Cookies on GOV.UK

We use some essential cookies to make this website work.

We’d like to set additional cookies to understand how you use GOV.UK, remember your settings and improve government services.

We also use cookies set by other sites to help us deliver content from their services.

You have accepted additional cookies. You can change your cookie settings at any time.

You have rejected additional cookies. You can change your cookie settings at any time.

- Business and self-employed

- Business finance and support

Write a business plan

Download free business plan templates and find help and advice on how to write your business plan.

Business plan templates

Download a free business plan template on The Prince’s Trust website.

You can also download a free cash flow forecast template or a business plan template on the Start Up Loans website to help you manage your finances.

Business plan examples

Read example business plans on the Bplans website.

How to write a business plan

Get detailed information about how to write a business plan on the Start Up Donut website.

Why you need a business plan

A business plan is a written document that describes your business. It covers objectives, strategies, sales, marketing and financial forecasts.

A business plan helps you to:

- clarify your business idea

- spot potential problems

- set out your goals

- measure your progress

You’ll need a business plan if you want to secure investment or a loan from a bank. Read about the finance options available for businesses on the Business Finance Guide website.

It can also help to convince customers, suppliers and potential employees to support you.

Related content

Is this page useful.

- Yes this page is useful

- No this page is not useful

Help us improve GOV.UK

Don’t include personal or financial information like your National Insurance number or credit card details.

To help us improve GOV.UK, we’d like to know more about your visit today. Please fill in this survey (opens in a new tab) .

Free Simple Business Plan Template

Our experts

Written and reviewed by:.

Startups.co.uk is reader supported – we may earn a commission from our recommendations, at no extra cost to you and without impacting our editorial impartiality.

Your business plan is the document that adds structure to your proposal and helps you focus your objectives on an achievable and realistic target. It should cover every aspect of what your business journey will look like, from licensing and revenue, to competitor and sector analysis.

Writing a business plan doesn’t need to be a difficult process, but it should take at least a month to be done properly.

In today’s capricious business climate there’s a lot to consider, such as the impact of political challenges like Brexit. These details are especially important in today’s bad economy. Investors are looking for entrepreneurs who are aware of the challenges ahead and how to properly plan for them.

Below, you’ll find everything you need to create a concise, specific and authoritative business plan. So let’s get started turning your idea into a reality!

Click here to download your free Business Plan template PDF – you can fill in your own details and those of your business, its target market, your customers, competitors and your vision for growth.

Our below guide will give you detailed advice on how to write a quality business plan, and our PDF download above can give you a clear template to work through.

But, creating an effective business plan needs….planning! That’s where a high quality planning tool can help.

We recommend creating an account with monday to use this tool – there’s even a free trial . Doing so means you can start your entrepreneurial journey on the right foot.

Get the latest startup news, straight to your inbox

Stay informed on the top business stories with Startups.co.uk’s weekly newsletter

By signing up to receive our newsletter, you agree to our Privacy Policy . You can unsubscribe at any time.

What to include in your business plan template

There’s a lot of information online about how to write a business plan – making it a confusing task to work out what is and isn’t good advice.

We’re here to cut through the noise by telling you exactly what you need to include for a business plan that will satisfy stakeholders and help develop a key identity for your brand. By the end, you’ll have a plan to make even Alan Sugar proud and can get started with the most exciting part – running your business.

Throughout this guide, we’ve featured an example business plan template for a new restaurant opening in Birmingham called ‘The Plew’. In each section, you’ll be able to see what the contents we’re describing would look like in a ‘real-life’ document.

What to include in your business plan:

- Executive Summary

- Personal summary

- Business idea

- Your product or service

- Market analysis

- Competitor analysis

- Cash forecast

- Operations and logistics

- Backup plan

- Top tips for writing a business plan

- Business plan template UK FAQs

1. Executive summary

This section is a summary of your entire business plan. Because of this, it is a good idea to write it at the end of your plan, not the beginning.

Just as with the overall business plan, the executive summary should be clearly written and powerfully persuasive, yet it should balance sales talk with realism in order to be convincing. It should be no more than 1,000 words.

It should cover:

- Mission statement – what is your company’s purpose?

- Business idea and opportunity – what unique selling point (USP) will you provide?

- Business model – how will your business operate?

- Business objectives – what are you aiming to achieve?

- Target market – who is your customer base?

- Management team – who are the owners/senior staff?

- Competition – who are you competing against?

- Financial summary – can you prove the business will be profitable?

- Marketing strategy – what is your marketing plan and associated costs?

- Timeline – how long will it take to launch/grow your new business?

It sounds like a lot – but don’t feel you have to spend hours putting this together. Here’s what the above information for an executive summary might look like when put into our example business plan template for ‘The Plew’:

Startups’ business plan template example: executive summary

2. Personal summary

Investors want to know who they’re investing in, as much as what. This is where you tell people who you are, and why you’re starting your business.

Outline your general contact details first, giving your telephone number, email address, website or portfolio, and any professional social media profiles you might have.

Run through this checklist to tell the reader more about yourself, and put your business ambitions into context.

- What skills/qualifications do you have?

- What are you passionate about?

- What is/are your area(s) of industry expertise?

- Why do you want to run your own business?

Here’s what our two fictional co-founders of ‘The Plew’ might write in their personal summaries for our example business plan. CEO Gabrielle Shelby, has highlighted her expertise in the restaurant industry, while CFO Freya Moore outlines her accounting and finance knowledge.

Startups’ business plan template example: personal summary

Richard Osborne, founder and CEO of UK Business Forums, says personality is important in a business plan.

“Having a strong, personal reason at the heart of your business model will help keep you going and give you the motivation to carry on,” he affirms.

3. Business idea

This section is essentially to offer a general outline of what your business idea is, and why it brings something new to the market.

Here, you should include your general company details, such as your business name and a one-line summary of your business idea known as an elevator pitch. This section should also list a few key business objectives to show how you plan to scale over the next 1-3 years.

We also recommend carrying out a SWOT analysis to tell investors what the strengths, weaknesses, opportunities, and threats are for your business idea. Think about:

- Strengths: ie. why is this a good time to enter the sector?

- Weaknesses: ie. what market challenges might you encounter?

- Opportunities: ie. what demand is your product/service meeting in today’s market?

- Threats: ie. how will the business be financed to maintain liquidity?

In the template below, you can see a breakdown of the above information for ‘The Plew’. At the top is its mission statement: “to craft an unforgettable dining experience in a chic atmosphere.”

Startups’ business plan template example: business idea

Need a business idea? We’ve crunched the numbers and come up with a list of the best business ideas for startup success in 2023 based on today’s most popular and growing industries.

4. Your products or services

Now it’s time to explain what you are selling to customers and how will you produce your sales offering.

Use this section to answer all of the below questions and explain what you plan to sell and how. Just like your business idea outline, your answers should be concise and declarative.

- What product(s) or service(s) will you sell?

- Do you plan to offer new products or services in the future?

- How much does the product or service cost to produce/deliver?

- What is your pricing strategy ?

- What sales channels will you use?

- Are there legal requirements to start this business?

- What about insurance requirements?

- What is the growth potential for the product or service?

- What are the challenges? eg. if you’re looking to sell abroad, acknowledge the potential delays caused by post-Brexit regulations.

What insurance and licensing requirements do you need to consider?

