Essay on Inflation: Types, Causes and Effects

Essay on Inflation!

Essay on the Meaning of Inflation:

Inflation and unemployment are the two most talked-about words in the contemporary society. These two are the big problems that plague all the economies. Almost everyone is sure that he knows what inflation exactly is, but it remains a source of great deal of confusion because it is difficult to define it unambiguously.

Inflation is often defined in terms of its supposed causes. Inflation exists when money supply exceeds available goods and services. Or inflation is attributed to budget deficit financing. A deficit budget may be financed by additional money creation. But the situation of monetary expansion or budget deficit may not cause price level to rise. Hence the difficulty of defining ‘inflation’ .

Inflation may be defined as ‘a sustained upward trend in the general level of prices’ and not the price of only one or two goods. G. Ackley defined inflation as ‘a persistent and appreciable rise in the general level or average of prices’ . In other words, inflation is a state of rising price level, but not rise in the price level. It is not high prices but rising prices that constitute inflation.

ADVERTISEMENTS:

It is an increase in the overall price level. A small rise in prices or a sudden rise in prices is not inflation since these may reflect the short term workings of the market. It is to be pointed out here that inflation is a state of disequilibrium when there occurs a sustained rise in price level.

It is inflation if the prices of most goods go up. However, it is difficult to detect whether there is an upward trend in prices and whether this trend is sustained. That is why inflation is difficult to define in an unambiguous sense.

Let’s measure inflation rate. Suppose, in December 2007, the consumer price index was 193.6 and, in December 2008 it was 223.8. Thus the inflation rate during the last one year was 223.8 – 193.6/193.6 × 100 = 15.6%.

As inflation is a state of rising prices, deflation may be defined as a state of falling prices but not fall in prices. Deflation is, thus, the opposite of inflation, i.e., rise in the value or purchasing power of money. Disinflation is a slowing down of the rate of inflation.

Essay on the Types of Inflation :

As the nature of inflation is not uniform in an economy for all the time, it is wise to distinguish between different types of inflation. Such analysis is useful to study the distributional and other effects of inflation as well as to recommend anti-inflationary policies.

Inflation may be caused by a variety of factors. Its intensity or pace may be different at different times. It may also be classified in accordance with the reactions of the government toward inflation.

Thus, one may observe different types of inflation in the contemporary society:

(a) According to Causes:

i. Currency Inflation:

This type of inflation is caused by the printing of currency notes.

ii. Credit Inflation:

Being profit-making institutions, commercial banks sanction more loans and advances to the public than what the economy needs. Such credit expansion leads to a rise in price level.

iii. Deficit-Induced Inflation:

The budget of the government reflects a deficit when expenditure exceeds revenue. To meet this gap, the government may ask the central bank to print additional money. Since pumping of additional money is required to meet the budget deficit, any price rise may be called deficit-induced inflation.

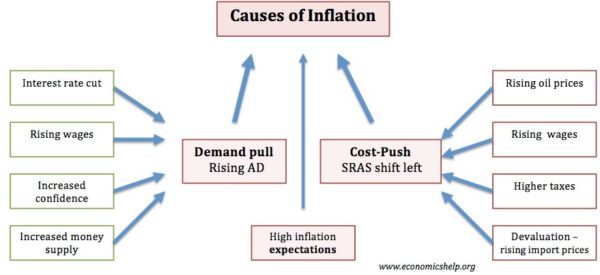

iv. Demand-Pull Inflation:

An increase in aggregate demand over the available output leads to a rise in the price level. Such inflation is called demand-pull inflation (henceforth DPI). But why does aggregate demand rise? Classical economists attribute this rise in aggregate demand to money supply.

If the supply of money in an economy exceeds the available goods and services, DPI appears. It has been described by Coulborn as a situation of “too much money chasing too few goods” .

Note that, in this region, price level begins to rise. Ultimately, the economy reaches full employment situation, i.e., Range 3, where output does not rise but price level is pulled upward. This is demand-pull inflation. The essence of this type of inflation is “too much spending chasing too few goods.”

v. Cost-Push Inflation:

Inflation in an economy may arise from the overall increase in the cost of production. This type of inflation is known as cost-push inflation (henceforth CPI). Cost of production may rise due to increase in the price of raw materials, wages, etc. Often trade unions are blamed for wage rise since wage rate is not market-determined. Higher wage means higher cost of production.

Prices of commodities are thereby increased. A wage-price spiral comes into operation. But, at the same time, firms are to be blamed also for the price rise since they simply raise prices to expand their profit margins. Thus we have two important variants of CPI: wage-push inflation and profit-push inflation. Anyway, CPI stems from the leftward shift of the aggregate supply curve.

The price level thus determined is OP 1 . As aggregate demand curve shifts to AD 2 , price level rises to OP 2 . Thus, an increase in aggregate demand at the full employment stage leads to an increase in price level only, rather than the level of output. However, how much price level will rise following an increase in aggregate demand depends on the slope of the AS curve.

Causes of Demand-Pull Inflation :

DPI originates in the monetary sector. Monetarists’ argument that “only money matters” is based on the assumption that at or near full employment, excessive money supply will increase aggregate demand and will thus cause inflation.

An increase in nominal money supply shifts aggregate demand curve rightward. This enables people to hold excess cash balances. Spending of excess cash balances by them causes price level to rise. Price level will continue to rise until aggregate demand equals aggregate supply.

Keynesians argue that inflation originates in the non-monetary sector or the real sector. Aggregate demand may rise if there is an increase in consumption expenditure following a tax cut. There may be an autonomous increase in business investment or government expenditure. Governmental expenditure is inflationary if the needed money is procured by the government by printing additional money.

In brief, an increase in aggregate demand i.e., increase in (C + I + G + X – M) causes price level to rise. However, aggregate demand may rise following an increase in money supply generated by the printing of additional money (classical argument) which drives prices upward. Thus, money plays a vital role. That is why Milton Friedman believes that inflation is always and everywhere a monetary phenomenon.

There are other reasons that may push aggregate demand and, hence, price level upwards. For instance, growth of population stimulates aggregate demand. Higher export earnings increase the purchasing power of the exporting countries.

Additional purchasing power means additional aggregate demand. Purchasing power and, hence, aggregate demand, may also go up if government repays public debt. Again, there is a tendency on the part of the holders of black money to spend on conspicuous consumption goods. Such tendency fuels inflationary fire. Thus, DPI is caused by a variety of factors.

Cost-Push Inflation Theory :

In addition to aggregate demand, aggregate supply also generates inflationary process. As inflation is caused by a leftward shift of the aggregate supply, we call it CPI. CPI is usually associated with the non-monetary factors. CPI arises due to the increase in cost of production. Cost of production may rise due to a rise in the cost of raw materials or increase in wages.

Such increases in costs are passed on to consumers by firms by raising the prices of the products. Rising wages lead to rising costs. Rising costs lead to rising prices. And rising prices, again, prompt trade unions to demand higher wages. Thus, an inflationary wage-price spiral starts.

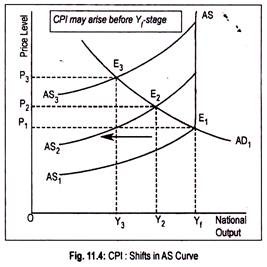

This causes aggregate supply curve to shift leftward. This can be demonstrated graphically (Fig. 11.4) where AS 1 is the initial aggregate supply curve. Below the full employment stage this AS curve is positive sloping and at full employment stage it becomes perfectly inelastic. Intersection point (E 1 ) of AD 1 and AS 1 curves determines the price level.

Now, there is a leftward shift of aggregate supply curve to AS 2 . With no change in aggregate demand, this causes price level to rise to OP 2 and output to fall to OY 2 .

With the reduction in output, employment in the economy declines or unemployment rises. Further shift in the AS curve to AS 2 results in higher price level (OP 3 ) and a lower volume of aggregate output (OY 3 ). Thus, CPI may arise even below the full employment (Y f ) stage.

