Bank Business Plan Template

Written by Dave Lavinsky

Bank Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their banks.

If you’re unfamiliar with creating a bank business plan, you may think creating one will be a time-consuming and frustrating process. For most entrepreneurs it is, but for you, it won’t be since we’re here to help. We have the experience, resources, and knowledge to help you create a great business plan.

In this article, you will learn some background information on why business planning is important. Then, you will learn how to write a bank business plan step-by-step so you can create your plan today.

Download our Ultimate Business Plan Template here >

What Is a Bank Business Plan?

A business plan provides a snapshot of your bank as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategies for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for Your Bank Business

If you’re looking to start a bank or grow your existing bank, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your bank to improve your chances of success. Your bank business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Banks

With regards to funding, the main sources of funding for a bank are personal savings, credit cards, bank loans, and angel investors. When it comes to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to ensure that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for banks.

Finish Your Business Plan Today!

How to write a business plan for a bank.

If you want to start a bank or expand your current one, you need a business plan. The guide below details the necessary information for how to write each essential component of your bank business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your executive summary is to quickly engage the reader. Explain to them the kind of bank you are running and the status. For example, are you a startup, do you have a bank that you would like to grow, or are you operating a chain of banks?

Next, provide an overview of each of the subsequent sections of your plan.

- Give a brief overview of the bank industry.

- Discuss the type of bank you are operating.

- Detail your direct competitors. Give an overview of your target customers.

- Provide a snapshot of your marketing strategy. Identify the key members of your team.

- Offer an overview of your financial plan.

Company Overview

In your company overview, you will detail the type of bank you are operating.

For example, you might specialize in one of the following types of banks:

- Commercial bank : this type of bank tends to concentrate on supporting businesses. Both large corporations and small businesses can turn to commercial banks if they need to open a checking or savings account, borrow money, obtain access to credit or transfer funds to companies in foreign markets.

- Credit union: this type of bank operates much like a traditional bank (issues loans, provides checking and savings accounts, etc.) but banks are for-profit whereas credit unions are not. Credit unions fall under the direction of their own members. They tend to serve people affiliated with a particular group, such as people living in the same area, low-income members of a community or armed service members. They also tend to charge lower fees and offer lower loan rates.

- Retail bank: retail banks can be traditional, brick-and-mortar brands that customers can access in-person, online, or through their mobile phones. They also offer general public financial products and services such as bank accounts, loans, credit cards, and insurance.

- Investment bank: this type of bank manages the trading of stocks, bonds, and other securities between companies and investors. They also advise individuals and corporations who need financial guidance, reorganize companies through mergers and acquisitions, manage investment portfolios or raise money for certain businesses and the federal government.

In addition to explaining the type of bank you will operate, the company overview needs to provide background on the business.

Include answers to questions such as:

- When and why did you start the business?

- What milestones have you achieved to date? Milestones could include the number of clients served, the number of clients with positive reviews, reaching X number of clients served, etc.

- Your legal business Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your legal structure here.

Industry Analysis

In your industry or market analysis, you need to provide an overview of the bank industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the bank industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your marketing strategy, particularly if your analysis identifies market trends.

The third reason is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section of your bank business plan:

- How big is the bank industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential target market for your bank? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section of your bank business plan must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, small businesses, families, and corporations.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of bank you operate. Clearly, corporations would respond to different marketing promotions than individuals, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, including a discussion of the ages, genders, locations, and income levels of the potential customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can recognize and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Bank Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other banks.

Indirect competitors are other options that customers have to purchase from that aren’t directly competing with your product or service. This includes trust accounts, investment companies, or the stock market. You need to mention such competition as well.

For each such competitor, provide an overview of their business and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as

- What types of customers do they serve?

- What type of bank are they?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide loans and retirement savings accounts?

- Will you offer products or services that your competition doesn’t?

- Will you provide better customer service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a bank business plan, your marketing strategy should include the following:

Product : In the product section, you should reiterate the type of bank company that you documented in your company overview. Then, detail the specific products or services you will be offering. For example, will you provide savings accounts, auto loans, mortgage loans, or financial advice?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your plan, you are presenting the products and/or services you offer and their prices.

Place : Place refers to the site of your bank. Document where your company is situated and mention how the site will impact your success. For example, is your bank located in a busy retail district, a business district, a standalone office, or purely online? Discuss how your site might be the ideal location for your customers.

Promotions : The final part of your bank marketing plan is where you will document how you will drive potential customers to your location(s). The following are some promotional methods you might consider:

- Advertise in local papers, radio stations and/or magazines

- Reach out to websites

- Distribute flyers

- Engage in email marketing

- Advertise on social media platforms

- Improve the SEO (search engine optimization) on your website for targeted keywords

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. Your operations plan should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your bank, including reconciling accounts, customer service, accounting, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to sign up your Xth customer, or when you hope to reach $X in revenue. It could also be when you expect to expand your bank to a new city.

Management Team

To demonstrate your bank’s potential to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally, you and/or your team members have direct experience in managing banks. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act as mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a bank or successfully running a small financial advisory firm.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet, and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenue and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you see 5 clients per day, and/or offer sign up bonuses? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your bank, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a lender writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

Your cash flow statement will help determine how much money you need to start or grow your business, and ensure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

When creating your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a bank:

- Cost of furniture and office supplies

- Payroll or salaries paid to staff

- Business insurance

- Other start-up expenses (if you’re a new business) like legal expenses, permits, computer software, and equipment

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your bank location lease or a list of accounts and loans you plan to offer.

Writing a business plan for your bank is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will understand the bank industry, your competition, and your customers. You will develop a marketing strategy and will understand what it takes to launch and grow a successful bank.

Bank Business Plan Template FAQs

What is the easiest way to complete my bank business plan.

Growthink's Ultimate Business Plan Template allows you to quickly and easily write your bank business plan.

How Do You Start a Bank Business?

Starting a bank business is easy with these 14 steps:

- Choose the Name for Your Bank Business

- Create Your Bank Business Plan

- Choose the Legal Structure for Your Bank Business

- Secure Startup Funding for Your Bank Business (If Needed)

- Secure a Location for Your Business

- Register Your Bank Business with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Bank Business

- Buy or Lease the Right Bank Business Equipment

- Develop Your Bank Business Marketing Materials

- Purchase and Setup the Software Needed to Run Your Bank Business

- Open for Business

Don’t you wish there was a faster, easier way to finish your Bank business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how a Growthink business plan consultant can create your business plan for you.

