- Personal Loan

- How to Apply for a PF Loan

What is a PF Loan?

Employee Provident Fund or EPF is a retirement benefits scheme approved by the Indian government for salaried employees. Under this scheme, a small sum of money is contributed by employees from eligible organizations from their monthly basic pay in their PF(Provident Fund) accounts.

Employees can withdraw a sum of money from their PF accounts and make use of the withdrawn money as a personal loan. While the name may signify that it is a loan, it is not like the typical personal loan where the person needs to repay the amount to the bank. In a PF loan, the repayment procedure is not included, as it is non-refundable.

The Employer’s Provident Fund Organization or EPFO oversees this procedure and allows an employee to withdraw money only after the reason is verified and justified. Usually, an employee who is in service for 5 years or above is sanctioned a loan from his/her PF account. This condition can change according to the reason for applying for a PF loan.

How to Apply for a PF loan?

There are two ways through which you can apply for a PF loan . They are as follows:

- You can submit a physical application

- You can submit an online application

Submit a Physical Application for PF Loan:

- Download the composite claim form (Aadhar) or the composite claim form (non-Aadhaar) from the EPFO site

- If you take the composite claim form (Aadhar), you will have to fill it and submit it to the respective EPFO office. You can submit the same without getting it attesting by your employer.

- If you take the composite claim form (non-Aadhar), then you will have to fill it and submit it after getting it attested by your employer.

- If you wish to withdraw only a certain sum from your PF account, you don't have to submit various certificates as the requirement has been removed. You can select the option to submit self-certification. To know more, click here.

Submit an Online Application for PF Loan:

Before you submit an online application to avail of a PF loan, you must meet the following requirements:

- Make sure that your Universal Account Number or UAN is activated. Also, ensure that the mobile number which you have used for activating your UAN is still active.

- Do not forget to link your UAN with your KYC (Aadhaar, PAN, and bank details).

Once you meet the above requirements, you won’t need the attestation from your previous employer.

You can follow the steps below to submit an online application:

- Open the UAN portal and log in by putting your UAN and password.

- Click on Manage > KYC. Follow this step to ensure that your KYC details are correct.

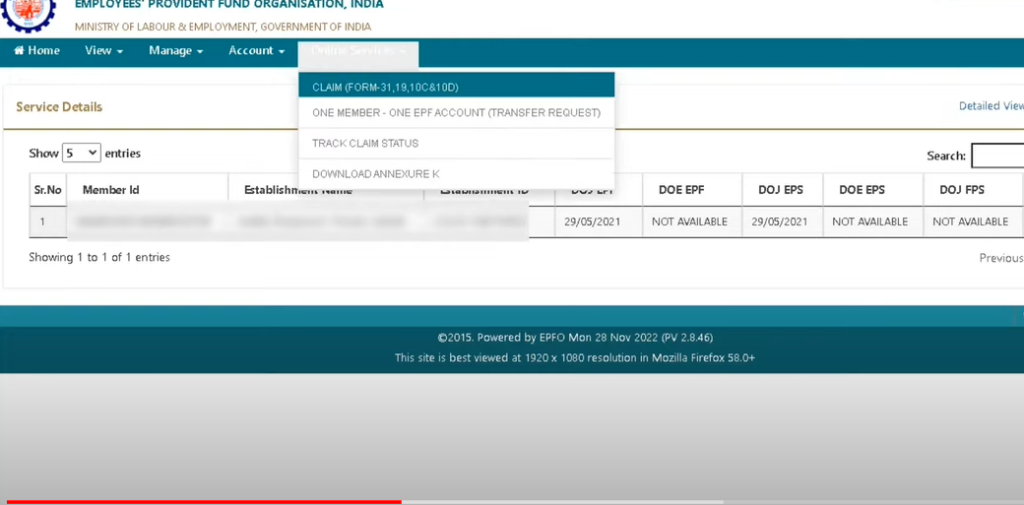

- Once your details are verified, click on Online Services > Claim (Form-31, 19 & 10C)