Causes of CPI :

It is the cost factors that pull the prices upward. One of the important causes of price rise is the rise in price of raw materials. For instance, by an administrative order the government may hike the price of petrol or diesel or freight rate. Firms buy these inputs now at a higher price. This leads to an upward pressure on cost of production.

Not only this, CPI is often imported from outside the economy. Increase in the price of petrol by OPEC compels the government to increase the price of petrol and diesel. These two important raw materials are needed by every sector, especially the transport sector. As a result, transport costs go up resulting in higher general price level.

Again, CPI may be induced by wage-push inflation or profit-push inflation. Trade unions demand higher money wages as a compensation against inflationary price rise. If increase in money wages exceeds labour productivity, aggregate supply will shift upward and leftward. Firms often exercise power by pushing up prices independently of consumer demand to expand their profit margins.

Fiscal policy changes, such as an increase in tax rates leads to an upward pressure in cost of production. For instance, an overall increase in excise tax of mass consumption goods is definitely inflationary. That is why government is then accused of causing inflation.

Finally, production setbacks may result in decreases in output. Natural disaster, exhaustion of natural resources, work stoppages, electric power cuts, etc., may cause aggregate output to decline.

In the midst of this output reduction, artificial scarcity of any goods by traders and hoarders just simply ignite the situation.

Inefficiency, corruption, mismanagement of the economy may also be the other reasons. Thus, inflation is caused by the interplay of various factors. A particular factor cannot be held responsible for inflationary price rise.

Essay on the Effects of Inflation :

People’s desires are inconsistent. When they act as buyers they want prices of goods and services to remain stable but as sellers they expect the prices of goods and services should go up. Such a happy outcome may arise for some individuals; “but, when this happens, others will be getting the worst of both worlds.” Since inflation reduces purchasing power it is bad.

The old people are in the habit of recalling the days when the price of say, meat per kilogram cost just 10 rupees. Today it is Rs. 250 per kilogram. This is true for all other commodities. When they enjoyed a better living standard. Imagine today, how worse we are! But meanwhile, wages and salaries of people have risen to a great height, compared to the ‘good old days’. This goes unusually untold.

When price level goes up, there is both a gainer and a loser. To evaluate the consequence of inflation, one must identify the nature of inflation which may be anticipated and unanticipated. If inflation is anticipated, people can adjust with the new situation and costs of inflation to the society will be smaller.

In reality, people cannot predict accurately future events or people often make mistakes in predicting the course of inflation. In other words, inflation may be unanticipated when people fail to adjust completely. This creates various problems.

One can study the effects of unanticipated inflation under two broad headings:

(i) Effect on distribution of income and wealth

(ii) Effect on economic growth.

(a) Effects of Inflation on Income and Wealth Distribution :

During inflation, usually people experience rise in incomes. But some people gain during inflation at the expense of others. Some individuals gain because their money incomes rise more rapidly than the prices and some lose because prices rise more rapidly than their incomes during inflation. Thus, it redistributes income and wealth.

Though no conclusive evidence can be cited, it can be asserted that following categories of people are affected by inflation differently:

i. Creditors and Debtors:

Borrowers gain and lenders lose during inflation because debts are fixed in rupee terms. When debts are repaid their real value declines by the price level increase and, hence, creditors lose. An individual may be interested in buying a house by taking a loan of Rs. 7 lakh from an institution for 7 years.

The borrower now welcomes inflation since he will have to pay less in real terms than when it was borrowed. Lender, in the process, loses since the rate of interest payable remains unaltered as per agreement. Because of inflation, the borrower is given ‘dear’ rupees, but pays back ‘cheap’ rupees.

However, if in an inflation-ridden economy creditors chronically loose, it is wise not to advance loans or to shut down business. Never does it happen. Rather, the loan- giving institution makes adequate safeguard against the erosion of real value.

ii. Bond and Debenture-Holders:

In an economy, there are some people who live on interest income—they suffer most.

Bondholders earn fixed interest income:

These people suffer a reduction in real income when prices rise. In other words, the value of one’s savings decline if the interest rate falls short of inflation rate. Similarly, beneficiaries from life insurance programmes are also hit badly by inflation since real value of savings deteriorate.

iii. Investors:

People who put their money in shares during inflation are expected to gain since the possibility of earning business profit brightens. Higher profit induces owners of firms to distribute profit among investors or shareholders.

iv. Salaried People and Wage-Earners:

Anyone earning a fixed income is damaged by inflation. Sometimes, unionized worker succeeds in raising wage rates of white-collar workers as a compensation against price rise. But wage rate changes with a long time lag. In other words, wage rate increases always lag behind price increases.

Naturally, inflation results in a reduction in real purchasing power of fixed income earners. On the other hand, people earning flexible incomes may gain during inflation. The nominal incomes of such people outstrip the general price rise. As a result, real incomes of this income group increase.

v. Profit-Earners, Speculators and Black Marketeers:

It is argued that profit-earners gain from inflation. Profit tends to rise during inflation. Seeing inflation, businessmen raise the prices of their products. This results in a bigger profit. Profit margin, however, may not be high when the rate of inflation climbs to a high level.

However, speculators dealing in business in essential commodities usually stand to gain by inflation. Black marketeers are also benefited by inflation.

Thus, there occurs a redistribution of income and wealth. It is said that rich becomes richer and poor becomes poorer during inflation. However, no such hard and fast generalizations can be made. It is clear that someone wins and someone loses from inflation.

These effects of inflation may persist if inflation is unanticipated. However, the redistributive burdens of inflation on income and wealth are most likely to be minimal if inflation is anticipated by the people.

With anticipated inflation, people can build up their strategies to cope with inflation. If the annual rate of inflation in an economy is anticipated correctly people will try to protect them against losses resulting from inflation.

Workers will demand 10 p.c. wage increase if inflation is expected to rise by 10 p.c. Similarly, a percentage of inflation premium will be demanded by creditors from debtors. Business firms will also fix prices of their products in accordance with the anticipated price rise. Now if the entire society “learns to live with inflation” , the redistributive effect of inflation will be minimal.

However, it is difficult to anticipate properly every episode of inflation. Further, even if it is anticipated it cannot be perfect. In addition, adjustment with the new expected inflationary conditions may not be possible for all categories of people. Thus, adverse redistributive effects are likely to occur.

Finally, anticipated inflation may also be costly to the society. If people’s expectation regarding future price rise become stronger they will hold less liquid money. Mere holding of cash balances during inflation is unwise since its real value declines. That is why people use their money balances in buying real estate, gold, jewellery, etc.

Such investment is referred to as unproductive investment. Thus, during inflation of anticipated variety, there occurs a diversion of resources from priority to non-priority or unproductive sectors.

b. Effect on Production and Economic Growth :

Inflation may or may not result in higher output. Below the full employment stage, inflation has a favourable effect on production. In general, profit is a rising function of the price level. An inflationary situation gives an incentive to businessmen to raise prices of their products so as to earn higher doses of profit.

Rising price and rising profit encourage firms to make larger investments. As a result, the multiplier effect of investment will come into operation resulting in higher national output. However, such a favourable effect of inflation will be temporary if wages and production costs rise very rapidly.

Further, inflationary situation may be associated with the fall in output, particularly if inflation is of the cost-push variety. Thus, there is no strict relationship between prices and output. An increase in aggregate demand will increase both prices and output, but a supply shock will raise prices and lower output.

Inflation may also lower down further production levels. It is commonly assumed that if inflationary tendencies nurtured by experienced inflation persist in future, people will now save less and consume more. Rising saving propensities will result in lower further outputs.

One may also argue that inflation creates an air of uncertainty in the minds of business community, particularly when the rate of inflation fluctuates. In the midst of rising inflationary trend, firms cannot accurately estimate their costs and revenues. Under the circumstance, business firms may be deterred in investing. This will adversely affect the growth performance of the economy.

