.

Finally, don't post here, post on urch.com and read econjobrumors.com . People here are a little bit retarded and think a PhD is something you do if you don't get a job and you want to be lazy. A finance assistant prof (ie straight out of PhD) at a top 25 school will get $200k+ for 9 months a year and a professorial lifestyle. Hell, even PhD students get a $30k stipend (and can raise external financing for the program). It's not as much as you get paid in industry, but it's pretty excellent when you consider the lifestyle and the fact that you don't have to wade through as much bullcrap in your career.

teenagepirate: IlliniProgrammer: It's fairly difficult. Princeton admits 1-2 PhDs each year. Same with the other top ten schools. My advice is to write a paper that gets published in a Big Three journal (Journal of Finance, Journal of Financial Economics, Review of Financial Studies.) If you can do that, you should get in just about anywhere.

How are the results for attending a program outside the top 30 or even top 50? Does it get increasingly tough to get tenure and industry opportunities?

Also, I was on academic probation during my freshman year due to poor grades. If I bounce back to about a 3.7 GPA or so by time of application, would it come back to bite me?

Thank you for your response, it helped greatly!

Between Harrison Hong, Markus Brunnermeier, and Ben Bernanke, we have our fair share of research on the financial markets.

Everyone has access to WRDS; everyone can crank out an analysis and figure out if there's something publishable in about a week's time; and the papers are examined blindly. This is something any 21 year old with Excel and WRDS can do; it's not exactly like this is 1978 and some 18 year old is trying to invent the PC in his parents' California garage. (Oh wait.)

Ask a tough question for which there is financial or economic data to answer it with. Then find an appropriate journal to submit your analysis to. They don't really consider the fact that you're an undergrad until the decision to publish has already been made.

Get something published- just make sure you have something really interesting. The JoF's submission fee is something like $250 and they have a twelve week turnaround time.

just u are, idiots

just ure retarded

The market is very good, solid 6 figure salaries for starting associate professors. Pretty much everything you read about getting into economics PhD programs can be cross applied to finance PhD programs. The most improtant things are going to be:

- Math background: math stats, probability, differential equations, and real analysis would be very good.

- Recs from profs

- Experience working as a research assistant, writing a senior thesis, etc. These are the sorts of things that make for good recs.

- A non disqualifying GRE quant score (as close to 800 as possible).

Also look into econ PhDs where you can concentrate in financial economics. They won't care about interning at a F500 or whatever, it's irrelevant.

(the reason I mentioned Etula there in the last paragraph is not because he's a retard or anything but because his asset pricing paper was mentioned on Falkenblog yesterday http://falkenblog.blogspot.com/2013/01/is-broker-dealer-leverage-elusiv… and I really wasn't convinced by it yet this guy is an "asset pricing expert" in QIS at GSAM )

teenagepirate: (the reason I mentioned Etula there in the last paragraph is not because he's a retard or anything but because his asset pricing paper was mentioned on Falkenblog yesterday http://falkenblog.blogspot.com/2013/01/is-broker-dealer-leverage-elusiv… and I really wasn't convinced by it yet this guy is an "asset pricing expert" in QIS at GSAM )

How difficult is getting into an accounting phd program? What undergrad/ MS concentrations would set me up best for this and/or finance?

jackd9999: teenagepirate: (the reason I mentioned Etula there in the last paragraph is not because he's a retard or anything but because his asset pricing paper was mentioned on Falkenblog yesterday http://falkenblog.blogspot.com/2013/01/is-broker-dealer-leverage-elusiv… and I really wasn't convinced by it yet this guy is an "asset pricing expert" in QIS at GSAM )

As for your undergrad, it's not super important. Undergraduate accounting tends to be way more practical than what research is. Your best bets are math, econ, statistics and finance, with a few accounting courses so that you understand the very basic concepts. After those come engineering, physics etc. Essentially, you just need to be able to show that you can handle the very quantitative courseload. Often, you'll need to have done a few basic courses in micro-economics and finance, but this is not a hard requirement at all schools. Some schools (Stanford comes to mind, MIT too I think) also require some programming proficiency so it makes sense to do a bit of compsci as well.

And are you serious about "everyone can crank out an analysis and figure out it there's something publishable"? It takes Hong, Brunnermeier etc. a year or so to go from idea to publication and that's with an army of research assistants and co-authors. It's virtually impossible for an undergrad to know the established methodologies for a given field, to know whether their question is relevant and to be able to write the paper in the right way to get their point across in a way that's acceptable to the editors. An undergrad is not going to get a top 3 pub in econ/acc/fin, they may get their dissertation in if their supervisor puts a lot of work into it, but I've never seen a BSc diss make it, only masters level ones. And, as I said, the supervisor usually helps a lot with that.

If you have a trading strategy that can generate a big enough sharpe ratio, it's not too tough to get it published in the JQFA. And if it's big enough and obvious enough to raise a lot of doubt about the EMH or CAPM , you're now talking about a big three publication.

You can vet a trading strategy in about three days in industry. It took me a week to come up with something that can consistently generate a Sharpe of 2.