Depending on what your business offers, you might need to invest in insurance or licensing. Our How To Start guides have more details about sector-specific insurance or licensing.

Public Liability, Professional Indemnity, and Employers’ Liability are the most well-known types of business insurance. We’ve listed some other common other licensing and insurance requirements below:

| Common insurance requirements: | Common license requirements: |

|---|---|

| Income Protection insurance Critical Illness insurance Life Cover insurance Office or Home insurance Automobile insurance | Health and Safety licensing Food Hygiene and Safety licensing Intellectual Property licensing Copyrights licensing Patent licensing |

In our example product/service page for ‘The Plew”s business plan, the founders choose to separate this information into multiple pages. Below, they outline their cost and pricing, as well as sales strategy. But they also include an example menu, to offer something a bit more unique and tantalising to the reader:

Startups’ business plan template example: product list and pricing strategy

5. Market analysis

This section demonstrates your understanding of the market you are entering, and any challenges you will likely face when trying to establish your company.

This section pulls all of your target market and customer research together to indicate to stakeholders that you are knowledgable about the sector and how to succeed in it.

- Who is your typical customer and where are they are based? Describe the profile of your expected customers eg. average age, location, budget, interests, etc.

- How many customers will your business reach? Outline the size of your market, and the share of the market that your business can reach.

- Have you sold any products/services to customers already? If yes, describe these sales. If no, have people expressed interest in buying your products or services?

- What have you learned about the market from desk-based research? What are the industry’s current challenges, and how has it been affected by the economic downturn?

- What have you learned about the market from field research? (eg. feedback from market testing like customer questionnaires or focus group feedback).

What is your marketing strategy?

Once you’ve highlighted who your rivals are in the market, you can provide details on how you plan to stand out from them through your marketing strategy. Outline your business’ USP, your current marketing strategy, and any associated advertising costs.

‘The Plew’ identifies its target audience as young, adventurous people in their mid-30s. Because of the restaurant’s premium service offering, its audience works in a well-paid sector like tech:

Startups’ business plan template example: customer analysis

6. Competitor analysis

This section demonstrates how well you know the key players and rivals in the industry. It should show the research you have carried out in a table format.

Begin by listing the key information about your competitors. Don’t worry about sounding too critical, or too positive. Try to prioritise accuracy above all else.

- Business size

- Product/service offering

- Sales channels

- Strengths/weaknesses

Competitors will take two forms, either direct or indirect. Direct competitors sell the same or similar products or services. Indirect competitors sell substitute or alternative products or services.

Here’s a breakdown of the strengths, weaknesses, and opportunities, and threats presented by a competitor restaurant for ‘The Plew’ called Eateria 24. At the bottom, the founders have written what learnings they can take from the chart.

Startups’ business plan template example: competitor analysis

Check out our list of the top competitor analysis templates to download free resources for your business, plus advice on what to include and how to get started.

7. Cash forecast

Outline your financial outlook including how much you expect to spend, and make, in your first year

All of your considered costs can be put into one easy-to-read document called a monthly cash forecast. Cash forecasts contain:

1. Incoming costs such as sales revenue, customer account fees, or funding.

2. Outgoing costs such as staff wages or operating expenses. The latter can cover everything from advertising costs to office supplies.

For those firms which have already started trading, include any previous year’s accounts (up to three years) as well as details of any outstanding loans or assets.

Annual cash forecast: what is it?

By conducting 12 monthly cash forecasts, you can create an annual cash forecast to work out when your company will become profitable (also known as breakeven analysis) . You will break even when total incoming costs = total outgoing costs.

In your annual cost budget, make sure to also include month opening/closing balance. This is important to monitor for accounting, particularly for year-end.

- Opening balance = the amount of cash at the beginning of the month

- Closing balance = the amount of cash at the end of the month

The opening balance of any month will always be the same as the closing balance of the previous month. If you are repeatedly opening months with a negative closing balance, you need to adjust your spending. Here’s an example of what ‘The Plew’s financials might look like in its first year of operation:

Startups’ business plan template example: cash forecast

8. Operations and logistics

Explain how your day-to-day business activities will be run, including key business partnerships around production and delivery.

A.) Production

List all of the behind the scenes information about how your business will operate. Include:

- Management team – who do you plan to hire as senior staff and why?

- Premises – where will you be based? What will be the cost?

- Materials – what materials/equipment will you need to make your product/service?

- Staffing – how many employees will you hire? How much will they cost?

- Insurance – what insurance do you need for production?

B.) Delivery

Detail how your customers will receive your product or service. Include:

- Distribution – how will you sell your product to customers?

- Transport – how will you transport the product/service to customers or partners?

- Insurance – what insurance do you need for delivery?

C.) Supplier analysis

Lastly, you should carry out a supplier analysis. Write down 2-3 suppliers you plan to use as part of your business operations and evaluate them on factors like location and pricing.

In our example business plan for ‘The Plew’, the founders have chosen to present this information in an easily-digestible chart, breaking down the leadership and employees into two different areas: product development and operations.

Startups’ business plan template example: staffing section

9. Backup plan

Explain how you will manage any surprise losses if your cash forecast does not go to plan.

In the event that your business does not go to plan, there will be costs to incur. A backup plan outlines to potential investors how you will pay back any outstanding loans or debt.

In the short-term:

If your cash-flow temporarily stalls, what steps could you take to quickly raise money or make savings? For example, by negotiating shorter payment terms with your customers.

In the long-term:

If you’ve noticed a drop in sales that seems to be persisting, what changes can you make that would improve cash flow longer term? For example, can you do more of your business online to reduce rent fees?

To placate investors even further, it’s a good idea to include details about potential support channels you can utilise (eg. a business network or contact) who might be able to help if you get caught in a sticky cash-flow situation.

Startups’ 5 top tips for writing a business plan

- Keep your predictions realistic. Your business plan should showcase your knowledge of the sector and what’s achievable. It’s not about impressing investors with big numbers or meaningless buzzwords.

- Don’t go over 15 pages. Business plans should be engaging, which means sticking to the point and avoiding a lot of long-winded sentences. Keep your executive summary to less than 1,000 words, for example.

- End with supporting documents. Use your appendix to include product diagrams or detailed research findings if these are helpful to your business case.

- Get a second pair of eyes. Everyone misses a spelling error or two – invite a trusted business contact or associate to look over your business plan before you send it anywhere.

- Leave enough time to write! It’s exciting to think about getting your business up and running – but planning is an important step that can’t be rushed over. Spend at least a month on writing to get all the details correct and laid-out.

At Startups.co.uk, we’re here to help small UK businesses to get started, grow and succeed. We have practical resources for helping new businesses get off the ground – use the tool below to get started today.

What Does Your Business Need Help With?

Designing a business plan is very important for laying the foundation of your business. Ensure you spend an appropriate amount of time filling it out, as it could save you many headaches further down the line.

Once your plan is complete, you’ll then be ready to look at other aspects of business set-up, such as registering your company. Sound daunting? Don’t worry!

Our experts have pulled together a simple, comprehensive guide on How to Start a Business in 2024, which will tell you everything you need to know to put your new plan into action.

- Can I write a business plan myself? Absolutely! There are plenty of resources available to help, but the truth is a business plan needs to reflect the owner's personal ambitions and passion - which is why entrepreneurs are best-placed to write their own.