However, slight dose of inflation is necessary for economic growth. Mild inflation has an encouraging effect on national output. But it is difficult to make the price rise of a creeping variety. High rate of inflation acts as a disincentive to long run economic growth. The way the hyperinflation affects economic growth is summed up here.

We know that hyperinflation discourages savings. A fall in savings means a lower rate of capital formation. A low rate of capital formation hinders economic growth. Further, during excessive price rise, there occurs an increase in unproductive investment in real estate, gold, jewellery, etc.

Above all, speculative businesses flourish during inflation resulting in artificial scarcities and, hence, further rise in prices. Again, following hyperinflation, export earnings decline resulting in a wide imbalance in the balance of payments account.

Often, galloping inflation results in a ‘flight’ of capital to foreign countries since people lose confidence and faith over the monetary arrangements of the country, thereby resulting in a scarcity of resources. Finally, real value of tax revenue also declines under the impact of hyperinflation. Government then experiences a shortfall in investible resources.

Thus, economists and policy makers are unanimous regarding the dangers of high price rise. But the consequence of hyperinflation is disastrous. In the past, some of the world economies (e.g., Germany after the First World War (1914-1918), Latin American countries in the 1980s) had been greatly ravaged by hyperinflation.

The German Inflation of 1920s was also Catastrophic:

During 1922, the German price level went up 5,470 per cent, in 1923, the situation worsened; the German price level rose 1,300,000,000 times. By October of 1923, the postage of the lightest letter sent from Germany to the United States was 200,000 marks.

Butter cost 1.5 million marks per pound, meat 2 million marks, a loaf of bread 200,000 marks, and an egg 60,000 marks Prices increased so rapidly that waiters changed the prices on the menu several times during the course of a lunch!! Sometimes, customers had to pay double the price listed on the menu when they observed it first!!!

During October 2008, Zimbabwe, under the President-ship of Robert G. Mugabe, experienced 231,000,000 p.c. (2.31 million p.c.) as against 1.2 million p.c. price rise in September 2008—a record after 1923. It is an unbelievable rate. In May 2008, the cost of price of a toilet paper itself and not the costs of the roll of the toilet paper came to 417 Zimbabwean dollars.

Anyway, people are harassed ultimately by the high rate of inflation. That is why it is said that ‘inflation is our public enemy number one’. Rising inflation rate is a sign of failure on the part of the government.

Related Articles:

- Essay on the Causes of Inflation (473 Words)

- Cost-Push Inflation and Demand-Pull or Mixed Inflation

- Demand Pull Inflation and Cost Push Inflation | Money

- Essay on Inflation: Meaning, Measurement and Causes

Presentations made painless

- Get Premium

100 Inflation Essay Topic Ideas & Examples

Inside This Article

Inflation is a key economic indicator that affects the purchasing power of consumers and the overall health of an economy. As such, it is a popular topic for essays and research papers in economics, finance, and related fields. If you are looking for inspiration for your next inflation essay, look no further. Here are 100 inflation essay topic ideas and examples to help you get started:

- The causes and effects of inflation

- The relationship between inflation and unemployment

- The impact of inflation on interest rates

- The role of the Federal Reserve in controlling inflation

- The differences between demand-pull and cost-push inflation

- The effects of hyperinflation on a country's economy

- The impact of inflation on fixed income earners

- The relationship between inflation and the stock market

- The effects of inflation on real estate prices

- The impact of inflation on international trade

- The role of inflation expectations in shaping economic behavior

- The effects of inflation on poverty and income inequality

- The impact of inflation on retirement savings

- The relationship between inflation and economic growth

- The effects of inflation on consumer spending

- The role of inflation in shaping monetary policy decisions

- The impact of inflation on business investment

- The effects of inflation on government finances

- The relationship between inflation and currency exchange rates

- The impact of inflation on the cost of living

- The effects of inflation on social welfare programs

- The role of inflation in causing economic recessions

- The impact of inflation on international competitiveness

- The effects of inflation on the environment

- The relationship between inflation and financial stability

- The role of inflation in shaping government policy decisions

- The impact of inflation on entrepreneurship and innovation

- The effects of inflation on consumer confidence

- The relationship between inflation and technological advancement

- The impact of inflation on the healthcare industry

- The effects of inflation on the education sector

- The role of inflation in shaping consumer behavior

- The impact of inflation on the agricultural sector

- The relationship between inflation and social mobility

- The effects of inflation on urban development

- The role of inflation in shaping labor market dynamics

- The impact of inflation on small businesses

- The effects of inflation on the tourism industry

- The relationship between inflation and government regulations

- The impact of inflation on infrastructure development

- The role of inflation in shaping energy policy

- The effects of inflation on the manufacturing sector

- The relationship between inflation and the digital economy

- The impact of inflation on the gig economy

- The effects of inflation on the sharing economy

- The role of inflation in shaping consumer preferences

- The impact of inflation on the automotive industry

- The relationship between inflation and the housing market

- The effects of inflation on the retail sector

- The impact of inflation on the hospitality industry

- The role of inflation in shaping supply chain dynamics

- The effects of inflation on the fashion industry

- The relationship between inflation and the art market

- The impact of inflation on the entertainment industry

- The effects of inflation on the music industry

- The role of inflation in shaping the sports industry

- The relationship between inflation and the gaming industry

- The impact of inflation on the film industry

- The effects of inflation on the publishing industry

- The role of inflation in shaping the food and beverage industry

- The impact of inflation on the beauty and personal care industry

- The effects of inflation on the health and wellness industry

- The relationship between inflation and the pharmaceutical industry

- The impact of inflation on the technology industry

- The effects of inflation on the telecommunications industry

- The role of inflation in shaping the media industry

- The relationship between inflation and the advertising industry

- The impact of inflation on the e-commerce industry

- The effects of inflation on the transportation industry

- The role of inflation in shaping the logistics industry

- The impact of inflation on the energy industry

- The effects of inflation on the renewable energy industry

- The relationship between inflation and the oil and gas industry

- The impact of inflation on the mining industry

- The effects of inflation on the construction industry

- The role of inflation in shaping the real estate industry

- The relationship between inflation and the property market

- The impact of inflation on the architecture and design industry

- The effects of inflation on the engineering industry

- The role of inflation in shaping the manufacturing industry

- The effects of inflation on the aerospace industry

- The relationship between inflation and the defense industry

- The impact of inflation on the security industry

- The effects of inflation on the law enforcement industry

- The role of inflation in shaping the healthcare industry

- The impact of inflation on the medical devices industry

- The effects of inflation on the biotechnology industry

- The role of inflation in shaping the life sciences industry

- The impact of inflation on the education industry

- The effects of inflation on the e-learning industry

- The relationship between inflation and the edtech industry

- The impact of inflation on the publishing industry

- The effects of inflation on the media and entertainment industry

- The role of inflation in shaping the sports and recreation industry

- The relationship between inflation and the leisure and travel industry

- The impact of inflation on the tourism and hospitality industry

- The effects of inflation on the food and beverage industry

- The role of inflation in shaping the retail and consumer goods industry

These are just a few examples of the many possible topics you could explore in an inflation essay. Whether you are interested in the macroeconomic implications of inflation or its effects on specific industries, there is no shortage of interesting and important questions to investigate. So pick a topic that interests you, do some research, and start writing!

Want to create a presentation now?

Instantly Create A Deck

Let PitchGrade do this for me

Hassle Free

We will create your text and designs for you. Sit back and relax while we do the work.

Explore More Content

- Privacy Policy

- Terms of Service

© 2023 Pitchgrade

Essay on Inflation

Essay generator.

