TOP 30 Case Studies of Customer Experience in Banking and Fintech Design

UXDA | Financial UX Design

This collection of the best UX case studies on creating and researching the customer experience in digital banking and Fintech apps. These articles are collected from Medium and arranged based on the amount of applause in 2023. This banking apps collection offers an excellent opportunity to get instant inspiration from 30 insightful UX case studies demonstrating how to design modern digital financial solutions.

Post by Alex Kreger, financial UX Strategist/Founder of UX Design Agency

1. Islamic Bank in Qatar: Creating Omni-Channel Experience

👏🏻 3.7k applause.

Case study by Atishay Goyal

A team of 8 developers, 1 Business Analyst, and 1 UX designer was setup onsite in Qatar to execute the revamp of CB’s digital presence and an Omni-Channel experience to its customers. This included retail, personal and corporate banking over web, mobile, ATM, call centers, and marketing channels.

We were not too focused on the competitor analysis as CB was one of the best apps in Qatar / Islamic Banking. Our major aim was to innovate and build something which ensures CB maintains the legacy.

In close collaboration with the marketing team, the design team came up with 7 factors (short-term and long-term) that would define the success of the new experience which CB offered. Initially was considered the HEART framework from Google and then cut short the parameters so that they can be measurable for an MVP.

UX Case Study: Omni-Channel Banking for the largest Islamic Bank in Qatar

An attempt to refine the banking experience of islamic banking with gesture and smart feature based workflow..

uxdesign.cc

2. Light Bank App: 10 Steps to Luxury Mobile Banking

👏🏻 3.3k applause.

Case study by UXDA | Financial UX design architects

UXDA team spent several months designing Light Bank. The end result is based on experience gained by solving financial design challenges daily and driven by their passion to disrupt the financial world in order to make it all about the users and their needs.

We dared to create the simplest, most beautiful and delightful banking UI experience in the world, while maintaining the full-scale digital banking functionality.

The story about Light Bank has become one of the most popular banking customer experience case studies ever made, reaching more than 50 000 views on Medium alone. It has been awarded by globally famous international design awards such as International Design Awards (IDA), London Design Awards, A’Design Award, DNA Paris Design Award, and also nominated for one of the world’s biggest and most prestigious design awards─the iF Design Award 2019 and the Red Dot Award 2019.

UX Guide: How to Create Simplest and Most Beautiful Banking Design in The World

What if there was a banking solution designed by apple would all the other digital financial services be forced out of….

uxplanet.org

3. ITTI Digital Back-Office: Complete Digital Transformation

👏🏻 1.2k applause.

The main challenge of ITTI Digital when they started working with UXDA was to disrupt the banking industry by creating a never-before-seen core-banking solution 100% focused on the employees: a solution that would take into account all bank employees’ pain points, needs and daily tasks, thus making their job easier, enjoyable and more meaningful from a banking end-customer perspective.

Most banks reveal they are very afraid of making such a huge and revolutionary shift, changing a structure that has been working for decades, but ITTI Digital is living proof that it’s 100% worth it.

During the project, ITTI Digital learned to make users their main priority, and their perception changed dramatically. It felt like they had finally opened their eyes to what has always been right in front of them─their users.

UX Design Case Study: Complete Banking Back-Office Transformation

We are sharing an exclusive step-by-step case study that clearly demonstrates the huge power of ux design transforming…, 4. cashmetrics: finance management service, 👏🏻 880 applause.

Case study by Tubik Studio

CashMetrics provides support for retailers, mainly in the fashion segment: it helps to organize their operations and monitor cash flows. It is aimed at simplifying operational processes, with a key focus on tracking profits, shipping costs, and fees.

Mobile and web applications help to effectively manage financial and communication issues and this way design directly supports the business.

When it comes to financing, the first idea that immediately comes to mind is boring tables and complex calculations. So, the primary goal was to step away from dull, unclear, and overwhelming data presentation and make the service eye-pleasing and easy to use.

Case Study: CashMetrics. User Experience Design for Finance Management Service

Ux design process for cashmetrics, the service helping retailers manage cash and operate effectively: dashboard and…, 5. banking as a game saving children’s financial future, 👏🏻 825 applause.

Adults struggle with finances but want their children to be successful people with good financial habits. Almost 60% of all working-age Americans have no retirement savings. At the same time, 49% of parents don’t know how to discuss finances with kids in an understandable and enjoyable way. Four in ten adults couldn’t cover a $400 emergency expense in the U.S.

We have to expand the horizon of banking apps by focusing not only on standard banking features and functionality but also on connecting finances with relationships between family members.

How could parents ensure their kids’ financial future? UXDA explored this challenge with a research-based kids’ banking app concept. It provides insights on how an app could impact family relationships, create a good foundation for their kids’ financial future and ensure a successful inclusion of children in the modern digital economy.

UI/UX Case Study: Banking as a Game Saving Children’s Financial Future

Adults struggle with finances but want children to be successful people with good financial habits. what if a banking…, 6. how we designed ai-powered spatial banking for apple vision pro, 👏🏻 813 applause.

With the launch of Vision Pro, Apple intends to shift the digital world from mobile computing, in which they have become trendsetters, to revolutionary spatial computing. Wizards from Cupertino offer a mind-blowing spatial experience on the visionOS platform. But how could spatial banking look and feel?

It looks like Apple is once again poised to take humanity to a new experiential frontier ahead of the next digital revolution. Vision Pro is just the first step toward mixed reality, testing technology and user experience. How should the banking industry prepare for this, and what should we consider?

Imagine a digital bank of the future. Unlike the traditional one, this future bank will be in constant dialogue with the user and take maximum care of the user’s financial life. At its heart will be an AI-powered advisor that constantly analyzes a multitude of data to find the best solutions for the user.

How We Designed AI-Powered Spatial Banking for Apple Vision Pro

Will the launch of apple vision pro start the next digital revolution wizards from cupertino offer a mind-blowing….

medium.muz.li

7. Banking Super App: Hundreds Of Features in One Mobile Solution

👏🏻 791 applause.

