or (+234) 0704-692-9508

Contact Today for Best Taxation Project Topics

Taxation latest final year project topics, research ideas and materials, list of taxation latest final year project topics, research ideas and materials, taxation project topics and research materials.

| S/N | CATEGORY | LATEST PROJECT TOPICS AND RESEARCH IDEAS | GET THE COMPLETE PROJECT |

|---|---|---|---|

| 1. | PROJECT PREVIEW --> | ||

| 2. | PROJECT PREVIEW --> | ||

| 3. | PROJECT PREVIEW --> | ||

| 4. | PROJECT PREVIEW --> | ||

| 5. | PROJECT PREVIEW --> | ||

| 6. | PROJECT PREVIEW --> | ||

| 7. | PROJECT PREVIEW --> | ||

| 8. | PROJECT PREVIEW --> | ||

| 9. | PROJECT PREVIEW --> | ||

| 10. | PROJECT PREVIEW --> | ||

| 11. | PROJECT PREVIEW --> | ||

| 12. | PROJECT PREVIEW --> | ||

| 13. | PROJECT PREVIEW --> | ||

| 14. | PROJECT PREVIEW --> | ||

| 15. | PROJECT PREVIEW --> | ||

| 16. | PROJECT PREVIEW --> | ||

| 17. | PROJECT PREVIEW --> | ||

| 18. | PROJECT PREVIEW --> | ||

| 19. | PROJECT PREVIEW --> | ||

| 20. | PROJECT PREVIEW --> | ||

| 21. | PROJECT PREVIEW --> | ||

| 22. | PROJECT PREVIEW --> | ||

| 23. | PROJECT PREVIEW --> | ||

| 24. | PROJECT PREVIEW --> | ||

| 25. | PROJECT PREVIEW --> | ||

| 26. | PROJECT PREVIEW --> | ||

| 27. | PROJECT PREVIEW --> | ||

| 28. | PROJECT PREVIEW --> | ||

| 29. | PROJECT PREVIEW --> | ||

| 30. | PROJECT PREVIEW --> | ||

| 31. | PROJECT PREVIEW --> | ||

| 32. | PROJECT PREVIEW --> | ||

| 33. | PROJECT PREVIEW --> | ||

| 34. | PROJECT PREVIEW --> | ||

| 35. | PROJECT PREVIEW --> | ||

| 36. | PROJECT PREVIEW --> | ||

| 37. | PROJECT PREVIEW --> | ||

| 38. | PROJECT PREVIEW --> | ||

| 39. | PROJECT PREVIEW --> | ||

| 40. | PROJECT PREVIEW --> | ||

| 41. | PROJECT PREVIEW --> | ||

| 42. | PROJECT PREVIEW --> | ||

| 43. | PROJECT PREVIEW --> | ||

| 44. | PROJECT PREVIEW --> | ||

| 45. | PROJECT PREVIEW --> | ||

| 46. | PROJECT PREVIEW --> | ||

| 47. | PROJECT PREVIEW --> | ||

| 48. | PROJECT PREVIEW --> | ||

| 49. | PROJECT PREVIEW --> | ||

| 50. | PROJECT PREVIEW --> | ||

| 51. | PROJECT PREVIEW --> | ||

| 52. | PROJECT PREVIEW --> | ||

| 53. | PROJECT PREVIEW --> | ||

| 54. | PROJECT PREVIEW --> | ||

| 55. | PROJECT PREVIEW --> | ||

| 56. | PROJECT PREVIEW --> | ||

| 57. | PROJECT PREVIEW --> | ||

| 58. | PROJECT PREVIEW --> | ||

| 59. | PROJECT PREVIEW --> | ||

| 60. | PROJECT PREVIEW --> | ||

| 61. | PROJECT PREVIEW --> | ||

| 62. | PROJECT PREVIEW --> | ||

| 63. | PROJECT PREVIEW --> | ||

| 64. | PROJECT PREVIEW --> | ||

| 65. | PROJECT PREVIEW --> | ||

| 66. | PROJECT PREVIEW --> | ||

| 67. | PROJECT PREVIEW --> | ||

| 68. | PROJECT PREVIEW --> | ||

| 69. | PROJECT PREVIEW --> | ||

| 70. | PROJECT PREVIEW --> | ||

| 71. | PROJECT PREVIEW --> | ||

| 72. | PROJECT PREVIEW --> | ||

| 73. | PROJECT PREVIEW --> |

Can't find what you are looking for? Hire An Eduproject Writer To Work On Your Topic or Call 0704-692-9508 . Proceed to Hire a Writer »

We Offer Latest Final Year Project Topics, Research Ideas and Materials

Nigerian Tax Research Network (NTRN)

The NTRN is dedicated to enhancing the generation and exchange of tax knowledge in Nigeria. It is concerned with all topics related to taxation, ranging from tax policy to tax administration, and from academic papers to practical case studies. Stakeholders include tax practitioners and researchers from Nigerian and international institutions, as well as donors and civil society organisation working on tax issues in Nigeria.

Discover the NTRN Library here: www.eldis.org/ntrn

News and events

Stakeholder meeting on taxing the informal sector held in Abuja

Nigeria is facing a looming fiscal crisis, with its debt servicing equal to the revenue it…

ICTD Research on Tax and Development Course 2022-2023 (Applications now open!)

We are accepting applications for the 2022 ‘Research on Tax and Development’ course until midnight (BST) on July 17th 2022….

Seminar: Digitalisation of Tax Administration in Nigeria

Join us on the 20th of June for this seminar on Digitalisation of Tax Administration in Nigeria. Hosted by NTRN, in partnership with the ACTG….

Connect with NTRN

Check us out on x, join our mailing list, send us an email.

Increasing collection of income taxes via property ownership: The Borno State experience

Borno State, in north-eastern Nigeria, has faced intractable security challenges in the last decade that has led…

Informal taxation in Nigeria: Significance, benefits and challenges

Across Nigeria, a journey through rural communities and interaction with community members will expose you to…

Urgent fossil fuel subsidy reforms needed to tackle climate crisis

As the G20 Environment Ministers meet today, one of the key issues they need to consider…

Digitising taxation in Nigeria: Challenges and recommendations

In 2016, Nigeria’s Presidential Enabling Business Environment Council recognised that Nigeria should not be left behind…

Insecurity underpins property rights in Lagos – no matter what class you are

Recurrent episodes of marginal communities being evicted from the waterfronts of Lagos have made global media headlines over…

Why Nigeria needs a huge tobacco tax hike to curb smoking

Cigarette sales in most African countries are going up all the time. But smoking rates are much lower than…

Publications

Assessing the equity and redistributive effects of taxation reforms in nigeria, taxation of digital financial services in nigeria, do tax policies discriminate against female traders a gender framework to study informal marketplaces in nigeria, the role of social influence in enforcing tax compliance: experimental evidence from nigeria, more on the positive fiscal and health effects of increasing tobacco taxes in nigeria, research projects, disentangling the effects of ethnicity and social intermediaries on informal sector tax in lagos, nigeria, estimating the impact of tax or price measures on tobacco smoking onset and cessation, the collateral effects of evictions on property tax morale: class, preferences and signals from the state, the link between tax revenue allocation and tax morale in nigeria, the role of information about peer behaviour on tax compliance in nigeria: an experimental study, formalization, tax appeals, and social intermediaries in lagos, nigeria.

All Research > Tax Reform and Political Economy Outcomes in Nigeria

Tax Reform and Political Economy Outcomes in Nigeria

December 2019 Annual Meeting of the Nigerian Tax Research Network | International Centre for Tax and Development, Stephanie Lenz

Study Context

What motivates citizens’ involvement in collective actions that promote social and political change and foster good governance? This is a key question in evaluating predictors of political participation that engenders good governance in developing countries. Despite the high level of citizens’ political participation observed during elections , civic commitment to good governance in many of Africa’s emerging democracies is weak. For instance, the average demand for democracy in Africa is about 95% and the average voter turnout is about 67.9% . Regardless, participation in other important determinants of government responsiveness is only about 10% participation in civil action when dissatisfied with government performance (Afrobarometer R7 2016/2018).

We will investigate if differences in historical (colonial) taxation systems help explain levels of local collective action (civic capital) and if this translates into differences in contemporary economic outcomes in Nigeria. Specifically, our project will address the following questions:

- Does the colonial investment in taxation capacity deepen contemporary institutionalized governance?

- What are the enduring plausible mechanisms supporting local cooperation, collective action, and citizens’ civic engagement in demand for good governance?

- What are the economic effects of the colonial investment in tax capacity in terms of living standards, education, and quality of health outcomes?

Study Design

We will use a spatial regression discontinuity design (RDD). The RDD analysis will minimize the concern about pre‐colonial differences and possible statistical cofounders of our household data set in areas near the borders between the pre-1914 Northern and Southern Protectorates. We will explore the plausible underlying mechanisms and show whether these persist and lead to differences in long-term socioeconomic outcomes at the household level.

