- United Kingdom

- New Zealand

- Philippines

- United States

Jobseeker log in

Don’t have a jora account register with:.

- Last 7 days

- Last 14 days

- Last 30 days

- Exact location

- Within 5 miles

- Within 10 miles

- Within 25 miles

- Within 50 miles

- Within 100 miles

Listed date

3 jobs – market research in york, ny, line cook - alltown fresh line cook - alltown fresh, don't miss out.

We will notify you when new market research jobs in york ny are posted.

Discover new jobs for this search

Stay up to date with new jobs that match what you are looking for.

Sign in to start saving jobs in your profile.

The stock market will drop 32% in 2025 as the Fed fails to save the economy from a recession, research firm says

- The S&P 500 will plunge 32% in 2025 as a recession finally hits the US economy, BCA Research predicts.

- The firm said the Fed will fail to prevent a recession as it takes its time cutting interest rates.

- Rising unemployment and constrained credit will curb consumer spending, worsening the downturn.

The stock market will crash 32% in 2025 as the Federal Reserve fails to prevent a recession, according to the most bearish strategist on Wall Street.

Peter Berezin, chief global strategist at BCA Research, said in a recent note that a recession will hit the US economy later this year or in early 2025, and the downturn will send the S&P 500 tumbling to 3,750.

"The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. Growth in the rest of the world will also slow sharply," Berezin said.

Part of Berezin's bearish outlook is based on the idea that the Fed will "drag its feet" in cutting interest rates, and the central bank will only meaningfully loosen financial conditions until a recession is apparent.

By then, it will be too late.

Berezin highlighted that the labor market is weakening as job openings decline materially from their post-pandemic peak. An ongoing decline in the quits rate, hiring rate, and recent downward revisions to the April and May jobs report also point to a slowing labor market.

"Two years ago, workers who lost their jobs could simply walk across the street to find new work. That has become increasingly difficult," Berezin said.

The June jobs report showed the unemployment rate ticking higher to 4.1% from 4.0%, yet another sign of some mild weakness in the jobs market.

Rising unemployment could ultimately lead to consumers reducing their spending to build up their "precautionary savings," Berezin said, and that will happen as consumers' ability to borrow money narrows due to rising delinquency rates.

Ultimately, a negative feedback loop will develop in the broader economy, which will send the stock market reeling.

"With little accumulated savings to draw on and credit availability becoming more constrained, many households will have little choice but to curb spending. Decreased spending will lead to less hiring. Rising unemployment will curb income growth, leading to less spending and even higher unemployment," Berezin explained.

And perhaps most importantly, the Fed's plan to blunt any economic decline via interest rate cuts simply won't work.

"It is important to recognize that what matters for the economy is not the fed funds rate per se, but the interest rate that households and businesses actually pay," Berezin said.

For example, the average mortgage rate paid by consumers is around 4%, compared to current mortgage rates of around 7%.

That means even if the Fed cuts interest rates and mortgage rates decline, the average mortgage rate paid by consumers will continue to rise.

That principal also applies to businesses and the loans they hope to refinance in the coming years.

"These dynamics will trigger more defaults, causing pain for the banking systems. The problems that affected regional banks last year have not gone away," Berezin said.

- Main content

Intelligent Investment

Global Data Center Trends 2024

Limited power availability drives rental rate growth worldwide.

June 24, 2024 20 Minute Read

Executive Summary

Data center insights & research.

Explore what’s next for digital infrastructure, including enterprise IT, networking and data center operations strategies—and what it means for corporate owners and users of data centers worldwide.

- A continued worldwide power shortage is significantly inhibiting the global data center market’s growth. Sourcing power is a top priority for operators across all regions (North America, Europe, Latin America and Asia-Pacific). Secondary markets with ample power should attract more data center investment.

- Vacancy rates continue to decline across most global markets due to strong demand. Singapore, the world's most power-constrained market, has only 7.2 MW of available capacity and a near record-low 1% vacancy rate.

- Large corporations face increasing difficulty securing data center capacity. Low supply, construction delays and power challenges are impacting all markets. For example, Querétaro, Mexico has only 0.6 MW available for lease.

- The worldwide power shortage continues to fuel price increases for data center capacity. In U.S. dollar terms, Singapore still has the highest rental rates at US$315 to US$480 per month for a 250- to 500-kW requirement, while Chicago still has the lowest at $155 to $165.

- Artificial intelligence (AI) advancements are projected to significantly drive future data center demand. High-performance computing will require rapid innovation in data center design and technology to manage rising power density needs.

All analysis in this report is based only on the four largest data center markets by inventory in each global region, as follows:

- North America: Northern Virgina, Dallas-Ft. Worth, Chicago and Silicon Valley.

- Europe: Frankfurt, London, Amsterdam and Paris.

- Latin America: Querétaro (Mexico), Sáo Paulo (Brazil), Santiago (Chile) and Bogotá (Colombia).

- Asia-Pacific: Singapore, Tokyo, Hong Kong and Sydney.

Inventory (MW)

North America Despite power supply issues, North American data center inventory grew by 24.4% year-over-year in Q1 2024, adding 807.5 MW across Northern Virginia, Chicago, Dallas and Silicon Valley. Northern Virginia led with 391.1 MW of new supply, due to demand from public cloud providers and AI companies. Local governments are addressing power constraints by simplifying permitting and integrating renewable energy into the grid.

Europe The European data center market grew by nearly 20% year-over-year in Q1 2024. There was significant development in all four major FLAP markets (Frankfurt, London, Amsterdam and Paris), with Paris leading at over 40% year-over-year growth. However, supply shortages persist across the continent, especially in core markets like Frankfurt. Preleasing new facilities is now common, indicating a need for ongoing investment in data center development. Power sourcing remains a key challenge.

Latin America The region's data center inventory grew by 15% year-over year in Q1 to 650.2 MW, with São Paulo accounting for 67% of the top four countries’ total inventory. Bogotá’s inventory grew the most at 25%.

Asia-Pacific The region’s data center inventory increased by 22% year-over year in Q1 to 2,996 MW. Tokyo, Sydney, Hong Kong and Singapore each contain well over a half-GW of live power capacity, despite tighter planning constraints in Singapore. The capacity pipeline is strong, with numerous developments under construction across the region.

Figure 1: Data Center Inventory by Market

North America North American data center vacancy rates hit new lows across major markets. Chicago led again with the biggest year-over-year decrease to 2.4% from 6.7%. Northern Virginia's vacancy rate decline closely followed, dropping to 0.9% from 1.8% the year prior despite an 18% increase in inventory over the same period.

Europe The FLAP markets' combined vacancy rate fell by 2 percentage points year-over-year in Q1 to 10.6%. Amsterdam had the largest decrease of nearly 8 percentage points to 11.5%. Despite expected new supply, the low vacancy rate should persist due to strong demand.

Latin America The region’s vacancy rate held steady year-over-year at 11.1%. Querétaro had the biggest decline (1.9 percentage points) to a record-low 1.2%. There is persistently strong regional demand, mainly from hyperscalers.

Asia-Pacific The vacancy rate slightly increased in Asia-Pacific due to many new project completions, with primary market vacancy rising to 16% from 13.5%. Hong Kong’s vacancy rate hit around 30% due to 195 MW of new 2023 supply amid softer leasing conditions. However, Singapore remained an extremely tight market with a vacancy rate of 1.0%.

Figure 2: Data Center Vacancy Rate by Market

Net absorption.

North America Public cloud providers and AI companies are driving strong demand for North American data centers. All four featured North American markets–Northern Virginia, Chicago, Dallas-Ft. Worth and Silicon Valley–had major year-over-year net absorption increases. Northern Virginia had the largest year-over-year increase at 407.4 MW. Chicago absorbed 218.7 MW, Dallas gained 140.2 MW and Silicon Valley secured 62.6 MW.

Europe Despite macroeconomic headwinds, Europe’s data center demand remains high. FLAP markets had a significant surge in net absorption, reaching a combined 487.6 MW from Q1 2023 to Q1 2024, nearly double the previous year’s absorption.

Latin America Latin America's data center demand continues to rise, with net absorption reaching 73.3 MW in Q1 2024. São Paulo, the region's leading market, absorbed 40.4 MW this year. Hyperscalers are expanding their regional presence, seeking reliable data center infrastructure for their growing needs.

Asia-Pacific Asia-Pacific leasing demand remains strong due to corporate and government digitization, and cloud services adoption. AI-related industries, particularly in Tokyo and Sydney, also show massive potential with multi-MW requirements. Singapore’s take-up increased despite supply constraints. Net absorption in Hong Kong improved due to demand from mainland Chinese companies and multinational hyperscalers.

Figure 3: Data Center Net Absorption by Market, Q1 2023 to Q1 2024

Pricing & rental rates.

North America North American data center pricing is significantly accelerating due to supply shortages and high demand. Average asking rates for a typical 250- to 500-kW requirement across all four featured North American markets surged by 20% year-over-year, the highest global increase.

Europe European data center pricing continues increasing due to high demand and rising construction costs. Rental rates in key markets like Frankfurt and London have steadily climbed over the past 18 months. Frankfurt saw a steeper 15% increase, reflecting its status as one of the most expensive markets in Europe.

