Build my resume

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- Free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

24 Accountant Resume Examples That Worked in 2024

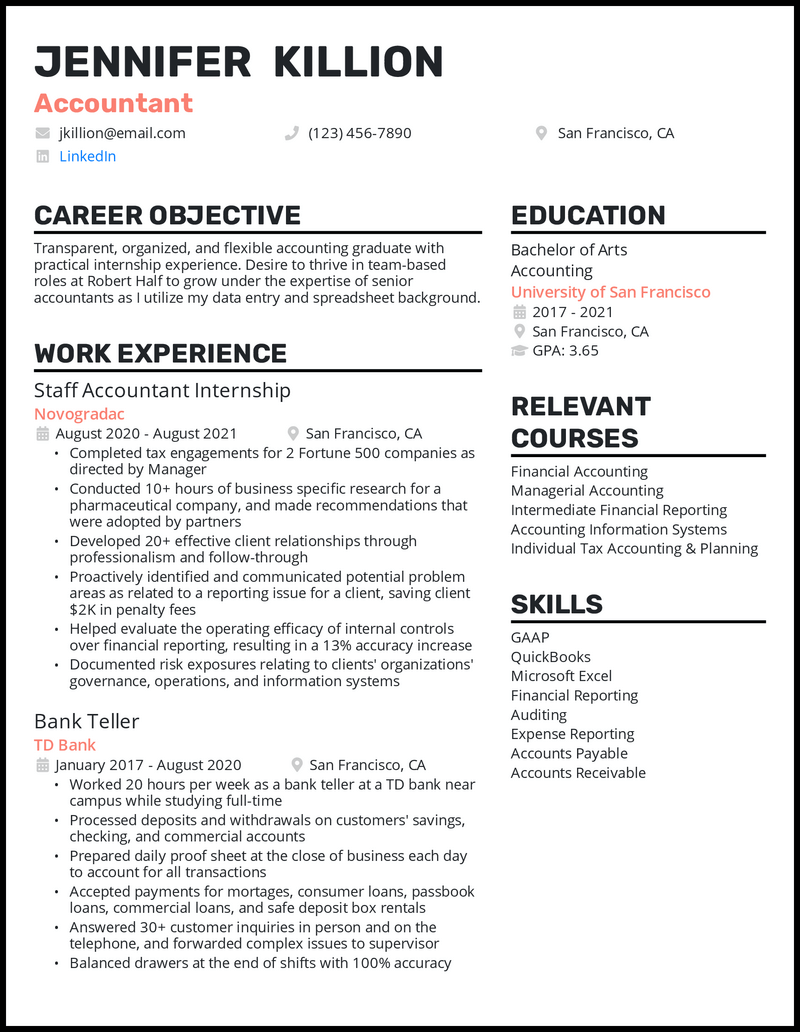

Accountant Resume

- Accountant Resumes by Experience

- Accountant Resumes by Role

Writing Your Accountant Resume

A business is only as valuable as its finances, so successful organizations are built on a foundation of solid accounting practices. To be a successful accountant, you need to be diligent, organized, and an expert with numbers and financial data.

However, to get a role as an accountant, you need to rely on a completely different skill set: resume writing . (And let’s not forget about cover letter writing! )

That’s where we come in. We’ve reviewed countless accountant resumes, distilling what works and what doesn’t into 24 accountant resume examples that you can use to help you get your next accounting job in 2024!