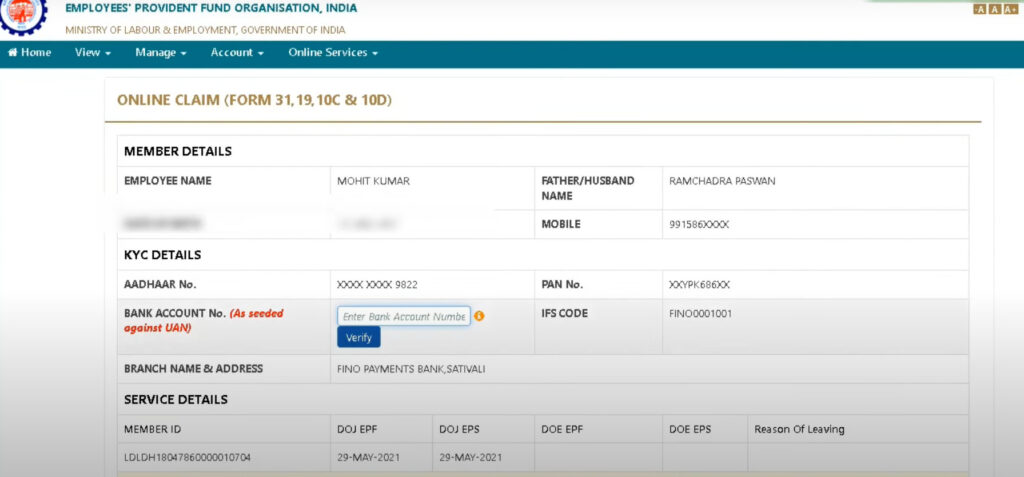

- Your details will now be displayed. You must now enter the last four digits of your bank account and then click on ‘Verify.’

- Select ‘Yes’ on the pop-up window to proceed.

- Click on ‘ Proceed for Online claim .’

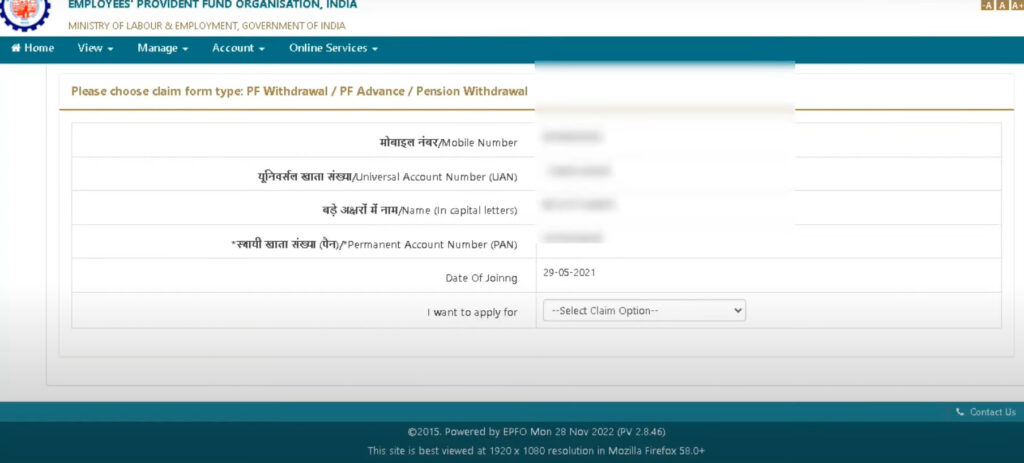

- Now, select the type of claim you want (full EPF settlement, EPF part withdrawal (loan/advance), or pension withdrawal) under the option ‘I Want To Apply For.’ If you are not eligible for PF withdrawal or pension withdrawal, then you will not see the option in the menu.

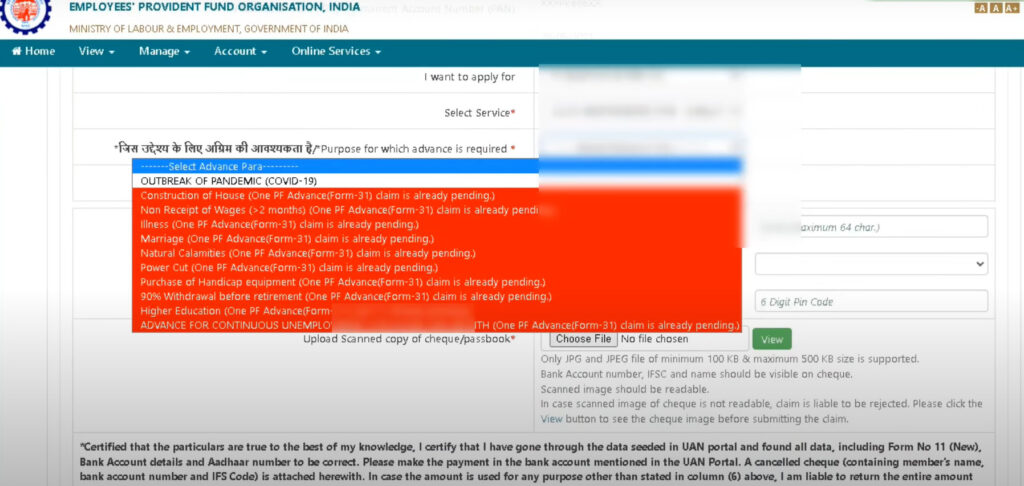

- Click on ‘PF Advance (Form 31)’ and fill in the details.

