Get A Free Consultation 866.834.7338

- Equipment Financing

- Ultimate Invoice Factoring Guide

- Recommended Load Boards

- Partner with Integrity

- Get Started

- Application to Become a New Client

- Why Integrity Factoring

- Employment Opportunities

What is a Notice of Assignment?

- What is a Notice of…

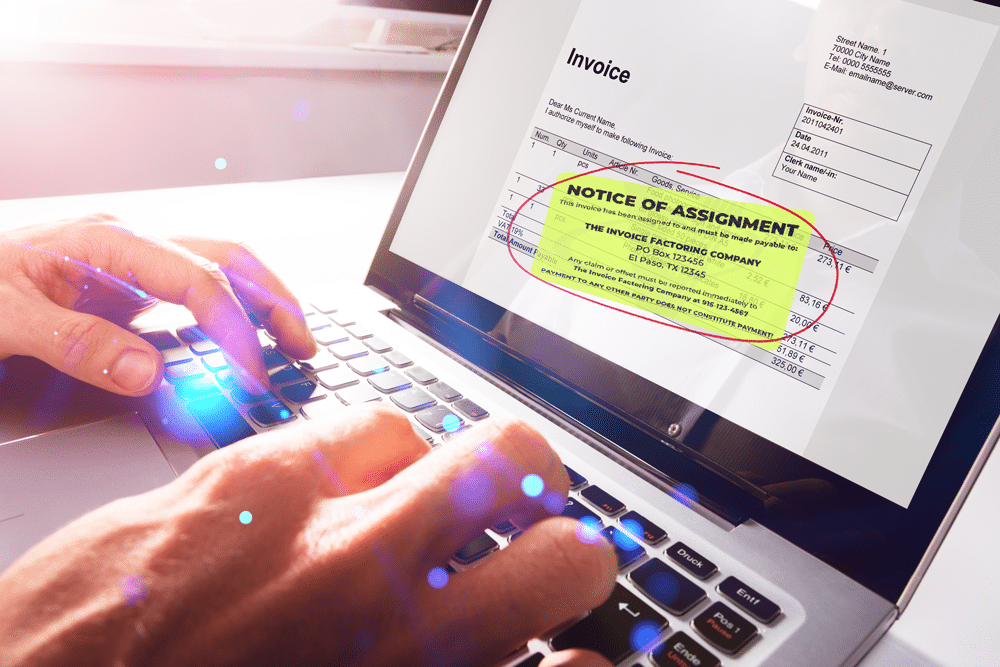

A factoring contract can contain many parts, but few are as important as the Notice of Assignment.

What are the parts of a notice of assignment.

A notice of assignment contains a few standard parts. First, it informs your customers that you are factoring your invoices and that your factoring company has been assigned as the payee for your accounts receivables. Next, a notice of assignment provides your customer with an updated remittance address for all current and future payments to be sent to. Third, it contains explicit instructions that all payments should be made to the factoring company’s remittance address only, and that no other payments should be made to any other address without explicit permission from the factoring company. It also contains verbiage that states that payments made in conflict to this notice of assignment will not be considered to have discharged a customer’s obligation for payment to the factoring company. Lastly, the factoring client signs the notice of assignment to prove it is valid.

Why do my customers need to know that I’m factoring?

The right to receive payments for amounts owed is one of the main protections a factoring company has in the factoring process. It is an essential part of almost every factoring program. In order to assure that payments are directed appropriately, a factoring company must contact a customer to verify that the notice of assignment has been accepted and the remittance address has been updated.

Why does my factoring company receive payments for invoices that weren’t factored?

A notice of assignment gives your factoring company the right to collect for ALL payments owed to you by your customer. Some factoring companies require that you factor every invoice for your customers, making this a non-issue. However, if you are working with a factoring company that allows you to pick and choose which invoices to factor for a customer, your factoring company will also receive payments for those unfactored invoices.

This happens for two reasons. First, allowing multiple remittance addresses for a payee exponentially increases the chance of a misdirected payment being made. Second, asking the customer to shoulder the additional workload of keeping track of which payments should be made to which remittance address would make invoice factoring unattractive for many customers, and thus limit the number of companies willing to work with a business that was factoring. All factoring companies have policies to efficiently deal with unfactored payments when they arrive.

What happens if I receive a payment that should have been sent to my factoring company?

Most factoring companies understand that accidents happen, and mistakes will be made. If an error in payment occurs in good faith, factoring companies have processes in place to deal with the issue. Firstly, it is important that a factoring client does not deposit the payment into their account, but rather they should immediately notify their factoring company of the errant payment and send it immediately to their factoring company. If a factoring client fails to do so, or attempts to hide the payment from their factoring company, then that client will be responsible for a misdirected payment, which often carries heavy penalties in the factoring contract.

(216) 292-5660

216.930.1983

Learn About Notice of Assignment for Invoice Factoring

In a factoring relationship, you agree to assign your selected receivables to the factoring company. By advancing your cash against your invoices, the factor has purchased the right to collect amounts due from your customers. The Notice of Assignment is a critical part of your factoring paperwork as it reflects the change in invoice ownership.

What is a Notice of Assignment?

The Notice of Assignment is a simple letter the factoring company sends to your customers whose invoices you are factoring. In writing, the notice informs your customers that the accounts receivable is assigned, and future payments should be made payable to the factoring company. The notice will also include a remittance address so your customer can change their payment information.

The Notice of Assignment legally explains to your customers that any payments they make to you instead of the factor will not satisfy their obligation. The factoring company may hold your customers liable for misdirected amounts. This may occur if your customers choose to ignore the notice or fail to update payment information.

Many factors will require your customers to sign and return a copy of the notice to acknowledge receipt. This is not always required, though. Instead, the Notice of Assignment may include language that considers your customer’s continued use of your services to constitute an agreement to the notice. In addition, the factor may only revoke a Notice of Assignment if they send a signed and notarized release notification to your customers. They will do so if you choose not to factor that account any longer or you end your factoring relationship. In either case, the account must have no outstanding balance.

What Programs Don’t Use a Notice of Assignment?

Financing programs that do not use a notice of assignment include non-notification factoring and sales ledger financing.

Non-notification factoring is similar to regular factoring, but with a few key differences. Instead of sending a conventional Notice of Assignment to customers, the factoring company informs them of a new payment address using the company’s regular letterhead. This allows the customer to still send payments to the new address without being aware that it belongs to the factor. To qualify for non-notification factoring, companies typically need to have monthly revenues of at least $300,000, a track record of over a year, reliable financial reports, and no serious financial difficulties.

Sales ledger financing operates like a line of credit based on outstanding receivables. Companies can access up to 90% of their outstanding receivables at any given time without the need to submit a factoring schedule of accounts for each transaction. Although the finance company still handles payments, the customer does not receive a Notice of Assignment. Instead, they receive a letter indicating a change in the payment address. Sales ledger financing offers greater flexibility compared to non-notification factoring, with daily rates allowing for better cost control. The qualification requirements for sales ledger financing usually include monthly revenues of at least $300,000, a track record of 1-2 years, reliable financial reports, good receivables management systems, and no serious financial difficulties.

Get Started Now

Secure the funds you need today. Complete the form or call.

Why do Factoring Companies Notify Your Customers?

The Notice of Assignment is a vital form of protection for a factoring company. It protects the factor in case the business owner (the factor’s client) receives the payment instead of the factoring company.

In a best-case scenario, the notice serves to inform every party in a factoring transaction of their rights and responsibilities. It also gives your customer the appropriate address to make account payments, allowing your factoring relationship to continue smoothly.

In a worst-case scenario, a factor can recover unpaid amounts from your customer should they continuously pay over notice or not pay at all. A Notice of Assignment is evidence in any legal proceeding — from a demand letter for payment to a full-fledged lawsuit — that asserts the factor’s standing and rights to payment.

What Will Your Customers Think?

Customers may have concerns or questions when they receive a letter regarding the use of invoice factoring. It’s understandable that they may be unsure or unfamiliar with this financing tool. As a business owner, it’s important to address these concerns and communicate with your customers effectively.

First and foremost, it’s essential to acknowledge that invoice factoring is a common practice utilized by many small and midsize companies to finance their operations and facilitate growth. Chances are, your customers are already aware of this financing method and how it works.