Most of the quants who held Finance PhDs I worked with in industry were published multiple times in grad school. Seriously, it's not all that tough. And it doesn't really matter your school's ranking- it matters what you, personally get published. Attending a school with a brand name can also be helpful, but you're only the sum of your work product.

Bottom line: If you want into grad school, get something published .

IlliniProgrammer: And are you serious about "everyone can crank out an analysis and figure out it there's something publishable"? It takes Hong, Brunnermeier etc. a year or so to go from idea to publication and that's with an army of research assistants and co-authors. It's virtually impossible for an undergrad to know the established methodologies for a given field, to know whether their question is relevant and to be able to write the paper in the right way to get their point across in a way that's acceptable to the editors. An undergrad is not going to get a top 3 pub in econ/acc/fin, they may get their dissertation in if their supervisor puts a lot of work into it, but I've never seen a BSc diss make it, only masters level ones. And, as I said, the supervisor usually helps a lot with that.

You can vet a trading strategy in about three days in industry; probably less. It took me a week to come up with something that can consistently generate a Sharpe of 2.

Just randomly picked 3 top 10 schools that showed CVs of their current students / job market candidates. Most of them have no publications, a few have one paper with a supervisor or something. You don't get a top 3 publication for figuring out a trading rule, you don't even get a JPM or FAJ for that. No one cares, it's probably the result of data mining or ignoring something like liquidity/ trading costs etc..

And what do you mean by quant? You mean someone working derivs, or a quant as in someone who specializes in quantitative investing? Basically mathematical finance vs. asset pricing? Because in mathematics and physics it's a lot easier to publish than in finance, articles are much shorter and take less time to get through.

If getting a top journal publication was easy, leading professors wouldn't travel half-way around the world to present papers at seminars and get comments on them.

teenagepirate: IlliniProgrammer: And are you serious about "everyone can crank out an analysis and figure out it there's something publishable"? It takes Hong, Brunnermeier etc. a year or so to go from idea to publication and that's with an army of research assistants and co-authors. It's virtually impossible for an undergrad to know the established methodologies for a given field, to know whether their question is relevant and to be able to write the paper in the right way to get their point across in a way that's acceptable to the editors. An undergrad is not going to get a top 3 pub in econ/acc/fin, they may get their dissertation in if their supervisor puts a lot of work into it, but I've never seen a BSc diss make it, only masters level ones. And, as I said, the supervisor usually helps a lot with that.

Uncovering Hedge Fund Skill from The Portfolio Holdings They Hide This paper studies the “confidential holdings” of institutional investors, especially hedge funds, where the quarter‐end equity holdings are disclosed with a delay through amendments to Form 13F and are usually excluded from the standard databases. Funds managing large risky portfolios with nonconventional strategies seek confidentiality more frequently. Stocks in these holdings are disproportionately associated with information‐sensitive events or share characteristics indicating greater information asymmetry. Confidential holdings exhibit superior performance up to 12 months, and tend to take longer to build. Together the evidence supports private information and the associated price impact as the dominant motives for confidentiality. http://onlinelibrary.wiley.com/doi/10.1111/jofi.12012/pdf

Ok, so someone had the neat idea of running a regression of hedge fund performance against the percentage of portfolios that they disclose through amendments. Woohoo! Journal of Finance! Oh, wow, it was probably mostly done by a grad student too (Yuehua Tang).

As for the strategies, of course you have to take bids and asks. These are reported in nearly every market database. You also have to be conservative in estimating market impact for larger strategies- the fact is that you may not be able to execute some strategy with millions of dollars off of a bid or ask of 500 shares, but there are a number of models commercially available for empirically guessing how much such a transaction would move the market.

If you (1) have a valid arbitrage strategy that WILL make money and (2) use it to make a convincing argument about financial theory, you pretty much have a publication in either the Big Three or one of the next few journals.

Of course, sometimes the best strategies and ideas never get published.

1.) Come up with a theory about the markets. Ideally one that relies on data that wasn't available 20 years ago. (This may rule out theories on cash equities) 2.) Design a strategy to test that theory. 3.) Figure out whether the results show anything. Ideally, try to have a natural experiment with a control and a test. 4.) Figure out how interesting and meaningful those results are. 5.) Clean it up and try to publish it.

You should be able to cycle through 1-4 in 40 hours of work. 5 will take another ~80 hours before you submit to your first journal. Also it's wise to submit to some repository so your idea doesn't get scooped.

I just noticed you also asked about the UK in your first post. So I'll mention that briefly as well.

Basically, in the UK, LBS is basically an American school and is the only UK school that ranks really well globally. LSE has a good name in industry but they're very large and not that respected internationally in "academic finance" or accounting, and apparently treat their PhD students quite poorly. LSE , Warwick, Imperial, Cass, Oxford and Cambridge are pretty much what you would treat as the second tier of schools in the UK after LBS with each having some sort of problem: Cambridge's faculty of finance is tiny and very junior but decent, at the other end of the spectrum you have LSE and Cass which are really big but with a lot of mediocre people and bought talent. Oxford had like 3 people go to this year's AFA meeting which was quite impressive for a faculty as small as theirs. For the UK and finance, LBS is the way to go and should that fail, then LSE and Oxford. But there are many many schools that are as good as LSE and Oxford which are not impossible to get into in the US so at that point it becomes a point of how much funding you can get and how well the research interests match yours. For accounting, I have no idea really because it seems like accounting research in Europe and accounting in the US are done completely differently and European researchers are just unable to get good publications into the top US journals but dominate publishing in AOS. I don't know enough to rank the schools but LBS's department of accounting seems fairly good by international standards (faculty seem to publish in the top US journals), even though it's quite small.