- Submit your form after clicking on the certificate. Once your employer approves your withdrawal request, the amount will be credited to your bank account within 15 to 20 days.

Documents that are required for a PF Loan Application

The following are the documents that are required for a PF loan:

- Form 19: This document is needed for the final PF settlement

- Form 10-C: This is required if you wish to avail of pension withdrawal benefit.

- Form 31: This is required to withdraw a partial sum of money from your PF account

Rate of Interest:

Though PF loans do not have an interest rate, you will have to pay a specific cost. This cost is calculated in terms of the amount which would have accumulated as an interest rate on the withdrawn amount had you not taken it out. The interest which is calculated on EPF deposits is 8.5%. This rate is based on the monthly running balance.

Reasons to Take a PF Loan:

As mentioned above, the EPFO will approve of a loan from your PF account only when your reason to apply for it is justified. This process ensures that employees do not take advantage of a PF loan and withdraw small amounts frequently. Saving in a PF account leads to the financial stability of an employee even after retirement. And so, frequent withdrawal of cash is not encouraged while the employee is still in service. If you wish to apply for a PF loan, then you can check out some of the reasons below for which such a loan is usually approved:

Marriage: In India, a wedding is not usually a one-day event. It spans for days. Therefore, a hefty amount of money is spent on the festivities. So, if you want to withdraw money for this reason, then the following are some of the conditions which should be met:

- You can withdraw 50% from your PF account.

- You can withdraw money for the marriage of your children or siblings.

- You must be in service for a minimum of 7 years.

- You can withdraw up to 3 times.

Illness: To withdraw money for medical purposes, the following are the conditions that you must adhere to:

- Unlike weddings, to take a PF loan for any medical treatment, you do not need to be in service for a specified time

- You can withdraw the entire amount in your PF account or six months of DA and basic salary.

- You can take this loan for yourself, your parents, and your spouse.

Renovation or Construction of a House: To own a house is a dream for many people. If you want to renovate your old house or construct a new one, then you can take a PF loan. Check the conditions required

- You must complete a minimum of 5 years of service.

- The property you wish to renovate or construct must be in your name or your spouse’s name. It can also be jointly owned by you and your spouse.

- You can withdraw the amount just once.

- You can withdraw your entire contribution or 36 times the basic salary and DA.

Education: If your child has bagged a seat in a university or college, then you can withdraw money from your PF account to contribute to the cause. Check the conditions below if you wish to take a loan for education purposes

- You can withdraw only 50% from your PF account.

- PF loan is sanctioned for only post-matriculation education of your children.

- A service period of 7 years is mandatory.

To Buy Land: If you wish to buy a piece of land, then you can withdraw money as a PF loan from your PF account. You can check the conditions below to know more

- A service period of 5 years is mandatory.

- The property must be in your name or your spouse’s name. The property can also be jointly owned by both of you.

- You can take out the money only one time

- You can withdraw your entire contribution or 24 times your basic salary and DA

Lock-out of the Company: If any employee stops receiving his/her salary in the event of a lock-out, then he/she can withdraw money from his/her PF account after meeting the following conditions:

- If a company has been shut down for 15 days and above or has stopped giving salary to the employees for two months or more, then the employees can take PF loans.

- You can withdraw only your share or an amount that is equivalent to your unpaid salary.

- If the company is shut for more than six months, then you can withdraw your employer’s share too

Unemployment: Those who are unemployed for a month can withdraw up to 75% from their PF accounts. If one is unemployed for 2 months and above, then he/she can withdraw the entire contribution from his/her PF account.

Apart from the above, one can also apply for a PF loan in the event of a natural calamity.

Advance Sanctioned for Covid-19

The coronavirus pandemic has wreaked havoc across the world and has led to the loss of millions of lives. With lockdowns enforced, many people have also lost their sources of income. To help affected employees in such turbulent times, a special provision has been added in the EPF Act by the EPFO. Under this provision, an affected person can withdraw a non-refundable COVID-19 emergency advance from his/her PF account.

Check the Eligibility Criteria Below:

- Employees who work in a factory or organization that is located in a government-declared containment zone and who have been affected by the outbreak are eligible.