Latin America Latin America’s data center pricing shows a mixed picture this year. Overall rental rates are rising slightly from last year, with market-specific variations. For example, Bogotá saw an unexpected 8% year-over-year colocation rate decrease, possibly due to increased competition or a temporary market correction. Conversely, Santiago’s rental rates increased by 15%, reflecting strong demand and limited supply.

Asia-Pacific Asia-Pacific pricing has steadily increased due to strong demand and rising construction and operational costs, despite a relatively large amount of new inventory. Singapore, one of the most expensive global markets, is asking over US$300 per kW. Tokyo’s pricing has generally increased, with rates around US$200 per kW. Sydney’s pricing remains steady at US$195 despite significant new supply.

Figure 4: Monthly Pricing Range for 250-500kW (Min-Max) $USD Without Electricity Cost

Availability.

North America North American data center availability keeps tightening due to robust demand. Significant supply additions from Q1 2023 to Q1 2024 were quickly absorbed, further reducing leasing availability. Northern Virginia saw the largest decrease (-16.2 MW), followed by Chicago (-10.6 MW) and Dallas (-1.5 MW). Silicon Valley was the only major market with increased availability (+19 MW).

Europe Despite significantly increased data center supply across FLAP markets, leasing availability stayed relatively flat from Q1 2023 to Q1 2024 due to robust demand quickly absorbing new supply. Amsterdam had Europe’s largest decline, dropping to 65.4 MW from 98.6MW.

Latin America Latin America's data center availability modestly increased in 2024, largely due to more space in São Paulo, the region's largest market. São Paulo’s availability increased to 62.1 MW from 52.3 MW in Q1 2024. However, this growth remains slight, indicating that demand still exceeds new supply in many Latin American markets.

Asia-Pacific Leasing availability in Asia-Pacific slightly rose due to a wave of recently completed facilities, yet demand remains high. Many companies are opting for pre-commitments, absorbing a sizable portion of the new supply. Singapore remains supply-constrained, benefiting alternative markets. Overall, Asia-Pacific maintains a balanced supply-and-demand dynamic, facilitating strong conditions for market entry and expansion.

Figure 5: Data Center Availability by Market

North america featured markets, northern virginia.

Northern Virginia, the world’s largest data center market, increased its inventory by 391.1MW year-over-year despite Dominion Power’s power supply issues. Public cloud providers and AI companies leased most of the market’s space, resulting in a record-low 0.9% vacancy rate. Consequently, rental rates surged by 41.6% year-over-year as tenants secured leases pre-construction to meet capacity needs. The high electricity demand also boosted power costs by 20.8% year-over-year.

Opportunities:

Dominion Energy's current transmission line projects should boost power capacity by 2026, potentially easing existing limitations. This may encourage further data center development in the region.

Persistently low vacancy and preleasing activity indicate sustained demand. Developers may explore opportunities in surrounding areas such as Central Virginia (including Fredericksburg and Richmond), Maryland and neighboring Virginia counties.

Challenges:

Power supply issues remain despite progress on transmission line construction. Power availability and permitting processes dictate data center construction timelines.

Land scarcity in core counties such as Loudoun and Prince William may increase development costs. Additionally, extended timelines could reduce profit margins for some developers.

Dallas-Ft. Worth

Dallas-Ft. Worth has cemented its status as the nation’s second-largest colocation market, with 31.9% year-over-year inventory growth to 573 MW. Currently, it has a record 372.2 MW of data center space under construction, with 91.8% pre-leased. Limited supply is driving rental rates up across all requirement sizes. Hyperscale and AI companies’ continued interest is further fueling market growth.

The independent decision-making and faster development timelines of Texas' energy grid, ERCOT, give it a unique advantage over many other markets facing power and supply chain delays. Oncor Electric's available power further strengthens Dallas-Ft. Worth's appeal for data center development.

Increasing land prices in South Dallas over the past three years indicate strong developer and hyperscale interest in this area, signaling potential for further regional expansion.

Unprecedented preleasing and record-high construction levels raise questions about the market's ability to sustain current growth and meet future demand.

Available colocation space in Chicago is scarce, with a record-low 1.9% vacancy rate, due to high demand from hyperscalers, enterprise users and especially financial services companies. This limited supply and high demand led to a 33% increase in rental rates over the past year. The challenge of power procurement is driving data center development westward towards areas like Elk Grove, Northlake, Wood Dale, Hoffman Estates and Itasca. Meanwhile, established providers are strategically acquiring developed land near existing campuses for future expansion.

Limited land availability in core areas is driving exploration of new submarkets and redevelopment opportunities, offering a chance for innovative solutions.

Affordable development land is scarce and power procurement poses a significant challenge.

Silicon Valley

Public cloud providers continue to dominate the tech industry’s epicenter, setting a gross leasing absorption record in 2023. Most leases were full building takeovers by cloud service providers, whose cloud businesses are growing partly due to AI adoption. The 6.5% market vacancy is solely in second-generation space, mainly smaller 1-2MW suites, which struggle to meet market standards for performance and efficiency. Power constraints will limit new data center supply for the foreseeable future. Asking rental rates in the 250- to 500-kW range have reached $155 to $250 per kW, the highest in our report.

The constrained power grid has opened opportunities for new technology and alternative power sources like fuel cells or on-site generation systems, to alleviate the market’s supply crunch.

Several developers who purchased property to build a data center have been informed that they won’t receive utility power for over a decade. They must decide whether to wait, sell, reposition or pursue a less-common alternative power source.

EMERGING MARKET

Northern indiana.

Two major hyperscaler announcements this year highlighted Northern Indiana as a new data center frontier. Located near major Midwest cities, it’s become one of North America’s fastest-growing markets for new greenfield data center projects. Cities within a 300-mile radius, including Chicago, Toledo, Cincinnati, Detroit, Cleveland and Columbus, are fueling interest in new data center development. Power and land availability, along with tax incentives, are set to drive further growth in 2025.

Boise, Idaho

In 2022, a leading hyperscaler announced a major development in Kuna, near Boise, Idaho, sparking significant interest for data center development land. We anticipate ongoing development in this region due to Idaho Power’s prevalent hydropower, a new solar facility in Pleasant Valley, abundant land and minimal natural disaster risk.

Europe Featured Markets

Germany’s financial capital maintains the lowest vacancy rate (6%) of any primary market. Data center space is typically preleased before a facility opens, making it nearly impossible for many organizations to find space in this market. Remaining capacity is quickly leased, with Frankfurt’s absorption rate being the lowest of any FLAP market. CBRE expects the vacancy rate to drop below 5% this year.

Despite this low availability, organizations are not deterred. There is strong demand for data center space in Frankfurt, with hyperscalers and many enterprises seeking to grow their substantial presence in the metro market. Operators have responded by adding significant capacity to their pipeline and initiating construction for 2024 and 2025 projects.

However, any space in Frankfurt not already pre-leased will likely be swiftly leased. This situation is further complicated by the difficulties providers face in delivering supply due to issues with securing power, finding suitable land and obtaining the necessary construction permits.

Providing service to Frankfurt from nearby areas like Mainz, located west of Frankfurt, may present an opportunity for providers due to its proximity to hyperscaler availability zones.

Providers face more regulations, limiting available building areas and increasing their already high construction costs.

The British capital still attracts significant demand despite its supply shortage. Hyperscalers primarily drive demand in London’s western corridor but are seeking data center space further afield. Expected demand growth from start-ups, enterprises and GPU-as-a-service providers will likely be challenged by capacity scarcity, limited power availability and few local AI-ready data centers. Hyperscalers and enterprises may struggle to find available power in the largest submarkets. However, areas well outside of London’s main regions, with less data center concentration, may offer more options. Consequently, London’s development radius will likely expand, even after key electricity substation upgrades.

Providers who find a site with available power and proximity to hyperscaler availability zones are far likelier to lease space in a data center that can be built on it.

Securing power sources for data centers is increasingly challenging for providers, potentially driving hyperscalers to invest elsewhere due to the considerable difficulty of development.

Amsterdam, a top global connectivity hub and Europe’s third-largest market, remains a strategic region for international data transfer and peering. However, stringent data center regulations and limited power availability make building data centers more challenging. This has slowed development relative to other primary European markets. There is no new supply this year and 2023’s growth was lower than any other FLAPD market, except the much larger London. Year-over-year new supply declines and take-up are common in Amsterdam, like any other data center market after a strong year.

In the short-term, limited power availability will deter development and limit new supply delivery. Numerous markets face this same issue. Still, the expected 2025 completion of a key local electricity substation upgrade should boost future data center development, as Europe faces a need for available wholesale capacity.

Amsterdam is underrepresented in hyperscaler deployments. It’s imperative for operators to make Amsterdam appealing to hyperscalers, as they account for the vast majority of data center demand.

Attracting data center investment may be difficult for Amsterdam due to regulatory constraints such as a national moratorium on data centers with a maximum IT load of over 70MW.

Paris recently surpassed Amsterdam and Dublin in terms of growth. It is expected to become Europe’s third-largest market for total supply this year, after Frankfurt and London. Demand, pricing and construction costs are rising due to record levels of data center capacity being delivered to meet the growing requirements of hyperscalers.

Over the past two years, take-up has surged due to the top hyperscalers’ local cloud regions, with much expansion and new construction delivering space in South Paris last year. Major cloud providers now offer, or soon will, a “Sovereign Cloud” product aimed at French public sector organizations and other security-needy sectors like healthcare and financial services.