or download as PDF

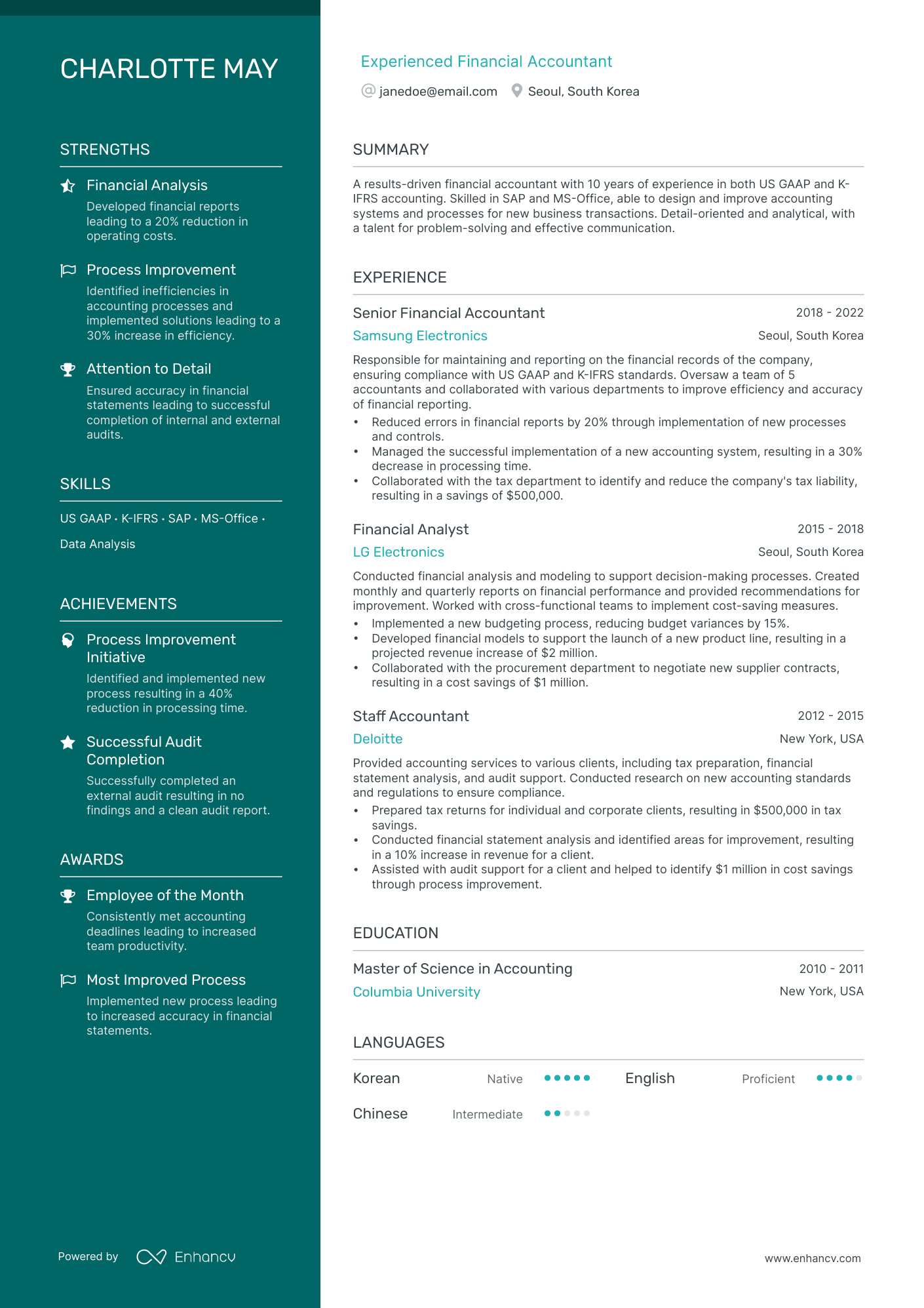

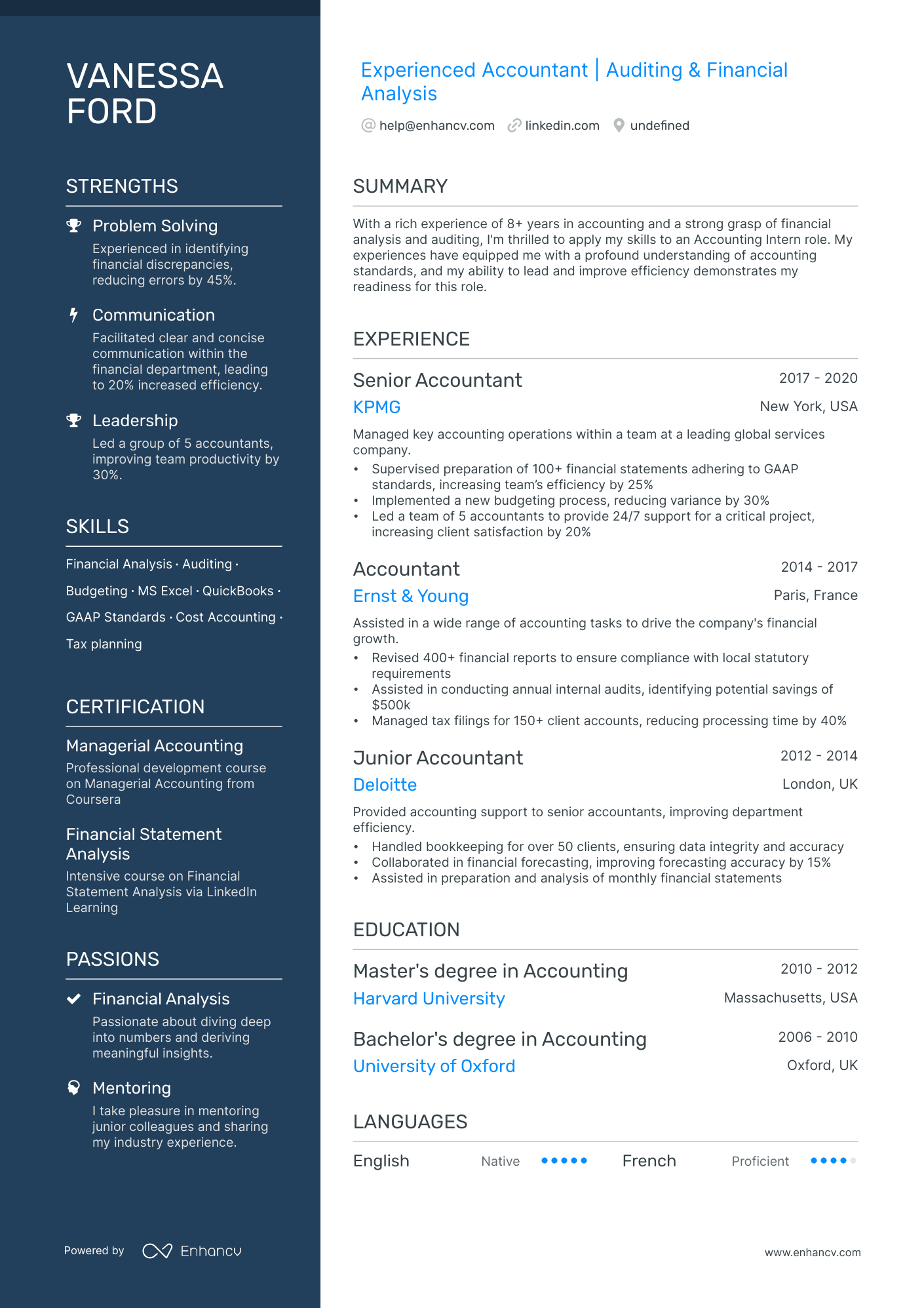

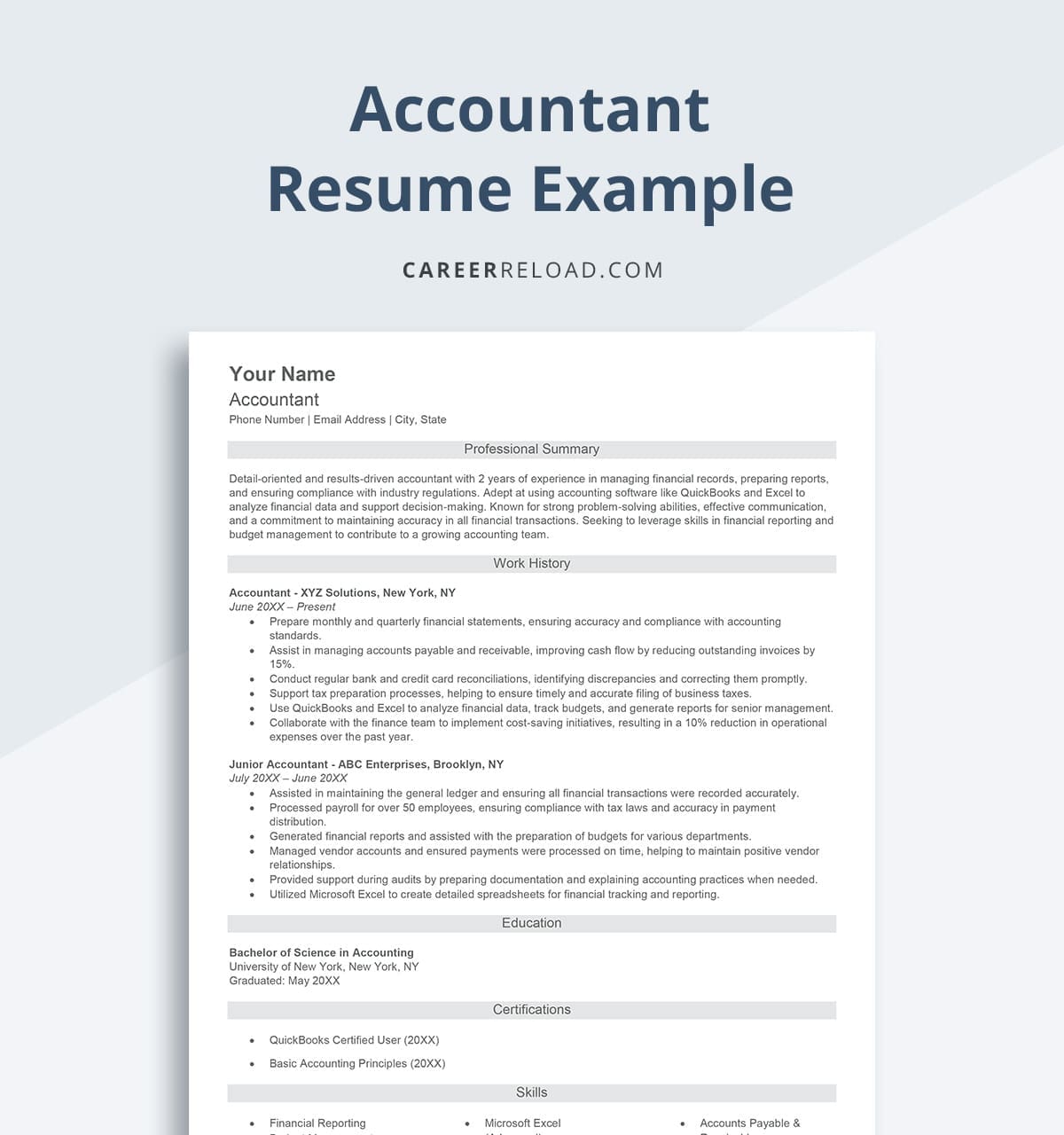

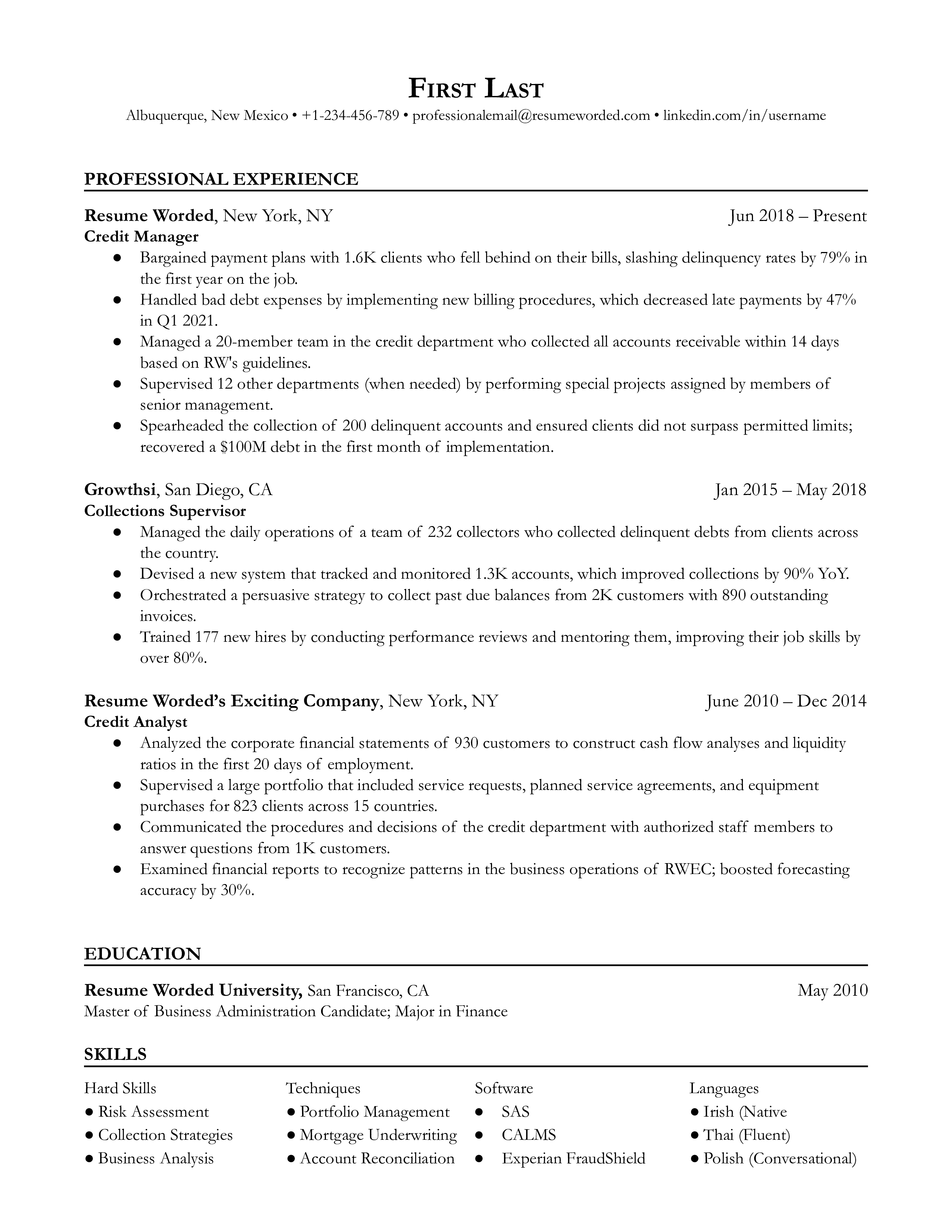

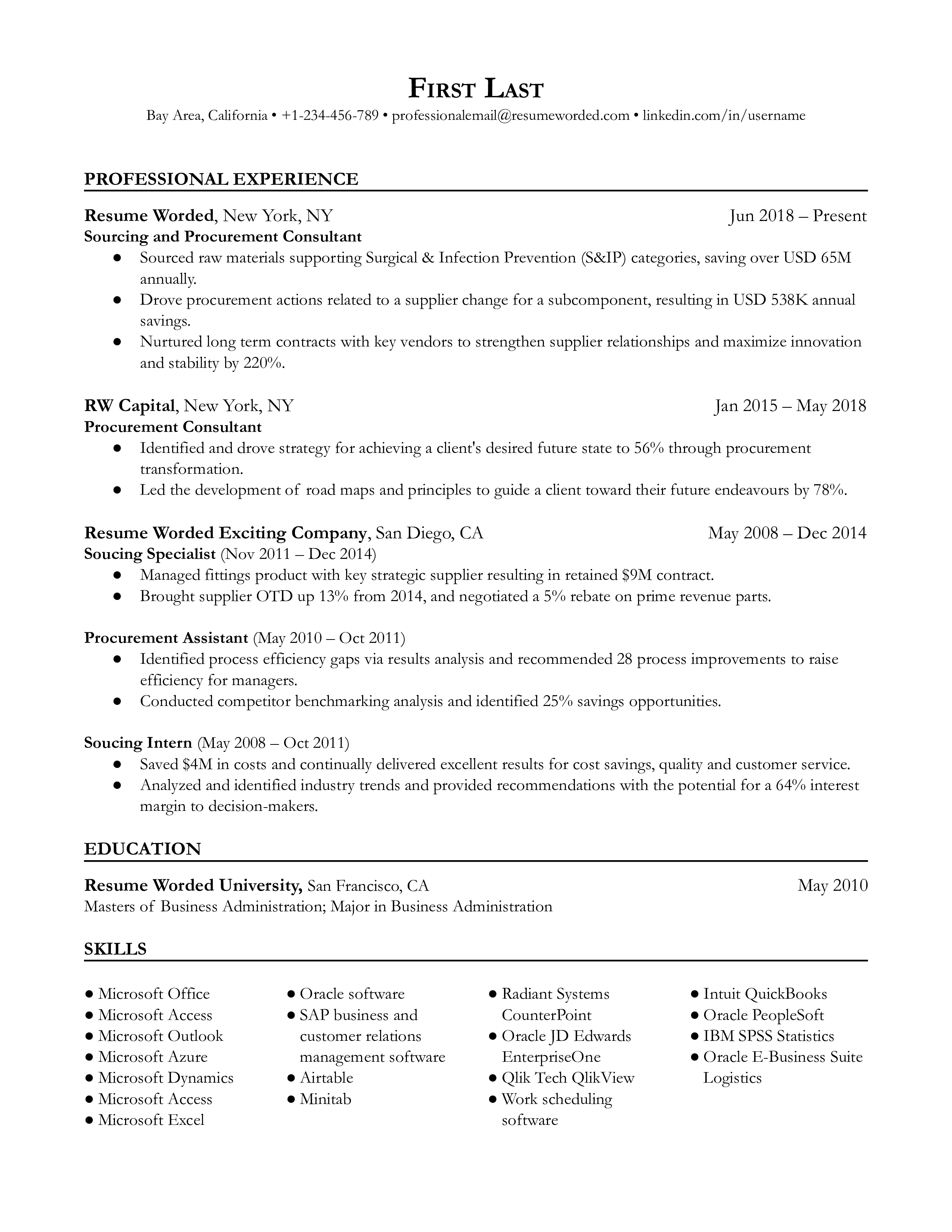

Why this resume works

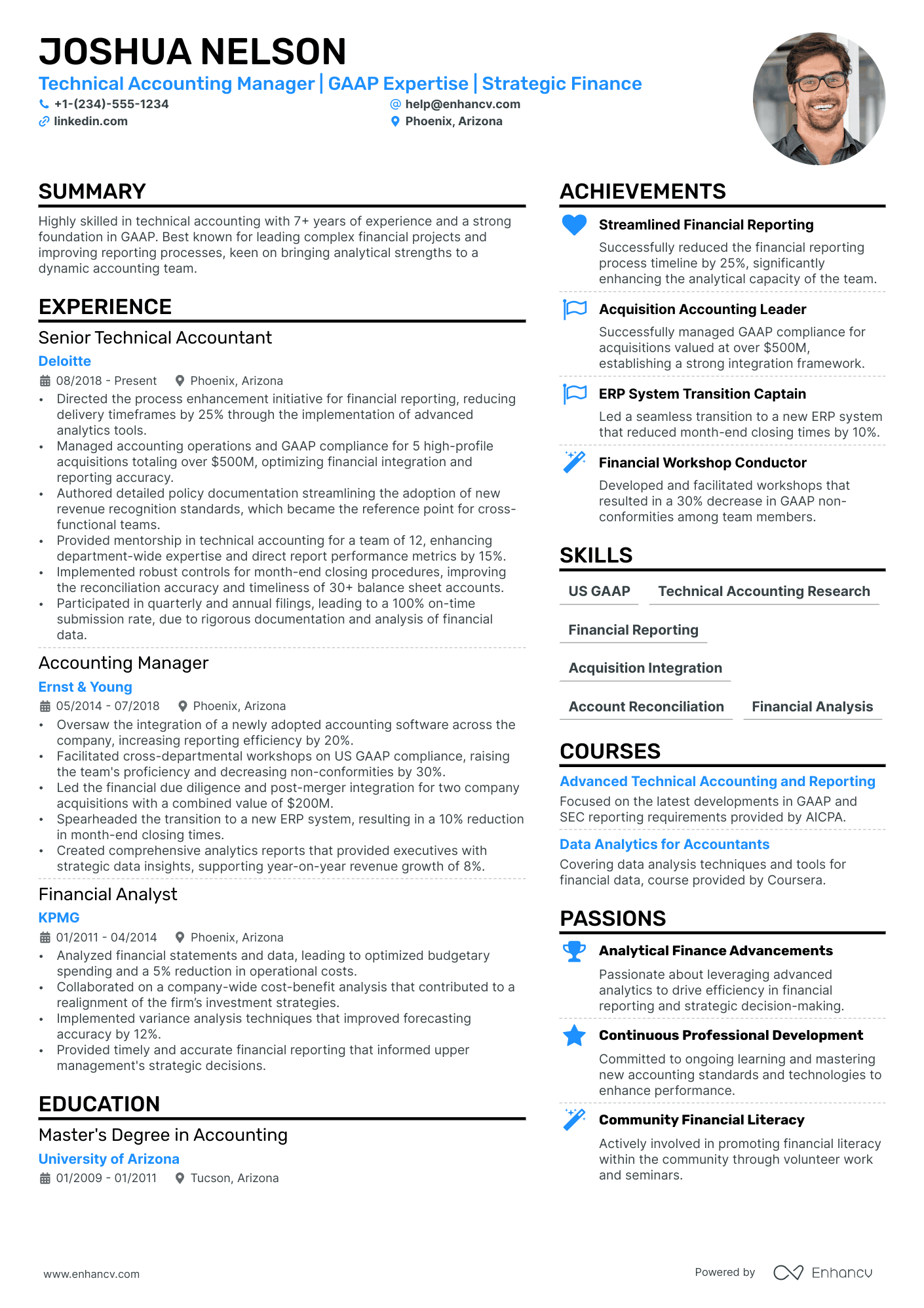

- Our special tip: avoid any images or graphics. Before a recruiter or hiring manager looks at your resume, a computer scans it for keywords, and graphics are hard for software to read.

- We’d also recommend putting your experience in reverse-chronological order. By putting your most recent job first, employers will see how you’ve progressed in your career.

- Include the name of the company you’re applying to, the position you’re seeking, and what you hope to achieve in your next role.

Accounting Intern Resume

- When you lack paid work experience, use relevant academic or personal projects to showcase your skills, passion, and capabilities.

Accounting Assistant Resume

- In this resume, the candidate carried out a simulated audit of a fictional company and showcased multiple skills that will help them be a better accounting assistant. If you have similar experiences to talk about, you want to add them to your accounting assistant resume .

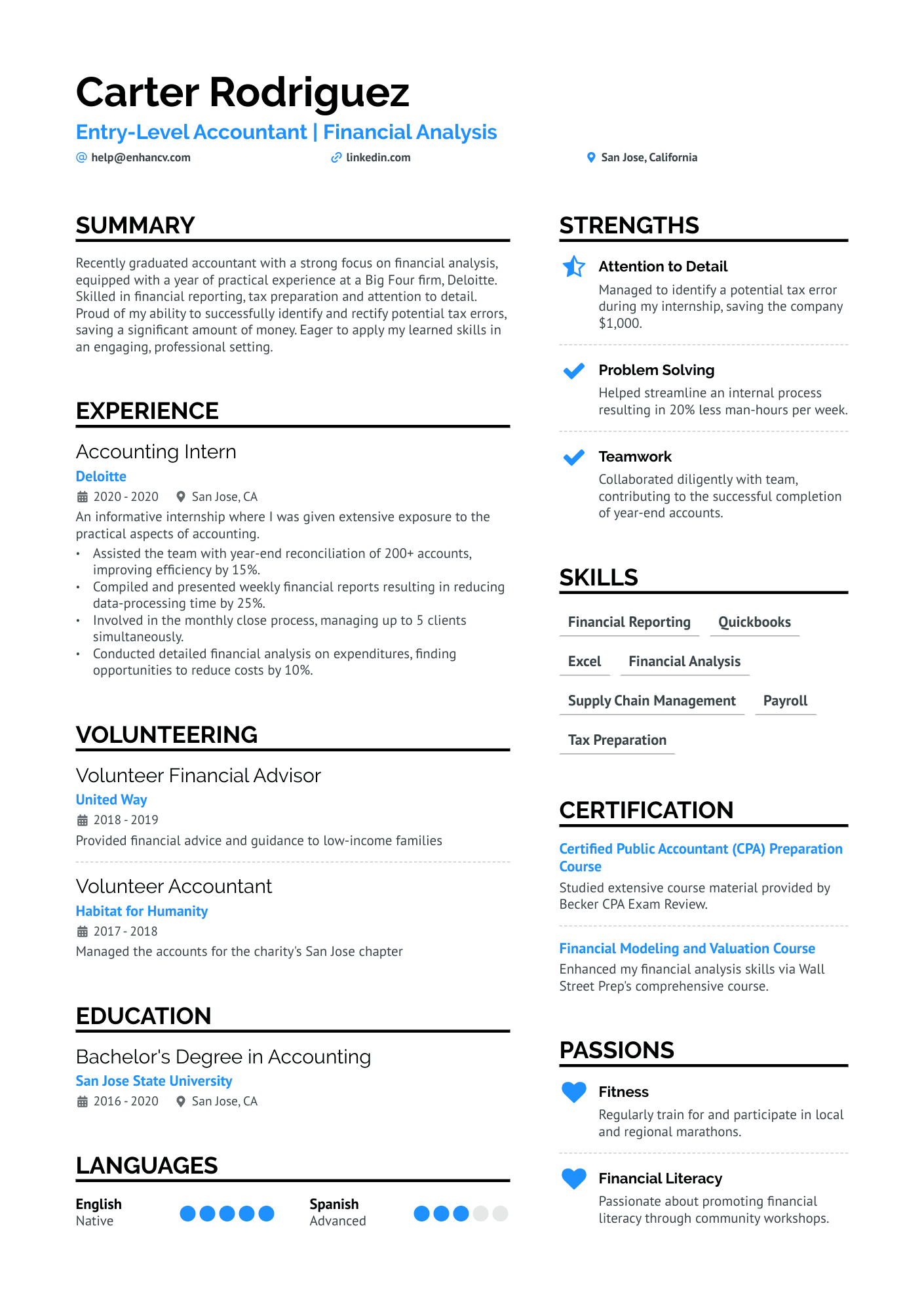

Entry-Level Accountant Resume

- Because of your limited background in accounting, don’t worry about trying to extend or fluff your minimal experience.

- Instead, list any work experience and highlight transferrable skills , like written communication, data analysis, and research.

- Try following a resume outline to help you organize your thoughts and ensure you’ve put everything you need onto a single sheet of paper.

- Once you’ve completed the outline, you can use a resume template to format your content correctly and make it look great, too.

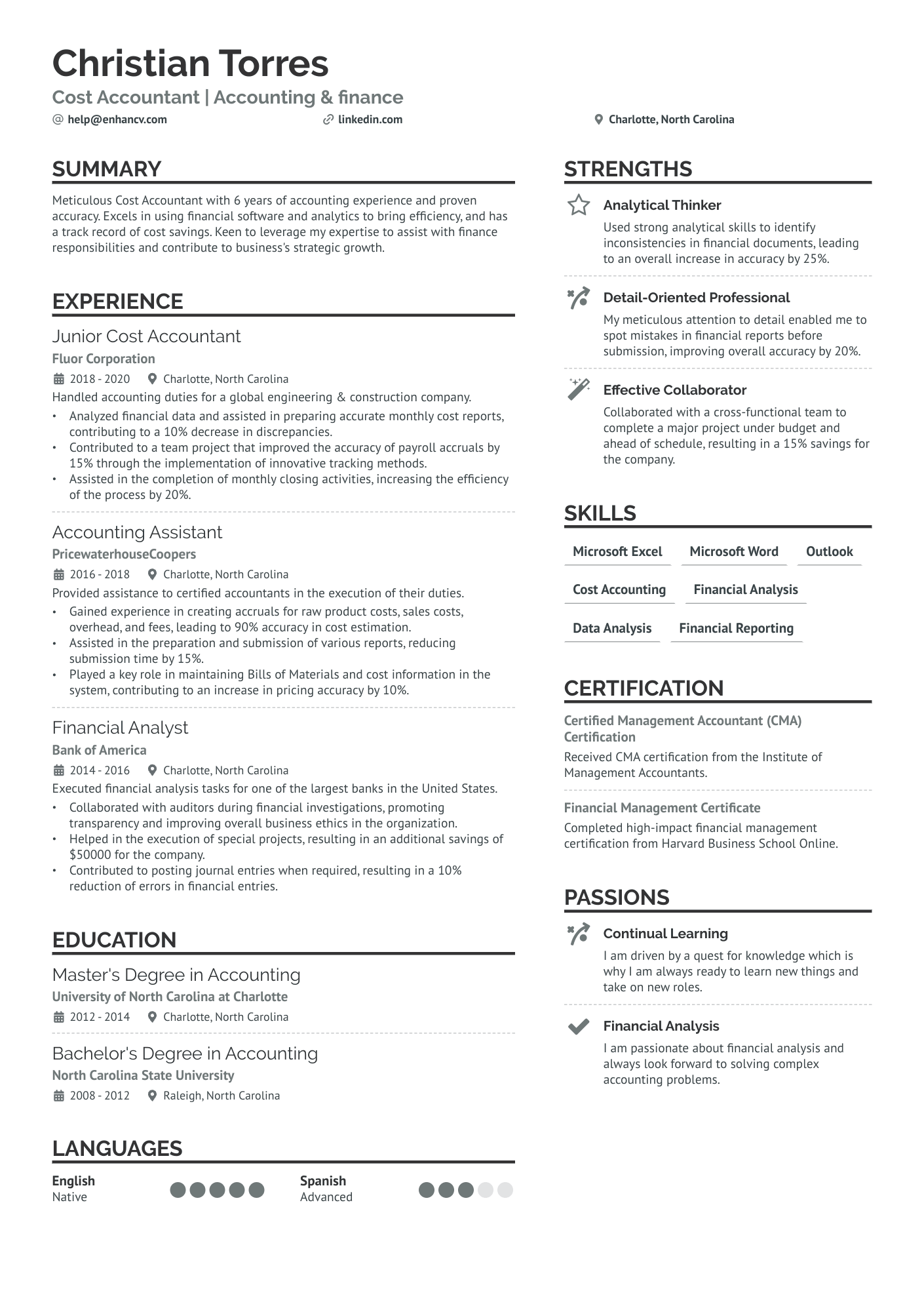

Junior Cost Accountant Resume

- Using a resume objective can be a great decision if you’re having trouble filling the page or trying to provide hiring managers with more context as to why you want the job.

- But please be cautious and double-check your resume before submitting an application!

- Imagine submitting your resume for a position at Instacart and realizing you left the name of another target company in your resume objective. Facepalm anyone?

Junior Accountant Resume

- A ChatGPT resume builder can help you highlight your past accomplishments in any roles or projects that are related to finance or show your knowledge/ability to use an accounting tool. Personalize the objective as much as possible to convey why you’re so passionate about getting hired!