- As the pandemic has spread across the country, all employees can take the EPF Advance.

- You do not have to submit any document to get this Advance.

- You can withdraw up to three months of your wages and DA. You can choose to withdraw 75% of your contribution from your PF account.

- No repayment is required.

If you wish to avail of the EPF COVID-19 Emergency Advance then you must fill the online claim form. Make sure that your UAN is validated with your Aadhar card and the KYC of your bank account. You must also link your mobile number to your UAN to ensure the completion of the withdrawal process.

You can even use the Unified Mobile Application for New-age Governance or the UMANG app to avail of the COVID- 19 Emergency Advance.

Know-How to Calculate Your Loan

It is easy to calculate the loan amount which will be sanctioned to you. We will explain with an example. Let’s say Miss Kavita has applied for a COVID-19 Emergency Advance loan. She has a balance of INR 2.5 lakhs in her PF account. Now, the sum of her monthly basic wage and DA is 25000. So, the total amount for three months would be 75000. If we calculate 75% of INR 2.5 lakh, it will be INR 187500

Now since the sum of Miss Kavita’s DA and basic wage is less than 75% of her PF account balance , she will be able to withdraw INR 75000 as her COVID-19 Emergency Advance loan.

Check the status of your loan

To check the status of your EPF Advance claim, follow the steps below:

- Open the EPFO website.

- Select ‘Services’ and click ‘For Employees.’

- You will now be redirected to a new window. In this window, select Services > Know your claim status.

- Now log in by entering your UAN and password. You must also provide your PF account number, the state name where your PF office is located, and the establishment code.

- Once done, you can check the status of your claim easily.

PF Loan - Frequently Asked Questions

Yes, you must contribute to your PF if you receive a salary of INR 15000 or more and you work at an organization where the workforce is over 20. If your organization’s workforce is less than 20, they can opt to get enrolled in EPF.

No, employees are not required to submit the forms to their employers.

No, the tax will not be deducted if you have been in service for five years consistently. If you have not worked continuously for five years, then tax will be deducted on the amount which is provided by the employer to the EPF.

Yes, you can check it online by visiting the official EPFO portal. However, you can access this feature only if you are still contributing to your PF account.

Internal Links

- Aadhar Bank Link

- Link Aadhaar with Mobile Number

- Pan Aadhaar Link

- Link Voter ID with Aadhaar Card

- Link UAN with Aadhaar Card

- Ration Card Aadhar Link

- Income Tax Aadhar Link

- How to Check PF Balance without UAN Number

- Employee Provident Fund Details

- Download E-Aadhaar Card

- How to Activate UAN Number

- EPF Balance Check

- Mudra Loan Eligibility

- How to Apply Mudra Loan Online

- MSME / SME Loan

- Mortgage Loan

- Types of Mortgage loans

- PF Loan Details

- Know About EXPERIAN Credit Score

- Know About CIBIL Score

- Important Banking Terms You Should Know

- Housing Finance Companies in India

- Microfinance Institutions in India

- PMEGP Loan Scheme

- PMEGP Loan Eligibility Documents

- CGTMSE Scheme

- Financial Inclusion Schemes in India

Was this information useful?

300 characters allowed (alphanumeric and special characters such as comma, full stop, @, ", &)

Thank you. Your feedback is important to us.

Apply for personal loan

Thank you for your interest!

We will reach out to you shortly

- Free Credit Score

- Emi Calculator

- A Step-by-Step Guide: Applying for EPF Loan Online

- November 2, 2023

The Employee Provident Fund (EPF) is a significant financial benefit for employees in India, offering a reliable savings avenue for retirement. However, did you know that you can also avail of an EPF loan in times of need? With the digitization of services, applying for an EPF loan online has become more accessible and convenient. In this blog, we’ll provide you with a comprehensive step-by-step guide on how to apply for an EPF loan online.

Step 1: Understand EPF Loan Eligibility

Before applying for an EPF loan, it’s crucial to be aware of the eligibility criteria. Generally, you should have a minimum EPF balance (more than Rs. 20,000) and an active EPF account.

You should also have a valid reason for availing the EPF Loan or Advance. You can request for an EPF loan for any of the following reasons:

- Medical treatment : You can withdraw up to six times your monthly salary (whichever is lower) for medical treatment of yourself, your spouse, your children, or your parents. There is no lock-in period or minimum service requirement for this type of withdrawal.

- Purchase or construction of a house : You can withdraw up to 25% of your EPF balance for the purchase or construction of a house. You must have at least 5 years of service to be eligible for this type of withdrawal.