More hyperscaler business is obtainable if operators can overcome regulatory and labor law challenges to deliver ample new capacity this year. The potential success makes the risk worthwhile, considering the scale of hyperscaler deployments, particularly in South Paris.

Securing land and power for new developments is increasingly difficult, particularly in the North. The zoning restrictions initiated due to the 2024 Olympics have further complicated matters for providers and others aiming to build in the region.

Data center development in Madrid is expected to accelerate this year despite its relatively high vacancy rate. In contrast, it experienced a development slowdown last year, following a peak in 2022 when market supply nearly doubled. This vacant space surplus distinguishes Madrid from other secondary markets like Milan and Vienna.

Norway’s capital and largest city hosts a mix of retail and wholesale colocation data centers. It had 70MW of supply as of Q4 2023. It is one of Europe’s faster-growing markets due to available, affordable power and land, prompting significant construction of wholesale data center campuses in the broader region.

Latin America Featured Markets

Querétaro, mexico.

Querétaro, an internet backbone connecting Mexico City and the U.S., is a favored location for hyperscale development in Mexico. Its ample land, professional industrial park operators and easy road access make it ideal for new developments. Additionally, it hosts several banks and telecom companies.

The region already hosts cloud availability zones for Amazon Web Services and Microsoft, with the latter having recently opened. Odata, KIO and Ascenty have consistently expanded their presence here over recent years. However, power challenges have slowed new data center launches and expansions. Hopes for resolving these challenges by 2025 are fading, making 2026 a more likely timeline for energy solutions implementation.

Electrical infrastructure limitations hinder market growth but strong demand persists. Securing extra electrical capacity can give operators a significant advantage. Solid government support for the tech sector enhances this market’s appeal for data center investment. Furthermore, land costs remain attractive compared with other markets.

Power supply is the main challenge in the region, impacting Querétaro and other Mexican markets. There are many industrial parks but few have secure energy capacity. Those that do often charge high prices.

São Paulo, Brazil

São Paulo is Latin America’s primary data center market, boasting its largest data center campus under development. This market’s advantages include the country’s best connectivity, strong energy supply and power infrastructure, and proximity to many corporate headquarters and a high-skilled IT labor force. Furthermore, it has the country’s largest concentration of rapidly expanding data center retailers and wholesalers. Its clean energy sources, primarily hydroelectricity, are diversifying with increasing investments in solar and wind power, ensuring stable energy supply.

The market’s potential for AI workload deployment has been studied, taking its clean energy matrix and energy availability into account. Certain areas in Barueri and Osasco have attracted development interest for smaller demands, as land and energy availability diminish.

Space and energy constraints are forcing new development farther from the market’s core.

Santiago, Chile

The Santiago market is connected to several submarine cables through Valparaíso, including the US$400-million Humboldt submarine cable project, a public-private partnership with Google, set to launch in 2026 and link the country to Sydney. This diverse data center market—encompassing retail, hyperscale and public cloud providers—creates a strong ecosystem in a key Latin American country, despite its small size and population. With market vacancy at a record-low 1.1%, hyperscalers and public cloud providers are demanding more energy. Regulation has been widely discussed, with debates over data center permits and usage in different zones.

The connection to Australia should bring more demand. New companies will likely enter the market with the lowest vacancy rate in Latin America, despite recent project completions.

This is a challenging region for data center development, with just a few areas permitting construction. Water restrictions also contribute to the difficulties developers have faced.

Bogotá, Colombia

Bogotá's data center market approached the size of Querétaro's last year due to increasing demand for cloud services, data storage and digital transformation initiatives. Hyperscalers have expanded their regional presence and newcomers have launched data centers through powered shell acquisitions in the main Free Trade Zones. These zones offer tax benefits and strategic locations near main highways and industrial corridors. The market utilizes green energy, despite some transmission constraints.

Several established free trade zones in the city’s main industrial corridors offer financial benefits. Due to some project delays in the region, there are opportunities this year to acquire remaining land subject to tax benefits.

Some free trade zones are far from the city’s core, with only a few fiber paths. Additionally, establishing the energy infrastructure needed for hyperscale projects may delay data center delivery dates.

Rio de Janeiro, Brazil

Brazil’s second-largest market has consistently grown, delivering key hyperscale developments. As some industrial regions become saturated, new areas are emerging, prioritizing energy supply expansion.

Peru has garnered attention for its significant data center activity. The market is transitioning from telecom sites to a third-party focus, facilitated by the entry of international companies like Equinix and Odata.

Asia-Pacific Featured Markets

As a major regional data center hub, Singapore has consistently high demand. However, scarce new supply has led to a 1.0% vacancy rate. An upcoming 80-MW supply awarded from the Data Center-Call for Application (DC-CFA) and 58 MW from the recently announced Singtel Tuas DC will provide temporary relief, supporting market expansion. As new capacity development extends to neighboring markets like Johor and Batam, Singapore will remain the regional interconnection hub. Data center operators will shift focus from size to technology and sustainability, driven by the AI demand boom requiring higher rack density specifications and advanced cooling technology.

Singapore is a top Asia-Pacific market, enjoying political stability, robust digital infrastructure and connectivity, and a tech-friendly business environment. Its serious focus on technological innovation and decarbonization also make it a regional leader, as well as a springboard to many fast-growing Asia-Pacific countries.

Power constraints and government restrictions have limited new supply. Competition from nearby countries with cheaper land, development costs, taxes and utility provide alternative opportunities to operators, investors and customers. Singapore must form part of multi-market strategy to sustain its regional leadership.

This key Asia-Pacific data center market is experiencing strong interest from occupiers and investors. The demand is largely driven by public cloud providers that seek space in strategically located central Tokyo edge facilities, and AI-related companies, which target suburban locations. Greater Tokyo’s current vacancy rate is around 10% to 15%. Despite the expected completion of numerous data centers over the next few years, prices remain stable or are rising due to strong demand. The government promotes data center development in regional areas like Osaka, Fukuoka and Hokkaido as part of its “digital garden city nation" vision.

Tokyo, Japan’s telecommunications hub, is an established data center market with strong international connectivity. It’s currently experiencing high data center demand due to the growth and adoption of cloud services. The surge in AI-related deployments also offers opportunities for colocation/edge providers.

Limited land and power constraints increase costs and potentially delay new developments. Emerging competitors from decentralized locations such as Hokkaido and Kyushu offer alternative options for non-latency-critical AI deployments.

Hong Kong is a major connectivity and commercial hub, acting as a gateway to China. Recent data center supply has outpaced demand, causing an uptick in vacancy levels. Mainland Chinese companies and international hyperscalers drive most absorption. Hong Kong IT service providers have also boosted regional take-up. The current wave of supply is expected to persist until mid-2025, then taper off, allowing greater long-term supply-and-demand balance. Given the softer vacancy rates, the outlook for colocation pricing in the retail & enterprise sectors remains relatively subdued.

Large multinational and domestic hyperscalers have leveraged the high vacancy rate to secure large transactions over the past year. Despite challenges, Hong Kong’s political and environmental stability, along with its role as a regional commercial hub, continues to attract data center occupiers with new supply and competitive prices.

Geopolitical issues still affect multinational retail & enterprise companies’ data center plans in Hong Kong, impacting absorption. The slowing Chinese economy has also reduced activity from mainland Chinese occupiers, though they remain the main market participants. With limited new land and power supply, developers and operators might retrofit existing industrial buildings for supply after 2026.

As one of Asia-Pacific’s largest data center markets, Sydney continues to attract public cloud providers, operators and investors. The persistent demand for colocation capacity is driven by governmental and corporate shifts from traditional on-premises/enterprise models to colocation and cloud service solutions. Despite a slight softening in vacancy levels, the market has seen an influx of new colocation developments, which has increased supply and kept pricing stable. Future growth is expected to be driven by significant activity in the cloud, content, gaming and AI-related industries, necessitating greater use of liquid cooling technologies for intensive computing workloads. The continued expansion by U.S.-based public cloud providers will support Sydney’s and Australia’s data center ecosystem.

Sydney offers a robust data center market, attracting public cloud providers, content, gaming and AI-related industries. With growth constraints in other Asia-Pacific markets, Sydney offers a viable alternative for meeting regional data center demand.

Sydney’s large development pipeline may pressure vacancy levels in the short-to-medium term. Power accessibility remains a challenge, impacting development timelines.

Mumbai, India

Mumbai, India’s largest data center market, boasts over 600 MW of live capacity, comprising about 54% of the overall market. Inventory is expected to surge due to strong demand from banking, financial services and insurance companies, hyperscalers, and media segments supported by international/domestic network connectivity and the government. Generative AI deployments are also fueling demand. Both established domestic and global operators are expanding in the market. International investors planning major developments in Greater Mumbai (Navi Mumbai) include Blackstone, Digital Edge, Digital Connexion and Princeton Digital Group.

Seoul, South Korea

Greater Seoul’s total capacity of 605 MW makes it Korea’s largest data center market. Previously dominated by domestic telecoms and Korean companies, the market now welcomes many new facilities from international developers, expecting a two-thirds increase in supply by 2026. The government’s restrictions on power availability are causing developers to explore land outside of Greater Seoul. Most facilities are pre-leased to hyperscalers because customer demand is high, limiting remaining capacity for enterprise users.

Related Insights

2024 global data center investor intentions survey.

June 3, 2024

The data center sector's momentum is continuing this year, fueled by institutional investment and strong underlying fundamentals.