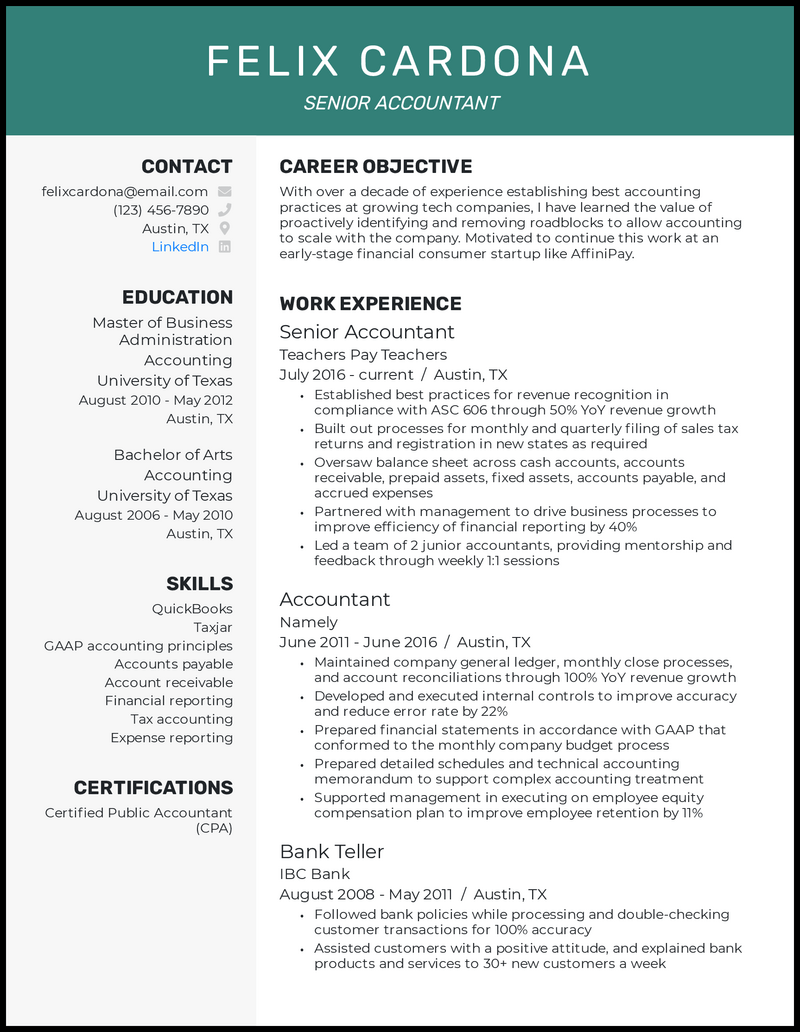

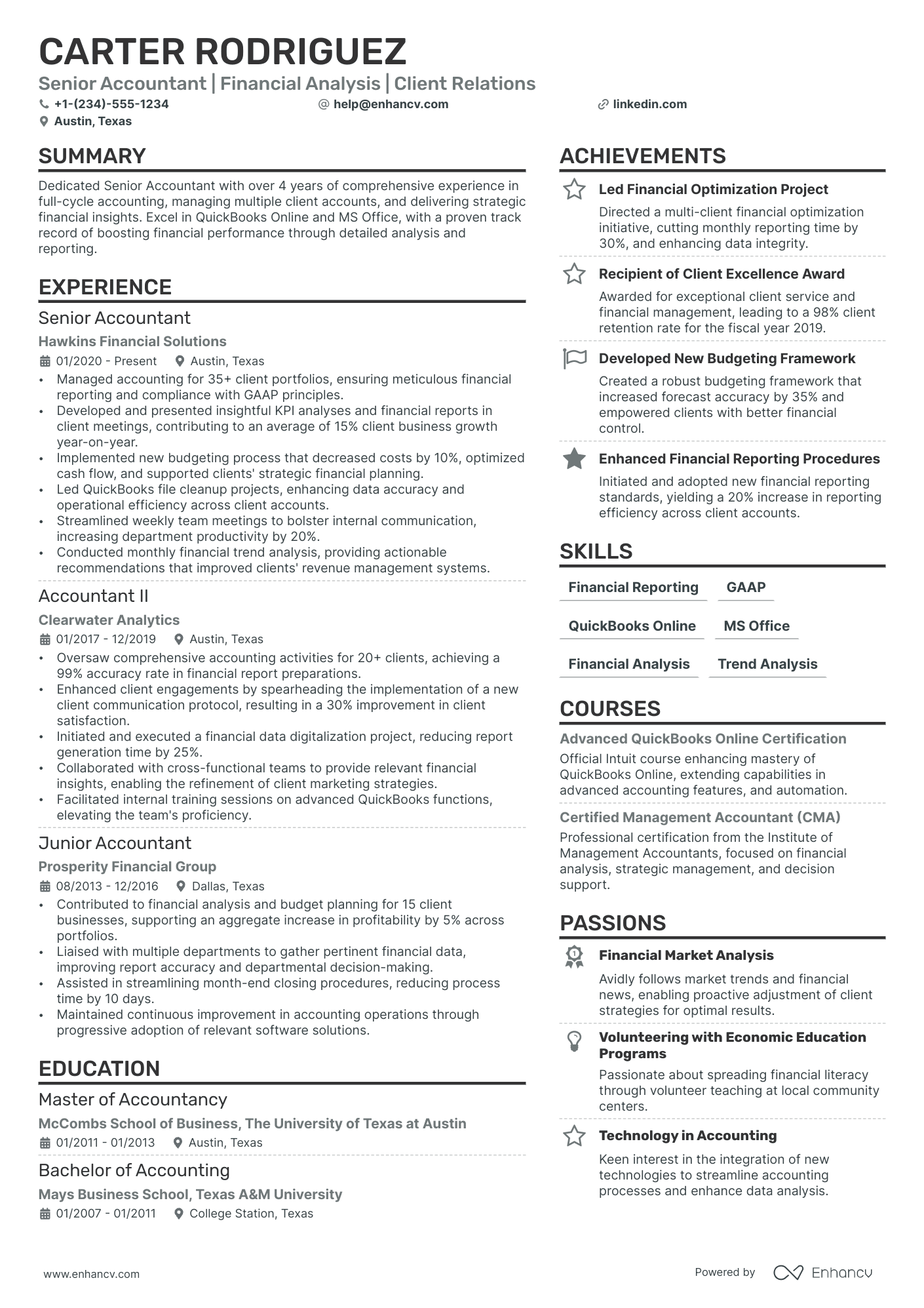

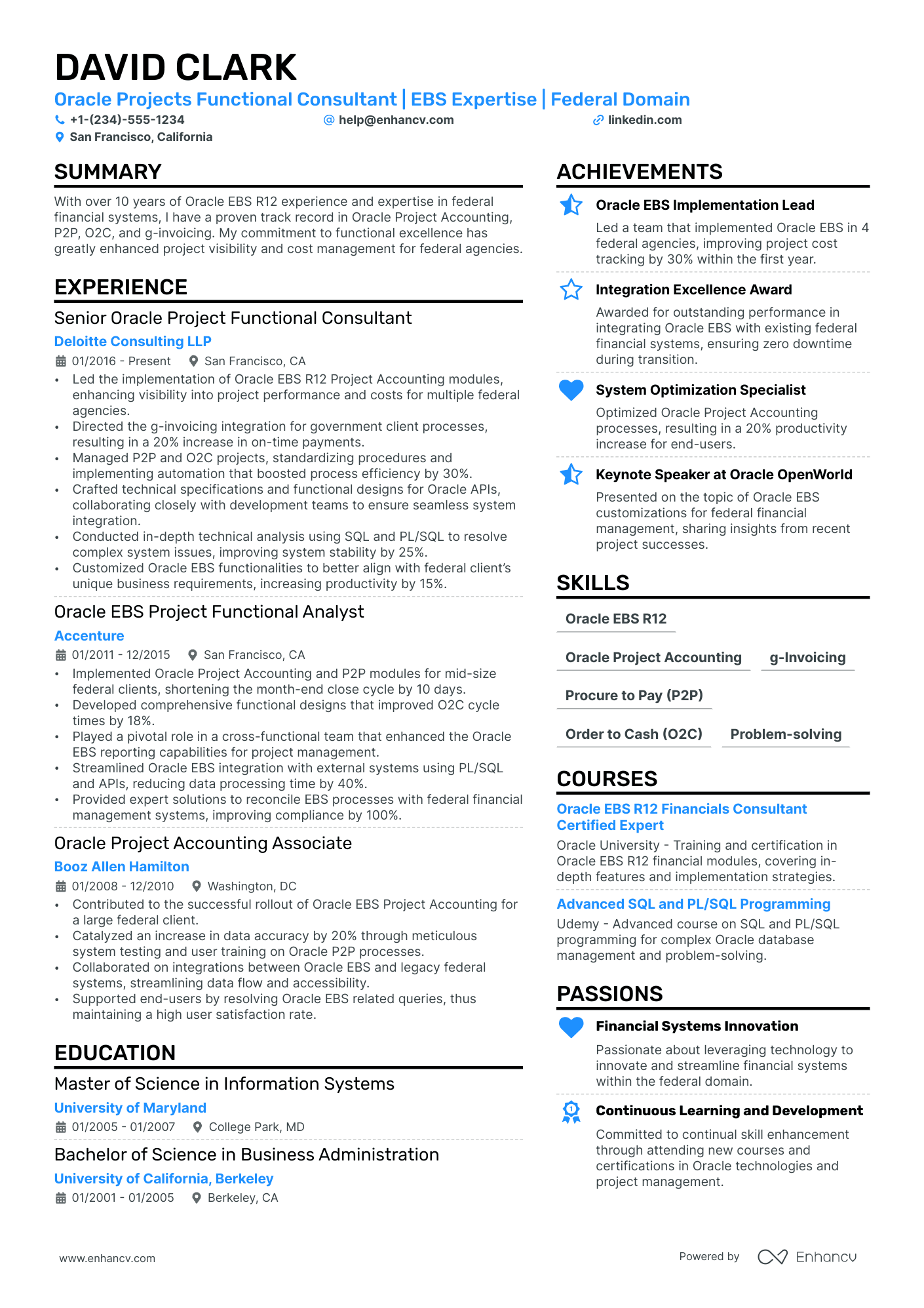

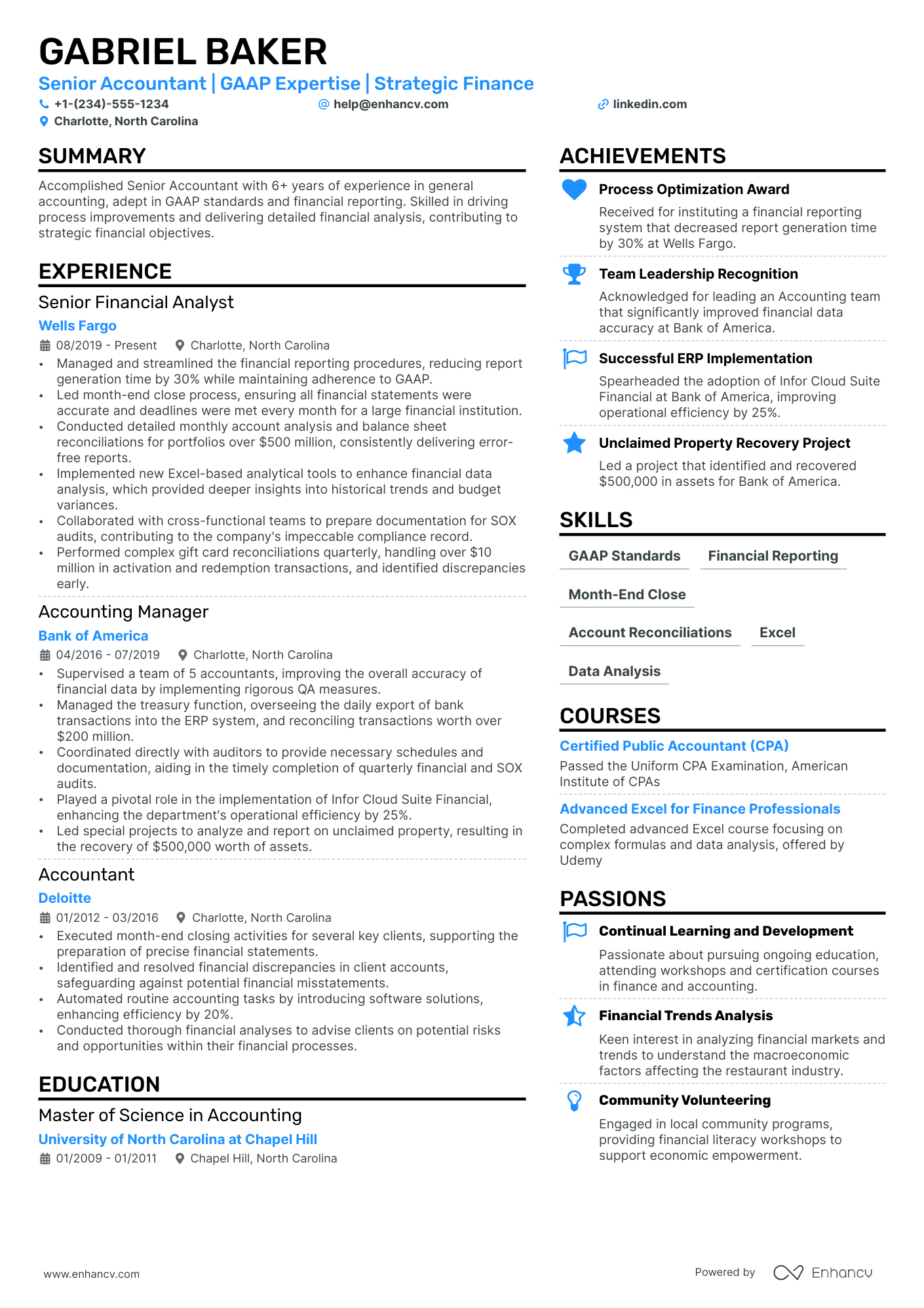

Senior Accountant Resume

- You can further support your work by adding metrics to show how you’ve helped the company , especially when it comes to revenue.

- But remember that even a spellcheck system misses things, so ask a colleague to review your resume! You’ll be amazed at what they’ll catch before you turn in your application.

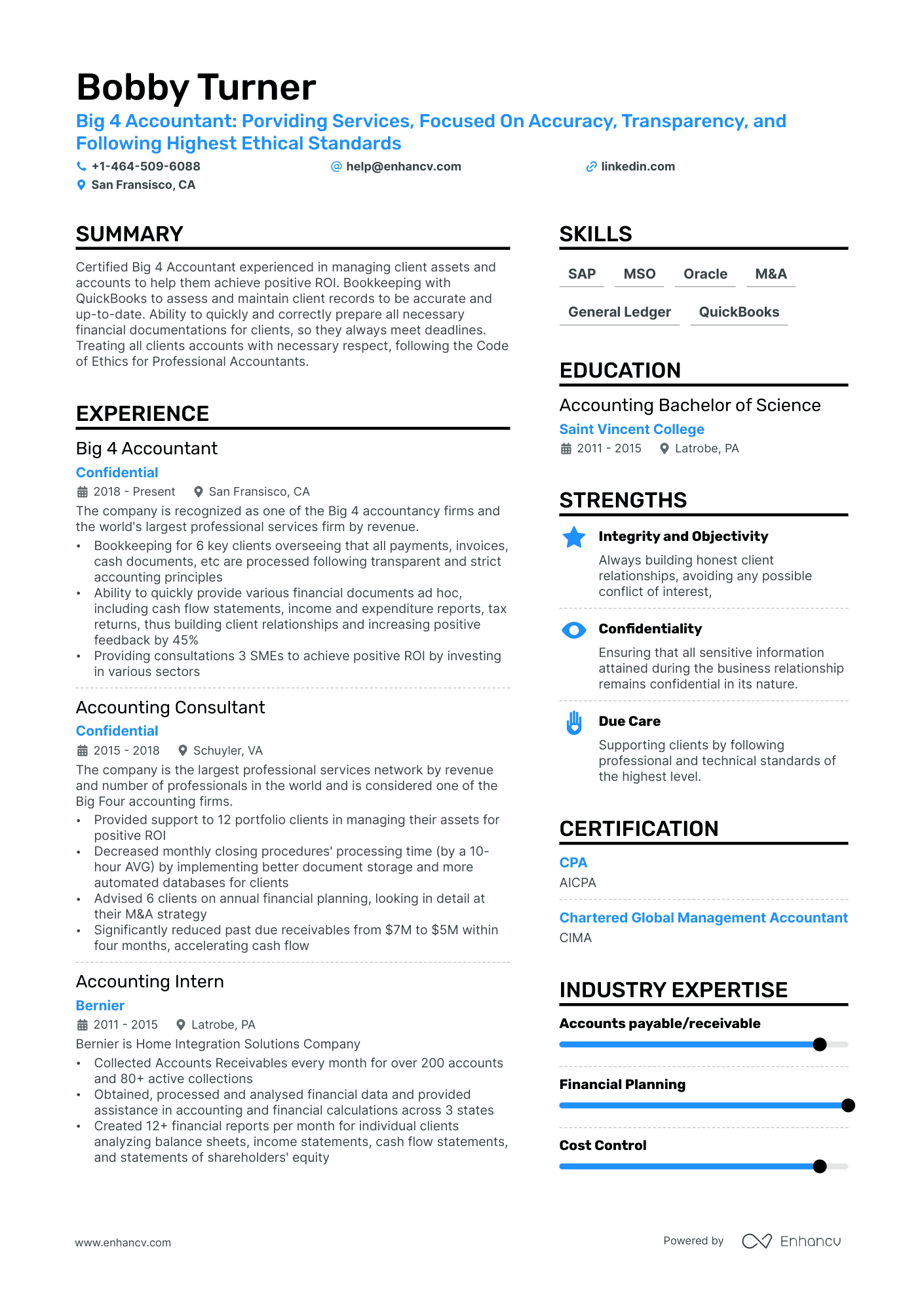

General Ledger Accountant Resume

- In your general ledger accountant resume, use a credible title such as “Certified Management Accountant (CMA).” Not only does this convey that you’re better than the average accountant in creating reports, but it also shows your dedication to the career at an early stage.

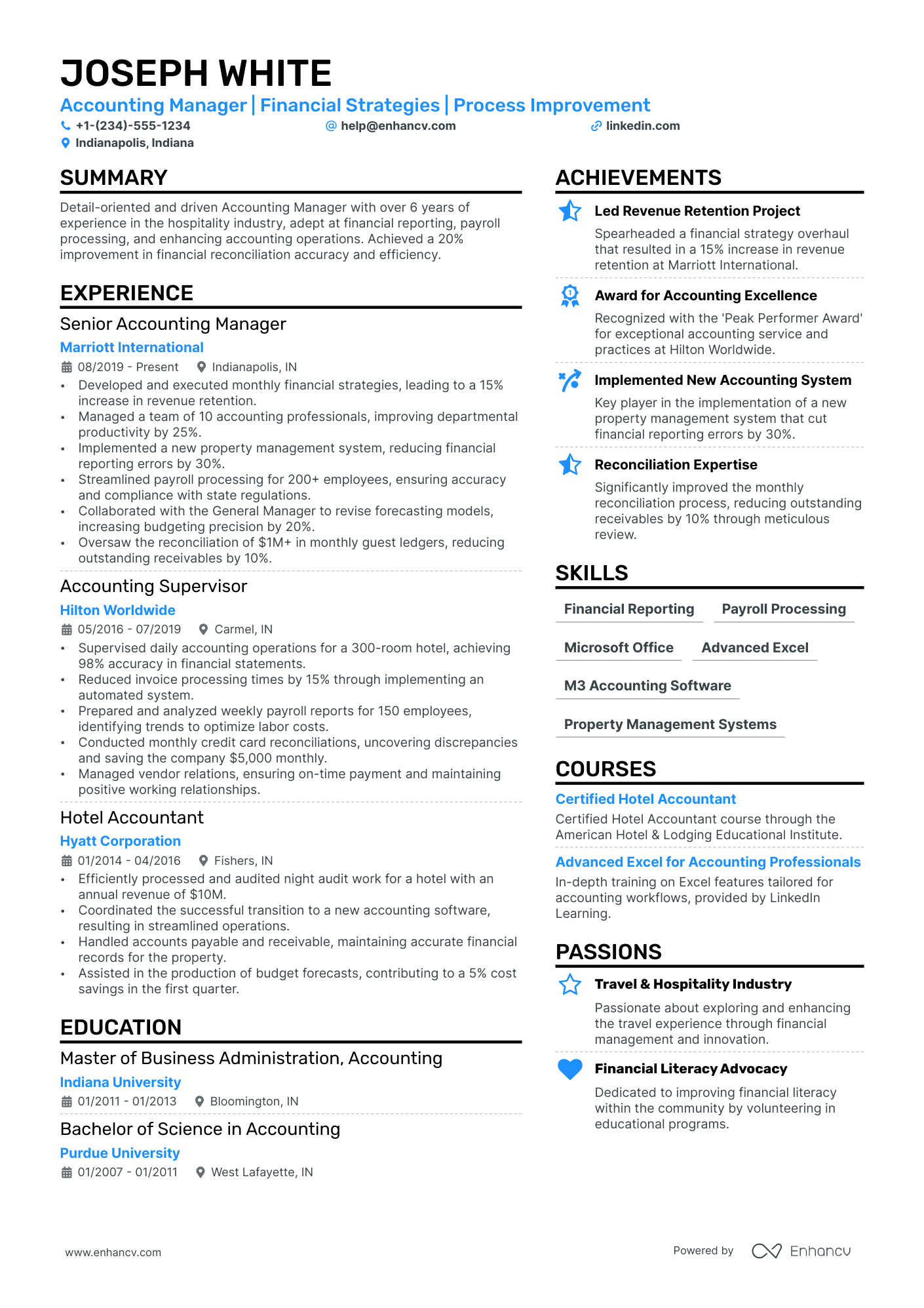

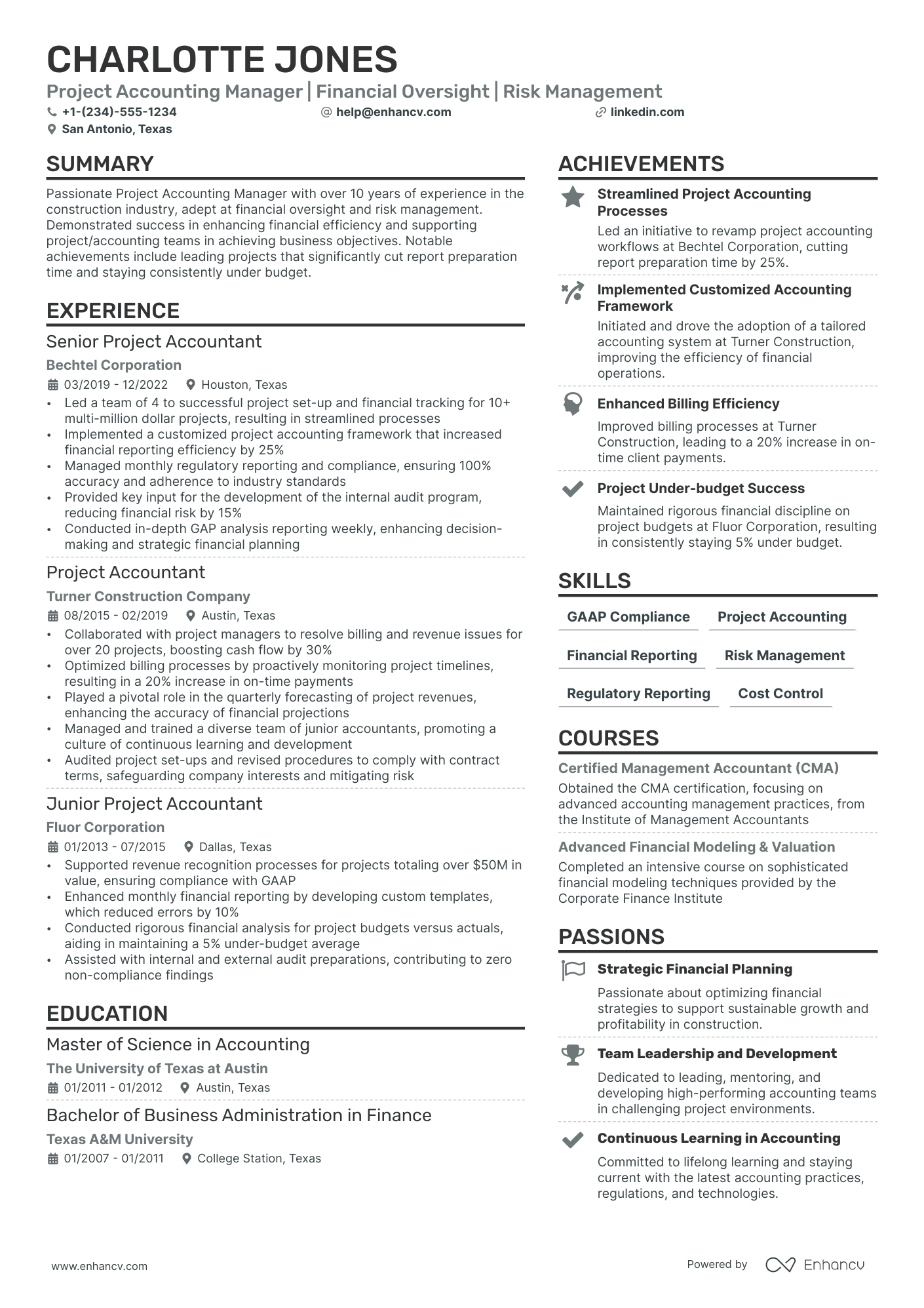

Project Accountant Resume

- Ready to move your resume from the backlog to the done folder? First, let’s embellish it – use a different color to distinguish the header, and then choose a larger and legible font for section subheadings. You can even bolden them to improve visibility and make the resume easier to scan.

