We deliver rigorous research that advances inclusive finance.

Using a systems-level approach and thorough research, we identify the most pressing issues impacting the financial inclusion of vulnerable people around the world. We build the evidence base and develop a deep understanding of how financial services can improve consumers’ resilience and livelihoods.

Our Priority Areas

Consumer Protection

We work with financial service providers, investors, and policymakers to ensure their practices promote the well-being of consumers.

Responsible Data Practices

We focus on promoting data transparency, preventing algorithmic bias, and safeguarding data privacy, portability, and consumer rights.

Climate Risk & Resilience

Leveraging our Green Inclusive Finance Framework, we work on solutions that help people prepare for and respond to climate change while improving green outcomes.

Women’s Financial Inclusion

We aim to discover and scale successful norms-transformative initiatives and influence the policy environment to move the needle on women’s financial inclusion.

Other Research Topics

Micro and Small Enterprises

We work to understand how MSEs can benefit from the digital economy and build resilience.

Inclusive Fintech

We focus on identifying responsible inclusive fintech solutions that put consumers’ best interests first.

Explore More

View our latest work and browse resources by topic.

Sign up for updates.

Reaching Financial Inclusion: Necessary and Sufficient Conditions

- Original Research

- Published: 06 January 2022

- Volume 162 , pages 599–617, ( 2022 )

Cite this article

- Helena Susana Amaral Geraldes ORCID: orcid.org/0000-0002-6581-3454 1 ,

- Ana Paula Matias Gama ORCID: orcid.org/0000-0002-8064-6244 1 &

- Mário Augusto ORCID: orcid.org/0000-0001-7345-1679 2

1114 Accesses

9 Citations

Explore all metrics

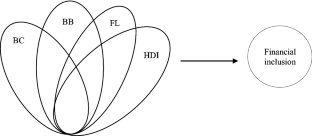

Financial inclusion is a vital development policy concern; different combinations and conditions of access to (supply) and use of (demand) financial services may predict levels of financial inclusion. With a fuzzy set qualitative comparative analysis, conducted across 61 countries worldwide, the current research establishes that financial literacy and human development are conditions of high financial inclusion; supply-side drivers, such as bank concentration and bank branches, represent substitutive conditions for attaining high levels of financial inclusion. With separate analyses of a split sample, designating developed and developing countries, the authors also determine that the absence of financial literacy and human development, as demand-side drivers, leads to diminished financial inclusion for both sets of countries. In turn, this research offers novel ideas for achieving more efficient policies to prompt financial inclusion.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

The effects of IMF loan conditions on poverty in the developing world

Sustainability, FinTech and Financial Inclusion

Financial literacy, financial advice, and financial behavior, availability of data and material.

Public data.

Code Availability

Public web sites.

Even in developed countries, Klapper et al. ( 2013 ) highlight that the lack of FL leaves people more vulnerable to macroeconomics shocks (e.g., international financial crisis of 2008).

Worldwide, 56% of adults do not use formal financial services, but this number diverges across high and low income countries. High income countries include 17% unbanked adults, but this number rises to 64% in low income countries (Ardic et al., 2011 ).

World Bank Data Catalog, Databank, available at https://databank.worldbank.org/source/world-development-indicators (accessed April 2021).

Financial Access Survey (2014), International Monetary Fund, available at https://data.imf.org/?sk=388dfa60-1d26-4ade-b505-a05a558d9a42 (accessed April 2021).

S&P Global FinLit Survey (2014), available at https://gflec.org/initiatives/sp-global-finlit-survey/ (accessed April 2021).

Human Development Data Center, UNDP, available at http://hdr.undp.org/en/data (accessed April 2021).

More traditional correlation-based analytical procedures (e.g., multiple regressions or structural equation modelling) assume causal relationships between the explanatory variables and the outcome. However, when the effects of the variables are asymmetrical, and the form of interactions among them is unknown, regression analysis may be inappropriate. Under these circumstances, fsQCA may return useful information by identifying the combinations of conditions that lead to a given outcome (Vis, 2012 ), and furthermore distinguishing between the necessary and the sufficient conditions (Schneider & Eggert, 2014 ).

Ababio, J. O. M., Attah-Botchwey, E., Osei-Assibey, E., & Barnor, C. (2020). Financial inclusion and human development in frontier countries. International Journal of Finance & Economics, 26 (1), 42–59. https://doi.org/10.1002/ijfe.1775

Article Google Scholar

Adetunji, O. M., & David-West, O. (2019). The relative impact of income and financial literacy on financial inclusion in Nigeria. Journal of International Development, 31 (4), 312–335. https://doi.org/10.1002/jid.3407

Allen, F., Demirgüç-Kunt, A., Klapper, L., & Peria, M. S. M. (2016). The foundations of financial inclusion: Understanding ownership and use of formal accounts. Journal of Financial Intermediation, 27 , 1–30. https://doi.org/10.1016/j.jfi.2015.12.003

Ardic, O. P., Heimann, M., & Mylenko, N. (2011). Access to financial services and the financial inclusion agenda around the world: A cross-country analysis with a new data set. Policy Research Working Paper Series 5537, The World Bank. Available at http://documents.worldbank.org/curated/en/519351468137108112/Access-to-financial-services-and-the-financial-inclusion-agenda-around-the-world-a-cross-country-analysis-with-a-new-data-set . Retrieved April 2021

Beck, T., Demirgüç-Kunt, A., & Honohan, P. (2009). Access to financial services: Measurement, impact, and policies. The World Bank Research Observer, 24 (1), 119–145.

Beck, T., Demirgüç-Kunt, A., & Martinez Peria, M. S. M. (2008). Banking services for everyone? Barriers to bank access and use around the world. The World Bank Economic Review, 22 (3), 397–430. https://doi.org/10.1093/wber/lhn020

Beck, T., Demirgüç-Kunt, A., & Peria, M. S. M. (2007). Reaching out: Access to and use of banking services across countries. Journal of Financial Economics, 85 (1), 234–266. https://doi.org/10.1016/j.jfineco.2006.07.002

Bongomin, G. O. C., Munene, J. C., Ntayi, J. M., & Malinga, C. A. (2017). Financial literacy in emerging economies: Do all components matter for financial inclusion of poor households in rural Uganda? Managerial Finance, 43 (12), 1310–1331. https://doi.org/10.1108/MF-04-2017-0117

Bongomin, G. O. C., Munene, J. C., Ntayi, J. M., & Malinga, C. A. (2018). Nexus between financial literacy and financial inclusion: Examining the moderating role of cognition from a developing country perspective. International Journal of Bank Marketing, 36 (7), 1190–1212. https://doi.org/10.1108/IJBM-08-2017-0175

Bongomin, G. O. C., Ntayi, J. M., Munene, J. C., & Nabeta, I. N. (2016). Social capital: Mediator of financial literacy and financial inclusion in rural Uganda. Review of International Business and Strategy, 26 (2), 291–312. https://doi.org/10.1108/RIBS-06-2014-0072

Boyd, J. H., & Prescott, E. C. (1986). Financial intermediary-coalitions. Journal of Economic Theory, 38 , 211–232. https://doi.org/10.1016/0022-0531(86)90115-8

Burgess, R., & Pande, R. (2005). Do rural banks matter? Evidence from the Indian social banking experiment. American Economic Review, 95 (3), 780–795. https://doi.org/10.1257/0002828054201242

Chakravarty, S. R., & Pal, R. (2013). Financial inclusion in India: An axiomatic approach. Journal of Policy Modelling, 35 (5), 813–837. https://doi.org/10.1016/j.jpolmod.2012.12.007

Chliova, M., Brinckmann, J., & Rosenbusch, N. (2015). Is microcredit a blessing for the poor? A meta-analysis examining development outcomes and contextual considerations. Journal of Business Venturing, 30 (3), 467–487. https://doi.org/10.1016/j.jbusvent.2014.10.003

Cucinelli, D., Trivellato, P., & Zenga, M. (2019). Financial literacy: The role of the local context. Journal of Consumer Affairs . https://doi.org/10.1111/joca.12270

Datta, S. K., & Singh, K. (2019). Variation and determinants of financial inclusion and their association with human development: A cross-country analysis. IIMB Management Review, 31 , 336–349. https://doi.org/10.1016/j.iimb.2019.07.013

Demir, A., Pesqué-Cela, V., Altunbas, Y., & Murinde, V. (2020). Fintech, financial inclusion and income inequality: A quantile regression approach. European Journal of Finance . https://doi.org/10.1080/1351847X.2020.1772335

Demirgüç-Kunt, A., Klapper, L. F., Singer, D., & Van Oudheusden, P. (2015). The global Findex database 2014: Measuring financial inclusion around the world. 7255. Policy Research Working Paper.