Results and Policy Lessons

Results forthcoming.

Researchers

- Jubril Animashaun

- Working Group in African Political Economy 6,000

2023 — 2023

Institutions & Governance

Learn more about our work in this sector

Our Resources

Global networks.

Learn more about our work from this theme

WGAPE 2022 Small Research Grants Request for Proposals

Working Group in African Political Economy (WGAPE) 2022 Annual Meeting

Get the resources, where local kings rule: long-term impacts of precolonial institutions and geography on access to public infrastructure services in nigeria.

- Engage with us

Copyright 2024. All Rights Reserved

Design & Dev by Wonderland Collective

- HOME iProject home

- PROJECTS projects catalog

- DEPARTMENTS new browse departments

- HIRE A WRITER request a project topic

- PAYMENTS payment details

- DOWNLOAD download project

- MAKE MONEY own a website

- CAMPUS REP become campus rep

- BLOG iproject blog

- CONTACT get in touch

What's your project topic?

Taxation project topics & research materials | final year research project topics with free chapter one, 1. the difficulties and prospects of tax administration in nigeria, » abstract reports have shown that despite the numerous efforts of government and its relevant agencies in the administration of tax in nigeria, there are still problems in the system such as under assessment of tax payers, tax evasion corruption among tax officials etc. as a result, this study was conducted, analyzing the areas the system has thrived in improving the standard ... continue reading ».

Item Type: Project Material | 65 pages | 1 engagements |

2. THE ROLES OF MULTINATIONAL COMPANIES IN TAX EVASION AND TAX AVOIDANCE IN NIGERIA

» chapter one introduction background to the study taxation is considered a veritable source of revenue for financing developmental as well as people oriented programs in virtually all countries, irrespective of whether they are classified as developed or developing economies. history has however shown that individuals often exhibit one form of tax reduction behavior or the other, with series of arg... continue reading ».

Item Type: Project Material | 65 pages | 10,770 engagements |

3. AN EVALUATION OF ROLE OF VALUE ADDED TAX AS SOURCE OF INCOME IN NIGERIA

» abstract this study was intended to evaluation of role of value added tax as a source of income in nigeria. this study was guided by the following objectives; to evaluate the role of value added tax as a source of income in nigeria.to examine the level of proper utilization of vat income generated by nigeria government. to examine the effect of income generated from value added tax on economic dev... continue reading ».

Item Type: Project Material | 65 pages | 9,339 engagements |

4. TAX REFORMS AND REVENUE GENERATION IN NIGERIA

» abstract the research provides a conceptual and analytical appraisal of tax reforms and revenue generation. the study seek to determine the effectiveness of tax reform policy toward achieving high revenue to government and public utility.it analyses the concept of taxation,types and significance. chapter one introduction the tax system in nigeria is made up of the tax policy, the tax laws and... continue reading ».

Item Type: Project Material | 65 pages | 11,926 engagements |

5. THE IMPACT OF COMPANY INCOME TAX REVENUE ON DEVELOPING ECONOMIES

» abstract taxation and its product, tax have been very important vehicles for economic policies of many countries of the world. for a very long time, tax has been a major source of revenue for various levels of governments. for instance, in nigeria, the laws of the land stipulate the categories of taxes that are collectable by each of the three tiers of government. this is with a view to enhancing ... continue reading ».

Item Type: Project Material | 65 pages | 10,792 engagements |

6. PROCEDURE, PROBLEM AND PROSPECTS OF PERSONAL INCOME TAX ADMINISTRATION IN NIGERI...

» chapter one 1.0 introduction there has been in existence various tax policies before enactment of the direct tax ordinance by fredrick lugard in 1946. however, the deficiency of the ordinance was dealt within 1950 through the introduction of basis principles of taxing income of individual other than limited liability company. the original purpose of taxation was to raise money to finan... continue reading ».

Item Type: Project Material | 65 pages | 7,957 engagements |

7. ASSESSMENT OF CAPITAL GAIN TAX ADMINISTRATION IN NIGERIA

» chapter one introduction background to the study taxation is a compulsory levy imposed by the government on the incomes of taxpayers in a geographical territory in order to defray the expenses of governance. this implies that anybody that generates income must compulsorily pay taxes. there are different types of taxation. these include the personal income tax, company’s income tax, and petrole... continue reading ».

Item Type: Project Material | 65 pages | 7,916 engagements |

8. RENT TAX COMPLIANCE

» chapter one introduction background of the study the ghana revenue authority (gra) is stepping up the collection of tax on rent income from owners of residential and commercial properties following the re launch of the tax in accra.though it has been in the statute books since 1973, compliance with the tax, which is charged at 8% of gross rent income, has not been encouraging and the gra said i... continue reading ».

Item Type: Project Material | 65 pages | 7,128 engagements |

9. AN APPROVAL OF PAY-AS YOU EARN SYSTEM OF TAXATION IN NIGERIA

» chapter one introduction the global economic recession, which started in 1980’s as a result of decline in the economic growth of industries nation, high rate of inflation, dramatics rise in price of crude oil, increase cost of important a massive building up of liquidity in the international capital market and unusual fluctuation in commodity prices was not fully felt in nigeria until 1982, w... continue reading ».

Item Type: Project Material | 65 pages | 406 engagements |

10. AN EVALUATION OF TAX PAYERS PERCEPTION ON THE VALUE ADDED TAX IN NIGERIA

» chapter one introduction taxation has long been practice in nigeria. initially, only men were expected to pay taxes but now all people working and anybody found in the capacity of paying tax are obligated to pay tax. tax in a mandatory levy on income charged for the purpose of carrying out government activities losses incurred by government in recent times ... continue reading ».

Item Type: Project Material | 65 pages | 7,559 engagements |

11. TAXATION AND LOCAL GOVERNMENT DEVELOPMENT IN NIGERIA

» chapter one literature review 2.0 development of local government in nigeria the evolution of local government in nigeria has under gone a lot of changes. these are all geared towards making the local government a system that could serve the purposes for which they are created, before the emergence of the british colonial/ administration; various communities in nigeria were governed throug... continue reading ».

Item Type: Project Material | 65 pages | 9,521 engagements |

12. TENANCY LAWS, MULTIPLE TAXATION AND RESIDENTIAL HOUSE RENTS

» chapter one introduction 1.1 background to the study lagos state can be described as the nigeria’s commercial capital, is the country’s most active and most expensive rental market where tenants at its highbrow areas pay expensively for residential apartment while similar apartments in the low mid income areas go for amount. apart from high demand and low supply, there are other factors re... continue reading ».

Item Type: Project Material | 65 pages | 8,304 engagements |

13. IMPACT OF NIGERIAN TAX POLICIES ON THE ECONOMY AND SMALL BUSINESSES IN NIGERIA

» abstract small and medium enterprises play a very important role in development of the nigerian economy. making up about 97% of the entire economy, they serve as a source of employment generation, innovation, competition, economic dynamism which ultimately lead to poverty alleviation and national growth. tax policy is one of the factors that constitute the small businesses’ economic environment.... continue reading ».

Item Type: Project Material | 65 pages | 10,949 engagements |

14. AN APPRAISAL OF PAY-AS YOU EARN SYSTEM OF TAXATION IN NIGERIA

» abstract the purpose of this research work is to describe the practical approach to an appraisal of pay as you earn system of taxation with referee to nssuka local government area. to guide this study, two hypotheses were formulated. a review of literature was down to ensure solid conclusion for the study. a structural questionnaire was developed and administered by the analysis adopted in this re... continue reading ».

Item Type: Project Material | 65 pages | 6,776 engagements |

15. THE EFFECT OF TAXATION POLICIES ON THE PROPERTY MARKET TRANSACTION

» chapter one introduction background of the study housing literallymeans building or shelters in which people live work dwell etc and to nation as a critical component in social and economic fabric [kabir and bustani, 2009]. it represents one of the most basic human needs. as a unit of environment, it has a profound influence on the health, efficiency, social behavior, satisfaction and general welf... continue reading ».

Item Type: Project Material | 65 pages | 8,348 engagements |

16. THE IMPACT OF TAX EVASION AND TAX AVOIDANCE IN NIGERIA ECONOMY

» chapter one history of development in nigeria their so many form of taxation dating back of the days of our great ground father whose by communities dated themselves through communal labour to prosecute community projects. taxation is process on machinery by which group or communities made contribution from their income in some agree amount and method for the purpose providing a... continue reading ».

Item Type: Project Material | 65 pages | 9,566 engagements |

17. IMPACT OF TAXATION ON PERFORMANCE IN SMALL SCALE ENTERPRISE

» abstract the study was carried out to find out the impact of taxes on performance of small scale business enterprises in nigeria (ssbs), taking a case study of river state. the study aimed at assessing the performance of business enterprises in rivers state, finding out if tax payers are aware of all their tax obligations, policies and problems affecting them as well as their businesses. the study... continue reading ».

