- < Previous

Home > CMC > CMC_STUDENT > CMC_THESES > 421

CMC Senior Theses

Mental accounting as a mediator of self-control in consumer decision making.

Lauren E. Yeske , Claremont McKenna College Follow

Graduation Year

Spring 2012

Document Type

Campus Only Senior Thesis

Degree Name

Bachelor of Arts

Gabriel I. Cook

Terms of Use & License Information

Terms of Use for work posted in Scholarship@Claremont .

Rights Information

© 2012 Lauren E. Yeske

Mental accounting is a technique for asserting self-control in the face of consumption decisions, functioning as a categorization system for income and expenses. A body of evidence supports the concept that consumers are driven by perception and emotion, not rational economic thought. Mental accounting is subject to the effects of cognitive biases, leading to imperfect financial behavior. In the following paper, I present a proposal for three consecutive experiments designed to investigate the influence that advanced planning (the formation of mental budgets) and unexpected financial shocks (windfalls) can have on our use of mental accounting to regulate spending. The dependent variable is a dollar measure of how much consumers indicated they are “willing to pay” (WTP) to hypothetically purchase a typical good. The experiments share an intertemporal manipulation of a monthly budget creation task. Experiment one investigates the combined effects of positive and negative windfalls and budget creation on WTP. Experiment 2 explores boundary conditions of timing on loss aversion by manipulating the length of the time period that separates a negative windfall from the WTP task. Experiment 3 focuses on one time period, manipulating wording of a negative financial shock to focus on framing effects. The three experiments, if carried out, should reveal significant effects on WTP, suggesting that manipulations of framing and timing can lead to inconsistent spending behaviors even in the presence of a self-control tool (the mental budget).

Recommended Citation

Yeske, Lauren E., "Mental Accounting As a Mediator of Self-Control in Consumer Decision Making" (2012). CMC Senior Theses . 421. https://scholarship.claremont.edu/cmc_theses/421

This thesis is restricted to the Claremont Colleges current faculty, students, and staff.

Since May 18, 2012

Advanced Search

- Notify me via email or RSS

- Colleges, Universities, and Library

- Schools, Programs, and Departments

- Disciplines

Author Corner

- Faculty Submission

- Student Submission

- Policies and Guidelines

Useful Links

- Claremont Colleges Library

- Claremont Colleges Digital Library

Home | About | FAQ | My Account | Accessibility Statement

Privacy Copyright

Mental Accounting and Saving Behavior

- Family and Consumer Sciences Research Journal 22(1):92 - 109

- 22(1):92 - 109

- University of Rhode Island

- This person is not on ResearchGate, or hasn't claimed this research yet.

Discover the world's research

- 25+ million members

- 160+ million publication pages

- 2.3+ billion citations

- Giuliana Triberti

- Thomas Korankye

- Deni Kusumawardani

- Sercin Sahin

- Daniel Kahneman

- Amos Tversky

- Robert B. Avery

- J ECON PERSPECT

- G. S. Maddala

- Kathryn D. Rettig

- Catherine L. Schulz

- J CONSUM AFF

- W. Keith Bryant

- JENNIFER L. GERNER

- REV ECON STAT

- Brian Motley

- Recruit researchers

- Join for free

- Login Email Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google Welcome back! Please log in. Email · Hint Tip: Most researchers use their institutional email address as their ResearchGate login Password Forgot password? Keep me logged in Log in or Continue with Google No account? Sign up

Perspectives on Mental Accounting: An Exploration of Budgeting and Investing

Financial Planning Review, Vol. 1, Issue 1-2, March-June 2018

Posted: 12 Nov 2019

C. Yiwei Zhang

University of Wisconsin - Madison

Abigail B. Sussman

University of Chicago - Booth School of Business

Date Written: September 19, 2018

This article provides an overview of recent advances in the literature on mental accounting within the context of consumer financial decision‐making. We first discuss the categorization process that underlies mental accounting and the methods people use to categorize funds. We then highlight some of the notable work that examines how mental accounting influences budgeting, spending, and investment decisions. The article concludes by proposing an agenda for future research, focusing on current gaps in our knowledge and promising areas to explore. Full Text Available Here: https://doi.org/10.1002/cfp2.1011

Suggested Citation: Suggested Citation

C. Yiwei Zhang (Contact Author)

University of wisconsin - madison ( email ).

HOME PAGE: http://www.yiwei-zhang.com

University of Chicago - Booth School of Business ( email )

5807 S. Woodlawn Avenue Chicago, IL 60637 United States

Do you have a job opening that you would like to promote on SSRN?

Paper statistics, related ejournals, behavioral & experimental finance ejournal.

Subscribe to this free journal for more curated articles on this topic

Microeconomics: General Equilibrium & Disequilibrium Models of Financial Markets eJournal

Subscribe to this fee journal for more curated articles on this topic

Financial Literacy eJournal

Decision-making in economics & finance ejournal.