Demirgüç-Kunt, A., Klapper, A., Singer, D., Ansar, S., & Hess, J. (2017). The Global Findex Database 2017. Measuring financial inclusion and the fintech revolution . World Bank.

Google Scholar

Demirgüç-Kunt, A., & Klapper, L. (2013). Measuring financial inclusion: Explaining variation in use of financial services across and within countries. Brookings Papers on Economic Activity, 44 (1), 279–340. https://doi.org/10.1353/eca.2013.0002

Dev, S. M. (2006). Financial inclusion: Issues and challenges. Economic and Political Weekly . https://doi.org/10.2307/4418799

Di Giannatale, S., & Roa, M. J. (2019). Barriers to formal saving: Micro- and macroeconomic effects. Journal of Economic Surveys, 33 (2), 541–566. https://doi.org/10.1111/joes.12275

Emara, N., & Kasa, H. (2020). The non-linear relationship between financial access and domestic savings: The case of emerging markets. Applied Economics, 53 (3), 345–363. https://doi.org/10.1080/00036846.2020.1808174

Esquivias, M. A., Sethi, N., Ramandha, M. D., & Jayanti, A. D. (2020). Financial inclusion dynamics in Southeast Asia: An empirical investigation on three countries. Business Strategy and Development . https://doi.org/10.1002/bsd2.139

Fiss, P. C. (2011). Building better causal theories: A fuzzy set approach to typologies in organization research. Academy of Management Journal, 54 (2), 393–420. https://doi.org/10.5465/amj.2011.60263120

Fouejieu, A., Sahay, R., Cihak, M., & Chen, S. (2020). Financial inclusion and inequality: A cross-country analysis. Journal of International Trade & Economic Development, 29 (8), 1018–1048. https://doi.org/10.1080/09638199.2020.1785532

Fu, J. (2020). Ability or opportunity to act: What shapes financial well-being? World Development, 128 , 1–20. https://doi.org/10.1016/j.worlddev.2019.104843

Goyal, K., & Kumar, S. (2020). Financial literacy: A systematic review and bibliometric analysis. International Journal of Consumer Studies, 45 , 80–105. https://doi.org/10.1111/ijcs.12605

Grohmann, A., Klühs, T., & Menkhoff, L. (2018). Does financial literacy improve financial inclusion? Cross-country evidence. World Development, 111 , 84–96. https://doi.org/10.1016/j.worlddev.2018.06.020

Hauswald, R., & Marquez, R. (2006). Competition and strategic information acquisition in credit markets. Review of Financial Studies, 19 (3), 967–1000. https://doi.org/10.1093/rfs/hhj021

Kabakova, O., & Plaksenkov, E. (2018). Analysis of factors affecting financial inclusion: Ecosystem view. Journal of Business Research, 89 , 198–205. https://doi.org/10.1016/j.jbusres.2018.01.066

Kaiser, T., & Menkhoff, L. (2017). Does financial education impact financial literacy and financial behavior, and if so, when? World Bank Economic Review, 31 , 611–630. https://doi.org/10.1093/wber/lhx018

Karakurum-Ozdemir, K., Kokkizil, M., & Uysal, G. (2019). Financial literacy in developing countries. Social Indicators Research, 143 , 325–353. https://doi.org/10.1007/s11205-018-1952-x

Kim, J. H. (2016). Study on the effect of financial inclusion on the relationship between income inequality and economic growth. Emerging Markets Finance and Trade, 52 (2), 498–512. https://doi.org/10.1080/1540496X.2016.1110467

Kimmitt, J., & Muñoz, P. (2017). Entrepreneurship and financial inclusion through the lens of instrumental freedoms. International Small Business Journal: Researching Entrepreneurship, 35 (7), 803–828. https://doi.org/10.1177/0266242617700699

Klapper, L., El-Zoghbi, M., & J. Hess. (2016). Achieving the Sustainable Development Goals: The role of financial inclusion. CGAP. Retrieved April 2021, from https://www.cgap.org/sites/default/files/Working-Paper-Achieving-Sustainable-Development-Goals-Apr-2016_0.pdf

Klapper, L., Lusardi, A., & Oudheusden, P. (2014). Financial literacy around the world: Insights from the Standard & Poor’s ratings services global financial literacy survey. Retrieved April 2021, from https://responsiblefinanceforum.org/wp-content/uploads/2015/12/2015-Finlit_paper_17_F3_SINGLES.pdf

Klapper, L., Lusardi, A., & Panos, G. A. (2013). Financial literacy and its consequences: Evidence from Russia during the financial crisis. Journal of Banking & Finance, 37 , 3904–3923. https://doi.org/10.1016/j.jbankfin.2013.07.014

Le, Q. H., Ho, H. L., & Mai, N. C. (2019). The impact of financial inclusion on income inequality in transition economies. Management Science Letters, 9 , 661–672. https://doi.org/10.5267/j.msl.2019.2.005

Levine, R. (1997). Financial development and economic growth: Views and agenda. Journal of Economic Literature, 35 (2), 688–726.

Lusardi, A., & Mitchell, O. S. (2014). The economic importance of financial literacy: Theory and evidence. Journal of Economic Literature, 52 (1), 5–44. https://doi.org/10.1257/jel.52.1.5

Mengistu, A., & Perez-Saiz, H. (2018). Financial inclusion and bank competition in sub-Saharan Africa. IMF Working Papers 18/256. Retrieved April, 2021, from https://www.imf.org/en/Publications/WP/Issues/2018/12/07/Financial-Inclusion-and-Bank-Competition-in-Sub-Saharan-Africa-46388

Nizam, R., Karim, Z. A., Rahman, A. A., & Sarmidi, T. (2020). Financial inclusiveness and economic growth: New evidence using a threshold regression analysis. Economic Research-Ekonomska Istraživanja, 33 (1), 1465–1484. https://doi.org/10.1080/1331677X.2020.1748508

Nuzzo, G., & Piermattei, S. (2020). Discussing Measures of financial inclusion for the main Euro area countries. Social Indicators Research, 148 , 765–786. https://doi.org/10.1007/s11205-019-02223-8

OECD. (2014). PISA 2012 technical background. In OECD (Ed.), PISA 2012 Results: Students and money—Financial literacy skills for the 21st century (Vol. VI, pp. 123–145). OECD Publishing.

Chapter Google Scholar

OECD. (2020a). OECD/INFE 2020 International Survey of Adult Financial Literacy. Retrieved April, 2021, from www.oecd.org/financial/education/launchoftheoecdinfeglobalfinancialliteracysurveyreport.htm

OECD. (2020b). PISA 2018 results (volume IV): Are students smart about money? PISA, OECD Publishing. https://doi.org/10.1787/48ebd1ba-en

Book Google Scholar

Omar, M. A., & Inaba, K. (2020). Does financial inclusion reduce poverty and income inequality in developing countries? A panel data analysis. Journal of Economic Structures, 9 (37), 1–25. https://doi.org/10.1186/s40008-020-00214-4

Owen, A. L., & Pereira, J. M. (2018). Bank concentration, competition, and financial inclusion. Review of Development Finance, 8 , 1–17. https://doi.org/10.1016/j.rdf.2018.05.001

Ozili, P. K. (2020). Financial inclusion research around the world: A review. Forum for Social Economics . https://doi.org/10.2139/ssrn.3515515

Peet, R., & Hartwick, E. (2009). Theories of development, contentions, arguments, alternative . Guilford Press.

Philippas, N. D., & Avdoulas, C. (2019). Financial literacy and financial well-being among generation-Z university students: Evidence from Greece. European Journal of Finance, 26 (4–5), 360–381. https://doi.org/10.1080/1351847X.2019.1701512

Ragin, C. (2000). Fuzzy set social science . University of Chicago Press.