Other Helpful Business Plan Articles & Templates

Need a business plan? Call now:

Talk to our experts:

- Business Plan for Investors

- Bank/SBA Business Plan

- Operational/Strategic Planning

- L1 Visa Business Plan

- E1 Treaty Trader Visa Business Plan

- E2 Treaty Investor Visa Business Plan

- EB1 Business Plan

- EB2 Visa Business Plan

- EB5 Business Plan

- Innovator Founder Visa Business Plan

- UK Start-Up Visa Business Plan

- UK Expansion Worker Visa Business Plan

- Manitoba MPNP Visa Business Plan

- Start-Up Visa Business Plan

- Nova Scotia NSNP Visa Business Plan

- British Columbia BC PNP Visa Business Plan

- Self-Employed Visa Business Plan

- OINP Entrepreneur Stream Business Plan

- LMIA Owner Operator Business Plan

- ICT Work Permit Business Plan

- LMIA Mobility Program – C11 Entrepreneur Business Plan

- USMCA (ex-NAFTA) Business Plan

- Franchise Business Planning

- Landlord Business Plan

- Nonprofit Start-Up Business Plan

- USDA Business Plan

- Cannabis business plan

- eCommerce business plan

- Online Boutique Business Plan

- Mobile Application Business Plan

- Daycare business plan

- Restaurant business plan

- Food Delivery Business Plan

- Real Estate Business Plan

- Business Continuity Plan

- Buy Side Due Diligence Services

- ICO whitepaper

- ICO consulting services

- Confidential Information Memorandum

- Private Placement Memorandum

- Feasibility study

- Fractional CFO

- How it works

- Business Plan Examples

How to Write a Business Plan to Start a Bank

Published Feb.29, 2024

Updated Apr.23, 2024

By: Alex Silensky

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

Table of Content

Bank Business Plan Checklist

A bank business plan is a document that describes the bank’s goals, strategies, operations, and financial projections. It communicates the bank’s vision and value proposition to potential investors, regulators, and stakeholders. A SBA business plan should be clear, concise, and realistic. It should also cover all the essential aspects of the bank’s business model.

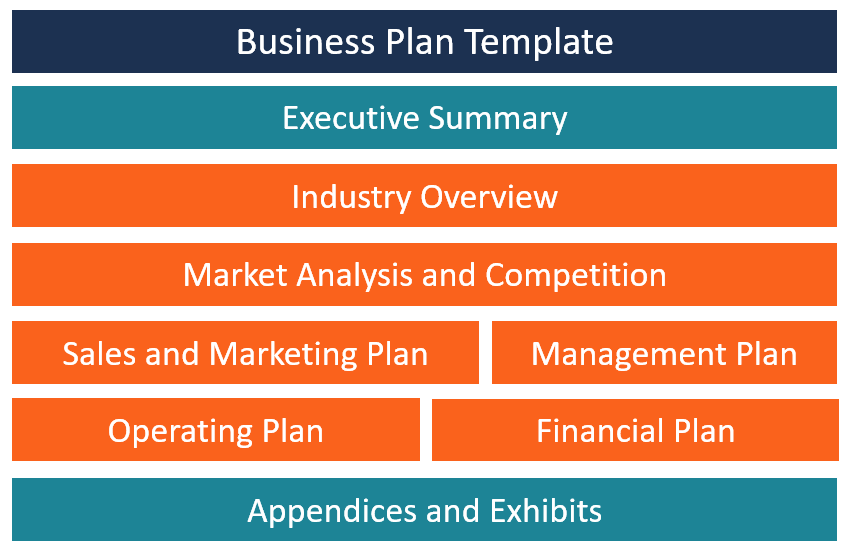

Here is a checklist of the main sections that you should keep in mind while building a bank business plan:

- Executive summary

- Company description

- Industry analysis

- Competitive analysis

- Service or product list

- Marketing and sales plan

- Operations plan

- Management team

- Funding request

- Financial plan

Sample Business Plan for Bank

The following is a bank business plan template that operates in the USA. This bank business plan example is regarding ABC Bank, and it includes the following sections:

Executive Summary

ABC Bank is a new bank for California’s SMBs and individuals. We offer convenient banking services tailored to our customers’ needs and preferences. We have a large target market with over 500,000 SMBs spending billions on banking services annually. We have the licenses and approvals to operate our bank and raised $20 million in seed funding. We are looking for another $30 million in debt financing.

Our goal is to launch our bank by the end of 2024 and achieve the following objectives in the first five years of operation:

- Acquire 100,000 customers and 10% market share

- Generate $100 million in annual revenue and $20 million in net profit

- Achieve a return on equity (ROE) of 15% and a return on assets (ROA) of 1.5%

- Expand our network to 10 branches and 50 ATMs

- Increase our brand awareness and customer loyalty

Our bank has great potential to succeed and grow in the banking industry. We invite you to read the rest of our microfinance business plan to learn about how to set up a business plan for the bank and how we will achieve our goals.

Industry Analysis

California has one of the biggest and most active banking industries in the US and the world. According to the Federal Deposit Insurance Corp , California has 128 financial institutions, with total assets exceeding $560 billion.

The California banking industry is regulated and supervised by various federal and state authorities. However, they also face several risks and challenges, such as:

- High competition and consolidation

- Increasing regulation and compliance

- Rising customer demand for digital and mobile banking

- Cyberattacks and data breaches

- Environmental and social issues

The banking industry in California is highly competitive and fragmented. According to the FDIC, the top 10 banks and thrifts in California by total deposits as of June 30, 2023, were:

Customer Analysis

We serve SMBs who need local, easy, and cheap banking. We divide our customers into four segments by size, industry, location, and needs:

SMB Segment 1 – Tech SMBs in big cities of California. These are fast-growing, banking-intensive customers. They account for a fifth of our market share and a third of our revenue and are loyal and referable.

SMB Segment 2 – Entertainment SMBs in California’s entertainment hubs. These are high-profile, banking-heavy customers. They make up a sixth of our market and a fourth of our revenue and are loyal and influential.

SMB Segment 3 – Tourism SMBs in California’s tourist spots. These are seasonal, banking-dependent customers. They represent a quarter of our market and a fifth of our revenue and are loyal and satisfied.

SMB Segment 4 – Other SMBs in various regions of California. These are slow-growing, banking-light customers. They constitute two-fifths of our market and a quarter of our revenue and are loyal and stable.