- How long should a business plan be? We recommend your business plan is kept to a maximum of 15 pages. Keep it short and concise - your executive summary, for example, should be no more than 1,000 words.

- Is it OK to copy a business plan? While not technically illegal, copying a business plan will leave you in a poor position to attract investment. Customising your plan to your unique business idea and industry specialism is the best way to persuade stakeholders that you have a winning startup formula.

Startups.co.uk is reader-supported. If you make a purchase through the links on our site, we may earn a commission from the retailers of the products we have reviewed. This helps Startups.co.uk to provide free reviews for our readers. It has no additional cost to you, and never affects the editorial independence of our reviews.

- Essential Guides

Written by:

Leave a comment.

Save my name, email, and website in this browser for the next time I comment.

We value your comments but kindly requests all posts are on topic, constructive and respectful. Please review our commenting policy.

Related Articles

Save up to 500 Hours on Paperwork 🙌 50% Off for 3 Months. Buy Now & Save

50% Off for 3 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

- Online Accountants

Track project status and collaborate with clients and team members

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Accounting Partner Program

- Collaborative Accounting™

- Accountant Hub

- A Beginner’s Guide to MTD

- Reports Library

- FreshBooks vs Quickbooks

- FreshBooks vs Xero

- Partners Hub

- Help Center

- +44 (800) 047 8164

- All Articles

- Productivity

- Project Management

- Making Tax Digital

Resources for Your Growing Business

How to calculate business startup costs: an essential guide.

You might think that starting a business is simple, financially. Unfortunately, not all business startup costs are clear. There are some that you may not consider until you’ve begun the process. Some business expenses might occur that you’ve never even heard of. Business owners will tell you that startup expenses are more than just office space and furnishings. If you’re contemplating starting a business , learn how to calculate your costs here!

Here’s What We’ll Cover:

What are Business Startup Costs?

Common business startup costs, costs that occur after business has started, how much does it cost to start a business in the uk, key takeaways.

Any good business plan will go through the task of calculating business startup costs. These are the organizational costs that occur during the creation of a new business. Some are one-time expenses, while others are ongoing expenses. Regardless, understanding and budgeting for all of the possible costs is crucial to success. Startup costs require planning and accounting, and if a business neglects this then they are less likely to thrive.

There are some common business startup costs that should always be considered when doing calculations. They’re all listed below and are all necessary to start a business.

A Business Plan

Believe it or not, a business plan should be part of your startup costs. Business plans take time to create, and often require professional services to polish. They’re a road map and a financial plan to present to possible investors. Without this part of your financial plan, you’ll be less likely to secure funding. Startup funding is crucial to getting a business off the ground.

Research is a necessary part of any startup. The company needs to be able to prove that it’s viable in the market. If research is neglected, a company may enter the market offering products that are unnecessary.

Borrowing Costs

Borrowing costs take into account the business loans received for a startup. This includes interest on loan payments, as well as any fees applied to debts over time. Borrowing costs make up a large portion of startup costs until they are paid off.

Business Insurance and Business License Fees

Businesses are required to have insurance, and as such they will have insurance payments to make. There may also be a requirement for commercial property insurance when selecting where your business will live. Business licensing and permitting are also necessary costs to factor in.

Tech Expenses

In today’s world, businesses need technology to thrive. This includes digital marketing costs and software needs. Many businesses can’t function without business accounting software . They also need content marketing and advertisements to create an online presence. Without it, they may be doomed.

Office Equipment and Basic Supplies

If your business is going to exist in a physical space, office equipment and basic supplies are necessary. You’ll need office furniture, fixtures, and office supplies to get started. Without them, daily tasks won’t be completed.

Everything mentioned prior to this is related to setting a business up. However, they aren’t the only business startup costs. Startup also includes post-opening costs, such as the ones below:

- Employee Costs: Hiring employees will require additional funding. You’ll need to take into account employee salaries, employee benefits, and employee training. All of these will cost money for your business.

- Promotion: While online advertising was mentioned prior, it’s worth mentioning again. Promotion is key in this world. Without paying for promotion and advertising, a business likely won’t get far.

Most businesses have reported that it takes about £5,000 to launch. However, that doesn’t take into account all of the costs spent during the startup period. As a general rule of thumb, the startup period is about a year before everything is off the ground. Small businesses have reported that additional startup costs amount to about £23,000 in the first year. Those costs break down into the following categories:

- Legal Costs: £6,500

- Accountancy: £4,000

- Human Resources: £4,500

- Company Formation: £8,000

Most people state that they underestimated their startup costs by about £2,000. As such, building a cushion to provide that is recommended.

Starting a business isn’t cheap. In fact, it takes a lot of work and money before you can start earning money. As such, calculating your startup costs before you dive in is suggested. Understanding the needs of your business and their associated costs is a recipe for success. If you want more small business articles like this, visit our resource hub ! We love supporting small businesses.

RELATED ARTICLES

Save Time Billing and Get Paid 2x Faster With FreshBooks

Want More Helpful Articles About Running a Business?

Get more great content in your Inbox.

By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy . You can unsubscribe at any time by contacting us at [email protected].

15 Startup Business Costs To Consider In The UK

We’re dedicated to helping people start their own successful businesses – and the key to success is transforming your idea and passion into a plan. it’s like the old saying goes, “failure to plan is planning to fail”. .

Unfortunately, 1 in 5 new businesses in the UK fail each year . The biggest reason for this is that they didn’t plan. Having an idea will only take you so far, but to reach success, you need to know how to translate this vision into actionable steps and get a clear view of the challenges you’ll face along the way.

One of these challenges is how much starting a business will cost you and all of the hidden expenses that you might not have thought of.

Knowing what to expect (and planning to cushion to fall back on!) will help you finance the right amount, soar through your first 12 months and ultimately put you on track to earning profit.

So to help you on the way, we’ve put together this guide on the startup business costs to consider and plan for in the UK.

What you'll get from this page:

The importance of knowing your startup business costs

Finances are arguably the most important part of any business. If you can’t make your business profitable, it’s game over. As much as you might love your business idea, if you can’t get the finances to line up, it will be like trying to cross the Atlantic on a sinking ship.

We’re not saying this to frighten you or dampen your spirits. It’s just to really hammer home the importance of knowing what startup and running costs you can expect to face.

The more you know, the more you can plan for and the less you will rely on sales as you find your feet.

In addition, if you plan on applying for finance, whether you’re applying for a loan or seeking an investor, knowing your costs will also ensure that you ask for the right amount to get your business in the best position possible.

Starting A UK Business?

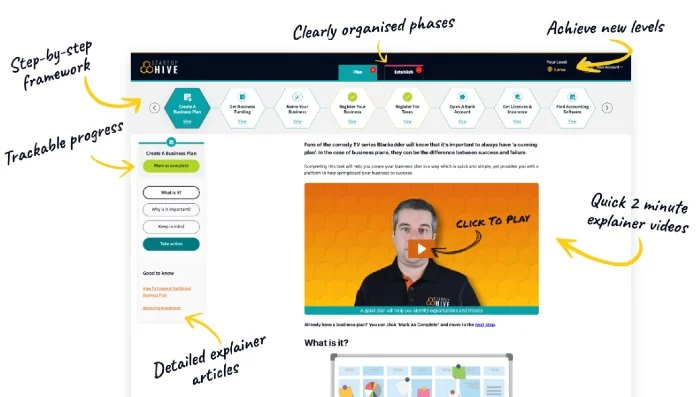

Get rid of the confusion and always know what to do next with Startup Hive , the step-by-step platform created by the Business4Beginners team.