- Repayment of an existing home loan : You can withdraw up to 25% of your EPF balance to repay an existing home loan. You must have at least 5 years of service to be eligible for this type of withdrawal.

- Marriage : You can withdraw up to 50% of your EPF balance for your own marriage or the marriage of your children. There is no lock-in period or minimum service requirement for this type of withdrawal.

- Education : You can withdraw up to 100% of your EPF balance for the education of yourself, your spouse, or your children. You must have at least 5 years of service to be eligible for this type of withdrawal.

- Pregnancy and childbirth : You can withdraw up to 6 times your monthly salary (whichever is lower) for pregnancy and childbirth expenses. There is no lock-in period or minimum service requirement for this type of withdrawal. Medical treatment: You can withdraw up to six times your monthly salary (whichever is lower) for medical treatment of yourself, your spouse, your children, or your parents. There is no lock-in period or minimum service requirement for this type of withdrawal.

Step 2: Log into the EPF UAN Portal

Visit the official EPFO (Employee Provident Fund Organization) website.

Log in to your UAN (Universal Account Number) portal using your UAN and password. If you haven’t registered, follow the registration process provided on the website.

Step 3: Access the Online Services and Select ‘Claim (Form-31, 19 & 10C)’

Once logged in, navigate to the ‘Online Services’ section on the portal’s main menu. Under the ‘Online Services’ section, select the ‘Claim (Form-31, 19 & 10C)’ option to initiate the EPF loan application.

Step 4: Enter and Verify Required Details

Your personal details such as name, date of birth, and Aadhaar number will be pre-filled based on your UAN information. Verify and provide your bank account details where you want the loan amount to be credited.

Step 5: Select the Loan Type

Choose the type of claim you wish to make – for an EPF advance (loan) or for partial withdrawal. Select the ‘PF Advance (Form-31)’ option for applying for an EPF loan.

Step 6: Specify the Purpose

Indicate the purpose for which you require the loan. Options include medical expenses, marriage, education, housing, etc. Provide additional information related to the purpose selected.

Step 7: Enter Loan Amount and Upload Documents

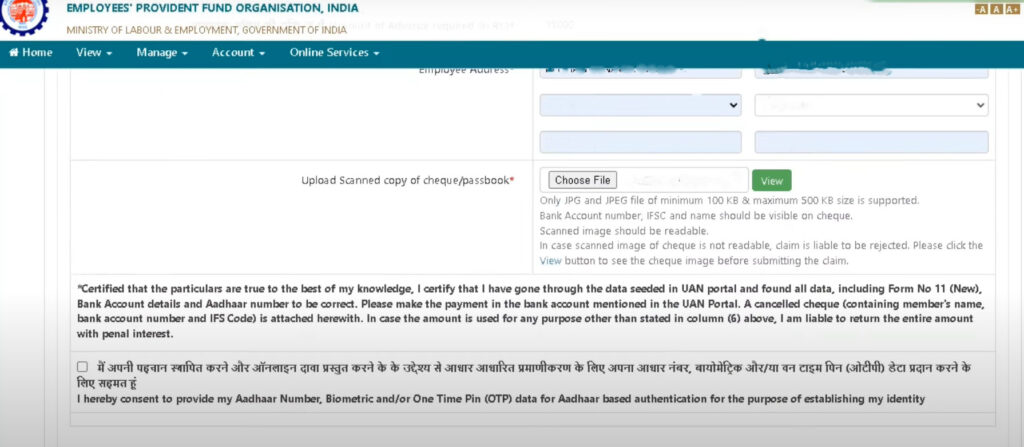

After you mention the amount of loan you want to apply for, upload any required supporting documents based on the purpose of the loan. This usually includes a scanned copy of your cheque or passbook.