Data Center Growth Has Economic Ripple Effects

May 23, 2024

Digital infrastructure has never been more important to providing reliable connectivity for business, commerce and communication.

Europe Data Centres Figures Q1 2024

May 17, 2024

The demand for data centre space in Europe's five largest markets – Frankfurt, London, Amsterdam, Paris, and Dublin (FLAPD) – exceeded supply in Q1 2024. This demand is projected to grow to 440MW this year as hyperscalers, start-ups and enterprises seek space that can accommodate their cloud and AI-related needs. For a comprehensive analysis of the key data centre markets tracked by CBRE, read the full report.

Asia Pacific Data Centre Trends - Q1 2024

April 3, 2024

Despite a challenging economic environment, data centres remain in focus for the commercial real estate industry in Asia Pacific, with notable market developments across the region. This report explores key data centre investment trends and outlook for the sector in Asia Pacific, and offers insights into the data centre occupier and investment market in Australia, Hong Kong SAR, Japan, Singapore, India and Korea.

North America Data Center Trends H2 2023

March 6, 2024

Technological innovation is driving record demand despite power constraints.

Related Service

Data center solutions.

Optimize your data center real estate with worldwide consulting, advisory and transaction, project management an...

North America

Executive Managing Director

- Phone +1 303 6281765

Molly Sackles

Senior Business Development Associate

- Phone +1 303 583 2048

Gordon Dolven

Director of Americas Data Center Research

Josh Ruttner

Associate Research Director

- Phone +1 212 984 8000

Head of EMEA Data Centre Solutions, Advisory & Transaction Services

- Phone +44 20 7182 3461

Kevin Restivo

Head of Data Centre Research, Advisory & Transaction Services, Europe

Latin America

Alison takano.

Industrial Manager

- Phone +55 30159964

Rafael Gubitoso

Asia-Pacific

Dedi iskandar.

Head of CBRE Data Center Solutions, Advisory & Transaction Services, Asia Pacific

Andrew Mackin

Head of Regional Consulting, Asia Pacific

Insights in Your Inbox

Stay up to date on relevant trends and the latest research.

Unprecedented U.S. immigration surge boosts job growth, output

July 02, 2024

The current U.S. immigration surge is unprecedented. The influx flew under the radar for some time, dismissed simply as pent-up immigration from when the borders essentially closed during the pandemic. But this year’s Congressional Budget Office (CBO) budget and economic outlook brought new attention to the migrant inflow and its expected economic effects.

By incorporating previously unavailable data on migration along the southwest border into the government’s economic and fiscal outlook, the macroeconomic implications of such high levels of migration come into focus.

The labor force in 2033 will be larger by 5.2 million people, mostly because of higher net immigration, according to CBO estimates . As a result of the immigration surge , GDP will be higher by about $8.9 trillion and federal government tax revenues by $1.2 trillion over the 2024-34 period. Deficits will be lower by $900 billion.

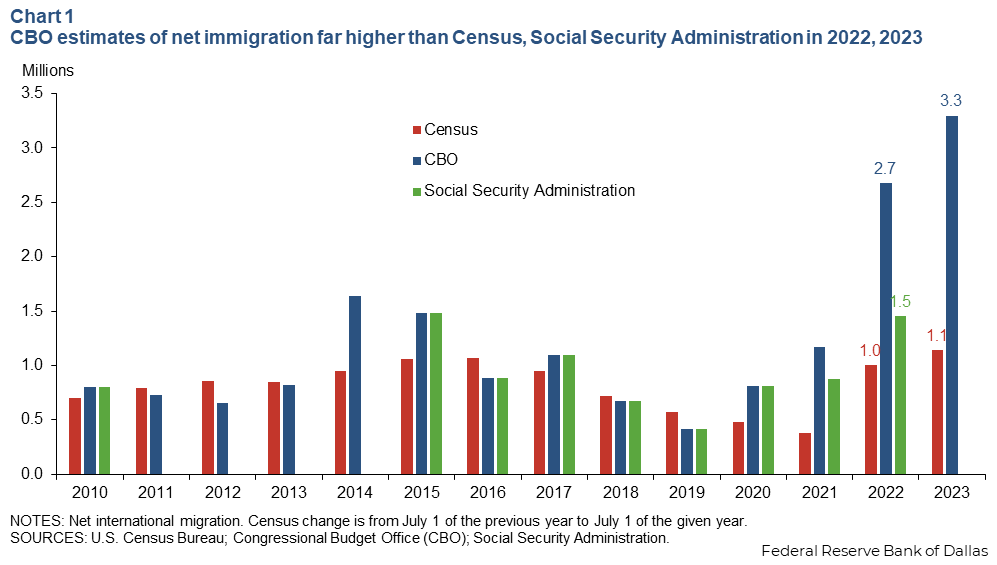

No consensus on volume of immigration

Government estimates of net immigration differ wildly. Census 2023 estimates (July to July) put net immigration at 1.1 million, far from CBO’s calendar-year 2023 estimate of 3.3 million ( Chart 1 ). CBO similarly estimated a much higher net immigration number than other agencies in 2022—2.7 million.

Net immigration is the sum of individuals who enter the country minus those who leave. Entries can be permanent or temporary but exclude short-term visitors such as tourists. Entries can also be legal, when people come with U.S. government visas, or otherwise, such as humanitarian migrants (asylum seekers and, more recently, humanitarian parolees) and unauthorized immigrants.

CBO included real-time data on the number of border crossers allowed into the country, statistics that the Department of Homeland Security (DHS) recently made available. Recently released 2023 data on immigrant work permits cast doubt on the lower immigration estimates in Chart 1 and are broadly supportive of CBO’s higher numbers.

Border surge sets record

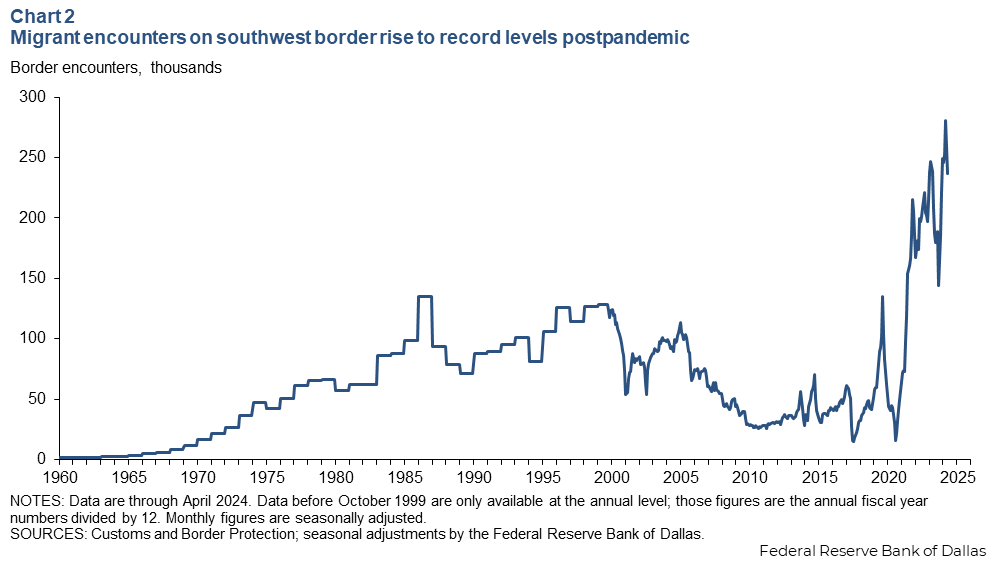

In 2023 alone, Customs and Border Protection (CBP) personnel encountered 2.54 million migrants at the southwest border ( Chart 2 ). This is about the same as the 2.58 million migrants in 2022, a record year. This compares with the prepandemic annual average of 500,000 migrants.

Since the pandemic began in the U.S. in February 2020, CBP has recorded almost 8 million encounters at the southwest border, along with almost 2 million encounters at the northern border, coastal border and airports.

“Encounters,” previously known as apprehensions, include all people at and between ports of entry who are either stopped by the Border Patrol or who turn themselves in. In recent years, an increasing share of migrants simply approaches the Border Patrol and states an intention to seek asylum.

During the pandemic and until May 2023, some of these migrants, typically single adults, were immediately expelled under a provision known as Title 42 , used to deny migrants entrance because of public health concerns related to COVID. However, more consideration was given to families and unaccompanied minors, and so even before the end of Title 42, the volume of migrants far exceeded available detention space. As a result, the majority of migrants has been paroled or otherwise released into the country to pursue asylum claims or other immigration pathways.

Notably, Border Patrol encounters do not include got-aways , or unauthorized immigrants, who escape the notice of Border Patrol while crossing or who are seen but not stopped. DHS publishes estimates of such migrants, although the figures differ significantly from estimates by demographers , at least in recent years.