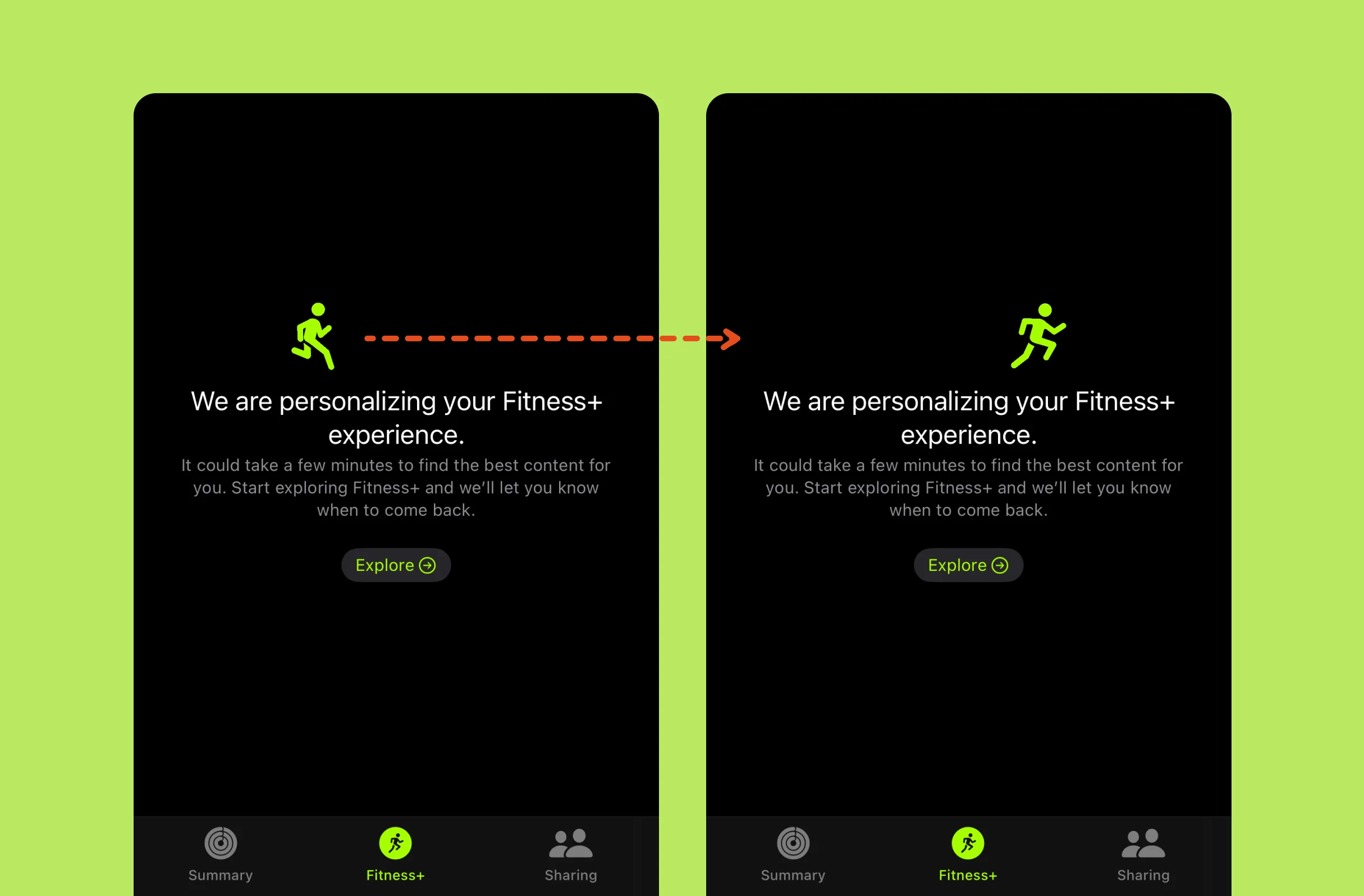

The presence of a large number of products and the flow of big data passing through the bank can become a promising basis for building a highly personalized banking ecosystem around a specific user. And, today, there are more and more advanced technological solutions of data processing and personalization through AI in banking accessible on the market.

However, despite the technological opportunities, the key challenge is delivering the super app experience in a clear and user-friendly way.

When considering how to create a banking super app, there’s an important question to answer: how will it work technically? As this kind of financial digital product is complex, a banking super app could rely on 10 digital banking trends.

UX Case Study: How to Create a Super App

The future of banking — the ultimate banking super app ux/ui design concept case study., 8. fintarget trading: how to attract newbies, 👏🏻 690 applause.

Case study by Purrweb

The BCS team suggested the hypothesis: the company will attract more customers if it proves that investing is easy — even for those who don’t have any experience. To quickly test the hypothesis, the BCS team decided to get started with an MVP.

BCS had a perfect tool for newbies — auto-following. The service was popular among current BCS clients but no one from the outside world knew about it.

The team found a perfect balance between deadlines, complicated topics, and agreements — this was the block-by-block UI/UX design for MVP. As a result, Fintarget released an investment platform within 1.5 months instead of the predicted three.

How to Attract Newbies to The Sophisticated Investment World. A UI/UX Case Study

Using a real-project example, the purrweb team explains how ui/ux design can simplify investments for newbies..

productcoalition.com

9. Metaverse Banking: First VR / AR Design Concept

👏🏻 687 applause.

True mixed reality potential lies far beyond games; it’s a new digital platform that provides a revolutionary user experience. VR and AR technologies will merge digital content with the real world to create one constant reality.

We could say that the modern digital world as we see it today is only the basic preparation stage for the immersive mixed reality that we will fully experience in a few decades.

The only way to be ready for the revolutionary switch to VR/AR digital reality is to start generating ideas and concepts today. With this case study, UXDA team encourages the industry to view financial products through the lens of the future. As technological advancements are rapidly developing and bringing more and more benefits for the customers, this is a must for any company that strives to become more successful, not only today but also in the future.

Case Study: World’s First Mixed Reality VR / AR Banking UX/UI Design Concept

Virtual reality (vr) and augmented reality (ar) are nothing new for passionate gamers, but, in other industries…, 10. next-gen hedge fund ui for nba players, 👏🏻 635 applause.

Magma Capital Funds, a Chicago-based private hedge fund investment manager hired UXDA to design a next-gen investment platform, Magma, for high-net-worth individuals. The aim was to create a quantitative hedge fund product to simplify and enhance the investment experience with cutting-edge technologies. The team has incorporated machine learning and artificial intelligence technology into the core of its back-end, and they needed an equally advanced client dashboard.

Magma Capital Fund’s challenge was to invent a digitally-driven customer-focused solution that makes the abstract concept of investment real and clear to digitally-native users. They needed a Magma product to wow the new generation of HNWI investors with luxury aesthetics and a simple and fully digitized onboarding experience while empowering them with a sense of control, sophistication and affiliation.

The traditional world of hedge fund investing is known for its high risks and requires an analytical approach with careful decision-making, which is what makes it so conservative. To create an innovative product in the conservative hedge fund industry, you need courage and a progressive mindset.

UX Case Study: Designing Next-Gen Hedge Fund UI for NBA Players

Magma capital funds, a chicago-based private hedge fund investment manager hired uxda to design a next-gen investment…, 11. applying chatgpt experience to conversational banking, 👏🏻 622 applause.

AI-powered solutions such as ChatGPT could fuel new types of products in banking, more personalized and more connected to users, but integrating innovative technologies often causes complications in terms of user experience. And here, the methods of financial UX design are very effective, as they help to imagine the unimaginable and create a digital solution, focusing on the needs of users. Let’s explore how it works with designing ChatGPT-like conversational banking products.

BELLA’s founders aimed to design their app as the heart and soul of their brand, to fulfill their mission and bring a breath of fresh air to the industry. They set out to bridge the emotional gap and break down the barriers of traditional user experience models by treating users like family members.

This case study illustrates an example of how disruptive AI technologies, such as ChatGPT, could be integrated into the banking experience with the help of customer-centered UX design.

UX Case Study: Applying ChatGPT Experience to Conversational Banking

Ai-powered solutions such as chatgpt could fuel new types of products in banking, more personalized and more connected…, 12. banking super app design to modernize mauritius, 👏🏻 607 applause.

Mauritius Telecom (MT), the largest telecommunications company in Mauritius, had the vision to ensure a powerful digital future for Mauritians. To achieve this, the MT team needed to expand their digital ecosystem by reinventing the existing my.t money app and transforming it into a digital bank. To open up new digital opportunities for the people of Mauritius, the MT team has moved beyond a regular service app and introduced the first financial Super App in Mauritian history.

Privacy is a crucial concern for users, and we addressed that in the design approach. The aim was to ensure a safe and secure experience for users, providing the option to hide sensitive information.

With a customer-centered mission, MT aims to modernize the islands of Mauritius Republic and make the lives of its 1.3 million inhabitants much more convenient and advanced through innovation and technology. As telecom leader MT uses its power to bridge a financial and payments technology gap.

Rich but well-balanced information architecture and a frictionless user journey were crucial to ensure easy access to essential everyday tasks while exploring multiple opportunities of the my.t money Super App. That required careful planning and continuous user testing and improvements throughout the user experience design process.

UI/UX Case Study: Banking Super App Design to Modernize Mauritius

Mauritius telecom (mt), the largest telecommunications company in mauritius, had the vision to ensure a powerful…, 13. purpose-driven financial investment platform design, 👏🏻 604 applause.

The Runrate app challenge was to seamlessly combine planning, budgeting and investing with a philosophy of manifesting the future. And, to create such a never-before-seen product, the project team needed the courage to change their mindset and enter the unknown.

Developing a new type of product always runs the risk of being unclear to users. As we implement non-standard features, user interaction may get complicated because of the need to learn and adapt to an unfamiliar mental model. To seamlessly integrate that unique model, we focused on researching user scenarios, prioritizing features in line with the business purpose and developing intuitive user flows.

We all get inspired by many different things ─ art, music, philosophy, movies, etc., and we don’t even think about how these things can sync with the financial industry. But, all of this relates to the human experience, to our emotions and the meaning of life. And we need the courage to shift our mindset and bring all of that into the financial world to put real meaning behind the money!

UX/UI Case Study: Purpose-Driven Financial Investment Platform Design

The runrate app challenge was to seamlessly combine planning, budgeting and investing with a philosophy of manifesting….

theuxda.medium.com

14. MasterCard: Pre-Paid Card Management

👏🏻 600 applause.

Case study by Davide Tremolada

MasterCard wants to allow users to manage their cards and solve problems in-app. To do that, they requested a redesign of the card management section, which would provide a clear and simple flow, where users feel secured.

We were able to work closely as a team, prioritizing a supportive approach to ideas and sketching instead of endless debating.

Using research and testing were fundamental steps into understanding the real needs and pain points of the users. More importantly, they gave us the knowledge to solve each step in an effective and smooth way.

MasterCard — Pre-Paid Card Management. A UX Case Study.

How to solve problems in-app, following users’ goals.

blog.prototypr.io

15. Akuna: Personal Budgeting Reimagined

👏🏻 586 applause.

Case study by Denislav Jeliazkov

On average, millennials who carry debt report owing to a total of $27,900 (excluding mortgages), slightly less than baby boomers and about $8,000 less than the average amount Gen Xers owe. 34% of Americans don’t know how much of their monthly income goes toward paying down their personal debt.