When discussing invoice factoring with your customers, emphasize the benefits it provides to them. By using factoring, you can offer them extended payment terms, such as 30- to 60-day terms, while still ensuring excellent service. This enables your customers to utilize their available cash resources more effectively. Without factoring, providing extended payment terms might be challenging, especially for businesses experiencing growth.

It’s crucial to assure your customers that little is changing in terms of the services and support your company provides. Reassure them that they will still have the same level of communication and engagement with you and your employees as before. Highlight that despite factoring being implemented, your commitment to their satisfaction remains unchanged.

Address the misconception that factoring indicates financial trouble within your company. Remind your customers that factoring is a versatile tool used to achieve various goals and objectives, just like other forms of financing such as loans or lines of credit. Factoring simply serves to smooth out your cash flow and support your business’s overall financial stability and growth.

Overall, open communication with your customers is key. Provide them with transparency and reassurance, explaining the benefits of factoring and emphasizing that it is a common and established financing practice. By effectively addressing their concerns, you can foster trust and maintain strong relationships with your valued customers.

Why a Notice of Assignment Matters To You

You will receive a copy of the Notice of Assignment that the factor sends to your customers. While the notice is to inform your customers, it also has an important implication for you as well.

As your factoring agreement explains, payments your company receives from your customers over notice are payable to the factoring company. Even in the smoothest transition, you may receive payments sent before receipt of the notice or released before your customers’ updated their payment system. There will likely be a provision explaining the procedure for sending misdirected payments to the factor in these cases. Misdirected payments are usually sent by overnight check or via bank transfer.

However, you may be responsible for additional penalties and fees if your customers continue to pay over notice, and you deposit those payments into your account. In addition, you may end up owing more, depending on fee structure, due to the extra time it takes for the factor to receive payment. Some factors include a misdirected payment fee in the factoring agreement that you will have to pay if you fail to return misdirected payments to the factor. Therefore, fees may be higher if you are responsible for the misdirection.

As with any legal document, be sure to be fully aware of the language used within the Notice of Assignment. Be mindful of your customers’ responsiveness to the notice. Take action immediately if you realize that any of your customers are not sending their payments on time. This transparency solidifies your factoring relationship, builds trust with your factor, and protects your interests.

What if the Payment is for an Invoice I Didn’t Factor?

When you assign your customers’ receivables to your factoring company, you agree to direct all payments to the factor, even for invoices that you did not factor. This eliminates complications for all parties and ensures that the factoring company receives every payment they should. Without an all-inclusive assignment, your customers would receive a notification every single time you factor an invoice. They would have to retain two addresses on file, increasing the likelihood of misdirected payments.

Your factoring company will have a straightforward procedure in place to address non-factored payments. This may include applying those payments to open invoices and sending you the difference or the total amount in a regularly scheduled reserve release. Stay prepared by asking your factor about their policies surrounding non-factored payments.

Factor Finders can help you find the right factoring company for your invoice factoring needs. Contact us to learn more about our factoring services for every industry and to get started today.

Don’t want to talk on the phone?

Get a free quote by filling out our online form .

Connect With Us

(216) 865-4922

Newsletter Sign-Up

Need fresh ideas on how to grow your small business? We've got you covered!

Quick Links

© 2024 Factor Finders, LLC All Rights Reserved.

Privacy Overview

Secure the funds you need today.

1.915-859-8900 Get a Free Quote

WE ARE CELEBRATING 25 YEARS OF EXCELLENCE! 🎉 JOIN US IN CELEBRATING THIS MILESTONE YEAR.

Factoring Notice of Assignment (NOA): Everything You Need to Know

A factoring notice of assignment (NOA) is usually required when you factor your invoices. Rest assured, NOAs are quite common in business and aren’t a cause for concern. However, it helps to understand what they are and how they work so that you can explain them to your customers as needed.

Assignment of Debt Explained

Companies transfer debt, along with all associated rights and obligations, to third parties all the time. One example of this occurs with collection companies. In these cases, the business, also referred to as the creditor, sells its uncollectable balances or assigns specific debts to the collection company. The collection company is then authorized to collect those specific balances on behalf of the creditor.

Assignment of debt may also come into play when businesses outsource their receivables and leverage certain types of funding, among other situations.

What Does Notice of Assignment Mean?

The customer, also referred to as the debtor, must be informed when a creditor assigns their debt to a third party. The document used in this process is referred to as a notice of assignment of debt.

What is a Notice of Assignment in Factoring?

When you leverage invoice factoring , you’re selling an unpaid B2B invoice to a factoring company at a discount. In exchange, you receive up to 98 percent of the invoice’s value right away and get the remaining sum minus a small factoring fee when your client pays. This means you’re not waiting 30, 60, or more days for payment. This cash flow acceleration helps businesses bridge cash flow gaps caused by slow-paying customers, seasonality, rapid growth, and more. Plus, the cash can be used for anything the business needs. This unique process means businesses can receive immediate funding without creating debt like other funding sources.

A notice of assignment is required in factoring because you’re assigning debt to a third party – the factoring company – and the customers involved need to know.

The Role of Notice of Assignment for Cash Flow

Invoice factoring stands out as a solution for businesses seeking to improve their cash flow. When a company decides to use invoice factoring, it enters into a factoring relationship, where accounts receivable and financial rights are handled differently than usual. This process involves the NOA, a pivotal document in factoring transactions. Essentially, NOA is a simple letter informing customers that the payment terms have changed and future payments should be made payable to the factoring company.

This notification ensures that there are no misdirected payments, which is a critical aspect when managing accounts payable and securing immediate cash. By using factoring, businesses can access working capital, which reduces the strain of slow-paying customers. It’s important for factoring clients to understand how factoring companies notify your customers and the implications of this process. The factoring contract typically outlines these details, ensuring that every party in a factoring transaction is aware of their responsibilities, especially regarding remittance addresses and payment information.

Factoring services offer an alternative to traditional lines of credit, providing businesses with high advances at low rates. This method is beneficial for companies that demand longer payment terms from their clients. By transferring the right to collect payments to the factoring company, the business can focus on its core operations while the finance company handles the receivables. Understanding the benefits of factoring and effectively communicating them to your customers may improve the factoring process and maintain healthy customer relationships, even when introducing new financial arrangements like invoice factoring.

The Importance of a Notice of Assignment in Factoring

Notice of Assignment in invoice factoring keeps your customers in the loop so they know who is collecting and why. It also lets them know where to send their payments. This streamlines the process and helps ensure there’s no confusion about where payments need to go.

Elements of a Factoring NOA Document

Each factoring company words its NOA a bit differently, but NOAs usually include:

- A statement that indicates the factoring company is now managing the invoice or invoices.

- A notice that payments should be made to the factoring company.

- Details on how payments can be made, including addresses, bank details, or payment portal information.

- What will occur if payments are sent to the business instead of the third party.

- A signature from someone at your business to show your customer that the NOA is authentic and a signature space for your customer to sign indicating that they’ve read and understand the document.

How Do Factoring Companies Notify Your Customers

A factoring notice of assignment is usually sent to customers by U.S. mail, though sometimes factoring companies use other delivery services or even digitize the NOA.

What Will Your Clients Think of You Factoring Your Invoices?

Sometimes, businesses that are new to invoice factoring have concerns about how customers will react to factoring or receiving an NOA. However, it’s usually not a cause for concern.

Although your factoring company isn’t an outsourcing company, it behaves quite similarly when collecting invoices. Nearly 40 percent of small businesses outsource at least one business process, Clutch reports. That means a significant portion of your customers already have some experience engaging with third parties. Furthermore, invoice factoring is growing in leaps and bounds and is expected to grow by eight percent in the coming years, per Grandview Research . Many of your customers already have experience with factoring or will very soon. Because most businesses have some exposure to factoring or will in the near future, it’s generally seen as an ordinary business practice – nothing more, nothing less.

However, even if factoring is entirely new to your customers, how they respond to your decision is often determined by how you present it. For instance, it accelerates payments without putting pressure on your customers to pay faster. It has benefits for them, too, and can help improve the relationship. This alone can actually help some businesses win bids or attract new customers. Explaining it to them this way can help soothe any concerns if customers come to you with questions.

