Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Please guide me on selecting research titles

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

- Browse All Articles

- Newsletter Sign-Up

- 18 Jun 2024

- Cold Call Podcast

How Natural Winemaker Frank Cornelissen Innovated While Staying True to His Brand

In 2018, artisanal Italian vineyard Frank Cornelissen was one of the world’s leading producers of natural wine. But when weather-related conditions damaged that year’s grapes, founder Frank Cornelissen had to decide between staying true to the tenets of natural wine making or breaking with his public beliefs to save that year’s grapes by adding sulfites. Harvard Business School assistant professor Tiona Zuzul discusses the importance of staying true to your company’s principles while remaining flexible enough to welcome progress in the case, Frank Cornelissen: The Great Sulfite Debate.

- Research & Ideas

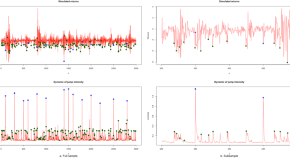

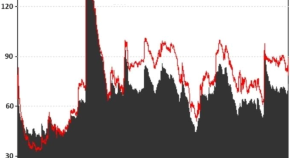

Central Banks Missed Inflation Red Flags. This Pricing Model Could Help.

The steep inflation that plagued the economy after the COVID-19 pandemic took many economists by surprise. But research by Alberto Cavallo suggests that a different method of tracking prices—a real-time model—could predict future surges better.

What Your Non-Binary Employees Need to Do Their Best Work

How can you break down gender boundaries and support the non-binary people on your team better? A study by Katherine Coffman reveals the motivations and aspirations of non-binary employees, highlighting the need for greater inclusion to unlock the full potential of a diverse workforce.

- 04 Jun 2024

How One Insurtech Firm Formulated a Strategy for Climate Change

The Insurtech firm Hippo was facing two big challenges related to climate change: major loss ratios and rate hikes. The company used technologically empowered services to create its competitive edge, along with providing smart home packages, targeting risk-friendly customers, and using data-driven pricing. But now CEO and president Rick McCathron needed to determine how the firm’s underwriting model could account for the effects of high-intensity weather events. Harvard Business School professor Lauren Cohen discusses how Hippo could adjust its strategy to survive a new era of unprecedented weather catastrophes in his case, “Hippo: Weathering the Storm of the Home Insurance Crisis.”

- 22 Apr 2024

When Does Impact Investing Make the Biggest Impact?

More investors want to back businesses that contribute to social change, but are impact funds the only approach? Research by Shawn Cole, Leslie Jeng, Josh Lerner, Natalia Rigol, and Benjamin Roth challenges long-held assumptions about impact investing and reveals where such funds make the biggest difference.

- 23 Jan 2024

More Than Memes: NFTs Could Be the Next Gen Deed for a Digital World

Non-fungible tokens might seem like a fad approach to selling memes, but the concept could help companies open new markets and build communities. Scott Duke Kominers and Steve Kaczynski go beyond the NFT hype in their book, The Everything Token.

- 12 Sep 2023

How Can Financial Advisors Thrive in Shifting Markets? Diversify, Diversify, Diversify

Financial planners must find new ways to market to tech-savvy millennials and gen Z investors or risk irrelevancy. Research by Marco Di Maggio probes the generational challenges that advisory firms face as baby boomers retire. What will it take to compete in a fintech and crypto world?

- 17 Aug 2023

‘Not a Bunch of Weirdos’: Why Mainstream Investors Buy Crypto

Bitcoin might seem like the preferred tender of conspiracy theorists and criminals, but everyday investors are increasingly embracing crypto. A study of 59 million consumers by Marco Di Maggio and colleagues paints a shockingly ordinary picture of today's cryptocurrency buyer. What do they stand to gain?

- 17 Jul 2023

Money Isn’t Everything: The Dos and Don’ts of Motivating Employees

Dangling bonuses to checked-out employees might only be a Band-Aid solution. Brian Hall shares four research-based incentive strategies—and three perils to avoid—for leaders trying to engage the post-pandemic workforce.

- 20 Jun 2023

Elon Musk’s Twitter Takeover: Lessons in Strategic Change

In late October 2022, Elon Musk officially took Twitter private and became the company’s majority shareholder, finally ending a months-long acquisition saga. He appointed himself CEO and brought in his own team to clean house. Musk needed to take decisive steps to succeed against the major opposition to his leadership from both inside and outside the company. Twitter employees circulated an open letter protesting expected layoffs, advertising agencies advised their clients to pause spending on Twitter, and EU officials considered a broader Twitter ban. What short-term actions should Musk take to stabilize the situation, and how should he approach long-term strategy to turn around Twitter? Harvard Business School assistant professor Andy Wu and co-author Goran Calic, associate professor at McMaster University’s DeGroote School of Business, discuss Twitter as a microcosm for the future of media and information in their case, “Twitter Turnaround and Elon Musk.”

- 06 Jun 2023

The Opioid Crisis, CEO Pay, and Shareholder Activism

In 2020, AmerisourceBergen Corporation, a Fortune 50 company in the drug distribution industry, agreed to settle thousands of lawsuits filed nationwide against the company for its opioid distribution practices, which critics alleged had contributed to the opioid crisis in the US. The $6.6 billion global settlement caused a net loss larger than the cumulative net income earned during the tenure of the company’s CEO, which began in 2011. In addition, AmerisourceBergen’s legal and financial troubles were accompanied by shareholder demands aimed at driving corporate governance changes in companies in the opioid supply chain. Determined to hold the company’s leadership accountable, the shareholders launched a campaign in early 2021 to reject the pay packages of executives. Should the board reduce the executives’ pay, as of means of improving accountability? Or does punishing the AmerisourceBergen executives for paying the settlement ignore the larger issue of a business’s responsibility to society? Harvard Business School professor Suraj Srinivasan discusses executive compensation and shareholder activism in the context of the US opioid crisis in his case, “The Opioid Settlement and Controversy Over CEO Pay at AmerisourceBergen.”

- 16 May 2023

- In Practice

After Silicon Valley Bank's Flameout, What's Next for Entrepreneurs?

Silicon Valley Bank's failure in the face of rising interest rates shook founders and funders across the country. Julia Austin, Jeffrey Bussgang, and Rembrand Koning share key insights for rattled entrepreneurs trying to make sense of the financing landscape.