I led efforts to evolve the service and address customer pain‐points related to the spending and planning experiences.

The team was focused on features related to solving some of the major desired outcomes found in the initial research. The app should be simple and easy to understand. Also, encouraging them to build financial habits.

Personal Budgeting Reimagined — A UI/UX Case Study

Contactless cards and online shopping sites make payment a breeze., 16. bank of jordan: from 2,8 to 4,7 app rate in six months, 👏🏻 563 applause.

It took six months for the Bank of Jordan’s mobile banking app to go from a 2.8 to 4.7 star rating on Google Play. How? By teaming up with UXDA to create a comprehensive UX transformation. This changed the app dramatically, making banking more accessible and convenient than ever before for millions of customers in the Middle East.

In a step-by-step UX case study, we guide you through this unique digital transformation that completely changed the way so many people view their banking.

In the last couple of years, there’s been a “spring” of rapid banking digitalization in the Middle Eastern regions. Many huge and influential market players have launched new mobile banking apps for their retail customers. One such success story comes from a well-known and respected Middle Eastern bank─the Bank of Jordan.

UX Case Study: Use Empathy to Rise the App Rating from 2,8 to 4,7 in Six Months

It took six months for the bank of jordan’s mobile banking app to go from a 2.8 to 4.7 star rating on google play. how…, 17. bitex: chinese stock analysis app, 👏🏻 520 applause.

The task was set to make a complete redesign of a live application Bitex oriented initially to the Chinese market. The application is an aggregator that collects data from world exchanges, processes it, builds the necessary charts and diagrams and displays this information in a user-friendly and digestible way. The main goal of Bitex is to help the trader decide on investments.

The fact is that many users from Asian countries believe that the more information is shown on the page, the better.

An interesting feature was discovered in the subconscious perception of color-coding. Here’s the simplest example: in Western resources about finance, the rise in the share price is indicated in green and the drop in red. Meanwhile, in Asian countries, everything is the opposite. Since investors planned to enter the Western market, we were forced to add a switch “color growth price” to solve this problem.

Case Study: Bitex. UX Design Challenge for a Stock Analysis App

When you start working on a new application as a ux designer, you never know beforehand what knowledge you might need…, 18. igtb: corporate banking with 5,000+ screens, 👏🏻 512 applause.

In the world of banking, there are a lot of complex digital solutions. Among them are some truly exceptional ones, such as Contextual Banking Experience (CBX), a corporate banking product by iGTB (Intellect Global Transaction Banking), part of Intellect Design Arena. It consists of 5,000+ screens and is continuously growing. An outstanding effort was needed to integrate Design Thinking principles and UX design approach into such a huge banking solution development.

Working with Intellect Design Arena has been a remarkable experience for UXDA in many ways. It’s a unique opportunity to get a chance to work closely together with one of the world’s leading banking software vendors.

If we use the analogy with spaceships, mankind dreams about spaceships that are easily able to travel billions of miles through our solar system. Unfortunately, existing spaceships weren’t constructed for multiple takeovers and landings on other planets until the “SpaceX” program appeared, with an ambitious mission to land on Mars. iGTB has a similar mission in corporate banking to ensure huge, corporate, multi-account budget management with ease. Hence, the innovative iGTB solution was built.

UX Case Study: Building a Banking SpaceUX Shuttle

In the world of banking, there are a lot of complex digital solutions. among them are some truly exceptional ones, such…, 19. monese: smart transactions and spending breakdowns, 👏🏻 493 applause.

Case study by Monese

For the spending management features to be understandable, Monese needed to get the clearest data out of the raw, original transaction data. Using location databases and online resources, Monese was able to match the name of the merchant, the address and a lot of other details. In addition, Monese built a merchant service in-house, to show the right logo for most merchants and treat chains and stand-alone businesses differently. The result was a drastically improved look and feel, with richer, smarter insights.

Since we are not the first company to offer spending features, we didn’t want to just do what others are doing. We wanted to create the best solution, one that will fix the pain points of other services.

Monese took a lot of inspiration from music charts. Not just because “top lists” are amazing but also because they are built to keep you engaged and excited. A music chart, just like the Monese merchant chart, is always updating and can point out changes and trends.

UX case study: Smart transactions and spending breakdowns using location data

At monese, we want people to bank freely wherever they are without all of the annoying, sometimes impossible…, 20. bkt: turning a 100-year-old bank into a digital innovator, 👏🏻 491 applause.

Banka Kombëtare Tregtare (BKT), the largest and oldest operating commercial bank in Albania, recognized that their digital offerings have lagged behind and needed a revamp to adapt to present-day service requirements. They challenged UXDA to update the bank’s legacy operations by designing an app that would enhance customer service and empower clients to make smarter financial decisions. The goal was to change the perception of the brand from complex and formal to friendly and pleasant.

The existing app had functionality problems, with users finding it difficult to perform certain tasks, such as easily accessing transactions, resulting in confusion about their financial situation. The outdated design also strengthened their perception of BKT as an old-fashioned and complex bank, which was not reflective of the bank’s brand identity and value proposition.

Embracing change in a large financial corporation can be a daunting task, but BKT demonstrated that even big, established 100-year-old banks can successfully update their legacy to keep up with the digital age. They recognized that the banking app was more than just a digital channel — it was a product in its own right. Therefore, they directed increased attention and funding to turn it into a key asset to execute the brand’s mission.

UX Case Study: Turning a 100-Year-Old Bank into a Digital Innovator

Banka kombëtare tregtare (bkt), the largest and oldest operating commercial bank in albania, recognized that their…, 21. united arab bank: transition to next-gen experience, 👏🏻 458 applause.

United Arab Bank (UAB) is an established, leading financial solutions provider in the United Arab Emirates (UAE), offering its clients tailor-made financial services in corporate and retail banking in the UAE. However, they felt that UAB’s mobile banking does not entirely reflect their brand’s values and mission of providing an excellent customer experience for digital banking in the UAE. UAB wanted to serve customers with a full range of digital offerings, but, for some tasks, people were still visiting the physical branch.

The UAB team faced a challenge in enhancing the mobile banking experience for its users. They viewed the existing app as having a complex, confusing flow and an outdated design, which made it difficult for users to perform tasks and left a negative perception of its functionality and even the brand. Users were presented with a lot of information and description of details before performing the action. As a result, many users preferred to visit a physical branch rather than use the app.

UAB team achieved a customer-centered design for the most important user flows in the app and make improvements in line with the established bank brand and digital strategy. These adjustments helped the bank enhance the customer experience and digitize financial behavior patterns. With the help of UX, the UAB team was able to reinvent traditional bank services and bring a breath of fresh air into its digital ecosystem.

UX Case Study: Arab Bank’s Transition to Next-Gen Experience

United arab bank (uab) is an established, leading financial solutions provider in the united arab emirates (uae)…, 22. budgit: made with vulnerable customers in mind, 👏🏻 438 applause.

Case study by Jaymie Gill

budgit is a money management app that empowers and encourages vulnerable customers to control, maintain, and track their spending. Customers can get control of their money with a budget, gain awareness of their spending habits with insights, and access tools that assist them with financial management.

This project was created as my submission for D&AD’s New Blood Awards 2020 ‘Barclays UI/UX/IxD Digital Service Design’ brief.

Offering adaptive & accommodating digital banking tools and services, budgit supports vulnerable customers with everyday banking, helping them manage their money better, and in doing so, improve their mental & financial health.

‘budgit by Barclays’, a UX Case Study

Making money management work for mental health, 23. instadapp: blockchain decentralized application redesign, 👏🏻 425 applause.

Case study by ULTIM STUDIO

InstaDApp is a decentralized application that allows individuals to track their distributed blockchain assets over a range of products and move them around based on real-time market data.

InstaDApp is a fairly new product and even though the overall product brings value to users, we‘ve spotted some UX issues that are undermining the user experience for power users.

If you are not familiar with what decentralized applications (dApps) are, dApps exist and run on a blockchain network in a public, open-source, decentralized environment and are free from control and interference from any single authority, unlike standard apps such as Airbnb or Uber that run on a system which is owned and operated by an organization giving it full authority over the app and its database.

Redesigning the InstaDApp Dashboard — A UX Case Study

Redefining the future of decentralized banking., 24. bkash: redesign of the first mobile banking in bangladesh, 👏🏻 409 applause.

Case study by pixorus studio

bKash is the very first mobile banking service provider in Bangladesh. People who have a mobile and a bKash account can utilize all of the facilities provided by bKash. This app is a simple, easy-to-use and highly secure mobile money app for sending cash quickly to people, recharging mobile balance, paying at your favorite stores and shops, making utility and other bill payments from home, and so much more.

Understanding the audience is the main thing to know, that is needed to develop something that works for users.