Role of Mental Accounting in Personal Financial Planning: A Study Among Indian Households

- Research in Progress

- Published: 27 November 2022

- Volume 67 , pages 568–582, ( 2022 )

Cite this article

- Mousumi Singha Mahapatra ORCID: orcid.org/0000-0003-3773-4633 1 ,

- Jayasree Raveendran 2 &

- Ram Kumar Mishra 1

792 Accesses

Explore all metrics

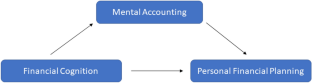

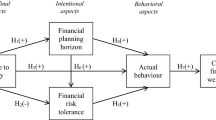

The mental accounting process of an individual plays an important role in financial decision-making. Little is known, especially in the Indian context, about individual differences in mental accounting and its influence on their financial planning. The study aims to understand the role of the mental accounting system of individuals in financial decisions. The authors also explore the influence of the individual’s cognitive ability in financial decision-making and name the antecedent as financial cognition. Partial least square structural equation modeling has been used to analyze the data. The analysis of the data supports the mediating role of mental accounting between financial cognition and personal financial planning. The result establishes the fact that the individuals’ financial cognitions influence the mental accounting process and reinforce the role of psychological processes that drive financial decisions. The study would be helpful to financial planners in customizing personal financial planning with the understanding of financial cognition and the mental accounting process and would be helpful to the financial professionals and advisors in understanding the influence of mental accounting in saving and expenditure patterns.

This is a preview of subscription content, log in via an institution to check access.

Access this article

Subscribe and save.

- Get 10 units per month

- Download Article/Chapter or Ebook

- 1 Unit = 1 Article or 1 Chapter

- Cancel anytime

Price includes VAT (Russian Federation)

Instant access to the full article PDF.

Rent this article via DeepDyve

Institutional subscriptions

Similar content being viewed by others

The Influence of Attitude to Money on Individuals’ Financial Well-Being

Financial planning behaviour: a systematic literature review and new theory development

Money on the mind: emotional and non-cognitive predictors and outcomes of financial behaviour of young adults

Availability of data and material.

Collected survey data is available with the authors.

Code availability

Not Applicable.

https://www.rbi.org.in/Scripts/BS_ViewBulletin.aspx?Id=18994 .

https://rbidocs.rbi.org.in/rdocs/Bulletin/PDFs/3PRELIMINARYESTIMATESFF6D077FCE4A477DA54577D501CECF4A.PDF .

Agarwal, K. (2020). A study on investor buying behavior and Financial Literacy in Urban India. https://doi.org/10.21203/rs.3.rs-104974/v1

Agarwal, S., & Mazumder, B. (2013). Cognitive abilities and household financial decision making. American Economic Journal: Applied Economics, 5 (1), 193–207. https://doi.org/10.1257/app.5.1.193

Article Google Scholar

Al Mamun, M., Syeed, M. A., & Yasmeen, F. (2015). Are investors rational, irrational or normal? Journal of Economic & Financial Studies, 3 (04), 01. https://doi.org/10.18533/jefs.v3i04.161

Altfest, L. (2004). Personal Financial Planning: Origins, developments and a plan for future direction. The American Economist, 48 (2), 53–60. https://doi.org/10.1177/056943450404800204

Antonides, G., Manon de Groot, I., & Fred van Raaij, W. (2011). Mental budgeting and the management of Household Finance. Journal of Economic Psychology, 32 (4), 546–555. https://doi.org/10.1016/j.joep.2011.04.001

Barber, B. M., & Odean, T. (2013). The behavior of individual investors. Handbook of the Economics of Finance . https://doi.org/10.1016/b978-0-44-459406-8.00022-6

Bardi, A., & Schwartz, S. H. (2003). Values and behavior: Strength and structure of relations. Personality and Social Psychology Bulletin, 29 (10), 1207–1220. https://doi.org/10.1177/0146167203254602

Benartzi, S., & Thaler, R. H. (1995). Myopic loss aversion and the equity premium puzzle. The Quarterly Journal of Economics, 110 (1), 73–92. https://doi.org/10.2307/2118511

Benjamin, D. J., Brown, S. A., & Shapiro, J. M. (2013). Who is ‘behavioral’? cognitive ability and anomalous preferences. Journal of the European Economic Association, 11 (6), 1231–1255. https://doi.org/10.1111/jeea.12055

Bernstein, P. L. (1999). Why the efficient market offers hope to active management*. Journal of Applied Corporate Finance, 12 (2), 129–136. https://doi.org/10.1111/j.1745-6622.1999.tb00014.x

Berry, R. E., & Williams, F. L. (1987). Assessing the relationship between quality of life and marital and income satisfaction: A path analytic approach. Journal of Marriage and the Family, 49 (1), 107. https://doi.org/10.2307/352675

Belsky, G., & Gilovich, T. (2010). Why smart people make big money mistakes and how to correct them: Lessons from the lifechanging science of behavioral economics. Simon and Schuster .