- 27 Apr 2023

Equity Bank CEO James Mwangi: Transforming Lives with Access to Credit

James Mwangi, CEO of Equity Bank, has transformed lives and livelihoods throughout East and Central Africa by giving impoverished people access to banking accounts and micro loans. He’s been so successful that in 2020 Forbes coined the term “the Mwangi Model.” But can we really have both purpose and profit in a firm? Harvard Business School professor Caroline Elkins, who has spent decades studying Africa, explores how this model has become one that business leaders are seeking to replicate throughout the world in her case, “A Marshall Plan for Africa': James Mwangi and Equity Group Holdings.” As part of a new first-year MBA course at Harvard Business School, this case examines the central question: what is the social purpose of the firm?

- 25 Apr 2023

Using Design Thinking to Invent a Low-Cost Prosthesis for Land Mine Victims

Bhagwan Mahaveer Viklang Sahayata Samiti (BMVSS) is an Indian nonprofit famous for creating low-cost prosthetics, like the Jaipur Foot and the Stanford-Jaipur Knee. Known for its patient-centric culture and its focus on innovation, BMVSS has assisted more than one million people, including many land mine survivors. How can founder D.R. Mehta devise a strategy that will ensure the financial sustainability of BMVSS while sustaining its human impact well into the future? Harvard Business School Dean Srikant Datar discusses the importance of design thinking in ensuring a culture of innovation in his case, “BMVSS: Changing Lives, One Jaipur Limb at a Time.”

- 18 Apr 2023

What Happens When Banks Ditch Coal: The Impact Is 'More Than Anyone Thought'

Bank divestment policies that target coal reduced carbon dioxide emissions, says research by Boris Vallée and Daniel Green. Could the finance industry do even more to confront climate change?

The Best Person to Lead Your Company Doesn't Work There—Yet

Recruiting new executive talent to revive portfolio companies has helped private equity funds outperform major stock indexes, says research by Paul Gompers. Why don't more public companies go beyond their senior executives when looking for top leaders?

- 11 Apr 2023

A Rose by Any Other Name: Supply Chains and Carbon Emissions in the Flower Industry

Headquartered in Kitengela, Kenya, Sian Flowers exports roses to Europe. Because cut flowers have a limited shelf life and consumers want them to retain their appearance for as long as possible, Sian and its distributors used international air cargo to transport them to Amsterdam, where they were sold at auction and trucked to markets across Europe. But when the Covid-19 pandemic caused huge increases in shipping costs, Sian launched experiments to ship roses by ocean using refrigerated containers. The company reduced its costs and cut its carbon emissions, but is a flower that travels halfway around the world truly a “low-carbon rose”? Harvard Business School professors Willy Shih and Mike Toffel debate these questions and more in their case, “Sian Flowers: Fresher by Sea?”

Is Amazon a Retailer, a Tech Firm, or a Media Company? How AI Can Help Investors Decide

More companies are bringing seemingly unrelated businesses together in new ways, challenging traditional stock categories. MarcAntonio Awada and Suraj Srinivasan discuss how applying machine learning to regulatory data could reveal new opportunities for investors.

- 07 Apr 2023

When Celebrity ‘Crypto-Influencers’ Rake in Cash, Investors Lose Big

Kim Kardashian, Lindsay Lohan, and other entertainers have been accused of promoting crypto products on social media without disclosing conflicts. Research by Joseph Pacelli shows what can happen to eager investors who follow them.

- 31 Mar 2023

Can a ‘Basic Bundle’ of Health Insurance Cure Coverage Gaps and Spur Innovation?

One in 10 people in America lack health insurance, resulting in $40 billion of care that goes unpaid each year. Amitabh Chandra and colleagues say ensuring basic coverage for all residents, as other wealthy nations do, could address the most acute needs and unlock efficiency.

Thank you for visiting nature.com. You are using a browser version with limited support for CSS. To obtain the best experience, we recommend you use a more up to date browser (or turn off compatibility mode in Internet Explorer). In the meantime, to ensure continued support, we are displaying the site without styles and JavaScript.

- View all journals

Finance articles from across Nature Portfolio

Latest research and reviews, speculative culture and corporate high-quality development in china: mediating effect of corporate innovation.

- Changwei Guo

Impact of CEO’s scientific research background on the enterprise digital level

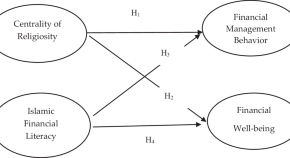

The impact of religiosity and financial literacy on financial management behavior and well-being among Indonesian Muslims

- Haykal Rafif Wijaya

- Sri Rahayu Hijrah Hati

- Salina Kassim

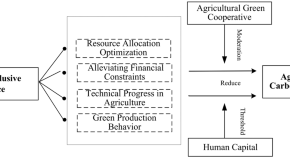

Transitioning to low-carbon agriculture: the non-linear role of digital inclusive finance in China’s agricultural carbon emissions

- Jiansheng You

Impact of COVID-19 on jump occurrence in capital markets

- Yuping Song

Dynamic analysis of the relationship between exchange rates and oil prices: a comparison between oil exporting and oil importing countries

- Shiying Chen

- Bisharat Hussain Chang

News and Comment

Hunger, debt and interest rates

Financial imperatives to food system transformation

Finance is a critical catalyst of food systems transformation. At the 2021 United Nations Food Systems Summit, the Financial Lever Group suggested five imperatives to tap into new financial resources while making better use of existing ones. These imperatives are yet to garner greater traction to instigate meaningful change.

- Eugenio Diaz-Bonilla

- Brian McNamara

Central bank digital currencies risk becoming a digital Leviathan

Central bank digital currencies (CBDCs) already exist in several countries, with many more on the way. But although CBDCs can promote financial inclusivity by offering convenience and low transaction costs, their adoption must not lead to the loss of privacy and erosion of civil liberties.

- Andrea Baronchelli

- Hanna Halaburda

- Alexander Teytelboym

ESG performance of ports

An article in Case Studies on Transport Policy quantifies the environmental, social, and governance performances of three ports.

- Laura Zinke

Venture capital accelerates food technology innovation

Start-ups are now the predominant source of innovation in all categories of food technology. Venture capital can accelerate innovation by enabling start-ups to pursue niche areas, iterate more rapidly and take more risks than larger companies, writes Samir Kaul.

Challenges for a climate risk disclosure mandate

The United States and other G7 countries are considering a framework for mandatory climate risk disclosure by companies. However, unless a globally acceptable hybrid corporate governance model can be forged to address the disparities among different countries’ governance systems, the proposed framework may not succeed.