The challenge was to find out the proper number of active app user, interviewing them to find out more problems, make a solution, exploring new ideas/features and finally design something that really solves user’s problems.

UIUX case study: Mobile banking app “bKash” redesign concept. (Step by step process)

A conversation between the three team members of pixorus that drove them to redesign a new concept for a pioneer of…, 25. accountable: a better solution to pfm, 👏🏻 368 applause.

Case study by Timothy Ogundipe

Accountable was designed to solve the problems around tracking of finances, access to financial records, spending analysis, budgeting and financial education.

Millennials want services that are immediate, reliable and offer a wide range of convenience.

We make use of money in our day to day activities. We spend money on what we want and what we need. Subscriptions and recurring expenses are ever-increasing due to our wants and needs. They begin to accumulate and get difficult to manage.

UI/UX case study: Providing a better solution to personal finance management.

Introduction, 26. monzo: designing a better borrowing experience, 👏🏻 344 applause.

Case study by Juliana Martinhago

There are cemented mental models around credit. Especially when it comes to loans. Some people are averse to the idea completely. This is often because of previous bad experiences of their own, or relatives. It doesn’t matter how well you build your product, some people just don’t want to use it.

We want to ensure that if anything goes wrong, we’ve got our customer’s backs. Human customer service is one of Monzo’s key attributes and it’s not different with Lending.

Designers will always strive for straight-forwardness, speed and simplicity. However, in Lending, you might want to reconsider. Monzo’s loans flow has always been incredibly smooth, but during some of user testing sessions, many people felt it might be “too easy”, and that can be scary. You might not want to offer people a loan in a couple of taps, but you still can keep it simple, of course.

Designing a better borrowing experience

What we’ve been learning while trying to solve a challenging problem and make borrowing work for everyone, 27. instadapp: blockchain decentralized application redesign, 28. loan management system redesign, 👏🏻 180 applause.

Case study by Julia Bondarenko

The old Loan system had an outdated UI and couldn’t support new business flows, which have developed over years in the industry. It was a stand-alone system, not included into the whole core banking system, which led to inconsistencies in the UI and data architecture.

The UI design was made to be easy for an eye, because users would typically work with the Core Banking system for majority of their work day.

The team updated the UI according to the new standards, also enhancing UX by intuitive flows and appropriate system feedback. New business flows were added to the system. The loan system was integrated into the complex architecture of the whole core banking system, accessible from multiple browsers.

Core banking system — a UX case study

This ux case study provides a detailed description of how i designed core banking systems as a senior ux…, 29. jenius redesign: solution toward a cashless society, 👏🏻 65 applause.

Case study by Floater

With Jenius, you’ll have full control of how you want to transact and manage your finance with your smartphone in a safe, easy, and smart way, just from the tip of your finger toe.

According to The Jakarta Post, the top five e-wallets based on monthly active users is GoPay, OVO, Dana, LinkAja, and Jenius. With the demographic users ranging from 20 to 35 years old.

Sometimes, with the redesign, there are remained new problems that may occur according to users. An in-depth interview may gather insights provided by users so that we can make our design better.

Jenius - All in one M-Banking Experience — UI/UX Redesign Case Study

In this our first case study, we want to share the process and decision made of how we redesign the jenius app., 30. erste bank: simplify banking for 300k seniors, 👏🏻 43 applause.

Case study by Madesense Digital

Erste Bank wanted to offer to people in their senior years smartphones equipped with our senior launcher and the new simplified banking app which is the subject of this case study.

Our screen design changed several times during testing, quite radically. The size of the font needed to almost double, seniors were not able to see the bottom navigation panel and they did not understand the chart on the main screen.

It works something like a visit to the doctor. We asked a lot of questions to better understand the needs of the business and its users. We dig deep for the reasons Erste Bank would want to create an application in the first place and how its functionalities should look to provide real value for older people.

How we helped Erste Bank to simplify mobile banking for almost 300k seniors | Case Study

It’s a holiday today and i finally found some time to look back a bit at how we created a mobile app for erste bank….

Showreel by UXDA | Financial UX design architects

10 UI Transformations that Show the Power of UX Design for Banking Innovation

The future of digital finance requires a paradigm shift toward a holistic, customer-centric approach that incorporates….

Written by UXDA | Financial UX Design

UX experts who focus exclusively on next-gen financial services and infuse soul into 150+ banking and Fintech products across 37 countries | theuxda.com

Text to speech

TymeBank Case Study: The Customer Impact of Inclusive Digital Banking

Full report.

This publication is also available in French and Spanish .

Executive Summary

This case study presents insights from customer research with TymeBank clients that bolsters CGAP’s hypotheses around how digital banks can support the mission of financial inclusion. As a fully digital South African bank that disproportionately serves low-income rural customers, TymeBank has created a suite of basic products that cater to the essential financial needs of those customers, namely a low-cost transactional account and a high-yield savings account. Judging from product uptake and client testimonials, these products add to a compelling value proposition that not only resonates with customers but improves their lives.

TymeBank’s distribution network, which is based on its partnerships with the nationwide Boxer and Pick n Pay (PnP) grocery store chains, helps to keep operational costs low and passes cost savings onto customers in the form of more affordable services. A clear majority of the bank’s customers cite affordability as a key source of value and the reason they opened a TymeBank account. The distribution network also extends the bank’s reach to areas that are underserved by traditional players. The affordability and accessibility likely explain why underserved segments, such as low-income women and rural customers, are over-represented in TymeBank’s (active) customer base as compared to the overall banked population in South Africa.

Despite having access to other banking options, TymeBank customers overwhelmingly see no compelling alternatives in the market. Crucially, the value customers see in the bank appears to be inversely related to income, with poorer customers reporting higher levels of satisfaction.

In today’s high-tech financial services landscape, which is often dominated by headlines about fintech startups and tech giants, it is easy to overlook the role banks can play in advancing financial inclusion. The high cost of running brick-and-mortar branch networks has traditionally inhibited banks from serving less profitable client segments, including the low-income groups that are the focus of financial inclusion. Banks have also been slow to adapt the digital innovations that have helped some newcomers reach these segments at lower cost. It is no surprise that some observers have questioned whether banks are even relevant to financial inclusion.

However, there are reasons to believe that banks can play an important role in financial inclusion if they overcome the challenges of their legacy systems and processes and digitize operations. In fact, banks have advantages over other types of financial services providers (FSPs) that may allow them to have an outsized impact on financial inclusion – if they are willing to expand down- market. Most importantly, banks do not face the same regulatory constraints as other providers. Whereas mobile money providers and fintechs generally cannot provide a wide array of financial products (ranging from savings to credit), banks can. License to intermediate retail deposits further plays to a bank’s advantage in the arena of digital credit. Banks can fund their lending portfolios with retail deposits that are typically cheaper than the other funding sources pure lenders use, which further reduces the cost of reaching low-income customers with credit.

CGAP previously presented three emerging business models in banking that we consider to be particularly promising for financial inclusion (Jeník and Zetterli 2020). These models are fully digital retail banks, marketplace banks, and Banking-as-a-Service (BaaS) (see Box 1). We conclude that they have the potential to deepen financial inclusion by:

- Lowering the cost of financial services;

- Improving access to a greater variety of services;

- Creating services that better meet the needs of various customer segments; and

- Improving the customer experience. 1

We analyzed several fully digital retail banks in a series of detailed case studies (Jeník, Flaming, and Salman 2020). One of these cases focused on TymeBank in South Africa. TymeBank is a fully digital retail bank founded with financial inclusion as a core business objective. Since its 2018 launch, the bank has onboarded over 4 million customers.

TymeBank offers low-income customers simple products at low prices, such as checking accounts, savings accounts, and debit cards – all through a distribution network that combines online and offline customer interaction based on partnerships with grocery store chains Boxer and PnP. In the area of credit products, TymeBank only offers a “buy now, pay later” option called MoreTyme. This case study provides a compelling example of how challenger banks can leverage digital technology to reach excluded customer segments with more affordable and useful products.

This paper builds on the TymeBank case study by examining the impact the bank’s services have had on low-income customers. By combining a quantitative analysis of TymeBank customer data with a phone-based survey of a randomly selected sample of low-income customers, the paper addresses the following questions:

- Does TymeBank serve low-income customers?

- Are its products relevant to low-income customers?

- What impact do the bank’s products have on low-income customers’ lives, in their own words?

The aim of this research is to shed light on the potential of digital banks to deepen financial inclusion in a way that improves the lives of low-income customers. CGAP is conducting additional research with other providers to better understand the impact of new financial services business models on customers. 2

TymeBank’s main value proposition consists of (i) simple, affordable, and accessible products; (ii) fast and automated onboarding; and (iii) incentive programs that appeal to target segments (e.g., the SmartShopper loyalty program). These are the qualities we would expect customers to point out when talking about the benefits of using TymeBank.