How to Ensure Your Customer Relationships Are Protected

Most factoring companies will take good care of their customers because they are a reflection of you. Your repeat business helps ensure they’ll have repeat business. However, reviewing a factoring company’s testimonials and success stories is always a good idea to understand better how they operate before you sign up.

It’s also essential to work with a company like Viva that doesn’t send mass notifications to all its customers. We only notify those who are debtors on the invoices you’d like to factor to eliminate any confusion.

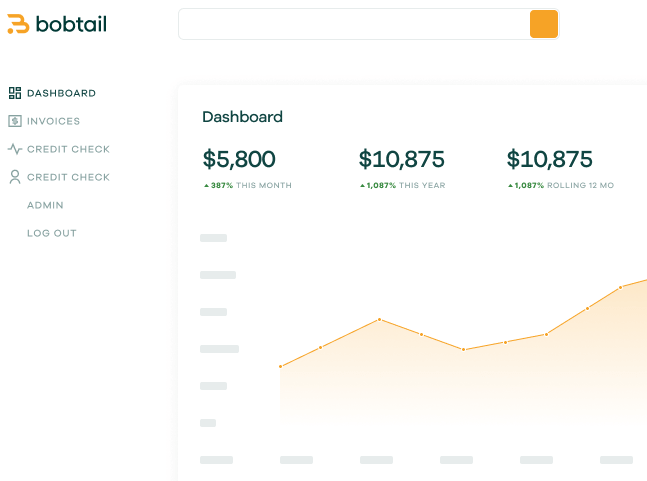

Lastly, it’s better to work with a company that provides you with 24/7 access to your account so you can see what’s paid and outstanding at a glance and can make decisions about orders using real-time data.

Request a Complimentary Invoice Factoring Quote

At Viva Capital, we always provide white glove care to the businesses we serve and their customers.As part of our service, we handle the Notice of Assignment with professionalism. Our collection experts make it easy for your customers to manage their bills and are happy to answer their questions. You’ll also have access to your personal Customer Account Portal so you can make informed decisions on the fly and always know what’s outstanding. To learn more or get started, request a complimentary invoice factoring quote .

- Recent Posts

- 4 Simple Debt-Free Cash Flow Strategies for Small Businesses - May 17, 2024

- 10 Credit Crunch Business Strategies to Boost Your Resilience - March 21, 2024

- 5 Benefits Factoring Companies Offer Other Than Factoring - February 9, 2024

About Armando Armendariz

The Cost of Invoice Factoring: Is it Worth It?

Why Relying on Business Credit Cards is Dangerous

Comments are closed.

Request FREE Funding Estimate

Discover how we've helped businesses just like yours.

How Medlock Contractors has forged better relationships with their subcontractors with the help of Viva Capital Funding.

How R. Ramirez Express saves $5,000 per year in fuel costs with Viva Capital Funding.

How BelCon Logistics grew 1,000% in just 3.5 years with Viva Capital Funding.

How Top of the Line Healthcare Staffing boosted revenue 1,000% with Viva Capital Funding.

How Sun City Pallets boosted revenue 400% with Viva Capital Funding.

How DMI Industries Supplies grew and continued its global expansion plans with Viva Capital Funding.

How Cold Way Transportation boosted revenue 47% with Viva Capital Funding.

Industries we serve

- Transportation

- Manufacturing

- Service providers

- Construction

- Other Industries

Latest articles and insights

- 4 Simple Debt-Free Cash Flow Strategies for Small Businesses May 17, 2024

- Asset-Based Lending for Businesses: A Comprehensive Guide May 1, 2024

- Agile Business Transformation: Navigating Market Shifts for Long-Term Success April 8, 2024

- 10 Credit Crunch Business Strategies to Boost Your Resilience March 21, 2024

- What to Include in an Invoice to Get Paid Fast March 7, 2024

13 February 2023

Notice of Assignment in Factoring in the U.S

When a business uses invoice factoring, they transfer ownership of its accounts receivable to a factoring company, which then has the responsibility to collect payment for those invoices.

Therefore, a document is issued to alert its customers of this. This is known as a notice of assignment.

Meaning of Notice of Assignment

A notice of assignment is a document that notifies clients that a factoring company has acquired ownership of their accounts receivable, or invoices, from the original business.

The notice's objective is to alert customers to the ownership change and specify who should receive payments.

Importance of Notice of Assignment

A notice of assignment is vital because it officially notifies customers that the ownership of an invoice has changed hands and that they should now direct payments to the factoring company.

The notice helps ensure that payments are sent to the appropriate parties , avoiding misunderstandings and potential conflicts and preventing uncertainty.

In the event of a disagreement, having a detailed and official notice of assignment can safeguard the legal interests of both the company and the factoring company.

Impact of Notice of Assignment on Businesses

The possible impacts faced by businesses by using a factoring company and sending their customers a notice of assignment are:

1. Enhanced customer relationships: By providing clear and official notification to customers of the change in ownership of invoices, a business can help maintain and strengthen its relationship with them.

2. Improved cash flow: By transferring ownership of invoices to a factoring company, a business can receive payment more quickly and improve its overall cash flow.

3. Increased operational efficiency: By using a factoring company to manage the collections process, a business can free up internal resources and focus on its core operations, leading to increased efficiency.

4. Reduced risk: By transferring the responsibility of collecting payment to a factoring company, a business can reduce its exposure to the risk of non-payment and bad debt.

However, before deciding to utilize factoring , it's crucial to consider any potential drawbacks, such as losing control over the collection process and the expense of the factoring service.

Factors Covered in a Notice of Assignment The main sections covered are:

- The company's accounts receivable have been transferred to a third-party financial institution, and payment should now be made to them

- The customer should now send payments to a new address, typically a secure payment processing location

- The customer will be responsible if they make a payment to the wrong address

Information in a Notice of Assignment

In a factoring notice of assignment, the following details are covered to notify the business’ customer about the transfer of ownership of accounts receivable:

- Particulars of the accounts receivable being assigned , including the amount and invoice numbers

- Details of the factor and the client/debtor

- Specifics of the assignment of the accounts receivable, including the effective date and any conditions of the assignment

- Instructions for the customer on how to direct future payments to the factor

- Any other relevant terms and conditions of the factoring agreement

What Happens When an Obligor Doesn’t Receive Notice of Agreement

A business that sells its accounts receivables (invoices) to a third-party factor must send a notice of agreement to its customers.

The purpose of the notice is to inform the customer that the factor has taken ownership of the invoice, and the payments should be made directly to the factor instead of the business.

If the customer does not receive the notice, they may continue to make the payments to the business, leading to confusion, delayed payments to the factor and potential disputes.

In some cases, the customer may have the right to demand a return of the payment made to the factor or stop payment if the notice of assignment was not correctly given.

How to Receive Notice of Agreement

A factoring notice of agreement is typically provided by the factoring company or third-party factor that has purchased the accounts receivable (invoices) from the business.

The notice is usually generated by the factor and given to the business to send to its customers.

The business may also be responsible for ensuring that the notice of assignment is delivered correctly to its customers.

Some factoring companies provide templates or sample notices that the business can use.

Requirements for a Notice of Assignment

To obtain a notice of assignment (NOA) from a factoring company, the following requirements are necessary:

- Monthly revenue of at least $300,000

- A stable financial track record of 1-2 years

- Accurate and trustworthy financial reports

- Effective management of accounts receivable

- No significant financial difficulties

1. Who Sends a Factoring Notice of Assignment? A factoring notice of assignment is typically sent by the business that has sold its accounts receivables or invoices to a third-party factor or factoring company.

The factor usually provides the notice of assignment, and the business may have to sign a factoring agreement with the factor to obtain the notice.

The notice informs the business’ customers that the factor has taken over the ownership of the invoices, and the payments should be made directly to the factoring company instead of the business.

2. How Much Does a Notice of Assignment Cost? The cost for issuing a notice of assignment in factor can differ based on various elements, such as the amount assigned, the state where the assignment is taking place and the particular provisions of the assignment agreement.

This cost may include legal fees, filing paperwork fees and other administrative expenses. It's crucial to examine the assignment agreement thoroughly to determine the precise cost and be aware of any additional fees that may be incurred.