- Paul Griffin

- Amy Myers Jaffe

Quick links

- Explore articles by subject

- Guide to authors

- Editorial policies

- General Finance & Investments

Journal of Financial Research

Vol 41(4 Issues in 2018 )

Print ISSN: 0270-2592

Online ISSN: 1475-6803

Impact Factor: 3.500

Southern Finance Association and the Southwestern Finance Association

Edited By:Erik Devos, William B. Elliott, and Murali Jagannathan

The Journal of Financial Research is a quarterly academic journal devoted to publication of original scholarly research in investment and portfolio management, capital markets and institutions, and corporate finance, corporate governance, and capital investment. The JFR, as it is popularly known, has been in continuous publication since 1978 and is sponsored by the Southern Finance Association (SFA) and the Southwestern Finance Association (SWFA).

Finance Research Letters

About the journal.

Finance Research Letters invites submissions in all areas of finance, broadly defined. Finance Research Letters offers and ensures the rapid publication of important new results in these areas. We aim to provide a rapid response to papers, with all papers undergoing a desk review by one of the …

View full aims & scope

Article publishing charge for open access

Compare APC with another journal

Editor-in-chief, laura ballester.

University of Valencia, Avenida de los Naranjos s/n, 46010, Valencia, Spain

Latest published

Articles in press, most downloaded, most popular, more from finance research letters, announcements, diversity & inclusion statement – finance research letters, special issues and article collections, boyhood in 21st century educative contexts, rethinking educational practices and responsibilities in the light of digitalisation, neoliberalism, education inequity and improvement, motivation of higher education faculty: theoretical approaches, empirical evidence, and future directions, partner journals.

The Finance Research Letters is a companion title of the Finance Research Letters is an open access, peer-reviewed journal which draws contributions from a wide community of international and interdisciplinary researchers …

Related journals

Educational Research...

Educational Research Review

Learning and Instruc...

Learning and Instruction

Teaching and Teacher...

Teaching and Teacher Education

International Journa...

Learning, Culture an...

Learning, Culture and Social Interaction

Copyright © 2024 Elsevier Ltd. All rights reserved

Smart. Open. Grounded. Inventive. Read our Ideas Made to Matter.

Which program is right for you?

Through intellectual rigor and experiential learning, this full-time, two-year MBA program develops leaders who make a difference in the world.

A rigorous, hands-on program that prepares adaptive problem solvers for premier finance careers.

A 12-month program focused on applying the tools of modern data science, optimization and machine learning to solve real-world business problems.

Earn your MBA and SM in engineering with this transformative two-year program.

Combine an international MBA with a deep dive into management science. A special opportunity for partner and affiliate schools only.

A doctoral program that produces outstanding scholars who are leading in their fields of research.

Bring a business perspective to your technical and quantitative expertise with a bachelor’s degree in management, business analytics, or finance.

A joint program for mid-career professionals that integrates engineering and systems thinking. Earn your master’s degree in engineering and management.

An interdisciplinary program that combines engineering, management, and design, leading to a master’s degree in engineering and management.

Executive Programs

A full-time MBA program for mid-career leaders eager to dedicate one year of discovery for a lifetime of impact.

This 20-month MBA program equips experienced executives to enhance their impact on their organizations and the world.

Non-degree programs for senior executives and high-potential managers.

A non-degree, customizable program for mid-career professionals.

Research Centers & Faculty Publications Making Impact

Our faculty pursue solutions to the world's most significant challenges through their research and collaborations. We have built Centers and Labs to bridge academia and industry promoting research with the greatest impact in the application of finance.

Research Centers

Featured Faculty Publications and Working Papers

Paul Asquith

Gordon Y Billard Professor of Finance

Featured Publications

Asquith, Paul, and Lawrence A. Weiss. Hoboken, New Jersey: John Wiley & Sons, Inc., 2019.

Weiss, Lawrence A. and Paul Asquith. Cambridge, MA: CreateSpace Independent Publishing Platform, 2014.

Asquith, Paul, Andrea Au, Thomas Covert and Parag Pathak. Journal of Financial Economics Vol. 107, No. 1 (2013): 155-182.

Nomura Professor of Finance

Chen, Hui, Scott Joslin, and Sophie Ni. Review of Financial Studies Vol. 32, No. 1 (2019): 228-265. Download Paper .

Chen, Hui, Rui Cui, Zhiguo He, and Konstantin Milbradt. Review of Financial Studies Vol. 31, No. 3 (2018): 852-897. Appendix . Download Paper .

Maryam Farboodi

Jon D. Gruber Career Development Professor

Featured Publication

Farboodi, Maryam. Journal of Monetary Economics Vol. 89, (2017): 68-70.

Leonid Kogan

Nippon Telegraph & Telephone Professor of Management

Kogan, Leonid, Dimitris Papanikolaou, and Noah Stoffman. Journal of Political Economy Vol. 128, No. 3 (2020): 855-906. Online Appendix . SSRN .

Dou, Winston Wei, Leonid Kogan, and Wei Wu. The Journal of Finance . Forthcoming.

Chen, Hui, Winston Wei Dou and Leonid Kogan. The Journal of Finance Vol. 79, No. 2 (2024): 843-902. SSRN .

Judy C. Lewent (1972) and Mark Shapiro Career Development Assistant Professor of Finance

Liu, Tong, MIT Sloan Working Paper 6736-21. Cambridge, MA: MIT Sloan School of Management, December 2021.

Andrew W. Lo

Charles E. and Susan T. Harris Professor

Wong, Chi Heem, Kien Wei Siah, and Andrew W. Lo. Biostatistics Vol. 20, No. 2 (2019): 273-286.

Cao, Charles, Bing Liang, Andrew W. Lo, and Lubomir Petrasek. Review of Asset Pricing Studies Vol. 8, No. 1 (2018): 77-116. SSRN Preprint .

Deborah J. Lucas

Sloan Distinguished Professor of Finance

Lucas, Deborah J., MIT Sloan Working Paper 5400-17. Cambridge, MA: MIT Sloan School of Management, December 2019.

Lucas, Deborah J., MIT Sloan Working Paper 5399-17. Cambridge, MA: MIT Sloan School of Management, October 2017.

Lucas, Deborah J., MIT Sloan Working Paper 5402-17. Cambridge, MA: MIT Sloan School of Management, September 2017.