Inflation is a term that resonates through the corridors of our daily lives, affecting decisions made by individuals, businesses, and governments alike. It refers to the rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling. Central banks attempt to limit inflation, and avoid deflation, to keep the economy running smoothly. This essay delves into the causes of inflation, its various effects on the economy and individuals, and the strategies employed to manage it, aiming to provide a comprehensive understanding suitable for a student participating in an essay writing competition.

The Causes of Inflation

Inflation is primarily caused by two factors: demand-pull and cost-push inflation. Demand-pull inflation occurs when demand for goods and services exceeds supply, causing prices to rise. This can happen due to increased consumer spending, government expenditure, or investment. Cost-push inflation, on the other hand, happens when the cost of production increases, leading producers to raise prices to maintain their profit margins. This increase in production costs can be due to rising wages, increased taxes, or higher prices for raw materials.

- Demand-pull inflation occurs when the overall demand for goods and services in an economy exceeds its supply. This excess demand leads to rising prices as businesses raise prices to capitalize on increased consumer demand.

- Factors contributing to demand-pull inflation include robust consumer spending, increased government spending, low-interest rates, and high levels of investment.

- Cost-push inflation is driven by rising production costs, which are then passed on to consumers in the form of higher prices. These rising costs can result from various factors, such as increased wages, higher energy prices, or supply chain disruptions.

- For example, if oil prices spike, it can lead to increased transportation costs, which may cause businesses to raise prices on their products.

- Built-in inflation, also known as the wage-price spiral, occurs when workers demand higher wages to keep up with rising prices. When businesses pay higher wages, they often pass those costs on to consumers, causing prices to rise further. This cycle can continue, perpetuating inflation.

- Expectations of future inflation can also contribute to built-in inflation, as people adjust their behavior and spending patterns in anticipation of rising prices.

- The policies of central banks, such as the Federal Reserve in the United States, can influence inflation. When central banks implement loose monetary policies, such as low-interest rates and quantitative easing, it can increase the money supply and potentially lead to demand-pull inflation.

- Central banks can also use tight monetary policies, such as raising interest rates, to combat inflation and reduce spending.

- Government fiscal policies, including changes in taxation and government spending, can affect inflation. An increase in government spending without corresponding revenue sources can stimulate demand and contribute to inflation.

- Tax cuts can also increase disposable income, leading to higher consumer spending and potential demand-pull inflation.

- Exchange rate fluctuations can impact inflation by influencing the prices of imported goods. A depreciating domestic currency can make imports more expensive, contributing to cost-push inflation.

- Conversely, a strengthening currency can lower import prices and help reduce inflation.

- Unforeseen events, such as natural disasters, geopolitical tensions, or disruptions in the supply chain, can cause sudden supply shortages or surpluses. These shocks can result in sharp price movements and contribute to inflation.

- For instance, a severe drought can reduce agricultural output, leading to higher food prices.

- Global economic conditions and trends, such as changes in international commodity prices or global economic growth, can influence inflation in individual countries.

- Economic policies in major trading partners can also have spill-over effects on domestic inflation.

The Effects of Inflation

Inflation impacts various facets of the economy and society. Moderate inflation is a sign of a growing economy, but high inflation can have detrimental effects.

Economic Effects

1. Reduced Purchasing Power: Inflation erodes the purchasing power of money, meaning consumers can buy less with the same amount of money. This reduction can impact living standards and consumer spending.

2. Income Redistribution: Inflation can act as a regressive tax, hitting harder on low-income families. Fixed-income recipients, such as pensioners, find their incomes do not stretch as far, while borrowers may benefit from repaying loans with money that is worth less.

3. Investment Uncertainty: High inflation can lead to uncertainty in the investment market. Investors become wary of long-term investments due to the unpredictability of future costs and returns.

Social Effects

1. Cost of Living: As the cost of goods and services increases, individuals may struggle to afford basic necessities, leading to a lower quality of life.

2. Wage-Price Spiral: Continuous inflation can lead to a wage-price spiral, where workers demand higher wages to keep up with rising prices, which in turn causes prices to rise further.

3. Access to Education and Healthcare: Rising costs can make education and healthcare less accessible to the general population, affecting long-term social and economic development.

Managing Inflation

Governments and central banks use various tools to manage inflation, aiming to maintain it at a level that promotes economic stability and growth.

Monetary Policy

The most common tool for managing inflation is monetary policy, which involves regulating the money supply and interest rates. Central banks can increase interest rates to reduce spending and borrowing, thereby slowing down the economy and reducing inflation. Conversely, lowering interest rates can stimulate spending and investment, increasing demand and potentially causing inflation.

Fiscal Policy

Governments can also use fiscal policy to control inflation by adjusting spending and taxation. Reducing government spending or increasing taxes can decrease the overall demand in the economy, lowering inflation. However, these measures can be unpopular politically as they may lead to reduced public services and higher taxes.

Supply-Side Policies

Improving efficiency and increasing supply can also combat inflation. This can be achieved through investment in technology, deregulation, and policies aimed at increasing productivity. By increasing the supply of goods and services, prices can stabilize or even decrease.

In conclusion, Inflation is a complex phenomenon with wide-ranging effects on the economy and society. Understanding its causes and impacts is crucial for effective management and policy-making. While moderate inflation is a sign of a healthy economy, unchecked inflation can lead to significant economic and social challenges. Through a combination of monetary, fiscal, and supply-side policies, governments and central banks strive to balance inflation to ensure economic stability and growth. As students delve into the intricacies of inflation, they gain insight into the delicate balance required to manage an economy, preparing them for informed citizenship and, possibly, roles in shaping economic policy in the future.

Text prompt

- Instructive

- Professional

Generate an essay on the importance of extracurricular activities for student development

Write an essay discussing the role of technology in modern education.

What Is Inflation: How it Works & Examples

What you need to know about the purchasing power of money and how it changes

- Search Search Please fill out this field.

What Is Inflation?

What causes inflation, how does inflation work, types of inflation.

- Impact on Consumers

- Protecting Your Finances

Types of Price Indexes

- Pros and Cons

- Controlling Inflation

- Deflation and Disinflation

The Bottom Line

:max_bytes(150000):strip_icc():format(webp)/jason_mugshot__jason_fernando-5bfc261946e0fb00260a1cea.jpg)

Pete Rathburn is a copy editor and fact-checker with expertise in economics and personal finance and over twenty years of experience in the classroom.

:max_bytes(150000):strip_icc():format(webp)/E7F37E3D-4C78-4BDA-9393-6F3C581602EB-2c2c94499d514e079e915307db536454.jpeg)

- What Is Inflation: How it Works & Examples CURRENT ARTICLE

- 9 Common Effects of Inflation

- How to Profit From Inflation

- When Is Inflation Good for the Economy?

- How Does Current Cost of Living Compare to 20 Years Ago?

- Why Are P/E Ratios Higher When Inflation Is Low?

- What Causes Inflation and Who Profits From It?

- Understand the Different Types of Inflation

- Wage Push Inflation

- Cost-Push Inflation

- Cost-Push Inflation vs. Demand-Pull Inflation: What's the Difference?

- Inflation vs. Stagflation: What's the difference?

- What is the Relationship Between Inflation and Interest Rates?

- Inflation's Impact on Stock Returns

- How Does Inflation Affect Fixed-Income Investments?

- How Inflation Affects Your Cost of Living

- How Inflation Impacts Your Savings

- How Inflation Eats Away at Your Retirement Income

- What Impact Does Inflation Have on the Dollar Value Today?

- Inflation and Economic Recovery

- Hyperinflation

- Why Didn't Quantitative Easing Lead to Hyperinflation?

- Worst Cases of Hyperinflation in History

- How the Great Inflation of the 1970s Happened

- Stagflation

- Purchasing Power

- Consumer Price Index (CPI)

- Why Is the Consumer Price Index Controversial?