Ragin, C. (2006). Set relations in social research: Evaluating their consistency and coverage. Political Analysis, 14 (3), 291–310. https://doi.org/10.1093/pan/mpj019

Ragin, C. (2008). Qualitative comparative analysis using fuzzy sets (fsQCA). In C. C. Ragin & B. Rihoux (Eds.), Configurational comparative methods: Qualitative comparative analysis (QCA) and related techniques (pp. 87–122). Sage.

Rihoux, B., & Ragin, C. (2008). Configurational comparative analysis . Sage.

Sarma, M. (2008). Index of financial inclusion. ICRIER working paper 215.

Schneider, C. Q., & Wageman, C. (2010). Standards of good practice in qualitative comparative analysis (QCA) and fuzzy-sets. Comparative Sociology, 9 (3), 397–418. https://doi.org/10.1163/156913210X12493538729793

Schneider, M. R., & Eggert, A. (2014). Embracing complex causality with the QCA method: An invitation. Journal of Business Marketing Management, 7 (1), 312–328.

Schneider, M. R., Schulze-Bentrop, C., & Paunescu, M. (2010). Mapping the institutional capital of high-tech firms: A fuzzy-set analysis of capitalist variety and export performance. Journal of International Business Studies, 41 (2), 246–266. https://doi.org/10.1057/jibs.2009.36

Sethi, D., & Acharya, D. (2018). Financial inclusion and economic growth linkage: Some cross-country evidence. Journal of Financial Economic Policy, 10 (3), 369–385. https://doi.org/10.1108/JFEP-11-2016-0073

United Nations. (2019). Human development report 2019. Beyond income, beyond averages, beyond today: Inequalities in human development in the 21st century. New York. Retrieved April, 2021, from http://hdr.undp.org/en/content/human-development-report-2019

Vis, B. (2012). The comparative advantages of fsQCA and regression analysis for moderately large-N analyses. Sociological Methods & Research, 41 , 168–198.

Zins, A., & Weill, L. (2016). The determinants of financial inclusion in Africa. Review of Development Finance, 6 , 46–57. https://doi.org/10.1016/j.rdf.2016.05.001

Download references

Acknowledgements

This work was funded by FCT, Fundação para a Ciência e a Tecnologia, I.P., Projects: PTDC/EGE-OGE/31246/2017, UIDB/04630/2020; UIDB/05037/2020.

The authors acknowledge financial, research and administrative support from the FCT (UBI&NECE: UIDB/04630/2020; PTDC/EGE-OGE/31246/2017).

Author information

Authors and affiliations.

University of Beira Interior, Research Center in Business Science (NECE), Covilhã, Portugal

Helena Susana Amaral Geraldes & Ana Paula Matias Gama

University of Coimbra, CeBER, Faculty of Economics, Coimbra, Portugal

Mário Augusto

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Helena Susana Amaral Geraldes .

Ethics declarations

Conflict of interest.

Not applicable.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Geraldes, H.S.A., Gama, A.P.M. & Augusto, M. Reaching Financial Inclusion: Necessary and Sufficient Conditions. Soc Indic Res 162 , 599–617 (2022). https://doi.org/10.1007/s11205-021-02850-0

Download citation

Accepted : 16 November 2021

Published : 06 January 2022

Issue Date : July 2022

DOI : https://doi.org/10.1007/s11205-021-02850-0

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Financial inclusion

- Financial literacy

- Human development

- Financial infrastructure

- Find a journal

- Publish with us

- Track your research

- Understanding Poverty

- Financial Inclusion

The list of publications is automatically pulled from the World Bank’s library of externally available documents based on keywords relevant to the financial inclusion topic. These documents include formal publications, working papers, and informal series from departments around the Bank Group, as well as operational and publicly-disclosed projects documents. The list doesn’t represent all research on financial inclusion.

You have clicked on a link to a page that is not part of the beta version of the new worldbank.org. Before you leave, we’d love to get your feedback on your experience while you were here. Will you take two minutes to complete a brief survey that will help us to improve our website?

Feedback Survey

Thank you for agreeing to provide feedback on the new version of worldbank.org; your response will help us to improve our website.

Thank you for participating in this survey! Your feedback is very helpful to us as we work to improve the site functionality on worldbank.org.

Click through the PLOS taxonomy to find articles in your field.

For more information about PLOS Subject Areas, click here .

Loading metrics

Open Access

Peer-reviewed

Research Article

New insights into the impact of financial inclusion on economic growth: A global perspective

Roles Writing – original draft

* E-mail: [email protected]

Affiliation Faculty of Economics, Kabul University, Kabul, Afghanistan

- Mohammad Naim Azimi

- Published: November 17, 2022

- https://doi.org/10.1371/journal.pone.0277730

- Peer Review

- Reader Comments

Financial inclusion is critical to inclusive growth, proffering policy solutions to eradicate the barriers that exclude individuals from financial markets. This study explores the effects of financial inclusion on economic growth in a global perspective with a large number of panels classified by income and regional levels from 2002–2020. The analysis begins with the development of a comprehensive composite financial inclusion index comprised of penetration, availability, and usage of financial services and the estimation of heterogeneous panel data models augmented with well-known variables. The results obtained from the panel cointegration test support a long-run relationship between economic growth, financial inclusion, and the control variables in the full panel, income-level, and regional-level economies. Furthermore, the study employs a GMM (generalized method of moment) approach using System-GMM estimators to examine the effects of financial inclusion and the control predictors on economic growth. The results of the GMM model clearly indicate that financial inclusion has a significantly positive impact on economic growth across all panels, implying that financial inclusion is an effective tool in fostering rapid economic growth in the world. Finally, the study delves into the causality relationship between the predictors and provides statistical evidence of bidirectional causality between economic growth and financial inclusion, whereas it only supports unidirectional causality relationships from credit to the private sector, foreign direct investment, inflation rate, the rule of law, school enrollment ratio, and trade openness with no feedback causality. Moreover, the study fails to provide causality evidence from the age dependency ratio and population to economic growth.

Citation: Azimi MN (2022) New insights into the impact of financial inclusion on economic growth: A global perspective. PLoS ONE 17(11): e0277730. https://doi.org/10.1371/journal.pone.0277730

Editor: Ricky Chee Jiun Chia, Universiti Malaysia Sabah, MALAYSIA

Received: September 17, 2022; Accepted: November 3, 2022; Published: November 17, 2022

Copyright: © 2022 Mohammad Naim Azimi. This is an open access article distributed under the terms of the Creative Commons Attribution License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Data Availability: The datasets for GDP growth, credit to the private sector, age dependency ratio, inflation rate, school enrollment rate, population growth rate, and trade openness (total imports of goods and services plus total exports of goods and services) are collected from the World Development Indicators that are available at ( https://databank.worldbank.org/source/world-development-indicators ). Datasets for the indicators of banking penetration, availability, and usage of financial services are collected from IMF’s Financial Access Survey available at ( https://data.imf.org/?sk=E5DCAB7E-A5CA-4892-A6EA-598B5463A34C ). Dataset for the rule of law is collected from the World Bank’s Worldwide Governance Indicators available at ( https://info.worldbank.org/governance/wgi/ ). All datasets are publicly available for replications by scholars.

Funding: The author received no specific funding for this work.

Competing interests: The author has declared that no competing interests exist.

1. Introduction

Financial inclusion is one of the growing research topics that has recently gained popularity in the literature and received considerable attention from scholars, academics, and policymakers alike. However, the theory of financial inclusion emerged during the 1930s (see, inter alia , [ 1 ]), but the root of a wide-ranging empirical literature dates back to the early 2000s [ 2 , 3 ]. Besides, since the spark of the millennium development goals by the United Nations, the policy orientation of the financial inclusion nexus with socioeconomic indicators, specifically economic growth, among all others, has gained prominence in the formulation and implementation of strategies for sustainable development regardless of the social and economic structure of the countries. The multi-dimensionality and non-uniformity of financial inclusion outreach [ 4 ] is assumed to foster economic growth through the gradual integration of people into a formal financial system by making financial services affordable and available at a reasonable cost, and, thus, it effects are highly pronounced vis-à-vis other growth drivers [ 5 ]. Although financial inclusion is observed as an effective instrument of social inclusion in satisfying the economic desires of poor and financially excluded individuals directly, it combats extreme poverty, reduces income inequality, and encourages human capital creativity indirectly, which, in turn, has a significant impact on the economic growth of a country. In this regard, perhaps, each jurisdiction requires contextual approaches translated into formal policy frameworks to facilitate an effective and extensive outreach of financial inclusion both for included and excluded segments of society to achieve a higher rate of economic growth in the long run [ 6 ]. However, financial inclusion-driven growth takes longer than general theoretical expectations, but the development of its policy framework must articulate three key principles: affordability and undue availability of financial services for all segments of society on the supply side; financial literacy and extensive accessibility on the demand side; and consumer protection, accountability, and institutional quality on the governance side [ 7 ].