3. How Long Does a Notice of Assignment Take? The duration of issuing a notice of assignment in factoring can differ based on particular circumstances. Usually, the process can take anywhere between a few days to weeks.

The length of the time may be influenced by factors such as the state in which the assignment is getting issued, the complexity of the assignment agreement and the accessibility of relevant parties.

Moreover, the time needed for the notice of assignment may be affected by any legal challenges or hindrances.

4. Does Notice of Assessment Mean You Owe Money? In the United States, a notice of assessment usually implies that you owe money to the government.

However, it is contingent on particular circumstances. The Internal Revenue Service (IRS) sends out the notice of assessment to inform taxpayers of any modification to their tax obligations.

If the notice displays an increase in the amount owed, it implies that the taxpayer has an outstanding balance with the IRS and should pay it promptly to prevent further interest and penalties.

On the other hand, if it shows a decrease in the amount owed, it showcases that the taxpayer has paid more taxes than required and may be eligible for a refund.

It is, therefore, always advisable to thoroughly examine the notice and to get help from a professional.

5. Is Notice of Agreement a Proof of Debt? A notice of agreement alone is not considered proof of a debt. The document merely outlines the terms and conditions agreed upon by the parties involved.

It is not enough evidence to confirm the presence of debt but rather serves as a record of the agreement between the parties.

To establish proof of debt, other financial documents such as receipts, invoices or other documentation may be necessary.

The specific requirements for proving a debt depend upon the type of debt and the laws of the jurisdiction where it is being established.

6. What is a Letter of Release? A letter of release from a factoring company is a declaration that a debt has been satisfied and is no longer the company's responsibility.

In factoring, a business sells its accounts receivable to a factoring company for a fee to receive cash quickly.

Upon receiving the payment on the accounts receivable by the business’ customer, the factoring company issues a letter of release, confirming that the debt has been fully paid off and the company is no longer obligated to it.

The letter serves as proof that the debt has been fully resolved. It can be used to clear the debt from the business's financial records.

The specifics of the letter of release, including the terms and conditions, will depend on the particular factoring agreement and the laws in the jurisdiction where it is formed and drafted.

Siddhi Parekh

Finance manager at drip capital.

Table of Content

- Information in a NOA

- What Happens When an Obligor Doesn’t Receive NOA

- How to Receive NOA

- Requirements for NOA

We use cookies to give you the best possible experience on our website. By continuing to browse this site, you give consent for cookies to be used in accordance with and for the purposes set out in our Privacy Policy and acknowledge that your have read, understood and consented to all terms and conditions therein.

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Bankers Factoring an Employee-Owned Accounts Receivable Factoring Company

July 25, 2023 By Chris Curtin

What is a Notice of Assignment in Factoring?

Why is a factoring notice of assignment (noa) important when selling your a/r.

Table of contents

What is a notice of assignment letter, what is included in the factor financing noa, how does factoring noa impact my customers, benefits of noa factoring:, factoring arrangement: assignment of accounts receivable, notice of assignment factoring, bankers factoring difference, what is a notice of assignment in factoring.

It is a letter that informs the business owner’s customers of your relationship with a factoring company. The notice of assignment letter is the first communication between the invoice factor company and the account debtor (your customer). The factoring contract spells out the change in invoice ownership.

The invoice factoring companies will send your customers, also known as debtors, a notice of assignment (NOA) letter. It will be sent immediately when you sell your unpaid receivables. The letter is also a standard document in factoring agreements. And accounts receivable (A/R) invoice factoring is a common financial product to accelerate the cash flows of small businesses.

Factoring invoices is a time-tested business funding solution to support operations and fund growth plans. Partnering with factoring companies allows your business to receive fast cash flow by selling invoices. Moreover, sending the NOA letter is a critical step to communicate your A/R has been assigned and is payable to the factoring company.

You can also read how factoring companies buy accounts receivable .

Complete Bankers Factoring online funding application to begin your debt-free funding process including Bad Debt Protection.

Contact Bankers Factoring to learn about the factoring NOA process and how we can provide consistent cash flow funding. We partner with you and your customers to provide an elite program for your business success.

A Notice of Assignment (NOA) is a letter that informs account debtors their creditor (our client) is factoring invoices under the Universal Commercial Code (UCC) . And invoice factoring is an agreement to assign your accounts receivable (A/R) to a factoring company. So the letter communicates that a third party (factoring company) is managing and collecting your A/R. An assignment letter notifies your customers or account debtors of the transfer in ownership.

The NOA letter is the first-time customers will learn that you are utilizing factor financing. But selling your unpaid invoices to a factoring company will not concern your customer. In addition, invoice funding is a popular financing vehicle to cover operating expenses and accelerate sales growth.

Keep reading, Factoring Company: What it is and Your Best Choice .

Factoring NOA letters are standard documents sent to customer (debtor) accounting departments. Assignment letters include language regarding the arrangement:

- NOA letter informs your customers that a factoring company is managing receivable invoices

- The notice includes language stating the factoring company has the right to payments

- Your business A/R has been assigned to a third party, and payment is transferred to them

- Updated information for making payments (remittance) to factor

- Notice of assignment letters include legal clauses related to the assignment

Assignment companies send NOA to establish their ownership and management position for your receivables. That’s because letting your customers know about the receivable assignment helps them make timely payments. Moreover, the factor provides specific remittance instructions to ensure an easy transaction for all parties involved.

Keep reading How Does a Factoring Company Work ?

Selling your receivables can cause stress about sending an NOA letter to your customer. However, invoice factoring demonstrates to your customers that you are serious about your operational performance by establishing financing lines. In fact, the US factoring market valued at $3.9 billion in 2022 shows how many companies use invoice services ( IBISWorld ).

- Streamlined accounting process between your debtor’s accounts payable team and the factoring company.

- Partnering with a factoring company demonstrates your plans to grow your company and shows you are serious about your finances.

- Invoice factoring companies enhance customer service relationships by providing highly skilled professionals to communicate with your customers.

If your company works with commercial customers that demand extended credit terms, a factoring facility can help your cash flow.

Keep reading How Factor Financing Impacts Customer Relations .

A/R factoring is a type of business funding that injects working capital into companies with slow-paying customers. However, factoring agreements are not debt-financing like business loans and do not dilute your equity position. To know more, keep reading How to Finance Your Business Without Giving Up Equity .

Assigning accounts receivable lets your account debtors know you have transferred ownership of A/R. By selling your unpaid invoices, you receive two cash installments.

The initial cash advance, the first installment, ranges from 80 to 93% of your total A/R purchase value. And the second and final installment, rebate, or discount releases the remaining balance, less our fee. Therefore, the assignment of accounts receivable removes cash flow obstacles by bypassing the lengthy receivable period.

Factoring your receivables is a great solution to overcome cash flow struggles. Additionally, factoring companies work closely with your customers allowing you to focus on your business. But with over 800 factoring companies in the US, finding a factoring company can be difficult. Bankers Factoring provides the best service with 20 years of experience. We make sure to communicate well with our customers while protecting our client’s interests.

Notice of assignment letters (NOA) can be scary for business owners unfamiliar with invoice factoring services. Most startups, small businesses, and companies extend credit terms requiring commercial funding. Offering net 30 to 120-day payment terms places cash flow problems for most entities.

Assignment letters should not turn you away from alternative financing. Your customers are familiar with NOA factoring and have other customers working with factoring companies.

Worrying about assignment letters only prevents your business from achieving its full potential. Bankers Factoring provides the best non-recourse factoring services and manages customer relations that enhance your business profile. Furthermore, we take on the credit risk from unpaid receivables while providing up to 93% cash advances. Accelerating your receivables cycle can unleash new sales growth and operational performance. Utilize free cash flow to improve profitability.

- Accounts Receivable Financing

- A/R Insurance through Factoring

- Bankers Factoring DIP Financing

- Best Payroll Funding Company

- Government Factoring

- Purchase Order Financing

- SAAS & Startup Factoring

- Small Business Invoice Factoring Company

- A/R Financing & Factoring Glossary

- Bankers Factoring Tax Lien Solutions

- Factoring Fees and Rates Explained

- How Does a Factoring Company Work?