Robert C. Merton

School of Management Distinguished Professor of Finance

Merton, Robert C., and Richard T. Thakor. Journal of Financial Intermediation Vol. 39, (2019): 4-18. SSRN Preprint .

Merton, Robert C., and Arun Muralidhar. Investments and Pensions Europe, April 2017.

Merton, Robert C., Arun S. Muralidhar. Industry Voices, Plansponsor, February 8, 2017.

Class of 1958 Career Development Assistant Professor

Darmouni, Olivier and Lira Mota, MIT Sloan Working Paper 6725-20. Cambridge, MA: MIT Sloan School of Management, April 2022.

Mota, Lira, MIT Sloan Working Paper 6724-21. Cambridge, MA: MIT Sloan School of Management, March 2021.

Stewart Myers

Robert C. Merton (1970) Professor of Financial Economics, Emeritus

Erel, Isil, Stewart Myers and James A. Read, Jr. Journal of Financial Economics Vol. 118, No. 3 (2015): 620-635.

Myers, Stewart. Annual Review of Financial Economics Vol. 7, (2015): 1-34.

Myers, Stewart. Boston, MA: Irwin/McGraw-Hill, 2013.

Christopher J. Palmer

Albert and Jeanne Clear Career Development Professor

Di Maggio, Marco, Amir Kermani, and Christopher John Palmer. Review of Economic Studies Vol. 87, No. 3 (2020): 1498-1528. Pre-publication Version . Appendix . Data and Code . Slides . VoxEU . Forbes . NBER Digest . MIT News .

Jonathan A. Parker

Robert C. Merton (1970) Professor of Financial Economics

Parker, Jonathan A. American Economic Journal: Macroeconomics Vol. 9, No. 4 (2017): 153-183. Publisher Page . Online appendix .

Fishman, Michael J., and Jonathan A. Parker. The Review of Financial Studies Vol. 28, No. 9 (2015): 2575-2607. Download Paper .

Brunnermeier, Markus K. and Jonathan A. Parker. American Economic Review Vol. 95, No. 4 (2005): 1092-1118. JSTOR .

Lawrence D.W. Schmidt

Victor J. Menezes (1972) Career Development Assistant Professor of Finance

Schmidt, Lawrence D. W., Allan Timmermann, and Russ Wermers. American Economic Review Vol. 106, No. 9 (2016): 2625-2657. Author Disclosures . Appendix . Data Set .

Schmidt, Lawrence D.W., MIT Sloan Working Paper 5500-16. Cambridge, MA: MIT Sloan School of Management, March 2022.

Beare, Brendan K., and Lawrence D. W. Schmidt. Journal of Applied Econometrics Vol. 31, No. 2 (2016): 338-356. Supplement .

Antoinette Schoar

Professor, Finance

Bruhn, Miriam, Dean Karlan, and Antoinette Schoar. Journal of Political Economy Vol. 126, No. 2 (2018): 635-687.

Lerner, Josh, Antoinette Schoar, Stanislav Sokolinski, and Karen Wilson. Journal of Financial Economics Vol. 127, No. ` (2018): 1-20.

Adelino, Manuel, Antoinette Schoar, and Felipe Severino. Review of Financial Studies Vol. 29, No. 7 (2016): 1635-1670.

Kerry Y. Siani

Olivier Darmouni and Kerry Siani. Center for Economic and Policy Research Press Discussion Paper No. 17191.

David Thesmar

Franco Modigliani Professor of Financial Economics

Bouchaud, Jean-Philippe, Philipp Krueger, Augustin Landier, and David Thesmar. Journal of Finance Vol. 74, No. 2 (2019): 639-674. Download Paper .

Fraisse, Henri, Mathias LÉ, and David Thesmar. Management Science Vol. 66, No. 1 (2020): 5-23. Supplement . Download Paper .

Perignon, Christophe, David Thesmar, and Guillaume Vuillemey. Journal of Finance Vol. 73, No. 2 (2018): 575-617. Download Paper .

Adrien Verdelhan

Stephens Naphtal Professor of Finance

Du, Wenxin, Alexandre Tepper, and Adrian Verdelhan. Journal of Finance Vol. 73, No. 3 (2018): 915-957. Appendix . Download Paper .

Verdelhan, Adrien. Journal of Finance Vol. 73, No. 1 (2018): 375-418. SSRN Preprint .

Lustig, Hanno, Nick Roussanov and Adrien Verdelhan. Review of Financial Studies Vol. 24, No. 11 (2011): 3731-3777. Download Paper .

Emil Verner

Associate Professor, Finance

Mizuho Financial Group Professor

Tsoukalas, Gerry, Jiang Wang, and Kay Giesecke. Management Science . Forthcoming.

Hu, Grace Xing, Jun Pan, and Jiang Wang. Journal of Financial Economics Vol. 126, No. 2 (2017): 399-421. Download Paper .

Kogan, Lenoid, Stephen Ross, Jiang Wang, and Mark Westerfield. Journal of Economic Theory Vol. 168, (2017): 209-236.

Haoxiang Zhu

Zhu, Haoxiang, and Songzi Du. Journal of Finance Vol. 27, No. 6 (2017): 2589-2628. SSRN Preprint . Appendix .

Song, Zhaogang and Haoxiang Zhu. Review of Financial Studies Vol. 32, No. 8 (2019): 2955-2996. SSRN Preprint .

Yang, Liyan, and Haoxiang Zhu. Journal of Finance Vol. 72, No. 6 (2017): 2759-2772. SSRN Preprint .

Egor Matveyev

Senior Lecturer and Research Scientist in Finance

Lyandres, Evgeny, Egor Matveyev, and Alexei Zhdanov, MIT Sloan Working Paper 5235-17. Cambridge, MA: MIT Sloan School of Management, April 2017.

Matveyev, Egor, Working Paper. December 2016.

Matthew Rhodes-Kropf

Visiting Associate Professor, Finance

Nanda, Ramana and Matthew Rhodes-Kropf. Management Science Vol. 63, No. 4 (2017): 901-918.

Nanda, Ramana, and Matthew Rhodes-Kropf. In Innovation Policy and the Economy, Vol. 16 , 1-23. Chicago, IL: University of Chicago Press, 2016.

Ramana Nanda and Matthew Rhodes-Kropf. In Moving to the Innovation Frontier , edited by Christian Keuschnigg. Washington, DC: March 2016.