Bhandari, G., Hassanein, K., & Deaves, R. (2008). Debiasing investors with decision support systems: An experimental investigation. Decision Support Systems, 46 (1), 399–410. https://doi.org/10.1016/j.dss.2008.07.010

Chang, Y. L. (1994). Saving behavior of US households in the 1980s: Results from the 1983 and 1986 Survey of Consumer Finance. Financial Counseling and Planning, 5 (1), 45–64.

Google Scholar

Chen, F., Zhang, T., & Ma, J. (2020). Financial education and consumer financial planning: Evidence from China. South Asian Journal of Social Studies and Economics . https://doi.org/10.9734/sajsse/2020/v7i230188

Cicchetti, C. J., & Dubin, J. A. (1994). A microeconometric analysis of risk aversion and the decision to self-insure. Journal of Political Economy, 102 (1), 169–186. https://doi.org/10.1086/261925

Dohmen, T., Falk, A., Huffman, D., & Sunde, U. (2007). Are risk aversion and impatience related to cognitive ability? SSRN Electronic Journal . https://doi.org/10.2139/ssrn.982149

Fornell, C., & Larcker, D. F. (1981). Structural equation models with unobservable variables and measurement error: Algebra and statistics. Journal of Marketing Research, 18 (3), 382–388. https://doi.org/10.1177/002224378101800313

Fox, J., & Bartholomae, S. (2020). Household finances, financial planning, and covid -19. Financial Planning Review . https://doi.org/10.1002/cfp2.1103

Fox, J., Bartholomae, S., & Lee, J. (2005). Building the case for financial education. Journal of Consumer Affairs, 39 (1), 195–214. https://doi.org/10.1111/j.1745-6606.2005.00009.x

Greenwald, A. G., & Banaji, M. R. (1995). Implicit social cognition: Attitudes, self-esteem, and stereotypes. Psychological Review, 102 (1), 4–27. https://doi.org/10.1037/0033-295x.102.1.4

Grinblatt, M., & Han, B. (2005). Prospect theory, mental accounting, and momentum. Journal of Financial Economics, 78 (2), 311–339. https://doi.org/10.1016/j.jfineco.2004.10.006

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice, 19 (2), 139–152. https://doi.org/10.2753/mtp1069-6679190202

Hair, J. F., Ringle, C. M., & Sarstedt, M. (2013). Partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long Range Planning, 46 (1–2), 1–12. https://doi.org/10.1016/j.lrp.2013.01.001

Haws, K. L., Bearden, W. O., & Nenkov, G. Y. (2011). Consumer spending self-control effectiveness and outcome elaboration prompts. Journal of the Academy of Marketing Science, 40 (5), 695–710. https://doi.org/10.1007/s11747-011-0249-2

Hayes, J., & Allinson, C. W. (1994). Cognitive style and its relevance for management practice. British Journal of Management, 5 (1), 53–71. https://doi.org/10.1111/j.1467-8551.1994.tb00068.x

Heath, C., & Soll, J. B. (1996). Mental budgeting and consumer decisions. Journal of Consumer Research, 23 (1), 40. https://doi.org/10.1086/209465

Hilgert, M., Hogarth, J., & Beverly, S. (2003). Household Financial Management: The Connection between Knowledge and Behavior. Federal Reserve Bulletin, 89 , 309–322.

Hunt, R. G., Krzystofiak, F. J., Meindl, J. R., & Yousry, A. M. (1989). Cognitive style and decision making. Organizational Behavior and Human Decision Processes, 44 (3), 436–453. https://doi.org/10.1016/0749-5978(89)90018-6

Jamil, R. A., ul Hassan, S. R., Farid, A., & Ahmad, N. (2017). Investigating the impact of consumer values and advocacy behavior on buying decision SATISFAC-Tion: A study through Gender Lens. Management Science Letters . https://doi.org/10.5267/j.msl.2017.1.001

Jammalamadaka, S. R., & Bernstein, P. L. (1999). Against the gods: The remarkable story of risk. The American Statistician, 53 (2), 171. https://doi.org/10.2307/2685740

Jana, S. (2016). Effect of investors’ sentiment on Indian Stock Market. Global Business Review, 17 (5), 1240–1249. https://doi.org/10.1177/0972150916656695

Joo, S.-H., & Grable, J. E. (2004). An exploratory framework of the determinants of financial satisfaction. Journal of Family and Economic Issues, 25 (1), 25–50. https://doi.org/10.1023/b:jeei.0000016722.37994.9f

Karlsson, N., Garling, T., & Selart, M. (1997). Effects of mental accounting on intertemporal choice. Göteborg Psychological Research , 27 , 1–17

Koh, B. (2012). Personal financial planning . FT Press.