- Core Inflation

- Headline Inflation

- GDP Price Deflator

- Inflation Accounting

- Inflation-Adjusted Return

- Inflation Targeting

- Real Economic Growth Rate

- Real Gross Domestic Product (GDP)

- Real Income

- Real Interest Rate

- Real Rate of Return

- Wage-Price Spiral

Inflation is a gradual loss of purchasing power, reflected in a broad rise in prices for goods and services over time.

The inflation rate is calculated as the average price increase of a basket of selected goods and services over one year. High inflation means that prices are increasing quickly, with low inflation meaning that prices are increasing more slowly. Inflation can be contrasted with deflation, which occurs when prices decline and purchasing power increases.

Key Takeaways

- Inflation measures how quickly the prices of goods and services are rising.

- Inflation is sometimes classified into three types: demand-pull inflation, cost-push inflation, and built-in inflation.

- The most commonly used inflation indexes are the Consumer Price Index and the Wholesale Price Index.

- Inflation can be viewed positively or negatively depending on the individual viewpoint and rate of change.

- Those with tangible assets, like property or stocked commodities, may like to see some inflation as that raises the value of their assets.

An increase in the supply of money is the root of inflation, though this can play out through different mechanisms in the economy. A country's money supply can be increased by the monetary authorities by:

- Printing and giving away more money to citizens

- Legally devaluing (reducing the value of) the legal tender currency

- Loaning new money into existence as reserve account credits through the banking system by purchasing government bonds from banks on the secondary market

Other causes of inflation include supply bottlenecks and shortages of key goods, which can push prices to rise.

When inflation occurs, money loses its purchasing power. This can occur across any sector or throughout an entire economy. When inflation takes hold, the expectation of inflation itself can further sustain the devaluation of money. Workers may demand higher wages and businesses may charge higher prices, in anticipation of sustained inflation. This in turn reinforces the factors that push prices up.

Inflation can be classified into three types: demand-pull inflation, cost-push inflation, and built-in inflation.

Melissa Ling {Copyright} Investopedia, 2019

Demand-Pull Effect

Demand-pull inflation occurs when an increase in the supply of money and credit stimulates the overall demand for goods and services to increase more rapidly than the economy's production capacity. This increases demand and leads to price rises.

When people have more money, it leads to positive consumer sentiment. This, in turn, leads to higher spending, which pulls prices higher. It creates a demand-supply gap with higher demand and less flexible supply, which results in higher prices.

Cost-Push Effect

Cost-push inflation is a result of the increase in prices working through the production process inputs. When additions to the supply of money and credit are channeled into a commodity or other asset markets, costs for all kinds of intermediate goods rise. This is especially evident when there's a negative economic shock to the supply of key commodities.

These developments lead to higher costs for the finished product or service and work their way into rising consumer prices. For instance, when the money supply is expanded, it creates a speculative boom in oil prices . This means that the cost of energy can rise and contribute to rising consumer prices, which is reflected in various measures of inflation.

Built-In Inflation

Built-in inflation is related to adaptive expectations or the idea that people expect current inflation rates to continue in the future. As the price of goods and services rises, people may expect a continuous rise in the future at a similar rate.

As such, workers may demand more costs or wages to maintain their standard of living. Their increased wages result in a higher cost of goods and services, and this wage-price spiral continues as one factor induces the other and vice-versa.

How Inflation Impacts Consumers

While it is easy to measure the price changes of individual products over time, human needs extend beyond just one or two products. Individuals need a big and diversified set of products as well as a host of services for living a comfortable life. They include commodities like food grains, metal, fuel, utilities like electricity and transportation, and services like healthcare , entertainment, and labor.

Inflation aims to measure the overall impact of price changes for a diversified set of products and services. It allows for a single value representation of the increase in the price level of goods and services in an economy over a specified time.

Prices rise, which means that one unit of money buys fewer goods and services. This loss of purchasing power impacts the cost of living for the common public which ultimately leads to a deceleration in economic growth. The consensus view among economists is that sustained inflation occurs when a nation's money supply growth outpaces economic growth.

The increase in the Consumer Price Index For All Urban Consumers (CPI-U) over the 12 months ending May 2024 on an unadjusted basis. Prices were flat on a seasonally adjusted basis in May 2024 from the previous month.

To combat this, the monetary authority (in most cases, the central bank ) takes the necessary steps to manage the money supply and credit to keep inflation within permissible limits and keep the economy running smoothly.

Theoretically, monetarism is a popular theory that explains the relationship between inflation and the money supply of an economy. For example, following the Spanish conquest of the Aztec and Inca empires, massive amounts of gold and silver flowed into the Spanish and other European economies. Since the money supply rapidly increased, the value of money fell, contributing to rapidly rising prices.

Inflation is measured in a variety of ways depending on the types of goods and services. It is the opposite of deflation , which indicates a general decline in prices when the inflation rate falls below 0%. Keep in mind that deflation shouldn't be confused with disinflation , which is a related term referring to a slowing down in the (positive) rate of inflation.

Investopedia / Julie Bang

How to Protect Your Finances During Inflation

There are a range of measures that individuals can take to protect their finances against inflation.

For instance, one may choose to invest in asset classes that outperform the market during inflationary times. This might include commodities like grain, beef, oil, electricity, and natural gas. Commodity prices typically stay one step ahead of product prices, and price increases for commodities are often seen as an indicator of inflation to come. However, commodities can also be volatile, easily affected by natural disasters, geopolitics, or conflict.

Real estate income may also help buffer against inflation, as landlords can increase their rent to keep pace with the rise of prices overall.

The U.S. government also offers Treasury Inflation-Protected Securities (TIPS), a type of security indexed to inflation to protect against declines in purchasing power.

Depending upon the selected set of goods and services used, multiple types of baskets of goods are calculated and tracked as price indexes. The most commonly used price indexes are the Consumer Price Index (CPI) and the Wholesale Price Index (WPI) .

The Consumer Price Index (CPI)

The CPI is a measure that examines the weighted average of prices of a basket of goods and services that are of primary consumer needs. They include transportation, food, and medical care.

CPI is calculated by taking price changes for each item in the predetermined basket of goods and averaging them based on their relative weight in the whole basket. The prices in consideration are the retail prices of each item, as available for purchase by the individual citizens. CPI can impact the value of one currency in relation to those of other nations.

Changes in the CPI are used to assess price changes associated with the cost of living , making it one of the most frequently used statistics for identifying periods of inflation or deflation. In the U.S., the Bureau of Labor Statistics (BLS) reports the CPI on a monthly basis and has calculated it as far back as 1913.

The CPI-U, which was introduced in 1978, represents the buying habits of approximately 88% of the non-institutional population of the United States.

The Wholesale Price Index (WPI)

The WPI is another popular measure of inflation. It measures and tracks the changes in the price of goods in the stages before the retail level.

While WPI items vary from one country to another, they mostly include items at the producer or wholesale level. For example, it includes cotton prices for raw cotton, cotton yarn, cotton gray goods, and cotton clothing.

Although many countries and organizations use WPI, many other countries, including the U.S., use a similar variant called the producer price index (PPI) .

The Producer Price Index (PPI)

The PPI is a family of indexes that measures the average change in selling prices received by domestic producers of intermediate goods and services over time. The PPI measures price changes from the perspective of the seller and differs from the CPI which measures price changes from the perspective of the buyer.

In all variants, the rise in the price of one component (say oil) may cancel out the price decline in another (say wheat) to a certain extent. Overall, each index represents the average weighted price change for the given constituents which may apply at the overall economy, sector , or commodity level.

The Formula for Measuring Inflation

The above-mentioned variants of price indexes can be used to calculate the value of inflation between two particular months (or years). While a lot of ready-made inflation calculators are already available on various financial portals and websites, it is always better to be aware of the underlying methodology to ensure accuracy with a clear understanding of the calculations. Mathematically,

Percent Inflation Rate = (Final CPI Index Value ÷ Initial CPI Value) x 100

Say you wish to know how the purchasing power of $10,000 changed between January 1975 and January 2024. One can find price index data on various portals in a tabular form. From that table, pick up the corresponding CPI figures for the given two months. For September 1975, it was 52.1 (initial CPI value) and for January 2024, it was 308.417 (final CPI value).