Competitive Analysis

We compete with other banks and financial institutions that offer similar or substitute products and services to our target customers in our target market. We group our competitors into four categories based on their size and scope:

1. National Banks

- Key Players – Bank of America, Wells Fargo, JPMorgan Chase, Citibank, U.S. Bank

- Strengths – Large customer base, strong brand, extensive branch/ATM network, innovation, robust operations, solid financial performance

- Weaknesses – High competition, regulatory costs, low customer satisfaction, high attrition

- Strategies – Maintain dominance through customer acquisition/retention, revenue growth, efficiency

2. Regional Banks

- Key Players – MUFG Union Bank, Bank of the West, First Republic Bank, Silicon Valley Bank, East West Bank

- Strengths – Loyal customer base, brand recognition, convenient branch/ATM network, flexible operations

- Weaknesses – Moderate competition, regulatory costs, customer attrition

- Strategies – Grow market presence through customer acquisition/retention, revenue optimization, efficiency

3. Community Banks

- Key Players – Mechanics Bank, Bank of Marin, Pacific Premier Bank, Tri Counties Bank, Luther Burbank Savings

- Strengths – Small loyal customer base, reputation, convenient branches, ability to adapt

- Weaknesses – Low innovation and technology adoption

- Strategies – Maintain niche identity through customer loyalty, revenue optimization, efficiency

4. Online Banks

- Key Players – Ally Bank, Capital One 360, Discover Bank, Chime Bank, Varo Bank

- Strengths – Large growing customer base, strong brand, no branches, lean operations, high efficiency

- Weaknesses – High competition, regulatory costs, low customer satisfaction and trust, high attrition

- Strategies – Disrupt the industry by acquiring/retaining customers, optimizing revenue, improving efficiency

Market Research

Our market research shows that:

- California has a large, competitive, growing banking market with 128 banks and $560 billion in assets.

- Our target customers are the SMBs in California, which is 99.8% of the businesses and employ 7.2-7.4 million employees.

- Our main competitors are national and regional banks in California that offer similar banking products and services.

We conclude that:

- Based on the information provided in our loan officer business plan , there is a promising business opportunity for us to venture into and establish a presence in the banking market in California.

- We should focus on the SMBs in California, as they have various unmet banking needs, preferences, behavior, and a high potential for growth and profitability.

Operations Plan

Our operational structure and processes form the basis of our operations plan, and they are as follows:

- Location and Layout – We have a network of 10 branches and 50 ATMs across our target area in California. We strategically place our branches and ATMs in convenient and high-traffic locations.

- Equipment and Technology – We use modern equipment and technology to provide our products and services. We have computers and software for banking functions; security systems to protect branches and ATMs; communication systems to communicate with customers and staff; inventory and supplies to operate branches and ATMs.

- Suppliers and Vendors – We work with reliable suppliers and vendors that provide our inventory and supplies like cash, cards, paper, etc. We have supplier management systems to evaluate performance.

- Staff and Management – Our branches have staff like branch managers, customer service representatives, tellers, and ATM technicians with suitable qualifications and experience.

- Policies and Procedures – We have policies for customer service, cash handling, card handling, and paper handling to ensure quality, minimize losses, and comply with regulations. We use various tools and systems to implement these policies.

Management Team

The following individuals make up our management team:

- Earl Yao, CEO and Founder – Earl is responsible for establishing and guiding the bank’s vision, mission, strategy, and overall operations. He brings with him over 20 years of banking experience.

- Paula Wells, CFO and Co-Founder – Paula oversees financial planning, reporting, analysis, compliance, and risk management.

- Mark Hans, CTO – Mark leads our technology strategy, infrastructure, innovation, and digital transformation.

- Emma Smith, CMO – Emma is responsible for designing and implementing our marketing strategy and campaigns.

- David O’kane, COO – David manages the daily operations and processes of the bank ensuring our products and services meet the highest standards of quality and efficiency.

Financial Projections

Our assumptions and drivers form the basis of our financial projections, which are as follows:

Assumptions: We have made the following assumptions for our collection agency business plan :

- Start with 10 branches, 50 ATMs in January 2024

- Grow branches and ATMs 10% annually

- 10,000 customers per branch, 2,000 per ATM

- 5% average loan rate, 2% average deposit rate

- 80% average loan-to-deposit ratio

- $10 average fee per customer monthly

- $100,000 average operating expense per branch monthly

- $10,000 average operating expense per ATM monthly

- 25% average tax rate

Our financial projections are as per our:

- Projected Income Statement

- Projected Cash Flow Statement

- Projected Balance Sheet

- Projected Financial Ratios and Indicators

Select the Legal Framework for Your Bank

Our legal structure and requirements form the basis of our legal framework, which are as follows:

Legal Structure and Entity – We have chosen to incorporate our bank as a limited liability company (LLC) under the laws of California.

Members – We have two members who own and control our bank: Earl Yao and Paula Wells, the founders and co-founders of our bank.

Manager – We have appointed Mark Hans as our manager who oversees our bank’s day-to-day operations and activities.

Name – We have registered our bank’s name as ABC Bank LLC with the California Secretary of State. We have also obtained a trademark registration for our name and logo.

Registered Agent – We have designated XYZ Registered Agent Services LLC as our registered agent authorized to receive and handle legal notices and documents on behalf of our bank.

Licenses and Approvals – We have obtained the necessary licenses and approvals to operate our bank in California, including:

- Federal Deposit Insurance Corporation (FDIC) Insurance

- Federal Reserve System Membership

- California Department of Financial Protection and Innovation (DFPI) License

- Business License

- Employer Identification Number (EIN)

- Zoning and Building Permits

Legal Documents and Agreements – We have prepared and signed the necessary legal documents and agreements to form and operate our bank, including:

- Certificate of Formation

- Operating Agreement

- Membership Agreement

- Loan Agreement

- Card Agreement

- Paper Agreement

Keys to Success

We analyze our market, customers, competitors, and industry to determine our keys to success. We have identified the following keys to success for our bank.

Customer Satisfaction

Customer satisfaction is vital for any business, especially a bank relying on loyalty and referrals. It is the degree customers are happy with our products, services, and interactions. It is influenced by:

- Product and service quality – High-quality products and services that meet customer needs and preferences

- Customer service quality – Friendly, professional, and helpful customer service across channels

- Customer experience quality – Convenient, reliable, and secure customer access and transactions

We will measure satisfaction with surveys, feedback, mystery shopping, and net promoter scores. Our goal is a net promoter score of at least 8.

Operational Efficiency

Efficiency is key in a regulated, competitive environment. It is using resources and processes effectively to achieve goals and objectives. It is influenced by:

- Resource optimization – Effective and efficient use and control of capital, staff, and technology

- Process improvement – Streamlined, standardized processes measured for performance

- Performance management – Managing financial, operational, customer, and stakeholder performance

We will measure efficiency with KPIs, metrics, dashboards, and operational efficiency ratios. Our goal is an operational efficiency ratio below 50%.

Partner with OGSCapital for Your Bank Business Plan Success

Highly efficient service.

Highly Efficient Service! I am incredibly happy with the outcome; Alex and his team are highly efficient professionals with a diverse bank of knowledge.

Are you looking to hire business plan writers to start a bank business plan? At OGSCapital, we can help you create a customized and high-quality bank development business plan to meet your goals and exceed your expectations.