Item Type: Project Material | 65 pages | 6,751 engagements |

18. EFFECTS OF TAX INCENTIVES IN THE DEVELOPMENT OF MANUFACTURING INDUSTRIES IN NIGE...

» abstract after the economic depression of the 1930’s the concept of economy. many nations began to implement policy measures aimed at both raising revenue for the government and encouraging investment via investment tax credit. in nigeria, the concept of taxation, especially as it relates to tax incentive had been an important topic for discussion both in the government circle and in the pri... continue reading ».

Item Type: Project Material | 65 pages | 9,460 engagements |

19. TAX REFORM AND ADMINISTRATION IN NIGERIA

» chapter one introduction background to the study the recent global crisis in the world has brought to the fore the need to note that this overdependence on oil creates unnecessary shocks and thus, the need for diversification of the nation’s resource base and long term growth path. the oil is an exhaustible and dwindling resource, while taxation is the only non exhaustible veritable source of re... continue reading ».

Item Type: Project Material | 65 pages | 9,907 engagements |

20. IMPACT OF INFLATION ON THE TAXATION OF CAPITAL GAIN (2000-2015)

» chapter one introduction background to the study taxation is a compulsory levy imposed by the government on the incomes of taxpayers in a geographical territory in order to defray the expenses of governance. this implies that anybody that generates income must compulsorily pay taxes. there are different types of taxation. these include the personal income tax, companies income tax, petroleum profi... continue reading ».

Item Type: Project Material | 65 pages | 6,220 engagements |

21. IMPACT OF TAXATION ON SMALL AND MEDIUM SCALE BUSINESS IN NIGERIA

Item Type: Project Material | 65 pages | 16,087 engagements |

22. INVESTIGATION INTO THE CAUSES OF TAX EVASION

» chapter one introduction background of the study the concept of taxation has been a concern of global significance as it affects every economy irrespective of national differences (oboh etal., 2012). according to omotoso (2001), in his definition of the modern taxes, defined tax as a compulsory charge imposed by a public authority on the income of individuals and companies as stipulated by the gov... continue reading ».

Item Type: Project Material | 65 pages | 7,952 engagements |

23. A STUDY INTO THE CHALLENGES OF INCOME TAXATION

» abstract revenue from tax which is a big source of revenue to the government has been a major concern to many developing countries such as ghana in recent times. this due to the fact that taxation faces a lot of challenges in developing countries, and once these challenges are not properly dealt with, it becomes a big disadvantage to the government and citizens of that country, as enough revenue w... continue reading ».

Item Type: Project Material | 65 pages | 7,273 engagements |

24. THE IMPACT OF TAX REFORMS ON INVESTMENT DECISIONS

» abstract governments need to put in more effort in attracting investors into their country through tax reforms if it wants to achieve economic growth and enhance standards of living. the research considered certain variables that affect investor’s decision as to where to invest. these included the location, type of activity and time variables, which were very important due to the fact that, ... continue reading ».

Item Type: Project Material | 65 pages | 8,746 engagements |

25. INVESTMENT AND TAXATION IN PERIOD OF ECONOMIC CRISIS

» chapter one introduction 1.1 background to the study investment inflow, particularly foreign investment is perceived to have a positive impact on economic growth of a host country through various direct and indirect channels. domestic investment is crucial to the attainment of sustained growth and development (ekpo, 1997).to invest is to allocate money (or sometimes another resource, ... continue reading ».

Item Type: Project Material | 65 pages | 6,733 engagements |

Can't find what you are looking for? Hire An IPROJECT Writer To Work On Your Topic. Go to Hire A Writer Page

| Nigerian Educational Consult - samphina.com.ng

- Taxation Topics

Project / Seminar Research Topics and Materials on Taxation

Project and Seminar Topics with Materials on Taxation

Welcome to Samphina Academy, this is the Official Project / Seminar Material Library for all students of the department of Taxation. The topics listed here can be used as guide to carryout academic research work for either Undergraduate / Postgraduate Project, Seminar or Thesis. We pride ourselves in rendering quality services.

The aim of providing these materials is to reduce the stress of moving from one school library to another all in the name of searching for research materials on Taxation.

HOW IT WORKS

- Save our contact on your phone – 08143831497 (Samphina Academy)

- Select about 3 topics from this page and submit to your supervisor for approval

- Send the approved topic to us on WhatsApp to get the complete material

That’s all, and you are good to go. T & C Apply

Do You Have An Approved Topic Already? Search Here

Search for:

N/B: Click on any of the listed topics below to preview its content

List of Taxation Project / Seminar Research Topics for Nigerian Students

Click Here to Check Research Topics for Other Departments

- Assessment Of Capital Gain Tax Administration In Nigeria

- Compilation On Bibliographic Abstract And Index Bibliographic Information On Taxation In Nigeria

- The Role Of Capital Allowance Avoidance And Personal Taxation In The Development Of Small Scale Business

- Effects Of Multiple Taxations On Business Survival In Nigeria

- Taxation In Rural Areas: Its Operational Effectiveness And Problems (A Case Study Of Baruten Local Government)

- Taxation As An Instrument Of Fiscal Policy In Nigeria

- The Impact Of Taxation As An Aid To Economic Development

- Taxation As A Major Source Of Government Funds And The Impact On Management Decision Making (A Case Study Of Enugu State Board Of Internal Revenue)

- Effect Of Taxation On The Economic Development Of Edo State (A Case Study Ikpoba Okha Local Government Area Of Edo State)

- The Effect Of Taxation On Fiscal Policy Development In Nigeria

- Taxation And Its Effect On The Nigerian Economy (A Case Study Of Edo State Tax System)

- Taxation In Nigeria And Offa Local Government Area

- Effects Of Tax Incentives In The Development Of Manufacturing Industries In Nigeria

- The Relationship Between Corporate Taxation And Economic Growth In Nigeria From 1990 To 2017

- Transfer Pricing And Business Profit Taxation Of Multinational Companies In Nigeria

- Taxation As The Significant Tool For Economic Development (The Study Of Internal Revenue Service, Uyo)

- The Implication Of Taxation On Investment Decision Making

- Tenancy Laws, Multiple Taxation And Residential House Rents In Lagos

- Taxation And Economic Growth In Nigeria: An Empirical Analysis

- The Macroeconomic Impact Of Taxation On The Economic Growth Of Nigeria (Empirical Study From 1980-2016)

- The Effect Of Indirect Taxation On Consumption In Nigeria

- Evaluation Of Taxation As A Source Of Government Revenue; A Case Study Of The State Board Of Internal Revenue

- The Impact Of Taxation On Profit Levels Of Small Scale Business Enterprises

- Impact Of Nigerian Tax Policies On The Economy And Small Businesses In Nigeria

- Effects Of Taxation On Economic Growth In Nigeria; An Empirical Analysis (A Case Study Of Federal Inland Revenue Lafia, Nasarawa State)

- Effect Of Taxation Procedures Revenue Generated By State Government In Nigeria

- Impact Of Personal Income Tax On Revenue Generation

- Bibliographic Information On Taxation In Nigeria

- The Effects And Implications Of Taxation On Entrepreneurship And Innovation

- A Study Into The Challenges Of Personal Income Taxation In Ghana

- Problems Of Tax Collection In Rivers State: A Case Study Of Degema Local Government Area

- Impact Of Inflation On The Taxation Of Capital Gain (2000-2015)

- Tax Assessment And Collection Practices Of Category “A” Taxpayers In Lagos State

- Procedure, Problem And Prospects Of Personal Income Tax Administration In Nigeria (A Case Study Of Oyo State Board Of Internal Revenue)

- An Appraisal Of The Administration Of Personal Income Taxation

- Tax Reform And Administration In Nigeria (A Case Study Of Ogun State Board Of Internal Revenue)

- An Examination Of Problems And Prospects Of Real Property Taxation In Nigeria

- The Effectiveness Of Taxation On Government Provision For Infrastructure

- The Effect Of Taxation Policies On The Property Market Transaction

- The Impact Of Taxation On Government Capital Expenditure And Economic Growth In Nigeria

- Impact Of Multiple Taxation On Business Survival In Delta State, A Survey Of Business Enterprises In Ika South

- The Roles Of Multinational Companies In Tax Evasion And Tax Avoidance In Nigeria

- The Role Of Taxation In An Economic Development And Planning

- Tax Justice And Tax Revenue Generation In Nigeria

- The Impact Of Taxation On Foreign Direct Investment (FDI) In Nigeria

- Taxation, Major Source Of Revenue In Nigeria (A Case Study Of Ekiti State Government)

- Inequality And Taxation In Nigeria (1987-2017)