Plugging in the formula yields:

Percent Inflation Rate = (308.417 ÷ 52.1) x 100 = (5.9197) x 100 = 591.97%

Since you wish to know how much $10,000 from January 1975 would be worth in January 2024, multiply the inflation rate by the amount to get the changed dollar value:

Change in Dollar Value = 5.9197 x $10,000 = $59,197

This means that $10,000 in January 1975 will be worth $59,197 today. Essentially, if you purchased a basket of goods and services (as included in the CPI definition) worth $10,000 in 1975, the same basket would cost you $59,197 in January 2024.

Advantages and Disadvantages of Inflation

Inflation can be construed as either a good or a bad thing, depending upon which side one takes, and how rapidly the change occurs.

Individuals with tangible assets (like property or stocked commodities) priced in their home currency may like to see some inflation as that raises the price of their assets, which they can sell at a higher rate.

Inflation often leads to speculation by businesses in risky projects and by individuals who invest in company stocks because they expect better returns than inflation.

An optimum level of inflation is often promoted to encourage spending to a certain extent instead of saving. If the purchasing power of money falls over time, there may be a greater incentive to spend now instead of saving and spending later. It may increase spending, which may boost economic activities in a country. A balanced approach is thought to keep the inflation value in an optimum and desirable range.

Disadvantages

Buyers of such assets may not be happy with inflation, as they will be required to shell out more money. People who hold assets valued in their home currency, such as cash or bonds, may not like inflation, as it erodes the real value of their holdings.

As such, investors looking to protect their portfolios from inflation should consider inflation-hedged asset classes, such as gold, commodities, and real estate investment trusts (REITs). Inflation-indexed bonds are another popular option for investors to profit from inflation .

High and variable rates of inflation can impose major costs on an economy. Businesses, workers, and consumers must all account for the effects of generally rising prices in their buying, selling, and planning decisions.

This introduces an additional source of uncertainty into the economy, because they may guess wrong about the rate of future inflation. Time and resources expended on researching, estimating, and adjusting economic behavior are expected to rise to the general level of prices. That's opposed to real economic fundamentals, which inevitably represent a cost to the economy as a whole.

Even a low, stable, and easily predictable rate of inflation, which some consider otherwise optimal, may lead to serious problems in the economy. That's because of how, where, and when the new money enters the economy.

Whenever new money and credit enter the economy, it is always in the hands of specific individuals or business firms. The process of price level adjustments to the new money supply proceeds as they then spend the new money and it circulates from hand to hand and account to account through the economy.

Inflation does drive up some prices first and drives up other prices later. This sequential change in purchasing power and prices (known as the Cantillon effect) means that the process of inflation not only increases the general price level over time. But it also distorts relative prices , wages, and rates of return along the way.

Economists, in general, understand that distortions of relative prices away from their economic equilibrium are not good for the economy, and Austrian economists even believe this process to be a major driver of cycles of recession in the economy.

Leads to higher resale value of assets

Optimum levels of inflation encourage spending

Buyers have to pay more for products and services

Impose higher prices on the economy

Drives some prices up first and others later

How Inflation Can Be Controlled

A country’s financial regulator shoulders the important responsibility of keeping inflation in check. It is done by implementing measures through monetary policy , which refers to the actions of a central bank or other committees that determine the size and rate of growth of the money supply.

In the U.S., the Fed's monetary policy goals include moderate long-term interest rates, price stability, and maximum employment. Each of these goals is intended to promote a stable financial environment. The Federal Reserve clearly communicates long-term inflation goals in order to keep a steady long-term rate of inflation , which is thought to be beneficial to the economy.

Price stability or a relatively constant level of inflation allows businesses to plan for the future since they know what to expect. The Fed believes that this will promote maximum employment, which is determined by non-monetary factors that fluctuate over time and are therefore subject to change.

For this reason, the Fed doesn't set a specific goal for maximum employment, and it is largely determined by employers' assessments. Maximum employment does not mean zero unemployment, as at any given time there is a certain level of volatility as people vacate and start new jobs.

Hyperinflation is often described as a period of inflation of 50% or more per month.

Monetary authorities also take exceptional measures in extreme conditions of the economy. For instance, following the 2008 financial crisis, the U.S. Fed kept the interest rates near zero and pursued a bond-buying program called quantitative easing (QE) .

Some critics of the program alleged it would cause a spike in inflation in the U.S. dollar, but inflation peaked in 2007 and declined steadily over the next eight years. There are many complex reasons why QE didn't lead to inflation or hyperinflation , though the simplest explanation is that the recession itself was a very prominent deflationary environment, and quantitative easing supported its effects.

Consequently, U.S. policymakers have attempted to keep inflation steady at around 2% per year. The European Central Bank (ECB) has also pursued aggressive quantitative easing to counter deflation in the eurozone, and some places have experienced negative interest rates . That's due to fears that deflation could take hold in the eurozone and lead to economic stagnation.

Moreover, countries that experience higher rates of growth can absorb higher rates of inflation. India's target is around 4% (with an upper tolerance of 6% and a lower tolerance of 2%), while Brazil aims for 3.25% (with an upper tolerance of 4.75% and a lower tolerance of 1.75%).

Meaning of Inflation, Deflation, and Disinflation

While a high inflation rate means that prices are increasing, a low inflation rate does not mean that prices are falling. Counterintuitively, when the inflation rate falls, prices are still increasing, but at a slower rate than before. When the inflation rate falls (but remains positive) this is known as disinflation .

Conversely, if the inflation rate becomes negative, that means that prices are falling. This is known as deflation , which can have negative effects on an economy. Because buying power increases over time, consumers have less incentive to spend money in the short term, resulting in falling economic activity.

Hedging Against Inflation

Stocks are considered to be the best hedge against inflation , as the rise in stock prices is inclusive of the effects of inflation. Since additions to the money supply in virtually all modern economies occur as bank credit injections through the financial system, much of the immediate effect on prices happens in financial assets that are priced in their home currency, such as stocks.

Special financial instruments exist that one can use to safeguard investments against inflation . They include Treasury Inflation-Protected Securities (TIPS) , low-risk treasury security that is indexed to inflation where the principal amount invested is increased by the percentage of inflation.

One can also opt for a TIPS mutual fund or TIPS-based exchange-traded fund (ETF). To get access to stocks, ETFs, and other funds that can help avoid the dangers of inflation, you'll likely need a brokerage account. Choosing a stockbroker can be a tedious process due to the variety among them.

Gold is also considered to be a hedge against inflation, although this doesn't always appear to be the case looking backward.

Examples of Inflation

Since all world currencies are fiat money , the money supply could increase rapidly for political reasons, resulting in rapid price level increases. The most famous example is the hyperinflation that struck the German Weimar Republic in the early 1920s.

The nations that were victorious in World War I demanded reparations from Germany, which could not be paid in German paper currency, as this was of suspect value due to government borrowing. Germany attempted to print paper notes, buy foreign currency with them, and use that to pay their debts.

This policy led to the rapid devaluation of the German mark along with the hyperinflation that accompanied the development. German consumers responded to the cycle by trying to spend their money as fast as possible, understanding that it would be worth less and less the longer they waited. More money flooded the economy, and its value plummeted to the point where people would paper their walls with practically worthless bills. Similar situations occurred in Peru in 1990 and in Zimbabwe between 2007 and 2008.

What Causes Inflation?

There are three main causes of inflation: demand-pull inflation, cost-push inflation, and built-in inflation.

- Demand-pull inflation refers to situations where there are not enough products or services being produced to keep up with demand, causing their prices to increase.