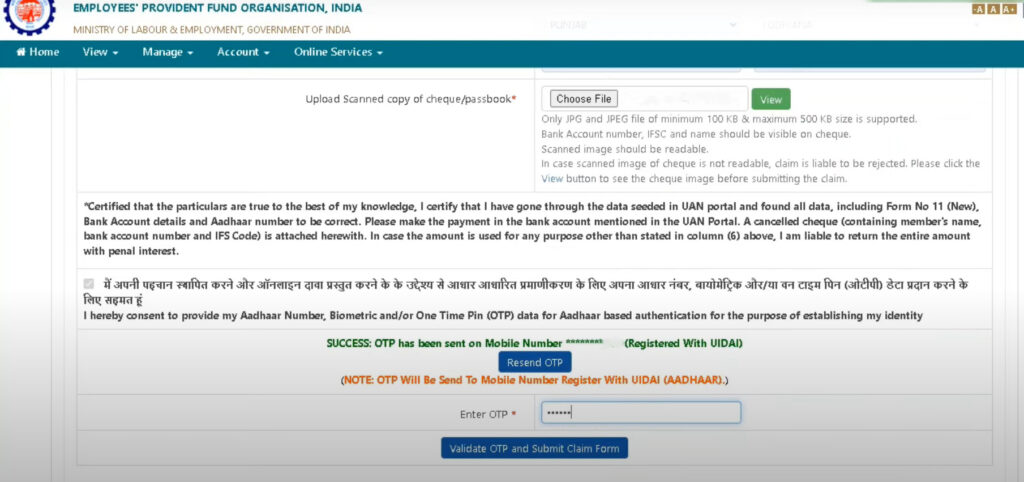

Step 10: Authenticate

Verify the details you’ve provided and authenticate your application using your Aadhaar-based e-KYC.

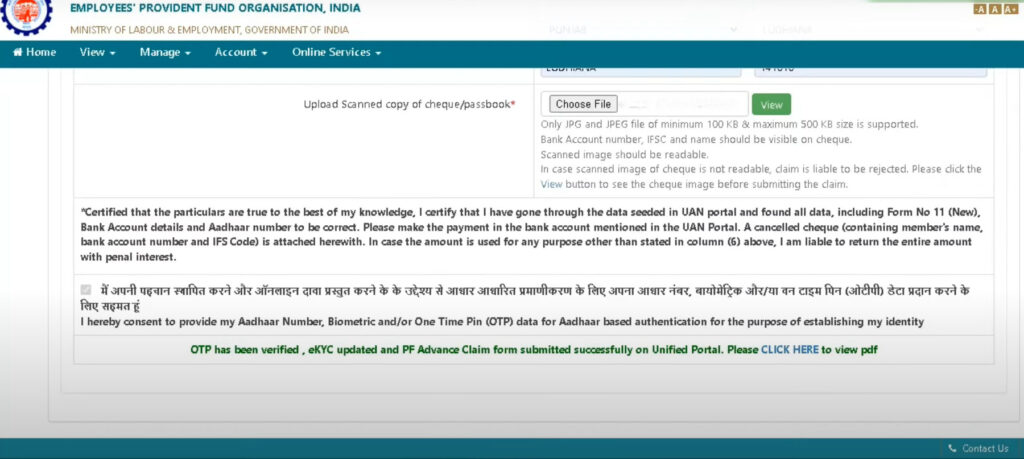

Step 11: Submit the Application

Once you’ve reviewed and verified your application, submit it electronically.

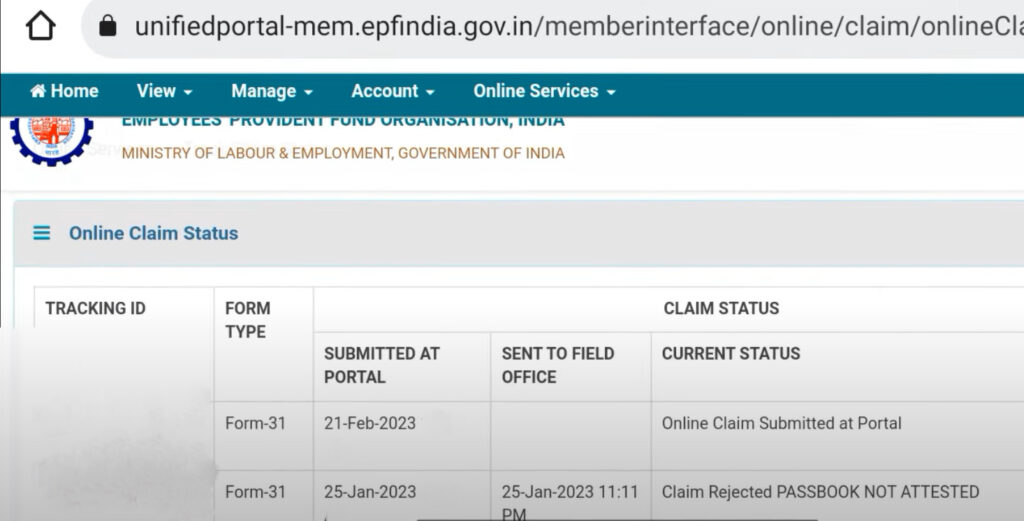

Step 12: Track Application Status

After submitting the application, you can track its status on the EPF UAN portal. The portal will provide updates on the progress of your application, including approval and disbursal.