Immigration policy, labor market shortages drive immigration

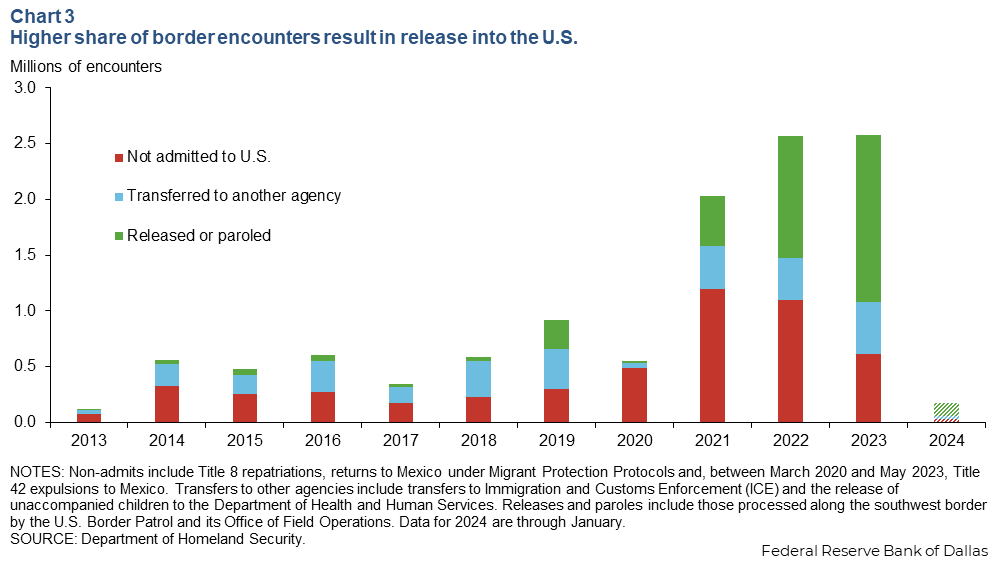

Though the number of encounters does not necessarily translate directly to the number of migrants admitted into the U.S., a smaller share is getting turned away than previously. In 2023, fewer than a quarter of encounters at the southwest U.S. border ended in migrants being refused entry into the U.S., and 58 percent of encounters resulted in migrants released or paroled into the interior ( Chart 3 ).

This is a reversal from the previous nine years, when more than half of the 8.7 million migrants apprehended at the southern border were not admitted to the U.S., and less than a quarter were allowed in.

Harsh and deteriorating conditions in many Latin American and Caribbean nations, including Cuba, Haiti, Nicaragua and Venezuela, prompted the U.S. government to expand programs such as humanitarian parole for those nations’ natives. Many migrants risk the trip to not only escape difficult circumstances, but also on the belief they can enter the United States under humanitarian provisions.

Another pull factor is the availability of work and rising wages. The postpandemic U.S. labor market was extremely tight, especially in sectors that tend to rely on immigrant labor. The job openings rate, or the number of job vacancies as a share of total employment in a sector, reached record highs in 2021 and 2022 for accommodation and food services, retail trade and health care and social assistance, among others.

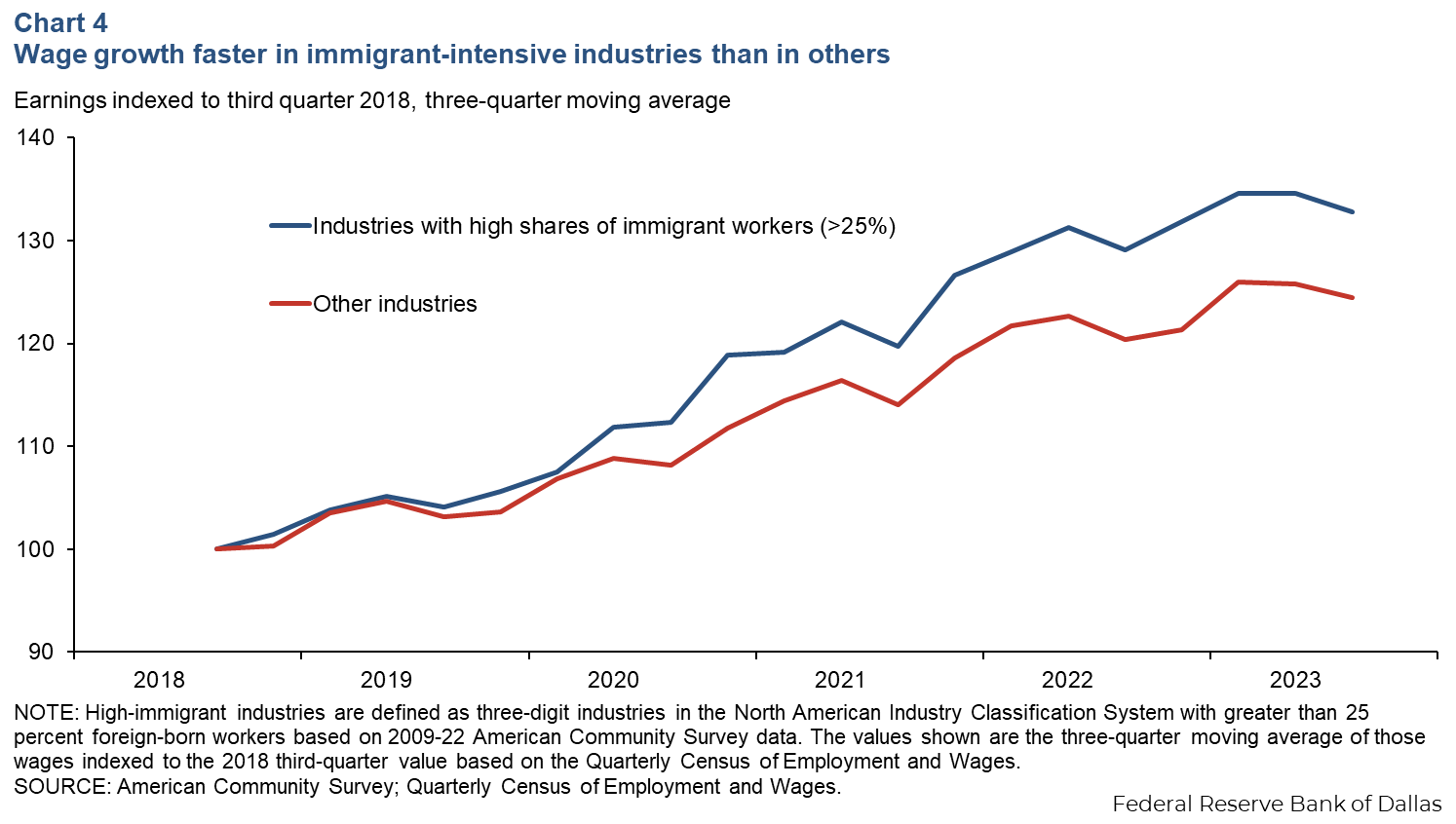

Wages also rose faster in immigrant-intensive occupations and industries than in those that had a lower share of immigrants ( Chart 4 ). Studies have shown that U.S. labor market conditions are among the main drivers of unauthorized immigration.

Influx has significant employment and GDP effects

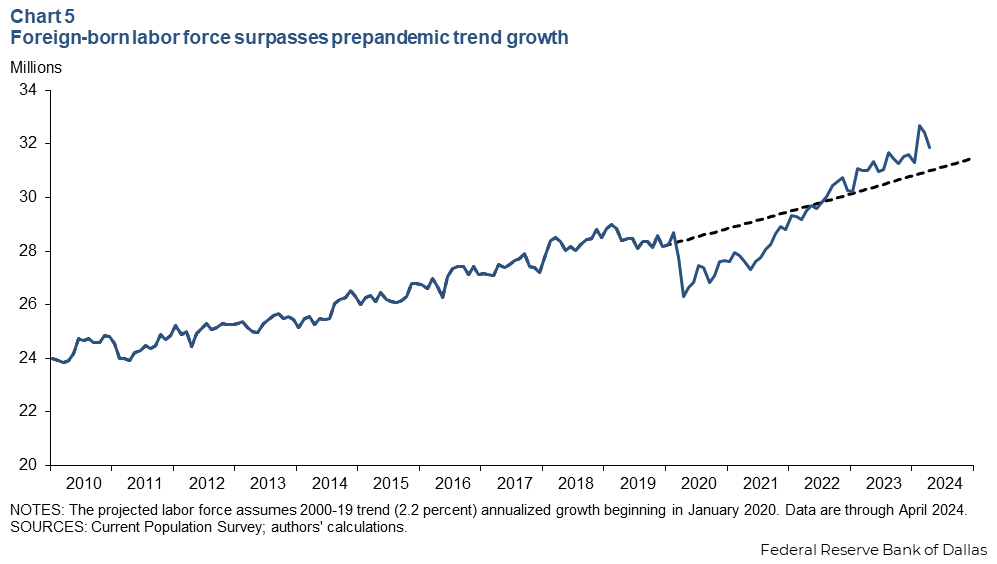

With this recent immigration wave, the foreign-born labor force has recovered completely from the pandemic drop, even exceeding what would have been expected absent the pandemic ( Chart 5 ). The foreign-born labor force reached February 2020 levels in November 2021, and surpassed trend growth in August 2022, according to the Current Population Survey.

If the foreign-born labor force had grown at the 2000–19 trend rate of 2.2 percent per year starting in January 2020, it would have been smaller by almost 900,000 people in April 2024.

The jump in ready-to-work immigrants has boosted population, labor force and job growth in the postpandemic U.S. economy. Estimates from the Hamilton Project suggest higher immigration boosted payroll job growth by 70,000 jobs per month in 2022 and by 100,000 jobs per month in 2023 and so far in 2024. The upper end of the range of job growth has doubled to 200,000 from 100,000 jobs per month absent the surge of immigration.