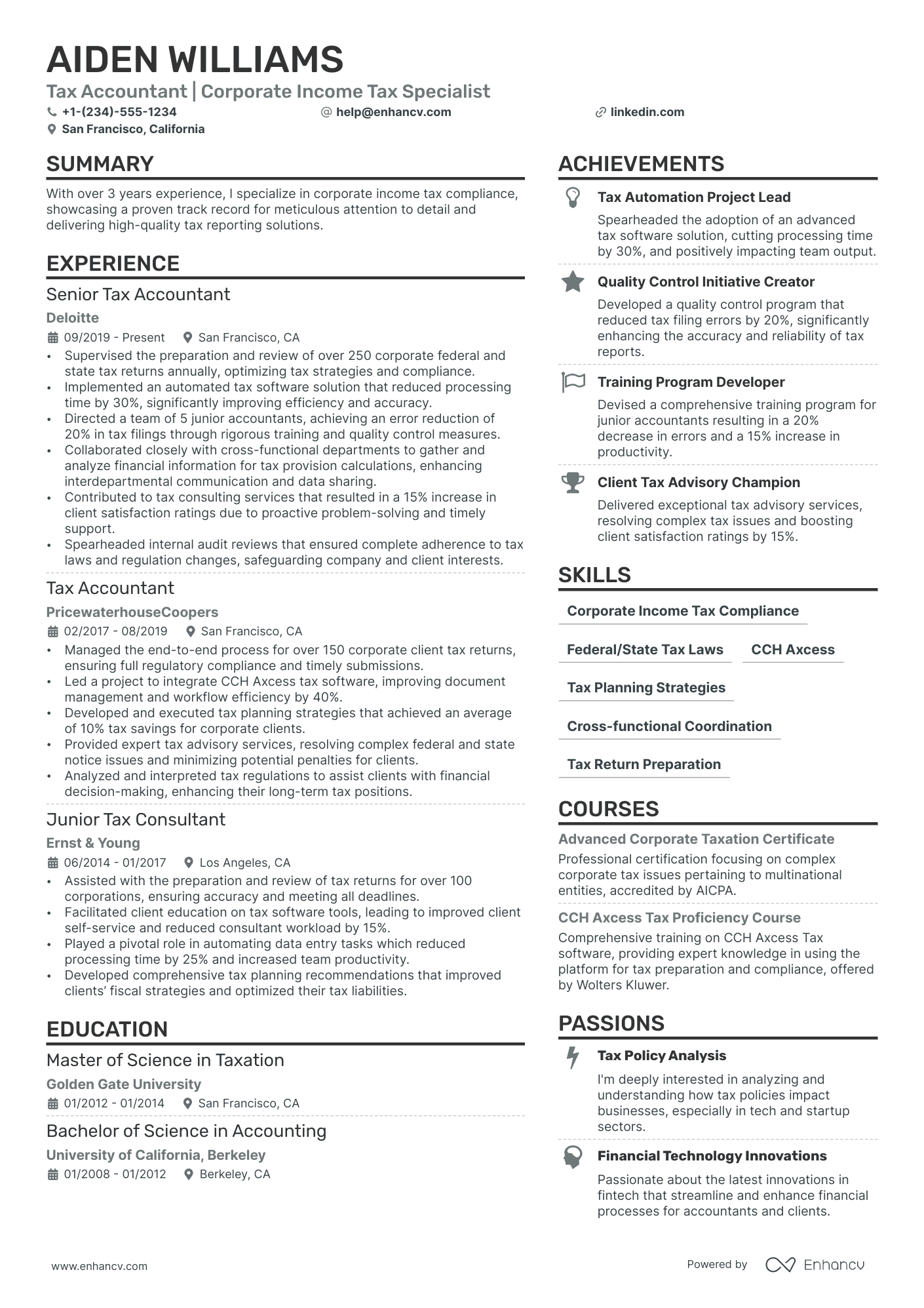

Senior Tax Accountant Resume

- For your work history section, use numbers (and percentages, too) to back up your vast experience as a senior tax accountant. Take a look at how Kevin capitalizes on this strategy – Directing a team of six in conducting in-depth analysis…, …reducing errors by 12%, and improving financial reporting accuracy to a rating of 9 out of 10- effectively presenting himself as an outcome-oriented expert.

Payroll Accountant Resume

- Certificates like Certified Public Accountant (CPA) prove that you possess the necessary financial skills , knowledge, and experience to apply for this role! Don’t be too overconfident though. Ensure you back your certification with performance metrics that depict you as a diligent and hard worker.

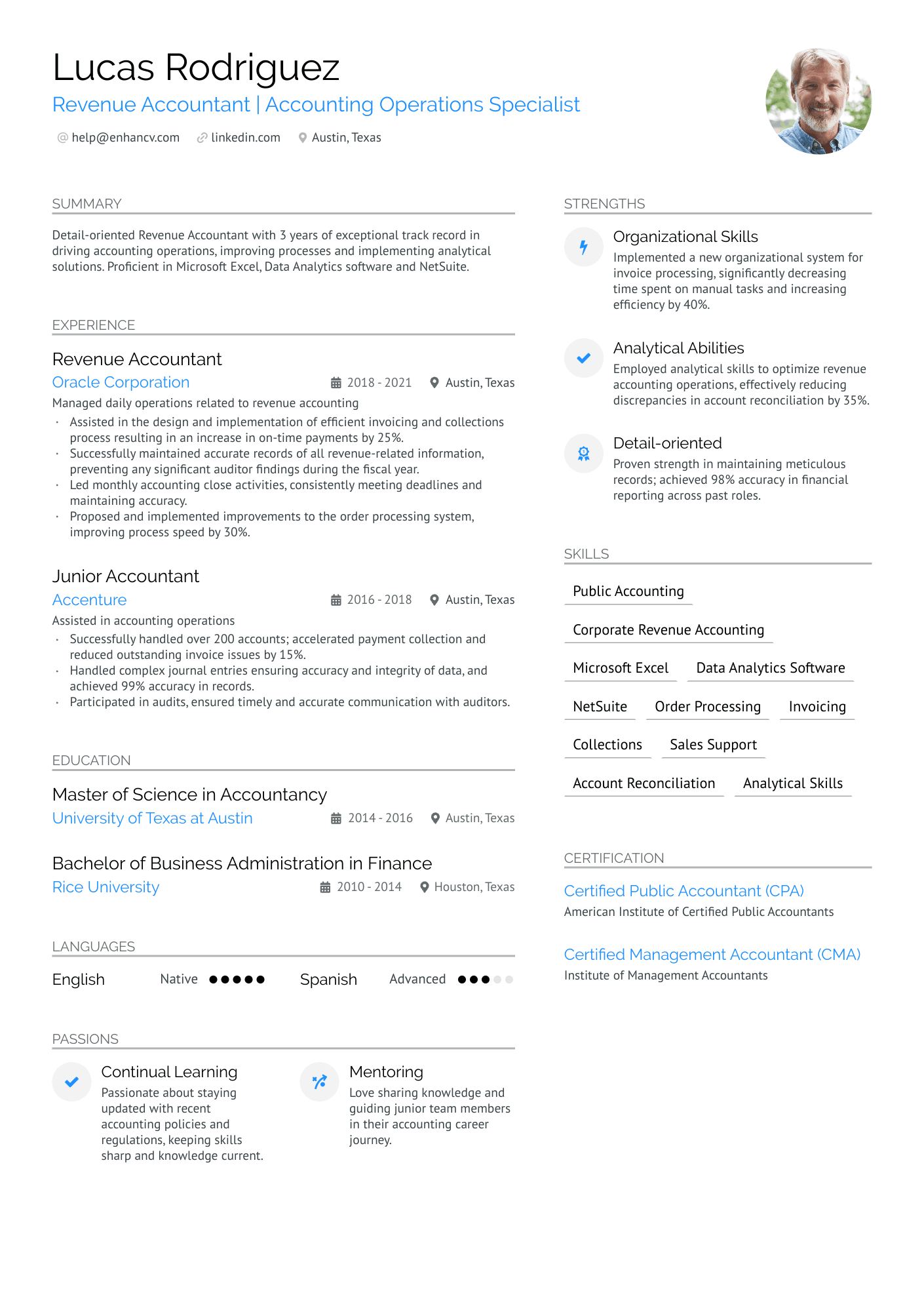

Accounting Analyst Resume

- As you tailor your accounting analyst resume hoping to get the job, include your measurable impact in expediting accounts, invoices, and response to ad-hoc request processing times.

Fund Accountant Resume

- Felix’s example is the best answer to that question. Everything is displayed for the recruiting team to see and make a quick decision. Follow this lead to boost the chances of your application sailing through.

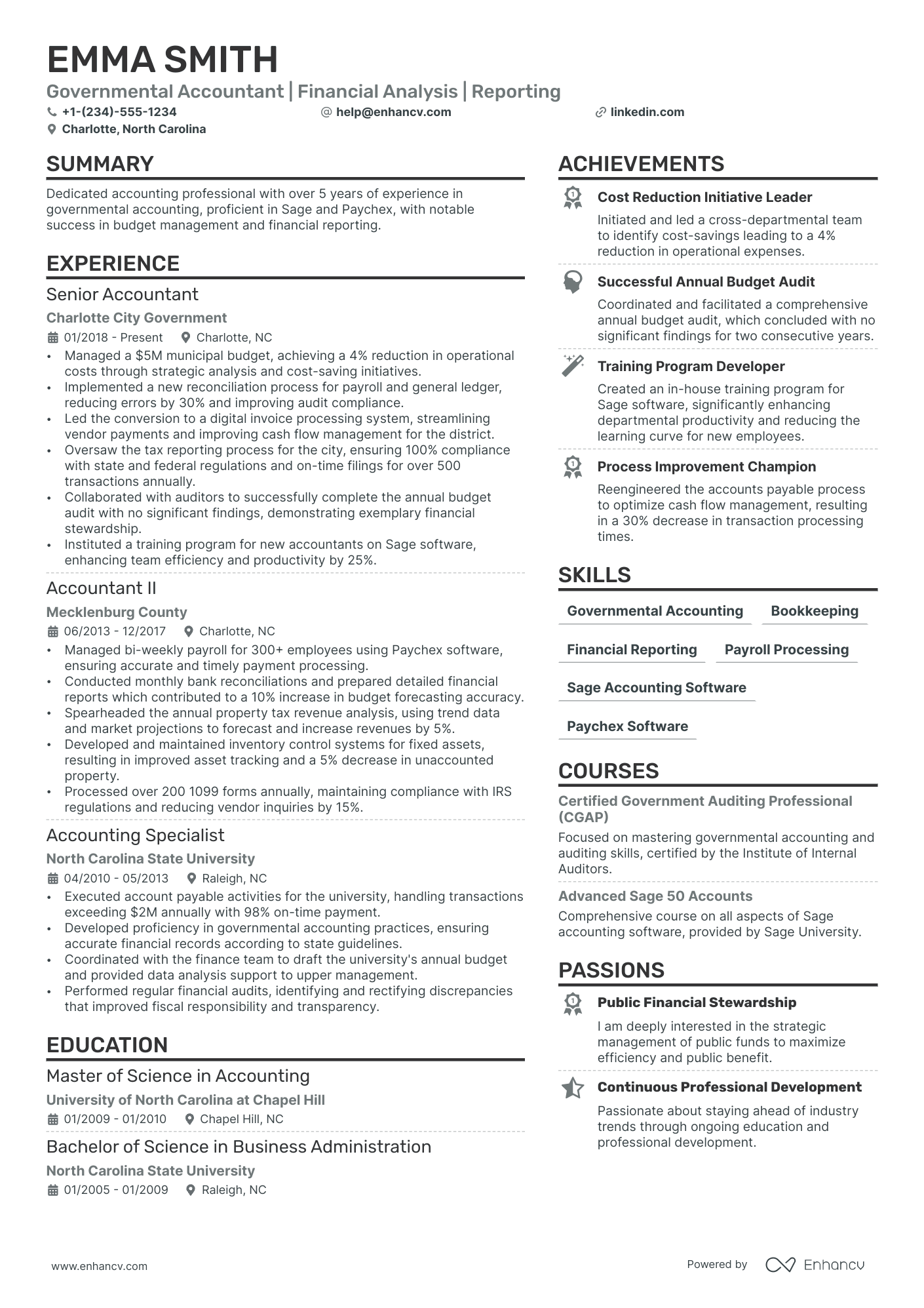

Accounting Specialist Resume

Cost Accountant Resume

- What was your impact in similar or related roles? Tap into you quantifiable achievements, such as accuracy rates, reduction in operational expenses, and workflow improvements.

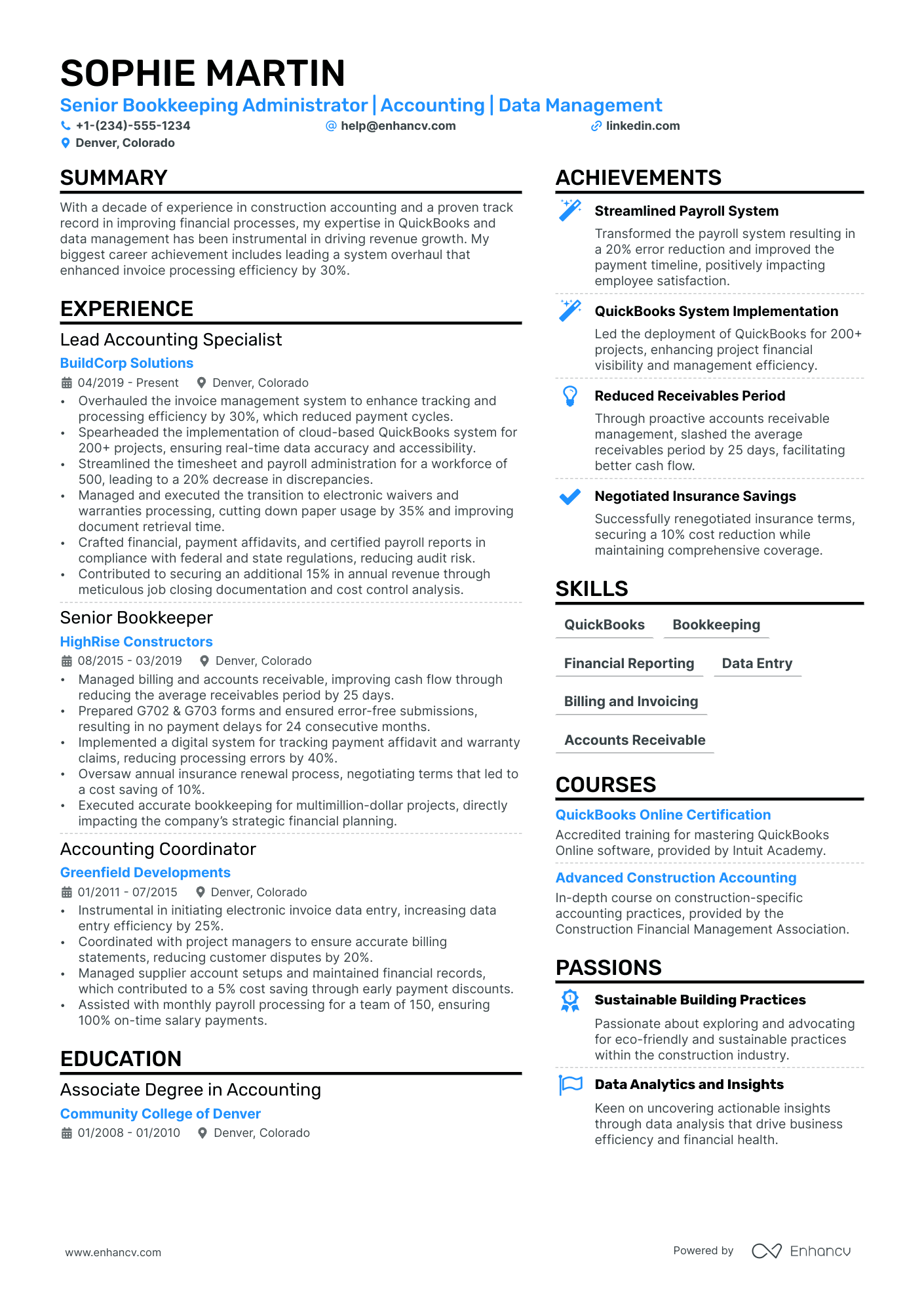

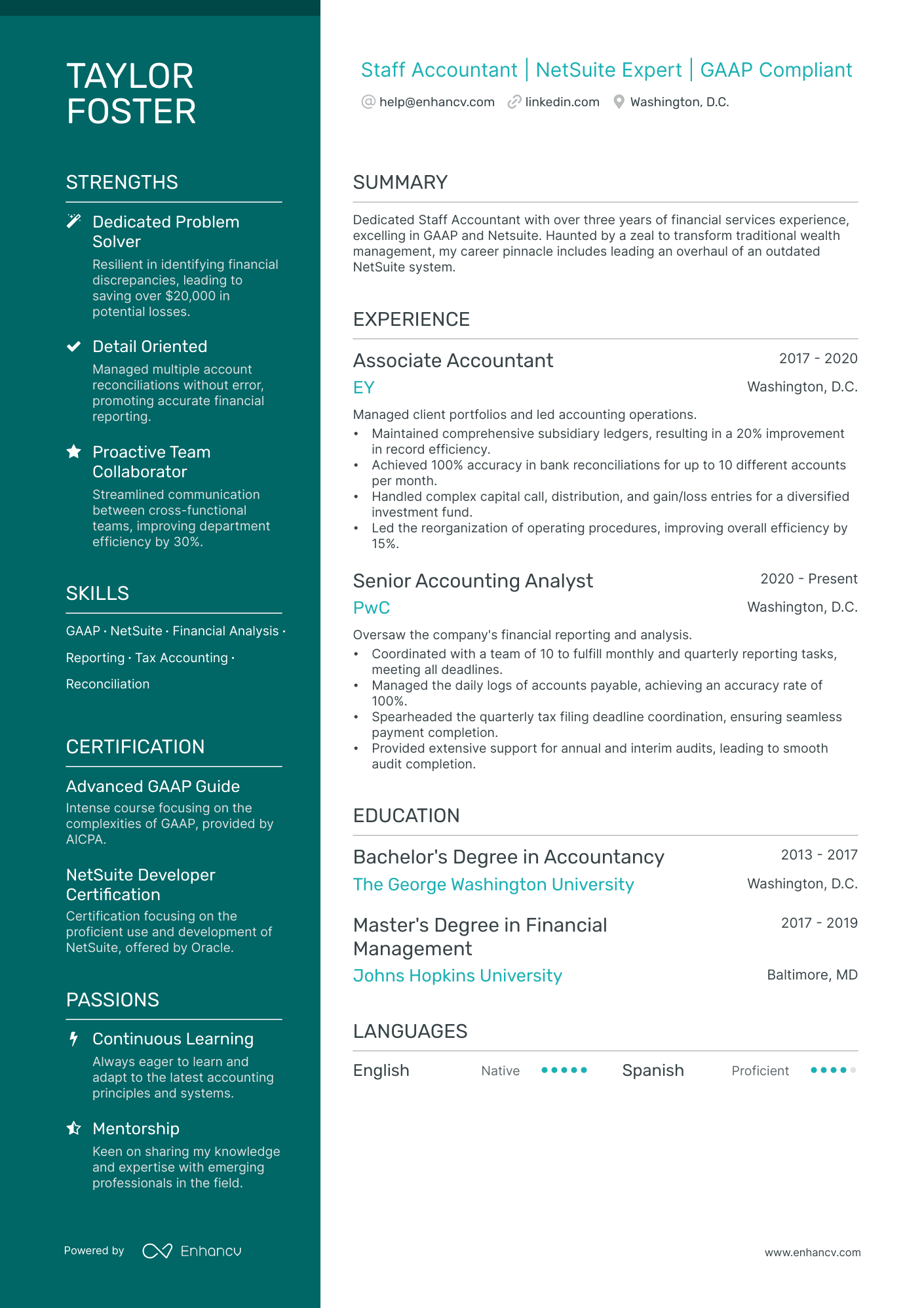

Staff Accountant Resume

- Beyond just your education section, you can include your progress in a resume objective or a resume summary .