In recognition of the importance of financial inclusion on economic growth, however, most of the recent studies have departed from the foundational theory of financial inclusion and dived either into endogenous or exogenous models. But regardless of the methodology and magnitude of the effects presented, the available empirical literature has taken three main directions. The first group of studies have examined the effects of financial inclusion on economic growth and other socioeconomic predictors in country-specific contexts with limited outcome generalizability (see, for instance, [ 8 – 14 ]). The second group of studies on financial inclusion impact has focused on specific regional classifications, such as Sub-Saharan Africa (SSA), Asia’s developing economies, the One Belt One Road Initiative (OBRI), the Organization for Islamic Cooperation (OIC), and the South Asian Association for Regional Cooperation (SAARC) member countries (see, inter alia , [ 15 – 19 ]). The third group of empirical studies has focused either on the panels of mixed economies or developed and developing economies (see, for example, [ 20 – 25 ]).

Although an exception is given to empirical studies by Okonkwo and Ifeanyi [ 26 ] in low and middle-income countries; Van and Linh [ 27 ] in East Asia and the Pacific region; Emara and Mohieldin [ 28 ] in the Middle-East and North Africa (MENA); and Ghassibe et al. [ 29 ] in the Middle-East and Central Asia, the existing literature reports the non-existence of a comprehensive empirical study to have examined the effects of financial inclusion on economic growth from a global perspective to provide both statistical evidence on the scale of effects and comparative results by region and income-level economies to support extensive policy formulation. Therefore, it is imperative to direct the study by formulating three important questions. First, does financial inclusion have positive effects on economic growth in global, regional, and income-level economies, though some recent empirical studies provide counter-evidence? Second, are the effects of financial inclusion non-monotonic and vary across panels (global, regional, and income-level) due to economic size as represented by GDP growth? Third, are there any causality relationships between financial inclusion and economic growth with a feedback response?

The present study is an attempt to delve into the effects of financial inclusion on economic growth by controlling for major macroeconomic predictors from global, income-level, and regional-level perspectives. As an empirical fact, the literature is still evolving to understand the magnitude, extent, and direction of the effects of financial inclusion on economic growth—an emerging paradox—and the number of studies that have focused on country-specific, developed, and developing economies with mixed and even confounded results is not sufficient to support a global agenda on the subject. Moreover, the scarcity of a comprehensive empirical study highlighting the effects of financial inclusion on economic growth from a global perspective to facilitate extensive policy comparison is a significant missing gap in the literature and forms the key motivation for the present study.

The remaining sections of the study are structured as follows. Section two presents a review of literature discussing both theoretical and empirical concepts of financial inclusion and growth. Section three presents the data, variables, and construction methodology of the composite financial inclusion index. Section four develops the theoretical model of the study. Section five explains the estimation strategy of the panel data. Section six presents the results and discusses the findings. Section seven concludes the study.

2. Literature review

2.1 theoretical background.

The existing literature on the finance-growth nexus owes to Schumpeter’s [ 1 ] initial theory, stating that financial intermediaries are essential to advance technical innovations in businesses to ensure stable economic growth through saving mobilization, project evaluation, risk analysis, transaction, and money circulation conduits [ 30 ]. The theory predicts that missed opportunities are caused by inactive assets held both at personal and organizational disposal due to the absence of financial intermediaries to mobilize savings and enlarge money circulation. This, in turn, forces people to rely on wage-based savings and limits money circulation through financially profitable conduits. On the other hand, market imperfection insulates poor citizens from eluding poverty through limitation of access to formal financial products [ 15 ], whereas wider access to financial services has been excoriated as one of the most useful tactics for combating poverty, owing to the fact that higher levels of financial inclusion are linked to lower levels of income inequality and higher economic growth [ 31 ]. Since then, scholars have attempted to build various theoretical models to capture the notion of growth around the concept of Schumpeter and have provided many definitions to describe financial services (see, inter alia , [ 32 – 35 ]). Among all others, Sarma [ 36 ] has provided a comprehensive definition for the notion of financial services—that is, "financial inclusion" as a set of formal financial services to bankable individuals and the process through which such services are made available, accessible, and usable at reasonable economic cost. Thus, in line with this definition, financial inclusion can be regarded as one of the key drivers of economic growth through an increase in general consumption, higher profitable investments, a reduction in monetary overhang by the availability of financial services, and a shift from wage-based savings to return on investments [ 37 ]. Therefore, it entails two main principles that postulate the theory of financial inclusion. First, the beneficiary theory of financial inclusion, which comprises vulnerable group theory, dissatisfaction theory, and public good theory; and second, the theory of delivery of financial inclusion, comprising public money theory, echelon theory, and private money theory [ 38 ]. Thus, the latter—that is, the theory of delivery of financial inclusion—forms the theoretical direction of the present study. However, far from the basic theory of financial inclusion, almost all recent studies have considered either endogenous or exogenous growth models.

2.2 Measurement of financial inclusion

Although based on the multi-faceted theory of financial inclusion, there are numerous definitions that have a general consensus on the outreach of financial inclusion to provide excessive financial services to the bankable members of a nation, prioritizing the gradual integration of the excluded people into the formal financial system of an economy. Thus, giving rise to the conceptual importance, a comprehensive tool is essential to measure the impact of financial inclusion on various socioeconomic indicators. Despite other quasi-mechanisms (see, inter alia , [ 10 , 38 – 40 ]), this study follows Sarma [ 41 ], who enhanced the construction methodology of the composite financial inclusion index using a distance-based approach dissimilar to the human development index adopted by the United Nations Development Programs (UNDP), using average dimension indexes. A three-dimensional approach to construct the composite financial inclusion index is the banking penetration, availability, and usage of financial services, which are defined as follows.

Banking penetration—that is, access to financial services—indicates the number of users of financial services in an economy, measured by the number of deposit accounts per 1,000 adults and the number of depositors per 1,000 adults [ 41 – 43 ]. Here, the first indicator reflects the size of the bankable segment of society, while the second indicator shows the total number of banked individuals, comprising both active and non-active account holders with financial institutions [ 44 , 45 ]. Next is the availability dimension, which comprises two key indicators, such as the number of banks per 100,000 adults and the number of automated teller machines (ATMs) per 100,000 adults. It reflects the geographical availability of financial services in terms of banking outlets, bank branches, and the ATMs that are available for utilization [ 40 , 46 ]. Third is the usage dimension, which also comprises two key indicators, such as the number of loan accounts in banks per 1,000 people and the number of borrowers from banks per 1,000 adults. This dimension measures how customers use financial services in the form of transfers, remittances, borrowing, and savings to reflect the efficiency and inclusiveness of the financial services that are available to people in an economy [ 35 , 47 ].

2.3 Review of recent studies

Although the existing literature still evolves in presenting a sufficient number of empirical works on the effects of financial inclusion on various socioeconomic indicators to encourage comprehensive macroeconomic policy attempts (see, for instance, [ 48 , 49 ]), it owes its first study to Marc et al. [ 50 ], who claimed to have found statistical relationships between financial structure and economic growth. For brevity, this section reviews the most recent studies about the effects of financial inclusion on economic growth in different geographical contexts. For instance, Estrada et al. [ 51 ] examined the effects of financial systems, banks, and equity markets on economic growth in 125 developing countries. The authors have used simple methods and found that the financial system’s outreach postulates significant effects on economic growth, though the results might be confounded due to misspecification and the choice of financial inclusion predictors. Kpodar and Andrianaivo [ 52 ] evaluated the effects of information and communication technologies, mobile phone rollout, and the number of deposits per head—that is, the predictors of financial inclusion—on economic growth in a sample of African economies from 1988–2007. The authors employed the system generalized method of moment technique to overcome any endogeneity issue and found that financial inclusion is an effective tool to increase economic growth in the context of Africa.

