- Search Search Please fill out this field.

- Corporate Finance

- Corporate Debt

Debt Assignment: How They Work, Considerations and Benefits

Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle.

:max_bytes(150000):strip_icc():format(webp)/daniel_liberto-5bfc2715c9e77c0051432901.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications.

:max_bytes(150000):strip_icc():format(webp)/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg)

Investopedia / Ryan Oakley

What Is Debt Assignment?

The term debt assignment refers to a transfer of debt, and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt . In most cases, a debt assignment is issued to a debt collector who then assumes responsibility to collect the debt.

Key Takeaways

- Debt assignment is a transfer of debt, and all the associated rights and obligations, from a creditor to a third party (often a debt collector).

- The company assigning the debt may do so to improve its liquidity and/or to reduce its risk exposure.

- The debtor must be notified when a debt is assigned so they know who to make payments to and where to send them.

- Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA), a federal law overseen by the Federal Trade Commission (FTC).

How Debt Assignments Work

When a creditor lends an individual or business money, it does so with the confidence that the capital it lends out—as well as the interest payments charged for the privilege—is repaid in a timely fashion. The lender , or the extender of credit , will wait to recoup all the money owed according to the conditions and timeframe laid out in the contract.

In certain circumstances, the lender may decide it no longer wants to be responsible for servicing the loan and opt to sell the debt to a third party instead. Should that happen, a Notice of Assignment (NOA) is sent out to the debtor , the recipient of the loan, informing them that somebody else is now responsible for collecting any outstanding amount. This is referred to as a debt assignment.

The debtor must be notified when a debt is assigned to a third party so that they know who to make payments to and where to send them. If the debtor sends payments to the old creditor after the debt has been assigned, it is likely that the payments will not be accepted. This could cause the debtor to unintentionally default.

When a debtor receives such a notice, it's also generally a good idea for them to verify that the new creditor has recorded the correct total balance and monthly payment for the debt owed. In some cases, the new owner of the debt might even want to propose changes to the original terms of the loan. Should this path be pursued, the creditor is obligated to immediately notify the debtor and give them adequate time to respond.

The debtor still maintains the same legal rights and protections held with the original creditor after a debt assignment.

Special Considerations

Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA). The FDCPA, a federal law overseen by the Federal Trade Commission (FTC), restricts the means and methods by which third-party debt collectors can contact debtors, the time of day they can make contact, and the number of times they are allowed to call debtors.

If the FDCPA is violated, a debtor may be able to file suit against the debt collection company and the individual debt collector for damages and attorney fees within one year. The terms of the FDCPA are available for review on the FTC's website .

Benefits of Debt Assignment

There are several reasons why a creditor may decide to assign its debt to someone else. This option is often exercised to improve liquidity and/or to reduce risk exposure. A lender may be urgently in need of a quick injection of capital. Alternatively, it might have accumulated lots of high-risk loans and be wary that many of them could default . In cases like these, creditors may be willing to get rid of them swiftly for pennies on the dollar if it means improving their financial outlook and appeasing worried investors. At other times, the creditor may decide the debt is too old to waste its resources on collections, or selling or assigning it to a third party to pick up the collection activity. In these instances, a company would not assign their debt to a third party.

Criticism of Debt Assignment

The process of assigning debt has drawn a fair bit of criticism, especially over the past few decades. Debt buyers have been accused of engaging in all kinds of unethical practices to get paid, including issuing threats and regularly harassing debtors. In some cases, they have also been charged with chasing up debts that have already been settled.

Federal Trade Commission. " Fair Debt Collection Practices Act ." Accessed June 29, 2021.

Federal Trade Commission. " Debt Collection FAQs ." Accessed June 29, 2021.

:max_bytes(150000):strip_icc():format(webp)/thinkstockphotos_80410231-5bfc2b97c9e77c0026b4fb20.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Assignment of Debt: Definition, Terms, Example

Jump to section, what is an assignment of debt.

Assignment of debt is an agreement that transfer debt, rights, and obligations from a creditor to a third party. Assignment of debt agreements are commonly found when a creditor issues past due debt to a debt collection agency. The original lender will be relieved of all obligations and the agency will become the new owner of the debt. Debt assignment allows creditors to improve liquidity by reducing their financial risk. If a creditor has taken on a large amount of unsecured debt, an assignment of debt agreement is a quick way to transfer some of the unsecured loans to another party.

Common Sections in Assignments Of Debt

Below is a list of common sections included in Assignments Of Debt. These sections are linked to the below sample agreement for you to explore.