- A great way to do this is through the use of action verbs like “owned,” “led,” and “advised.”

- It’s also a good idea to show how you’ve made a positive difference in the company. Use metrics to strut your stuff!

- For example, did you increase revenue or efficiency? Discuss it with numbers and percentages that show your impact.

Forensic Accountant Resume

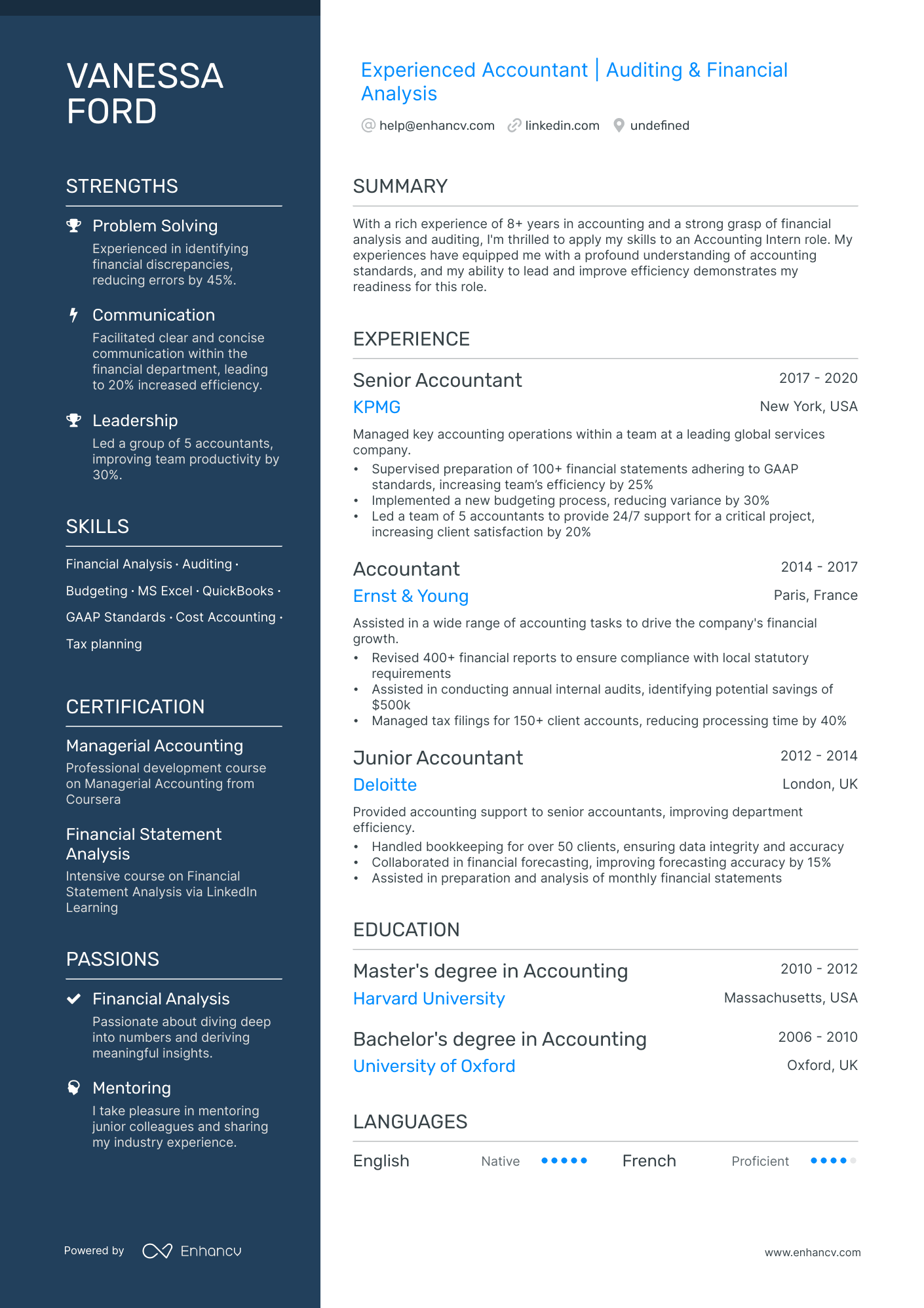

- Unlike a resume objective , a summary statement focuses on leveraging the abilities you’ve learned throughout your career.

- Make sure your summary statement includes your years of experience in accounting and the company to which you’re applying (plus the job title).

- Start by putting your work experience in reverse-chronological order, meaning that your most recent work experience will be listed at the top of the page.

- Then you can consider things like alignment, color, and consistency. Whatever you do, make sure your resume is easy to read at a glance!

Financial Analyst Accountant Resume

- Have you joined or started a group for accountants? Maybe you’ve written a personal finance book? Or perhaps you occasionally discuss financial trends at events outside of work? These are on-point examples of using your skills in unique ways, so they’re perfect resume components.

- Focus on including projects and volunteer experience that can demonstrate essential skills (like collaboration and communication).

- Look for similar structures, word usage, and metrics to see how you can make your resume pop.

Management Accountant Resume

- Make sure that your management accountant resume shows your most relevant experience. Include your most significant accomplishments, like if you’ve led any projects or saved your company a lot of money.

- Although your goal is to show your most relevant work, having a cohesive career progression is more important. Employers want to see that you’ve been consistently working.

- Look for specific skill keywords and responsibilities listed in the job description and incorporate them into your work experience and skills section to make the best impact.

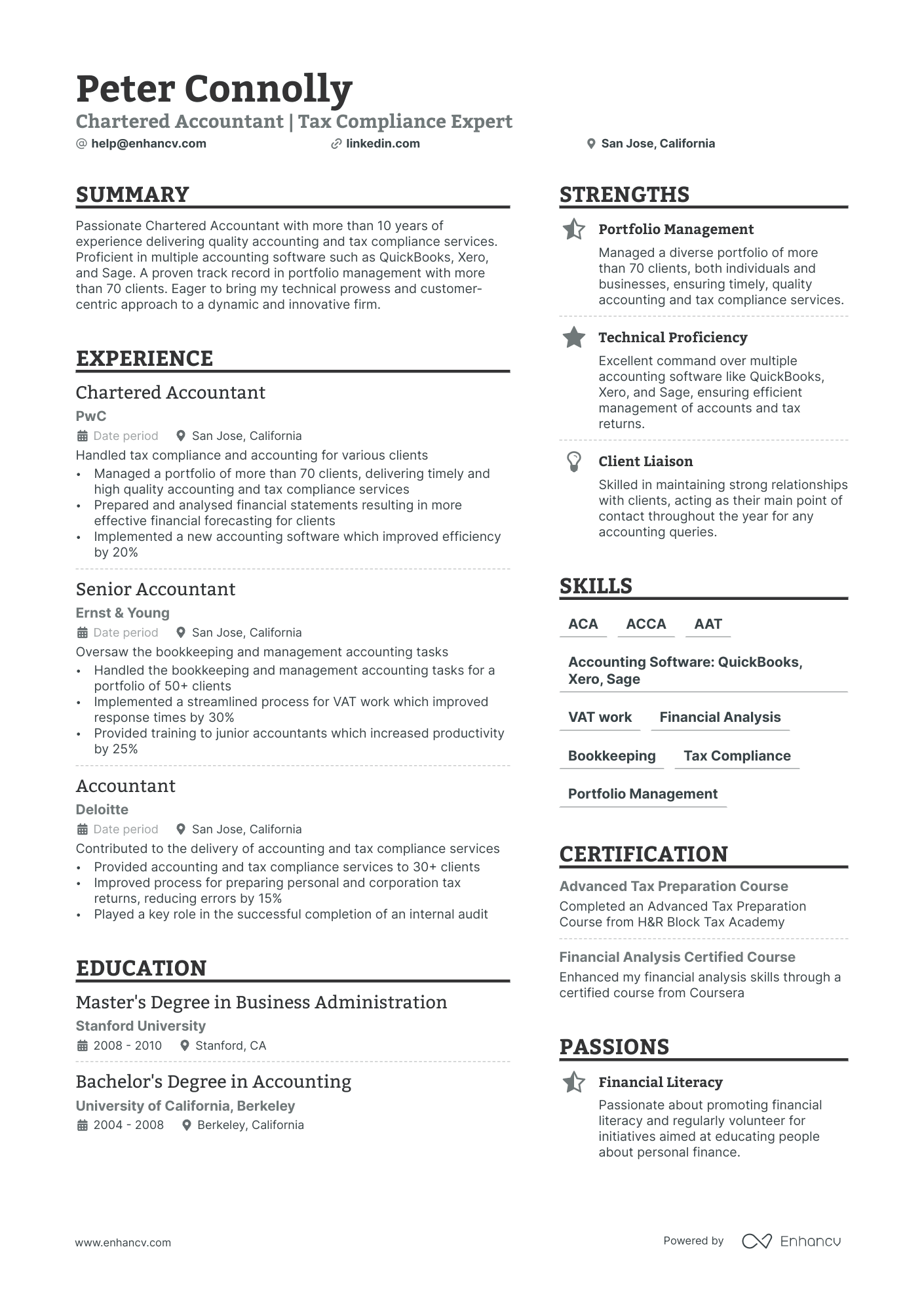

Certified Public Accountant (CPA) Resume

- To keep to a single page, make your bullet points short. Ideally, every point should be one sentence and a maximum of three lines long .

- List accomplishments and achievements by all means, but don’t clutter your space with empty adjectives or adverbs. Words like “successfully” and “as needed” are generally assumed, so leave them out.

- Certifications need their own section, but you don’t need to add much more than the name of your certificate. You can include the organization that offers the certificate, but most hiring managers will know that information already, so don’t stress about it.

Onboarding Accountant Resume

- However, your resume is not your cv . As hard as it is to break up with your old jobs, it’s for the best. The best resumes include just three to six of your most relevant work experience roles.

- Put yourself in the shoes of the hiring team reviewing 100+ resumes. What work experience would stand out and be the most relevant for the position?

- And if you’re worried about forgetting or losing information from your work history that could be relevant later on, don’t sweat it. You can create a separate document with a “master list” of work experience that you can pull from for different jobs.

Accounting Clerk Resume

- Think of the skills section of your resume as a peek into your technical prowess with accounting software. Any tools that help you do your job better are worth adding to this part of your accounting clerk resume .

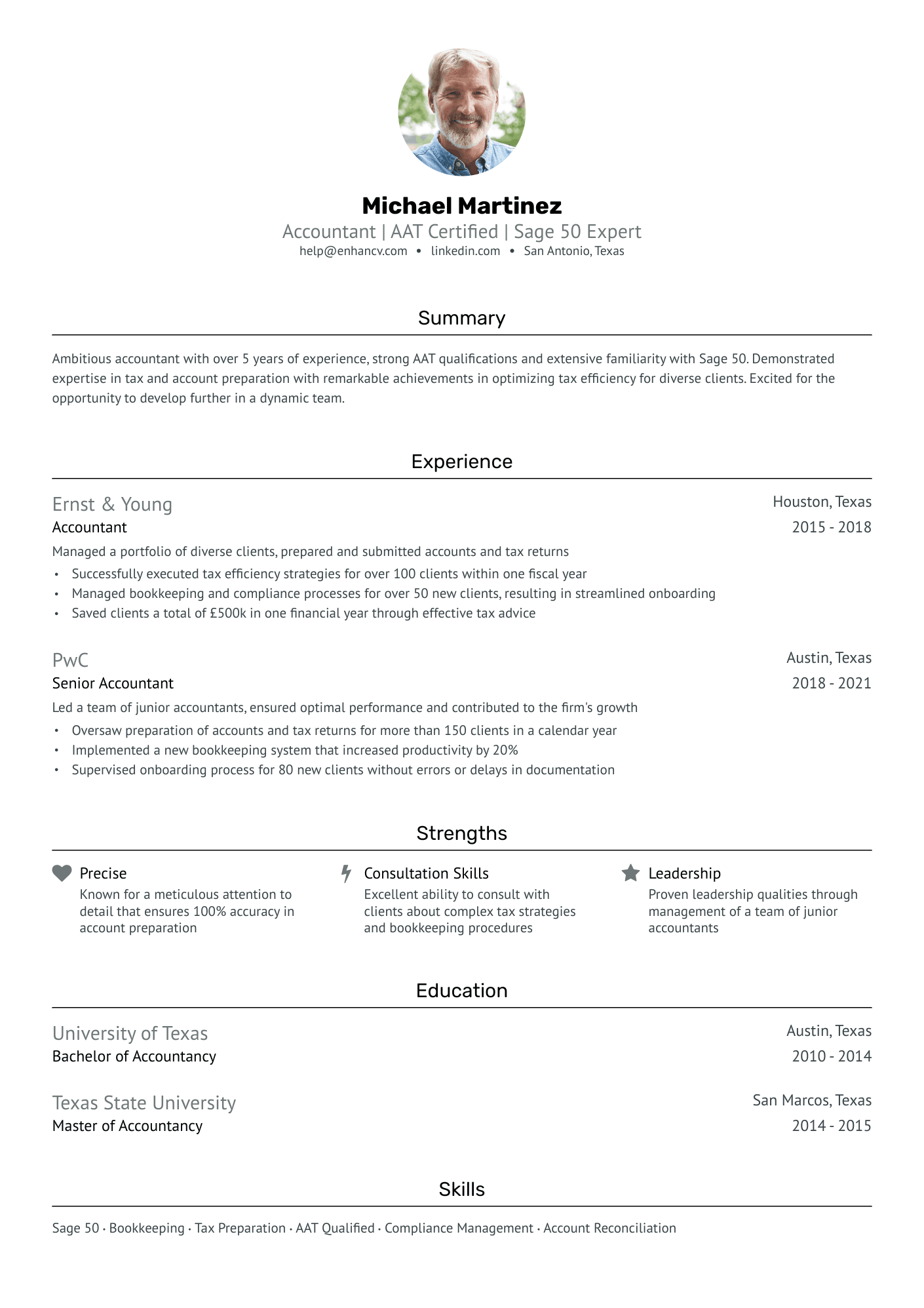

Tax Accountant Resume

- In this resume example, the candidate’s last job was as a tax accountant—the same position they’re applying to. Putting it at the top highlights what you’ve been able to achieve at your previous job.

Public Accounting Resume

- Do you hold a Certified Public Accountant (CPA) certification? If you’ve completed your CPA, it’s proof that you have a license and the knowledge to provide accounting services to the public.

Related resume guides

- Bank Teller

- Accounts Payable

- Financial Analyst

As an accountant, you know that precision matters. You’re expected to be an analytical expert who can produce reliable research and solve complex legal and financial problems. So, think of your resume not only as a place to highlight your experience but also as a place to demonstrate your attention to detail and high standard of work.

Boosting your resume’s potential requires special attention to these four areas:

- Listing accounting skills

- Formatting your accountant resume properly

- Quantifying your previous impact

- Customizing your resume to each job

List the right accountant skills

When recruiters post an accountant job description , it’s not unheard of for them to receive upwards of 100 resumes. With the sheer number of applicants, companies can’t carefully review every accountant’s application. The applicant tracking system (ATS) software helps weed out applicants before a recruiter reviews them, which saves time and gets rid of candidates without the right experience.

Applicant tracking systems work by using algorithms that match keywords from the company to keywords in your resume. So even if you’re highly qualified for a job, your resume may be thrown out if it doesn’t include the right keywords. To avoid this, you need to know how to include job-appropriate skills on your resume (keywords).

What are the right skills? The right skills will vary depending on the accountant role. Read this excerpt from a sample accountant job description and see if you can pick up on the essential skills:

Greenhill is seeking a certified accountant who can tackle every level of the accounting process, from balancing ledgers to researching the law and analyzing data to ensure efficient and effective operations. This position is ideal for candidates who are jacks of all trades! Must possess strong public speaking and collaboration skills while demonstrating initiative and the capacity to conduct independent work.

Based on this small sample, we can create a list of essential skills customized for the job. You do not want to take exact words from the job description or lie about your skill level . Instead, use the accountant job description as a jumping-off point to think about the most relevant skills you possess:

- Accounting applications: Quickbooks, ERP, Concur, Taxjar

- Tax accounting

- Expense reporting

- State law compliance

- Accounts payable/receivable

- Collaboration and communication

- Data analysis and research presentations

On other accountant job postings, you can expect to see different skills emphasized, such as:

Choose the best resume format

It’s not just about what you write on your accountant resume; it’s about how you write it. Your resume format is important for ensuring that your resume is visually appealing, easy to read, and easy for the ATS to recognize. For these reasons, we always suggest the reverse-chronological format to keep your most recent job experience listed at the top of your resume, but there are some other aspects of resume formatting you need to know.

Here are some other essential elements of resume formatting that you should pay attention to:

- Resume length: Always ensure your resume is a full, single-sided page.

- Bullet points: Break up large text sections about your work experience with classic round bullet points.

- Avoiding icons/images: The ATS does not seem to appreciate icons/images; neither will recruiters.

- Listing the title of the position you’re seeking: Specialize your resume for each job you apply for to show respect and genuine interest in the job. (This is especially useful for a company that may be hiring for multiple positions.)

- Objective/Summary: Only use one when necessary (hang tight—we’re about to cover this in-depth).

Remember these formatting tips, and you’ll be confident that your resume is ATS-friendly and easy to read for recruiters.