- Harvard Business School →

- Faculty & Research →

- Featured Topics

- Business & Environment

- Business History

- Entrepreneurship

- Globalization

- Health Care

- Human Behavior & Decision-Making

- Social Enterprise

- Technology & Innovation

Dynamics of Demand for Index Insurance: Evidence from a Long-Run Field Experiment

This paper estimates how experimentally-manipulated experiences with a novel financial product, rainfall index insurance, affect subsequent insurance demand. Using a seven-year panel, we develop three main findings. First, recent experience matters for demand, consistent with overinference from small samples. Second, spillovers also matter, in the sense that the recent payout experience of village co-residents affects insurance demand about as much as one's own recent payout experience. Third, the spillover effect decays as time passes while the effect of one's own experience does not. We discuss implications of this analysis for commercial sustainability of this complicated but promising risk management technology.

This paper estimates how experimentally-manipulated experiences with a novel financial product, rainfall index insurance, affect subsequent insurance demand. Using a seven-year panel, we develop three main findings. First, recent experience matters for demand, consistent with overinference from small samples. Second, spillovers also matter, in the...

Expectations of Returns and Expected Returns

We analyze time-series of investor expectations of future stock market returns from six data sources between 1963 and 2011. The six measures of expectations are highly positively correlated with each other, as well as with past stock returns and with the level of the stock market. However, investor expectations are strongly negatively correlated with model-based expected returns. The evidence is not consistent with rational expectations representative investor models of returns.

We analyze time-series of investor expectations of future stock market returns from six data sources between 1963 and 2011. The six measures of expectations are highly positively correlated with each other, as well as with past stock returns and with the level of the stock market. However, investor expectations are strongly negatively correlated...

- August 2014

Mortgage Convexity

Most home mortgages in the United States are fixed-rate loans with an embedded prepayment option. When long-term rates decline, the effective duration of mortgage-backed securities (MBS) falls due to heightened refinancing expectations. I show that these changes in MBS duration function as large-scale shocks to the quantity of interest rate risk that must be borne by professional bond investors. I develop a simple model in which the risk tolerance of bond investors is limited in the short run, so these fluctuations in MBS duration generate significant variation in bond risk premia. Specifically, bond risk premia are high when aggregate MBS duration is high. The model offers an explanation for why long-term rates could appear to be excessively sensitive to movements in short rates and explains how changes in MBS duration act as a positive-feedback mechanism that amplifies interest rate volatility. I find strong support for these predictions in the time series of US government bond returns.

Most home mortgages in the United States are fixed-rate loans with an embedded prepayment option. When long-term rates decline, the effective duration of mortgage-backed securities (MBS) falls due to heightened refinancing expectations. I show that these changes in MBS duration function as large-scale shocks to the quantity of interest rate risk...

- Working Paper

Financial Repression in the European Sovereign Debt Crisis

By the end of 2013, the share of government debt held by the domestic banking sectors of Eurozone countries was more than twice its 2007 level. We show that this type of increasing reliance on the domestic banking sector for absorbing government bonds generates a crowding out of corporate lending. For a given domestic firm, new debt is less likely to be a loan—i.e., the loan supply contracts—when local banks have purchased more domestic sovereign debt and when that debt is risky (as measured by CDS spreads). These effects are most pronounced in the period following the second Greek bailout in early 2010.

By the end of 2013, the share of government debt held by the domestic banking sectors of Eurozone countries was more than twice its 2007 level. We show that this type of increasing reliance on the domestic banking sector for absorbing government bonds generates a crowding out of corporate lending. For a given domestic firm, new debt is less likely...

Faculty Unit

Our intellectual roots are based in a long line of scholars from Robert Merton whose collaborative work on risk management and option pricing won him the Nobel Prize in Economics in 1997, to John Lintner who co-created the Capital Asset Pricing Model and made significant contributions to dividend policy , and Gordon Donaldson whose work helped shape the field of corporate finance . We strive to understand how managers and firms make value-enhancing decisions; and how financial institutions, markets, and instruments contribute to this process. Our approach to research is distinguished by its unique combination of theory, empirical analysis, mathematical modeling, and field observations at companies.

The Finance Unit produces research addressing issues of present and future importance to managers, regulators, and policy-makers.

Recent Publications

Lana ghanem: pushing the boundaries of health care through venture capital.

- June 2024 |

- Faculty Research

Caesars Entertainment: Governance on the Road to Bankruptcy

Driving scale with otto, accounting for loans at sofi technologies, investor influence on media coverage: evidence from venture capital-backed startups.

- Working Paper |

Real Growth in Space Manufacturing Output Substantially Exceeds Growth in the Overall Space Economy

- Acta Astronautica

MStudio and Djoli: Accelerating Startup Growth in Francophone Africa

Naked wines: the profit vs. growth decision, private equity and digital transformation, creditor-on-creditor violence and secured debt dynamics, hbs working knowlege.

- 18 Jun 2024

How Natural Winemaker Frank Cornelissen Innovated While Staying True to His Brand

Central banks missed inflation red flags. this pricing model could help., what your non-binary employees need to do their best work, harvard business publishing.

- December 9, 2020

Give Employees Cash to Purchase Their Own Insurance

Hbr guide to buying a small business: think big, buy small, own your own company.

Browse Econ Literature

- Working papers

- Software components

- Book chapters

- JEL classification

More features

- Subscribe to new research

RePEc Biblio

Author registration.

- Economics Virtual Seminar Calendar NEW!

Search IDEAS All Articles Papers Chapters Books Software In: Whole record Abstract Keywords Title Author Sort by: new options Relevance Oldest Most recent Most cited Title alphabet Recently added Recent & relevant Relevant & cited Recent & cited From: Any Year 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1985 1980 1975 1970 1960 1950 1940 1930 1900 1800 1700 To: Any Year 2024 2023 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1985 1980 1975 1970 1960 1950 1940 1930 1900 1800 1700 More advanced search New: sort by citation count and by recently added --> What is IDEAS? IDEAS is the largest bibliographic database dedicated to Economics and available freely on the Internet. Based on RePEc , it indexes over 4,700,000 items of research, including over 4,200,000 that can be downloaded in full text. RePEc is a large volunteer effort to enhance the free dissemination of research in Economics which includes bibliographic metadata from over 2,000 participating archives , including all the major publishers and research outlets. IDEAS is just one of several services that use RePEc data. For some statistics about the holdings on this site, see here . Authors are invited to register with RePEc to create an online profile. Then, anyone finding some of their research here can find your latest contact details and a listing of their other research. They will also receive a monthly mailing about the popularity of their works, their ranking and newly found citations. How do I find on IDEAS what I am looking for?