Masoud and Hardaker [ 53 ] employed an endogenous growth model and a set of data for twelve years to examine the effects of stock market development and the banking sector on economic growth in forty-two emerging economies. The authors found that the stock market has a significant influence on the economic growth of the emerging markets and that they move together in the long run. Moreover, they argue that the banking sector is complementary to the stock market in easing customers’ access to their desired financial services. Lenka and Sharma [ 54 ] examined the effect of financial inclusion (penetration, access, and usage dimension) on economic growth in India. The authors used a set of time-series data from 1980–2014, a principal component analysis method to construct the financial inclusion index and the autoregressive distributed lag (ARDL) and error-correction methods to estimate the short and long-run effects of financial inclusion on growth. The authors found that financial inclusion has a positive effect on economic growth both in the short and long runs. Moreover, they also provided evidence of a unidirectional relationship between financial inclusion and economic growth.

Le et al. [ 55 ] tested the linkage between financial inclusion, growth, and other socioeconomic indicators in 20 Asian economies from 2011–2016 using a random effects model for panel data analysis. The authors found that Asian countries with a higher growth rate have higher financial inclusion to channelize higher economic growth; an inverse association between financial inclusion and unemployment rate; and the role of financial literacy in effectively utilizing the available financial services. Erlando et al. [ 56 ] examined the effects of financial inclusion on economic growth using a set of panel data for Eastern Indonesia. The authors employed the modified vector autoregressive method of Toda and Yamamoto, bivariate causality, and dynamic panel vector autoregressive methods. They found a statistically strong nexus between financial inclusion and economic growth, noticing that financial inclusion spurs economic. On the other hand, Nizam et al. [ 57 ] analyzed the effects of financial inclusion on economic growth in 63 developed and developing countries over the period from 2014–2017 using threshold regression analysis. The authors found that there is a threshold effect of financial inclusion on economic growth, implying that the effects are positive but are translated at a higher level than in the low level of the financial inclusion index.

Moreover, the existing literature indicates a counter-example about the negative effects of financial inclusion on economic growth by Rodríguez et al. [ 58 ]; who analyzed the relationships between them in 71 countries using a set of data spanning from 2007–2016; and applied ordinary least squares, the generalized method of moment with two-way fixed effects, and Granger causality methods to test their developed hypotheses. They found a negative association between financial inclusion and economic growth, highlighting that financial inclusion exerts an adverse effect on growth and a statistically significant causality nexus between them. Meanwhile, Shen et al. [ 59 ] used datasets from the WDI (World Development Indicators) and the IMF (International Monetary Funds) to examine the effects of financial inclusion index on economic growth in 105 countries. The authors used spatial data techniques to analyze the relationships between digital financial inclusion, growth, and other control variables and found that digital financial inclusion has a significantly positive impact on the economic growth of the countries.

Finally, Ozturk and Sana [ 60 ] examined the effects of financial inclusion on economic growth and environmental quality in forty-two countries linked with the One Belt One Road Initiative (OBRI) using a set of data spanning from 2007–2019. The authors employed pooled ordinary least squares (OLS), two-stage OLS, and the generalized method of moment (GMM) models. They found that financial inclusion has a positive impact on economic growth but has negative effects on environmental quality through the flow of CO2 emissions.

The purview of the existing literature reveals that the empirical studies conducted to examine the effects of financial inclusion on economic growth have left two significant gaps. First, it reports no comprehensive study to reflect the impact of financial inclusion on growth from a global perspective and no comparative results for cross-country groupings by income and regional levels using unified analytical methodology to highlight comprehensive policy implications to support the literal arguments of the paradigm shift—that is, a shift from financial development to financial inclusion as a global agenda. Second, the mixed and confounded results presented by the existing literature have enhanced the paradox of the effects of financial inclusion as a driver of growth. Therefore, to fill these gaps, it is important to formulate three key hypotheses. H 1 : As claimed by the initial concept, financial inclusion has a positive impact on economic growth regardless of economic size and structure across the globe. H 2 : Though the effects are positive on growth, they are non-monotonic and specified by the size of the economies, viz-à-viz, the GDP. H 3 : While financial inclusion explains economic growth, it is strongly affected by the growth rate of an economy—that is, there is a bidirectional link between them.

3. Data and variables

The datasets contain 218 countries across the world, employing annual observations spanning from 2004–2021 compiled from reliable sources and are organized by various panels reflecting income and regional level economies reported by the World Bank classification report [ 61 ]. The variables used are consistent with recent empirical literature and include GDP growth, the composite financial inclusion index, school enrollment rate, age dependency ratio, credit to the private sector, the rule of law, inflation rate, trade openness, the Gini index, and population growth rate. Table 1 provides complete information about them. The study employs GDP growth as the dependent variable proxied for economic growth and the composite financial inclusion index as the independent and key variable of interest. However, the construction method of the composite financial inclusion index (CFII) is discussed later; the present study controls for several macroeconomic predictors to avoid any omitted variable bias. Thus, the school enrollment ratio (SER) is used as a proxy for human capital development. Intuitively, an increase in school enrollment increases skills, knowledge, and creativity, thereby stimulating economic growth. Moreover, the age dependency ratio is used to control its effects on growth. Theory predicts that either too young or too old citizens would be cost-burdensome and negatively impact the growth. Credit to the private sector may also influence economic progression, viz-à-viz greater access to credit facilitates higher capital investment, thus spurring economic growth. Studies by Le et al. [ 55 ], Sayed and Shusha [ 43 ], and Rashdan and Eissa [ 45 ] suggest including the inflation rate as a control variable when delving into the effects of CFII on growth. It is important to understand the effects of higher inflationary episodes that cause the saving rates to decrease and suppress the citizens’ use of desired financial services. In light of the globalized economy, it is essential to augment the trade openness in the model to measures the cross-country access of financial services by traders. Despite controlling for the income inequality proxied by Gini index, the study also controls for the effects of institutional quality proxied by the rule of law. It is widely documented that the rule of law is an appropriate proxy for institutional quality when analyzing the effects of CFII on growth [ 62 ]. Finally, population growth rate is also used to control its effects on economic growth.

- PPT PowerPoint slide

- PNG larger image

- TIFF original image

https://doi.org/10.1371/journal.pone.0277730.t001

This method of CFII construction is widely used in financial econometrics as a standardized predictor of comprehensive financial inclusion index (see, for instance, [ 43 , 46 , 66 ]).

4. Model specification

5. Econometric methods

5.1 cointegration test.

5.2 GMM approach

Moreover, GMM estimation has several empirical advantages over the common techniques for panel data analysis. First, it controls for omitted variable bias, correlation between the variables, and any potential measurement errors. Second, it produces consistent and accurate results of the coefficients for panel samples with N > T. Third, it corrects the unobserved endogeneity by transforming the regressors through differencing and removing the fixed effects. Fourth, in terms of heteroskedasticity and serial correlation, the Sys-GMM, which is an augmentation of the Diff-GMM, is more consistent, robust, and efficient.

As suggested by the existing literature, in this study, the analysis begins with the estimation of Eq (4) by pooled ordinary least squares (OLS) and the least squares dummy variable (LSDV) using fixed effects methods. Doing so leads the study to select an appropriate GMM estimator and avoid misspecification. Therefore, the pooled OLS panel estimate for φ is used as an upper bound, while the fixed effect estimates are used as the lower bounds. If the Diff-GMM estimates are close to or below the fixed effects estimates, Sys-GMM is more consistent and efficient as Diff-GMM would be biased due to weak instrumentation. Moreover, it is also important to test for instruments validity, for which Hansen’s [ 81 ] J-statistics and Sargan’s [ 82 ] methods are employed to test the validity of the instrumental variables augmented in the GMM model. Rejecting the null hypothesis implies that the instruments are invalid [ 83 ], while failing to reject the null implies otherwise. Furthermore, this study tests the null of no second-order serial correlation in the error term using the Arellano and Bond [ 79 ] method. Failing to reject the null implies that no second-order serial correlation exists and that the moment conditions are appropriately specified.

5.3 Panel causality test

6. Results and discussion

6.1 descriptive statistics.