- Cost-push inflation, on the other hand, occurs when the cost of producing products and services rises, forcing businesses to raise their prices.

- Built-in inflation (which is sometimes referred to as a wage-price spiral) occurs when workers demand higher wages to keep up with rising living costs. This in turn causes businesses to raise their prices in order to offset their rising wage costs, leading to a self-reinforcing loop of wage and price increases.

Is Inflation Good or Bad?

Too much inflation is generally considered bad for an economy, while too little inflation is also considered harmful. Many economists advocate for a middle ground of low to moderate inflation, of around 2% per year.

Generally speaking, higher inflation harms savers because it erodes the purchasing power of the money they have saved; however, it can benefit borrowers because the inflation-adjusted value of their outstanding debts shrinks over time.

What Are the Effects of Inflation?

Inflation can affect the economy in several ways. For example, if inflation causes a nation’s currency to decline, this can benefit exporters by making their goods more affordable when priced in the currency of foreign nations.

On the other hand, this could harm importers by making foreign-made goods more expensive. Higher inflation can also encourage spending, as consumers will aim to purchase goods quickly before their prices rise further. Savers, on the other hand, could see the real value of their savings erode, limiting their ability to spend or invest in the future.

Why Is Inflation So High As of 2024?

In 2022, inflation rates around the world rose to their highest levels since the early 1980s. While there is no single reason for this rapid rise in global prices, a series of events worked together to boost inflation to such high levels.

The COVID-19 pandemic led to lockdowns and other restrictions that greatly disrupted global supply chains, from factory closures to bottlenecks at maritime ports. Governments also issued stimulus checks and increased unemployment benefits to counter the financial impact on individuals and small businesses. When vaccines became widespread and the economy bounced back, demand (fueled in part by stimulus money and low interest rates) quickly outpaced supply, which still struggled to get back to pre-COVID levels.

Russia's unprovoked invasion of Ukraine in early 2022 led to economic sanctions and trade restrictions on Russia, limiting the world's supply of oil and gas since Russia is a large producer of fossil fuels. Food prices also rose as Ukraine's large grain harvests could not be exported. As fuel and food prices rose, it led to similar increases down the value chains. The Fed raised interest rates to combat the high inflation, which significantly came down in 2023, though it remains above pre-pandemic levels .

Inflation is a rise in prices, which results in the decline of purchasing power over time. Inflation is natural and the U.S. government targets an annual inflation rate of 2%; however, inflation can be dangerous when it increases too much, too fast.

Inflation makes items more expensive, especially if wages do not rise by the same levels of inflation. Additionally, inflation erodes the value of some assets, especially cash. Governments and central banks seek to control inflation through monetary policy.

U.S. Bureau of Labor Statistics. " CONSUMER PRICE INDEX ," Page 1.

Edo, Anthony, and Melitz, Jacques. " The Primary Cause of European Inflation in 1500-1700: Precious Metals or Population? The English Evidence ." CEPII Working Paper , October 2019, pp. 13-14. Download PDF.

U.S. Bureau of Labor Statistics. " Consumer Price Index: Overview ."

U.S. Bureau of Labor Statistics. " Chapter 17. The Consumer Price Index (Updated 2-14-2018) ," Page 2.

U.S. Bureau of Labor Statistics. " Consumer Price Index Chronology ."

U.S. Bureau of Labor Statistics. " Producer Price Index Frequently Asked Questions (FAQs) ," Select "4. How does the Producer Price Index differ from the Consumer Price Index?"

U.S. Bureau of Labor Statistics. " Producer Price Index Frequently Asked Questions (FAQs) ," Select "3. When did the Wholesale Price Index become the Producer Price Index?"

U.S. Bureau of Labor Statistics. " Producer Price Indexes ."

U.S. Bureau of Labor Statistics. " Consumer Price Index Historical Tables for U.S. City Average ."

U.S. Bureau of Labor Statistics. " Historical CPI-U ," Page 3.

Adam Smith Institute. " The Cantillion Effect ."

Foundation for Economic Education. " The Current Economic Crisis and the Austrian Theory of the Business Cycle ."

Board of Governors of the Federal Reserve System. " Review of Monetary Policy Strategy, Tools, and Communication ."

Board of Governors of the Federal Reserve System. " What is the Lowest Level of Unemployment that the U.S. Economy Can Sustain? "

Fischer, Stanley and et al. " Modern Hyper- and High Inflations ." Journal of Economic Literature , vol. 40, no. 3, September 2002, pp. 837.

Federal Reserve History. " The Great Recession and its Aftermath ."

Federal Reserve Bank of New York. " Liberty Street Economics: Ten Years Later—Did QE Work? "

Congressional Budget Office. " How the Federal Reserve’s Quantitative Easing Affects the Federal Budget ."

Board of Governors of the Federal Reserve System. " FAQs: Why Does the Federal Reserve Aim for Inflation of 2 Percent Over the Longer Run? "

European Central Bank. " How Quantitative Easing Works ."

Reserve Bank of India. " Monetary Policy ," Select "The Monetary Policy Framework."

Central Bank of Brazil. " Inflation Targeting Track Record ."

TreasuryDirect. " Treasury Inflation-Protected Securities (TIPS) ."

University of Illinois, Urbana-Champaign. " 1920s Hyperinflation in Germany and Bank Notes ."

Rossini, Renzo (Editors Alejandro M. Werner and Alejandro Santos). " Staying the Course of Economic Success: Chapter 2. Peru’s Recent Economic History: From Stagnation, Disarray, and Mismanagement to Growth, Stability, and Quality Policies ." International Monetary Fund, September 2015.

Kramarenko, Vitaliy and et al. " Zimbabwe: Challenges and Policy Options after Hyperinflation ." International Monetary Fund , June 2010, no. 6.

The World Bank. " Inflation, Consumer Prices (Annual %) ."

Federal Reserve Bank of St. Louis, FRED. " Consumer Price Index for All Urban Consumers: All Items in U.S. City Average ."

Board of Governors of the Federal Reserve System. " Open Market Operations ."

:max_bytes(150000):strip_icc():format(webp)/-statue-of-alexander-hamilton-in-front-of-the-united-states-department-of-treasury-washington-d-c-73071086-5750d6b43df78c9b466d6f15.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Free Samples

- Premium Essays

- Editing Services Editing Proofreading Rewriting

- Extra Tools Essay Topic Generator Thesis Generator Citation Generator GPA Calculator Study Guides Donate Paper

- Essay Writing Help

- About Us About Us Testimonials FAQ

Essays on inflation

- Studentshare

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY

Economic essays on inflation

- Definition – Inflation – Inflation is a sustained rise in the cost of living and average price level.

- Causes Inflation – Inflation is caused by excess demand in the economy, a rise in costs of production, rapid growth in the money supply.

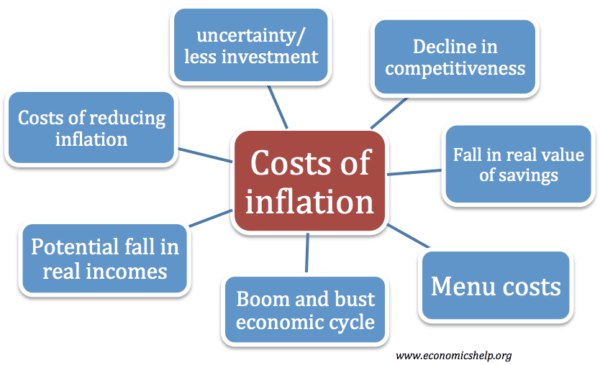

- Costs of Inflation – Inflation causes decline in value of savings, uncertainty, confusion and can lead to lower investment.

- Problems measuring inflation – why it can be hard to measure inflation with changing goods.

- Different types of inflation – cost-push inflation, demand-pull inflation, wage-price spiral,

- How to solve inflation . Policies to reduce inflation, including monetary policy, fiscal policy and supply-side policies.