- Impact Of Taxation On Small And Medium Scale Business In Nigeria

- The Effect Of Taxation On Business Decision (A Case Study Of Guinness Breweries, Onitsha)

- An Empirical Investigation Of The Influence Of Taxation On The Nigerian Economy (1980 – 2006)

- The Effect Of Taxation In Business Development And Decision Making

- An Appraisal Of Pay-As You Earn System Of Taxation In Nigeria

- Effects Of Multiple Taxation On The Performance Of Small And Medium Scale Business Enterprise

- The Effect Of Multiple Taxation On The Growth And Profitability Of Small-Scale Enterprises In Nigeria

- Prospect And Challenges Of Taxation System In 21st Century (A Case Study Of Ilorin West Local Government Area Of Kwara State)

- Impact Of Multiple Taxations On Business Survival In Nigeria

- The Impact Of Tax Reforms On Investment Decisions

- The Administration Of Colonial Taxation In Zaria Province

- The Impact Of Taxation Law On Investment Activity In Nigeria (A Case Study Of Global Soap And Detergent Industry Ltd Ilorin)

- The Effective Taxation In Local Government (A Case Study Of Ugwuogo Nike Community)

- Impact Of Multiple Taxation On Small And Medium Scale Enterprise

- Taxation As A Tool Of Fiscal Policy In Nigeria

- An Evaluation Of Tax Payers Perception On The Value Added Tax In Nigeria

- The Difficulties And Prospects Of Tax Administration In Nigeria

- Evaluation Of The Impact Of Taxation On Transportation Agenda

- Effects Of Multiple Taxation On Business Survival In Nigeria

- The Impact Of Taxation As An Aid To Economic Development In Enugu State

- The Impact Of Taxation As An Aid To Economic Development In The Rural Areas Of Enugu State (A Case Study Of Oji River Local Government Area, Enugu State, Nigeria)

- Effect Of Multiple Taxation On The Survival Of Small Scale Enterprises

- Taxation And Revenue Generation In Nigeria Local Government Administration (A Case Study Of Asa Local Government Area Of Kwara State)

- Impact Of Taxation On Performance In Small Scale Enterprise

- The Effect Of Taxation On Manufacturing Firms (A Case Study Of Ikeji Plastic Company Limited Onitsha)

- Taxation As A Major Source To Government Funding

- Effectiveness Of Taxation In Nigeria In Comparison With Other Nations Of The World

- Impact Of Taxation On The Operation Of Small And Medium Scale Business (A Case Study Of SMEs In Abeokuta Metropolis)

- Investment And Taxation In Period Of Economic Crisis

- The Impact Of Taxation As A Tool Of Fiscal Policy In Nigeria

- A Study Into The Challenges Of Income Taxation

- Taxation As An Alternative To Dwindling Oil Revenue In Nigeria

- Taxation And Local Government Development In Nigeria

- A Legal Examination Of The Role Of Taxation In Revenue Generation And Economic Development In Nigeria

- Appraisal Of Nigeria Taxation: Its Aims, Objectives And Contribution To The Economy (A Case Study Of Federal Board Of Inland Revenue Ilorin)

- The Impact Of Taxation On Nigeria Economy Growth

- An Evaluation Of Role Of Value Added Tax As Source Of Income In Nigeria

- Rent Tax Compliance

- The Impact Of Multiple Taxation On Business Survival In Nigeria

- Bibliographic Information On Taxation In Nigeria (2008-2014)

- The Analysis Of Effectiveness Of Value Added Tax (VAT) In Federal Government Revenue Generation Taxation As A Major Source Of Revenue In Nigeria

- The Effect Of E-Taxation On Government Revenue In Nigeria

- The Impact Of Taxation On Economic Development In Nigeria (2003 – 2012)

- Taxation As An Instrument Of Economic Development In Nigeria

- Taxation A System Of Generating Revenue By Government

- The Impact Of Tax Evasion And Tax Avoidance In Nigeria Economic Development

Samphina Academy

Samphina Academy is an Online Educational Resource Center that is aimed at providing students with quality information and materials to aid them in succeeding in their academic pursuit.

- Next story Project / Seminar Research Topics and Materials on Peace Studies and Conflict Resolution

- Previous story Project / Seminar Research Topics and Materials on Public Administration (PA)

Nursing (Science) Seminar Topics PDF

Computer Science Seminar Topics PDF

Public Health Seminar Topics PDF

Education Seminar Topics PDF

Biology Seminar Topics PDF

Geology Seminar Topics PDF

Medical Laboratory Science Seminar Topics PDF

Business Education Seminar Topics PDF

Midwifery Seminar Topics PDF

Business Seminar Topics PDF

Botany Seminar Topics PDF

Mass Communication Seminar Topics PDF

Biochemistry Seminar Topics PDF

Anatomy Seminar Topics PDF

Accounting Seminar Topics PDF

Science Laboratory Technology Seminar Topics PDF

Chemistry Seminar Topics PDF

Zoology Seminar Topics PDF

Community Health Seminar Topics PDF

Food Science and Technology Seminar Topics PDF

- Research Library

- My Knight Frank

- South Africa

- Chinese Mainland

- Hong Kong SAR

- New Zealand

- Philippines

- South Korea

- Czech Republic

- Germany - Berlin

- Germany - Frankfurt

- Germany - Munich

- Netherlands

- Switzerland

- Saudi Arabia

Subdued residential sector

In the luxury residential leasing market, a nuanced challenge has emerged, driven by the escalating impact of inflation on construction costs. To navigate this, build-to-rent developers are adapting their pricing strategies with a preference towards dollar-denominated rents. This shift is particularly pronounced among landlords servicing dollar-denominated loans and those procuring construction materials internationally. Ultimately, these costs are being transferred to tenants in the form of escalating rents. Currently, the average monthly rent for a 4-bedroom home in Lagos is c.US$ 5,000, an increase of 4.2 % since 2020.

Inflation impacting retail footfall

The continuous rise in inflation, which reached a 28-year high of 33.2% in March, has unsurprisingly lowered consumer spending while retail footfall has also declined.

Over the past 12 months, prominent retailers, such as the South African supermarket chains, Mr Price and Shoprite, have exited the market due to the increasingly challenging trading conditions.

Elsewhere, retail developers have turned their attention to neighbourhood mall developments, and/or the expansion of neighbourhood malls, where footfall remains resilient.

Tenant-Led Office Market

Mirroring other African nations, most businesses have made a full return to the office. Notably, the prime offices occupancy levels in Lagos and Abuja stand at over 80%.

Despite this return in demand, office rental growth across Nigeria is being tempered by an oversupply of office space, especially in Lagos. For instance, the completion of Centrepoint (Famfa Towers) and Trinity Towers, located in Ikoyi and Victoria Island, respectively, have together added 30,000 sqm of new office space to the Lagos office market. Consequently, tenants remain firmly in the driving seat when it comes to lease negotiations. Monthly prime office rents have held steady for the third quarter in a row at c.US$ 50 psm.

Increased demand for top-tier warehouses

The burgeoning demand for top-tier warehouses is discernible, notably driven by the escalating storage and distribution needs in key industrial nodes and specialised economic zones, such as the Lagos Free Trade Zone (LFTZ), which has seen increased infrastructure spending from both the public and private sectors.

The subdued supply of grade A warehousing is fuelling a premium for best-in-class space, with monthly lease rates reaching approximately US$ 6 psm, representing a 10% rise on 2020.

- Luxury Investment

- The House View

- Agriculture

- Development

- Residential Lettings

- Residential Sales

- UK Country Homes

- Living Sectors

- Data Centres

Publications

- The Wealth Report

- Active Capital

- London Report

- Rural Report

- Asia Pacific Horizon

- UK Residential Investment Report

- European Logistics

- European Office

- Africa Report

- M25 & South East Office Market Report

- Waterfront View

- ESG Property Investor Survey

- Asia-Pacific

- Australasia

- Middle East

- United States

- All Publications

Nigerian Budget Allocates N100M To Atomic Energy Commission For Sewing, Grinding Machines In Anambra, N100M To Chemical Research Agency For Tricycles In Borno