Assignment Of Debt Sample

Reference : Security Exchange Commission - Edgar Database, EX-10 19 ex107.htm ASSIGNMENT OF DEBT AND SECURITY , Viewed October 25, 2021, View Source on SEC .

Who Helps With Assignments Of Debt?

Lawyers with backgrounds working on assignments of debt work with clients to help. Do you need help with an assignment of debt?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignments of debt. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Assignment Of Debt Lawyers

I am passionate about legal research and writing. I have excellent research and writing skills. My entire legal career has centered around fact-finding, contract and statute interpretation, legal analysis, as well as legal research and writing.

Experiences corporate and general counsel. Particular expertise in all contract matters

Experienced In-House Counsel

Marcia is an experienced business litigation and transactional attorney providing general counsel to individuals and small businesses owners in transactions and business disputes. Marcia's law practice focuses primarily on commercial litigation and transactional law. She represents and defends individuals, partnerships, limited liability companies, corporations, and not-for-profit corporations in a variety of commercial and employment disputes including partnership disputes, shareholder disputes, member disputes, and contract disputes. Additionally, she advises clients on transactional matters including contract creation, review, and negotiation, real estate transactions, mergers and acquisitions, donations, corporate governance, municipal governance, policy formation, and various compliance issues.

I graduated honors from the University of Iowa, University of Chicago and Brooklyn Law School. I’m an innovative corporate M&A attorney with 7 years of experience and a software developer experienced in front end development. A highly experienced and entrepreneurial lawyer, I work primarily with business owners and founders in connection with mergers and acquisitions, securities law and software contracts.

Highly skilled attorney with more than 12 years of experience in delivering ongoing support to an international organization, government organizations, law firms, and long-term healthcare facilities. Eager to leverage experience in negotiations, contracts, and strategic planning into a corporate attorney role with room for growth in the organization.

Experienced attorney with a substantial history of crafting, evaluating, and bargaining multimillion-dollar commercial and government contracts across diverse sectors, encompassing the US Army, DoD contractors, employee benefits, NASDAQ, Pharmaceuticals, and Finance.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Financial lawyers by top cities

- Austin Financial Lawyers

- Boston Financial Lawyers

- Chicago Financial Lawyers

- Dallas Financial Lawyers

- Denver Financial Lawyers

- Houston Financial Lawyers

- Los Angeles Financial Lawyers

- New York Financial Lawyers

- Phoenix Financial Lawyers

- San Diego Financial Lawyers

- Tampa Financial Lawyers

Assignment Of Debt lawyers by city

- Austin Assignment Of Debt Lawyers

- Boston Assignment Of Debt Lawyers

- Chicago Assignment Of Debt Lawyers

- Dallas Assignment Of Debt Lawyers

- Denver Assignment Of Debt Lawyers

- Houston Assignment Of Debt Lawyers

- Los Angeles Assignment Of Debt Lawyers

- New York Assignment Of Debt Lawyers

- Phoenix Assignment Of Debt Lawyers

- San Diego Assignment Of Debt Lawyers

- Tampa Assignment Of Debt Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

Understanding Deed of Assignment: Definition, Uses, and Legal Implications Explained

A deed of assignment is a legal document that transfers the ownership of a tangible or intangible asset from one party (assignor) to another (assignee). It is used to formalize the transfer of rights, interests, or benefits associated with the asset specified in the deed. This document is commonly used in various legal and financial transactions to ensure clarity and enforceability of the transfer.

Table of Contents

Key characteristics of deed of assignment.

- Legal Form : It is a formal written document recognized under legal jurisdictions.

- Transfer of Rights : Involves transferring ownership or interests in a specific asset.

- Specificity : Clearly defines the asset being transferred and the terms of transfer.

- Enforceability : Once executed, it becomes legally binding on both parties.

How Deed of Assignment Works

Examples and usage, 1. transfer of debt example.

- Definition : A debtor assigns their debt obligation to a new creditor.

- Process : A deed of assignment is used to transfer the rights to receive payment from the debtor to the new creditor.

2. Intellectual Property Transfer

- Definition : An author assigns their copyright in a book to a publishing company.

- Procedure : A deed of assignment outlines the transfer of intellectual property rights from the author to the publisher.

Advantages of Deed of Assignment

- Legal Clarity : Provides a clear record of the transfer of rights or interests.

- Enforceability : Ensures that the assignee can legally enforce their rights against the assignor.

- Asset Protection : Helps protect the rights of the assignee against claims by third parties.

Challenges of Deed of Assignment

Considerations.

- Legal Requirements : Must adhere to specific legal formalities to be enforceable.

- Risk of Breach : Potential for disputes over the validity or terms of the assignment.