- FREE Step-By-Step Platform

- FREE Bank Account

- FREE Bookkeeping Software

- FREE Email Platform

- FREE Domain Name

- Discounted Company Formation

- Plus Much, Much More!

Join today for 100% FREE access to the entire Plan & Establish phases , taking you from validating your business idea through to setting it up, getting your accounts sorted, and creating a website.

“Excellent guide to build your business”

“The perfect starting point”

“Incredibly simple and intuitive to use”

Startup Hive is your trusted companion as you look to turn all of your business dreams into reality. Join today for free .

What type of start-up costs can I expect?

It’s time for our favourite answer: it depends!

The type and amount of start-up costs you can expect will vary by the type of business, industry, location and ambition. For example, different company structures (i.e. a sole trader or limited company) will see different costs involved with company formation and taxation.

Generally speaking, all start-up costs can be grouped into one of three categories.

Investigatory costs

These are the costs that are involved in researching your market, making a business plan and ultimately assessing your business before you register it.

This could include costs of buying competitor products as part of industry analysis, running surveys or panel groups to create user research or any consultancy fees for research or advice.

Enjoying this article?

Get the latest small business advice in your inbox

Get more articles like this when you join our exclusive email newsletter packed with regular updates & business-boosting tips.

You can unsubscribe at any time. See our Privacy Policy .

Pre-launch startup costs

These costs happen as you prepare to register and launch your business, but before you are ready to start trading. This could include anything from equipment, formation fees, training and qualifications, office furnishings, and initial inventory.

Which Company Formation Package Is Right For You?

Answer 5 multiple choice questions to get a personal recommendation:

OPTIONAL: Claim your free guide to forming a new company?

Insert your email below and we'll send you it along with our regular newsletter and other downloadable guides to help grow your business. You can unsubscribe at any time.

Post-opening startup costs

Post-opening startup costs happen after your business is officially launched and trading and cover the day-to-day management and promotion of your services.

For example, they can include bills like insurance and utility bills, licensing, stock management, rent and finance repayments, and any advertising, marketing and promotion. If you hire employees, payroll will also fall under this category.

15 startup business costs to consider

Now you have an understanding of startup costs, let’s help you plan with some of the most common expenses that you will be facing.

1. Research expenses

We briefly mentioned these in the investigatory costs section, but this expense will cover anything that you need to research your business, audience, industry and competitors. For example, this could include:

- Hiring an external research agency to help you explore your industry and market fit.

- Any software you use to research, such as survey websites for audience research.

- Offered incentives to your audience if they speak with you, such as gift cards or physical gifts.

- Access to paid market research insights that other companies have already completed in your sector.

- Any professional fees for paid advice from accountants, consultants or legal professionals.

Another important research cost to consider is money to purchase competitor’s products or services.

Just looking at a website will only get you so far, sometimes you need to go through the entire journey and stress test their products to get insights that you wouldn’t otherwise. For example, how are their products shipped and packaged? What is the unboxing experience like? What is their customer service team like? What emails or after-care do they provide? Unless you act as one of their consumers, you won’t easily get these answers.

2. Professional fees

This will cover the costs of any professional that you will need to hire for your business, whether it’s for one-off use or an ongoing basis. This can include:

- Accountants

- IT manager

- And more.

Basically, any service or advice that you pay a professional for will be included in this section. This could be anything from helping manage the books, to getting your equipment installed, to helping write contracts or even gaining appropriate certification.

When looking at this cost, don’t assume that you will be able to do everything in-house without help. Even if you don’t hire an accountant and choose to manage the books yourself, you still will want to consider any one-off services that you might need help with, like annual reports.

In addition, you’ll want to think about the cost of the accounting software you will use instead, which we’ll cover a little bit more in the subscriptions section.

EXCLUSIVE OFFERS – Save On Your Accountancy Costs

10% Off Accountancy Packages

Read Full Review

10% Off Accounting Software

3. Finance fees

Whether you’re considering applying for a loan, attracting an investor or borrowing from friends – you don’t get money for anything. Whatever method you’re using to finance your startup costs, you need to factor in any interest and fees that you’ll accrue and how you can pay the amount back.

4. Insurance costs

The level of coverage and types of insurance that businesses will need depend on your industry, structure, and the services that you offer. If you’re a sole trader, technically, you don’t need to take out any insurance.

However, there are very big caveats to that and instances where insurance is essential for any business. For example:

- Professional or Public Liability Insurance could be required depending on the contracts you enter into, especially if you work closely with or in the public eye. Some clients may refuse to work with you unless you have a minimum coverage amount, ranging between £1-£10 million. But the good news is that if you’re held responsible for injury or property damage, you’re covered.

- Employers’ liability insurance is a legal requirement if you have employees – and you can be fined up to £2,500 every day you don’t have this protection in place.

- Building and contents insurance protects your premises and equipment if the worst should happen. If you’re running a business from home, note that your personal building and contents insurance might not cover your business, so you will need a separate policy for this side.

- Vehicle insurance is essential if you’re using a business vehicle or travelling as part of your work.

There may also be policies you can choose to take out for extra protection, such as personal accident insurance, which guarantees your income if an injury prevents you from working.

5. Rent or property costs

If you’re planning on renting or purchasing a property to run your business from, then you need to factor the cost of rent or mortgage into your plan.

But as well as the rent, you will need to consider any changes or upgrades you need to make to the space to make it suitable. This could include any remodelling or installations (particularly if you work with specialised equipment) or even essential furnishings like desks and chairs.

6. Employment

If you want to employ staff, then you need to factor in costs for wages, payroll and employer expenses – such as national insurance and pension contributions.

This will also be a factor for anyone that wants to set up a limited company, as you will class as an employee of the company and therefore earn a monthly salary .

Alternatively, if you’re considering hiring any contractors or freelancers, you will need to factor in where you will hire people from. If you plan on using an agency or external recruiter, you must factor in their fees on top of the contractor’s salary.

7. Equipment and supplies

What equipment and supplies do you need to get started with your business? These could be big-ticket items, such as computers, machinery, trade tools, office furniture, or even vehicles.

But as well as thinking big, you should also think about every day or unseen costs that you will also need, such as:

- Uniforms or protective clothing;

- Stationary;

- Power cables/extension cords;

- First aid supplies;

- Kitchenware;

- Refreshments (never forget the tea).

Think about the items you will come into contact with and use daily. Then, make sure you add its cost to the list.

8. Technology or subscriptions

As well as physical assets and supplies, there will be a list of technological services and subscriptions that you will need to factor into your business. This will include any software licenses you may need (i.e. Microsoft or Adobe), as well as data, storage, and security.

Bills and utility also come under this heading, so think about the power, gas and water costs of your building – as well as the internet. If you have a business phone, you will also need to cover the costs of the mobile network.

You’ll also need to consider any third-party programs or applications you might use, such as CRM, marketing or accounting software .

It is worth noting that some of this software can come with free tiers or options.

Which Accounting Software Is Right For You?

OPTIONAL: Claim your free Bookkeeping for Beginners guide?