We have a team of senior business plan experts with extensive experience and expertise in various industries and markets. We will conduct thorough market research, develop a unique value proposition, design a compelling financial model, and craft a persuasive pitch deck for your business plan. We will also offer you strategic advice, guidance, and access to a network of investors and other crucial contacts.

We are not just a business plan writing service. We are a partner and a mentor who will support you throughout your entrepreneurial journey. We will help you achieve your business goals with smart solutions and professional advice. Contact us today and let us help you turn your business idea into a reality.

Frequently Asked Questions

How do I start a small bank business?

To start a small bank business in the US, you need to raise enough capital, understand how to make a business plan for the bank, apply for a federal or state charter, register your bank for taxes, open a business bank account, set up accounting, get the necessary permits and licenses, get bank insurance, define your brand, create your website, and set up your phone system.

Are banks profitable businesses?

Yes, banks are profitable businesses in the US. They earn money through interest on loans and fees for other services. The commercial banking industry in the US has grown 5.6% per year on average between 2018 and 2023.

Download Bank Business Plan Sample in pdf

OGSCapital’s team has assisted thousands of entrepreneurs with top-rate business plan development, consultancy and analysis. They’ve helped thousands of SME owners secure more than $1.5 billion in funding, and they can do the same for you.

Case: OGScapital Provides Quality of Earnings (QoE) Support

Ice Vending Machine Business Plan

OGScapital at the National Citizenship and Immigration Conference

How to Start a Plumbing Business in 2024: A Detailed Guide

Vegetable Farming Business Plan

Trading Business Plan

Any questions? Get in Touch!

We have been mentioned in the press:

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Search the site:

Small Business Resources is now the Center for Business Empowerment.

Suggested Keywords

Center for Business Empowerment

How to write an effective business plan in 11 steps (with workbook)

February 02, 2023 | 14 minute read

Writing a business plan is a powerful way to position your small business for success as you set out to meet your goals. Landmark studies suggest that business founders who write one are 16% more likely to build viable businesses than those who don’t and that entrepreneurs focused on high growth are 7% more likely to have written a business plan. 1 Even better, other research shows that owners who complete business plans are twice as likely to grow their business successfully or obtain capital compared with those who don’t. 2

The best time to write a business plan is typically after you have vetted and researched your business idea. (See How to start a business in 15 steps. ) If conditions change later, you can rewrite the plan, much like how your GPS reroutes you if there is traffic ahead. When you update your plan regularly, everyone on your team, including outside stakeholders such as investors, will know where you are headed.

What is a business plan?

Typically 15-20 pages long, a business plan is a document that explains what your business does, what you want to achieve in the business and the strategy you plan to use to get there. It details the opportunities you are going after, what resources you will need to achieve your goals and how you will define success.

Why are business plans important?

Business plans help you think through barriers and discover opportunities you may have recognized subconsciously but have not yet articulated. A business plan can also help you to attract potential lenders, investors and partners by providing them with evidence that your business has all of the ingredients necessary for success.

What questions should a business plan answer?

Your business plan should explain how your business will grow and succeed. A great plan will provide detailed answers to questions that a banker or investor will have before putting money into the business, such as:

- What products or services do you provide?

- Who is your target customer?

- What are the benefits of your product and service for customers?

- How much will you charge?

- What is the size of the market?

- What are your marketing plans?

- How much competition does the business face in penetrating that market?

- How much experience does the management team have in running businesses like it?

- How do you plan to measure success?

- What do you expect the business’s revenue, costs and profit to be for the first few years?

- How much will it cost to achieve the goals stated in the business plan?

- What is the long-term growth potential of the business? Is the business scalable?

- How will you enable investors to reap the rewards of backing the business? Do you plan to sell the business to a bigger company eventually or take it public as your “exit strategy”?

How to write a business plan in 11 steps

This step-by-step outline will make it easier to write an effective business plan, even if you’re managing the day-to-day demands of starting a new business. Creating a table of contents that lists key sections of the plan with page numbers will make it easy for readers to flip to the sections that interest them most.

- Use our editable workbook to capture notes and organize your thoughts as you review these critical steps. Note: To avoid losing your work, please remember to save this PDF to your desktop before you begin.

1. Executive summary

The executive summary is your opportunity to make a great first impression on investors and bankers. It should be just as engaging as the enthusiastic elevator pitch you might give if you bumped into a potential backer in an elevator.

In three to five paragraphs, you’ll want to explain what your business does, why it will succeed and where it will be in five years. The executive summary should include short descriptions of the following:

- Business concept. What will your business do?

- Goals and vision. What do you expect the business to achieve, both financially and for other key stakeholders, such as the community?

- Product or service. What does your product or service do — and how is it different from those of competitors?

- Target market. Who do you expect to buy your product or service?

- Marketing strategy. How will you tell people about your product or service?

- Current revenue and profits. If your business is pre-revenue, offer sales projections.

- Projected revenue and profits. Provide a realistic look at the next year, as well as the next three years, ideally.

- Financial resources needed. How much money do you need to borrow or raise to fund your plan?

- Management team. Who are the company’s leaders and what relevant experience will they contribute?

2. Business overview

Here is where you provide a brief history of the business and describe the product(s) or service(s) it offers. Make sure you describe the problem you are attempting to solve, for whom you will solve it (your customers) and how you will solve it. Be sure to describe your business model (such as direct-to-consumer sales through an online store) so readers can envision how you will make sales. Also mention your business structure (such as a sole proprietorship , general partnership, limited partnership or corporation) and why it is advantageous for the business. And be sure to provide context on the state of your industry and where your business will fit into it.

3. Business goals and vision

Explain what you hope to achieve in the business (your vision) as well as its mission and value proposition. Most founders judge success by the size to which they grow the business using measures such as revenue or number of employees. Your goals may not be solely financial. You may also wish to provide jobs or solve a societal problem. If that’s the case, mention those goals as well.

If you are seeking outside funding, explain why you need the money, how you will put it to work to grow the business and how you expect to achieve the goals you have set for the business. Also explain your exit strategy—that is, how you would enable investors to cash out, whether that means selling the business or taking it public.

4. Management and organization

Many investors say they bet on the team behind a business more than the business idea, trusting that talented and experienced people will be capable of bringing sound business concepts to life. With that in mind, make sure to provide short bios of the key members of your management team (including yourself) that emphasize the relevant experience each individual brings, along with their special talents and industry recognition. Many business plans include headshots of the management team with the bios.

Also describe more about how your organization will be structured. Your company may be a sole proprietorship, a limited liability company (LLC) or a corporation in one or more states.