More services and features.

Follow serials, authors, keywords & more

Public profiles for Economics researchers

Various research rankings in Economics

RePEc Genealogy

Who was a student of whom, using RePEc

Curated articles & papers on economics topics

Upload your paper to be listed on RePEc and IDEAS

New papers by email

Subscribe to new additions to RePEc

EconAcademics

Blog aggregator for economics research

Cases of plagiarism in Economics

About RePEc

Initiative for open bibliographies in Economics

News about RePEc

Questions about IDEAS and RePEc

RePEc volunteers

Participating archives

Publishers indexing in RePEc

Privacy statement

Corrections.

Found an error or omission?

Opportunities to help RePEc

Get papers listed

Have your research listed on RePEc

Open a RePEc archive

Have your institution's/publisher's output listed on RePEc

Get RePEc data

Use data assembled by RePEc

FinancialResearch.gov

Inside the ofr.

The Office of Financial Research (OFR) helps to promote financial stability by looking across the financial system to measure and analyze risks, perform essential research, and collect and standardize financial data.

Our job is to shine a light in the dark corners of the financial system to see where risks are going, assess how much of a threat they might pose, and provide policymakers with financial analysis, information, and evaluation of policy tools to mitigate them.

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 ( P.L. 111-203 ) established the OFR principally to support the Financial Stability Oversight Council and its member agencies.

The OFR has a director appointed by the President and confirmed by the Senate, and an organization built around a Research and Analysis Center, and a Data Center.

Promote financial stability by delivering high-quality financial data, standards and analysis principally to support the Financial Stability Oversight Council and its member agencies.

A transparent, accountable, and resilient financial system.

| | Office of Financial Research U.S. Department of the Treasury 717 14th Street, NW Washington, DC 20220 | OFR New York 290 Broadway Floor 13 New York, NY 10007 |

Congressional Justification

Treasury publishes its annual performance plan and report as a part of its congressional budget justification, which includes the high-level results from its internal strategic reviews. As an Office within Treasury can be found on Treasury’s budget documents page .

Open Government Initiative

Treasury is Committed to Open Government. Implementation of the Open Government Directive is a major step in creating a culture of transparency, participation, and collaboration in government operations, opening new lines of communication and cooperation between the government and the American people.

Learn more about Treasury’s Open Government Initiative

Information Quality Guidelines

The Department of the Treasury disseminates a variety of information to the public. Section 515 of the Treasury and General Government Appropriations Act for Fiscal Year 2001 [Public Law 106-554] requires Federal agencies to issue guidelines ensuring and maximizing the quality, utility, objectivity, and integrity of disseminated information.

Learn more about Treasury’s information quality guidelines

Last updated:

You are now leaving the OFR’s website.

You will be redirected to:

You are now leaving the OFR Website. The website associated with the link you have selected is located on another server and is not subject to Federal information quality, privacy, security, and related guidelines. To remain on the OFR Website, click 'Cancel'. To continue to the other website you selected, click 'Proceed'. The OFR does not endorse this other website, its sponsor, or any of the views, activities, products, or services offered on the website or by any advertiser on the website.

Thank you for visiting www.financialresearch.gov.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Why Are Companies That Lose Money Still So Successful?

- Vijay Govindarajan,

- Shivaram Rajgopal,

- Anup Srivastava,

- Aneel Iqbal,

- Elnaz Basirian

New research on how to identify investments that produce delayed but real profits — not just those that produce short-term accounting profits.

In a well-functioning capital market, profits should be the sole criterion for firm survival; that is, firms reporting losses should disappear. Of late, however, loss-making firms are highly sought after by investors — often more than some profitable firms. Unicorns, or startups with valuations exceeding a billion dollars, are examples of such loss-making firms. What has changed over time? When and why did losses lose their meaning? The authors’ series of new research papers provide some answers, guiding managers to make the right investments: those that produce delayed but real profits — not just those that produce short-term accounting profits but decimate shareholder wealth in long run.

In 1979, psychologists Daniel Kahneman and Amos Tversky famously posited that losses loom larger than gains in human decision-making. For example, a dollar of loss affects our behavior more than a dollar of profits . Likewise, when a firm announces losses, its stock price declines more dramatically than it increases for the same dollar amount of profits. Investors abandon and lenders tend to stop financing loss-making firms , which then start restructuring their business lines and laying off employees. Some firms go even further, conducting M&A transactions without substance and “managing earnings” to report profits instead of a loss.

- Vijay Govindarajan is the Coxe Distinguished Professor at Dartmouth College’s Tuck School of Business, an executive fellow at Harvard Business School, and faculty partner at the Silicon Valley incubator Mach 49. He is a New York Times and Wall Street Journal bestselling author. His latest book is Fusion Strategy: How Real-Time Data and AI Will Power the Industrial Future . His Harvard Business Review articles “ Engineering Reverse Innovations ” and “ Stop the Innovation Wars ” won McKinsey Awards for best article published in HBR. His HBR articles “ How GE Is Disrupting Itself ” and “ The CEO’s Role in Business Model Reinvention ” are HBR all-time top-50 bestsellers. Follow him on LinkedIn . vgovindarajan

- Shivaram Rajgopal is the Roy Bernard Kester and T.W. Byrnes Professor of Accounting and Auditing and Vice Dean of Research at Columbia Business School. His research examines financial reporting and executive compensation issues and he is widely published in both accounting and finance.

- Anup Srivastava holds Canada Research Chair in Accounting, Decision Making, and Capital Markets and is a full professor at Haskayne School of Business, University of Calgary. In a series of HBR articles, he examines the management implications of digital disruption. He specializes in the valuation and financial reporting challenges of digital companies. Follow Anup on LinkedIn .

- Aneel Iqbal is an assistant professor at Thunderbird School of Global Management, Arizona State University. He examines the accounting measurement and financial disclosures for new-economy firms and incorporates his wide-ranging industry experience into his research and teaching. He is a seasoned accounting and finance professional with diverse experience in auditing, financial analysis, business advisory, performance management, and executive training. Follow Aneel on LinkedIn .

- Elnaz Basirian is a PhD student at the Haskayne School of Business. She examines the influence and role of intangibles in accounting and finance, aimed at improving valuation and market efficiency. She brings a decade of work experience in international financial markets. Follow Elnaz on LinkedIn .