9. Stock

If your business model relies on selling stock, you must source where and how you will get it. Ask yourself:

- What manufacturers, supplies or distributors are you going to use?

- How much do they charge?

- How much stock do you need to start?

- Where will you store your stock and how much room do you have?

- How much does it cost to move your stock?

Our recommendation: don’t go all in on your first order. Test the waters first and reassess when you have more data.

10. Delivery

If you ship out physical items to customers, you should factor in delivery and packaging costs and which provider you will use. This will also help you price your product, especially if you charge for delivery.

Although it might be tempting to go for the cheapest option out there, unboxing plays a key element in how customers see your product and brand. It’s why Apple have spent so much time and money on designing their patented white boxes – so users get that slick experience from the very first second. Obviously, you don’t have the money and resources of Apple, but it could be worth researching and costing custom printed boxes or inserts to add that extra something special.

11. Marketing and promotion

You got to spend money to make money, right? In the case of marketing your business, that is true. There’s no point putting all this time, money, and effort into a business if your audience doesn’t know that you exist.

Marketing is all about promoting your business to your audience, getting them to trust your brand and ultimately spend money on your products and services.

There are tons of ways that you can market your business, some of them free (including social media). But depending on your business and tactic, you might want to set aside some money to spend on paid advertising or creating assets for your business.

If you’re looking for some marketing tips, we’ve got a host of guides and ideas to get you started, including:

- How To Promote Your Business On Google

- 6 Best Website Builders For Small Businesses

- Top 17 Small Business Website Design Tips

- How To Convert More Website Visitors Into Customers

- How To Market A Small Business On Social Media

- What’s The Difference Between PPC & SEO?

- 7 Small Business PPC Tips

- 7 Affordable Small Business SEO Tips

12. Website

More and more business is happening online. If you don’t have a website, your customers won’t be able to find you.

Having a website comes with varying costs, from hosting and building to professional design or copy work that you might want to invest in. For most startups, we’d recommend using a website builder as they offer relatively inexpensive packages that cover most services in one. Some builders even offer free tiers to get started, but we wouldn’t rely on those options forever.

13. Formation fees

If you’re planning on forming a limited company, there are formation fees that you will need to pay. In many cases, though, this cost can be around £50.

In fact, if you don’t want to handle the paperwork, you can hire a company formation agent to form your company on your behalf for just £12.99 or under.

Top-Rated Company Formation Agents

| Formation Agent | Cheapest Package | Add On Services | Our Rating | Review | Official Site |

|---|---|---|---|---|---|

| £52.99 | Excellent | ||||

| £51.99 | Excellent | ||||

| £50 | Average |

14. Taxes

No company is exempt from taxes. If you’re a sole trader, you will be liable to submit a self-assessment tax return each year and pay income tax on your profits, as well as Class 2 and 4 National Insurance .

If you’re a limited company, you will be expected to submit annual reports and pay corporation tax at a fixed rate.

You will also be liable to pay VAT if you are VAT registered.

Although it will be hard to work out your exact tax bill until you get a clear idea of your expenses and profits, an accountant could help you complete a financial forecast to better understand what money you will need to set aside for your tax bills.

15. Rainy days

Finally, it’s always a good idea to set extra money aside for overlooked or unexpected expenses that you might come across. Having that extra cushion will always come in handy.

FREE Download:

The Business Success Planner

Set clear goals for your business

Plan and manage your time more effectively

Brainstorm ideas and log inspirations

Stay motivated and encouraged

How to calculate startup business costs

We’ve given a lot of examples of startup business costs to consider when creating a business in the UK. Now it’s time to get into how you use this list to calculate your expenses.

First, use the above costs to list all the necessary expenses. During this step, it might be useful to separate these items into one-time expenses (i.e. equipment) and ongoing costs (i.e. technology).

Once you have a full list, it’s time to research how much each item will cost your business. This step could involve talking to different vendors to get their price lists, or even scouting properties available for rent.

With a full list of estimates, it’s time to get your total amount. When looking at ongoing expenses, it might be useful to break this down into how much it will cost you for the first 6 or 12 months of your business. Then, add a safety cushion to help you account for any hiccups, price increases or expenses you’ve overlooked.

With this figure, you’ll be armed with the data you need to complete your business plan and apply for the investment needed to get started. And for anything else that you will need on the way, you can always rely on Business4Beginners for advice, tips, and help.

SPECIAL REPORT:

Why 1 In 5 Businesses Fail In Their First Year

Download your FREE copy when you subscribe to our email newsletter with regular updates and business-boosting tips.

Related Posts:

The Small Parties’ Election Manifestos 2024 And SMEs

Labour Manifesto 2024: What It Means For SMEs

Conservative Manifesto 2024: What’s In It For SMEs

Frequently Asked Questions About Patents, Trade Marks and Copyright

Consumer Card Spending Up By Only 1% Compared To 2023

New Online Consumer Rights Laws To Come Into Effect

Blog / Small business tips / How much does it cost to start a business in the UK?

How much does it cost to start a business in the UK?

Before you can launch a new business, you have to have enough cash to get it off the ground. But, how much exactly does it cost to start a new business?

This figure varies widely depending on your chosen industry, location and venue—launching an online freelance writing business will cost significantly less than opening a brick and mortar retail store.

On average, UK startups budget £5,000 to launch . Further, the average UK startup spends £22,756 in their first year , according to a study commissioned by Geniac .

But, as only 42.4% of SMEs survive past their first five years , the key is budgeting enough to not only launch, but survive and thrive in the long-term.

In this article, we’ll explain the importance of calculating business startup costs, define the types of startup costs you may encounter and provide tools to help you calculate and organise your small business finances to boost your chances of long term success.

Table of contents:

Why do you need to calculate business startup costs.

- How do you figure out how much cash you’ll require to get started?

What are startup expenses?

What are startup assets, what are the different types of startup costs, 13 common business startup costs, should you try to minimise startup costs , where to find capital for your new business, wrapping up.

Financial preparedness helps you to budget for expected and unexpected costs. A clear-cut view of your financial health can help you make better business decisions, keep your business afloat and ultimately boost profits.

According to the same Geniac study , approximately two-thirds of small business owners experienced unexpected costs during their first year, leading to reduced profits and stunted growth.

By strategically calculating your own business startup costs and factoring unexpected expenses into your budget, you increase your chances of success.

Calculating startup costs also helps you to:

- Figure out if you can afford to launch your business at all

- Explore multiple funding options if you do not have enough cash to self-fund your venture

- Demonstrate to investors that you understand your startup costs, thus building trust

- Decipher if your business idea is financially viable in the long-term

- Discern if you can afford any staff to help you launch

- Calculate a budget for all areas of your business, such as what and how many materials and equipment you will need to launch, how much it will cost to market and promote your brand, etc.

If you fail to calculate your startup costs before you launch, you may end up grossly underestimating your needs.

How do you figure out how much cash you’ll need to get started?

The best practice is to overestimate what you’ll need in your business plan . Expenses can rise over time, so account for that inflation in your startup costs. Don’t make the mistake of overestimating revenue and thus underestimating costs—hope for the best, but plan for the worst.

Before you can calculate how much cash you’ll need to get started, you have to fully understand how your own business will run. You may want to seek business advice to help you determine the best legal and financial models for your business type, as they vary based on your business goals.