If you will need to hire people for specific roles, this is the place to mention those plans. And if you will rely on outside consultants for certain roles — such as an outsourced CFO — be sure to make a note of it here. Outside backers want to know if you’ve anticipated the staffing you need.

5. Service or product line

A business will only succeed if it sells something people want or need to buy. As you describe the products or services you will offer, make sure to explain what benefits they will provide to your target customers, how they will differ from competing offerings and what the buying cycle will likely be so it is clear that you can actually sell what you are offering. If you have plans to protect your intellectual property through a copyright or patent filing, be sure to mention that. Also explain any research and development work that is underway to show investors the potential for additional revenue streams.

6. Market/industry analysis

Anyone interested in providing financial backing to your business will want to know how big your company can potentially grow so they have an idea of what kind of returns they can expect. In this section, you’ll be able to convey that by explaining to whom you will be selling and how much opportunity there is to reach them. Key details to include are market size; a strengths, weaknesses, opportunities and threats (SWOT) analysis ; a competitive analysis; and customer segmentation. Make it clear how you developed any projections you’ve made by citing interviews or research.

Also describe the current state of the industry. Where is there room for improvement? Are most companies using antiquated processes and technology? If your business is a local one, what is the market in your area like? Do most of the restaurants where you plan to open your café serve mediocre food? What will you do better?

In this section, also list competitors, including their names, websites and social media handles. Describe each source of competition and how your business will address it.

7. Sales and marketing

Explain how you will spread the word to potential customers about what you sell. Will you be using paid online search advertising, social media promotions, traditional direct mail, print advertising in local publications, sponsorship of a local radio or TV show, your own YouTube content or some other method entirely? List all of the methods you will use.

Make sure readers know exactly what the path to a sale will be and why that approach will resonate with customers in your ideal target markets as well as existing customer segments. If you have already begun using the methods you’ve outlined, include data on the results so readers know whether they have been effective.

8. Financials

In a new business, you may not have any past financial data or financial statements to include, but that doesn’t mean you have nothing to share. Preparing a budget and financial plan will help show investors or bankers that you have developed a clear understanding of the financial aspects of running your business. (The U.S. Small Business Administration (SBA) has prepared a guide you can use; SCORE , a nonprofit organization that partners with the SBA, offers a financial projections template to help you look ahead.) For an existing business, you will want to include income statements, profit and loss statements, cash flow statements and balance sheets, ideally going back three years.

Make a list of the specific steps you plan to take to achieve the financial results you have outlined. The steps are generally the most detailed for the first year, given that you may need to revise your plan later as you gather feedback from the marketplace.

Include interactive spreadsheets that contain a detailed financial analysis showing how much it costs your business to produce the goods and services you provide, the profits you will generate, any planned investments and the taxes you will pay. See our startup costs calculator to get started.

9. Financial projections

Creating a detailed sales forecast can help you get outside backers excited about supporting you. A sales forecast is typically a table or simple line graph that shows the projected sales of the company over time with monthly or quarterly details for the next 12 months and a broader projection as much as five years into the future. If you haven’t yet launched the company, turn to your market research to develop estimates. For more information, see “ How to create a sales forecast for your small business. ”

10. Funding request

If you are seeking outside financing such as a loan or equity investment, your potential backers will want to know how much money you need and how you will spend it. Describe the amount you are trying to raise, how you arrived at that number and what type of funding you are seeking (such as debt, equity or a combination of both). If you are contributing some of your own funds, it is worth noting this, as it shows that you have skin in the game.

11. Appendix

This should include any information and supporting documents that will help investors and bankers gain a greater understanding of the potential of your business. Depending on your industry, you might include local permits, licenses, deeds and other legal documents; professional certifications and licenses; media clips; information on patents and other intellectual property; key customer contracts and purchase orders; and other relevant documents.

Some business owners find it helpful to develop a list of key concepts, such as the names of the company’s products and industry terms. This can be helpful if you do business in an industry that may not be familiar to the readers of the business plan.

Tips for creating an effective business plan

Use clear, simple language. It’ll be easier to win people over if your plan is easy to read. Steer clear of industry jargon, and if you must use any phrases the average adult won’t know, be sure to define them.

Emphasize what makes your business unique. Investors and bankers want to know how you will solve a problem or gap in the marketplace differently from anyone else. Make sure you’re conveying your differentiating factors.

Nail the details. An ideal business plan will be detailed and accurate. Make sure that any financial projections you make are realistic and grounded in solid market research. (If you need help in making your calculations, you can get free advice at SCORE.) Seasoned bankers and investors will quickly spot numbers that are overly optimistic.

Take time to polish it. Your final version of the plan should be neat and professional with an attractive layout and copy that has been carefully proofread.

Include professional photos. High-quality shots of your product or place of business can help make it clear why your business stands out.

Updating an existing business plan

Some business owners in rapidly growing businesses update their business plan quarterly. Others do so every six months or every year. When you update your plan make sure you consider these three things:

- Are your goals still current? As you’ve tested your concept, your goals may have changed. The plan should reflect this.

- Have you revised any strategies in response to feedback from the marketplace? You may have found that your offerings resonated with a different customer segment than you expected or that your advertising plan didn’t work and you need to try a different approach. Given that investors will want to see a marketing and advertising plan that works, keeping this section current will ensure you are always ready to meet with one who shows interest.

- Have your staffing needs changed? If you set ambitious goals, you may need help from team members or outside consultants you did not anticipate when you first started the business. Take stock now so you can plan accordingly.

Final thoughts

Most business owners don’t follow their business plans exactly. But writing one will get you off to a much better start than simply opening your doors and hoping for the best, and it will be easier to analyze any aspects of your business that aren’t working later so you can course-correct. Ultimately, it may be one of the best investments you can make in the future of your business.

Business plan FAQs

What are common mistakes when writing a business plan.

The biggest mistake you can make when writing a business plan is creating one before the idea has been properly researched and tested. Not every idea is meant to become a business. Other common mistakes include:

- Not describing your management team in a way that is appealing to investors. Simply cutting and pasting someone’s professional bio into the management section won’t do the trick. You’ll want to highlight the credentials of each team member in a way that is relevant to this business.

- Failing to include financial projections — or including overly optimistic ones. Investors look at a lot of business plans and can tell quickly whether your numbers are accurate or pie in the sky. Have a good small business accountant review your numbers to make sure they are realistic.

- Lack of a clear exit strategy for investors. Investors may want the option to cash out eventually and would want to know how they can go about doing that.

- Slapdash presentation. Make sure to fact-check any industry statistics you cite and that any charts, graphs or images are carefully prepared and easy to read.

What are the different types of business plans?

There are a variety of styles of business plans. Here are three major types:

Traditional business plan. This is a formal document for pitching to investors based on the outline in this article. If your business is a complicated one, the plan may exceed the typical length and stretch to as many as 50 pages.