It’s not unusual for immigration to account for high shares of job growth. Before the pandemic, from 2010 to 2019, the share of job growth attributable to immigration averaged 45 percent.

The jump in jobs, along with immigrants’ consumption of goods and services in the United States, also bolsters GDP growth. According to the Hamilton Project study, higher immigration has contributed about 0.1 percentage points to GDP growth annually in 2022 and 2023 and is projected to do so again in 2024.

The effect on inflation, meanwhile, could be neutral on average. Higher immigration represents a labor supply shock, which should be disinflationary. But immigrants are also consumers and add to aggregate demand. While certain sectors that extensively depend on immigrants should see costs and prices fall—for example, landscaping and child care—the population influx could put upward pressure on rents and house prices, particularly in the short run before new supply can be built.

Long-run outlook uncertain, but immigration needed for growth

The immigration surge has surprised many, and not everyone agrees with the CBO numbers. But household survey data from the Current Population Survey (CPS) are consistent with CBO estimates of immigration in 2023.

According to the CPS, the foreign-born population rose by 2.5 million from December 2022 to December 2023, even as we estimate about 500,000 immigrants died. These data points are consistent with a net immigrant inflow of at least 3 million over the year. The doubts about CBO’s large number involve problems with encounter data (it measures events, not individuals), debates about migrant return rates and criticism of the household survey (whether it overcounts or undercounts immigrants).

CBO’s immigration projections are even more uncertain, with expected net immigration of 3.3 million in 2024, 2.6 million in 2025, 1.6 million in 2026 and a return to the historical average 1.1 million in 2027–33.

It’s unclear what factors drive these transitions. Potential changes in U.S. immigration policy, such as the Biden administration’s recent executive action limiting the entry of some migrants, or an economic downturn could result in gradual normalization of immigration at the border. Even so, many of the migrants who arrived in recent years will want to stay in the United States.

Asylum approval rates have risen since 2020 but reflect cases filed in years prior. It’s impossible to know what approval rates will be for those who filed their claims more recently. Humanitarian parolees, in contrast, are supposed to return to their home countries after two years.

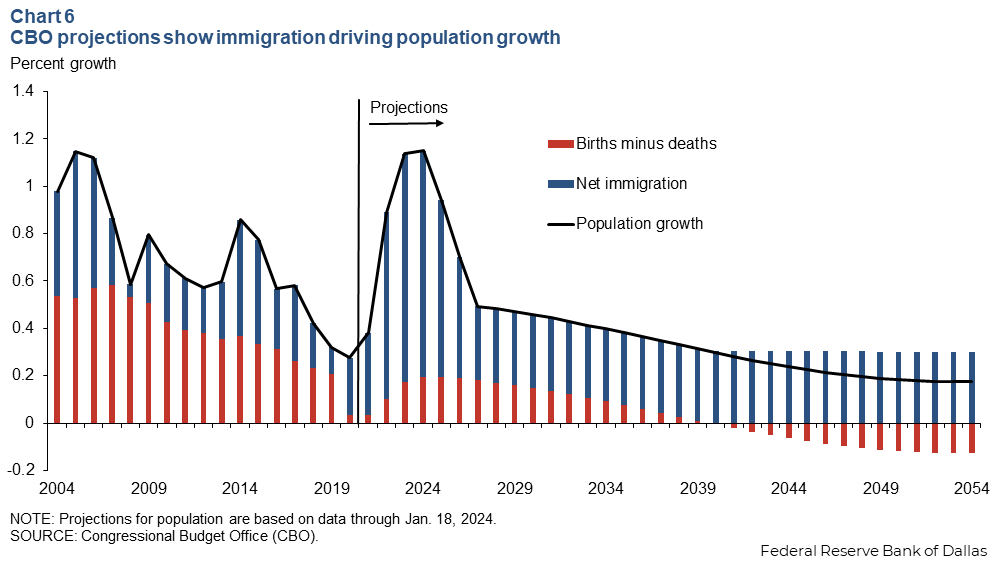

If immigration normalizes, it will return to rates that are insufficient to sustain the type of economic growth the U.S. is accustomed to. The nation is in a sort of demographic autumn, and winter is coming. The retirement of the baby boomers and overall aging of the workforce, as well as low and falling birth rates mean population growth will become entirely dependent on immigration by 2040, as deaths of U.S.-born will outpace births ( Chart 6 ).

Because economic growth depends on labor, capital and productivity, growth in these factors will set the speed limit of the economy. While technological advances and incentives for investment will contribute to productivity growth, immigration will be vital to propping up labor force growth.

About the authors

Pia M. Orrenius is a senior economist in the Research Department at the Federal Reserve Bank of Dallas.

Ana Pranger is a research analyst in the Research Department at the Federal Reserve Bank of Dallas.

Madeline Zavodny is a professor of economics at the University of North Florida.

Isabel Dhillon is a research analyst in the Research Department at the Federal Reserve Bank of Dallas.

Related Articles

U.S. Job Growth Remains Solid

The labor market showed resiliency in June, adding 206,000 jobs, a sign that economic growth remains healthy. The unemployment rate ticked up, to 4.1 percent.

- Share full article

Monthly change in jobs

+206,000 jobs in June

Talmon Joseph Smith

What to know about the latest report.

The American labor market produced another solid month of employment gains in June, the Labor Department reported on Friday. The economy added 206,000 jobs, while the unemployment rate was 4.1 percent, up from 4 percent the month before.

It was the 42nd consecutive month of job growth. But the unemployment rate surpassed 4 percent for the first time since November 2021.

Here’s what else to know:

Wage growth cooled: Average hourly earnings rose 0.3 percent from the previous month, and 3.9 percent from a year earlier, compared with a 4.1 percent year-over-year change in May. Wages have been moderating since 2022, when earnings growth was routinely above 5 percent. But in good news for workers, those milder wage gains are now outpacing inflation.

Job gains were unevenly spread : The strongest hiring increases were in government (70,000 jobs added in June), health care (49,000), social assistance (34,000) and construction (27,000). Many other industries produced scant increases, and a few, including manufacturing and retail, shed jobs last month.

Previous months looked weaker: The overall gain for June was greater than most forecasts. But revisions for April and May showed weaker growth than reported earlier. April was restated at 108,000, from the previously reported 165,000, and May’s gain was put at 218,000, rather than 272,000.

Markets were sanguine : The S&P 500 nudged higher and yields on government bonds fell, reflecting investors’ growing confidence that the Federal Reserve would begin cutting interest rates in September.

The White House hailed the job gains: “We have more work to do, but wages are growing faster than prices and more Americans are joining the work force, with the highest share of working-age Americans in the work force in over 20 years,” President Biden said in a statement. But, he added, “too many Americans are still feeling squeezed by the cost of the living.”

What economists said about the report: “These numbers are good numbers,” said Claudia Sahm, the chief economist for New Century Advisors. She added, however, that “the importance of the unemployment rate is it can actually tell us a bit about where we might be going” and noted that this rate “has been drifting up since 2023.”

Jim Tankersley

April, May and June are now officially the weakest three-month stretch of job growth in Biden’s presidency. Today’s numbers, including revisions, show average job gains during that stretch were a bit under 180,000 per month.

To be clear, 180,000 jobs per month is still a historically strong pace with an unemployment rate this low. It’s more than the economy was averaging for most of 2019, under former President Donald J. Trump, for example.

And on balance, there are real upsides in these numbers for Biden — particularly if the slowing in the job market is enough to spur the Fed to cut interest rates before the election. The president and his aides would very much like to see at least one cut before November.

Danielle Kaye

The S&P 500 inched up when it opened on Friday, boosted by investors predicting rate cuts this year. But the Russell 2000, an index of smaller companies that’s seen as more closely tied to the ebb and flow of the economy, fell 0.3 percent, a sign of concern about what a weaker labor market could mean for the economy.

S&P 500

Joe Rennison

Seema Shah, chief global strategist at Principal Asset Management, said that investors may feel a little conflicted following the jobs data. The numbers shored up expectations of rate cuts that typically act as a tailwind to stocks, “but those same figures cannot help but prompt a twinge of concern about the direction of the U.S. economy,” she said.

Advertisement

Jeanna Smialek and Joe Rennison

Fresh jobs data spurs investors to bet on a September Fed rate cut.

Year-over-year percentage change in earnings vs. inflation

+3.9% in June

+3.3% in May

Consumer Price Index

Avg. hourly earnings

A fresh employment report on Friday showed that unemployment ticked up in June as wage growth cooled, signs that the labor market continued to moderate after years of remarkable strength. That could keep Federal Reserve officials wary as they watch for clues that the job market is on the cusp of cracking.

Fed policymakers have two main goals: achieving low, stable inflation and a strong labor market. They try to accomplish that by setting interest rates, either leaving them low to bolster the economy or raising them to high levels to weigh on growth.

Since early 2022, Fed officials have been using higher rates to battle rapid inflation, focusing more on wrestling price increases under control than on the employment side of their mandate. But inflation is now cooling markedly, and keeping the job market strong has once again become a big priority for central bankers.

That is why the jobs report on Friday could be a cautionary moment.

Unemployment has been ticking steadily higher over the past year: June’s 4.1 percent reading was up from 3.6 percent a year earlier. The rate measures people who are actively looking for work but struggling to find it, so the trends suggests that it is not as easy to land a job as it was a year ago.