- Invoice Factoring Blog

- Invoice Factoring FAQ

- Online 24-hour Factoring Reporting

- Quickbooks Factoring Journal Entries

Partner With Us

- Bank & Credit Union Partnerships

- Factoring Broker Program

- Bankers Factoring Careers

- Factoring Client Testimonials

- Industries that Use Factoring

Follow Bankers Factoring

- Bankers Factoring Company: Accounts Receivable Factoring Company

- Privacy Policy & Legal

- Bankers Factoring Sitemap

- Bankers Factoring Locations & Offices

- Contact Bankers Factoring

- Invoice Factoring

- Accounts Receivable Financing

- DIP Financing

- Working Capital Loans

- Asset Based Lending

- Bridge Loans

- Purchase Order Financing

- Inventory Financing

- M&A Financing

- Manufacturing

- Distribution

- Consumer Packaged Goods

- Service Companies

- Oil & Gas

- Transportation

- Application

- Case Studies

- DOWNLOADABLE RESOURCES

- Financial Calculators

- Financial Glossary

- Request A Quote

What is a Notice of Assignment?

Table of Contents - Quick Links

When you enter a factoring contract, you agree to sell your invoices, or accounts receivable, to a factoring company or third party that gives you a cash advance. This third party will then become your company’s collection department on these invoices. To notify your clients of this change of invoice ownership, the financial provider will send them a Notice of Assignment (NOA).

If you’re considering factoring your accounts receivable, you may be wondering what an NOA contains and what effects it may have on your customers and business. In this guide, we’ll cover the components of an NOA, how your factoring company sends them, and their role in the factoring process.

What is a NOA in Factoring?

A notice of assignment is a simple letter from a third party to your customers. It legally explains that a change of invoice ownership has occurred, informing your clients that a third party (bank, factoring company, financing company) will now manage and collect accounts receivable. The NOA will provide a remittance address so customers can update their payment information. The purpose of this communication is to notify your customers of a change in the collection process.

What Is a Notice of Assignment?

Understand how implementing a Notice of Assignment with Porter Capital’s factoring services can fast-track your receivables!

Discover Our Factoring Services

How Do Factoring Companies Notify Your Customers?

Factoring is more common than ever and clients range from NYC modeling agencies and namesake branded product line manufacturers, to small startup companies selling gourmet food items. No company is too large or too small to factor their invoices and many work with big box stores that demand longer payment terms to have products on their shelves. These 90 to 120 day payment terms can make factoring a necessity for smooth cash flow.

Your customers will receive the NOA as a letter in the mail to sign and return. Your business will also receive a copy of this letter. Ensure you fully understand the language used in the NOA and your responsibilities in the transition process. Sometimes business owners worry about their customers’ reactions to receiving an NOA. Invoice factoring is becoming an increasingly popular and acceptable means for financing businesses across many industries, so your customers may already be accustomed to the process. You can alert your clients about a coming NOA, proactively resolving any questions or concerns that may arise.

Why Is a NOA in Factoring Important?

When you enter a factoring contract, you agree to sell the intangible financial rights to your invoices and receive cash up front for those invoices. Because the rights are intangible, factoring companies need legal language that outlines ownership of the AR. Once the NOA is completed, a business receives the cash advance while the factor waits for invoice payments. The NOA is a critical part of the financial relationship and protects the financing provider in the event of misdirected payments. An NOA ensures all parties are aware of their responsibilities throughout the factoring process so everyone can enjoy the benefits.

Components of a NOA Document

The NOA document will contain a few vital pieces of information, including:

- Notification that accounts receivable have been assigned and is payable to a third party

- An updated payment address.

- An explanation of customer liability in the event of a misdirected payment.

Each component of the NOA ensures the factoring relationship runs smoothly by giving customers the information they need to make correct payments. It may also outline steps for your company to take if you receive a misdirected payment.

Contact Porter Capital for a Factoring Quote

When you need to improve your cash flow, consider invoice factoring with Porter Capital. With over 30 years in the business, we can offer you and your customers the reliable and trustworthy services you expect and deserve. We will help you find the best solutions for your specific business demands, enabling you to enjoy greater stability and flexibility.

Work with a trusted factoring company to expand your business, get ahead of the competition and increase customer satisfaction. Contact us online today to receive a quote for our factoring services.

Share This Article

Related posts.

Corporate Factoring vs. Traditional Loans: Which Funding Option is Best for Your Business?

How to Manage Financial Risks With Alternative Financing

2023 Deals of the Year – ABFJournal

Factoring , Newsletters

THE NOTICE OF ASSIGNMENT: A REFRESHER COURSE

Allen J. Heffner Nov 20, 2023

The Notice of Assignment is probably the single most important document for a Factor. Understanding what needs to be included in the Notice of Assignment, how to send it, and who to send it to can mean the difference between getting paid and not. Despite the fact that every Factor is (or should be) familiar with legal requirements relating to Notices of Assignment, we still find that many of our factoring clients who end up in litigation make basic mistakes relating to their Notices of Assignment. The article focuses on what information needs to be included in the Notice, who the Notice should be sent to, and how the Notice should be delivered.

What needs to be included in the Notice of Assignment?

To be effective, there is certain information that must be included in the Notice of Assignment. The Uniform Commercial Code (“UCC”) requires that the notice must:

- Notify the Account Debtor that the amount due or to become due has been assigned;

- Notify the Account Debtor that payment is to be made to the Factor;

- Reasonably identify the rights assigned; and

- Be signed by the Factor or its client.

The Notice of Assignment should also include a remittance address so the Account Debtor is informed how and in what manner the Factor should be paid.

Additionally, while not explicitly required under the current version of the UCC, Factors should include language in their Notice of Assignment that: (i) the Client has assigned all of its present and future accounts receivable to Factor; (ii) the Factor holds a first priority security interest in all of the client’s accounts receivable; and (iii) all payments owing to the client must be paid to the Factor.

Who should the Notice of Assignment be sent to?

Notices of Assignment should not be sent directly to individuals with an Account Debtor. Sending the Notice to a specific individual may lead to issues relating to the authority of that individual to receive documents on behalf of the Account Debtor. Moreover, Factors that direct Notices of Assignment directly to individuals open themselves up to arguments that the Notices of Assignment was not properly delivered. For instance, our clients that have sent Notices of Assignment to individuals have ended up in situations where the individual to whom the Notice of Assignment was addressed no longer worked with the Account Debtor or the individual was located at a different office and the Notice of Assignment was not sent to the proper location. To be safe and to avoid unnecessary issues, Factors should send the Notice of Assignment to the Account Debtor’s accounts payable department.

Additionally, some states have specialized definitions for what constitutes “notice” on behalf of a company. If there is any question as to where a Notice of Assignment should be sent, Factors should check with their attorney to determine where these should be sent.

How should the Notice of Assignment be delivered?

The crucial issue for the enforceability of a Notice of Assignment is proof of receipt by the Account Debtor, not proof of delivery. Therefore, it is good business practice to send the Notice of Assignment either certified mail or other method that provides for proof of delivery.

Many of our clients have asked about whether it is proper to deliver the Notice of Assignment via e-mail asking the Account Debtor to confirm receipt or with “read receipts” turned on. Some Factors prefer this method because it is more cost efficient.

While sending Notices of Assignment via e-mail is enforceable, we would not recommend it as a general business practice. Sending the Notice in this manner requires delivering the Notice to a specific individual, which we have discussed above can be problematic. Sometimes officers and directors of companies have assistants or other personnel manage their e-mail accounts, raising the possibility that the individual to whom the Notice was sent, never saw the e-mail, even though the e-mail was “read.”

Last, there is no requirement that the Notice be signed by the Account Debtor and returned to the Factor. Often, we see our client’s Notice include a “confirmation of receipt” line for the Account Debtor to sign and return. Sometimes, the Factor will have proof of delivery to the Account Debtor but the Notice was not signed and returned by the Account Debtor. This adds unnecessary ambiguity as to whether the Notice was actually received by the Account Debtor. Therefore, we instruct our clients not to include such requests for proof of receipt.

Who should send the Notice of Assignment?