On the legal side, you have to determine your company formation type before you can register your business. Will you be registering as a sole trader, a limited company, a business partnership, or a limited liability partnership?

Each has its pros and cons as well as varying rules regarding taxes, reporting and responsibilities. We will detail the exact costs of registering your business under each company formation type in a later section.

Top Tip: To learn more about how to choose your company formation type as well as the benefits and drawbacks of each, read our guide on how to register a business in the UK 📖

On the financial side, you’ll need to grasp the basic fundamentals of accounting to avoid running into cash flow problems. This includes choosing the right accounting method and knowing the three main financial statements so that you can work bookkeeping tasks into your business plan.

Top Tip: To learn more about how to streamline your small business accounting process, read our complete guide to accounting for startups 📂

Once you choose your business formation type and accounting principles, you’ll have a much better handle on how your business will operate. This is key for helping you to accurately create a cash flow forecast and determine your projected revenue, things you need to include in your business plan if you are looking for investment.

When starting a new business there are things you’ll need to spend money on in order to get up and running. These are your startup expenses.

Startup expenses are ‘sunk costs’, meaning you won’t get back what you spend, regardless of whether your business succeeds or not. These expenses are essential in not only getting your business to market but determining how successful you are in the early months and years of your operation.

That’s because the money you invest in your business early on will determine how quickly you can attract and engage a loyal audience, thus bringing in enough revenue to stay afloat and scale.

Examples of startup business expenses include:

- Marketing and branding: Money spent on web design, website hosting, logo design, content creation, social media advertising, business signage, flyers, posters, brochures, business cards and any other marketing collateral.

- Professional fees: Money spent on business consultants and advisors to help with writing a business plan, for example, or accountants and solicitor fees for registering your business with Companies House.

- Recruitment fees: Money spent on job boards to advertise vacancies or recruiters to hire new employees.

- Registering your business: As mentioned above, this is a one time fee that you will pay after you choose your company formation type.

Top Tip: You can get a free business bank account when you register your business with Tide, plus you’ll only pay £14.99 instead of £50! We’ll pay the rest on your behalf. Register your business today 👍

Unlike startup expenses, startup assets are things you’ll invest in that have ‘asset value’. This simply means they retain their value over time.

For example, if you’re setting up a photography business, your camera, laptop and printer would be assets. These all have sell on (asset) value and could be sold to make your business some money back.

If your asset qualifies, you can deduct the full cost of the item from your profits before tax under HMRC’s annual investment income (AIA) . So while you’ll still need to account for assets in your initial startup calculations, these costs aren’t sunk expenses in the same way that a lot of other purchases will be.

AIA can be claimed on most plant and machinery up to the AIA amount. The AIA amount varies frequently, so make sure to check the GOV.UK website for the latest numbers. Here are the most recent reported amounts, as of June 2020:

| 1 January 2019 – 31 December 2020 | 1 January 2019 – 31 December 2020 | £1 million |

| 1 January 2016 – 31 December 2018 | 1 January 2016 – 31 December 2018 | £200,000 |

| 6 April 2014 – 31 December 2015 | 1 April 2014 – 31 December 2015 | £500,000 |

| 1 January 2013 – 5 April 2014 | 1 January 2013 – 31 March 2014 | £250,000 |

| 6 April 2012 – 31 December 2012 | 1 April 2012 – 31 December 2012 | £25,000 |

| 6 April 2010 – 5 April 2012 | 1 April 2010 – 31 March 2012 | £100,000 |

| 6 April 2008 – 5 April 2010 | 1 April 2008 – 31 March 2010 | £50,000 |

According to GOV.UK , you can claim capital allowances on:

- Items that you keep to use in your business (including lorries, vans, trucks and motorcycles, but not cars)

- Costs of demolishing plant and machinery

- Parts of a building considered integral, known as ‘integral features’

- Some fixtures, for example, fitted kitchens or bathroom suites

- Alterations to a building to install other plant and machinery – this does not include repairs

You cannot claim capital allowances on:

- Things you lease (you must own them)

- Buildings, including doors, gates, shutters, mains water and gas systems

- Land and structures, for example, bridges, roads, docks

- Items used only for business entertainment, for example, a yacht or karaoke machine

HMRC also says that you cannot claim AIA on:

- Items you owned for another reason before you started using them in your business

- Items given to you or your business

Not all costs are created equal. With some costs, you will never earn back what you spend, while others are paid with the intention of earning a return on your investment (ROI).

Here are the various startup cost types.

- One-time costs: These are the ‘sunk’ costs that most startups experience, such as the cost to incorporate your business, purchase a top-level domain (TLD) for your website or buy an expensive piece of equipment.

- Fixed or ongoing costs: Ongoing costs are paid on a regular basis and rarely fluctuate. These costs include rent, utilities, interest fees on business loans and labour. Fixed costs are usually contractually agreed upon.

- Variable costs: Conversely, variable costs vary and depend on the amount of goods or services you need to produce in a given time period. For example, seasonal costs affect many retail businesses, causing a spike in purchase orders when demand is higher. As such, the cost of running a business reliant on seasonal demand will fluctuate throughout the year.

- Essential costs: Essential costs are purchases you make that are absolutely necessary in order for your business to either stay afloat or grow. Critical research and development (R&D), new staff hires and game-changing SaaS tools may fall into this category.

- Optional costs: You should only spend on optional costs when you have enough cash to cover crucial expenses and keep your emergency fund fully stocked. If that is the case, you may want to spend money on optimising your website, upgrading to a more advanced subscription-model on a key SaaS tool, or increase your digital ad spend to broaden your reach.

Understanding your business expenses will help you work backwards to determine how much cash you’ll need to launch.

Top Tip: Learning how to manage your expenses is crucial to business survival. Read more about how to save money, pay the right amount of taxes and keep a pulse on your financial health in our guide to business expenses 💳

The specific startup expenses, assets, variable costs and fixed costs you’ll incur in getting your small business off the ground depends on the industry you’re in, but there are typical costs for every business. Let’s dive in.

1. Research

Coming up with solid business ideas and then understanding how to start a business in the UK requires thorough research. And before you launch your business, best practice is to first validate your idea(s) by learning about and talking with your target audience to see if there’s purchasing interest

A lot of market research , like searching on Google, scanning social media sites, finding competitors and questioning family and friends, for example, can be done for free. But if you need to dig deep into industry data, you may need to invest in a market research firm or paid online market research platforms.

Rates for market research can vary widely, from £100 for a survey to upwards of £8,000 for online consumer data.

2. Equipment

Equipment costs cover the plant and machinery you’ll need to produce your product or offer your service. This includes office space and/or shop costs.

For example, if you run an ecommerce business, you’ll need a computer, desk, chair and printer, as well as other office furniture such as filing cabinets and bookshelves. If you’re selling products in a shop, you’ll need display units, a till and a contactless payment machine. If you buy stock from a wholesaler, you may need a van to transport goods.

On top of the equipment you need to do the work, you may need other essentials to provide a comfortable workspace – things like kitchen appliances, water coolers, air conditioning and bathroom fittings, for example.

Write down every item you need to run your business and furnish your premises.

3. Registration fees

Depending on the structure of your business, you may need to pay an incorporation fee.