Understand the elusive resume objective and summary

All right, back to the objective and summary. A resume objective is one of the most misunderstood sections of your resume. Most people think objectives are outdated and pointless, but that’s only the case if you don’t tailor them and keep them short.

But what exactly is a resume objective? And what’s the difference between that and a resume summary? Let’s dive in!

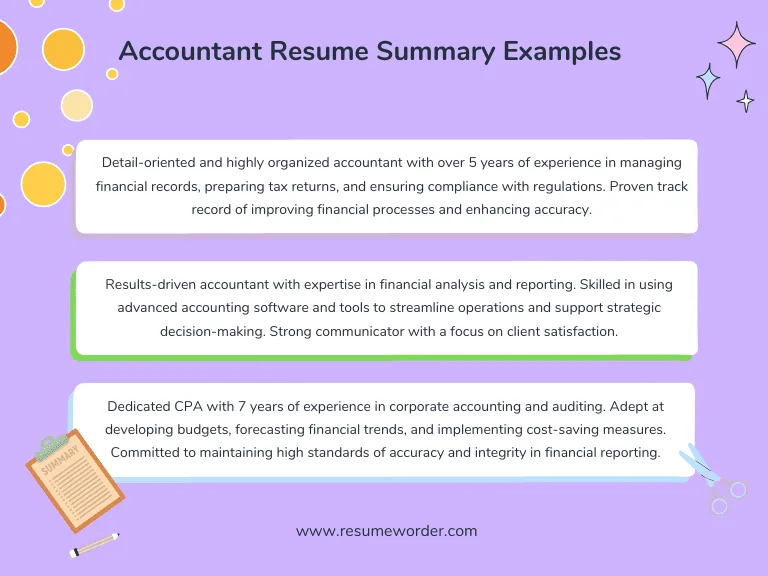

A resume objective and summary statement are both short, two to three-sentence paragraphs at the top of a resume to express your interest in a position or a brief career synopsis. Both require customization and should be avoided if you don’t plan on writing a new one for every job application.

However, these two types of paragraphs differ in how they communicate interest in the job. An objective describes the value you’ll add to a company and why you want the job . Objectives are best suited to accountants who are just starting their careers or going through a career change (like from a staff accountant to an accounts payable specialist).

A resume summary highlights your past work experience , leveraging it to prove your qualifications and skills . Because the summary relies on many past job experiences, it’s only recommended for senior accountants with many years of industry experience.

Let’s work through a few examples together, so you can better understand all the moving parts:

Poor resume objective: Years of experience in the industry, looking for a full-time job in the accounting field with benefits.

- There are multiple issues at play here. First, it’s uninformative. The applicant doesn’t list anything that provides concrete evidence of their skills. Secondly, it’s not specific. They don’t mention a particular job title, applicable skills, or the company to which they’re applying. Lastly, this candidate is only focused on what the job will do for them . You need to mention why you’ll be an asset to the company, not what the job will provide for you personally.

Better resume objective: Detailed junior accountant with 4+ years of experience working for Big Four accounting firms. Seeking an opportunity as a staff accountant at a smaller-scale operation like Fender Co., where my specializations in optimizing pricing through software adoption and systems streamlining would positively impact sales.

- This resume objective makes the case that the applicant is valuable to the company by highlighting relevant skills and years of experience. Furthermore, it’s customized to the specific job the candidate is seeking, which is a major green flag for employers.

Poor summary statement: Experience as an accountant for 3 businesses. My role, which was providing organized, detailed work for all 3 companies, positively impacted the companies.

- This statement is vague and confusing, not to mention it’s poorly worded. Would you trust this person with your company’s financial accounts?

Better summary statement: Data-driven certified accountant with specialized work in small and mid-size businesses for 22 years. Dedicated to providing services that adhere to GAAP standards while optimizing operations and financial performance. Expertise in many types of accounting software relevant to business size, including Xero, QuickBooks, Zoho, and SAP. Experience supervising and collaborating across cross-functional teams and departments while increasing ROI by 5%+ YTD.

- This summary statement provides specific metrics, specialized skills, and a job title. It’s a great example of a strong statement that would impress a hiring team.

Quantify your positive impact as an accountant

If you want to prove to a company that you’re an excellent accountant, you’ll want to focus on numbers. Quantifying your impact on your accountant resume provides concrete proof that you’re an asset to the company.

Fortunately, as an accountant, there are many ways to quantify your impact, such as:

- Internal company operations: Have you worked with company executives to propose financial incentives to improve employee retention? Have you instituted software adoption that reduced error rates?

- Leadership: Do you manage, mentor, or collaborate with a team? Do you work across several departments?

- Work with vendors: Do you assess vendor invoicing or review vendor statements? Do you manage accounts payable for vendors?

- Clients: How many clients do you advise if you work with individual clients? How long have you retained these clients?

- Revenue: How much revenue does the company you work for generate? How many assets do you oversee? How much have you saved in potential penalty costs?

- Reductions in error rates: Have you reduced errors during employment at your past jobs? Do you use specific types of software to minimize mistakes?

Based on the above, check out these examples that demonstrate how metrics can fuel your bullet points:

- Proactively identified and communicated potential problem areas related to a client’s reporting issue, saving the client $2K+ in penalty fees

- Supported management in executing an employee equity compensation plan to improve employee retention by 11%

- Led a team of 2 junior accountants, providing mentorship and feedback through weekly 1:1 sessions

- Reconciled vendor statements in QuickBooks, investigating and correcting any discrepancies within 48 hours

Optimize your accountant resume for each job

Unfortunately, you can’t just have one copy of your resume that you submit for every accountant job application. Every application deserves a tailored resume.

With the job description in view, these are the areas you’ll need to pay special attention to:

- Objective/summary statement: Remember how we encouraged you to include specific company names? One of an applicant’s worst mistakes is failing to change the company name on multiple job applications. Make sure you read over your statement (if included) before submitting your resume, changing the job title, skills, and company name.

- Skills: To customize your skills section, read the job description. Often, hiring managers will overtly say what skills are important for the specific accounting job (but be careful not to plagiarize).

- Job description bullet points: Are you applying to a job that needs you to interface with clients? Or maybe you’ll be working behind the scenes with data? Think about how you can shift how you discuss your work experience to highlight what’s important for each particular job.

We know it’s frustrating to focus on customizations when you want to submit multiple applications in a short amount of time. Consider creating a document with a master list of job description bullet points and skills, sorted into groups based on the skills you need to highlight (e.g., one section that demonstrates your accuracy, another for client interactions, another for public speaking, etc.). Then, you can pick and pull things from this document to create fully customized resumes in no time.

For now, we think you’ll find something to help you get started on your accountant resume, no matter the exact role:

Accountant resume

- Do you have experience in general ledger (GL) accounting?

- Remember, you don’t need to include all of these accounting skills in each position, but they must be covered at least once somewhere on your accountant resume.

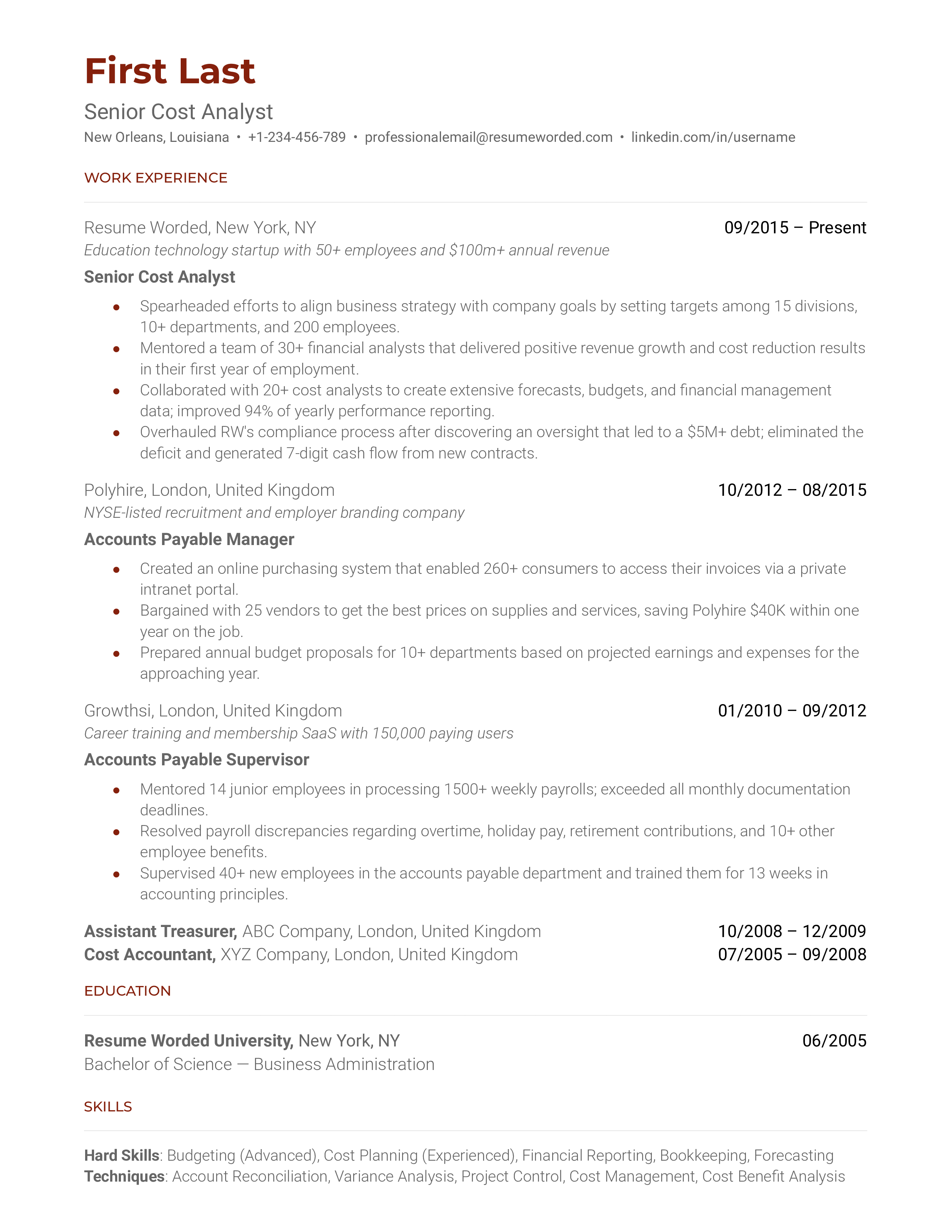

Senior accountant resume

- Underscore things like extensive improvements in efficiency rates, accuracy, and year-to-year financial growth.

- Have you collaborated with upper management to set company-wide standards or implement internal policies or financial work incentives?

- Highlight your ability to step into leadership and mentorship roles.

Accounts payable resume

- Hone in on what matters by discussing payment processing and review, tracking business expenses (such as vendor invoices), and ensuring GL and GAAP compliance.

- Highlight your attention to detail and how it has saved revenue for companies you’ve worked for in the past.

Entry-level accountant resume

- You can leverage almost any job position to highlight particularly relevant skills in accounting. For example, a restaurant server can still balance payments, check receipts against bills, etc.

- Read the job description carefully, noting what skills are most important to the hiring team and emphasizing your capacity to work in accounting based on their requirements.

Staff accountant resume

- Your staff accountant resume should focus on general ledger maintenance/oversight, tax revenue billing, accounts payable/receivable, reports, and general record-keeping.

- Don’t forget to showcase your potential for job advancement down the road by highlighting any aspects in which you provided management/supervisory work.

Final takeaway for improving your accountant resume

The hardest part of writing your accountant resume is getting started, so congratulate yourself on starting your resume journey! You’re one step closer to creating your best-ever accounting resume. We’ve laid out all the essential tips, including optimizing your skills section, formatting, metrics, and resume customizations, so you can write an amazing resume in no time.

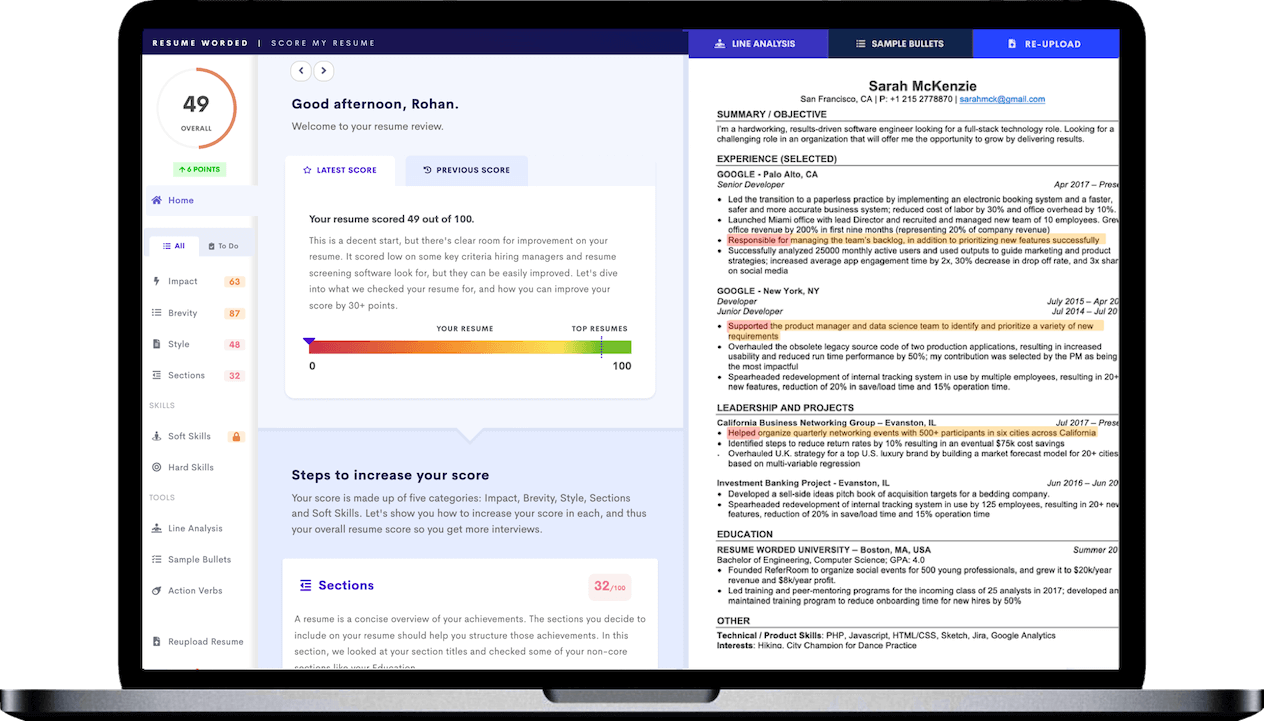

We also have a host of tools to make resume writing easier. See how your resume stacks up against our AI-powered tips. Or, if it’s time to write your resume for the first time, you can use our resume builder with built-in formatting standards and corresponding recommendations to keep the process stress-free, easy, and quick—leaving you time also to craft a killer accountant cover letter for your dream role.

No matter what stage you’re at, we’re here to help, and we wish you the best of success!

13 Accountant Resume Examples & Writing Guide

Want to land your ideal accounting job? A strong resume is key. This guide provides 13 real-world accountant resume samples and expert tips. Learn what to include and how to structure it for maximum impact. By implementing this advice, you can create a resume that grabs attention and opens doors. Put your best foot forward and increase your interview chances.

Writing an accountant resume that catches the attention of employers isn't easy. Your resume needs to showcase your skills, experience, and the value you'd bring to the company, all while standing out from other applicants.

But don't worry - in this article, we'll break down everything you need to create an impressive accountant resume. We'll provide:

- A step-by-step guide to writing each critical section of your resume

- Tips to highlight your most relevant skills and achievements

- 13 real-life accountant resume examples to give you inspiration

- Advice on choosing the best format and design for your resume

By the end, you'll know exactly how to craft an accountant resume that gets you noticed by employers and increases your chances of landing an interview. We'll cover what to include in your resume summary, work experience, education, and skills sections.

So if you're ready to create an accountant resume that opens doors to exciting new job opportunities, keep reading. Applying our expert tips and studying the resume examples in this article will put you on the path to job search success.

Common Responsibilities Listed on Accountant Resumes

- Preparing and analyzing financial statements, including balance sheets, income statements, and cash flow statements

- Maintaining and reconciling general ledger accounts and ensuring accuracy of financial records

- Managing accounts payable and accounts receivable, including invoicing, payment processing, and collections

- Developing and monitoring budgets, forecasts, and financial plans to optimize financial performance

- Ensuring compliance with tax laws and regulations, preparing and filing tax returns, and managing tax audits

- Collaborating with internal and external stakeholders, such as management, auditors, and regulatory agencies

- Implementing and maintaining internal controls and financial policies to mitigate risk and prevent fraud

- Providing financial analysis and insights to support decision-making and strategic planning

Resume ATS Scanner

Drop your resume file here to scan for ATS compatibility.

How to write a Resume Summary

The summary or objective section of your resume is akin to the opening act of a performance; it sets the scene for the rest of your resume to follow. This small yet crucial section can make or break your application; the quality of your summary is your first chance to make a strong impression on potential employers.

Why Does a Summary/Objective Matter?

A well-written summary/objective paints a vivid picture of who you are as a professional. It provides a condensed-yet-comprehensive snapshot of your skills, experiences, achievements, and what you can bring to the table.

This section is particularly crucial when applying for jobs like accounting where the fundamentals of the role are clear-cut and understood industry-wide. Your summary/objective sets you apart from the rest of the applicants who have similar qualifications and experiences as you.

The Makeup of a Solid Summary/Objective

When it comes to creating a compelling summary or objective, there are certain elements that form the foundation. Rule number one is to draw upon your key skills and expertise. Focus on what value you bring to the job. As an Accountant, do you specialize in financial reporting and analysis? Have you honed your skills in budget management and strategic planning? Make sure to emphasize these aspects in your summary.

Rule number two is to highlight your achievements to persuade potential employers of your expertise. Did you play a crucial role in a previous company's financial turnaround? Have you won awards or received recognition for your performance? Include these demonstrable outcomes in your summary to showcase your capabilities.

Lastly, in rule number three, we ask you to weave personal qualities and traits into your summary. If decision-making, attention to detail, ethics and confidentiality are your strong suits, make sure to mention your character defining traits, alongside your technical qualifications.

Crafting Your Accounting Summary/Objective

So, how do we bring it all together?

Let's start with those in the early stages of their career. For entry-level applicants or recent graduates, your objective statement will probably focus more on your accounting education, internships, or relevant coursework. It's also a good place to pinpoint your career objective.

Here's an example to give you an idea:

"A recently CPA certified Accountant fluent in financial software, with a comprehensive understanding of ledger management, budget planning, and financial analysis. Looking to utilize my skills to effectively improve the financial stability at XYZ Corporation."

For those further along in their careers, the focus should be on skills and specific professional achievements.

Here's an example:

"Seasoned Accountant with over 10 years of experience in creating and implementing financial strategies for the food and beverage sector. Proven track record in improving profitability by 10% through effective budget management and cost optimization. Adept at financial analysis to guide decision-making."

While these insights give you a comprehensive guide to crafting a potent resume summary or objective section, the ultimate effectiveness rests on your ability to tailor your skills, achievements, and career aspirations to the specific job requirements. By knowing and highlighting what you bring to the table, you can capture your potential employer's attention and convince them that you are a great fit for the role.

Strong Summaries

- Detail-oriented and highly analytical Accountant with over ten years of experience in providing professional and comprehensive financial advice to a variety of business structures. Proven abilities in financial reporting, tax preparation, and budget management.

- Experienced Accountant with a strong background in financial management and forecasting. Proven track record of managing large scale budgeting systems and steering cross-functional teams towards financial stability.