Korniotis, G. M., & Kumar, A. (2011). Cognitive abilities and financial decisions. Behavioral Finance . https://doi.org/10.1002/9781118258415.ch30

Krishnamurthy, P., & Prokopec, S. (2010). Resisting that triple-chocolate cake: Mental budgets and self-control. Journal of Consumer Research, 37 (1), 68–79. https://doi.org/10.1086/649650

Leonard, N. H., Scholl, R. W., & Kowalski, K. B. (1999). Information processing style and decision making. Journal of Organizational Behavior, 20 (3), 407–420. https://doi.org/10.1002/(sici)1099-1379(199905)20:3%3c407::aid-job891%3e3.0.co;2-3

Lohmöller, J.-B. (1989). Predictive vs. structural modeling: PLS vs. ML. Latent Variable Path Modeling with Partial Least Squares . https://doi.org/10.1007/978-3-642-52512-4_5

Lusardi, A. (2011). Americans' financial capability. https://doi.org/10.3386/w17103

Lusardi, A., & Mitchell, O. (2011). Financial literacy around the world: An overview. Journal of Pension Economics and Finance, 10 (4), 497–508. https://doi.org/10.1017/s1474747211000448

Mahapatra, M. S., & Mishra, R. (2020). Behavioral influence and financial decision of individuals: A study on mental accounting process among Indian households. Cogent Economics & Finance, 8 (1), 1827762. https://doi.org/10.1080/23322039.2020.1827762

Mahapatra, M. S., & Mishra, R. K. (2019). Role of self-control and money attitude in Personal Financial Planning. The Indian Economic Journal, 67 (3–4), 362–366. https://doi.org/10.1177/0019466220933408

Mahapatra, M. S., Raveendran, J., & De, A. (2019). Building a model on influence of behavioural and cognitive factors on Personal Financial Planning: A study among Indian households. Global Business Review, 20 (4), 996–1009. https://doi.org/10.1177/0972150919844897

Manis, M. (1978). Cognitive social psychology and attitude change. American Behavioral Scientist, 21 (5), 675–690. https://doi.org/10.1177/000276427802100504

Masuo, D. M., Lakshmi Malroutu, Y., Hanashiro, R., & Kim, J. H. (2004). College students’ money beliefs and behaviors: An Asian perspective. Early Childhood Education Journal, 25 (4), 469–481. https://doi.org/10.1007/s10834-004-5491-z

McGuire, W. J. (1969). The nature of attitudes and attitude change. In G. Lindzey & E. Aronson (Eds.), The handbook of social psychology (2nd ed., Vol. 3, pp. 136–314). Essay, Reading, MA: Addison-Wesley.

Moore, T. V. (1939). Cognitive psychology . Lippincott.

Muehlbacher, S., & Kirchler, E. (2019). Individual differences in mental accounting. Frontiers in Psychology . https://doi.org/10.3389/fpsyg.2019.02866

Muehlbacher, S., Hartl, B., & Kirchler, E. (2016). Mental accounting and tax compliance. Public Finance Review, 45 (1), 118–139. https://doi.org/10.1177/1091142115602063

Murphy, D. S., & Yetmar, S. (2010). Personal Financial Planning Attitudes: A preliminary study of graduate students. Management Research Review, 33 (8), 811–817. https://doi.org/10.1108/01409171011065617

Nunally, J. (1978). Psychometric . McGraw Hill.

Olsen, J., Kasper, M., Kogler, C., Muehlbacher, S., & Kirchler, E. (2019). Mental accounting of income tax and value added tax among self-employed business owners. Journal of Economic Psychology, 70 , 125–139. https://doi.org/10.1016/j.joep.2018.12.007

Palmer, L., Goetz, J. W., & Chatterjee, S. (2009). Expanding financial education and planning opportunities through service-learning. Financial Services Review, 18 (3), 157–175.

Perry, V., & Morris, M. (2005). Who is in control? the role of self-perception, knowledge, and income in explaining consumer financial behavior. Journal of Consumer Affairs, 39 (2), 299–313. https://doi.org/10.1111/j.1745-6606.2005.00016.x

Prakash, A., Shukla, A. K., Ekka, A. P., & Priyadarshi, K. (2018). Quarterly Estimates of Households’ Financial Assets and Liabilities . India: RBI Bulletin.

Prakash, A., Shukla, A. K., Ekka, A. P., Priyadarshi, K., & Bhowmick, C. (2019). Financial Stocks and Flows of the Indian Economy 2011–12 to 2017–18 . India: RBI Bulletin.