Important Factors to Consider Before Taking EPF Loan

Here are some things you should keep in mind before applying for an EPF loan:

- You will need to have at least 5 years of service to be eligible for an EPF loan.

- The current EPF loan interest rate is 8.5% (as of August, 2023). The interest rate on EPF loans is calculated on the monthly running balance of the loan amount. This means that the interest you pay will be lower in the early months of the loan, when the loan amount is still high, and higher in the later months, when the loan amount is lower.

- The interest on EPF loans is tax-deductible. This means that you can claim the interest you pay on your EPF loan as a deduction from your taxable income.

- The amount of loan you can take is limited to 90% of your EPF balance.

- The loan repayment period is up to 30 years. You can repay the loan in full or in installments. If you repay the loan in full, you will not have to pay any interest. However, if you repay the loan in installments, you will have to pay interest on the outstanding amount of the loan.

The ability to apply for an EPF loan online has simplified and expedited the process for employees in need of financial assistance. By following this step-by-step guide, you can navigate the EPF UAN portal with ease and apply for an EPF loan tailored to your specific requirements. As with any financial decision, it’s essential to understand the terms and conditions associated with EPF loans and ensure you are well-informed before proceeding.

Frequently Asked Questions (FAQs):

Finnable has set a required minimum age for personal loan of 21 years for individuals to be eligible for a personal loan. This ensures that applicants have reached legal adulthood and are capable of entering into a financial agreement.

Yes, Finnable understands the financial needs of young borrowers and offers personalised loan options tailored to their specific requirements. Whether it's financing higher education, purchasing essential items, or starting a business venture, Finnable provides support to young individuals seeking financial assistance.

Borrowers nearing retirement may have unique financial needs, such as retirement planning, medical expenses, or supporting their children's education. Finnable offers personalised loan solutions that consider the specific circumstances of pre-retirement individuals, helping them meet their financial goals.

Unfortunately, no. Finnable does not, at the moment, offer any loans to senior citizens. Currently, 60 is the maximum age for personal loans set by Finnable

Other than personal loan age limits , Finnable considers various other factors for determining loan eligibility. These factors may include the applicant's income, credit score, repayment capacity, and employment stability. By assessing these aspects comprehensively, Finnable ensures that borrowers across different age groups can access the loan products that best suit their financial needs.

- Personal loan in Bangalore

- Personal Loan in Jalandhar

- Personal loan in Vapi

- Personal loan in Udaipur

- Personal loan in Prayagraj

- Personal loan in Delhi

- Personal loan in Kolkata

- Personal loan in Mysore

- Personal loan in Amritsar

- Personal loan in Chennai

- Personal loan in Jodhpur

- Personal loan in Nashik

- Personal loan in Mumbai

- Personal loan in Vijayawada

- Personal loan in Hubli

- Personal loan in Ahmedabad

- Personal loan in Nellore

- Personal loan in Jabalpur

- Personal loan in Aurangabad

- Personal loan in Pune

- Personal loan in Patna

- Personal loan in Bhubaneshwar

- Personal loan in Surat

- Personal loan in Calicut

- Personal loan in Gwalior

- Personal loan in Nagpur

- Personal loan in Madurai

- Personal loan in Chandigarh

- Personal loan in Bharuch

- Personal loan in Thiruvananthapuram

- Personal loan in Varanasi

- Personal loan in Hyderabad

- Personal loan in Cochin

Terms and condition and legal disclaimer

Finnable is a personal loan app developed by Finnable Technologies Private Limited, which is a subsidiary of Finnable Credit Private Limited, a RBI licensed NBFC.

Example of Personal Loan for Salaried Professionals ✓ Loan Amount from ₹50,000 to ₹10,00,000 ✓ Repayment period (loan tenor) options vary from 6 to 60 months ✓ Annual Interest Rate (APR) is 16% to 26% (on a reducing balance basis) + processing fees of 3 to 4% on the principal loan amount ✓ For Example – a loan of ₹1,00,000 with an APR of 16% (on a reducing balance basis), repayment tenure of 12 months, processing fee of 3%. The processing fee will be ₹3,000 + ₹540 GST with monthly EMI will be ₹9,394. The total loan amount will be ₹1,03,540. Total interest payable over 12 months will be ₹9,191. Total loan repayment amount is ₹103540 + ₹9191 = ₹1,12,731 *These numbers are for representation only and the final interest rate or processing fee may vary from one borrower to another depending on his/her credit assessment. ✓ Loan Prepayment Charges: 3 to 6% charge + 18% GST on the remaining principal amount (allowed after 6 EMI payments) Why is Finnable the best personal loan app? Instant Loans within 48 hours: Gone are the days when you had to wait weeks & months to get a loan approved. Completely Digital/Paperless: Finnable instant loan app offers a complete digital service to help save time as well as paper!