- Certified Public Accountant with over 15 years of experience in corporate and small business financial management. Expertise in financial planning, analysis, and reporting. Committed to improving overall business performance and growth.

- Dedicated Accountant skilled in regulatory reporting, budget development, and financial forecasting. Demonstrates a consistent record of maximizing cost efficiency by strategizing financial management.

Why these are strong ?

The above are good examples of a summary section for an Accountant resume because they highlight the candidate's relevant experience, skills, and achievements. They present the candidate as highly skilled and experienced in their field with key skills such as financial reporting, tax preparation, budget management, and financial planning. This would attract potential employers as the summaries provide a broad view of their capabilities and how they can bring value to the company. Hence, incorporating these elements in a resume summary can be regarded as a good practice.

Weak Summaries

- Highly motivated and detail-oriented accountant.

- Ingredient in team success, passion for numbers and finance.

- Senior Accountant who is a hard worker and team player.

- Graduated with bachelor's degree in accounting.

- Accounting professional with 10+ years of experience.

Why these are weak ?

These examples are bad for a few reasons. Firstly, they are very generic and not specific to the individual's skills, achievements or experience. Phrases such as 'highly motivated', 'hard worker' and 'team player' are overused and do not provide any concrete information about the candidate. Secondly, stating your degree and years of experience is unnecessary in the summary section as these will be discussed in more detail in other parts of the resume. Lastly, saying 'Accounting professional with 10+ years of experience' does not give the employer an accurate picture of your capabilities or specialities within the accounting sector.

Showcase your Work Experience

A successful career journey is a string of well-told, compelling stories from your work experiences. This is especially true when penning down your resume, where the 'Work Experience' section becomes the heart of the narrative and a crucial part of making a great first impression. For professions like accounting, displaying a strategic, detailed, yet simple-to-understand walk-through of your career achievements allows potential employers to view you as a compatible candidate for the job.

Crafting The Dominant Picture: The Headline

Start by presenting a clear headline for each job entry in your work experience section. It should include your job title, the name of the organisation, the duration of employment, and the location if necessary. An effective headline immediately provides a snapshot of the role you played in the corporate world.

Writing Your Story: Job Responsibilities

Next, move on to illustrate your day-to-day tasks, roles and responsibilities. For an accountant, this could involve tasks such as preparing financial records, analysing financial data, and ensuring tax compliance. Be specific and to-the-point, keeping away from overwhelming details. But this doesn't mean you should undersell your capabilities. Maintain the balance.

Showcasing Success: Highlight Achievements

Most candidates do well in listing their roles and responsibilities. However, to present your expertise, you should draw attention to your professional accomplishments. Did you help increase the company’s revenue? Or maybe you optimized a process that helped reduce cost? Focus on the impact you made in your accounting role. Quantify your achievements whenever possible. Remember, numbers speak louder than words in the accounting domain.

Quantify your achievements and impact in each role using specific metrics, percentages, or numbers to demonstrate the value you brought to your previous employers. This helps hiring managers quickly understand the scope and significance of your contributions.

Strategy: Tailoring Your Experience

General resumes that fit all jobs are a thing of the past. Tailored resumes are in vogue now. Customize each 'Work Experience' section for the specific job you're applying for. Figure out what the company is seeking and align your description in a way that showcases you as a perfect fit for the job requirements.

Prioritize: Use Reverse Chronological Order

Presenting your work experience in reverse chronological order (most recent job first) makes it easier for hiring managers to assess your experience relevancy. Make sure to give priority to the most pertinent, impactful aspects of each role.

The Finer Nuance: Use Action Verbs

Use action verbs like 'Led', 'Managed', 'Directed', and 'Analyzed' to start your job description bullets. These showcase you as a doer and an active participant in your professional journey. This gives an impression of you being a go-getter and a dynamic employee.

Remember, your 'Work Experience' doesn't just communicate where you've been, but also indicates where you can go with the potential employer. So, value each word and make sure your experience resonates with the job you're aspiring for.

Strong Experiences

- Set a company record by decreasing month-end closing process by 3 days, increasing overall productivity.

- Managed a budget of $1M, demonstrating excellent allocation skills and financial acumen.

- Implemented new tax strategies that saved the company 15% in the 2019-2020 fiscal year.

- Lead a team of 8 junior accountants, promoting collaboration and professional growth.

- Automated quarterly accounting reports, saving 40 weekly work hours.

- Saved company $200,000 by implementing new cost-saving procedures.

- Maintained 100% accuracy in preparing reports and managing large datasets.

- Contributed to audit preparations that resulted in zero discrepancies or adjustments.

These are good examples as they offer specific details and measurable results, which reflect the accomplished goals clearly. Each bullet point begins with an action verb that highlights the achievement. Moreover, they demonstrate hard skills such as budget management, data accuracy, and team leading along with soft skills like collaboration. Furthermore, they reveal the applicant's initiative to improve systems for cost saving and efficiency. These qualities would be attractive to potential employers.

Weak Experiences

- Started a new ERP system

- Just managed financial department

- Handled invoices

- Updated financial records

- Took care of tax files

The above examples are considered bad practices for several reasons. Firstly, they are too vague. For instance, 'started a new ERP system', while technically a duty an accountant might have, doesn't provide any specific details about the task, the size or complexity of the system, what challenges were faced, or the outcome. Secondly, the use of passive terms like 'handled', 'updated', or 'took care of' does not effectively promote the candidate's skills or accomplishments. Such phrases are overused and lack specificity. Finally, these examples do not quantify the candidate's achievements. In the field of accounting, the ability to demonstrate concrete, measured results is crucial. Any bullet points should indicate measurable accomplishments, impact, or value-added to the employer's operations. It's also important to include how well you performed these tasks, the challenges overcome, how you increased efficiency, saved costs, or improved processes.

Skills, Keywords & ATS Tips

The resume is your chance to present a strong image of yourself. It's important to highlight both hard skills and soft skills, particularly for the role of an Accountant. Moreover, to make your resume stand out in the sea of applications, you need to understand the connection between keywords, Applicant Tracking Systems (ATS) and matching skills.

Hard Skills & Soft Skills

In simple terms, hard skills are the technical competencies you need to complete job-specific tasks, while soft skills relate to how you carry out your work and interact with others. Both are critical for an Accountant.

Hard skills are vital because they show your technical aptitude, accuracy, and level of training. They include skills like financial analysis, financial reporting, tax preparation, and proficiency in software like QuickBooks or Excel.

Soft skills , on the other hand, display your ability to work well within a team, manage your time effectively, and make informed decisions. Such skills include teamwork, communication, problem-solving, and self-motivation. While you can't always demonstrate these skills on a resume, you can certainly showcase them in your cover letter or in an interview.

The Role of Keywords, ATS, and Matching Skills

Many employers use Applicant Tracking Systems (ATS) to sort through resumes. These systems search for specific keywords related to the job description. Thus, to have a chance of making it through the ATS to a human reader, your resume should include relevant keywords.

However, it's important to remember that after you pass the ATS, a human recruiter will read your resume. What's more, most recruiters can easily spot a resume that's been keyword-stuffed just to get past an ATS.

A better strategy is to match your skills - both hard and soft - to the job description. Read the requirements carefully and identify the key skills that the employer is looking for. Then, make sure your resume shows that you have these skills. In this way, your keywords will resonate naturally with the ATS, and your resume will be relevant and engaging for human readers too.

Top Hard & Soft Skills for Full Stack Developers

Hard skills.

- Financial reporting

- Account reconciliation

- Tax preparation

- Financial analysis

- Risk management

- Knowledge of accounting software

- Management accounting

- Financial statement preparation

- Inventory management

- Cash flow management

- Cost accounting

- Financial forecasting

- Knowledge of GAAP

- Payroll processing

- Profit and loss analysis

- Quantitative analysis

- Revenue generation

- Strategic financial planning

Soft Skills

- Attention to detail

- Problem-solving

- Critical thinking

- Time management

- Organization

- Communication

- Adaptability

- Customer service

- Ethical conduct

- Confidentiality

- Self-motivation

- Stress management

- Decision-making

- Proactiveness

- Reliability

Top Action Verbs

Use action verbs to highlight achievements and responsibilities on your resume.

- Collaborated

- Coordinated

- Implemented

- Administered

- Streamlined

- Interpreted

Education & Certifications

Adding your education and certificates to your resume as an accountant is quite straightforward. Start by creating a section titled 'Education'. If you have a degree, list it first, followed by the name of the university and the date you graduated. For certificates, put them under a new section named 'Certifications', again in chronological order. For both, be specific on fields of study or certificate names. The idea is to make your qualifications transparent and easy to understand for potential employers.

Some of the most important certifications for Accountants

The most widely recognized certification for accountants in the United States.

A globally recognized certification for management accountants.

A certification for accountants and financial professionals in business.

A globally recognized certification for internal auditors.

A certification for information systems audit, control, and security professionals.

A certification for anti-fraud professionals.

A certification for tax professionals authorized to represent taxpayers before the IRS.

A certification for government financial managers.

A certification for payroll professionals.

A globally recognized certification for investment and financial professionals.

Resume FAQs for Accountants

What is the best format for an accountant resume.

The most effective format for an accountant resume is the reverse-chronological format. This format highlights your most recent experience and achievements first, making it easy for hiring managers to see your relevant qualifications. It also allows you to showcase your career progression and growth within the accounting field.

How long should an accountant resume be?

An accountant resume should typically be one to two pages long, depending on your level of experience. If you have less than 10 years of experience, aim for a one-page resume. For those with more than 10 years of experience or a extensive list of relevant achievements, a two-page resume is acceptable. Be sure to focus on the most relevant and impactful information that showcases your skills and qualifications.

What are the most important skills to include on an accountant resume?

When creating your accountant resume, focus on highlighting your technical skills, such as proficiency in accounting software (e.g., QuickBooks, Xero), knowledge of financial reporting standards (GAAP, IFRS), and expertise in areas like tax preparation, auditing, and financial analysis. Additionally, emphasize your soft skills, such as attention to detail, problem-solving abilities, and communication skills, as these are crucial for success in the accounting field.

How can I make my accountant resume stand out?

To make your accountant resume stand out, focus on quantifying your achievements and impact. Use specific numbers and percentages to demonstrate how you have contributed to your previous employers' success, such as reducing costs, improving efficiency, or identifying tax savings. Additionally, tailor your resume to the specific job description, highlighting the skills and experiences that align with the company's needs. Finally, use a clean, professional design and clear, concise language to ensure your resume is easy to read and navigate.

An Accountant prepares financial records, maintains accounting systems, and ensures regulatory compliance. To craft an effective Accountant resume, highlight relevant experience, skills like data analysis and accounting software expertise, CPA certification if applicable, and quantifiable achievements. Use clear formatting, be concise, and proofread thoroughly.

Highly analytical and detail-oriented Accountant with a proven track record of delivering accurate financial reports and optimizing accounting processes. Skilled in financial analysis, budgeting, and tax compliance. Adept at collaborating with cross-functional teams to drive financial performance and support strategic decision-making.

- Led the preparation and analysis of monthly, quarterly, and annual financial statements for clients across various industries.

- Implemented process improvements that reduced month-end close cycle by 30%, enhancing reporting efficiency and accuracy.

- Managed a team of 5 junior accountants, providing guidance and mentorship to ensure high-quality deliverables.

- Conducted in-depth financial audits, identifying and resolving discrepancies, and ensuring compliance with GAAP and IFRS standards.

- Collaborated with clients' management teams to develop and monitor budgets, forecasts, and financial projections.

- Prepared and reviewed financial statements, general ledger entries, and account reconciliations for multiple clients.

- Assisted in the development and implementation of internal control procedures, enhancing financial data integrity.

- Conducted research on complex accounting issues and provided recommendations to senior management.

- Participated in the successful completion of annual financial audits, ensuring timely submission of deliverables.

- Provided exceptional client service, building strong relationships and addressing inquiries in a timely manner.

- Assisted in the preparation of financial statements and supporting schedules for various clients.

- Performed account reconciliations and analyzed financial data to identify potential discrepancies.

- Supported the audit team in the execution of audit procedures and documentation of findings.

- Conducted research on accounting standards and regulations to ensure compliance and accuracy.

- Demonstrated strong work ethic and attention to detail, receiving positive feedback from supervisors and clients.

- Financial Reporting

- Financial Analysis

- Budgeting and Forecasting

- Tax Compliance

- GAAP and IFRS Standards

- Process Improvement

- Team Leadership

- Financial Modeling

- Variance Analysis

- Account Reconciliation

- Internal Controls

- Data Analytics

- Excel and Accounting Software

A Staff Accountant plays a vital role in maintaining a company's financial records and transactions. Responsibilities include ensuring accurate invoicing, managing accounts payable and receivable, preparing reports, and assisting with budgeting. To secure this role, craft a well-structured resume highlighting your bachelor's degree in accounting, 1-3 years of progressive experience, and proficiency in accounting software. Feature a compelling summary section to immediately convey your expertise and passion for the field.

Highly motivated and detail-oriented Staff Accountant with a proven track record of delivering accurate and timely financial reports. Skilled in managing complex accounting systems, implementing process improvements, and collaborating with cross-functional teams to achieve organizational goals.

- Managed the financial reporting process for multiple high-profile clients, ensuring compliance with GAAP and IFRS standards.

- Implemented a new accounting system that streamlined processes and reduced month-end close time by 30%.

- Collaborated with the audit team to successfully complete the annual external audit with no material adjustments.

- Provided training and mentorship to junior accounting staff, fostering a culture of continuous learning and development.

- Conducted in-depth financial analyses to support strategic decision-making and identify opportunities for cost savings.

- Prepared monthly, quarterly, and annual financial statements for a diverse portfolio of clients.

- Assisted in the development and implementation of new accounting policies and procedures.

- Conducted account reconciliations and resolved discrepancies in a timely manner.

- Collaborated with the tax team to ensure accurate and compliant tax filings.

- Participated in process improvement initiatives that resulted in a 15% increase in efficiency.

- Assisted in the preparation of financial statements and supporting schedules.

- Performed account reconciliations and maintained accurate and up-to-date financial records.

- Collaborated with the accounts payable and accounts receivable teams to ensure timely processing of transactions.

- Participated in the annual budget preparation process and assisted in variance analysis.

- Demonstrated a strong work ethic and dedication to delivering high-quality work within tight deadlines.

- GAAP and IFRS

- Accounting Systems (SAP, Oracle)

- Microsoft Excel (Advanced)

- Teamwork and Collaboration

- Leadership and Mentoring

- Attention to Detail

- Problem Solving

- Effective Communication

- Time Management

Cost Accountants track production costs, analyze expenditures, and optimize cost-effectiveness. When crafting a resume, emphasize skills in data analysis, budgeting, and accounting software proficiency. Highlight experiences streamlining cost control processes while quantifying accomplishments using clear, compelling language. Present a focused narrative showcasing your ability to drive operational efficiency.

Highly analytical and detail-oriented Cost Accountant with a proven track record of driving cost reduction initiatives and optimizing financial performance. Adept at collaborating with cross-functional teams to identify cost-saving opportunities and implement process improvements. Extensive experience in financial modeling, budgeting, and variance analysis.

- Developed and implemented cost allocation methodologies, resulting in a 15% reduction in overhead costs.

- Conducted comprehensive cost-benefit analyses for proposed projects, leading to informed decision-making and optimized resource allocation.

- Collaborated with the procurement team to negotiate favorable contract terms with suppliers, achieving annual cost savings of $500,000.

- Designed and maintained accurate cost accounting systems, ensuring compliance with GAAP and internal control requirements.

- Mentored and trained junior cost accountants, fostering a culture of continuous learning and professional development.

- Prepared detailed cost reports and analyses, providing valuable insights for management decision-making.

- Conducted variance analyses and identified root causes of budget discrepancies, recommending corrective actions.

- Collaborated with department heads to develop and monitor departmental budgets, ensuring alignment with organizational goals.

- Implemented cost allocation models for shared services, improving accuracy and transparency of cost distribution.

- Assisted in the preparation of financial statements and supported the monthly close process.

- Assisted in the development and maintenance of standard cost systems, ensuring accuracy and consistency.

- Performed cost-volume-profit analysis to evaluate the profitability of products and services.

- Supported the preparation of budgets and forecasts, collaborating with various departments.

- Conducted inventory valuations and reconciliations, ensuring accurate financial reporting.

- Participated in process improvement initiatives, contributing to enhanced efficiency and cost reduction.

- Cost Accounting

- Cost Allocation

- GAAP Compliance

- Oracle Hyperion

- Microsoft Excel

- Project Management

- Cross-functional Collaboration

As an Accountant Assistant, you'll play a vital supporting role in maintaining financial records and assisting accountants with day-to-day accounting operations. This multifaceted position requires a keen eye for detail, strong math aptitude, computer proficiency, and exceptional organizational skills. When crafting your resume, highlight any relevant education in accounting principles along with prior experience handling financial data entry, bookkeeping, and reporting duties. Emphasize your quantitative abilities, adeptness with spreadsheets and accounting software, and your knack for maintaining meticulous records. With a clear, accomplishment-driven resume tailored to the role's demands, you'll be well-positioned to secure an opportunity in this indispensable field.

Highly motivated and detail-oriented Accounting Assistant with a passion for financial accuracy and efficiency. Proven track record of streamlining accounting processes, ensuring compliance, and collaborating with cross-functional teams to achieve organizational goals. Adept at leveraging technology to optimize financial reporting and analysis.

- Assisted in the preparation and analysis of financial statements, ensuring accuracy and compliance with GAAP

- Collaborated with cross-functional teams to streamline accounting processes, resulting in a 20% reduction in month-end close time

- Implemented a new expense management system, saving the company over $50,000 annually in processing costs

- Provided support during internal and external audits, ensuring timely and accurate documentation

- Trained and mentored junior accounting staff, fostering a culture of continuous learning and development

- Processed over 1,000 invoices per month, ensuring timely and accurate payments to vendors

- Implemented a new vendor management system, reducing payment errors by 15% and improving vendor satisfaction

- Collaborated with the procurement team to negotiate favorable payment terms, resulting in improved cash flow

- Conducted regular account reconciliations, identifying and resolving discrepancies in a timely manner

- Assisted in the development and implementation of SOX-compliant accounts payable policies and procedures

- Assisted in the preparation of monthly financial reports, ensuring accuracy and timely submission

- Conducted research on new accounting standards and regulations, providing updates to senior management

- Participated in the annual budget planning process, contributing to the development of departmental budgets

- Supported the accounts receivable team in collections efforts, helping to reduce outstanding receivables by 10%

- Demonstrated a strong work ethic and eagerness to learn, earning a full-time offer upon graduation

- GAAP compliance

- Accounts payable

- Accounts receivable

- Expense management

- Vendor management

- SOX compliance

- Budgeting and forecasting

- Process improvement

- Cross-functional collaboration

- ERP systems (SAP, Oracle)

- Accounting software (QuickBooks, Xero)

Public accountants handle financial records, tax preparations, and compliance for clients. Key duties involve data analysis, tax law advisement, and ensuring regulatory adherence. To craft an impactful resume, emphasize your accounting degree, CPA certification, tax software proficiency, and relevant experience. Highlight transferable skills like detail-orientation, problem-solving, and communication. Tailor your resume for each role.

Highly skilled and motivated Public Accountant with a proven track record of delivering exceptional financial services to a diverse range of clients. Possessing a keen eye for detail and a strong analytical mindset, I excel in preparing financial statements, conducting audits, and providing strategic advice to optimize financial performance. With a passion for integrity and accuracy, I am committed to ensuring compliance with accounting standards and fostering long-lasting client relationships built on trust and professionalism.