One-page business plan. This is a simplified version of a formal business plan designed to fit on one page. Typically, each section will be described in bullet points or in a chart format rather than in the narrative style of an executive summary. It can be helpful as a summary document to give to investors — or for internal use. Another variation on the one-page theme is the business model canvas .

Lean plan. This methodology for creating a business plan is ideal for a business that is evolving quickly. It is designed in a way that makes it easy to update on a regular basis. Lean business plans are usually about one page long. The SBA has provided an example of what this type of plan includes on its website.

Is the business plan for a nonprofit different from the plan for other business types?

Many elements of a business plan for a nonprofit are similar to those of a for-profit business. However, because the goal of a nonprofit is achieving its mission — rather than turning a profit — the business plan should emphasize its specific goals on that front and how it will achieve them. Many nonprofits set key performance indicators (KPIs) — numbers that they track to show they are moving the needle on their goals.

Nonprofits will generally emphasize their fundraising strategies in their business plans rather than sales strategies. The funds they raise are the lifeblood of the programs they run.

What is the difference between a business plan, a strategic plan and a marketing plan?

A strategic plan is different from the type of business plan you’ve read about here in that it emphasizes the long-term goals of the business and how your business will achieve them over the long run. A strong business plan can function as both a business plan and a strategic plan.

A marketing plan is different from a business plan in that it is focused on four main areas of the business: product (what you are selling and how you will differentiate it), price (how much your products or services will cost and why), promotion (how you will get your ideal customer to notice and buy what you are selling) and place (where you will sell your products). A thorough business plan may cover these topics, doing double duty as both a business plan and a marketing plan.

Explore more

Editable business plan workbook

Starting a new business

1 . Francis J. Green and Christian Hopp. “Research: Writing a Business Plan Makes Your Startup More Likely to Succeed.” HBR. July 14, 2017. Available online at https://hbr.org/2017/07/research-writing-a-business-plan-makes-your-startup-more-likely-to-succeed.

2 . CorpNet, “The Startup Business Plan: Why It’s Important and How You Can Create One,” June 29, 2022.

Important Disclosures and Information

Bank of America, Merrill, their affiliates and advisors do not provide legal, tax or accounting advice. Consult your own legal and/or tax advisors before making any financial decisions. Any informational materials provided are for your discussion or review purposes only. The content on the Center for Business Empowerment (including, without limitations, third party and any Bank of America content) is provided “as is” and carries no express or implied warranties, or promise or guaranty of success. Bank of America does not warrant or guarantee the accuracy, reliability, completeness, usefulness, non-infringement of intellectual property rights, or quality of any content, regardless of who originates that content, and disclaims the same to the extent allowable by law. All third party trademarks, service marks, trade names and logos referenced in this material are the property of their respective owners. Bank of America does not deliver and is not responsible for the products, services or performance of any third party.

Not all materials on the Center for Business Empowerment will be available in Spanish.

Certain links may direct you away from Bank of America to unaffiliated sites. Bank of America has not been involved in the preparation of the content supplied at unaffiliated sites and does not guarantee or assume any responsibility for their content. When you visit these sites, you are agreeing to all of their terms of use, including their privacy and security policies.

Credit cards, credit lines and loans are subject to credit approval and creditworthiness. Some restrictions may apply.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also referred to as “MLPF&S" or “Merrill") makes available certain investment products sponsored, managed, distributed or provided by companies that are affiliates of Bank of America Corporation (“BofA Corp."). MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC , and a wholly owned subsidiary of BofA Corp.

Banking products are provided by Bank of America, N.A., and affiliated banks, Members FDIC, and wholly owned subsidiaries of BofA Corp.

“Bank of America” and “BofA Securities” are the marketing names used by the Global Banking and Global Markets division of Bank of America Corporation. Lending, derivatives, other commercial banking activities, and trading in certain financial instruments are performed globally by banking affiliates of Bank of America Corporation, including Bank of America, N.A., Member FDIC. Trading in securities and financial instruments, and strategic advisory, and other investment banking activities, are performed globally by investment banking affiliates of Bank of America Corporation (“Investment Banking Affiliates”), including, in the United States, BofA Securities, Inc., which is a registered broker-dealer and Member of SIPC , and, in other jurisdictions, by locally registered entities. BofA Securities, Inc. is a registered futures commission merchant with the CFTC and a member of the NFA.

Investment products:

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

How to Write a Business Plan Banks Can't Resist Here's what your business plan needs if you want startup capital from a bank.

By Entrepreneur Staff Nov 13, 2014

In the book, Write Your Business Plan , the staff of Entrepreneur Media offer an in-depth understanding of what's essential to any business plan, what's appropriate for your venture and what it takes to ensure success. In this edited excerpt, the authors discuss the ABCs of getting a bank loan for your business.

Many of the most successful businesses are financed by banks, which can provide small to moderate amounts of capital at market costs. They don't want control—at least beyond the control exerted in the covenants of a loan document. And they don't want ownership. Bankers make loans, not investments, and as a general rule, they don't want to wind up owning your company.

Bankers primarily provide debt financing. You take out a loan and pay it back, perhaps in installments consisting of principal and interest, perhaps in payments of interest only, followed by a balloon payment of the principal. One of the nice things about debt financing is that the entrepreneur doesn't have to give up ownership of his company to get it.

Bankers can usually be counted on to want minimal, if any, input into how the business is run. Get behind on the payment schedule, however, and you're likely to find a host of covenants buried in your loan documentation. Loan covenants may require you to do all sorts of things, from setting a minimum amount of working capital you must maintain to prohibiting you from making certain purchases or signing leases without bank approval. Be sure to have your accountant, financial advisor or attorney review your loan documents and spell out everything for you very carefully before you sign.

A banker's first concern is getting the bank's money back plus a reasonable return. To increase their odds, bankers look for certain things, including everything from a solid explanation of why you need the money and what you're going to use it for to details about other borrowing or leasing deals you've entered into.

Bank loan applications can be almost as long and complete as a full-fledged business plan. Plans and loan applications aren't interchangeable, however. A banker may not be interested in your rosy projections of future growth. In fact, when confronted with the kind of growth projection required to interest a venture capitalist, a banker may be turned off. On the other hand, a banker is likely to be quite interested in seeing a contingency plan that will let you pay back the loan, even in the event of a worst-case scenario.

The five things a banker will look for you to address are:

1. Cash flow. One of the most convincing things you can show a banker is the existence of a strong, well-documented flow of cash that will be more than adequate to repay a loan's scheduled principal and interest. You'll need more than a projection of future cash flow, by the way. Most bankers will want to see cash flow statements as well as balance sheets and income statements for the past three or so years. And don't forget your tax returns for the same period.