The analysis begins with some important summary statistics about the variables, reported in Table B1 of Appendix B in S2 Appendix . It shows that the mean value for GDP growth is 2.74% for the full panel, while it is 2%, 4.48%, 5.69%, 6.13%, 1.52%, 1.11%, 4.91%, 1.41%, 2.12%, 3.87%, 1.78%, 5.71%, and 3.99% for low-income, middle-income, upper middle-income, high-income, OECD, non-OECD, East Asia and the Pacific, Europe and Central Asia, Latin America and Caribbean, MENA, North America, South Asia, and Sub-Saharan African economies, respectively. On the other hand, the summary statistics indicate that the mean value for the composite financial inclusion index is 0.26, 0.78, 0.73, 0.69, 0.71, 0.82, 0.74, 0.71, 0.73, 0.68, 0.74, 0.79, 0.68, and 0.72 for the full panel, low-income, middle-income, upper middle-income, high-income, OECD, non-OECD, East Asia and the Pacific, Europe and Central Asia, Latin America and Caribbean, MENA, North America, South Asia, and Sub-Saharan African economies, respectively. It reveals that among all others, although the growth rate of the high-income countries has been the highest throughout the period, their CFII rank has relatively been lower than those of the low-income, middle-income, upper middle-income, OECD, MENA, North America, South Asia, and Sub-Saharan African countries. Moreover, another interesting indicator is the rule of law, which shows that its mean value does not necessarily correspond to the growth rate and the mean value of the financial inclusion outreach. For instance, the mean value of the rule of law is 90.33 percentile rank for high-income economies, which is the highest among all others, while its growth rate and CFII average rate are reported otherwise. For brevity, one can read through the variations among the predictors, but the study proceeds to delve into the cointegration among them.

6.2 Cointegration analysis

To ascertain the long-run nexus amid predictors, the Westerlund and Edgerton [ 77 ] cointegration test by LM bootstraps was computed, and the results are shown in Table 2 . For the rejected null hypothesis of no cointegration, except for the low-income economies, the findings reveal that there exists significant cointegration among the predictors in all panels. This implies that panel predictors move together in the long run—that is, the composite financial inclusion index, which is the key variable of interest, and other explanatory variables postulate significant effects on economic growth and cannot be deviated from long-run equilibrium. The results are consistent with the findings of Nwanne [ 85 ], Hassan [ 86 ], Ratnawati [ 87 ], and Ain et al. [ 88 ], who also established statistical long-run relationships between financial inclusion and economic growth. Moreover, the results satisfy the underlying theory of growth-financial inclusion [ 14 ], implying that excessive financial inclusion outreach facilitates higher capital mobility and integration of a higher proportion of unbanked individuals into the formal financial system, which leads to higher economic growth in the long run.

https://doi.org/10.1371/journal.pone.0277730.t002

6.3 GMM estimates

As for the key results of interest, Tables 3 and 4 report the results of robust GMM estimation—that is, 1Sys-GMM, 2Sys-GMM, and Diff-GMM for the full panel, income level groupings, and regional economies. As discussed earlier, using empirical diagnostics, the Sys-GMM estimators are preferred over the Diff-GMM, and thus, the interpretation of the results and discussion of findings are based on the 2Sys-GMM results, though the results of the 1Sys-GMM are similar to those of the 2Sys-GMM. For robustness, it follows the Windmeijer [ 89 ] correction in the standard errors of the 2Sys-GMM estimation to control for the downward biasedness of standard errors, controlling the instrument matrix, observation weight, the difference-in-Sargan/Hansen test of instrument validity, and the forward orthogonal transform, which is an alternative to the differencing approach of Arellano and Bover [ 90 ], preserving sample size in panels with observational gaps.

https://doi.org/10.1371/journal.pone.0277730.t003

https://doi.org/10.1371/journal.pone.0277730.t004

For simplicity and use of limited space, the results of the pooled OLS and LSDV fixed effects models are omitted from the present study and will be available upon request. Moreover, to simplify reading through the results and to highlight significant findings, the study reports the results by income and regional classifications as shown in Tables 3 and 4 .

6.3.1 Full panel.

The results of the full panel, thereby the world panel, reflect the overall effects of financial inclusion—a key variable of interest—and other explanatory predictors on economic growth, consisting of (218) countries. The results indicate that financial inclusion proxied by CFII (composite financial inclusion index) has a significantly positive impact on the world’s economic growth, implying that one percent increase in financial inclusion (penetration, availability, and usage of financial services) increases the world’s economic growth by 0.316%, ceteris-paribus. The results are consistent with the theoretical expectations about the positive growth-financial inclusion nexus and empirical findings of Kim et al. [ 15 ] for 55 member countries of the OIC (Organization of Islamic Cooperation), Siddik et al. [ 19 ] for 24 Asian developing economies, Singh and Stakic [ 18 ] for 8 SAARC (South Asian Association for Regional Cooperation) member countries, and Huang et al. [ 17 ] for 27 countries of the European Union. Though, for brevity, other explanatory variables, such as age dependency ratio (–), inflation rate (–), foreign direct investment (+), school enrollment ratio (+), trade openness (+), and population growth (–) have their varying expected effects on economic growth, the rule of law, which is augmented in the model to ascertain its mediating effects on growth, shows that institutional quality is significant to ease the impact of financial inclusion on growth. For instance, the results demonstrate that a 1% increase in the percentile rank of the rule of law causes economic growth to increase by 0.321% in a global context. This is supported by recent empirical findings by Valeriani and Peluso [ 91 ], Nguyen et al. [ 68 ], Salman et al. [ 12 ], and Radulović [ 92 ], who also documented the effects of institutional quality on economic growth. Furthermore, an economic intuition suggests that higher institutional quality—that is, comprehensive rule of law—facilitates indirect economic growth through various conduits, one of which is financial inclusion outreach.

Moreover, the control variables, such as age dependency ratio, inflation rate, and population growth rate, decrease economic growth by 0.024%, 0.010%, and 0.081%, respectively. The negativity of the age dependency ratio implies the reduction of productivity in the world and a declining long-run trend in growth, whilst the negativity of the inflation rate on growth may additionally cause excessive cost-burden for bankable customers and reduce the scope of financial inclusion. Although some recent studies found that population growth has a positive impact on the economy, the current study finds that a 1% increase in population growth rate reduces economic growth by 0.081%. This is consistent with the findings of Easterlin [ 93 ], Klasen [ 11 ], and Mason and Lee [ 94 ] on the combined population projected effects on lowering economic growth by 1 percentage point per year.

6.3.2 Income-level.

However, the results are statistically significant for all income-level economies, but they reveal that for low-income countries, financial inclusion has a positive impact and increases economic growth by 0.085%, while comparatively, it increases the economic growth of middle-income, upper middle-income, high-income, OECD, and non-OECD member countries by 0.119%, 0.212%, 0.419%, 0.405%, and 0.146%, respectively. This highlights an important variation in the effects of financial inclusion on economic growth, varying with respect to the income level of the countries. Considering the rule of law as a proxy for institutional quality, the results indicate that its effect also varies across income-level groupings. It shows that, ceteris paribus, one percentile rank increase in the rule of law causes economic growth by 0.112%, 0.348%, 0.417%, 0.537%, 0.642%, 0.240% in low-income, middle-income, upper middle-income, high-income, OECD, and non-OECD countries, respectively. Thus, the variation of the effects of financial inclusion may be due to two key reasons: the economic size of the countries and the implementation of the rule of law in governing, allocating, and using financial resources for the sake of rapid growth. Consistently, Azimi [ 95 ] also clearly shows that the non-monotonic effects of the rule of law are based on the varying economic size of the country. The findings indicate that the higher the income level, the greater the impact of financial inclusion on economic growth will be. Furthermore, the results show that the theoretically expected effects of the control variables, such as age dependency ratio (–), credit to the private sector (+), foreign direct investment (+), inflation rate (–), school enrollment rate (+), trade openness (+), and population growth rate (–) on the economic growth of the income-level grouping are achieved. Not surprisingly, the impact of the control variables on growth is also found to be non-monotonic.