Prelec, D., & Loewenstein, G. (1998). The red and the black: Mental accounting of savings and debt. Marketing science , 17 (1), 4–28.

Raut, R. K., Das, N., & Mishra, R. (2018). Behaviour of individual investors in stock market trading: Evidence from India. Global Business Review, 21 (3), 818–833. https://doi.org/10.1177/0972150918778915

Rejeki, A., Suryani, T., & Sulasmi, S. (2019). Self-regulation as a mediator between the effect of mental accounting on decision satisfaction of car purchases. Journal of Educational, Health and Community Psychology . https://doi.org/10.12928/jehcp.v8i1.12467

Ringle, C. M., Sarstedt, M., & Straub, D. M. (2012). Editor’s comments: A critical look at the use of PLS-SEM in “MIS Quarterly.” MIS Quarterly . https://doi.org/10.2307/41410402

Schwartz, S. (2006). A theory of cultural value orientations: Explication and applications. Comparative Sociology, 5 (2–3), 137–182. https://doi.org/10.1163/156913306778667357

Sensenig, D. J., Walsh, B. C., Machiz, I. C., Stanley, N. C., Russell, M., McCoy, M., & CET, P. L. (2020). Utilizing what we know about tele-mental health in tele-financial planning: a systematic literature review. Journal of Financial Planning , 33 , 48–58

Shavit, T., & Adam, A. M. (2011). A preliminary exploration of the effects of rational factors and behavioral biases on the managerial choice to invest in corporate responsibility. Managerial and Decision Economics, 32 (3), 205–213. https://doi.org/10.1002/mde.1530

Shefrin, H. M., & Thaler, R. H. (1988). The behavioral life-cycle hypothesis. Economic Inquiry, 26 (4), 609–643. https://doi.org/10.1111/j.1465-7295.1988.tb01520.x

Shefrin, H. M., & Thaler, R. H. (2004). Mental accounting, saving, and self-control. Advances in behavioral economics, 395–428.

Smith, J. P., McArdle, J. J., & Willis, R. (2010). Financial decision making and cognition in a family context. The Economic Journal . https://doi.org/10.1111/j.1468-0297.2010.02394.x

Soper, D. S. (2021). Sobel Test Calculator for the Significance of Mediation [Software]. https://www.danielsoper.com/statcalc

Statman, M. (1999). Behaviorial finance: Past battles and future engagements. Financial Analysts Journal, 55 (6), 18–27. https://doi.org/10.2469/faj.v55.n6.2311

Agarwal, S., Driscoll, J. C., Gabaix, X., & Laibson, D. (2009). The age of reason: Financial decisions over the life cycle and implications for regulation. Brookings Papers on Economic Activity, 2009 (2), 51–117. https://doi.org/10.1353/eca.0.0067

Thaler, R. (1980). Toward a positive theory of Consumer Choice. Journal of Economic Behavior & Organization, 1 (1), 39–60. https://doi.org/10.1016/0167-2681(80)90051-7

Thaler, R. (1985). Mental Accounting and consumer choice. Marketing Science, 4 (3), 199–214. https://doi.org/10.1287/mksc.4.3.199

Thaler, R. H. (1990). Anomalies: Saving, fungibility, and mental accounts. Journal of Economic Perspectives, 4 (1), 193–205. https://doi.org/10.1257/jep.4.1.193

Thaler, R. H. (1999). Mental accounting matters. Journal of Behavioral Decision Making, 12 (3), 183–206. https://doi.org/10.1002/(sici)1099-0771(199909)12:3%3c183::aid-bdm318%3e3.0.co;2-f

Winnett, A., & Lewis, A. (1995). Household accounts, mental accounts, and savings behaviour: Some old economics rediscovered? Journal of Economic Psychology, 16 (3), 431–448. https://doi.org/10.1016/0167-4870(95)00019-k

Witkin, H. A., & Goodenough, D. R. (1977). Field dependence and interpersonal behavior. Psychological Bulletin, 84 (4), 661–689. https://doi.org/10.1037/0033-2909.84.4.661

Wold, H. O. (1982). Soft modeling: The basic design and some extensions. In K. G. Jöreskog & H. O. Wold (Eds), Systems under indirect observations (Part II, pp. 1–54). essay, Amsterdam: North-Holland.

Wong, K. K. K. (2013). Partial least squares structural equation modeling (PLS-SEM) techniques using SmartPLS. Marketing Bulletin, 24 (1), 1–32.

Xiao, J.-J., & Olson, G. I. (1993). Mental accounting and saving behavior. Home Economics Research Journal, 22 (1), 92–109. https://doi.org/10.1177/004677749302200105

Yeske, L. E. (2012). Mental Accounting As a Mediator of Self-Control in Consumer Decision Making. CMC Senior Theses . https://scholarship.claremont.edu/cmc_theses/421

Zajonc, R. B. (1980). Feeling and thinking: Preferences need no inferences. American Psychologist, 35 (2), 151–175. https://doi.org/10.1037/0003-066x.35.2.151

Download references

Acknowledgements

The authors are grateful for the support of all the survey participants for their valuable response and deeply thankful to the reviewers for their precious comments.