Security & Privacy Policy Finnable instant loan app ensures the safety of its customers via standard security. In simple terms, we do not share personal information with third-party apps.

Contact Us: Drop us an email: [email protected] Address: IndiQube Lakeside, 4th Floor Municipal No. 80/2 Wing A, Bellandur Village Varthur, Hobli, Bengaluru, Karnataka 560103

Responsible Lending Finnable has partnered with RBI authorised & regulated NBFCs/Financial Institutions. Our policies and services are fully regulated and legally compliant.

Lending Partners

Do’s & Don’ts to Prevent Frauds

Grievance Redressal Policy

Popular Searched Words

Personal loan in Ahmedabad | What Is Unsecured Loans | Education Loan For MBBS | Types Of Personal Loan | Difference Between Secured And Unsecured Loans | How To Apply For A Student Loan | Difference Between Credit Score And Cibil Score | Types Of Unsecured Loans | Home Loan Vs Personal Loan | How To Repay Loan Faste

Terms and conditions

Finnable is one of the fastest growing financial technology (Fintech) start-up with an NBFC license from RBI providing hassle free loans. Our mission is to make Personal loans available in less than 24 hours

Example of Personal Loan for Salaried Professionals ✓ Loan Amount from ₹50,000 to ₹10,00,000 ✓ Repayment period (loan tenor) options vary from 6 to 60 months ✓ Annual Interest Rate (APR) is 16% to 26% (on a reducing balance basis) + processing fees of 3 to 4% on the principal loan amount ✓ For Example – a loan of ₹1,00,000 with an APR of 16% (on a reducing balance basis), repayment tenure of 12 months, processing fee of 3%. The processing fee will be ₹3,000 + ₹540 GST with monthly EMI will be ₹9,394. The total loan amount will be ₹1,03,540. Total interest payable over 12 months will be ₹9,191. Total loan repayment amount is ₹103540 + ₹9191 = ₹1,12,731 *These numbers are for representation only and the final interest rate or processing fee may vary from one borrower to another depending on his/her credit assessment. ✓ Loan Prepayment Charges: 3 to 6% charge + 18% GST on the remaining principal amount (allowed after 6 EMI payments) Why is Finnable the best personal loan app? Instant Loans within 48 hours: Gone are the days when you had to wait weeks & months to get a loan approved. Completely Digital/Paperless: Finnable instant loan app offers a complete digital service to help save time as well as paper! Why is Finnable the best personal loan app? Instant Loans within 48 hours: Gone are the days when you had to wait weeks & months to get a loan approved. Completely Digital/Paperless: Finnable instant loan app offers a complete digital service to help save time as well as paper! CIBIL Score Not Required for Taking a Loan: Unlike other personal loan apps online, you can take a loan even without an existing CIBIL Score No Hidden Charges: A key feature that makes Finnable one of the best loan apps available is transparency. There are no hidden charges whatsoever, making the entire process a smooth one. Finnable instant loan app offers a wide range of EMI plans. You can also use our personal loan EMI calculator to help you choose the perfect plan. Loan Eligibility Criteria for Salaried Individuals (No Blue-Collar Employees) •The net in-hand salary of the individual has to be ₹25k and above in metros or ₹15k and above in tier 2 & other cities •He/she should have worked for more than six months •First-time borrowers need to have a Finnable score of 650 •The individual should have valid Aadhaar, Pan & Address proof •Finnable Loan is currently available in 23 cities How to Apply for Instant Personal Loans Online? • Register with OTP • Ensure that you have the documents listed on the Web/App • Provide details of amount required, net monthly salary & any other EMIs • Do KYC & profile setup • Validate address with pin code verification • Select amount & tenure • Provide bank details

APR Charges The APR (Annual Percentage Rate) charges differ from person to person as it considers the different products availed and the risk profile of the customer. However, it generally ranges between 16%-26%.

Contact Us: Drop us an email: [email protected] Address: IndiQube Lakeside, 4th Floor Municipal No. 80/2 Wing A, Bellandur Village Varthur, Hobli, Bengaluru, Karnataka 560103 Responsible Lending Finnable has partnered with RBI authorised & regulated NBFCs/Financial Institutions. Our policies and services are fully regulated and legally compliant.

Check your Loan Eligibility in 2 min