Some of our clients that have had bad experiences with Account Debtors after delivering a Notice of Assignment have chosen to have their Client be the one to deliver the Notice of Assignment. There is no legal requirement as to whether the Factor or the Client is the correct party to deliver the Notice of Assignment. However, we recommend the Factor be the one to deliver the Notice of Assignment. This way, the Factor is in complete control of the contents of the Notice of Assignment, how it is delivered, and receives confirmation of its delivery. We have been in situations in which the Factor allowed the Client to deliver the Notice of Assignment, but the Client did not deliver the Notice of Assignment in accordance with the law, leading to avoidable litigation.

Should a Factor respond to an Account Debtors questions regarding a Notice of Assignment?

Absolutely, yes. If requested by an Account Debtor, pursuant to the UCC, a Factor must furnish reasonable proof of the assignment for the Notice of Assignment to be valid. Too often we see situations in which requests are made or questions are posed by Account Debtors that the Factor ignores, thinking that because the Account Debtor received the Notice of Assignment, nothing else needs to be done. The Factor should respond to the Account Debtor and provide reasonable proof of the assignment. These communications can also provide invaluable insight as to the relationship between the client and the Account Debtor, how and when payments will be made, and can provide the Account Debtor a sense of trust with the Factor.

A Notice of Assignment is crucial for Factors because it provides legal protection, establishes priority of interest, prevents confusion, facilitates legal recourse, and enables effective communication with Account Debtors. Without this notice, Factors may encounter difficulties in asserting their rights and collecting payments from Account Debtors, potentially jeopardizing the financial transaction.

Bruce Loren and Allen Heffner of the Loren & Kean Law Firm are based in Palm Beach Gardens and Fort Lauderdale. For over 25 years, Mr. Loren has focused his practice on construction law and factoring law. Mr. Loren has achieved the title of “Certified in Construction Law” by the Florida Bar. The Firm represents factoring companies in a wide range of industries, including construction, regarding all aspects of litigation and dispute resolution. Mr. Loren and Mr. Heffner can be reached at [email protected] or [email protected] or 561-615-5701

Bruce E. Loren · Michael I. Kean · Allen J. Heffner · Kyle W. Ohlenschlaeger · Frank Sardinha, III · Lucia E. DeFilippo

Newsletters & Media

Testimonials

Press Releases Privacy Policy Terms of Use

© 2022 All Rights Reserved

What is a Notice of Assignment?

Last Updated May 1, 2024

If you’re a business owner considering invoice factoring, the Notice of Assignment (NOA) may cause you some concern. What will my customers think? Why is it necessary? Can we skip sending it? Let’s address these questions to clarify what the NOA covers and put to rest any lingering apprehension.

What Is a Factoring Notice of Assignment?

The notice of assignment (NOA) informs your customer that a third party (bank, financing company, or factoring company) will manage and collect your accounts receivable (AR) going forward. The NOA arrives in the mail in the format of a letter, as the initial communication notifying your customers of the change in structure and process.

What Will My Customers Think?

Tremendous growth in the use of invoice factoring across many industries has made factoring more common than ever. According to the Global Factoring Market 2016-2020 report, analysts expect factoring to grow over 10% annually for the next several years.

Many of our factoring clients work with Fortune 500 companies who simply demand longer payment terms in order to do business. Clients using invoice factoring often show an appetite for accelerating growth and more efficiently managing operations and collections.

In short, you are most likely more concerned about it than your customers. Factoring is a widely used and acceptable means for financing your business.

Why Is a Notice of Assignment Important?

In a factoring relationship, a business sells the future collection of accounts receivable (AR) in exchange for cash advances. So, the asset (future AR) belongs to the third party upon completion of the work or delivery of the goods. The business receives the cash advance, and the third party waits for payment by the business’ customer.

Mildred Glaze, Senior Account Manager at altLINE, explains further, “The factor sends out the notice of assignment to be sure they place their client’s customers on notice to submit all payments to the factor and not to their client. The factor will essentially become their client’s accounts receivable department, documenting invoices and payments.”

Due to the intangible nature of AR, the third-party provider needs legal language showing ownership of the AR. Thus, the legal language found in the NOA minimizes the risk placed on the third-party provider. Third party providers require a NOA. It is critical to the structure of the factoring relationship and protects the third-party provider in the event of misdirected payments.

In the case of a redirected payment, Glaze explains, “If a payment is in inadvertently sent to the client [instead of the factoring company], then the client turns around and forwards/sends the original method of payment to the factor…We then turnaround and re-notify that particular customer to have them confirm updating the remittance in their system.”

What Is Covered in a Notice of Assignment?

The main points covered in a Notice of Assignment include:

- Business’ accounts receivable has been assigned and is payable to a third party provider

- Updated payment address, typically a lock box

- Liability on the customer in the event of misdirected payment

How We’re Different

By working with altLINE, your customers recognize the reliability and stability of your financing partner. Rather than receiving an NOA from an unknown entity or independent financing company, the bank’s reputation as the lender of choice strengthens your customer relationship.

Read our article on the benefits of factoring through a bank for more information or get a free quote today!

What does a notice of assignment mean in trucking?

A notice of assignment (NOA) is a document that notifies your customers that your factoring company has the right to collect payments on invoices. In a factoring relationship, a business sells its invoices to a third-party factoring company, which then collects payment on them. An NOA notifies your customers of this change in structure.

Who provides a notice of assignment?

Grey was previously the Director of Marketing for altLINE by The Southern Bank. With 10 years’ experience in digital marketing, content creation and small business operations, he helped businesses find the information they needed to make informed decisions about invoice factoring and A/R financing.

Turn your outstanding invoices into cash

Rated Top Factoring Company of 2024 Investopedia, TheBalanceSMB, Fundera and more

Lending Options

- Invoice Factoring Services

- Accounts Receivable Financing

- Freight Factoring

- Browse by Location

- How Does Factoring Work?

- Invoice Factoring Rates

- Financial Terms Glossary

- Invoice Factoring Calculator

- Invoice Template

- Disclosures

- Privacy Policy

- Oil & Gas

- Manufacturing

- Commercial Cleaning

- Professional Services

- More Industries

- Customer Login

What Is a Factoring Notice of Assignment?

If you have already worked with a factoring company, then you have probably heard the term Notice of Assignment (NOA) before. There can be so much paperwork involved with the operation of a small business these days. It can be hard to keep up with the times and know what everything is.

For example, a notice of assignment (NOA) is actually a very common document utilized in the trucking industry. It’s ideal for companies using a factoring transaction service because a factoring fee will pay them on the load in advance.

From there, the factoring company will be responsible for collecting payment for the service from the customer. Today, we will be taking a deeper look into the Notice of Assignment to better understand the importance of NOAs and why we need them.

TAFS is More than Freight Factoring

How does an noa work.

Once a factoring company has paid the client for the load, it is important that the debtor knows that the money they owe is now due to another party. This official notification is delivered via a Notice of Assignment. It will be sent out to the debtor as a way of informing them that their payments must now be remitted to the factoring company instead of the carrier.

Why is an NOA Important?

An NOA is a legal document that acts as a way of notifying the debtor about who they need to pay. When a carrier works with a factoring company, the TAFs Factoring carrier will be paid in advance by the factoring company, so it is important that the debtor is informed of the presence of the third party that will now be managing that company’s accounts receivable (AR).

An NOA can also ensure that the debtor understands there’s a third party that will be collecting payments from them on behalf of the carrier. Notifying the debtor of this change will make it more likely to avoid payments being sent to the wrong party as well as conflicts and violations of the factoring client agreement.

What Is Covered in an NOA?

In a standard Notice of Assignment, you will find legal forms stating that the assignment of accounts receivable of the business has been assigned to a third-party provider. As such, payments are now payable directly to them.

The NOA will include an updated address of the third party so that the debtor knows where to send any future payments, as well as the third party’s phone number and a statement letting the customer know that he or she will be held liable in the event of a misdirected payment.

Will Factoring Affect My Work With My Client?

Working with a factoring company should not negatively impact any work that you do for your clients. The truth is that factoring is extremely common these days and in the larger picture, most business owners work with some form of a lender.

What you can do on a personal level to avoid any confusion or worry is to simply assure your customers that invoice factoring will not affect the service you are providing to them and they can continue to expect the same level of service and attention in working with you.

What Will Customers Think When They Receive an NOA?