Importance of Deed of Assignment

Practical applications, legal transfers.

- Debt Assignments : Transferring debt obligations from one creditor to another.

- Property Transfers : Assigning ownership rights in real estate or intellectual property.

Real-world Implications

Legal and financial security.

- Contractual Agreements : Facilitates smooth transfers of rights and responsibilities.

- Risk Management : Helps mitigate risks associated with ownership disputes or claims.

Example Scenario

Application in debt assignment, scenario: debt transfer deed of assignment.

- Context : A company assigns its accounts receivable to a factoring company.

- Procedure : Signing a deed of assignment outlining the transfer of rights to receive payment from debtors to the factoring company.

A deed of assignment is a crucial legal instrument used to transfer ownership or rights from one party to another. Whether for debts, intellectual property, or other assets, it ensures clarity and enforceability in legal transactions. By documenting the specifics of the transfer and adhering to legal requirements, parties can safeguard their interests and ensure that the transfer is legally binding. Understanding the purpose and implications of a deed of assignment is essential for navigating legal transfers of rights and assets effectively. It provides a structured approach to asset transfers, protecting the rights of both assignors and assignees under legal frameworks. Overall, deeds of assignment play a significant role in facilitating smooth and legally secure transfers of various types of assets and rights between parties.

Related Posts

Written-down value (wdv) explained for beginners.

If you’re new to finance and accounting, terms like “Written-Down Value” or WDV might sound…

Activity Sampling (Work Sampling): Unveiling Insights into Work Efficiency

Activity Sampling, also known as Work Sampling, is a method used in various industries to…

Automated page speed optimizations for fast site performance

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

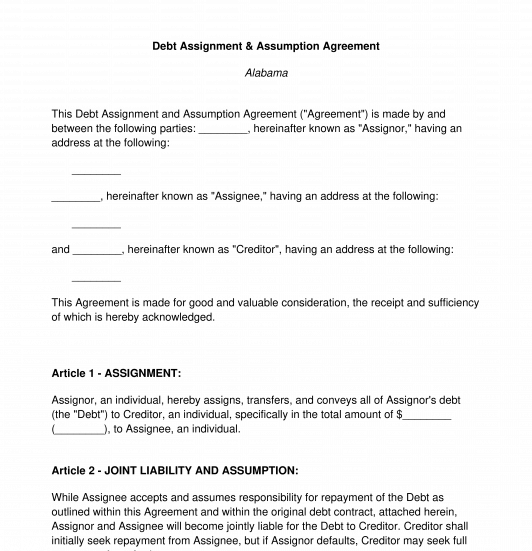

Debt Assignment and Assumption Agreement

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor. The party that is assuming the debt is the new debtor; they are called the assignee.

The debt is owed to a creditor.

This document is different than a Debt Settlement Agreement , because there, the original debtor has paid back all of the debt and is now free and clear. Here, the debt still stands, but it will just be owed to the creditor by another party.

This is also different than a Debt Acknowledgment Form , because there, the original debtor is simply signing a document acknowledging their debt.

How to use this document

This document is extremely short and to-the-point. It contains just the identities of the parties, the terms of the debt, the debt amount, and the signatures. It is auto-populated with some important contract terms to make this a complete agreement.

When this document is filled out, it should be printed, signed by the assignor and the creditor, and then signed by the assignee in front of a notary. It is important to have the assignee's signature notarized, because that is the party that is taking on the debt.

Applicable law

Debt Assignment and Assumption Agreements are generally covered by the state law where the debt was originally incurred.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Debt Assignment and Assumption Agreement - FREE

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Contract Assignment Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Other downloadable templates of legal documents

IMAGES

VIDEO

COMMENTS

A debt assignment agreement allows a person who owes money to assign the debt to someone else who assumes its obligation. This is common when a person takes possession of an asset where the seller still owes money.

Debt assignment is a transfer of debt, and all the associated rights and obligations, from a creditor to a third party (often a debt collector). The company assigning the debt may do so to...

Assignment of debt is an agreement that transfer debt, rights, and obligations from a creditor to a third party. Assignment of debt agreements are commonly found when a creditor issues past due debt to a debt collection agency.

How Deed of Assignment Works Examples and Usage 1. Transfer of Debt Example. Definition: A debtor assigns their debt obligation to a new creditor. Process: A deed of assignment is used to transfer the rights to receive payment from the debtor to the new creditor. 2. Intellectual Property Transfer

A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor.

Use Lawlive's Deeds of Assignment of Debt (Loans) to assign a debt as between companies and individuals or between each. The deeds assign rights and accordingly it is important to consider the requirements to assign a debt and the risks of doing so.