- Led a team of 5 accountants in conducting comprehensive financial audits for clients with annual revenues exceeding $100 million.

- Developed and implemented streamlined accounting processes, resulting in a 20% reduction in monthly close times.

- Provided strategic tax planning advice to high-net-worth individuals, successfully minimizing their tax liabilities by an average of 15%.

- Collaborated with cross-functional teams to ensure seamless integration of financial data across various departments.

- Mentored junior accountants, fostering a culture of continuous learning and professional development within the team.

- Conducted financial statement audits for a diverse portfolio of clients, ensuring compliance with GAAP and IFRS standards.

- Identified and resolved complex accounting issues, providing clear and concise recommendations to senior management.

- Managed the successful preparation and filing of corporate tax returns, consistently meeting all deadlines.

- Developed and delivered training sessions on updated accounting regulations for internal staff and clients.

- Assisted in the implementation of new accounting software, resulting in enhanced efficiency and accuracy of financial reporting.

- Prepared monthly, quarterly, and annual financial statements for multiple clients across various industries.

- Assisted in the execution of financial audits, ensuring adherence to established audit procedures and documentation standards.

- Conducted in-depth research on complex accounting issues, providing well-supported recommendations to senior accountants.

- Collaborated with clients to gather and analyze financial data, ensuring accuracy and completeness of information.

- Participated in process improvement initiatives, contributing to the development of more efficient and effective accounting practices.

- Financial Statement Preparation

- Tax Planning & Preparation

- GAAP & IFRS Compliance

- Budgeting & Forecasting

- Risk Assessment

- Sarbanes-Oxley Compliance

A Fund Accountant maintains financial records, tracks transactions, and reconciles accounts for investment funds. When crafting a resume, highlight accounting proficiency, data analysis skills, and meticulous attention to detail. Summarize relevant experience in fund accounting, reporting, and regulatory compliance while quantifying achievements. Showcase technical expertise with fund accounting software and spreadsheet mastery.

Highly motivated and detail-oriented Fund Accountant with over 8 years of experience in financial reporting, reconciliations, and analysis. Proven track record of delivering accurate and timely results in fast-paced environments. Skilled in collaborating with cross-functional teams to streamline processes and enhance operational efficiency.

- Managed a portfolio of 25+ mutual funds with assets exceeding $10 billion

- Conducted daily reconciliations, identifying and resolving discrepancies within 24 hours

- Implemented process improvements that reduced month-end close timeline by 20%

- Collaborated with auditors to ensure compliance with accounting standards and regulatory requirements

- Mentored and trained junior accountants, fostering a culture of continuous learning and development

- Prepared daily NAV calculations for a diverse range of fund types, consistently meeting deadlines

- Performed monthly reconciliations of fund expenses, ensuring accuracy and completeness

- Assisted in the preparation of annual financial statements and regulatory filings

- Developed a comprehensive training manual for new hires, reducing onboarding time by 30%

- Actively participated in process improvement initiatives, contributing to increased team efficiency

- Supported senior accountants in daily reconciliations and NAV calculations for multiple funds

- Maintained accurate and up-to-date records of fund transactions and holdings

- Assisted in the preparation of monthly client reporting packages

- Identified and corrected accounting errors, ensuring data integrity

- Demonstrated a strong aptitude for learning and quickly adapted to new systems and processes

- Fund accounting

- Reconciliations

- NAV calculations

- Regulatory reporting

- Data analysis

An entry-level accountant records transactions, maintains ledgers, and prepares financial reports. For the resume, highlight accounting coursework, internships, and software skills. Quantify accomplishments and use strong verbs like "analyzed" or "reconciled." Keep formatting clean and easy to scan. Clearly delineate roles, achievements, and qualifications.

Highly motivated and detail-oriented entry-level accountant with a strong foundation in financial reporting, bookkeeping, and data analysis. Skilled in utilizing accounting software to ensure accurate and timely financial records. Eager to contribute to a dynamic accounting team and deliver exceptional results in a fast-paced environment.

- Assisted in preparing financial statements and reconciling accounts, resulting in a 15% reduction in discrepancies.

- Collaborated with senior accountants to streamline the month-end close process, reducing the average closing time by 2 days.

- Conducted thorough research and analysis to support various audit engagements, contributing to the successful completion of 10+ client projects.

- Developed and implemented a new filing system for financial documents, improving the team's efficiency by 20%.

- Participated in professional development workshops and training sessions to expand knowledge of accounting principles and industry best practices.

- Processed and managed vendor invoices, ensuring timely and accurate payments for over 200 accounts.

- Identified and resolved discrepancies in vendor accounts, saving the company $25,000 in potential overpayments.

- Collaborated with cross-functional teams to improve the accounts payable workflow, resulting in a 30% increase in efficiency.

- Maintained detailed records and documentation for all accounts payable transactions, ensuring compliance with internal policies and external regulations.

- Assisted in the successful implementation of a new accounts payable software, providing training and support to team members.

- Assisted in maintaining accurate financial records for 50+ client accounts, ensuring timely and precise data entry.

- Reconciled bank statements and credit card accounts, identifying and resolving discrepancies promptly.

- Prepared and submitted sales tax returns, ensuring compliance with state and local regulations.

- Collaborated with the accounting team to develop and implement process improvements, resulting in a 25% reduction in manual data entry.

- Provided exceptional customer service to clients, addressing inquiries and concerns in a professional and timely manner.

- Bookkeeping

- Bank reconciliation

- Audit support

- Tax compliance

- Accounting software (QuickBooks, SAP, Oracle)

- Microsoft Excel (advanced)

A Junior Accountant is an entry-level position responsible for supporting accounting operations such as maintaining financial records, processing transactions, and assisting in audits. To secure this role, craft a compelling resume highlighting your accounting education, relevant internships or work experience, and strong skills in data analysis, attention to detail, and proficiency with accounting software. Tailor your resume to the specific job requirements, quantifying your achievements and using industry keywords. Ensure your resume is well-organized, visually appealing, and free of errors. Emphasize your ability to work in a team, meet deadlines, and adhere to accounting principles and regulations.

Detail-oriented and analytical Junior Accountant with a strong foundation in financial reporting, bookkeeping, and accounting principles. Adept at collaborating with cross-functional teams to deliver accurate and timely financial information. Committed to continuous learning and professional growth in the field of accounting.

- Assisted in the preparation of monthly, quarterly, and annual financial statements in accordance with GAAP

- Performed bank reconciliations and maintained accurate records of financial transactions

- Collaborated with the accounts payable team to ensure timely processing of vendor invoices and payments

- Participated in the implementation of a new accounting software, resulting in improved efficiency and accuracy

- Supported the preparation of audit schedules and provided documentation to external auditors

- Assisted in the preparation of corporate tax returns for clients in various industries

- Performed research on tax regulations and provided summaries to senior team members

- Collaborated with the audit team to gather and organize client financial data

- Participated in professional development workshops and training sessions

- Received positive feedback from supervisors for accuracy and attention to detail

- Processed vendor invoices and ensured timely payment in accordance with company policies

- Maintained accurate records of accounts payable transactions and resolved discrepancies

- Collaborated with the procurement team to verify purchase orders and receipt of goods

- Assisted in the preparation of 1099 forms for vendors at year-end

- Implemented process improvements that reduced the average invoice processing time by 20%

- Bank Reconciliations

- Accounts Payable

- Tax Preparation

- Audit Support

- Data Analysis

A Payroll Accountant ensures accurate employee compensation by calculating wages, deductions, and tax withholdings. Key responsibilities include timely payroll processing, maintaining compliance, and reconciling accounts. When crafting a resume, highlight proficiency with payroll software, attention to detail, relevant certifications, and quantifiable achievements demonstrating efficiency and accuracy. Use a clear format focused on applicable skills and payroll experience.

Highly motivated and detail-oriented Payroll Accountant with a proven track record of accurately processing payroll for large organizations. Skilled in navigating complex payroll systems, ensuring compliance with federal and state regulations, and providing exceptional customer service to employees. Adept at identifying process improvements to increase efficiency and reduce errors.

- Processed bi-weekly payroll for over 5,000 employees across multiple states and jurisdictions

- Implemented a new payroll system, reducing processing time by 25% and increasing accuracy to 99.9%

- Managed year-end payroll processes, including W-2 and 1099 preparation and distribution

- Served as a subject matter expert for payroll inquiries, providing guidance to HR and Finance teams

- Conducted regular audits to ensure compliance with internal policies and external regulations

- Processed semi-monthly payroll for 3,000+ employees, ensuring accurate and timely payments

- Reconciled payroll accounts and resolved discrepancies, maintaining a 98% accuracy rate

- Assisted with the implementation of a new time and attendance system, providing training to employees

- Managed garnishment and child support orders, ensuring compliance with legal requirements

- Prepared monthly, quarterly, and annual payroll reports for management review

- Processed weekly payroll for 1,500 employees across multiple departments

- Managed employee onboarding and offboarding processes, ensuring accurate payroll setup

- Assisted with the preparation and filing of quarterly and annual payroll tax returns

- Maintained employee payroll records and addressed inquiries regarding pay and deductions

- Participated in the successful implementation of a paperless payroll system

- Payroll Processing

- Payroll Systems (ADP, Workday, Ceridian)

- Payroll Tax Compliance

- Multi-State Payroll

- Garnishment Management

- Time and Attendance Systems

- Payroll Accounting

- Payroll Auditing

- Payroll Reporting

- Payroll Reconciliation

- Employee Onboarding/Offboarding

- Customer Service

- Microsoft Office Suite (Excel, Word, PowerPoint)

A General Ledger Accountant oversees an organization's financial records and transactions. Key responsibilities involve maintaining accurate general ledger accounts, reconciling discrepancies, and preparing reports. For the resume, concisely highlight relevant accounting education, experience updating ledgers, and expertise with bookkeeping software. Emphasize analytical skills and meticulous attention to detail.

Highly analytical and detail-oriented General Ledger Accountant with a proven track record of ensuring accurate financial reporting and maintaining the integrity of the general ledger. Skilled in identifying and resolving discrepancies, optimizing accounting processes, and collaborating with cross-functional teams to drive financial success.

- Managed the general ledger for a diverse portfolio of clients, ensuring accurate and timely financial reporting.

- Developed and implemented process improvements that reduced month-end close time by 20%.

- Collaborated with internal and external auditors to ensure compliance with GAAP and SOX requirements.

- Trained and mentored junior accountants, fostering a culture of continuous learning and development.

- Played a key role in the successful implementation of a new ERP system, streamlining accounting processes.

- Prepared and analyzed financial statements for multiple clients across various industries.

- Identified and resolved complex accounting issues, ensuring the accuracy of financial reports.

- Led the automation of key accounting processes, resulting in a 15% increase in efficiency.

- Conducted in-depth research on accounting standards and provided guidance to clients and team members.

- Received the "Outstanding Performer" award for consistently exceeding performance expectations.

- Assisted in the preparation and review of financial statements for a diverse client base.

- Performed account reconciliations and investigated discrepancies to ensure accurate financial reporting.

- Supported the successful completion of financial audits by providing timely and accurate documentation.

- Participated in process improvement initiatives that streamlined accounting procedures.

- Consistently met tight deadlines while maintaining a high level of accuracy and attention to detail.

- Financial statement preparation and analysis

- Month-end close process

- Variance analysis

- Advanced Excel (Vlookup, Pivot Tables, Macros)

- Data analysis and visualization

- Interpersonal communication

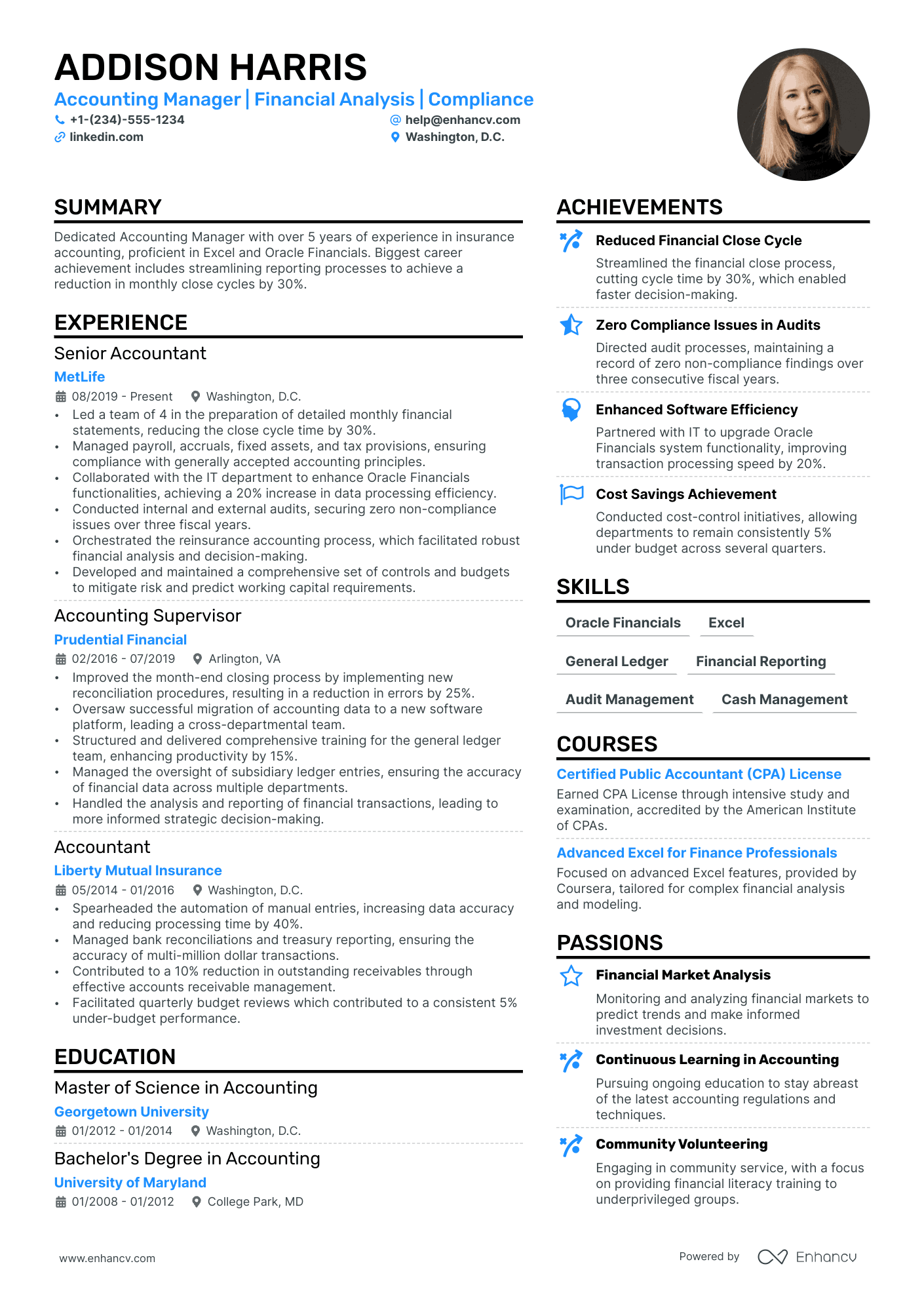

A Senior Accountant plays a pivotal role in an organization, taking charge of all accounting operations to maintain financial integrity and regulatory compliance. Their responsibilities encompass overseeing accounts, preparing financial statements and reports, analyzing complex data, and managing accounting teams. When crafting a resume for this position, emphasize your extensive accounting expertise, leadership qualities in team management, and quantifiable achievements that showcase your impact. Highlight technical proficiencies with accounting software, certifications, and a deep understanding of accounting principles to demonstrate your qualifications as a seasoned financial professional.

Results-driven Senior Accountant with over 10 years of experience in financial reporting, auditing, and financial analysis. Proven track record of implementing cost-saving measures and improving financial processes. Skilled in managing cross-functional teams and collaborating with stakeholders to achieve organizational goals.

- Led a team of 5 accountants in preparing financial statements and reports for clients with annual revenues exceeding $500 million.

- Implemented a new financial reporting system, reducing month-end close process by 30% and saving the company $100,000 annually.

- Conducted internal audits and identified areas for improvement, resulting in a 15% increase in operational efficiency.

- Collaborated with cross-functional teams to develop and execute financial strategies aligned with organizational goals.

- Provided technical guidance and mentorship to junior accountants, fostering a culture of continuous learning and professional development.

- Prepared and analyzed financial statements for clients in various industries, ensuring compliance with GAAP and IFRS standards.

- Conducted financial audits and identified areas for improvement, resulting in a 10% reduction in financial errors.

- Assisted in the development and implementation of internal control procedures, enhancing financial data accuracy and reliability.

- Collaborated with tax professionals to optimize tax strategies and ensure compliance with federal and state regulations.

- Provided exceptional client service, building strong relationships and receiving positive feedback from clients and senior management.

- Assisted in the preparation of financial statements and reports for clients in the technology and healthcare industries.

- Conducted account reconciliations and analyzed financial data to identify discrepancies and ensure accuracy.

- Supported senior accountants in the preparation of audit workpapers and the execution of audit procedures.

- Demonstrated strong attention to detail and problem-solving skills, consistently delivering high-quality work within tight deadlines.

- Team Management

A Chartered Accountant (CA) provides financial advisory, auditing, taxation, and consulting services. They ensure organizations comply with regulations and maximize profitability. For a CA resume, highlight your accreditation, specialized experience auditing accounts or filing taxes, technical skills like expertise in accounting software, and quantified accomplishments demonstrating your impact. Use a clear, achievement-focused structure with concise phrasing.

Highly accomplished Chartered Accountant with over a decade of experience in financial reporting, auditing, and strategic planning. Proven track record of optimizing financial processes, driving profitability, and ensuring compliance with regulatory standards. Adept at collaborating with cross-functional teams to deliver outstanding results in fast-paced environments.

- Spearhead financial audits for multinational clients, ensuring compliance with IFRS and GAAP standards.

- Implement advanced financial reporting systems, reducing month-end close process by 30%.

- Provide strategic advisory services to C-suite executives, resulting in annual cost savings of £1.5 million.

- Mentor and train a team of 10 junior accountants, fostering professional growth and development.

- Recognized as 'Employee of the Year' in 2021 for outstanding contributions to the firm.

- Conducted financial audits for diverse clients across various industries, ensuring timely and accurate completion.

- Developed and implemented robust internal control systems, enhancing financial transparency and mitigating risk.

- Provided tax advisory services to high-net-worth individuals, optimizing tax strategies and ensuring compliance.

- Collaborated with cross-functional teams to deliver seamless client service and exceed expectations.

- Received multiple 'Excellence in Client Service' awards for outstanding performance.

- Assisted in the preparation of financial statements and tax returns for corporate and individual clients.

- Conducted in-depth financial analyses to identify areas for improvement and cost optimization.

- Participated in the development and implementation of new accounting policies and procedures.

- Supported senior accountants in the execution of complex audits and advisory projects.

- Demonstrated strong attention to detail and a keen ability to learn quickly in a demanding environment.

- Financial Reporting (IFRS, GAAP)

- Tax Advisory

- Strategic Planning

- Risk Management

- Process Optimization

- Mentoring and Training

- Regulatory Compliance

- Stakeholder Management

A property accountant oversees financial reporting, budgeting, and tax compliance for real estate properties. They manage accounts payable/receivable and prepare financial statements. For the resume, highlight experience with property management accounting software, strong analytical skills, and real estate tax law knowledge. Quantify achievements like cost savings or process improvements made.

Highly motivated and detail-oriented Property Accountant with a proven track record of maintaining accurate financial records and generating insightful reports. Skilled in maximizing property value through effective budgeting, forecasting, and financial analysis. Adept at collaborating with cross-functional teams to streamline accounting processes and drive operational efficiency.