Nowadays, a large percentage of companies use factoring or some sort of third-party financing option to help keep their operations flowing smoothly from one invoice payout to the next. This is often a display of good business management and dependability in the eyes of your clients. By taking control of your company’s finances, you’re letting them know that you are serious about your business and you plan to be around for years to come.

Is There a Financing Option That Will Not Send an NOA?

Select factoring companies may offer what is known as a non-notification factoring plan in which a conventional deed of assignment is not used. This plan is not often used because it leads to unnecessary confusion, which often results in payments being sent to the wrong party.

This happens because no matter what, the debtor is still required to mail the payment to the factoring company, but instead of an NOA being issued and making this clear, the company’s letterhead is included.

Example of an NOA

An NOA is often used in circumstances where a trucking company is utilizing a factoring company to manage their receivable financing for them. The Notice of Assignment is sent to the debtor with clear notification that the accounts receivable of the company they are doing business with are being managed by a third party.

It will properly advise the remittance address for their payments moving forward. With this official notice being received it is now up to the debtor to comply and update their system to make sure payments are processed to the correct party.

4 Things To Consider When Factoring

If you are going to use a factoring company here are some things you may want to consider regarding the NOA.

Responsibility

The responsibility lies with both the carrier and the factoring company. The factoring company will send NOAs to many debtors but it is hard for a factoring company to know every customer a carrier has or will work with. For this reason, the responsibility also falls on the carrier as well to notify all of their customers of the new payment conditions.

Requirements

The Notice of Assignment is required to be sent out so that the customer is fully aware of who they are legally obligated to pay. Without this notice, many payments would be sent to the incorrect party causing many issues that would deeply complicate the process.

If the trucking company accepts payment from the customer when it should have gone to the factoring company, the trucking company would be in violation of the contract and could be assessed additional fees or charged with fraud.

Being notified of a factoring company being used is not a bad thing. Utilizing a f actoring company allows the carrier the ability to maintain operations within the windows of payment terms on the loads which may not pay out for 30 days or 60 days. In some cases, it might even be 90 days.

Most factoring company contracts require carriers to submit every single invoice to minimize the likelihood of causing confusion. If the debtor has to change who they pay for different invoices, the odds are that errors will occur and payment will be sent to the wrong place. That is also why debtors don’t change who they pay after receiving an NOA unless they have an official release letter from the factoring company. This is a red flag for a carrier trying to commit fraud.

Receiving an NOA Is Actually a Good Thing

In conclusion, we now know that receiving an NOA will inform the recipient that the carrier they used is collecting money via a factoring company or other third-party business. As such, they will not be managing their accounts receivable. This means they are taking their business seriously and making moves to ensure their company will be around for years to come, and with the ability to grow and expand.

We are excited to announce the launch of move.freightwaves.com , a revolutionary resource designed to transform how consumers choose auto-shipping companies. Check it out today!

More From Education

How to implement a fleet safety program, best team driving companies, 7 freight truck types & what they haul, does curb weight include fuel.

FreightWaves Ratings reference a list of approved sources for use of research to support editorial research and drafting. These include the Federal Motor Carrier Safety Administration , U.S Department of Transportation , Better Business Bureau® , International Fuel Tax Association, Inc , Federal Highway Administration , additional Federal, State, and Local government websites, internal data compiling, original research, and commentary from industry experts.

As one of the industry leaders, TAFS assists trucking companies to increase cash flow with some of the lowest factoring rates in the industry and a 1-hour advance option.

TAFS Freight Factoring

As one of the industry leaders, TAFS assists trucking companies to increase cash flow with some of the lowest factoring rates in the industry and 1-hour advance option.

- 1-866-477-1778

How a Factoring Notice of Assignment Works & Why You Need It

Running a business means keeping an eye on how money comes in and goes out. But sometimes, waiting for payments can slow things down. That’s where invoice factoring comes into play, offering a quicker way to access your money. At the center of this process is something called the factoring notice of assignment (NOA). It’s not much more than a slip of paper, but it plays a significant role in making factoring work smoothly. We’ll explore what an NOA is and why it’s a key piece for businesses looking into factoring below.

How Factoring Works

NOAs are a stepping stone on your path to invoice factoring, so let’s start with the basics of how factoring works.

It can be difficult for small and mid-sized businesses to maintain a healthy cash flow . This critical issue contributes to the closure of eight in ten small businesses, Forbes reports. Invoice factoring addresses this issue head-on by allowing you to sell your invoices to a factoring company, also called a factor, at a slight discount in exchange for instant payment. The typical factoring process is outlined below.

- Step 1: Work. Complete work or deliver goods as usual.

- Step 2: Invoice. Send an invoice to your client via your everyday process and send a copy to your factoring company.

- Step 3: Get paid instantly. The factoring company quickly confirms the invoice is valid, and you receive most of the invoice’s value right away. Payments are typically made via ACH, so funds hit your bank account within a couple of business days. Some offer accelerated solutions, including same-day payments.

- Step 4: Move forward. Your factoring company waits on payment and takes care of collecting the balance for you, saving you the time and trouble of chasing invoices. Meanwhile, you can focus on the core areas of your business and keep serving your clients.

- Step 5: Receive the remaining balance. Once your client pays, your factoring company sends you the remaining balance minus a small factoring fee. It’s not a loan, so there’s nothing for you to pay back.

What is a Notice of Assignment in Factoring?

With factoring, your customers send their payments to the factoring company rather than to you. That means they need to be notified of this change so they can start sending payments to the correct location. Your factoring notice of assignment serves this purpose. It’s a short note to your client that explains what’s happening and why. It generally includes the following details:

- Who: NOAs express the new partnership between your business and the factoring company.

- What: Clients learn that their unpaid balances are being assigned to the factoring company and that they need to send payment to them.

- Where: NOAs explain how to remit payment and provide a physical address for the factoring company.

- When: Most NOAs are open-ended, meaning they tell clients they should remit all future payments to the factor unless otherwise instructed. However, some factoring companies will provide service for a single invoice, so the language will reflect that if it’s part of your factoring agreement.

- Why: NOAs often explain the need for factoring in a client-friendly way, such as “In order to serve you better…” or “To continue providing you with extended payment terms…”

NOAs are common in business and used in lots of different situations. Because most businesses have had some exposure to third-party billing companies or factoring, they’re already accustomed to NOAs and adjust accordingly.

Purpose of NOAs in Factoring

NOAs serve several purposes in the factoring process.

- Ensures Transparency: NOAs clearly communicate to your customers that a factoring company is now handling the invoices. This open communication prevents confusion and maintains the trust your customers have in your business.

- Provides Legal Clarity: By formally notifying your customers about the assignment of invoices to the factoring company, the NOA provides a legal basis for the redirection of payments. This clarity is crucial for avoiding disputes over who should receive payments.

- Facilitates Smooth Operations: With the NOA in place, both your business and the factoring company can expect a smoother operation. Payments go directly to the factoring company, aligning with the agreement’s terms, ensuring that your business receives its funds promptly and without unnecessary complications.

Maintaining Positive Customer Relationships with Factoring and NOAs

Invoice factoring, and thereby NOAs, can be a helpful tool that supports and enhances your customer relationships.

- Transparent Communication: The issuance of an NOA is a prime opportunity for clear communication. By informing customers about the factoring arrangement and what it means for them, you’re prioritizing transparency. This openness can strengthen trust, as customers appreciate being kept in the loop about changes that might affect their payment processes.

- Simplifying Customer Payments: Factoring, facilitated by the NOA, simplifies the payment process for customers. By directing them to send payments to the factoring company, you’re streamlining their accounts payable process. This can be particularly beneficial if the factoring company offers multiple payment methods, making it easier for your customers to fulfill their invoices.

- Reassuring Your Clients: A well-crafted NOA can highlight your decision to factor as part of your business’s strategy to ensure stability and continuous improvement in service delivery. This reassures customers that your business is financially proactive, focusing on long-term partnerships and reliability.

- Focus on Core Business Values: With the administrative aspect of invoice processing handed over to the factoring company, your business can devote more attention to its core offerings. This can lead to improved services or products for your customers, reinforcing the value of your business relationship with them.