- Trade off between inflation and unemployment . Is there a trade-off between the two, as Phillips Curve suggests?

- The relationship between inflation and the exchange rate – Why high inflation can lead to a depreciation in the exchange rate.

- What should the inflation target be? – Why do government typically target inflation of 2%

- Deflation – why falling prices can lead to negative economic growth.

- Monetarist Theory – Monetarist theory of inflation emphasises the role of the money supply.

- Criticisms of Monetarism – A look at whether the monetarist theory holds up to real-world scenarios.

- Money Supply – What the money supply is.

- Can we have economic growth without inflation?

- Predicting inflation

- Link between inflation and interest rates

- Should low inflation be the primary macroeconomic objective?

See also notes on Unemployment

- Entertainment

- Environment

- Information Science and Technology

- Social Issues

Home Essay Samples Government

Essay Samples on Inflation

How to reduce inflation: the role of monetary policy and measures.

Inflation, the persistent rise in the general price level, poses challenges for individuals, businesses, and economies as a whole. Controlling and reducing inflation is a crucial objective for policymakers seeking to maintain stable economic conditions. There are several ways how to reduce inflation and this...

- Monetary Policy

Unraveling Theories of Inflation in Economics and Its Problem Nature

Inflation is the continual rise in prices, this is also known as a monetary problem. There are different monetary policies in order to keep inflation below a certain level one of these consist of inflation targeting which allows banks to keep a good stability on...

- Economic Problem

How to Reduce Unemployment: What the Government Can Do for People

Unemployment is defined as 'People willing and able to work at the current rate of pay but who are unable to find a job'. There are a number of types of unemployment, including structural, cyclical, seasonal and frictional unemployment. Unemployment is a key measure of...

- Unemployment

Teachers And Professional Athletes Are Paid Differently: Teachers Should Be Paid More

Is it fair that Teachers and Professional Athletes are paid differently? I think the real question should be if they can even be categorized the same. I don't believe the wages of the two can even compare, simply because who is to say one is...

The Political Stance on Raising the Minimum Wage

The lowest wage permitted by law or by a special agreement is a country’s Minimum wage [1]. With a population of 7.6 billion people in the world of whom 2.5 billion live on less than $2 a day [2]. The cost of water in the...

- Minimum Wage

Stressed out with your paper?

Consider using writing assistance:

- 100% unique papers

- 3 hrs deadline option

Minimum Wage: The Slow Increase and Development History

Politicians had been advocating for minimum salary growth often over the previous couple of years and elections. Most Democrats argue for growth at the same time as Republicans generally oppose it. Democrats say we want a boom in the minimal salary to raise human beings...

The Effects of Inflation on a Financial Situation of People

Have you ever thought about how inflation can affect us in a financial sense? This paper will go in-depth and explain the causes of inflation and how it affects consumer behavior, income, investment, and business. In this paper we will go over the methods on...

- Financial Crisis

Understanding Inflation'S Dangers To Philippine Economy

Throughout the most parts of the world, consistent efforts are placed to reduce skyrocketing inflation rates to fall on targeted bands of an economy. Motivated by the convention that inflation bring harmful effects. In the Philippines’ inflation rate soared up to 6.7% for months September...

- Philippines

How Does Inflation Affect the Imbalance of Payments

Inflation rate is a significant variable in economy and affected nation’s balance of payments. It is determined as a stable increase in the overall price level of goods and services in the economy. According to Quah and Vahey (1995), inflation rate is general increase in...

- World Economy

Perception Of Ofw Children On The Inflation In Saudi Arabia

Introduction The economy is a man-made organization with the purpose of satisfying human wants by using limited or scarce resources available and known to a society (Aggarwal & Devi, 2002). It encompasses all of the activities involved in the production and distribution of goods and...

- Saudi Arabia

Effect Of Rupee Depreciation On Indian Economy

Lower value of Currency leads to rattle the economic growth of every small scale to large scale business affecting the population adversely. The terms Inflation, Price Hike, Imports, and taxes can’t remain untouched with the inclusion of Currency Depreciation for any country. Ultimately the financial...

Best topics on Inflation

1. How to Reduce Inflation: the Role of Monetary Policy and Measures

2. Unraveling Theories of Inflation in Economics and Its Problem Nature

3. How to Reduce Unemployment: What the Government Can Do for People

4. Teachers And Professional Athletes Are Paid Differently: Teachers Should Be Paid More

5. The Political Stance on Raising the Minimum Wage

6. Minimum Wage: The Slow Increase and Development History

7. The Effects of Inflation on a Financial Situation of People

8. Understanding Inflation’S Dangers To Philippine Economy

9. How Does Inflation Affect the Imbalance of Payments

10. Perception Of Ofw Children On The Inflation In Saudi Arabia

11. Effect Of Rupee Depreciation On Indian Economy

- Police Brutality

- Gun Control

- Community Policing

- Abraham Lincoln

- Fire Safety

- Declaration of Independence

- Gerrymandering

- American Government

- Infrastructure

Need writing help?

You can always rely on us no matter what type of paper you need

*No hidden charges

100% Unique Essays

Absolutely Confidential

Money Back Guarantee

By clicking “Send Essay”, you agree to our Terms of service and Privacy statement. We will occasionally send you account related emails

You can also get a UNIQUE essay on this or any other topic

Thank you! We’ll contact you as soon as possible.

Essay on Inflation

Students are often asked to write an essay on Inflation in their schools and colleges. And if you’re also looking for the same, we have created 100-word, 250-word, and 500-word essays on the topic.

Let’s take a look…

100 Words Essay on Inflation

Understanding inflation.

Inflation is when prices of goods and services rise over time. This means you need more money to buy the same things. It’s like a slow-motion robbery!

Causes of Inflation

Inflation is often due to increased production costs or increased demand for goods and services. When people want more of something, and it’s scarce, prices go up.

Impact of Inflation

Inflation affects everyone. If your income doesn’t increase as fast as inflation, you’ll have less buying power. But, if you’re a business owner, you might be able to raise prices and make more money.

Controlling Inflation

Governments try to control inflation by adjusting interest rates, taxes, and government spending. It’s a tricky balancing act to keep inflation low but not too low.

Also check:

250 Words Essay on Inflation

Inflation, a crucial economic concept, refers to the rate at which the general level of prices for goods and services is rising, subsequently eroding purchasing power. It’s an indicator of the economic health of a nation, with moderate inflation signifying a growing economy.

The Causes of Inflation

Inflation generally occurs due to two primary factors: demand-pull and cost-push inflation. Demand-pull inflation transpires when demand for goods and services surpasses their supply. On the other hand, cost-push inflation arises when the costs of production escalate, causing producers to increase prices to maintain profit margins.

Effects of Inflation

Inflation impacts various aspects of the economy. It erodes the purchasing power of money, causing consumers to spend more for the same goods or services. Inflation can also create uncertainty in the economy, affecting investment and saving decisions. However, moderate inflation can stimulate spending and investment, driving economic growth.

Managing Inflation

Central banks attempt to control inflation through monetary policy. By adjusting interest rates, they influence the level of spending and investment in the economy. Higher interest rates typically reduce spending, curbing inflation. Conversely, lower interest rates stimulate spending, potentially leading to inflation.

Inflation is a complex and multifaceted subject. Understanding its causes, effects, and the measures to control it is essential for both macroeconomic stability and individual financial well-being. As future leaders, it’s crucial for us as students to grasp these concepts to make informed decisions in our professional and personal lives.

500 Words Essay on Inflation

Introduction to inflation.

Inflation is primarily caused by an increase in the money supply that outpaces economic growth. Ever since the end of the gold standard, governments have had the ability to create money at will. If a nation’s money supply grows too rapidly compared to its production of goods and services, prices will increase, leading to inflation.