For instance, the credit to the private sector has a significantly positive effects on growth, showing that a 1% increase in credit to the private sector, the economic growth increases by 0.130%, 0.322%, 0.332%, 0.348% in low-income, middle-income, upper middle-income, and high-income economies, respectively. Olowofeso et al. [ 24 ], Cuong [ 23 ], and Samuel-Hope et al. [ 22 ] also found statistical evidence of the positive effects of credit to the private sector on economic growth in various economic contexts. On the other hand, foreign direct investment also posits positive effects on growth. Its effect on growth is 0.514%, 0.438%, 0.502%, 0.612%, 0.441%, and 0.604% for low-income, middle-income, upper middle-income, high-income, OECD (Organization for Economic Cooperation and Development), and non-OECD member countries, respectively. Moreover, the negative association between the inflation rate and the age dependency ratio is lower in high-income but higher in low-income economies. For example, the negative effect of the inflation rate on growth is -0.382% in low-income countries, while it is -0.118%, -0.218%, and -0.117% in middle-income, upper middle-income, and high-income countries, respectively. Studies by Babajide et al. [ 96 ]; Lenka and Sharma [ 97 ]; Dahiya and Kumar [ 13 ]; and Okonkwo and Ifeanyi [ 26 ] also provide statistical evidence of the effects of financial inclusion on economic growth in low and middle-income countries. Consistently, Sethi and Acharya [ 21 ] found a significant association between growth and financial inclusion in 31 countries across the world, consisting of low, middle, and high-income economies, while Li et al. [ 20 ] extended the statistical findings of the effects of financial inclusion in OECD member countries, supporting the findings of the present study.

6.3.3 Regional-level.

To facilitate better analysis and deeper insights into the effects of financial inclusion on economic growth, the present study delves into the matter using the regional classification of the countries. Comparatively, the results provide much deeper views of the growth-financial inclusion association in regional contexts. The results demonstrate that financial inclusion, which is the key variable of interest, is statistically significant at 1% level and spurs economic growth by 0.218% in East Asia and the Pacific, 0.209% in Europe and Central Asia, 0.408% in Latin America and the Caribbean, 0.501% in MENA, 0.256% in North America, 0.783% in South Asia, and 0.642% in Sub-Saharan African countries. Comparatively, the results indicate that South Asia’s growth has the highest reaction to financial inclusion among all others, while Europe and Central Asia’s growth rate has the lowest response to financial inclusion. The results are consistent with the findings of Van and Linh [ 27 ] in East Asia and the Pacific and Abdul Karim et al. [ 25 ] in sixty developed and developing economies, Adalessossi and Kaya [ 98 ] and Wokabi and Fatoki [ 99 ] in African countries, Thathsarani et al. [ 2 ] in eight South Asian countries, Gakpa [ 100 ] and Adedokun and Ağa [ 16 ] in Sub-Saharan African countries, Emara and Mohieldin [ 28 ] in MENA, and Ghassibe et al. [ 29 ] in the Middle-East and Central Asia, who also found that financial inclusion is a significant determinant of economic growth and an effective tool to facilitate greater financial integration. From a macroeconomic standpoint, increasing unbanked individuals’ access to financial services leads to increased money circulation and credit exchange in the economy, resulting in a significant impact on stable economic growth [ 101 ], whereas integrating unbanked individuals into the formal financial system results in a meaningful reduction in tax avoidance, money laundering, and transaction costs [ 57 ]. However, the proportional impact of financial inclusion is relatively lower than that of financial deepening, but it continues to encourage more unbanked populations to join the formal financial system to generate higher impacts on economic growth. For instance, in East Asia and the Pacific, the results indicate that financial inclusion significantly increases economic growth by 0.218%, while other predictors, such as credit to the private sector, foreign direct investment, the rule of law, school enrollment rate, and trade openness, also exert positive effects on growth by 1.378%, 0.783%, 0.321%, 1.032%, and 1.016%, respectively. A quick intra-comparison shows that financial deepening, human capital, and economic openness—that is, credit to the private sector, school enrollment ratio, and trade, respectively—have much higher effects on growth than financial inclusion in East Asia and the Pacific. The same results apply to all regional economies, except for South Asian countries that exhibit a different scale but similar magnitude. It is found that, in South Asia, a 1% increase in financial inclusion significantly causes economic growth to increase by 0.783%. With respect to both the inter-region and intra-region comparisons, the effects of financial inclusion on growth are higher than in other regional and income-level economies. This could be due to obvious factors such as significant advancements and support for financial inclusion in South Asia’s three most populous countries, India, Pakistan, and Bangladesh, which are constantly expanding the reach of their financial inclusion services. This finding is also supported by Thathsarani et al. [ 2 ] in eight South Asian economies, who found that the comparative effects of financial inclusion are lower than other financial development predictors on growth, and by Park and Mercado [ 102 ] in thirty-three developing economies, who provided similar findings on the comparative effects of financial inclusion on economic growth. For the control variables, the results indicate that age dependency ratio, inflation rate, and population growth are statistically significant and posit negative impacts on the economic growth of the regional economies, while credit to the private sector, foreign direct investment, school enrollment rate, and trade openness have positive associations with economic growth. Moreover, the results also show that institutional quality proxied by the rule of law has a significantly positive impact on economic growth, whereas, as theory suggests, higher institutional quality leads to efficient and effective delivery of financial services and thus paves the way for swift economic growth. The results reported in Tables 3 and 4 are statistically robust. The diagnostic checks of the relevant tests are reported at the rear part of the tables.

6.4 Causality nexus

Finally, the present study computes the panel causality test of Dumitrescu and Hurlin [ 84 ] and reports the results in Table 5 , highlighting interesting results. They reveal that there is a significant bidirectional causality relationship between economic growth and financial inclusion at a 1% level in the full panel, income-level panels, and regional panels. Since feedback responses—that is, reverse causality statistics of the control variables—have not been significant, they are not reported in Table 5 . The results indicate that except for the age dependency ratio (ADR) and population growth rate (PGR), which are insignificant in causing economic growth in the full and all other classified panels, the rest of the variables, such as credit to the private sector, foreign direct investment, inflation rate, the rule of law, school enrollment ratio, and trade openness, are significant enough to exhibit unidirectional causality to cause economic growth. The results support the findings of Sharma [ 103 ], Mlachila et al. [ 104 ], Sethi and Acharya [ 21 ] in a panel of both developed and developing countries, and Gourène and Mendy [ 105 ] in the West African Economic and Monetary Union, who also found directional causality relationships between financial inclusion and economic growth in different economic contexts. The results are in contrast with those of Asmalidar and Pratomo [ 106 ], who claimed that there is no causality nexus amid financial inclusion and economic growth.

https://doi.org/10.1371/journal.pone.0277730.t005

7. Conclusion

The present study explored the effects of financial inclusion on the world’s economic growth and extended the analysis to delve into how financial inclusion influences economic growth in a number of panels classified by income-level (low, middle, upper middle, high, OECD, and non-OECD) economies and regional-level (East Asia and the Pacific, Europe and Central Asia, Latin America and the Caribbean, MENA, North America, South Asia, and Sub-Saharan Africa) economies using panel datasets spanning from 2002–2020 compiled from the World Bank’s World Development Indicators and IMF’s Financial Access Survey databases. To test the developed hypotheses, the study employed heterogeneous robust panel cointegration by bootstraps, GMM (generalized method of moment), and heterogeneous panel causality tests for two key objectives: ascertaining the scale of the effects of financial inclusion on economic growth and the causality nexus among them. First, to provide consistent results, the study used the methodology proposed by Sarma [ 41 ] and developed a comprehensive composite financial inclusion index comprised of penetration, availability, and usage of financial services for all panels under consideration. Next, the study provides statistically significant cointegration between composite financial inclusion, economic growth proxied by GDP growth, and other control variables, such as age dependency ratio, credit to the private sector, foreign direct investment, inflation rate, the rule of law, school enrollment ratio, trade openness, and population growth rate. The cointegration results support the idea that, in the long run, financial inclusion moves in tandem with economic growth, suggesting a thorough examination of their interactions. To that end, led by the nature of the data, the study employed a GMM approach using 1Sys-GMM, 2Sys-GMM, and Diff-GMM estimators to examine the effects of financial inclusion and other control predictors on economic growth. Based on statistical satisfaction, 2Sys-GMM has attained the preference and, thus, the conclusion is based on the findings from 2Sys-GMM estimators. The results clearly indicate that financial inclusion is a significant variable to influence economic growth in the full panel, income-level panels, and regional-level panels and causes the economies to foster rapid growth. The results obtained from the GMM estimates encouraged the study to delve into the causality relationship between financial inclusion, economic growth, and the control variables. In this regard, the results of the Dumitrescu and Hurlin [ 84 ] model extend the findings and provide evidence of bidirectional causality between financial inclusion and economic growth, while the results only support a unidirectional causality running from credit to the private sector, foreign direct investment, inflation rate, rule of law, school enrollment ratio, and trade openness with no feedback response. Moreover, the findings also failed to provide causality evidence for the age dependency ratio-economic growth and population growth-economic growth.