2. Collateral. If you're just starting out in business or dealing with a banker you don't know well, you're unlikely to be able to borrow from a bank without collateral. Collateral is just something the bank can seize and sell to get back some or all of the money you've borrowed in the event that everything goes wrong and you can't pay it back with profits from operations. It may consist of machinery, equipment, inventory or, all too often, the equity you own in your home.

Why do bankers seek collateral? They have no desire to own second-hand equipment or your house. Experience has taught them that entrepreneurs who have their own assets at risk are more likely to stick to a business than those who have none of their own assets at risk.

3. Co-signers. They provide an added layer of protection for lenders. If your own capacity for taking on additional debt is shaky, a co-signer (who's essentially lending you their creditworthiness) may make the difference.

4. Marketing plans. More than ever before, bankers are taking a closer look at the marketing plans embedded in business plans. Strong competitors, price wars, me-too products, the fickle habits of the buying public and other market-related risks must be addressed. Your banker (and most other investors) have to know that you recognize these risks and have well-thought-out ways to deal with them. Besides, it's the cash flow from operations that pays off bank loans.

5. Management. Bankers like to stress the personal aspect of their services. Many state that they're interested in making loans based on a borrower's character as well as their financial strength. In fact, the borrower's track record and management ability are concerns for bankers evaluating a loan application. If you can show you've run one or more other companies successfully, it will increase your chances of landing a loan to get a startup going.

Bank financing is most appropriate for up-and-running enterprises that can show adequate cash flow and collateral to service and secure the loan. Bankers are less likely to provide startup money to turn a concept into a business, and they're even less likely to put up seed money to prove a concept unless you have a track record of launching previous businesses with successful results.

The old saying about bankers lending only to people who don't need to borrow is almost true. Bankers prefer to lend to companies that are almost, but not quite, financially robust enough to pursue their objective without the loan. Their natural tendency is to be conservative.

This is important to understand because it affects how and when you will borrow. You should try to foresee times you'll need to borrow money and arrange a line of credit or other loan before you need it. That will make it easier and, in many cases, cheaper in terms of interest rates than if you wait until you're a needier and, in bankers' eyes, less-attractive borrower.

Entrepreneur Staff

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- Lock The Average American Can't Afford a House in 99% of the U.S. — Here's a State-By-State Breakdown of the Mortgage Rates That Tip the Scale

- Richard Branson Shares His Extremely Active Morning Routine : 'I've Got to Look After Myself'

- Lock This Flexible, AI-Powered Side Hustle Lets a Dad of Four Make $32 an Hour , Plus Tips: 'You Can Make a Substantial Amount of Money'

- Tennis Champion Coco Gauff Reveals the Daily Habits That Help Her Win On and Off the Court — Plus a 'No Brainer' Business Move

- Lock 3 Essential Skills I Learned By Growing My Business From the Ground Up

- 50 Cent Once Sued Taco Bell for $4 Million. Here's How the Fast-Food Giant Got on the Rapper's Bad Side .

Most Popular Red Arrow

She grew her side hustle sales from $0 to over $6 million in just 6 months — and an 'old-school' mindset helped her do it.

Cynthia Sakai, designer and founder of the luxury personal care company evolvetogether, felt compelled to help people during the pandemic.

63 Small Business Ideas to Start in 2024

We put together a list of the best, most profitable small business ideas for entrepreneurs to pursue in 2024.

'Why Shouldn't They Participate?': AT&T CEO Calls on Big Tech to Help Subsidize Internet Access

AT&T's CEO called out the seven biggest tech companies in the world.

I Started Over 300 Companies. Here Are 4 Things I Learned About Scaling a Business.

It takes a delicate balance of skill, hard work and instinct to grow a successful business. This serial entrepreneur loves the unique challenge; here are the key lessons she's learned along the way.

5 SEO Techniques to Help Your SaaS Business Rank in 2024

Discover five game-changing SEO techniques that can help you rely less on paid ads and cut down your customer acquisition costs.

Disney World Is Making a Major Change to Its Popular Genie+ System — Here's What to Know

Resort guests can now book a ride up to a week in advance among other changes.

Successfully copied link

Bank Business Plan [Sample Template]

By: Author Tony Martins Ajaero

Home » Business ideas » Financial Service Industry » Bank

Are you about starting a bank? If YES, here is a complete sample commercial bank business plan template & feasibility report you can use for FREE .

Okay, so we have considered all the requirements for starting a bank . We also took it further by analyzing and drafting a sample bank business marketing plan template backed up by actionable guerrilla marketing ideas for banks. So let’s proceed to the business planning section.

Why Start a Bank?

Starting your own bank is a huge step and needs a good deal of planning and preparation. Extensive information about the founders, the business plan, senior management team, finances, capital adequacy, risk management infrastructure, and other relevant factors must be provided to the appropriate authorities.

There are also a number of legal regulations and requirements that must be fulfilled in order to start your own bank. Some of these requirements are dependent upon the regulations in the niche you wish to establish your bank.

As hard as the task of starting a bank can be, anyone who wishes to start their own bank is able to enjoy the many benefits of making a major investment. Although the process of registering and setting up a bank involves lengthy planning and a relatively complex licensing procedure, once it is completed, the owner is able to conduct financial activity in their chosen niche.

Note that the very first step when starting your bank is to choose the niche and type of activity which you wish to engage in. Before you obtain the necessary licensing from the financial regulatory body, it is very crucial you identify whether you wish to specialize in investment banking or trade finance.

The advantages of owning your own bank are huge and include the potential to make large profits during a short period.

Note that if you know your target market and your target market’s specific requirements, you will be in a better position to provide a range of attractive services. To successfully start and run this business, it is advised you seek the help of a professional consultancy firm.

Through the advice and guidance of expert consultants, you will be able to establish a banking institution in a professional manner. Also have it in mind that any proposed bank must first receive the approval of a federal or state banking charter.

Before granting a charter, the chartering regulator must determine that the applicant bank has a reasonable chance for success and will operate in a safe and sound manner.

Then, the proposed bank must obtain approval for deposit insurance from the Federal Deposit Insurance Corporation. Additional approvals are required from the Federal Reserve if, at formation, a holding company would control the new bank or a state-chartered bank would become a member of the Federal Reserve.

A Sample Bank Business Plan Template

1. industry overview.

According to global banking industry reports, part of the broad financial services market, bank credit remain the leading market segment, with around 60% of the overall market in terms of value. Statistics has shown that the EU is the largest regional market, with over 57% of the global market.

Note that the economic recession that began in 2008 affected the industry and resulted in the crash of several financial institutions, which in turn led to the examination of practices and deployment of new guidelines in the banking industry.