Here is the cost breakdown of registering your business:

- Registering as a sole trader is free

- Registering a limited company costs between £50 and £100 depending on the method you choose, although you can register for only £14.99 with Tide as we take care of the rest for you

- Registering a limited partnership costs £71

- Registering as a limited liability partnership costs between £50 and £100 depending on the method you choose

4. Business premises

If you’re able to work from home, the cost of your business premises will be free and you’ll be able to claim back a proportion of household bills on your tax return. If you need to rent commercial space, costs vary widely.

According to Statista, the cost of renting prime office space in London in Q1 of 2021 was as high as £110 per square foot (so a 1,400 sq ft office would cost around £154,000).

However, some areas charge per person per month. For example, in Leeds the average rent is around £250 per person per month. So for a small team of four, office rent would be around £12,000.

For prime industrial space , rental costs in 2021 were as high as £17 per square foot in London and as low as £5.50 per square foot in Wales. Rent for a 5,000 square foot industrial space would cost up to £85,000 in London but around £27,500 in Wales.

For prime retail space in UK cities in 2021, costs varied between £2,150 per square foot per year in London to £92 per square foot per year in Bristol.

While some office and business space rents include utilities, others don’t. If utilities aren’t included in the space you’re thinking about renting, add the following to your startup costs and ongoing monthly expenses:

- Water

5. Inventory

If your new business is in retail, manufacturing, wholesale, distribution or hospitality, you’ll need stock to be able to hit the ground running.

Working out how much stock you need can be challenging. Too much can leave you stuck with items you’ll never sell. In the case of hospitality, in particular, this can mean spoilage and, thus, financial losses. On the other hand, too little stock may leave you unable to meet demand.

Estimate your startup inventory costs by working out:

- What products you’re going to sell

- How many products you’ll need to open your business

- The recommended retail price (RRP) of your products (which helps to standardise the price of goods)

- The product markup

Let’s say you plan to sell mugs that retail at £10. The average product markup is between 30% and 40%, which means the wholesale price of the mug would be £6-£7. Multiplying the wholesale price by how many items you’ll need to open your business will give you an estimate of how much you’ll need to spend on stock.

So if the wholesale price of the mug was £6 and you need 300:

£6 x 300 = £1800

According to research f rom Deloitte , in 2020 38% of consumers did more shopping online relative to pre-lockdown levels.

A website is your online business shop front and an important sales and marketing tool for any new startup. The type of website you’ll need depends on what you plan to offer. If your site will primarily promote services, a template-based design on an all-inclusive platform such as Wix or Squarespace may be suitable.

- Wix plans start from £13 a month

- Squarespace plans start from £15 a month

Both include domain, hosting and storage.

If you’re running an ecommerce business, Shopify or WordPress WooCommerce might be better suited, both of which offer templates and simple tools to help you create and manage an online store.

- Shopify plans start from $29 (around £21) a month

- WordPress and WooCommerce are free, but you’ll need to purchase a domain (around £10-15 a year) and hosting (between £3 and £200 a month depending on your demand)

If you want to work with a web designer to create a custom design for your website, the average cost, according to TechRad ar, can be anywhere from a few hundred pounds to several thousand.

Top Tip: To learn more about joining the online business world, read our guide on how to start a business online 💡

7. Marketing

To get customers or clients to buy from you, you’ll need to market and promote your business. This will require a digital marketing strategy .

The good thing about marketing is that it doesn’t have to cost anything. Word of mouth and social media are two of the most effective ways of promoting a business and both are completely free.

However, you may want to get the word out about your business through paid online, print or media advertising, or by hiring a marketing company to promote your business.

According to Nuanced Media founder , Ryan Flannagan, you can work out your marketing budget by calculating your revenue and company size.

According to this study, new companies should spend 12%-20% of their gross revenue on marketing.

Top Tip: To learn more about creating an effective marketing strategy to drive traffic to your product or service even before you launch, read our guide on how to build a go-to-market strategy that attracts ideal customers 👀

8. Branding

Branding is a reflection of who you are and what you do as a company. As a new business, your brand will play a critical role in how customers perceive you and consistent presentation has been shown to increase revenue by as much as 33% .

Like marketing, branding doesn’t have to cost anything. If you have a clear vision in mind and are competent with graphic design, it’s possible to create your own name and logo, brand guidelines, values and mission statement.

However, you’ll need to factor in costs for additional assets related to your brand, such as business cards, product packaging, point of sale, signage or event flyers.

If you’re new to the concept of branding or want to be sure that what you create is going to have the desired impact, hiring a branding agency or freelancer is a worthwhile investment. But it might not be cheap.

Research by canny shows that branding prices range from £300 for stationery design to as much as £50,000 for brand strategy.

| Brand audit / Discovery | £1,000 | £10,000 |

| Brand Strategy | £1,000 | £50,000 |

| Brand Identity | £2,500 | £50,000 |

| Brand Guidelines | £1,500 | £10,000+ |

| Signage Design | £500 | £5,000 |

| Stationery Design | £300 | £10,000 |

| Packaging Design | £1,000 | £10,000 |

| Vehicle Livery | £500 | £10,000+ |

| Website Design / Development | £2,500 | £100,000+ |

| SEO / Digital Marketing | £500 per month | Thousands monthly |

| Social Media | Your own time | Thousands monthly |

Top Tip: As your business and customers grow, you may need to shift your brand’s tone and voice to stay aligned with current trends. The best practice is to consistently revisit and evaluate your brand presence as your business evolves. To learn more about what makes up a brand and when and how to rebrand as you grow, read our five-step approach to rebranding your company 🔎

9. Office supplies

Along with the equipment you need to furnish your business premises, you’ll need office supplies to help you do the work.

Small purchases like paper, pens, printer ink and first aid supplies can soon add up when purchasing everything at once, so focus only on the things you need and look at where you can save by doing things digitally.

For example, rather than using paper forms, think about using online forms for processes to reduce paper and printer ink usage.

10. Professional services

As tempting as it is to do everything yourself as a new business owner, getting professional help can benefit you in the long run. Whether it’s accounting , legal or IT assistance, or business mentorship, being able to turn to someone skilled in a specific area can help you prevent costly mistakes down the line.

Prices for business consultants vary depending on the discipline and amount of help you need.

In some cases, you may be able to get advice for free. GOV.UK’s Business Helpline , the Federation of Small Businesses and mentorsme all give you access to experts without charge.

However, for specialised, on-going expertise you should add professional services to your startup costs.

According to Consultancy.uk , the average price range for business consultants is £50-£300. This price often covers a specific time period that the business consultant will be working with you. Some consultants charge hourly or daily prices, while others charge based on the project at large. This varies widely from consultant to consultant, so make sure to get a full understanding of how your consultant will charge you before moving forward.

Top Tip: It may be smart to talk with an accountant or bookkeeper to guarantee your business finances are above board, organised and categorised correctly for tax purposes. To learn more, read our guide on how to choose an accountant for your small business 📂

11. Business insurance

Insurance is important to protect your business, assets and customers should anything go wrong.

Here are some of the typical types of insurances new businesses in the UK need:

- Building and contents insurance: Covering all stock and materials in the event of damage, theft, fire or natural disaster

- Professional indemnity insurance: Protecting you from claims made by unhappy clients/customers

- Public liability insurance: Protecting you against claims from members of the public who have been injured or suffered property damage due to carelessness

- Employer’s liability insurance: The same as public liability insurance, but for employees

- Vehicle insurance: Covering any vehicles used for business purposes

Insurance costs vary depending on the type and amount of cover you need, excess amount and additional features. The easiest way to find out how much a premium will be is to get a quick online quote through a comparison website like Simply Business .