They are also important features that respond to three frequently cited barriers to financial inclusion: (i) expensive services, (ii) limited access points, and (iii) prohibitive know-your-customer (KYC) requirements. 3

Product affordability relies on TymeBank’s ability to maintain low operational costs and proportionally reduce them further as the bank grows. Current cost efficiency is due to the bank’s technology and microservice architecture (Flaming and Jeník 2020), its branchless model, and digitally facilitated onboarding. TymeBank onboards approximately 110,000 customers per month: about 93,500 through kiosks at an estimated cost of US$3 per customer, and about 16,500 via web at approximately US$0.60 per customer. 4

SOUTH AFRICA 5

South Africa enjoys relatively high levels of financial inclusion, including a banked adult population of approximately 85 percent in a market dominated by the country’s well-established commercial banks. However, many customers only use their bank account to receive government benefits; other use cases lag. There is little to no use of non-bank mobile money wallets.

Across demographic, socioeconomic, and geographic factors, financial inclusion levels positively corelate with higher age (people aged 18–29 are among those least included), urban areas, income level and regularity. Only 38 percent of individuals who reported having no income are banked, while 31 percent are entirely excluded.

METHODOLOGY

For the qualitative analysis based on customer interviews, 1,162 customers were screened from an overall sample of 10,000. The aim was to reach those TymeBank customers living in poverty (i.e., 70 percent or more likely to be living on less than US$5.50). Ultimately, 278 customers were identified for in-depth interviews. The screener surveys were conducted partly through interactive voice response (IVR) surveys and partly through live phone calls.

The quantitative analysis used customer data from TymeBank to assess the potential impact of the bank’s offering on its customer base, particularly individuals from groups that generally exhibit lower levels of financial inclusion. The data examined spanned a nine-month period from July 2020 to March 2021. The analyzed data correlated to active EveryDay account customers, defined as those who had performed a transaction within the past 30 days. Various sets of proxies were applied to estimate income level (e.g., onboarding location, outstanding balance, frequency of transactions, average size of transactions).

The analysis considered several important caveats:

a) We recognize that TymeBank is not representative of all fully digital retail banks in South Africa or elsewhere. The findings presented in this paper should not be interpreted as automatically applicable to other digital banks without careful consideration.

b) The research was conducted during the COVID-19 pandemic; some findings were or could be affected (e.g., as customer behavior changes in response to the pandemic).

c) Despite our best efforts to exclusively focus the analysis on low-income segments, we were unable to identify customers based on their stated income levels since TymeBank does not collect that information. Customer segmentation was performed through the previously mentioned set of proxies for the customer data analysis and through the screening questionnaire for the customer interviews. 6

d) The quantitative analysis focused on active customers with at least one transaction performed over the past 30 days, unless otherwise noted.

e) Where customers stated they had been financially excluded before opening a TymeBank account, we did not identify the underlying cause(s) of financial exclusion.

Key Findings

Does tymebank serve low-income customers.

Our research showed that TymeBank serves a higher proportion of low-income customers than the typical bank in South Africa, and a significantly higher portion of the most financially excluded segment.

Low-income customers in South Africa are relatively highly banked, although they are under-represented. South Africans earning US$200 per month or less constitute 47 percent of the population but only 41 percent of the banked population. 7 However, we estimate that this segment represents 48 percent of TymeBank’s active user base. 8

Among the three-quarters of TymeBank customers for whom data are available, 58 percent live in metropolitan areas and 42 percent in rural areas. This compares to South Africa’s rural population of 35 percent (as of 2016); we estimated this share to be even lower in 2021 (approximately 30 percent). 9 Hence, rural customers appeared to be noticeably overrepresented in the TymeBank user base.

Young, rural, low-income women comprise the most financially excluded and underserved segment in South Africa. This group forms 2.3 percent of South Africa’s banked population but 7 percent of TymeBank’s active base – nearly three times as much. 10 Finally, 13 percent of TymeBank’s active customers are first-time bank customers. 11

From a more general perspective, women in the low-income segment represent a higher-than- average share of the bank’s overall customer base sample (65 percent versus 57 percent),12 which suggests that low-income women particularly benefit from TymeBank’s services.

These findings lead us to conclude that TymeBank customers disproportionately seem to come from traditionally unbanked and underserved segments. In fact, the evidence suggests that the bank’s customer base may particularly skew toward the most underserved segments.

DOES TYMEBANK OFFER PRODUCTS THAT ARE RELEVANT TO LOW-INCOME CUSTOMERS?

Customers find TymeBank’s products useful and act upon features designed to promote certain behaviors.

The bank’s customers particularly value the low cost of its services and the convenience of access and usage. The lower their income, the more value customers seem to derive from its services. While the vast majority of TymeBank customers have previously held bank accounts, 67 percent say they see no good alternative to TymeBank (Figure 4). This response is despite the fact that, as of the time the research was conducted, the bank still only had a relatively modest payments and savings offering and had yet to launch credit products. (TymeBank has since launched MoreTyme, a “buy now, pay later” consumer credit product.) Customer endorsement seems driven by the strength of the bank’s value proposition and the low cost of its services. When asked, customers specifically appreciate the low fees (48 percent) and the high-yield savings account (38 percent).

Importantly, women make up a larger share of the total number of GoalSave (savings account) users compared to their representation in the overall customer base (3 percentage points higher). This finding suggests that female customers find value in the product, although they had slightly lower savings per user than men (US$58 versus US$59). The number of their deposits exceeds the number of withdrawals.

We did not find any significant differences in usage and product lifecycle patterns across income groups (aside from the frequency and size of transactions that correlate with income level), which suggests that TymeBank covers its customers’ essential needs across segments. The similarities in lifecycle (behavior patterns across products, such as most frequently performed type of transaction and their change over time) indicate that customers across income levels increase their engagement as they grow confident with the products.

However, important nuances do exist. For instance, the most excluded segment uses till machines for cash-in and cash-out transactions that are free-of-charge (and perhaps more accessible in certain areas), compared to the ATMs other segments prefer. This may be explained by price sensitivity that drives the preference for free till point withdrawals compared to ATM withdrawals, which are charged at US$0.61 per part of US$70.

The value generated for low(er) income customers will hopefully further expand as TymeBank expands its product offering (e.g., insurance and diverse credit products).

WHAT IMPACT DOES TYMEBANK HAVE ON CUSTOMERS’ LIVES?

Most customers report positive life changes due to their use of TymeBank. Importantly, levels of customer satisfaction increase as customer income decreases. This suggests that the TymeBank value proposition tailored to lower-income customers resonates well.

We relied on the actual voices of customers from the demand survey to gauge the impact the TymeBank offering had on its users. When asked, 73 percent of customers reported a positive change in quality of life attributable to TymeBank. The change could be associated with multiple factors. For instance, 80 percent of interviewed customers reported a decrease in the amount spent on bank fees, which is crucial for low-income segments that have historically experienced cost as one of the biggest barriers to financial inclusion. Nearly a third (31 percent) of customers who reported life improvement said that their access to financial services had expanded thanks to TymeBank. Customers also reported an improved ability to digitally transact and receive money (51 percent and 55 percent of all interviewees, respectively).

One of the most important findings concerned the ability to save. Seventy-three percent of interviewed customers reported an increase in their savings balance due to TymeBank. Savings likely drove customers’ ability to achieve their financial goals (68 percent) and improve financial resilience (32 percent).

These findings support our overall hypothesis that digital banks are well placed to deepen financial inclusion with cheaper, better products that reach beyond payments and are relevant to improving the lives of low-income customers.

It is critical to note that the high-interest yield on the GoalSave savings account was among the reasons most prominently cited by customers as driving them toward TymeBank. Our finding that female and young TymeBank customers were more likely to save using the bank service compared to what nationwide averages suggest was also important. While the national numbers show a 9 percentage point gap in formal savings between men and women (35 percent versus 26 percent), the gap among TymeBank customers favored women by 10 percentage points (45 percent versus 55 percent).

Our findings also revealed areas for improvement. Perhaps not surprisingly, TymeBank customers have not been spared the surge of fraud in South Africa. Ten percent of customers reported challenges concerning security and protection of funds. Six percent of respondents mentioned delays in service delivery and nearly the same share complained of issues related to digital access. Complaints were related to system downtime, clearing time (TymeBank is planning to offer real-time clearing), and the general concerns first-time users may have about their funds.

When asked about potential improvements, the presence of physical branches scored the highest (11 percent), followed by improved security (9 percent) related to the challenges mentioned in the previous paragraph and improved digital services (5 percent).