But reports have it that the sector is beginning to rebound, and cross-border investment is one area contributing to recovery, with a few big banks dominating certain national markets. Advantages of cross-border practices include economies of scale, though institutions must compete with established domestic banks.

It’s very important to state that in the world retail banking and bank lending sectors, mortgage lending represents the leading market segment, accounting for almost 76% of the overall market in terms of value. Other key segments of the banking industry include private banking and payments business.

Note that in the US banking sector, experts believe that market growth will be driven by cross-border expansion due to the breaking down of obstacles to cross-border investment.

Competition between international banks is also expected to aid market growth along with the introduction of new products, reduction of costs and launching of new services. Report also has it that mobile and internet banking are becoming increasingly intertwined, especially due to the advent and success of smartphones. This provides consumers with convenient access to internet banking.

Have it in mind that the global mobile internet market will continue to drive the expansion of the mobile banking services sector. Report has shown that banking institutions are responding by launching downloadable applications and encouraging consumers to bank online and through mobile devices by rolling out mobile and internet banking services.

2. Executive Summary

Apex Investment Bank, LLC (AIB LLC) is a Portland Oregon based investment bank that will provide investment packages, underwriting, proprietary trading, and investment management for its investors. Our objective at AIB LLC is to create value for owners, employees, and investors through the establishment of an investment bank designed for the Third Generation.

This Generation is explicitly defined in the ground breaking research effort by Lincoln Swan & Co., Inc. and Netley Strategic business Group as a stage in the investment industry requiring a special set of skills for success. We at AIB LLC have leveraged this study, with more other studies, and perhaps most importantly, our own experience in the industry, to define a plan for the success of our clients.

Portland’s location is beneficial for several industries. Relatively low energy cost, accessible resources, north–south and east–west Interstates, international air terminals, large marine shipping facilities, and both west coast intercontinental railroads are all economic advantages.

AIB LLC will be structured as a Limited Liability Company with excellent plans to make use of industry research performed by one of our founding entrepreneurs, Solomon Drane during his professional career in investment management research.

Within the past three years, Solomon Drane has conducted research visits at the investment offices of over 80 companies. He has also held countless meetings with key investment professionals from around the globe either in person or via telephone conference.

We at AIB LLC plan to offer our clients the opportunity to assume minority ownership positions in exchange for contributions to our operating capital and for providing seed assets to establish the investment products described herein.

It is very important to state that this document alone does not create an offer of any type, nor does it give any guarantee, financial, or otherwise. This is a well detailed business plan designed to strategically dictate AIB LLC plans and visions for the next five years. It is open to correction or improvement within or after the specified time.

3. Our Products and Services

We at AIB LLC will provide investment packages and underwrite securities for sale to private investors and the general public among companies that are seeking to raise capital. At the onset of operations, we at AIB LLC will solely seek to sell debt instruments on behalf of our customers.

The standard fee for this service is 8% of the total underwritten instrument. We at AIB LLC will also solicit capital from accredited investors with the purpose of making use of this capital to make investment marketable securities. Our goal is to generate compounded annual returns of 30% to 35% per year on capital invested into our Bank’s portfolio holdings. We also plan to make sure that our management retains a 25% ownership interest at AIB LLC.

4. Our Mission and Vision Statement

- Our vision at AIB LLC is to develop into a large scale investment bank that will provide underwriting income, advisory income, dividend income, capital appreciation, and interest income to investors.

- Our mission at AIB LLC is to ensure that investment decisions are implemented quickly and efficiently across all portfolios, to also make sure a trading research and rotation is used to avoid any type of systematic advantage or disadvantage an account may experience.

Our Business Structure

We at AIB LLC understand that the strength of our management team and board of directors is perhaps the most important factor in starting a bank and effectively providing for its future success. We also found out through our detailed research that for a new bank charter to be approved for us, all our senior management team must be experienced bankers with a history of relevant success.

The more reason we made sure our board of directors are made up of individuals with successful careers in business, banking, and other fields, and have representation in the necessary disciplines.

We also understand the role of the board and management as investors and how important they are. Regulators and other investors will look to the investment of these directors and senior officers as an important sign of their commitment to the bank.

We also understand that the typical investment bank is operated on a rigid, strict hierarchy, than most corporate or financial institutions. We have taken our time to analyse our market and what we need that is why we have decided to start with the listed workforce.

Managing director

- Senior vice president

Vice president

Investment Banking Associate

Investment Banking Analyst

- Marketing manager

- Security man

5. Job Roles and Responsibilities

- Broaden and/or enhance the bank’s industry coverage,

- Will partner with the firm’s leadership to grow and build the bank

- Will tirelessly work to deliver superior results to the firms’ clients

- Participate as a key member of the senior leadership team, contributing to the strategy, growth and success of the firm

- Lead efforts on sell-side and buy-side acquisition assignments, refinancing, recapitalization and restructuring assignments

- Interact seamlessly with prospects, clients, acquirors, investors and attorneys on all aspects of a M&A deal and/or capital raise

- Direct a team of junior bankers to support all elements of deal sourcing and execution.

Senior Vice president

- Involved in executing and managing equity offerings that will include the drafting and structuring of material, logistics management, issue identification, its analysis and the resolution.

- Responsible for mergers and acquisitions and manages the creation of buyers list, their contacts, drafting the relevant material, financial analysis and private equity placement.

- Researches and identify deal opportunities by formulating and issuing factual financial analyses and creating different kinds of financial plans.

- Involved in pitching or selling the organization’s products and services to new clients and may be involved in other projects as well.

- May participate in due diligence meetings with non-proprietary or proprietary investment managers and create relevant call reports that include their opinions.

- May be involved in analyzing the investment products and screening them by making effective use of a variety of investment data and the relevant software applications

- Monitors the investment products and their performance.

- Analyses the relevant statistics to evaluate the appropriateness of the product.

- Manages relationships with the investment management organizations and regularly gets him/her updated by getting valuable information from them.

- Attends industry conferences and training sessions so as to present innovative ideas to clients

- Responsible for providing leadership and overseeing the work of the subordinate members.

- Call on prospective clients such as privately held business owners, publicly traded companies and private equity firms.

- Conceptualize, organize and deliver new business presentations.

- Lead transaction implementation across industry groups.

- Manage, educate and develop banking analysts and associates.

- Develop marketing and new business presentations.

- Monitor financial analysis and modeling.

- Perform and analyze industry research.

- Create client presentations, proposals, engagement letters term sheets, legal agreements and offer memorandums.

- Create and foster client relationships.

- Managing and assisting in the preparation of financial models and business valuations

- Creating client marketing presentations

- Attending client meetings

- Conducting industry and company-specific due diligence related to transactions

- Drafting memoranda for sale assignments