Alternatives to NOAs

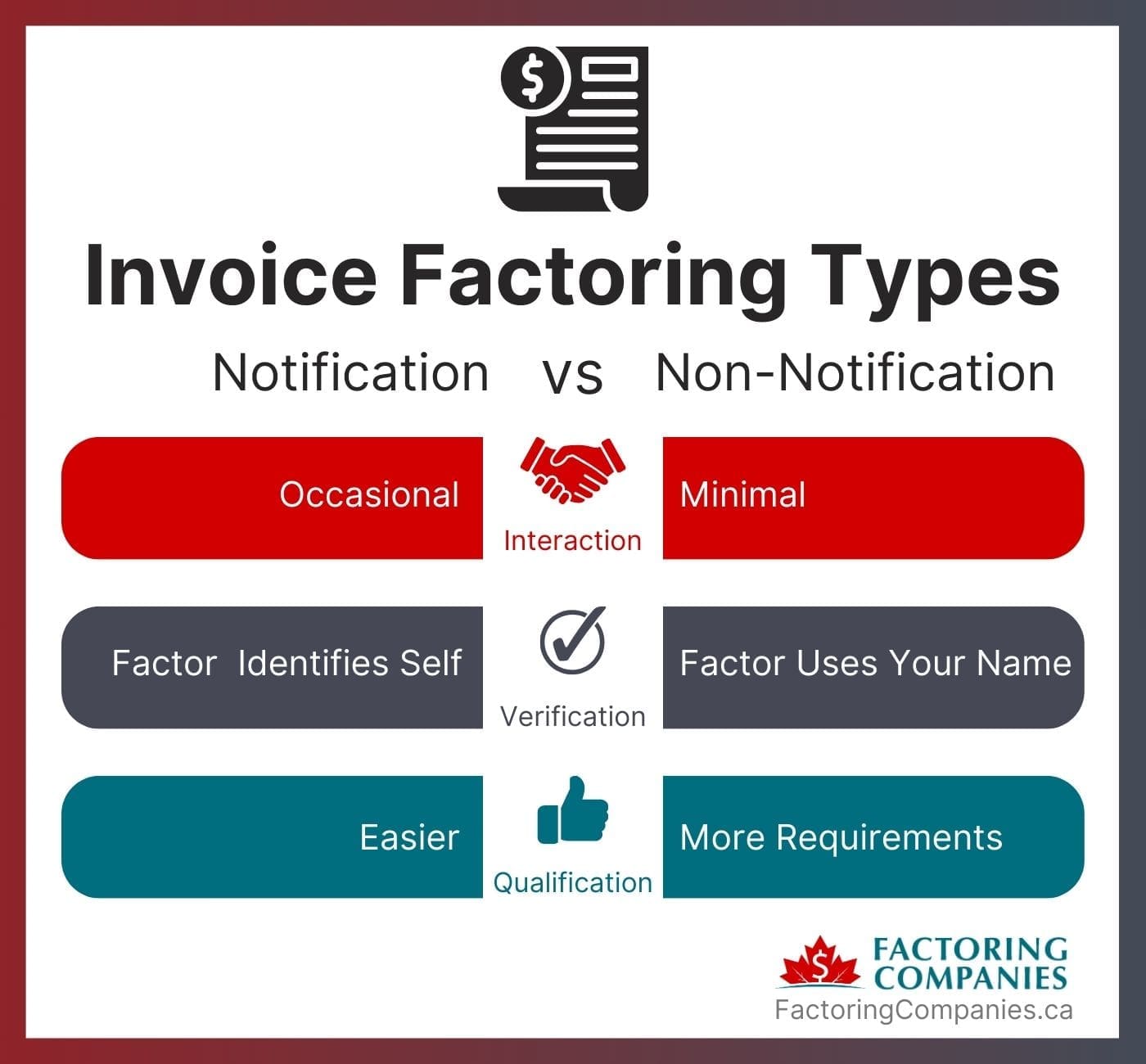

While NOAs are common in business, sometimes businesses still ask whether NOAs are mandatory in invoice factoring. Traditional invoice factoring, sometimes referred to as “notification factoring” or “full notification factoring,” always requires NOAs. However, there is a newer form of invoice factoring called “non-notification factoring” offered by some factoring companies. In these cases, the factoring company doesn’t make a point of announcing its presence. It changes the nature of your agreement a bit, and there are additional requirements.

Full Notification vs Non-Notification Factoring

- Interaction: Factors limit their interactions with your clients more when you choose non-notification factoring.

- Verification: Your clients know that your factoring company is the one verifying invoices under a traditional factoring agreement. With non-notification factoring, they use your company name while doing it instead.

- Qualification: It’s easy to qualify for traditional factoring because your client’s creditworthiness is evaluated, not yours. With non-notification factoring, you’ll also need to meet specific eligibility requirements.

Unlock Your Business’s Potential with Factoring

Factoring and the use of notices of assignment streamline cash flow and foster transparent, trusting relationships with customers. By embracing this financial strategy, you can also access funds faster, ensure smooth operations, and focus on growth without the wait. However, it’s important to work with an experienced factoring company that is committed to providing your clients with top-notch service and understands your business. We’re happy to match you with a provider that meets your needs. If you’re ready to explore how invoice factoring can transform your business cash flow, request a complimentary factoring rate quote .

About Factoring Companies Canada

Related Articles

How to Address Common Hiccups in the Factoring Process

8 Ways Outsourcing Invoice Collection Frees Up Resources

How Factoring Companies Provide Rapid Cash Advances

How to Choose a Factoring Company That Aligns with Your Business Goals

5 Tips for Balancing Customer Relationships and Factoring

How Single Invoice Finance Works & When to Use It

Get an instant factoring estimate.

Factoring results estimation is based on the total dollar value of your invoices. The actual rates may differ.

GET YOUR FREE FACTORING QUOTE!

PREFER TO TALK? You can reach us at 1-866-477-1778

PREFER TO TALK? You can reach us at 1-866-477-1778

What is a Notice of Assignment and How Does it Protect the Construction Business?

by CapitalPlus Financial | Nov 8, 2023 | Blog

The Notice of Assignment, or NOA, is commonly used in business, including the construction industry. Let’s learn about the definition and how it protects us, construction businesses.

A Notice of Assignment is used when rights or obligations under a contract are transferred from one party to another. For example, if a company assigns its rights to payment under a construction contract to a third party like a factoring company , a Notice of Assignment would be sent to the party owing the payment to inform them of the new payee. The NOA helps to ensure that a construction company’s actions are transparent and that it has taken the necessary steps to inform and coordinate with all parties who may be impacted by its activities.

How does the “Notice of Assignment” protect construction trades?

Being a formal document, the Notice of Assignment states that a contract or obligation has been transferred from one party (the assignor) to another (the assignee). Here’s how it protects a construction company:

- Clarity of Responsibility : An NOA clearly delineates the transfer of rights or obligations under a contract, such as the right to receive payment or the duty to perform work, ensuring that all parties know who is now responsible.

- Proof of Notification : In the event of any disputes arising regarding the assignment, the NOA serves as legal proof that all parties were properly informed. This can be crucial in the event there is litigation or arbitration.

- Protection of Payment Rights : For a construction company that has sold or assigned its right to receive payment for work performed, the NOA informs the client or project owner of the Factoring company to which payments should be made, thus protecting the company’s financial interests.

- Avoidance of Duplication : The NOA prevents the original client from making payments to the assignor when the right to receive payment has been assigned to another entity, thus avoiding duplicate payments or financial confusion.

- Legal Requirement : In some jurisdictions, a NOA is a legal requirement to enforce the assignment against third parties. Without it, the assignee may not be able to legally claim their rights under the contract.

- Maintaining Business Relationships : By formally notifying clients of the assignment, the NOA provides the construction company transparency and trust in its business relationships, which is essential for ongoing and future business.

In summary, the Notice of Assignment ensures that all parties are informed about where contractual rights and obligations lie after an assignment has taken place.

If you have questions about NOAs or any other aspect of the invoice factoring process , feel free to reach out. We are glad to help.

Advanced Commercial Capital

Freight factoring articles.

What is a Notice of Assignment in Trucking?

When you factor your invoices, you are essentially selling them to the factoring company. The factoring company then collects the payment from your customer on your behalf. In order for the factoring company to have the legal right to collect payment from your customer, you will need to sign a notice of assignment.