12. Payroll

If you plan on recruiting staff or contractors from the start, you’ll need to factor in their salary and/or fees .

Hiring full-time employees will mean paying wages , as well as regular pension and insurance payments, plus setting up PAYE . Using contractors or freelancers will give you greater flexibility, but the one-off costs will likely be greater.

You’ll also need to take recruitment costs into account. If you’re sourcing talent through an agency or job board, you’ll most likely need to pay a fee.

Recruitment fees depend on the industry, the salary and whether the vacancy is temporary or permanent, as this infographic by Agency Central shows:

If you’re advertising a role through a job board, prices differ depending on the platform you use.

Here are typical prices for the leading job boards, from Recruitee :

- Indeed: Free or sponsored for $0.10 (around 8p) per click up to $5 per post (around £4).

- Monster: $375 (around £298) for a single job for 30 days or $399 (around £317) for 60 days, with the cost per job reducing on a sliding scale to $135 (around £107) per job for between 100 to 249 postings.

- LinkedIn: LinkedIn Recruiter starts at $8,999 (around £7,100) and Recruiter Lite at $2,399 (around £1,900) per annum. The cost of a job post per day is 1.3 times your pay per click budget.

- Facebook: Prices start at $5 (around £4) and increase to what you can afford. The more you pay, the higher the distribution of your job post.

You can also find freelancers on sites like Upwork , Fiverr , Toptal . Depending on the site, you may need to pay a small fee to use their services.

13. Software and licences

Most businesses need some form of software to carry out work.

Whether it’s a Customer Relationship Management (CRM) platform to manage customer interactions, an email marketing tool to capture email addresses and contact customers, accounting software like Xero or Quickbooks for invoicing or bookkeeping, or a specialist design tool like Adobe Photoshop, most software will require you to pay a one-off licence fee or ongoing subscription cost.

You’ll also need to include the cost of data storage and back-up to protect data should anything go wrong.

Software prices can range from a few pounds a month for a basic page up to hundreds for a top-end premium solution.

Write down every piece of software that’s essential for your business to get started and the cost of the required package.

Where to find prices

Some of your required startup costs will have defined prices that are easy to find. For example, the price of a website builder like Squarespace can be found on the company’s website. Other costs, such as the price of raw materials or office suppliers may be hidden from public view.

If you don’t know the cost of what you need, you can find estimated prices by:

- Searching online and gathering average prices

- Talking directly to vendors and service providers. Based on your business needs, they’ll be able to provide you with a free quote.

- Asking other business owners. A business that’s of a similar size to yours may have similar costs for office supplies, insurance, professional services and branding.

- Asking business mentors. An experienced mentor who has worked with business owners in your industry may be able to help provide ballpark costs for common purchases.

How to calculate your business startup costs

To calculate your startup costs, you need to create an expenses list that covers the costs of everything you need to open your business.

You can do this on a spreadsheet or, if you prefer, using pen and paper.

- Write down all of your required startup expenses and assets (the things you’ll need to start your business) and total how much they’ll cost. Some purchases will have a defined cost, others you’ll need to estimate based on research and average industry prices.

- Organise your startup expenses and assets into a list of one-time expenses.

- Create another list of monthly expenses which includes all of your fixed costs (your monthly outgoings) and estimated variable costs for 12 months (or longer if you prefer). To work out your variable costs, you’ll need to estimate how many products you’ll sell in each month of the first 12 months. For example, you might estimate selling 100 mugs in month one, 500 by month five and 1200 mugs by month twelve. From that, you’ll be able to work out how much you need to spend to meet customer demand.

- Add your one-time expenses list to your list of monthly expenses to get a figure for how much capital you’ll need to start and run your business.

Download this spreadsheet template for free.

Our free template helps you to easily and automatically calculate these costs. The top half is designated for monthly costs and the bottom half for one-time costs.

In the top half, enter your monthly costs in the “Monthly Costs” column and then enter the number of months those costs apply to your business in the “# of Months” column. The spreadsheet will automatically calculate your Total Monthly Costs in the far right column.

In the bottom half, enter your one-time costs in the “Total Cost” column on the far right. As they are one-time costs, there are no further calculations necessary.

Once complete, the spreadsheet will automatically add up your monthly and one-time costs to produce a “Total Startup Costs” number.

Create a formal report for your costs and add them to your business plan. Having clearly presented figures will help you in securing capital or investment.

It’s important to try to keep your startup business costs as low as possible. Why? Because slow and steady wins the race. Avoid investing a lot of money upfront in case your idea doesn’t take off right away or you encounter any problems post-launch.

Because many startup costs are sunk costs, it may take you some time to break even. If you can keep your costs low, you will break even and reach profitability faster.

If you can get into the habit of keeping costs low and thus retaining more revenue, you will give yourself a better chance of successfully scaling your business. Plus, if you can retain more revenue, you can reinvest that money back into your business.

Here are a few ways to minimise your startup costs:

- Work remotely: Renting an office space is incredibly expensive, with the average price in some areas reaching £455 per square metre per year . To avoid that, if possible, try launching your business from home, a cafe or a coworking space, either alone or with a distributed team, and grow from there.

- Opt for low-cost or no-cost alternatives: Avoid paying premium prices for goods or services when starting out. Instead, opt for refurbished or second hand equipment, or use a template website like Squarespace or Wix instead of paying a seasoned developer, in order to cut costs. You can always upgrade later on when you reinvest in your business.

- Prioritise organic marketing initiatives: There are plenty of ways to promote your business online entirely for free. Build an audience on social media, create blog content, ebooks, newsletter content, etc. and distribute it via online channels. Record webinars, create videos on a budget , attend networking events, and so on. Until you have enough money to spend on paid media, build a customer base organically with a thorough digital marketing strategy .

- Look for the best deal from suppliers: Don’t sign a contract with the first supplier you meet with. Often, international suppliers are cheaper than local suppliers , but each has its benefits and drawbacks. Don’t sacrifice quality, especially if it’s for a customer-facing item. When you do find an eligible supplier, negotiate the price, respectfully, to see if you can land an even better deal.

Top Tip: Working online is a great way to reduce startup costs. It’s also crucial for many businesses who are following work-from-home guidelines in response to COVID-19. Working online allows you to work remotely, often requires little to no large upfront costs and gives you ultimate freedom and flexibility over where and how you spend your workday. To learn more, read our in-depth guide to starting a business online 🖥

With the average cost of starting a business in the UK at around £12,600 , you may need to secure capital for your new venture.

There are several ways you can do this:

- Bank loan: Many major banks offer unsecured loans of up to £250,000, over one to 15 years

- Start Up Loan: A government-backed unsecured small business loan of £500 to £250,000, with a fixed interest rate of 6% per year payable over one to five years.

- Startup grants: Grants are offered on a case-by-case basis by the British Small Business Grants , InnovateUK and Horizon2020 .

- Angel investment: Investment from successful entrepreneurs and long-time investors in exchange for equity.

- Crowdfunding: A large number of people pooling small amounts of capital to finance a business venture.