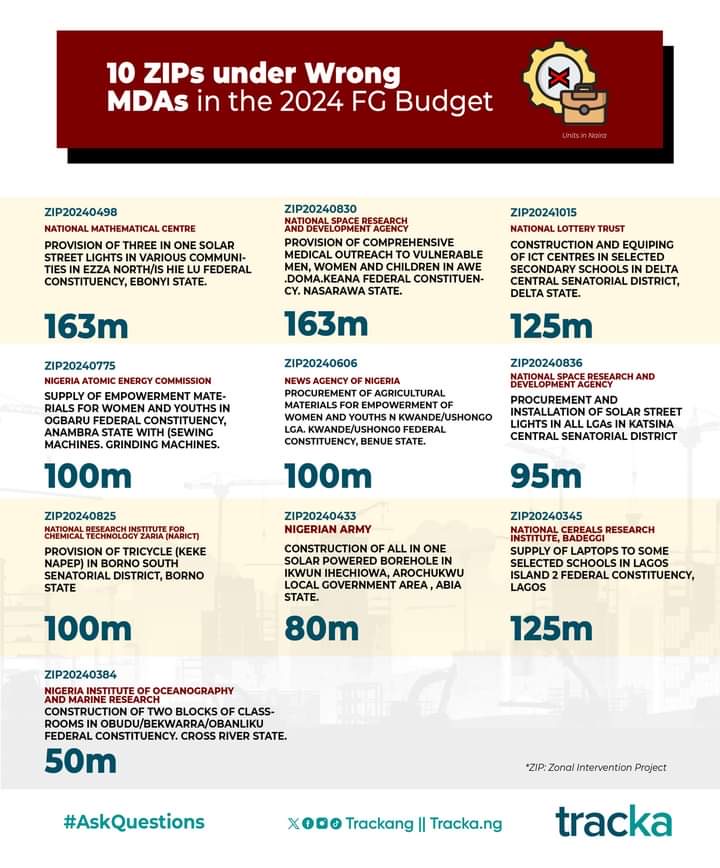

According to Tracka, an accountability organisation monitoring public projects across the country there are instances where funds designated for specific constituencies were incorrectly assigned to unrelated government agencies, raising concerns about fiscal accountability and transparency.

The 2024 Federal Government budget has come under scrutiny following revelations of significant misallocation of funds across several Zonal Constituency Intervention Projects (ZIPs).

Among the discrepancies identified, the National Mathematical Centre received N163 million for the provision of three-in-one solar street lights in various communities within Ezza North/Isihe Local Government Area, Federal Constituency of Ebonyi State.

This allocation is originally intended for local development projects aimed at enhancing infrastructure within the constituency.

Similarly, the Nigeria Atomic Energy Commission was allocated N100 million for empowerment materials, including sewing and grinding machines, purportedly for Ogbaru Federal Constituency, Anambra State.

Meanwhile, the National Research Institute for Chemical Technology (NARICT) in Zaria received N100 million for the provision of tricycles (Keke Napep) in Borno South Senatorial District, Borno State, which deviates from its intended scope.

Further discrepancies include the Nigeria Institute of Oceanography and Marine Research, which was allocated N50 million for the construction of classrooms in Obudu/Bekwarra/Obanliku Federal Constituency, Cross River State.

These misallocations extend to projects such as the provision of comprehensive medical outreach by the National Space Research and Development Agency (NASRDA) in Awe, Doma, and Keana Federal Constituency, Nasarawa State.

Moreover, the News Agency of Nigeria (NAN) received N100 million for agricultural empowerment in Kwande/Ushongo LGA, Benue State, originally earmarked for women and youth empowerment initiatives.

The Nigerian Army was also allocated N80 million for a solar-powered borehole in Arochukwu Local Government Area, Abia State, which was meant for infrastructure projects within the state.

Also, the National Lottery Trust, allocated N125 million for ICT centres in Delta Central Senatorial District, Delta State, and the National Space Research and Development Agency Development, which received N95 million naira for solar street lights in Katsina Central Senatorial District, also faced scrutiny for improper allocations.

This incident underscores the importance of transparency and accountability in public finance management to maintain public trust and foster effective implementation of developmental projects nationwide.

View the discussion thread.

Articles on Finance Bill 2024

Displaying all articles.

Kenya protests show citizens don’t trust government with their tax money: can Ruto make a meaningful new deal?

Eric Magale , University of Pretoria and Mario Schmidt , Max Planck Institute for Social Anthropology

Kenya’s protests are different this time: 3 things that make it harder for government to crush them

Awino Okech , SOAS, University of London

Kenyan police use excessive force because they’re serving political elites, not the public – policy analyst

Kamau Wairuri , Edinburgh Napier University

Related Topics

- Informal sector

- Kenya police

- Kenya protests

- KenyaTaxProtests

- Police brutality

- William Ruto

Top contributors

Lecturer in criminology, Edinburgh Napier University

Professor of Feminist and Security Studies, SOAS, University of London

Associate Researcher, Max Planck Institute for Social Anthropology

Postdoctoral Research Fellow, University of Pretoria

- X (Twitter)

- Unfollow topic Follow topic

Iowa Property Tax Overview

Related topics:.

The property tax cycle in Iowa takes a total of eighteen months from start to finish. It begins with the assessor determining the assessed values and classification for individual parcels of property January 1st of the assessment year. The first half payment for property taxes related to this assessment is due in the fall of the next year and the second half payment is due in the spring of the year following the first half payment. As an example, the assessment for January 2023 would have the associated taxes due in the fall of 2024 and the spring of 2025.

In Iowa, the local assessor establishes the valuation and classification of the property, the county auditor determines levy rates based on budgets provided from local levying authorities and the tax base applicable to each authority. The county auditor then bills the taxes and they are collected by the county treasurer. The county treasurer then allocates the collected tax dollars to each authority. There are over 2,000 levying authorities in the state.

What is taxable for property tax purposes in Iowa?

The Iowa property tax is primarily a tax on real property, land, buildings, structures, and other improvements that are constructed on or in the land, attached to the land, or placed upon a foundation. Additionally, the Department of Revenue assesses some property.

- Residential

- Agricultural

- Utilities/railroad (state assessed)

Primary recipients of property taxes levied include:

- K-12 Schools

- Merged Area Schools

- Agricultural Extension Districts

Current details on property taxes paid and levied are available from the Iowa Department of Management .

How often is property assessed?

All real property is assessed every odd-numbered year. Centrally assessed properties, including railroads and public utilities, are assessed every year. Residential, commercial, industrial and state assessed properties are to be valued at actual value or market value. Agricultural property is assessed based on a statewide productivity value, which is a use value. A few additional exceptions to the market value requirement for real property assessment include Section 42 housing and newly platted property.

How are property taxes determined?

- The value of property is established. The assessor (or the Iowa Department of Revenue for centrally assessed property) determines the assessed value of each property. The assessed value is to be at actual or market value for most property.

- Assessed values for each property classification are reported to the county auditor.

- The Department examines total assessed values. Each year assessors are required to report aggregate assessed values by classification, by city by township to the Department. Each odd year, the Department reviews the aggregated valuations in conjunction with a review of all arm’s length transactions to determine the 100% aggregate value by classification. If aggregated values by classification as reported by assessors are not compliant with the established 100% valuation criteria established by law, the Department can and does order aggregated changes by class to be implemented by local auditors. This process is known as equalization. Additionally, the county auditor applies an “assessment limitation” to the assessed value of residential, agricultural, commercial, industrial, railroad, and utility properties to find the taxable value of those classes of property. Commercial, industrial and railroad property have statutory assessment limitations equal to the residential limitation for the first $150,000[RJ[2] of assessed value for a property unit and 90% limitation for value greater than $150,000 for a property unit. Residential and agricultural assessment limitations are calculated each year to restrict the growth in aggregate taxable value across the state to 3%. The 3% limitation in growth is for the total taxable value within the state for that class of property. It is not a limitation to an individual growth in assessed value.

- Budgets and tax rates are established. Iowa statutes determine which local authorities have the power to levy tax dollars. These authorities determine their own budgetary needs. The budgets are used to provide the required and desired services received by local taxpayers. Approved budgets are submitted to the county auditor, who then determines levy rates associated to each authority based on the aggregate taxable value for each authority. The sum of the levy rates for each authority is considered the consolidated levy rate for each tax district, which is the unique combination of authorities. The consolidated levy rates are expressed as mills or dollars per thousand.

- Credits are subtracted Credits are subtracted from the final tax bill. An example of a credit that reduces the final tax bill is the Homestead Tax Credit.

Iowa Property Tax Assessment Cycle

- January 1 - Assessment date

- April 1 - Assessors complete assessments and notify taxpayers

- April 2 - 25 - Taxpayers may request informal review of assessment by assessor

- On or before April 25 - Following informal review, Assessor may enter into a signed written agreement with the property owner or aggrieved taxpayer authorizing the assessor to correct or modify the assessment according to the agreement of the parties

- April 2 - 30 - Taxpayers may protest assessments to local boards of review.

- May 1 - May 31 - Local boards of review consider protests. This time may be extended to July 15 by the Iowa Department of Revenue Director.

- June 15 - Local boards of review submit reports to the Director.

- July 1 - Assessors submit abstracts of the assessments to the Director.

- August 15 - The Department issues tentative equalization notices to assessors.

- September - The Department holds equalization hearings, which are held for public input.

- October 1 - The Department issues final equalization orders to county auditors.

- October 2 - 12 - Assessing jurisdictions may apply for alternative methods of implementing equalization orders.

- By October 8 - The county auditor must publish notice of the final equalization order by this date, and must provide notice by mail to the taxpayers if the equalization order results in an increase in valuation.