The authors did not receive support from any organization for the submitted work.

Author information

Authors and affiliations.

Institute of Public Enterprise (IPE), Hyderabad, India

Mousumi Singha Mahapatra & Ram Kumar Mishra

Behavioural, Business and Social Sciences Research Area, TCS Research and Innovation, Hyderabad, India

Jayasree Raveendran

You can also search for this author in PubMed Google Scholar

Contributions

All authors contributed to the study conception and design. Material preparation, data collection, and analysis were performed by Dr. Mousumi Singha Mahapatra, Dr. Jayasree Raveendran, and Prof. Ram Kumar Mishra. The first draft of the manuscript was written by Dr. Mousumi Singha Mahapatra, and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Correspondence to Mousumi Singha Mahapatra .

Ethics declarations

Ethics approval.

The approval was obtained from the research committee of the Institute of Public Enterprise. The procedures used in this study adhere to the tenets of the Declaration of Helsinki. The current research involved human participants and the data is collected through survey method.

Conflicts of interest

The authors have no conflict of interest to declare that are relevant to the content of this article.

Consent to participate

Informed consent was obtained from all the individual participants. As the data collected through an online/offline survey, the individuals were informed about the survey purpose and if interested can provide their response.

Consent for publication

I, as the corresponding author warrant that the manuscript with title ‘Role of Mental Accounting in Personal Financial Planning: A Study among Indian Households’ submitted by me for publication in the journal ‘Psychological Studies’ and all the co-authors have given their consent for publication. The manuscript has not been communicated elsewhere for publication. All mater included in the manuscript does not infringe upon any existing copyright and does not violate any intellectual property right of any person or entity.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

Reprints and permissions

About this article

Mahapatra, M.S., Raveendran, J. & Mishra, R.K. Role of Mental Accounting in Personal Financial Planning: A Study Among Indian Households. Psychol Stud 67 , 568–582 (2022). https://doi.org/10.1007/s12646-022-00683-6

Download citation

Received : 21 June 2021

Accepted : 03 May 2022

Published : 27 November 2022

Issue Date : December 2022

DOI : https://doi.org/10.1007/s12646-022-00683-6

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Mental accounting

- Personal financial planning

- Financial cognition

- Find a journal

- Publish with us

- Track your research

- Search Search Please fill out this field.

What Is Mental Accounting?

Understanding mental accounting, example of mental accounting, mental accounting in investing.

- Frequently Asked Questions

The Bottom Line

- Behavioral Economics

Mental Accounting: Definition, Avoiding Bias, and Example

:max_bytes(150000):strip_icc():format(webp)/troypic__troy_segal-5bfc2629c9e77c005142f6d9.jpg)

Mental accounting refers to the different values a person places on the same amount of money based on subjective criteria.

Mental accounting is a concept in the field of behavioral economics . Developed by economist Richard H. Thaler, it contends that individuals classify funds differently and are therefore prone to irrational decision-making in their spending and investment behavior.

Key Takeaways

- Mental accounting, a behavioral economics concept introduced by Nobel Prize-winning economist Richard Thaler, refers to the different values people place on money.

- Mental accounting often leads people to make irrational investment decisions and behave in financially counterproductive or detrimental ways, such as funding a low-interest savings account while carrying large credit card balances.

- To avoid the mental accounting bias, individuals should treat money as completely interchangeable no matter where they allocate it—whether to a budgeting account for everyday living expenses, a discretionary spending account, or a wealth-building account like a savings and investment vehicle.

In his 1999 paper "Mental Accounting Matters," Richard Thaler, currently a professor of economics at the University of Chicago Booth School of Business , defined mental accounting as “the set of cognitive operations used by individuals and households to organize, evaluate, and keep track of financial activities."

Underlying the theory is the concept of the fungibility of money. To say money is fungible means that, regardless of its origins or intended use, all money is the same.

To avoid the mental accounting bias, individuals should treat money as perfectly fungible when they allocate it among different accounts. They also should value a dollar the same whether it is earned through work or given to them.

Thaler observed that people frequently violate the fungibility principle, especially in a windfall situation. Take a tax refund . Getting a check from the IRS is generally regarded as "found money," something extra that the recipient often feels free to spend on a discretionary item. But in fact, the money rightfully belonged to the individual in the first place, as the word "refund" implies, and is mainly a restoration of money (in this case, an overpayment of tax), not a gift. Therefore, it should not be treated as a gift, but rather viewed in much the same way that the individual would view their regular income.