Partner Center

Steven R. Grenadier

William f. sharpe professor of financial economics.

Phone: (650) 725-0706

Graduate School of Business, Stanford, CA 94305-5015

Email: [email protected]

Bio | Research |

Demographics

The Demographic Research Unit (DRU) of the California Department of Finance is designated as the single official source of demographic data for state planning and budgeting. Download a Unit overview brochure .

- Estimates – Official population estimates of the state, counties and cities produced by the Demographic Research Unit for state planning and budgeting.

- Projections – Forecasts of population, births and public school enrollment at the state and county level produced by the Demographic Research Unit.

- State Census Data Center – Demographic, social, economic, migration, and housing data from the decennial censuses, the American Community Survey, the Current Population Survey, and other special and periodic surveys.

- Data In Action – Interactive visualizations, charts, and maps that illustrate the data that the DRU tabulates and produces.

- DRU Data Hub – DRU’s interactive data portal for exploring, sharing, and visualizing data. It includes maps, dashboards, and other applications featuring a range of demographic, housing and socioeconomic data.

2020 Census

- Dates, Details, and Updates

- Detailed Demographic and Housing Characteristics File A, Demographic Profile, Demographic and Housing Characteristic File, and Redistricting (P.L. 94-171) Data

2030 Census

- Planning, Activities, and Resources

Featured Publications

- E-1 Cities, Counties, and the State Population Estimates with Annual Percent Change

- State and County Population Projections

- Price and Population Factors Used for Appropriations Limits (see More Resources section on the Estimate webpage)

- E-2 California County Population Estimates and Components of Change by Year

- Public K-12 Graded Enrollment and High School Graduate Projections by County

More Resources

- California State Data Center Network

- Designated Census Tracts for the New Employment Credit

- California Opportunity Zones

- DRU Mailing List Subscriptions

Comments, suggestions, or questions? Please email [email protected] .

Cambridge Investment Research

Fred spicknall investment advisor representative.

- Phone: 408 971 2060

Plan for Tomorrow

Live for today

Let us help you plan for the future.

We’re here to help educate you about the basic concepts of financial management; to help you learn more about who we are; and to give you fast, easy access to market performance data. We hope you take advantage of this resource and visit us often.

Newsletters

The federal reserve’s key meeting dates in 2024.

This article outlines the Federal Reserve’s three main objectives and provides the meeting schedule of the Federal Open Market Committee.

Market Measures: Beyond the Dow

In addition to the better-known Dow Jones Industrial Average and S&P 500 stock indexes, this article provides an overview of some stock indexes that are commonly used as benchmarks.

Do You Have These Key Estate Planning Documents?

This article provides an overview of four estate planning documents that almost everyone should have: a durable power of attorney, a medical directive, a will, and a letter of instruction.

ESG Investing in the Spotlight

This article explains environmental, social, and governance (ESG) investing and its potential effect on portfolio performance.

Calculators

Loan payoff.

How much will it cost to pay off a loan over its lifetime?

Savings Accumulation

Estimate the future value of your current savings.

Long-Term Care Self Insurance

Will you be able to afford nursing home care?

Tax-Deferred Savings

Compare the potential future value of tax-deferred investments to that of taxable investments.

Learning Center

Educate yourself on a variety of financial topics.

A host of financial tools to assist you.

Timely Newsletters to help you stay current.

A dynamic library of videos.

These magazine-style flipbooks provide helpful information.

Financial terms from A to Z.

Tax Library

Manage your taxes and prepare for the upcoming tax season.

Check the background of this investment professional

DHRUVA RESEARCH is launched – Building India’s top financial education platform

Mr. Prabhat Kumar, a well-known SEBI registered research analyst, announced today that his financial market research institute DHRUVA RESEARCH is officially launched. The institute is committed to improving the financial literacy and investment capabilities of Indian investors through education and research, and fundamentally changing investors’ perception of the market.

“Over the years, I have accumulated rich experience in the global financial market. The epidemic has not only changed the global economic landscape, but also made me re-examine my own development direction,” said Mr. Prabhat Kumar. “I firmly believe that through education and the dissemination of knowledge, more investors can succeed in the financial market.”

Professor Prabhat Kumar has a rich educational background and professional experience in the field of finance. He graduated from the famous Indian institution Indian Institute of Management Bangalore (IIM Bangalore), and went to Rutgers Business School in the United States in 2001 to study for an MBA and a master’s degree in finance, graduating in 2004.

Throughout his career, Professor Prabhat Kumar has demonstrated outstanding financial analysis and management capabilities:

- From August 2009 to August 2011, he worked as a commercial banking account manager at Citibank, USA, during which he was transferred to Citibank's investment banking analyst assistant for 8 months.

- From 2012 to November 2015, he worked as an analyst at Merrill Lynch, USA, and was promoted to chief analyst in 2014 due to his excellent trading performance.

- From March 2016 to December 2019, he served as deputy team leader in the wealth management department of Barclays Capital, and transferred to the research department in June 2017 and was promoted to the main person in charge.

Professor Prabhat Kumar has more than 15 years of experience in the financial field and is a well-respected SEBI registered research analyst. He has accumulated rich research and investment experience in financial markets around the world and has a deep understanding of financial instruments such as stocks, bonds, and derivatives. He has worked in many internationally renowned financial institutions and played an important role in many financial research projects, committed to providing customers with excellent investment advice and market analysis.

Professor Prabhat Kumar is passionate about education and knowledge dissemination. He firmly believes that education is the key to improving investor literacy. He has given speeches at international financial conferences and seminars many times, sharing his research results and investment experience, which has been widely recognized and praised. As the founder and chief mentor of DHRUVA RESEARCH, he hopes to pass on his knowledge and experience to more investors through this platform and help them find a successful path in the complex financial market.

With the official launch of DHRUVA RESEARCH, all related services will be open to the public free of charge during the trial operation phase. The institute will also participate in the analyst challenge organized by the CFA Institute to take this opportunity to demonstrate its strength and attract more attention.

Through exchanges with friends and people in the investment circle, Professor Prabhat Kumar concluded that the main reasons for losses of Indian investors are concentrated in the following aspects: first, they cannot adapt to market fluctuations, second, they lack sufficient knowledge and research, third, they over-trade, and fourth, they do not know how to diversify risks. However, as the world's most populous country and a future economic giant, India's financial market is booming, and the influx of domestic and foreign funds has prompted more and more ordinary people to get involved in the stock market. This phenomenon further deepened the professor's determination to establish a high-end financial research institute, hoping to improve the quality of investors through education and fundamentally change the status quo.