- October 9 - 31 - Taxpayers may protest the final equalization order to local boards of review.

- October 10 - November 15 - Local boards of review meet to hear equalization protests.

- November 1 - The Director certifies assessment limitation percentages to county auditors.

- November 15 - Local boards of review submit a report about the equalization protests to the Department.

- Dec. 1 - Feb. 28 - The taxing authorities adopt the budgets based on the valuations.

- March 1 - The county board of supervisors levies the taxes.

- July 1 - The county treasurer receives authorization to collect taxes.

- September 30 - First half of taxes are due.

- March 31 - Second half of taxes are due.

What causes property taxes to change?

These variables must interact to decrease or increase your property taxes:

- The budgets of the various taxing authorities

- The total taxable value of all the property with the geographic boundary of the taxing authority, which impacts the levy rates

- The taxable value of your individual property

- Taxable values of other properties with the city, county, school district in which your property is located

Why might you pay higher taxes than your neighbor?

The first component to consider when comparing tax burdens on different properties is the classification. There are different assessment limitations on the different classes of property which impacts the taxable value. Assessed value times the assessment imitation for the applicable class of property is what determines the beginning point in a property’s taxable value. The second component that impacts an individual taxpayer’s property tax bill is what levying authorities are a part of the taxing district that the property is geographically located in. Each city, county, school district and other levying authorities set their budgets annually and determine the amount of property tax they intend to levy within their geographic boundary. As an example, city budgets tend to be greater than township budgets, so a property located within a city generally pays more in property tax for the city component of the overall tax bill than if a property was located within a township. This is because cities provide significantly more services to their constituents than townships provide such as curb, gutter, water, sewer and other amenities. A third component of an individual’s property tax bill is the influence of the total taxable value within the levying authorities boundary’s that they are subject to. As other classes of property and the taxable valuations of other properties within the boundaries of the levying authority increase or decrease there is an impact to the properties located within the levying authority’s boundary’s causing a shift of the tax burden from one property to another property.

There are also credits and exemptions such as Homestead, Ag Land, Military or other things that potentially impact a final tax bill for an individual property.

I disagree with my assessed value

If a property owner feels their assessed value is not a reflection of actual or market value, they have the right to appeal their assessed value to the local board of review. Taxpayers may contact their local assessor to obtain forms to appeal their assessment. Additionally, forms are available on the Iowa Department of Revenue website. Property owners or aggrieved taxpayers may also contact their assessor and request an informal review of the assessment. Following this review the assessor may recommend the property owner file a protest with the local board or review, or may enter into a signed written agreement with the property owner authorizing the assessor to correct or modify the assessment according to the agreement of the parties.

If a property owner is dissatisfied with the decision of the local board of review they may appeal to the Property Assessment Appeal Board , or district court. If dissatisfied with a property assessment appeal board decision, the decision may be appealed to district court. In the alternative, property owners or aggrieved taxpayers may still file appeals directly with the district court and forego filing with the property assessment appeal board. Contact your assessor's office for more information.

About Assessors

Local assessors are employees of either the city or county in which they serve. They are hired by a conference board, which is comprised of the mayors of all incorporated cities in the county, one representative from the board of directors of each high school district of the county, and members of the board of supervisors. In cities having an assessor, the conference board consists of the members of the city council, the school board, and the county board of supervisors. Assessors are appointed by the conference board, and confirmed by the Department of Revenue to a six-year term. Each county in Iowa has a county assessor and several of the larger cities have a city assessor including Ames, Sioux City, Mason City, Davenport, Dubuque City, Iowa City, and Cedar Rapids. However, any city having a population of ten thousand or more according to the latest federal census may create, by ordinance, the office of city assessor.

Assessors determine classification and valuation of property as well as make recommendations for approval or denial for exemptions and some credits. The recommendations of the assessor are forwarded to the county board of supervisors for final approval for some credits.

Assessors do not determine overall budgets for the levying authorities outside of their own budget. They do not calculate taxable values or determine tax rates and they do not bill or collect taxes. The assessed value and classification of a property is a component of the overall tax burden specific to an individual property but assessors do not do any actual billing or collection of taxes.

The classification of property determined by the assessor is based upon the rules found within Iowa Administrative Code chapter 701--102. Administrative Rules can be found at the Iowa Legislature website at www.legis.iowa.gov .

Since Iowa law requires that property be assessed at a market value standard, assessors generally use arm’s length sales transactions to establish assessed values that are to be a reflection of actual or market value, excluding agriculturally classed property[BN[1]. Agricultural property is based on a use value, i.e. productivity. For properties with limited sales activity other factors may be applied such as a cost approach or an income approach to value. The productivity value is a five year average landlord crop share income model using production, yields, prices, government programs less expenses and capitalized at 7% to yield a county productivity value per acre. This productivity value per acre is applied to agricultural land within the county and city.

Assessors in Iowa are required to have a high school diploma or equivalent, preliminary education, such as Basic Principles and Procedures of Appraisal, or a course on Iowa Laws or Iowa Assessment and Taxation. Additionally, assessors must have two years of appraisal related experience and must pass an examination to be employed as an assessor. Individuals that do not have two years of appraisal experience may be provisionally appointed as an assessor until they complete provisional training through the Department. Continuing education is required during the six year term to continue to be employed as an assessor.

What is the role of the Iowa Department of Revenue?

The role of the Department is to have and exercise general supervision of the administration of the assessment and tax laws of the state, over boards of supervisors and all other officers or boards in performance of their official duties in matters relating to assessments and taxation. The Director of Revenue determines the uniformity of aggregate valuation as between the various assessing jurisdictions through the equalization process.

The equalization process occurs every odd year. The Department examines declaration of valuation documents from sales transactions and uses this information to determine the level assessment in an assessing jurisdiction. This level of assessment for the prior year is used to establish the 100% aggregate valuation for the current year. The abstract of assessment submitted by the assessor for the current odd year must be within 5% above or below the established 100% aggregate valuation. In the case where the aggregate valuation for the current year is not within 5%, the Department orders the county auditor to increase or decrease the aggregate valuation to be equivalent to the 100% valuation determined by the Department.

The Department also calculates assessment limitations annually. Assessment limitations are designed to restrict the growth in taxable valuation for residential and agricultural property values in the aggregate statewide. Assessed valuations times the assessment limitation is the starting point for taxable values which are used in the tax calculation process for individual properties. The aggregate taxable value is also used in the determination of levy rates for the levying authorities. Assessment limitations for commercial, industrial and railroad properties are calculated by a statutory limitation that is not different each year, except the first $150,000 of value for those properties, which receives the same assessment limitation as the residential property classification.

Additional Department responsibilities include technical support for local officials, including assessors, auditors, treasurers and recorders. Educational programs for assessors and boards of review are provided in collaboration with Iowa State University Extension and others. The Department also produces forms for taxpayers for credits and exemptions to be filed with local officials and administers examinations for individuals to be eligible to become an assessor or deputy assessor. The Department also distributes approximately two and a half billion dollars of state funding for various programs. Finally, the Department assesses utility and railroad properties in the state and assists with the administration of the Utility Replacement Tax and statewide property tax.

The Distributional Effects of U.S. Tax Credits for Heat Pumps, Solar Panels, and Electric Vehicles

Over the last two decades, U.S. households have received $47 billion in tax credits for buying heat pumps, solar panels, electric vehicles, and other “clean energy” technologies. Using information from tax returns, we show that these tax credits have gone predominantly to higher-income households. The bottom three income quintiles have received about 10% of all credits, while the top quintile has received about 60%. The most extreme is the tax credit for electric vehicles, for which the top quintile has received more than 80% of all credits. The concentration of tax credits among high-income filers is relatively constant over time, though we do find a slight broadening for the electric vehicle credit since 2018. The paper then turns to the related question of cost effectiveness, examining how clean energy technology adoption has changed over time and discussing some of the broader economic considerations for this type of tax credit.

We are grateful to seminar participants at UC Irvine and UC Berkeley for helpful comments. This paper is under preparation for the March 2025 National Tax Journal Forum “Tax and Environmental Policy”. We have not received any financial compensation for this project nor do we have any financial relationships that relate to this research. The analysis relies entirely on publicly-available data and all data and code will be posted on our websites upon completion of the project. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research.

MARC RIS BibTeΧ

Download Citation Data

Mentioned in the News

More from nber.