To avoid mental accounting bias, people should value every dollar they receive in the same way—whether it is earned through work or given to them. Don't think of a tax refund as a windfall, suitable for splurging.

The mental accounting line of thinking seems to make sense but is in fact highly illogical. For instance, some people keep a special “money jar” or similar fund set aside for a vacation or a new home, while at the same time carrying substantial credit card debt . They are likely to treat the money in this special fund differently from the money that is being used to pay down debt, in spite of the fact that diverting funds from the debt-repayment process increases interest payments, thereby reducing their total net worth .

Broken down further, it’s illogical (and, in fact, detrimental) to maintain a savings jar that earns little or no interest while simultaneously holding credit card debt that accrues double-digit figures annually. In many cases, the interest on this debt will erode any interest you could earn in a savings account. Individuals in this scenario would be best off using the funds they have saved in the special account to pay off the expensive debt before it accumulates any further.

The solution to this problem seems straightforward yet many people do not behave in this way. The reason has to do with the type of personal value that individuals place on particular assets. Many people feel, for example, that money saved for a new house or a child’s college fund is simply “too important” to relinquish, even if doing so would be the most logical and beneficial move. So the practice of maintaining money in a low- or no-interest account while also carrying outstanding debt remains common.

Professor Thaler made a cameo appearance in the movie "The Big Short" to explain the "hot hand fallacy" as it applied to synthetic collateralized debt obligations (CDOs) during the housing bubble prior to the 2007-2008 financial crisis.

People also tend to experience mental accounting bias when investing. For instance, many investors divide their assets between safe portfolios and speculative ones on the premise that they can prevent the negative returns from speculative investments impacting the total portfolio.

In this case, the difference in net wealth is zero, regardless of whether the investor holds multiple portfolios or one larger portfolio. The only discrepancy in these two situations is the amount of time and effort the investor takes to separate the portfolios from one another.

Borrowing from Daniel Kahneman and Amos Tversky's groundbreaking theory on loss aversion , Thaler offers this example: An investor owns two stocks, one with a paper gain, the other with a paper loss. The investor needs to raise cash and must sell one of the stocks. Mental accounting is biased toward selling the winner even though selling the loser is usually the rational decision, due to tax-loss benefits as well as the fact that the losing stock is a weaker investment. The pain of realizing a loss is too much for the investor to bear, so the investor sells the winner to avoid that pain. This is the loss-aversion effect that can lead investors astray with their decisions.

Why Do We Do Mental Accounting?

People have a natural tendency to treat money differently, depending on factors such as its origin and intended use. That way of thinking gradually makes less sense the more you think about it and can end up actually being detrimental to our finances.

Is Mental Accounting a Behavioral Bias?

Yes. Behavioral biases can be described as irrational beliefs or behaviors that unconsciously influence our decision-making. And mental accounting can be described as resulting in illogical ways of viewing and managing our money.

How Can Mental Accounting be Prevented?

The key to dealing with mental accounting and not succumbing to it is to treat money as interchangeable and not give it labels. Don’t consider certain money less important because it came from an unexpected source or continue to park money in a savings account paying little to no interest when you have debts to repay with much higher borrowing costs.

Mental accounting is a trap that many including seasoned investors fall into. The majority of people assign subjective value to money, usually based on where it came from and how it’s intended to be used. While that approach may sound harmless and totally reasonable, it can work against us and leave us economically worse off.

Richard H. Thaler. " Mental Accounting and Consumer Choice ." Marketing Science, Vol. 4, No. 3 (Summer, 1985). Pages 199-214.

The University of Chicago Booth School of Business. “ Richard H. Thaler .”

Richard H. Thaler. “ Mental Accounting Matters .” Journal of Behavioral Decision Making, 12. Page 183.

Richard H. Thaler. “ Mental Accounting Matters .” Journal of Behavioral Decision Making, 12. Pages 183-206.

IMDB. " Full Cast & Crew: The Big Short (2015) ."

:max_bytes(150000):strip_icc():format(webp)/behavioraleconomics.asp-final-10e6085b26754eea8b50bc54882a1b8a.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

IMAGES

VIDEO

COMMENTS

The role of the value function in mental accounting is to describe how events are perceived and coded in making decisions. To introduce this topic, it is useful to de®ne some terms. Tversky and Kahneman (1981, p. 456) de®ne a mental account{ quite narrowly as `an outcome frame which speci®es (i) the set.

This dissertation is structured in the form of two empirical essays, each investigating one type of irrational decision caused by mental accounting. The first essay, titled "Managing the Cost of Multiple Debt Accounts: A Behavioral Perspective", explores why many people pay off credit cards' with the lowest rate first when rationally speaking they should repay the debt with the highest rate ...