To this end, Professor Prabhat Kumar has a lofty vision - to establish a financial market research institute to cultivate high-end financial talents in India and even the world, and change investors' perception of the market. He knows that shaping a mature investment culture is inseparable from the guidance and demonstration of a high-end circle. Therefore, he plans to enhance his social influence by participating in the CFA Institute Research Challenge organized by the CFA Institute to attract more people with lofty ideals to join this movement of knowledge popularization and ability improvement.

The CFA Institute Research Challenge is not only a platform to demonstrate personal ability, but also an excellent opportunity to learn and communicate with industry elites. Professor Prabhat Kumar hopes to attract more investors and financial practitioners by making a name for himself in the competition, and accumulate popularity and demonstrate strength through his own teaching and practice to help more people understand the essence of the stock market. The professor will also selflessly share his experience accumulated over the years, so that investors can ride the wind and waves in the turbulent stock market and sail to the other side of profitability.

Professor Prabhat Kumar's wish is not limited to personal achievements. He hopes to make important contributions to India's financial education brand through his own efforts. With the help of the CFA Analyst Challenge platform, he will make more like-minded friends to jointly promote the healthy development of India's financial market and create a more stable and knowledge-rich investment environment.

Professor Prabhat Kumar firmly believes that through the dissemination of knowledge and the guidance of the circle, India's investment environment will definitely get better and better. Let us look forward to the financial education platform he has built to bring new enlightenment and gains to investors in India and even the world, so that more people can realize their dreams on the road of investment and welcome a promising future together.

Media contact

Company Name:Dhruva Research

Email: [email protected]

Country:India

Website:dhruvaresearch.com

Why Nvidia just got a rare stock downgrade

- Nvidia stock was downgraded to 'Neutral' by NewStreet Research on valuation concerns.

- Analyst Pierre Ferragu cited limited upside in the shares after a 157% year-to-date rally.

- "We would be buyers again, but only on prolonged weakness," NewStreet Research said.

Nvidia stock got a rare downgrade on Wall Street on Friday.

NewStreet Research analyst Pierre Ferragu downgraded shares of the artificial intelligence powerhouse to "Neutral" from "Buy" in a Friday note, arguing that the stock appears to be fully valued.

Ferragu hasn't necessarily turned bearish on the stock. The analyst has a one-year and two-year price target of $135 and $143, respectively, representing potential upside of 6% and 12% from current levels.

He's simply less bullish than he has been recently, and less optimistic than much of the rest of Wall Street.

"We see limited further upside based on what we hear from the value chain," Ferragu said. "We downgrade the stock to Neutral today, as upside will only materialize in a bull case, in which the outlook beyond 2025 increases materially, and we do not have the conviction on this scenario playing out yet."

Ferragu said that while Nvidia still has the strongest AI franchise amongst its competitors, a "more prudent view on the stock" is necessary after its year-to-date rally of 157%.

"The quality of the franchise is nevertheless intact, and we would be buyers again, but only on prolonged weakness," Ferragu said.

Downbeat opinions on Nvidia are rare among Wall Street analysts, with 89% of the 72 analysts who cover the company rating the stock a "Buy," according to data from Bloomberg.

Ferragu's $135 price target falls in-line with the average 12-month price target on the stock at $134.77.

On the more bullish side, some expect Nvidia's meteoric rise to keep going, with one analyst predicting the stock will nearly double to a $6 trillion valuation by the end of the year.

- Main content

What does it mean to achieve the unthinkable?

Complexity excites us. Collaboration drives us. At Lam, we relentlessly pursue innovation that pushes the boundaries of technical limitations, creating solutions that enable chipmakers to power progress.

No matter what innovation means to you, we won’t stop until it’s proven.

Breakthrough isn’t just a product. It’s a process.

Making semiconductors is a highly complex and iterative process. And as technology gets smaller, we think bigger meeting the challenges of precision control at the atomic scale. For every innovative product you see, we’re already thinking… what’s next?

View Products

Together we go further

Everyone at Lam is a deep listener, in tune with what customers, suppliers, and key stakeholders in the entire ecosystem expect. And in turn, we’ve created an environment based on effective communication, implicit trust, and past success.

News & Events

Learn about our company, people, and products.

View Blog Posts >>

Press Releases

Read the latest news.

View Press Releases >>

Stay up-to-date with our activities.

View Event Calendar >>

Find your next role

How a New York short-seller took on one of the world's richest people, wiped out $150 billion in market value, and barely made any money

- Activist short-seller Hindenburg Research wiped out $153 billion in market value from Adani Group.

- It recently disclosed that it made just $4 million for its efforts.

- Detailed below is the war of words that's taken place over the past 18 months.

Nate Anderson, the chief mind behind activist short-seller Hindenburg Research, has had an eventful past 18 months.

In January 2023, he accused the Indian conglomerate owned by Gautam Adani — one of the world's richest people — of fraud, subsequently wiping out $153 billion in market value from its associated companies. This led Indian regulators to his doorstep and forced him into defensive mode. A war of words has persisted ever since.

A year and a half later, the battle continues. And based on new information released by Hindenburg, one might wonder whether it was all worth it.

The firm — which describes itself as specializing in " forensic financial research " — recently disclosed that it's made just $4 million from its considerable efforts. Compared to the nine figures of market value it helped erase, and the $80 billion wiped from Adani's personal fortune, that's a drop in the bucket.

Detailed below is the considerable back-and-forth that's taken place since Hindenburg's initial shot across the bow of Adani Group. The tale that follows highlights the lengths a global conglomerate — and the regulatory body with a vested interest in keeping it afloat — will go to defend itself. It also shows the resolute nature of Anderson as he continues fighting back.

The initial report

Hindenburg accused Indian business magnate Gautam Adani in 2023 of pulling off the "largest con in corporate history." It was the result of a two-year-long investigation, which found a number of financial and accounting irregularities in Adani's empire, the firm said in its 106-page report.

"Indian conglomerate Adani Group has engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades," the report said. "We believe the Adani Group has been able to operate a large, flagrant fraud in broad daylight in large part because investors, journalists, citizens and even politicians have been afraid to speak out for fear of reprisal," it later added.