7.1 Policy recommendations

The findings extracted from a wide range of sophisticated methods and large panel spectra; suggest three important policy recommendations, among all others. First, it clearly indicates that financial inclusion is an assistive growth conduit in all economies regardless of any classification, and, thus, it is important to enhance the scope of its coverage via more extensive and swift channels, such as the advancement of financial services through financial technologies. This approach will lead to a higher and quicker integration of the excluded segment of society into formal financial systems and will maximize the effects of financial inclusion on economic growth. Second, it is imperative to gear policies to avert the existing digital gaps stemming from access inequality to digital technology. Informed investments in enhancing digital financial services including mobile banking and digital agent networking will substantially reduce the cost of transactions and encourage more entrants into the financial sector of an economy. Third, both public and private sector organizations need to provide an appropriate platform for hasty adaptation of financial technologies to pave the way for easy use of financial services by customers, enhance financial literacy to support effective use, and extend the scope of financial inclusion coverage. These policy measures will lead to extensive money circulation in the economy and growth channelization via higher financial system integration and investments.

7.2 Limitations of the study

Although the results are robust and cannot be doubted, the study suffers from one major limitation—that is, the use of the rule of law as a proxy for institutional quality, which may not be sufficient to capture the effects of institutional quality in its entirety. Future studies may overcome this shortcoming by including all institutional quality predictors, such as control of corruption, voice and accountability, government effectiveness, political stability, and regulatory quality when assessing the effects of financial inclusion on growth.

Supporting information

S1 appendix. table a1 of appendix a provides statistical detail about cfii aggregate index..

https://doi.org/10.1371/journal.pone.0277730.s001

S2 Appendix. Table B1 of Appendix B provides the descriptive statistics of the panel predictors.

https://doi.org/10.1371/journal.pone.0277730.s002

- 1. Schumpeter J. A., The Theory of Economic Development : An Inquiry into Profits , Capital , Credit , Interest , and the Business Cycle . Harvard University Press, 1934.

- View Article

- Google Scholar

- PubMed/NCBI

- 35. World Bank, “Financial inclusion,” Global financial development report , 2014. https://openknowledge.worldbank.org/bitstream/handle/10986/16238/9780821399859.pdf?sequence=4&isAllowed=y (accessed Jun. 19, 2022).

- 36. M. Sarma, “Index of Financial Inclusion,” Indian Council for Research on International Economic Relations Working Paper No 215 , 2008. https://www.econstor.eu/bitstream/10419/176233/1/icrier-wp-215.pdf .

- 47. L. Rojas-Suarez and M. A. Amado, “Understanding Latin America’s Financial Inclusion Gap,” Center for Global Development Working Paper 367 . Washington, DC, 2014. https://www.cgdev.org/sites/default/files/latin-american-financial-inclusion-gap.pdf (accessed Jun. 12, 2022).

- 61. World Bank, “World Bank list of economies,” List of economies , 2020. https://www.ilae.org/files/dmfile/World-Bank-list-of-economies-2020_09-1.pdf .

- 66. C.-Y. Park and R. J. Mercado, “Financial Inclusion, Poverty, and Income Inequality in Developing Asia,” 2015. [Online]. https://www.adb.org/sites/default/files/publication/153143/ewp-426.pdf .

- 102. C. Y. Park and R. V. Mercado, “Financial inclusion: New measurement and cross-country impact assessment,” ADB Economics Working Paper Series 539 . Manila , Philippines ., 2018. https://www.adb.org/sites/default/files/publication/408621/ewp-539-financial-inclusion.pdf (accessed Jun. 19, 2022).

- 106. Asmalidar and W. A. Pratomo, “Causality between Financial Inclusion and Economic Development: Lesson from the Emerging Indonesia Economy,” in In Proceedings of the 2nd Economics and Business International Conference (EBIC 2019)—Economics and Business in Industrial Revolution 4 . 0 , 2021 , pp. 573–578, 10.5220/0009326805730578.

Topics for CGAP's Work

Maximizing the potential of financial inclusion.

The world has recently faced many unprecedented shocks and stresses that have exacerbated existing development challenges—all of which have disproportionate impacts on the most vulnerable, especially women and girls. Against the backdrop of such a challenging global context, financial inclusion is an essential foundation for building a more inclusive, resilient, and green world. The advancement of digital economies and digital inclusion, as well as the increase of socially minded investments, provide hope, while innovations in digital financial services are helping redefine what inclusive financial ecosystems look like, and how they can be used as an enabler of many UN Sustainable Development Goals (SDGs) and broader development outcomes. CGAP works on many aspects of financial inclusion and on its intersection with many development challenges. Below you’ll find more information about the topics we have been working on.

Women's Financial Inclusion

The Role of Financial Services in Rural Women’s Climate Resilience

Micro and Small Enterprises

MSE Financing

Microfinance Digitization

Building resilience.

Climate Change

Climate Resilience

Asset Finance for Global Development

Digital innovation.

Cash-In / Cash-Out for Rural Agent Networks

Fintech and the Future of Banking

Gig Platforms and Financial Inclusion

OPEN APIs FOR DIGITAL FINANCE

Digitizing Merchant Payments

Beyond Switches, What Makes Interoperability Work?

Data-driven Financial Services

Enabling and responsible financial policy.

Regulation for Inclusive Digital Finance

An Ecosystem Approach to Consumer Protection: What, Why and How?

Proportional Supervision for Digital Financial Services

Building an enabling regulatory framework is fundamental for fostering inclusive digital financial services (DFS), but it is not enough. Supervision...

Market monitoring for financial consumer protection

© 2024 CGAP

- Privacy Notice

Financial Inclusion Research around the World: A Review

- Citation: Ozili, Peterson K. “Financial Inclusion Research around the World: A Review.” Forum for Social Economics 38, no. 4 (2020).

- Business and Trade

- financial inclusion

- poverty reduction

- economic cycle

- systemic risk

This paper provides a comprehensive review of the recent evidence on financial inclusion from all regions of the World. It identifies the emerging themes in the financial inclusion literature as well as some controversy in policy circles regarding financial inclusion. In particular, I draw attention to some issues such as optimal financial inclusion, extreme financial inclusion, how financial inclusion can transmit systemic risk to the formal financial sector, and whether financial inclusion and exclusion are pro-cyclical with changes in the economic cycle. The key findings in this review indicate that financial inclusion affects, and is influenced by, the level of financial innovation, poverty levels, the stability of the financial sector, the state of the economy, financial literacy, and regulatory frameworks which differ across countries. Finally, the issues discussed in this paper opens up several avenues for future research.

Related Resources

Implications of cryptocurrency energy usage on climate change.

Zhang, Dongna, Xihui Haviour Chen, Chi Keung Lau, and Bing Xu. 2023. “Implications of Cryptocurrency Energy Usage on Climate Change.” Technological Forecasting and Social Change 187: 122219.

- Authors with Diverse Backgrounds

How Much Does Racial Bias Affect Mortgage Lending? Evidence from Human and Algorithmic Credit Decisions

Bhutta, Neil and Hizmo, Aurel and Ringo, Daniel. 2022. “How Much Does Racial Bias Affect Mortgage Lending? Evidence from Human and Algorithmic Credit Decisions.” FEDS Working Paper No. 2022-67, SSRN

- Open Source Results

Enable JavaScript in your browser to view this website correctly.

Close panel

- Publications

- Reading lists

- Financial Inclusion

Financial Inclusion latest publications

Filter all of our publications to find the ones you are most interested in by content language, date, geography and/or topic.

More recent Most read

Sort our publications chronologically from newest to oldest, regardless of geography and/or topic matter.

Sort publications according to the number of time reads by our users, regardless of geography and/or topic matter.

June 6, 2024

Mexico | From 2004 to 2021, coverage of ATMs increased from 28 to 62 per 100,000 adults

Financial inclusion has four pillars, one of them has to do with “access”, generally it is seen as the supply of financial products; therefore, this note presents information on the coverage of traditional mechanisms that the population has to access multiple banking.

- Geography Tags

- Sustainable Development

- Types of files Downloads:

Share Other tools