While these findings are encouraging, more research is needed before conclusive statements can be made about the broader role of digital banks in advancing financial inclusion. We encourage other experts to undertake similar research and add to the emerging evidence on the impact of digital banks on financial inclusion.

Acknowledgments

This case study features insights from research commissioned by CGAP and conducted by 60 Decibels and Genesis Analytics under the leadership of Ivo Jeník.

The author thanks CGAP colleagues Gayatri Vikram Murthy and Mehmet Kerse for reviewing this paper, and Gcinisizwe Andrew Mdluli for contributions and insights. Peter Zetterli and Xavier Faz oversaw the effort. Andrew Johnson led the editorial work.

This paper would not have been possible without the time and dedication of the team from TymeBank and TymeGlobal.

Flaming, Mark, and Ivo Jeník. 2020. “ How Does Tech Make a Difference in Digital Banking ?” CGAP blog post, 11 November.

Jeník, Ivo, Mark Flaming, and Arisha Salman. 2020. “ Inclusive Digital Banking: Emerging Markets Case Studies .” Working Paper. Washington, D.C.: CGAP.

Jeník, Ivo, and Peter Zetterli. 2020. “ Digital Banks: How Can They Deepen Financial Inclusion? ” Slide deck. Washington, D.C.: CGAP.

Download a PDF of this Case Study >>

1 To assess bank inclusivity, we developed and implemented a four-dimensional framework focused on cost, access, fit, and experience (CAFE). See Jeník and Zetterli (2020), page 42. In a business-to business (B2B) model, BaaS providers have other FSPs as their customers. Thus, their impact on end users is indirect.

2 see collection of cgap research on fintech and new financial services business models: www.cgap.org/fintech, 3 world bank global findex database (2017)., 4 atm-like machines placed in partner grocery stores – mainly pnp and boxer – allow for automated customer onboarding in less than five minutes., 5 this section is based on data from the finmark trust finscope (south africa) 2018 database., 6 the quantitative analysis used the average monthly inflows of customers originated at pnp value stores (us$271) and boxer stores (us$224) to estimate income level. the qualitative analysis estimated that 35 percent of tymebank’s customers live on less than us$5.50 per day, based on the screener survey findings., 7 the finmark trust finscope (south africa) 2018 database., 8 using place of origination (pnp value and boxer stores) as a proxy for low income., 9 south africa gateway . , 10 the finmark trust finscope (south africa) 2018 database., 11 n = 1,162., 12 comparing screened customers (n = 1,162) and interviewed customers (n = 278)., related resources, inclusive digital banking: emerging markets case studies, digital banks: how can they deepen financial inclusion, related research, 8 billion reasons: inclusive finance as a catalyst for climate action, open finance self-assessment tool and development roadmap, global landscape: data trails of digitally included poor (dip) people.

© 2024 CGAP

- Privacy Notice

- Harvard Business School →

- Faculty & Research →

- August 2020 (Revised August 2023)

- HBS Case Collection

Nubank: Democratizing Financial Services

- Format: Print

- | Language: English

- | Pages: 33

Related Work

- Faculty Research

- Nubank: Democratizing Financial Services By: Michael Chu, Carla Larangeira and Pedro Levindo

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Case Study: How Aggressively Should a Bank Pursue AI?

- Thomas H. Davenport

- George Westerman

A Malaysia-based CEO weighs the risks and potential benefits of turning a traditional bank into an AI-first institution.

Siti Rahman, the CEO of Malaysia-based NVF Bank, faces a pivotal decision. Her head of AI innovation, a recent recruit from Google, has a bold plan. It requires a substantial investment but aims to transform the traditional bank into an AI-first institution, substantially reducing head count and the number of branches. The bank’s CFO worries they are chasing the next hype cycle and cautions against valuing efficiency above all else. Siti must weigh the bank’s mixed history with AI, the resistance to losing the human touch in banking services, and the risks of falling behind in technology against the need for a prudent, incremental approach to innovation.

Two experts offer advice: Noemie Ellezam-Danielo, the chief digital and AI strategy at Société Générale, and Sastry Durvasula, the chief information and client services officer at TIAA.

Siti Rahman, the CEO of Malaysia-headquartered NVF Bank, hurried through the corridors of the university’s computer engineering department. She had directed her driver to the wrong building—thinking of her usual talent-recruitment appearances in the finance department—and now she was running late. As she approached the room, she could hear her head of AI innovation, Michael Lim, who had joined NVF from Google 18 months earlier, breaking the ice with the students. “You know, NVF used to stand for Never Very Fast,” he said to a few giggles. “But the bank is crawling into the 21st century.”

- Thomas H. Davenport is the President’s Distinguished Professor of Information Technology and Management at Babson College, a visiting scholar at the MIT Initiative on the Digital Economy, and a senior adviser to Deloitte’s AI practice. He is a coauthor of All-in on AI: How Smart Companies Win Big with Artificial Intelligence (Harvard Business Review Press, 2023).

- George Westerman is a senior lecturer at MIT Sloan School of Management and a coauthor of Leading Digital (HBR Press, 2014).

Partner Center

Member Login

Welcome to the Fiserv Member Portal

Don't have a Fiserv.com profile? Register now

Forgot password?

- Resource Center

Welcome to the Fiserv Resource Center. You'll find timely insights and valuable information to help your business keep up with the digital transformation of the financial services industry.

Featured Resources

Tri counties bank delivers a strong digital banking experience.

Tri Counties Bank wanted to compete against large institutions, so they enabled Configure Digital for Corillian from Fiserv, a simply delivered digital platform to provide a better digital experience.

Seamless connections to real-time networks

Consumers want and expect real-time money movement. With multiple options for connectivity to the FedNow ® Service and RTP ® Network, our real-time solutions are designed to fit each financial institution’s unique needs and enable you to deliver the experiences people demand.

Move money faster and bring in more deposits

Bethpage Federal Credit Union leveraged the repeatable infrastructure of NOW ® Gateway: RTP ® Network to give members more real-time payments capabilities.

| Title | Type | Solution | Date published |

|---|---|---|---|

| Brochures | Banks, Credit Unions, Source Capture Solutions | ||

| Brochures | Banks, Customer & Channel Management, Online Banking Solutions | ||

| Videos | Banks, Credit Unions, Fraud Risk & AML Compliance Management | ||

| Infographics | Banks, Cash & Logistics, Credit Unions, Insights & Optimization, Retail & Commerce | ||

| Consumer Research | Corporate Services, Credit Unions, Payments, Processing Services, Risk & Compliance | ||

| Consumer Research | Associations, Corporate Services, Insights & Optimization, Risk & Compliance | ||

| Consumer Research | Billers, Business Banking, Payments, Processing Services, Telecommunications | ||

| Consumer Research | Billers, Business Banking, Credit Unions, Payments, Processing Services | ||

| Research Papers | Billers, Payments, Payments, Processing Services, Telecommunications | ||

| Consumer Research | Banks, Business Banking, Corporate Services, Customer & Channel Management, Payments | ||

| Videos | Banks, Credit Unions, Fraud Risk & AML Compliance Management | ||

| Videos | Account Processing Solutions, Bank Platforms, Banks, Credit Union Platforms, Credit Union Platforms, Credit Union Platforms, Credit Union Platforms, Credit Unions, Fraud Risk & AML Compliance Management, Risk & Compliance | ||

| Case Studies | Bank Platforms, Business Banking | ||

| Point of View Papers | Banks, Credit Unions, Financial Performance & Risk Management | ||

| Case Studies | Card Solutions, Credit & Debit Solutions, Credit Unions | ||

| Point of View Papers | Banks, Card Solutions, Credit & Debit Solutions, Credit Unions | ||

| Point of View Papers | Enterprise Content Management, Lending Solutions | ||

| Brochures | Banks, Online Banking Solutions | ||

| White Papers | Banks, Business Banking, Credit Unions, Fraud Risk & AML Compliance Management | ||

| Brochures | Electronic Billing & Payment Solutions, Payments, Telecommunications | ||

| Videos | Account Processing Solutions, Bank Intelligence Solutions, Bank Platforms, Banks, Branch Solutions, Business Banking, Business Technology Services, Card Risk Solutions, Card Solutions, Commercial Banking Solutions, Credit & Debit Solutions, Credit Union Platforms, Credit Unions, Customer & Channel Management, Cybersecurity Solutions, Electronic Billing & Payment Solutions, Enterprise Content Management, Enterprise Payments Solutions, Information Management Solutions, Insights & Optimization, Lending Solutions, Loyalty & Rewards Solutions, Mobile Solutions, Online Banking Solutions, Output Solutions, Payments, Payments Network, Personal Payments Services, Processing Services, Remittance Solutions, Risk & Compliance, Source Capture Solutions, Treasury Management, Walk-In Solutions, Wealth Management Solutions | ||