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

Americans are split over the state of the American dream

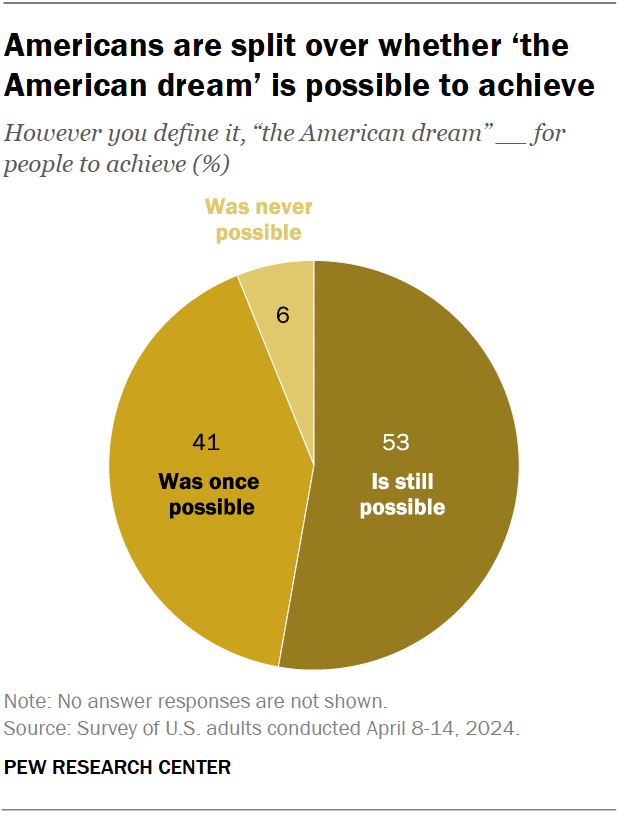

“The American dream ” is a century-old phrase used to describe the idea that anyone can achieve success in the United States through hard work and determination. Today, about half of Americans (53%) say that dream is still possible.

Pew Research Center asked Americans about their views of the American dream as part of a larger survey exploring their social and political attitudes.

We surveyed 8,709 U.S. adults from April 8 to 14, 2024. Everyone who took part in this survey is a member of the Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way nearly all U.S. adults have a chance of selection. The survey is weighted to be representative of the U.S. adult population by gender, race, ethnicity, partisan affiliation, education and other categories. Read more about the ATP’s methodology .

Here are the questions used for this analysis , along with responses, and its methodology .

Another 41% say the American dream was once possible for people to achieve – but is not anymore. And 6% say it was never possible, according to a recent Pew Research Center survey of 8,709 U.S. adults.

While this is the first time the Center has asked about the American dream in this way, other surveys have long found that sizable shares of Americans are skeptical about the future of the American dream .

Who believes the American dream is still possible?

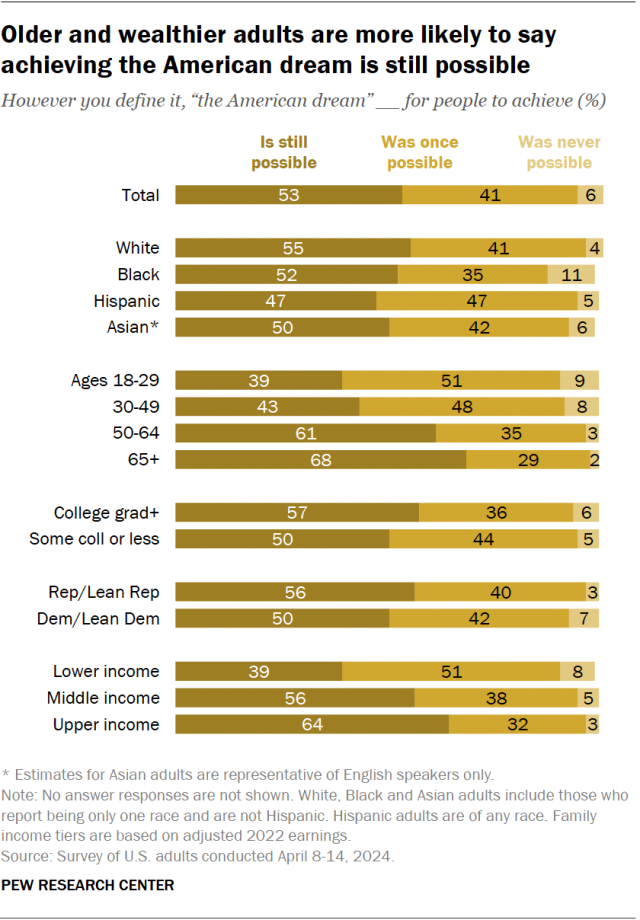

There are relatively modest differences in views of the American dream by race and ethnicity, partisanship, and education. But there are wider divides by age and income.

Americans ages 50 and older are more likely than younger adults to say the American dream is still possible. About two-thirds of adults ages 65 and older (68%) say this, as do 61% of those 50 to 64.

By comparison, only about four-in-ten adults under 50 (42%) say it’s still possible for people to achieve the American dream.

Higher-income Americans are also more likely than others to say the American dream is still achievable.

While 64% of upper-income Americans say the American dream still exists, 39% of lower-income Americans say the same – a gap of 25 percentage points.

Middle-income Americans fall in between, with a 56% majority saying the American dream is still possible.

Race and ethnicity

Roughly half of Americans in each racial and ethnic group say the American dream remains possible. And while relatively few Americans – just 6% overall – say that the American dream was never possible, Black Americans are about twice as likely as those in other groups to say this (11%).

Partisanship

While 56% of Republicans and Republican leaners say the American dream is still possible to achieve, 50% of Democrats and Democratic leaners say the same.

A 57% majority of adults with a bachelor’s degree or more education say the American dream remains possible, compared with 50% of those with less education.

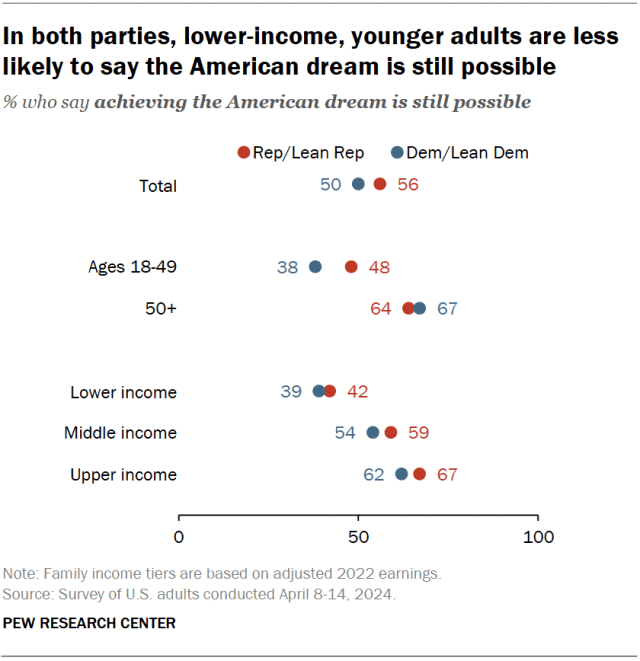

Age and income differences within both parties

Age and income differences in views of the American dream persist within each political party.

Clear majorities of both Republicans (64%) and Democrats (67%) ages 50 and older say achieving the American dream is still possible.

In contrast, just 38% of Democrats under 50 and 48% of Republicans under 50 view the American dream as still possible.

In both parties, upper-income Americans are about 25 points more likely than lower-income Americans to say it is still possible for people to achieve the American dream.

Do people think they can achieve the American dream?

Americans are also divided over whether they think they personally can achieve the American dream. About three-in-ten (31%) say they’ve achieved it, while a slightly larger share (36%) say they are on their way to achieving it. Another 30% say it’s out of reach for them. These views are nearly identical to when the Center last asked this question in 2022.

White adults (39%) are more likely than Black (15%) and Hispanic adults (19%), and about as likely as Asian adults (34%), to say they have already achieved the American dream.

Black (48%), Hispanic (47%) and Asian adults (46%) are more likely than White adults (29%) to say they are on their way to achieving it.

Republicans are more likely than Democrats to say they have achieved the American dream (38% vs. 28%). But Democrats are somewhat more likely than Republicans to say they’re on the way to achieving it (38% vs. 34%). Democrats are also more likely than Republicans to view the American dream as personally out of reach.

Income and age

Older and higher-income Americans are more likely than younger and less wealthy Americans to say they have achieved or are within reach of the American dream. These patterns are similar to those for views about the American dream more generally.

Note: Here are the questions used for this analysis , along with responses, and its methodology .

- Economic Conditions

- Income, Wealth & Poverty

Gabriel Borelli is a research associate focusing on U.S. politics and policy at Pew Research Center .

Income inequality is greater among Chinese Americans than any other Asian origin group in the U.S.

The state of the asian american middle class, the state of the american middle class, is college worth it, 7 facts about americans and taxes, most popular.

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

© 2024 Pew Research Center

Project 2025 Explained: What To Know About The Controversial Right-Wing Policy Map For Trump—As RNC Kicks Off

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Former President Donald Trump will secure the GOP’s nomination at the Republican National Convention this week, bringing renewed attention to Project 2025, a conservative think tank’s wide-ranging blueprint for a potential second Trump term that covers everything from recruiting like-minded personnel to eliminating entire agencies—a platform assembled partly by ex-Trump staffers, though the former president has tried to distance himself.