As for if you have a valid arbitrage strategy, lots of people think they do and try to publish them but get rejected. Why? Because most likely they're ignoring something... A lot of professionals think they've got a winning strategy but if they exposed that strategy to the kind of scrutiny that academic ideas get they'd realize just how flawed it actually is.

There have been a couple of arbitrages published in recent years but in reality they're quite rare.. If you have a valid arbitrage strategy that will make money, chances are that either you can use it to make a lot of money (doesn't happen often in practice) or you can publish it (doesn't happen often either).

This isn't that complicated, though.

Anyhow, OP, I strongly recommend http://www.urch.com/forums/phd-business/ instead of here. Here you just have too few people who know anything about the process and too many people who will answer without knowing anything for this forum to be useful (not referring to anyone on this thread but this whole forum)

PhD in Finance vs. Working ( Originally Posted: 10/28/2012 )

I'm early into a PhD program in Finance at a 10-20 ranked b-school. I'm not so sure about going the academia route if I do complete my degree, and find myself more excited about building a career as a researcher in the AM industry. Considering the options of (1) finishing the PhD and going into AM as a researcher, or (2) trying to find a buy or sell side research job and quitting the program (I already have a Master's), does anyone out there with experience have any advice or comparisons for these two paths? Is the ceiling higher with the PhD, and is it worth the 5 year investment?

Geez, finance PhD programs are insanely competitive. If you're in a good program, I would stay where you are.

Depending on your location, you should be able to find part-time work/ internships / consulting jobs while you are working on your degree. If you come out with strong work experience and a good thesis, just about any buyside firm will at least give you a look.

I assume you have a stipend? Then the only cost is opportunity. In this market, staying in a PhD program isn't a terrible idea. You could always quit if you get an offer from a top fund - but in the meantime, you are building your resume (and hopefully getting work experience).

I do have a stipend, but unfortunately my program won't allow me to take outside work while enrolled in the program. So my options for building work experience are pretty limited.

A phD will definitely get you noticed but if you don't have any relevant experience, summer internship , etc, then you will be just like every other PhD who is having a career crises. The problem with a masters at a non-feeder school is that there are many people with them (MFE, etc.) so your resume won't stand out too much. I would say the ceiling is not higher with a PhD but it will help you get noticed by top shops/ AM firms.

If you don't want to do quant/systematic strategies then the value proposition of a PhD diminishes. But again, a PhD will get you noticed in any shop that isn't straight fundamental.

I would think that if you're at a top school then many of your professors consult for the industry. you should ask them about their experience and then also see if they can help you get a summer internship or help them on a project. that should give you a better idea if you think it's worth quitting your program.

Since you're pursuing a PhD in Finance, you're most likely going to be offered positions in quantitative finance research(derivatives pricing). It isn't that bad of a place to be. If you don't want to complete your thesis, then by all means start applying to all the major companies.

You're most likely in a small predicament. I'm guessing you don't know how to program the common languages used like c, c++, java, and python which would rule you out of many quantitative research positions. Given that, you'll be in a more competitive pool competing with students straight out of undergrad for research positions. Since you have a masters, many company HR reps will say you deserve higher pay. But then you've got to think about the department budget and who's running it and what they're willing to sacrifice. In a sense, you run the risk of being overqualified for a research position but under-qualified for another(quant finance research).

With that said, i'd recommend you get through the remainder years and complete your phd.

If you really want to go into industry, 2 years of programming will do you well, C++, Java, and Python at the minimum.

I would have to disagree with one of the above posters. Do not tell your professors that you're planning to go into industry. As you already know, the whole point of a PhD is to prepare you to be an academic researcher. You'll most likely face some opposition when planning your thesis if you tell your professors that your headed to industry.

These are some links which should be of help if you're looking for an industry career post PhD

http://www.econjobrumors.com/topic/phd-in-finance-for-private-sector http://www.econjobrumors.com/topic/afa-private-sector-aqr-blackrock http://www.econjobrumors.com/topic/us-industry-salaries-for-phds/page/1 http://www.econjobrumors.com/topic/most-economists-are-losers

http://www.econjobrumors.com/topic/accounting-phd-vs-finance-phd

afajof.org/association/jobs.asp

Also, finish the PhD. Somehow. The signal premium is worth it. You could arguably drop out with an MS which was paid for and go to work on the street as a quant, but Dr. ABC > Mr. ABC.

Also the buy side roles which are available to Finance PhDs are VERY different from the roles held by MFEs.

Incremental benefit for doing Phd finance ( Originally Posted: 04/13/2013 )