| Point of View Papers | Associations, Banks, Risk & Compliance | ||

| Brochures | ACH Solutions, Payments, Payments | ||

| Fact Sheets | Banks, Credit Unions, Fraud Risk & AML Compliance Management | ||

| Brochures | Fraud Risk & AML Compliance Management, Institutional Asset Management, Wealth Management | ||

| Brochures | Fraud Risk & AML Compliance Management, Insurance | ||

| Videos | Banks, Credit Unions, Fraud Risk & AML Compliance Management, Insurance, Risk & Compliance, Wealth Management | ||

| Brochures | Banks, Business Banking, Credit Unions, Fraud Risk & AML Compliance Management | ||

| Brochures | Fraud Risk & AML Compliance Management, Investment Services, Wealth Management | ||

| Brochures | Fraud Risk & AML Compliance Management, Insurance | ||

| Case Studies | Bank Intelligence Solutions, Banks, Branch Solutions, Credit Union Platforms, Credit Unions, Customer & Channel Management | ||

| Case Studies | Banks, Credit & Debit Solutions, Credit Unions | ||

| Brochures | Banks, Credit Unions, Treasury Management | ||

| Brochures | ATM Solutions, Banks, Business Banking, Credit Unions, Payments | ||

| Brochures | ATM Solutions, Banks, Card Solutions, Credit & Debit Solutions, Credit Unions | ||

| Brochures | Banks, Business Banking, Credit Unions, Payments, Payments Network | ||

| Brochures | Enterprise Content Management, Lending | ||

| Brochures | Banks, Card Solutions, Card Solutions, Credit Unions | ||

| eBooks | Account Processing Solutions, Credit Union Platforms, Credit Union Platforms, Credit Unions | ||

| Brochures | Banks, Credit Unions, Cybersecurity Solutions, Risk & Compliance | ||

| Brochures | Banks, Financial Control & Accounting, Financial Performance & Risk Management, Risk & Compliance | ||

| White Papers | Banks, Credit Unions, Lending Solutions, Lending Solutions, Lending Solutions | ||

| Brochures | Bank Platforms, Banks, Credit Unions, Insights & Optimization, Risk & Compliance | ||

| White Papers | Banks, Credit Unions, Fraud Risk & AML Compliance Management | ||

| Videos | Banks, Card Solutions, Credit & Debit Solutions, Fraud Risk & AML Compliance Management, Lending | ||

| Point of View Papers | Biller Solutions, Retail & Commerce, Walk-In Solutions | ||

| Webinars | Banks, Business Banking, Credit Unions, Enterprise Payments Solutions, Payments | ||

| Case Studies | Banks, Business Banking, Credit Unions, Fraud Risk & AML Compliance Management, Institutional Asset Management, Insurance, Lending | ||

| Brochures | Electronic Billing & Payment Solutions, Payments, Payments, Wealth Management Solutions | ||

| Videos | Account Aggregation Services, Bank Platforms, Banks, Biller Solutions, Billers, Electronic Billing & Payment Solutions, Insurance, Lending, Property Management, Retail & Commerce, Wealth Management | ||

| Brochures | Banks, Credit Unions, Electronic Billing & Payment Solutions | ||

| Videos | Account Aggregation Services, Banks, Business Banking, Corporate Services, Insights & Optimization, Payments, Processing Services | ||

| Videos | Account Aggregation Services, Bank Platforms, Banks, Biller Solutions, Billers, Electronic Billing & Payment Solutions, Insurance, Lending, Property Management, Retail & Commerce, Wealth Management | ||

| Brochures | Banks, Corporate Services, Credit Unions, Healthcare, Insurance, Output Solutions, Output Solutions, Output Solutions, Telecommunications, Utilities | ||

| Brochures | Banks, Business Technology Services, Credit Unions | ||

| Brochures | Bank Platforms, Banks, Business Banking, Corporate Services, Insurance | ||

| Brochures | Banks, Business Technology Services, Credit Unions | ||

| Brochures | Business Banking, Business Technology Services, Corporate Services | ||

| Brochures | Banks, Business Banking, Credit Unions, Enterprise Payments Solutions | ||

| Brochures | Bank Platforms, Banks, Branch Solutions | ||

| Brochures | Banks, Credit Union Platforms, Credit Union Platforms, Credit Union Platforms, Credit Union Platforms, Credit Unions, Lending Solutions, Lending Solutions, Lending Solutions, Mobile Solutions, Mobile Solutions, Online Banking Solutions | ||

| Videos | credit unions, Credit Unions | ||

| Brochures | Bank Platforms, Banks, Card Risk Solutions, Card Solutions, Credit & Debit Solutions, Credit Union Platforms, Credit Unions, Payments | ||

| Infographics | Banks, Business Banking, Credit Unions, Financial Control & Accounting | ||

| Point of View Papers | Banks, Credit Unions, Financial Control & Accounting | ||

| Case Studies | Government, Insurance, Retail & Commerce, Treasury Management | ||

| White Papers | Banks, Business Banking, Fraud Risk & AML Compliance Management, Payments | ||

| Brochures | Banks, Credit Unions, Financial Performance & Risk Management | ||

| Brochures | Banks, Credit Unions, Financial Performance & Risk Management | ||

| Brochures | Corporate Services, Financial Control & Accounting | ||

| Case Studies | Business Banking, Processing Services | ||

| Case Studies | Account Processing Solutions, Bank Platforms, Banks | ||

| Case Studies | Banks, Credit Unions, Item Processing Solutions, Item Processing Solutions, Risk & Compliance, Source Capture Solutions | ||

| Videos | Account Processing Solutions, Bank Platforms, Banks | ||

| Videos | Banks, Credit Unions, De Novos, Risk & Compliance | ||

| Infographics | Billers, Customer & Channel Management, Healthcare, Payments, Risk & Compliance | ||

| Point of View Papers | |||

| Point of View Papers | Biller Solutions, Electronic Billing & Payment Solutions, Insurance, Mobile Solutions, Output Solutions, Risk & Compliance | ||

| Point of View Papers | Biller Solutions, Electronic Billing & Payment Solutions, Mobile Solutions, Output Solutions, Risk & Compliance, Telecommunications | ||

| Point of View Papers | Biller Solutions, Electronic Billing & Payment Solutions, Mobile Solutions, Output Solutions, Risk & Compliance, Utilities | ||

| Brochures | Biller Solutions, Billers, Payments | ||

| Videos | Business Banking, Corporate Services, Insurance, Payments, Processing Services | ||

| Research Papers | Cash & Logistics, Retail & Commerce | ||

| Podcasts | Banks, Biller Solutions, Business Banking, Credit Union Platforms | ||

| Podcasts | Banks, Corporate Services, Payments, Processing Services, Risk & Compliance | ||

| Podcasts | Bank Platforms, Banks, Branch Solutions, Credit Union Platforms, Online Banking Solutions, Walk-In Solutions | ||

| Videos | Banks, Biller Solutions, Business Banking, Credit Union Platforms | ||

| Videos | Banks, Biller Solutions, Business Banking, Credit Union Platforms | ||

| Brochures | Banks, Credit Unions | ||

| Point of View Papers | Banks, Billers, Insights & Optimization, Payments, Payments, Processing Services, Telecommunications | ||

| Videos | Bank Platforms, Banks, Branch Solutions | ||

| Brochures | Bank Intelligence Solutions, Bank Platforms, Banks, Billers, Branch Solutions, Credit Union Platforms, Credit Unions, Customer & Channel Management | ||

| White Papers | Banks, Business Banking, Credit Unions, Enterprise Payments Solutions | ||

| White Papers | Banks, Credit Unions, Financial Control & Accounting | ||

| Brochures | Banks, Credit Unions, Insights & Optimization | ||

| Case Studies | Account Processing Solutions, Banks, Insights & Optimization | ||

| Brochures | Bank Platforms, Bank Platforms | ||

| Brochures | Bank Platforms, Bank Platforms | ||

| Brochures | Banks, Government, Remittance Solutions, Remittance Solutions | ||

| Brochures | Credit Unions, Property Management, Telecommunications | ||

| Videos | Credit Union Platforms, Credit Union Platforms, Credit Union Platforms, Credit Unions | ||

| Brochures | Banks, Business Banking, Credit Unions, Payments, Source Capture Solutions | ||

| Research Papers | Credit & Debit Solutions, Cybersecurity Solutions, Electronic Billing & Payment Solutions, Enterprise Content Management, Enterprise Payments Solutions, Financial Control & Accounting, Insights & Optimization, Loyalty & Rewards Solutions, Mobile Solutions, Payments, Processing Services, Retail & Commerce, Risk & Compliance | ||

| Brochures | Banks, Card Solutions, Credit & Debit Solutions, Credit Unions | ||