That’s not a huge surprise, based on other data. Job openings have come down sharply after spiking in the wake of coronavirus lockdowns. Wage growth has been moderating, a sign that employers are no longer paying so handsomely to lure new workers — average hourly earnings increased 3.9 percent from a year earlier in the June data, still solid by historical standards but the lowest reading in years.

All of it adds up to a job market that could be on the verge of cooling more drastically.

Fed officials have been clear that a sudden and notable weakening of the labor market could spur them to cut rates. The slowdown underway probably falls short of that standard, but economists and investors increasingly think that combined with cooling inflation, the labor market moderation will pave the way for a rate cut as soon as September.

Investors, who tend to prefer lower rates, pushed up stocks slightly in early trading on Friday.

Wall Street had already been leaning toward a bet that the Fed would begin to cut interest rates in September. The numbers released on Friday firmed up those expectations, with two quarter-point cuts now fully priced in this year.

President Biden cheered the jobs report, while adding his now-regular caveat about consumer prices being too high. “We have more work to do, but wages are growing faster than prices and more Americans are joining the workforce, with the highest share of working-age Americans in the workforce in over 20 years,” Mr. Biden said in a statement released by the White House.

But, Mr. Biden added, “too many Americans are still feeling squeezed by the cost of the living.”

Ben Casselman

Teen summer jobs are back! 37.3 percent of 16-to-19-year-olds were working in June, the highest rate of employment in that month since 2007. Although that pales in comparison to the record of 55.3 percent in June 1978.

Lydia DePillis

One way of looking at the composition of private-sector employment growth is to divide it into goods-producing and service-providing positions. Goods-producing jobs currently account only for 13.7 percent of jobs in the private sector, and they’ve been growing more slowly , adding only 19,000 jobs last month.

Tom Simons, a U.S. economist at Jefferies, has a persuasive take on why the fall in temp jobs might not herald a downturn: “Rather than indicating a big decline in labor market demand, we view this data as a sign that workers themselves have better opportunities for full-time employment such that they do not have to go to a temp agency."

A weaker dollar this morning also gave another boost to the strengthening of the British pound following the landslide election victory for the Labour Party in the U.K. The pound has risen 0.4 percent for the day so far, close to its strongest level since March.

Government employment is almost back to not just its prepandemic level, but also its prepandemic trend , fueled by federal stimulus funding — which will likely peter out this year, creating challenges for state and local budgets in particular.

As Ben noted, the rise in the unemployment rate was largely driven by people entering the labor force. As we’ve reported , much of that is due to increased levels of immigration, which economists at Goldman Sachs estimate added 80,000 people per month to the labor supply last year and will add another 50,000 each month this year.

The uptick in the unemployment rate doesn’t quite trigger the “Sahm Rule,” a rule of thumb that has historically indicated a recession has begun. But if historical patterns hold, the recent increase is sufficient to suggest that recession risks are elevated.

Unemployment rate

For context, another series from the Labor Department told us this week that the job openings rate was almost back to its prepandemic level, and the rate of hiring has been below its prepandemic level for several months, indicating a very low level of churn.

The thing that’s been keeping the unemployment rate low for so long has been an exceptionally low level of layoffs. But that might be changing: Initial claims for unemployment insurance have been creeping up in recent months, as have the number of people still receiving unemployment checks.

The labor force grew by 277,000 in June, as more people started jobs and began looking for work. That suggests some confidence among workers even as the job market softens.

Even before the fresh data, investors had been leaning toward the expectation that the Fed would start to cut interest rates in September, and those bets inched up slightly in response to the report. The two-year Treasury yield, which is sensitive to changes in rate expectations, fell to about 4.6 percent.

Lower interest rates also tend to lead to a lower dollar, with the currency falling 0.2 percent for the day so far. That will be welcome news to many central bankers around the world grappling with the effects of a strong dollar this year.

Jeanna Smialek

For the Fed, “today’s employment report ought to firm up expectations of a September rate cut,” Neil Dutta at Renaissance Macro wrote in a note.

Fed officials have been clear that they are trying to land the economy softly without causing a big deterioration in the labor market, so signs of higher unemployment could nudge them toward an earlier rate cut.

As has been largely the case over the past year, the gains were largely driven by three big services categories: Health care, government, and social assistance accounted for 153,000 out of the 206,000 jobs added last month.

More industries are seeing job losses

Change in jobs in June 2024, by sector

Education and health

+82,000 jobs

Construction

Leisure and hospitality

Manufacturing

Business services

Construction, which has been a surprisingly strong category as interest rates slow new investment in structures, also added 27,000.

Other sectors were pretty weak. Leisure and hospitality added just 7,000 jobs, and retailers cut 8,500 positions.

And temp jobs, which can be a bellwether for the health of the labor market, fell sharply.

It’s been remarkable to see temp jobs decline steadily from a peak of March of 2022, which is the month when the labor market reached its tightest point by a lot of indicators.

The immediate reaction in the stock market has been muted, with the S&P 500 moving from being slightly lower for the day to slightly higher after the numbers were released.

With revisions, June’s job growth is only slightly down from the 220,000 average over the previous 12 months.

Average hourly earnings climbed 3.9 percent on an annual basis, in line with economist forecasts and slightly cooler than in May. Pay increases have been gradually cooling as the labor market comes off its boil.

The unemployment rate ticked up to 4.1 percent and wage growth cooled, in line with expectations. From the Fed’s perspective, this is not a job market to panic about, but it’s definitely got some details that will keep them wary that the job market is on the cusp of slowing markedly.

U.S. employers added 206,000 jobs in June and the unemployment rate ticked up to 4.1 percent. This is the first time the jobless rate has been over 4 percent since November 2021.

April and May’s job gains were both revised down somewhat, by a combined 111,000 jobs.

Joe Rennison and Danielle Kaye

Investors are betting on rate cuts as recent data suggests a potential slowdown.

Investors are poised for a report on Friday to show a slowdown in the pace of hiring in June, building on weak services and manufacturing data, and to firm up their expectations of interest rate cuts starting as soon as September.

Signs of lower rates in the near future, which would make it cheaper for consumers and companies to borrow, have typically been accompanied by market rallies.

Stock indexes tracking larger companies have been buoyed in recent weeks. The S&P 500 has repeatedly set fresh records and is up more than 16 percent this year. However, the Russell 2000 index, which tracks smaller companies that are more sensitive to the ebb and flow of the economy, has largely flatlined, with weaker economic data this week nudging the index 0.5 percent lower ahead of the Independence Day holiday.

Economists are forecasting that the June jobs report will show a healthy labor market, albeit with fewer jobs added and an easing in wage growth. Earlier this week, widely watched surveys of manufacturing and services activity both came in lower than forecast.

Coupled with signs of cooling inflation, a deceleration in economic growth would give the Federal Reserve a justification for cutting rates, which have been held at high levels for months.

Jerome H. Powell, the Fed chair, said at a conference this week that if the economic data continued to come in as it has recently, the Fed could consider cutting interest rates.

“We’ve made quite a bit of progress in bringing inflation back down to our target, while the labor market has remained strong and growth has continued,” Mr. Powell said. “We want that process to continue.”

Mr. Powell didn’t specify when the Fed would start to cut rates but investors are forecasting that it will take action in September, with roughly two quarter-point cuts expected for the year. Those bets have increased from the start of the week, when a cut in September was seen as more of a 50/50 proposition.

The data has come in “a bit weaker than expected,” noted analysts at Deutsche Bank, “and it all added to the theme that the economy was losing momentum as we arrive in the second half of the year.”

Fed officials are keeping an eye out for cracks in the job market.

The labor market has maintained surprising vigor over the past year, but as fewer jobs go unfilled and a growing number of people linger on unemployment insurance rosters, Federal Reserve officials have begun to watch for cracks.

Central bankers have recently begun to clearly say that if the labor market softens unexpectedly, they could cut interest rates — a slight shift in their stance after years in which they worked to cool the economy and bring a hot job market back into balance.

Policymakers have left interest rates at 5.3 percent since July 2023, a decades-long high that is making it more expensive to get a mortgage or carry a credit card balance. That policy setting is slowly weighing on demand across the economy, with the goal of wrestling rapid inflation fully under control.

But as inflation cools, Fed officials have made it clear that they are trying to strike a careful balance: They want to ensure that inflation is in check, but they want to avoid upending the job market. Given that, policymakers have signaled over the past month that they would react to a sudden labor market weakening by slashing borrowing costs.

The Fed would like to see more cooling inflation data “like what we’ve been seeing recently” before cutting rates, Jerome H. Powell, the Fed chair, said during a speech this week. “We’d also like to see the labor market remain strong. We’ve said that if we saw the labor market unexpectedly weakening, that is also something that could call for a reaction.”

That’s why employment reports are likely to be a key reference point for central bankers and Wall Street investors who are eager to see what the Fed will do next.

For years, the Fed had been watching the job market for a different reason.

Officials had worried that if conditions in the labor market remained too tight for too long, with employers fighting to hire and paying ever-rising wages to attract workers, it could help keep inflation faster than usual. That’s because companies with higher labor costs would probably charge more to protect profits, and workers earning more would probably spend more, fueling continued demand.

But recently, job openings have come down and wage growth has abated, signals that the job market is cooling from its boil. That has caught the Fed’s attention.

“At this point, we have a good labor market, but not a frothy one,” Mary C. Daly, the president of the Federal Reserve Bank of San Francisco, said in a recent speech . “Future labor market slowing could translate into higher unemployment, as firms need to adjust not just vacancies but actual jobs.”