Then-President Donald Trump gives a speech at the Heritage Foundation's President's Club Meeting on ... [+] October 17, 2017, in Washington D.C.

Project 2025, spearheaded by the Heritage Foundation with help from more than 100 other conservative groups , is a multi-part plan for the next conservative administration—namely a Trump presidency—which includes a LinkedIn-style database for presidential personnel hopefuls, training programs for executive branch positions and an as-yet-unreleased “playbook” laying out what Trump should do in his first 180 days.

Though the project is led by the Heritage Foundation and other private third-party groups and is not formally tied to Trump, who has tried to distance himself from the operation, its proposals were developed in part by former members of his administration and other Trump allies, and the ex-president has previously praised Heritage for its policy work.

The project has drawn the most attention for its “Mandate for Leadership,” a 900-page proposed policy agenda that describes itself as a “plan to unite the conservative movement and the American people against elite rule and woke culture warriors,” laying out plans for all aspects of the executive branch.

Personnel: Project 2025 broadly proposes to insert far more political appointees who are ideologically aligned with the president into the executive branch—replacing many of the nonpartisan career civil servants who serve in it now—proposing an executive order that would put political appointees into any “confidential, policy-determining, policymaking, or policy-advocating positions” (which Trump previously did at the end of his presidency, but President Joe Biden then overturned it).

Federal Agencies: It proposes a scaled-down federal government, including the abolishment of multiple agencies—including the Department of Education, Department of Homeland Security, National Oceanic and Atmospheric Administration and Consumer Financial Protection Bureau—whose remaining departments would be folded into other agencies or privatized, including the Transportation Security Administration.

Transgender Rights: Transgender rights and gender identity beyond biological sex are roundly rejected, with such steps as reinstating the ban on transgender Americans serving in the military, prohibiting public school educators from referring to students by anything other than their birth name and pronouns without parental permission, and ensuring no federal funds are used to provide gender-affirming care.

DEI and LGBTQ Rights: Project 2025 seeks to eliminate diversity, equity and inclusion programs from throughout the federal government and in universities, and while it doesn’t outlaw same-sex marriage, it supports “nuclear families” that include a “married mother, father, and their children,” and calls for restricting laws that bar discrimination on the basis of sex to exclude sexual orientation and gender identity.

Climate Change: The proposal would undo much of the federal government’s climate work, including by leaving the Paris Climate Agreement, overhauling the Department of Energy to promote oil and natural gas and deemphasize green energy sources, removing the Department of Agriculture’s focus on sustainability and curtailing climate research.

Abortion: While Project 2025 doesn’t explicitly call for an abortion ban, it would take many steps to restrict the procedure, including directing the Food and Drug Administration to revoke its approval of abortion drug mifepristone, using the Comstock Act to block any abortion equipment or medication from being mailed—which abortion rights advocates have said would be a “backdoor” way to ban abortion—barring federal funds being used to provide healthcare coverage for abortion and requiring states to report all abortions that take place there to the federal government.

Education: Project 2025 emphasizes a “school choice” policy that directs public funds to be used for students to attend private or religious schools, bars “critical race theory” from being taught in federally funded schools and advocates for legislation that would allow parents to sue schools they feel have acted improperly—such as by teaching controversial subjects or requiring students to disclose information about their religious beliefs.

Student Loans: Student loan relief efforts would come to an end—including the public service loan forgiveness program and income-driven repayment plans—as the proposal states “borrowers should be expected to repay their loans.”

Big Tech: TikTok would be banned, and the proposal calls for reforming Section 230 —which shields tech companies and social media networks from being sued over content on their platforms—and allowing laws like those passed in Florida and Texas that seek to punish social media companies who ban or suspend users based on their “viewpoints.”

Justice Department: Project 2025 calls for a “top-to-bottom overhaul” of the DOJ and FBI that gets rid of what it calls an “unaccountable bureaucratic managerial class and radical Left ideologues,” proposing an agency that would be more focused on violent crime and filing litigation that’s “consistent with the President’s agenda” and filled with far more political appointees; it also proposes prohibiting the FBI from investigating misinformation or making “politically motivated” moves against U.S. citizens.

Taxes: Project 2025 would seek to get rid of current tax rates and most deductions and credits, instead proposing a 15% rate for anyone under the Social Security wage base ( $168,000 in 2024) and 30% for taxpayers earning more than that—which means the lowest-income taxpayers will now pay more and some higher earners will pay less, and it would also lower the corporate income tax rate to 18%.

Federal Reserve: The project seeks to reform the Federal Reserve by “tak[ing] the monetary steering wheel out of [its] hands and return[ing] it to the people,” which the authors propose could be done by getting rid of the government’s control over the nation’s money entirely—instead leaving it up to banks—or returning to the gold standard, in which the dollar’s value would be tied to a specific weight of gold.

Foreign Relations: Project 2025 emphasizes opposing China, which it describes as “a totalitarian enemy of the United States,” and directs the U.S. to pull out of international organizations when they don’t serve the administration’s interests, including the World Health Organization and various United Nations agencies.

Healthcare: Project 2025 does not seek to overturn the Affordable Care Act, but would make significant cuts to Medicaid and impose work requirements to receive coverage, as well as reform Medicare—including by making Medicare Advantage, a paid supplement to Medicare, the default option for patients.

Get Forbes Breaking News Text Alerts: We’re launching text message alerts so you'll always know the biggest stories shaping the day’s headlines. Text “Alerts” to (201) 335-0739 or sign up here .

Is Trump Involved With Project 2025?

Trump has denied any connection to Project 2025, claiming on Truth Social last week that he has “nothing to do with them,” has “no idea” who’s behind the plan and finds some of its ideas “absolutely ridiculous and abysmal.” But many aren’t buying his claims: The team behind Project 2025 includes 140 people who worked for Trump in his administration, according to CNN , including six former Cabinet secretaries and four people he nominated as ambassadors. The ex-president has also seemingly endorsed the project in the past, saying at a 2022 dinner for the Heritage Foundation that the group was “going to lay the groundwork and detail plans for exactly what our movement will do … when the American people give us a colossal mandate.”

What Impact Could Project 2025’s Policies Have?

Experts have warned Project 2025’s proposals could have seismic impacts on how the federal government operates if carried out. In an article for Justia , criminal defense attorney and former prosecutor John May suggested Project 2025’s language endorsing the executive branch being able to “restrain the excesses” of the judicial branch and Congress means “if the President wants to, the President can defy any decision of the Supreme Court, any legislation by Congress, maybe even the act of impeachment and removal from office.”

Who’s Behind Project 2025?

The main team behind Project 2025 includes Heritage Foundation director Paul Gans and former Trump White House personnel leaders Spencer Chretien (who also served as Trump’s special assistant) and Troup Hemenway, according to the project’s website. Other groups listed as participating in the project include ex-Trump adviser Stephen Miller’s America First Legal, legal group Alliance Defending Freedom, Liberty University, Susan B. Anthony Pro-Life America and Turning Point USA. The 900-page policy agenda was co-authored by a series of conservative figures, with chapters penned by such Trump allies as former Housing Secretary Dr. Ben Carson, former Deputy Homeland Security Secretary Ken Cuccinelli, former HHS Civil Rights Director Roger Severino and former Trump advisor Peter Navarro, who went to prison in March for contempt of Congress.

Will Trump Have To Follow Project 2025’s Plans?

Trump will not be under any obligation to follow Project 2025’s proposals if he wins the presidency, though history suggests he’ll listen to at least some of them. The Heritage Foundation made a similar policy proposal for Trump ahead of his presidency in 2016, and boasted two years into his tenure that Trump had already followed 64% of its recommendations, CBS News notes .

Would Project 2025 Change Social Security?

One area that Project 2025 doesn’t touch on is Social Security benefits and any potential cuts to the program, even as proposals outline changes to numerous other government “entitlements.” Changing Social Security and making cuts to its spending has been a priority for the GOP for decades, though the American public has long opposed slashing benefits. Republicans’ efforts have waned under Trump, however, and the ex-president publicly claimed in March he “will never do anything that will jeopardize or hurt Social Security or Medicare,” after he came under fire for suggesting otherwise in an interview with CNBC.

Surprising Fact

While much of Project 2025’s policy agenda concerns federal agencies, the proposal has also gotten attention for its call to outlaw all pornography, which it claims is tied to “the omnipresent propagation of transgender ideology and sexualization of children” and is not protected under the First Amendment. Project 2025 calls not only for pornography to be made illegal, but also for anyone involved with its production and distribution to be imprisoned, for any librarians or educators who “purvey it” to be registered as sex offenders and for telecommunications and technology firms that facilitate its distribution to be shut down.

Key Background