| Videos | Card Solutions, Output Solutions, Payments | ||

| Brochures | Banks, Card Solutions, Corporate Services, Credit & Debit Solutions, Credit Unions | ||

| Case Studies | Bank Platforms, Banks, Card Solutions, Card Solutions, Credit & Debit Solutions, Credit & Debit Solutions, Credit Union Platforms, Credit Union Platforms, Credit Unions, Insights & Optimization, Payments, Payments Network | ||

| Brochures | Banks, Business Banking, Credit Unions, Insurance, Output Solutions, Retail & Commerce | ||

| Brochures | Banks, Credit & Debit Solutions, Credit Unions | ||

| Brochures | Banks, Card Solutions, Credit Unions, Mobile Solutions, Payments, Payments Network | ||

| Brochures | ATM Solutions, Card Solutions, Payments Network | ||

| Brochures | Banks, Card Solutions, Credit Unions, Mobile Solutions, Payments, Payments Network | ||

| Videos | Banks, Card Solutions, Credit Unions, Payments | ||

| Brochures | Banks, Card Solutions, Credit & Debit Solutions, Credit Unions | ||

| Videos | Bank Platforms, Banks, Business Banking, Credit Union Platforms, Credit Unions, Mobile Solutions, Online Banking Solutions | ||

| Videos | Banks, Credit Unions, Enterprise Content Management | ||

| Videos | Banks, Credit Unions, Online Banking Solutions, Risk & Compliance | ||

| Brochures | Cash & Logistics, Corporate Services, Insights & Optimization, Insurance, Payments | ||

| Videos | Banks, Cash & Logistics, Insights & Optimization, Payments | ||

| Point of View Papers | Banks, Cash & Logistics, Credit Unions, Insights & Optimization, Retail & Commerce | ||

| Case Studies | Account Processing Solutions, Bank Platforms, Banks, Business Banking, Commercial Banking Solutions, Customer & Channel Management | ||

| Case Studies | Account Processing Solutions, Bank Intelligence Solutions, Bank Platforms, Banks, Information Management Solutions, Loyalty & Rewards Solutions | ||

| Videos | Government | ||

| Brochures | Banks, Credit Unions, Electronic Billing & Payment Solutions | ||

| Brochures | Banks, Electronic Billing & Payment Solutions, Payments, Property Management, Retail & Commerce | ||

| Videos | Business Banking, Corporate Services, Payments, Processing Services | ||

| Brochures | Billers, Electronic Billing & Payment Solutions, Payments, Payments | ||

| Brochures | Bank Platforms, Banks | ||

| Case Studies | Associations, Billers, Business Banking, Credit Unions, Government, Insurance, Property Management, Retail & Commerce, Treasury Management, Wealth Management | ||

| White Papers | Banks, Business Banking, Credit Unions, Fraud Risk & AML Compliance Management | ||

| White Papers | Credit Unions, Credit Unions | ||

| Videos | Business Banking, Customer & Channel Management, Online Banking Solutions | ||

| Brochures | banking, Banks, Business Banking, Customer & Channel Management, Online Banking Solutions | ||

| Brochures | Banks, Customer & Channel Management, Online Banking Solutions | ||

| Brochures | Banks, Customer & Channel Management, Online Banking Solutions | ||

| Brochures | Banks, Customer & Channel Management, Online Banking Solutions | ||

| Brochures | Banks, Customer & Channel Management, Online Banking Solutions | ||

| Brochures | Associations, Business Banking, Customer & Channel Management, Output Solutions | ||

| Brochures | Bank Platforms, Banks | ||

| Case Studies | Credit Unions, Cybersecurity Solutions, Financial Performance & Risk Management | ||

| Brochures | Electronic Billing & Payment Solutions, Lending, Payments, Payments, Wealth Management | ||

| Podcasts | Bank Platforms, Banks, Business Banking, Credit Union Platforms, Credit Unions, Enterprise Payments Solutions | ||

| Brochures | Associations, Banks, Biller Solutions, Billers, Business Banking, Corporate Services, Credit Unions, De Novos, Government, Healthcare, Institutional Asset Management, Insurance, Lending, Payments, Property Management, Retail & Commerce, Telecommunications, Thrifts, Utilities, Wealth Management | ||

| Videos | Bank Platforms, Banks, Branch Solutions, Mobile Solutions | ||

| Point of View Papers | Biller Solutions, Retail & Commerce, Walk-In Solutions | ||

| Brochures | Biller Solutions, Retail & Commerce, Walk-In Solutions | ||

| Brochures | Banks, Card Solutions, Credit Unions, Payments | ||

| Brochures | Banks, Credit Unions, Output Solutions, Payments, Payments | ||

| Brochures | Banks, Credit Unions, Sentry℠ Unified Communications | ||

| Brochures | Banks, Credit Unions, Sentry℠ Unified Communications | ||

| Brochures | Account Processing Solutions, Bank Platforms, Banks | ||

| Resources | Government, Payments | ||

| Brochures | Banks, Credit Unions, Enterprise Content Management, Lending, Wealth Management | ||

| Videos | Bank Platforms, Banks, Credit Unions | ||

| Point of View Papers | Banks, Credit Unions, Electronic Billing & Payment Solutions, Payments | ||

| Case Studies | Bank Platforms, Bank Platforms, Banks, Insights & Optimization | ||

| Brochures | Bank Platforms, Bank Platforms | ||

| Case Studies | Bank Platforms, Banks, Business Banking, Card Solutions, Credit & Debit Solutions, Credit Union Platforms, Credit Unions, Payments | ||

| Brochures | Banks, Card Solutions, Credit & Debit Solutions, Credit Unions, Payments | ||

| Brochures | Banks, Credit Unions, Customer & Channel Management, Mobile Solutions | ||

| Videos | Banks, Business Banking, Credit Unions, Mobile Solutions, Online Banking Solutions | ||

| Case Studies | Credit Unions, Payments, Risk & Compliance | ||

| Brochures | Account Processing Solutions, Credit Union Platforms, Credit Unions | ||

| Research Papers | Banks, Credit Unions, Enterprise Payments Solutions | ||

| Brochures | Banks, Credit Unions, Risk & Compliance | ||

| Brochures | Banks, Credit Unions, Risk & Compliance | ||

| Videos | Bank Platforms, Banks, Credit Unions | ||

| Videos | Banks, Credit Unions, Risk & Compliance | ||

| Brochures | Bank Platforms, Banks, Credit Unions | ||

| Videos | Banks, Business Banking, Credit Unions, Cybersecurity Solutions, Insurance, Property Management, Retail & Commerce, Wealth Management | ||

| Brochures | Banks, Risk & Compliance | ||

| Brochures | Credit Unions, Risk & Compliance | ||

| Videos | Bank Platforms, Corporate Services | ||

| Videos | Bank Platforms, Banks, Credit Union Platforms, Credit Unions | ||

| Brochures | Bank Platforms, Business Banking, Corporate Services, Credit Unions | ||

| Videos | Bank Platforms, Banks, Credit Union Platforms, Credit Unions | ||

| Brochures | Account Aggregation Services, Banks, Business Banking, Credit Unions, Lending, Property Management, Retail & Commerce, Wealth Management | ||

| Case Studies | Electronic Billing & Payment Solutions, Payments, Payments, Wealth Management Solutions | ||

| Videos | Electronic Billing & Payment Solutions, Electronic Payments, Payments | ||

| Videos | Account Aggregation Services, Bank Platforms, Banks, Biller Solutions, Billers, Electronic Billing & Payment Solutions, Insurance, Lending, Property Management, Retail & Commerce, Wealth Management | ||

| Videos | Electronic Billing & Payment Solutions, Electronic Payments, Payments | ||

| Videos | Account Aggregation Services, Bank Platforms, Banks, Biller Solutions, Billers, Electronic Billing & Payment Solutions, Insurance, Lending, Property Management, Retail & Commerce, Wealth Management | ||

| Videos | Account Aggregation Services, Bank Platforms, Banks, Biller Solutions, Billers, Electronic Billing & Payment Solutions, Insurance, Lending, Property Management, Retail & Commerce, Wealth Management | ||

| Case Studies | Banks, Insights & Optimization | ||

| Brochures | Banks, Business Banking, Commercial Banking Solutions, Credit Unions, Cybersecurity Solutions, Financial Performance & Risk Management, Fraud Risk & AML Compliance Management, Risk & Compliance | ||

| Brochures | Account Aggregation Services, Business Technology Services, Investment Services, Personal Payments Services, Wealth Management | ||

| Brochures | Banks, Business Technology Services, Credit Unions | ||

| Point of View Papers | Banks, Credit Unions, Electronic Billing & Payment Solutions | ||

| White Papers | Banks, Credit & Debit Solutions, Insurance, Payments | ||