Mental accounting is a framework that helps you understand how people label and track their money ( Thaler, 1985, 1999 ). It describes people's tendency to code, categorize and evaluate economic outcomes by grouping their assets into any number of non-fungible, non-interchangeable mental accounts ( Gou et al., 2013 ).

Dissertation (MBA)--University of Pretoria, 2006. When standard economic theories failed to be consistent predictors of consumer behaviour, Thaler (1980, 1985) developed the theory of mental accounting, which takes behavioural factors into consideration.

School of Economics and Management, University of M inho, Braga, Portugal. ABSTRACT. This study was motivated by the need to characterize. scientific research on th e "Mental Accountin g ...

This dissertation is structured in the form of two empirical essays, each investigating one type of irrational decision caused by mental accounting. The first essay, titled " Managing the Cost of Multiple Debt Accounts: A Behavioral Perspective ", explores why many people pay off credit cards' with the lowest rate first when rationally

Objective: This study maps the scientific production on the influence of Mental Accounting bias in decision-making processes in order to understand the intellectual structure of research on the subject. Theoretical Framework: Since Thaler developed the concept of mental accounting in the 1980s, it has been widely used by economics, finance and ...

This article provides an overview of recent advances in the literature on mental accounting within the context of consumer financial decision-making. We first discuss the categorization process that underlies mental accounting and the methods people use to categorize funds. We then highlight some of the notable work that examines how mental ...

Mental accounting is a technique for asserting self-control in the face of consumption decisions, functioning as a categorization system for income and expenses. A body of evidence supports the concept that consumers are driven by perception and emotion, not rational economic thought. Mental accounting is subject to the effects of cognitive biases, leading to imperfect financial behavior.

Mental accounting is a process whereby people code, categorize, and evaluate their economic outcomes (Thaler, 1980). It describes that the subjective framing of the utility of a transaction divides income and expenditure into different cognitive accounts based on the source and the frequency (Gourville & Soman, 1998; Prelec & Loewenstein, 1998 ...

The keywords "mental accounting," or a variation are present in all extracted papers—in either the title, abstract or the main text of the paper, which ensures applicability and relevance. ... and one doctoral thesis. As described in the review protocol, the quality standard for this systematic literature review is to only include ...

The implicit process of coding, categorizing, evaluating, and keeping a track of all economic outcomes is described as mental accounting (Thaler, 1999). Individuals use mental accounts to manage ...

iour on the way accounting models are constructed and the effects of the way accounting models are constructed on human behaviour. Mental Budgeting (MB) is consistent with research on mental accounting (Henderson & Peterson, 1992; Kahneman & Tversky, 1984) that demonstrates that peo-ple use resources differently based on how they are labelled.

This article provides an overview of recent advances in the literature on mental accounting within the context of consumer financial decision‐making. We first discuss the categorization process that underlies mental accounting and the methods people use to categorize funds. We then highlight some of the notable work that examines how mental ...

Mental accounting is a process whereby people code, categorize, and evaluate their economic outcomes (Thaler, Citation 1980). It describes that the subjective framing of the utility of a transaction divides income and expenditure into different cognitive accounts based on the source and the frequency (Gourville & Soman, Citation 1998; Prelec & ...

which mental accounting can influence how people man-age their finances is of great importance. This article pro-vides a summary overview of mental accounting within the context of consumer financial decision-making.1 We first discuss the categorization process that underlies men-tal accounting and the methods people use to categorize funds.

University of New Hampshire Scholars' Repository | University of New ...

amined by making financial eva. ation.2. Concept of Mental Accounting Mental Accounting, which is quite new in business literature; it is a process in which people encode, classify and evaluate economic outcomes; it is about remembering and perceiving various expenditures, and. this is a way to make sense o.

The paper shows that for each of the four themes there are multiple mental account-. ing effects with an impact on for example willingness to pay, the experienced pain of. paying or the ultimate purchase decision. Further, the paper identifies potential direc-. tions for future research in mental accounting, including the influence of product ...

Abstract. The mental accounting process of an individual plays an important role in financial decision-making. Little is known, especially in the Indian context, about individual diferences in mental accounting and its influence on their financial planning. The study aims to understand the role of the mental accounting system of individuals in ...

ns.Study HypothesesBased on the study's questions, we can formulate the following hypotheses:-The first hypothesis is that there is a contribution to mental ac. ounting in helping investors devel-op a strategy for making financial and investment decisions.Second hypothesis: There is an impact of mental accou.

Mental Accounting (MA) is a key concept in BF that may include both the effects of human behaviour on the way accounting models are constructed and the effects of the way accounting models are constructed on human behaviour. ... The study is based on Master minor thesis of me that was submitted to the Economics of Consumers and Household (ECH ...

Mental accounting is an economic concept established by economist Richard Thaler, which contends that individuals divide their current and future assets into separate, non-transferable portions ...