The unemployment rate has ticked up slightly this year, and officials are watching warily for a more pronounced move. Research shows that a sudden and marked uptick in unemployment is a signal of recession — a rule of thumb set out by the economist Claudia Sahm and often referred to as the “Sahm Rule.”

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Research: Using AI at Work Makes Us Lonelier and Less Healthy

- David De Cremer

- Joel Koopman

Employees who use AI as a core part of their jobs report feeling more isolated, drinking more, and sleeping less than employees who don’t.

The promise of AI is alluring — optimized productivity, lightning-fast data analysis, and freedom from mundane tasks — and both companies and workers alike are fascinated (and more than a little dumbfounded) by how these tools allow them to do more and better work faster than ever before. Yet in fervor to keep pace with competitors and reap the efficiency gains associated with deploying AI, many organizations have lost sight of their most important asset: the humans whose jobs are being fragmented into tasks that are increasingly becoming automated. Across four studies, employees who use it as a core part of their jobs reported feeling lonelier, drinking more, and suffering from insomnia more than employees who don’t.

Imagine this: Jia, a marketing analyst, arrives at work, logs into her computer, and is greeted by an AI assistant that has already sorted through her emails, prioritized her tasks for the day, and generated first drafts of reports that used to take hours to write. Jia (like everyone who has spent time working with these tools) marvels at how much time she can save by using AI. Inspired by the efficiency-enhancing effects of AI, Jia feels that she can be so much more productive than before. As a result, she gets focused on completing as many tasks as possible in conjunction with her AI assistant.

- David De Cremer is a professor of management and technology at Northeastern University and the Dunton Family Dean of its D’Amore-McKim School of Business. His website is daviddecremer.com .

- JK Joel Koopman is the TJ Barlow Professor of Business Administration at the Mays Business School of Texas A&M University. His research interests include prosocial behavior, organizational justice, motivational processes, and research methodology. He has won multiple awards from Academy of Management’s HR Division (Early Career Achievement Award and David P. Lepak Service Award) along with the 2022 SIOP Distinguished Early Career Contributions award, and currently serves on the Leadership Committee for the HR Division of the Academy of Management .

Partner Center

We've detected unusual activity from your computer network

To continue, please click the box below to let us know you're not a robot.

Why did this happen?

Please make sure your browser supports JavaScript and cookies and that you are not blocking them from loading. For more information you can review our Terms of Service and Cookie Policy .

For inquiries related to this message please contact our support team and provide the reference ID below.

How a New York short-seller took on one of the world's richest people, wiped out $150 billion in market value, and barely made any money

- Activist short-seller Hindenburg Research wiped out $153 billion in market value from Adani Group.

- It recently disclosed that it made just $4 million for its efforts.

- Detailed below is the war of words that's taken place over the past 18 months.

Nate Anderson, the chief mind behind activist short-seller Hindenburg Research, has had an eventful past 18 months.

In January 2023, he accused the Indian conglomerate owned by Gautam Adani — one of the world's richest people — of fraud, subsequently wiping out $153 billion in market value from its associated companies. This led Indian regulators to his doorstep and forced him into defensive mode. A war of words has persisted ever since.

A year and a half later, the battle continues. And based on new information released by Hindenburg, one might wonder whether it was all worth it.

The firm — which describes itself as specializing in " forensic financial research " — recently disclosed that it's made just $4 million from its considerable efforts. Compared to the nine figures of market value it helped erase, and the $80 billion wiped from Adani's personal fortune, that's a drop in the bucket.

Detailed below is the considerable back-and-forth that's taken place since Hindenburg's initial shot across the bow of Adani Group. The tale that follows highlights the lengths a global conglomerate — and the regulatory body with a vested interest in keeping it afloat — will go to defend itself. It also shows the resolute nature of Anderson as he continues fighting back.

The initial report

Hindenburg accused Indian business magnate Gautam Adani in 2023 of pulling off the "largest con in corporate history." It was the result of a two-year-long investigation, which found a number of financial and accounting irregularities in Adani's empire, the firm said in its 106-page report.

"Indian conglomerate Adani Group has engaged in a brazen stock manipulation and accounting fraud scheme over the course of decades," the report said. "We believe the Adani Group has been able to operate a large, flagrant fraud in broad daylight in large part because investors, journalists, citizens and even politicians have been afraid to speak out for fear of reprisal," it later added.

Hindenburg identified at least 38 shell companies closely related to Adani Group, which it said appeared to engage in stock manipulation and money laundering. It cited "numerous examples"of those companies funneling money through private companies owned by Adani, before cash was set to Adani's listed public companies.

The short-seller's investigation also found Adani's private and public companies to have "numerous" undisclosed transactions with other parties, the researchers found, which violates regulatory laws in India.

The "labyrinthian network of shells appears to serve several functions, including shuffling losses into private entities to boost reported earnings, and surreptitiously moving money to prop up entities in the group," Hindenburg said.

Adani Group was also affiliated with a number of funds that displayed "flagrant irregularities," the research firm said, such as being offshore entities, having concealed ownership information, and having portfolios being "almost exclusively" invested in Adani's firms.

One such fund, Elara, controlled another fund that was around 99% concentrated in Adani shares. That suggested to the researchers it was "obvious Adani controls the shares," the report said.

Hindenburg attached a list of 88 questions for Adani to answer, which included inquiries into the billionaire's close contacts, Adani Group executives, and investigations into the company by regulators.

"If Gautam Adani embraces transparency, as he claims, they should be easy questions to answer," the report said.

The response

Nursing deep stock losses, Adani Group hit back with its own 413-page response , calling Hindenburg's original report "nothing but a lie."

"We are shocked and deeply disturbed to read the report published by the 'Madoffs of Manhattan,'" the reply said, referring to Hindenburg.

"The document is a malicious combination of selective misinformation and concealed facts relating to baseless and discredited allegations to drive an ulterior motive," it added.

The firm disclosed information on its accounting practices and professional relationships, while disputing many of the claims in the Hindenburg report.

Transactions that were identified as suspicious by Hindenburg's team were in compliance with local laws and accounting standards, it said. Offshore companies and funds mentioned in Hindenburg's report were merely public shareholders in Adani-listed companies, the retort added.

Related stories

"A listed entity does not have control over who buys/sells/owns the publicly traded shares or how much volume is traded, or the source of funds for such public shareholders nor it is required to have such information for its public shareholders under the laws of India. Hence we cannot comment on trading pattern or behavior of public shareholders," Adani's report said.

The firm also criticized Hindenburg for its financial stake in releasing the report, calling the firm an "unethical short seller" and guilty of a "flagrant breach of applicable securities and foreign exchange laws."

"This is rife with conflict of interest and intended only to create a false market in securities to enable Hindenburg, an admitted short seller, to book massive financial gain through wrongful means at the cost of countless investors," it said.

Hindenburg issued a reply to Adani on the same day, denying any wrongdoing from its original report. They argued that Adani Group's reply failed to answer most of their questions. The conglomerate also didn't dispute the existence of certain "suspect" transactions, nor did it explain "their obvious irregularities," researchers added.

"We also believe that fraud is fraud, even when it's perpetrated by one of the wealthiest individuals in the world," Hindenburg Research said in its reply.

Adani Group eventually lawyered up and readied for a fight, though the damage had already been done. In less than a week, Adani, known as the world's third richest man, saw his personal wealth plummet by $52 billion.

Conflict over Hindenburg's short-selling arrangement

Indian regulators have raised specific questions about the structure of Hindenburg's short bet on Adani Group. The Securities and Exchange Board of India — the country's version of the SEC — sent a notice to Hindenberg in June 2024, raising questions about the nature of the report and the firm's relationship with Kingdon Capital Management, a New York hedge-fund involved in building a short position against Adani Group.

Hindenburg's initial report was described to be "misleading" and have contained "inaccurate statements."

"These misrepresentations built a convenient narrative through selective disclosures, reckless statements, and catchy headlines, in order to mislead readers of the report and cause panic in Adani Group stocks, thereby deflating prices to the maximum extent possible and profit from the same," the notice read.

Regulators also revealed that Hindenburg had shared its research with Kingdon prior to publication. The two companies had a profit-sharing agreement, the notice says, with Hindenburg set to get 25% of Kingdon's profits for the short bet.

Kingdon ended up making $22.3 million on the bet, $5.5 million of which is owed Hindenburg. $4.1 million of that had been paid as of the start of June, the document shows.

Hindenburg shrugged off the letter as "nonsense," and an attempt to ward off whistleblowers who expose corruption among the country's most powerful people and companies.

"One might think that a securities regulator would be interested in meaningfully pursuing the parties that ran a secret offshore shell empire engaging in billions of dollars of undisclosed related party transactions through public companies while propping up its stocks through undisclosed share ownership via a network of sham investment entities," Hindenburg said in its reply.

It added: "Instead, SEBI seems more interested in pursuing those who expose such practices."

A passion for 'finding scams'

Backlash is nothing new to Anderson, who's targeted other high-profile financiers and began sniffing out wrongdoers on Wall Street long before he launched Hindenburg Research in 2017.

This decade alone he's been instrumental in weeding out companies in the electric-vehicle industry. His work on Nikola led to fraud charges against its founder, and he also called out now-defunct Lordstown Motors for hyping up commercial interest in its product.